Investor PRESENTATION December 2023 Exhibit 99.1

This Management Presentation (this “Presentation”) is the property of Vince Holding Corp. and its subsidiaries (collectively, “Vince” or the “Company”). By accepting this Presentation, the recipient acknowledges that it has read, understood and accepted the terms of this disclaimer. This Presentation is not a formal offer to sell or solicitation of an offer to buy the Company’s securities. Information contained in this Presentation should not be relied upon as advice to buy or sell or hold such securities or as an offer to sell such securities. No representation or warranty, express or implied, is or will be given by the Company or its affiliates, directors, officers, partners, employees, agents or advisers or any other person as to the accuracy, completeness, reasonableness or fairness of any information contained in this Presentation and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements relating thereto. By acceptance of this Presentation, each recipient agrees not to copy, reproduce or distribute to others the Presentation, in whole or in part, without the prior written consent of the Company, and will promptly return this Presentation to the Company upon request. This Presentation may contain forward-looking statements under the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact or relating to present facts or current conditions included in this presentation are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “target,” “plan,” “intend,” “believe,” “may,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. These forward-looking statements are not guarantees of actual results, and our actual results may differ materially from those suggested in the forward-looking statements. These forward-looking statements involve a number of risks and uncertainties, some of which are beyond our control, including those as set forth from time to time in our Securities and Exchange Commission (the “SEC”) filings, including those described in our Annual Report on Form 10-K under “Item 1A – Risk Factors” filed with the SEC on April 28, 2023. Any forward-looking statement made by the Company in this Presentation speaks only as of the date on which it is made. Except as may be required by law, the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Market data and industry information used in this presentation are based on independent industry surveys and publications and other publicly available information prepared by third party sources. Although the Company believes that these sources are reliable as of their respective dates, it has not verified the accuracy or completeness of this information from independent sources. Disclaimer

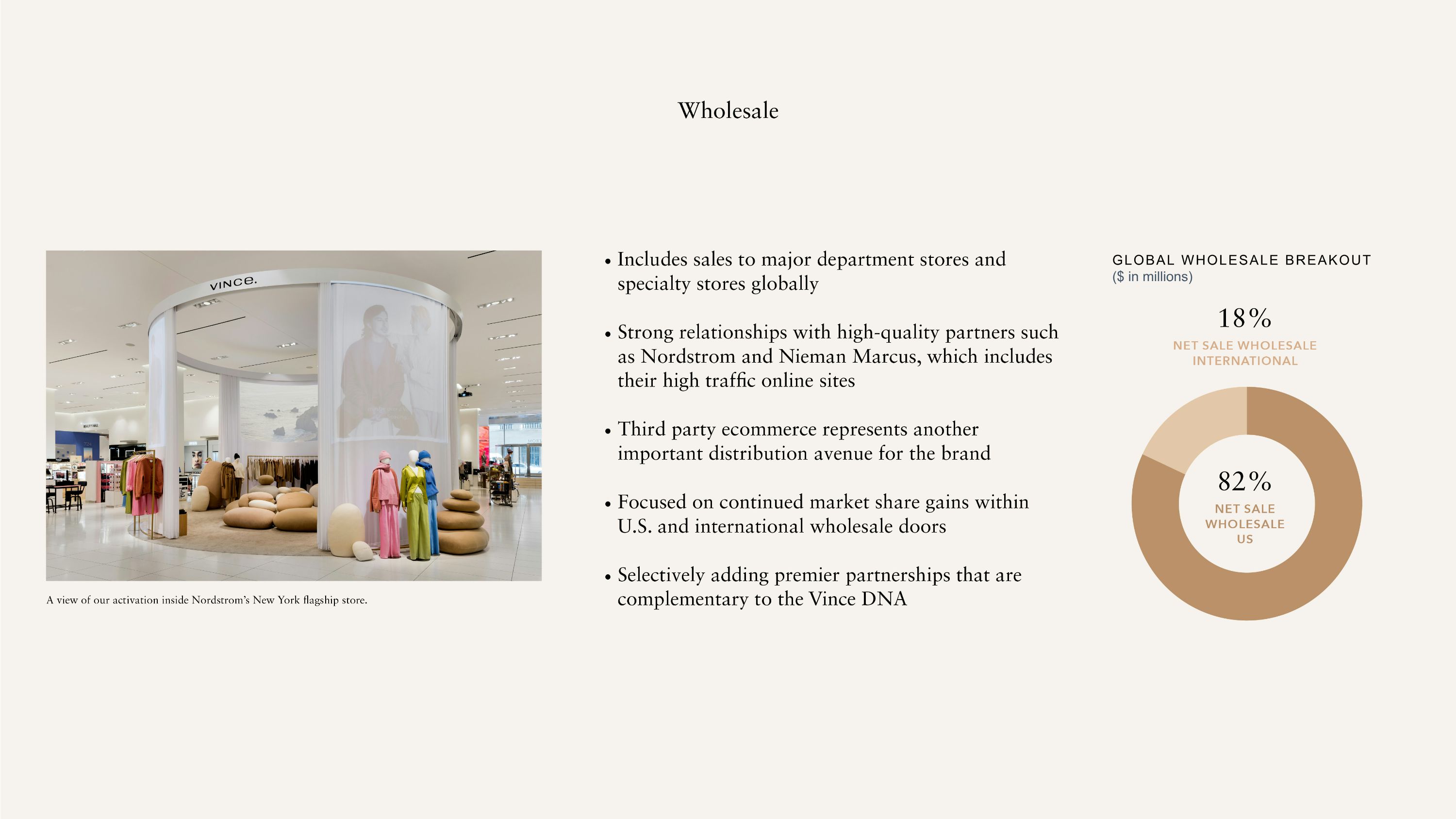

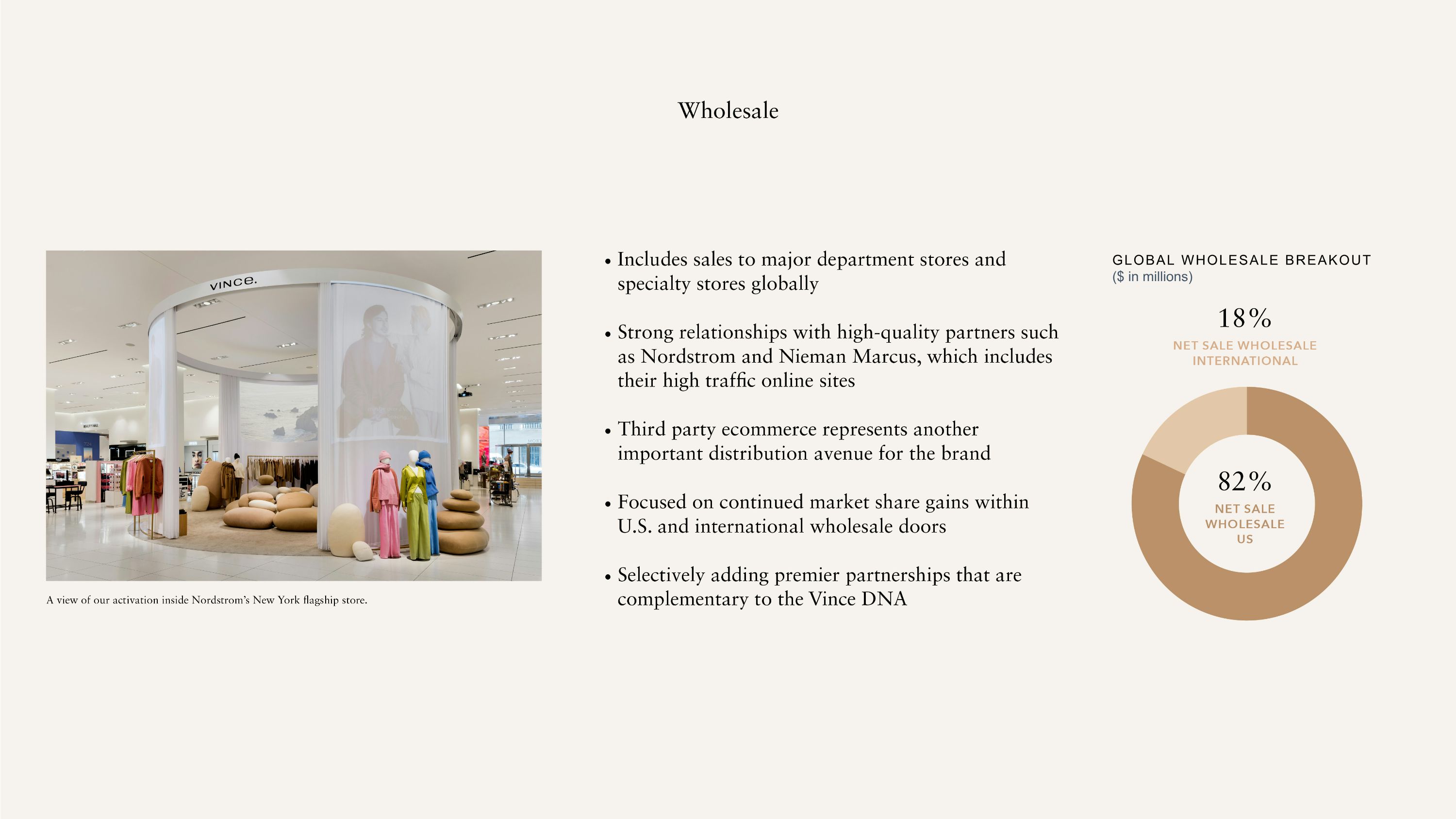

GLOBAL WHOLESALE BREAKOUT ($ in millions)

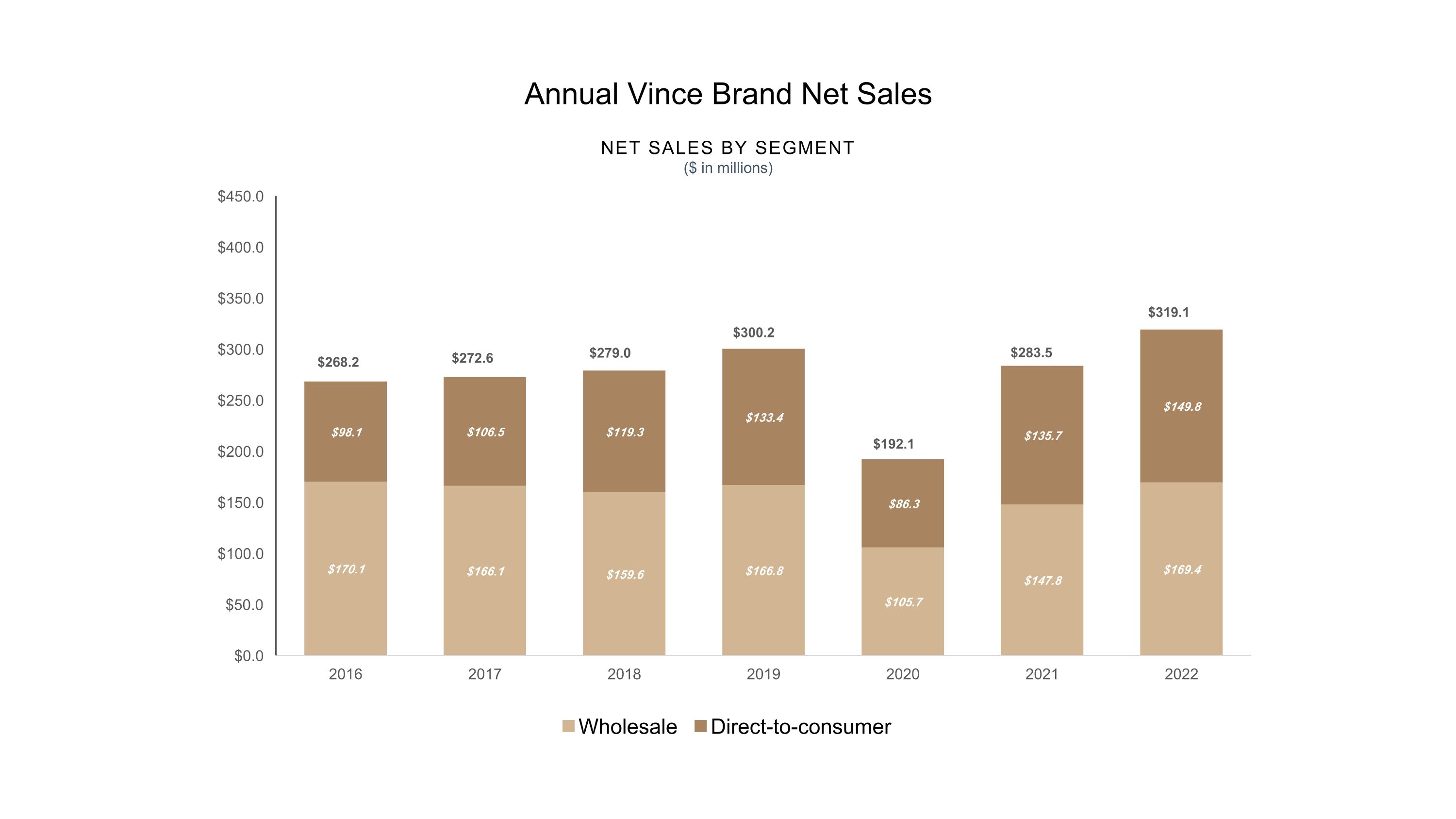

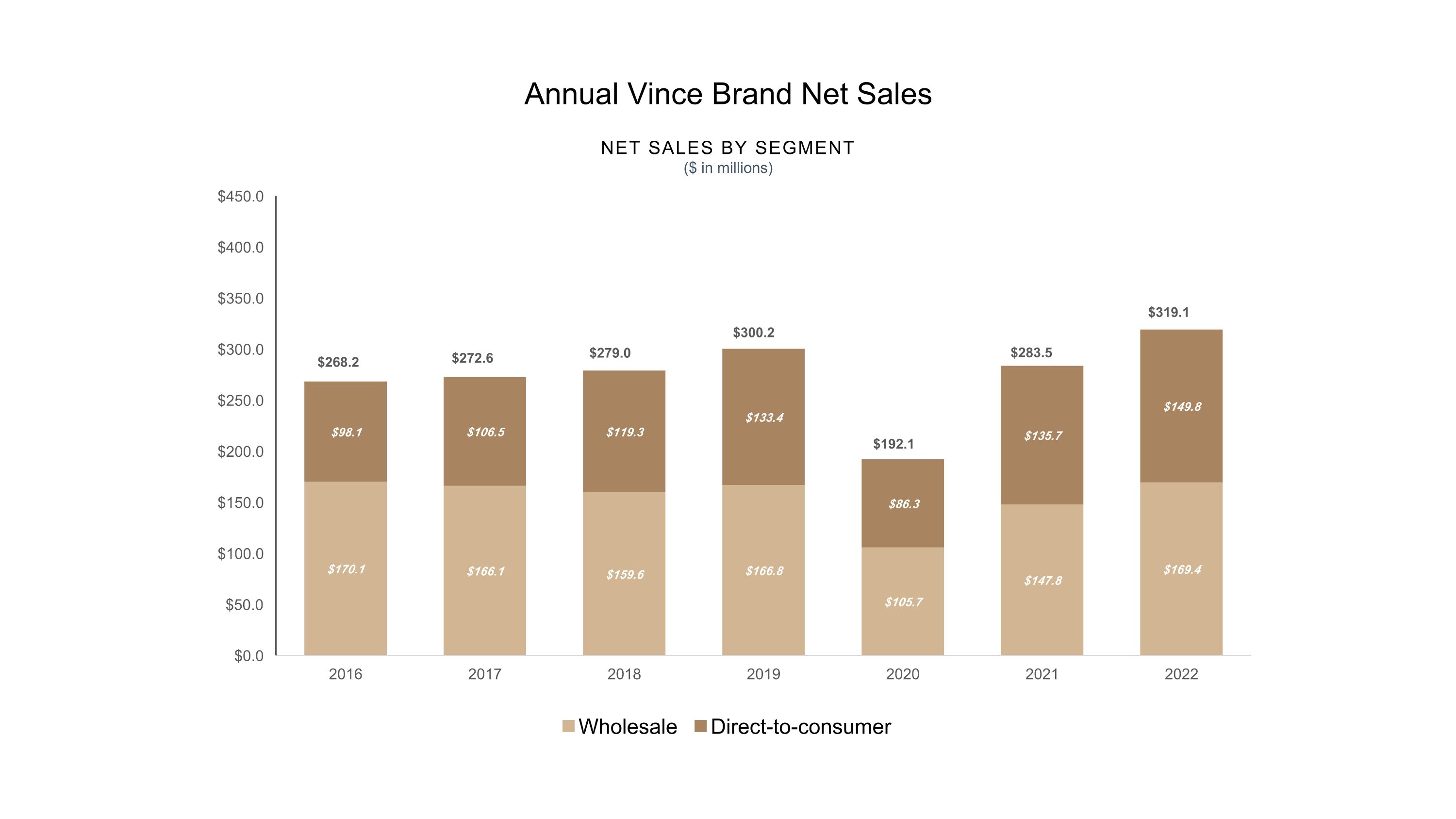

NET SALES BY SEGMENT ($ in millions) 45.8% 44.7% 46.9% $268.2 $272.6 $279.0 $300.2 $192.1 $283.5 $319.1 Annual Vince Brand Net Sales

Q3 NET SALES ($ in millions) $15.0 $15.1 $89.7 $84.1 Q3 OPERATIONS INCOME ($ in millions) Q3 Vince Total Net Sales Declined 6.2% vs. LY Driven By: Strategic Decision to Pullback Off-price Wholesale Business Given Improved Inventory Position Ongoing challenging macro environment Q3 Vince Income from Operations Approx. Flat vs. LY Despite Lower Sales and Approx. $4M Royalty Expenses Not Incurred in Prior Year Q3 Vince Income from Operations Margin Expanded 120 Bps vs. LY Driven by: Lower Freight Expenses Lower Promotional Activity Partially Offset by Royalty Expenses Q3 Fiscal 2023 Vince Brand Results