UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22883

ARK ETF Trust

(Exact name of registrant as specified in charter)

c/o ARK Investment Management LLC

200 Central Avenue, Suite 220

St. Petersburg, FL 33701

(Address of principal executive offices) (Zip code)

Corporation Service Company

251 Little Falls Drive

Wilmington, DE 19808

(Name and address of agent for service)

Registrant’s telephone number, including area code: (727) 810-8160

Date of fiscal year end: July 31

Date of reporting period: July 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

Item 1. Reports to Stockholders.

(a) The Report to Shareholders is attached herewith.

Table of Contents

Table of Contents | |

|

| | |

Table of Contents

Shareholder Letter (Unaudited) | | |

| | |

Dear Shareholder:

ARK Investment Management LLC (“ARK” or the “Adviser”), the investment adviser to the ARK ETF Trust (the “ARK ETFs”) specializes in thematic investing in disruptive innovation. The ARK ETFs include portfolio companies that we believe are leading and benefiting from five innovation platforms: artificial intelligence (AI), energy storage, robotics, multiomic sequencing, and blockchain technology. These platforms involve 14 technologies, including neural networks, multiomic technologies, autonomous mobility, and cryptocurrencies. According to ARK’s research, these five innovation platforms are converging to create unprecedented growth trajectories. AI is the most important catalyst, its velocity cascading through all other technologies. The market value of disruptive innovation platforms could scale 40% at an annual rate during this business cycle, from $13 trillion today to $200 trillion by 2030.1 In 2030, the market value associated with disruptive innovation could account for the majority of the global equity market capitalization.

In 2022, one of the most challenging years in market history, transparency was more important than ever as shares of innovation-focused companies suffered disproportionately. In our view, the equity market largely ignored game-changing innovation throughout the year. These technological breakthroughs are corroborating our original research and boosting our confidence that ARK’s strategies are on the right side of change. Disruption can surface in surprising forms and at unexpected times. Innovation solves problems and has historically gained share during turbulent times.

For example, thanks to a new form of gene editing, a young girl in the UK with leukemia went from her death bed in May to cancer-free in November 2022. Base editing and multiplexing have the potential to provide more effective CAR-T treatments for patients with otherwise incurable cancers. Relating to the next generation of the internet, AI is advancing at an unprecedented rate, with ChatGPT, a version of GPT-3 optimized for conversation, signing up one million users in just five days in 2022. This uptake is particularly impressive compared to the original GPT-3, which took 24 months to reach the same level. ChatGPT already scores above the national average on the SAT, demonstrating its potential to revolutionize the way we approach knowledge work.

Fast forward to 2023, and the market appears to agree that AI is reshaping industries, and we believe it could be a long-term growth driver more impactful than the internet. During the second quarter of 2023, ChatGPT continued its momentum in capturing the imagination of businesses and consumers, unleashing excitement that sparked a rally in mega-cap technology stocks. Relatedly, shares of NVIDIA soared in May after the company reported its fiscal first-quarter earnings and became a clear beneficiary of the boom in generative AI that ChatGPT unleashed. Seemingly, many investors assumed that benchmark-heavy incumbents that came of age during the internet revolution would benefit disproportionately from the AI revolution as well.

In our view, the rapidly evolving AI landscape is likely to disrupt major segments of the broad-based benchmarks. AI training costs have been declining at an average rate of 70%, roughly 3x, per year.2 In our view, common benchmarks may not be capturing effectively this potential opportunity set. As such, it may be prudent to complement, hedge, or diversify core benchmark exposures by investing in alternative public equity exposures. Since 2014, with tech-specific domain expertise, ARK analysts have focused on the industries, companies, and stocks that ARK believes are likely to be prime beneficiaries of the AI revolution. Given ARK analysts’ understanding of hardware, software, and applications, ARK portfolios offer significant exposure to the AI opportunity.

On the following pages, you will find information relating to your ARK ETF investment. If you have any questions, I encourage you to contact your financial advisor or ARK directly. You can find additional information, including our daily portfolio holdings, on the ARK ETF website located at: www.ark-funds.com.

We appreciate the opportunity to help you meet your investment goals and thank you for enabling us to invest for you at the pace of innovation!

Sincerely,

Catherine D.Wood

Chief Investment Officer and Chief Executive Officer

ARK Investment Management LLC

1

Table of Contents

Management’s Discussion of Fund Performance (Unaudited) | |

|

Market Review and Investment Strategy | |

In the fiscal year ended July 31, 2023, global equity markets appreciated as NVIDIA’s guidance for the second quarter shocked on the high side of expectations, thanks to provocative proofs of concepts from artificial intelligence (AI) generally and ChatGPT specifically. Increased demand for AI hardware is pointing toward a significant acceleration in software revenue growth. As companies develop AI-powered products and services, ARK estimates that software may generate up to $8 of revenue for every dollar spent on AI hardware by 2030. In what could be “winner take most” opportunities, we believe companies with large pools of proprietary data and broad-based distribution should be best positioned to capitalize on AI use cases and reap the potentially dramatic productivity gains associated with generative AI.

Recent economic data and comments from the US Federal Reserve (Fed) appear to have tempered investors’ previous expectations of interest rate declines. Now, interest rate futures are pricing in a slowdown or recession and one or two more rate hikes could occur before interest rates start to decline. Should an economic slowdown evolve into a hard landing, the slope of interest rate declines could steepen.

Economic data was not as clear-cut. While the labor market seemed resilient, a number of leading indicators were warning of recession.

• With a strong correlation to Gross Domestic Product (GDP), the US Leading Economic Index (LEI) has dropped for 14 consecutive months and now is down 7.9% year-over-year.2 In 2022, GDP declined for two consecutive quarters, a technical recession. During the last two quarters, Gross Domestic Income (GDI) – which should equal GDP over time – has declined sequentially. The divergence in growth between GDP and GDI is begging the question about future revisions: will GDI be revised up or GDP down. Our view is the latter.

• Based on monthly surveys from the Federal Reserve District Banks of Dallas, New York, Philadelphia, Richmond, and Kansas, manufacturing activity is contracting at an accelerated rate. Corroborating this evidence, new orders in the national Purchasing Managers’ Index, an index of the prevailing direction of economic trends in the manufacturing and service sectors, are declining.

• According to the Senior Loan Officer Opinion Survey (SLOOS), the willingness of banks to lend is plummeting, often a leading indicator of recession. Borrowing and lending play pivotal roles during economic expansions. The demand for commercial and industrial (C&I) loans is consistent with previous recession levels, and the Bank of America Fund Manager Survey suggests that commercial real estate could be the epicenter of the next financial crisis.

• US consumer sentiment3 remains at levels last seen during the Global Financial Crisis in 2008-2009 and back-to-back recessions with double-digit inflation and interest rates during the early 1980s. Meanwhile, the personal saving rate has collapsed from 9.3% pre-COVID to 4.6%4 which, when coupled with historically low consumer sentiment, is pointing toward weakness in consumption growth. Adding to those concerns, the third largest category of non-housing debt, credit card balances have reached a record high level at ~$1 trillion.5 Because interest rates on credit cards nearly doubled to 20-21% during the past ten years, the burden of credit card debt has intensified. Additionally, student loan payments are slated to resume this October, further pressuring consumer purchasing power.

• In recent months, PIMCO and Brookfield have defaulted on commercial property mortgages across major US cities, a trend exacerbated by the combination of rapid interest rate increases and the lower occupancy rates associated with the shift to remote work environments. Recent trends have hit San Francisco particularly hard, the value of one commercial use building dropping from $300 million to $60 million, or 80%, in four years.6 Moreover, two of San Francisco’s largest hotels are vacating the city.

The movement in interest rates over this fiscal period was remarkable. The Federal Funds Target Rate has surged 22-fold in the last year, a faster pace than all previous tightening cycles – including the one in 1980-1981 that crushed inflation – creating significant strains at regional banking and in commercial real estate. Bank deposits have dropped 4.0% year-over-year, the largest decline since 1948. We believe additional rate hikes will exacerbate this fragile situation.

2

Table of Contents

Management’s Discussion of Fund Performance (continued) (Unaudited) | | |

| | |

While the Fed is determined to squelch inflation by increasing interest rates, the bond market has been signaling that it could be making a major mistake. Since March 2021, the yield curve7 has flattened by 265 basis points, inverting from +159 to -106 basis points,8 the worst inversion since the early 1980s when the Fed was fighting entrenched double-digit inflation. This dynamic suggests that both real growth and inflation could surprise on the low side of expectations. In ARK’s view, the Fed is making decisions based on lagging indicators – employment and headline inflation – and ignoring leading indicators that are telegraphing recession and/or price deflation.

The Federal Reserve began increasing interest rates when the year-over-year Consumer Price Index (CPI) – a lagging economic indicator – reached 8.5% in March 2022. Shortly thereafter, an inflationary surge influenced by geopolitical pressures and inventory hoarding peaked at 9.1% year-over-year. Since then, CPI inflation has dropped to 3.0%,9 thanks to various deflationary forces – good, bad, and cyclical. Tesla’s CEO Elon Musk10 and DoubleLine’s CEO Jeff Gundlach11 have echoed our concerns about the risk of deflation.

Innovation is a potential source of good deflation, as learning curves can cut costs and increase productivity. Yet, we believe many companies have catered to short-term-oriented, risk-averse shareholders, satisfying their demands for profits/dividends “now”. On balance, they have leveraged their balance sheets to buy back stock, bolster earnings, and increase dividends. In so doing, many have curtailed investments and could be ill-prepared for the potential disintermediation associated with disruptive innovation. Saddled with aging products and services, they could be forced to cut prices to clear unwanted inventories and service debt, causing bad deflation.

If we are correct in our assessment that growth, inflation, or both will surprise on the low side of expectations, scarce double-digit growth opportunities should be rewarded accordingly. The adoption of new technologies typically accelerates during tumultuous times as concerned businesses and consumers change their behavior much more rapidly than otherwise would be the case. As a result, stocks of innovation-oriented companies have historically performed better and emerge as new market leaders toward the end of a bear market. We believe the coronavirus crisis and Russia’s invasion of Ukraine have transformed the world significantly and permanently, suggesting that many innovation-driven strategies and stocks could be productive holdings during the next five to ten years.

ARK continues to research and discover companies that are causing or embracing disruptive innovation, and that are creating pockets of rapid growth in an otherwise uncertain growth environment. Relative to the S&P 500 Index and the MSCI World Index, ARK Genomic Revolution ETF, ARK Autonomous Technology and Robotics ETF, ARK Innovation ETF, ARK Space Exploration ETF, and ARK’s self-indexed ETFs underperformed these broad-based indexes during the fiscal year ended July 31, 2023, while the ARK Next Generation Internet ETF and ARK Fintech Revolution ETF overperformed these indexes.

3

Table of Contents

Management’s Discussion of Fund Performance (continued) (Unaudited) | |

|

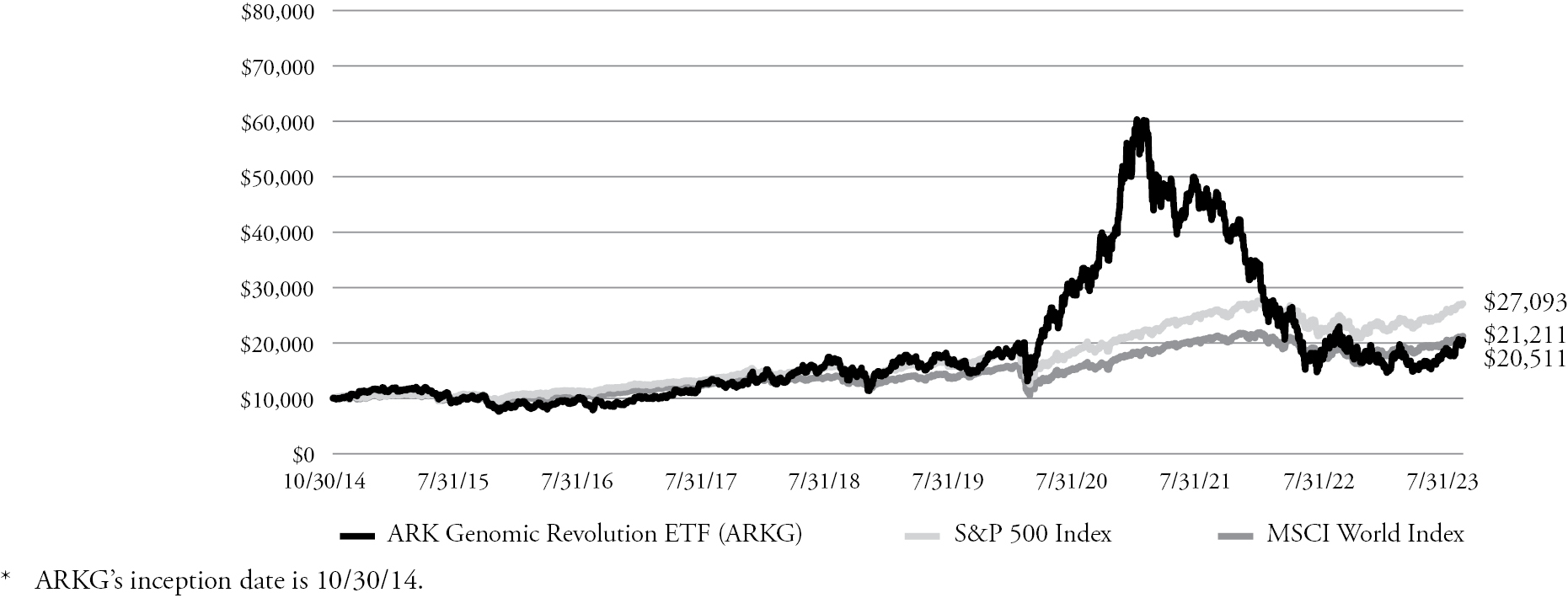

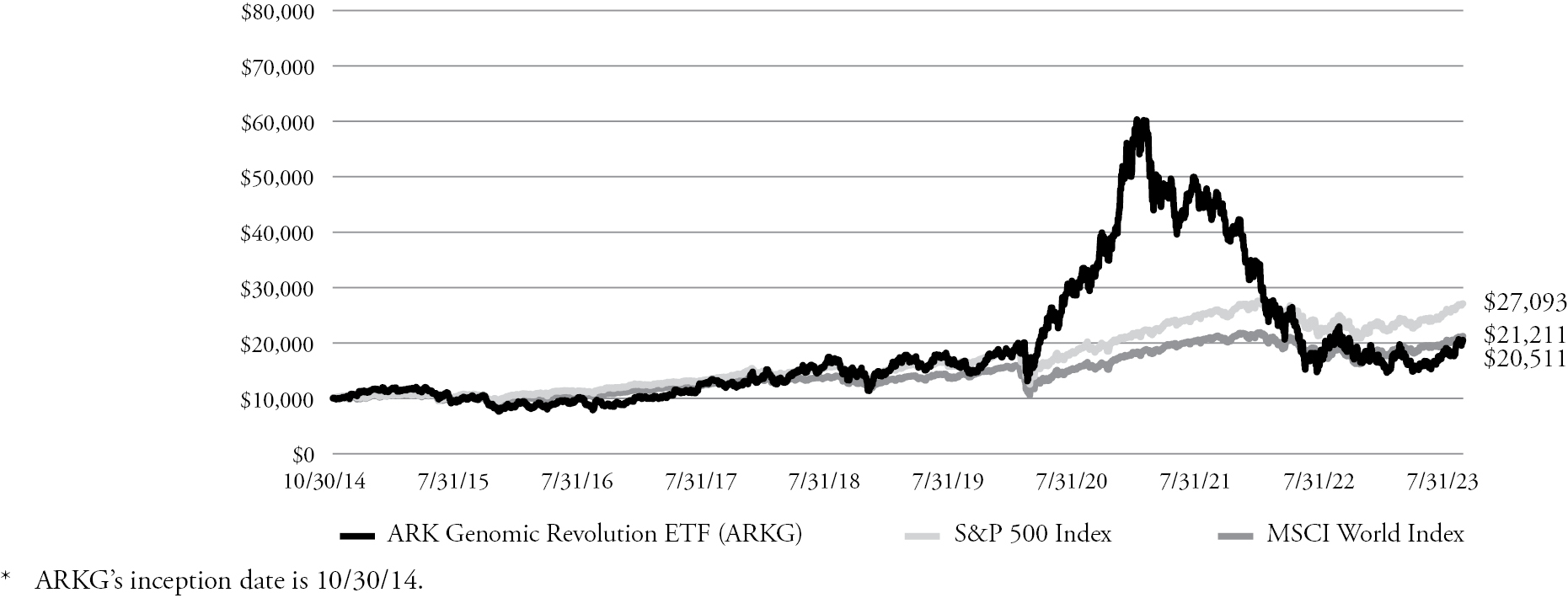

Investment Results: ARK Genomic Revolution ETF (ARKG) | |

The ARK Genomic Revolution ETF (ARKG) is an actively managed exchange-traded fund that invests in companies across multiple sectors, including health care, information technology, materials, energy, and consumer discretionary, that are relevant to the Fund’s Genomic Revolution investment theme.

During the fiscal year ended July 31, 2023, ARKG underperformed the S&P 500 Index and the MSCI World Net Index.

The top positive contributors to ARKG’s performance were Exact Sciences Corp. (EXAS or Exact Sciences), Pacific Biosciences of California, Inc. (PACB), Schrödinger, Inc. (SDGR or Schrödinger), Signify Health, Inc. (SGFY), and NVIDIA Corp. (NVDA or NVIDIA). Shares of Exact Sciences contributed to performance after the company surpassed revenue and earnings expectations for the first quarter of 2023 and guided to positive free cash flow, which is the residual amount of cash that a business has earned from its operations, over a specific period of time, less maintenance, during 2023. In addition, Exact Sciences’ next-generation Cologuard screening test for colon cancer demonstrated better specificity and sensitivity than Exact Sciences’ existing product, so it will seek FDA approval of the new test by the end of this year. Schrödinger specializes in developing computational tools and software for drug discovery and materials science. In the absence of meaningful company-specific news in second-quarter 2023, shares of Schrödinger rallied in tandem with a broad rotation into the beneficiaries of artificial intelligence in 2023. Shares of NVIDIA appreciated after the company announced much better than expected guidance for the second quarter of 2023, thanks to demand for data center products in response to breakthroughs in generative AI. As the primary provider of accelerated computing hardware for developing and running large language models, NVIDIA should be an early beneficiary of the boom in generative AI that ChatGPT unleashed late last year.

The biggest detractors to ARKG’s performance were Fate Therapeutics, Inc. (FATE or Fate Therapeutics), CareDX, Inc. (CDNA), Beam Therapeutics, Inc. (BEAM or Beam Therapeutics), 908 Devices (MASS) and Twist Bioscience Corp. (TWST or Twist Bioscience).

ARK started exiting its position in Fate Therapeutics in December 2022. Shares of the company declined in the fourth quarter of 2022 after Fate Therapeutics announced disappointing preclinical data from a project with GT Biopharma focused on the potential for a new therapeutic approach to treating acute myeloid leukemia. Shares of Beam Therapeutics declined in a broad-based sell-off in gene-editing names in 2023 on no meaningful company specific news. Beam Therapeutics is focused on applying its novel base-editing method to rare disease indications. Shares of Twist Bioscience traded down after the company issued light fiscal 2023 second-quarter revenue guidance based on a weaker-than-expected biopharma outlook. Twist Bioscience left full-year and long-term top-line guidance intact based on 30% growth in quarterly order bookings. Historically, Twist Bioscience has generated approximately 55-60% of its revenue in the second half. In our view, Twist Bioscience is a preeminent provider of synthetic biology reagents and tools – particularly oligonucleotides – to the translational research and clinical markets. Thanks to the capture efficiency of its oligos, Twist Bioscience’s next-generation sequencing (NGS) business is gaining momentum.

Average Annual Total Returns as of 7/31/23 |

| | 1 Year | 3 Year | 5 Year | Since

Inception

(Annualized) |

ARK Genomic Revolution ETF |

Net Asset Value | 3.46% | -10.50% | 6.63% | 8.56% |

Market Price | 3.80% | -10.45% | 6.64% | 8.58% |

S&P 500 Index | 13.02% | 13.72% | 12.20% | 12.08% |

MSCI World Net Index | 13.48% | 11.67% | 9.12% | 8.97% |

Growth of an Assumed $10,000 Investment Since Inception* Through 7/31/23 (At Net Asset Value)

4

Table of Contents

Management’s Discussion of Fund Performance (continued) (Unaudited) | | |

| | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.arkfunds.com. As stated in the ARK ETFs’ current prospectuses, the expense ratio for ARKG is 0.75%. Additional information about fees and expense levels can be found in the ARK ETFs’ current prospectuses. Net asset value (“NAV”) returns are based on the dollar value of a single share of an ARK ETF, calculated using the value of the underlying assets of the ARK ETF minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the Cboe BZX Exchange, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times.

The returns for the Fund do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or upon sale of Fund shares.

This graph represents the growth of a hypothetical investment of $10,000. It assumes reinvestment of dividends and capital gains and reflects ongoing fund expenses, but does not reflect sales loads, redemption fees, or the effects of taxes on any capital gains and/or distributions.

5

Table of Contents

Management’s Discussion of Fund Performance (continued) (Unaudited) | |

|

Investment Results: ARK Autonomous Technology & Robotics ETF (ARKQ) | |

The ARK Autonomous Technology & Robotics ETF (ARKQ) is an actively managed exchange-traded fund that invests in securities of autonomous technology and robotics companies that are relevant to the Fund’s Robotics and Autonomous Technology investment theme.

During the fiscal year ended July 31, 2023, ARKQ underperformed the S&P 500 Index and the MSCI World Net Index.

The top positive contributors to ARKQ’s performance were NVIDIA Corp. (NVDA or NVIDIA), Archer Aviation, Inc. (ACHR), Tesla, Inc. (TSLA or Tesla), Iridium Communications, Inc. (IRDM or Iridium), and Deere & Co. (DE). NVIDIA shares contributed to performance, for the reasons discussed above. Tesla shares rallied following several events in 2023, after a decline in the second half of 2022 due to broad macro environment concerns over consumer demand. First, Tesla held its Investor Day in March 2023, as to what will be its next-generation vehicle. Second, during its annual shareholder meeting, Tesla announced that co-founder J.B. Straubel would join the Board of Directors. Third, Tesla competitors General Motors, Ford, and Volvo announced that they will adopt the Tesla charging connector and join the Tesla Supercharger network in the coming years. Furthermore, SAE International, the automotive industry body that sets and reviews engineering standards, announced that it would standardize Tesla’s North American Charging Standard connector. Lastly, Tesla reaffirmed its promise to deliver the first Cybertrucks this year. Shares of Iridium surged in the first quarter of 2023 after the company announced a partnership with Qualcomm to provide satellite service for smartphones. The shares later pulled back, in July 2023, after the company reported second quarter earnings, missing Wall Steet revenue and earnings estimates. Additionally, Iridium had a great second half of 2022 due to momentum across business lines and an agreement with SpaceX.

The biggest detractors from ARKQ’s performance were TuSimple Holdings, Inc. (TSP or TuSimple), Trimble, Inc. (TRMB or Trimble), XPeng, Inc. (XPEV), Velo3D, Inc. (VLD or Velo3D), and Proto Labs (PRLB). TuSimple experienced turbulence after the company fired Xiaodi Hou, CEO and Co-Founder. Additionally, a

Wall Street Journal report alleged TuSimple was facing investigations from the FBI, SEC, and the Committee on Foreign Investment in the US over its ties to a Chinese startup (Hydron). With the three US organizations investigating TuSimple, ARK believed incremental partners and customers would likely avoid working with TuSimple and sought to lower the exposure to this name. Earlier in 2023, the Norwegian Public Roads Administration (NPRA) selected Trimble’s software to manage, maintain and operate the country's road network and associated transportation infrastructure. However, shares of Trimble fell as the company reported fourth-quarter 2022 earnings that were below expectations, with a decline in revenue and operating margin. In December 2022, shares of the company also depreciated after the company announced that it would acquire Transporeon, a company that makes transportation management software, for the equivalent of $2 billion in cash. Trimble is a leader in advanced positioning solutions, including Global Navigation Satellite System (GNSS), Global Positioning System (GPS), laser, optics, and inertial technologies. Much of the depreciation in Velo3D shares occurred in the second half of 2022 after the company reported that supply chain delays caused shipment disruptions during the third quarter 2022 and lowered full-year revenue guidance. Movement in 2023 can be related to the merger and acquisition activity within the 3D Printing industry involving Nano Dimension Ltd., Stratasys Ltd., 3D Systems Corp., and Desktop Metal, Inc. Velo3D is an additive manufacturing and 3D printing company specializing in support-free powder bed fusion.

Average Annual Total Returns as of 7/31/23 |

| | 1 Year | 3 Year | 5 Year | Since

Inception

(Annualized) |

ARK Autonomous Technology & Robotics ETF |

Net Asset Value | 4.85% | 4.32% | 11.99% | 13.89% |

Market Price | 4.98% | 4.28% | 11.96% | 13.90% |

S&P 500 Index | 13.02% | 13.72% | 12.20% | 12.08% |

MSCI World Net Index | 13.48% | 11.67% | 9.12% | 8.80% |

Growth of an Assumed $10,000 Investment Since Inception* Through 7/31/23 (At Net Asset Value)

6

Table of Contents

Management’s Discussion of Fund Performance (continued) (Unaudited) | | |

| | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.arkfunds.com. As stated in the ARK ETFs’ current prospectuses, the expense ratio for ARKQ is 0.75%. Additional information about fees and expense levels can be found in the ARK ETFs’ current prospectuses. Net asset value (“NAV”) returns are based on the dollar value of a single share of an ARK ETF, calculated using the value of the underlying assets of the ARK ETF minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the Cboe BZX Exchange, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times.

The returns for the Fund do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or upon sale of Fund shares.

This graph represents the growth of a hypothetical investment of $10,000. It assumes reinvestment of dividends and capital gains and reflects ongoing fund expenses, but does not reflect sales loads, redemption fees, or the effects of taxes on any capital gains and/or distributions.

7

Table of Contents

Management’s Discussion of Fund Performance (continued) (Unaudited) | |

|

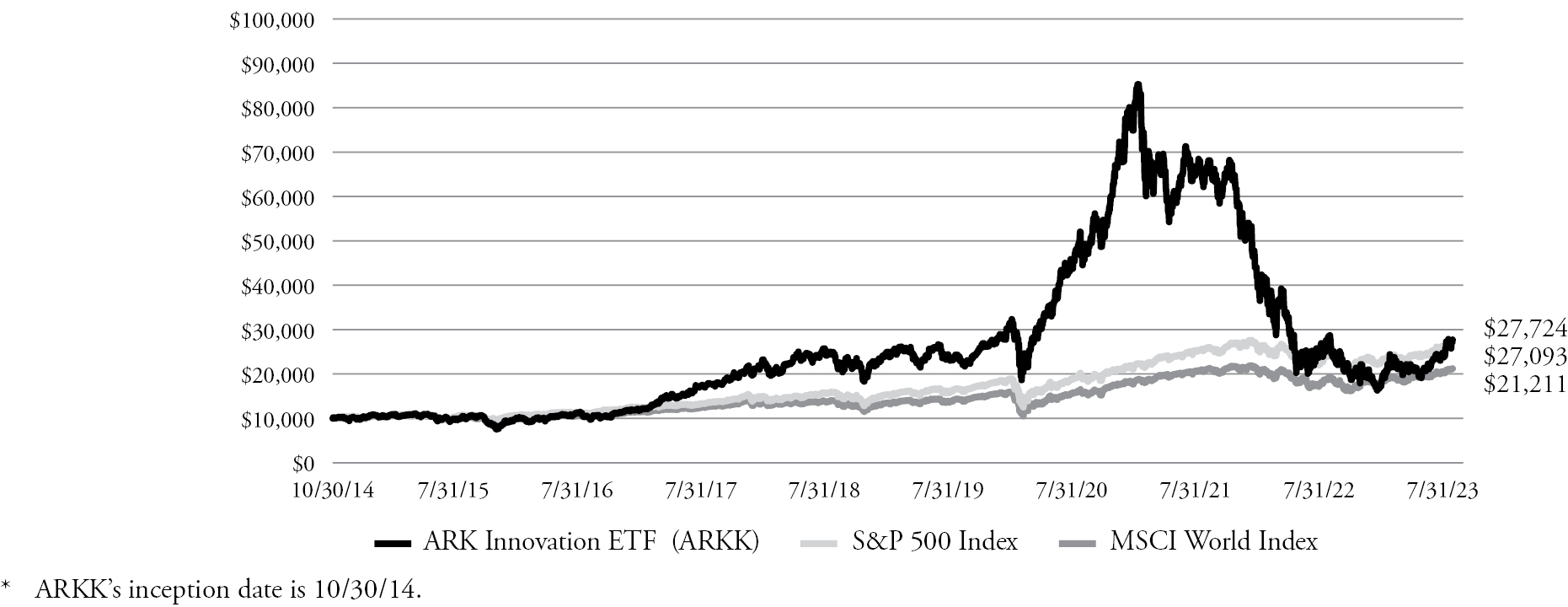

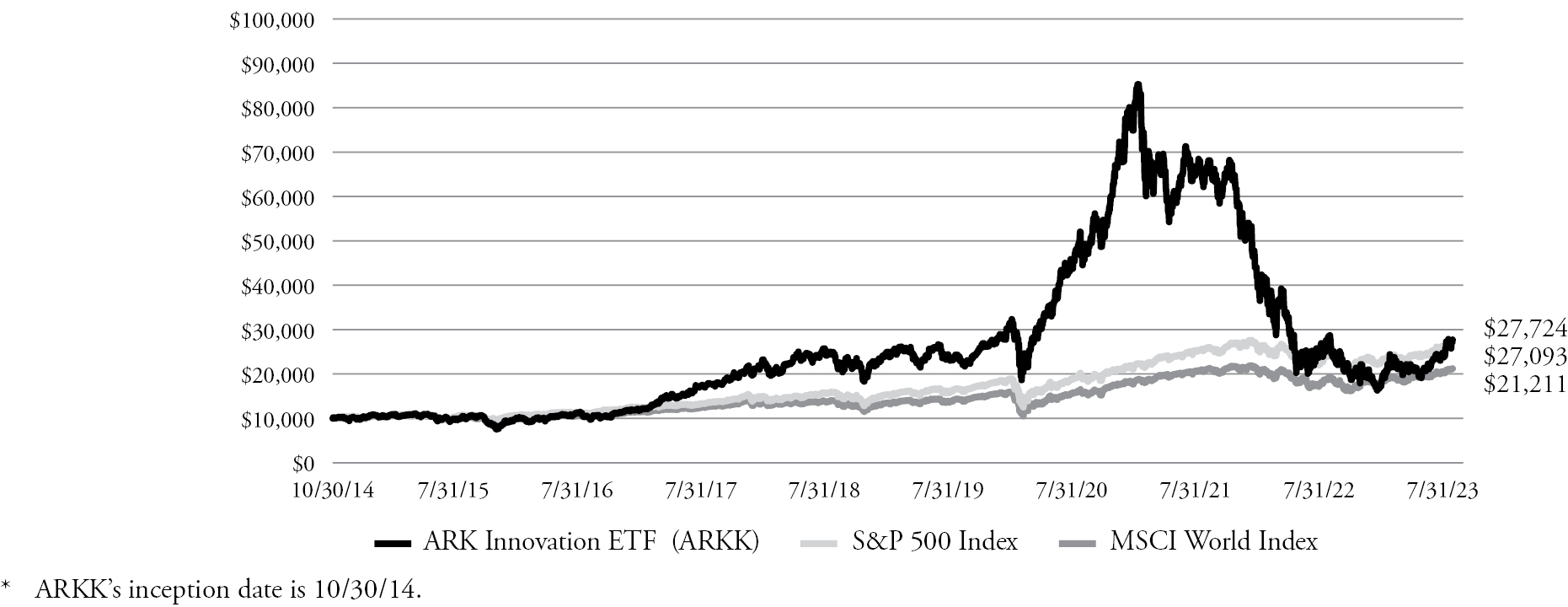

Investment Results: ARK Innovation ETF (ARKK) | |

The ARK Innovation ETF (ARKK) is an actively managed exchange-traded fund that invests in securities of companies that rely on or benefit from the development of new products or services, technological improvements, and scientific advancement related to ARK’s strategic platform areas of genomics (“Genomic Revolution Theme”), robotics and autonomous technology (“Robotics and Autonomous Technology Theme”), next generation internet (“Next Generation Internet Theme”), or financial technology (“Fintech Theme”).

During the fiscal year ended July 31, 2023, ARKK underperformed the S&P 500 Index and the MSCI World Net Index.

The top positive contributors to ARKK’s performance were Exact Sciences Corp. (EXAS), Coinbase Global, Inc. (COIN or Coinbase), Shopify, Inc. (SHOP or Shopify), DraftKings, Inc. (DKNG or DraftKings), and Roku, Inc. (ROKU). Shares of crypto-related companies, including Coinbase, surged during the first quarter of 2023. In July, Shares of Coinbase and other crypto-related stocks rallied after the company relisted Ripple’s XRP after a landmark ruling by a U.S. District Court, which states that the coin is not a security in terms of sales to the general public. Earlier in June, the U.S. Securities and Exchange Commission (SEC) charged Coinbase with operating an unregistered securities exchange, broker, and clearing agency, a move telegraphed by its Wells Notice in March. The new case followed the SEC’s recent actions against other prominent players that list similar assets – Kraken, Bittrex, and Binance, for example. Despite the SEC’s threat to end its staking operations, Coinbase appears well-positioned to navigate the regulatory environment following the downfall of FTX, which eliminated one of its primary competitors. Shares of Shopify appreciated after the company posted first-quarter 2023 revenue and earnings that surpassed analysts' expectations. Shopify also announced that it will sell its logistics

business – launched in 2019 with the purchase of warehouse robot startup 6 River Systems – to Flexport, Inc., with whom Shopify will continue to partner and in whom it now will have a 13% equity position. Shares of DraftKings rose after the company reported positive first-quarter 2023 results, including 84% year-over-year revenue growth. In the past year, DraftKings’ share of total wagers in mobile sports betting has increased from 28% to 32%. The company also has taken share in gross gaming revenues (GGR) and, at 26% for the quarter, is leading the industry.

The biggest detractors from ARKK’s performance were Zoom Video Communications, Inc. (ZM or Zoom), Beam Therapeutics, Inc. (BEAM or Beam Therapeutics), Fate Therapeutics, Inc. (FATE or Fate Therapeutics), Intellia Therapeutics, Inc. (NTLA) and Teladoc Health, Inc. (TDOC). Shares of Zoom declined relatively recently after an analyst from Citibank focused on increased competition in the enterprise communications space and negative data points suggesting slower growth generally. We maintain conviction in Zoom’s potential to share most of the enterprise communications platform space with Microsoft Corp. Shares of Beam Therapeutics and Fate Therapeutics also detracted from performance, for the reasons discussed above.

Average Annual Total Returns as of 7/31/23 |

| | 1 Year | 3 Year | 5 Year | Since

Inception

(Annualized) |

ARK Innovation ETF |

Net Asset Value | 11.71% | -13.69% | 3.76% | 12.36% |

Market Price | 11.79% | -13.67% | 3.75% | 12.38% |

S&P 500 Index | 13.02% | 13.72% | 12.20% | 12.08% |

MSCI World Net Index | 13.48% | 11.67% | 9.12% | 8.97% |

Growth of an Assumed $10,000 Investment Since Inception* Through 7/31/23 (At Net Asset Value)

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.arkfunds.com. As stated in the ARK ETFs’ current prospectuses, the expense ratio for ARKK is 0.75%. Additional information about fees and expense levels can be found in the ARK ETFs’ current prospectuses. Net asset value (“NAV”) returns are based on the dollar value of a single share of an ARK ETF, calculated using the value of the underlying assets of the ARK ETF minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times.

The returns for the Fund do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or upon sale of Fund shares.

This graph represents the growth of a hypothetical investment of $10,000. It assumes reinvestment of dividends and capital gains and reflects ongoing fund expenses, but does not reflect sales loads, redemption fees, or the effects of taxes on any capital gains and/or distributions.

8

Table of Contents

Management’s Discussion of Fund Performance (continued) (Unaudited) | | |

Investment Results: ARK Next Generation Internet ETF (ARKW) | |

The ARK Next Generation Internet ETF (ARKW) is an actively managed exchange-traded fund that invests in securities of companies that are relevant to the Fund’s Next Generation Internet investment theme.

During the fiscal year ended July 31, 2023, ARKW outperformed the S&P 500 Index and the MSCI World Net Index.

The top contributors to ARKW’s performance were Shopify, Inc. (SHOP), Coinbase Global, Inc. (COIN), DraftKings, Inc. (DKNG), for reasons discussed above, Roku, Inc. (ROKU) and Grayscale Bitcoin Trust (GBTC).

The biggest detractors from ARKW’s performance were Zoom Video Communications, Inc. (ZM or Zoom), Tesla, Inc. (TSLA), Teladoc Health, Inc. (TDOC or Teladoc), Twilio, Inc. (TWLO) and Vuzix Corp. (VUZI). Shares of Zoom detracted from performance for the reasons discussed above. Shares of Teladoc fell in the third quarter of 2022 following a downgrade by Wall Street analysts, who raised concerns about near term performance. Shares depreciated after the company

reported its fourth-quarter earnings results, which missed Wall Street expectations, and management issued weak guidance. Management attributed the results to macroeconomic challenges affecting both of its revenue segments. Nevertheless, Teladoc expects growth in the portion of its chronic care segment that pertains to diabetes due to the growth in GLP-1 agonist medications. This could prove a significant headwind for this already important care vertical for Teladoc.

Average Annual Total Returns as of 7/31/23 |

| | 1 Year | 3 Year | 5 Year | Since

Inception

(Annualized) |

ARK Next Generation Internet ETF |

Net Asset Value | 23.25% | -11.05% | 7.54% | 17.43% |

Market Price | 23.55% | -11.02% | 7.57% | 17.45% |

S&P 500 Index | 13.02% | 13.72% | 12.20% | 12.08% |

MSCI World Net Index | 13.48% | 11.67% | 9.12% | 8.80% |

Growth of an Assumed $10,000 Investment Since Inception* Through 7/31/23 (At Net Asset Value)

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.arkfunds.com. As stated in the ARK ETFs’ current prospectuses, the expense ratio for ARKW is 0.75%. Additional information about fees and expense levels can be found in the ARK ETFs’ current prospectuses. Net asset value (“NAV”) returns are based on the dollar value of a single share of an ARK ETF, calculated using the value of the underlying assets of the ARK ETF minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times.

The returns for the Fund do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or upon sale of Fund shares.

This graph represents the growth of a hypothetical investment of $10,000. It assumes reinvestment of dividends and capital gains and reflects ongoing fund expenses, but does not reflect sales loads, redemption fees, or the effects of taxes on any capital gains and/or distributions.

9

Table of Contents

Management’s Discussion of Fund Performance (continued) (Unaudited) | |

|

Investment Results: ARK Fintech Innovation ETF (ARKF) | |

The ARK Fintech Innovation ETF (ARKF) is an actively managed exchange-traded fund that invests in securities of companies that are relevant to the Fund’s investment theme of financial technology (“Fintech”) innovation.

During the fiscal year ended July 31, 2023, ARKF outperformed the S&P 500 Index and the MSCI World Net Index.

The top positive contributors to ARKF’s performance were Shopify, Inc. (SHOP), Coinbase Global, Inc. (COIN or Coinbase), DraftKings, Inc. (DKNG), for the reasons discussed above, Global-e Online Ltd. (GLBE), and MercadoLibre, Inc. (MELI).

The biggest detractors from ARKF’s performance were Silvergate Capital Corp. (SICP or Silvergate), Twilio, Inc. (TWLO or Twilio), Teladoc Health, Inc. (TDOC or Teladoc), Z Holdings Corp. (4689 JP), and Sea Ltd. (SE). ARK started exiting its position in Silvergate in early January after losing conviction in the company. In March, Silvergate announced that it had entered Federal Deposit Insurance Corporation (FDIC) receivership and would liquidate assets and wind down operations. Silvergate catered to institutional investors seeking to transfer government issued (fiat) currency to crypto exchanges. Taking fiat deposits and routing them through its Silvergate Exchange Network (SEN), Silvergate grew crypto-related

deposits more than six-fold in two years, from less than $2 billion in early 2020 to approximately $13 billion in 2022. After the collapse of FTX last November, its customers began to draw down deposits, which Silvergate honored initially by liquidating assets on its balance sheet and tapping the Federal Home Loan Bank of San Francisco for a credit line. In early March, citing audit procedures and regulatory inquiries, the company delayed its 10-K filing, and one week later wound up in FDIC receivership. Prior to its demise, several crypto firms, including Coinbase, had moved their banking from Silvergate to other crypto-friendly banks, one of which – Signature Bank – also entered FDIC receivership. Twilio and Teladoc shares also detracted from performance, for the reasons discussed above.

Average Annual Total Returns as of 7/31/23 |

| | 1 Year | 3 Year | 5 Year | Since

Inception

(Annualized) |

ARK Fintech Innovation ETF (ARKF) |

Net Asset Value | 34.92% | -12.49% | – | 4.67% |

Market Price | 35.35% | -12.50% | – | 4.71% |

S&P 500 Index | 13.02% | 13.72% | – | 14.41% |

MSCI World Net Index | 13.48% | 11.67% | – | 11.45% |

Growth of an Assumed $10,000 Investment Since Inception* Through 7/31/23 (At Net Asset Value)

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.arkfunds.com. As stated in the ARK ETFs’ current prospectuses, the expense ratio for ARKF is 0.75%. Additional information about fees and expense levels can be found in the ARK ETFs’ current prospectuses. Net asset value (“NAV”) returns are based on the dollar value of a single share of an ARK ETF, calculated using the value of the underlying assets of the ARK ETF minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the NYSE Arca, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times.

The returns for the Fund do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or upon sale of Fund shares.

This graph represents the growth of a hypothetical investment of $10,000. It assumes reinvestment of dividends and capital gains and reflects ongoing fund expenses, but does not reflect sales loads, redemption fees, or the effects of taxes on any capital gains and/or distributions.

10

Table of Contents

Management’s Discussion of Fund Performance (continued) (Unaudited) | | |

Investment Results: ARK Space Exploration & Innovation ETF (ARKX) | |

The ARK Space Exploration & Innovation ETF (ARKX) is an actively managed exchange-traded fund that invests in securities of companies that are relevant to the Fund’s Space Exploration investment theme. ARK defines “Space Exploration” as leading, enabling, or benefitting from technologically-enabled products and/or services that occur beyond the surface of the Earth.

During the fiscal year ended July 31, 2023, ARKX underperformed the S&P 500 Index and the MSCI World Net Index.

The top positive contributors to ARKX’s performance were Archer Aviation, Inc. (ACHR or Archer Aviation), Iridium Communications, Inc. (IRDM or Iridium), Joby Aviation, Inc. (JOBY or Joby Aviation), Komatsu Ltd. (6301 JP), and Rocket Lab USA, Inc. (RKLB or Rocket Lab). Shares of Archer Aviation rose after the company reported its first-quarter 2023 results and announced former FAA Administrator Billy Nolen as its Chief Safety Officer. This is on the back of a strong second half of 2022, where Archer Aviation continued to execute on its timeline for commercial launch in 2025. Archer Aviation is an aerospace company aiming to revolutionize mobility with its all-electric vertical take-off and landing (eVTOL) products and services. Our research suggests that an eVTOL service operating at scale should be able to transport individuals from big cities to airports in a fraction of the time and at the same price as taxi rides today. Shares of Iridium also contributed to performance, for the reasons discussed above. Shares of Joby Aviation appreciated after the Federal Aviation Administration (FAA) granted the company a Special Airworthiness Certificate enabling tests of its first production prototype in flight – a major milestone for the industry. Throughout the period, Joby Aviation continued to execute on its timeline for commercial launch in 2025. Joby Aviation is an eVTOL company aiming to commercialize operations by 2025.

The biggest detractors from ARKX’s performance were Trimble (TRMB or Trimble), L3Harris Technologies, Inc. (LHX or L3Harris), Velo3D, Inc. (VLD), Blade Air Mobility, Inc. (BLDE), and JD Logistics, Inc. (2618 HK or JD Logistics). Shares of Trimble detracted from performance, for the reasons discussed above. Shares of L3Harris declined along with other industrial names in the first-quarter of 2023 on no meaningful company news. In July of 2023, L3Harris received FTC approval for its proposed acquisition of Aerojet Rocketdyne, after announcing the deal in December 2022. During the second half of 2022, L3Harris received multiple contracts from multiple vendors, including the U.S. Army, and Boeing, amongst others. L3Harris Corporation is a provider of electronic systems with applications in defense, civil government, and commercial activity. Shares of JD Logistics declined on relatively little company specific news and we believe the underperformance is attributed to lower investor confidence in China as the June Purchasing Managers Index came in lower than expected and concerns mounted over Chinese companies lagging in artificial intelligence capability. JD Logistics is a pioneer in integrated supply-chain services in China and focused on investing in logistics robotics. The company offers warehousing and distribution, express delivery, bulk delivery, cold chain logistics, cross-border import and export, overseas logistics, and international transport services. ARK believes JD Logistics is well-positioned to capture a larger share of supply-chain and fulfillment services in China over the next 5-10 years.

Average Annual Total Returns as of 7/31/23 |

| | 1 Year | 3 Year | 5 Year | Since

Inception

(Annualized) |

ARK Space Exploration & Innovation ETF (ARKX) |

Net Asset Value | 4.27% | – | – | -10.16% |

Market Price | 4.42% | – | – | -10.11% |

S&P 500 Index | 13.02% | – | – | 8.19% |

MSCI World Net Index | 13.48% | – | – | 5.50% |

Growth of an Assumed $10,000 Investment Since Inception* Through 7/31/23 (At Net Asset Value)

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.arkfunds.com. As stated in the ARK ETFs’ current prospectuses, the expense ratio for ARKX is 0.75%. Additional information about fees and expense levels can be found in the ARK ETFs’ current prospectuses. Net asset value (“NAV”) returns are based on the dollar value of a single share of an ARK ETF, calculated using the value of the underlying assets of the ARK ETF minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the Cboe BZX Exchange, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times.

The returns for the Fund do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or upon sale of Fund shares.

This graph represents the growth of a hypothetical investment of $10,000. It assumes reinvestment of dividends and capital gains and reflects ongoing fund expenses, but does not reflect sales loads, redemption fees, or the effects of taxes on any capital gains and/or distributions.

11

Table of Contents

Management’s Discussion of Fund Performance (continued) (Unaudited) | |

|

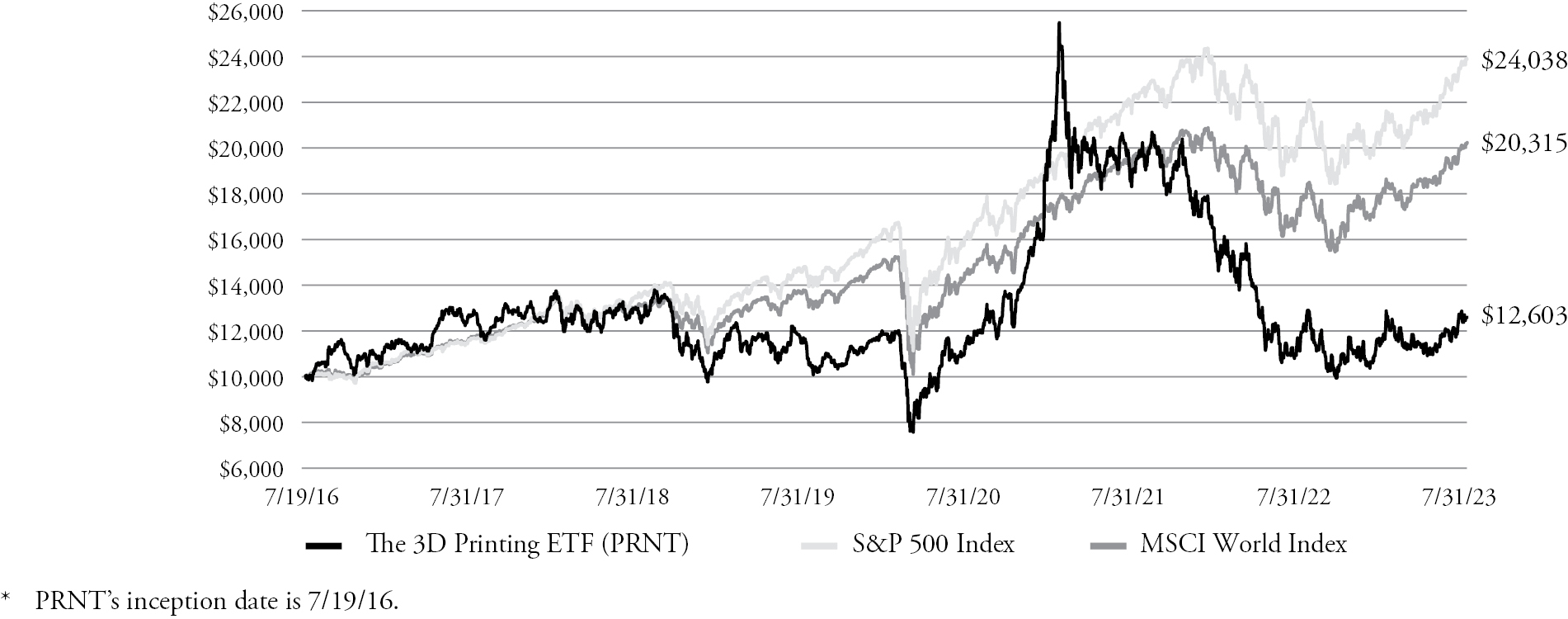

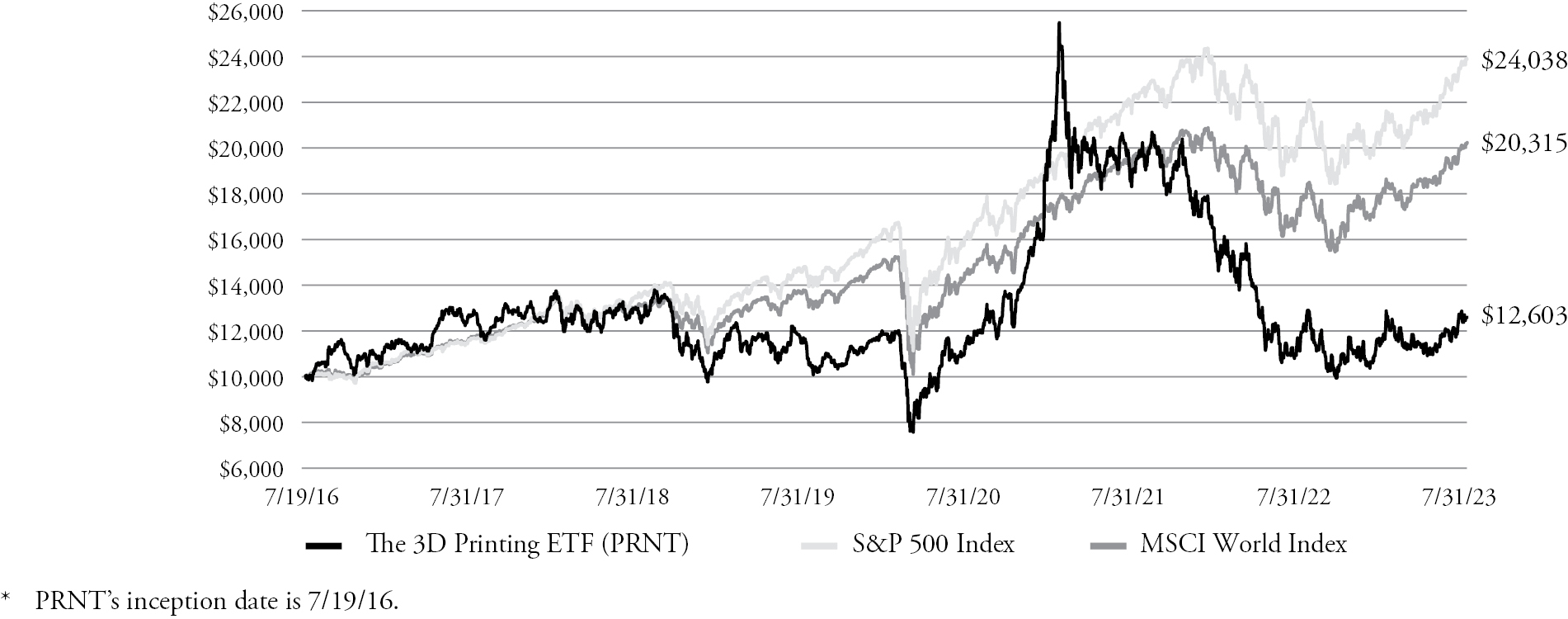

Investment Results: The 3D Printing ETF (PRNT) | |

The 3D Printing ETF (PRNT) is an indexed exchange-traded fund that seeks investment results corresponding to the performance of the Total 3D-Printing Index, which tracks the price movements of the stocks in the industry. The 3D Printing ETF is the only pure-play ETF dedicated to the 3D printing ecosystem.

During the fiscal year ended July 31, 2023, PRNT underperformed the S&P 500 Index and the MSCI World Net Index.

The top positive contributors to PRNT’s performance were BICO Group AB (BICO SS or BICO), Nikon Corp. (AM3D GR), Markforged Holding Corp. (MKFG), Altair Engineering, Inc. (ALTR), and Straumann Holding AG (STMN SW). Shares of BICO, a biotechnology company specializing in 3D bioprinting, were the largest positive contributor to PRNT’s performance based on news that Sartorius, the German-based life sciences company, acquired a 10% stake in the company and will collaborate on 3D cell printing and other digital solutions for cell line development workflows.

The biggest detractors from PRNT’s performance were FARO Technologies, Inc. (FARO), Fathom Digital Manufacturing Corporation (FATH), Materialise NV (MTLS), Velo3D, Inc. (VLD or Velo3D), and Trimble, Inc. (TRMB). Velo3D and Trimble detracted from performance for the reasons outlined above.

Average Annual Total Returns as of 7/31/23 |

| | 1 Year | 3 Year | 5 Year | Since

Inception

(Annualized) |

ARK The 3D Printing ETF (PRNT) |

Net Asset Value | 5.61% | 3.16% | 0.37% | 3.34% |

Market Price | 5.48% | 3.30% | 0.27% | 3.33% |

S&P 500 Index | 13.02% | 13.72% | 12.20% | 13.29% |

MSCI World Net Index | 13.48% | 11.67% | 9.12% | 10.60% |

Growth of an Assumed $10,000 Investment Since Inception* Through 7/31/23 (At Net Asset Value)

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.arkfunds.com. As stated in the ARK ETFs’ current prospectuses, the expense ratio for PRNT is 0.66%. Additional information about fees and expense levels can be found in the ARK ETFs’ current prospectuses. Net asset value (“NAV”) returns are based on the dollar value of a single share of an ARK ETF, calculated using the value of the underlying assets of the ARK ETF minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the Cboe BZX Exchange, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times.

The returns for the Fund do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or upon sale of Fund shares.

This graph represents the growth of a hypothetical investment of $10,000. It assumes reinvestment of dividends and capital gains and reflects ongoing fund expenses, but does not reflect sales loads, redemption fees, or the effects of taxes on any capital gains and/or distributions.

12

Table of Contents

Management’s Discussion of Fund Performance (concluded) (Unaudited) | | |

Investment Results: ARK Israel Innovative Technology ETF (IZRL) | |

The ARK Israel Innovative Technology ETF (IZRL) is an indexed exchange-traded fund that seeks investment results corresponding to the performance of the ARK Israeli Innovation Index, which is designed to track the price movements of exchange-listed Israeli companies whose main business operations are causing disruptive innovation in the areas of genomics, biotechnology, industrials, manufacturing, the Internet, and/or information technology.

During the fiscal year ended July 31, 2023, IZRL underperformed the S&P 500 Index and the MSCI World Net Index.

The top positive contributors to IZRL’s performance were Urogen Pharma Ltd. (URGN), Taboola.com Ltd. (TBLA), Perion Network Ltd. (PERI), Nano-X Imaging Ltd. (NNOX or Nano-X Imaging), and Camtek Ltd. (CAMT). Shares of Nano-X Imaging appreciated in the second quarter of 2023 after the US Food and Drug Administration (FDA) granted the company clearance under Section 510(k) of the Food, Drug and Cosmetic Act to market the Nanox.ARC X-ray system, which complements conventional radiography with tomographic images of the human musculoskeletal system. Nano-X Imaging is focused on applying its proprietary medical imaging technology to make diagnostic medicine more accessible and affordable.

The biggest detractors from IZRL’s performance were HUB Cyber Security Ltd. (HUBC), SatixFy Communications Ltd. (SATX or SatixFy), Audiocodes Ltd. (AUDC), Allot Ltd. (ALLT), and Partners Communications (PTNR). Shares of SatixFy, a leader in next-generation satellite communication systems based on in-house-developed chipsets, declined after Chief Executive Officer Ido Gur announced that he was leaving the company in the second quarter of 2023. The company's former Chief Commercial Officer, Nir Barkan, returned as acting Chief Executive Officer on June 1, 2023. The company has seen several leadership changes since its founder, Yoel Gat, passed away in 2022.

Average Annual Total Returns as of 7/31/23 |

| | 1 Year | 3 Year | 5 Year | Since

Inception

(Annualized) |

ARK Israel Innovative Technology ETF (IZRL) |

Net Asset Value | 3.72% | -6.93% | 0.36% | 1.06% |

Market Price | 3.67% | -6.63% | 0.17% | 1.05% |

S&P 500 Index | 13.02% | 13.72% | 12.20% | 12.22% |

MSCI World Net Index | 13.48% | 11.67% | 9.12% | 9.02% |

Growth of an Assumed $10,000 Investment Since Inception* Through 7/31/23 (At Net Asset Value)

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.arkfunds.com. As stated in the ARK ETFs’ current prospectuses, the expense ratio for IZRL is 0.49%. Additional information about fees and expense levels can be found in the ARK ETFs’ current prospectuses. Net asset value (“NAV”) returns are based on the dollar value of a single share of an ARK ETF, calculated using the value of the underlying assets of the ARK ETF minus its liabilities, divided by the number of shares outstanding. The NAV is typically calculated at 4:00 pm Eastern time on each business day the New York Stock Exchange is open for trading. Market returns are based on the trade price at which shares are bought and sold on the Cboe BZX Exchange, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times.

The returns for the Fund do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or upon sale of Fund shares. Returns for less than one year are not annualized.

This graph represents the growth of a hypothetical investment of $10,000. It assumes reinvestment of dividends and capital gains and reflects ongoing fund expenses, but does not reflect sales loads, redemption fees, or the effects of taxes on any capital gains and/or distributions.

13

Table of Contents

Portfolio holdings will change and should not be considered as investment advice or a recommendation to buy, sell or hold any particular security. Please visit www.ark-funds.com for the most current list of portfolio holdings for the ARK ETFs.

The S&P 500 Index is a widely recognized capitalization-weighted index that measures the performance of the large-capitalization sector of the U.S. stock market. The MSCI World Index represents large and mid-cap equity performance across 23 developed markets. Returns shown for the MSCI World Index are net of foreign withholding taxes applicable to U.S. investors. Securities indexes assume reinvestment of all distributions and interest payments and do not take into account brokerage fees or taxes. Index performance information was furnished by sources deemed reliable and is believed to be accurate, however, no warranty or representation is made as to the accuracy thereof and the information is subject to correction. You cannot invest directly in an index, securities in an ARK ETF will not exactly match those in an index, and performance of an ARK ETF will differ from the performance of an index. Although reinvestment of dividend and interest payments is assumed, no expenses are netted against an index’s returns.

14

Table of Contents

Shareholder Expense Examples (Unaudited) | | |

| | |

As a shareholder of an ARK ETF (each, a “Fund” and collectively, “Funds”) you incur two types of costs: (1) transaction costs for purchasing and selling shares; and (2) ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

The examples below are based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period (February 1, 2023 through July 31, 2023).

Actual Expenses

The first line under each Fund in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second line under each Fund in the table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate your actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line under each Fund in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning

Account Value

2/1/2023 | Ending

Account Value

7/31/2023 | Annualized

Expense Ratios

for the Period | Expenses Paid

During the

Period(a) |

ARK Genomic Revolution ETF | | | | |

Actual | $1,000.00 | $1,126.10 | 0.75% | $7.97 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,021.42 | 0.75% | $3.82 |

ARK Autonomous Technology & Robotics ETF | | | | |

Actual | $1,000.00 | $1,210.00 | 0.75% | $8.29 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,021.42 | 0.75% | $3.82 |

ARK Innovation ETF | | | | |

Actual | $1,000.00 | $1,263.50 | 0.75% | $8.49 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,021.42 | 0.75% | $3.82 |

ARK Next Generation Internet ETF | | | | |

Actual | $1,000.00 | $1,351.30 | 0.75% | $8.82 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,021.42 | 0.75% | $3.82 |

ARK Fintech Innovation ETF | | | | |

Actual | $1,000.00 | $1,312.70 | 0.75% | $8.68 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,021.42 | 0.75% | $3.83 |

ARK Space Exploration & Innovation ETF | | | | |

Actual | $1,000.00 | $1,113.60 | 0.71% | $7.54 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,021.61 | 0.71% | $3.63 |

The 3D Printing ETF | | | | |

Actual | $1,000.00 | $1,062.50 | 0.66% | $6.81 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,021.88 | 0.66% | $3.37 |

ARK Israel Innovative Technology ETF | | | | |

Actual | $1,000.00 | $1,071.10 | 0.49% | $5.11 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,022.72 | 0.49% | $2.52 |

15

Table of Contents

Sector Diversification (as a percentage of total investments) July 31, 2023 (Unaudited) | |

|

| | |

16

Table of Contents

Sector Diversification (as a percentage of total investments) (concluded) July 31, 2023 (Unaudited) | | |

| | |

17

Table of Contents

Schedule of Investments

ARK Genomic Revolution ETF | |

|

July 31, 2023 | | |

Investments | | Shares | | Value |

COMMON STOCKS – 99.5% |

Biotechnology – 49.9% | | | | | |

Arcturus Therapeutics Holdings, Inc.*† | | 1,969,031 | | $ | 68,837,324 |

Beam Therapeutics, Inc.* | | 2,172,166 | | | 67,054,764 |

CareDx, Inc.*† | | 6,916,159 | | | 75,455,294 |

Compass Pathways PLC (United Kingdom)*†(a) | | 2,518,187 | | | 23,469,503 |

CRISPR Therapeutics AG (Switzerland)* | | 1,539,505 | | | 88,259,822 |

Exact Sciences Corp.* | | 2,661,490 | | | 259,601,735 |

Incyte Corp.* | | 511,078 | | | 32,565,890 |

Intellia Therapeutics, Inc.* | | 1,931,374 | | | 81,755,061 |

Ionis Pharmaceuticals, Inc.* | | 2,500,627 | | | 103,600,977 |

Iovance Biotherapeutics, Inc.* | | 34,852 | | | 253,025 |

Moderna, Inc.* | | 248,031 | | | 29,183,327 |

Nurix Therapeutics, Inc.* | | 2,333,922 | | | 22,662,383 |

Prime Medicine, Inc.* | | 2,222,737 | | | 33,496,647 |

Recursion Pharmaceuticals, Inc., Class A* | | 5,050,199 | | | 71,308,810 |

Regeneron Pharmaceuticals, Inc.* | | 33,257 | | | 24,673,701 |

Repare Therapeutics, Inc. (Canada)*† | | 2,713,177 | | | 24,961,228 |

Senti Biosciences, Inc.* | | 2,125,632 | | | 1,832,295 |

Surface Oncology, Inc.* | | 65 | | | 63 |

Twist Bioscience Corp.*† | | 2,966,854 | | | 72,213,227 |

Veracyte, Inc.* | | 2,198,419 | | | 60,346,601 |

Vertex Pharmaceuticals, Inc.* | | 119,371 | | | 42,059,178 |

Verve Therapeutics, Inc.* | | 2,968,983 | | | 60,834,462 |

Total Biotechnology | | | | | 1,244,425,317 |

Chemicals – 5.1% | | | | | |

Ginkgo Bioworks Holdings, Inc.* | | 50,687,267 | | | 127,225,040 |

Electronic Equipment, Instruments & Components – 1.1% |

908 Devices, Inc.*† | | 4,100,372 | | | 28,538,589 |

Health Care Equipment & Supplies – 2.2% |

Butterfly Network, Inc.*† | | 13,161,198 | | | 33,824,279 |

Cerus Corp.* | | 6,515,227 | | | 20,001,747 |

Total Health Care Equipment & Supplies | | | | | 53,826,026 |

Health Care Providers & Services – 5.0% | | | | | |

Accolade, Inc.*† | | 5,939,451 | | | 89,210,554 |

Guardant Health, Inc.* | | 593,523 | | | 23,159,268 |

Invitae Corp.* | | 8,742,543 | | | 12,414,411 |

Total Health Care Providers & Services | | | | | 124,784,233 |

Health Care Technology – 13.8% | | | | | |

Schrodinger, Inc.*† | | 3,507,238 | | | 183,463,620 |

Teladoc Health, Inc.* | | 4,051,438 | | | 120,611,309 |

Veeva Systems, Inc., Class A* | | 206,921 | | | 42,257,407 |

Total Health Care Technology | | | | | 346,332,336 |

Investments | | Shares | | Value |

Life Sciences Tools & Services – 16.3% |

10X Genomics, Inc., Class A* | | 754,125 | | $ | 47,494,792 |

Adaptive Biotechnologies Corp.*† | | 11,045,837 | | | 93,226,864 |

Codexis, Inc.*† | | 3,483,766 | | | 12,541,558 |

Pacific Biosciences of California, Inc.* | | 11,299,896 | | | 149,271,626 |

Personalis, Inc.*† | | 5,920,884 | | | 13,973,286 |

PhenomeX, Inc.* | | 2,284,158 | | | 1,256,287 |

Quantum-Si, Inc.*† | | 14,809,603 | | | 57,609,356 |

SomaLogic, Inc.*† | | 13,104,112 | | | 32,105,075 |

Total Life Sciences Tools & Services | | | | | 407,478,844 |

Pharmaceuticals – 0.7% |

Pfizer, Inc. | | 480,489 | | | 17,326,433 |

Semiconductors & Semiconductor Equipment – 2.7% |

NVIDIA Corp. | | 142,955 | | | 66,801,442 |

Software – 2.7% |

UiPath, Inc., Class A* | | 3,762,819 | | | 68,031,767 |

Total Common Stocks

(Cost $5,894,348,071) | | | | | 2,484,770,027 |

MONEY MARKET FUND – 0.2% |

Goldman Sachs Financial Square Treasury Obligations Fund, 5.15%(b)

(Cost $5,005,878) | | 5,005,878 | | | 5,005,878 |

Total Investments – 99.7%

(Cost $5,899,353,949) | | | | | 2,489,775,905 |

Other Assets in Excess of Liabilities – 0.3% | | | | | 6,885,694 |

Net Assets – 100.0% | | | | $ | 2,496,661,599 |

See accompanying Notes to Financial Statements.

18

Table of Contents

Schedule of Investments (continued)

ARK Genomic Revolution ETF | | |

July 31, 2023 | | |

Affiliated Issuer Transactions

An affiliated company is a company in which the Fund has ownership of at least 5% of the total outstanding voting securities, or a company that is under common ownership or control. Fiscal year-to-date transactions with companies which are or were affiliates are as follows:

Value ($) at 7/31/2022 | Purchases

Cost

($) | Sales

Proceeds

($) | Net Realized

Gain/(Loss)

($) | Net Change in

Unrealized

Appreciation

(Depreciation)

($) | Dividend

Income

($) | Capital Gain Distributions

($) | Number of

Shares at

7/31/2023 | Value ($) at

7/31/2023 |

Common Stocks — 32.4% | | | | | | | | |

Biotechnology — 10.6% | | | | | | | | |

Arcturus Therapeutics Holdings, Inc. |

39,811,175 | 25,897,252 | (29,756,551) | (8,514,840) | 41,400,288 | — | — | 1,969,031 | 68,837,324 |

CareDx, Inc. | | | | | | | | |

104,441,573 | 104,510,770 | (61,129,316) | (245,330) | (72,122,403) | — | — | 6,916,159 | 75,455,294 |

Compass Pathways PLC | | | | | | | | |

— | 38,465,114 | (10,211,294) | 360,603 | (5,144,920) | — | — | 2,518,187 | 23,469,503 |

Repare Therapeutics, Inc. | | | | | | | | |

34,591,003 | 23,493,363 | (23,854,949) | (5,758,323) | (3,509,866) | — | — | 2,713,177 | 24,961,228 |

Surface Oncology, Inc.^ | | | | | | | | |

10,813,242 | 3,018,275 | (8,578,286) | (44,886,210) | 39,633,042 | — | — | 65 | 63 |

Twist Bioscience Corp. | | | | | | | | |

113,950,836 | 62,653,287 | (54,194,027) | (7,429,768) | (42,767,101) | — | — | 2,966,854 | 72,213,227 |

Chemicals — 0.0% | | | | | | | | |

Zymergen, Inc.^ | | | | | | | | |

19,213,895 | 2,867,953 | (20,336,476) | (46,330,747) | 44,585,375 | — | — | — | — |

Electronic Equipment, Instruments & Components — 1.1% |

908 Devices, Inc. | | | | | | | | |

80,344,058 | 39,336,495 | (32,015,198) | (2,639,751) | (56,487,015) | — | — | 4,100,372 | 28,538,589 |

Health Care Equipment & Supplies — 1.4% |

Butterfly Network, Inc. | | | | | | | | |

36,949,002 | 44,558,754 | (27,220,759) | (6,361,516) | (14,101,202) | — | — | 13,161,198 | 33,824,279 |

Health Care Providers & Services — 3.6% |

Accolade, Inc. | | | | | | | | |

56,841,976 | 47,774,905 | (48,145,598) | 7,037,183 | 25,702,088 | — | — | 5,939,451 | 89,210,554 |

Health Care Technology — 7.3% |

Schrodinger, Inc. | | | | | | | | |

107,424,667 | 94,847,051 | (96,786,412) | (16,303,457) | 94,281,771 | — | — | 3,507,238 | 183,463,620 |

Life Sciences Tools & Services — 8.4% |

Adaptive Biotechnologies Corp. |

79,152,238 | 77,051,061 | (57,403,646) | 811,091 | (6,383,880) | — | — | 11,045,837 | 93,226,864 |

Codexis, Inc. |

30,479,069 | 15,237,887 | (18,659,742) | (19,815,503) | 5,299,847 | — | — | 3,483,766 | 12,541,558 |

Pacific Biosciences of California, Inc.^ |

52,499,699 | 74,394,233 | (78,653,072) | (831,625) | 101,862,391 | — | — | 11,299,896 | 149,271,626 |

Personalis, Inc. | | | | | | | | |

19,984,442 | 13,133,752 | (11,620,198) | (290,099) | (7,234,611) | — | — | 5,920,884 | 13,973,286 |

Quantum-Si, Inc. |

37,961,956 | 27,566,988 | (20,234,601) | (2,809,371) | 15,124,384 | — | — | 14,809,603 | 57,609,356 |

SomaLogic, Inc. |

43,910,861 | 36,077,869 | (22,977,946) | 309,528 | (25,215,237) | — | — | 13,104,112 | 32,105,075 |

$868,369,692 | $730,885,009 | $(621,778,071) | $(153,698,135) | $134,922,951 | $ — | $ — | 103,455,830 | $958,701,446 |

See accompanying Notes to Financial Statements.

19

Table of Contents

Schedule of Investments (continued) ARK Genomic Revolution ETF | |

|

July 31, 2023 | | |

Fair Value Measurement

The Fund discloses the fair value of its investments in a hierarchy that distinguishes between: (i) market participant assumptions developed based on market data obtained from sources independent of the Fund (observable inputs) and (ii) the Fund’s own assumptions about market participant assumptions developed based on the best information available under the circumstances (unobservable inputs). The three levels defined by the hierarchy are as follows:

• Level 1 – Quoted prices in active markets for identical assets.

• Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

• Level 3 – Significant unobservable inputs (including each Fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the valuations as of July 31, 2023, based upon the three levels defined above:

ARK Genomic Revolution ETF | Level 1 | Level 2 | Level 3 | Total |

Assets | | | | |

Common Stocks‡ | $2,484,770,027 | $ — | $ — | $2,484,770,027 |

Money Market Fund | 5,005,878 | — | — | 5,005,878 |

Total | $2,489,775,905 | $ — | $ — | $2,489,775,905 |

See accompanying Notes to Financial Statements.

20

Table of Contents

Schedule of Investments ARK Autonomous Technology & Robotics ETF | | |

July 31, 2023 | | |

Investments | | Shares | | Value |

COMMON STOCKS – 100.0% | | | | | |

Aerospace & Defense – 18.4% | | | | | |

AeroVironment, Inc.* | | 391,760 | | $ | 37,319,058 |

Archer Aviation, Inc., Class A* | | 7,384,416 | | | 49,697,120 |

Elbit Systems Ltd. (Israel) | | 84,645 | | | 17,964,208 |

Kratos Defense & Security Solutions, Inc.* | | 5,339,302 | | | 80,570,067 |

Lockheed Martin Corp. | | 20,724 | | | 9,250,572 |

Rocket Lab USA, Inc.* | | 2,773,566 | | | 20,441,181 |

Total Aerospace & Defense | | | | | 215,242,206 |

Automobile Components – 1.8% | | | | | |

Magna International, Inc. (Canada) | | 336,045 | | | 21,617,775 |

Automobiles – 15.5% | | | | | |

BYD Co. Ltd. (China)(a) | | 192,577 | | | 13,740,369 |

General Motors Co. | | 304,510 | | | 11,684,048 |

Tesla, Inc.* | | 584,611 | | | 156,342,520 |

Total Automobiles | | | | | 181,766,937 |

Diversified Consumer Services – 0.3% | | | | | |

2U, Inc.* | | 610,488 | | | 2,918,133 |

Diversified Telecommunication – 6.3% | | | | | |

Iridium Communications, Inc. | | 1,404,007 | | | 73,780,568 |

Electronic Equipment, Instruments & Components – 8.8% |

Teledyne Technologies, Inc.* | | 33,073 | | | 12,717,561 |

Trimble, Inc.* | | 1,400,580 | | | 75,351,204 |

Vuzix Corp.* | | 2,872,879 | | | 15,168,801 |

Total Electronic Equipment, Instruments & Components | | | | | 103,237,566 |

Health Care Equipment & Supplies – 1.5% | | | | | |

Intuitive Surgical, Inc.* | | 52,874 | | | 17,152,325 |

Interactive Media & Services – 2.2% | | | | | |

Alphabet, Inc., Class C* | | 193,833 | | | 25,801,111 |

Machinery – 14.6% | | | | | |

3D Systems Corp.* | | 2,618,519 | | | 22,807,301 |

Caterpillar, Inc. | | 75,491 | | | 20,017,949 |

Deere & Co. | | 97,879 | | | 42,048,818 |

Komatsu Ltd. (Japan)(a) | | 1,583,441 | | | 44,447,189 |

Markforged Holding Corp.*† | | 11,916,443 | | | 24,905,366 |

Velo3D, Inc.* | | 7,174,860 | | | 16,430,429 |

Total Machinery | | | | | 170,657,052 |

Oil, Gas & Consumable Fuels – 1.1% | | | | | |

Cameco Corp. (Canada) | | 350,520 | | | 12,324,283 |

Passenger Airlines – 3.5% | | | | | |

Blade Air Mobility, Inc.*† | | 5,323,376 | | | 22,198,478 |

Joby Aviation, Inc.* | | 2,058,238 | | | 18,421,230 |

Total Passenger Airlines | | | | | 40,619,708 |

Investments | | Shares | | Value |

Semiconductors & Semiconductor Equipment – 11.3% | | | | |

Advanced Micro Devices, Inc.* | | 47,959 | | $ | 5,486,510 | |

NVIDIA Corp. | | 72,011 | | | 33,650,020 | |

Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan)(a) | | 174,634 | | | 17,314,961 | |

Teradyne, Inc. | | 674,600 | | | 76,189,324 | |

Total Semiconductors & Semiconductor Equipment | | | | | 132,640,815 | |

Software – 13.6% | | | | | | |

ANSYS, Inc.* | | 45,707 | | | 15,636,365 | |

Materialise NV (Belgium)*(a) | | 1,065,971 | | | 8,506,448 | |

Synopsys, Inc.* | | 35,915 | | | 16,226,397 | |

UiPath, Inc., Class A* | | 5,289,928 | | | 95,641,898 | |

Unity Software, Inc.* | | 511,362 | | | 23,440,834 | |

Total Software | | | | | 159,451,942 | |

Technology Hardware, Storage & Peripherals – 1.1% | | | | |

Stratasys Ltd.* | | 739,231 | | | 13,402,258 | |

Total Common Stocks

(Cost $1,594,485,037) | | | | | 1,170,612,679 | |

MONEY MARKET FUND – 0.0%(b) | | | | | | |

Goldman Sachs Financial Square Treasury Obligations Fund, 5.15%(c)

(Cost $409,920) | | 409,920 | | | 409,920 | |

Total Investments – 100.0%

(Cost $1,594,894,957) | | | | | 1,171,022,599 | |

Liabilities in Excess of Other Assets – (0.0)%(b) | | | (364,875 | ) |

Net Assets – 100.0% | | | | $ | 1,170,657,724 | |

See accompanying Notes to Financial Statements.

21

Table of Contents

Schedule of Investments (continued)

ARK Autonomous Technology & Robotics ETF | |

|

July 31, 2023 | | |

Affiliated Issuer Transactions

An affiliated company is a company in which the Fund has ownership of at least 5% of the total outstanding voting securities, or a company that is under common ownership or control. Fiscal year-to-date transactions with companies which are or were affiliates are as follows:

Value ($) at 7/31/2022 |

Purchases

Cost

($)

|

Sales

Proceeds

($)

|

Net Realized

Gain/(Loss)

($)

| Net Change in

Unrealized

Appreciation

(Depreciation)

($) |

Dividend

Income

($)

|

Capital Gain

Distributions

($)

|

Number of

Shares at

7/31/2023

|

Value ($) at

7/31/2023

|

Common Stocks — 4.0% | | | | | | | | |

Aerospace & Defense — 0.0% | | | | | | | | |

Kratos Defense & Security Solutions, Inc.^ | | | | | | |

96,360,376 | 5,128,622 | (21,118,635) | (23,646,203) | 23,845,907 | — | — | 5,339,302 | 80,570,067 |

Machinery — 2.1% | | | | | | | | |

Markforged Holding Corp. | | | | | | | | |

21,267,591 | 6,977,087 | (2,581,133) | (990,333) | 232,154 | — | — | 11,916,443 | 24,905,366 |

Passenger Airlines — 1.9% | | | | | | | | |

Blade Air Mobility, Inc. | | | | | | | | |

32,091,985 | 1,290,966 | (3,367,709) | (3,386,785) | (4,429,979) | — | — | 5,323,376 | 22,198,478 |

$149,719,952 | $13,396,675 | $(27,067,477) | $(28,023,321) | $19,648,082 | $ — | $ — | 22,579,121 | $127,673,911 |

Fair Value Measurement

The Fund discloses the fair value of its investments in a hierarchy that distinguishes between: (i) market participant assumptions developed based on market data obtained from sources independent of the Fund (observable inputs) and (ii) the Fund’s own assumptions about market participant assumptions developed based on the best information available under the circumstances (unobservable inputs). The three levels defined by the hierarchy are as follows:

• Level 1 – Quoted prices in active markets for identical assets.

• Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

• Level 3 – Significant unobservable inputs (including each Fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the valuations as of July 31, 2023, based upon the three levels defined above:

ARK Autonomous

Technology &

Robotics ETF | |

Level 1

| |

Level 2

| |

Level 3

| |

Total

|

Assets | | | | | | | | |

Common Stocks‡ | | $1,170,612,679 | | $ — | | $ — | | $1,170,612,679 |

Money Market Fund | | 409,920 | | — | | — | | 409,920 |

Total | | $1,171,022,599 | | $ — | | $ — | | $1,171,022,599 |

See accompanying Notes to Financial Statements.

22

Table of Contents

Schedule of Investments

ARK Innovation ETF | | |

July 31, 2023 | | |

Investments | | Shares | | Value |

COMMON STOCKS – 99.9% | | | | | |

Automobiles – 10.1% | | | | | |

Tesla, Inc.* | | 3,526,119 | | $ | 942,990,004 |

Biotechnology – 15.5% | | | | | |

Beam Therapeutics, Inc.*† | | 6,079,245 | | | 187,666,293 |

CRISPR Therapeutics AG (Switzerland)*† | | 5,272,758 | | | 302,287,216 |

Exact Sciences Corp.* | | 4,136,732 | | | 403,496,840 |

Intellia Therapeutics, Inc.*† | | 6,758,894 | | | 286,103,983 |

Twist Bioscience Corp.*† | | 3,732,917 | | | 90,859,200 |

Veracyte, Inc.*† | | 4,544,089 | | | 124,735,243 |

Verve Therapeutics, Inc.* | | 2,274,127 | | | 46,596,862 |

Total Biotechnology | | | | | 1,441,745,637 |

Capital Markets – 10.8% | | | | | |

Coinbase Global, Inc., Class A* | | 7,600,911 | | | 749,525,834 |

Robinhood Markets, Inc., Class A* | | 20,163,255 | | | 259,299,459 |

Total Capital Markets | | | | | 1,008,825,293 |

Chemicals – 3.1% | | | | | |

Ginkgo Bioworks Holdings, Inc.*† | | 114,951,623 | | | 288,528,574 |

Diversified Consumer Services – 0.3% | | | |

2U, Inc.*† | | 6,016,113 | | | 28,757,020 |

Entertainment – 12.3% | | | | | |

ROBLOX Corp., Class A* | | 6,854,805 | | | 269,051,096 |

Roku, Inc.*† | | 9,097,337 | | | 875,800,633 |

Total Entertainment | | | | | 1,144,851,729 |

Financial Services – 6.3% | | | | | |

Block, Inc.* | | 7,254,485 | | | 584,203,677 |

Health Care Equipment & Supplies – 0.5% | | | |

Cerus Corp.*† | | 13,396,623 | | | 41,127,633 |

Health Care Providers & Services – 0.3% | | | |

Invitae Corp.*† | | 19,358,067 | | | 27,488,455 |

Health Care Technology – 3.9% | | | | | |

Teladoc Health, Inc.*† | | 12,268,555 | | | 365,234,882 |

Hotels, Restaurants & Leisure – 4.2% | | | | | |

DraftKings, Inc., Class A* | | 12,350,507 | | | 392,499,112 |

Interactive Media & Services – 0.8% | | | | | |

Meta Platforms, Inc., Class A* | | 223,228 | | | 71,120,441 |

IT Services – 7.7% | | | | | |

Shopify, Inc., Class A (Canada)* | | 5,572,258 | | | 376,573,196 |