- NAVI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFR14A Filing

Navient (NAVI) DEFR14ARevised proxy

Filed: 17 Apr 24, 4:20pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 1)

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

|

|

☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ | Definitive Proxy Statement |

|

|

☐ | Definitive Additional Materials |

|

|

☐ | Soliciting Material Pursuant to Section 240.14a-12 |

Navient Corporation |

(Name of Registrant as Specified in Its Charter) |

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of filing fee (check all boxes that apply):

☒ | No fee required. |

|

|

☐ | Fee paid previously with preliminary materials. |

|

|

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

EXPLANATORY NOTE

Navient Corporation is filing this Amendment No. 1 to its definitive proxy statement on Schedule 14A (the “Proxy Statement”), originally filed with the Securities and Exchange Commission (the “SEC”) on April 11, 2024 (the “Original Filing”), for the purpose of (i) including the cover page required under 17 CFR § 240.14a-101 that was inadvertently omitted from the Original Filing; (ii) clarifying the “Voting Options”, “Vote Required for Approval” and “Abstentions” correcting certain columns in the table on page 20 of the Original Filing and conforming certain corresponding disclosures on page 11 of the Original Filing; (iii) revising the formatting of our Board Diversity Matrix included on page 13 of the Original Filing; (iv) reflecting certain clarifying edits to our pay versus performance disclosure; (v) attaching a copy of our proxy card and (vi) updating page numbers to reflect the page numbers of this Proxy Statement.

Except as described above, no other changes have been made to the Original Filing, and this Proxy Statement does not modify, amend or update any of the other information contained in the Original Filing. The information contained in this Proxy Statement is as of the date of the Original Filing and does not reflect any information or events occurring after the date of the Original Filing.

| 2024 Proxy Statement |

|

| 2024 Proxy Statement |

| 2 |

| 2024 Proxy Statement |

| 3 |

13865 Sunrise Valley Drive

Herndon, Virginia 20171

April 11, 2024

Dear Fellow Shareholders:

Please join us for Navient’s 2024 Annual Meeting of Shareholders, which will be held virtually on Thursday, May 23, at 8:00 a.m., Eastern Daylight Time. Read on for instructions on how to participate in the meeting.

Navient is focused on meeting the needs of our customers and clients, while at the same time carrying out strategic actions that we believe will establish a new foundation for future success. As announced in January, we are working to simplify our company, reduce our expense base, and enhance our flexibility as a result of an in-depth review overseen by the Board of Directors.

We are carrying out three strategic actions that we expect will be largely complete over the next 18 to 24 months:

| · | Adopt a variable, outsourced servicing model. Navient has entered into a binding letter of intent that will transition our student loan servicing to MOHELA, a leading provider of student loan servicing for government and commercial enterprises. This transaction is intended to create a variable cost structure for the servicing of our student loan portfolios and provides attractive unit economics across a wide range of servicing volume scenarios. Navient and MOHELA will work toward ensuring a seamless transition in the coming months and providing customers with uninterrupted servicing of their loans. |

|

|

|

| · | Explore strategic options for the business processing division. Navient has launched a process to explore a range of value-creating options for our business processing division. Through various subsidiary brands, this division provides high-quality business processing services for a variety of government and healthcare clients, including hospitals, toll-road authorities, state revenue divisions, and federal agencies. With the decision to outsource student loan servicing, exploring options for the business processing division increases the opportunities for shared cost reduction. Navient is working with financial and legal advisors to assist the company in exploring strategic options for this division, which may include a sale of the division in whole or in part. |

|

|

|

| · | Streamline shared services infrastructure and corporate footprint. As we implement these actions, we also plan to reshape our shared services functions and corporate footprint to align with the needs of a more focused, flexible and streamlined company. |

Over the longer-term, we believe these actions will increase the value shareholders derive from our loan portfolios and the returns we can achieve on business-building investments. We look forward to sharing future updates.

In the meantime, at our Annual Meeting, we will consider the matters described in this proxy statement. This document contains important information, and we urge you to read it carefully. Your vote is important, and we strongly encourage you to vote your shares using one of the voting methods described in this proxy statement.

We are again making our proxy materials available to you electronically. We hope that this continues to offer you a convenient way to review the materials while continuing to allow us to reduce our environmental footprint and expense.

|

|

|

David Yowan |

| Linda A. Mills |

President and Chief Executive Officer |

| Chair of the Board of Directors |

| 2024 Proxy Statement |

| 4 |

| 2024 Proxy Statement |

| 5 |

13865 Sunrise Valley Drive

Herndon, Virginia 20171

April 11, 2024

__________________________

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS OF

NAVIENT CORPORATION

__________________________

To Our Shareholders:

Navient Corporation (“Navient” or the “Company”) will hold its 2024 Annual Meeting of Shareholders (the “Annual Meeting”) as follows:

| Date: | Thursday, May 23, 2024 | ||

|

|

|

| |

| Time: | 8:00 a.m., Eastern Daylight Time |

| |

|

|

|

| |

| Access: | Meeting Live via the Internet Please visit www.virtualshareholdermeeting.com/NAVI2024 | ||

|

|

|

| |

| Items of Business: |

| ||

|

|

|

| |

|

| (1) | Elect the 8 nominees named in the proxy statement to serve as directors for one-year terms or until their successors have been duly elected and qualified; |

|

|

| (2) | Ratify the appointment of KPMG LLP as Navient’s independent registered public accounting firm for 2024; |

|

|

| (3) | Approve, in a non-binding advisory vote, the compensation paid to Navient’s named executive officers; |

|

|

| (4) | Approve the Navient Corporation 2024 Omnibus Incentive Plan to replace the expiring 2014 Omnibus Incentive Plan; and |

|

|

| (5) | Act on such other business as may properly come before the Annual Meeting or any adjournment or postponement of the meeting. | |

|

|

| ||

| Record Date: |

| ||

|

|

|

| |

|

| You may vote if you were a shareholder of record as of the close of business on March 25, 2024. | ||

We have determined that the 2024 Annual Meeting will be held in a virtual meeting format only, via the Internet. If you plan to participate in the virtual meeting, please refer to instructions on page 12 of this proxy statement.

| 2024 Proxy Statement |

| 6 |

Your participation in the Annual Meeting is important. You can vote by telephone, Internet or, if you request that proxy materials be mailed to you, by completing and signing the proxy card enclosed with those materials and returning it in the envelope provided. If you wish to attend and participate in the virtual meeting, you must provide evidence of your ownership as of March 25, 2024, or a valid proxy showing that you are representing a shareholder who owned shares as of that date.

Thank you for your interest in Navient.

| By Order of the Board of Directors, |

|

|

|

|

|

|

|

|

|

|

| Mark L. Heleen Secretary |

|

| 2024 Proxy Statement |

| 7 |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on May 23, 2024.

This notice and proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Form 10-K”) are available free of charge at http://materials.proxyvote.com.

You may also obtain these materials at the Securities and Exchange Commission (“SEC”) website at www.sec.gov or by contacting the Office of the Corporate Secretary, 13865 Sunrise Valley Drive, Herndon, Virginia 20171. Navient will provide a copy of our Form 10-K without charge to any shareholder upon written request.

Except to the extent specifically referenced herein, information contained or referenced on our website is not incorporated by reference into and does not form a part of this proxy statement. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Our shareholder letter and this proxy statement contain forward-looking statements, within the meaning of the Federal securities laws, about our business and prospects. These forward-looking statements are subject to risks and uncertainties and are based on the beliefs and assumptions of our management based on information currently available. Use of words such as “believes,” “expects,” “anticipates,” “intends,” “plans,” “should,” “may,” “could,” “likely” or similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these words. Our future results may differ materially from our past results and from those projected in the forward-looking statements due to various uncertainties and risks, including, but not limited to, those described in Item 1A of Part I (Risk Factors) of our 2023 Form 10-K. We disclaim any obligation to update any forward-looking statements contained herein after the date of this proxy statement. |

No Incorporation By Reference

This proxy statement includes several website addresses and references to additional materials found on those websites. These websites and materials are not incorporated by reference herein.

| 2024 Proxy Statement |

| 8 |

Table of Contents

PROXY SUMMARY.........................................................................................................................................................…....................................................... | 12 |

Annual Meeting of Shareholders......................................................................................................................................................................................... | 12 |

Meeting Agenda Voting Matters................................................................................................................................…...................................................... | 12 |

Board and Governance Practices........................................................................................................................................................................................ | 13 |

Board of Directors Composition.......................................................................................................................................................................................... | 14 |

Director Nominees................................................................................................................................….............................................................................. | 15 |

GENERAL INFORMATION ...................................................................................................................................................................................................... | 16 |

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING ....................................................................................................... | 17 |

OVERVIEW OF PROPOSALS................................................................................................................................................................................................. | 22 |

PROPOSAL 1 — ELECTION OF DIRECTORS.................................................................................................................................................................... | 23 |

Agreements with the Sherborne Group............................................................................................................................................................................... | 32 |

CORPORATE GOVERNANCE................................................................................................................................................................................................. | 33 |

Role and Responsibilities of the Board of Directors......................................................................................................................................................... | 33 |

Board Governance Guidelines.............................................................................................................................................................................................. | 33 |

Board Leadership Structure................................................................................................................................….............................................................. | 34 |

Board Succession Planning.................................................................................................................................................................................................. | 34 |

Management Succession Planning...................................................................................................................................................................................... | 34 |

Director Independence........................................................................................................................................................................................................... | 35 |

Board of Directors Meetings and Attendance at Annual Meeting................................................................................................................................. | 35 |

Committee Membership................................................................................................................................…...................................................................... | 35 |

Compensation Consultant and Independence................................................................................................................................................................... | 38 |

Compensation Committee Interlocks and Insider Participation.................................................................................................................................... | 38 |

The Board of Directors’ Role in Risk Oversight................................................................................................................................................................. | 38 |

Risk Assessment of Compensation Policies......................................................................................................................................................................... | 40 |

Nominations Process............................................................................................................................................................................................................... | 41 |

Proxy Access.............................................................................................................................................................................................................................. | 42 |

Director Orientation and Continuing Education............................................................................................................................................................... | 42 |

Our Commitment to Environment, Social and Governance.............................................................................................................................................. | 42 |

Policy on Political Contributions, Disclosure and Oversight......................................................................................................................................... | 43 |

Code of Business Conduct....................................................................................................................................................................................................... | 44 |

Policy on Review and Approval of Transactions with Related Parties.......................................................................................................................... | 44 |

Shareholder Engagement........................................................................................................................................................................................................ | 45 |

DIRECTOR COMPENSATION................................................................................................................................................................................................... | 46 |

Director Compensation Elements........................................................................................................................................................................................... | 46 |

Share Ownership Guidelines................................................................................................................................…............................................................... | 46 |

| 2024 Proxy Statement |

| 9 |

Anti-Hedging and Pledging Policy........................................................................................................................................................................................ | 47 |

Policy on Rule 10b5-1 Trading Plans................................................................................................................................................................................... | 47 |

Other Compensation................................................................................................................................................................................................................. | 48 |

Deferred Compensation Plan for Directors.......................................................................................................................................................................... | 48 |

Director Compensation Table................................................................................................................................................................................................. | 48 |

PROPOSAL 2 — RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM............. | 50 |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM............................................................................................................................................ | 51 |

Fees Paid to Independent Registered Public Accounting Firms for 2023 and 2022................................................................................................... | 51 |

Pre-approval Policies and Procedures................................................................................................................................................................................. | 51 |

REPORT OF THE AUDIT COMMITTEE................................................................................................................................................................................... | 52 |

OWNERSHIP OF COMMON STOCK...................................................................................................................................................................................... | 53 |

EXECUTIVE OFFICERS............................................................................................................................................................................................................... | 55 |

PROPOSAL 3 — ADVISORY VOTE ON EXECUTIVE COMPENSATION...................................................................................................................... | 56 |

EXECUTIVE COMPENSATION.................................................................................................................................................................................................. | 57 |

Compensation and Human Resources Committee Report.............................................................................................................................................… | 57 |

Compensation Discussion and Analysis............................................................................................................................................................................... | 58 |

Summary Compensation Table................................................................................................................................................................................................ | 79 |

Grants of Plan-Based Awards................................................................................................................................................................................................. | 80 |

Outstanding Equity Awards at Fiscal Year End................................................................................................................................................................. | 82 |

Option Exercises and Stock Vested During Fiscal Year 2023......................................................................................................................................... | 83 |

Pension Benefits........................................................................................................................................................................................................................ | 83 |

Non-Qualified Deferred Compensation................................................................................................................................................................................ | 83 |

Arrangements with Named Executive Officers..................................................................................................................................................................... | 84 |

Potential Payments upon Termination or Change in Control........................................................................................................................................ | 85 |

CEO Pay Ratio.......................................................................................................................................................................................................................... | 88 |

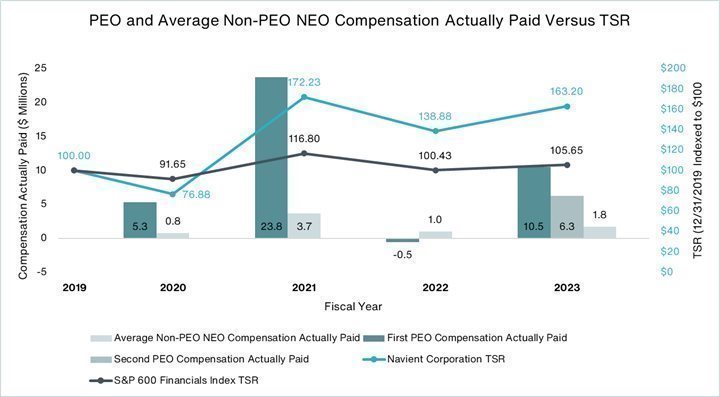

PAY VERSUS PERFORMANCE................................................................................................................................................................................................. | 89 |

Pay versus Performance Table............................................................................................................................................................................................... | 89 |

PROPOSAL 4 — APPROVAL OF THE NAVIENT CORPORATION 2024 OMNIBUS INCENTIVE PLAN TO REPLACE THE EXPIRING 2014 OMNIBUS INCENTIVE PLAN | 95 |

| 2024 Proxy Statement |

| 10 |

OTHER MATTERS....................................................................................................................................................................................................................... | 101 |

Certain Relationships and Related Transactions............................................................................................................................................................... | 101 |

Other Matters for the 2024 Annual Meeting....................................................................................................................................................................... | 101 |

Delinquent Section 16(a) Reports........................................................................................................................................................................................ | 101 |

Shareholder Proposals for the 2025 Annual Meeting...................................................................................................................................................... | 102 |

Proxy Access Procedures......................................................................................................................................................................................................... | 102 |

Solicitation Costs...…............................................................................................................................................................................................................... | 102 |

Householding………………………………………………………………………………………………………………………………………………… | 102 |

| 2024 Proxy Statement |

| 11 |

Proxy Summary

This summary is intended as an overview of the information found elsewhere in this proxy statement. Because this is only a summary, you should read the entire proxy statement before voting.

Annual Meeting of Shareholders |

DATE AND TIME: May 23, 2024 8:00 a.m. local time | LOCATION: Virtual Meeting Only Live via the Internet Please Visit www.virtualshareholdermeeting.com/NAVI2024 | RECORD DATE: March 25, 2024 |

Meeting Agenda Voting Matters |

This year, there are four Company-sponsored proposals on the agenda.

Election of a director nominee pursuant to Proposal 1 will require the affirmative vote of the holders of a majority of the votes cast with respect to that director nominee’s election, meaning that the number of votes cast for such director nominee’s election must exceed the number of votes cast against that nominee’s election (with abstentions and broker non-votes not counted as votes cast either for or against the nominee’s election).

Approval of Proposals 2, 3 and 4 at the Annual Meeting will require an affirmative vote of the holders of shares of stock having a majority in voting power of the votes cast by the holders of all of the shares of stock present or represented at the meeting and voting affirmatively or negatively on such matter.

Proposals | Board Voting Recommendations | Page | ||

|

|

|

|

|

1. | Election of each director nominee | FOR EACH NOMINEE | 23 | |

| ||||

2. | Ratification of the appointment of KPMG as Navient’s independent registered public accounting firm for 2024 | FOR | 50 | |

|

|

|

| |

3. | Non-binding advisory shareholder vote to approve the compensation paid to our named executive officers | FOR | 56 | |

| ||||

4. | Approval of the Navient Corporation 2024 Omnibus Incentive Plan to replace the expiring 2014 Omnibus Incentive Plan | FOR | 95 |

| 2024 Proxy Statement |

| 12 |

Board and Governance Practices |

Corporate Governance Highlights

We believe our corporate governance policies reflect best practices. In addition to executive compensation practices that strongly link pay and performance, Navient’s Code of Business Conduct and Board of Directors governance policies help to ensure that we meet high standards of ethical behavior, corporate governance and business conduct. The following chart highlights key Board information and governance practices in place on December 31, 2023.

Governance Oversight

| ✓

| Independent Chair

|

✓ | Eight Independent Directors (out of nine)

| |

✓ | All Board Committees (other than the Executive Committee) are comprised solely of Independent Directors

| |

✓ | Industry Standard Proxy Access

| |

✓ | Regular executive sessions of Independent Directors

| |

✓ | Majority voting for Directors (uncontested elections)

| |

Board Effectiveness

| ✓

| Strong commitment to Board diversity of thought, gender, race and ethnicity

|

✓ | Robust risk oversight framework to assess and oversee risks

| |

✓ | Annual Election for all Board members

| |

✓ | Annual Self-Evaluation of the Board and each Committee

| |

✓ | Active Board and Management Succession Planning

| |

Executive Compensation Oversight

| ✓ | Pay-for-Performance Philosophy Emphasizes “At Risk” Pay and Equity-Based Incentives

|

✓ | Double-Trigger Change in Control

| |

✓ | Long-Term Incentive Metrics Designed to Promote Growth and Sustainable Profitability

| |

✓ | Enhanced Compensation Recovery/Clawback Policy

| |

✓ | No Excessive Perquisites

| |

✓ | Multi-year Vesting Periods for Equity Awards

| |

✓ | No Tax Gross-Ups Upon Change-in-Control

| |

✓ | Anti-Hedging and Pledging Policy

| |

✓ | No Executive Employment Agreements

| |

✓ | Executive Stock Ownership Guidelines

|

Effective as of May 23, 2024, the Board has approved the reduction of the size of the Board from nine directors to eight directors.

| 2024 Proxy Statement |

| 13 |

Board of Directors Composition |

The composition of our Board reflects a breadth and variety of skills, business experiences and backgrounds.

The composition of our Board reflects the great wealth of experience and skills of our directors. The following table highlights each director’s specific skills, knowledge and experiences that he or she brings to the Board. A particular director may possess additional skills, knowledge or experience even though they are not indicated below.

| Arnold | Bramson | Cabral | Klane | Lawson | Mills | Thompson | Yowan |

Skills and Experience |

|

|

|

|

|

|

|

|

Executive Leadership: Business and strategic management experience from service in a significant leadership position, such as CEO, CFO or other senior leadership position. | X | X | X | X | X | X | X | X |

Industry Experience: Experience in the Company’s businesses, including consumer lending, business process, and loan management | X |

|

| X |

| X | X | X |

Operations and Strategic Planning: Experience managing the operations of a business or large organization and driving strategic direction and growth | X | X |

| X | X | X | X | X |

Finance/Accounting/Capital Markets: Background or experience in finance, accounting, capital markets or financial reporting | X | X |

| X |

|

|

| X |

Legal/Regulatory: Experience in navigating legal risks acquired as a practicing attorney; experience in regulatory matters or government relations |

|

| X |

| X |

| X |

|

Risk Management: Experience with reviewing or managing risk in a large organization, including specific types of risk (e.g., financial risk, physical security, cybersecurity) | X | X |

| X |

| X |

| X |

Human Capital Management / Compensation: Experience in retaining, managing and developing a large workforce, including in the areas of compensation, training and diversity, equity and inclusion | X | X | X | X | X | X | X |

|

Environmental, Governance & Social: Experience in corporate governance, environmental and sustainability initiatives and/or corporate social responsibility |

|

| X |

| X |

| X |

|

Technology: Experience in technology or information security, including the use of technology to facilitate business operations |

| X |

|

|

| X |

|

|

Board Diversity Matrix (as of April 11, 2024)

| Arnold | Bramson | Cabral | Klane | Lawson | Mills | Thompson | Yowan |

Race and Ethnicity |

|

|

|

|

|

|

|

|

African American |

|

|

|

| X |

|

|

|

Asian/Pacific Islander |

|

|

|

|

|

|

|

|

White/Caucasian | X | X |

| X |

| X | X | X |

Hispanic/Latino |

|

| X |

|

|

|

|

|

Gender |

|

|

|

|

|

|

|

|

Male | X | X |

| X | X |

|

| X |

Female |

|

| X |

|

| X | X |

|

Board Tenure |

|

|

|

|

|

|

|

|

Years | 6 | 2 | 10 | 5 | 3 | 10 | 10 | 7 |

Board Diversity | Age of Director Nominees | Tenure of Director Nominees |

|

|

|

For more information about our governance programs and our Board of Directors, see Proposal 1 beginning on Page 23.

| 2024 Proxy Statement |

| 14 |

Director Nominees |

Name* | Age(1) | Director Since | Occupation and Experience | Independent | Standing Committee Memberships(2) | Other Public Boards | ||||

EC | AC | CC | NGC | RC | ||||||

Frederick Arnold | 70 | 2018 | Financial Executive | Yes |

| M |

|

| M | 1 |

Edward Bramson | 73 | 2022 | Partner, Sherborne Investors Management LP | Yes (3) |

|

|

|

|

| 0 |

Anna Escobedo Cabral | 64 | 2014 | Partner, Cabral Group, LLC | Yes | M | C |

| M |

| 0 |

Larry A. Klane | 63 | 2019 | Co-Founding Principal, Pivot Investment Partners LLC | Yes | M |

| M |

| C | 1 |

Michael A. Lawson | 70 | 2021 | Partner, Ellis George LLP | Yes |

| M | M |

|

| 0 |

Linda A. Mills | 74 | 2014 | President and CEO, Cadore Group LLC | Yes | C |

|

|

|

| 1 |

Jane J. Thompson | 72 | 2014 | CEO, Jane J. Thompson Financial Services | Yes | M |

| C | M |

| 2 |

David L Yowan | 67 | 2017 | President and Chief Executive Officer, Navient | No | M |

|

|

|

| 0 |

(1) | Ages are as of April 11, 2024. |

(2) | Membership as of April 11, 2024. |

(3) | Mr. Bramson is independent with regard to his membership on the Board of Directors. Mr. Bramson has declined to serve on any Committees. |

* | Ms. Unger will remain as Chair of the Nominations and Governance Committee until the Annual Meeting on May 23, 2024. It is anticipated that the Board will realign the membership and leadership of the Board Committees after the Annual Meeting. |

EC | Executive Committee | NGC | Nominations and Governance Committee | C | Chair | ||

AC | Audit Committee | RC | Risk Committee | M | Member | ||

CC | Compensation and Human Resources Committee |

|

|

|

| ||

| |||||||

Additional information about our director nominees, including summaries of their business and leadership experience, skills and qualifications, can be found in the director biographies that begin on page 23 of this proxy statement. | |||||||

| 2024 Proxy Statement |

| 15 |

General Information |

Navient Corporation (“Navient,” the “Company,” “we,” “our” or “us”) is furnishing this proxy statement to solicit proxies on behalf of the Board of Directors (the “Board of Directors” or “Board”) for use at our 2024 Annual Meeting of Shareholders (the “Annual Meeting”). This year’s Annual Meeting will be a virtual meeting conducted solely via live webcast. You will be able to attend the Annual Meeting, vote your shares electronically, and submit questions during the meeting by visiting a special website established for this purpose: www.virtualshareholdermeeting.com/NAVI2024. You will not be able to attend the Annual Meeting in person. A copy of the Notice of 2024 Annual Meeting of Shareholders accompanies this proxy statement. This proxy statement is being sent or made available, as applicable, to our shareholders beginning on or about April 11, 2024.

| 2024 Proxy Statement |

| 16 |

Questions and Answers about the Annual Meeting and Voting

| Why is this year’s Annual Meeting being held as a virtual only meeting? |

This year’s Annual Meeting will again be held as a virtual only meeting. At this point in time, the Board continues to believe that holding a virtual only meeting is the best practice as it allows us to reach the broadest number of shareholders. Over the past few years, the Company has experienced more shareholders attending its virtual annual meetings than it historically had for its recent in-person shareholder meetings.

Who is entitled to attend and vote at the Annual Meeting? |

Only shareholders who owned shares of Navient’s Common Stock, par value $0.01 per share (“Common Stock”), at the close of business on March 25, 2024, the record date for the Annual Meeting, are entitled to notice of, and to vote at, the Annual Meeting. Navient’s Common Stock is listed on the Nasdaq Stock Market (“Nasdaq”) under the symbol “NAVI.” On March 25, 2024, 112,032,783 shares of Common Stock were outstanding and eligible to be voted. Each share of Common Stock is entitled to one vote with respect to each matter on which holders of Common Stock are entitled to vote.

| How do I attend the Annual Meeting? |

This year’s Annual Meeting will once again be a virtual only meeting conducted solely via live webcast.

To participate in the Annual Meeting, visit www.virtualshareholdermeeting.com/NAVI2024 and enter the sixteen-digit control number included on your Notice of Internet Availability of Proxy Materials or your proxy card. The live webcast will begin at 8:00 a.m. EDT on Thursday, May 23, 2024. We encourage you to access the virtual meeting platform at least 15 minutes prior to the start time. If you do not have a sixteen-digit control number, you will still be able to access the webcast as a guest, but will not be able to vote your shares or ask a question during the meeting.

We believe the virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and mobile phones) running the most updated version of applicable software and plugins. Participants should ensure they have a strong Wi-Fi connection wherever they intend to participate in the meeting. Further instructions on how to attend and participate in the Annual Meeting, including how to demonstrate proof of stock ownership, will be posted on the virtual meeting website.

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. Technical support will be available on the virtual meeting platform beginning at 7:00 a.m. EDT on the day of the meeting and will remain available until thirty minutes after the meeting has finished.

Why did I receive a “Notice Regarding the Availability of Proxy Materials”? |

Navient furnishes proxy materials to its shareholders primarily via the Internet, instead of mailing printed copies of those materials to each shareholder. By doing so, we save money and reduce our environmental impact. On or about April 11, 2024, Navient will mail a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) to certain of the Company’s shareholders. The Notice of Internet Availability contains instructions on how to access Navient’s proxy materials and vote online or vote by telephone. The Notice of Internet Availability also contains a 16-digit control number that you will need to vote your shares. If you previously chose to receive Navient’s proxy materials electronically, you will continue to receive access to these materials via an e-mail that provides electronic links to these documents unless you elect otherwise.

| 2024 Proxy Statement |

| 17 |

How do I request paper copies of the proxy materials? |

You may request paper copies of the proxy materials for the Annual Meeting by following the instructions included on your Notice of Internet Availability or listed at www.proxyvote.com, by telephoning 1-800-579-1639, or by sending an e-mail to sendmaterial@proxyvote.com.

What is the difference between holding shares as a beneficial owner in street name and as a shareholder of record? |

If your shares are held in street name through a broker, bank, trustee or other nominee, you are considered the beneficial owner of those shares. As the beneficial owner, you have the right to direct your broker, bank, trustee or other nominee how to vote your shares. Without your voting instructions, your broker, bank, trustee or other nominee may only vote your shares on proposals considered to be routine matters. The only routine matter being considered at the Annual Meeting is Proposal 2 (relating to the ratification of the independent registered public accounting firm). Proposals 1, 3 and 4 are considered non-routine matters. For non-routine matters, your shares will not be voted without your specific voting instructions. We encourage you to vote your shares.

If your shares are registered directly in your name with Navient’s transfer agent, Computershare, you are considered to be a shareholder of record with respect to those shares. As a shareholder of record, you have the right to grant your voting proxy directly to Navient’s Board of Directors or to a third party, or to vote at the Annual Meeting.

| What if I hold my shares in street name and I do not provide my broker, bank, trustee or other nominee with instructions about how to vote my shares? |

You may instruct your broker, bank, trustee or other nominee on how to vote your shares using any of the methods described above. If you do not provide them with instructions on how to vote your shares prior to the Annual Meeting, they will have discretionary authority to vote your shares only with respect to routine matters. Only Proposal 2 (relating to the ratification of the independent registered public accounting firm) is considered to be a routine matter, and your broker, bank, trustee or other nominee will not have discretion to vote your shares with respect to Proposals 1, 3 or 4. If you do not give your instructions on how to vote your shares on Proposals 1, 3 or 4, your shares will then be referred to as “broker non-votes” and will not be counted in determining whether Proposals 1, 3 or 4 are approved. Please participate in the election of directors and vote on all the proposals by returning your voting instructions to your broker, bank, trustee or other nominee.

| How do I vote shares of Common Stock held in my 401(k) Plan? |

If you participate in the Navient 401(k) Savings Plan, you may vote the number of shares equivalent to your interest in the plan’s company stock fund, if any, as credited to your account on the record date. You will need to instruct the 401(k) Savings Plan trustee by telephone, internet or by mail on how to vote your shares. Voting instructions must be received no later than 5:00 p.m., Eastern Daylight Time, on May 22, 2024. If you own shares through the Navient 401(k) Savings Plan and do not provide voting instructions with respect to your plan shares, the trustee will vote your plan shares on each proposal in the same proportion as other plan shares are being voted.

| 2024 Proxy Statement |

| 18 |

| How do I vote? |

Navient encourages shareholders to vote in advance of the Annual Meeting, even if you plan to attend the Annual Meeting. You may vote in one of the following ways:

VOTE BY INTERNET BEFORE THE MEETING |

|

| Vote your shares at www.proxyvote.com. Votes submitted via the Internet must be received by 11:59 p.m., Eastern Daylight Time, on May 22, 2024. Please have your Notice of Internet Availability or proxy card available when you log on. |

| If you hold shares directly in your name as a shareholder of record, you may either vote or be represented by another person at the Annual Meeting by executing a legal proxy designating that person as your proxy to vote your shares. If you hold your shares in a street name, you must obtain a legal proxy from your broker, bank, trustee or other nominee and present it to the inspector of elections with your ballot to be able to vote at the Annual Meeting. To request a legal proxy, please follow the instructions at www.proxyvote.com |

|

|

|

| ||

VOTE BY PHONE |

|

| Call the toll-free number (1-800-690-6903). You may call this toll-free telephone number, which is available 24-hours a day, and follow the pre-recorded instructions. Please have your Notice of Internet Availability or proxy card available when you call. If you hold your shares in street name, your broker, bank, trustee or other nominee may provide you additional instructions regarding voting your shares by telephone. Votes submitted telephonically must be received by 11:59 p.m., Eastern Daylight Time, on May 22, 2024. | ||

|

|

|

| ||

VOTE BY MAIL |

|

| If you hold your shares in a street name through a broker, bank, trustee or other nominee and want to vote by mail, you must request paper copies of the proxy materials. Once you receive your paper copies, you will need to complete, sign and date the voting instruction form and return it in the prepaid return envelope provided. Your voting instruction form must be received no later than the close of business on May 22, 2024.

| ||

VOTE BY INTERNET DURING THE MEETING |

|

| Go to www.virtualshareholdermeeting.com/NAVI2024

Vote must be submitted by the close of polls during the Annual Meeting.

|

| 2024 Proxy Statement |

| 19 |

| How do proxies work? |

Navient’s Board of Directors is requesting your proxy. Giving your proxy means that you authorize the persons named as proxies therein to vote your shares at the Annual Meeting in the manner you specify in your proxy (or to exercise their discretion as described herein). If you hold your shares as a record holder and sign and return a proxy card but do not specify how to vote on a proposal, the persons named as proxies will vote your shares in accordance with the Board of Directors’ recommendations. The Board of Directors has recommended that shareholders vote:

| · | “FOR” the election of each of the director nominees named in Proposal 1; |

|

|

|

| · | “FOR” ratification of the appointment of Navient’s independent registered public accounting firm, as set forth in Proposal 2; |

|

|

|

| · | “FOR” approval, on a non-binding advisory basis, of the compensation paid to our named executive officers as set forth in this proxy statement as Proposal 3; and |

|

|

|

| · | “FOR” approval of the Navient Corporation 2024 Omnibus Incentive Plan to replace the expiring 2014 Omnibus Incentive Plan, as set forth in Proposal 4. |

Giving your proxy also means that you authorize the persons named as proxies to vote on any other matter properly presented at the Annual Meeting in the manner they determine is appropriate. Navient does not know of any other matters to be presented at the Annual Meeting as of the date of this proxy statement.

| Can I change my vote? |

Yes. If you hold your shares as a record holder, you may revoke your proxy or change your vote at any time prior to the final tallying of votes by:

| · | Delivering a written notice of revocation to Navient’s Corporate Secretary at the Office of the Corporate Secretary, Navient Corporation, 13865 Sunrise Valley Drive, Herndon, Virginia 20171; |

|

|

|

| · | Submitting another timely vote via the Internet, by telephone or by mailing a new proxy (following the instructions listed under the “How do I vote?” section above); or |

|

|

|

| · | If you are eligible to vote during the Annual Meeting, you also can revoke your proxy or voting instructions and change your vote during the Annual Meeting by logging into the website at www.virtualshareholdermeeting.com/NAVI2024 and following the voting instructions. |

If your shares are held in street name, you need to contact your broker, bank, trustee or nominee for instructions on how to revoke or change your voting instructions. Virtual attendance at the Annual Meeting constitutes presence in person for purposes of quorum at the Annual Meeting.

| What constitutes a quorum? |

A quorum of shareholders is necessary to transact business at the Annual Meeting. A quorum will exist when the holders of a majority of the shares of Common Stock entitled to vote are deemed present or represented by proxy, including proxies on which abstentions (withholding authority to vote) are indicated. Abstentions and broker non-votes will be counted in determining whether a quorum exists.

| 2024 Proxy Statement |

| 20 |

| What vote is necessary to approve each matter to be voted on at the Annual Meeting? |

The following table provides a summary of the voting criteria for the Board’s voting recommendations for the matters on the agenda for the 2024 Annual Meeting:

Proposal |

| Voting Options |

| Vote Required for Approval | Abstentions |

| Broker Non-Votes |

| Broker Discretionary Vote Permitted |

| Board's Voting Recommendation | ||

1. | Election of Directors |

| "FOR" or "AGAINST" or “ABSTAIN” from voting |

| Affirmative vote of the holders of a majority of the votes cast. |

| NOT COUNTED |

| NOT COUNTED |

| NO |

| FOR the election of each of the director nominees |

|

|

|

|

|

|

| |||||||

2. | Ratify the appointment of KPMG LLP as Navient’s independent registered public accounting firm for 2024 |

| "FOR" or "AGAINST" or "ABSTAIN" from voting |

| Affirmative vote of the holders of shares of stock having a majority in voting power of the votes cast by the holders of all of the shares of stock present or represented at the meeting and voting affirmatively or negatively on such matter. |

| NOT COUNTED |

| NOT COUNTED |

| YES |

| FOR |

|

|

|

|

|

|

| |||||||

3. | Approve, in a non-binding advisory vote, the compensation paid to Navient’s named executive officers |

| "FOR" or "AGAINST" or "ABSTAIN" from voting |

| Affirmative vote of the holders of shares of stock having a majority in voting power of the votes cast by the holders of all of the shares of stock present or represented at the meeting and voting affirmatively or negatively on such matter. |

| NOT COUNTED |

| NOT COUNTED |

| NO |

| FOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. | Approve the Navient Corporation 2024 Omnibus Incentive Plan to replace the expiring 2014 Omnibus Incentive Plan |

| "FOR" or "AGAINST" or "ABSTAIN" from voting |

| Affirmative vote of the holders of shares of stock having a majority in voting power of the votes cast by the holders of all of the shares of stock present or represented at the meeting and voting affirmatively or negatively on such matter. |

| NOT COUNTED |

| NOT COUNTED |

| NO |

| FOR |

Who will count the vote? |

Votes will be tabulated by an independent inspector of elections.

Who can attend the Annual Meeting? |

Only shareholders as of the record date, March 25, 2024, or their duly appointed proxies, may attend. No guests will be allowed to attend the Annual Meeting.

| 2024 Proxy Statement |

| 21 |

Overview of Proposals

This proxy statement contains four proposals requiring shareholder action, each of which is discussed in more detail below.

| · | Proposal 1 requests the election of the director nominees named in this proxy statement to the Board of Directors. |

|

|

|

| · | Proposal 2 requests ratification of the appointment of KPMG LLP as Navient’s independent registered public accounting firm for the fiscal year ending December 31, 2024. |

|

|

|

| · | Proposal 3 requests the approval, in a non-binding advisory vote, of the compensation paid to our named executive officers as set forth in this proxy statement. |

|

|

|

| · | Proposal 4 requests the approval of the Navient Corporation 2024 Omnibus Incentive Plan to replace the expiring 2014 Omnibus Incentive Plan. |

| 2024 Proxy Statement |

| 22 |

Proposal 1 — Election of Directors

Under the Navient Bylaws (the “Bylaws”), the Board of Directors has the authority to determine the size of the Board of Directors and to fill any vacancies that may arise prior to the next annual shareholder meeting. Although the Board has the authority to change its size at any time, the Board has set the size of our Board at 8, effective as of the Annual Meeting.

On April 4, 2024, Laura S. Unger informed the Board that she would not be standing for reelection to the Board in 2024. On April 4, 2024, the Company’s Nominations and Governance Committee recommended and the Board of Directors nominated the following directors for election at the Annual Meeting:

Frederick Arnold

Edward J. Bramson

Anna Escobedo Cabral

Larry A. Klane

Michael A. Lawson

Linda A. Mills

Jane J. Thompson

David L. Yowan

Biographical information and qualifications and experience for each nominee appear beginning on the next page. In addition to fulfilling the general criteria for director nominees described in the section titled “Nominations Process,” each nominee possesses experience, skills, attributes and other qualifications that the Board of Directors has determined support its oversight of Navient’s business, operations and structure. These qualifications are discussed beginning on the next page along with biographical information regarding each member of the Board of Directors being nominated, including each individual’s age, principal occupation and business experience during the past five years. Information concerning each director is based in part on information received from him or her and in part from Navient’s records.

All nominees listed above have consented to being named in this proxy statement and to serve if elected. Should any nominee subsequently decline or be unable to accept such nomination to serve as a director, an event that the Board of Directors does not now expect, the Board of Directors may designate a substitute nominee or the persons voting the shares represented by proxies solicited hereby may vote those shares for a reduced number of nominees. If the Board of Directors designates a substitute nominee, persons named as proxies will vote “FOR” that substitute nominee.

Navient’s Bylaws generally provide that the election of a director nominee will be by a majority of the votes cast and voting affirmatively or negatively with respect to the nominee at a meeting for the election of directors at which a quorum is present. Accordingly, a director nominee will be elected to the Board of Directors if the number of shares voted “FOR” the nominee exceeds the number of votes cast “AGAINST” the nominee’s election, without regard to abstentions or broker non-votes. Shares that are not voted affirmatively or negatively in the election of directors, including abstentions and broker non-votes, have no direct effect in the election of directors. Those shares, however, are taken into account in determining whether a sufficient number of shares are present to establish a quorum.

If any director nominee fails to receive a majority of the votes cast “FOR” in an uncontested election, that nominee has agreed to automatically tender his or her resignation upon certification of the election results. If such an event were to occur, Navient’s Nominations and Governance Committee will make a recommendation to the Board of Directors on whether to accept or reject such nominee’s resignation. The Board of Directors will act on the recommendation of the Nominations and Governance Committee and publicly disclose its decision and the rationale behind it within 90 days from the date of certification of the election results.

| 2024 Proxy Statement |

| 23 |

Name and Age Service as a Director | Position, Principal Occupation, Business Experience and Directorships |

David L. Yowan, 67

Director since March 2017 |

President and Chief Executive Officer Navient Corporation

Business Experience: President and Chief Executive Officer, Navient Corporation – 2023 to present Executive Vice President and Treasurer, American Express Company — 2006 to 2022 Senior Treasury Management, American Express Company — 1999 to 2006 Senior Vice President, North American Consumer Bank Treasury, Citigroup — 1987 to 1998

Skills, Experience and Qualifications: Mr. Yowan has been the Company’s President and Chief Executive Officer since May 2023. His extensive experience in consumer financial services including his long tenure with the world’s largest payment card issuer makes him a valuable addition to Navient’s Board of Directors. His insight and experience in risk management, balance sheet management, asset securitization and strategy make him ideally suited to assist our Board in overseeing financial, operational and credit risk management. |

| 2024 Proxy Statement |

| 24 |

Name and Age Service as a Director |

Position, Principal Occupation, Business Experience and Directorships |

|

|

Linda Mills, 74

Chair of the Board since June 2019

Director since May 2014 | President and CEO Cadore Group LLC

Business Experience: President and CEO, Cadore Group LLC, a management and IT consulting company — 2015 to present Corporate Vice President, Operations, Northrop Grumman — 2013 to 2015 Corporate Vice President & President, Information Systems and Information Technology Sectors, Northrop Grumman — 2008 to 2012

Directorships of Other Public Companies: American International Group, Inc. (NYSE: AIG) — 2015 to present Chair of the Compensation and Management Resources Committee; Former member, Audit Committee; Member, Risk Committee

Other Professional and Leadership Experience: Board Member Emeritus, Smithsonian National Air & Space Museum Former Member, Board of Visitors, University of Illinois, College of Engineering Former Senior Advisory Group and Board Member, Northern Virginia Technology Council Former Board Member, Wolf Trap Foundation for the Performing Arts

Skills, Experience and Qualifications: Ms. Mills’ extensive experience in leading businesses and operations for large, complex multinational companies brings a valuable perspective to our Board of Directors in the areas of operations, financial management, strategic re-positioning, risk management, technology, federal, state and local government contracting, and cybersecurity risk. Through insights gained as a director on the board of another large, publicly traded corporation in a highly regulated industry, as well as her service on many nonprofit boards, Ms. Mills brings a unique and wide range of valuable strategic and operational perspectives to our Board. |

| 2024 Proxy Statement |

| 25 |

Name and Age Service as a Director |

Position, Principal Occupation, Business Experience and Directorships |

|

|

Edward Bramson, 73

Vice Chair of the Board since December 2023

Director since May 2022

| Partner Sherborne Investors Management LP

Business Experience:

Partner, Sherborne Investors – 1986-to present Chief Executive Officer, Electra Private Equity plc – 2015 - 2019 Executive Chairman, F&C Asset Management plc – 2010 - 2013 Chairman and Chief Executive Officer, Nautilus, Inc. – 2007 - 2011 Chairman/Executive Chairman, Spirent Communications – plc 2006 - 2010 Chairman/Executive Chairman, Elementis plc – 2005 - 2007 Executive Chairman, 4imprint Group plc – 2003-2005 Chairman, Ampex Corporation – 1992 - 2007

Skills, Experience and Qualifications:

Mr. Bramson has extensive business experience as a Chief Executive Officer, including seven publicly traded companies in the consumer products, electronics and regulated financial services sectors. He co-founded Sherborne Investors in 1986. The firm manages private and public equity turnaround investments and currently holds approximately 25.87% of the outstanding shares of Navient. Mr. Bramson has worked successfully with people from diverse backgrounds, and brings to our Board valuable experience in creating long-term value for shareholders. |

| 2024 Proxy Statement |

| 26 |

Name and Age Service as a Director | Position, Principal Occupation, Business Experience and Directorships |

|

|

Frederick Arnold, 70

Director since August 2018 | Financial Executive

Business Experience: Chief Financial Officer, Convergex Group, LLC — July 2015 to May 2017 Executive Vice President and Chief Financial Officer, Capmark Financial Group, Inc. — September 2009 to January 2011 Executive Vice President of Finance, Masonite Corporation — February 2006 to September 2007 Executive Vice President, Strategy and Development, Willis North America — 2001 to 2003 Chief Administrative Officer, Willis Group Holdings Ltd. — 2000 to 2001 Chief Financial and Administrative Officer, Willis North America — 2000

Former Directorships of Other Public Companies: M3-Brigade Acquisition III Corp. Cyxtera Technologies, Inc. Valaris plc Syncora Holdings Ltd. FS KKR Capital Corp. Corporate Capital Trust CIFC Corp. The We Company Lehman Commercial Paper Inc.

Other Professional and Leadership Experience: Chairman, Metropolitan Gaming HoldCo Ltd Current Chairman of the Board, Lehman Brothers Holdings Inc.

Skills, Experience and Qualifications: Mr. Arnold spent 20 years as an investment banker primarily at Lehman Brothers and Smith Barney, where he served as managing director and head of European corporate finance. His experience originating and executing mergers and acquisitions and equity financings across a wide variety of industries and geographies, as well as his other board experience, brings a valuable perspective to our Board of Directors. Subsequent to his employment at Lehman Brothers and Smith Barney, Mr. Arnold spent 15 years in various senior financial positions at a number of private equity-owned portfolio companies. |

| 2024 Proxy Statement |

| 27 |

Name and Age Service as a Director |

Position, Principal Occupation, Business Experience and Directorships |

|

|

Anna Escobedo Cabral, 64

Director since December 2014 | Partner Cabral Group, LLC

Business Experience: Partner, Cabral Group — 2018 to present Senior Advisor, Inter-American Development Bank — 2009 to 2018 Treasurer of the United States, U.S. Department of the Treasury — 2004 to 2009 Director, Smithsonian Institution’s Center for Latino Initiatives — 2003 to 2004 CEO, Hispanic Association on Corporate Responsibility — 1999 to 2003 Deputy Staff Director & Chief Clerk, U.S. Senate Committee on the Judiciary — 1993 to 1999 Executive Staff Director, U.S. Senate Republican Conference Task Force on Hispanic Affairs — 1991 to 1999

Other Professional and Leadership Experience: Member, Diversity Advisory Committee, Comcast NBCU Member, NACD Center for Inclusive Governance Advisory Council Chair, Jessie Ball duPont Fund Chair, BBVA Microfinance Foundation Board Treasurer, Lideramos Former Chair, Financial Services Roundtable Retirement Security Council Former Member, Providence Hospital Foundation Board Former Member, American Red Cross Board of Directors Former Member, Sewall Belmont House Board of Directors Former Member, Martha’s Table Board of Directors

Skills, Experience and Qualifications: Through her vast experience in public policy, government, public affairs, corporate social responsibility, international development, and financial literacy, as well as her experience as a chief operating officer in the nonprofit sector, Ms. Cabral provides our Board with key insights on our inclusion, diversity and equity initiatives and provides judgment regarding regulatory policy and the political and legislative process. |

| 2024 Proxy Statement |

| 28 |

Name and Age Service as a Director |

Position, Principal Occupation, Business Experience and Directorships |

|

|

Larry A. Klane, 63

Director since May 2019

| Co-Founding Principal Pivot Investment Partners LLC

Business Experience: Co-Founding Principal, Pivot Investment Partners LLC – 2014 to present Global Financial Institutions Leader, Cerberus Capital Management — 2012 to 2013 Chair, Korea Exchange Bank — 2010 to 2012 CEO, Korea Exchange Bank — 2009 to 2012 President of Global Financial Services, Capital One — 2000 to 2008 Managing Director, Bankers Trust/Deutsche Bank — 1994 to 2000

Directorships of Other Public Companies: The Real Brokerage, Inc. (Nasdaq: REAX) — June 2020 to present

Former Directorships of Other Public Companies: VeriFone Systems, Inc. Korea Exchange Bank Aozora Bank Ltd. Bottomline Technologies, Inc.

Other Professional and Leadership Experience: Director, Goldman Sachs Bank USA Former Director, Nexi Group S.p.A. Former Director, Ethoca Limited

Skills, Experience and Qualifications: Mr. Klane brings an important strategic and operational perspective to our Board given his extensive background in financial services and payment services, including his service in various leadership positions in the financial services industry. |

| 2024 Proxy Statement |

| 29 |

Name and Age Service as a Director |

Position, Principal Occupation, Business Experience and Directorships |

|

|

Michael A. Lawson, 70

Director since August 2021 | Partner Ellis George LLP

Business Experience: Partner, Ellis George LLP – 2024 to present President and CEO, Los Angeles Urban League – 2017 to 2023 U.S. Ambassador, Council of the International Civil Aviation Organization, a United Nations agency — 2013 to 2017 President, Board of Airport Commissioners — 2008 to 2011 Partner, Skadden, Arps, Slate, Meagher & Flom — 1980 to 2011

Other Professional and Leadership Experience: Member, Board of Directors, Southern California Public Radio 2020 Member, Board of Directors, The United Way of Greater Los Angeles Member, Board of Directors, The Pacific Council on International Policy Former Member, Board of Airport Commissioners, Los Angeles World Airports Former Member, Board of Trustees of the California State Teachers’ Retirement System Former Chair, Oversight Board for the Community Redevelopment Agency for the City of Los Angeles Former Member, Board of Trustees, Morehouse College, Atlanta GA Former Member, Board of Trustees, Loyola Marymount University, Los Angeles Former Chair/Member, Constitutional Rights Foundation Former Vice Chair/Member, Board of Directors, Performing Arts Center of Los Angeles County/The Music Center Former Member, Board of Directors, Music Center Foundation Former Member, Western Regional Selection Panel for the White House Fellow Program Former Member, Board of Directors, The Advancement Project

Skills, Experience and Qualifications: Mr. Lawson brings experience to our Board and the Compensation and Human Resources Committee as a result of his extensive background in the area of executive compensation and benefits. Mr. Lawson also possesses extensive experience in structured finance and proxy contests. |

| 2024 Proxy Statement |

| 30 |

Name and Age Service as a Director |

Position, Principal Occupation, Business Experience and Directorships |

|

|

Jane J. Thompson, 72

Director since March 2014 | Chief Executive Officer Jane J. Thompson Financial Services LLC

Business Experience: Chief Executive Officer, Jane J. Thompson Financial Services LLC, a management consulting firm — 2011 to present President, Financial Services, Walmart Stores, Inc. — 2002 to 2011 Executive Vice President, Credit, Home Services, Online and Corporate Planning, Sears, Roebuck and Co. — 1988 to 1999 Consultant/Partner, McKinsey & Company — 1978 to 1988

Directorships of Other Public Companies: CompoSecure, Inc. (Nasdaq: CMPO) — 2021 to present Katapult Holdings, Inc. (Nasdaq: KPLT) — 2022 to present

Former Directorships of Other Public Companies: Mitek Systems, Inc. OnDeck Capital, Inc. Blackhawk Network Holdings, Inc. VeriFone Systems, Inc. The Fresh Market ConAgra Brands

Other Professional and Leadership Experience: Former Executive Chair, Pangea Universal Holdings, Inc. Former Member, CFPB Consumer Advisory Board Former Member, Commercial Club of Chicago Former Member, Financial Health Network Board Former Member and Chair, The Chicago Network Former Member and Board Member, The Economic Club of Chicago Former Member, Lurie Children’s Hospital of Chicago Board of Trustees Former Trustee, Bucknell University Former Member, Corporate Advisory Board, Darden Graduate School of Business, University of Virginia Former Member, Corporate Advisory Board, Walton Graduate School of Business, University of Arkansas

Skills, Experience and Qualifications: Ms. Thompson brings a unique depth and breadth of expertise to our Board of Directors in the areas of consumer behavior, financial services, consumer lending, finance and financial services regulation. She has extensive experience in consumer lending, as well as management experience with large, publicly traded businesses. Combined with other leadership roles in business—including service as a director of several public companies and as a member of various audit, compensation, risk management and governance committees—Ms. Thompson brings valuable insights to our Board in a variety of areas. |

| 2024 Proxy Statement |

| 31 |

| Agreements with the Sherborne Group |

On April 14, 2022, Navient Corporation (the “Company”) entered into a Nomination and Cooperation Agreement (as amended by Amendment No. 1 to Nomination and Cooperation Agreement, dated as of December 14, 2023, the “Agreement”), by and among the Company and Sherborne Investors Management LP, Newbury Investors LLC and Edward J. Bramson (collectively, the “Sherborne Group”). The Agreement included various terms, conditions and provisions, including those pursuant to which Mr. Bramson was nominated and elected as a member of the board of directors of the Company (the “Board”) and other terms applicable during the “Covered Period.” The Covered Period ends on the date that is the later of (i) the earlier of (a) the closing of the 2024 annual meeting of stockholders of the Company and (b) 5:00 p.m. Eastern Time on June 30, 2024 and (ii) the date that is twenty (20) business days following the date Mr. Bramson ceases to be a member of the Board. Therefore, assuming Mr. Bramson is reelected to the Board, the terms and conditions contained in the Agreement will continue to be in effect. Mr. Bramson, while serving as a member of the Board, is required to (i) meet all applicable director independence and other requirements of the Company, of stock exchange listing standards and of the Securities and Exchange Commission and related securities laws and regulations, (ii) be qualified to serve as a director under the Delaware General Corporation Law and (iii) comply with Company policies, guidelines and codes of conduct applicable to non-management directors.

If the Sherborne Group (which currently holds approximately a 25.87% ownership position in the Company, as of March 1, 2024) ceases to hold at least 10.0% of the Company’s common stock, the Agreement requires Mr. Bramson to offer his resignation from the Board. Such offer of resignation would also be required in certain other circumstances set forth in the Agreement.

Under the Agreement, the Sherborne Group is subject to various restrictions, including, among other things, limitations on proposing or engaging in certain extraordinary transactions and other matters involving the Company and prohibitions on the Sherborne Group acquiring more than 20.0% of the Company’s outstanding shares other than as a result of share repurchases undertaken by the Company. The Agreement also prohibits the Sherborne Group from engaging in proxy solicitations and certain other stockholder-related matters and proposals, forming groups with other investors, disposing of its shares to a third party who, to the Sherborne Group’s knowledge, would subsequently own 5.0% or more of the Company’s outstanding shares outside of open market broker sale transactions or transactions approved by the Board, engaging in short sales of Company shares, and making certain statements regarding the Company and on certain interactions with third parties and employees of the Company. The Sherborne Group has agreed to vote its shares as set forth in the Agreement, including with respect to board elections. Certain non-disparagement provisions also apply to the Company and to the Sherborne Group under the Agreement.

The foregoing description of the Agreement is qualified in its entirety by reference to the complete agreements included as Exhibit 99.1 within the Company’s Current Report on Form 8-K, filed with the SEC on April, 18, 2022, and Exhibit 10.1 within the Company’s Current Report on Form 8-K, filed with the SEC on December 15, 2023, each incorporated herein by reference.

| 2024 Proxy Statement |

| 32 |

Corporate Governance

| Role and Responsibilities of the Board of Directors |

The Board of Directors believes strong corporate governance is critical to achieving Navient’s performance goals, enhancing shareholder value, and maintaining the trust and confidence of investors, employees, regulatory agencies and other stakeholders.

The primary responsibilities of the Board of Directors are to:

| · | Review Navient’s long-term strategies and set long-term performance metrics; |

|

|

|

| · | Review and approve Navient’s annual business plan and multi-year strategic plan, regularly review performance against such plans and ensure alignment between the Company’s actions and its longer-term strategic objectives; |

|

|

|

| · | Review risks affecting Navient and its processes for managing those risks, and oversee management performance with regard to various aspects of risk management, compliance and governance; |

|

|

|

| · | Select, evaluate and compensate the Chief Executive Officer; |

|

|

|

| · | Plan for succession of the Chief Executive Officer and other members of the executive management team; |

|

|

|

| · | Review and approve major transactions; |

|

|

|

| · | Through its Audit Committee, select and oversee Navient’s independent registered public accounting firm; |

|

|

|

| · | Oversee financial matters, including financial reporting, financial controls and capital allocation; |

|

|

|

| · | Recommend director candidates for election by shareholders and plan for the succession of directors; and |

|

|

|

| · | Evaluate the Board’s composition, succession, and effectiveness. |

| Board Governance Guidelines |

The Board of Directors’ Governance Guidelines (the “Guidelines”) are reviewed, at least annually, by the Nominations and Governance Committee. The Guidelines can be found at on our website at https://navient.com/investors/corporate-governance and a written copy may be obtained by contacting the Corporate Secretary at corporatesecretary@navient.com. The Guidelines, along with Navient’s Bylaws, embody the following governance practices, among others:

| · | A majority of the members of the Board of Directors must be independent directors and all members of the Audit, Compensation and Human Resources, and Nominations and Governance Committees must be independent. |

|

|

|

| · | All directors stand for re-election each year and must be elected by a majority of the votes cast in uncontested elections. |

|

|

|

| · | No individual is eligible for nomination to the Board after the earlier of (i) their 75th birthday or (ii) after having served in the aggregate more than 15 years on the Board. |

|

|

|

| · | The Board of Directors has separated the roles of Chair of the Board and CEO, and an independent, non-executive director serves as Chair. |

| 2024 Proxy Statement |

| 33 |

| · | Independent members of the Board of Directors and its committees meet in executive session, outside the presence of management or the CEO during each scheduled Board or committee meeting. The Chair of the Board (or the applicable committee chair) presides over these sessions. |

|

|

|