- PYPL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

PayPal (PYPL) DEFA14AAdditional proxy soliciting materials

Filed: 6 May 24, 4:31pm

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant Filed by the Registrant |  Filed by a Party other than the Registrant Filed by a Party other than the Registrant |

Check the appropriate box: |

| Preliminary Proxy Statement | |||

|

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

|

| Definitive Proxy Statement | ||

|

| Definitive Additional Materials | ||

|

| Soliciting Material under §240.14a-12 | ||

PAYPAL HOLDINGS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply): | ||

|

| No fee required. | ||

|

| Fee paid previously with preliminary materials. | ||

|

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

Spring 2024 Stockholder Outreach

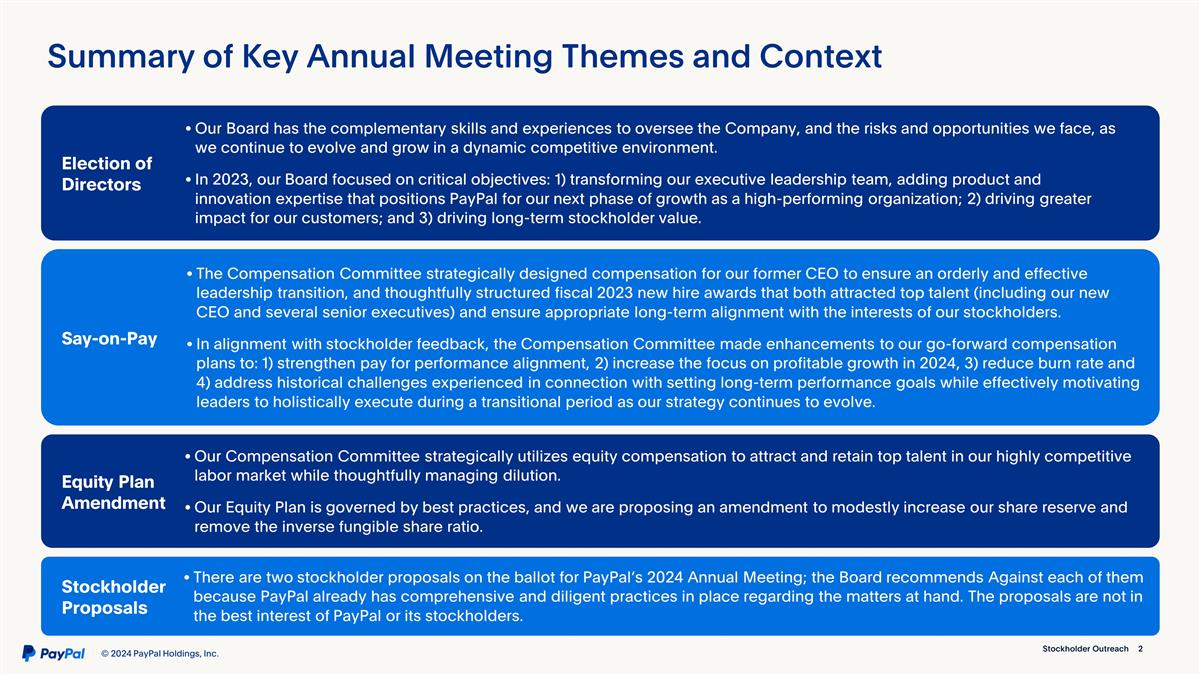

The Compensation Committee strategically designed compensation for our former CEO to ensure an orderly and effective leadership transition, and thoughtfully structured fiscal 2023 new hire awards that both attracted top talent (including our new CEO and several senior executives) and ensure appropriate long-term alignment with the interests of our stockholders. In alignment with stockholder feedback, the Compensation Committee made enhancements to our go-forward compensation plans to: 1) strengthen pay for performance alignment, 2) increase the focus on profitable growth in 2024, 3) reduce burn rate and 4) address historical challenges experienced in connection with setting long-term performance goals while effectively motivating leaders to holistically execute during a transitional period as our strategy continues to evolve. Say-on-Pay There are two stockholder proposals on the ballot for PayPal’s 2024 Annual Meeting; the Board recommends Against each of them because PayPal already has comprehensive and diligent practices in place regarding the matters at hand. The proposals are not in the best interest of PayPal or its stockholders. Stockholder Proposals Our Board has the complementary skills and experiences to oversee the Company, and the risks and opportunities we face, as we continue to evolve and grow in a dynamic competitive environment. In 2023, our Board focused on critical objectives: 1) transforming our executive leadership team, adding product and innovation expertise that positions PayPal for our next phase of growth as a high-performing organization; 2) driving greater impact for our customers; and 3) driving long-term stockholder value. Election of Directors Summary of Key Annual Meeting Themes and Context Our Compensation Committee strategically utilizes equity compensation to attract and retain top talent in our highly competitive labor market while thoughtfully managing dilution. Our Equity Plan is governed by best practices, and we are proposing an amendment to modestly increase our share reserve and remove the inverse fungible share ratio. Equity Plan Amendment

Power all aspects of digital checkout online and in store Provide access to seamless credit solutions to enable growth Offer tools and insights to attract new customers and increase sales Protect against fraud and improve risk management Deliver flexibility with payment options globally, across platforms and merchants Help people manage and move money domestically and internationally Offer credit and installment pay services that are accessible and cost effective Facilitate simple, secure payments across devices Merchants Consumers Our Two-Sided Platform Serves Merchants and Consumers Business Overview(1) Transactions Scale Reach Represents total payments volume (TPV) and revenue for FY’23. PayPal is a global digital payments leader with a two-sided network at scale that positions us to drive durable, profitable growth Total Payment Volume $1.5T Revenue (up 8% year over year) $29.7B 25B ~200 Global Markets

A refreshed executive leadership team driving the next phase of our growth Michelle Gill EVP, General Manager - Small Business & Financial Services Group Archana (Archie) Deskus EVP, Chief Technology Officer Bimal Patel SVP, General Counsel John Kim EVP, Chief Product Officer Diego Scotti EVP, General Manager - Consumer Group & Global Marketing and Communications Kausik Rajgopal EVP, Strategy, Corporate Development & Partnerships Frank Keller EVP, General Manager - Large Enterprise & Merchant Platform Group Suzan Kereere President, Global Markets The Board conducted an intensive CEO search process and identified Alex Chriss to serve as CEO given his extensive product and innovation, technology and global payments experience, which position him to drive growth across the PayPal platform for years to come. Alex also possesses deep expertise in leading high-growth businesses, global product strategy, and customer-driven innovation gained through his experience founding and selling two start-ups and leading a fast-growing division of a leading financial software company. Isabel Cruz EVP, Chief People Officer Alex Chriss President & Chief Executive Officer Jamie Miller EVP, Chief Financial Officer A rigorous search for the right CEO to lead PayPal into our next chapter Members of our executive leadership team who have joined PayPal since September 2023 are highlighted with blue outlines. Our transformed, innovation-focused executive leadership embodies our values of Inclusion, Innovation, Collaboration, and Wellness. Aaron Webster EVP, Chief Enterprise Services Officer

Scope of Outreach Since 2023 Annual Meeting Stockholder engagement informs Board decision-making Stockholder feedback is regularly shared with our Board and continues to serve as a meaningful input in our Board’s deliberations and decision-making. Since our last Annual Meeting in May 2023, we contacted investors representing ~50% of our common stock. We engaged with investors holding ~19% of our common stock. Directors met with 8 investors representing ~12% of our common stock. ~50% Contacted Engaged ~19% In 2024, began including the impact of stock-based compensation expense in our non-GAAP financial metric reporting to increase accountability and transparency. In 2020, amended our Corporate Governance Guidelines to specify the maximum number of public company board seats our directors may hold (four seats, including PayPal’s Board). Additionally in 2020, amended our Compensation and Corporate Governance and Nominating Committee charters to more clearly reflect the Committees’ specific oversight responsibilities. Since 2017, have added five directors to the Board, enhancing the Board’s gender and ethnic diversity and adding skills and experiences that have improved the overall effectiveness of the Board. Stockholder Outreach Actions taken in response to stockholder feedback have included: Our Longstanding Stockholder Dialogue has Shaped the Board’s Actions

Diverse, qualified, and engaged director nominees Our 11 Board nominees(1) provide effective oversight of management and the Company to support the long-term interests of PayPal and its stockholders, employees, customers, and communities. We demonstrate our commitment to diversity and inclusion at all levels at the Company, from our Board to our workforce. 45% of the Board are women or from diverse ethnic groups.(2) Diverse Ethnic Group Women 2 3 6 Alex Chriss President & CEO Rodney Adkins Jonathan Christodoro David Dorman Comp. Committee Chair Enrique Lores Gail McGovern Gov/Nom Committee Chair Deborah Messemer David Moffett ARC Committee Chair Ann Sarnoff Frank Yeary John Donahoe Independent Chair Payments / Financial Services / FinTech Technology / Innovation Global Business Go to Market Senior Leadership Business Development and Strategy Regulatory / Governmental Risk Mgmt. & Compliance Cybersecurity / Information Security Risk Mgmt. Finance / Accounting Environmental and Social Risk Mgmt. Human Capital Mgmt. Other Public Company Board Service 6/11 9/11 11/11 9/11 11/11 11/11 7/11 3/11 11/11 10/11 11/11 10/11 Skillsets Properly Aligned With Our Go-Forward Strategy(2) Proposal 1: Election of 11 Director Nominees As previously announced, Ms. Belinda Johnson will not be standing for re-election to PayPal’s Board of Directors at the 2024 Annual Meeting. In addition, we announced that the Board intends to appoint Carmine Di Sibio as an independent director of the Company effective July 1, 2024. Reflects PayPal’s expected Board composition effective immediately following the 2024 Annual Meeting.

Our Board’s systematic approach for effective risk oversight Our Board oversees PayPal’s overall risk assessment and risk management; primary responsibility for certain risk topics are delegated to specific Committees, which regularly report to the full Board. Compensation Risk: Oversees and reviews the risks associated with PayPal’s compensation policies, plans, and programs and regulatory compliance with respect to compensation matters. Human Capital Management: Oversees and monitors PayPal’s strategies related to talent management, including the recruitment and retention of key talent, pay equity, corporate culture, Belonging, and other key human capital management programs and initiatives. Succession Planning: Oversees executive succession planning. Compensation Committee Primarily responsible for oversight of PayPal’s risk framework and reports to the full Board on a regular basis on the following matters: Financial and Audit Risk: Reviews the quality and integrity of financial statements, disclosure controls and procedures, performance of independent and internal auditors, and the effects of new accounting standards. Enterprise-Wide Risk and Compliance: Reviews the ERCM Program and key risk-management policies; oversees and assesses the Company’s overall risk management framework and risk appetite framework, which address key current and emerging risks, including risks associated with cybersecurity, information security, and privacy. Legal and Regulatory Risks: Reviews regulatory or compliance matters that could materially impact PayPal’s business or compliance policies. Audit, Risk, and Compliance (ARC) Committee Corporate Governance: Oversees and reviews the risks associated with PayPal’s overall corporate governance framework, principles, policies and practices. Corporate Sustainability and Impact (“CSI”) Matters: Oversees PayPal’s CSI matters generally, including overall CSI strategy, risks and opportunities, stakeholder engagement and reporting, programs and initiatives in social innovation and environmental sustainability, and our annual Global Impact Report. Political Activities: Oversees PayPal’s political activities and expenditures. Corporate Governance and Nominating Committee Proposal 1: Election of 11 Director Nominees

Form of Payment Performance Period Performance Criteria Objectives 2023 Outcomes Salary Cash Ongoing Alignment of salary with performance is evaluated on an annual basis Compensates for expected day-to-day performance Rewards individuals’ current contributions Reflects scope of roles and responsibilities N/A Annual Incentive Plan (”AIP”) PBRSUs One year Revenue and Non-GAAP Operating Margin Rewards successful annual performance Motivates achievement of short-term performance goals tied to annual operating plan and designed to enhance value of PayPal Significant equity portion to further align with stockholder interests Revenue: 200% Non-GAAP Operating Margin: 102% Company Performance Score: 151% All eligible NEOs met their performance criteria, and each received an individual performance score of 100% Cash One year Individual performance Long-Term Incentive Plan (“LTI”) PBRSUs Three years FX-Neutral Revenue Compound Annual Growth Rate (“CAGR”) and Free Cash Flow CAGR Rewards successful achievement of three-year performance goals designed to enhance long-term value of PayPal Supports pay-for-performance alignment Intended to satisfy long-term retention objectives 2021-2023 PBRSUs FX-Neutral Revenue CAGR: 0% Free Cash Flow CAGR: 0% Aggregate Percent of Target Achieved): 0% RSUs Vests over three years Service-based vesting; ultimate value based on stock price performance Rewards the creation of long-term value Supports alignment with shareholders Recognizes potential future contributions Intended to satisfy long-term retention objectives N/A 2023 compensation program closely tied to PayPal’s performance Our 2023 executive compensation program and outcomes are aligned with our stockholders’ interests and include key components reflecting PayPal’s strategic imperatives for growth. 100% 75% 25% 50% 50% Proposal 2: Approval of Named Executive Officer Compensation

Recent compensation actions reflect stockholder feedback Following our 2023 Annual Meeting, we sought stockholder input regarding executive leadership and executive compensation; our Compensation Committee leveraged that feedback to implement responsive enhancements to the compensation program. Proposal 2: Approval of Named Executive Officer Compensation Executive Leadership Transformation: Encouraged PayPal to recruit a CEO with deep product and innovation expertise Incentive Program Metrics: Requested more emphasis on profitability metrics Encouraged a relative total shareholder return (rTSR) metric and/or return on capital metric in the long-term plan Emphasized the importance of including stock-based compensation expense in non-GAAP metrics underlying the compensation plan Compensation Program Structure: Highlighted that long-term incentive should utilize a reasonably long-term performance period Encouraged thoughtful use of equity compensation to manage dilution What We Heard Executive Leadership Transformation: Attracted new executives, including Alex Chriss, as a CEO with extensive product and innovation expertise; thoughtfully structured new hire compensation with a significant portion tied to rigorous performance criteria What We Did Compensation Program Structure: Moved 2024-2026 PBRSUs to a three-year performance period using three discrete measurement periods of 12, 24, and 36 months to minimize impact of short-term share price volatility; no vesting prior to end of the three-year period and payout will be capped at target if absolute TSR is negative for the 36-month period Moved annual incentive to 100% cash structure to align actual payout with intended value to be delivered and reduce burn rate Incentive Program Metrics: Updated 2024 annual incentive metrics to Non-GAAP Operating Income and Transaction Margin Dollars Moved 2024-2026 PBRSUs to an rTSR metric to better align PBRSU payouts with long-term shareholder value and effectively motivate leaders to holistically execute while strategy continues to evolve; target for rTSR set at 55th percentile to ensure rigor of goal Beginning with Q1 2024, include stock-based compensation expense in non-GAAP financial metric reporting

2023 executive transition-related compensation attracted top talent The Compensation Committee took a thoughtful approach in establishing new hire awards to attract Mr. Chriss, Ms. Miller, and Ms. Gill to join PayPal and ensure appropriate long-term alignment with stockholders. They will not receive any additional equity awards in the 2024 reward cycle. Compensation Arrangements Through 2024 Special, Non-Recurring New Hire Awards NEO Annual Base Salary Rate Target Annual Incentive Plan Bonus as a % of Annual Base Salary(1) Initial RSU Grant Initial PBRSU Grant (at target) Cash Sign–On Bonus Make-Whole or Sign-On Incentive RSUs $1.25M 200% $16.75M(2) $17M (target value) Three-year performance period Based on achievement against FX-Neutral Revenue CAGR and Free Cash Flow CAGR goals (2023-2025 PBRSU formulation) N/A $10M(3) (Make-Whole) Critical to successfully recruit Mr. Chriss from his prior employer, where he forfeited ~$18M upon joining PayPal Three-year performance period Based on achievement against FX-Neutral Revenue CAGR and Free Cash Flow CAGR goals (2023-2025 PBRSU formulation) Critical to successfully recruit Mr. Chriss from his prior employer, where he forfeited ~$18M upon joining PayPal $750K 125% $6.25M(2) $6.25M (target value) Three-year performance period Based on achievement of relative total shareholder return (rTSR) metric, measured as compared to the S&P 500 (2024-2026 PBRSU formulation) $6M(4) $2M(2) (Sign-On) Ensures a meaningful ownership stake to align with stockholder interests $750K 125% $6.25M(2) $6.25M (target value) Three-year performance period Based on achievement of relative total shareholder return (rTSR) metric, measured as compared to the S&P 500 (2024-2026 PBRSU formulation) $2M(4) $2M(2) (Sign-On) Ensures a meaningful ownership stake to align with stockholder interests Three-year performance period Based on achievement of relative total shareholder return (rTSR) metric, measured as compared to the S&P 500 (2024-2026 PBRSU formulation) Ensures a meaningful ownership stake to align with stockholder interests CFO – Jamie Miller Started Nov. 2023 Started Nov. 2023 EVP, General Manager – Small Business & Financial Services Group – Michelle Gill CEO – Alex Chriss Started Sep. 2023 Proposal 2: Approval of Named Executive Officer Compensation Ms. Miller and Ms. Gill were not eligible to receive an AIP payment for 2023 based on their respective start dates with PayPal. Standard RSU vesting over three years: one-third vest on first anniversary of grant date; one-twelfth vest on each quarterly grant date thereafter. One-half vest on first anniversary of grant; second half vest on the second anniversary . 50% payable within two pay periods following start date; remaining 50% payable within two pay periods following six-month anniversary; subject to repayment requirements Future annual grant decisions made by the Committee will consider competitive market positioning, adjusted for performance

Departing CEO compensation designed to facilitate an effective transition The Compensation Committee structured the departing CEO’s 2023 compensation to ensure the Board had time to conduct a rigorous CEO search process and to enable an effective CEO transition, while aligning his incentives with stockholders. The Compensation Committee determined it was appropriate to accelerate vesting for the second tranche of Mr. Schulman’s transition award to vest when he departed the Board in December, in recognition of his facilitation of a rapid, effective and efficient transition which enabled Mr. Chriss to onboard quickly 2023 LTI Target Value: $18.7M reduced from 2022 LTI Target Value: $24M Mr. Schulman’s 2023 total LTI target value was reduced by $5.3M year-over-year as a result of an assessment of our performance against financial, strategic and operational objectives, our stockholders’ experience and to reflect our pay-for-performance philosophy Departing CEO 2023 Long-Term Incentives Departing CEO 2023 Long-Term Incentive Plan Component / Form of Payment Vesting Schedule 2023-2025 Performance-Based Restricted Stock Units (PBRSUs) Scheduled to vest, to the extent earned, after three-year performance period in accordance with the terms of the Executive Long Term Incentive Program Restricted Stock Units (RSUs) Scheduled to vest over standard three-year vesting schedule in accordance with the terms of the Executive Long Term Incentive Program Transition-Related PBRSUs (Split in Two Equal Tranches) Tranche 1: Granted to retain Mr. Schulman through the CEO transition, successfully recruit a new CEO and ensure the Company remained focused on execution of our financial, strategic and operating goals Status: Vested in full in Sept. 2023 upon Mr. Chriss’ start date Tranche 2: Granted to onboard Mr. Chriss and execute an orderly and effective CEO transition; originally scheduled to vest in Jun. 2024, in anticipation of Mr. Schulman completing the transition of his duties and stepping down from the Board in May 2024 Status: Vested in full in Dec. 2023 upon Mr. Schulman’s successful transition of responsibilities and departure from the Board $6.7M (total target value) Total LTI Target Value Proposal 2: Approval of Named Executive Officer Compensation $6.0M $6.0M (total target value)

Strategic Equity Compensation Coupled With Competitive Hiring to Accelerate Long-Term Profitable Growth The Equity Plan supports a broad-based program that is critical to our ability to effectively attract and retain talented employees in a highly competitive labor market. Equity awards support our pay-for-performance philosophy, promote an ownership mentality and create strong alignment between employees and stockholders. Our equity request reflects our market for talent, with 43% of our full-time employees classified within our technology function. We actively manage our long-term stockholder dilution by closely managing the number of equity awards granted annually, while our significant share repurchase program helps offset dilution from equity awards. The Compensation Committee is mindful of the dilutive impact of our equity programs and is committed to thoughtfully managing our burn rate, including assessing our equity usage as compared to peers. Our three-year average gross burn rate was 1.5% for fiscal years 2021 through 2023, below the median (1.9%) of our technology peers during the same period(1). We intend to seek annual approval for any additional share requests in the near term in order to provide more frequent opportunities for stockholder input, and are seeking a modest increase to the share reserve at this time. Gross burn rate is defined as the number of shares subject to equity awards granted divided by the weighted average number of shares outstanding for that fiscal year. Technology peers are the 10 technology companies included in our compensation peer group: Adobe, Apple, Block, Intuit, Netflix, Oracle, Salesforce, ServiceNow, Shopify, and Uber Technologies. Equity incentive plan designed to attract, retain, and reward top talent We are requesting approval to increase the share reserve under our equity plan by 20 million shares to ensure that we attract and retain top talent in our highly competitive labor market, and to remove the inverse fungible share ratio for future awards. Proposal 3: Approval of PayPal Holdings, Inc. 2015 Equity Incentive Award Plan, as Amended and Restated

Administered by 100% independent Compensation Committee. Minimum vesting for equity awards. Required stockholder approval for additional shares. Share counting provisions. Annual limits on non-employee director awards. Stock ownership guidelines and mandatory retention requirement. Grant performance-based equity awards to our executives. What We Do Subject to stockholder approval of the amended plan, we are removing the inverse fungible share ratio for future awards. Explicit prohibition on repricing without stockholder approval. No discounted stock options or stock appreciation rights. No dividends paid on awards prior to vest and no dividend equivalents on options or stock appreciation rights. Limited transferability and no share pledging. No tax gross-ups, except in connection with limited foreign living allowances. Equity incentive plan governed by best practices What We Don’t Do Proposal 3: Approval of PayPal Holdings, Inc. 2015 Equity Incentive Award Plan, as Amended and Restated Our Equity Plan incorporates leading compensation governance practices designed to protect stockholder interests.

Stockholder proposals misaligned with stockholder interests Vote AGAINST: Report on Respecting Workforce Civil Liberties – Proponent: NCPPR PayPal already publicly provides robust reporting of its inclusion and anti-discrimination initiatives. The Proposal presents an inaccurate and erroneous view of PayPal's diversity, inclusion, equity and belonging (“Belonging”) performance. Devoting additional time and resources to the proposed report would be unnecessary, costly and would only distract from the ongoing diversity and anti-discrimination programs already in place at PayPal. Vote AGAINST: Bylaw Requiring Stockholder Approval of Director Compensation – Proponent: John Chevedden PayPal’s director compensation program is reasonable and reflects market practice. PayPal already provides opportunities for shareholders to express their views on director compensation through our annual election of directors and direct dialogue with investors. The director compensation scheme mandated by the proposed bylaw would place PayPal at an extreme disadvantage relative to other US public companies and hinder PayPal’s ability to attract and retain a qualified, high-performing Board of Directors. PayPal already has comprehensive and diligent practices in place on the matters raised by both stockholder proposals and believes that each of these proposals would be unnecessary and not in the interests of PayPal or its stockholders. Proposals 5, 6: Stockholder Proposals

We request your support at the 2024 Annual Meeting The Board asks that you vote FOR all management proposals and AGAINST both stockholder proposals. A vote FOR the Election of the 11 Director Nominees Named in PayPal’s 2024 Proxy Statement A vote FOR the Advisory Vote to Approve Named Executive Officer Compensation (“say-on-pay” vote) A vote FOR the Approval of the PayPal Holdings, Inc. 2015 Equity Incentive Award Plan, as Amended and Restated A vote FOR the Ratification of the Appointment of PricewaterhouseCoopers LLP as Our Independent Auditor for 2024 A vote AGAINST the Stockholder Proposal Regarding a Report on Respecting Workforce Civil Liberties A vote AGAINST the Stockholder Proposal Regarding Stockholder Approval of Director Compensation Our Board recommends:

Appendix

This presentation includes financial measures defined as “non-GAAP financial measures” by the Securities and Exchange Commission (SEC), including non-GAAP operating margin and free cash flow. These measures may be different from non-GAAP financial measures used by other companies. The presentation of this financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation of, or as a substitute for, the financial information prepared and presented in accordance with generally accepted accounting principles (GAAP). Information on how we compute these non-GAAP financial measures and a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measures is available in our Q4 2023 Investor Update provided on February 7, 2024. Non-GAAP Financial Measures Q4 2023 Investor Update Stockholder Outreach

Thank you