Q3 2024 SUPPLEMENTAL FINANCIAL & OPERATING INFORMATION Four Corners Property Trust NYSE: FCPT

Cautionary note regarding forward-looking statements: This presentation contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include all statements that are not historical statements of fact and those regarding FCPT’s intent, belief or expectations, including, but not limited to, statements regarding: operating and financial performance, acquisition pipeline, expectations regarding the making of distributions and the payment of dividends, and the effect of pandemics on the business operations of FCPT and FCPT’s tenants and their continued ability to pay rent in a timely manner or at all. Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. Forward-looking statements speak only as of the date on which such statements are made and, except in the normal course of FCPT’s public disclosure obligations, FCPT expressly disclaims any obligation to publicly release any updates or revisions to any forward-looking statements to reflect any change in FCPT’s expectations or any change in events, conditions or circumstances on which any statement is based. Forward-looking statements are based on management’s current expectations and beliefs and FCPT can give no assurance that its expectations or the events described will occur as described. For a further discussion of these and other factors that could cause FCPT’s future results to differ materially from any forward-looking statements, see the risk factors described under the section entitled “Item 1A. Risk Factors” in FCPT’s annual report on Form 10-K for the year ended December 31, 2023 and other risks described in documents subsequently filed by FCPT from time to time with the Securities and Exchange Commission. Notice regarding non-GAAP financial measures: The information in this communication contains and refers to certain non-GAAP financial measures, including FFO and AFFO. These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in the supplemental financial and operating report, which can be found in the Investors section of our website at www.fcpt.com, and on page 17 of this presentation. FORWARD LOOKING STATEMENTS AND DISCLAIMERS Q3 2024

Q3 2024 CONTENTS 1 FINANCIAL SUMMARY PG 3 2 REAL ESTATE PORTFOLIO SUMMARY PG 12 3 EXHIBITS PG 16

Q3 2024 CONSOLIDATING BALANCE SHEET

Q3 2024 CONSOLIDATED INCOME STATEMENT

Q3 2024 FFO & AFFO RECONCILIATION

Q3 2024 NET ASSET VALUE COMPONENTS

Q3 2024 CAPITALIZATION & KEY CREDIT METRICS

Q3 2024 DEBT SUMMARY Note: FCPT has entered into interest rate swaps that fix $460 million (95% of total debt fixed as of 9/30/2024) of Term Loans through November 2024, $435 million (93% of total debt fixed as of 9/30/2024) through November 2025, $435 million (93% of total debt fixed as of 9/30/2024) through November 2026, and $385 million (89% of total debt fixed as of 9/30/2024) through November 2027. See footnotes for further details

Q3 2024 4.0-year Weighted average term for notes/term loans 95% Fixed rate debt 3.94% Weighted average cash interest rate $250 million Available on revolver 1 DEBT MATURITY SCHEDULE

Q3 2024 DEBT COVENANTS

Q3 2024 1 FINANCIAL SUMMARY PG 3 3 EXHIBITS PG 16 CONTENTS 3 EXHIBITS PG 1 2 REAL ESTATE PORTFOLIO SUMMARY PG 12

Q3 2024 1,176 Leases / 156 Brands Annual Base Rent of $229.2 million1 49% Darden Exposure 57% Investment Grade3 1.4% Average Annual Rent Escalator4 FCPT PORTFOLIO BRAND DIVERSIFICATION Other casual dining restaurants Auto service Medical retail Other retail 2 Quick service restaurants

Q3 2024 WA OR CA MT ID NV AZ UT WY CO NM TX OK KS NE SD ND MN IA MO AR LA MS AL GA FL SC TN NC IL WI MI OH IN KY WV VA PA NY ME VT NH NJ DE MD MA CT RI GEOGRAPHIC DIVERSIFICATION 5.0%–10.0% 3.0%–5.0% 2.0%–3.0% Annualized Base Rent1 (%) 1.0 %–2.0% <1.0% No Properties 14

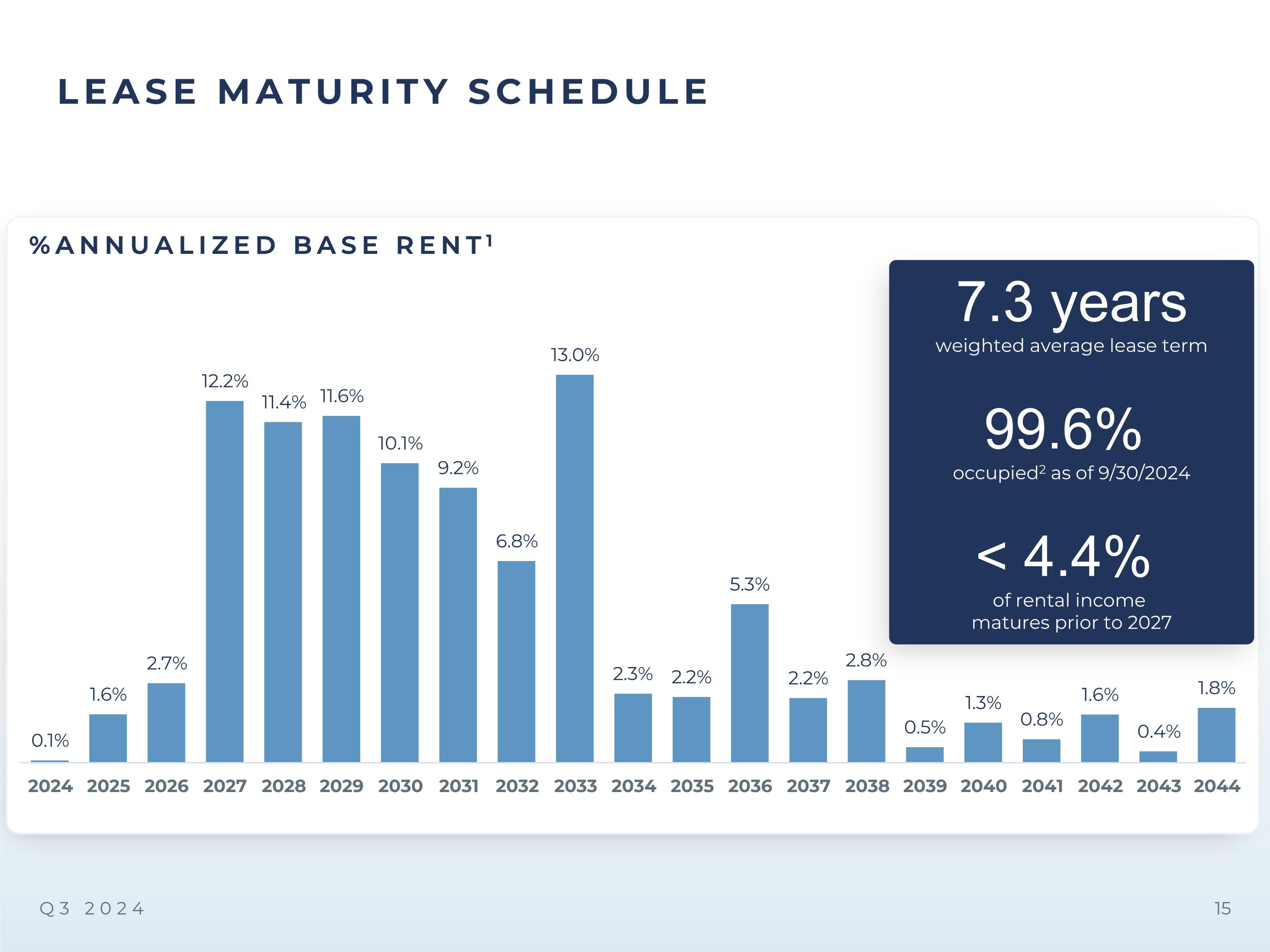

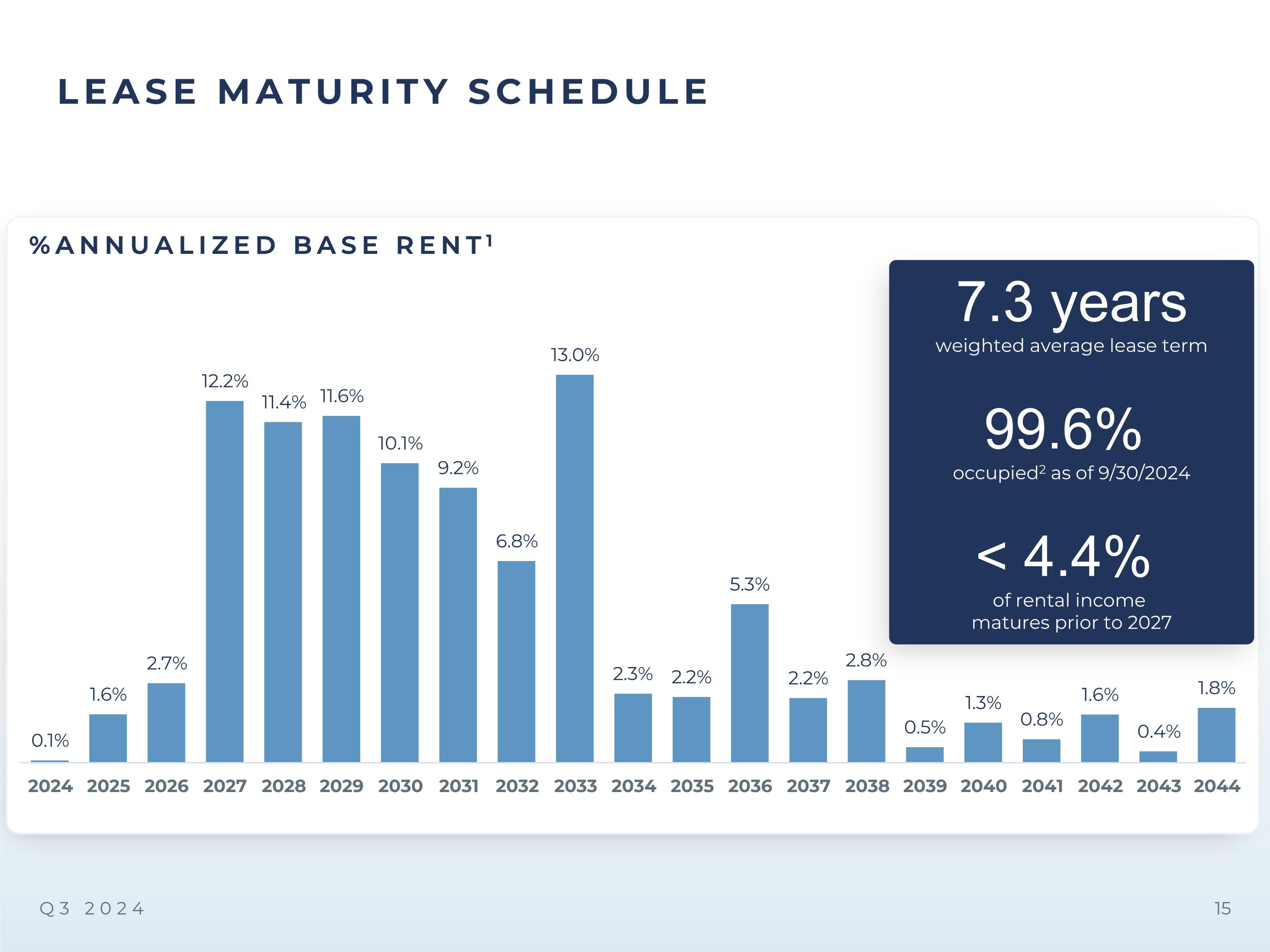

Q3 2024 %ANNUALIZED BASE RENT1 99.6% occupied2 as of 9/30/2024 7.3 years weighted average lease term < 4.4% of rental income matures prior to 2027 LEASE MATURITY SCHEDULE

Q3 2024 2 REAL ESTATE PORTFOLIO SUMMARY PG 12 3 EXHIBITS PG 16 1 FINANCIAL SUMMARY PG 3 CONTENTS

This document includes certain non-GAAP financial measures that management believes are helpful in understanding our business, as further described below. Our definition and calculation of non-GAAP financial measures may differ from those of other REITs and therefore may not be comparable. The non-GAAP measures should not be considered an alternative to net income as an indicator of our performance and should be considered only a supplement to net income, and to cash flows from operating, investing or financing activities as a measure of profitability and/or liquidity, computed in accordance with GAAP. ABR refers to annual cash base rent as of 9/30/2024 and represents monthly contractual cash rent, excluding percentage rents, from leases, recognized during the final month of the reporting period, adjusted to exclude amounts received from properties sold during that period and adjusted to include a full month of contractual rent for properties acquired during that period. EBITDA represents earnings (GAAP net income) plus interest expense, income tax expense, depreciation and amortization. EBITDAre is a non-GAAP measure computed in accordance with the definition adopted by the National Association of Real Estate Investment Trusts (“NAREIT”) as EBITDA (as defined above) excluding gains (or losses) on the disposition of depreciable real estate and real estate impairment losses. Adjusted EBITDAre is computed as EBITDAre (as defined above) excluding transaction costs incurred in connection with the acquisition of real estate investments and gains or losses on the extinguishment of debt. We believe that presenting supplemental reporting measures, or non-GAAP measures, such as EBITDA, EBITDAre and Adjusted EBITDAre, is useful to investors and analysts because it provides important information concerning our on-going operating performance exclusive of certain non-cash and other costs. These non-GAAP measures have limitations as they do not include all items of income and expense that affect operations. Accordingly, they should not be considered alternatives to GAAP net income as a performance measure and should be considered in addition to, and not in lieu of, GAAP financial measures. Our presentation of such non-GAAP measures may not be comparable to similarly titled measures employed by other REITs. Tenant EBITDAR is calculated as EBITDA plus rental expense. EBITDAR is derived from the most recent data provided by tenants that disclose this information. For Darden, EBITDAR is updated quarterly by multiplying the most recent individual property level sales information (reported by Darden twice annually to FCPT) by the average trailing twelve brand average EBITDA margin reported by Darden in its most recent comparable period, and then adding back property level rent. FCPT does not independently verify financial information provided by its tenants. Tenant EBITDAR coverage is calculated by dividing our reporting tenants’ most recently reported EBITDAR by annual in-place cash base rent. Funds From Operations (“FFO”) is a supplemental measure of our performance which should be considered along with, but not as an alternative to, net income and cash provided by operating activities as a measure of operating performance and liquidity. We calculate FFO in accordance with the standards established by NAREIT. FFO represents net income (loss) (computed in accordance with GAAP), excluding gains (or losses) from sales of property and undepreciated land and impairment write-downs of depreciable real estate, plus real estate related depreciation and amortization (excluding amortization of deferred financing costs) and after adjustments for unconsolidated partnerships and joint ventures. We also omit the tax impact of non-FFO producing activities from FFO determined in accordance with the NAREIT definition. Our management uses FFO as a supplemental performance measure because, in excluding real estate related depreciation and amortization and gains and losses from property dispositions, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We offer this measure because we recognize that FFO will be used by investors as a basis to compare our operating performance with that of other REITs. However, because FFO excludes depreciation and amortization and captures neither the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effect and could materially impact our financial condition and results from operations, the utility of FFO as a measure of our performance is limited. FFO is a non-GAAP measure and should not be considered a measure of liquidity including our ability to pay dividends or make distributions. In addition, our calculations of FFO are not necessarily comparable to FFO as calculated by other REITs that do not use the same definition or implementation guidelines or interpret the standards differently from us. Investors in our securities should not rely on these measures as a substitute for any GAAP measure, including net income. Adjusted Funds From Operations (“AFFO”) is a non-GAAP measure that is used as a supplemental operating measure specifically for comparing year over year ability to fund dividend distribution from operating activities. AFFO is used by us as a basis to address our ability to fund our dividend payments. We calculate adjusted funds from operations by adding to or subtracting from FFO: Transaction costs incurred in connection with business combinations Straight-line rent Stock-based compensation expense Non-cash amortization of deferred financing costs Other non-cash interest expense (income) Non-real estate investment depreciation Merger, restructuring and other related costs Impairment charges Other non-cash revenue adjustments, including amortization of above and below market leases and lease incentives Amortization of capitalized leasing costs Debt extinguishment gains and losses Non-cash expense (income) adjustments related to deferred tax benefits AFFO is not intended to represent cash flow from operations for the period, and is only intended to provide an additional measure of performance by adjusting the effect of certain items noted above included in FFO. AFFO is a widely-reported measure by other REITs; however, other REITs may use different methodologies for calculating AFFO and, accordingly, our AFFO may not be comparable to other REITs. Properties refers to properties available for lease. Q3 2024 GLOSSARY AND NON-GAAP DEFINITIONS

Q3 2024 RECONCILIATION SCHEDULES RECONCILIATION OF NET INCOME TO ADJUSTED EBITDARE RENTAL REVENUE AND PROPERTY EXPENSE DETAIL

Q3 2024 PAGE 6 FFO & AFFO RECONCILIATION Amount represents non-cash deferred income tax (benefit) expense recognized at the Kerrow Restaurant Business Assumes the issuance of common shares for OP units held by non-controlling interest PAGE 9 DEBT SUMMARY Borrowings under the term loans accrue interest at a rate of daily SOFR plus 0.10% plus a 0.95%-1.00% credit spread. FCPT has entered into interest rate swaps that fix $460 million of Term Loans through November 2024, $435 million through November 2025, and $435 through November 2026, and $385 through November 2027. The all-in cash interest rate on the portion of the term loan that is fixed and including the credit spread is approximately 3.5% for 2024, 3.4% for 2025, 3.8% for 2026, and 3.7% for 2027. A daily simple SOFR rate of 4.96% as of 9/30/2024 is used for the 11% of term loans that are not fixed through hedges These notes are senior unsecured fixed rate obligations of the Company. Cash interest rate excludes amortization of swap gains and losses incurred in connection with the issuance of these notes. The annual amortization (benefit) of net hedge gains is currently $182 thousand per year As of 9/30/2024, FCPT had no mortgage debt and 100% of FCPT properties were unencumbered Excludes amortization of deferred financing costs on the credit facility and unsecured notes PAGE 10 DEBT MATURITY SCHEDULE Figures as of 9/30/2024 The revolving credit facility expires on November 9, 2025 subject to FCPT’s availability to extend the term for one additional six-month period to May 9, 2026 PAGE 15 LEASE MATURITY SCHEDULE Note: Excludes renewal options. All data as of 9/30/2024 Annual cash base rent (ABR) as defined in glossary Occupancy based on portfolio square footage PAGE 7 NET ASSET VALUE COMPONENTS See glossary on page 17 for tenant EBITDAR and tenant EBITDAR coverage definitions: results based on tenant reporting representing 100% of Darden annual cash base rent (ABR), 50% of other restaurant ABR and 9% of non-restaurant ABR or 66% of total portfolio ABR. We have estimated Darden current EBITDAR coverage using sales results for the reported FCPT portfolio for the year ending May 2024 and updated average trailing twelve months brand average margins for the year ended May 2024 Lease term weighted by annual cash base rent (ABR) as defined in glossary Current scheduled minimum contractual rent as of 9/30/2024 FCPT acquired 21 properties and leasehold interests in Q3 2024; FCPT had no dispositions in the quarter PAGE 13 BRAND DIVERSIFICATION Represents current scheduled minimum Annual Cash Base Rent (ABR) as of 9/30/2024, as defined in glossary Other retail includes properties leased to cell phone stores, bank branches, grocers amongst others. These are often below market rent leases, and many were purchased through the outparcel strategy Investment Grade Ratings represent the credit rating of our tenants, their subsidiaries or affiliated companies from Fitch, S&P or Moody’s Average annual rent escalation through December 31, 2028 (weighted by annualized base rent) PAGE 14 GEOGRAPHIC DIVERSIFICATION Annual cash base rent (ABR) as defined in glossary. Includes two leases in Alaska (not pictured) PAGE 18 RECONCILIATION SCHEDULES See glossary on page 17 for non-GAAP definitions Other non-reimbursed property expenses include non-reimbursed tenant expenses, vacant property expenses, abandoned deal costs, property legal costs, and franchise taxes PAGE 8 CAPITALIZATION & KEY CREDIT METRICS Third quarter 2024 dividend was declared on 9/16/2024, payable on 10/15/2024 Principal debt amount less cash and cash equivalents Current quarter annualized. See glossary on page 17 for definitions of EBITDAre and Adjusted EBITDAre and page 18 for reconciliation to net income Includes forward equity contracts outstanding as of 9/30/2024 for anticipated net proceeds of $88 million FOOTNOTES

Q3 2024 SUPPLEMENTAL FINANCIAL & OPERATING INFORMATION