UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23148

Guardian Variable Products Trust

(Exact name of registrant as specified in charter)

10 Hudson Yards New York, N.Y. 10001

(Address of principal executive offices) (Zip code)

Dominique Baede

President

Guardian Variable Products Trust

10 Hudson Yards

New York, N.Y. 10001

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-598-8000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

| Item 1. | Reports to Stockholders. |

| | (a) | A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is filed herewith. |

Guardian Variable

Products Trust

2023

Annual Report

All Data as of December 31, 2023

Guardian Core Fixed Income VIP Fund

| | |

| Not FDIC insured. May lose value. No bank guarantee. | | www.guardianlife.com |

TABLE OF CONTENTS

Guardian Core Fixed Income VIP Fund

Except as otherwise specifically stated, all information, including portfolio security positions, is as of December 31, 2023. The views expressed in the Fund Commentary are those of Park Avenue Institutional Advisers LLC as of the date of this report and are subject to change without notice. The Fund Commentary may contain some forward-looking statements providing expectations or forecasts of future events as of the date of this report; they do not necessarily relate to historical or current facts. There can be no guarantee that any forward-looking statement will be realized. We undertake no obligation to update forward-looking statements, whether as a result of new information, future events, or otherwise. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary. Information contained herein has been obtained from sources believed reliable, but is not guaranteed.

GUARDIAN CORE FIXED INCOME VIP FUND

FUND COMMENTARY OF

PARK AVENUE INSTITUTIONAL ADVISERS LLC, MANAGER

(UNAUDITED)

Highlights

| • | | Guardian Core Fixed Income VIP Fund (the “Fund”) returned 5.52% for the 12 months ended December 31, 2023, modestly underperforming its benchmark, the Bloomberg US Aggregate Bond Index1 (the “Index”). |

| • | | The Index returned 5.53% for the same period. |

| • | | The Fund’s performance was mainly driven by an out-of-benchmark allocation to collateralized loan obligations (“CLOs”). Security selection within investment grade investments aided performance, but it was mitigated by an underweight allocation to the sector. In addition, an out-of-benchmark allocation to investment grade (“IG”) Credit Default Swap Index2 (“CDX”) (which is beneficial in a spread widening environment) detracted from performance, but we reduced the position in the second half of the year. |

Market Overview

A heightened level of volatility in the credit markets lingered in 2023, despite very low volatility in the broader equity markets. Rate volatility specifically drove much of the volatility of the credit markets but the flare ups from the regional banking crisis and commercial real estate areas also contributed. Throughout 2023, inflation risks were still running high and the path of the U.S. Federal Reserve’s (the “Fed”) monetary policy tightening remained uncertain in light of views of a pending recession.

The Standard & Poor’s 500® Index3 (the “S&P 500 Index”) returned 26.29% for the year. This performance was fueled by a big year-end push after lower November inflation data, the Fed’s outlook, and more healthy economic data on jobs, gross domestic product (GDP), and even consumer confidence. Fixed income asset classes joined in, with positive returns in the fourth quarter of 2023. For the year, the Index returned 5.53%, the Bloomberg Corporate High Yield Bond Index4 (the “High Yield Index”) returned 13.44%, and the 10-year U.S. Treasury returned 3.17% after a big rally into year end.

Headline inflation ended the year at 3.1%, not at the Fed’s target level but trending that way. We believe the “last mile” to the Fed’s target will be bumpy, but on the other end of the spectrum, growth is not plummeting as many had feared earlier in the year. It will not be easy coming down from the fastest and highest interest rate hiking cycle in history, but we believe the fact that peak interest rates and peak inflation are in the rearview mirror are beneficial for risk markets.

Portfolio Review

The Fund’s performance was mainly driven by an out-of-benchmark allocation to CLOs. Security selection within investment grade also aided performance, but it was mitigated by an underweight allocation to the sector. An out-of-benchmark allocation to IG CDX detracted from performance; we reduced the position in the second half of the year.

Outlook

As we enter 2024, we maintain a modestly positive outlook. The yields and dollar-price of many fixed income assets look attractive and supportive. From our view, disinflation continues, and a severe recession outlook is not the baseline. Yet some spread levels and recent year-end rallies give us pause that 2024 might have better entry points. This is not currently an all-in market, but we remain invested in our process and flexibility with both allocation and security selection, and disciplined in our target levels. We believe that volatility is likely to continue this year. Finally, we are also closely watching the large amounts of retail and institutional assets invested in cash. A record absolute level of cash, as well as relative to the economy, has been parked in overnight investments as volatility is peaking. When the $6 trillion of cash in institutional money markets looks to invest spread and duration assets, we believe it can move fast. We strive to remain disciplined in our investment approach but also seek the most relatively attractive assets that we believe are prudent investments for the Fund’s portfolio.

| 1 | The Index is an index of U.S. dollar-denominated, investment-grade U.S. government and corporate securities, and mortgage pass-through securities, and asset-backed securities. You may not invest in the Index and, unlike the Fund, the Index does not incur fees or expenses. |

| 2 | CDX is a benchmark index that tracks a basket of U.S. and emerging market single-issuer credit default swaps (“CDSs”). The CDX is also a tradable financial product that investors can use to gain broad exposure to the CDS market. |

| 3 | The S&P 500 Index is an unmanaged market-capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. You may not invest in the S&P 500 Index and, unlike the Fund, the S&P 500 Index does not incur fees or expenses. |

| 4 | The High Yield Index is generally considered to be representative of the investable universe of the U.S. dollar–denominated high-yield debt market. You may not invest in the High Yield Index and, unlike the Fund, the High Yield Index does not incur fees or expenses. |

GUARDIAN CORE FIXED INCOME VIP FUND

Fund Characteristics (unaudited)

| | |

| Total Net Assets: $424,553,552 | | |

|

| |

Bond Sector Allocation1 As of December 31, 2023 |

|

| |

| |

Bond Quality Allocation2 As of December 31, 2023 |

|

GUARDIAN CORE FIXED INCOME VIP FUND

| | | | | | | | | | | | |

| | | | |

Top Ten Holdings1 As of December 31, 2023 | | | | | | | | | |

| | | | |

| Holding | | Coupon Rate | | | Maturity Date | | | % of Total

Net Assets | |

| U.S. Treasury Bonds | | | 4.750% | | | | 11/15/2043 | | | | 9.7% | |

| U.S. Treasury Notes | | | 4.875% | | | | 10/31/2028 | | | | 6.3% | |

| U.S. Treasury Bonds | | | 4.750% | | | | 11/15/2053 | | | | 5.4% | |

| U.S. Treasury Notes | | | 5.000% | | | | 10/31/2025 | | | | 5.1% | |

| U.S. Treasury Notes | | | 4.500% | | | | 11/15/2033 | | | | 2.0% | |

| Federal National Mortgage Association | | | 3.000% | | | | 5/1/2052 | | | | 2.0% | |

| Federal Home Loan Mortgage Corp. | | | 3.500% | | | | 6/1/2052 | | | | 1.4% | |

| U.S. Treasury Notes | | | 4.375% | | | | 11/30/2030 | | | | 1.2% | |

| Federal National Mortgage Association | | | 4.000% | | | | 10/1/2052 | | | | 1.1% | |

| Federal National Mortgage Association | | | 4.500% | | | | 10/1/2053 | | | | 1.1% | |

| Total | | | | 35.3% | |

| 1 | Portfolio holdings are subject to change and should not be considered a recommendation to buy or sell individual securities. Cash includes short-term investments and net other assets and liabilities. |

| 2 | The Bond Quality Allocation chart displays the percentage of fund assets allocated to each rating. Rating agencies’ independent ratings of individual securities are aggregated by Bloomberg, and market weights are reported using Standard & Poor’s letter rating conventions. Rating methodology uses the middle rating of Moody’s Investors Service, Inc., Standard & Poor’s Ratings Services, and Fitch Ratings. When a rating from only two of the rating agencies is available, the lower rating is used. Credit quality ratings assigned by a rating agency are subject to change periodically and are not absolute standards of credit quality. Rating agencies may fail to make timely changes in credit ratings, and an issuer’s current financial condition may be better or worse than a rating indicates. In formulating investment decisions for the Fund, Park Avenue Institutional Advisers LLC develops its own analysis of the credit quality and risks associated with individual debt instruments, rather than relying exclusively on rating agency ratings. |

GUARDIAN CORE FIXED INCOME VIP FUND

Fund Performance (unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Average Annual Total Returns As of December 31, 2023 | | | | | | | | | | | | | | | |

| | | | | | |

| | | Inception Date | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception | |

| Guardian Core Fixed Income VIP Fund | | | 5/2/2022 | | | | 5.52% | | | | — | | | | — | | | | 0.84% | |

| Bloomberg US Aggregate Bond Index | | | | | | | 5.53% | | | | — | | | | — | | | | 2.05% | |

| | |

| |

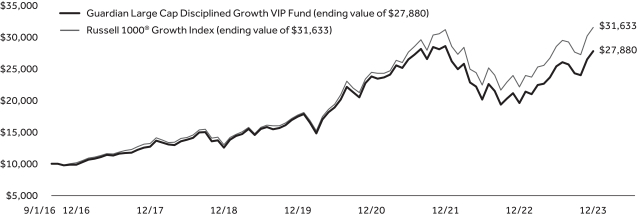

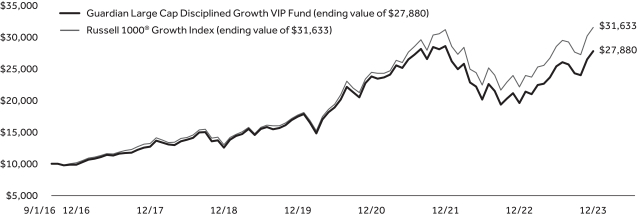

Results of a Hypothetical $10,000 Investment As of December 31, 2023 |

| | |

The chart above shows the performance of a hypothetical $10,000 investment made on inception date in Guardian Core Fixed Income VIP Fund and the Bloomberg US Aggregate Bond Index. Index returns do not include the fees and expenses of the Fund, but do include reinvestment of dividends, if any.

Performance quoted represents past performance and does not guarantee or predict future results. Investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost. The Fund’s fees and expenses are detailed in the Financial Highlights section of this report. Fees and expenses are factored into the net asset value of Fund shares and any performance numbers we release. Total return figures include the effect of expense limitations in effect during the periods shown, if applicable; without such limitations, the performance shown would have been lower. Performance results assume the reinvestment of dividends and capital gains. The return figures shown do not reflect the deduction of taxes that a contract owner/policyholder may pay on redemption units. The actual total returns for owners of variable annuity contracts or variable life insurance policies that provide for investment in the Fund will be lower to reflect separate account and contract/policy charges. Current and month-end performance information, which may be lower or higher than that cited, is available by calling 1-888-GUARDIAN (1-888-482-7342) and is periodically updated on our website: http://guardianlife.com.

UNDERSTANDING YOUR FUND’S EXPENSES (UNAUDITED)

By investing in the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including, as applicable, investment advisory fees, distribution and/or service (12b-1) fees, if any, and other Fund expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2023 to December 31, 2023. The table below shows the Fund’s expenses in two ways:

Expenses based on actual return

This section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Expenses based on hypothetical 5% return for comparison purposes

This section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with the cost of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore the second section is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher. Charges and expenses at the insurance company separate account level are not reflected in the table.

| | | | | | | | | | | | | | |

| | | | | |

| | | Beginning

Account Value 7/1/23 | | Ending Account Value

12/31/23 | | | Expenses Paid During Period* 7/1/23-12/31/23 | | | Expense Ratio During Period 7/1/23-12/31/23 | |

| Based on Actual Return | | $1,000.00 | | $ | 1,034.70 | | | $ | 2.56 | | | | 0.50% | |

Based on Hypothetical Return (5% Return Before Expenses) | | $1,000.00 | | $ | 1,022.69 | | | $ | 2.55 | | | | 0.50% | |

| * | Expenses are equal to the Fund’s annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

SCHEDULE OF INVESTMENTS — GUARDIAN CORE FIXED INCOME VIP FUND

| | | | | | | | |

| December 31, 2023 | | Principal

Amount | | | Value | |

| Agency Mortgage–Backed Securities – 14.7% | |

| | | |

Federal Home Loan Mortgage Corp.

3.00% due 3/1/2052 | | $ | 2,644,399 | | | $ | 2,339,791 | |

3.50% due 6/1/2052 | | | 6,428,290 | | | | 5,897,833 | |

4.00% due 10/1/2037 | | | 408,434 | | | | 400,862 | |

4.00% due 6/1/2052 | | | 3,054,252 | | | | 2,893,252 | |

4.50% due 8/1/2052 | | | 3,737,352 | | | | 3,626,731 | |

4.50% due 9/1/2052 | | | 468,613 | | | | 454,755 | |

5.50% due 9/1/2053 | | | 4,282,753 | | | | 4,308,338 | |

6.00% due 8/1/2053 | | | 2,023,111 | | | | 2,055,371 | |

6.00% due 10/1/2053 | | | 4,100,948 | | | | 4,164,825 | |

| | | |

Federal National Mortgage Association

3.00% due 7/1/2051 | | | 3,491,525 | | | | 3,086,274 | |

3.00% due 5/1/2052 | | | 9,396,149 | | | | 8,315,873 | |

3.50% due 6/1/2052 | | | 4,780,357 | | | | 4,392,513 | |

3.50% due 9/1/2052 | | | 3,712,627 | | | | 3,412,921 | |

3.50% due 10/1/2052 | | | 3,900,541 | | | | 3,582,264 | |

4.00% due 6/1/2052 | | | 4,728,753 | | | | 4,479,485 | |

4.00% due 10/1/2052 | | | 4,890,720 | | | | 4,629,879 | |

4.50% due 10/1/2053 | | | 4,631,569 | | | | 4,494,229 | |

| | | | | | | | | |

| | |

Total Agency Mortgage–Backed Securities

(Cost $63,319,732) | | | | 62,535,196 | |

| Asset–Backed Securities – 20.7% | |

| | | |

Aligned Data Centers Issuer LLC

Series 2021-1A, Class A2

1.937% due 8/15/2046(1) | | | 2,016,000 | | | | 1,806,943 | |

| | | |

Allegro CLO VI Ltd.

Series 2017-2A, Class B

7.164% (3 mo. USD Term SOFR + 1.76%)

due 1/17/2031(1)(2) | | | 2,000,000 | | | | 1,982,600 | |

| | | |

Ally Auto Receivables Trust

Series 2022-1, Class A3

3.31% due 11/15/2026 | | | 3,684,112 | | | | 3,630,906 | |

| | | |

AmeriCredit Automobile

Receivables Trust

Series 2020-3, Class C

1.06% due 8/18/2026 | | | 2,625,000 | | | | 2,526,784 | |

| | | |

Anchorage Capital CLO 17 Ltd.

Series 2021-17A, Class A1

6.826% (3 mo. USD Term SOFR + 1.43%)

due 7/15/2034(1)(2) | | | 2,800,000 | | | | 2,787,120 | |

| | | |

Anchorage Capital CLO 21 Ltd.

Series 2021-21A, Class B

7.427% (3 mo. USD Term SOFR + 2.01%)

due 10/20/2034(1)(2) | | | 1,750,000 | | | | 1,739,850 | |

| | | |

Ares XXVII CLO Ltd.

Series 2013-2A, Class BR2

7.302% (3 mo. USD Term SOFR + 1.91%)

due 10/28/2034(1)(2) | | | 2,000,000 | | | | 1,986,746 | |

| | | |

Ares XXVIIIR CLO Ltd.

Series 2018-28RA, Class A2

7.064% (3 mo. USD Term SOFR + 1.66%)

due 10/17/2030(1)(2) | | | 2,400,000 | | | | 2,387,105 | |

| | | | | | | | | |

| | | | | | | | |

| December 31, 2023 | | Principal

Amount | | | Value | |

| Asset–Backed Securities (continued) | |

| | | |

Avis Budget Rental Car Funding AESOP LLC

Series 2019-3A, Class A

2.36% due 3/20/2026(1) | | $ | 2,440,000 | | | $ | 2,363,814 | |

| | | |

Barings CLO Ltd.

Series 2020-1A, Class AR

6.806% (3 mo. USD Term SOFR + 1.41%)

due 10/15/2036(1)(2) | | | 2,800,000 | | | | 2,789,399 | |

| | | |

Battery Park CLO II Ltd.

Series 2022-1A, Class A1

7.626% (3 mo. USD Term SOFR + 2.21%)

due 10/20/2035(1)(2) | | | 3,550,000 | | | | 3,560,295 | |

| | | |

Benefit Street Partners CLO XVI Ltd.

Series 2018-16A, Class BR

7.214% (3 mo. USD Term SOFR + 1.81%)

due 1/17/2032(1)(2) | | | 2,800,000 | | | | 2,786,000 | |

| | | |

Canyon Capital CLO Ltd.

Series 2022-1A, Class B

7.253% (3 mo. USD Term SOFR + 1.85%)

due 4/15/2035(1)(2) | | | 2,000,000 | | | | 1,974,420 | |

| | | |

CarMax Auto Owner Trust

Series 2020-4, Class B

0.85% due 6/15/2026 | | | 2,200,000 | | | | 2,103,790 | |

| | | |

Cathedral Lake VI Ltd.

Series 2021-6A, Class AN

6.89% (3 mo. USD Term SOFR + 1.51%)

due 4/25/2034(1)(2) | | | 2,500,000 | | | | 2,495,350 | |

| | | |

CIFC Funding Ltd.

Series 2013-4A, Class BRR

7.249% (3 mo. USD Term SOFR + 1.86%)

due 4/27/2031(1)(2) | | | 2,000,000 | | | | 1,993,400 | |

| | | |

Dryden 80 CLO Ltd.

Series 2019-80A, Class AR

6.653% (3 mo. USD Term SOFR + 1.25%)

due 1/17/2033(1)(2) | | | 3,350,000 | | | | 3,329,565 | |

| | | |

Dryden Senior Loan Fund

Series 2017-47A, Class CR

7.706% (3 mo. USD Term SOFR + 2.31%)

due 4/15/2028(1)(2) | | | 2,100,000 | | | | 2,094,960 | |

| | | |

Ford Credit Auto Owner Trust

Series 2020-1, Class A

2.04% due 8/15/2031(1) | | | 2,400,000 | | | | 2,317,723 | |

| | | |

GM Financial Consumer Automobile Receivables Trust

Series 2020-4, Class A4

0.50% due 2/17/2026 | | | 3,579,000 | | | | 3,473,956 | |

| | | |

Hertz Vehicle Financing III LLC

Series 2022-3A, Class A

3.37% due 3/25/2025(1) | | | 1,070,000 | | | | 1,065,882 | |

| | | | | | | | | |

| | | | |

| 6 | | | | The accompanying notes are an integral part of these financial statements. |

SCHEDULE OF INVESTMENTS — GUARDIAN CORE FIXED INCOME VIP FUND

| | | | | | | | |

| December 31, 2023 | | Principal

Amount | | | Value | |

| Asset–Backed Securities – (continued) | |

| | | |

Hyundai Auto Lease Securitization Trust

Series 2022-B, Class A3

3.35% due 6/16/2025(1) | | $ | 2,411,336 | | | $ | 2,395,365 | |

| | | |

ICG U.S. CLO Ltd.

Series 2022-1A, Class A1

6.956% (3 mo. USD Term SOFR + 1.54%)

due 7/20/2035(1)(2) | | | 2,500,000 | | | | 2,496,000 | |

| | | |

Jamestown CLO XI Ltd.

Series 2018-11A, Class A2

7.356% (3 mo. USD Term SOFR + 1.96%)

due 7/14/2031(1)(2) | | | 2,800,000 | | | | 2,784,040 | |

| | | |

KKR CLO 38 Ltd.

Series 38A, Class A1

6.714% (3 mo. USD Term SOFR + 1.32%)

due 4/15/2033(1)(2) | | | 2,800,000 | | | | 2,783,292 | |

| | | |

Master Credit Card Trust

Series 2021-1A, Class A

0.53% due 11/21/2025(1) | | | 3,120,000 | | | | 3,058,018 | |

| | | |

Neuberger Berman Loan Advisers CLO 26 Ltd.

Series 2017-26A, Class BR

7.057% (3 mo. USD Term SOFR + 1.66%)

due 10/18/2030(1)(2) | | | 1,050,000 | | | | 1,037,610 | |

| | | |

Neuberger Berman Loan Advisers CLO 40 Ltd.

Series 2021-40A, Class A

6.716% (3 mo. USD Term SOFR + 1.32%)

due 4/16/2033(1)(2) | | | 2,900,000 | | | | 2,896,230 | |

| | | |

Nissan Auto Lease Trust

Series 2023-A, Class A4

4.80% due 7/15/2027 | | | 1,600,000 | | | | 1,591,928 | |

| | | |

OHA Credit Partners XIV Ltd.

Series 2017-14A, Class B

7.174% (3 mo. USD Term SOFR + 1.76%)

due 1/21/2030(1)(2) | | | 2,000,000 | | | | 1,987,000 | |

| | | |

Oscar U.S. Funding XV LLC

Series 2023-1A, Class A3

5.81% due 12/10/2027(1) | | | 1,300,000 | | | | 1,304,082 | |

| | | |

PPM CLO 2 Ltd.

Series 2019-2A, Class BR

7.408% (3 mo. USD Term SOFR + 2.01%)

due 4/16/2032(1)(2) | | | 2,500,000 | | | | 2,485,500 | |

| | | |

RRX 6 Ltd.

Series 2021-6A, Class A1

6.846% (3 mo. USD Term SOFR + 1.45%)

due 1/15/2037(1)(2) | | | 1,800,000 | | | | 1,794,420 | |

| | | |

Santander Drive Auto Receivables Trust

Series 2022-3, Class A3

3.40% due 12/15/2026 | | | 1,359,775 | | | | 1,349,962 | |

| | | | | | | | | |

| | | | | | | | |

| December 31, 2023 | | Principal

Amount | | | Value | |

| Asset–Backed Securities (continued) | |

| | | |

TCW CLO Ltd.

Series 2021-1A, Class A

6.847% (3 mo. USD Term SOFR + 1.43%)

due 3/18/2034(1)(2) | | $ | 850,000 | | | $ | 847,620 | |

| | | |

TIAA CLO IV Ltd.

Series 2018-1A, Class A2

7.377% (3 mo. USD Term SOFR + 1.96%)

due 1/20/2032(1)(2) | | | 1,240,000 | | | | 1,234,420 | |

| | | |

Toyota Auto Loan Extended Note Trust

Series 2021-1A, Class A

1.07% due 2/27/2034(1) | | | 2,175,000 | | | | 2,002,691 | |

| | | |

Voya CLO Ltd.

Series 2015-3A, Class A3R

7.377% (3 mo. USD Term SOFR + 1.96%)

due 10/20/2031(1)(2) | | | 2,000,000 | | | | 1,989,384 | |

| | | |

World Omni Auto Receivables Trust

Series 2021-B, Class A4

0.69% due 6/15/2027 | | | 2,800,000 | | | | 2,634,593 | |

| | | | | | | | | |

| | |

Total Asset–Backed Securities

(Cost $87,953,652) | | | | 87,868,763 | |

| Corporate Bonds & Notes – 24.2% | |

| Aerospace & Defense – 0.5% | |

| | | |

RTX Corp.

6.10% due 3/15/2034 | | | 1,400,000 | | | | 1,520,792 | |

| | | |

6.40% due 3/15/2054 | | | 400,000 | | | | 464,388 | |

| | | | | | | | | |

| | | |

| | | | | | | | 1,985,180 | |

| Agriculture – 0.6% | |

| | | |

Altria Group, Inc.

3.40% due 5/6/2030 | | | 800,000 | | | | 731,440 | |

| | | |

Philip Morris International, Inc.

5.375% due 2/15/2033 | | | 1,000,000 | | | | 1,027,550 | |

| | | |

5.625% due 11/17/2029 | | | 800,000 | | | | 839,344 | |

| | | | | | | | | |

| | | |

| | | | | | | | 2,598,334 | |

| Auto Manufacturers – 0.3% | |

| | | |

General Motors Financial Co., Inc.

6.10% due 1/7/2034 | | | 500,000 | | | | 515,275 | |

| | | |

Volkswagen Group of America Finance LLC

6.45% due 11/16/2030(1) | | | 500,000 | | | | 532,885 | |

| | | | | | | | | |

| | | |

| | | | | | | | 1,048,160 | |

| Beverages – 0.9% | |

| | | |

Anheuser-Busch InBev Worldwide, Inc.

3.50% due 6/1/2030 | | | 2,200,000 | | | | 2,098,426 | |

| | | |

5.55% due 1/23/2049 | | | 400,000 | | | | 431,316 | |

| | | |

PepsiCo, Inc.

3.60% due 2/18/2028 | | | 800,000 | | | | 783,680 | |

| | | |

4.65% due 2/15/2053 | | | 500,000 | | | | 497,475 | |

| | | | | | | | | |

| | | |

| | | | | | | | 3,810,897 | |

| | | | |

| The accompanying notes are an integral part of these financial statements. | | | | 7 |

SCHEDULE OF INVESTMENTS — GUARDIAN CORE FIXED INCOME VIP FUND

| | | | | | | | |

| December 31, 2023 | | Principal

Amount | | | Value | |

| Biotechnology – 0.4% | |

| | | |

Amgen, Inc.

5.25% due 3/2/2033 | | $ | 600,000 | | | $ | 615,738 | |

| | | |

5.65% due 3/2/2053 | | | 200,000 | | | | 211,256 | |

| | | |

Gilead Sciences, Inc.

5.25% due 10/15/2033 | | | 700,000 | | | | 730,870 | |

| | | |

5.55% due 10/15/2053 | | | 100,000 | | | | 108,606 | |

| | | | | | | | | |

| | | |

| | | | | | | | 1,666,470 | |

| Building Materials – 0.1% | |

| | | |

Carrier Global Corp.

5.90% due 3/15/2034(1) | | | 500,000 | | | | 542,130 | |

| | | | | | | | | |

| | | |

| | | | | | | | 542,130 | |

| Chemicals – 0.2% | |

| | | |

Nutrien Ltd.

2.95% due 5/13/2030 | | | 800,000 | | | | 724,376 | |

| | | | | | | | | |

| | | |

| | | | | | | | 724,376 | |

| Commercial Banks – 6.0% | |

| | | |

Bank of America Corp. | | | | | | | | |

| | | |

1.898% (1.898% fixed rate until

7/23/2030; SOFR + 1.53% thereafter)

due 7/23/2031(2) | | | 1,900,000 | | | | 1,553,193 | |

| | | |

4.271% (4.271% fixed rate until 7/23/2028; 3 mo. USD Term

SOFR + 1.57% thereafter)

due 7/23/2029(2) | | | 3,000,000 | | | | 2,898,780 | |

| | | |

Barclays PLC

4.972% (4.972% fixed rate until

5/16/2028; SOFR + 2.12% thereafter)

due 5/16/2029(2) | | | 1,600,000 | | | | 1,573,328 | |

| | | |

BNP Paribas SA

2.159% (2.159% fixed rate until

9/15/2028; SOFR + 1.22% thereafter)

due 9/15/2029(1)(2) | | | 1,500,000 | | | | 1,305,690 | |

| | | |

Deutsche Bank AG

2.311% (2.311% fixed rate until

11/16/2026; SOFR + 1.22% thereafter)

due 11/16/2027(2) | | | 3,900,000 | | | | 3,567,018 | |

| | | |

Fifth Third Bank NA

2.25% due 2/1/2027 | | | 2,050,000 | | | | 1,890,182 | |

| | | |

Huntington National Bank

4.552% (4.552% fixed rate until

5/17/2027; SOFR + 1.65% thereafter)

due 5/17/2028(2) | | | 1,400,000 | | | | 1,351,924 | |

| | | |

JPMorgan Chase & Co.

2.956% (2.956% fixed rate until

5/13/2030; 3 mo. USD Term

SOFR + 2.52% thereafter)

due 5/13/2031(2) | | | 2,100,000 | | | | 1,847,874 | |

| | | |

4.493% (4.493% fixed rate until

3/24/2030; 3 mo. USD Term

SOFR + 3.79% thereafter)

due 3/24/2031(2) | | | 1,000,000 | | | | 976,360 | |

| | | | | | | | | |

| | | | | | | | |

| December 31, 2023 | | Principal

Amount | | | Value | |

| Commercial Banks – (continued) | |

| | | |

Morgan Stanley

5.123% (5.123% fixed rate until

2/1/2028; SOFR + 1.73% thereafter)

due 2/1/2029(2) | | $ | 3,700,000 | | | $ | 3,718,944 | |

| | | |

5.424% (5.424% fixed rate until

7/21/2033; SOFR + 1.88% thereafter)

due 7/21/2034(2) | | | 600,000 | | | | 608,814 | |

| | | |

NatWest Group PLC

5.808% (5.808% fixed rate until

9/13/2028; 1 yr. CMT rate + 1.95% thereafter)

due 9/13/2029(2) | | | 2,500,000 | | | | 2,567,450 | |

| | | |

Truist Financial Corp.

7.161% (7.161% fixed rate until

10/30/2028; SOFR + 2.45% thereafter)

due 10/30/2029(2) | | | 1,500,000 | | | | 1,621,440 | |

| | | | | | | | | |

| | | |

| | | | | | | | 25,480,997 | |

| Computers – 0.3% | |

| | | |

Apple, Inc.

2.65% due 2/8/2051 | | | 500,000 | | | | 343,275 | |

| | | |

3.25% due 8/8/2029 | | | 100,000 | | | | 95,654 | |

| | | |

3.35% due 8/8/2032 | | | 1,000,000 | | | | 938,370 | |

| | | | | | | | | |

| | | |

| | | | | | | | 1,377,299 | |

| Diversified Financial Services – 1.3% | |

| | | |

AerCap Ireland Capital DAC/AerCap

Global Aviation Trust

3.00% due 10/29/2028 | | | 2,750,000 | | | | 2,508,165 | |

| | | |

Air Lease Corp.

5.30% due 2/1/2028 | | | 1,000,000 | | | | 1,012,610 | |

| | | |

Charles Schwab Corp.

6.136% (6.136% fixed rate until

8/24/2033; SOFR + 2.01% thereafter)

due 8/24/2034(2) | | | 700,000 | | | | 737,310 | |

| | | |

Jefferies Financial Group, Inc.

5.875% due 7/21/2028 | | | 1,100,000 | | | | 1,129,304 | |

| | | |

Mastercard, Inc.

4.85% due 3/9/2033 | | | 200,000 | | | | 206,750 | |

| | | | | | | | | |

| | | |

| | | | | | | | 5,594,139 | |

| Electric – 2.1% | |

| | | |

Alabama Power Co.

3.94% due 9/1/2032 | | | 1,000,000 | | | | 952,530 | |

| | | |

Duke Energy Carolinas LLC

4.95% due 1/15/2033 | | | 1,000,000 | | | | 1,020,800 | |

| | | |

Duke Energy Corp.

3.50% due 6/15/2051 | | | 950,000 | | | | 701,366 | |

5.00% due 8/15/2052 | | | 400,000 | | | | 376,040 | |

| | | |

Eversource Energy

5.125% due 5/15/2033 | | | 900,000 | | | | 905,688 | |

| | | |

Exelon Corp.

5.60% due 3/15/2053 | | | 400,000 | | | | 406,640 | |

| | | |

Pacific Gas & Electric Co.

4.55% due 7/1/2030 | | | 500,000 | | | | 476,710 | |

4.95% due 7/1/2050 | | | 500,000 | | | | 429,630 | |

| | | | | | | | | |

| | | | |

| 8 | | | | The accompanying notes are an integral part of these financial statements. |

SCHEDULE OF INVESTMENTS — GUARDIAN CORE FIXED INCOME VIP FUND

| | | | | | | | |

| December 31, 2023 | | Principal

Amount | | | Value | |

| Electric (continued) | |

| | | |

PPL Electric Utilities Corp.

5.00% due 5/15/2033 | | $ | 400,000 | | | $ | 409,588 | |

| | | |

Public Service Electric & Gas Co.

4.65% due 3/15/2033 | | | 2,000,000 | | | | 2,001,560 | |

5.45% due 8/1/2053 | | | 300,000 | | | | 324,948 | |

| | | |

Southern Co.

5.70% due 3/15/2034 | | | 400,000 | | | | 421,844 | |

| | | |

Wisconsin Public Service Corp.

2.85% due 12/1/2051 | | | 400,000 | | | | 266,080 | |

| | | | | | | | | |

| | | |

| | | | | | | | 8,693,424 | |

| Electronics – 0.2% | |

| | | |

Honeywell International, Inc.

1.95% due 6/1/2030 | | | 800,000 | | | | 695,576 | |

| | | | | | | | | |

| | | |

| | | | | | | | 695,576 | |

| Environmental Control – 0.6% | |

| | | |

Waste Management, Inc.

4.15% due 4/15/2032 | | | 2,800,000 | | | | 2,738,288 | |

| | | | | | | | | |

| | | |

| | | | | | | | 2,738,288 | |

| Food – 0.5% | |

| | | |

JBS USA LUX SA/JBS USA Food

Co./JBS USA Finance, Inc.

5.75% due 4/1/2033 | | | 1,200,000 | | | | 1,188,228 | |

| | | |

Kroger Co.

1.70% due 1/15/2031 | | | 800,000 | | | | 648,368 | |

| | | |

Pilgrim’s Pride Corp.

3.50% due 3/1/2032 | | | 400,000 | | | | 338,748 | |

| | | | | | | | | |

| | | |

| | | | | | | | 2,175,344 | |

| Gas – 0.3% | |

| | | |

CenterPoint Energy Resources Corp.

5.40% due 3/1/2033 | | | 1,100,000 | | | | 1,149,775 | |

| | | | | | | | | |

| | | |

| | | | | | | | 1,149,775 | |

| Healthcare-Services – 0.7% | |

| | | |

Elevance Health, Inc.

4.75% due 2/15/2033 | | | 800,000 | | | | 801,048 | |

5.125% due 2/15/2053 | | | 200,000 | | | | 200,434 | |

| | | |

UnitedHealth Group, Inc.

2.30% due 5/15/2031 | | | 1,700,000 | | | | 1,473,696 | |

5.875% due 2/15/2053 | | | 400,000 | | | | 453,500 | |

| | | | | | | | | |

| | | |

| | | | | | | | 2,928,678 | |

| Insurance – 0.3% | |

| | | |

Lincoln National Corp.

3.40% due 1/15/2031 | | | 700,000 | | | | 627,711 | |

4.35% due 3/1/2048 | | | 300,000 | | | | 239,019 | |

| | | |

MetLife, Inc.

5.25% due 1/15/2054 | | | 300,000 | | | | 309,321 | |

| | | | | | | | | |

| | | |

| | | | | | | | 1,176,051 | |

| Machinery-Diversified – 0.4% | |

| | | |

John Deere Capital Corp.

4.15% due 9/15/2027 | | | 900,000 | | | | 894,771 | |

| | | |

Series I

5.15% due 9/8/2033 | | | 800,000 | | | | 843,712 | |

| | | | | | | | | |

| | | |

| | | | | | | | 1,738,483 | |

| | | | | | | | |

| December 31, 2023 | | Principal

Amount | | | Value | |

| Media – 0.7% | |

| | | |

Charter Communications Operating LLC/Charter Communications Operating Capital

2.25% due 1/15/2029 | | $ | 900,000 | | | $ | 781,614 | |

| | | |

Comcast Corp.

1.95% due 1/15/2031 | | | 410,000 | | | | 346,147 | |

4.25% due 1/15/2033 | | | 1,700,000 | | | | 1,653,301 | |

| | | | | | | | | |

| | | |

| | | | | | | | 2,781,062 | |

| Miscellaneous Manufacturing – 0.1% | |

| | | |

Parker-Hannifin Corp.

4.00% due 6/14/2049 | | | 300,000 | | | | 262,572 | |

4.50% due 9/15/2029 | | | 300,000 | | | | 301,515 | |

| | | | | | | | | |

| | | |

| | | | | | | | 564,087 | |

| Oil & Gas – 1.0% | |

| | | |

BP Capital Markets America, Inc.

4.812% due 2/13/2033 | | | 1,300,000 | | | | 1,313,689 | |

| | | |

Cenovus Energy, Inc.

2.65% due 1/15/2032 | | | 500,000 | | | | 414,570 | |

| | | |

Diamondback Energy, Inc.

3.50% due 12/1/2029 | | | 1,100,000 | | | | 1,022,802 | |

| | | |

Occidental Petroleum Corp.

7.50% due 5/1/2031 | | | 1,500,000 | | | | 1,683,090 | |

| | | | | | | | | |

| | | |

| | | | | | | | 4,434,151 | |

| Oil & Gas Services – 0.3% | |

| | | |

Schlumberger Investment SA

4.85% due 5/15/2033 | | | 1,400,000 | | | | 1,424,472 | |

| | | | | | | | | |

| | | |

| | | | | | | | 1,424,472 | |

| Pharmaceuticals – 1.7% | |

| | | |

AbbVie, Inc.

3.20% due 11/21/2029 | | | 1,000,000 | | | | 935,290 | |

4.55% due 3/15/2035 | | | 1,400,000 | | | | 1,375,206 | |

| | | |

CVS Health Corp.

5.30% due 6/1/2033 | | | 2,000,000 | | | | 2,052,660 | |

5.875% due 6/1/2053 | | | 900,000 | | | | 950,193 | |

| | | |

Pfizer Investment Enterprises Pte. Ltd.

4.75% due 5/19/2033 | | | 1,700,000 | | | | 1,705,202 | |

5.30% due 5/19/2053 | | | 100,000 | | | | 102,495 | |

| | | | | | | | | |

| | | |

| | | | | | | | 7,121,046 | |

| Pipelines – 0.8% | |

| | | |

Cheniere Energy Partners LP

5.95% due 6/30/2033(1) | | | 1,400,000 | | | | 1,437,702 | |

| | | |

Targa Resources Corp.

6.50% due 3/30/2034 | | | 800,000 | | | | 866,128 | |

| | | |

Western Midstream Operating LP

6.15% due 4/1/2033 | | | 1,100,000 | | | | 1,144,803 | |

| | | | | | | | | |

| | | |

| | | | | | | | 3,448,633 | |

| Real Estate Investment Trusts – 0.6% | |

| | | |

American Tower Corp.

5.65% due 3/15/2033 | | | 1,000,000 | | | | 1,041,170 | |

| | | |

Extra Space Storage LP

5.50% due 7/1/2030 | | | 1,500,000 | | | | 1,535,895 | |

| | | | | | | | | |

| | | |

| | | | | | | | 2,577,065 | |

| | | | |

The accompanying notes are an integral part of these financial statements. | | | | 9 |

SCHEDULE OF INVESTMENTS — GUARDIAN CORE FIXED INCOME VIP FUND

| | | | | | | | |

| December 31, 2023 | | Principal

Amount | | | Value | |

| Retail – 0.4% | |

| | | |

Lowe’s Cos., Inc.

5.15% due 7/1/2033 | | $ | 1,400,000 | | | $ | 1,441,090 | |

5.625% due 4/15/2053 | | | 200,000 | | | | 210,082 | |

| | | | | | | | | |

| | | |

| | | | | | | | 1,651,172 | |

| Semiconductors – 0.6% | |

| | | |

Intel Corp.

5.20% due 2/10/2033 | | | 1,200,000 | | | | 1,255,416 | |

| | | |

Marvell Technology, Inc.

5.95% due 9/15/2033 | | | 1,100,000 | | | | 1,169,432 | |

| | | | | | | | | |

| | | |

| | | | | | | | 2,424,848 | |

| Software – 1.0% | |

| | | |

Microsoft Corp.

2.921% due 3/17/2052 | | | 1,300,000 | | | | 959,283 | |

3.30% due 2/6/2027 | | | 1,300,000 | | | | 1,267,513 | |

| | | |

Oracle Corp.

5.55% due 2/6/2053 | | | 300,000 | | | | 300,390 | |

6.25% due 11/9/2032 | | | 1,700,000 | | | | 1,850,297 | |

| | | | | | | | | |

| | | |

| | | | | | | | 4,377,483 | |

| Telecommunications – 0.5% | |

| | | |

AT&T, Inc.

3.50% due 9/15/2053 | | | 500,000 | | | | 364,450 | |

5.40% due 2/15/2034 | | | 1,000,000 | | | | 1,032,050 | |

| | | |

T-Mobile USA, Inc.

2.70% due 3/15/2032 | | | 600,000 | | | | 512,052 | |

3.40% due 10/15/2052 | | | 200,000 | | | | 146,312 | |

| | | |

Verizon Communications, Inc.

2.355% due 3/15/2032 | | | 200,000 | | | | 166,510 | |

| | | | | | | | | |

| | | |

| | | | | | | | 2,221,374 | |

| Toys, Games & Hobbies – 0.4% | |

| | | |

Mattel, Inc.

3.75% due 4/1/2029(1) | | | 2,000,000 | | | | 1,829,120 | |

| | | | | | | | | |

| | | |

| | | | | | | | 1,829,120 | |

| Transportation – 0.4% | |

| | | |

Union Pacific Corp.

3.95% due 9/10/2028 | | | 300,000 | | | | 298,275 | |

4.50% due 1/20/2033 | | | 500,000 | | | | 503,315 | |

4.95% due 5/15/2053 | | | 900,000 | | | | 920,925 | |

| | | | | | | | | |

| | | |

| | | | | | | | 1,722,515 | |

| | |

Total Corporate Bonds & Notes

(Cost $98,920,393) | | | | 102,700,629 | |

| Non–Agency Mortgage–Backed Securities – 6.6% | |

| | | |

Benchmark Mortgage Trust

Series 2018-B3, Class AS

4.195% due 4/10/2051(2)(3) | | | 2,550,000 | | | | 2,356,231 | |

| | | |

Citigroup Commercial Mortgage Trust

Series 2014-GC23, Class AS

3.863% due 7/10/2047 | | | 2,750,000 | | | | 2,683,858 | |

| | | |

Commercial Mortgage Trust

Series 2017-COR2, Class A3

3.51% due 9/10/2050 | | | 2,920,000 | | | | 2,692,880 | |

Series 2019-GC44, Class AM

3.263% due 8/15/2057 | | | 2,415,000 | | | | 2,087,577 | |

| | | | | | | | | |

| | | | | | | | |

| December 31, 2023 | | Principal

Amount | | | Value | |

| Non–Agency Mortgage–Backed Securities (continued) | |

| | | |

DBGS Mortgage Trust

Series 2018-C1, Class AM

4.627% due 10/15/2051(2)(3) | | $ | 2,400,000 | | | $ | 2,254,388 | |

| | | |

DBUBS Mortgage Trust

Series 2017-BRBK, Class A

3.452% due 10/10/2034(1) | | | 1,760,000 | | | | 1,613,700 | |

| | | |

Freddie Mac STACR REMIC Trust

Series 2021-DNA7, Class M2

7.137% due 11/25/2041(1)(2)(3) | | | 2,200,000 | | | | 2,156,053 | |

Series 2021-HQA4, Class M1

6.287% due 12/25/2041(1)(2)(3) | | | 1,267,382 | | | | 1,247,844 | |

Series 2022-DNA1, Class M1A

6.337% due 1/25/2042(1)(2)(3) | | | 1,061,199 | | | | 1,054,411 | |

Series 2022-HQA3, Class M1A

7.637% due 8/25/2042(1)(2)(3) | | | 2,306,636 | | | | 2,342,187 | |

| | | |

Hilton USA Trust

Series 2016-HHV, Class A

3.719% due 11/5/2038(1) | | | 1,875,000 | | | | 1,779,655 | |

| | | |

Wells Fargo Commercial Mortgage Trust

Series 2015-NXS4, Class A4

3.718% due 12/15/2048 | | | 3,120,000 | | | | 3,008,055 | |

Series 2018-C43, Class A4

4.012% due 3/15/2051(2)(3) | | | 3,000,000 | | | | 2,860,179 | |

| | | | | | | | | |

| | |

Total Non–Agency Mortgage–Backed Securities

(Cost $29,096,107) | | | | 28,137,018 | |

| U.S. Government Securities – 29.8% | |

| | | |

U.S. Treasury Bonds

4.75% due 11/15/2043 | | | 38,300,000 | | | | 41,220,375 | |

4.75% due 11/15/2053 | | | 20,500,000 | | | | 23,097,735 | |

| | | |

U.S. Treasury Notes

4.375% due 11/30/2030 | | | 5,000,000 | | | | 5,150,781 | |

4.50% due 11/15/2033 | | | 8,000,000 | | | | 8,416,250 | |

4.875% due 10/31/2028 | | | 25,600,000 | | | | 26,746,000 | |

5.00% due 10/31/2025 | | | 21,600,000 | | | | 21,848,906 | |

| | | | | | | | | |

| | |

Total U.S. Government Securities

(Cost $120,255,295) | | | | 126,480,047 | |

| Commercial Paper – 0.7% | |

| | | |

Equinor ASA

5.425% due 1/4/2024(1) | | | 3,000,000 | | | | 2,998,665 | |

| | | | | | | | | |

| | |

Total Commercial Paper

(Cost $2,998,665) | | | | 2,998,665 | |

| U.S. Treasury Bills – 0.1% | |

| | | |

U.S. Treasury Bills

2.713% due 1/2/2024(4) | | | 200,000 | | | | 199,971 | |

| | | | | | | | | |

| | |

Total U.S. Treasury Bills

(Cost $199,971) | | | | 199,971 | |

| | | | | | | | |

| | | Shares | | | Value | |

| Exchange–Traded Funds – 2.0% | |

| | | |

iShares MBS ETF | | | 45,640 | | | | 4,293,811 | |

| | | |

Vanguard Mortgage-Backed Securities ETF | | | 85,580 | | | | 3,967,489 | |

| | | | | | | | | |

| | |

Total Exchange–Traded Funds

(Cost $7,662,852) | | | | 8,261,300 | |

| | | | |

| 10 | | | | The accompanying notes are an integral part of these financial statements. |

SCHEDULE OF INVESTMENTS — GUARDIAN CORE FIXED INCOME VIP FUND

| | | | | | | | |

| December 31, 2023 | | Principal

Amount | | |

Value | |

| Repurchase Agreements – 0.2% | |

| | | |

Fixed Income Clearing Corp.,

1.60%, dated 12/29/2023,

proceeds at maturity value of

$960,546, due 1/2/2024(5) | | $ | 960,375 | | | $ | 960,375 | |

| | |

Total Repurchase Agreements

(Cost $960,375) | | | | 960,375 | |

| | |

Total Investments – 99.0%

(Cost $411,367,042) | | | | 420,141,964 | |

| | |

| Assets in excess of other liabilities – 1.0% | | | | 4,411,588 | |

| | |

| Total Net Assets – 100.0% | | | $ | 424,553,552 | |

| (1) | Securities that may be resold in transactions exempt from |

| | registration under Rule 144A of the Securities Act of 1933, as amended, normally to certain qualified buyers. At December 31, 2023, the aggregate market value of these securities amounted to $89,396,886, representing 21.1% of net assets. These securities have been deemed liquid by the investment adviser pursuant to the Fund’s liquidity procedures approved by the Board of Trustees. |

| (2) | Variable rate securities, which may include step-up bonds or adjustable rate mortgages. The rate shown is the rate in effect at December 31, 2023. |

| (3) | Variable coupon rate based on weighted average interest rate of underlying mortgages. |

| (4) | Interest rate shown reflects the discount rate at time of purchase. |

| (5) | The table below presents collateral for repurchase agreements. |

| | | | | | | | | | | | | | | | |

| Security | | Coupon | | | Maturity

Date | | | Principal

Amount | | | Value | |

| U.S. Treasury Note | | | 0.375% | | | | 1/31/2026 | | | $ | 1,059,000 | | | $ | 979,633 | |

Open futures contracts at December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Type | | Expiration | | | Contracts | | | Position | | | Notional

Amount | | | Notional

Value | | | Unrealized

Appreciation | |

| U.S. 2-Year Treasury Note | | | March 2024 | | | | 476 | | | | Long | | | $ | 97,197,106 | | | $ | 98,015,093 | | | $ | 817,987 | |

| U.S. 5-Year Treasury Note | | | March 2024 | | | | 303 | | | | Long | | | | 32,217,378 | | | | 32,958,352 | | | | 740,974 | |

| U.S. Long Bond | | | March 2024 | | | | 14 | | | | Long | | | | 1,741,046 | | | | 1,749,125 | | | | 8,079 | |

| Total | | | $ | 131,155,530 | | | $ | 132,722,570 | | | $ | 1,567,040 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Type | | Expiration | | | Contracts | | | Position | | | Notional

Amount | | | Notional

Value | | | Unrealized

Depreciation | |

| U.S. Ultra 10-Year Treasury Note | | | March 2024 | | | | 76 | | | | Short | | | $ | (8,643,336 | ) | | $ | (8,969,188 | ) | | $ | (325,852 | ) |

Centrally cleared credit default swap agreements — buy protection(6):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reference Entity | | Implied Credit

Spread at

12/31/2023(7) | | | Notional Amount(8) | | | Maturity | | | (Pay)/Receive

Fixed Rate | | | Periodic

Payment

Frequency | | | Upfront

Payments | | | Value | | | Unrealized

Depreciation | |

| CDX.NA.IG.S41 | | | 0.57% | | | | USD | | | | 14,600,000 | | | | 12/20/2028 | | | | (1.00)% | | | | Quarterly | | | $ | (154,666) | | | $ | (283,199) | | | $ | (128,533) | |

| (6) | When a credit event occurs as defined under the terms of the swap agreement, the Fund as a buyer of credit protection will either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or underlying securities comprising the referenced obligation or (ii) receive a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced obligation. |

| (7) | Implied credit spread, represented in absolute terms, utilized in determining the value of the credit default swap agreements as of period end will serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default for the credit derivative. The implied credit spread of a referenced entity reflects the cost of buying/selling protection and may include payments required to be made to enter into the agreement. Generally, wider credit spreads represent a perceived deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the swap agreement. |

| (8) | The notional amount represents the maximum potential amount the Fund could be required to pay as a buyer of credit protection if a credit event occurs, as defined under the terms of the swap agreement, for each security included in the CDX North America Investment Grade Index. |

Legend:

CLO — Collateralized Loan Obligation

CMT — Constant Maturity Treasury

REMIC — Real Estate Mortgage Investment Conduit

SOFR — Secured Overnight Financing Rate

STACR — Structured Agency Credit Risk

USD — United States Dollar

| | | | |

| The accompanying notes are an integral part of these financial statements. | | | | 11 |

SCHEDULE OF INVESTMENTS — GUARDIAN CORE FIXED INCOME VIP FUND

The following is a summary of the inputs used as of December 31, 2023 in valuing the Fund’s investments. For more information on valuation inputs, please refer to Note 2a of the accompanying Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | Valuation Inputs | | | | |

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Agency Mortgage–Backed Securities | | $ | — | | | $ | 62,535,196 | | | $ | — | | | $ | 62,535,196 | |

| Asset–Backed Securities | | | — | | | | 87,868,763 | | | | — | | | | 87,868,763 | |

| Corporate Bonds & Notes | | | — | | | | 102,700,629 | | | | — | | | | 102,700,629 | |

| Non–Agency Mortgage–Backed Securities | | | — | | | | 28,137,018 | | | | — | | | | 28,137,018 | |

| U.S. Government Securities | | | — | | | | 126,480,047 | | | | — | | | | 126,480,047 | |

| Commercial Paper | | | — | | | | 2,998,665 | | | | — | | | | 2,998,665 | |

| U.S. Treasury Bills | | | — | | | | 199,971 | | | | — | | | | 199,971 | |

| Exchange–Traded Funds | | | 8,261,300 | | | | — | | | | — | | | | 8,261,300 | |

| Repurchase Agreements | | | — | | | | 960,375 | | | | — | | | | 960,375 | |

| Total | | $ | 8,261,300 | | | $ | 411,880,664 | | | $ | — | | | $ | 420,141,964 | |

| Other Financial Instruments | |

| Futures Contracts | | | | | | | | | | | | | | | | |

Assets | | $ | 1,567,040 | | | $ | — | | | $ | — | | | $ | 1,567,040 | |

Liabilities | | | (325,852 | ) | | | — | | | | — | | | | (325,852 | ) |

| Swap Contracts | | | | | | | | | | | | | | | | |

Liabilities | | | — | | | | (128,533 | ) | | | — | | | | (128,533 | ) |

| Total | | $ | 1,241,188 | | | $ | (128,533 | ) | | $ | — | | | $ | 1,112,655 | |

| | | | |

| 12 | | | | The accompanying notes are an integral part of these financial statements. |

FINANCIAL INFORMATION — GUARDIAN CORE FIXED INCOME VIP FUND

| | | | |

Statement of Assets and Liabilities As of December 31, 2023 | | | |

Assets | | | | |

| | |

Investments, at value | | $ | 420,141,964 | |

| | |

Interest receivable | | | 3,249,969 | |

| | |

Cash deposits with brokers for futures contracts | | | 882,200 | |

| | |

Receivable for variation margin on futures contracts | | | 466,081 | |

| | |

Receivable for variation margin on swap contracts | | | 352,164 | |

| | |

Reimbursement receivable from adviser | | | 30,533 | |

| | |

Receivable for fund shares subscribed | | | 187 | |

| | |

Prepaid expenses | | | 15,087 | |

| | | | | |

| | |

Total Assets | | | 425,138,185 | |

| | | | | |

| | |

Liabilities | | | | |

| | |

Cash due to broker for swap contracts | | | 174,180 | |

| | |

Payable for fund shares redeemed | | | 165,442 | |

| | |

Investment advisory fees payable | | | 156,688 | |

| | |

Accrued audit fees | | | 27,577 | |

| | |

Accrued custodian and accounting fees | | | 15,132 | |

| | |

Accrued trustees’ and officers’ fees | | | 3,493 | |

| | |

Accrued expenses and other liabilities | | | 42,121 | |

| | | | | |

| | |

Total Liabilities | | | 584,633 | |

| | | | | |

| | |

Total Net Assets | | $ | 424,553,552 | |

| | | | | |

| | |

Net Assets Consist of: | | | | |

| | |

Paid-in capital | | $ | 421,256,798 | |

| | |

Distributable earnings | | | 3,296,754 | |

| | | | | |

| | |

Total Net Assets | | $ | 424,553,552 | |

| | | | | |

Investments, at Cost | | $ | 411,367,042 | |

| | | | | |

| | |

Pricing of Shares | | | | |

| | |

Shares of Beneficial Interest Outstanding with

No Par Value | | | 41,888,627 | |

| | |

Net Asset Value Per Share | | | $10.14 | |

| | | | | |

| | | | |

Statement of Operations For the Year Ended December 31, 2023 | | | |

Investment Income | | | | |

| | |

Interest | | $ | 19,922,270 | |

| | |

Dividends | | | 384,913 | |

| | | | | |

| | |

Total Investment Income | | | 20,307,183 | |

| | | | | |

| | |

Expenses | | | | |

| | |

Investment advisory fees | | | 1,902,610 | |

| | |

Professional fees | | | 136,648 | |

| | |

Trustees’ and officers’ fees | | | 106,834 | |

| | |

Administrative fees | | | 69,809 | |

| | |

Custodian and accounting fees | | | 58,415 | |

| | |

Shareholder reports | | | 30,561 | |

| | |

Transfer agent fees | | | 20,942 | |

| | |

Other expenses | | | 24,789 | |

| | | | | |

| | |

Total Expenses | | | 2,350,608 | |

| | |

Less: Fees waived | | | (159,844 | ) |

| | | | | |

| | |

Total Expenses, Net | | | 2,190,764 | |

| | | | | |

| | |

Net Investment Income/(Loss) | | | 18,116,419 | |

| | | | | |

| | |

Realized Gain/(Loss) and Change in Unrealized Appreciation/(Depreciation) on Investments and Derivative Contracts | | | | |

| | |

Net realized gain/(loss) from investments | | | (30,293,852 | ) |

| | |

Net realized gain/(loss) from futures contracts | | | (2,471,524 | ) |

| | |

Net realized gain/(loss) from swap contracts | | | (141,668 | ) |

| | |

Net change in unrealized appreciation/(depreciation) on investments | | | 36,291,583 | |

| | |

Net change in unrealized appreciation/(depreciation) on futures contracts | | | 1,185,639 | |

| | |

Net change in unrealized appreciation/(depreciation) on swap contracts | | | (128,533 | ) |

| | | | | |

| | |

Net Gain on Investments and Derivative Contracts | | | 4,441,645 | |

| | | | | |

| | |

Net Increase in Net Assets Resulting From Operations | | $ | 22,558,064 | |

| | | | | |

| | | | | |

| | | | |

| The accompanying notes are an integral part of these financial statements. | | | | 13 |

FINANCIAL INFORMATION — GUARDIAN CORE FIXED INCOME VIP FUND

| | | | | | | | |

Statements of Changes in Net Assets | | | | | | |

| | | |

| | | For the

Year Ended

12/31/23 | | | For the

Period Ended

12/31/221 | |

| | | | |

Operations | |

| | | |

Net investment income/(loss) | | $ | 18,116,419 | | | $ | 10,906,076 | |

| | | |

Net realized gain/(loss) from investments and derivative contracts | | | (32,907,044 | ) | | | (2,706,274 | ) |

| | | |

Net change in unrealized appreciation/(depreciation) on investments and derivative contracts | | | 37,348,689 | | | | (27,461,112 | ) |

| | | | | | | | | |

| | | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | | | 22,558,064 | | | | (19,261,310 | ) |

| | | | | | | | | |

| | | |

Capital Share Transactions | | | | | | | | |

| | | |

Proceeds from sales of shares | | | 36,651,130 | | | | 524,761,918 | |

| | | |

Cost of shares redeemed | | | (84,460,527 | ) | | | (55,695,723 | ) |

| | | | | | | | | |

| | | |

Net Increase/(Decrease) in Net Assets Resulting from Capital Share Transactions | | | (47,809,397 | ) | | | 469,066,195 | |

| | | | | | | | | |

| | | |

Net Increase/(Decrease) in Net Assets | | | (25,251,333 | ) | | | 449,804,885 | |

| | | | | | | | | |

| | | |

Net Assets | | | | | | | | |

| | | |

Beginning of period | | | 449,804,885 | | | | — | |

| | | | | | | | | |

| | | |

End of period | | $ | 424,553,552 | | | $ | 449,804,885 | |

| | | | | | | | | |

| | | |

Other Information: | | | | | | | | |

| | | |

Shares | | | | | | | | |

| | | |

Sold | | | 3,747,836 | | | | 52,488,133 | |

| | | |

Redeemed | | | (8,649,366 | ) | | | (5,697,976 | ) |

| | | | | | | | | |

| | | |

Net Increase/(Decrease) | | | (4,901,530 | ) | | | 46,790,157 | |

| | | | | | | | | |

| | | | | | | | | |

| 1 | Commenced operations on May 2, 2022. |

| | | | |

| 14 | | | | The accompanying notes are an integral part of these financial statements. |

This Page Intentionally Left Blank

FINANCIAL INFORMATION — GUARDIAN CORE FIXED INCOME VIP FUND

The Financial Highlights table is intended to help you understand the Fund’s financial performance for the past five years (or, if shorter, the period since inception). Certain information reflects financial results for a single Fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund.

| | | | | | | | | | | | | | | | | | | | | | | | |

Financial Highlights | | | | | | |

| | | Per Share Operating Performance | | | | |

| | |

Net Asset Value,

Beginning of

Period | | | Net Investment

Income(1) | | | Net Realized

and Unrealized

Gain/(Loss) | | | Total

Operations | | | Net Asset

Value, End of

Period | | | Total

Return(2) | |

| | | | | | | |

Year Ended 12/31/23 | | $ | 9.61 | | | $ | 0.40 | | | $ | 0.13 | | | $ | 0.53 | | | $ | 10.14 | | | | 5.52% | |

| | | | | | | |

Period Ended 12/31/22(4) | | | 10.00 | | | | 0.22 | | | | (0.61 | ) | | | (0.39 | ) | | | 9.61 | | | | (3.90)%(5) | |

| | | | |

| 16 | | | | The accompanying notes are an integral part of these financial statements. |

FINANCIAL INFORMATION — GUARDIAN CORE FIXED INCOME VIP FUND

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | |

Net Assets, End

of Period (000s) | | | Net Ratio of

Expenses to

Average Net

Assets(3) | | | Gross Ratio of

Expenses to

Average Net

Assets | | | Net Ratio of Net

Investment Income

to Average

Net Assets(3) | | | Gross Ratio of Net

Investment Income

to Average

Net Assets | | | Portfolio

Turnover Rate | |

| | | | | |

| $ | 424,554 | | | | 0.50% | | | | 0.54% | | | | 4.13% | | | | 4.09% | | | | 316% | |

| | | | | |

| | 449,805 | | | | 0.50%(5) | | | | 0.52%(5) | | | | 3.41%(5) | | | | 3.39%(5) | | | | 90%(5) | |

| (1) | Calculated based on the average shares outstanding during the period. |

| (2) | Total returns do not reflect the effects of charges deducted pursuant to the terms of The Guardian Insurance & Annuity Company, Inc.’s variable contracts. Inclusion of such charges would reduce the total returns for all periods shown. |

| (3) | Net Ratio of Expenses to Average Net Assets and Net Ratio of Net Investment Income to Average Net Assets include the effect of fee waivers and expense limitations. |

| (4) | Commenced operations on May 2, 2022. |

| (5) | Ratios for periods less than one year have been annualized, except for total return and portfolio turnover rate. For the period ended December 31, 2022, certain non-recurring fees (i.e., audit fees) are not annualized. |

| | | | |

| The accompanying notes are an integral part of these financial statements. | | | | 17 |

NOTES TO FINANCIAL STATEMENTS — GUARDIAN CORE FIXED INCOME VIP FUND

December 31, 2023

1. Organization

Guardian Variable Products Trust (the “Trust”), a Delaware statutory trust organized on January 12, 2016, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust currently has twenty-four series. Guardian Core Fixed Income VIP Fund (the “Fund”) is a series of the Trust. The Fund is a diversified fund and commenced operations on May 2, 2022. The financial statements for other series of the Trust are presented in separate reports.

The Trust has authorized an unlimited number of shares of beneficial interest with no par value. Shares are bought and sold at closing net asset value (“NAV”). Shares of the Fund are only sold to certain separate accounts of The Guardian Insurance & Annuity Company, Inc. (“GIAC”) that fund certain variable annuity contracts and variable life insurance policies issued by GIAC. GIAC is a wholly-owned subsidiary of The Guardian Life Insurance Company of America (“Guardian Life”).

The Fund seeks to provide a high level of current income and capital appreciation without undue risk to principal.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services – Investment Companies. The following policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

a. Investment Valuations The Board of Trustees has designated Park Avenue Institutional Advisers LLC (“Park Avenue”) as the valuation designee for the Fund pursuant to Rule 2a-5 under the 1940 Act. Park Avenue has established a Fair Valuation Committee and has adopted fair valuation procedures that provide methodologies for fair valuing securities. These procedures include monitoring the appropriateness of fair values based on results of ongoing valuation oversight, including but not limited to consideration of

security specific events, market events, and pricing vendor and broker-dealer evaluation. The Fair Valuation Committee oversees and carries out the policies for the valuation of investments held in the Fund. The Fair Valuation Committee is responsible for discussing and assessing the potential impacts to the fair values on an ongoing basis, and reports to the Board of Trustees on at least a quarterly basis.

The valuations of debt securities for which quoted bid prices are readily available are valued at the bid price by independent pricing services (each, a “Service”). Debt securities for which quoted bid prices are not readily available are valued by a Service at the evaluated bid price provided by the Service or the bid price provided by an independent broker-dealer or at a calculated price based on the spread to an appropriate benchmark provided by such broker-dealer.

Equity securities traded on an exchange other than NASDAQ Stock Market, LLC (“NASDAQ”) are valued at the last reported sale price on the principal exchange or market on which they are traded; or, if there were no sales that day, at the mean between the closing bid and ask prices. Securities traded on the NASDAQ are generally valued at the NASDAQ official closing price, which may not be the last sale price. If the NASDAQ official closing price is not available for a security, that security is generally valued at the mean between the closing bid and ask prices. Repurchase agreements are carried at cost, which approximates fair value (see Note 5c). Foreign securities are valued in the currencies of the markets in which they trade and then converted to U.S. dollars by the application of foreign exchange rates at the close of the New York Stock Exchange (“NYSE”).

Exchange-traded financial futures contracts are valued at the last settlement price on the market where they are primarily traded.

Securities for which market quotations are not readily available or securities whose values have been materially affected by events occurring before the Fund’s valuation time but after the close of the securities’ principal exchange or market are valued at their fair values as determined in good faith by Park Avenue, as the Board of Trustee’s valuation designee (as defined in Rule 2a-5 under the 1940 Act), in accordance with Park Avenue’s procedures and under the general oversight of the Board of Trustees. Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

NOTES TO FINANCIAL STATEMENTS — GUARDIAN CORE FIXED INCOME VIP FUND

Various inputs are used in determining the valuation of the Fund’s investments. These inputs are summarized in three broad levels listed below.

| • | | Level 1 – unadjusted inputs using quoted prices in active markets for identical investments. |

| • | | Level 2 – other significant observable inputs, including, but not limited to, quoted prices for similar investments, inputs other than quoted prices that are observable for investments (such as interest rates, prepayment speeds, credit risks, etc.) or other market corroborated inputs. |

| • | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

Inputs may include price information, volatility statistics, specific and broad credit data, liquidity statistics, and other factors. A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input; both individually and in aggregate, that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Trust. The Trust considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, and provided by independent sources that are actively involved in the relevant market. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Changes in valuation techniques may result in transfers into or out of a financial instrument’s assigned level within the hierarchy.

The FASB requires reporting entities to make disclosures about purchases, sales, issuances and settlements of Level 3 securities on a gross basis. For the year ended December 31, 2023, there were no transfers into or out of Level 3 of the fair value hierarchy.

In determining a financial instrument’s placement within the hierarchy, the Trust separates the Fund’s investment portfolio into two categories: investments and derivatives (e.g., futures). A summary of inputs used to value the Fund’s assets and liabilities carried at fair value as of December 31, 2023 is included in the Schedule of Investments.

Investments Investments whose values are based on quoted market prices in active markets, and are therefore classified within Level 1, include active listed equities. Investments that trade in markets that are not considered to be active, but are valued based on quoted market prices, dealer quotations or alternative pricing

sources supported by observable inputs are classified within Level 2. These include certain U.S. government and sovereign obligations, most government agency securities, investment-grade corporate bonds, certain mortgage products, state, municipal and provincial obligations, and certain foreign equity securities, including securities whose prices may have been affected by events occurring after the close of trading on their principal exchange or market and, as a result, whose values are determined by a pricing service as described above, or securities whose values are otherwise determined using fair valuation methods approved by the Fund’s Board of Trustees.

Investments classified within Level 3 have significant unobservable inputs, as they trade infrequently or not at all. Level 3 investments include, among others, private placement securities. When observable prices are not available for these securities, the Trust uses one or more valuation techniques for which sufficient and reliable data is available. The inputs used by the Trust in estimating the value of Level 3 investments include, for example, the original transaction price, recent transactions in the same or similar instruments, completed or pending third-party transactions in the underlying investment or comparable issuers, subsequent rounds of financing, recapitalizations, and other transactions across the capital structure. Level 3 investments may also be adjusted to reflect illiquidity and/or non-transferability, with the amount of such discount estimated by the Trust in the absence of market information. Assumptions used by the Trust due to the lack of observable inputs may significantly impact the resulting fair value and therefore the Fund’s results of operations. As of December 31, 2023, the Fund had no securities classified as Level 3.

Derivatives Exchange-traded derivatives, such as futures contracts, exchange-traded option contracts and certain swaps, are typically classified within Level 1 or Level 2 of the fair value hierarchy depending on whether or not they are deemed to be actively traded. Certain non-exchange-traded derivatives, such as generic forwards, certain swaps and options, have inputs which can generally be corroborated by market data and are therefore classified within Level 2.

b. Securities Transactions Securities transactions are accounted for on the date securities are purchased or sold (trade date). Realized gains or losses on securities transactions are determined on the basis of specific identification.

c. Futures Contracts The Fund may enter into financial futures contracts. In entering into such contracts, the

NOTES TO FINANCIAL STATEMENTS — GUARDIAN CORE FIXED INCOME VIP FUND

Fund is required to deposit with the counterparty, either in cash or securities, an amount equal to a certain percentage of the face value of the contract. Subsequent payments are received or made by the Fund each day, depending on the daily fluctuations in the values of the contracts, and are recorded for financial statement purposes as variation margin received or paid by the Fund. Daily changes in variation margin are recognized as unrealized gains or losses by the Fund. The Fund may not achieve the anticipated benefits of the financial futures contracts and may realize a loss.

d. Credit Derivatives The Fund may enter into credit derivatives, including credit default swaps on individual obligations or credit indices. The Fund may use these investments (i) as alternatives to direct long or short investment in a particular security or securities, (ii) to adjust the Fund’s asset allocation or risk exposure, (iii) to enhance potential return, or (iv) for hedging purposes. The use by the Fund of credit default swaps may have the effect of creating a short position in a security. Credit derivatives can create investment leverage and may create additional investment risks that may subject the Fund to greater volatility than investments in more traditional securities, as described in the Statement of Additional Information.

The Fund may enter into credit default swap agreements either as a buyer or seller. The Fund may buy protection under a credit default swap to attempt to mitigate the risk of default or credit quality deterioration in one or more individual holdings or in a segment of the fixed income securities market. The Fund may sell protection under a credit default swap in an attempt to gain exposure to an underlying issuer’s credit quality characteristics without investing directly in that issuer.

For swaps entered with an individual counterparty, the Fund bears the risk of loss of the uncollateralized amount expected to be received under a credit default swap agreement in the event of the default or bankruptcy of the counterparty. Credit default swap agreements are generally valued at a price at which the counterparty to such agreement would terminate the agreement. In entering into swap contracts, the Fund is required to deposit with the broker (or for the benefit of the broker), either in cash or securities, an amount equal to a percentage of the notional value of the contract. Subsequent payments are received or made by the Fund each day, depending on the daily fluctuations in the values of the contracts, and are recorded for financial statement purposes as variation margin received or paid by the Fund. Daily changes in variation margin are recognized as unrealized gains or losses by the Fund.

The Fund may also enter into cleared swaps with a central clearinghouse. In a centrally cleared derivative transaction, a Fund typically enters into the transaction with a financial institution counterparty serving as the clearinghouse, and performance of the transaction is effectively guaranteed against default by such counterparty, thereby reducing or eliminating the Fund’s exposure to the credit risk of the original counterparty. The Fund typically will be required to post specified levels of margin with the clearinghouse or at the instruction of the clearinghouse. The margin required by a clearinghouse may be greater than the margin the Fund would be required to post in an uncleared derivative transaction.

The Fund may not achieve the anticipated benefits of swap contracts and may realize a loss. During the year ended December 31, 2023, the Fund entered into credit default swaps for risk exposure management and to enhance potential return.

e. Options Transactions The Fund can write (sell) put and call options on securities and indexes to earn premiums, for hedging purposes, for risk management purposes or otherwise as part of its investment strategies. In writing options, the Fund is required to deposit with the broker or counterparty, either in cash or securities, an amount equal to a percentage of the face value of the options. When an option is written, the premium received is recorded as an asset with an equal liability that is subsequently marked to market to reflect the market value of the written option. These liabilities, if any, are reflected as written options, at value, in the Fund’s Statement of Assets and Liabilities. Premiums received from writing options which expire unexercised are recorded on the expiration date as a realized gain. The difference between the premium received and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or if the premium is less than the amount paid for the closing purchased transactions, as a realized loss. If a written call option is exercised, the premium is added to the proceeds from the sale of the underlying security in determining whether there has been a realized gain or loss. If a written put option is exercised, the premium reduces the cost basis of the security. In writing an option, the Fund bears the market risk of an unfavorable change in the price of the security underlying the written option. Exercise of a written option could result in the Fund purchasing or selling a security at a price different from its current market value. There were no options transactions as of December 31, 2023.

NOTES TO FINANCIAL STATEMENTS — GUARDIAN CORE FIXED INCOME VIP FUND

f. Investment Income Dividend income net of foreign taxes withheld, if any, is generally recorded on the ex-dividend date. Distributions received from real estate investment trusts, if any, may be classified as dividends, capital gains and/or return of capital. Interest income, which includes amortization/accretion of premium/discount, is determined using the interest income accrual method, and is accrued and recorded daily.

g. Allocation of Income and Expenses Many of the expenses of the Trust can be directly attributed to a specific series of the Trust. Expenses that cannot be directly attributed to a specific series of the Trust are generally apportioned among all the series in the Trust, based on relative net assets. In calculating net asset value per share for each series of the Trust, investment income, realized and unrealized gains and losses, and expenses other than series-specific expenses are allocated daily to each series based upon the proportion of net assets attributable to each series.

3. Transactions with Affiliates

a. Investment Advisory Fee and Expense Limitation Under the terms of the advisory agreement, which, after its two year initial term, is reviewed and approved annually by the Board of Trustees, the Fund pays an investment advisory fee to Park Avenue. Park Avenue is a wholly-owned subsidiary of Guardian Life and receives an investment advisory fee at an annual rate of 0.45% of the first $300 million, and 0.40% in excess of $300 million of the Fund’s average daily net assets. The fee is accrued daily and paid monthly. The Fund has no sub-adviser.