ARS Corporate Presentation June 28, 2024 Exhibit 99.1

Forward-looking statements Statements in this presentation that are not purely historical in nature are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this presentation include, without limitation, statements regarding: the anticipated timing for regulatory review decisions on the neffy NDA and MAA; ARS Pharma’s belief that neffy will be approved for the treatment of Type I allergic reactions; the timing for the potential U.S. launch of neffy, if approved; the potential market, demand and expansion opportunities for neffy; ARS Pharma’s expected competitive position; whether the results will be sufficient to demonstrate that neffy is at least as effective as injectable epinephrine; the timelines for potential regulatory filings, approvals and commercialization of neffy in ex-US regions; ARS Pharma’s marketing and commercialization strategies, including potential partnerships in foreign jurisdictions; potential benefits of neffy, if approved, including the likelihood that doctors will prescribe neffy and that allergy patients and caregivers will choose to carry and dose neffy compared to needle-bearing options; the expectation of neffy attaining coverage, including without restriction for 80% of commercial lives within a year of launch; ARS Pharma’s anticipated cash, cash equivalents and short-term investments on hand upon any future approval and launch of neffy; the expected size, composition and reach of ARS Pharma’s sales force; the availability and functionality of neffyExperience and neffyConnect; the anticipated pricing and co-pay buydown; the anticipated timing and costs of future studies and commercialization efforts, and their impact on operating runway; ARS Pharma’s projected operating runway; expected intellectual property protection; and any statements of assumptions underlying any of the foregoing. These forward-looking statements are subject to the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “anticipate,” “could,” “demonstrate,” “expect,” “indicate,” “may,” “plan,” “potential,” “will” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based upon ARS Pharma’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation: the PDUFA target action date may be further delayed due to various factors outside ARS Pharma’s control; the ability to obtain and maintain regulatory approval for neffy; the results of the new clinical trial may not support the approval of neffy; results from clinical trials may not be indicative of results that may be observed in the future; potential safety and other complications from neffy; the labelling for neffy, if approved; the scope, progress and expansion of developing and commercializing neffy; potential for payers to delay, limit, or deny coverage for neffy; the size and growth of the market therefor and the rate and degree of market acceptance thereof vis-à-vis intramuscular injectable products; ARS Pharma’s ability to protect its intellectual property position; uncertainties related to capital requirements; and the impact of government laws and regulations. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included under the caption “Risk Factors” in ARS Pharma’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the Securities and Exchange Commission (“SEC”) on May 9, 2024. This and other documents ARS Pharma files with the SEC can also be accessed on ARS Pharma’s website at ir.ars-pharma.com by clicking on the link “Financials & Filings” under the “Investors & Media” tab. The forward-looking statements included in this presentation are made only as of the date hereof. ARS Pharma assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

Potential to Transform the Treatment of Type I Allergic Reactions neffy®: first potential “no needle, no injection” solution for Type I allergic reactions to address an unmet market need Positive CHMP Opinion (EU decision) with FDA reviewing same data package for the U.S. with assigned Oct 2, 2024 PDUFA date Registration program demonstrates comparable PK and PD, without risk of needle-related safety concerns, fear and hesitation Significant opportunity to disrupt and expand current epinephrine injectables market, which is highly dissatisfied Potential multi-billion-dollar market driven by HCP and consumer preference and adoption NCE-like IP exclusivity potential until at least 2038 $223.6 million in cash and short-term investments as of 3/31/2023 with an anticipated >$200 million at anticipated FDA approval in H2 2024

Anaphylaxis is Accompanied by Many Frequent Symptoms References: 1. Shaker MS, et al. J Allergy Clin Immunol. 2020. 2. Pistiner M, et al. J Allergy Clin Immunol Pract. 2021. 3. Jalil M, et al. Abstract at AAAAI 2020 Virtual Meeting. 4. Gonzelez-Estrada A, et al. Ann Allergy Asthma Immunol. 2018. 5. Lee S, et al. J Allergy Clin Immunol. 2017. 6. Lee S, et al. J Allergy Clin Immunol Pract. 2014. 7. Manivannan V, et al. Am J Emerg Med. 2014. 8. Wood RA, et al. J Allergy Clin Immunol 2014. 9. Walsh KE, et al. Pharmacoepidemiol Drug Saf 2013. 10. Decker WW, et al. J Allergy Clin Immunol. 2008. 11. Ross MP, et al. J Allergy Clin Immunol. 2008. 12. Webb LM & Lieberman P. Ann Allergy Asthma Immunol. 2006. 13. Ditto AM, et al. Ann Allergy Asthma Immunol. 1996. 14. Rudders SA, et al. Pediatrics. 2010. Note that some publications do not specify angioedema symptom subtype. Angioedema subtype frequency aggregated when reported. Symptoms (>2%) reported during US anaphylaxis events 2-14 Mucosal Respiratory Cardiac GI urticaria (hives, erythema) or angioedema (swelling of the face, lips, tongue or larynx) >85% >55% gastrointestinal (eg, vomiting, nausea) Common Anaphylaxis Symptoms Include: difficult breathing >40%

Epinephrine: The First Line of Defense Against Anaphylaxis Patients with Type 1 Severe Allergic Reactions are prescribed epinephrine to use at symptom onset Used for over 100 years Well-known mechanism of action, and only drug known to reverse a systemic allergic reaction Well-established efficacy and safety profile Products approved based on pharmacologic properties, not clinical efficacy studies All approved products demonstrate efficacy (90% response on a single dose) despite different pharmacokinetic (PK) properties Clinical studies are considered unethical/unfeasible All approved products are needle-based High unmet need for needle-free, easy-to-carry epinephrine remains Rapid, reliable delivery Small and easy to carry Place and Press administration Well-tolerated in extensive trials neffy is the first “no needle, no injection” solution for Type I allergic reactions to address an unmet market need

Rapid administration without a needle No risk of needle-related injuries; lacerations2 or cardiotoxic blood vessel injections Less hesitation to dose NO NEEDLE NO INJECTION Fits in your pocket; easy to carry the recommended 2 devices ~10% of cases require repeat doses of epinephrine1 EASIER AND MORE CONSISTENT DOSING 100% of untrained adults and children can dose neffy successfully7 High bioavailability, low 2 mg dose of neffy achieves comparable PK without overexposure risk including any side effects that mimic anaphylaxis RELIABLE 99.999% delivery of effective dose in reliability testing; not obstructed by any anaphylaxis symptoms; no inhalation required 24-month shelf-life at room temperature, with up to 3 months at high temperatures (122oF) ~50% of patients carry1 (<20% carry two) ~25% - 60% do not administer, 1,3 5, 6 NO TREATMENT AVAILABLE REFUSAL OF TREATMENT ~40% - 60% of patients delay2 DELAY IN TREATMENT 23% - 35% fail to dose correctly4 USER ERROR IN TREATMENT SOLUTION: neffy Unmet Need / Current Challenges Vast Majority of Type I Allergy Patients Face Significant Limitations with Current Treatment Options References: 1. Warren CM, et al. Ann Allergy Asthma Immunol. 2018. 2. Rooney E, et al. Poster Presentation at ACAAI 2022 (Louisville, KY). 3. Brooks C, et al. Ann Allergy Asthma Immunol. 2017. 4. El Turki A, et al. Emerg Med J. 2017. 5. Asthma and Allergy Foundation of American Patient Survey Report 2019. 6. Mehta GD, et al. Expert Rev Clin Immunol. 2023. 7. ARS company estimates based on IQVIA data and references 1 through 6. 4. Data on file from neffy human factors studies. PROBLEM: ONLY 10% - 20% of patients with active Rx use as indicated7 SMALL

neffy Designed for Ease of Use and Easy Carry For epinephrine to be effective, patients must: neffy has a simple place and press administration (no hold time) 100% of adults and children able to use neffy successfully without any training Relative Size of neffy two pack Compared to iPhone 15 and EpiPen Regularly have their device on hand Not hesitate to dose immediately after symptom onset Have a second device on hand if needed (~10% of cases) Administer the device as intended Case holds two neffy 2mg devices 6” 5.8” 3.1”

Registrational studies demonstrate comparability on both PD surrogates for efficacy and PK with neffy Safety Data 2 mg neffy met all clinical endpoints PD surrogates for efficacy comparable to approved products (SBP/HR approved injection products) Rapid and significant response on PD surrogates for efficacy observed even 1 minute after dosing PK bracketed by approved products (exposures IM/SC for efficacy, < EpiPen for safety) Repeat doses (including during rhinitis) within range of approved injection products Adverse events generally mild in nature with no meaningful nasal irritation or pain up to 4 mg dose Most common adverse events (>5%) were mild nasal discomfort (9.7%) and mild headache (6%), with no correlation of nasal discomfort to pain or irritation Mean VAS pain scores between 5 to 8 out of 100 No irritation based on formal assessment No serious adverse events in any clinical study No risk of needle-related injuries or blood vessel injections with neffy PD and PK Data Positive CHMP Opinion (EMA recommendation for approval) received on June 27, 2024 Response to FDA submitted on April 2, 2024 followed by up to 6-month FDA review

Results from neffy 2 mg Studies Satisfies Bracketing Approach agreed with FDA to Reference Historic Efficacy and Safety Mean Epinephrine Concentration (pg/mL) Time (Minutes) neffy 2 mg (HCP) (n=78)* EpiPen 0.3 mg (n=77) SC 0.3 mg (n=35) neffy 2 mg (self-administration) (n=42) IM 0.3 mg (n=178) Upper bracket for safety Lower bracket for efficacy *Includes Studies EPI-15 and EPI-16 FDA focused on PK properties to ensure efficacious and safe epinephrine exposures within range of approved products (“Bracketing”) Minimum exposure must be ≥ IM/SC (efficacy) Maximum exposures must be < EpiPen (safety) No difference in efficacy between all injection products ~90% response to single dose irrespective of device

Second Dose Frequency Demonstrates Similar Efficacy Between IM and Autoinjectors (the only FDA approved products today) Autoinjector reactions n = 79911 IM Needle-in-Syringe reactions n = 570 Treated Reactions Requiring Second Epinephrine Dose (%) ~90% resolution on first dose Analysis of 12 studies with 100% autoinjector (≥ 80% EpiPen) or 100% IM-needle-and-syringe use in community or ED setting1-11 Differences in PK profile across products do not impact efficacy based on need for repeat dosing to resolve symptoms References: 1. Patel N, et al. J Allergy Clin Immunol. 2021. 2. Kahveci M, et al. Pediatr Allergy Immunol. 2020. 3. Oya S, et al. J Emerg Med. 2020. 4. Kondo A, et al. Air Med J. 2018. 5. Cardona V, et al. Int Arch Allergy Immunol. 2017. 6. Arkwright PD. J Allergy Clin Immunol. 2008. 7. Gold MS & Sainsbury R. J Allergy Clin Immunol. 2020. 8. Noimark L, et al. Clin Exp Allergy. 2011. 9. Soller L, et al. J Allergy Clin Immunol Pract. 2019. 10. Webb LM & Lieberman P. Ann Allergy Asthma Immunol. 2006. 11. White MV, et al. Allergy Ashm Proc. 2015; note that this publication reports data on 636 reactions treated exclusively with EpiPen

Robust response on PD surrogate markers for efficacy shows engagement of receptors that reverse anaphylaxis symptoms Mean Change HR (BPM) Time (Minutes) Heart Rate Response Mean Change SBP (mmHg) Time (Minutes) Systolic Blood Pressure Response First PD 1 minute First PD 1 minute neffy 2 mg IM 0.3 mg neffy 2 mg IM 0.3 mg ** Significance level: ** p <0.01, *** p <0.001 **** p <0.0001 **** **** *** ** **** **** **** Epi 53 pg/mL (2 min PK) Epi 53 pg/mL (2 min PK) Integrated analysis of ARS clinical studies (EPI-15 and EPI-16)

Exposures of repeat doses of neffy in healthy subjects are also in the range of FDA approved epinephrine injection products Geometric Mean Plasma Concentration (pg/mL) Time (mins) 1.65x Integrated data from ARS clinical studies, FDA Briefing Document May 2023 PADAC for NDA/BLA# 214697 (neffy) neffy exposure similar to EpiPen to ensure safety neffy exposure greater than IM to ensure efficacy Repeat-dosing (10 min apart) results in healthy subjects

PK/PD profile and ability to dose may be influenced by anaphylaxis itself, so FDA asked ARS to evaluate rhinitis in clinical studies Anaphylaxis Symptom US % Intranasal Sublingual Oral* Inhalation* Nasal symptoms or rhinitis 4% X X Oropharyngeal edema 10% X X X Vomiting / Emesis 20% X X X Dysphagia 23% X X Laryngeal Edema 24% X X Bronchospasm 24% X Intraoral Edema or Tongue Swelling 24% X X X Angioedema (e.g. face, lips, tongue or larynx) 45% X X X Difficulty Breathing / Dyspnea 55% X *insufficient oral and inhalation systemic absorption due to rapid conjugation and oxidation in GI tract or difficulty taking in enough puffs14 References: 1. Pistiner M, et al. J Allergy Clin Immunol Pract. 2021. 2. Jalil M, et al. Abstract at AAAAI 2020 Virtual Meeting. 3. Gonzelez-Estrada A, et al. Ann Allergy Asthma Immunol. 2018. 4. Lee S, et al. J Allergy Clin Immunol. 2017. 5. Lee S, et al. J Allergy Clin Immunol Pract. 2014. 6. Manivannan V, et al. Am J Emerg Med. 2014. 7. Wood RA, et al. J Allergy Clin Immunol 2014. 8. Walsh KE, et al. Pharmacoepidemiol Drug Saf 2013. 9. Decker WW, et al. J Allergy Clin Immunol. 2008. 10. Ross MP, et al. J Allergy Clin Immunol. 2008. 11. Webb LM & Lieberman P. Ann Allergy Asthma Immunol. 2006. 12. Ditto AM, et al. Ann Allergy Asthma Immunol. 1996. 13. Rudders SA, et al. Pediatrics. 2010.14. Simons KJ, et al. J Allergy Clin Immunol. 2004. Note that some publications do not specify angioedema symptom subtype. Angioedema subtype frequency aggregated when reported. Potential effect on ability to dose or absorption profile by theoretical route of administration for epinephrine Intranasal formulation least impacted by anaphylaxis symptoms compared to alternate non-injectable routes Nasal symptoms or rhinitis only impact only 4% of cases (analysis of 4,805 US anaphylaxis events)1-12 ARS successfully evaluated patients with rhinitis, which responded positively to single and repeat doses of neffy

neffy on track for potential US launch in H2 2024 with market exclusivity potential until at least 2038 Issued composition of matter patent (US10,576,156) on Intravail® + epinephrine provides foundational exclusivity blocking any generic products. Method of treatment patents (US11,173,209; US11,191,838) block other alkyl glycosides. Issued method of treatment patent (US10,682,414, US11,744,895, US11,717,571, US11,191,655) also blocks intranasal epinephrine product using a different technology using a low dose (<4 mg) PCT patent granted in Europe (EP19751807), UK (GB2583051), Japan (JP6941224), Canada (3088909), Australia (AUS2019217643), Korea (10-2375232), China (2019800010042), with same claims as the US Extensive studies in the lab and clinic completed to develop a proprietary product with expected NCE-like exclusivity EXPECTED LAUNCH FIRST PATENT EXPIRATION ADDITIONAL PROTECTION 2024 2038

Commercialization Strategy

Significant Opportunity to Address Unmet Needs in Current US Severe Allergic Reaction Market Promotional Responsiveness ~20M diagnosed and under physician care over the last 3 years11 Epidemiology prevalence data estimates ~40M patients with type 1 allergic reactions2-10 ~50% increase over market growth trend with consumer promotion (2010 to 20151) Consistent Market Growth (Units) +6.5% CAGR since 2010, +12.7% YoY in 20231 ~3.2M patients filled Rx in 2023, but ~80-90% do not use as indicated11 (1) do not carry (~50%), (2) do not inject (25-60%), (3) wait to inject (40-60%) or (4) dose incorrectly (23-35%) References: 1. Based on IQVIA prescription data (~5.2 million two-packs sold in 2023) and weighted average generic/branded epinephrine auto-injector net pricing. 2. Gupta RS, et al. Pediatrics. 2011. 4. Gupta RS, et al. Pediatrics 2018. 5. McGowan EC, et al. J Clin Allergy Immunol. 2013. 6. Jackson KD, et al. NCHS Data Brief. 2013. 7. Black LI, et al. CDC National Center for Health Statistics Data Brief. 2019. 8. Gupta RS, et al. JAMA Netw Open. 2019. 9. Verrill L, et al. Allergy Asthma Pro. 2015. 10. Bilo BM, et al. Current Opin Allergy Clin Immunol. 2008. 11. IQVIA Claims Data, 2023 ~13.5M Type 1 diagnosed but not prescribed Rx (past 3 years)11 ~3.3M don’t fill regularly, haven’t refilled or haven’t filled a written Rx in 202211 PHYSICIAN ~$1 billion net today based on generic autoinjector pricing1

neffy has the ability to address the unmet need and is aligned with what healthcare providers, patients and parents want1 72% OF THE TIME, PEOPLE WHO USE AN OTC WOULD USE neffy FIRST2 81% OF PEOPLE WOULD USE neffy SOONER THAN CURRENT NEEDLE INJECTORS3 OF NON-FILLING PATIENTS STATED THEY WOULD ASK THEIR PHYSICIAN ABOUT neffy RX1 89% n = 392 Current Users OF PATIENTS LIKELY TO VERY LIKELY TO ASK THEIR PHYSICIAN ABOUT neffy Rx1 88% n = 88 Non-fillers References: 1. ARS market research on file. 2. Lowenthal R, et al. Presentation at AAAAI 2023 (San Antonio, Texas). 3. Kaplan H, et al. Presentation at ACAAI 2022 (Louisville, Kentucky).

PHYSICIAN Physicians supportive of adopting neffy into practice Would prescribe neffy if their patients asked for it1 99% 10 = MAJOR ADVANCE / 1 = NOT AN ADVANCE AT ALL 8.5 out of 10 rating1 viewed as a major advance in therapy n = 75 Physicians n = 185 Physicians References: 1. ARS market research on file.

PHYSICIAN Two-Thirds of Allergists and Half of GPs Ready to Prescribe neffy as Soon as Possible; Majority of Pediatricians Expected to Prescribe within One Year Timeline for Prescribing neffy – % of physicians References: ARS market research on file. Allergists (n=98) General Practitioners (n=48) Pediatricians (n=56)

neffy: Innovative Treatment to Overcome Known Challenges with Needle-Injectors for SAR Patients Carry 55% N = 9172 Would Carry 85% N = 1503 % of Time Carrying at least One Epinephrine Device2,3 More allergy patients and caregivers are likely to carry neffy compared to current needle-bearing options Patients are likely to dose neffy more rapidly with a needle-free device Current Device neffy Market Research N = 100 Patient N = 100 Caregiver 45% REDUCTION IN TIME TO USE Average Time (minutes) from Symptom Start to Device Use1 N = 200 Benefits of needle-free alternative to address major unmet needs References: 1. Kaplan H, et al. Presentation at ACAAI 2022 (Louisville, Kentucky). 2. Warren CM, et al. Ann Allergy Asthma Immunol. 2018. 3. ARS market research on file. PATIENT

~ 72% of Respondents would Make a Special Appointment to Discuss neffy with their HCP References: ARS market research on file. PATIENT Action Taken to Discuss neffy with HCP Respondents who may ask their HCP about neffy, Aug-23: Total (n=476), Patient (n=244), Caregiver (n=232) % of respondents

neffy Strategic Objectives ACTIVATE PATIENTS Create awareness and motivate patients and caregivers to seek neffy FACILITATE ACCESS neffy access, affordability and support services EDUCATE PRESCRIBERS Drive adoption within specialty and high decile prescribers on the compelling value-proposition of neffy

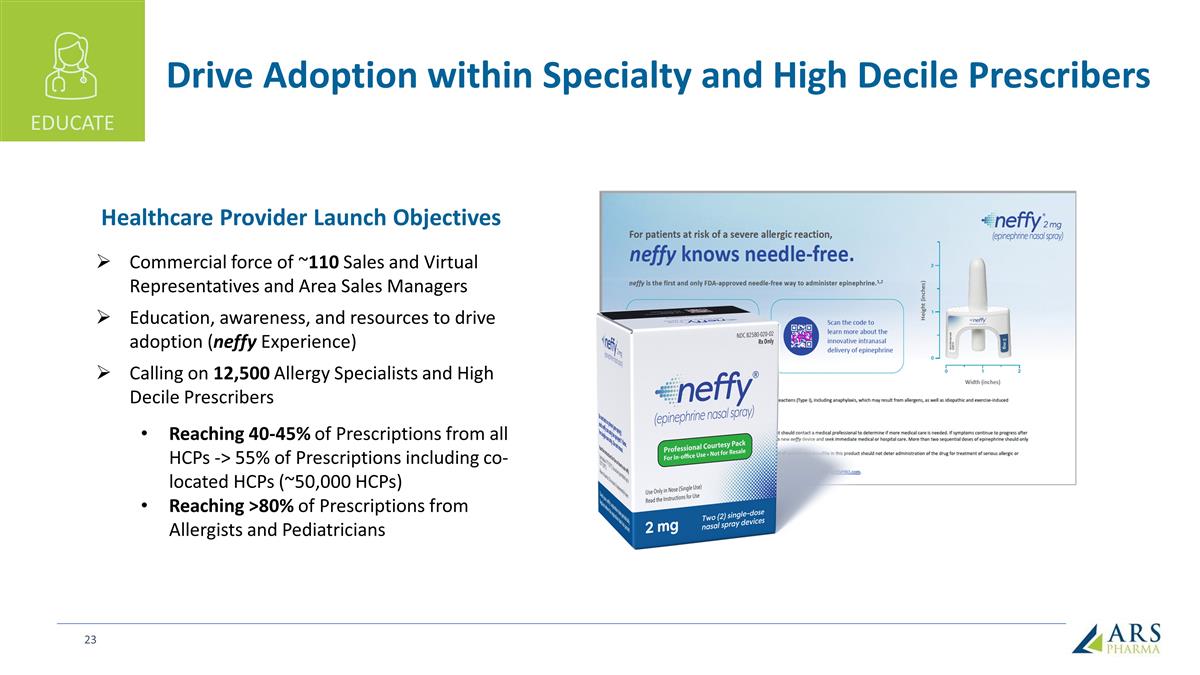

Drive Adoption within Specialty and High Decile Prescribers EDUCATE Healthcare Provider Launch Objectives Commercial force of ~110 Sales and Virtual Representatives and Area Sales Managers Education, awareness, and resources to drive adoption (neffy Experience) Calling on 12,500 Allergy Specialists and High Decile Prescribers Reaching 40-45% of Prescriptions from all HCPs -> 55% of Prescriptions including co-located HCPs (~50,000 HCPs) Reaching >80% of Prescriptions from Allergists and Pediatricians

EDUCATE 100% of patients responded to a single dose of neffy in the first 15 minutes, and did not require a second dose of epinephrine per treatment guidelines 100% of patients experienced complete resolution of the anaphylaxis symptoms with single dose of neffy2 16 min median time to complete resolution of anaphylaxis following single dose of neffy References: 1. Ebisawa M, et al. Presentation at AAAAI 2024 (Washington DC). 2. 100% of EPI-JP-03 patients dosed with neffy did not require a second dose in the first 15 minutes per guidelines because a response was not being observed, and 100% of patients achieved complete resolution of symptoms. 1 of the 16 subjects (6.7%) challenged with egg experienced a biphasic reaction 2h 45 min after being dosed with a single dose of neffy and achieving complete resolution of symptoms. This is consistent with the 12.8% frequency of biphasic reactions reported in children with food-induced anaphylaxis.(Gupta RS, et al. J Allergy Clin Immunol Pract. 2021). Clinical Response Rate (%) neffy (EPI-JP-03) Efficacy Study of neffy in Oral Food Challenge Induced Anaphylaxis (EPI-JP-03, n = 15 pediatric subjects)1 Enable real-world experience with neffy Target allergist offices that conduct in-office food challenge testing HCPs will have the ability to gain first-hand knowledge of neffy’s effectiveness Patients undergoing allergy challenge will also be exposed to neffy neffy Experience Program (rescue therapy at allergy challenge clinics) neffy shows robust and rapid clinical resolution of oral food challenge anaphylaxis symptoms (preview of neffy experience)

Committed to ensuring neffy access for all patients FACILITATE Key findings from discussions with the major payers and PBMs: High degree of interest in neffy and positive receptivity in early conversations; proactively requesting clinical presentations prior to approval Epinephrine is covered as a pharmacy benefit, and we expect to achieve coverage without restriction for 80% of commercial lives within a year of launch ARS is committed to access and affordability – we will offer a co-pay buydown to $25 for commercial patients, a cash price of $199, and a Patient Assistance Program for uninsured or underinsured neffyconnect will assist in managing coverage by providing patients, caregivers and healthcare providers with information regarding support programs and financial aid “This is a game-changer; it really addresses the unmet needs we currently have in this space, specifically the safety and tolerability issues.” – Payer “If this is priced properly, this could be a ‘state-of-the-art therapy’ for patients.” – PBM “There is no value in delaying access to a product like this and nothing to prior authorize (PA). We can’t PA if the patient needs it.” – PBM

Create Awareness & Motivate Patients and Caregivers to Request neffy ACTIVATE Consumer Launch Objectives Drive awareness & motivate patients and caregivers to request neffy by name Enable patients and caregivers to feel fully prepared to act during a potential crisis moment Activate patients and caregivers to share their neffy story to encourage peer uptake

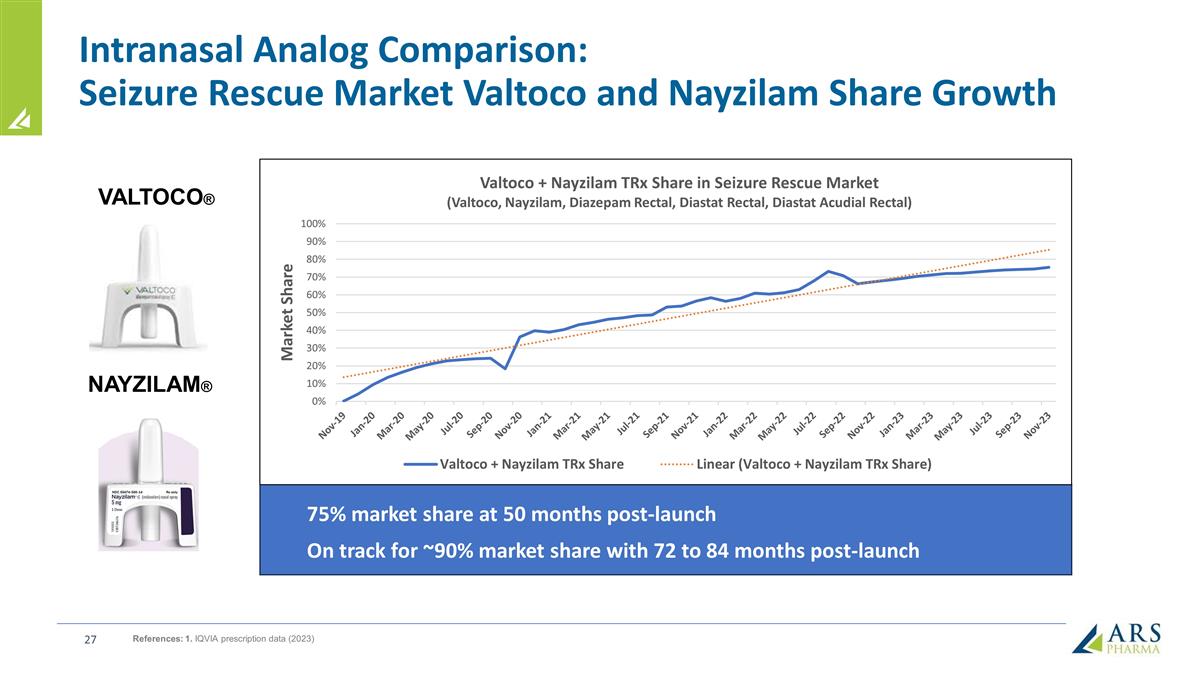

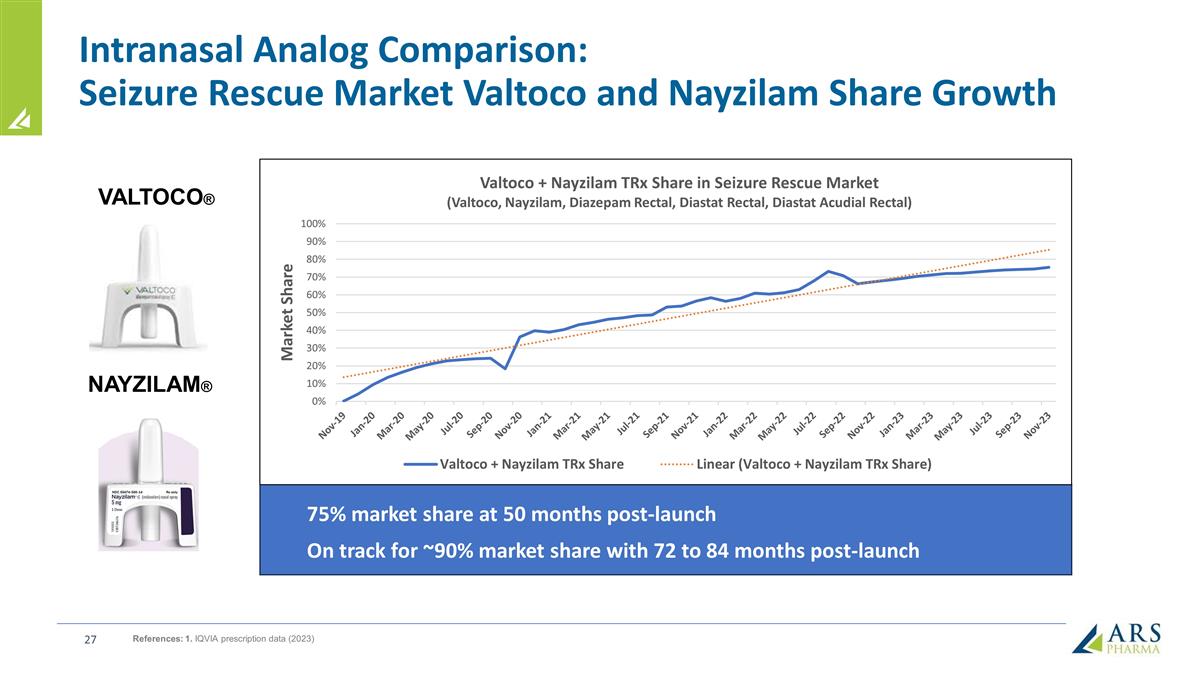

Intranasal Analog Comparison: Seizure Rescue Market Valtoco and Nayzilam Share Growth VALTOCO® NAYZILAM® References: 1. IQVIA prescription data (2023) 75% market share at 50 months post-launch On track for ~90% market share with 72 to 84 months post-launch

US Epinephrine Market Evolution Due to the Availability of neffy Supports Significant Revenue Opportunity1 References: 1. ARS company estimates and market research on file. 2. Market estimates based only on prescription volume from community use epinephrine autoinjector products, not intramuscular injection vials and syringes, 3. Net sales estimate are based on current autoinjector pricing (90%+ of current volume is generic), not branded or innovator epinephrine product pricing ~$1B+ net sales US market based on generic epinephrine pricing in 20233 (~5M 2-packs, ~3.2M active patients) +11% YoY Volume Growth (2024-2034) Millions of epinephrine 2-pack devices sold in US 1 2 3 1 2 3 4 5 6 5M 7 4 5 6 7 14M Conversion of some lapsed Rx patients Conversion of some never filled Rx patients Natural population growth (~0.6% YoY growth) Conversion of some never Rx’ed patients Growth in diagnosed population due to branding, marketing and DTC 8 8 Increased Rx/year (improved persistency) Increased devices/Rx (patient demand for neffy)

neffy Shows Robust and Rapid Clinical Responses in Treatment-Resistant Urticaria; Phase 2b outpatient study to initiate in 2024 ~2M diagnosed chronic urticaria patients based on 12 month US prevalence of 0.78%1 ~1M US chronic urticaria patients reported to be treated with Rx medication1 ~8-9 HCP visits per year1 ~4-5 ER visits per year1,2 ~50% with angioedema, ~7-8 episodes per year3 Significant peak sales opportunity References: 1. Patil D, et al. Prevalence and clinical profile of patients with chronic spontaneous urticaria in the USA. American Academy of Dermatology Associate Annual Meeting (March 2022), 2. Barniol C, et al. Annals of Emergency Medicine (2018). 3. Bernstein J, et al. Frequency of angioedema in chronic spontaneous urticaria: Report from the Urticaria Voices study. American Academy of Asthma and Immunology Annual Meeting (February 2024). neffy may provide episodic relief of acute flares to improve quality of life without escalating to chronic use of systemic biologics with potentially more side effects or having to visit ER/hospital

Significant Ex-US opportunity for neffy Europe EAI Market: ~$169M TODAY Japan EAI Market: ~$12M TODAY China EAI market: no approved products Significant Potential References:: Calendar Year 2023 IQVIA MIDAS (USD MNF) Canada EAI Market: ~$67M TODAY AUS/NZ EAI market: ~$18M TODAY <10% TYPE I ALLERGY MARKET PENETRATION (LESS THAN HALF OF US ADOPTION RATES)

Multiple Attributes Contribute to neffy’s Potential Best-in-Class Epinephrine Product Profile Will patients use it? Benign safety profile – mild nasal discomfort and headache Palatable – no meaningful pain/irritation, no taste/smell Small – fits in pocket Easy to use – 100% of adults and children can use without training (even passerby’s); ability to dose not obstructed by anaphylaxis symptoms Is it safe? Benign safety profile – mild nasal discomfort (9.7%) and mild headache (6%) No risk of injury (no needle) and minimal risk of overdose even with population variability (high bioavailability, low dose) Side effects do not mimic anaphylaxis, which could confound clinical monitoring and treatment Does it work? PK/PD response shows onset within 1 minute after dosing Rapid efficacy profile in OFC anaphylaxis (100% response rate in first 15 min), as well as treatment-resistant urticaria Predictable dose-proportional PK/PD profile within range of approved injection products even under real-world co-morbidities (e.g. rhinitis) Only anaphylaxis symptom that may alter PK/dosing is rhinitis, and for neffy, no negative impact on PK/PD 99.999% reliable sprayer device – tens of millions of units sold annually in US

neffy: the first needle-free way to administer epinephrine Rapid, reliable delivery Small and easy to carry Place and Press administration Well-tolerated in extensive trials AVOIDS ALL NEEDLE-RELATED ADVERSE EVENTS