UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.___)

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| | | | | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | | | |

| ☒ | Definitive Proxy Statement |

| | | | | |

| ☐ | Definitive Additional Materials |

| | | | | |

| ☐ | Soliciting Material under §240.14a-12 |

THE TRADE DESK, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| ☐ | Fee paid previously with preliminary materials. |

| | | | | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

The Trade Desk, Inc.

42 N. Chestnut Street

Ventura, California 93001

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held May 28, 2024

To our stockholders:

You are cordially invited to attend the 2024 annual meeting of stockholders of The Trade Desk, Inc. (the “Annual Meeting”) to be held virtually on Tuesday, May 28, 2024, at 4:30 p.m. Pacific Time. You can attend the Annual Meeting via the Internet, vote your shares electronically and submit your questions during the Annual Meeting, by visiting www.virtualshareholdermeeting.com/TTD2024 (there is no physical location for the Annual Meeting). You will need to have your 16-Digit Control Number included on your Notice of Internet Availability of Proxy Materials (the “Notice”) or your proxy card (if you received a printed copy of the proxy materials) to join the Annual Meeting.

We are holding the Annual Meeting for the following purposes:

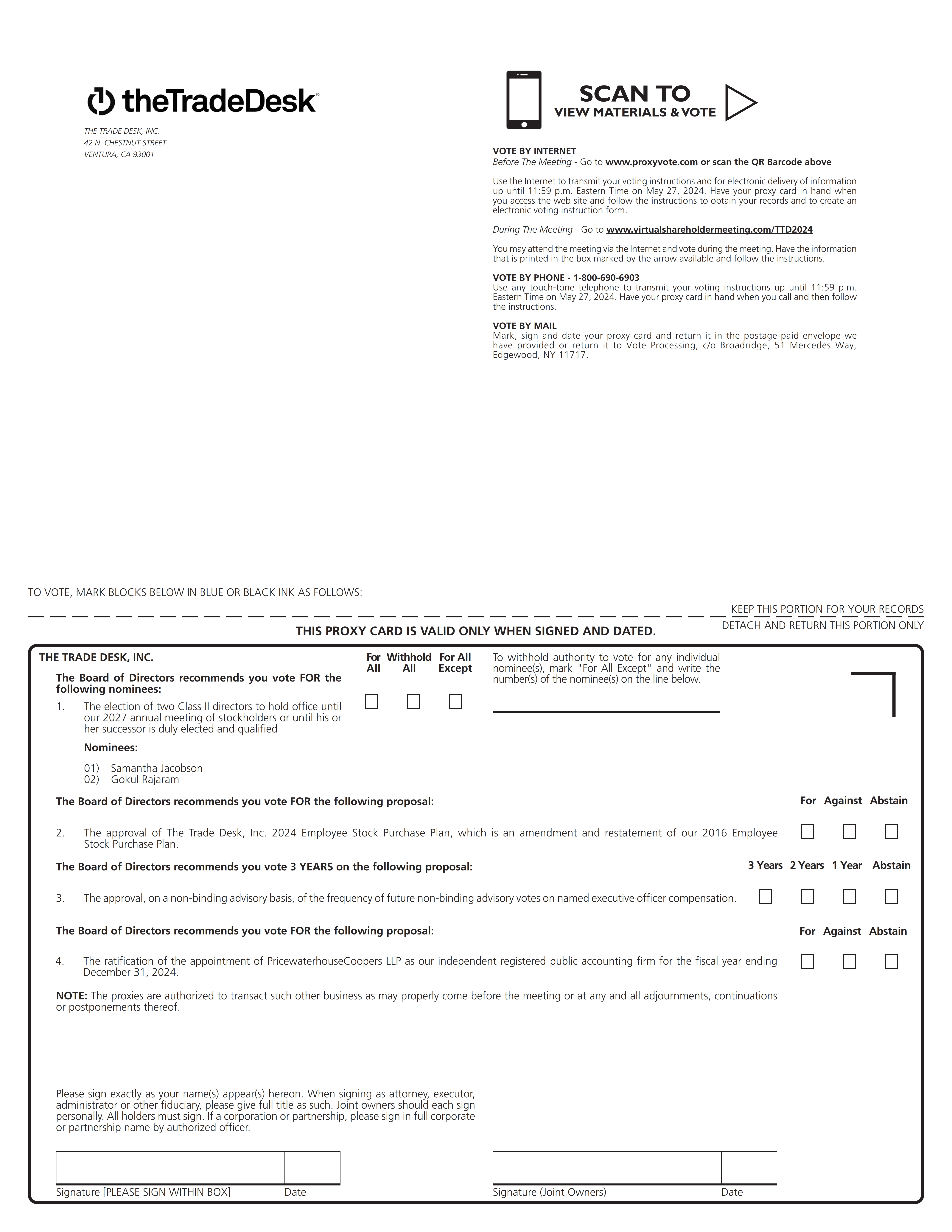

1.To elect two Class II directors;

2.To approve The Trade Desk, Inc. 2024 Employee Stock Purchase Plan, which is an amendment and restatement of our 2016 Employee Stock Purchase Plan;

3.To conduct a non-binding advisory vote on the frequency of future non-binding advisory votes on named executive officer compensation;

4.To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and

5.To transact such other business as may properly come before the Annual Meeting or at any and all adjournments, continuations or postponements thereof.

If you owned our Class A common stock or Class B common stock at the close of business on April 1, 2024, you may attend and vote at the Annual Meeting. A list of stockholders eligible to vote at the Annual Meeting will be available for review during our regular business hours at our headquarters in Ventura, California for the ten days prior to the Annual Meeting for any purpose related to the Annual Meeting. On or about April 12, 2024, we expect to mail to our stockholders the Notice containing instructions on how to access our proxy statement for our Annual Meeting (the “Proxy Statement”) and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Annual Report”). The Proxy Statement and the Annual Report can be accessed directly at the following Internet address: www.proxyvote.com. All you have to do is enter the control number located on your proxy card.

Your vote is important. Whether or not you plan to attend the Annual Meeting, I hope that you will vote as soon as possible. You may vote your shares via a toll-free telephone number or over the Internet. You may also submit your proxy card or voting instruction card for the Annual Meeting by completing, signing, dating and returning your proxy card or voting instruction card in the envelope provided. Any stockholder of record attending the Annual Meeting may vote during the Annual Meeting, even if you have already returned a proxy card or voting instruction card.

Thank you for your ongoing support of The Trade Desk.

| | | | | |

| Sincerely, |

| |

| Jeff T. Green |

| Chief Executive Officer |

Ventura, California

April 12, 2024

| | |

YOUR VOTE IS IMPORTANT ALL STOCKHOLDERS ARE INVITED TO ATTEND THE ANNUAL MEETING. WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE VOTE AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING. PLEASE NOTE THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE ANNUAL MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME. |

THE TRADE DESK, INC.

2024 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

TABLE OF CONTENTS

PROXY STATEMENT

2024 ANNUAL MEETING OF STOCKHOLDERS

THE TRADE DESK, INC.

GENERAL INFORMATION

The board of directors of The Trade Desk, Inc. is soliciting proxies for our 2024 annual meeting of stockholders (the “Annual Meeting”) to be held on Tuesday, May 28, 2024, at 4:30 p.m. Pacific Time. This year's Annual Meeting will be held entirely via the Internet. Stockholders may participate in the Annual Meeting by visiting the following website: www.virtualshareholdermeeting.com/TTD2024. To participate in the Annual Meeting, you will need the 16-digit control number included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials.

The Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for our Annual Meeting (the “Proxy Statement”) and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Annual Report”) is first being mailed on or about April 12, 2024, to stockholders entitled to vote at the Annual Meeting. We also made these materials available on our website at www.thetradedesk.com under the headings “Investors” on or about April 12, 2024. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully. Unless the context requires otherwise, the words “The Trade Desk,” “we,” “the Company,” “us,” and “our” refer to The Trade Desk, Inc.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING,

THE PROXY MATERIALS AND VOTING YOUR SHARES

WHY DID I RECEIVE A NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS INSTEAD OF A FULL SET OF PROXY MATERIALS?

We have elected to furnish our proxy materials, including this Proxy Statement and our Annual Report, primarily via the Internet. The Notice is being provided in accordance with the Securities and Exchange Commission (“SEC”) rules and contains instructions on how to access our proxy materials. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact and cost of our annual meetings of stockholders.

WHAT ITEMS WILL BE VOTED ON AT THE ANNUAL MEETING?

There are four items that will be voted on at the Annual Meeting:

1.The election of two Class II directors;

2.The approval of The Trade Desk, Inc. 2024 Employee Stock Purchase Plan, which is an amendment and restatement of our 2016 Employee Stock Purchase Plan;

3.The approval, on a non-binding advisory basis, of the frequency of future non-binding advisory votes on named executive officer compensation; and

4.The ratification of the appointment of PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

WHAT ARE OUR BOARD OF DIRECTORS’ VOTING RECOMMENDATIONS?

Our board of directors recommends that you vote your shares “FOR” each of the nominees to the board of directors, “FOR” the approval of the Company’s 2024 Employee Stock Purchase Plan, for “THREE YEARS,” on a non-binding, advisory basis, with respect to the frequency of future non-binding advisory votes on the compensation of our named executive officers and “FOR” the ratification of the appointment of PwC as our independent registered public accounting firm.

WHAT IS A PROXY?

Our board of directors is soliciting your vote at the Annual Meeting. A proxy is your legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy, that designation also is called a “proxy” or, if in a written document, a “proxy card.” Jeff Green, Laura Schenkein and Jay Grant have been designated as proxies for the Annual Meeting.

WHO CAN VOTE AT THE ANNUAL MEETING?

Only holders of record of our Class A common stock and Class B common stock at the close of business on April 1, 2024 (the “Record Date”) will be entitled to vote at the Annual Meeting. The Record Date was established by our board of directors. Stockholders of record at the close of business on the Record Date are entitled to:

•Receive notice of the Annual Meeting; and

•Vote at the Annual Meeting and any adjournments, continuations or postponements of the Annual Meeting.

On the Record Date, there were 444,809,136 shares of our Class A common stock outstanding and 43,918,900 shares of our Class B common stock outstanding. Our Class A common stock and Class B common stock will vote as a single class on all matters described in this Proxy Statement for which your vote is being solicited. Stockholders are not permitted to cumulate votes with respect to the election of directors. Each share of Class A common stock is entitled to one vote on each proposal and each share of Class B common stock is entitled to 10 votes on each proposal. Our Class A common stock and Class B common stock are collectively referred to in this Proxy Statement as our “common stock.”

IS MY VOTE CONFIDENTIAL?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either among our employees or to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote and (3) to facilitate a successful proxy solicitation. Occasionally, stockholders provide written comments on their proxy card, which are then forwarded to our management.

WHAT IS THE DIFFERENCE BETWEEN HOLDING SHARES AS A “STOCKHOLDER OF RECORD” AND HOLDING SHARES AS “BENEFICIAL OWNER” (OR IN “STREET NAME”)?

Most stockholders are considered “beneficial owners” of their shares, that is, they hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially or in “street name.”

Stockholder of Record: If your shares are registered directly in your name with our transfer agent, you are considered the “stockholder of record” with respect to those shares and we are sending the Notice directly to you to access proxy materials. As a stockholder of record, you have the right to grant your voting proxy directly to us or to vote at the Annual Meeting.

Beneficial Owner: If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in street name, and proxy materials are being forwarded to you by your broker, bank or other nominee (who is considered the stockholder of record with respect to those shares). As a beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares if you follow the instructions you receive from your broker, bank or other nominee. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares at the Annual Meeting unless you request, complete and deliver the proper documentation provided by your broker, bank or other nominee.

WHAT ARE THE DIFFERENT METHODS THAT I CAN USE TO VOTE MY SHARES OF COMMON STOCK?

By Internet: Until 11:59 p.m. Eastern Time on May 27, 2024, you can vote via the Internet by visiting the website noted on your proxy card. Internet voting is available 24 hours a day. We encourage you to vote via the Internet, as it is the most cost-effective way to vote. Beneficial owners may vote by telephone or the Internet if their banks, brokers or nominees make those methods available, by following the instructions provided to them with the proxy materials.

By Telephone: Until 11:59 p.m. Eastern Time on May 27, 2024, you can also vote your shares by telephone by calling the toll-free telephone number indicated on your proxy card and following the voice prompt instructions. Telephone voting is available 24 hours a day.

By Mail: You can vote your shares by marking, signing and timely returning the proxy card enclosed with the proxy materials that are provided in printed form. Beneficial owners must follow the directions provided by their broker, bank or other nominee in order to direct such broker, bank or other nominee as to how to vote their shares.

During the Annual Meeting: You can vote and submit questions during the Annual Meeting by attending the virtual meeting at www.virtualshareholdermeeting.com/TTD2024. Please have your Notice or proxy card in hand when you visit the website.

HOW MANY SHARES MUST BE PRESENT TO HOLD THE ANNUAL MEETING?

The holders of a majority of the voting power of all of our issued and outstanding shares of our common stock as of the Record Date must be present at the Annual Meeting or represented by proxy for the transaction of business at the Annual Meeting. This is called a quorum.

Your shares will be counted for purposes of determining if there is a quorum, if you:

•Are entitled to vote and you are present at the Annual Meeting; or

•Have voted on the Internet, by telephone or by properly submitting a proxy card or voting instruction form by mail.

Broker non-votes and abstentions are counted for purposes of determining whether a quorum is present. If there are not enough shares present both at the Annual Meeting and by timely and properly submitted proxy cards to constitute a quorum, the Annual Meeting may be adjourned until such time as a sufficient number of shares are present.

HOW ARE ABSTENTIONS COUNTED?

You may choose to abstain or refrain from voting your shares on one or more issues presented for a vote at the Annual Meeting. However, for purposes of determining the presence of a quorum, abstentions are counted as present. For the purpose of determining whether the stockholders have approved a matter, abstentions will not affect the outcome of the vote of any matter being voted on at the Annual Meeting.

WHAT IF A STOCKHOLDER DOES NOT PROVIDE A PROXY OR, IF A PROXY IS RETURNED, IT DOES NOT SPECIFY A CHOICE FOR ONE OR MORE ISSUES?

You should specify your choice for each issue to be voted upon at the Annual Meeting. If no proxy is returned or if a proxy is signed and returned but no specific instructions are given on one or more of the issues to be voted upon at that Annual Meeting, proxies will be voted in accordance with applicable rules, laws and regulations as follows:

Stockholders of Record. If you are a stockholder of record and you do not return a proxy and you do not vote at the Annual Meeting, your shares will not be voted at our Annual Meeting, and if you are not present at the Annual Meeting, your shares will not be counted for purposes of determining whether a quorum exists for the Annual Meeting. If you do return a proxy via the Internet, telephone or mail, but you fail to specify how your shares should be voted on one or more issues to be voted upon at the Annual Meeting, then to the extent you did not specify a choice, your shares will be voted: (i) FOR Proposal One for the election of all of the director nominees, (ii) FOR Proposal Two approving the Company’s 2024 Employee Stock Purchase Plan, (iii) FOR Proposal Three to approve, on a non-binding, advisory basis, submitting the non-binding advisory vote on the compensation of the Company’s named executive officers to the stockholders every three years and (iv) FOR Proposal Four ratifying the selection of PwC as our independent registered public accounting firm.

Beneficial Owners. If you are a beneficial owner and (i) you do not provide your broker or other nominee who holds your shares with voting instructions, or (ii) you do provide a proxy card but you fail to specify your voting instructions on one or more of the issues to be voted upon at our Annual Meeting, under applicable rules, your broker or other nominee may exercise discretionary authority to vote your shares on routine proposals but may not vote your shares on non-routine proposals.

The shares that cannot be voted by brokers and other nominees on non-routine matters but are represented at the Annual Meeting will be deemed present at our Annual Meeting for purposes of determining whether the necessary quorum exists to proceed with the Annual Meeting but will not be considered entitled to vote on the non-routine proposals.

We believe that under applicable rules Proposal Four: Ratification of Appointment of Independent Registered Public Accounting Firm is considered a routine matter for which brokerage firms may vote shares that are held in the name of brokerage firms and which are not voted by the applicable beneficial owners.

However, we believe that Proposal One: Election of Directors, Proposal Two: Approval of The Trade Desk, Inc. 2024 Employee Stock Purchase Plan and Proposal Three: Approval, on a Non-Binding Advisory Basis, of the Frequency of

Future Non-Binding Advisory Votes on Named Executive Officer Compensation are considered non-routine matters under applicable rules. Accordingly, brokers or other nominees cannot vote on these proposals without instruction from beneficial owners.

WHAT IS THE VOTING REQUIREMENT TO APPROVE EACH OF THE PROPOSALS?

The following table sets forth the voting requirement with respect to each of the proposals:

| | | | | | | | |

| Proposal One—Election of directors | | As set forth in our bylaws, each director must be elected by a plurality of the votes cast, meaning that the two nominees receiving the most “FOR” votes (among votes properly cast at the Annual Meeting or by proxy) will be elected. Only votes “FOR” will affect the outcome. Brokers will not have discretionary voting authority with respect to shares held in street name for their clients. Abstentions and broker non-votes will not affect the outcome of the vote. |

| | | |

| Proposal Two—Approval of The Trade Desk, Inc. 2024 Employee Stock Purchase Plan | | As set forth in our bylaws, to be approved by our stockholders, a majority of the votes cast at the Annual Meeting or by proxy must vote “FOR” this proposal. Brokers will not have discretionary voting authority with respect to shares held in street name for their clients. Abstentions and broker non-votes will not affect the outcome of the vote. |

| | |

| Proposal Three—Approval, on a Non-Binding Advisory Basis, of the Frequency of Future Non-Binding Advisory Votes on Named Executive Officer Compensation | | The option of one year, two years or three years that receives the highest number of votes cast will be the frequency of the vote on the compensation of our named executive officers that has been approved by stockholders on an advisory basis. Even though your vote is advisory and therefore will not be binding on the Company, the board of directors will review the voting results and take them into consideration when making future decisions regarding the frequency of the advisory vote on named executive officer compensation. |

| | |

| Proposal Four—Ratification of appointment of independent registered public accounting firm | | As set forth in our bylaws, to be approved by our stockholders, a majority of the votes cast at the Annual Meeting or by proxy must vote “FOR” this proposal. Brokers will have discretionary voting authority with respect to shares held in street name for their clients, even if the broker does not receive voting instructions from their client. Accordingly, we do not anticipate that there will be any broker non-votes on this proposal; however, broker non-votes will not be counted as votes cast and will therefore have no effect on the proposal. Abstentions will also have no effect on the proposal. |

HOW DO I CHANGE OR REVOKE MY PROXY?

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may vote again on a later date on the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted), or by signing and returning a new proxy card with a later date, or by attending the Annual Meeting and voting during the Annual Meeting. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again at the Annual Meeting or specifically request in writing that your prior proxy be revoked.

WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE PROXY CARD?

It means that your shares are registered differently or you have multiple accounts. Please vote all of these shares separately to ensure all of the shares you hold are voted.

HOW CAN STOCKHOLDERS SUBMIT A PROPOSAL FOR INCLUSION IN OUR PROXY STATEMENT FOR THE 2025 ANNUAL MEETING?

To be included in our proxy statement for the 2025 annual meeting, stockholder proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and be received by our Secretary at our principal executive offices no later than December 13, 2024, which is one hundred twenty (120) calendar days before the one-year anniversary of the date on which we first released this Proxy Statement to stockholders in connection with this year’s Annual Meeting. In connection with the 2025 annual meeting, we intend to file a proxy statement and a WHITE proxy card with the SEC in connection with our solicitation of proxies for that meeting.

HOW CAN STOCKHOLDERS SUBMIT PROPOSALS TO BE RAISED AT THE 2025 ANNUAL MEETING THAT WILL NOT BE INCLUDED IN OUR PROXY STATEMENT FOR THE 2025 ANNUAL MEETING?

To be raised at the 2025 annual meeting, stockholder proposals must comply with our bylaws. Under our bylaws, a stockholder must give advance notice to our Secretary of any business, including nominations of candidates for election as directors to our board, that the stockholder wishes to raise at our annual meeting. To be timely, a stockholder’s notice must be delivered to, or mailed and received at, our principal executive offices not less than ninety (90) days nor more than one hundred twenty (120) days prior to the one-year anniversary of the preceding year’s annual meeting. Since our Annual Meeting is on May 28, 2024, stockholder proposals must be received by our Secretary at our principal executive offices no earlier than January 28, 2025 and no later than February 27, 2025, in order to be raised at our 2025 annual meeting.

In addition to satisfying the foregoing requirements under our bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than our nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act.

WHAT IF THE DATE OF THE 2025 ANNUAL MEETING CHANGES BY MORE THAN 30 DAYS FROM THE ANNIVERSARY OF THIS YEAR’S ANNUAL MEETING?

Under Rule 14a-8 of the Exchange Act, if the date of the 2025 annual meeting changes by more than 30 days from the anniversary of this year’s annual meeting, to be included in our proxy statement, stockholder proposals must be received by us within a reasonable time before our solicitation is made.

Under our bylaws, if the date of the 2025 annual meeting is advanced by more than thirty (30) days or delayed by more than sixty (60) days from the anniversary of this year’s annual meeting, stockholder proposals to be brought before the 2025 annual meeting must be delivered, or mailed and received, not more than the hundred twentieth (120th) day prior to such annual meeting and not less than the ninetieth (90th) day prior to such annual meeting or, if later, the tenth (10th) day following the day on which public disclosure of the date of such annual meeting was first made.

DOES A STOCKHOLDER PROPOSAL REQUIRE SPECIFIC INFORMATION?

With respect to a stockholder’s nomination of a candidate for our board of directors, the stockholder notice to the Secretary must contain certain information as set forth in our bylaws about both the nominee and the stockholder making the nomination. With respect to any other business that the stockholder proposes, the stockholder notice must contain a brief description of such business and the reasons for conducting such business at the Annual Meeting, as well as certain other information as set forth in our bylaws. If you wish to bring a stockholder proposal or nominate a candidate for director, you are advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations. A copy of our bylaws is available via the website of the Securities and Exchange Commission at http://www.sec.gov. You may also contact our Secretary at the address set forth above for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

WHAT HAPPENS IF WE RECEIVE A STOCKHOLDER PROPOSAL THAT IS NOT IN COMPLIANCE WITH THE TIME FRAMES DESCRIBED ABOVE?

If we receive notice of a matter to come before the 2025 annual meeting that is not in accordance with the deadlines described above, we will use our discretion in determining whether or not to bring such matter before such meeting. If such matter is brought before such meeting, then our proxy card for such meeting will confer upon our proxy holders’ discretionary authority to vote on such matter.

WHAT HAPPENS IF ADDITIONAL MATTERS ARE PRESENTED AT THE ANNUAL MEETING?

Other than the four items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Jeff Green, Laura Schenkein and Jay Grant, or any of them, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. If for any reason any of the nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by our board of directors.

WHO BEARS THE COST OF THIS SOLICITATION?

We pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. In addition, we may reimburse banks, brokers and other custodians, nominees and fiduciaries representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. Proxies may be solicited by certain of our directors, officers and employees, personally or by mail, telephone, facsimile, email or other means of communication (electronic or otherwise). No additional compensation will be paid for such services.

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports, or Notices of Internet Availability of Proxy Materials, with respect to two or more stockholders sharing the same address by delivering a single proxy statement and annual report, or Notice of Internet Availability of Proxy Materials, addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies. In accordance with these rules, only one proxy statement and annual report, or Notice of Internet Availability of Proxy Materials, will be delivered to multiple stockholders sharing an address unless we have received contrary instructions from one or more of the stockholders. Stockholders who currently receive multiple copies of the proxy statement and annual report, or Notice of Internet Availability of Proxy Materials, at their address and would like to request “householding” of their communications should contact their broker if they are beneficial owners or direct their request to Broadridge at the contact information below if they are record holders.

If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement and annual report, or Notice of Internet Availability of Proxy Materials, please notify your broker, if you are a beneficial owner or, if you are a record holder, direct your written request to Broadridge Financial Solutions, Inc., Householding Department, 51 Mercedes Way, Edgewood, New York 11717 or call Broadridge at 1-866-540-7095.

If requested, we will also promptly deliver, upon oral or written request, a separate copy of the proxy statement and annual report, or Notice of Internet Availability of Proxy Materials, to any stockholder residing at an address to which only one copy was mailed.

WHERE CAN I FIND THE VOTING RESULTS OF THE ANNUAL MEETING?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K filed with the SEC within four business days after the Annual Meeting, which will be available on our website.

PROPOSAL ONE:

ELECTION OF DIRECTORS

In voting on the election of our director nominees, stockholders may:

•Vote in favor of all nominees;

•Vote in favor of specific nominees; or

•Withhold votes as to specific nominees.

Assuming a quorum is present; directors will be elected by a plurality of the votes cast.

Our bylaws provide that the authorized number of directors shall be determined from time to time by resolution of the board of directors, provided the board of directors shall consist of at least one (1) member. Our board of directors is currently comprised of seven (7) directors. Our certificate of incorporation provides that our board of directors shall be divided into three classes, each consisting of as nearly one-third of the total number of directors as possible. Each class of directors serves a three-year term expiring at the annual meeting of stockholders in the year listed in the table below:

| | | | | | | | | | | | | | |

| Class I (2026) | | Class II (2024) | | Class III (2025) |

| Jeff T. Green | | Samantha Jacobson | | Lise J. Buyer |

| Andrea L. Cunningham | | Gokul Rajaram | | Kathryn E. Falberg |

| | | | David B. Wells |

Based on the recommendation of the nominating and corporate governance committee, our board of directors has nominated Samantha Jacobson and Gokul Rajaram for election as Class II directors, each to serve a three-year term that expires at the annual meeting of stockholders in 2027 and until his or her successor is duly elected and qualified. Each of Ms. Jacobson and Mr. Rajaram are currently serving as Class II directors and have consented to serve for a new term.

Directors listed in Class I and Class III above are not being elected this year and will continue in office for the remainder of their terms, as described above, unless such directors resign or their service as directors otherwise ceases in accordance with our certificate of incorporation or bylaws.

Vote Required

The Class II directors being voted on this year are elected by a plurality of the votes cast. This means that the director nominee with the most affirmative votes for a particular seat is elected for that seat. Abstentions have no effect on the outcome of the vote.

It is the intention of the persons named as proxies herein to vote in favor of the candidates nominated by our board of directors unless such authority is withheld, either by affirmative vote of the stockholders or deemed withheld by the failure of stockholders to submit their votes. If any nominee should not be available for election, the proxies will be voted in the best judgment of the persons authorized as proxies.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF THE DIRECTOR NOMINEES.

Information Concerning Director Nominees

The name and age of each nominee for director, his or her position with us, the year in which he or she first became a director, and certain biographical information as of April 12, 2024 is set forth below:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Positions and Offices Held with the Company | | Director Since |

| Samantha Jacobson | | 39 | | Chief Strategy Officer, Director | | January 2024 |

| Gokul Rajaram | | 49 | | Director | | May 2018 |

| | | | | | |

| | | | | | |

Samantha Jacobson has served as a member of our board of directors since January 2024 and as our Chief Strategy Officer since February 2022. Prior to her appointment as our Chief Strategy Officer, Ms. Jacobson served as Vice President, Strategic Partnerships. Before joining The Trade Desk in 2021, Ms. Jacobson served as Vice President of Strategy and Business Development at Oracle from March 2019 to March 2021 and as Senior Director of Strategy and Business Development for Oracle Data Cloud from April 2015 to March 2019. Ms. Jacobson received a B.S.E in Finance and Management from The Wharton School at the University of Pennsylvania and an M.B.A. from the Harvard Business School.

We believe that Ms. Jacobson is qualified to serve on our board of directors due to her extensive management experience leading strategic initiatives and industry background.

Gokul Rajaram has served as a member of our board of directors since May 2018. Mr. Rajaram invests in and advises technology companies. Mr. Rajaram served on the executive team at DoorDash Inc. (“DoorDash”) from November 2019 until April 2024, after DoorDash acquired a food delivery business owned by Square, Inc. (“Square”) called Caviar, Inc. (“Caviar”), where he served as the Lead for Caviar. Prior to DoorDash, Mr. Rajaram worked as the Product Engineering Lead from July 2013 to October 2019 at Square, where he led several product development teams and served on Square’s executive team. Before joining Square in July 2013, Mr. Rajaram served as Product Director, Ads at Facebook, Inc. from August 2010 to July 2013, where he helped Facebook transition its advertising business to become mobile-first. Mr. Rajaram served as Product Management Director for Google AdSense from January 2003 to November 2007, where he helped launch the product and grow it into a substantial portion of Google's business. Mr. Rajaram has served on the boards of directors of Coinbase Inc. since August 2020 and publicly traded Pinterest, Inc. since February 2020. He also served on the board of directors of publicly traded RetailMeNot, Inc. from September 2013 until it was taken private in May 2017. Mr. Rajaram received a B. Tech in Computer Science from the Indian Institute of Technology Kanpur, an M.S. in Computer Science from the University of Texas and an M.B.A. from the Massachusetts Institute of Technology Sloan School of Management.

We believe that Mr. Rajaram is qualified to serve on our board of directors due to his extensive entrepreneurial background, strategic leadership track record and service on other boards of directors of technology companies.

Information Concerning Current Directors and Directors Continuing in Office

The name and age of each director currently or continuing in office, his or her position with us, the year in which he or she first became a director, and certain biographical information as of April 12, 2024 is set forth below:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Positions and Offices Held with the Company | | Director Since |

| Lise J. Buyer | | 64 | | Lead Independent Director | | March 2019 |

| Andrea L. Cunningham | | 67 | | Class A Director | | January 2022 |

| Kathryn E. Falberg | | 63 | | Director | | August 2016 |

| Jeff T. Green | | 47 | | President and Chief Executive Officer, Director | | November 2009 |

| David B. Wells | | 52 | | Director | | December 2015 |

Lise J. Buyer has served as a member of our board of directors since March 2019, and she was appointed as lead independent director in February 2021. Since 2006, Ms. Buyer has served as a partner of Class V Group LLC, a consulting firm she co-founded that advises companies on initial public offerings and other market strategies. From August 2005 to August 2006, she served as vice president of Tellme Networks, Inc., a private Internet telephone business. Between April 2003 and August 2005, Ms. Buyer served as the director of business optimization at Google. From September 2002 to March 2003, she served as a consultant and the director of research for Vista Research LLC, an independent equity research firm in New York, New York. From May 2000 to July 2002, she was a general partner at Technology Partners, a Palo Alto, California venture capital firm. Ms. Buyer was the director of internet/new media research at Credit Suisse First Boston from July 1998 to May 2000. Prior to that, she spent six years as vice president at T. Rowe Price Group, Inc. working predominantly on its Science and Technology Fund, and the preceding nine years as an institutional equity investor and analyst of both the technology and media industries. Ms. Buyer served on the board of directors of publicly traded Greenfield Online Inc., an online survey company, from April 2004 until it was acquired by Microsoft Corporation. Ms. Buyer received a B.A. in Economics and Geology from Wellesley College and an M.B.A. from the Owen Graduate School of Management at Vanderbilt University.

We believe that Ms. Buyer is qualified to serve on our board of directors due to her extensive management experience, high-growth company background and strategic leadership track record.

Andrea L. Cunningham has served as a member of our board of directors since January 2022. Since 2012, Ms. Cunningham has served as the president of Cunningham Collective, a consulting firm she founded that advises companies on marketing, brand and communication strategies. She previously held various senior marketing positions at various companies, including serving as Chief Marketing Officer for Avaya Inc., a cloud communications company, from 2014 to 2015. Ms. Cunningham currently serves on the boards of directors of numerous private companies, and previously served on the boards of directors of RhythmOne plc (formerly Blinkx), a digital advertising technology company then-traded on the London Stock Exchange, from February 2016 to February 2018. Ms. Cunningham received a B.A. in English from Northwestern University and completed the Harvard Business School Executive Education program.

Ms. Cunningham currently serves as a representative of the holders of our Class A common stock. For more information, see “Information About the Board of Directors and Corporate Governance-Class A Director.”

We believe that Ms. Cunningham is qualified to serve on our board of directors due to her extensive management experience, track record at other technology companies and industry background.

Kathryn E. Falberg has served as a member of our board of directors since August 2016. Ms. Falberg served as executive vice president and chief financial officer of Jazz Pharmaceuticals, PLC, a biopharmaceutical company, from March 2012 to March 2014 after serving as senior vice president and chief financial officer since December 2009. From 2001 through 2009, Ms. Falberg worked with a number of smaller companies, including AdECN, Inc. (“AdECN”), while serving as a corporate director and audit committee chair for several companies. Ms. Falberg was with Amgen from 1995 through 2001, where she served as senior vice president, finance and strategy and chief financial officer and before that as vice president, controller and chief accounting officer, and vice president, treasurer. Ms. Falberg currently serves on the board of directors of publicly traded Arcus Biosciences, Inc., and Nuvation Bio, and previously served on a number of boards including publicly traded Tricida, Inc., Urogen Pharma Ltd., Aimmune Therapeutics, Inc., Axovant Sciences Ltd., BioMarin Pharmaceutical Inc, Medivation, Inc., Halozyme Therapeutics, Inc., and aTyr Pharma, Inc. Ms. Falberg received a B.A. in Economics and an M.B.A. from the University of California, Los Angeles and is a Certified Public Accountant (inactive).

We believe that Ms. Falberg is qualified to serve on our board of directors due to her extensive management experience, strategic leadership track record and service on other boards of directors.

Jeff T. Green co-founded The Trade Desk and has served as our president and chief executive officer and as a member of our board of directors since November 2009. Prior to joining The Trade Desk, from May 2004 to October 2009, Mr. Green founded AdECN, the world’s first online advertising exchange, and served as its chief operating officer, where he led strategy, product and business development until it was acquired by Microsoft in 2007. At Microsoft Corporation, Mr. Green oversaw the AdECN exchange business, as well as all reseller and channel partner business. Mr. Green has also played a leadership role in the ad tech industry, having served on the Networks and Exchanges Quality Assurance Guidelines Committee for the Internet Advertising Bureau (“IAB”) from 2011 to 2012. At IAB, Mr. Green led working groups that established rules and best practices for acquiring inventory and set data transaction standards.

We believe that Mr. Green is qualified to serve on our board of directors due to his extensive management experience and sophisticated industry background.

David B. Wells has served as a member of our board of directors since December 2015. Mr. Wells served as the chief financial officer of Netflix, Inc., a media-services provider, for eight years, retiring in early 2019 after nearly 15 years with the company and having served as vice president of financial planning and analysis prior to chief financial officer. Mr. Wells is also a director for public direct to consumer healthcare company HIMS, where he is audit chair, and is the chairman of the board and a member of the remuneration committee (formerly the senior independent director) for UK based fintech company WISE PLC. Mr. Wells received a B.S. in Commerce and English from the University of Virginia and an M.B.A./M.P.P. Magna Cum Laude from the University of Chicago.

We believe that Mr. Wells is qualified to serve on our board of directors due to his extensive management experience, financial expertise, high-growth company background and strategic leadership track record.

PROPOSAL TWO:

APPROVAL OF THE TRADE DESK 2024 EMPLOYEE STOCK PURCHASE PLAN

Background

The board of directors has adopted, subject to stockholder approval, The Trade Desk, Inc. 2024 Employee Stock Purchase Plan (the “ESPP”). The ESPP is an amendment and restatement of our existing The Trade Desk, Inc. 2016 Employee Stock Purchase Plan (the “Existing ESPP”), which we adopted in connection with our initial public offering. Stockholders are being asked to approve the ESPP at the Annual Meeting. If our stockholders approve the ESPP, the ESPP will become effective on May 28, 2024. If the ESPP is not approved by our stockholders, then the ESPP will not become effective, and the Existing ESPP will continue in full force and effect until the expiration of its term on August 17, 2026.

The material terms of the ESPP are summarized in this Proposal, and a copy of the ESPP is attached as Appendix B to this Proxy Statement. The summary contained in this Proposal is subject in its entirety to the specific provisions contained in the complete text of the ESPP set forth in Appendix B to this Proxy Statement. The following is an overview of the key changes to the Existing ESPP contained in the ESPP:

•Term. The term of the ESPP will remain in effect until terminated by the plan administrator in accordance with the ESPP.

•No New Evergreen Provision. The existing “evergreen” provision under the ESPP, which provides for annual increases to the share limit through January 1, 2026, will lapse in 2026, and no new “evergreen” provision will apply under the ESPP.

•Other Updates. The ESPP contains other minor, technical and administrative updates.

We believe that maintaining an employee stock purchase plan aligns employee interests with those of our stockholders and provides an important employee retention incentive that ultimately benefits our stockholders.

Stockholder Approval

Stockholder approval of the ESPP is necessary in order for us to meet the stockholder approval requirements of Nasdaq and to meet the requirements of Code Section 423.

Material Terms of the ESPP

The material terms of the ESPP are summarized below, and a copy of the ESPP is attached as Appendix B to this Proxy Statement. The following summary is subject in its entirety to the specific provisions contained in the complete text of the ESPP set forth in Appendix B to this Proxy Statement.

Overview of the ESPP. The ESPP is comprised of two distinct components in order to provide increased flexibility to grant purchase rights under the ESPP to U.S. and to non-U.S. employees. Specifically, the ESPP authorizes (1) the grant of purchase rights to U.S. employees that are intended to qualify for favorable U.S. federal tax treatment under Section 423 of the Code, (referred to as the Section 423 Component), and (2) the grant of purchase rights that are not intended to be tax-qualified under Section 423 of the Code to facilitate participation for employees located outside of the United States who do not benefit from favorable U.S. tax treatment and to provide flexibility to comply with non-U.S. law and other considerations, (the Non-Section 423 Component). Where possible under local law and custom, we expect that the Non-Section 423 Component generally will be operated and administered on terms and conditions similar to the Section 423 Component.

Purpose. The purpose of the ESPP is to provide employees with an opportunity to acquire an equity ownership interest in the Company.

Share Reserve. The aggregate number of shares of Class A common stock that may be issued pursuant to rights granted under the ESPP will be 8,000,000 shares. In addition, on the first day of each calendar year beginning on January 1, 2017 and ending on (and including) January 1, 2026, the number of shares available for issuance under the ESPP will be increased by a number of shares equal to the least of (1) 8,000,000 shares, (2) 1% of the shares outstanding (on an as-converted basis) on the final day of the immediately preceding calendar year, and (3) such smaller number of shares as determined by our board of directors. If any right granted under the ESPP terminates for any reason without having been exercised, the shares subject thereto that are not purchased under such right will again be available for issuance under the ESPP.

Administration. Our compensation committee will administer the ESPP, unless otherwise determined by our board of directors. The compensation committee may delegate its duties and responsibilities to committees of directors. To the extent necessary to comply with Rule 16b-3 of the Exchange Act, the plan administrator will consist solely of two

members of our board of directors, each of whom is intended to qualify as an “outside director,” within the meaning of Section 162(m) of the Code, a “non-employee director” for purposes of Rule 16b-3 under the Exchange Act and an “independent director” within the meaning of the rules of the applicable stock exchange on which shares of Class A common stock are traded. Subject to the terms and conditions of the ESPP, the plan administrator has the authority to determine when rights to purchase shares will be offered and the provisions of each offering under the ESPP, to determine which subsidiaries will participate in the ESPP (including in the Non-Section 423 and the Section 423 Components), and to make all other determinations and to take all other actions necessary or advisable for the administration of the ESPP. The administrator is also authorized to establish, amend or revoke rules relating to administration of the ESPP.

Eligible Employees. Employees eligible to participate in the ESPP for a given offering generally include employees who are employed by the Company or one of its designated subsidiaries on the first trading day of the offering, referred to as the enrollment date. However, an employee who owns (or is deemed to own through attribution) 5% or more of the combined voting power or value of all classes of the Company's or one of its subsidiaries' stock will not be allowed to participate in the Section 423 Component. In addition, the plan administrator may provide that an employee may not be eligible to participate in an offering under the Section 423 Component if the employee is a citizen or resident of a non-U.S. jurisdiction and the grant of a right to purchase shares would be prohibited under applicable law or would cause the Section 423 Component (or any offering thereunder) to violate the requirements of Section 423 of the Code. Additionally, the plan administrator may provide that certain highly compensated, seasonal and/or part-time employees may not be eligible to participate in an offering or, with respect to offerings under the Non-Section 423 Component, that only certain employees are eligible to participate in such offerings (regardless of the foregoing rules). As of March 31, 2024, there were approximately 3,180 employees eligible to participate in the ESPP.

Participation. Employees may become participants in the ESPP for an offering by completing an enrollment form prior to the enrollment date of the applicable offering, which will designate a whole percentage or fixed dollar amount of the employee's compensation to be withheld by the Company as payroll deductions under the ESPP during the offering. The compensation to be withheld with respect to each employee may not be less than 1% or more than 25% of the employee's compensation (or such other percentage designated by the plan administrator in the applicable offering document). The accumulated deductions will be applied to the purchase of shares on each purchase date during an offering. However, a participant may not purchase more than 60,000 shares during any one purchase period and, with respect to the Section 423 Component, may not subscribe for more than $25,000 worth of shares under the ESPP per calendar year in which such rights to purchase stock are outstanding (considered together with any other ESPP maintained by the Company or certain parent or subsidiary entities) based on the fair market value of the shares at the time the purchase right is granted.

Offerings; Purchase Periods. Under the ESPP, participants are offered the right to purchase shares of the Company's Class A common stock at a discount during a series of offerings. Following the effectiveness of the ESPP, offerings will cover the 24-month periods commencing each November 15th and May 15th during the effectiveness of the ESPP. Each offering will be comprised of one or more purchase periods designated by the plan administrator in the applicable offering document.

The purchase price for each offering will be designated by the plan administrator in the applicable offering document or, in the absence of a designation by the plan administrator, the purchase price will be the lower of 85% of the closing trading price per share of the Company's Class A common stock on the enrollment date of the applicable offering or 85% of the closing trading price per share on the applicable purchase date, which will occur on the last trading day of each purchase period during an offering.

Unless a participant has previously withdrawn his or her participation in, or has otherwise become ineligible to participate in the ESPP prior to any applicable purchase date, the participant's accumulated payroll deductions will be applied to the purchase of whole shares as of each purchase date. The participant will purchase the maximum number of whole shares of Class A common stock that his or her accumulated payroll deductions will buy at the purchase price, subject to the participation limitations described above, and any fractional shares will be credited to the participant's account and carried forward and applied toward the purchase of whole shares for the next offering.

In the event that the fair market value of a share of Class A common stock on any purchase date during an offering is less than the fair market value of a share on the enrollment date of such offering, the offering will automatically terminate after the purchase of shares of Class A common stock on the purchase date and a new subsequent offering will commence on such purchase date. In the event of any such offering reset, each participant in the offering will automatically be enrolled in the next-subsequent offering on the same terms and conditions on which he or she participated in the terminated offering.

Payroll Deduction Changes and Withdrawals. A participant may increase or decrease his or her payroll deductions twice during any purchase period. In addition, a participant may cancel his or her payroll deductions and withdraw his or her participation from the ESPP at any time by submitting written notice to the Company at least one week prior to the end of

the offering in which such participant is enrolled. Upon withdrawal, the participant will receive a refund of the participant's account balance in cash, and his or her payroll deductions shall cease.

Transfer Restrictions. A participant may not transfer (other than by will or the laws of descent and distribution) any right granted under the ESPP and, during a participant's lifetime, purchase rights granted under the ESPP shall be exercisable only by such participant. In addition, except as otherwise provided in an offering document, a participant may not transfer, sell or otherwise dispose of any shares purchased under the ESPP until the earlier of (1) the six-month anniversary of the purchase date on which the participant purchased the shares and (2) the occurrence, after the applicable purchase date, of a change in control of the Company.

Adjustments; Changes in Capitalization. The plan administrator has broad discretion to take action under the ESPP, as well as make adjustments to the terms and conditions of existing and future purchase rights, to prevent the dilution or enlargement of intended benefits and facilitate necessary or desirable changes in the event of certain transactions and events affecting the Company's Class A common stock, such as stock dividends, stock splits, mergers, acquisitions, consolidations and other corporate transactions. In the event of certain changes in control of our Company (as defined in the ESPP) in which outstanding rights are not assumed or substituted, the plan administrator will set a new purchase date on which all offering periods under the ESPP will terminate.

Amendment and Termination. The plan administrator may amend, suspend or terminate the ESPP at any time, subject to stockholder approval to the extent required under Section 423 of the Code (with respect to the Section 423 Component) or other applicable law. The ESPP will terminate upon the expiration of the purchase period during which the administrator terminates the ESPP. The ESPP has no set termination date.

U.S. Federal Income Tax Consequences of the ESPP

The material federal income tax consequences of the ESPP under current U.S. federal income tax law are summarized in the following discussion, which deals with the general tax principles applicable to the ESPP. The following discussion is based upon laws, regulations, rulings and decisions now in effect, all of which are subject to change. Foreign, state and local tax laws, and employment, estate and gift tax considerations are not discussed due to the fact that they may vary depending on individual circumstances and from locality to locality.

As described above, the ESPP has a Section 423 Component and a Non-Section 423 Component. The tax consequences for a U.S. taxpayer will depend on whether he or she participates in the Section 423 Component or the Non-Section 423 Component.

Tax Consequences to U.S. Participants in the Section 423 Component. The Section 423 Component of the ESPP, and the right of participants to make purchases thereunder, is intended to qualify under the provisions of Section 423 of the Code. Under the applicable Code provisions, no income will be taxable to a participant until the sale or other disposition of the shares purchased under the Section 423 Component of the ESPP. This means that an eligible employee will not recognize taxable income on the date the employee is granted an option under the Section 423 Component of the ESPP (i.e., the first day of the offering period). In addition, the employee will not recognize taxable income upon the purchase of shares. Upon such sale or disposition, the participant will generally be subject to tax in an amount that depends upon the length of time such shares are held by the participant prior to disposing of them. If the shares are sold or disposed of more than two years from the first day of the offering period during which the shares were purchased and more than one year from the date of purchase, or if the participant dies while holding the shares, the participant (or his or her estate) will recognize ordinary income measured as the lesser of (1) the excess of the fair market value of the shares at the time of such sale or disposition over the purchase price or (2) an amount equal to 15% of the fair market value of the shares as of the first day of the offering period. Any additional gain will be treated as long-term capital gain. If the shares are held for the holding periods described above but are sold for a price that is less than the purchase price, there is no ordinary income and the participating employee has a long-term capital loss for the difference between the sale price and the purchase price.

If the shares are sold or otherwise disposed of before the expiration of the holding periods described above, the participant will recognize ordinary income generally measured as the excess of the fair market value of the shares on the date the shares are purchased over the purchase price and we will be entitled to a tax deduction for compensation expense in the amount of ordinary income recognized by the employee. Any additional gain or loss on such sale or disposition will be long-term or short-term capital gain or loss, depending on how long the shares were held following the date they were purchased by the participant prior to disposing of them. If the shares are sold or otherwise disposed of before the expiration of the holding periods described above but are sold for a price that is less than the purchase price, the participant will recognize ordinary income equal to the excess of the fair market value of the shares on the date of purchase over the purchase price (and we will be entitled to a corresponding deduction), but the participant generally will be able to report a capital loss equal to the difference between the sales price of the shares and the fair market value of the shares on the date of purchase.

We are not entitled to a deduction for amounts taxed as ordinary income or capital gain to a participant except to the extent of ordinary income recognized upon a sale or disposition of shares prior to the expiration of the holding periods described above.

Tax Consequences to U.S. Participants in the Non-Section 423 Component. A U.S. participant in the Non-Section 423 Component will have compensation income equal to the value of the common stock on the day he or she purchased the common stock less the purchase price.

When the participant sells the common stock he or she purchased under the Non-Section 423 Component of the ESPP, he or she also will have a capital gain or loss equal to the difference between the sales proceeds and the value of the common stock on the day he or she purchased it. This capital gain or loss will be long-term if the participant held the common stock for more than one year and otherwise will be short-term.

Any compensation income that the participant receives upon the purchase of shares of common stock under the Non-Section 423 Component of the ESPP is subject to applicable tax withholding. In addition, the compensation income is required to be reported as ordinary income to the participant on his or her annual Form W-2, and the participant is responsible for ensuring that this income is reported on his or her individual income tax return.

With respect to U.S. participants, we are entitled to a deduction for amounts taxed as ordinary income to a participant to the extent of ordinary income recognized upon a purchase made under the Non-Section 423 Component.

Stock Price

The closing price of the Company’s common stock on Nasdaq as of April 5, 2024 was $85.83 per share.

New Plan Benefits

The number of shares that may be purchased under the ESPP will depend on each employee’s voluntary election to participate, the rate of contributions by such employees and the purchase price of the shares issuable under the ESPP at future dates. Accordingly, it is not possible to determine the value of the future benefits which may be received by participants under the ESPP.

Plan Benefits

From the inception of the Existing ESPP through April 11, 2024, the number of shares of our common stock purchased by our named executive officers and certain other persons under the Existing ESPP is as follows: (i) Laura Schenkein, Chief Financial Officer (named executive officer), 50,422 shares; (ii) Jay R. Grant, Chief Legal Officer (named executive officer), 1,746 shares; (iii) Blake J. Grayson, Former Chief Financial Officer (named executive officer), 3,019 shares; (iv) David R. Pickles, Senior Advisor and Former Chief Technology Officer (named executive officer), 48,222 shares; (v) all current executive officers as a group, 52,168 shares; (vi) Samantha Jacobson (director nominee), 1,477 shares; (vii) each associate of any of such directors, executive officers or nominees, zero shares; (viii) each other person who received or is to receive 5 percent of such options, warrants or rights, zero shares; and (ix) all employees, including all current officers who are not executive officers, as a group, 23,691,140 shares. Each of Mr. Green and our non-employee directors are not eligible to participate in, and have not purchased any shares of our common stock under, the Existing ESPP and are therefore omitted from this disclosure.

Vote Required

Assuming a quorum is present, the ESPP will be approved if the affirmative vote of a majority of the votes cast on the matter at the Annual Meeting is obtained (meaning the number of shares voted “FOR” the proposal must exceed the number of shares voted “AGAINST” the proposal). In the event that the stockholders do not approve the ESPP, The Trade Desk, Inc. 2016 Employee Stock Purchase Plan will continue in full force and effect on its terms and conditions as in effect immediately prior to the date that the ESPP was first approved by the Board. Abstentions and broker non-votes are not considered votes cast for the foregoing purpose and will have no effect on the vote for this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE APPROVAL OF THE TRADE DESK, INC. 2024 EMPLOYEE STOCK PURCHASE PLAN.

PROPOSAL THREE:

APPROVAL, ON A NON-BINDING ADVISORY BASIS, OF THE FREQUENCY OF FUTURE NON-BINDING ADVISORY VOTES ON NAMED EXECUTIVE OFFICER COMPENSATION

Section 14A of the Exchange Act enables our stockholders to indicate how frequently we should seek an advisory vote from our stockholders on the compensation of our named executive officers. By voting on this say-on-frequency proposal, stockholders may indicate whether they would prefer an advisory vote on named executive officer compensation (commonly known as “say-on-pay”) once every one, two or three years, or to abstain entirely from voting on the proposal.

Recommendation

Our board of directors has considered the frequency of the say-on-pay vote that it should recommend. After considering the benefits and consequences of each option for the frequency of submitting the say-on-pay vote to stockholders, our board of directors recommends submitting the say-on-pay vote to our stockholders every three years, or a triennial vote, for the following reasons:

•Our executive compensation program is designed to support long-term value creation. A triennial vote will allow stockholders to better judge our compensation program in relation to our long-term performance.

•A triennial vote will provide our compensation committee and our board of directors sufficient time to thoughtfully evaluate the results of the most recent advisory vote on named executive officer compensation, to discuss the implications of the vote with our stockholders and to develop and implement any changes to our executive compensation program that may be appropriate in light of the vote.

•A triennial vote will allow for any changes to our executive compensation program to be in place long enough for stockholders to see and evaluate the effectiveness of these changes before another non-binding advisory vote on named executive officer compensation is conducted.

•We view the say-on-pay vote as just one opportunity for stockholders to communicate with us regarding their views on our executive compensation program and its alignment with long-term stockholder value creation. We encourage stockholders who have concerns about executive compensation during the period between say-on-pay votes to bring such concerns to the attention of the Company.

•Less frequent say-on-pay votes will improve the ability of institutional stockholders to exercise their voting rights in a more deliberate, thoughtful and informed way that is in the best interests of stockholders, and is less burdensome to such stockholders than a more frequent vote.

For the reasons discussed above, our board of directors recommends that stockholders vote in favor of holding a say-on-pay vote at an annual meeting of stockholders once every three years. When voting to recommend the frequency of the Company’s “say-on-pay” vote, stockholders should be aware that they are not voting “for” or “against” our board of directors’ recommendation to vote for a frequency of every year for holding future say-on-pay votes. Rather, stockholders will be casting votes to recommend a say-on-pay vote every year, once every two years or once every three years, or they may abstain entirely from voting on the proposal.

The option on the frequency of the say-on-pay vote that receives the most votes from stockholders will be considered by our compensation committee as the stockholders’ recommendation as to the frequency of future say-on-pay votes. However, the outcome of this advisory vote on the frequency of the say-on-pay vote is not binding on us or our board of directors or our compensation committee. Nevertheless, our board of directors will review and consider the outcome of this vote when making determinations as to when the say-on-pay vote will again be submitted to stockholders for approval at an annual meeting of stockholders.

Vote Required for Approval

The advisory approval of the frequency of the say-on-pay vote requires a majority of the shares present in person or represented by proxy and entitled to vote on each proposal at the annual meeting. As this is an advisory vote, the result will not be binding on us, our board of directors or our compensation committee, although our compensation committee will consider the outcome of the vote when evaluating our compensation principles, design and practices.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE OF “THREE YEARS” WITH RESPECT TO THE FREQUENCY OF FUTURE NON-BINDING ADVISORY VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

PROPOSAL FOUR:

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

On the recommendation of our audit committee, our board of directors has appointed PwC, an independent registered public accounting firm, to audit our consolidated financial statements for the fiscal year ending December 31, 2024 and attest to our internal control over financial reporting as of December 31, 2024. We are submitting this selection to our stockholders for ratification. Although we are not required to seek stockholder approval for this appointment, we believe it is sound corporate practice to do so. Representatives from PwC will be in attendance at the Annual Meeting to respond to any appropriate questions and will have the opportunity to make a statement, if they so desire.

In the vote on the ratification of the selection of PwC as our independent auditors, stockholders may:

•Vote in favor of ratification;

•Vote against ratification; or

•Abstain from voting on ratification.

Vote Required for Approval

Assuming a quorum is present, the selection of PwC as our independent auditors will be ratified if the affirmative vote of a majority of the votes cast on the matter at the Annual Meeting is obtained (meaning the number of shares voted “FOR” the proposal must exceed the number of shares voted “AGAINST” the proposal). In the event that the stockholders do not ratify the selection of PwC, the appointment of the independent auditors will be reconsidered by the audit committee of the board of directors. Abstentions and broker non-votes are not considered votes cast for the foregoing purpose and will have no effect on the vote for this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE RATIFICATION OF PWC AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2024.

Auditor Information

Set forth below are the fees for services rendered by PwC for the fiscal years ended December 31, 2023 and 2022:

| | | | | | | | | | | | | | |

| Fee Category | | 2023 | | 2022 |

Audit Fees(1) | | $ | 4,509,464 | | | $ | 4,111,960 | |

Audit-Related Fees(2) | | 300,000 | | | 480,000 | |

Tax Fees(3) | | 1,077,862 | | | 676,173 | |

All Other Fees(4) | | 4,589 | | | 108,818 | |

| Total | | $ | 5,891,915 | | | $ | 5,376,951 | |

(1)Audit Fees for 2023 and 2022 cover professional services rendered for the audit of our annual financial statements included in our Annual Report on Form 10-K, review of financial statements included in our Quarterly Reports on Form 10-Q, audit of our internal control over financial reporting, new and existing statutory audits of subsidiaries of the Company and services normally provided by PwC in connection with regulatory filings or engagements.

(2)Audit-Related Fees were for assurance and other services related to service provider compliance reports, including Service Organization Controls (SOC) reports on the effectiveness of our controls for our demand side platform.

(3)Tax Fees cover tax compliance, advice, and planning services and consisted primarily of review of consolidated federal income tax returns and foreign tax planning and advice.

(4)All Other Fees include professional services rendered by PwC not reported in any other category such as pre-approved permissible advisory and other services, including SOC-1 and SOC-2 readiness advisory services in 2022 and the license fees for accounting research software in 2023 and 2022.

Pre-Approval Policies and Procedures

The audit committee has adopted policies and procedures regarding pre-approval of permitted audit and non-audit services. Each year, and as needed at other times during the year, (1) the independent registered public accounting firm will submit to the audit committee for approval the terms, fees and conditions of our engagement of the independent registered public accounting firm to perform an integrated audit of our consolidated financial statements and to review our interim financial statements; and (2) management and the independent registered public accounting firm will submit to the audit committee for approval a written pre-approval request of additional audit and non-audit services to be performed for us during the year, including a budgeted range of fees for each category of service outlined in such request. The audit committee has designated the audit committee chair to have the authority to pre-approve interim requests for permissible services that were not contemplated in the engagement letter or in pre-approval requests. The audit committee chair may approve or reject any interim service requests and shall report any interim service pre-approvals at the next regular audit committee meeting. All services provided by PwC during the fiscal years ended December 31, 2023 and 2022 were pre-approved by the audit committee.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The information contained in this audit committee report shall not be deemed to be (1) “soliciting material,” (2) “filed” with the SEC, (3) subject to Regulations 14A or 14C of the Exchange Act, or (4) subject to the liabilities of Section 18 of the Exchange Act. No portion of this audit committee report shall be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act, through any general statement incorporating by reference in its entirety the Proxy Statement in which this report appears, except to the extent that The Trade Desk, Inc. specifically incorporates this report or a portion of it by reference. In addition, this report shall not be deemed filed under either the Securities Act or the Exchange Act.

The audit committee of our board of directors is comprised of three members and acts under a written charter that has been approved by our board of directors. The members of the audit committee are independent directors, based upon standards set forth in applicable laws, rules, and regulations. The audit committee has reviewed and discussed the audited financial statements with management and has discussed with PwC the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (United States) (the “PCAOB”) and the SEC.

The audit committee has also received the written disclosures and the letter from PwC required by the applicable requirements of the PCAOB regarding PwC’s communications with the audit committee concerning independence and has discussed with PwC its independence.

Management is responsible for our financial reporting process and the system of internal controls, including internal control over financial reporting, and procedures designed to promote compliance with accounting standards and applicable laws and regulations. PwC is responsible for the audit of the consolidated financial statements and our internal control over financial reporting in accordance with the standards of the PCAOB. The audit committee's responsibility is to monitor and oversee these processes and procedures. The members of the audit committee are not professionally engaged in the practice of accounting or auditing and are not professionals in these fields. The audit committee relies, without independent verification, on the information provided by and on the representations made by management regarding the effectiveness of internal control over financial reporting, that the financial statements have been prepared with integrity and objectivity, and that such financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America. The audit committee also relies on the opinion of PwC on the consolidated financial statements and internal controls over financial reporting.

The audit committee’s meetings facilitate communication among the members of the audit committee, management and PwC. The audit committee separately met with PwC, with and without management, to discuss the results of their examinations and their observations and recommendations regarding our internal controls. The audit committee also met separately with management.

Based on its discussions with management and PwC, and its review of the representations and information provided by management and PwC, the audit committee recommended to our board of directors that our audited financial statements for the fiscal year ended December 31, 2023 be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

By order of the audit committee of the board of directors of The Trade Desk,

AUDIT COMMITTEE

David B. Wells (Chairperson)

Lise J. Buyer

Gokul Rajaram

INFORMATION ABOUT THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Leadership Structure of the Board of Directors

Our board of directors recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide effective oversight of management. Our bylaws and corporate governance guidelines provide our board of directors with flexibility to combine or separate the positions of chairman of the board of directors and chief executive officer.

Our board of directors currently believes that our existing leadership structure, under which our chief executive officer, Mr. Green, serves as chairman of our board of directors is effective. Mr. Green’s knowledge of the issues, opportunities and risks facing us, our business and our industry renders him best positioned among our directors to fulfill the chairman’s responsibility to develop agendas that focus the time and attention of our board of directors on the most critical matters.