- COIN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Coinbase Global (COIN) 8-KResults of Operations and Financial Condition

Filed: 1 Aug 24, 4:12pm

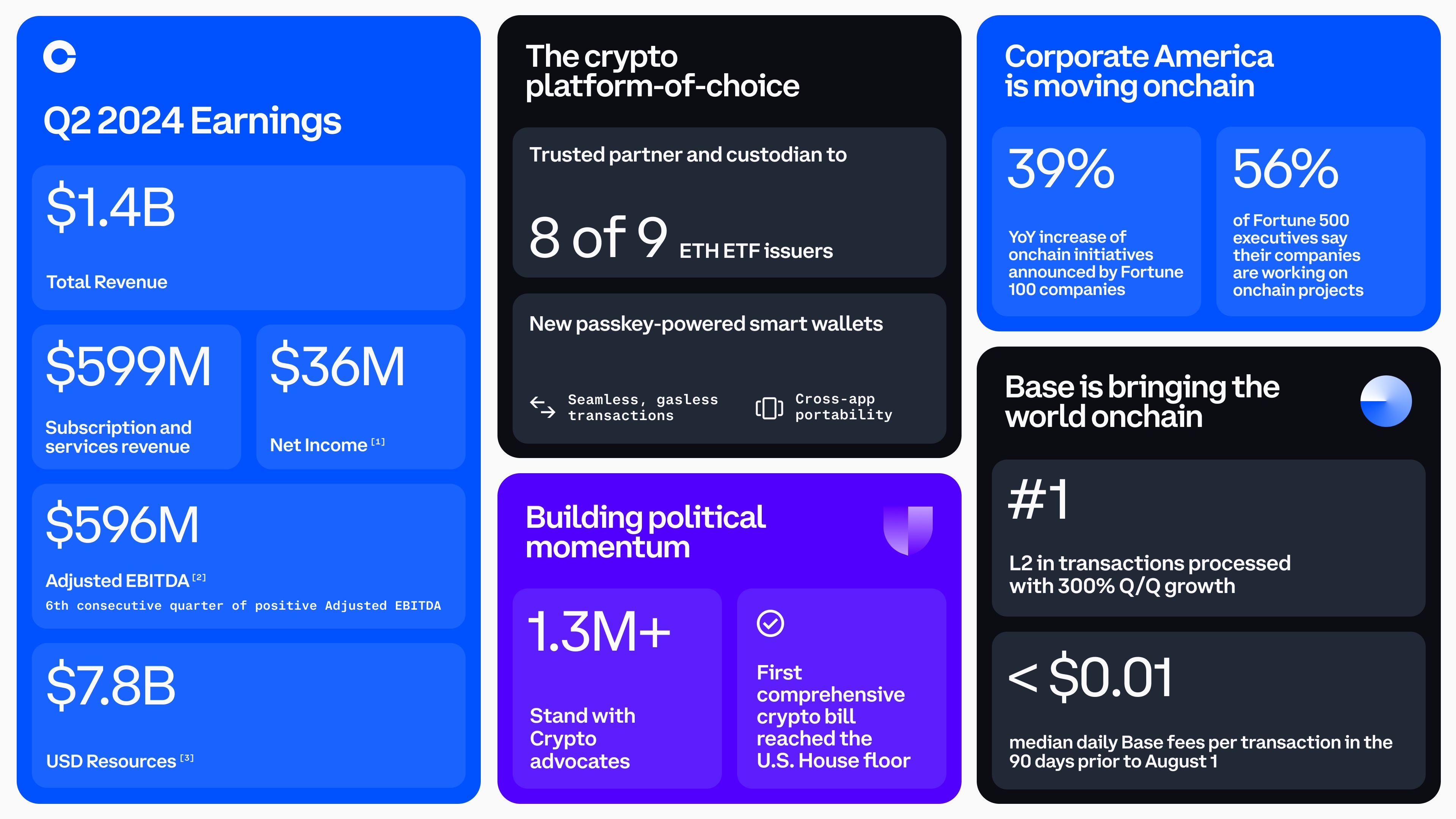

Fellow Shareholders, * See footnote (1) below. | Q2 was a quarter of strong progress for Coinbase and the crypto industry. In addition to solid financial results and continuing to build trusted products to help drive crypto adoption, Coinbase and the crypto industry made great strides towards achieving regulatory clarity in the US, which we believe will be a major unlock for innovation in the industry. We generated $1.4 billion in total revenue and $36 million in net income* in Q2. Adjusted EBITDA was $596 million, and Q2 marked our 6th consecutive quarter of positive Adjusted EBITDA. We are making good progress on diversifying our revenues, as subscription and services revenue reached nearly $600 million. Lastly, our balance sheet strengthened to $7.8 billion in $USD resources, up $733 million Q/Q. We also saw extraordinary strides in achieving regulatory clarity, which serves as a vital unlock for Coinbase and the broader cryptoeconomy. Advancing crypto legislation is now a mainstream issue. Stand With Crypto has amassed over 1.3 million crypto advocates, many in swing states, politicians on both sides of the aisle have taken notice, and there is real energy in both the House and Senate around passing legislation. We will continue driving this forward through the fall elections and beyond. On the product front, we made innovative updates to expand utility, speed, efficiency, and ease of use in Q2. These updates are highlighted by 300% Q/Q growth in the number of transactions on Base — our Layer 2 solution — the expansion of USDC through partnerships and compliance, the launch of smart wallets, improvements to Simple and Advanced trading, and the expansion of Coinbase Financial Market’s derivatives offering. | |||||||

Figures have been rounded for presentation purposes only. 1.Net income included $319 million in pre-tax crypto asset losses on our crypto investment portfolio, the vast majority of which were unrealized. These losses were $248 million after reflecting the tax impact. 2.Adjusted EBITDA is a non-GAAP financial measure. 3.$USD resources is defined as cash and cash equivalents and USDC (net of USDC loaned or pledged as collateral). For additional financial information and a reconciliation between GAAP and non-GAAP results, please refer to the reconciliation of GAAP to Non-GAAP results table in this shareholder letter and our Q2’24 Form 10-Q filed with the SEC on August 1, 2024. |  | |||||||

| 1 | ||||||||||||||

Chapter 1: Q2 results reflect continued revenue diversification and execution on our goal to generate positive Adjusted EBITDA in all market conditions. Q2 total revenue was $1.4 billion, down 11% Q/Q. Transaction revenue was $781 million, down 27% Q/Q, while subscription and services revenue grew 17% Q/Q to $599 million. Total operating expenses were $1.1 billion, up 26% Q/Q, while technology & development, general & administrative, and sales & marketing expenses were collectively $850 million, up 14% Q/Q. Net income was $36 million and included $319 million in pre-tax crypto asset losses on our crypto investment portfolio — the vast majority of which were unrealized — as crypto prices were lower on June 30, 2024 as compared to March 31, 2024. These losses were $248 million after reflecting the tax impact. Adjusted EBITDA was $596 million. Our balance sheet remains strong, as we ended Q2 with $7.8 billion in $USD resources, up $733 million Q/Q. Chapter 2: In Q2, we made innovative product updates to expand utility, speed, efficiency, and ease of use. In Q2, we laser focused on reducing the barriers and friction points that come with transacting onchain to execute on our goal of driving crypto utility. Our work with Base to improve efficiency and lower costs resulted in 300% Q/Q growth in the number of transactions processed. We announced a partnership with Stripe to expand the adoption of crypto globally, and launched smart wallets, which reduce friction by simplifying onboarding and much more. We also improved features and design to increase engagement on our Simple and Advanced trading products, and expanded the Coinbase Financial Market’s derivatives offering. Finally, Coinbase Prime strengthened its position as the platform of choice for institutions. We were selected by 8 of 9 ETH ETF issuers as a trusted partner and custodian. Chapter 3: In Q2, we made extraordinary progress towards driving regulatory clarity in the US and around the world. Crypto legislation has become a mainstream issue in the US, garnering bipartisan support, and there is real energy within both the House and the Senate to pass meaningful legislation. We continue to support Stand With Crypto - which now has over 1.3 million advocates - and will continue to invest in policy initiatives throughout the 2024 election cycle to help elect pro-crypto candidates. The approval and launch of the ETH ETFs was another huge step forward for regulatory clarity as it confirmed what we have been saying for years: ETH is not a security. Outside the US, we saw USDC become the first stablecoin to achieve compliance with the European Union's landmark Markets in Crypto-Assets (MiCA) regulatory framework. Chapter 4: Q3’24 Outlook. In July, we generated approximately $210 million of total transaction revenue and expect Q3 subscription and services revenue to be within a range of $530-$600 million. We expect Q3 transaction expenses will be in the mid-teens as a percentage of net revenue. We expect technology & development and general & administrative expenses to increase Q/Q to $700-$750 million, largely driven by the non-linear expense recognition of our stock-based compensation. Finally, we expect sales and marketing expenses to increase Q/Q to $160-$210 million, primarily driven by higher variable digital marketing. | ||||||||

| *During the first quarter of 2024, we revised our definition of Adjusted EBITDA and recast prior periods for comparability. For the revised definition and for a reconciliation of net income (loss) to Adjusted EBITDA, please refer to the section titled “Revised Definition of Adjusted EBITDA” and the reconciliation table included at the end of this shareholder letter. | Select Financial Metrics | |||||||||||||||||||||||||||||||

| FINANCIAL METRICS ($M) | Q2’23 | Q3’23 | Q4’23 | Q1’24 | Q2’24 | |||||||||||||||||||||||||||

| Net Revenue | 663 | 623 | 905 | 1,588 | 1,380 | |||||||||||||||||||||||||||

| Net Income (Loss) | (97) | (2) | 273 | 1,176 | 36 | |||||||||||||||||||||||||||

| Adjusted EBITDA* | 189 | 178 | 324 | 1,014 | 596 | |||||||||||||||||||||||||||

| Q2’24 Coinbase Results vs. Outlook | ||||||||||||||||||||||||||||||||

| METRIC | COINBASE Q2 OUTLOOK (May 2024) | Q2 ACTUALS | ||||||||||||||||||||||||||||||

| Subscription and Services Revenue | $525 – $600 million | $599 million | ||||||||||||||||||||||||||||||

Transaction Expenses as a percentage of net revenue | Mid teens as a % of net revenue Dependent on revenue mix | 14% | ||||||||||||||||||||||||||||||

Technology and Development + General and Administrative Expenses including stock-based compensation | $660 – $710 million including ~$210 million in stock-based compensation | $684 million including $201 million in stock-based compensation | ||||||||||||||||||||||||||||||

Sales and Marketing Expenses including stock-based compensation | $150 – $180 million including ~$17 million in stock-based compensation | $165 million including $17 million in stock-based compensation | ||||||||||||||||||||||||||||||

| 2 | ||||||||||||||

| Chapter 1 | Q2 results reflect continued revenue diversification and execution on our goal to generate positive Adjusted EBITDA in all market conditions. Q2 total revenue was $1.4 billion, down 11% Q/Q. Transaction revenue was $781 million, down 27% Q/Q, while subscription and services revenue grew 17% Q/Q to $599 million. Total operating expenses were $1.1 billion, up 26% Q/Q, while technology & development, general & administrative, and sales & marketing expenses were collectively $850 million, up 14% Q/Q. Net income was $36 million and included $319 million in pre-tax crypto asset losses on our crypto investment portfolio — the vast majority of which were unrealized — as crypto prices were lower on June 30, 2024 as compared to March 31, 2024. These losses were $248 million after reflecting the tax impact. Adjusted EBITDA was $596 million. Our balance sheet remains strong, as we ended Q2 with $7.8 billion in $USD resources, up $733 million Q/Q. | |||||||

| Total Revenue ($M) | |||||||||||||||||||||||||||||

| Note: Figures presented may not sum precisely due to rounding | TOTAL REVENUE | Q2’23 | Q3’23 | Q4’23 | Q1’24 | Q2’24 | |||||||||||||||||||||||

| Transaction Revenue | |||||||||||||||||||||||||||||

Consumer, net1 | 289.0 | 247.0 | 468.9 | 935.2 | 664.8 | ||||||||||||||||||||||||

| Institutional, net | 17.1 | 14.1 | 36.7 | 85.4 | 63.6 | ||||||||||||||||||||||||

1.During the first quarter of 2024, we reclassified Base and payment-related revenue from consumer, net to other transaction revenue. Prior period amounts have been reclassified to conform to current period presentation. | Other transaction revenue1 | 21.1 | 27.5 | 23.6 | 56.1 | 52.5 | |||||||||||||||||||||||

| Total transaction revenue | 327.1 | 288.6 | 529.3 | 1,076.7 | 780.9 | ||||||||||||||||||||||||

| Subscription and services revenue | |||||||||||||||||||||||||||||

| Stablecoin revenue | 151.4 | 172.4 | 171.6 | 197.3 | 240.4 | ||||||||||||||||||||||||

| Blockchain rewards | 87.6 | 74.5 | 95.1 | 150.9 | 185.1 | ||||||||||||||||||||||||

2.During the first quarter of 2024, we reclassified Prime Financing fees earned to interest income, and renamed interest income to interest and finance fee income. Prime Financing fees were previously included in Other subscription and services revenue. Prior period amounts have been reclassified to conform to current period presentation. | Interest and finance fee income2 | 51.9 | 42.5 | 48.9 | 66.7 | 69.4 | |||||||||||||||||||||||

| Custodial fee revenue | 17.0 | 15.8 | 19.7 | 32.3 | 34.5 | ||||||||||||||||||||||||

Other subscription and services revenue2 | 27.5 | 29.3 | 40.1 | 63.7 | 69.6 | ||||||||||||||||||||||||

| Total subscription and services revenue | 335.4 | 334.4 | 375.4 | 510.9 | 599.0 | ||||||||||||||||||||||||

| Net Revenue | 662.5 | 623.0 | 904.6 | 1,587.7 | 1,379.9 | ||||||||||||||||||||||||

| Corporate interest and other income | 45.4 | 51.1 | 49.2 | 49.9 | 69.7 | ||||||||||||||||||||||||

| Total Revenue | 707.9 | 674.1 | 953.8 | 1,637.6 | 1,449.6 | ||||||||||||||||||||||||

| 3 | ||||||||||||||

*Trading volume represents the total U.S. dollar equivalent value of spot matched trades transacted between a buyer and seller through our platform during the period of measurement. | Transaction Revenue Total crypto market capitalization decreased 11% Q/Q when comparing the end of Q2 to the end of Q1, as crypto asset prices were elevated towards the end of Q1 in connection with the launch of the BTC ETF products. The average crypto market capitalization increased 20% Q/Q over the same period. Meanwhile, crypto asset volatility - a key driver of revenue - declined approximately 13% when comparing the Q2 average with the Q1 average, resulting in softer crypto spot market trading conditions in Q2 compared to Q1, particularly in the US. Total Coinbase trading volume* was $226 billion, down 28% Q/Q, outperforming the US spot market - where we derive the majority of our trading volume - which declined 30% Q/Q. Total transaction revenue was $781 million, down 27% Q/Q, and benefited from growth in derivatives and Coinbase Wallet trading fees, where we do not report trading volume associated with revenue. Consumer Transaction Revenue. Q2 consumer transaction revenue was $665 million, down 29% Q/Q. Q2 consumer trading volume was $37 billion, down 34% Q/Q. Consumer transaction revenue outperformed trading volume, driven by growth in revenue that is not directly associated with spot trading volume on our exchange. The mix of Advanced trading volume and Simple trading volume was largely similar in Q2 compared to Q1. Institutional Transaction Revenue. Q2 institutional transaction revenue was $64 million, down 25% Q/Q. Q2 institutional trading volume was $189 billion, down 26% Q/Q. Other Transaction Revenue. Other transaction revenue was $53 million in Q2, down 6% Q/Q, driven by lower Base sequencer fee revenue. We were able to significantly reduce Base fees in the quarter, which helped fuel 300% Q/Q growth in the number of transactions on Base. | |||||||

| TRADING VOLUME ($B) | Q2’23 | Q3’23 | Q4’23 | Q1’24 | Q2’24 | ||||||||||||||||||||||||

| Consumer | 14 | 11 | 29 | 56 | 37 | ||||||||||||||||||||||||

| Institutional | 78 | 65 | 125 | 256 | 189 | ||||||||||||||||||||||||

| Total | 92 | 76 | 154 | 312 | 226 | ||||||||||||||||||||||||

| TRADING VOLUME (% OF TOTAL) | Q2’23 | Q3’23 | Q4’23 | Q1’24 | Q2’24 | ||||||||||||||||||||||||

| Bitcoin | 40 | % | 38 | % | 31 | % | 33 | % | 35 | % | |||||||||||||||||||

| Ethereum | 23 | % | 19 | % | 15 | % | 13 | % | 15 | % | |||||||||||||||||||

| * Below reporting threshold of 10% | USDT | * | 15 | % | 13 | % | 11 | % | 10 | % | |||||||||||||||||||

| Other crypto assets | 38 | % | 28 | % | 42 | % | 43 | % | 40 | % | |||||||||||||||||||

| Total | 100% | 100% | 100% | 100% | 100 | % | |||||||||||||||||||||||

| TRANSACTION REVENUE (% OF TOTAL) | Q2’23 | Q3’23 | Q4’23 | Q1’24 | Q2’24 | ||||||||||||||||||||||||

| Bitcoin | 39 | % | 37 | % | 29 | % | 30 | % | 31 | % | |||||||||||||||||||

| Ethereum | 21 | % | 18 | % | 13 | % | 15 | % | 17 | % | |||||||||||||||||||

| Solana | * | * | * | * | 10 | % | |||||||||||||||||||||||

| Note: Figures presented may not sum precisely due to rounding | Other crypto assets | 39 | % | 46 | % | 57 | % | 55 | % | 42 | % | ||||||||||||||||||

| Total | 100% | 100% | 100% | 100% | 100 | % | |||||||||||||||||||||||

| 4 | ||||||||||||||

Subscription and Services Revenue Q2 subscription and services revenue was $599 million, up 17% Q/Q. On a Q/Q basis, subscription and services revenue benefited from higher average USDC on-platform balances and USDC market capitalization, as well as higher average crypto asset prices - notably SOL and ETH. Stablecoin revenue was $240 million, up 22% Q/Q. The primary drivers were higher average USDC on-platform balances and higher average USDC market capitalization. While on-platform balances of $5.7 billion at the end of Q2 were only 2% higher compared to $5.5 billion at the end of Q1, average on-platform balances grew 53% Q/Q in Q2. Similarly, USDC market capitalization at the end of Q2 was flat Q/Q at $32.4 billion, although average USDC market capitalization increased 17% Q/Q to $32.9 billion in Q2. Blockchain rewards revenue was $185 million, up 23% Q/Q. The primary driver of the Q/Q growth was higher average SOL and ETH prices. Additionally, we benefited from $8 million in one-time validator rewards. Interest and finance fee income was $69 million, up 4% Q/Q. The primary driver of the Q/Q growth was higher average custodial fiat balances. As a reminder, custodial fiat balances vary on a quarter-to-quarter basis and we do not manage our business to grow these balances. To a lesser extent, we also saw Q/Q growth in our Prime Financing revenue. Custodial fee revenue was $35 million, up 7% Q/Q. The primary driver of the Q/Q growth was higher average crypto asset prices in Q2 compared to Q1. To a lesser extent, we benefited from native unit inflows related to our role as the custodian on BTC ETF products. Other subscription and services revenue was $70 million up 9% Q/Q. The Q/Q growth was driven by an increase in Coinbase One revenue. Expenses In Q2, total operating expenses were $1.1 billion - up 26% or $229 million Q/Q - driven primarily by an $86 million gain on crypto assets held for operations in Q1 combined with a $31 million loss on crypto assets held for operations in Q2. Technology & development, general & administrative, and sales & marketing expenses collectively increased $106 million or 14% Q/Q, driven primarily by higher USDC reward payouts, variable performance marketing spend, and policy spend. We ended Q2 with 3,486 full-time employees, up 2% Q/Q. | ||||||||

| 5 | ||||||||||||||

Note: Figures presented may not sum precisely due to rounding | Operating Expenses ($M) | ||||||||||||||||||||||||||||

| OPERATING EXPENSES | Q2’23 | Q3’23 | Q4’23 | Q1’24 | Q2’24 | ||||||||||||||||||||||||

| Transaction expense | 108.2 | 90.6 | 125.6 | 217.4 | 191.5 | ||||||||||||||||||||||||

| % of net revenue | 16 | % | 15 | % | 14 | % | 14 | % | 14 | % | |||||||||||||||||||

| Technology and development | 320.7 | 322.8 | 323.1 | 357.9 | 364.3 | ||||||||||||||||||||||||

| Sales and marketing | 83.9 | 78.2 | 106.3 | 98.6 | 165.3 | ||||||||||||||||||||||||

General and administrative1 | 259.0 | 252.6 | 313.9 | 287.2 | 320.1 | ||||||||||||||||||||||||

| (Gains) losses on crypto assets held for operations, net | 0.0 | 0.0 | 0.0 | (86.4) | 31.0 | ||||||||||||||||||||||||

| Crypto asset impairment, net | (8.1) | 7.2 | (51.8) | 0.0 | 0.0 | ||||||||||||||||||||||||

1.During the second quarter of 2024, we reclassified certain policy expenses from Other operating expenses, net to General and administrative. Prior period amounts have been reclassified to conform to current period presentation. | Restructuring | (1.0) | (0.9) | 0.0 | 0.0 | 0.0 | |||||||||||||||||||||||

Other operating expenses, net1 | 18.9 | 3.5 | 21.1 | 2.4 | 34.4 | ||||||||||||||||||||||||

| Total operating expenses | 781.5 | 754.0 | 838.2 | 877.1 | 1,106.5 | ||||||||||||||||||||||||

| Full-time employees (end of quarter) | 3,406 | 3,427 | 3,416 | 3,416 | 3,486 | ||||||||||||||||||||||||

Q2 transaction expenses declined 12% Q/Q to $191 million or 14% of net revenue. The Q/Q decline was largely driven by lower miner fees in connection with lower trading volume, partially offset by higher blockchain rewards fees. Technology and development expenses were $364 million, up 2% Q/Q. The Q/Q growth was primarily driven by increases in website hosting and infrastructure expenses, amortization, and other expenses, partially offset by lower headcount-related expenses. Sales and marketing expenses were $165 million, up 68% Q/Q. The Q/Q growth was primarily driven by higher USDC rewards - driven primarily by higher on-platform balances - and higher variable performance marketing given favorable market conditions. General and administrative expenses were $320 million, up 11% Q/Q. The Q/Q growth was primarily driven by policy spend in support of driving regulatory clarity. Given the impact of our spend to date, we anticipate additional expenses in the future, however, we expect that the amounts may vary meaningfully by quarter and will be elevated in election years. Beginning in Q2, all policy spend will be recorded in general and administrative expenses (prior periods have been reclassified to conform). General and administrative expense growth was also driven by elevated customer support expenses associated with higher trading activity in late Q1. Other operating expenses were $34 million, driven by an increase in costs due to platform-related incidents. Stock-based compensation was $218 million. | ||||||||

| 6 | ||||||||||||||

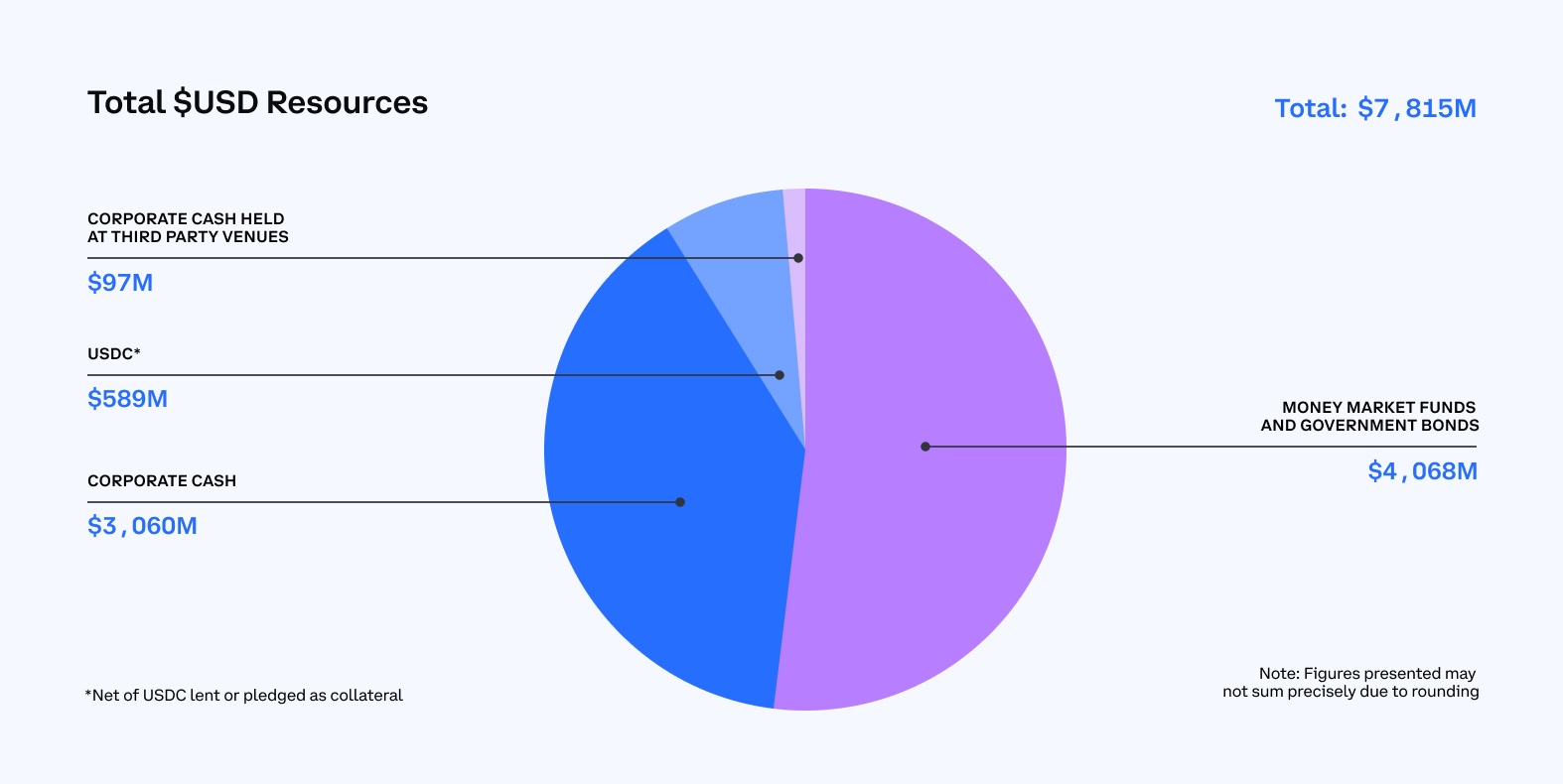

Our Q2 effective tax rate was 160%. Our tax rate was higher than the US statutory rate primarily due to tax benefits from stock-based compensation and research and development credits. Q2 net income was $36 million and was impacted by $319 million in pre-tax crypto asset losses on our crypto investment portfolio, the vast majority of which were unrealized. These losses were $248 million after reflecting the tax impact. Adjusted EBITDA was $596 million. Share Count Our Q2 fully diluted share count was 284.1 million, flat Q/Q. This includes 248.4 million common shares and 35.7 million in dilutive shares. Capital and Liquidity We ended Q2 with $7.8 billion in $USD resources, which we define as cash & cash equivalents and USDC (net of USDC loaned or pledged as collateral). This represents an increase of $733 million or 10% Q/Q of net unencumbered liquid resources available to us. | ||||||||

| 7 | ||||||||||||||

| ||||||||

We consider our crypto assets held as investments and crypto assets held as collateral as other unencumbered resources to us. The fair market value of crypto assets held as collateral was $21.1 million and crypto assets held as investments was $1.2 billion as of June 30, 2024. When including these crypto assets, total available resources totaled $9.1 billion, up from $8.6 billion at the end of Q1. Collateralized & Financing Arrangements and Counterparty Risk We maintained our longstanding commitment to operational and risk excellence in Q2. At the end of Q2, we had $936 million in total credit and counterparty risk (excluding banks), stemming from $712 million in loans to customers, $159 million held at third party venues (including $97 million in unrestricted cash), and $64 million in collateral posted. | ||||||||

| 8 | ||||||||||||||

| Chapter 2 | In Q2, we made innovative product updates to expand utility, speed, efficiency, and ease of use. One of our key priorities is driving crypto utility. One barrier to adoption has been complexity in transacting onchain. In Q2, we laser focused on reducing the barriers and friction points that come with transacting onchain. From seasoned crypto developers, traders, and institutional clients, to those setting up their first crypto wallet, we have made important strides in broadening our product offering, improving the quality of the network, expanding access to stablecoins like USDC, and driving significant improvements that make crypto easier to use. Base Advances Toward Sub-1 Second, Sub-1 Cent Transactions For the last 5 years, poor scalability and high costs have been major constraints for crypto adoption, just like dial up was a constraint on internet adoption before the creation of broadband networks. With advancements in Layer 2 (L2) solutions, such as Base, we are making major progress in overcoming this hurdle. Base plays a crucial role as a secure, open, and efficient platform for developers and users to engage onchain. Base is designed to optimize the infrastructure of Ethereum by boosting the network’s speed and affordability, thereby removing barriers to access and increasing bandwidth and utility. In Q2, we continued to improve the efficiency of the network while reducing transaction costs. In the 90 days prior to August 1, median daily Base fees per transaction were below 1 cent, making it one of the cheapest L2s. Our work to increase the speed of the network and reduce costs is paying off with developers as Base is now #1 in contracts deployed, and #1 L2 in transactions processed, growing 300% Q/Q in Q2, doubling Ethereum's number of transactions. While it’s still early days, Base is making important progress in improving the speed and effectiveness of the cryptoeconomy. USDC Expands Adoption Through Partnerships and Compliance Stablecoins are crucial for making the financial system more accessible and equitable, merging the benefits of cryptocurrencies with the reliability of fiat currencies. To expand adoption of crypto, Coinbase and Stripe announced a partnership in Q2. Stripe integrated USDC on Base, enabling faster, cheaper transfers to over 150 countries and quick fiat-to-crypto conversions for US customers. Coinbase now includes Stripe's fiat-to-crypto onramp in Coinbase Wallet, allowing instant crypto purchases with credit cards and Apple Pay. This collaboration leverages Stripe's vast network and Base's efficient transaction infrastructure, significantly expanding USDC's global reach and utility, and reinforcing our commitment to improving the financial system. Additionally, USDC is the first stablecoin to achieve MiCA compliance, marking a significant milestone in expanding compliant access to USD-backed stablecoins and paving the way for broader adoption across Europe. Smart Wallets Simplifies Onchain Access Bringing 1 billion people onchain requires a seamless user experience where interacting with crypto is intuitive and effortless. That’s why in Q2, we launched smart wallets, a major advancement in self-custodial wallets. These wallets reduce the friction typically associated with crypto by simplifying the set up process, eliminating network fees, and removing the need for recovery phrases. With multi-chain support and easy integration with major applications, smart wallets have the potential to make onchain activities as easy as email. | |||||||

| 9 | ||||||||||||||

For existing Coinbase Wallet users, we’re creating migration tools to ensure a smooth transition to smart wallets. Developers can easily integrate smart wallets into their apps, enhancing user onboarding with features like gas sponsorship. This innovation pushes the technological complexity below a simplified interface, and paves the way for broader onchain adoption, making it more accessible and efficient for everyone. Through improving network speed and cost with Base, increasing access to stable digital currencies like USDC, and reducing barriers to self custody with smart wallets, Coinbase is accelerating adoption by providing the foundational tools needed to bring 1 billion people onchain. This important infrastructure layer is critical to support our other products like trading, derivatives, institutional adoption through Coinbase Prime and our subscriptions and services offerings. Coinbase Simple and Advanced Trading Improves Features and Design to Increase Engagement For Simple spot trading we rolled out a brand new app redesign that included a transact tab on our mobile app making it easier to view prior transactions quickly, and simplified how balances are shown on the assets tab. We’ve seen a notable reduction in customer support outreach which is a promising sign that our updated design language has reduced friction. Coinbase One, our premium subscription product for retail users, also has continued to gain traction. While it is still early, we have seen promising user retention despite slower trading volumes in Q2. We also launched boosted USDC rewards in Q2, which drove uplifts in trading, subscribers and overall revenue. For Advanced trading, we launched new order types and price alert notifications, and added derivatives functionality to our API. Outside the US, we continued to focus on adding payment rails, enabling more payment options, and improving onboarding experiences. We also launched referrals for both Advanced and Simple trading - all of which are helping unlock growth. Coinbase Financial Markets (CFM) Expands Contracts, and Expands Leverage CFM is focused on making futures trading more accessible to a broader range of traders in the US. CFM expanded Coinbase Advanced to include more contracts, becoming the first platform to offer crypto futures for Dogecoin, Bitcoin Cash, and Litecoin, as well as the ability to trade futures on the Coinbase mobile app on both iOS and Android. Additionally, CFM introduced up to 20x leverage on commodity futures and 5x leverage on crypto futures, providing more opportunities for our traders. Coinbase Prime Strengthens its Position as the Platform-Of-Choice for Institutions In Q2, Coinbase won custodial mandates with 8 of 9 ETH ETFs - building on top of our foundation as the trusted primary custodian for 9 of 11 US BTC ETFs products. ETFs provide a simplified way to invest in funds that own ETH and open up a regulated avenue for additional capital to enter the crypto market. In May 2024, ETH ETFs were approved by the SEC, and these products launched in July 2024. This is another huge step forward for regulatory clarity as it confirms what we have been saying for years: ETH is not a security. As we look ahead, our focus remains on growing adoption and utility, and making crypto safe, accessible, and easy for everyone. Our ongoing product enhancements are designed to break down barriers, simplify user experiences, and unlock new opportunities for all types of users, from individual traders to large institutions. By continuously refining our offerings—whether through advanced trading features, innovative smart wallets, or robust custody solutions like Coinbase Prime—we are paving the way for a more inclusive cryptoeconomy. | ||||||||

| 10 | ||||||||||||||

| Chapter 3 | In Q2, we made extraordinary progress towards driving regulatory clarity in the US and around the world. We have seen crypto legislation become a mainstream issue, garnering bipartisan support, and there is real energy within both the House and the Senate to pass meaningful legislation. We also saw the IRS issue long awaited final regulations for reporting digital assets. Outside the US, we saw USDC become the first stablecoin to achieve compliance with the European Union's landmark MiCA regulatory framework. Advocacy Stand With Crypto, an independent grassroots organization, has been instrumental in organizing the millions of Americans who own crypto to join the fight for regulatory clarity. Over 1 million people have signed up as crypto advocates. These advocates cut across economic, geographical, and political lines, and are becoming recognized as a critical voting block in battleground states. Their voices are prompting politicians on both sides of the aisle to recognize that everyday Americans have embraced crypto, and that they expect their elected representatives to enact clear and comprehensive crypto regulations. Legislative Milestones The crypto advocacy momentum has helped catalyze significant legislative achievements. Recent bipartisan measures have passed with majorities typically reserved for must-pass legislation. In May 2024, House Republicans and Democrats passed the Financial & Innovation Technology Act for the 21st Century (FIT21), the first comprehensive crypto bill to reach the House floor. FIT21 would strengthen the crypto market by clearly defining the roles of the CFTC and SEC in regulating digital assets, and providing a pathway for digital asset developers to raise funds and eventually decentralize. Both the House and Senate also voted to repeal SAB 121, which served as a clear rebuke of the SEC's overreach. Regardless of the ultimate veto, the repeal signals encouraging bipartisan support of better crypto regulation. Coinbase remains committed to supporting pro crypto policy efforts. We will continue to invest in policy initiatives throughout the 2024 election cycle and beyond. | |||||||

| 11 | ||||||||||||||

Litigation We also continue to seek clarity through the courts. As we shared in our May 2024 shareholder letter, our ongoing litigation with the SEC has entered the discovery phase, which we will be engaged in for the remainder of the year. We, and others in the industry, also continue to engage in affirmative litigation against the SEC where necessary, such as on our petition for rulemaking. We remain confident in the strength of our legal arguments. Clarity is the ultimate goal and the courts help continue us on that path. | ||||||||

The Importance of Regulatory Clarity We have consistently emphasized the critical need for regulatory clarity. Clear regulations will foster a stable environment that encourages investment and innovation. Although the impact of regulatory clarity might not be immediate, it would open the doors for many developers, entrepreneurs, and companies that are eager to build with crypto but are currently hesitant due to regulatory uncertainties and SEC enforcement actions. We frequently hear from businesses of all sizes that they are waiting for clear rules before fully committing to the crypto space. Approximately 90% of institutional investors have indicated that regulatory clarity would boost their confidence in investing in crypto. Furthermore, 56% of Fortune 500 companies have onchain projects, and they cite concerns about available talent as a primary blocker to wider adoption. Talent that is being driven overseas due to lack of regulatory clarity in the US. Coinbase is strategically positioned to benefit from growth that will be unlocked by regulatory clarity given our role as the leading consumer, institutional, and developer crypto platform in the US. While we are still in the early stages of this industry and technology adoption curve, regulatory clarity will accelerate this curve, allowing the technology to realize its full potential sooner. | ||||||||

| 12 | ||||||||||||||

| Chapter 4 | Q3’24 Outlook | |||||||

| Coinbase Q3 2024 Outlook | ||||||||||||||||||||

| METRIC | OUTLOOK | |||||||||||||||||||

| Subscription and Services Revenue | $530 – $600 million | |||||||||||||||||||

| Transaction Expenses | Mid teens as a % of net revenue Dependent on revenue mix | |||||||||||||||||||

| Technology and Development + General and Administrative Expenses | $700 - $750 million Including ~$230 million in stock-based compensation | |||||||||||||||||||

| Sales and Marketing Expenses | $160 - $210 million Including ~$19 million in stock-based compensation | |||||||||||||||||||

Transaction Revenue We generated approximately $210 million of total transaction revenue in July 2024. As always, we continue to urge caution in extrapolating these results. Subscription and Services Revenue We expect Q3 subscription and services revenue to be within $530-$600 million. Our Q3 range reflects some modest headwinds, including a 3% decline in the average price of Ethereum in July as compared to the Q2 average, expectations of a September rate cut, an increase in expenses related to USDC as we work to drive global adoption of USDC as the most compliant stablecoin, and a one-time $8M blockchain rewards revenue benefit in Q2. Expenses We expect technology & development and general & administrative expenses to increase Q/Q, largely driven by the non-linear expense recognition of our stock-based compensation. We plan to prudently increase headcount through the rest of the year primarily to support our product and international expansion, and to strengthen our product foundations and quality. Despite anticipated headcount growth, we expect total stock-based compensation in the second half of the year to be largely consistent with the first half of the year, however, similar to prior years, we expect it to be higher in Q3 compared to Q4. Sales and marketing expenses are expected to increase Q/Q, primarily driven by higher variable digital marketing. Achieving the high end of this range will depend on our ability to spend on favorable opportunities. As disclosed in our 10-Q, Q2 marketing program and USDC rewards expenses combined were $114 million or 69% of total sales and marketing spend. Both these spend categories are composed primarily of variable digital marketing aimed at acquiring new customers and retaining existing customers on our platform. These expenses can fluctuate greatly depending on USDC assets on platform, market trends, and number of available marketing opportunities that meet our customer cost of acquisition targets. Given the volatility of crypto markets, the cost to acquire customers can change rapidly within the quarter, which necessitates a wider range to accommodate potential changes in market conditions. | ||||||||

| 13 | ||||||||||||||

Beginning in late Q1, we have seen more marketing opportunities that meet our investment criteria. We continue to take a disciplined approach to balancing marketing investments with growth, with clear guardrails that ensure that the vast majority of our non-brand marketing spend pays back within one year. We are widening our sales and marketing range this quarter to encompass the range of possibilities with this spend. Given the growth of our variable marketing programs, we will be evaluating alternative approaches to this outlook in future quarters. Webcast Information We will host a conference call to discuss the results for the second quarter 2024 on August 1, 2024 at 2:30 pm PT. The live webcast of the call will be available at youtube.com/@coinbase/streams. A replay of the call, as well as a transcript, will be available on our Investor Relations website at investor.coinbase.com. | ||||||||

| 14 | ||||||||||||||

Forward Looking Statements This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. These statements include, but are not limited to, statements regarding our future operating results and financial position, including for the third quarter ending September 30, 2024, anticipated future expenses and investments; expectations relating to certain of our key financial and operating metrics; our business strategy and plans; expectations relating to legal and regulatory proceedings; expectations relating to our industry, the regulatory environment, market conditions, trends and growth; expectations relating to customer behaviors and preferences; our market position; potential market opportunities; and our objectives for future operations. The words “believe,” “may,” “will,” “estimate,” “potential,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “target,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are based on management’s expectations, assumptions, and projections based on information available at the time the statements were made. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including, among others: our ability to successfully execute our business and growth strategy and generate future profitability; market acceptance of our products and services; our ability to further penetrate our existing customer base and expand our customer base; our ability to develop new products and services; our ability to expand internationally; the success of any acquisitions or investments that we make; the effects of increased competition in our markets; our ability to stay in compliance with applicable laws and regulations; stock price fluctuations; market conditions across the cryptoeconomy, including crypto asset price volatility; and general market, political, and economic conditions, including interest rate fluctuations, inflation, instability in the global banking system, economic downturns, and other global events, including regional wars and conflicts and government shutdowns. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, our actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Further information on risks that could cause actual results to differ materially from forecasted results are, or will be included, in our filings we make with the Securities and Exchange Commission (SEC) from time to time, including our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 15, 2024 and our Quarterly Report on Form 10-Q for the quarter ended on June 30, 2024 filed with the SEC on August 1, 2024. Except as required by law, we assume no obligation to update these forward-looking statements, or to update the reasons if actual results differ materially from those anticipated in the forward-looking statements. | ||||||||

| 15 | ||||||||||||||

Non-GAAP Financial Measure In addition to our results determined in accordance with GAAP, we believe Adjusted EBITDA, a non-GAAP financial performance measure, is useful information to help investors evaluate our operating performance because it: enables investors to compare this measure and component adjustments to similar information provided by peer companies and our past financial performance; provides additional company-specific adjustments for certain items that may be included in income from operations but that we do not consider to be normal, recurring, operating expenses (or income) necessary to operate our business given our operations, revenue generating activities, business strategy, industry, and regulatory environment; and provides investors with visibility to a measure management uses to evaluate our ongoing operations and for internal planning and forecasting purposes. Limitations of Adjusted EBITDA We believe that Adjusted EBITDA may be helpful to investors for the reasons noted above. However, Adjusted EBITDA is presented for supplemental informational purposes only, has limitations as an analytical tool, and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. There are a number of limitations related to Adjusted EBITDA rather than net (loss) income, which is the nearest GAAP equivalent of Adjusted EBITDA. Some of these limitations are that Adjusted EBITDA excludes: •provision for (benefit from) income taxes; •interest expense, or the cash requirements necessary to service interest or principal payments on our debt, which reduces cash available to us; •depreciation and intangible assets amortization expense and, although these are non-cash expenses, the assets being depreciated and amortized may have to be replaced in the future; •stock-based compensation expense, which has been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy; •net gains or losses on our crypto assets held for investment, net, after the adoption of ASU 2023-08; •other (income) expense, net, which represents foreign exchange gains or losses, gains or losses on strategic investments, and other non-operating income and expense activity; •non-recurring lease charges, which represent a non-recurring fee and write-off related to an early lease termination; •non-recurring accrued legal contingencies, settlements, and related costs, which includes non-recurring loss contingencies recognized for legal related claims against the company; •impairment on crypto assets still held, net, which represents impairment on crypto assets still held and is a non-cash expense, prior to the adoption of ASU 2023-08; and •the impact of restructuring, which is not related to normal operations but impacted our results in 2023. | ||||||||

| 16 | ||||||||||||||

In addition, other companies, including companies in our industry, may calculate Adjusted EBITDA differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our disclosure of Adjusted EBITDA as a tool for comparison. For more information, including a reconciliation of Adjusted EBITDA to net (loss) income, the most directly comparable financial measure stated in accordance with GAAP, please see the reconciliation of GAAP to non-GAAP results table in this shareholder letter. Investors are encouraged to review the related GAAP financial measure and the reconciliation of Adjusted EBITDA to net (loss) income, and not to rely on any single financial measure to evaluate our business. We have not reconciled our Adjusted EBITDA outlook to net (loss) income because certain items that impact net (loss) income are uncertain or out of our control and cannot be reasonably predicted. For example, stock-based compensation is impacted by the future fair market value of our Class A common stock and other factors, all of which are difficult to predict, subject to frequent change, or not within our control. The actual amount of these expenses during 2024 will have a significant impact on our future GAAP financial results. Accordingly, a reconciliation of Adjusted EBITDA outlook to net (loss) income is not available without unreasonable effort. Revised Definition of Adjusted EBITDA During the first quarter of 2024, we revised our definition of Adjusted EBITDA as follows and recast prior periods for comparability: •to adjust for other (income) expense, net in total, as the entire line item represents non-operating activity, and as a majority of the activity recorded in other (income) expense, net had been included in the calculation of Adjusted EBITDA previously in separate rows while this combined presentation is more streamlined and easily reconciled to our condensed consolidated statements of operations; •to revise our definition of Adjusted EBITDA to remove the adjustment for crypto assets borrowing costs on Prime Financing, as even though these costs are akin to interest expense on debt, we believe they represent normal, recurring, operating expenses necessary to expand and grow Prime Financing; and •to revise our definition of Adjusted EBITDA to change what is adjusted with respect to gains and losses on crypto assets in connection with the adoption of ASU 2023-08, adjusting post-adoption only for gains and losses on crypto assets held for investment, as they do not represent normal, recurring, operating expenses (or income) necessary to operate our business. | ||||||||

| 17 | ||||||||||||||

| June 30, | December 31, | ||||||||||||||||

| 2024 | 2023 | ||||||||||||||||

| Assets | |||||||||||||||||

| Current assets: | |||||||||||||||||

| Cash and cash equivalents | $ | 7,225,535 | $ | 5,139,351 | |||||||||||||

| Restricted cash and cash equivalents | 34,282 | 22,992 | |||||||||||||||

| Customer custodial funds | 4,197,837 | 4,570,845 | |||||||||||||||

| Safeguarding customer crypto assets | 269,198,067 | 192,583,060 | |||||||||||||||

| USDC | 1,056,648 | 576,028 | |||||||||||||||

| Loan receivables | 440,351 | 193,425 | |||||||||||||||

| Crypto assets held as collateral | 21,119 | — | |||||||||||||||

| Crypto assets borrowed | 223,123 | 45,212 | |||||||||||||||

| Accounts receivable, net | 236,444 | 168,290 | |||||||||||||||

| Other current assets | 253,226 | 286,643 | |||||||||||||||

| Total current assets | 282,886,632 | 203,585,846 | |||||||||||||||

| Crypto assets held for investment | 1,234,158 | 330,610 | |||||||||||||||

| Deferred tax assets | 1,010,154 | 1,272,233 | |||||||||||||||

| Goodwill | 1,139,670 | 1,139,670 | |||||||||||||||

| Other non-current assets | 688,559 | 654,594 | |||||||||||||||

| Total assets | $ | 286,959,173 | $ | 206,982,953 | |||||||||||||

| Liabilities and Stockholders’ Equity | |||||||||||||||||

| Current liabilities: | |||||||||||||||||

| Customer custodial cash liabilities | $ | 4,197,837 | $ | 4,570,845 | |||||||||||||

| Safeguarding customer crypto liabilities | 269,198,067 | 192,583,060 | |||||||||||||||

| Crypto asset borrowings | 237,474 | 62,980 | |||||||||||||||

| Obligation to return collateral | 272,171 | 1,063 | |||||||||||||||

| Accrued expenses and other current liabilities | 448,170 | 496,183 | |||||||||||||||

| Total current liabilities | 274,353,719 | 197,714,131 | |||||||||||||||

| Long-term debt | 4,228,019 | 2,979,957 | |||||||||||||||

| Other non-current liabilities | 6,666 | 7,216 | |||||||||||||||

| Total liabilities | 278,588,404 | 200,701,304 | |||||||||||||||

| Commitments and contingencies | |||||||||||||||||

| Stockholders’ equity: | |||||||||||||||||

| Preferred stock, $0.00001 par value; 500,000 shares authorized and zero shares issued and outstanding at each of June 30, 2024 and December 31, 2023 | — | — | |||||||||||||||

| Class A common stock, $0.00001 par value; 10,000,000 shares authorized at June 30, 2024 and December 31, 2023; 202,766 and 195,192 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | 2 | 2 | |||||||||||||||

| Class B common stock, $0.00001 par value; 500,000 shares authorized at June 30, 2024 and December 31, 2023; 45,571 and 46,856 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | — | — | |||||||||||||||

| Additional paid-in capital | 4,816,808 | 4,491,571 | |||||||||||||||

| Accumulated other comprehensive loss | (40,271) | (30,270) | |||||||||||||||

| Retained earnings | 3,594,230 | 1,820,346 | |||||||||||||||

| Total stockholders’ equity | 8,370,769 | 6,281,649 | |||||||||||||||

| Total liabilities and stockholders’ equity | $ | 286,959,173 | $ | 206,982,953 | |||||||||||||

| 18 | ||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Revenue: | |||||||||||||||||||||||

| Net revenue | $ | 1,379,942 | $ | 662,500 | $ | 2,967,619 | $ | 1,398,898 | |||||||||||||||

| Other revenue | 69,686 | 45,411 | 119,579 | 81,542 | |||||||||||||||||||

| Total revenue | 1,449,628 | 707,911 | 3,087,198 | 1,480,440 | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Transaction expense | 191,477 | 108,200 | 408,884 | 204,569 | |||||||||||||||||||

| Technology and development | 364,258 | 320,667 | 722,121 | 678,698 | |||||||||||||||||||

| Sales and marketing | 165,262 | 83,853 | 263,847 | 147,829 | |||||||||||||||||||

| General and administrative | 320,115 | 258,988 | 607,351 | 507,749 | |||||||||||||||||||

| Losses (gains) on crypto assets held for operations, net | 31,016 | — | (55,342) | — | |||||||||||||||||||

| Crypto asset impairment, net | — | (8,053) | — | 9,909 | |||||||||||||||||||

| Restructuring | — | (1,035) | — | 143,454 | |||||||||||||||||||

| Other operating expense (income), net | 34,383 | 18,866 | 36,759 | (14,318) | |||||||||||||||||||

| Total operating expenses | 1,106,511 | 781,486 | 1,983,620 | 1,677,890 | |||||||||||||||||||

| Operating income (loss) | 343,117 | (73,575) | 1,103,578 | (197,450) | |||||||||||||||||||

| Interest expense | 20,507 | 21,672 | 39,578 | 43,208 | |||||||||||||||||||

| Losses (gains) on crypto assets held for investment, net | 319,020 | — | (331,409) | — | |||||||||||||||||||

| Other expense (income), net | 63,827 | (16,564) | 18,222 | 3,701 | |||||||||||||||||||

| (Loss) income before income taxes | (60,237) | (78,683) | 1,377,187 | (244,359) | |||||||||||||||||||

| (Benefit from) provision for income taxes | (96,387) | 18,722 | 164,792 | (68,058) | |||||||||||||||||||

| Net income (loss) | $ | 36,150 | $ | (97,405) | $ | 1,212,395 | $ | (176,301) | |||||||||||||||

| Net income (loss) attributable to common stockholders: | |||||||||||||||||||||||

| Basic | $ | 36,127 | $ | (97,405) | $ | 1,211,611 | $ | (176,301) | |||||||||||||||

| Diluted | $ | 36,128 | $ | (97,601) | $ | 1,217,829 | $ | (176,497) | |||||||||||||||

| Net income (loss) per share attributable to common stockholders: | |||||||||||||||||||||||

| Basic | $ | 0.15 | $ | (0.42) | $ | 4.95 | $ | (0.76) | |||||||||||||||

| Diluted | $ | 0.14 | $ | (0.42) | $ | 4.49 | $ | (0.76) | |||||||||||||||

| Weighted-average shares of common stock used to compute net income (loss) per share attributable to common stockholders: | |||||||||||||||||||||||

| Basic | 246,298 | 234,614 | 244,546 | 233,060 | |||||||||||||||||||

| Diluted | 266,831 | 234,641 | 271,003 | 233,087 | |||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Technology and development | $ | 133,622 | $ | 123,469 | $ | 273,452 | $ | 246,165 | |||||||||||||||

| Sales and marketing | 16,691 | 14,930 | 33,314 | 29,139 | |||||||||||||||||||

| General and administrative | 67,621 | 61,373 | 135,672 | 123,328 | |||||||||||||||||||

| Restructuring | — | — | — | 84,042 | |||||||||||||||||||

| Total | $ | 217,934 | $ | 199,772 | $ | 442,438 | $ | 482,674 | |||||||||||||||

| 19 | ||||||||||||||

| Six Months Ended June 30, | |||||||||||

| 2024 | 2023 | ||||||||||

| Cash flows from operating activities | |||||||||||

| Net income (loss) | $ | 1,212,395 | $ | (176,301) | |||||||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | 63,828 | 78,190 | |||||||||

| Stock-based compensation expense | 442,438 | 398,632 | |||||||||

| Deferred income taxes | 83,961 | (71,435) | |||||||||

| Non-cash lease expense | 5,575 | 34,173 | |||||||||

| Gains on crypto assets held for investment and operations, net | (386,751) | (95,390) | |||||||||

| Gains on crypto assets borrowed and borrowings, net | (1,173) | (13,930) | |||||||||

| Restructuring stock-based compensation expense | — | 84,042 | |||||||||

| Crypto asset impairment expense (prior to ASU 2023-08) | — | 54,333 | |||||||||

| Realized loss on crypto futures contract | — | 43,339 | |||||||||

| Crypto assets received as revenue (prior to ASU 2023-08) | — | (211,923) | |||||||||

| Crypto asset payments for expenses (prior to ASU 2023-08) | — | 135,002 | |||||||||

| Other operating activities, net | 43,043 | 28,626 | |||||||||

| Net changes in operating assets and liabilities | (567,634) | 326,844 | |||||||||

| Net cash provided by operating activities | 895,682 | 614,202 | |||||||||

| Cash flows from investing activities | |||||||||||

| Fiat loans originated | (808,334) | (144,283) | |||||||||

| Proceeds from repayment of fiat loans | 646,700 | 109,630 | |||||||||

| Purchase of crypto assets held for investment | — | (99,064) | |||||||||

| Sale of crypto assets held for investment | 52,425 | 188,026 | |||||||||

| Settlement of crypto futures contract | — | (43,339) | |||||||||

| Other investing activities, net | (35,083) | (23,724) | |||||||||

| Net cash used in investing activities | (144,292) | (12,754) | |||||||||

| Cash flows from financing activities | |||||||||||

| Issuance of common stock upon exercise of stock options, net of repurchases | 69,521 | 16,649 | |||||||||

| Taxes paid related to net share settlement of equity awards | (117,225) | (115,392) | |||||||||

| Customer custodial cash liabilities | (357,657) | (987,957) | |||||||||

| Issuance of convertible senior notes, net | 1,246,025 | — | |||||||||

| Repurchases of senior and convertible notes | — | (45,469) | |||||||||

| Purchase of capped calls | (104,110) | — | |||||||||

| Fiat received as collateral | 493,499 | 5,169 | |||||||||

| Fiat received as collateral returned | (243,510) | (3,766) | |||||||||

| Other financing activities | 7,445 | (11,497) | |||||||||

| Net cash provided by (used in) financing activities | 993,988 | (1,142,263) | |||||||||

| Net increase (decrease) in cash, cash equivalents, and restricted cash and cash equivalents | 1,745,378 | (540,815) | |||||||||

| Effect of exchange rates on cash, cash equivalents, and restricted cash and cash equivalents | (25,923) | (4,370) | |||||||||

| Cash, cash equivalents, and restricted cash and cash equivalents, beginning of period | 9,555,429 | 9,429,646 | |||||||||

| Cash, cash equivalents, and restricted cash and cash equivalents, end of period | $ | 11,274,884 | $ | 8,884,461 | |||||||

| Supplemental disclosure of cash flow information | |||||||||||

| Cash paid during the period for interest | $ | 33,424 | $ | 38,684 | |||||||

| Cash paid during the period for income taxes | $ | 81,552 | $ | 10,669 | |||||||

| Operating cash outflows for amounts included in the measurement of operating lease liabilities | $ | 6,291 | $ | 7,559 | |||||||

| 20 | ||||||||||||||

| Six Months Ended June 30, | |||||||||||

| 2024 | 2023 | ||||||||||

| USDC | $ | (492,242) | $ | 508,752 | |||||||

| Accounts receivable | (69,779) | (36,579) | |||||||||

| Deposits in transit | (5,012) | (88,680) | |||||||||

| Income taxes, net | (1,667) | (7,012) | |||||||||

| Other current and non-current assets | (2,971) | 31,003 | |||||||||

| Other current and non-current liabilities | 4,037 | (80,640) | |||||||||

| Net changes in operating assets and liabilities | $ | (567,634) | $ | 326,844 | |||||||

| June 30, | |||||||||||

| 2024 | 2023 | ||||||||||

| Cash and cash equivalents | $ | 7,225,535 | $ | 5,166,733 | |||||||

| Restricted cash and cash equivalents | 34,282 | 20,697 | |||||||||

| Customer custodial cash and cash equivalents | 4,015,067 | 3,697,031 | |||||||||

| Total cash, cash equivalents, and restricted cash and cash equivalents | $ | 11,274,884 | $ | 8,884,461 | |||||||

| Six Months Ended June 30, | |||||||||||

| 2024 | 2023 | ||||||||||

| Crypto asset loan receivables originated | $ | 837,729 | $ | — | |||||||

| Crypto asset loan receivables repaid | 741,500 | — | |||||||||

| Cumulative-effect adjustment due to the adoption of ASU 2023-08 | 561,489 | — | |||||||||

| Non-cash assets received as collateral returned | 372,691 | 86,390 | |||||||||

| Non-cash assets received as collateral | 361,718 | 59,516 | |||||||||

| Crypto assets borrowed | 225,037 | 272,590 | |||||||||

| Crypto assets borrowed repaid with crypto assets | 100,285 | 304,433 | |||||||||

| Non-cash assets pledged as collateral | 59,138 | 63,460 | |||||||||

| Non-cash assets pledged as collateral returned | 47,013 | 42,514 | |||||||||

| Disposal of crypto asset investments for USDC | 10,346 | 7,283 | |||||||||

| Purchase of strategic investments with USDC | 7,902 | 2,750 | |||||||||

| Purchase of crypto asset investments with USDC | 1,941 | 6,580 | |||||||||

| Non-cash consideration paid for business combinations | — | 51,494 | |||||||||

| Realized gains on crypto assets held for investment (prior to ASU 2023-08) | — | 48,491 | |||||||||

| 21 | ||||||||||||||

| Q2’23 | Q3’23 | Q4’23 | Q1’24 | Q2’24 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Net (loss) income | $ | (97,405) | $ | (2,265) | $ | 273,437 | $ | 1,176,245 | $ | 36,150 | ||||||||||

| Adjusted to exclude the following: | ||||||||||||||||||||

| Provision for (benefit from) income taxes | 18,722 | 36,926 | (140,584) | 261,179 | (96,387) | |||||||||||||||

| Interest expense | 21,672 | 20,821 | 18,737 | 19,071 | 20,507 | |||||||||||||||

| Depreciation and amortization | 36,982 | 31,967 | 29,485 | 29,327 | 34,501 | |||||||||||||||

| Stock-based compensation | 199,772 | 218,153 | 163,883 | 224,504 | 217,934 | |||||||||||||||

| Gains (losses) on crypto assets held for investment, net (post-adoption of ASU 2023-08) | (650,429) | 319,020 | ||||||||||||||||||

| Other (income) expense, net | (16,564) | (135,307) | (35,977) | (45,605) | 63,827 | |||||||||||||||

| Non-recurring lease charges | 18,088 | — | — | — | — | |||||||||||||||

| Non-recurring accrued legal contingencies, settlements, and related costs | — | — | 15,000 | — | — | |||||||||||||||

| Impairment on crypto assets still held, net (pre-adoption of ASU 2023-08) | 8,499 | 8,897 | — | — | — | |||||||||||||||

| Restructuring | (1,035) | (860) | — | — | — | |||||||||||||||

| Adjusted EBITDA | $ | 188,731 | $ | 178,332 | $ | 323,981 | $ | 1,014,292 | $ | 595,552 | ||||||||||

| Revised definition no longer adjusts for: | ||||||||||||||||||||

| Crypto asset borrowing costs | $ | 1,218 | $ | 706 | $ | 1,362 | ||||||||||||||

| Other impairment expense | 2,586 | 1,956 | 8,724 | |||||||||||||||||

| Revised definition newly adjusts for: | ||||||||||||||||||||

Additional other expense (income), net(1) | 1,417 | (50) | (28,961) | |||||||||||||||||

| Adjusted EBITDA, previous definition | $ | 193,952 | $ | 180,944 | $ | 305,106 | ||||||||||||||

| 22 | ||||||||||||||