Exhibit 99.1

Dear Shareholders,

The third quarter was another exceptional quarter for Carvana.

We had record performance in virtually every key financial measure. Our Net Income in the third quarter was $148 million, leading to a Net Income margin of 4.0%. Our Operating Income was $337 million. And our Adjusted EBITDA was $429 million. This translates to an 11.7% Adjusted EBITDA margin.

And these profitability records have to be viewed in a very important context: they were achieved while growing at 34% year-over-year by a company that currently has just 1% market share. The machine we have built is fundamentally differentiated and the result is an opportunity with few precedents.

Most importantly, our customer experiences, our financial performance, and our pace of growth continue to separate us further from the pack in our industry. Today, we are the most profitable and fastest-growing automotive retailer and there is still much more to do.

While we are extremely proud of the exceptional experiences we deliver to our customers, we know they can be even better.

We see the path, and we know how to keep improving.

While we are extremely proud of our financial performance, there are still significant opportunities for fundamental improvements in our unit economics.

We see the path, and we know how to keep getting more efficient.

And while we are already the second largest used automotive retailer in the country, we are only a small fraction of what we can ultimately become.

We see the path, and we know how to keep scaling.

As we have discussed in the past, we believe there are three fundamental drivers of our growth:

1.Continuously improving our customer offering

2.Increasing awareness, understanding, and trust of our brand

3.Increasing inventory selection and other benefits of scale

Later in this letter, we discuss the ways we continue to integrate and benefit from our acquisition of ADESA. In our growth frame above, we believe ADESA is a clear, tangible, and easily extrapolated example of growth driver #3. We hope you find this as exciting as we do.

The pieces are all in place.

We are a team that knows how to build. We have an offering customers love. We have a uniquely profitable and highly scalable business model. And we have already built, acquired, and invested in the most complex and expensive parts of the infrastructure necessary to be many multiples larger than we are today.

Our existing reconditioning infrastructure can support annual production capacity of over 1 million retail units and our real estate footprint can support annual production capacity of over 3 million retail units. The future is bright.

We remain firmly on the path to buying and selling millions of cars, to becoming the largest and most profitable automotive retailer, and to fulfilling our mission of changing the way people buy and sell cars.

Summary of Q3 Results

Q3 2024 Financial Results: All financial comparisons stated below are versus Q3 2023 unless otherwise noted. Complete financial tables appear at the end of this letter.

•Retail units sold totaled 108,651, an increase of 34%

•Revenue totaled $3.655 billion, an increase of 32%

•Total gross profit was $807 million, an increase of 67%

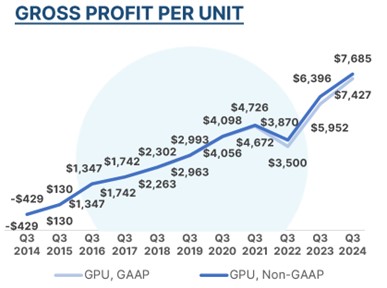

•Total gross profit per unit (“GPU”) was $7,427, an increase of $1,475

•Non-GAAP Total GPU was $7,685, an increase of $1,289

•Net income margin was 4.0%, a decrease from 26.7%1

◦Net income totaled $148 million2

•Adjusted EBITDA margin was 11.7%, an increase from 5.3%

◦Adjusted EBITDA totaled $429 million

•GAAP Operating income was $337 million, an increase of $289 million

•Basic and diluted net earnings per Class A share were $0.69 and $0.64, respectively, based on 124 million and 134 million shares of Class A common stock outstanding, respectively

◦Assuming full conversion of LLC units and other dilutive effects, there would have been 219 million shares of Class A common stock outstanding

Outlook

Our results through Q3 position us well for a strong finish to 2024. Looking toward the fourth quarter, we expect the following as long as the environment remains stable:

•A sequential increase in our year-over-year growth rate in retail units sold, and

•Adjusted EBITDA significantly above the high end of our previously communicated range of $1.0 to $1.2 billion for the full year 2024.3

Third Quarter Results

Q3 again demonstrated the benefits of Carvana’s vertically-integrated and differentiated business model4. We marked our third consecutive quarter of positive Net Income margin by achieving 4.0% in Q3, and we again set records for Adjusted EBITDA, Adjusted EBITDA margin, GAAP Operating Income, GAAP Operating Income margin, and GAAP Gross Profit margin. Adjusted EBITDA Margin of 11.7% surpassed the midpoint of our Long Term Financial Model range of 8% to 13.5% for EBITDA Margin. As with last quarter, we achieved this financial progress while carrying many costs associated with excess capacity to support annual volume of over 1 million retail units. Going forward, we plan to maintain operational focus and to realize further fundamental gains from scale and additional operating efficiencies over time.

Q3 experienced strong customer demand similar to that of Q1 and Q2. Retail units sold in Q3 grew by 34% year-over-year. As stated last quarter, we are pursuing growth at a rate that seeks to balance the clear long-term benefits of scale while continuing to pursue opportunities we see for fundamental unit economics gains and ever-improving customer experiences. Q3 results again demonstrate that this balance is achievable.

Production output at our inspection and reconditioning centers continued to increase in line with our production growth plans for the quarter. While inventory availability has improved throughout Q3, we still remain below our target available website inventory levels.

Q3 GAAP and Non-GAAP GPU of $7,427 and $7,685, respectively, set company records, supported by consistent performance across all components of GPU. GAAP and Non-GAAP Retail GPU of $3,497 and $3,617, respectively, both set company records for the sixth consecutive quarter. Strength in Retail GPU remains driven by fundamental gains in several areas, including non-vehicle cost of sales (primarily consisting of reconditioning and inbound transport costs), customer-sourcing, inventory turn times, and revenues from fulfillment services.

GAAP and Non-GAAP SG&A per retail unit sold were $4,317 and $3,737, respectively, down $1,030 and $832 on a year-over-year basis. Carvana Operations expense totaled $1,731 per retail unit sold in Q3, a year-over-year decrease of $220 primarily driven by our operational efficiency initiatives. Overhead expense totaled $147 million in Q3, a year-over-year reduction of $388 per retail unit sold due to higher unit volume.

Net Income was $148 million and net income margin was 4.0%. Adjusted EBITDA was $429 million and Adjusted EBITDA margin was 11.7%, both company records.

1 Net income in Q3 2023 benefitted from an ~$878 million gain on debt extinguishment as a result of our corporate debt exchange.

2 Net income in Q3 2024 included a negative $26 million impact from the decline in the fair value of our warrants to acquire Root common stock.

3 In order to clearly demonstrate our progress and highlight the most meaningful drivers within our business, we continue to use forecasted Non-GAAP financial measures, including forecasted Adjusted EBITDA. We have not provided a quantitative reconciliation of forecasted GAAP measures to forecasted Non-GAAP measures within this communication because we are unable, without making unreasonable efforts, to calculate one-time or restructuring expenses. These items could materially affect the computation of forward-looking Net Income (loss).

4 For additional details please see the “Benefits of Carvana's Differentiated Business Model” presentation on our Investor Relations website. Information on our website is not incorporated by reference into this letter.

Q3 represents another example of our ability to achieve both strong unit growth and industry-leading profitability. As we remain focused on executing our plan, we expect to continue progressing toward becoming the largest and most profitable automotive retailer and buying and selling millions of cars per year.

Unlocking the Long-Term Potential of Carvana and ADESA Together

2 ½ years ago we completed the acquisition of ADESA with the belief that combining Carvana’s e-commerce model with ADESA’s physical wholesale auction business would accelerate our path to becoming the largest and most profitable automotive retailer. As we deepen our integration with ADESA and realize these benefits, the power of this combination is apparent.

The combination of Carvana and ADESA allows us to unlock positive feedback, drive gains in unit economics, and deepen vertical integration. Over time, the continued integration will improve our customer experience for Carvana customers, enhance ADESA’s offering to its commercial customers, and strengthen our role in the automotive industry by adding complementary services and partnerships that are only enabled by vertical integration.

Unlocking Positive Feedback:

Throughout 2024, we have been focused on increasing inventory selection (a component of Growth Driver #3) to better match demand, not only by increasing production capacity at existing locations but also by integrating Carvana IRC operations at ADESA locations. We have developed a repeatable playbook to enable these site integrations efficiently. Our integrations introduce Carvana inspection and reconditioning activities to ADESA sites while maintaining existing wholesale auction operations within a single location.

These integrations generate positive feedback. Having more pools of inventory across the country increases selection for all Carvana customers, puts more cars closer to more customers which reduces delivery times, results in better customer experiences, and drives more sales. These benefits should only increase as we complete additional ADESA integrations. Today we have unlocked just 5 of the 56 ADESA locations and will soon announce our 6th. As shown below, there remains a significant runway for future growth within our existing footprint.

Unlocking Gains in Unit Economics:

Broadening our footprint benefits Carvana and our customers by reducing inbound and outbound transit distances and costs, as well as by enabling faster delivery times. These benefits in turn drive additional customer purchases resulting in further economic benefits throughout our cost structure. We believe integrating more ADESA sites will continue to accelerate these as well as other key sources of positive feedback in our model.

We continue to deepen and improve relationships with commercial partners who can leverage our technology and logistics network to sell more vehicles, more efficiently. The combined capabilities of Carvana and ADESA enable these partnerships to be larger and more mutually impactful than they would be if either company operated independently. Our combined capabilities will continue to create new opportunities for additional services and complementary partnerships.

Management Objectives

Our current focus is centered on profitable growth. However, this letter maintains our historical format built around the three objectives, (1) Grow Retail Units and Revenue; (2) Increase Total Gross Profit Per Unit; and (3) Demonstrate Operating Leverage, to discuss our key results.

1 Net Income margin in FY 2023 benefited from a one-time gain on debt extinguishment of ~$878 million.

2 Adjusted EBITDA is defined as net income (loss) plus income tax (benefit) provision, interest expense, other operating expense, net, other expense (income), net, depreciation and amortization expense in cost of sales and SG&A expenses, goodwill impairment, share-based compensation expense in cost of sales and SG&A expenses, loss on debt extinguishment, and restructuring expense in cost of sales and SG&A expenses, minus revenue related to our Root warrants and gain on debt extinguishment. Adjusted EBITDA margin is Adjusted EBITDA as a percentage of total revenues. For additional information on Adjusted EBITDA and other Non-GAAP financial metrics referenced in this letter, please see the financial tables at the end of this letter and our Q3 2024 supplemental financial tables posted on our investor relations website.

3 EBITDA Margin is calculated as net income (loss) plus income tax (benefit) provision, interest expense, and depreciation and amortization expense, divided by revenues.

Objective #1: Grow Retail Units and Revenue

Retail units sold totaled 108,651 in Q3, a year-over-year increase of 34%. Revenue was $3.655 billion, a year-over-year increase of 32%. Q3 experienced strong customer demand similar to that of Q1 and Q2.

Our growth in Q3 was driven by our three fundamental growth drivers of improving our customer offering, building awareness, understanding and trust, and the early stages of increasing inventory selection and other sources of positive feedback. In addition, we are delivering strong year-over-year growth gains while maintaining a tighter credit policy and a steady vehicle mix compared to 2023.

Retail revenue per retail unit sold was $23,405 in Q3 2024, a slight decrease compared to $24,066 in Q3 2023. In Q4 2024, we expect retail revenue per retail unit sold of ~$21k, a change from ~$23.4k in both Q3 2024 and Q4 2023, driven in part by industry-wide price changes and in part by an increase in retail marketplace units sold as a share of total retail units sold.

Over the past several years, we have developed a retail marketplace offering in which we sell retail vehicles on consignment from commercial sellers.5 As our reconditioning capacity scales and Carvana becomes more tightly integrated with ADESA, we have more capacity to expand our relationship with commercial vehicle sellers, creating the opportunity to grow traditional retail unit acquisition volume, retail marketplace unit volume, and wholesale marketplace unit volume with these sellers over time.

Retail marketplace units sold are fundamentally similar to traditional retail units sold sourced from auctions or other wholesale acquisition channels with the most important distinction being that the retail marketplace transaction structure means we do not record the gross sales price of the vehicle as retail revenue.

As a result, the largest impact of retail marketplace units sold on our financial statements is on retail revenue. We expect to grow our retail marketplace volume in Q4, which as noted above, we expect will contribute to a reduction in retail revenue per retail unit sold in Q4. That said, because we are more focused on profit than on revenue, we are largely neutral on whether a retail sale is structured as a traditional retail transaction or a retail marketplace transaction.

Objective #2: Increase Total Gross Profit Per Unit

Year-over-year and sequential changes in Total GPU in Q3 2024 were driven by a variety of factors described below in more detail.

5 In the past, we have referred to this offering as dealer marketplace or partner marketplace; for simplicity, here we refer to it simply as retail marketplace.

For Q3 2024

•Total

◦Total GPU was $7,427 vs. $5,952 in Q3 2023 and $7,049 in Q2 2024.

◦Non-GAAP Total GPU was $7,685 vs. $6,396 in Q3 2023 and $7,344 in Q2 2024.6

•Retail

◦Retail GPU was $3,497 vs. $2,692 in Q3 2023 and $3,421 in Q2 2024.

◦Non-GAAP Retail GPU was $3,617 vs. $2,877 in Q3 2023 and $3,539 in Q2 2024.

◦The year-over-year increase in Retail GPU was primarily driven by higher spreads between wholesale and retail market prices, lower retail depreciation rates, lower average days to sale, and reductions in reconditioning and inbound transport costs.

◦The sequential increase in Retail GPU was primarily driven by reductions in reconditioning and inbound transport costs.

◦Looking ahead to Q4, we expect seasonality in Retail GPU to be more similar to our average seasonality in 2018 through 2021 than our seasonality in 2022 and 2023, with the latter two years both impacted by unique internal factors.

•Wholesale

◦Wholesale GPU was $930 vs. $618 in Q3 20237 and $878 in Q2 2024.

◦Non-GAAP Wholesale GPU was $1,123 vs. $951 in Q3 2023 and $1,104 in Q2 2024.

◦Wholesale Vehicle

▪Wholesale Vehicle GPU was $562 vs. $347 in Q3 2023 and $474 in Q2 2024.

▪Non-GAAP Wholesale Vehicle GPU was $571 vs. $372 in Q3 2023 and $483 in Q2 2024.

▪The year-over-year improvement was primarily driven by lower wholesale depreciation rates, higher profit per wholesale vehicle, and a higher ratio of wholesale units sold to retail units sold, partially offset by a lower wholesale inventory allowance adjustment.

▪The sequential increase was primarily driven by higher profit per wholesale vehicle and a higher ratio of wholesale units sold to retail units sold.

◦Wholesale Marketplace

▪Wholesale Marketplace GPU was $368 vs. $271 in Q3 2023 and $404 in Q2 2024.

▪Non-GAAP Wholesale Marketplace GPU was $552 vs. $579 in Q3 2023 and $621 in Q2 2024.

▪The year-over-year and sequential changes in Wholesale Marketplace GPU were primarily driven by a decrease in the ratio of wholesale marketplace units sold to retail units sold, partially offset by lower depreciation expense impacting GAAP Wholesale Marketplace GPU.

◦Looking ahead to Q4, we expect seasonality in Wholesale Gross Profit Dollars to be similar to our average seasonality in 2018 through 2023.

•Other

◦Other GPU was $3,000 vs. $2,642 in Q3 2023 and $2,750 in Q2 2024.

◦Non-GAAP Other GPU was $2,945 vs. $2,568 in Q3 2023 and $2,701 in Q2 2024.

◦The year-over-year increase in Other GPU was primarily driven by higher spreads between origination interest rates and benchmark rates, partially offset by the impacts of hedging benchmark interest rate changes and selling a smaller proportion of loans relative to originations in Q3 2024 compared to Q3 2023.

◦The sequential increase in Other GPU was primarily driven by higher spreads between origination interest rates and benchmark rates and selling a greater volume of loans relative to originations in Q3 compared to Q2, partially offset by the impact of hedging benchmark interest rate changes.

▪We estimate that selling a greater volume of loans than we originated generated ~$150 of incremental Other GPU in Q3, other things being equal.

▪We also estimate that the decline in benchmark interest rates between loan origination and sale generated ~$100 of incremental Other GPU in Q3, other things being equal.

6 Non-GAAP gross profit per unit excludes depreciation and amortization, share-based compensation, and restructuring costs, as well as Root warrant revenue. For additional information, please see our Q3 2024 supplemental financial tables.

7 Wholesale gross profit and wholesale GPU includes gross profit from the sale of wholesale marketplace vehicles at our acquired ADESA locations.

Objective #3: Demonstrate Operating Leverage

Q3 2024 Net Income margin declined by 22.7% (from 26.7%) on a year-over-year basis due to the non-recurring impacts of our corporate debt exchange in Q3 2023. The corporate debt exchange, net of taxes, had a positive 30.6% impact to net income margin in Q3 2023. Adjusted EBITDA margin improved by 6.4% on a year-over-year basis. These improvements were driven by fundamental gains in GPU and operations expenses, as well as levering our overhead expenses.

The Carvana Operations portion of SG&A expense totaled $1,731 per retail unit sold in Q3, a year-over-year decrease of $220 and sequential increase of $35. The year-over-year decrease was primarily driven by our operational efficiency initiatives.

The Overhead portion of SG&A expense totaled $147 million in Q3, a year-over-year increase of $6 million, primarily driven by $4 million of non-recurring benefits in Q3 2023, and a year-over-year reduction of $388 per retail unit sold due to higher unit volume.

2024 has been an incredible year for Carvana. To say thank you to our team members who helped make this a reality, we have recently internally announced a Thank You cash bonus to thousands of operations and corporate employees across the company that will impact Adjusted EBITDA by approximately $10 million in Q4.

For Q3 2024, as a percentage of revenue:

•Year-over-year, all components of SG&A improved. Total SG&A decreased by 2.8% and non-advertising SG&A decreased by 2.3%. Compensation and benefits decreased by 1.0%, Other SG&A decreased by 1.0%, advertising decreased by 0.5%, logistics decreased by 0.2%, and market occupancy decreased by 0.1%.

•On a sequential basis, Total SG&A decreased by 0.5% and non-advertising SG&A decreased by 0.4%. Other SG&A decreased by 0.3%, compensation and benefits and advertising each decreased by 0.1%, and logistics and market occupancy were flat.

Summary

It is an exciting time for Carvana.

Opportunity remains in every area of the business.

Given the ambition and creativity of our team, we believe we will continue to uncover additional opportunities at least as quickly as we can execute. Accordingly, we believe that the biggest determinant of the ultimate degree of our success is execution.

We are executing very well today, but our experiences and progress in recent years are a constant reminder that hardship sharpens focus and drives hunger while success often does the opposite. We will work hard to fight the relentless human tendency to drift toward comfort. It will be hard. But our teams have already proven their ambition and grit. We can do hard things and we are up to this challenge.

The march continues,

Ernie Garcia, III, Chairman and CEO

Mark Jenkins, CFO

Appendix

Conference Call Details

Carvana will host a conference call today, October 30, 2024, at 5:30 p.m. EST (2:30 p.m. PST) to discuss financial results. To participate in the live call, analysts and investors should dial (833) 255-2830 or (412) 902-6715. A live audio webcast of the conference call along with supplemental financial information will also be accessible on the company's website at investors.carvana.com. Following the webcast, an archived version will also be available on the Investor Relations section of the company’s website. A telephonic replay of the conference call will be available until Wednesday, November 6, 2024, by dialing (877) 344-7529 or (412) 317-0088 and entering passcode 9979887#.

Forward Looking Statements

This letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect Carvana’s current expectations and projections with respect to, among other things, its financial condition, results of operations, plans, objectives, strategy, future performance, and business. These statements may be preceded by, followed by or include the words "aim," "anticipate," "believe," "estimate," "expect," "forecast," "intend," "likely," "outlook," "plan," "potential," "project," "projection," "seek," "can," "could," "may," "should," "would," "will," the negatives thereof and other words and terms of similar meaning.

Forward-looking statements include all statements that are not historical facts, including expectations regarding our operational and efficiency initiatives and gains, our strategy, expected gross profit per unit, forecasted results, including forecasted Adjusted EBITDA, potential infrastructure capacity utilization, efficiency gains and opportunities to improve our results, including opportunities to increase our margins and reduce our expenses, trends or expectations regarding inventory, expected customer patterns and demand, potential benefits from new technology, anticipated benefits of integrations, and our long-term financial goals and growth opportunities. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Among these factors are risks related to: our ability to utilize our available infrastructure capacity and realize the expected benefits therefrom, including increased margins and lower expenses; the benefits from our initiatives relating to ADESA; our ability to scale up our business; the larger automotive ecosystem, including consumer demand, global supply chain challenges, and other macroeconomic issues; our ability to raise additional capital and our substantial indebtedness; our history of losses and ability to maintain profitability in the future; our ability to effectively manage our rapid growth; our ability to maintain customer service quality and reputational integrity and enhance our brand; the seasonal and other fluctuations in our quarterly operating results; our relationship with DriveTime and its affiliates; the highly competitive industry in which we participate, which among other consequences, could impact our long-term growth opportunities; the changes in prices of new and used vehicles; our ability to effectively manage our inventory or acquire desirable inventory; our ability to sell our inventory expeditiously; and the other risks identified under the “Risk Factors” section in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

There is no assurance that any forward-looking statements will materialize. You are cautioned not to place undue reliance on forward-looking statements, which reflect expectations only as of this date. Carvana does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise.

Use of Non-GAAP Financial Measures

As appropriate, we supplement our results of operations determined in accordance with U.S. generally accepted accounting principles (“GAAP”) with certain non-GAAP financial measurements that are used by management, and which we believe are useful to investors, as supplemental operational measurements to evaluate our financial performance. These measurements should not be considered in isolation or as a substitute for reported GAAP results because they may include or exclude certain items as compared to similar GAAP-based measurements, and such measurements may not be comparable to similarly-titled measurements reported by other companies. Rather, these measurements should be considered as an additional way of viewing aspects of our operations that provide a more complete understanding of our business. We strongly encourage investors to review our consolidated financial statements included in publicly filed reports in their entirety and not rely solely on any one, single financial measurement or communication.

Reconciliations of our non-GAAP measurements to their most directly comparable GAAP-based financial measurements are included at the end of this letter.

Investor Relations Contact Information: Mike Mckeever, investors@carvana.com

CARVANA CO. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In millions, except number of shares, which are reflected in thousands, and par values) | | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 871 | | | $ | 530 | |

| Restricted cash | 61 | | | 64 | |

| Accounts receivable, net | 363 | | | 266 | |

| Finance receivables held for sale, net | 553 | | | 807 | |

| | | |

| | | |

| Vehicle inventory | 1,305 | | | 1,150 | |

| Beneficial interests in securitizations | 463 | | | 366 | |

| Other current assets, including $4 and $3, respectively, due from related parties | 149 | | | 138 | |

| Total current assets | 3,765 | | | 3,321 | |

| Property and equipment, net | 2,826 | | | 2,982 | |

| Operating lease right-of-use assets, including $13 and $10, respectively, from leases with related parties | 452 | | | 455 | |

| Intangible assets, net | 39 | | | 52 | |

| | | |

| Other assets | 286 | | | 261 | |

| Total assets | $ | 7,368 | | | $ | 7,071 | |

| LIABILITIES & STOCKHOLDERS' EQUITY (DEFICIT) | | | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities, including $14 and $7, respectively, due to related parties | $ | 772 | | | $ | 596 | |

| Short-term revolving facilities | 76 | | | 668 | |

| Current portion of long-term debt | 209 | | | 189 | |

| Other current liabilities, including $13 and $3, respectively, due to related parties | 102 | | | 83 | |

| Total current liabilities | 1,159 | | | 1,536 | |

| Long-term debt, excluding current portion | 5,431 | | | 5,416 | |

| | | |

| Operating lease liabilities, excluding current portion, including $10 and $7, respectively, from leases with related parties | 429 | | | 433 | |

| Other liabilities, including $17 and $11, respectively, due to related parties | 63 | | | 70 | |

| Total liabilities | 7,082 | | | 7,455 | |

| Commitments and contingencies | | | |

| | | |

| Stockholders' equity (deficit): | | | |

| | | |

| | | |

| Preferred stock, $0.01 par value - 50,000 shares authorized; none issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | — | | | — | |

| Class A common stock, $0.001 par value - 500,000 shares authorized; 126,444 and 114,239 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | — | | | — | |

| Class B common stock, $0.001 par value - 125,000 shares authorized; 80,935 and 85,619 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | — | | | — | |

| Additional paid-in capital | 2,106 | | | 1,869 | |

| | | |

| Accumulated deficit | (1,495) | | | (1,626) | |

| Total stockholders' equity attributable to Carvana Co. | 611 | | | 243 | |

| Non-controlling interests | (325) | | | (627) | |

| Total stockholders' equity (deficit) | 286 | | | (384) | |

| Total liabilities & stockholders' equity (deficit) | $ | 7,368 | | | $ | 7,071 | |

CARVANA CO. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In millions, except number of shares, which are reflected in thousands, and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Sales and operating revenues: | | | | | | | |

| Retail vehicle sales, net | $ | 2,543 | | | $ | 1,949 | | | $ | 7,129 | | | $ | 5,737 | |

| Wholesale sales and revenues, including $7, $4, $21 and $14, respectively, from related parties | 786 | | | 610 | | | 2,163 | | | 2,005 | |

| Other sales and revenues, including $52, $35, $141 and $104, respectively, from related parties | 326 | | | 214 | | | 834 | | | 605 | |

| | | | | | | |

| Net sales and operating revenues | 3,655 | | | 2,773 | | | 10,126 | | | 8,347 | |

| Cost of sales, including $1, $1, $4 and $3, respectively, to related parties | 2,848 | | | 2,291 | | | 8,013 | | | 7,025 | |

| Gross profit | 807 | | | 482 | | | 2,113 | | | 1,322 | |

| Selling, general and administrative expenses, including $7, $8, $22 and $26, respectively, to related parties | 469 | | | 433 | | | 1,380 | | | 1,357 | |

| Other operating expense, net | 1 | | | 1 | | | 3 | | | 7 | |

| Operating income (loss) | 337 | | | 48 | | | 730 | | | (42) | |

| Interest expense | 157 | | | 153 | | | 503 | | | 467 | |

| Loss (Gain) on debt extinguishment | 4 | | | (878) | | | 6 | | | (878) | |

| Other expense (income), net | 29 | | | 3 | | | (23) | | | (8) | |

| Net income before income taxes | 147 | | | 770 | | | 244 | | | 377 | |

| Income tax (benefit) provision | (1) | | | 29 | | | (1) | | | 27 | |

| Net income | 148 | | | 741 | | | 245 | | | 350 | |

| Net income (loss) attributable to non-controlling interests | 63 | | | (41) | | | 114 | | | (214) | |

| Net income attributable to Carvana Co. | $ | 85 | | | $ | 782 | | | $ | 131 | | | $ | 564 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net earnings per share of Class A common stock - basic | $ | 0.69 | | | $ | 7.05 | | | $ | 1.09 | | | $ | 5.24 | |

| Net earnings per share of Class A common stock - diluted | $ | 0.64 | | | $ | 3.60 | | | $ | 1.01 | | | $ | 1.78 | |

| | | | | | | |

| Weighted-average shares of Class A common stock outstanding - basic | 123,883 | | | 110,844 | | | 119,719 | | | 107,692 | |

| Weighted-average shares of Class A common stock outstanding - diluted | 133,555 | | | 205,958 | | | 129,253 | | | 197,124 | |

CARVANA CO. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, In millions)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| Cash Flows from Operating Activities: | | | |

| Net income | $ | 245 | | | $ | 350 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization expense | 231 | | | 270 | |

| Equity-based compensation expense | 69 | | | 52 | |

| Loss on disposal of property and equipment | 3 | | | 8 | |

| Loss (Gain) on debt extinguishment | 6 | | | (878) | |

| Payment-in-kind interest expense | 388 | | | 46 | |

| Provision for bad debt and valuation allowance | 24 | | | 34 | |

| Amortization of debt issuance costs | 13 | | | 20 | |

| Unrealized gain on warrants to acquire Root Class A common stock | (27) | | | (3) | |

| Unrealized gain on beneficial interests in securitizations | (15) | | | (12) | |

| | | |

| Changes in finance receivable related assets: | | | |

| Originations of finance receivables | (6,051) | | | (4,509) | |

| Proceeds from sale of finance receivables, net | 6,464 | | | 5,207 | |

| | | |

| Gain on loan sales | (541) | | | (360) | |

| Principal payments received on finance receivables held for sale | 142 | | | 160 | |

| Other changes in assets and liabilities: | | | |

| Vehicle inventory | (154) | | | 777 | |

| Accounts receivable | (105) | | | (73) | |

| | | |

| Other assets | (16) | | | 27 | |

| Accounts payable and accrued liabilities | 171 | | | (84) | |

| Operating lease right-of-use assets | 3 | | | 63 | |

| | | |

| | | |

| Operating lease liabilities | 1 | | | (52) | |

| Other liabilities | 7 | | | (1) | |

| Net cash provided by operating activities | 858 | | | 1,042 | |

| Cash Flows from Investing Activities: | | | |

| | | |

| Purchases of property and equipment | (67) | | | (69) | |

| Proceeds from disposal of property and equipment | 9 | | | 58 | |

| Payments for acquisitions, net of cash acquired | — | | | (7) | |

| Principal payments received on and proceeds from sale of beneficial interests | 52 | | | 40 | |

| | | |

| Net cash (used in) provided by investing activities | (6) | | | 22 | |

| Cash Flows from Financing Activities: | | | |

| Proceeds from short-term revolving facilities | 2,601 | | | 5,756 | |

| Payments on short-term revolving facilities | (3,193) | | | (6,861) | |

| Proceeds from issuance of long-term debt | 160 | | | 110 | |

| Payments on long-term debt | (427) | | | (470) | |

| Payments of debt issuance costs | (3) | | | (52) | |

| Net proceeds from issuance of Class A common stock | 347 | | | 453 | |

| Proceeds from equity-based compensation plans | 3 | | | — | |

| Tax withholdings related to restricted stock units and awards | (2) | | | (12) | |

| | | |

| | | |

| | | |

| Net cash used in financing activities | (514) | | | (1,076) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 338 | | | (12) | |

| Cash, cash equivalents and restricted cash at beginning of period | 594 | | | 628 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 932 | | | $ | 616 | |

CARVANA CO. AND SUBSIDIARIES

OUTSTANDING SHARES AND LLC UNITS

(Unaudited)

The following table presents potentially dilutive securities, as of the end of the period, excluded from the computations of diluted net earnings per share of Class A common stock for the three and nine months ended September 30, 2024 and 2023, respectively:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (in thousands) |

Stock Options (1) | 365 | | | 640 | | | 371 | | | 979 | |

Restricted Stock Units and Awards (1) | 5 | | | 650 | | | 41 | | | 1,822 | |

Class A Units (2) | 83,323 | | | — | | | 84,888 | | | — | |

Class B Units (2) | 1,815 | | | — | | | 1,797 | | | — | |

(1) Represents number of instruments outstanding at the end of the period that were evaluated under the treasury stock method for potentially dilutive effects and were determined to be anti-dilutive.

(2) Represents the weighted-average as-converted LLC units that were evaluated under the if-converted method for potentially dilutive effects and were determined to be anti-dilutive.

CARVANA CO. AND SUBSIDIARIES

RESULTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | | | Nine Months Ended September 30, | | |

| 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

| | | | | | | | | | | |

| (dollars in millions, except per unit amounts) | | | | (in millions, except unit and per unit amounts) | | |

| Net sales and operating revenues: | | | | | | | | | | |

| Retail vehicle sales, net | $ | 2,543 | | | $ | 1,949 | | | 30.5 | % | | $ | 7,129 | | | $ | 5,737 | | | 24.3 | % |

Wholesale sales and revenues (1) | 786 | | | 610 | | | 28.9 | % | | 2,163 | | | 2,005 | | | 7.9 | % |

Other sales and revenues (2) | 326 | | | 214 | | | 52.3 | % | | 834 | | | 605 | | | 37.9 | % |

| Total net sales and operating revenues | $ | 3,655 | | | $ | 2,773 | | | 31.8 | % | | $ | 10,126 | | | $ | 8,347 | | | 21.3 | % |

| Gross profit: | | | | | | | | | | | |

| Retail vehicle gross profit | $ | 380 | | | $ | 218 | | | 74.3 | % | | $ | 1,010 | | | $ | 532 | | | 89.8 | % |

Wholesale gross profit (1) | 101 | | | 50 | | | 102.0 | % | | 269 | | | 185 | | | 45.4 | % |

Other gross profit (2) | 326 | | | 214 | | | 52.3 | % | | 834 | | | 605 | | | 37.9 | % |

| Total gross profit | $ | 807 | | | $ | 482 | | | 67.4 | % | | $ | 2,113 | | | $ | 1,322 | | | 59.8 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Unit sales information: | | | | | | | | | | | |

| Retail vehicle unit sales | 108,651 | | | 80,987 | | | 34.2 | % | | 301,969 | | | 236,757 | | | 27.5 | % |

| Wholesale vehicle unit sales | 56,487 | | | 40,886 | | | 38.2 | % | | 151,010 | | | 122,449 | | | 23.3 | % |

| | | | | | | | | | | |

| Per unit revenue: | | | | | | | | | | | |

| Retail vehicles | $ | 23,405 | | | $ | 24,066 | | | (2.7) | % | | 23,608 | | | 24,232 | | | (2.6) | % |

Wholesale vehicles (3) | $ | 9,861 | | | $ | 9,612 | | | 2.6 | % | | 9,688 | | | 11,058 | | | (12.4) | % |

| | | | | | | | | | | |

| Per retail unit gross profit: | | | | | | | | | | | |

| Retail vehicle gross profit | $ | 3,497 | | | $ | 2,692 | | | 29.9 | % | | $ | 3,345 | | | $ | 2,247 | | | 48.9 | % |

| Wholesale gross profit | 930 | | | 618 | | | 50.5 | % | | 891 | | | 781 | | | 14.1 | % |

| | | | | | | | | | | |

| Other gross profit | 3,000 | | | 2,642 | | | 13.6 | % | | 2,762 | | | 2,555 | | | 8.1 | % |

| Total gross profit | $ | 7,427 | | | $ | 5,952 | | | 24.8 | % | | $ | 6,998 | | | $ | 5,583 | | | 25.3 | % |

| Per wholesale unit gross profit: | | | | | | | | | | | |

Wholesale vehicle gross profit (4) | $ | 1,080 | | | $ | 685 | | | 57.7 | % | | $ | 1,026 | | | $ | 906 | | | 13.2 | % |

| | | | | | | | | | | |

| Wholesale marketplace: | | | | | | | | | | | |

| Wholesale marketplace units sold | 234,361 | | | 221,368 | | 5.9 | % | | 724,143 | | | 662,830 | | 9.3 | % |

| Wholesale marketplace revenues | $ | 229 | | | $ | 217 | | | 5.5 | % | | $ | 700 | | | $ | 651 | | | 7.5 | % |

Wholesale marketplace gross profit (5) | $ | 40 | | | $ | 22 | | | 81.8 | % | | $ | 114 | | | $ | 74 | | | 54.1 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1) Includes $7, $4, $21 and $14, respectively, of wholesale sales and revenues from related parties.

(2) Includes $52, $35, $141 and $104, respectively, of other sales and revenues from related parties.

(3) Excludes wholesale marketplace revenues and wholesale marketplace units sold.

(4) Excludes wholesale marketplace gross profit and wholesale marketplace units sold.

(5) Includes $20, $25, $67 and $77, respectively, of depreciation and amortization expense.

CARVANA CO. AND SUBSIDIARIES

COMPONENTS OF SG&A

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| Sep 30, 2023 | | Dec 31, 2023 | | Mar 31, 2024 | | Jun 30, 2024 | | Sep 30, 2024 |

| | | | | | | | | |

| (in millions) |

Compensation and benefits (1) | $ | 160 | | | $ | 162 | | | $ | 173 | | | $ | 168 | | | $ | 175 | |

| | | | | | | | | |

| Advertising | 56 | | | 59 | | | 54 | | | 55 | | | 56 | |

Market occupancy (2) | 16 | | | 16 | | | 18 | | | 17 | | | 17 | |

Logistics (3) | 29 | | | 26 | | | 29 | | | 28 | | | 29 | |

Other (4) | 172 | | | 176 | | | 182 | | | 187 | | | 192 | |

| Total | $ | 433 | | | $ | 439 | | | $ | 456 | | | $ | 455 | | | $ | 469 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

(1) Compensation and benefits includes all payroll and related costs, including benefits, payroll taxes, and equity-based compensation, except those related to preparing vehicles for sale, which are included in cost of sales, and those related to the development of software products for internal use, which are capitalized to software and depreciated over the estimated useful lives of the related assets.

(2) Market occupancy costs includes occupancy costs of our vending machine and hubs. It excludes occupancy costs related to reconditioning vehicles which are included in cost of sales and the portion related to corporate occupancy which are included in other costs.

(3) Logistics includes fuel, maintenance and depreciation related to operating our own transportation fleet, and third-party transportation fees, except the portion related to inbound transportation, which is included in cost of sales.

(4) Other costs include all other selling, general and administrative expenses such as IT expenses, corporate occupancy, professional services and insurance, limited warranty, and title and registration.

CARVANA CO. AND SUBSIDIARIES

LIQUIDITY RESOURCES

(Unaudited)

We had the following committed liquidity resources, secured debt capacity, and other unpledged assets available as of September 30, 2024 and December 31, 2023:

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| | | |

| (in millions) |

| Cash and cash equivalents | $ | 871 | | | $ | 530 | |

Availability under short-term revolving facilities (1) | 1,522 | | | 1,006 | |

| | | |

| Committed liquidity resources available | $ | 2,393 | | | $ | 1,536 | |

| | | |

| | | |

Super senior debt capacity (2) | 1,500 | | | 1,262 | |

Pari passu senior debt capacity (2) | 425 | | | 250 | |

Unpledged beneficial interests in securitizations (3) | 104 | | | 80 | |

Total liquidity resources (4) | $ | 4,422 | | | $ | 3,128 | |

(1)Availability under short-term revolving facilities is the available amount we can borrow under the Floor Plan Facility and Finance Receivable Facilities based on the pledgeable value of vehicle inventory and finance receivables on our balance sheet on the period end date. Availability under short-term revolving facilities is distinct from the total commitment amount of these facilities because it represents the currently borrowable amount, rather than committed future amounts that could be borrowed to finance future additional assets.

(2)Super senior debt capacity and pari passu senior debt capacity represents basket capacity to incur additional debt that could be senior or pari passu in lien priority to the collateral securing the obligations under the Senior Secured Notes, subject to the terms and conditions set forth in the indentures governing the Senior Secured Notes. The availability of such additional sources depends on many factors and there can be no assurance that financing alternatives will be available to us in the future.

(3)Unpledged beneficial interests in securitizations includes retained beneficial interests in securitizations that have not been previously pledged or sold. We historically have financed the majority of our retained beneficial interests in securitizations and expect to continue to do so in the future.

(4)Our total liquidity resources are composed of cash and cash equivalents, availability under existing credit facilities, additional capacity under the indentures governing our Senior Secured Notes, which allow us to incur additional debt that can be senior or pari passu in lien priority as to the collateral securing the obligations under the Senior Secured Notes, and additional unpledged securities that can be financed using traditional asset-based financing sources.

CARVANA CO. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(Unaudited)

Adjusted EBITDA; Adjusted EBITDA margin; Gross profit, non-GAAP; Total gross profit per retail unit, non-GAAP; SG&A expenses, non-GAAP; and Total SG&A expenses per retail unit, non-GAAP

Adjusted EBITDA; Adjusted EBITDA margin; Gross profit, non-GAAP; Total gross profit per retail unit, non-GAAP; SG&A expenses, non-GAAP; and Total SG&A expenses per retail unit, non-GAAP are supplemental measures of operating performance that do not represent and should not be considered an alternative to net income (loss), gross profit, or SG&A expenses, as determined by GAAP.

Adjusted EBITDA is defined as net income (loss) plus income tax (benefit) provision, interest expense, other operating expense, net, other expense (income), net, depreciation and amortization expense in cost of sales and SG&A expenses, goodwill impairment, share-based compensation expense in cost of sales and SG&A expenses, loss on debt extinguishment, and restructuring expense in cost of sales and SG&A expenses, minus revenue related to our Root Warrants and gain on debt extinguishment. Adjusted EBITDA margin is Adjusted EBITDA as a percentage of total revenues.

Gross profit, non-GAAP is defined as GAAP gross profit plus depreciation and amortization expense in cost of sales, share-based compensation expense in cost of sales, and restructuring expense in cost of sales, minus revenue related to our Root Warrants. Total gross profit per retail unit, non-GAAP is Gross profit, non-GAAP divided by retail vehicle unit sales.

SG&A expenses, non-GAAP is defined as GAAP SG&A expenses minus depreciation and amortization expense in SG&A expenses, share-based compensation expense in SG&A expenses, and restructuring expense in SG&A expenses. Total SG&A expenses per retail unit, non-GAAP is SG&A expenses, non-GAAP divided by retail vehicle unit sales.

We use these non-GAAP measures to measure the operating performance of our business as a whole and relative to our total revenues and retail vehicle unit sales. We believe that these metrics are useful measures to us and to our investors because they exclude certain financial, capital structure, and non-cash items that we do not believe directly reflect our core operations and may not be indicative of our recurring operations, in part because they may vary widely across time and within our industry independent of the performance of our core operations. We believe that excluding these items enables us to more effectively evaluate our performance period-over-period and relative to our competitors. Adjusted EBITDA; Adjusted EBITDA margin; Gross profit, non-GAAP; Total gross profit per retail unit, non-GAAP; SG&A expenses, non-GAAP; and Total SG&A expenses per retail unit, non-GAAP may not be comparable to similarly titled measures provided by other companies due to potential differences in methods of calculations.

A reconciliation of Adjusted EBITDA to net income (loss), Gross profit, non-GAAP to gross profit, and SG&A expenses, non-GAAP to SG&A expenses, which are the most directly comparable GAAP measures, and calculations of Adjusted EBITDA margin, Total gross profit per retail unit, non-GAAP, and Total SG&A expenses per retail unit, non-GAAP is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | For the Three Months Ended |

| (dollars in millions) | | | | | Sep 30, 2023 | | Dec 31, 2023 | | Mar 31, 2024 | | Jun 30, 2024 | | Sep 30, 2024 |

| Net income (loss) | | | | | $ | 741 | | | $ | (200) | | | $ | 49 | | | $ | 48 | | | $ | 148 | |

| Income tax (benefit) provision | | | | | 29 | | | (2) | | | (1) | | | 1 | | | (1) | |

| Interest expense | | | | | 153 | | | 165 | | | 173 | | | 173 | | | 157 | |

| Other expense (income), net | | | | | 3 | | | (1) | | | (87) | | | 35 | | | 29 | |

| Loss (gain) on debt extinguishment | | | | | (878) | | | — | | | — | | | 2 | | | 4 | |

| Operating income (loss) | | | | | $ | 48 | | | $ | (38) | | | $ | 134 | | | $ | 259 | | | $ | 337 | |

| Other operating expense, net | | | | | 1 | | | 1 | | | 1 | | | 1 | | | 1 | |

| Depreciation and amortization expense in cost of sales | | | | | 42 | | | 39 | | | 39 | | | 35 | | | 33 | |

| Depreciation and amortization expense in SG&A expenses | | | | | 45 | | | 43 | | | 43 | | | 41 | | | 40 | |

| Share-based compensation expense in cost of sales | | | | | — | | | — | | | — | | | — | | | 1 | |

| Share-based compensation expense in SG&A expenses | | | | | 18 | | | 20 | | | 23 | | | 24 | | | 23 | |

| | | | | | | | | | | | | |

| Root warrant revenue | | | | | (6) | | | (5) | | | (5) | | | (5) | | | (6) | |

| | | | | | | | | | | | | |

| Adjusted EBITDA | | | | | $ | 148 | | | $ | 60 | | | $ | 235 | | | $ | 355 | | | $ | 429 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total revenues | | | | | $ | 2,773 | | | $ | 2,424 | | | $ | 3,061 | | | $ | 3,410 | | | $ | 3,655 | |

| Net income (loss) margin | | | | | 26.7 | % | | (8.3) | % | | 1.6 | % | | 1.4 | % | | 4.0 | % |

| Adjusted EBITDA margin | | | | | 5.3 | % | | 2.5 | % | | 7.7 | % | | 10.4 | % | | 11.7 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | For the Three Months Ended |

| (dollars in millions, except per unit amounts) | | | | | Sep 30, 2023 | | Dec 31, 2023 | | Mar 31, 2024 | | Jun 30, 2024 | | Sep 30, 2024 |

| Gross profit | | | | | $ | 482 | | | $ | 402 | | | $ | 591 | | | $ | 715 | | | $ | 807 | |

| Depreciation and amortization expense in cost of sales | | | | | 42 | | | 39 | | | 39 | | | 35 | | | 33 | |

| Share-based compensation expense in cost of sales | | | | | — | | | — | | | — | | | — | | | 1 | |

| Root warrant revenue | | | | | (6) | | | (5) | | | (5) | | | (5) | | | (6) | |

| | | | | | | | | | | | | |

| Gross profit, non-GAAP | | | | | $ | 518 | | | $ | 436 | | | $ | 625 | | | $ | 745 | | | $ | 835 | |

| | | | | | | | | | | | | |

| Retail vehicle unit sales | | | | | 80,987 | | | 76,090 | | | 91,878 | | | 101,440 | | | 108,651 | |

| Total gross profit per retail unit | | | | | $ | 5,952 | | | $ | 5,283 | | | $ | 6,432 | | | $ | 7,049 | | | $ | 7,427 | |

| Total gross profit per retail unit, non-GAAP | | | | | $ | 6,396 | | | $ | 5,730 | | | $ | 6,802 | | | $ | 7,344 | | | $ | 7,685 | |

| | | | | | | | | | | | | |

| SG&A expenses | | | | | $ | 433 | | | $ | 439 | | | $ | 456 | | | $ | 455 | | | $ | 469 | |

| Depreciation and amortization expense in SG&A expenses | | | | | 45 | | | 43 | | | 43 | | | 41 | | | 40 | |

| Share-based compensation expense in SG&A expenses | | | | | 18 | | | 20 | | | 23 | | | 24 | | | 23 | |

| | | | | | | | | | | | | |

| SG&A expenses, non-GAAP | | | | | $ | 370 | | | $ | 376 | | | $ | 390 | | | $ | 390 | | | $ | 406 | |

| | | | | | | | | | | | | |

| Retail vehicle unit sales | | | | | 80,987 | | | 76,090 | | | 91,878 | | | 101,440 | | | 108,651 | |

| Total SG&A expenses per retail unit | | | | | $ | 5,347 | | | $ | 5,769 | | | $ | 4,963 | | | $ | 4,485 | | | $ | 4,317 | |

| Total SG&A expenses per retail unit, non-GAAP | | | | | $ | 4,569 | | | $ | 4,942 | | | $ | 4,245 | | | $ | 3,845 | | | $ | 3,737 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | For the Three Months Ended |

| (dollars in millions, except per unit amounts) | | | | | | | | | | | | | | | | | Sep 30, 2023 | | Dec 31, 2023 | | Mar 31, 2024 | | Jun 30, 2024 | | Sep 30, 2024 |

| Retail gross profit | | | | | | | | | | | | | | | | | $ | 218 | | | $ | 214 | | | $ | 283 | | | $ | 347 | | | $ | 380 | |

| Depreciation and amortization expense in cost of sales | | | | | | | | | | | | | | | | | 15 | | | 12 | | | 12 | | | 12 | | | 12 | |

| Share-based compensation expense in cost of sales | | | | | | | | | | | | | | | | | — | | | — | | | — | | | — | | | 1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Retail gross profit, non-GAAP | | | | | | | | | | | | | | | | | $ | 233 | | | $ | 226 | | | $ | 295 | | | $ | 359 | | | $ | 393 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Retail vehicle unit sales | | | | | | | | | | | | | | | | | 80,987 | | | 76,090 | | | 91,878 | | | 101,440 | | | 108,651 | |

| Retail gross profit per retail unit | | | | | | | | | | | | | | | | | $ | 2,692 | | | $ | 2,812 | | | $ | 3,080 | | | $ | 3,421 | | | $ | 3,497 | |

| Retail gross profit per retail unit, non-GAAP | | | | | | | | | | | | | | | | | $ | 2,877 | | | $ | 2,970 | | | $ | 3,211 | | | $ | 3,539 | | | $ | 3,617 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Wholesale vehicle gross profit | | | | | | | | | | | | | | | | | $ | 28 | | | $ | 28 | | | $ | 46 | | | $ | 48 | | | $ | 61 | |

| Depreciation and amortization expense in cost of sales | | | | | | | | | | | | | | | | | 2 | | | 2 | | | 2 | | | 1 | | | 1 | |

| Wholesale vehicle gross profit, non-GAAP | | | | | | | | | | | | | | | | | $ | 30 | | | $ | 30 | | | $ | 48 | | | $ | 49 | | | $ | 62 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Retail vehicle unit sales | | | | | | | | | | | | | | | | | 80,987 | | | 76,090 | | | 91,878 | | | 101,440 | | | 108,651 | |

| Wholesale vehicle gross profit per retail unit | | | | | | | | | | | | | | | | | $ | 347 | | | $ | 368 | | | $ | 501 | | | $ | 474 | | | $ | 562 | |

| Wholesale vehicle gross profit per retail unit, non-GAAP | | | | | | | | | | | | | | | | | $ | 372 | | | $ | 394 | | | $ | 522 | | | $ | 483 | | | $ | 571 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Wholesale marketplace gross profit | | | | | | | | | | | | | | | | | $ | 22 | | | $ | 12 | | | $ | 33 | | | $ | 41 | | | $ | 40 | |

| Depreciation and amortization expense in cost of sales | | | | | | | | | | | | | | | | | 25 | | | 25 | | | 25 | | | 22 | | | 20 | |

| Wholesale marketplace gross profit, non-GAAP | | | | | | | | | | | | | | | | | $ | 47 | | | $ | 37 | | | $ | 58 | | | $ | 63 | | | $ | 60 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Retail vehicle unit sales | | | | | | | | | | | | | | | | | 80,987 | | | 76,090 | | | 91,878 | | | 101,440 | | | 108,651 | |

| Wholesale marketplace gross profit per retail unit | | | | | | | | | | | | | | | | | $ | 271 | | | $ | 158 | | | $ | 359 | | | $ | 404 | | | $ | 368 | |

| Wholesale marketplace gross profit per retail unit, non-GAAP | | | | | | | | | | | | | | | | | $ | 579 | | | $ | 487 | | | $ | 631 | | | $ | 621 | | | $ | 552 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Other gross profit | | | | | | | | | | | | | | | | | $ | 214 | | | $ | 148 | | | $ | 229 | | | $ | 279 | | | $ | 326 | |

| Root warrant revenue | | | | | | | | | | | | | | | | | (6) | | | (5) | | | (5) | | | (5) | | | (6) | |

| Other gross profit, non-GAAP | | | | | | | | | | | | | | | | | $ | 208 | | | $ | 143 | | | $ | 224 | | | $ | 274 | | | $ | 320 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Retail vehicle unit sales | | | | | | | | | | | | | | | | | 80,987 | | | 76,090 | | | 91,878 | | | 101,440 | | | 108,651 | |

| Other gross profit per retail unit | | | | | | | | | | | | | | | | | $ | 2,642 | | | $ | 1,945 | | | $ | 2,492 | | | $ | 2,750 | | | $ | 3,000 | |

| Other gross profit per retail unit, non-GAAP | | | | | | | | | | | | | | | | | $ | 2,568 | | | $ | 1,879 | | | $ | 2,438 | | | $ | 2,701 | | | $ | 2,945 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | For the Years Ended December 31, |

| (dollars in millions, except per unit amounts) | | | | | 2016 | | 2017 | | 2018 | | 2019 | | 2020 | | 2021 | | 2022 | | 2023 |

| Net income (loss) | | | | | $ | (93) | | | $ | (164) | | | $ | (255) | | | $ | (365) | | | $ | (462) | | | $ | (287) | | | $ | (2,894) | | | $ | 150 | |

| Income tax provision | | | | | — | | | — | | | — | | | — | | | — | | | 1 | | | 1 | | | 25 | |

| Interest expense | | | | | 4 | | | 8 | | | 25 | | | 81 | | | 131 | | | 176 | | | 486 | | | 632 | |

| Other operating expense, net | | | | | — | | | 1 | | | 1 | | | 3 | | | 10 | | | 9 | | | 14 | | | 8 | |

| Other (income) expense, net | | | | | — | | | — | | | — | | | 1 | | | (11) | | | (3) | | | 56 | | | (9) | |

| Depreciation and amortization expense in cost of sales | | | | | — | | | — | | | — | | | — | | | 10 | | | 24 | | | 114 | | | 169 | |

| Depreciation and amortization expense in SG&A expenses | | | | | 4 | | | 11 | | | 24 | | | 41 | | | 74 | | | 105 | | | 200 | | | 183 | |

| Share-based compensation expense in cost of sales | | | | | — | | | — | | | 4 | | | 5 | | | 1 | | | — | | | 16 | | | — | |

| Share-based compensation expense in SG&A expenses | | | | | 1 | | | 6 | | | 21 | | | 30 | | | 25 | | | 39 | | | 69 | | | 73 | |

| Goodwill impairment | | | | | — | | | — | | | — | | | — | | | — | | | — | | | 847 | | | — | |

| Root warrant revenue | | | | | — | | | — | | | — | | | — | | | — | | | — | | | (7) | | | (21) | |

| Gain on debt extinguishment | | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (878) | |

Restructuring expense (1) | | | | | — | | | — | | | — | | | — | | | — | | | — | | | 57 | | | 7 | |

| Adjusted EBITDA | | | | | $ | (84) | | | $ | (138) | | | $ | (180) | | | $ | (204) | | | $ | (222) | | | $ | 64 | | | $ | (1,041) | | | $ | 339 | |

| | | | | | | | | | | | | | | | | | | |

| Total revenues | | | | | $ | 365 | | | $ | 859 | | | $ | 1,955 | | | $ | 3,940 | | | $ | 5,587 | | | $ | 12,814 | | | $ | 13,604 | | | $ | 10,771 | |

| Net income (loss) margin | | | | | (25.5) | % | | (19.1) | % | | (13.0) | % | | (9.3) | % | | (8.3) | % | | (2.2) | % | | (21.3) | % | | 1.4 | % |

| Adjusted EBITDA margin | | | | | (23.0) | % | | (16.1) | % | | (9.2) | % | | (5.2) | % | | (4.0) | % | | 0.5 | % | | (7.7) | % | | 3.1 | % |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

(1) Restructuring includes costs related to our May 2022 and November 2022 reductions in force, as well as lease termination and other restructuring expenses.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in millions, except per unit amounts) | For the Three Months Ended September 30, |

| 2014 | | 2015 | | 2016 | | 2017 | | 2018 | | 2019 | | 2020 | | 2021 | | 2022 | | 2023 | | 2024 |

| Net income (loss) | $ | (4) | | | $ | (8) | | | $ | (23) | | | $ | (41) | | | $ | (64) | | | $ | (93) | | | $ | (18) | | | $ | (68) | | | $ | (508) | | | $ | 741 | | | $ | 148 | |

| Income tax (benefit) provision | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 29 | | | (1) | |

| Interest expense | — | | | — | | | 1 | | | 1 | | | 6 | | | 21 | | | 20 | | | 48 | | | 153 | | | 153 | | | 157 | |

| Other operating expense, net | — | | | — | | | — | | | 1 | | | — | | | 1 | | | 2 | | | 3 | | | 2 | | | 1 | | | 1 | |

| Other expense (income), net | — | | | — | | | — | | | — | | | — | | | — | | | (11) | | | (6) | | | 56 | | | 3 | | | 29 | |

| Depreciation and amortization expense in cost of sales | — | | | — | | | — | | | — | | | — | | | — | | | 2 | | | 6 | | | 36 | | | 42 | | | 33 | |

| Depreciation and amortization expense in SG&A expenses | — | | | 1 | | | 1 | | | 3 | | | 6 | | | 11 | | | 19 | | | 26 | | | 57 | | | 45 | | | 40 | |

| Share-based compensation expense in cost of sales | — | | | — | | | — | | | — | | | 1 | | | 1 | | | — | | | — | | | 2 | | | — | | | 1 | |

| Share-based compensation expense in SG&A expenses | — | | | — | | | 1 | | | 2 | | | 10 | | | 9 | | | 6 | | | 11 | | | 16 | | | 18 | | | 23 | |

| Root warrant revenue | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (6) | | | (6) | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss (Gain) on debt extinguishment | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (878) | | | 4 | |

| | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA | $ | (4) | | | $ | (7) | | | $ | (20) | | | $ | (34) | | | $ | (41) | | | $ | (50) | | | $ | 20 | | | $ | 20 | | | $ | (186) | | | $ | 148 | | | $ | 429 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total revenues | $ | 12 | | | $ | 36 | | | $ | 99 | | | $ | 225 | | | $ | 535 | | | $ | 1,095 | | | $ | 1,544 | | | $ | 3,480 | | | $ | 3,386 | | | $ | 2,773 | | | $ | 3,655 | |

| Net income (loss) margin | (36.1) | % | | (26.0) | % | | (22.2) | % | | (17.6) | % | | (12.0) | % | | (8.4) | % | | (1.2) | % | | (2.0) | % | | (15.0) | % | | 26.7 | % | | 4.0 | % |

| Adjusted EBITDA margin | (32.4) | % | | (22.9) | % | | (20.1) | % | | (14.8) | % | | (7.6) | % | | (4.5) | % | | 1.3 | % | | 0.6 | % | | (5.5) | % | | 5.3 | % | | 11.7 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Gross profit | $ | — | | | $ | — | | | $ | 7 | | | $ | 20 | | | $ | 58 | | | $ | 138 | | | $ | 262 | | | $ | 523 | | | $ | 359 | | | $ | 482 | | | $ | 807 | |

| Depreciation and amortization expense in cost of sales | — | | | — | | | — | | | — | | | — | | | — | | | 2 | | | 6 | | | 36 | | | 42 | | | 33 | |

| Share-based compensation expense in cost of sales | — | | | — | | | — | | | — | | | 1 | | | 1 | | | — | | | — | | | 2 | | | — | | | 1 | |

| Root warrant revenue | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (6) | | | (6) | |

| | | | | | | | | | | | | | | | | | | | | |

| Gross profit, non-GAAP | $ | — | | | $ | — | | | $ | 7 | | | $ | 20 | | | $ | 59 | | | $ | 139 | | | $ | 264 | | | $ | 529 | | | $ | 397 | | | $ | 518 | | | $ | 835 | |

| | | | | | | | | | | | | | | | | | | | | |

| Retail vehicle unit sales | 579 | | | 1,776 | | | 5,023 | | | 11,719 | | | 25,324 | | | 46,413 | | | 64,414 | | | 111,949 | | | 102,570 | | | 80,987 | | | 108,651 | |

| Total gross profit per retail unit | $ | (429) | | | $ | 130 | | | $ | 1,347 | | | $ | 1,742 | | | $ | 2,263 | | | $ | 2,963 | | | $ | 4,056 | | | $ | 4,672 | | | $ | 3,500 | | | $ | 5,952 | | | $ | 7,427 | |

| Total gross profit per retail unit, non-GAAP | $ | (429) | | | $ | 130 | | | $ | 1,347 | | | $ | 1,742 | | | $ | 2,302 | | | $ | 2,993 | | | $ | 4,098 | | | $ | 4,726 | | | $ | 3,870 | | | $ | 6,396 | | | $ | 7,685 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |