Reaching Patients Through Immunology Innovation 3 Q 2 0 2 4 E A R N I N G S C A L L | O c t o b e r 3 1 , 2 0 2 4

Forward Looking Statements This presentation has been prepared by argenx se (“argenx” or the “company”) for informational purposes only and not for any other purpose. Nothing contained in this presentation is, or should be construed as, a recommendation, promise or representation by the presenter or the company or any director, employee, agent, or adviser of the company. This presentation does not purport to be all-inclusive or to contain all of the information you may desire. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third-party sources and the company’s own internal estimates and research. While argenx believes these third-party studies, publications, surveys and other data to be reliable as of the date of this presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, no independent source has evaluated the reasonableness or accuracy of argenx’s internal estimates or research, and no reliance should be made on any information or statements made in this presentation relating to or based on such internal estimates and research. Certain statements contained in this presentation, other than present and historical facts and conditions independently verifiable at the date hereof, may constitute forward-looking statements. These forward-looking statements can be identified by the use of forward-looking terminology, including the terms “continuing,” “pending,” and “starting,” and include statements argenx makes regarding its goal to have five registrational trials by the end of 2024; the anticipated timing of the start of Phase 3 study of empasiprubart in MMN; the anticipated timing of pending VYVGART regulatory decisions for gMG in Australia and Saudi Arabia; the anticipated timing of pending VYVGART Hytrulo regulatory decisions for CIDP in China, Japan, and Europe; its continued expansion with VYVGART and VYVGART Hytrulo in China; its Wave 2 growth plan for 2026-2027; its Wave 3 growth plan for 2028-2030; its future opportunities for VYVGART, empasiprubart, and ARGX- 119, including having 50,000 patients treated; and its 2024 research and development and selling, general and administrative expenses. By their nature, forward-looking statements involve risks and uncertainties and readers are cautioned that any such forward-looking statements are not guarantees of future performance. argenx’s actual results may differ materially from those predicted by the forward-looking statements as a result of various important factors, including the results of argenx's clinical trials; expectations regarding the inherent uncertainties associated with the development of novel drug therapies; preclinical and clinical trial and product development activities and regulatory approval requirements in products and product candidates; the acceptance of argenx's products and product candidates by patients as safe, effective and cost-effective; the impact of governmental laws and regulations on our business; disruptions caused on our reliance of third parties suppliers, service provides and manufacturing; inflation and deflation and the corresponding fluctuations in interest rates; and regional instability and conflicts. A further list and description of these risks, uncertainties and other risks can be found in argenx’s U.S. Securities and Exchange Commission (the “SEC”) filings and reports, including in argenx’s most recent annual report on Form 20-F filed with the SEC as well as subsequent filings and reports filed by argenx with the SEC. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date of publication of this document. argenx undertakes no obligation to publicly update or revise the information in this presentation, including any forward-looking statements, except as may be required by law. This presentation contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. 2

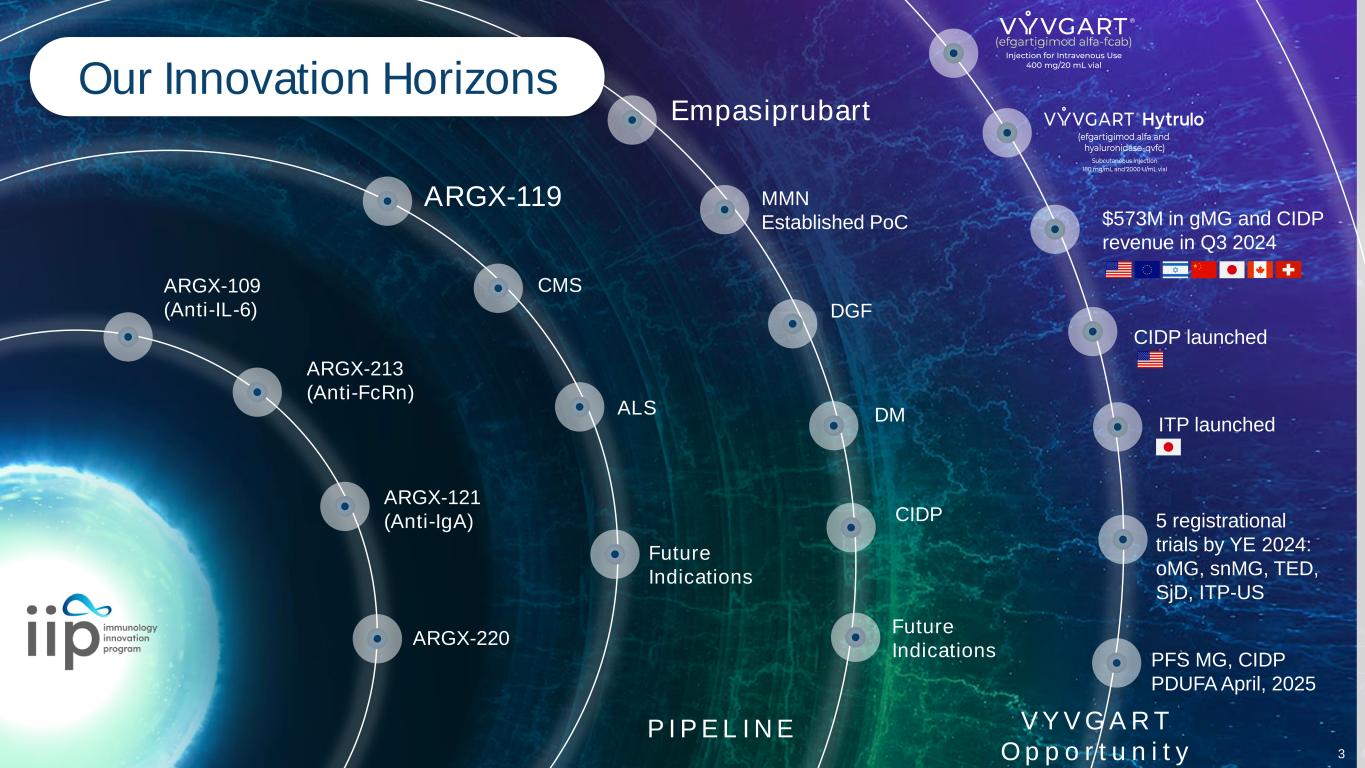

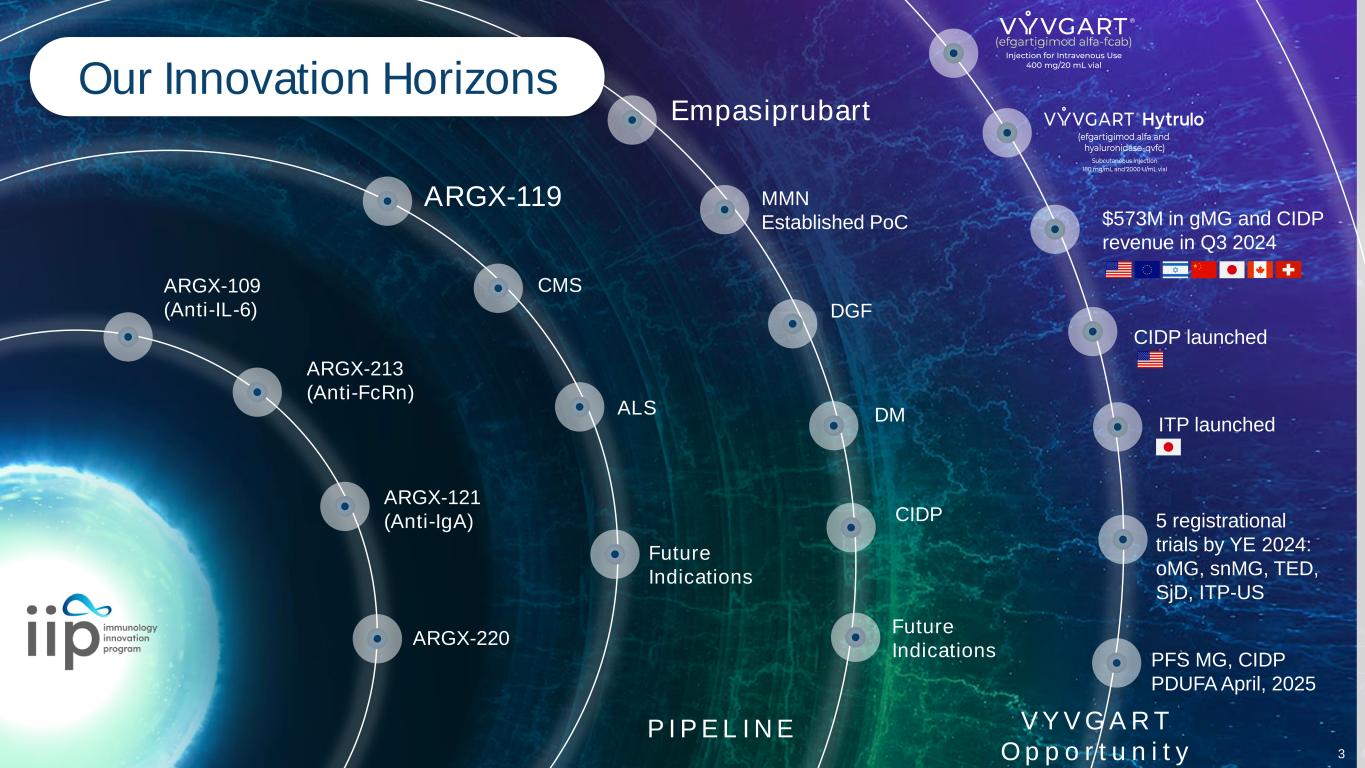

5 registrational trials by YE 2024: oMG, snMG, TED, SjD, ITP-US Empasiprubart ARGX-119 CIDP launched $573M in gMG and CIDP revenue in Q3 2024 ARGX-109 (Anti-IL-6) ARGX-213 (Anti-FcRn) ARGX-220 ARGX-121 (Anti-IgA) Our Innovation Horizons ITP launched CMS ALS P I P E L I N E MMN Established PoC DGF DM CIDP V Y V G AR T O p p o r t u n i t y Future Indications Future Indications PFS MG, CIDP PDUFA April, 2025 3

Reaching Patients ‘We have a renewed lease on life’– VYVGART Hytrulo patient 4

Delivering Innovation Across Our Assets MG 0 10 20 30 40 50 60 70 80 90 100 ≥1 ≥2 ≥3 ≥4 Functional Ability (aINCAT) Efgartigimod PH20 SC P e rc e n t o f P a rt ic ip a n ts Driving impact with VYVGART Rapid, deep, sustained responses achieved in patients CIDP Consistent responses and regain of function 80.9% 42.7% 28.2% 11.8% MMN ARDA POC data Advancing Empasiprubart CMS Ph1b ALS Ph2a ARGX-119 Estimated 8,000 patient years of safety follow-up between clinical trial and real-world experience 54% 42% MSE1 TAPERED TO ≤ 5 MG STEROIDS2 25% TAPERED TO 0 MG STEROIDS2 1.ADAPT/ADAPT+ combined real world and clinical data 2. IQVIA Claims analysis: 1-year post efgartigimod initiation 5

USUS US Executing Across the Business to Advance Our Vision Geographic Expansion Broaden Immunology Pipeline Pioneering FcRn Class of Medicines Reaching More Patients ARGX-119 POC studies in CMS and ALS started Empasiprubart to start Phase 3 study in MMN POC in Sjogren’s Disease Sn gMG and oMG Phase 3 trials started Go/No Go Decisions for Myositis and Bullous Pemphigoid CIDP launched July 2024 Earlier lines of treatment PFS submission in US and EU CIDP submission in China, JP and EU VYVGART approved in Switzerland ITP launched in Japan 6

Product Net Sales: Q3 of $573 million 21 50 100 150 200 250 300 350 400 450 500 550 600 0 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 75 131 173 218 269 329 374 398 478 573 Q1 2023 China ROW Japan US 7 7 2 14 11 1 6 11 12 26 24 31 36 46 2 6 8 10 13 15 17 18 20 24 21 73 124 159 197 244 280 326 347 407 492 $’m Q3 2024: growth of 20% vs Q2 2024 *All growth is operational and excludes the impact of FX (in millions of $) Q3 2024 Q2 2024 QoQ % Growth * US 492 407 21% Japan 24 20 20% ROW 46 36 28% China supply 11 14 (21)% Total 573 478 20% Total excluding China 562 464 21% (in millions of $) Q3 2024 Q3 2023 Growth % * US 492 280 76% Japan 24 15 49% ROW 46 26 76% China supply 11 7 44% Total 573 329 74% Q3 2024: growth of 74% vs Q3 2023Product Net Sales by Quarter *Net sales growth % excludes the impact of fx. 7

Ended third quarter 2024 with cash of $3.4B Q3 2024 Financial Summary 2024 Financial Guidance ($B) 2024 Combined R&D and SG&A expenses ~ 2.0 Cash reflects cash, cash equivalents and current financial assets CashNine months ended September 30 2024 2023 Three months ended September 30 2024 2023 Summary P/L Sustainable Company. Top Priority Remains Investing in our Innovation Mission Product net sales 573 329 1,449 816 Collaboration revenue - 1 3 3 Other operating income 16 10 39 31 Total operating income 589 340 1,491 851 Cost of sales (59) (36) (155) (78) Research and development expenses (236) (192) (686) (553) Selling, general and administrative expenses (278) (192) (769) (503) Loss from investment in joint venture (2) (1) (5) (3) Total operating expenses (575) (420) (1,616) (1,137) Operating profit/(loss) 14 (81) (125) (286) Financial income 41 30 118 67 Financial expense (1) - (2) (1) Exchange gains/(losses) 34 (33) 7 (23) Profit/(Loss) for the period before taxes 88 (83) (1) (243) Income tax benefit/(expense) 3 11 60 47 Profit/(Loss) for the period 91 (73) 59 (196) 8

Innovation Has No Meaning Unless It Reaches Patients & Provides Real Benefit 9

Executing on VYVGART Hytrulo Launch Priorities in CIDP Broad Access Early Enthusiasm Delivering Impact Payors Physicians Patients >300 patients on treatment* 85-90% of patients coming from IVIg Favorable policies 54% commercial lives 72% overlap MG and CIDP physicians 25% new Hytrulo prescribers *Patients on treatment as of end of 3Q 2024 10

US Driving Patient Growth with VYVGART P A T I E N T G R O W T H E A R L I E R L I N E P A T I E N T S P R E S C R I B E R E X P A N S I O N P A T I E N T E X P E R I E N C E Expanding VYVGART Hytrulo share 60% Hytrulo patients new to VYVGART YTD Breadth of prescribers >3k Total VYVGART prescribers US patients ~60% New VYVGART patients coming from orals Expanding patient reach PFS PDUFA April 10th 11 1. VYVGART and VYGART Hytrulo 2. VYVGART Hytrulo only 1 12

D E C I S I O N S P E N D I N G F O R 2 0 2 4 Reaching Patients Across the Globe gMG Australia Saudi Arabia EU • Reimbursement complete in France, Belgium and Luxembourg • Approved in Switzerland US • CIDP launched with >300 patients on treatment as of end of 3Q Japan • Early positive indicators of ITP launch China • Continued expansion with VYVGART and VYVGART Hytrulo D E C I S I O N S P E N D I N G F O R 2 0 2 5 CIDP China Europe Japan VYVGART Hytrulo is marketed as VYVGART-SC in Europe and VYVDURA® in Japan 12

Myositis Sjögren’s oMG snMG TED gMG CIDP ITP DM MMN CMS BP CIDP 50K Wave 2 (2026-2027) Wave 3 (2028-2030)Wave 1: TODAY 10K Opportunities Ahead Strengthen Our Leadership VYVGART Empasiprubart ARGX-119 13

We are On a Bold Mission Humility Innovation Excellence Co-Creation Empowerment 14