Long-term debt refinancing

During the year ended December 31, 2021, we completed a series of transactions (collectively, the “2021 Refinancing Transactions”) to refinance our then-existing debt. The 2021 Refinancing Transactions included the following:

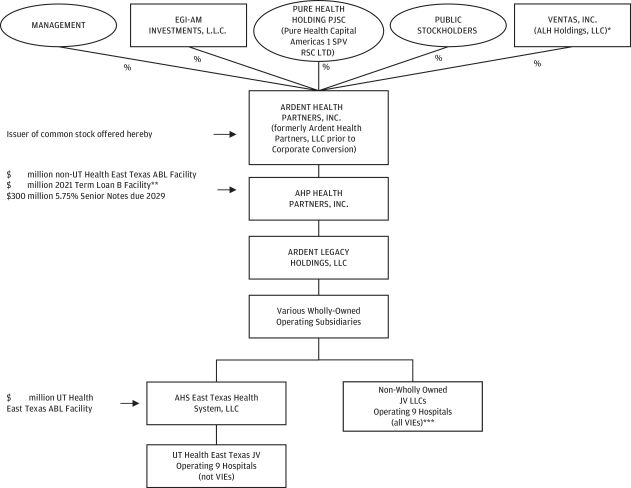

On July 8, 2021, we completed the issuance of $300.0 million aggregate principal amount of 5.750% Senior Notes due 2029 (the “5.75% Senior Notes”), which will mature on July 15, 2029, pursuant to an indenture, dated as of July 8, 2021. Concurrent with the issuance of our 5.75% Senior Notes, we entered into an amended and restated agreement for our $225.0 million secured asset-based revolving credit facility (the “2021 ABL Credit Agreement”), which consists of a $225.0 million senior secured asset-based revolving credit facility with a five-year maturity. The terms of the amended and restated agreement for our revolving credit facility are substantially similar to those applicable to the prior revolving credit facility, except for, among other things, the maturity date, which is July 8, 2026, and the applicable interest rate margins. See “—Senior Secured Credit Facilities.”

On July 15, 2021, we used net proceeds from the issuance of the 5.75% Senior Notes, along with cash on hand, to redeem all $475.0 million aggregate principal amount of our 9.75% Senior Notes due 2026 (“9.75% Senior Notes”) at a redemption price equal to (a) 107.313% of the principal amount of the 9.75% Senior Notes plus (b) accrued and unpaid interest to, but excluding, the redemption date of July 15, 2021.

On August 24, 2021, we entered into an amended and restated agreement to refinance our existing senior secured term loan facility (“2018 Term Loan B Facility”), which had $797.4 million principal outstanding, with a $900.0 million principal outstanding senior secured term loan facility (“2021 Term Loan B Facility”). The terms of the amended and restated credit agreement are substantially similar to those applicable to the 2018 Term Loan B Facility, except for, among other things, the maturity date, which is seven years from the closing date of the 2021 Term Loan B Facility, and the applicable interest rate margins. See “—Senior Secured Credit Facilities.”

On April 21, 2023 and June 8, 2023, the Company amended its 2021 ABL Credit Agreement and agreement related to the 2021 Term Loan B Facility, respectively, to transition the reference interest rates from LIBOR to SOFR. We intend to use the net proceeds of this offering to repay $ million of our outstanding borrowings under the 2021 Term Loan B Facility. See “Use of proceeds.”

Key factors impacting our results of operations

Ongoing impact of COVID-19

As a provider of healthcare services, we have been, and may continue to be, affected by the public health and economic effects of COVID-19. The impact of COVID-19 on our operations, cash flows and financial position was driven by many factors, most of which were beyond our control and ability to forecast. Such factors included, but were not limited to, the duration and severity of COVID-19 related impacts, the spread of potentially more contagious and/or virulent forms of the virus, the volume of canceled or rescheduled procedures and the volume and acuity of COVID-19 patients cared for across our hospitals and facilities, and the demand for clinical personnel and its corresponding impact on labor costs and hospital availability. During 2021 and 2022, the COVID-19 pandemic adversely affected our operations, as well as our patients, communities and employees, to varying degrees. As described in greater detail below within this section, ongoing waves of COVID-19 infections, changes in COVID-related patient acuity and broad economic factors resulting from COVID-19 have affected, and may in the future continue to affect, our patient volumes, service mix, revenue mix, operating expenses and net operating revenues.

On May 11, 2023, the public health emergency, which began January 31, 2020, expired. With the expiration of the public health emergency, there is no assurance or expectation that we will continue to receive or remain

83