Robinhood Financial LLC - Held NMS Stocks and Options Order Routing Public Report Generated on Mon Jul 22 2024 12:08:12 GMT-0400 (Eastern Daylight Time) 2nd Quarter, 2024 April 2024 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 14.43 40.67 33.92 10.98 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 60.86 53.27 61.76 61.39 65.89 216,282.60 180.9590 252,844.63 113.1915 118,387.27 145.1230 194,403.33 76.7606 CITADEL SECURITIES LLC 16.92 16.17 15.39 18.27 19.36 186,364.42 127.0811 200,257.22 79.7655 99,713.75 102.0482 150,376.52 74.2439 Jane Street Capital 7.34 6.70 6.89 10.28 0.72 89,545.76 120.6100 96,907.81 73.9185 52,764.38 74.1453 2,251.66 63.1790 G1 Execution Services, LLC 7.31 13.02 8.74 5.27 0.81 81,894.50 146.4891 46,213.10 72.1427 12,155.30 60.1196 1,958.02 82.3386 Two Sigma Securities, LLC 7.07 9.86 6.63 4.41 13.21 56,657.20 129.7233 29,113.40 54.7085 8,327.21 67.6924 5,133.42 103.3568 Material Aspects: Virtu Americas, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. CITADEL SECURITIES LLC:

Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. G1 Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Two Sigma Securities, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. April 2024 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 12.15 38.81 44.36 4.68 Venues

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 29.75 23.94 28.42 31.81 36.24 519,026.87 16.9628 596,646.47 8.6704 299,872.98 8.6950 210,604.38 19.8602 CITADEL SECURITIES LLC 29.74 26.12 27.39 32.26 34.62 964,592.35 21.0049 1,106,474.09 10.3993 515,856.18 10.8890 343,175.20 26.3505 Jane Street Capital 25.49 21.98 25.17 28.89 5.06 843,484.87 17.5629 927,411.91 8.4739 460,165.66 8.8687 26,332.45 15.0553 Two Sigma Securities, LLC 10.21 18.64 12.65 4.44 22.92 396,765.90 15.3877 234,446.23 8.1007 46,750.33 11.6223 35,920.94 15.6339 Material Aspects: Virtu Americas, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Two Sigma Securities, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above.

April 2024 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.01 32.62 50.87 16.51 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 41.28 36.39 43.69 38.60 44.79 635.89 38.6794 10,217,787.66 31.6820 6,494,351.76 39.1749 2,004,777.93 33.8314 Wolverine Execution Services, LLC 20.23 19.09 20.71 19.21 22.41 361.49 91.0554 4,416,010.64 36.4066 3,217,485.50 47.7564 1,150,845.46 42.6804 Global Execution Brokers, LP 15.81 22.55 13.26 16.69 18.10 486.20 84.2634 3,427,867.90 39.9168 3,107,530.80 58.1057 919,436.76 44.3261 Dash/IMC Financial Markets 11.74 10.24 10.25 12.13 13.45 172.91 84.7598 3,180,451.37 36.1580 2,494,829.70 49.4604 891,011.66 46.0799 Morgan Stanley & Co., LLC 10.95 11.73 12.09 13.37 1.25 205.46 68.2591 3,417,426.30 37.6376 2,747,887.60 50.5851 50,446.51 39.1170 Material Aspects: CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Wolverine Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Global Execution Brokers, LP: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Dash/IMC Financial Markets: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Morgan Stanley & Co., LLC:

Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. May 2024 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 15.50 38.84 35.64 10.02 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 53.93 43.24 52.32 57.75 63.16 196,731.48 185.3063 244,241.83 121.1833 93,839.31 118.2212 220,707.95 82.4219 CITADEL SECURITIES LLC 14.94 13.08 13.85 16.21 17.53 150,378.90 112.3730 169,520.69 75.8416 73,795.10 79.0403 165,413.02 69.1981 G1 Execution Services, LLC 14.09 24.84 17.44 9.24 1.67 163,303.18 142.6796 97,497.98 69.3707 22,445.05 54.4192 3,266.20 85.5082 Two Sigma Securities, LLC 8.34 11.18 8.04 5.03 16.92 57,035.27 116.6483 31,832.18 51.1701 7,360.78 36.2341 5,417.87 82.3470 Jane Street Capital 8.17 6.66 7.73 11.40 0.69 76,232.13 103.1120 89,512.95 68.4275 43,468.34 56.0657 2,255.42 77.7241 Material Aspects: Virtu Americas, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. CITADEL SECURITIES LLC:

Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. G1 Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Two Sigma Securities, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. May 2024 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 12.92 42.89 39.85 4.34 Venues

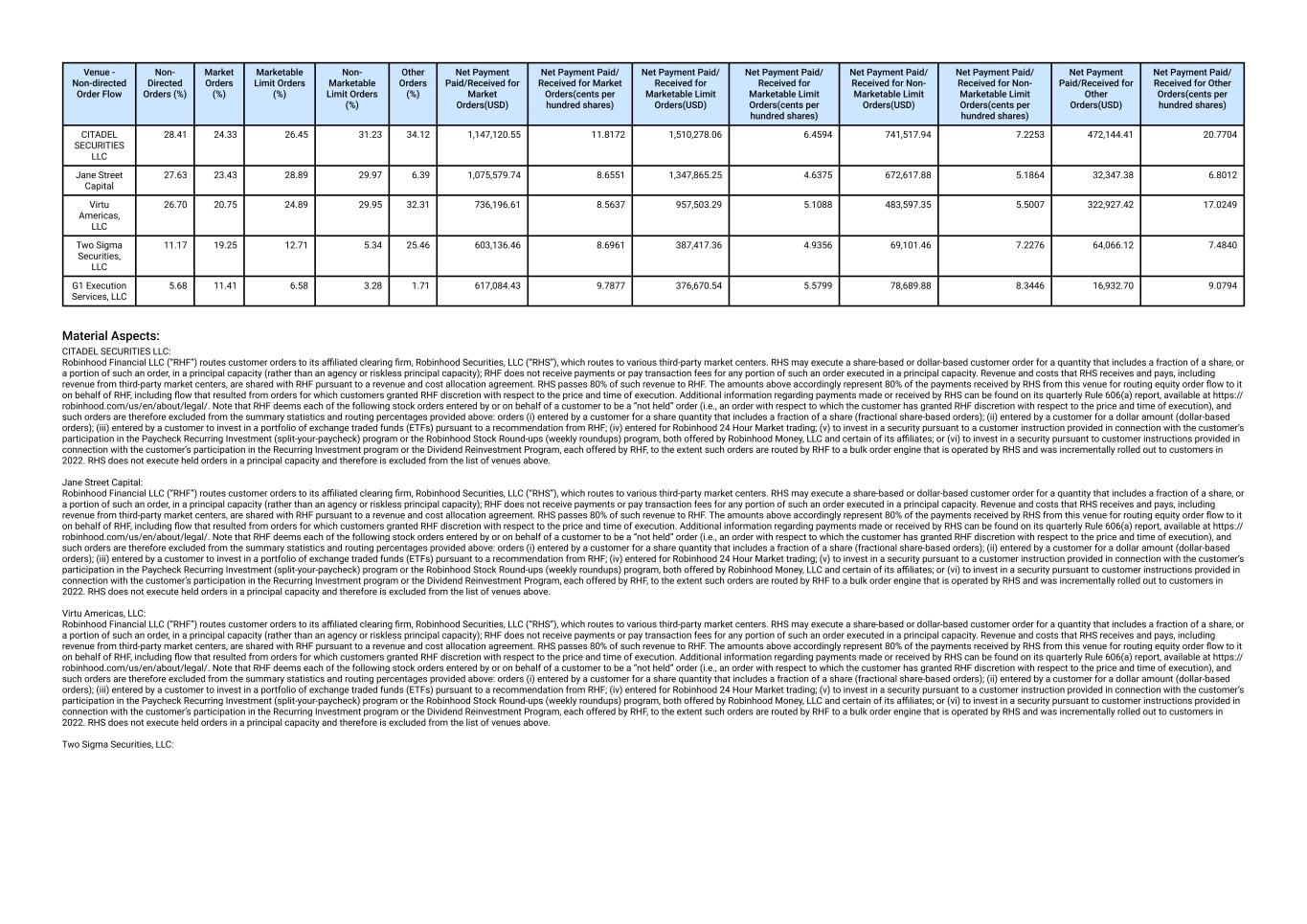

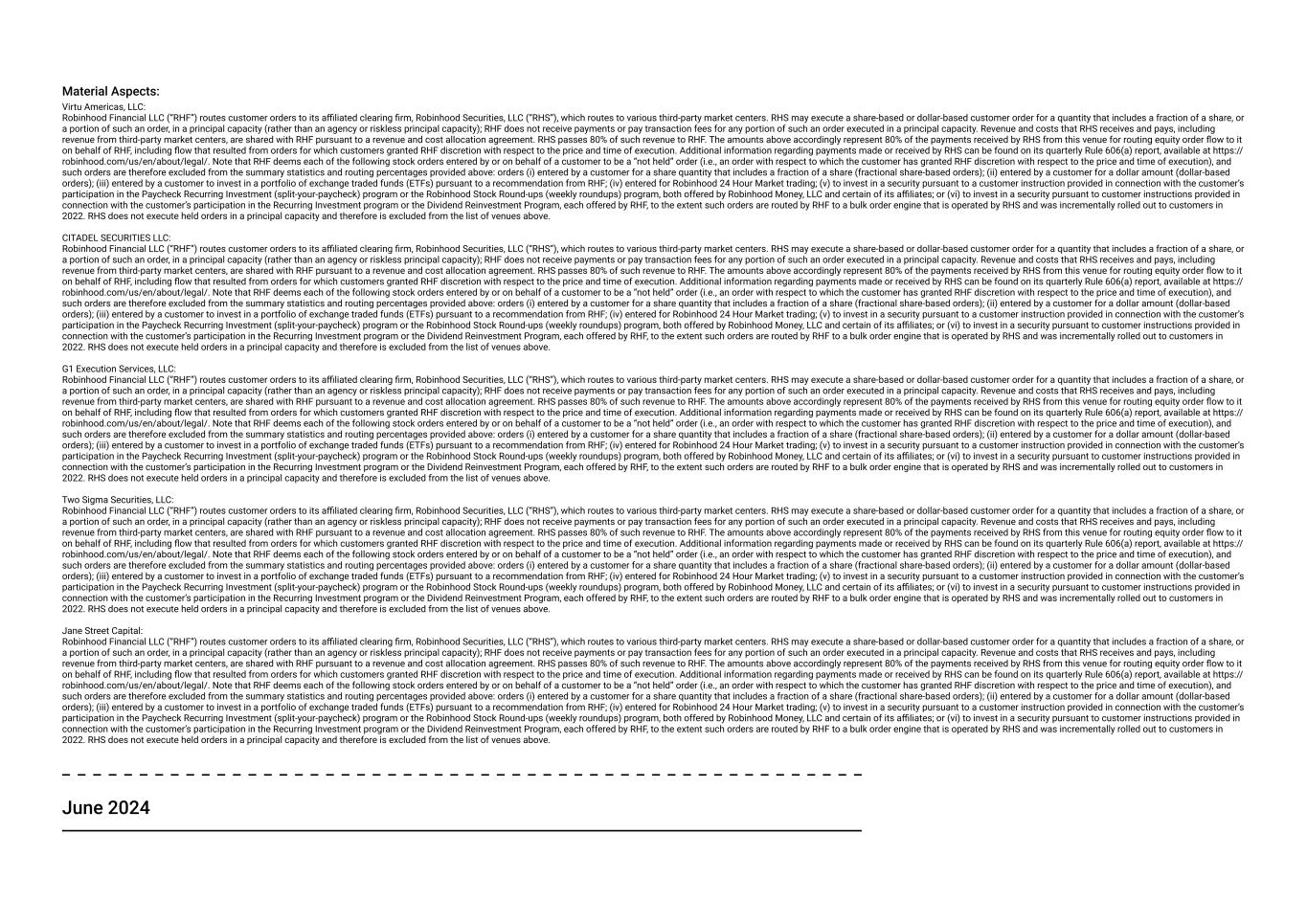

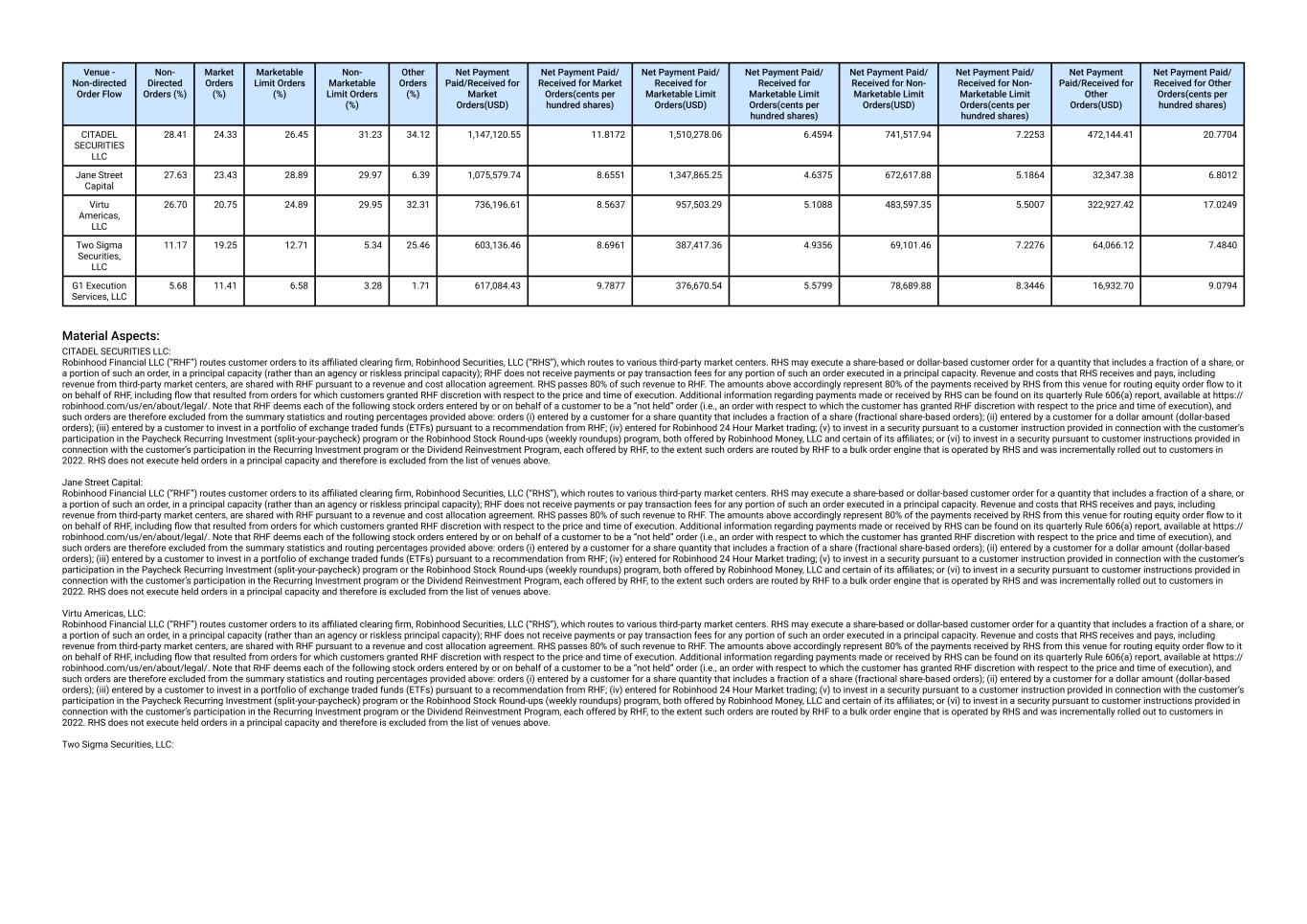

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 28.41 24.33 26.45 31.23 34.12 1,147,120.55 11.8172 1,510,278.06 6.4594 741,517.94 7.2253 472,144.41 20.7704 Jane Street Capital 27.63 23.43 28.89 29.97 6.39 1,075,579.74 8.6551 1,347,865.25 4.6375 672,617.88 5.1864 32,347.38 6.8012 Virtu Americas, LLC 26.70 20.75 24.89 29.95 32.31 736,196.61 8.5637 957,503.29 5.1088 483,597.35 5.5007 322,927.42 17.0249 Two Sigma Securities, LLC 11.17 19.25 12.71 5.34 25.46 603,136.46 8.6961 387,417.36 4.9356 69,101.46 7.2276 64,066.12 7.4840 G1 Execution Services, LLC 5.68 11.41 6.58 3.28 1.71 617,084.43 9.7877 376,670.54 5.5799 78,689.88 8.3446 16,932.70 9.0794 Material Aspects: CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Jane Street Capital: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Virtu Americas, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. Two Sigma Securities, LLC:

Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. G1 Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. RHS may execute a share-based or dollar-based customer order for a quantity that includes a fraction of a share, or a portion of such an order, in a principal capacity (rather than an agency or riskless principal capacity); RHF does not receive payments or pay transaction fees for any portion of such an order executed in a principal capacity. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing equity order flow to it on behalf of RHF, including flow that resulted from orders for which customers granted RHF discretion with respect to the price and time of execution. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at https:// robinhood.com/us/en/about/legal/. Note that RHF deems each of the following stock orders entered by or on behalf of a customer to be a “not held” order (i.e., an order with respect to which the customer has granted RHF discretion with respect to the price and time of execution), and such orders are therefore excluded from the summary statistics and routing percentages provided above: orders (i) entered by a customer for a share quantity that includes a fraction of a share (fractional share-based orders); (ii) entered by a customer for a dollar amount (dollar-based orders); (iii) entered by a customer to invest in a portfolio of exchange traded funds (ETFs) pursuant to a recommendation from RHF; (iv) entered for Robinhood 24 Hour Market trading; (v) to invest in a security pursuant to a customer instruction provided in connection with the customer’s participation in the Paycheck Recurring Investment (split-your-paycheck) program or the Robinhood Stock Round-ups (weekly roundups) program, both offered by Robinhood Money, LLC and certain of its affiliates; or (vi) to invest in a security pursuant to customer instructions provided in connection with the customer’s participation in the Recurring Investment program or the Dividend Reinvestment Program, each offered by RHF, to the extent such orders are routed by RHF to a bulk order engine that is operated by RHS and was incrementally rolled out to customers in 2022. RHS does not execute held orders in a principal capacity and therefore is excluded from the list of venues above. May 2024 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.02 32.52 53.18 14.27 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 35.06 25.97 40.26 30.89 38.74 3,267.54 46.0801 10,366,691.27 30.6294 6,128,392.63 38.8758 1,934,185.22 34.1665 Dash/IMC Financial Markets 23.19 26.49 20.61 24.43 24.42 2,161.58 58.5001 4,447,832.42 37.5839 3,871,220.34 50.8405 1,175,185.98 48.9889 Wolverine Execution Services, LLC 18.22 17.75 17.14 18.09 21.18 2,067.22 59.8674 4,035,057.58 35.7414 3,053,995.30 48.8048 1,088,876.01 44.4049 Global Execution Brokers, LP 12.49 15.06 10.51 13.20 14.37 1,744.06 49.9731 3,051,320.08 37.6296 2,697,362.86 54.2036 922,692.91 45.3110 Morgan Stanley & Co., LLC 11.04 14.73 11.48 13.39 1.29 1,649.52 52.0025 3,686,865.02 34.9483 2,983,246.04 47.4934 50,995.07 38.4236

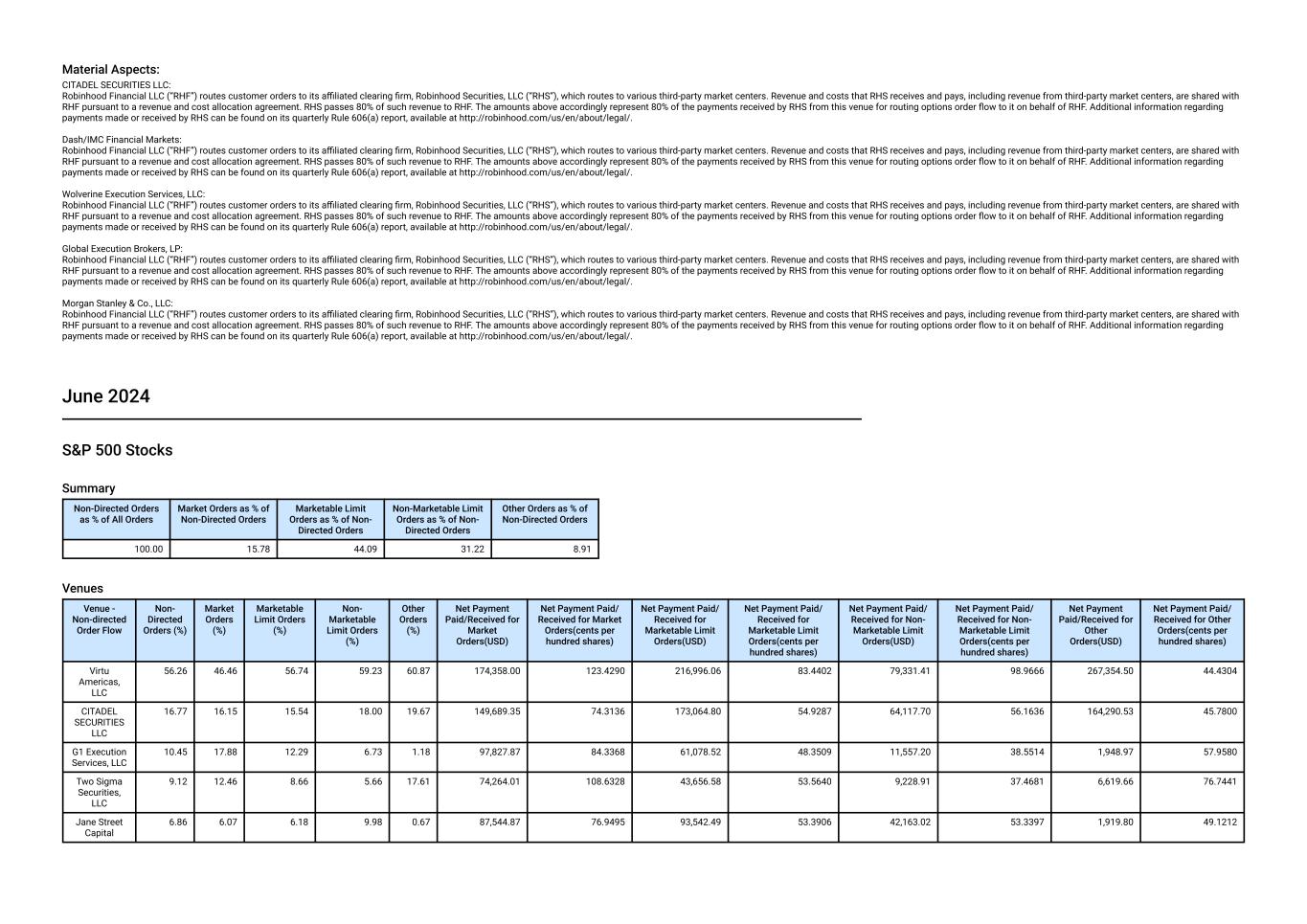

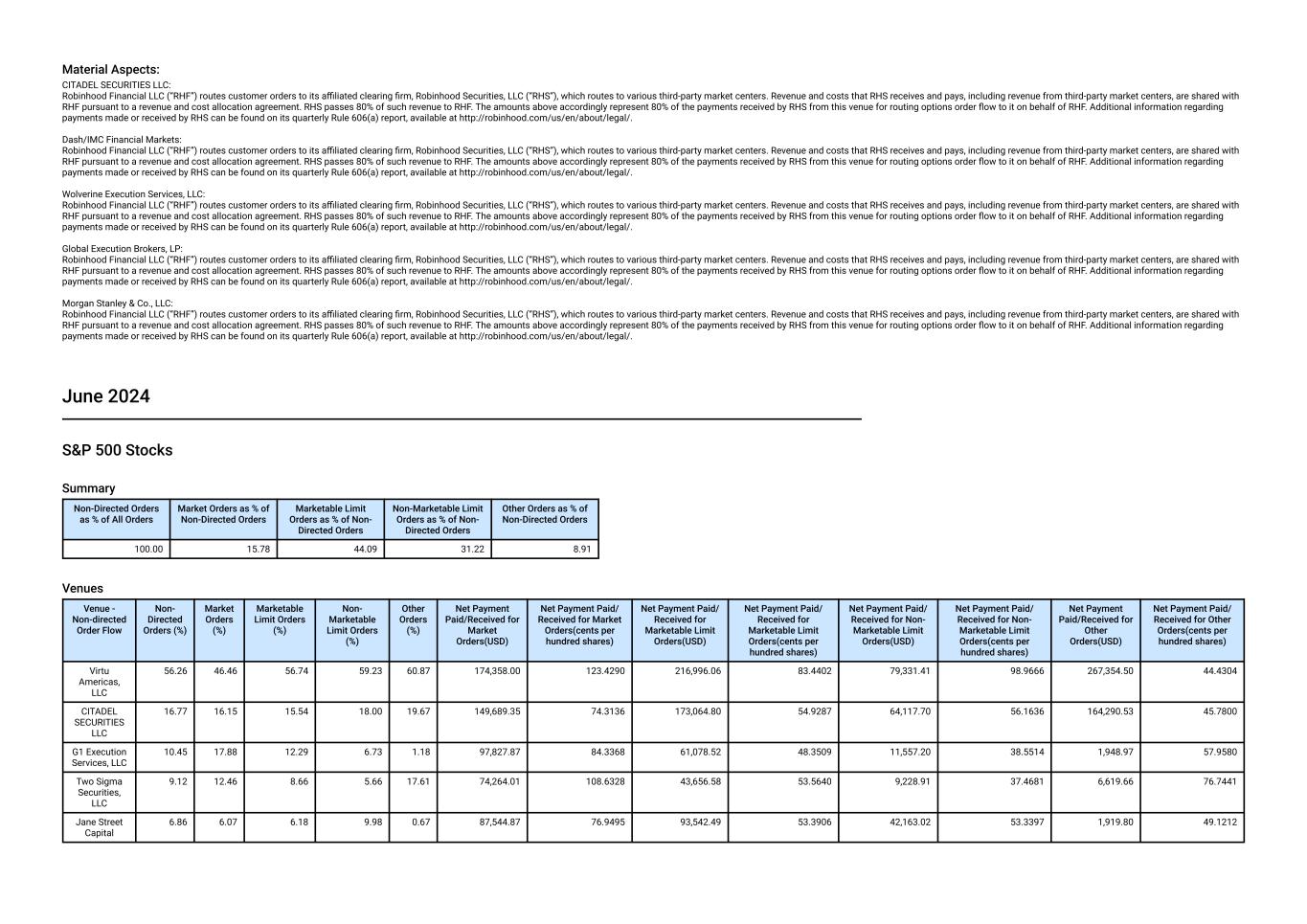

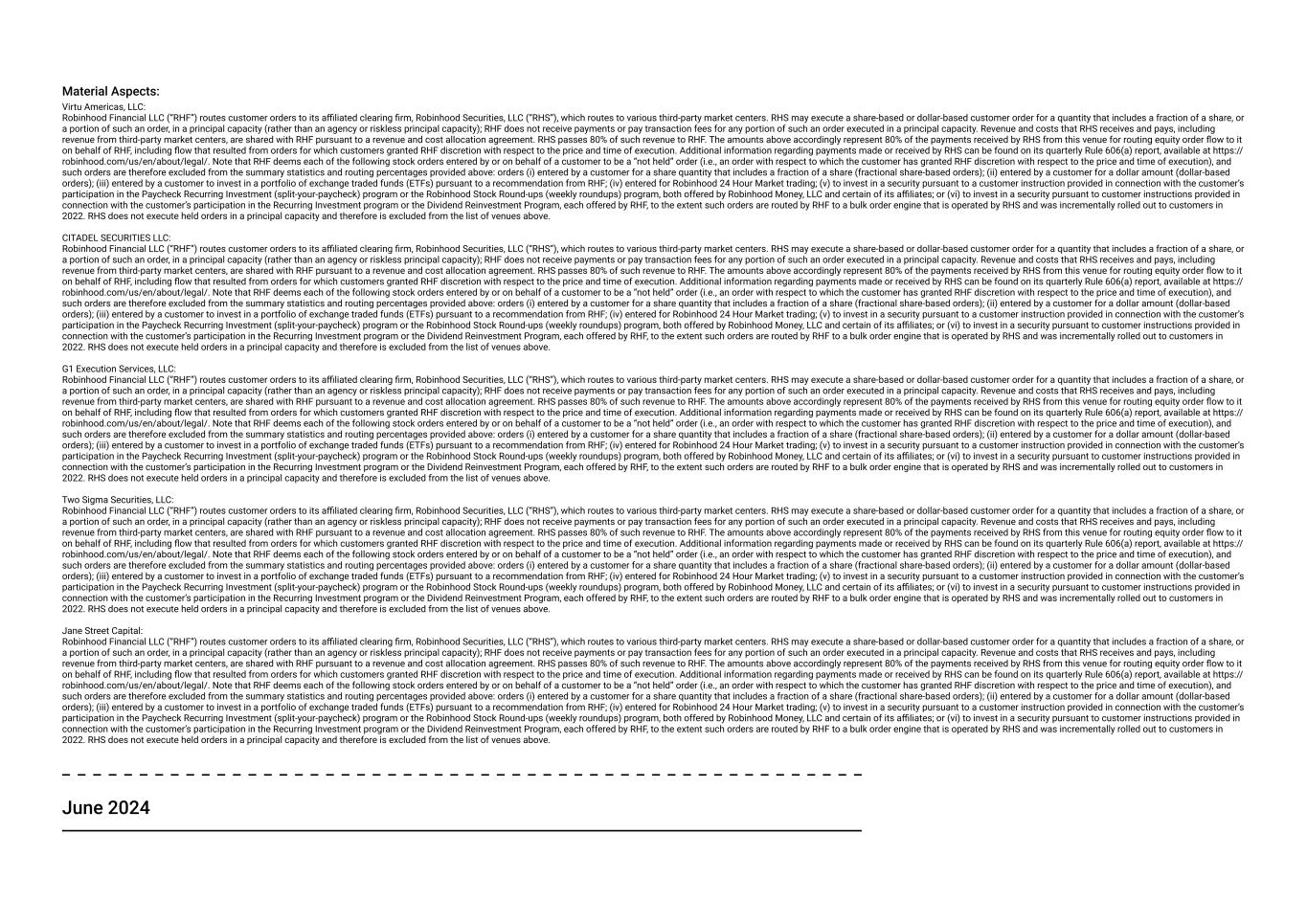

Material Aspects: CITADEL SECURITIES LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Dash/IMC Financial Markets: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Wolverine Execution Services, LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Global Execution Brokers, LP: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. Morgan Stanley & Co., LLC: Robinhood Financial LLC (“RHF”) routes customer orders to its affiliated clearing firm, Robinhood Securities, LLC (“RHS”), which routes to various third-party market centers. Revenue and costs that RHS receives and pays, including revenue from third-party market centers, are shared with RHF pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above accordingly represent 80% of the payments received by RHS from this venue for routing options order flow to it on behalf of RHF. Additional information regarding payments made or received by RHS can be found on its quarterly Rule 606(a) report, available at http://robinhood.com/us/en/about/legal/. June 2024 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 15.78 44.09 31.22 8.91 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 56.26 46.46 56.74 59.23 60.87 174,358.00 123.4290 216,996.06 83.4402 79,331.41 98.9666 267,354.50 44.4304 CITADEL SECURITIES LLC 16.77 16.15 15.54 18.00 19.67 149,689.35 74.3136 173,064.80 54.9287 64,117.70 56.1636 164,290.53 45.7800 G1 Execution Services, LLC 10.45 17.88 12.29 6.73 1.18 97,827.87 84.3368 61,078.52 48.3509 11,557.20 38.5514 1,948.97 57.9580 Two Sigma Securities, LLC 9.12 12.46 8.66 5.66 17.61 74,264.01 108.6328 43,656.58 53.5640 9,228.91 37.4681 6,619.66 76.7441 Jane Street Capital 6.86 6.07 6.18 9.98 0.67 87,544.87 76.9495 93,542.49 53.3906 42,163.02 53.3397 1,919.80 49.1212