UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-23575

KKR Real Estate Select Trust Inc.

(Exact name of registrant as specified in charter)

30 Hudson Yards, New York, NY 10001

(Address of principal executive offices) (Zip code)

Lori Hoffman, Esq.

Megan Gaul

KKR Registered Advisor LLC

30 Hudson Yards

New York, NY 10001

(Name and address of agent for service)

Copies to:

Rajib Chanda, Esq.

Benjamin C. Wells, Esq.

Simpson Thacher & Bartlett LLP

900 G Street, N.W.

Washington, DC 20001

Registrant’s telephone number, including area code: (212) 750-8300

Date of fiscal year end: December 31

Date of reporting period: June 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange

Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| | (a) | The Report to Shareholders is attached herewith. |

KKR Real Estate Select Trust Inc.

Semi-Annual Report

June 30, 2024 (Unaudited)

Table of Contents

KKR Real Estate Select Trust Inc. (the “Fund”) publicly files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-PORT, and the reports for the last month in each quarter are made publicly available on the Commission’s website at http://www.sec.gov.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Fund voted proxies relating to portfolio securities during the most recent period ended June 30, will be available (i) without charge, upon request, by calling 855-844-8655; and (ii) on the Commission’s website at http://www.sec.gov.

INFORMATION ABOUT THE FUND’S DIRECTORS

The Fund’s Statement of Additional Information includes information about the Fund’s Directors and is available without charge, upon request, by calling 855-844-8655 and by visiting the Commission’s website at www.sec.gov.

Dear KREST Shareholders,

We appreciate your continued trust and support of KKR Real Estate Select Trust Inc. (“KREST” or the “Fund”). We established KREST with the goal of creating an investment solution that provides access to the potential benefits of high quality, income-oriented private real estate equity and credit in a single fund. KREST’s flexible strategy and balanced portfolio construction are designed to seek to generate long-term performance and consistent, tax-advantaged income through a wide range of market environments.

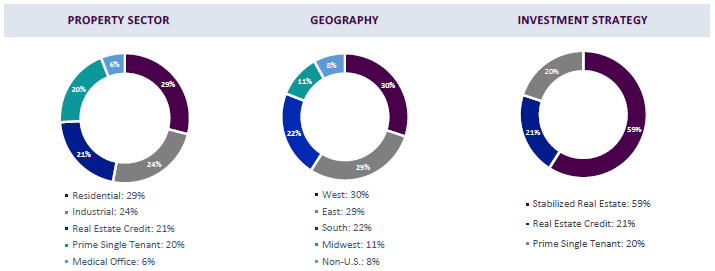

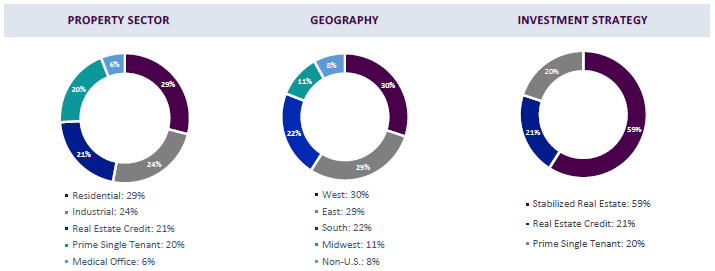

Over the first six months of 2024, real estate markets continued to evolve. It has now been more than two years since interest rates started to rise, and dislocation resulting from the impact of higher interest rates and higher inflation continues to evolve. The commodity office sector is undergoing a major secular shift while other sectors have undergone a cyclical reset in values. Since real estate values peaked in April 2022, the current, resulting drawdown has been the second largest decline in U.S. property values in the last 80 years, after only the global financial crisis.(1) Within KREST, the Fund’s independent valuation agent has widened the exit capitalization rates for KREST’s industrial and residential portfolio, which serve as key inputs for mark-to-market valuations, by more than 32% since property values peaked in April 2022.(2) The growing cash flows from KREST’s real estate equity portfolio and our 21% allocation to real estate credit have offset some of the performance impact from these macro-driven adjustments in property valuation assumptions. This contributed to KREST’s year-to-date 2024 and inception-to-date performance of -2.26% and 7.14% (Class I, annualized for ITD)(3) respectively, and helped support KREST’s dividend, currently at a 6.07% annualized net distribution rate (Class I).(4)

As we look ahead, we believe the impacts of moving to today’s “higher for longer” macro environment for both rates and inflation have resulted in a new market cycle. In our view, the new cycle is supported by strong medium- and long-term fundamentals, as the demand themes for our highest conviction sectors remain robust. To that end, the Fund executed an industrial renewal lease with a major global logistics tenant at a 45% increase over the prior rent in March. At the same time, one of the most notable follow-on effects of higher rates and higher inflation has been a material decline in new supply given higher costs of labor, materials and construction financing. However, one of the lessons of the current down-cycle has been that performance in the current down-cycle has varied significantly based on property type, region, and portfolio construction. We expect dispersion to continue in the recovery. While the early periods of new investing cycles have historically led to some of the most attractive returns for investors, as global transaction activity accelerates, we think that successful investors will need to rely upon disciplined deployment underpinned by strong theme identification and investing across geographies and the capital stack.

We believe KREST’s portfolio and our flexible strategy are well-positioned for the current environment. We have emphasized real estate credit and what we consider “needs-based” sectors in high-barrier-to-entry markets, with a focus on industrial, residential, medical office, and triple-net leased trophy real estate. KREST’s portfolio construction is also supported by the fact that the Fund’s property-level financing is 100% fixed or hedged with an average effective interest rate of 3.9% and five years of remaining loan term. We also do not have exposure to commodity office in our portfolio – equity or credit – and used spread tightening in the first quarter as an opportunity to exit the trophy office exposure in our real estate credit portfolio. Importantly, we have significant liquidity of 33% of Net Asset Value (“NAV”) as of June 30, 2024.(5) This should enable the Fund to continue providing a level of liquidity to investors of up to 5% of NAV through quarterly repurchases, while also positioning the Fund to capitalize on the attractive investment opportunities that may arise in the upcoming months and quarters.(6)

Shifting market dynamics coupled with the NAV support of the KREST Shareholder Priority Plan(6) over the next three years should, in our view, provide KREST shareholders with a unique ability to participate in an expected real estate recovery with a buffer against share price decline. The KREST Shareholder Priority Plan, which we announced on June 4, 2024, supports up to a $27 per share price on June 1, 2027. This is achieved through a commitment by KKR Alternative Assets LLC (“KAA”), an affiliate of the Fund’s Adviser, to continue to hold approximately 7.7 million KAA-owned KREST shares (~$200 million based on the June 30, 2024 share price) and, to the extent necessary, contribute such shares to the Fund. If the KREST NAV is less than $27 per share on June 1, 2027, contributing KAA-owned KREST shares on June 1, 2027 would reduce the total KREST share count in order to increase the NAV per share up to $27. KAA also invested $50 million in new capital into KREST at the June 4, 2024 NAV, reflecting our conviction in KREST’s strategy, portfolio and the attractiveness of the current entry point. Importantly, KREST shareholders retain full upside above a $27 share price, and there are no changes to KREST’s existing subscription or redemption terms in connection with the KREST Shareholder Priority Plan. We have appreciated the positive early feedback on the KREST Shareholder Priority Plan and look forward to continuing these conversations.

1

We appreciate your continued trust and are excited to build upon KREST’s results as we expand our portfolio and seek to continue to deliver high-quality and resilient, tax-efficient income.

Sincerely,

| | | | |

| |  | |  |

| | |

| Ralph Rosenberg | | Matt Salem | | Julia Butler |

| Chairman of the Board | | Vice Chairman of the Board | | Chief Executive Officer & President |

| | | | | | | | | | | | | | | | |

|

| KREST Performance Summary as of June 30, 20243 |

| Share Class | | Net Distribution

Rate4 | | 1-Month Net

Total Return | | 3-Month Net

Total Return | | YTD ‘24 Net

Total Return | | 3-Yr. Net

Total Return

(annualized) | | ITD Net

Total Return

(annualized) | | NAV per Share | | Inception Date |

Class I | | 6.07% | | 0.74% | | -0.24% | | -2.26% | | 4.06% | | 7.14% | | $25.62 | | 7/2/2020 |

Class U (No Sales Load) | | 5.22% | | 0.63% | | -0.45% | | -2.71% | | 3.16% | | 3.16% | | $25.61 | | 6/30/2021 |

Class D7 | | 5.82% | | 0.68% | | -0.30% | | -2.41% | | - | | -2.80% | | $25.61 | | 3/4/2022 |

Class S (No Sales Load) | | 5.22% | | 0.67% | | -0.45% | | -2.67% | | - | | -6.60% | | $25.62 | | 9/9/2022 |

| | | | | | | | |

|

| KREST Portfolio Summary as of June 30, 20243 |

Fund Statistics | | $1.3 billion Total Assets (GAAP) | | $1.3 billion Net Asset Value | | 0% Fund-Level Gross Leverage |

| Real Estate Metrics | | $3.3 billion Gross Property Value (inc. unconsolidated subsidiaries) | | 82 Total Properties | | 98% Occupancy Rate | | 53% Combined Net Leverage (inc. unconsolidated subsidiaries) |

2

Notes:

All figures are approximate and as of June 30, 2024, unless otherwise indicated. The terms “we”, “us” and “our” refer to KREST with reference to portfolio and performance data. In all other instances, including with respect to current and forward-looking views and opinions of the market and KREST’s portfolio and performance positioning, as well as the experience of KREST’s management team, these terms refer to KREST’s adviser, KKR Registered Advisor LLC, which is part of the real estate group of Kohlberg Kravis Roberts & Co. L.P. (together with its affiliates, “KKR”), a leading global investment firm.

Certain information contained in this material constitutes “forward-looking statements” within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by the use of forward-looking terminology, such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “identified,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates”, “confident,” “conviction” or the negative versions of these words or other comparable words thereof. These may include KREST’s financial estimates and their underlying assumptions, statements about plans, objectives and expectations with respect to future operations, statements with respect to acquisitions, statements regarding future performance, and statements regarding identified but not yet closed acquisitions. Such forward-looking statements are inherently uncertain and there are or may be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. KREST believes these factors also include but are not limited to those described under the section entitled “Risk Factors” in its prospectus and most recent annual report, and any such updated factors included in its periodic filings with the Securities and Exchange Commission (the “SEC”), which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in the annual report (or KREST’s prospectus and other filings). Except as otherwise required by federal securities laws, KREST undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.

| 1. | Based on KKR GMAA Analysis. Quarterly data sourced from Federal Reserve Board Commercial Property Prices Index for 1951-1997 and Green Street Advisors from 1998 onwards. Average of all real estate downcycles from 1953 onward, based on quarterly peak-to-trough. Green Street CPPI valuation peaked in April 2022. Downcycles are defined as periods where real estate values declined. |

| 2. | Reflects changes in the weighted average exit capitalization rates for industrial and residential properties, as determined by the Fund’s independent valuation agent, Altus Group, between April 30, 2022 and June 30, 2024. Please refer to the KREST Supplemental Report for additional information about the metrics utilized as valuation inputs and assumptions, which is available at https://www.krest.reit/resources/for-shareholders/ |

| 3. | The Fund employs leverage, which increases the volatility of investment returns and subjects the Fund to magnified losses if investments decline in value. Diversification of portfolio holdings does not assure a profit or protect against loss in a declining market. The Fund is classified as “non-diversified” under the Investment Company Act of 1940, and is not intended to be a complete investment program. Past performance does not guarantee future results. There can be no guarantee that current trends will continue. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when repurchased, may be worth more or less than their original cost and current performance may be lower or higher than the performance data quoted. Class I information is presented above; please refer to www.krest.reit for additional information, including performance details for Class U, Class S and Class D shares. Class I Inception Date is June 2, 2020. |

| 4. | Any distributions we make will be at the discretion of our Board of Directors. The Adviser intends to continue to recommend that the Board of Directors of the Fund (the “Board”) approve a $1.56 per share annual distribution rate to be paid to all Shareholders throughout the term of the Shareholder Priority Plan, absent a material change in the Fund’s financial condition that would cause the payment of a distribution at the current rate to be contrary to the best interests of the Fund and all Shareholders. KREST may pay distributions from sources other than cash flow from operations, including, without limitation, the sale of assets, borrowings, return of capital, or offering proceeds. |

| 5. | Includes assets such as cash, short-term assets and liquid securities, as well as committed and undrawn credit facility capacity. |

| 6. | KREST Shareholder Priority Plan: On June 4, 2024, KAA contractually committed to the Fund to continue to hold approximately 7.7 million of KREST Class I shares currently owned by KAA, representing approximately $200 million based on the Fund’s NAV as of June 30, 2024 (the “Support Shares”) through June 1, 2027 and, to the extent necessary, contribute such shares to the Fund to support a NAV per share of $27.00 per share for each class on such date (the “Shareholder Priority Plan”). If the contribution of the Support Shares is not sufficient to reach a NAV per share of $27.00, KAA will contribute all such Support Shares to support KREST’s NAV per share on such date. While the Shareholder Priority Plan is a contractual obligation to support the Fund’s NAV per share, there is no guarantee the contribution of the Support Shares will be sufficient to achieve a $27.00 NAV per share on June 1, 2027. For the avoidance of doubt, KAA is not obligated to contribute shares prior to June 1, 2027, and KAA is not obligated to contribute any of the Support Shares if the NAV per share for each class equals or exceeds $27.00 per share on June 1, 2027. If KAA were to effect the Shareholder Priority Plan today it would contribute 2.5 million shares (out of the total 7.7 million shares agreed to be contributed) to KREST, which would result in a NAV per share of $27.00 per share for each class. KAA’s allocation of $50 million in new capital investment in KREST along with any future investments are not subject to subordination and/or cancellation. |

| 7. | On May 11, 2023, KREST’s outstanding Class D shares were converted to Class I shares, and there were no outstanding Class D shares between May 12, 2023 and September 18, 2023. For periods including May 11, 2023 through September 18, 2023, which includes the monthly, 3-month, YTD, and ITD periods, net returns presented for Class D are calculated based on actual performance for Class I plus the impact of the Servicing Fee of 0.25% per annum applicable to Class D shares, as detailed in the Fund’s Prospectus. Commissions, fees and expenses are identical between Class D and Class I shares, with the exception of the Servicing Fee. For purposes of performance calculation, Class D inception date reflects the original share class inception date of March 4, 2022. Class D re-issue inception date is September 19, 2023. There have been no changes to the Class D share class specifics from inception to re-issuance. |

Glossary of Terms:

Annualized ITD Net Return and Net Return by Period: Reflects the percentage change in NAV per share plus the applicable distributions per share for the applicable period. Assumes the reinvestment of distributions pursuant to the Fund’s distribution reinvestment plan. Past performance is historical and not a guarantee of future results. Performance since inception through date indicated. Class I inception date is July 2, 2020; Class U inception date is June 30, 2021; Class D inception date is March 4, 2022; Class S inception date is September 9, 2022. On May 11, 2023, KREST’s outstanding Class D shares were converted to Class I and there were no outstanding Class D shares between May 12, 2023 and September 18, 2023. Class D re-issue inception date is September 19, 2023. There have been no changes to the Class D shares terms and offering provisions from inception to re-issuance. ITD performance number is annualized if time period is longer than one year.

3

Net Distribution Rate: Reflects the annualized monthly dividend for June 2024 divided by the month-end NAV for the respective share class. KREST intends to make distributions necessary to maintain its qualification as a real estate investment trust. However, there is no assurance that we will pay distributions in any particular amount, if at all. Any distributions we make will be at the discretion of our board of directors. KREST may pay distributions from sources other than cash flow from operations, including without limitations, the sale of assets, borrowings, return of capital or offering proceeds. For the 12 months ended December 31, 2023, 99% of KREST’s distributions were funded through adjusted funds from operations (“AFFO”). The Fund defines AFFO as the increase in net assets applicable to common stockholders from operations (calculated in accordance with GAAP), excluding (i) the change in net unrealized (appreciation) depreciation of investments, (ii) amortization premium (accretion of discount) on real estate securities, (iii) amortization of deferred origination fees on real estate loans, (iv) amortization of deferred financing costs, (v) management and incentive fees paid in shares of the Fund and (vi) realized and including undistributed income attributable to the Fund’s unconsolidated subsidiaries. This statement is not an indication of the tax treatment of any KREST distributions. Stockholders will be informed of the tax characteristics of any distributions after the close of KREST’s fiscal year. For the 2023 tax year, 100% of KREST’s distributions were classified as Return of Capital (“ROC”). As of June 30, 2024, the Class I net distribution rate is 6.07%, the Class U net distribution rate is 5.22%, the Class D net distribution rate is 5.82% and the Class S net distribution rate is 5.22%.

Gross Property Value: Represents real estate and other assets held by KREST’s unconsolidated subsidiaries, including any portion not owned by the Fund. As of June 30, 2024, the Fund’s economic interest in such joint ventures ranges from 50.5% to 99.5%. For financial reporting purposes, KREST includes the fair value of its equity interests in these subsidiaries in its total assets. As of June 30, 2024, the estimated fair value of the Fund’s net equity interest in these subsidiaries is $934.5 million.

Fund-Level Gross Leverage: Refers only to borrowings made by the Fund and its consolidated subsidiaries. The Fund may employ leverage in the form of loans, preferred stock, reverse repurchase agreements and/or other instruments. As of June 30, 2024, KREST had no borrowings outstanding under its credit facility and no Fund-level leverage outstanding.

Combined Net Leverage: Is a calculation provided to illustrate the combined leverage of the Fund and the Weighted Average LTV of the Fund’s unconsolidated subsidiaries. It is calculated as the ratio of i) the Fund’s borrowings, less cash and subscription proceeds receivable, plus the Equity-Weighted Unconsolidated Debt of the Fund’s investments divided by ii) the Fund’s total assets plus the Equity-Weighted Unconsolidated Debt of the Fund’s investments.

Equity-Weighted Unconsolidated Debt: Is a measure of the non-recourse property level financing of the Fund’s investments weighted by the Fund’s equity exposure in such investments, calculated as the Fund’s total investments divided by one minus the Weighted Average LTV, with the result then multiplied by the Weighted Average LTV.

Weighted Average LTV: Is the loan-to-value ratio of each of the Fund’s investments (whether consolidated or unconsolidated) averaged with a weighting based on the value of the Fund’s equity in each such investment.

Properties and Occupancy: Are reported based on the equity portion of the KREST portfolio. Excludes equity investment deposits and Real Estate Credit, which includes private real estate debt, including securities, and preferred equity. Property count excludes single family rental homes. Occupancy excludes single family rental homes that have been acquired and/or renovated, as applicable, within 3 months or less.

4

Consolidated Schedule of Investments (Unaudited)

| | | | | | | | |

| | | | | | Value | |

Real Estate Equity (a)(b) —74.0% | | | | | | | | |

Industrial - AIP-PMR 3-Pack | | | | | | $ | 82,837,065 | |

Industrial - Charleston | | | | | | | 31,254,748 | |

Industrial - Lakemont Blvd | | | | | | | 7,193,502 | |

Industrial - Lambert Farms | | | | | | | 28,539,678 | |

Industrial - MB Parts Korea DC | | | | | | | 39,689,419 | |

Industrial - Rickenbacker Logistics Park | | | | | | | 29,358,968 | |

Industrial - S. 500 Whitestown | | | | | | | 17,984,622 | |

Industrial - Veterans Point | | | | | | | 44,784,553 | |

Medical Office - Southeastern Portfolio I | | | | | | | 69,311,752 | |

Prime ST - 300 Pine | | | | | | | 71,189,506 | |

Prime ST - El Camino Real | | | | | | | 24,270,040 | |

Prime ST - HQ @ First | | | | | | | 146,277,468 | |

Residential - 80 Dekalb | | | | | | | 60,551,189 | |

Residential - Main Line 4-Pack | | | | | | | 38,934,333 | |

Residential - National Portfolio 1a | | | | | | | 8,808,661 | |

Residential - National Portfolio 1b | | | | | | | 85,762,140 | |

Residential - Presidential City | | | | | | | 80,972,325 | |

Residential - The Beach House Apartments | | | | | | | 32,860,446 | |

Residential - Tokyo Multifamily Portfolio I | | | | | | | 33,949,208 | |

| | | | | | | | |

Total Real Estate Equity (Cost — $1,035,983,896) | | | | | | | 934,529,623 | |

| | | | | | | | |

| | | Principal Amount | | | | |

Real Estate Debt — 19.3% | | | | | | | | |

Investments in Real Estate Loans — 5.2% | | | | | | | | |

Chicago NEMA, 7.000%, 8/26/2026 (a) | | $ | 65,000,000 | | | | 65,490,802 | |

| | | | | | | | |

Total Investments in Real Estate Loans (Cost — $64,729,663) | | | | | | | 65,490,802 | |

| | | | | | | | |

Real Estate Securities —14.1% | | | | | | | | |

Commercial Mortgage-backed Securities —14.1% | | | | | | | | |

BX Commercial Mortgage Trust 2021-XL2 J, 9.333% (SOFR + 4.004%), 10/15/2038 (c)(d) | | | 26,393,061 | | | | 25,816,054 | |

BX Commercial Mortgage Trust 2022-LP2, 6.891% (SOFR + 1.562%), 2/15/2039 (c)(d) | | | 1,186,095 | | | | 1,171,275 | |

BX Commercial Mortgage Trust 2022-LP2, 9.435% (SOFR + 4.106%), 2/15/2039 (c)(d) | | | 3,953,651 | | | | 3,907,927 | |

BX Trust 2022-GPA D, 9.390% (SOFR + 4.061%), 8/15/2043 (c)(d) | | | 28,084,851 | | | | 28,210,499 | |

BX Trust 2022-GPA HRR, 10.737% (SOFR + 5.408%), 8/15/2039 (a)(d) | | | 55,874,071 | | | | 55,733,827 | |

BXSC Commercial Mortgage Trust 2022-WSS G, 11.654% (SOFR + 6.325%), 3/15/2035 (c)(d) | | | 4,500,000 | | | | 4,444,160 | |

JPMCC 2022-ACBI HRR, 12.333% (SOFR + 7.000%), 3/15/2039 (a)(d) | | | 30,573,000 | | | | 30,487,915 | |

LAQ Mortgage Trust 2023-LAQ E, 10.516% (SOFR + 5.187%), 3/15/2036 (c)(d) | | | 7,500,000 | | | | 7,479,442 | |

LAQ Mortgage Trust 2023-LAQ F, 12.263% (SOFR + 6.934%), 3/15/2036 (c)(d) | | | 7,312,500 | | | | 7,282,538 | |

OPG Trust 2021-PORT J, 8.789% (SOFR + 3.460%), 10/15/2036 (c)(d) | | | 14,300,000 | | | | 13,904,448 | |

| | | | | | | | |

Total Commercial Mortgage-backed Securities (Cost — $177,947,383) | | | | | | | 178,438,085 | |

| | | | | | | | |

Total Real Estate Debt (Cost — $242,677,046) | | | | | | | 243,928,887 | |

| | | | | | | | |

Total Investments (Cost — $1,278,660,942) — 93.3% | | | | | | | 1,178,458,510 | |

| | | | | | | | |

| | | Shares | | | | |

Money Market Fund —6.1% | | | | | | | | |

U.S. Government Securities —6.1% | | | | | | | | |

UBS Select Government Institutional Fund, 5.21% (e) | | | 77,519,087 | | | | 77,519,087 | |

| | | | | | | | |

Total Money Market Fund (Cost — $77,519,087) | | | | | | | 77,519,087 | |

| | | | | | | | |

Total Investments Including Money Market Fund (Cost — $1,356,180,029) — 99.4% | | | | | | | 1,255,977,597 | |

| | | | | | | | |

Other Assets in Excess of Liabilities — 0.6% | | | | | | | 8,082,750 | |

| | | | | | | | |

Total Net Assets Applicable to Common Stockholders — 100.0% | | | | | | $ | 1,264,060,347 | |

| | | | | | | | |

See accompanying notes to consolidated financial statements.

5

| (a) | Level 3 assets (Note 2). |

| (b) | Affiliated investments. All of the Fund’s investments in real estate equity are joint ventures entered into by one of the Fund’s operating entities and secured by real estate owned by such operating entities. The Fund’s current economic interest in such joint ventures ranges from 50% to 99.5% of the venture. In these arrangements the Fund is subject to shared control arrangements where the consents of both the Fund and the joint venture party are required for all material decisions. |

| (c) | Securities exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold to qualified institutional buyers in transactions exempt from registration. At June 30, 2024 these securities amounted to $92,216,343 or 7.3% of net assets. |

| (d) | Variable rate investments. Coupon rate, reference index and spread shown at June 30, 2024. |

| (e) | Rate disclosed is the 7-day yield at June 30, 2024. |

At June 30, 2024, the Fund had the following open forward foreign currency contracts:

| | | | | | | | | | | | | | | | | | | | |

| | | Currency | | | Currency | | | | | Settlement | | | Unrealized | |

| | | Purchased | | | Sold | | | Counterparty | | Date | | | Appreciation | |

| |

| | | | | | |

| | USD | | | 29,183,078 | | | | KRW 34,377,666,350 | | | SCB | | | 12/07/2026 | | | $ | 2,862,398 | |

| | | | | | |

| | USD | | | 1,183,792 | | | | JPY 126,500,000 | | | GSC | | | 12/03/2029 | | | | 173,099 | |

| | | | | | |

| | USD | | | 36,632,111 | | | | JPY 3,965,000,000 | | | MBL | | | 12/03/2029 | | | | 5,045,399 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | 8,080,896 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Abbreviations: | | | | | | |

| | |

GSC | | | - | | | Goldman Sachs & Co. |

| | |

JPMCC | | | - | | | J.P. Morgan Chase Commercial Mortgage Securities |

| | |

JPY | | | - | | | Japanese Yen |

| | |

KRW | | | - | | | Korean Won |

| | |

MBL | | | - | | | Macquarie Bank Limited |

| | |

SCB | | | - | | | Standard Chartered Bank |

| | |

SOFR | | | - | | | Secured Overnight Financing Rate |

| | |

USD | | | - | | | United States Dollar |

See accompanying notes to consolidated financial statements.

6

Consolidated Statement of Assets and Liabilities (Unaudited)

| | | | |

Assets | | | | |

Investments, at fair value (cost $1,278,660,942) | | $ | 1,178,458,510 | |

Cash and cash equivalents | | | 77,519,087 | |

Receivable for Fund shares sold | | | 3,983,591 | |

Deferred financing costs | | | 1,212,568 | |

Dividend and interest receivable | | | 1,338,816 | |

Due from Adviser | | | 453,307 | |

Forward foreign currency contracts | | | 8,080,896 | |

Other assets | | | 669,657 | |

| | | | |

Total Assets | | $ | 1,271,716,432 | |

| | | | |

| |

Liabilities | | | | |

Distributions payable to Common Stockholders | | | 3,458,330 | |

Legal fees payable | | | 2,485,895 | |

Distribution and servicing fees payable | | | 556,901 | |

Administration and custody fees payable | | | 393,815 | |

Audit and tax fees payable | | | 248,893 | |

Directors’ fees payable | | | 67,563 | |

Interest payable | | | 7,172 | |

Other accrued expenses | | | 437,516 | |

| | | | |

Total Liabilities | | $ | 7,656,085 | |

| | | | |

| |

Net Assets Applicable to Common Stockholders | | $ | 1,264,060,347 | |

| | | | |

| |

Net Assets Applicable to Common Stockholders: | | | | |

Capital stock, $0.001 par value | | $ | 49,349 | |

Paid-in capital ($0.001 par value, 500 million shares authorized) | | | 1,278,257,953 | |

Total distributable (loss) | | | (14,246,955) | |

| | | | |

Total Net Assets Applicable to Common Stockholders | | $ | 1,264,060,347 | |

| | | | |

| |

Net Asset Value Per Share(1): | | | | |

Class I : Net Asset Value per share ($504,840,846 / 19,707,853 shares outstanding) | | $ | 25.62 | |

| | | | |

Class U : Net Asset Value per share ($758,965,494 / 29,631,443 shares outstanding) | | $ | 25.61 | |

| | | | |

Class D : Net Asset Value per share ($168,719 / 6,587 shares outstanding) | | $ | 25.61 | |

| | | | |

Class S : Net Asset Value per share ($85,288 / 3,329 shares outstanding) | | $ | 25.62 | |

| | | | |

| |

Maximum Offering Price Per Share: | | | | |

Class S (based on $25.62 net asset value per share/100%-3.50% maximum sales charge)(2) | | $ | 26.55 | |

| | | | |

(1) Please refer to Note 6 for a discussion of distribution and servicing fees incurred by each class of shares.

(2) A maximum sales charge of up to 3.00% of the offering price and a dealer manager fee of 0.50%.

See accompanying notes to consolidated financial statements.

7

Consolidated Statement of Operations (Unaudited)

For the Six Months Ended June 30, 2024

| | | | |

Investment Income | | | | |

Dividend income (net of foreign taxes withheld $215,227) | | $ | 18,781,106 | |

Interest income | | | 15,643,357 | |

| | | | |

Total Investment Income | | | 34,424,463 | |

| | | | |

| |

Expenses | | | | |

Advisory fees | | | 7,774,076 | |

Interest expense | | | 865,799 | |

Legal fees | | | 1,408,920 | |

Administration and custody fees | | | 764,287 | |

Directors’ fees | | | 316,258 | |

Audit and tax fees | | | 231,727 | |

Transfer agent fees | | | 300,471 | |

Insurance | | | 222,627 | |

Distribution and servicing fees | | | | |

Class U | | | 3,361,373 | |

Class D | | | 212 | |

Class S | | | 364 | |

Incentive fees | | | 2,937,436 | |

Other expenses | | | 1,281,593 | |

| | | | |

Total expenses | | | 19,465,143 | |

| | | | |

Less: Expenses reimbursed by the Adviser | | | (1,336,293) | |

| | | | |

Net Expenses | | | 18,128,850 | |

| | | | |

Net Investment Income | | | 16,295,613 | |

| | | | |

| |

Realized and Unrealized Gain (Loss) on Investments | | | | |

Net Realized Gain (Loss) From: | | | | |

Investments | | | (15,472,458) | |

Foreign currency transactions | | | (12,923) | |

| | | | |

Net Realized Loss | | | (15,485,381) | |

| | | | |

Change in Net Unrealized Appreciation (Depreciation) From: | | | | |

Investments | | | (37,394,621) | |

Forward foreign currency contracts | | | 4,797,338 | |

Foreign currency transactions | | | (15,671) | |

| | | | |

Change in Net Unrealized Depreciation | | | (32,612,954) | |

| | | | |

| |

Net Realized and Unrealized Loss on Investments | | | (48,098,335) | |

| | | | |

| |

Decrease in Net Assets Applicable to Common Stockholders from operations | | $ | (31,802,722) | |

| | | | |

See accompanying notes to consolidated financial statements.

8

Consolidated Statements of Changes in Net Assets

| | | | | | |

| | | For the Six Months | | | |

| | | Ended | | | |

| | | June 30, 2024 | | | For the Year Ended |

| | | (Unaudited) | | | December 31, 2023 |

| | | |

Operations: | | | | | | |

Net Investment Income | | $ | 16,295,613 | | | $ 33,710,926 |

Net realized loss | | | (15,485,381 | ) | | (3,748,128) |

Change in net unrealized (depreciation) | | | (32,612,954 | ) | | (128,313,720) |

| | | |

(Decrease) in Net Assets Applicable to Common Stockholders from Operations | | | (31,802,722 | ) | | (98,350,922) |

| | | |

| | |

Distributions to Common Stockholders From: | | | | | | |

Return of capital | | | (33,599,537 | )(1) | | (70,331,063)(2) |

| | | |

Decrease in Net Assets from Distributions to Common Stockholders | | | (33,599,537 | ) | | (70,331,063) |

| | | |

| | |

Fund Share Transactions | | | | | | |

Net proceeds from sale of shares | | | 110,287,011 | | | 180,395,897 |

Reinvestment of distributions | | | 13,775,281 | | | 29,612,792 |

Cost of shares repurchased through tender offer | | | (128,151,836 | ) | | (311,603,476) |

| | | |

Increase in Net Assets from Fund Share Transactions | | | (4,089,544 | ) | | (101,594,787) |

| | | |

| | |

Increase in Net Assets Applicable to Common Stockholders | | | (69,491,803 | ) | | (270,276,772) |

| | | |

| | |

Net Assets Applicable to Common Stockholders: | | | | | | |

Beginning of period | | | 1,333,552,150 | | | 1,603,828,922 |

End of period | | $ | 1,264,060,347 | | | $ 1,333,552,150 |

| | | |

| (1) | Stockholders will be informed of the tax characteristics of the distributions after the close of the 2024 fiscal year. |

| (2) | Taxed as a return of capital. The characterization of the amounts of dividends and distributions of net investment income are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. |

See accompanying notes to consolidated financial statements.

9

Consolidated Statement of Cash Flows (Unaudited)

For the Six Months Ended June 30, 2024

| | | | |

Cash Flows from Operating Activities:(1) | | | | |

Net increase (decrease) in net assets applicable to Common Stockholders resulting from operations | | $ | (31,802,722) | |

Adjustments to reconcile net increase (decrease) in net assets from operations to net cash provided by (used in) operating activities: | | | | |

Purchases of real estate investments and portfolio securities | | | (11,062,632) | |

Proceeds from disposition of real estate investments and portfolio securities | | | 72,332,448 | |

Net accretion and amortization of discount/premium on investment securities | | | (236,904) | |

Management fee paid in shares of the Fund | | | 7,774,076 | |

Incentive fee paid in shares of the Fund | | | 2,937,436 | |

Directors’ fee paid in shares of the Fund | | | 150,000 | |

Amortization of deferred financing costs | | | 367,337 | |

(Increase) decrease in dividends and interest receivable | | | 607,338 | |

(Increase) decrease in receivable due from Adviser | | | (164,391) | |

(Increase) decrease in other assets | | | 221,871 | |

Increase (decrease) in administration and custody fees payable | | | (142,186) | |

Increase (decrease) in directors’ fees payable | | | (79,733) | |

Increase (decrease) in legal fees payable | | | 857,296 | |

Increase (decrease) in interest payable | | | (20) | |

Increase (decrease) in audit and tax fees payable | | | (68,150) | |

Increase (decrease) in distribution and servicing fees | | | (100,522) | |

Increase (decrease) in other expenses payable | | | (72,248) | |

Change in net unrealized (appreciation) depreciation on investments | | | 37,394,621 | |

Change in net unrealized (appreciation) depreciation on forward foreign currency contracts | | | (4,797,338) | |

Net realized (gain) loss on investment security transactions | | | 15,472,458 | |

| | | | |

Net cash and foreign currency provided by (used in) operating activities | | | 89,588,035 | |

| | | | |

Cash Flows from Financing Activities: | | | | |

Proceeds from revolving credit facility | | | 62,000,000 | |

Repayment of revolving credit facility | | | (62,000,000) | |

Proceeds from sale of common stock | | | 98,087,329 | |

Payment of dividends and distributions to Common Stockholders | | | (19,775,920) | |

Payment of shares repurchased through tender offer | | | (128,151,836) | |

| | | | |

Net cash and foreign currency provided by (used in) financing activities | | | (49,840,427) | |

| | | | |

Net Increase (Decrease) in Cash and Foreign Currency | | | 39,747,608 | |

| | | | |

Cash and Cash Equivalents: | | | | |

Beginning of period | | | 37,771,479 | |

| | | | |

End of period | | $ | 77,519,087 | |

| | | | |

(1) Interest expense paid by the Fund was $498,482. | | | | |

| |

Supplemental disclosure of non-cash financing activities: | | | | |

Reinvestment of distributions | | $ | 13,775,281 | |

See accompanying notes to consolidated financial statements.

10

Consolidated Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | For the Period | |

| | | For the Six | | | | | | | | | | | | | | | | | | | | | | | | from July | |

| | | Months Ended | | | | | | For the Year | | | | | | For the Year | | | | | | For the Year | | | | | | 2, 2020(1) to | |

| | | June 30, 2024 | | | | | | Ended December | | | | | | Ended December | | | | | | Ended December | | | | | | December 31, | |

| | | (Unaudited) | | | | | | 31, 2023 | | | | | | 31, 2022 | | | | | | 31, 2021 | | | | | | 2020 | |

Class I Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Per Share Operating Performance(2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 27.00 | | | | | | | $ | 30.39 | | | | | | | $ | 29.49 | | | | | | | $ | 26.32 | | | | | | | $ | 25.00 | | | | | |

| | | | | | | | | | |

Income (Loss) from operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.41 | | | | | | | | 0.83 | | | | | | | | 1.02 | | | | | | | | 1.37 | | | | | | | | 0.35 | | | | | |

Net realized and unrealized gain (loss) | | | (1.01) | | | | | | | | (2.66) | | | | | | | | 1.44 | | | | | | | | 5.09 | | | | | | | | 0.97 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total income (loss) from operations | | | (0.60) | | | | | | | | (1.83) | | | | | | | | 2.46 | | | | | | | | 6.46 | | | | | | | | 1.32 | | | | | |

Less distributions: | | | (0.78)(3) | | | | | | | | (1.56)(4) | | | | | | | | (1.56)(4) | | | | | | | | (3.29)(4) | | | | | | | | – | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 25.62 | | | | | | | $ | 27.00 | | | | | | | $ | 30.39 | | | | | | | $ | 29.49 | | | | | | | $ | 26.32 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

Total return(5) | | | (2.26)% | | | | | | | | (6.25)% | | | | | | | | 8.32% | | | | | | | | 26.06% | | | | | | | | 5.29% | | | | | |

Ratio to average net assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses, before waivers(6) | | | 2.60% | | | | | | | | 2.56% | | | | | | | | 3.11% | | | | | | | | 4.09% | | | | | | | | 8.35% | | | | | |

Expenses, after waivers(6) | | | 2.38% | | | | | | | | 2.47% | | | | | | | | 2.58% | | | | | | | | 1.67% | | | | | | | | 0.50% | | | | | |

Expenses, after waivers and excluding expenses outside the Expense Limitation Agreement(6) | | | 0.50% | | | | | | | | 0.50% | | | | | | | | 0.50% | | | | | | | | 0.50% | | | | | | | | 0.50% | | | | | |

Net investment income(6) | | | 3.16% | | | | | | | | 2.85% | | | | | | | | 3.25% | | | | | | | | 4.91% | | | | | | | | 3.97% | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 504,841 | | | | | | | $ | 460,975 | | | | | | | $ | 511,959 | | | | | | | $ | 340,123 | | | | | | | $ | 88,863 | | | | | |

Portfolio turnover rate(5),(7) | | | 0.91% | | | | | | | | 6.41% | | | | | | | | 7.44% | | | | | | | | 32.00% | | | | | | | | 0.77% | | | | | |

| (1) | Class I Shares commenced operations on July 2, 2020. |

| (2) | Per share calculations were performed using the average shares outstanding for the period. |

| (3) | Stockholders will be informed of the tax characteristics of the distributions after the close of the 2024 fiscal year. |

| (4) | Taxed as a return of capital. |

| (5) | Total return and Portfolio turnover rate are for the period indicated and have not been annualized. Total return assumes a purchase of common stock at the net asset value on the first day and a sale at the net asset value on the last day of each period reported on the table. Total return assumes reinvestment of dividends and distributions at prices obtained pursuant to the Fund’s dividend reinvestment plan. |

| (6) | Periods less than one year are annualized. Please refer to Note 6 for a discussion of the timing of management and incentive fees (as applicable) as well as the Expense Limitation Agreement. |

| (7) | Portfolio turnover is calculated on the basis of the Fund as a whole. |

See accompanying notes to consolidated financial statements.

11

Consolidated Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | For the Period | |

| | | For the Six | | | | | | | | | | | | | | | | | | from July | |

| | | Months Ended | | | | | | For the Year | | | | | | For the Year | | | | | | 1, 2021(1) to | |

| | | June 30, 2024 | | | | | | Ended December | | | | | | Ended December | | | | | | December 31, | |

| | | (Unaudited) | | | | | | 31, 2023 | | | | | | 31, 2022 | | | | | | 2021 | |

Class U Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Per Share Operating Performance(2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 27.00 | | | | | | | $ | 30.39 | | | | | | | $ | 29.49 | | | | | | | $ | 26.71 | | | | | |

| | | | | | | | |

Income (Loss) from operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.30 | | | | | | | | 0.59 | | | | | | | | 0.75 | | | | | | | | 0.54 | | | | | |

Net realized and unrealized gain (loss) | | | (1.02) | | | | | | | | (2.67) | | | | | | | | 1.45 | | | | | | | | 2.90 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total income (loss) from operations | | | (0.72) | | | | | | | | (2.08) | | | | | | | | 2.20 | | | | | | | | 3.44 | | | | | |

Less distributions: | | | (0.67)(3) | | | | | | | | (1.31)(4) | | | | | | | | (1.30)(4) | | | | | | | | (0.66)(4) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 25.61 | | | | | | | $ | 27.00 | | | | | | | $ | 30.39 | | | | | | | $ | 29.49 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Total return(5) | | | (2.71)% | | | | | | | | (7.04)% | | | | | | | | 7.40% | | | | | | | | 13.03% | | | | | |

Ratio to average net assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses, before waivers(6) | | | 3.43% | | | | | | | | 3.41% | | | | | | | | 3.93% | | | | | | | | 5.10% | | | | | |

Expenses, after waivers(6) | | | 3.22% | | | | | | | | 3.32% | | | | | | | | 3.44% | | | | | | | | 2.81% | | | | | |

Expenses, after waivers and excluding expenses outside the Expense Limitation Agreement(6) | | | 0.50% | | | | | | | | 0.50% | | | | | | | | 0.50% | | | | | | | | 0.50% | | | | | |

Net investment income(6) | | | 2.31% | | | | | | | | 2.00% | | | | | | | | 2.39% | | | | | | | | 3.77% | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 758,965 | | | | | | | $ | 872,317 | | | | | | | $ | 1,091,336 | | | | | | | $ | 370,590 | | | | | |

Portfolio turnover rate(5),(7) | | | 0.91% | | | | | | | | 6.41% | | | | | | | | 7.44% | | | | | | | | 32.00% | | | | | |

| (1) | Class U Shares commenced operations on July 1, 2021. |

| (2) | Per share calculations were performed using the average shares outstanding for the period. |

| (3) | Stockholders will be informed of the tax characteristics of the distributions after the close of the 2024 fiscal year. |

| (4) | Taxed as a return of capital. |

| (5) | Total return and Portfolio turnover rate are for the period indicated and have not been annualized. Total return assumes a purchase of common stock at the net asset value on the first day and a sale at the net asset value on the last day of each period reported on the table. Total return assumes reinvestment of dividends and distributions at prices obtained pursuant to the Fund’s dividend reinvestment plan. |

| (6) | Periods less than one year are annualized. Please refer to Note 6 for a discussion of the timing of management and incentive fees (as applicable) as well as the Expense Limitation Agreement. |

| (7) | Portfolio turnover is calculated on the basis of the Fund as a whole. |

See accompanying notes to consolidated financial statements.

12

Consolidated Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | For the Six | | | | | For the Period | | | | | | For the Period | | | | | | For the Period | |

| | | Months Ended | | | | | from September | | | | | | from January 1, | | | | | | from March | |

| | | June 30, 2024 | | | | | 19, 2023(1) to | | | | | | 2023 to | | | | | | 4, 2022(1) to | |

| | | (Unaudited) | | | | | December 31, 2023 | | | | | | May 11, 2023(1) | | | | | | December 31, 2022 | |

Class D Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Per Share Operating Performance(2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 27.00 | | | | | | | $ | 28.52 | | | | | | | $ | 30.39 | | | | | | | $ | 30.80 | | | | | |

| | | | | | | | |

Income (Loss) from operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.38 | | | | | | | | 0.16 | | | | | | | | 0.27 | | | | | | | | 0.78 | | | | | |

Net realized and unrealized gain (loss) | | | (1.03)(3) | | | | | | | | (1.26)(4) | | | | | | | | (0.03)(4) | | | | | | | | 0.03(4) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total income (loss) from operations | | | (0.65) | | | | | | | | (1.10) | | | | | | | | 0.24 | | | | | | | | 0.81 | | | | | |

Less distributions(3): | | | (0.74) | | | | | | | | (0.42) | | | | | | | | (0.53) | | | | | | | | (1.22) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 25.61 | | | | | | | $ | 27.00 | | | | | | | $ | 30.10 | | | | | | | $ | 30.39 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Total return(5) | | | (2.41)% | | | | | | | | (3.89)% | | | | | | | | 0.80% | | | | | | | | 2.56% | | | | | |

Ratio to average net assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses, before waivers(6) | | | 2.84% | | | | | | | | 2.79% | | | | | | | | 2.80% | | | | | | | | 3.26% | | | | | |

Expenses, after waivers(6) | | | 2.63% | | | | | | | | 2.70% | | | | | | | | 2.73% | | | | | | | | 2.83% | | | | | |

Expenses, after waivers and excluding expenses outside the Expense Limitation Agreement(6) | | | 0.50% | | | | | | | | 0.50% | | | | | | | | 0.50% | | | | | | | | 0.50% | | | | | |

Net investment income(6) | | | 2.91% | | | | | | | | 2.02% | | | | | | | | 2.52% | | | | | | | | 3.00% | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 169 | | | | | | | $ | 173 | | | | | | | $ | – | | | | | | | $ | 440 | | | | | |

Portfolio turnover rate(5),(7) | | | 0.91% | | | | | | | | 0.47% | | | | | | | | 3.96% | | | | | | | | 7.44% | | | | | |

| (1) | Class D Shares commenced operations on March 4, 2022. On May 11, 2023, all outstanding Class D Shares were converted to Class I Shares at $30.10 per share. Class D Shares were reopened on September 19, 2023 at $28.52 per share. |

| (2) | Per share calculations were performed using the average shares outstanding for the period. |

| (3) | Stockholders will be informed of the tax characteristics of the distributions after the close of the 2024 fiscal year. |

| (4) | Taxed as a return of capital. |

| (5) | Total return and Portfolio turnover rate are for the period indicated and have not been annualized. Total return assumes a purchase of common stock at the net asset value on the first day and a sale at the net asset value on the last day of each period reported on the table. Total return assumes reinvestment of dividends and distributions at prices obtained pursuant to the Fund’s dividend reinvestment plan. |

| (6) | Periods less than one year are annualized. Please refer to Note 6 for a discussion of the timing of management and incentive fees (as applicable) as well as the Expense Limitation Agreement. |

| (7) | Portfolio turnover is calculated on the basis of the Fund as a whole. |

See accompanying notes to consolidated financial statements.

13

Consolidated Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | For the Period | |

| | | For the Six | | | | | | For the Year | | | | | | from September | |

| | | Months Ended | | | | | | Ended | | | | | | 9, 2022(1) to | |

| | | June 30, 2024 | | | | | | December 31, | | | | | | December 31, | |

| | | (Unaudited) | | | | | | 2023 | | | | | | 2022 | |

Class S Shares | | | | | | | | | | | | | | | | | | | | | | | | |

Per Share Operating Performance(2) | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 27.00 | | | | | | | $ | 30.39 | | | | | | | $ | 31.50 | | | | | |

| | | | | | |

Income (Loss) from operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.30 | | | | | | | | 0.56 | | | | | | | | 0.21 | | | | | |

Net realized and unrealized loss | | | (1.01) | | | | | | | | (2.64) | | | | | | | | (0.93) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total (loss) from operations | | | (0.71) | | | | | | | | (2.08) | | | | | | | | (0.72) | | | | | |

Less distributions: | | | (0.67)(3) | | | | | | | | (1.31)(4) | | | | | | | | (0.39)(4) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 25.62 | | | | | | | $ | 27.00 | | | | | | | $ | 30.39 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total return(5) | | | (2.67)% | | | | | | | | (7.04)% | | | | | | | | (2.29)% | | | | | |

Ratio to average net assets | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses, before waivers(6) | | | 3.44% | | | | | | | | 3.41% | | | | | | | | 4.32% | | | | | |

Expenses, after waivers(6) | | | 3.23% | | | | | | | | 3.32% | | | | | | | | 3.57% | | | | | |

Expenses, after waivers and excluding expenses outside the Expense Limitation Agreement(6) | | | 0.50% | | | | | | | | 0.50% | | | | | | | | 0.50% | | | | | |

Net investment income(6) | | | 2.31% | | | | | | | | 2.01% | | | | | | | | 2.26% | | | | | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 85 | | | | | | | $ | 88 | | | | | | | $ | 94 | | | | | |

Portfolio turnover rate(5),(7) | | | 0.91% | | | | | | | | 6.41% | | | | | | | | 7.44% | | | | | |

| (1) | Class S Shares commenced operations on September 9, 2022. |

| (2) | Per share calculations were performed using the average shares outstanding for the period. |

| (3) | Stockholders will be informed of the tax characteristics of the distributions after the close of the 2024 fiscal year. |

| (4) | Taxed as a return of capital. |

| (5) | Total return and Portfolio turnover rate are for the period indicated and have not been annualized. Total return assumes a purchase of common stock at the net asset value on the first day and a sale at the net asset value on the last day of each period reported on the table. Total return assumes reinvestment of dividends and distributions at prices obtained pursuant to the Fund’s dividend reinvestment plan. |

| (6) | Periods less than one year are annualized. Please refer to Note 6 for a discussion of the timing of management and incentive fees (as applicable) as well as the Expense Limitation Agreement. |

| (7) | Portfolio turnover is calculated on the basis of the Fund as a whole. |

See accompanying notes to consolidated financial statements.

14

Notes to Consolidated Financial Statements (Unaudited)

1. Organization

KKR Real Estate Select Trust Inc. (the “Fund”) is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), that continuously offers its shares of common stock. The Fund is a Maryland corporation and has elected and has qualified, and intends to continue to qualify annually, as a real estate investment trust (a “REIT”) for U.S. federal income tax purposes under the Internal Revenue Code of 1986, as amended (the “Code”). The Fund’s Board of Directors (the “Board”) authorized 500 million shares of $0.001 par value common stock. The Fund’s currently effective registration statement has registered for sale to the public a total of $5,000,000,000 in shares of common stock. The Fund’s primary investment objective is to provide attractive current income with a secondary objective of long-term capital appreciation. The Fund seeks to achieve its objective by investing primarily in a portfolio of real estate, including in the form of property investments and real estate-related debt interests and to a lesser extent in traded real estate-related securities.

KKR Registered Advisor LLC serves as the Fund’s investment adviser (the “Adviser”). The Fund entered into an investment advisory agreement (the “Advisory Agreement”) with KKR Registered Advisor LLC on May 18, 2021, following Board approval on July 29, 2020. The Board most recently approved the continuation of the Advisory Agreement for an additional year on November 7, 2023.

As of June 30, 2024, the Fund had the following shares outstanding:

| | | | |

Class I Shares | | | 19,707,853 | |

| |

Class U Shares | | | 29,631,443 | |

| |

Class D Shares | | | 6,587 | |

| |

Class S Shares | | | 3,329 | |

As of June 30, 2024 and December 31, 2023, respectively, an affiliate of the Adviser owned 9,798,477 and 7,430,497 Class I Shares.

Class I Shares, Class U Shares, Class D Shares and Class S Shares are offered at net asset value (“NAV”) per share, plus in the case of Class S Shares, a maximum sales charge of up to 3.00% of the offering price and a dealer manager fee of 0.50% of the offering price. Certain participating broker-dealers may offer Class S Shares subject to a dealer manager fee of up to 1.50%, provided that the sum of the sales charge and dealer manager fee will not exceed 3.50% of the offering price.

2. Summary of Significant Accounting Policies

Basis of Presentation — The Fund is considered an investment company as defined in Accounting Standards Codification (“ASC”) Topic 946 Financial Services – Investment Companies (“ASC 946”). The accompanying financial statements are presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”), using the specialized guidance in ASC 946, and are stated in United States (“U.S.”) dollars. The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in these consolidated financial statements. Actual results could differ from those estimates. The Fund owns and plans to continue to own all or substantially all of its property investments through a wholly-owned operating partnership. These financial statements are consolidated financial statements of the Fund and its wholly-owned operating partnership. All intercompany transactions have been eliminated in consolidation.

Valuation of Investments — The Board of the Fund has approved valuation policies and procedures adopted by the Adviser to ensure investments are valued in a manner consistent with GAAP as required by the 1940 Act. The Board has designated the Adviser as its “valuation designee” pursuant to Rule 2a-5 under the 1940 Act, and in that role the Adviser is responsible for performing fair value determinations relating to all of the Fund’s investments, including periodically assessing and managing any material valuation risks and establishing and applying fair value methodologies, in accordance with valuation policies and procedures that have been approved by the Board. The Board ultimately is responsible for fair value determinations under the 1940 Act and satisfies its responsibility through the oversight of the valuation designee in accordance with Rule 2a-5.

Investments are stated at fair value in a manner consistent with GAAP. Fair value is the price that would be received from the sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Where available, fair value is based on observable market prices or parameters, or derived from such prices or parameters. Where observable prices or inputs are not available, valuation models are applied. These valuation techniques involve some level of management estimation and judgment, the degree of which is dependent on the price transparency for the instruments or market and the instruments’ complexity for disclosure purposes.

15

Assets and liabilities recorded at fair value on the Consolidated Statement of Assets and Liabilities are categorized based upon the level of judgment associated with the inputs used to measure their value. Hierarchical levels, as defined under GAAP, are directly related to the amount of subjectivity associated with the inputs to fair valuations of these assets and liabilities, are as follows:

Level 1 — Inputs are unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date.

Level 2 — Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 inputs include quoted prices for similar instruments in active markets, and inputs other than quoted prices that are observable for the asset or liability.

Level 3 — Inputs are unobservable for the asset or liability, and include situations where there is little, if any, market activity for the asset or liability.

A significant decrease in the volume and level of activity for the asset or liability is an indication that transactions or quoted prices may not be representative of fair value because in such market conditions there may be increased instances of transactions that are not orderly. In those circumstances, further analysis of transactions or quoted prices is needed, and a significant adjustment to the transactions or quoted prices may be necessary to estimate fair value.

The availability of observable inputs can vary depending on the financial asset or liability and is affected by a wide variety of factors, including, for example, the type of product, whether the product is new, whether the product is traded on an active exchange or in the secondary market, and the current market condition. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement in its entirety falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and consideration of factors specific to the asset. The variability of the observable inputs affected by the factors described above may cause transfers between Levels 1, 2 and/or 3, which the Adviser recognizes at the beginning of the period the inputs change.

Many financial assets and liabilities have bid and ask prices that can be observed in the marketplace. Bid prices reflect the highest price that the Fund and others are willing to pay for an asset. Ask prices represent the lowest price that the Fund and others are willing to accept for an asset. For financial assets and liabilities whose inputs are based on bid-ask prices, the Adviser does not require that fair value always be a predetermined point in the bid-ask range. The Adviser’s policy is to allow for mid-market pricing and adjust to the point within the bid-ask range that meets the Fund’s best estimate of fair value.

Depending on the relative liquidity in the markets for certain assets, the Adviser may transfer assets to Level 3 if it determines that observable quoted prices, obtained directly or indirectly, are not available. Assets and liabilities that are valued using Level 3 of the fair value hierarchy are initially valued at transaction price and are subsequently valued using market data for similar instruments (e.g., recent transactions or broker quotes), comparisons to benchmark derivative indices and valuation models. Valuation models are based on discounted cash flow techniques, for which the key inputs are the amount of expected future cash flows, market yields for such instruments and recovery assumptions. Inputs are determined based on relative value analyses, which incorporate similar instruments from similar issuers.

Independent Valuation Advisor — The Board, including a majority of the independent directors, has appointed an independent valuation advisor (“Independent Valuation Advisor”) to provide valuation services to the Fund in respect of the Fund’s investments in real estate debt (e.g., mortgage loans and mezzanine loans) and real property (e.g., direct investments in real property and interests in private holding vehicles of real property), which do not have readily available market prices. The Independent Valuation Advisor, subject to the oversight of the Adviser in its capacity as valuation designee, and ultimately the Board, is responsible for coordinating third party appraisals of the Fund’s underlying investments in real properties (including investments held through unconsolidated subsidiaries) and providing valuations and appraisals of the Fund’s underlying investments in real properties and debt investments for which there are not reliable readily available market prices.

Private Commercial Real Estate — The Fund’s investments in real estate ventures are valued based on the fair value of the underlying real estate and any related mortgage loans payable. The Adviser expects the primary methodology used to value the Fund’s underlying real properties owned by the Fund’s real estate ventures will be the income approach, whereby value is derived by determining the present value of an asset’s expected stream of future cash flows. Consistent with industry practices, the income approach incorporates subjective judgments regarding comparable rental and operating expense data, the capitalization or discount rate and projections of future rent and expenses based on appropriate evidence. Fair value using the income approach is generally assessed at regular intervals and also in response to material, unbudgeted non-recurring income and expense events such as capital expenditures, prepayment penalties, assumption fees, tenant buyouts, lease termination fees and tenant turnover with respect to such property when the Adviser becomes aware of such events and the relevant

16

information is available. Ongoing adjustments to the fair value derived using the income approach are also made to reflect (1) the accrual of income by the Fund’s investment in real estate ventures on the basis of data extracted from the annual budget for such property and (2) the calculated change in fair value resulting from the application of the income approach as of the next regular future valuation date recognized on straight-line basis through such date. Other methodologies that may also be used to value properties include sales comparisons and replacement cost approaches. Under the sales comparison approach, the Independent Valuation Advisor or the third-party appraiser, as applicable, develops an opinion of value by comparing the subject property to similar, recently sold properties in the surrounding or competing area. For portfolios of properties, the sales comparison approach could include a portfolio premium or portfolio discount, as applicable. The replacement cost approach relies on the principle of substitution, which holds that when a property is replaceable in the market, its value tends to be set at the cost of acquiring an equally desirable substitute property, assuming that no costly delay is encountered in making the substitution.

Except for single family rental properties, each asset is appraised by a third-party appraiser other than the Independent Valuation Advisor at least once per year and is valued by the Independent Valuation Advisor (or, in the case of certain assets located outside of the United States, a valuation firm designated by the Independent Valuation Advisor and approved by the Adviser) the remaining months of the year. Single family rental properties that have been acquired leased will be valued by the Independent Valuation Advisor each month following the first 45 days after acquisition. Single family rental properties that have been acquired vacant will be valued at cost until 45 days following the date the property is leased or the later of (a) 45 days following the date the property completes renovations or (b) three months after the acquisition date, and thereafter will be valued by the Independent Valuation Advisor each month.

Commercial Mortgage-backed Securities — Commercial mortgage-backed securities (“CMBS”) are securities backed by obligations (including certificates of participation in obligations) that are principally secured by commercial mortgages on real property or interests therein having a multifamily or commercial use, such as retail, office or industrial properties, hotels, apartments, nursing homes and senior living facilities. CMBS are typically issued in multiple tranches whereby the more senior classes are entitled to priority distributions from the trust’s income to make specified interest and principal payments on such tranches. Losses and other shortfalls from expected amounts to be received on the mortgage pool are borne by the most subordinate classes, which receive principal payments only after the more senior classes have received all principal payments to which they are entitled. The credit quality of CMBS depends on the credit quality of the underlying mortgage loans, which is a function of factors such as the principal amount of loans relative to the value of the related properties; the cash flow produced by the property; the mortgage loan terms, such as principal amortization; market assessment and geographic location; construction quality of the property; and the creditworthiness of the borrowers. The Fund has historically invested a significant portion of its portfolio in CMBS.

The valuations for CMBS are typically the prices supplied by independent third party pricing services, which may use market prices or broker/ dealer quotations or a variety of valuation techniques and methodologies. If independent third party pricing services are unable to supply prices for a portfolio investment, or if the prices supplied are deemed by the Adviser to be unreliable, the market price may be determined by the Adviser using quotations from one or more broker/dealers or at the transaction price if the security has recently been purchased and no value has yet been obtained from a pricing service or pricing broker.

Real Estate Loans — The Fund currently holds a mezzanine loan. Mezzanine loans are a type of subordinate loan in which the loan is secured by one or more direct or indirect ownership interests in an entity that directly or indirectly owns real estate. Mezzanine loans are subordinate to a first mortgage or other senior debt. Investors in mezzanine loans are generally compensated for the increased credit risk from a pricing perspective and still benefit from the right to foreclose on its security, in many instances more efficiently than the rights of foreclosure for first mortgage loans. Upon a default by the borrower under a mezzanine loan, the mezzanine lender generally can take control of the property owning entity on an expedited basis, subject to the rights of the holders of debt senior in priority on the property. Rights of holders of mezzanine loans are usually governed by intercreditor or interlender agreements, which may limit the Fund’s ability to pursue remedies.

Investment Transactions and Investment Income — Investment transactions are accounted for on the trade date, the date the order to buy or sell is executed. Amortization and accretion is calculated using the effective interest method over the life of the investment. Realized gains and losses are calculated on the identified cost basis.

Share Class Accounting — The Fund’s investment income, expenses (other than class-specific expenses, such as distribution and servicing fees) and unrealized and realized gains and losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day. Please refer to Note 6 for additional information on distribution and servicing fees allocated to certain share classes.

Cash and Cash Equivalents — Cash and cash equivalents substantially consists of money market funds with financial institutions that invest in securities with maturities of three or fewer months. As of June 30, 2024, the Fund was invested in the UBS Select Government Institutional Fund.

17

Statement of Cash Flows — Information on financial transactions which have been settled through the receipt or disbursement of cash or foreign cash is presented in the Consolidated Statement of Cash Flows. Cash and foreign cash include cash and foreign cash on hand at the Fund’s custodian bank and do not include any short-term investments. As of and for the six months ended June 30, 2024, the Fund had no restricted cash presented on the Consolidated Statement of Assets and Liabilities.

Foreign Currency Translation — Assets and liabilities initially expressed in non-U.S. currencies are translated into U.S. dollars based on the applicable exchange rates at the date of the last business day of the financial statement period. Purchases and sales of securities, interest income, dividends, variation margin received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rates in effect on the transaction date. The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices of securities held. Such changes are included with the net realized gain or loss and change in unrealized appreciation or depreciation on investments in the Statement of Operations. Other foreign currency transactions resulting in realized and unrealized gain or loss are reported separately as net realized gain or loss and change in unrealized appreciation or depreciation on foreign currency transactions in the Statement of Operations.

Income from Underlying Investments — Distributions made to the Fund by the underlying investments in which the Fund invests may take several forms. The Fund re-characterizes distributions received from the underlying investments based on information provided by the underlying investment into the following categories: dividend income, long-term capital gains, and return of capital.

Financing Costs — Financing costs related to the Fund’s credit agreements are recorded as a deferred charge and amortized through the maturity date of the respective credit agreement. For the six months ended June 30, 2024, the amortization of deferred financing costs totaled $367,337.

Distributions to Stockholders — Distributions from net investment income of the Fund, if any, are paid on a monthly basis. Distributions to stockholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP. For tax purposes, a distribution that for purposes of GAAP is comprised of return of capital and net investment income may be subsequently re-characterized to also include capital gains. Stockholders will be informed of the tax characteristics of the distributions after the close of the 2024 fiscal year.

Income Taxes — The Fund has elected to be taxed as a REIT. The Fund’s qualification and taxation as a REIT depend upon the Fund’s ability to meet on a continuing basis, through actual operating results, certain qualification tests set forth in the U.S. federal tax laws. Those qualification tests involve the percentage of income that the Fund earns from specified sources, the percentage of the Fund’s assets that falls within specified categories, the diversity of the ownership of the Fund’s shares of common stock, and the percentage of the Fund’s taxable income that the Fund distributes. No assurance can be given that the Fund will in fact satisfy such requirements for any taxable year. If the Fund qualifies as a REIT, the Fund generally will be allowed to deduct dividends paid to stockholders and, as a result, the Fund generally will not be subject to U.S. federal income tax on that portion of the Fund’s ordinary income and net capital gain that the Fund annually distributes to stockholders. The Fund intends to make distributions to stockholders on a regular basis as necessary to avoid material U.S. federal income tax and to comply with the REIT distribution requirements.