Filed Pursuant to General Instruction II.L. of Form F-10

File No. 333-272989

SECOND AMENDED AND RESTATED PROSPECTUS SUPPLEMENT

amending and restating the prospectus supplement dated March 8, 2024, as first amended and restated on October 4, 2024, to the short form base shelf prospectus dated November 10, 2023

| New Issue | December 17, 2024 |

BITFARMS LTD.

Up to US$86,913,570

Common Shares

This document amends and restates the prospectus supplement of Bitfarms Ltd. (the “Company”, “Bitfarms”, “we” or “our”) dated March 8, 2024 (the “March Supplement”), as first amended and restated by the prospectus supplement dated October 4, 2024 (the “October Supplement”), and accordingly the information contained in this second amended and restated prospectus supplement supersedes the information contained in the March Supplement and the October Supplement. The March Supplement qualified the distribution of up to $375,000,000 of common shares in the capital of the Company (the “Common Shares”) pursuant to an at the market offering agreement dated March 8, 2024 (the “Sales Agreement”) between the Company and H.C. Wainwright & Co., LLC (the “Agent”). To date, the Company has distributed 128,888,346 Common Shares under the Sales Agreement for gross proceeds of approximately $288,086,430. Accordingly, this prospectus supplement, together with the base shelf prospectus, hereby qualifies the distribution (the “Offering”) of up to $86,913,570 of Common Shares (each Common Share being qualified hereunder, an “Offered Share”) in accordance with the Sales Agreement. Pursuant to the Sales Agreement, the Company may distribute Offered Shares from time to time through the Agent, as the agent for distribution of the Offered Shares, in accordance with the terms of the Sales Agreement pursuant to the Offering. The Offering is being made in the United States under the terms of a registration statement on Form F-10 (File No. 333-272989) (the “Registration Statement”), as amended, filed with the United States Securities and Exchange Commission (the “SEC”). No Offered Shares will be sold under the Sales Agreement in Canada or on the Toronto Stock Exchange (the “TSX”) or any other trading markets in Canada. See “PLAN OF DISTRIBUTION”.

The Common Shares are listed for trading on the Nasdaq Stock Market (“Nasdaq”) and on the TSX under the symbol “BITF”. On December 16, 2024, being the last trading day prior to the date hereof, the closing prices of the Common Shares on the TSX and Nasdaq were C$2.99 and $2.10, respectively. The Company has submitted a notification of listing to list the Offered Shares on Nasdaq and has received conditional approval to list the Offered Shares on the TSX. Listing on Nasdaq and the TSX will be subject to the Company fulfilling all of the listing requirements of Nasdaq and the TSX, respectively.

No Agent, and no person or company acting jointly or in concert with an Agent, may, in connection with the Offering, enter into any transaction that is intended to stabilize or maintain the market price of the Offered Shares or securities of the same class as the Offered Shares, including selling an aggregate number or principal amount of securities that would result in the Agent creating an over-allocation position in the Offered Shares.

In the opinion of counsel, the Offered Shares, if issued on the date hereof, generally would be qualified investments under the Income Tax Act (Canada) and the regulations thereunder (collectively, the “Tax Act”) for certain tax-exempt trusts. See “CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS”.

Prospective investors should be aware that the acquisition, holding or disposition of the Offered Shares may have tax consequences in both Canada and the United States. Such consequences for investors who are resident in, or citizens of, the United States may not be described fully in this prospectus supplement. Prospective investors should read the tax discussion in this prospectus supplement and consult their own tax advisor with respect to their own particular circumstances. See “CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS” and “CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS”.

Investing in the Offered Shares is highly speculative and involves significant risks that you should consider before purchasing such securities. You should carefully review the risks outlined in this prospectus supplement and the accompanying base shelf prospectus and in the documents incorporated by reference as well as the information under the heading “Cautionary Note Regarding Forward-Looking Statements” and consider such risks and information in connection with an investment in the Offered Shares.

Prospective investors are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the party has appointed an agent for service of process. Certain of the Company’s material subsidiaries are incorporated outside of Canada, namely: Bitfarms Ltd. (Israel), Backbone Mining Solutions LLC (Delaware, U.S.A.), Backbone Hosting Solutions SAU (Argentina), D&N Ingenieria SA (Paraguay), and Backbone Hosting Solutions Paraguay SA (Paraguay). In addition, certain of the Company’s directors and officers reside outside of Canada, namely: Benjamin Gagnon, Edith M. Hofmeister, Fanny Philip, Jeffrey Lucas and Andrew Chang reside outside of Canada and have appointed the Company at its registered office set forth below as their agent for service of process in Canada.

| Name of Person | | Name and Address of Agent |

| Benjamin Gagnon | | Bitfarms Ltd.

110 Yonge Street, Suite 1601,

Toronto, ON M5C 1T4 |

| Edith M. Hofmeister | |

| Fanny Philip | |

| Jeffrey Lucas | |

| Andrew Chang | |

The enforcement by investors of civil liabilities under the United States federal securities laws may be affected adversely by the fact that the Company is incorporated or organized under the laws of Canada, that some of its officers and directors are not residents of the United States, that some or all of the agents or experts that may be named in the prospectus supplement and the accompanying base shelf prospectus may not be residents of the United States, and that all or a substantial portion of the assets of the Company and said persons may be located outside the United States.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SEC NOR ANY STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY NOR HAS THE SEC OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Offering is being made by a Canadian issuer that is permitted, under a multijurisdictional disclosure system adopted by the United States and Canada, to prepare this prospectus supplement and the accompanying base shelf prospectus in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those of the United States. Financial statements included or incorporated by reference herein have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards”), and may be subject to foreign auditing and auditor independence standards, and thus may not be comparable to financial statements of United States companies.

Upon delivery of a placement notice by the Company, if any, the Agent may sell the Offered Shares in the United States only. Such sales of Offered Shares, if any, under this prospectus supplement and the accompanying base shelf prospectus will only be made in transactions that are deemed to be “at-the-market distributions” or an “at-the-market” offering under applicable securities laws, including, without limitation, sales made directly on Nasdaq or any other recognized marketplace upon which the Common Shares are listed or quoted or where the Common Shares are traded in the United States. The sales, if any, of Offered Shares made under the Sales Agreement will be made by means of ordinary brokers’ transactions on Nasdaq or another existing trading market in the United States at market prices, or as otherwise agreed upon by the Company and the Agent. No Offered Shares will be offered or sold in Canada or on the TSX or any other trading market in Canada. The Agent is not required to sell any specific number or dollar amount of Common Shares but will use its commercially reasonable efforts, consistent with its normal sales and trading practices, to sell the Offered Shares under the terms and conditions of the Sales Agreement. In this offering, prices may vary as between purchasers and during the period of distribution. There is no minimum amount of funds that must be raised under the Offering. As a result, the Offering may terminate after only raising a small portion of the offering amount set out above, or none at all. See “PLAN OF DISTRIBUTION”.

The Company will pay the Agent a fee of 3.0% of the gross sales price per Offered Share sold through the Agent as the Company’s agent under the Sales Agreement (the “Broker Fee”). In addition, the Company has agreed to reimburse the Agent for certain expenses incurred by it in connection with the Sales Agreement as described under “PLAN OF DISTRIBUTION.” In connection with sales of the Offered Shares, the Agent may be deemed to be an “underwriter” within the meaning of the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), and the compensation of the Agent may be deemed to be underwriting commissions or discounts. The Company has agreed to provide indemnification and contribution to the Agent against certain liabilities, including liabilities under the U.S. Securities Act.

Investing in the Offered Shares is subject to certain risks that should be considered carefully by prospective purchasers. Please see “RISK FACTORS” in this prospectus supplement and the accompanying base shelf prospectus and the risk factors in the Company’s documents which are incorporated by reference herein for a description of risks involved in an investment in Offered Shares.

The Company’s registered office is located at 110 Yonge Street, Suite 1601, Toronto, ON M5C 1T4.

AGENT

H.C. WAINWRIGHT & CO.

TABLE OF CONTENTS FOR THE PROSPECTUS SUPPLEMENT

TABLE OF CONTENTS FOR THE SHELF PROSPECTUS

IMPORTANT NOTICE

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of the securities the Company is offering and the method of distribution of such securities and also adds to and updates certain information contained in the accompanying base shelf prospectus and the documents incorporated by reference herein and therein. The second part, the base shelf prospectus, gives more general information, some of which may not apply to the Offered Shares. This prospectus supplement is deemed to be incorporated by reference into the base shelf prospectus solely for the purposes of the Offering. This prospectus supplement may add, update or change information contained in the accompanying base shelf prospectus or any of the documents incorporated by reference herein or therein. To the extent that any statement made in this prospectus supplement is inconsistent with statements made in the accompanying base shelf prospectus or any documents incorporated by reference herein or therein filed prior to the date of this prospectus supplement, the statements made in this prospectus supplement will be deemed to modify or supersede those made in the accompanying base shelf prospectus and such documents incorporated by reference herein or therein.

You should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying base shelf prospectus. The Company and the Agent have not authorized anyone to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. The Company is not making an offer to sell or seeking an offer to buy the securities offered pursuant to this prospectus in any jurisdiction where such offer or sale is not permitted. The distribution of this prospectus supplement and the Offering in certain jurisdictions may be restricted by law. You should assume that the information contained in this prospectus supplement, the accompanying base shelf prospectus and the documents incorporated by reference herein and therein is accurate only as of its respective date, regardless of the time of delivery of the base shelf prospectus, this prospectus supplement or any amendment thereto, or of any sale of the Offered Shares. The Company’s business, financial condition, results of operations and prospects may have changed since those dates. The Company does not undertake to update the information contained or incorporated by reference herein, except as required by applicable Canadian and U.S. securities laws.

The Company is subject to the information requirements of the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), and applicable Canadian securities legislation, and, in accordance therewith, the Company files reports and other information with the SEC and with the securities regulatory authorities in each of the provinces of Canada. Under a multijurisdictional disclosure system adopted by the United States and Canada, the Company may generally prepare those reports and other information in accordance with the Canadian disclosure requirements. Those requirements are different from those of the United States. As a foreign private issuer, the Company is exempt from the rules under the U.S. Exchange Act prescribing the furnishing and content of proxy statements, and the Company’s officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the U.S. Exchange Act.

This prospectus supplement does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation. This prospectus supplement shall not be used for anyone for any purpose other than in connection with the Offering.

In this prospectus supplement, unless otherwise indicated, all dollar amounts and references to “US$” or “$” are to United States dollars and references to “C$” are to Canadian dollars. This prospectus supplement and the documents incorporated by reference contain translations of certain United States dollar amounts into Canadian dollars solely for your convenience. See “CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION”.

In this prospectus supplement, unless the context otherwise requires, references to “we”, “us”, “our” or similar terms, as well as references to “Bitfarms” or the “Company”, refer to Bitfarms Ltd. together, where context requires, with its subsidiaries and affiliates.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements and other information contained in this prospectus constitute “forward-looking information” under Canadian Securities Laws and “forward-looking statements” under United States securities laws (collectively “forward-looking statements”). Such forward-looking statements include, but are not limited to:

| ● | the future price of cryptocurrencies, such as Bitcoin and the other types of digital assets which Bitfarms and its subsidiaries may earn, hold and trade; |

| ● | the Company’s intended use of net proceeds from the Offering; |

| ● | the amount of Offered Shares the Company intends to issue; |

| ● | the future pricing for services and solutions in the businesses of the Company and its subsidiaries; |

| ● | the liquidity and market price of the Common Shares; |

| ● | the Company’s expectations regarding the sufficiency of its capital resources and requirements for additional capital; |

| ● | risks related to the decrease of the market price of the Common Shares if the Company’s shareholders sell substantial amounts of Common Shares; |

| ● | risks related to future sales or issuances of equity securities diluting voting power and reducing future earnings per share; |

| ● | changes to governmental laws and regulations, including tax regulations; |

| ● | effects of new or existing global pandemics; and |

| ● | the Stronghold Merger (as defined herein) and consummation of the Stronghold Merger. |

These forward-looking statements relate to future events or future performance. All statements other than statements of historical fact may be forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe”, “future”, “continue” or similar expressions or the negatives thereof.

By their very nature, forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements and such forward-looking statements included in this prospectus should not be unduly relied upon. These statements speak only as of the date of this prospectus.

The forward-looking statements in this document are based on what the Company currently believes are reasonable assumptions, including the material assumptions set out in the Company’s applicable annual information form and management discussion and analysis. These documents are available electronically under the Company’s Canadian System for Electronic Document Analysis and Retrieval (“SEDAR+”) profile at www.sedarplus.ca and through the SEC’s Electronic Data Gathering, Analysis and Retrieval System (“EDGAR”) at the SEC’s website at www.sec.gov. Other material factors or assumptions that were applied in formulating the forward-looking statements contained herein include or relate to the following:

| ● | the business and economic conditions affecting the Company’s operations in their current state, including, general levels of economic activity, regulations, taxes and interest rates; |

| ● | the Company’s ability to profitably produce the computational power sold to Mining Pools (as defined herein) to solve block regards, which may be paid in Bitcoin, United States dollars, or other currency; |

| ● | the Company’s ability to successfully acquire and maintain required regulatory licenses and qualifications; |

| ● | historical prices of cryptocurrencies; |

| ● | the emerging cryptocurrency and blockchain markets and sectors; |

| ● | the Company’s ability to maintain good business relationships; |

| ● | the Company’s ability to manage and integrate acquisitions; |

| ● | the Company’s ability to identify, hire and retain key personnel; |

| ● | the Company’s ability to raise sufficient debt or equity financing to support the Company’s continued growth; |

| ● | economic dependence on regulated terms of service and electricity rates; |

| ● | the technology, proprietary and non-proprietary software, data and intellectual property of the Company and third parties in the cryptocurrencies and digital asset sector is able to be relied upon to conduct the Company’s business; |

| ● | the Company does not suffer a material impact or disruption from a cybersecurity incident, cyber-attack or theft of digital assets; |

| ● | continued maintenance and development of cryptocurrency Mining facilities; |

| ● | continued growth in usage and in the blockchain for various applications; |

| ● | continued development of a stable public infrastructure, with the necessary speed, data capacity and security required to operate blockchain networks; |

| ● | the absence of adverse regulation or law; |

| ● | the absence of material changes in the legislative, regulatory or operating framework for the Company’s existing and anticipated business; |

| ● | the ability of the Company to satisfy the conditions required to close the Stronghold Merger; |

| ● | the absence of the occurrence of any event, change or other circumstance that could give rise to the termination of the Stronghold Merger or require the Company to modify the terms and conditions of the Stronghold Merger; |

| ● | the ability of the Company to consummate the Stronghold Merger without delays; and |

| ● | the ability of the Company to achieve all or any of the anticipated benefits and synergies of the Stronghold Merger. |

Inherent in forward-looking statements are risks, uncertainties and other factors beyond the Company’s ability to predict or control. Some of the risks or factors that could cause outcomes and results to differ materially from those expressed in the forward-looking statements include:

| ● | management of growth and expansion; |

| ● | the timing to consummate the Stronghold Merger and the failure to consummate or delays in consummating the Stronghold Merger; |

| ● | the failure to satisfy the conditions required to consummate the Stronghold Merger; |

| ● | the occurrence of any event, change or other circumstance that could give rise to the termination of the Stronghold Merger or otherwise require the Company to modify the terms and conditions of the Stronghold Merger, including to achieve regulatory or stockholder approval; |

| ● | the inherent risks, costs and uncertainties associated with integrating the business successfully and risks of not achieving all or any of the anticipated benefits and synergies of the Stronghold Merger, or the risk that the anticipated benefits and synergies of the Stronghold Merger may not be fully realized or take longer to realize than expected; |

| ● | unexpected costs, liabilities or delays in connection with or with respect to the Stronghold Merger; |

| ● | certain restrictions during the pendency of the Stronghold Merger that may impact the ability of Bitfarms to pursue certain business opportunities or strategic transactions; |

| ● | currency exchange risks; |

| ● | valuation and price volatility of cryptocurrencies; |

| ● | share price fluctuations; |

| ● | future capital needs, uncertainty of additional financing and dilution; |

| ● | global financial conditions; |

| ● | possibility of bitcoin Mining algorithms transitioning to proof of stake validation; |

| ● | limited operating history; |

| ● | employee retention and growth; |

| ● | cybersecurity threats and hacking; |

| ● | limited history of de-centralized financial system; |

| ● | risk related to technological obsolescence and difficulty in obtaining hardware; |

| ● | cryptocurrency network difficulty and impact of increased global computing power; |

| ● | economic dependence on regulated terms of service and electricity rates risks; |

| ● | increases in commodity prices or reductions in the availability of such commodities; |

| ● | future profits/losses and production revenues/expenses; |

| ● | fraud and failure of cryptocurrency exchanges, custodians and other trading venues; |

| ● | significant costs and demands upon management and accounting and finance resources as a result of complying with the laws and regulations affecting public companies; |

| ● | expense and impact of restatement of the company’s historical financial statements; |

| ● | lack of comprehensive accounting guidance for cryptocurrencies under IFRS accounting standards; |

| ● | internal control material weakness; |

| ● | insolvency, bankruptcy, or cessation of operations of Mining Pool operator; |

| ● | independent Mining risks; |

| ● | indemnification of Mining Pool; |

| ● | reliance on foreign Mining Pool operator; |

| ● | Mining Pool agreements governed by foreign laws; |

| ● | political and regulatory risk; |

| ● | reliance on manufacturing in foreign countries and the importation of equipment to the jurisdictions in which the Company operates; |

| ● | environmental regulations; |

| ● | environmental liability; |

| ● | erroneous transactions and human error; |

| ● | acceptance and/or widespread use of cryptocurrency is uncertain; |

| ● | hazards associated with high-voltage electricity transmission and industrial operations; |

| ● | adoption of ESG practices and the impacts of climate change; |

| ● | emerging legislation and scrutiny regarding human rights issues; |

| ● | U.S. foreign corrupt practices act and similar legislation; |

| ● | third-party supplier risks; |

| ● | potential of the Company being classified as a Passive Foreign Investment Company; |

| ● | pandemic and infectious disease risk (including Covid-19); |

| ● | economic volatility and other challenges in Argentina and/or Paraguay; |

| ● | vulnerability of Argentina and Paraguay economies to external shocks; |

| ● | impacts of corruption and anti-corruption laws in operating locations; |

| ● | unpredictability of tax rates, capital controls and foreign exchange restrictions in Argentina; |

| ● | discretion over use of proceeds; |

| ● | absence of a public market for certain of the securities; |

| ● | unsecured debt facilities; |

| ● | effect of changes in interest rates on debt securities; |

| ● | effect of fluctuations in foreign currency markets on debt securities; |

| ● | trading price of common shares and volatility; |

| ● | unallocated proceeds of the offering; |

| ● | no certainty regarding the net proceeds to the Company; |

| ● | investors likely to pay different prices; |

| ● | limitations on the enforcement of civil judgments; |

| ● | return on investment is not guaranteed; |

| ● | unsolicited take-over bids; and |

| ● | risk of potential adverse U.S. federal income tax consequences to United States persons. |

Additional information on these and other factors is discussed under the heading “RISK FACTORS” in this prospectus supplement, in the accompanying base shelf prospectus and in the documents incorporated by reference herein including in the 2023 MD&A (as defined herein) under the headings “Financial Instruments and Risks” and “Other Risks”, in the Q3 2024 MD&A (as defined herein) under the heading “Risk Factors” and in the 2023 AIF (as defined herein) under the heading “Risk Factors”, as may be modified or superseded by other subsequently filed documents that are also incorporated or deemed to be incorporated by reference in this prospectus supplement.

The forward-looking statements contained in this prospectus are expressly qualified by this cautionary statement. Except as required by law, the Company does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this prospectus supplement and the accompanying base shelf prospectus from documents filed with the securities commissions or similar authorities in Canada and filed with, or furnished to, the SEC.

Copies of the documents incorporated herein by reference may be obtained on request without charge from the Chief Financial Officer of Bitfarms at 110 Yonge Street, Suite 1601, Toronto, ON M5C 1T4 (Telephone 647 259-1790) Attn: Chief Financial Officer. Such documents are also available without charge on SEDAR+ at www.sedarplus.ca or through EDGAR at the SEC’s website at www.sec.gov. The filings of the Company available on SEDAR+ and EDGAR are not incorporated by reference in this prospectus except as specifically set out herein.

As of the date hereof, the following documents, filed by the Company with securities commissions or similar authorities in each of the provinces of Canada and filed with, or furnished to, the SEC, are specifically incorporated by reference in, and form an integral part of, this prospectus supplement and the accompanying base shelf prospectus:

| ● | the annual information form for the year ended December 31, 2023 dated March 6, 2024 (the “2023 AIF”); |

| ● | the restated audited consolidated financial statements as at and for the years ended December 31, 2023 and 2022, the notes thereto and the Report of Independent Registered Public Accounting Firm thereon (the “2023 Annual Financial Statements”); |

| ● | the restated unaudited interim condensed consolidated financial statements as at September 30, 2024 and for the three and nine months ended September 30, 2024 and 2023; |

| ● | the restated management’s discussion and analysis for the year ended December 31, 2023 (the “2023 MD&A”); |

| ● | the restated management’s discussion and analysis for the three and nine months ended September 30, 2024; (the “Q3 2024 MD&A”); |

| ● | the management information circular dated April 16, 2024 with respect to an annual general and special meeting of shareholders held on May 31, 2024; |

| ● | the management information circular dated October 17, 2024 with respect to a special meeting of shareholders held on November 20, 2024; |

| ● | the material change report dated January 2, 2024, relating to the Company’s December 2023 monthly update; |

| ● | the material change report dated January 24, 2024, relating to the Company’s purchase of land in Yguazu, Paraguay; |

| ● | the material change report dated February 1, 2024, relating to the Company’s January 2024 monthly update; |

| ● | the material change report dated March 1, 2024, relating to the Company’s February 2024 monthly update; |

| ● | the material change report dated March 7, 2024, relating to the Company’s reporting of its results for the quarter and year ended December 31, 2023; |

| ● | the material change report dated March 8, 2024 relating to the Company’s $375 million at-the-market equity offering program; |

| ● | the material change report dated March 11, 2024 relating to the Company’s purchase of additional miners; |

| ● | the material change report dated March 25, 2024 relating to the Company’s chief executive officer transition; |

| ● | the material change report dated April 1, 2024 relating to the Company’s March 2024 monthly update; |

| ● | the material change report dated April 12, 2024 relating to the completion of the Company’s fleet upgrade at the Garlock and Farnham facilities; |

| ● | the material change report dated May 1, 2024 relating to the Company’s April 2024 monthly update; |

| ● | the material change report dated May 13, 2024 relating to the acceleration of the Company’s chief executive officer transition; |

| ● | the material change report dated May 14, 2024 relating to the increase in power capacity at the Yguazu facility in Paraguay; |

| ● | the material change report dated May 15, 2024 relating to the Company’s first quarter 2024 results; |

| ● | the material change report dated May 29, 2024 relating to the Company’s response to an unsolicited proposal by Riot Platforms, Inc.; |

| ● | the material change report dated May 31, 2024 relating to the results of the Company’s annual general and special meeting of shareholders; |

| ● | the material change report dated June 3, 2024 relating to the Company’s May 2024 monthly update; |

| ● | the material change report dated June 10, 2024 relating to the Company’s adoption of a shareholder rights plan; |

| ● | the material change report dated June 10, 2024 relating to the TSX deferral of consideration of a shareholder rights plan; |

| ● | the material change report dated June 12, 2024 relating to a statement by the Company regarding the ongoing strategic alternatives review process; |

| ● | the material change report dated June 13, 2024 relating to an agreement by the Company to develop up to 120 MW of power capacity in the United States; |

| ● | the material change report dated June 24, 2024 relating to the requisition by Riot Platforms, Inc. of a special shareholder meeting; |

| ● | the material change report dated June 27, 2024 relating to the appointment of Fanny Philip to the board of directors; |

| ● | the material change report dated July 1, 2024 relating to the Company’s June 2024 monthly update; |

| ● | the material change report dated July 8, 2024 relating to the appointment of Ben Gagnon as chief executive officer; |

| ● | the material change report dated July 12, 2024 relating to the date of the special meeting of shareholders; |

| ● | the material change report dated July 24, 2024 relating to the decision by the Ontario Securities Commission Capital Markets Tribunal; |

| ● | the material change report dated July 26, 2024 relating to the TSX deferral of consideration of a shareholder rights plan; |

| ● | the material change report dated August 1, 2024 relating to the Company’s July 2024 monthly update; |

| ● | the material change report dated August 8, 2024 relating to the Company’s second quarter 2024 results; |

| ● | the material change report dated August 13, 2024 relating to board of directors and leadership updates; |

| ● | the material change report dated August 21, 2024 relating to an agreement (the “Stronghold Merger Agreement”) and plan of merger (the “Stronghold Merger”) between the Company, Backbone Mining Solutions LLC, HPC & AI Megacorp, Inc. and Stronghold Digital Mining, Inc. (“Stronghold”); |

| ● | the material change report dated August 27, 2024 relating to the Company’s assumption of control of a data center in Sharon, Pennsylvania; |

| ● | the material change report dated September 3, 2024 relating to the Company’s August 2024 monthly update; |

| ● | the material change report dated September 4, 2024 relating to the Company’s statement regarding certain claims made by Riot Platforms, Inc.; |

| ● | the material change report dated September 9, 2024 relating to the rescheduling of the Company’s special meeting of shareholders; |

| ● | the material change report dated September 10, 2024 relating to changes to the Company’s operations teams; |

| ● | the material change report dated September 23, 2024 relating to the Company’s settlement with Riot Platforms, Inc.; |

| ● | the material change report dated October 1, 2024 relating to the Company’s September 2024 monthly update; |

| ● | the material change report dated October 29, 2024 relating to the nomination of Andrew J. Chang to the board of directors; |

| ● | the material change report dated October 31, 2024 related to the second miner hosting agreement with Stronghold; |

| ● | the material change report dated November 1, 2024 related to the Company’s October 2024 monthly update; |

| ● | the material change report dated November 13, 2024 related to the Company’s 2024 third quarter results; |

| ● | the material change report dated November 20, 2024 related to the results of the Company’s special meeting of shareholders; |

| ● | the material change report dated December 2, 2024 related to the Company’s November 2024 monthly update; and |

| ● | the material change report dated December 9, 2024 related to the Company’s restatement of previously issued financial statements. |

Any documents of the type described in Section 11.1 of Form 44-101F1 Short Form Prospectus filed by the Company with a securities commission or similar authority in any province or territory of Canada subsequent to the date of this prospectus supplement and prior to the termination of the Offering, will be deemed to be incorporated by reference into this prospectus supplement and the accompanying base shelf prospectus and the previous documents of the type referred to in this paragraph will no longer be deemed to be incorporated by reference in this prospectus supplement. To the extent that any document or information incorporated by reference into this prospectus supplement is included in a report that is filed with or furnished to the SEC pursuant to the U.S. Exchange Act, such document or information shall also be deemed to be incorporated by reference as an exhibit to the Registration Statement (in the case of a report on Form 6-K, only if and to the extent expressly provided in such report).

Any statement contained in this prospectus supplement, in the accompanying base shelf prospectus, or in a document incorporated or deemed to be incorporated by reference herein or therein will be deemed to be modified or superseded for purposes of this prospectus supplement or the accompanying base shelf prospectus, to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement is not to be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement or the prospectus.

References to the Company’s website in this prospectus supplement, the accompanying base shelf prospectus or any documents that are incorporated by reference herein and therein do not incorporate by reference the information on such website into this prospectus supplement and the accompanying base shelf prospectus, and the Company disclaims any such incorporation by reference.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

All dollar amounts and references to “US$” or “$” are to United States dollars and references to “C$” are to Canadian dollars, unless otherwise indicated.

The high, low, average and closing exchange rates for one United States dollar expressed in Canadian dollars for each of the periods indicated below, as quoted by the Bank of Canada, are set forth in the following table:

| | | Three Months ended

September 30, 2024 | | Three Months ended

September 30, 2023 | | Year ended

December 31, 2023 | | Year ended

December 31, 2022 |

| | | | (expressed in Canadian dollars) | |

| High | | | 1.3858 | | | | 1.3674 | | | | 1.3875 | | | | 1.3856 | |

| Low | | | 1.3460 | | | | 1.3128 | | | | 1.3128 | | | | 1.2451 | |

| Average | | | 1.3641 | | | | 1.3411 | | | | 1.3497 | | | | 1.3011 | |

| Closing | | | 1.3499 | | | | 1.3520 | | | | 1.3226 | | | | 1.3544 | |

On December 16, 2024, the daily average exchange rate for United States dollars in terms of Canadian dollars, as quoted by the Bank of Canada, was $1.00 = C$1.4239.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been, or will be, filed with the SEC as part of the Registration Statement, of which this prospectus supplement forms a part: (1) the documents listed under “DOCUMENTS INCORPORATED BY REFERENCE”; (2) the powers of attorney from certain of the Company’s directors and officers; (3) the consent of PricewaterhouseCoopers LLP (“PwC”); (4) the consent of Urish Popeck & Co., LLC and (5) the Sales Agreement.

AVAILABLE INFORMATION

The Company is subject to the informational requirements of the U.S. Exchange Act and applicable Canadian requirements and, in accordance therewith, files reports and other information with the SEC and with securities regulatory authorities in Canada. Under the multijurisdictional disclosure system adopted by the United States and Canada, such reports and other information may be prepared in accordance with the disclosure requirements of Canada, which requirements are different from those of the United States. As a foreign private issuer, the Company is exempt from the rules under the U.S. Exchange Act prescribing the furnishing and content of proxy statements, and the Company’s officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the U.S. Exchange Act. Reports and other information filed by the Company with, or furnished to, the SEC may be obtained on EDGAR at the SEC’s website: www.sec.gov.

The Company has filed with the SEC the Registration Statement with respect to certain securities of the Company, including the Offered Shares. This prospectus supplement and the accompanying base shelf prospectus, including the documents incorporated by reference herein, which form a part of the Registration Statement, do not contain all of the information set forth in the Registration Statement, certain parts of which are contained in the exhibits to the Registration Statement as permitted by the rules and regulations of the SEC. For further information with respect to the Company and the Offered Shares, reference is made to the Registration Statement and the exhibits thereto. Statements contained in this prospectus supplement and the accompanying base shelf prospectus, including the documents incorporated by reference herein, as to the contents of certain documents are not necessarily complete and, in each instance, reference is made to the copy of the document filed as an exhibit to the Registration Statement. Each such statement is qualified in its entirety by such reference. The Registration Statement can be found on EDGAR at the SEC’s website: www.sec.gov.

THE COMPANY

The following description of the Company is, in some instances, derived from selected information about the Company contained in the documents incorporated by reference into this prospectus supplement and the accompanying base shelf prospectus. This description does not contain all of the information about the Company and its business that you should consider before investing in any securities. You should carefully read this entire prospectus supplement and the accompanying base shelf prospectus, including the section entitled “Risk Factors”, as well as the documents incorporated by reference herein and therein, before making an investment decision.

Name, Address and Incorporation

The Company was incorporated under the Canada Business Corporations Act on October 11, 2018, and continued under the Business Corporations Act (Ontario) on August 27, 2021. The Company has its registered and head office located at 110 Yonge Street, Suite 1601, Toronto, ON M5C 1T4. The Company’s Common Shares are listed for trading on Nasdaq and on the TSX under the trading symbol “BITF”.

Subsidiaries

The table below lists the principal material subsidiaries of the Company as of the date hereof.

| Name | | Jurisdiction | | Assets Held |

| Bitfarms Ltd. (Israel) | | Israel | | Holding Company |

| Backbone Hosting Solutions Inc. | | Canada | | Computer equipment, cryptocurrency |

| Backbone Hosting Solutions SAU | | Argentina | | Computer equipment |

| D&N Ingenieria SA | | Paraguay | | Computer equipment |

| Backbone Mining Solutions LLC | | United States | | Computer equipment |

| 9159-9290 Québec Inc. (operating under the name “Volta Électrique Inc.”) (“Volta”) | | Quebec | | Provides professional electrical services to Backbone Hosting Solutions Inc., Orion Constellation Technologies Inc. and outside customers |

| Orion Constellation Technologies Inc. | | Quebec | | Computer equipment |

| Bitfarms Paraguay Limited Partnership (operating under Bitfarms - Sucursal Paraguay) | | Ontario | | Computer equipment |

| Backbone Hosting Solutions Paraguay SA | | Paraguay | | Computer equipment |

| Zunz S.A. | | Paraguay | | Facility under construction |

Summary Description of the Business

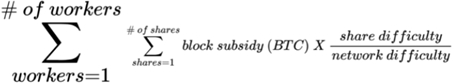

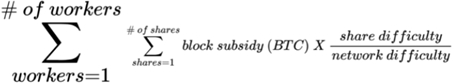

The Company’s primary business is the mining of cryptocurrency. Through its subsidiaries, the Company owns and operates server farms, composed of computers (referred to as “Miners”) designed for the purpose of validating transactions on the Bitcoin Blockchain (referred to as “Mining”). Bitfarms generally operates Miners 24 hours a day producing computational power (measured by hashrate) which it sells to Mining Pool operators for a formula-driven rate commonly known in the industry as Full Pay Per Share (“FPPS”). For more information regarding the Company’s Mining Pool arrangements, see the accompanying base shelf prospectus under the heading “THE COMPANY – Summary Description of the Business – Mining Pool Participation”. For more information regarding the business of the Company, see the 2023 AIF under the heading “DESCRIPTION OF BUSINESS”.

In the description of the business of the Company in this prospectus supplement:

“Bitcoin” shall refer to a decentralized digital currency that is not controlled by any centralized authority (e.g. a government, financial institution or regulatory organization) that can be sent from user to user on the Bitcoin network without the need for intermediaries to clear transactions. Transactions are verified through the process of Mining and recorded in a public ledger known as the Blockchain. Bitcoin is created when the Bitcoin network issues Block Rewards through the Mining process;

“Block Reward” shall refer to the new Bitcoins that are awarded by the Blockchain to eligible cryptocurrency Miners for each block they successfully mine. The current block reward is 3.125 Bitcoin per block;

“Blockchain” shall refer to a cloud-based public ledger that exists on computers that participate on the network globally. The Blockchain grows as new sets of data, or ‘blocks’, are added to it through Mining. Each block contains a timestamp and a link to the previous block, such that the series of blocks form a continuous chain. Given that each block has a separate Hash and each Hash requires information from the previous block, altering information in an established block would require recalculating all the Hashes on the Blockchain which would require an enormous and impracticable amount of computing power. As a result, once a block is added to the Blockchain it is very difficult to edit and impossible to delete;

“Hash” shall refer to a function that converts or maps an input of letters and numbers into an encrypted output of a fixed length, which outputs are often referred to as Hashes. A Hash is created using an algorithm. The algorithm used in the validation of Bitcoin transactions is the SHA-256 algorithm;

“Hashrate” shall refer to the number of Hash operations performed per second and is a measure of computing power in Mining cryptocurrency;

“Mining Pool” shall refer to when cryptocurrency Miners aggregate their processing power or Hashrate over a network and Mine transactions together in order to increase the probability of finding a block on the Bitcoin Blockchain. Mining Pools administer regular payouts to mitigate the risk of Miners operating for a prolonged period of time without finding a block; and

“MW” shall refer to a megawatt, which is 1,000 kilowatts of electricity and, in the industry of cryptocurrency Mining, is typically a reference to the number of megawatts of electricity that is available for use.

Prior to January 2021, the Company routinely exchanged cryptocurrencies earned into U.S. dollars through reputable cryptocurrency trading platforms. At the beginning of Fiscal 2021, the Company implemented the Digital Asset Management Program under which the Company decided how many earned Bitcoin would be held by the Company through its custodians. See the 2023 AIF under the heading “4.8. Digital Asset Management Program”.

As of September 30, 2024, Bitfarms operates twelve Bitcoin data centers around the world. Eight Bitcoin data centers are located in Québec, Canada, with electrical infrastructure capacity of 159 MW for Mining Bitcoin and opportunities to increase this capacity to up to a total of 180 MW; one Bitcoin data center is located in Washington State, United States, with operational electrical infrastructure capacity of 17 MW and expansion opportunities up to 21 MW; two Bitcoin data centers are located in Villarrica, Paraguay, with electrical infrastructure capacity of 80 MW and opportunities to increase this capacity to up to a total of 280 MW in Paraguay; and one Bitcoin data center is located in Argentina, with current operational electrical infrastructure capacity of 54 MW and expansion opportunities up to 210 MW in Argentina. In Argentina, the Company currently has a permit in place to draw up to 100 MW of the 210 MW from a private energy supplier; however, the Company may draw all 210 MW from the Argentina public energy grid at any time, without additional permits. In addition, Bitfarms owns proprietary software, known as the MGMT System, that is used to monitor, control, manage, report and secure mining operations. The MGMT System scans and reports the location, status, computing power and temperature of all Miners at regular intervals to allow the Company to monitor performance and maximize up-time. The MGMT System was substantially upgraded during 2023 and is continually being updated to enhance its features and improve its functionality. The revised system is referred to as MGMT-2.

Volta, a wholly owned subsidiary of the Company, provides electrician services to both commercial and residential customers in Québec, while assisting Bitfarms in building and maintaining its server farms in Quebec.

Recent Developments

There have been no material developments in the business of the Company since the date of the Company’s 2023 Annual Financial Statements which have not been disclosed in this prospectus supplement, the accompanying base shelf prospectus, or the documents incorporated by reference herein.

PROMOTERS

The following table sets forth the Promoters of the Company:

| Name | | Class of

Securities

Owned | | Quantity of Securities Owned | | % of

Class(3) |

| Emiliano Joel Grodzki(1) | | Common Shares | | | Nil | | | | Nil | |

| Nicolas Bonta(2) | | Common Shares | | | 125,000 | | | | >0.1 | % |

| Total | | | | | 125,000 | | | | >0.1 | % |

Notes:

| (1) | In addition to the Common Shares noted in the table above, Mr. Grodzki holds 2,314,900 options to purchase Common Shares at an average price of C$2.12 per Common Shares and 25,000 RSUs (as defined herein). |

| (2) | In addition to the Common Shares noted in the table above, Mr. Bonta holds 2,304,900 options to purchase Common Shares at an average price of C$2.13 per Common Shares and 25,000 RSUs. |

| (3) | A total of 472,551,346 Common Shares are issued and outstanding as of the date hereof. |

No Promoter was within 10 years before the date of this prospectus supplement, a director, chief executive officer, or chief financial officer of any person or company that: (a) was subject to an order that was issued while the Promoter was acting in the capacity as director, chief executive officer or chief financial officer; or (b) was subject to an order that was issued after the Promoter ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while the Promoter was acting in the capacity as director, chief executive officer or chief financial officer.

No Promoter has: (a) been within the 10 years before the date of this prospectus supplement a director or executive officer of any person or company that, while the Promoter was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets, state the fact; or (b) become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or became subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the promoter, state the fact.

No Promoter has been subject to: (a) any penalties or sanctions imposed by a court relating to provincial and territorial securities legislation or by a provincial and territorial securities regulatory authority or has entered into a settlement agreement with a provincial and territorial securities regulatory authority; or (b) any other penalties or sanctions imposed by a court or regulatory body that would be likely to be considered important to a reasonable investor in making an investment decision.

RISK FACTORS

Before deciding to invest in the Offered Shares, prospective purchasers should carefully consider the risk factors and the other information contained in this prospectus supplement and the accompanying base shelf prospectus and the documents incorporated by reference herein and therein. Investing in the Company’s securities is speculative and involves a high degree of risk due to the nature of the Company’s business and the present stage of its development. The following risk factors, as well as risks currently unknown to us, could materially and adversely affect the Company’s future business, operations and financial condition and could cause them to differ materially from the estimates described in forward-looking statements relating to the Company, or its business or financial results, each of which could cause purchasers of the Company’s securities to lose part or all of their investment. The risks set out below are not the only risks the Company faces; risks and uncertainties not currently known to the Company or that the Company currently deems to be immaterial may also materially and adversely affect the Company’s business, financial condition, results of operations and prospects. You should also refer to the other information set forth or incorporated by reference in this prospectus supplement and the accompanying base shelf prospectus, including the Company’s 2023 AIF, the 2023 MD&A and annual financial statements and the related notes, and the Q3 2024 MD&A and interim financial statements and the related notes. A prospective investor should carefully consider the risk factors set out below along with the other matters set out or incorporated by reference in this prospectus.

Risks Related to the Stronghold Merger

There is no assurance when or if the Stronghold Merger will be completed, and regulatory approvals may not be received, may take longer than expected or may impose conditions that are not presently anticipated or cannot be met.

The completion of the Stronghold Merger is subject to satisfaction or waiver of certain customary mutual closing conditions, including (i) the approval of the Stronghold Merger proposal by the holders of Stronghold common stock, (ii) the absence of any governmental order or law that makes consummation of the Stronghold Merger illegal or otherwise prohibited, (iii) receipt of certain approvals and consents from specified governmental entities, including, if applicable, the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, (iv) the effectiveness of a registration statement on Form F-4, pursuant to which the Company’s Common Shares to be issued in connection with the Stronghold Merger are registered with the SEC and (v) the authorization for listing of the Company’s Common Shares to be issued in connection with the Stronghold Merger on the TSX and Nasdaq, subject to customary conditions and official notice of issuance. The obligation of each party to consummate the Stronghold Merger is also conditioned upon, among other things, (1) the other party’s representations and warranties being true and correct (subject to applicable materiality and de minimis standards), (2) the other party having performed in all material respects its obligations required to be performed by it under the Stronghold Merger Agreement at or prior to the effective time, (3) the absence of a material adverse effect on the other party and (4) certain conditions pertaining to Stronghold’s mining facilities. There can be no assurance as to when these conditions will be satisfied or waived, if at all, or that other events will not intervene to delay or result in the failure to complete the Stronghold Merger.

Stronghold and the Company have each agreed to, promptly following the execution of the Stronghold Merger Agreement, prepare and file certain filings, submissions and notices and obtain consents, orders and approvals necessary to complete the Stronghold Merger and the other transactions contemplated by the Stronghold Merger Agreement. No assurance can be given that the required consents, orders and approvals will be obtained or that the required conditions to the completion of the Stronghold Merger will be satisfied and an adverse development in either party’s regulatory standing or other factors could result in an inability to obtain one or more of the required regulatory approvals or delay receipt of required approvals. Even if all such consents, orders and approvals are obtained and such conditions are satisfied, no assurance can be given as to the terms, conditions and timing of such consents, orders and approvals. For example, these consents, orders and approvals may impose conditions on or require divestitures relating to the divisions, operations or assets of Stronghold and the Company or may impose requirements, limitations or costs or place restrictions on the conduct of Stronghold’s or the Company’ business, and if such consents, orders or approvals require an extended period of time to be obtained, such extended period of time could increase the chance that a material adverse event occurs with respect to Stronghold or the Company. Such extended period of time also may increase the chance that other adverse effects with respect to Stronghold or the Company could occur. Each party’s obligation to complete the Stronghold Merger is also subject to the accuracy of the representations and warranties of the other party (subject to certain qualifications and exceptions) and the performance in all material respects of the other party’s covenants under the Stronghold Merger Agreement. As a result of these conditions, the Company cannot provide assurance that the Stronghold Merger will be completed on the terms or timeline currently contemplated, or at all.

The announcement and pendency of the Stronghold Merger could adversely affect the Company’s business, results of operations and financial condition.

The announcement and pendency of the Stronghold Merger could cause disruptions in and create uncertainty surrounding the Company’s business, including affecting the Company’s relationships with its existing and future business partners, suppliers and employees, which could have an adverse effect on the Company’s business, results of operations and financial condition, regardless of whether the Stronghold Merger is completed.

If the Stronghold Merger is not completed, the trading prices of the Company’s Common Shares may fall to the extent that the current prices reflect a market assumption that the Stronghold Merger will be completed. In addition, the failure to complete the Stronghold Merger may result in negative publicity or a negative impression of Stronghold and/or the Company in the investment community and may affect the Company’s relationship with employees, suppliers and other partners in the business community.

The Company will incur substantial transaction fees and costs in connection with the Stronghold Merger.

The Company has incurred and expects to incur additional material non-recurring expenses in connection with the Stronghold Merger and completion of the transactions contemplated by the Stronghold Merger Agreement, including costs relating to obtaining required approvals. The Company has incurred significant legal, advisory and financial services fees in connection with the process of negotiating and evaluating the terms of the Stronghold Merger. Additional significant unanticipated costs may be incurred in the course of coordinating the businesses of Stronghold and the Company after completion of the Stronghold Merger. Even if the Stronghold Merger is not completed, the Company will be required to pay certain costs relating to the Stronghold Merger incurred prior to the date the Stronghold Merger was abandoned, such as legal, accounting, financial advisory, filing and printing fees. Such costs may be significant and could have an adverse effect on the Company’s future results of operations, cash flows and financial condition.

Significant demands will be placed on the Company as a result of the Stronghold Merger.

The Company has expended, and continues to expend, significant management resources in an effort to complete the Stronghold Merger, which are being diverted from the Company’s day-to-day operations. In addition, as a result of the completion of the Stronghold Merger, significant demands will be placed on the managerial, operational and financial personnel and systems of the Company. The Company cannot assure that their systems, procedures and controls will be adequate to support the expansion of operations following and resulting from the Stronghold Merger. The future operating results of the combined company will be affected by the ability of its officers and key employees to manage changing business conditions and to implement and expand its operational and financial controls and reporting systems in response to the Stronghold Merger.

The unaudited pro forma condensed combined financial information of Stronghold and the Company is presented for illustrative purposes only and may not be indicative of the results of operations or financial condition of the combined company following the Stronghold Merger.

The unaudited pro forma condensed combined financial information included as Schedule “A-1” of this prospectus supplement has been prepared using the consolidated historical financial statements of the Company and Stronghold, respectively, is presented for illustrative purposes only and should not be considered to be an indication of the results of operations or financial condition of the combined company following the Stronghold Merger. In addition, the pro forma combined financial information included as Schedule “A-1” hereto is based in part on certain assumptions regarding the Stronghold Merger. These assumptions may not prove to be accurate, and other factors may affect the combined company’s results of operations or financial condition following the Stronghold Merger. Accordingly, the historical and pro forma financial information included herein does not necessarily represent the combined company’s results of operations and financial condition had Stronghold and the Company operated as a combined entity during the periods presented, or of the combined company’s results of operations and financial condition following completion of the Stronghold Merger. The combined company’s potential for future business success and operating profitability must be considered in light of the risks, uncertainties, expenses and difficulties inherent in the Company’s and Stronghold’s respective businesses, as well as those typically encountered by recently combined companies.

In preparing the pro forma financial information contained herein, the Company has given effect to, among other items, the completion of the Stronghold Merger and related transactions, the payment of the Stronghold Merger consideration and the indebtedness of the Company on a combined basis after giving effect to the Stronghold Merger, including the indebtedness of Stronghold. The unaudited pro forma financial information does not reflect all of the costs that are expected to be incurred by Stronghold and the Company in connection with the Stronghold Merger. In addition, the Stronghold Merger is based on a share exchange ratio with the result that the purchase price recorded upon completion of the acquisition will not be known until that time and cannot be predicted due to volatility of prices in the trading of Company’s Common Shares. For more information, see the section entitled “PROBABLE ACQUISITION.”

While the Stronghold Merger Agreement is in effect, the Company and its respective subsidiaries’ businesses are subject to restrictions on its business activities.

Under the Stronghold Merger Agreement, the Company is subject to certain restrictions on the conduct of its business and generally must operate its business in the ordinary course prior to completing the Stronghold Merger (unless the Company obtains Stronghold’s written consent, which is not to be unreasonably withheld, delayed or conditioned), which may restrict the Company’s ability to exercise certain of its business strategies. These restrictions may prevent the Company from pursuing otherwise attractive business opportunities, making certain investments or acquisitions, selling assets, engaging in capital expenditures in excess of certain agreed limits or incurring indebtedness prior to the completion of the Stronghold Merger or termination of the Stronghold Merger Agreement, as applicable. These restrictions could have an adverse effect on the Company’s businesses, financial results, financial condition or share price.

The termination of the Stronghold Merger Agreement could negatively impact the Company and, in certain circumstances, could require Stronghold or the Company to pay certain termination fees.

The Stronghold Merger Agreement is subject to a number of customary closing conditions that must be fulfilled in order to complete the Stronghold Merger and contains certain termination rights for both Stronghold and the Company, which, if exercised, would result in the Stronghold Merger not being completed. If the Stronghold Merger is not completed for any reason, including as a result of Stronghold stockholders failing to approve the Stronghold Merger proposal or if the Stronghold Merger Agreement is terminated in accordance with its terms, the ongoing business of the Company may be adversely affected and, without realizing any of the anticipated benefits of having completed the Stronghold Merger, the Company would be subject to a number of risks, including the following:

| ● | the Company may experience negative reactions from the financial markets, including a decline of its share price (which may reflect a market assumption that the Stronghold Merger will be completed); |

| ● | the Company may experience negative reactions from or irreparable reputational harm as perceived by the Company’s investment community, suppliers, peers regulators, employees, partners in the business community and any other third party whether presently known or unknown; and |

| ● | the Company may experience a material adverse effect on the Company’s businesses, operations, earnings and financial results. |

If the Stronghold Merger Agreement is terminated under circumstances specified in the Stronghold Merger Agreement, Stronghold may be required to pay the Company a termination fee of $5,000,000 and the Company may be required to pay Stronghold a reverse termination fee of $12,500,000 (minus the amount of the deposit, as defined in the hosting agreement between Stronghold and the Company dated September 12, 2024 (the “hosting agreement”), held by Stronghold and not yet returned to the Company under the hosting agreement as of the date of the termination of the Stronghold Merger Agreement, such deposit amount being up to a maximum of $5,000,000), in the form of cash and/or Bitcoin (at the election of the Company), depending on the circumstances surrounding the termination. There is no guarantee that Stronghold or the Company will have sufficient funds to make these contractually required payments to the other party, as applicable.

The Company may be the target of securities class action and derivative lawsuits which could result in substantial costs and may delay or prevent the Stronghold Merger from being completed.

Securities class action lawsuits and derivative lawsuits are often brought against companies that have entered into merger agreements. Even if the lawsuits are without merit, defending against these claims can result in substantial costs and divert management time and resources. Additionally, if a plaintiff is successful in obtaining an injunction prohibiting consummation of the Stronghold Merger, then that injunction may delay or prevent the Stronghold Merger from being completed.

The market value of the Company’s Common Shares may decline as a result of the Stronghold Merger.

The consideration to be paid by the Company pursuant to the Stronghold Merger Agreement consists primarily of the Company’s Common Shares, and the market value of the Company’s Common Shares may decline as a result of the Stronghold Merger if, among other things, the combined company is unable to achieve the expected growth in earnings or if the transaction costs related to the Stronghold Merger are greater than expected. The market value also may decline if the combined company does not achieve the perceived benefits of the Stronghold Merger as rapidly or to the extent anticipated by the market or if the effect of the Stronghold Merger on the combined company’s business, financial position, results of operations or cash flows is not consistent with the expectations of financial or industry analysts. See also “RISK FACTORS – Risks Related to the Offering of Securities – You may suffer dilution in this Offering or other offerings of the Company’s securities”.

The combined company may not realize all of the anticipated benefits of the Stronghold Merger.

The Company believes that the Stronghold Merger will provide benefits to the combined company. However, there is a risk that some or all of the expected benefits of the Stronghold Merger may fail to materialize, or may not occur within the time periods anticipated by the Company. The realization of such benefits may be affected by a number of factors, including regulatory considerations and decisions, many of which are beyond the control of the Company. The challenge of coordinating previously independent businesses makes evaluating the business and future financial prospects of the combined company following the Stronghold Merger difficult. Stronghold and the Company have operated and, until completion of the Stronghold Merger, will continue to operate, independently. The success of the Stronghold Merger, including anticipated benefits, will depend, in part, on the ability to successfully integrate the operations of both companies. The past financial performance of each of Stronghold and the Company may not be indicative of their future financial performance. Realization of the anticipated benefits in the Stronghold Merger will depend, in part, on the combined company’s ability to successfully integrate Stronghold and the Company’s businesses. The combined company will be required to devote significant management attention and resources to integrating its business practices and support functions. The diversion of management’s attention and any delays or difficulties encountered in connection with the Stronghold Merger and the coordination of the two companies’ operations could have an adverse effect on the business, financial results, financial condition or the share price of the combined company following the Stronghold Merger. The coordination process may also result in additional and unforeseen expenses.

Failure to realize all of the anticipated benefits of the merger may impact the financial performance of the combined company and the price of the combined company’s common shares.

Risks Related to the Offering of the Common Shares

The Company is in the process of resolving SEC comments relating to the Company’s Annual Report on Form 40-F for the fiscal year ended December 31, 2023 regarding certain accounting and financial disclosure matters, which could result in changes to existing accounting and financial disclosure.

The Company recently received comments from the staff of the SEC’s Division of Corporation Finance (the “Staff”) relating to the Company’s Annual Report on Form 40-F for the fiscal year ended December 31, 2023 (the “2023 Annual Report”). The Staff’s comments are focused on the Company’s accounting of its Bitcoin-related operations and related accounting policies. Because of the limited precedent available and a lack of formal accounting guidance for cryptocurrencies under certain applicable accounting standards, including, among other things, revenue recognition, there is uncertainty associated with how Bitcoin miners (in particular, non-U.S. companies such as the Company that report in accordance with IFRS Accounting Standards) may be required to account for cryptocurrency operations, transactions and assets and related revenue recognition.

The Company determined that the consolidated financial statements for the fiscal years ended December 31, 2023 and 2022 and the related management’s discussion and analysis for the year ended December 31, 2023, as well as the unaudited interim condensed consolidated financial statements for the three and nine months ended September 30, 2024 and 2023 and the related management’s discussion and analysis for the three and nine months ended September 30, 2024, should be restated in response to the Staff’s comments and to correct a material error in the classification of proceeds derived from the sale of digital assets. The Company is committed to addressing any additional Staff questions. However, until these comments are resolved, or until any additional comments raised by the Staff in this process are resolved, the Company cannot provide assurance that it will not be required to further amend or restate its 2023 Annual Report or other public disclosures or make any material changes to the accounting or financial disclosures contained in the 2023 Annual Report or other public disclosures, the Company’s accounting policies, or related disclosures made in any future filings.

The Company and its management will have broad discretion in the use of proceeds from the Offering.

The Company currently intends to allocate the net proceeds it will receive from the Offering, if any, as described under “USE OF PROCEEDS” in this prospectus supplement. However, the Company and its management will have broad discretion in the actual application of the net proceeds, as well as the timing of their expenditures, and there can be no assurance as to such net proceeds will be allocated. The Company may elect to allocate the net proceeds differently from the allocation described under “USE OF PROCEEDS” in this prospectus supplement if management believes it would be in the Company’s best interests to do so. The Company’s investors may not agree with the manner in which the Company chooses to allocate and spend the net proceeds from the Offering. The failure by the Company to apply these funds effectively could have a material adverse effect on the business of the Company and cause the price of Common Shares to decline. Pending their use, the Company may invest the net proceeds from the Offering in a manner that does not produce income or that loses value.

There is no certainty regarding the net proceeds to the Company of the Offering.

There is no certainty that any Offered Shares will be sold in the Offering or that gross proceeds of $86,913,570 will be raised in the Offering. The Agent has agreed to use its commercially reasonable efforts to sell, on the Company’s behalf, the Offered Shares designated by the Company, but the Company is not required to request the sale of the maximum amount offered or any amount and, if the Company requests a sale, the Agent is not obligated to purchase any unsold Offered Shares as principal. As a result of the Offering being made on a commercially reasonable efforts basis with no minimum, and only as requested by the Company, the Company may raise substantially less than the maximum total offering amount or nothing at all.

Investors will likely pay different prices in the Offering.

Investors who purchase Offered Shares in this Offering at different times will likely pay different prices, and as a result may experience different outcomes in their investment results. The Company will have discretion, subject to market demand, to vary the timing, prices and numbers of Offered Shares sold, and there is no minimum or maximum sales price. Investors may experience a decline in the value of their Offered Shares as a result of Common Share sales made at prices lower than the prices they paid or for other reasons. Moreover, if the prevailing market price for the Common Shares declines, then the Corporation will be able to issue more Offered Shares under the Offering and investors may suffer greater dilution.

As a Company organized in Canada, it may be difficult to bring and enforce suits against the Company in the United States.

It may be difficult to bring and enforce suits against the Company in the United States because the Company is organized pursuant to the laws of the Province of Ontario, Canada, the Company is governed by the Business Corporations Act (Ontario), and most of the Company’s assets are located outside the United States. It may not be possible for an investor to effect service of process within the United States on, or enforce judgments obtained in the United States courts against, the Company or certain of the Company’s directors and officers based upon the civil liability provisions of United States federal securities laws or the securities laws of any state of the United States.