As filed with the Securities and Exchange Commission on April 16, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

________________________

Global Gas Corporation

(Exact Name of Registrant as Specified in Its Charter)

________________________

Delaware | | 85-1617911 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

99 Wall Street, Suite 436

New York, New York 10005

(917) 203-4436

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

________________________

William Bennett Nance, Jr.

Chief Executive Officer

99 Wall Street, Suite 436

New York, New York 10005

(917) 203-4436

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

________________________

Copies to:

Michael P. Heinz

Sidley Austin LLP

787 7th Avenue

New York, New York 10019

Tel: (212) 839-5300

________________________

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 under the Securities Exchange Act of 1934:

Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

Non-accelerated filer | | ☒ | | Smaller reporting company | | ☒ |

| | | | | Emerging growth company | | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling securityholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION — DATED APRIL 16, 2024

21,168,701 Shares of Class A Common Stock

Up to 4,850,000 Private Placement Warrants

________________________

This prospectus relates to (i) the resale by the selling securityholders named in this prospectus (the “Selling Securityholders”) of up to 4,312,500 shares of Class A common stock, par value $0.0001 per share, of the Company (“Class A Common Stock”), (ii) the issuance by us of up to 8,624,981 shares of Class A Common Stock upon exercise of the warrants issued to the public as part of the units in Dune’s initial public offering (the “Public Warrants”), (iii) the issuance by us and resale by the Selling Securityholders of up to 4,850,000 shares of Class A Common Stock upon exercise of the warrants originally issued to Dune Acquisition Holdings LLC in a private placement in connection with the initial public offering (the “IPO”) of Dune (the “Private Placement Warrants” and, together with the Public Warrants, the “Warrants”), (iv) the issuance by us and resale by the Selling Securityholders of up to 2,700,000 shares of Class A Common Stock issuable upon exchange of shares of Class B voting non-economic common stock, par value $0.0001 per share, of the Company (“Class B Common Stock”) and units in Global Gas Holdings LLC (“Holdings Common Units”), (v) the resale by the Selling Securityholders of up to 681,220 shares of Class A Common Stock issued pursuant to a subscription agreement, dated December 1, 2023 (the “Subscription Agreement”), by and among Dune and Meteora Strategic Capital, LLC (“MSC”), Meteora Capital Partners, LP (“MCP”) and Meteora Select Trading Opportunities Master, LP (“MSTO” and, collectively with MSC and MCP, the “Meteora Entities”) and (vi) the resale by the Selling Securityholders of up to 4,850,000 Private Placement Warrants. We will not receive any proceeds from the sale of shares of Class A Common Stock or Warrants by the Selling Securityholders pursuant to this prospectus.

The Class A Common Stock being registered for resale was issued to, purchased or will be purchased by the Selling Securityholders for the following consideration: (i) a purchase price of approximately $0.006 per share of Class A Common Stock for the 4,312,500 shares held by the Sponsor, (ii) for the Subscription Agreement, the 681,220 shares of Class A Common Stock were issued to the Meteora Entities as consideration for entering into a forward purchase agreement, (iii) the 2,700,000 shares of Class A Common Stock will be issued upon exchange of shares of Class B Common Stock and Holdings Common Units, which were issued as consideration to the Sellers pursuant to the Purchase Agreement and after giving effect to the Forfeitures (in each case, as defined below), (iv) a purchase price of $1.00 per share was paid for a share of Private Placement Warrant for the 4,850,000 Private Placement Warrants issued to the Selling Securityholders. The shares of Class A Common Stock underlying the Warrants will be purchased, if at all, by such holders at an exercise price of $11.50 per share.

We are registering the securities for resale pursuant to the Selling Securityholders’ registration rights under certain agreements between us and the Selling Securityholders. Our registration of the securities covered by this prospectus does not mean that the Selling Securityholders will offer or sell any of the shares of Class A Common Stock or Warrants. The Selling Securityholders may offer, sell or distribute all or a portion of their shares of Class A Common Stock or Warrants publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any proceeds from the sale of shares of Class A Common Stock or Warrants by the Selling Securityholders pursuant to this prospectus. We provide more information about how the Selling Securityholders may sell shares of Class A Common Stock or Warrants in the section entitled “Plan of Distribution.”

Our Class A Common Stock and our Public Warrants are listed on The Nasdaq Capital Market (“Nasdaq”), under the symbols “HGAS” and “HGASW,” respectively. On April 11, 2024, the closing price of our Class A Common Stock was $1.84 and the closing price for our Public Warrants was $0.05. Because, in the near term, the exercise prices of the Warrants are greater than the current market price of our Common Stock, such Warrants are unlikely to be exercised and therefore the Company does not expect to receive any proceeds from such exercise of the Warrants in the near term. Any cash proceeds associated with the exercise of the Warrants are dependent on the stock price. Whether any holders of Warrants determine to exercise such Warrants, which would result in cash proceeds to the Company, will likely depend upon the market price of our Common Stock at the time of any such holder’s determination.

Sales of a substantial number of shares of our Class A Common Stock in the public market, including any sales by the Selling Securityholders, could occur at any time. These sales, or the perception that such sales may occur, could have a significant negative impact on the trading price of our Class A Common Stock. Given the current market price of the Company’s Class A Common Stock, certain of the Selling Securityholders who paid less for their shares than such current market price will receive a higher rate of return on any such sales than the public securityholders who purchased the Class A Common Stock in Dune’s IPO or any Selling Securityholder who paid more for their shares than the current market price.

We are an “emerging growth company” under federal securities laws and are subject to reduced public company reporting requirements. Investing in our Class A Common Stock involves a high degree of risks. See the section entitled “Risk Factors” beginning on page 10 of this prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is .

Table of Contents

TABLE OF CONTENTS

You should rely only on the information provided in this prospectus, as well as the information incorporated by reference into this prospectus and any applicable prospectus supplement. Neither we nor the Selling Securityholders have authorized anyone to provide you with different information. Neither we nor the Selling Securityholders are making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus, any applicable prospectus supplement or any documents incorporated by reference is accurate as of any date other than the date of the applicable document. Since the respective dates of this prospectus and the documents incorporated by reference into this prospectus, our business, financial condition, results of operations and prospects may have changed.

Unless the context indicates otherwise, references in this prospectus to the “Company,” “Global Gas,” “we,” “us,” “our” and similar terms refer to Global Gas Corporation (f/k/a Dune Acquisition Corporation), a Delaware corporation, and its consolidated subsidiaries. References to “Dune” refer to the Company prior to the consummation of the Business Combination (as defined herein).

i

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the U.S. Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf registration process, the Selling Securityholders may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale by such Selling Securityholders of the securities offered by them described in this prospectus. This prospectus also relates to the issuance by us of the shares of Class A Common Stock issuable upon the exercise of any Warrants. We will receive proceeds from any exercise of the Warrants for cash.

Neither we nor the Selling Securityholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Securityholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Securityholders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the section of this prospectus entitled “Where You Can Find More Information.”

ii

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein and therein may contain forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and assumptions of management. Although the Company believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, the Company cannot assure you that it will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning the Company’s possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends” or similar expressions.

Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements which speak only as of the date hereof. You should understand that the following important factors, among others, could affect the Company’s future results and could cause those results or other outcomes to differ materially from those expressed or implied in the Company’s forward-looking statements:

• the Company’s ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition and the ability of the Company to grow and manage growth profitability following the Closing;

• the ability of the Company to maintain the listing of its Class A Common Stock and warrants on Nasdaq, and the potential liquidity and trading of such securities;

• the future financial performance of the Company following the Business Combination;

• the Company’s ability to sell and expand its product and service offerings, implement its growth strategy and retain its key employees;

• risks relating to the Company’s operations and business, including the Company’s ability to raise financing, hire employees, secure supplier, customer and other commercial contracts, obtain licenses and information technology and protect itself against cybersecurity risks;

• intense competition and competitive pressures from other companies worldwide in the industries in which the Company operates;

• litigation and the ability to adequately protect the Company’s intellectual property rights;

• costs related to the Business Combination;

• changes in applicable laws or regulations; and

• the possibility that the Company may be adversely affected by other economic, business and/or competitive factors.

These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this prospectus are more fully described in the “Risk Factors” section. The risks described in “Risk Factors” are not exhaustive. New risk factors emerge from time to time and it is not possible for us to predict all such risk factors, nor can the Company assess the impact of all such risk factors on its business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. The Company undertakes no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

iii

Table of Contents

SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus or the documents incorporated by reference herein. Because it is a summary, it may not contain all of the information that may be important to you. To understand this offering fully, you should read this entire prospectus, the registration statement of which this prospectus is a part and the documents incorporated by reference herein carefully, including the information set forth under the heading “Risk Factors “ and our financial statements.

Our Business

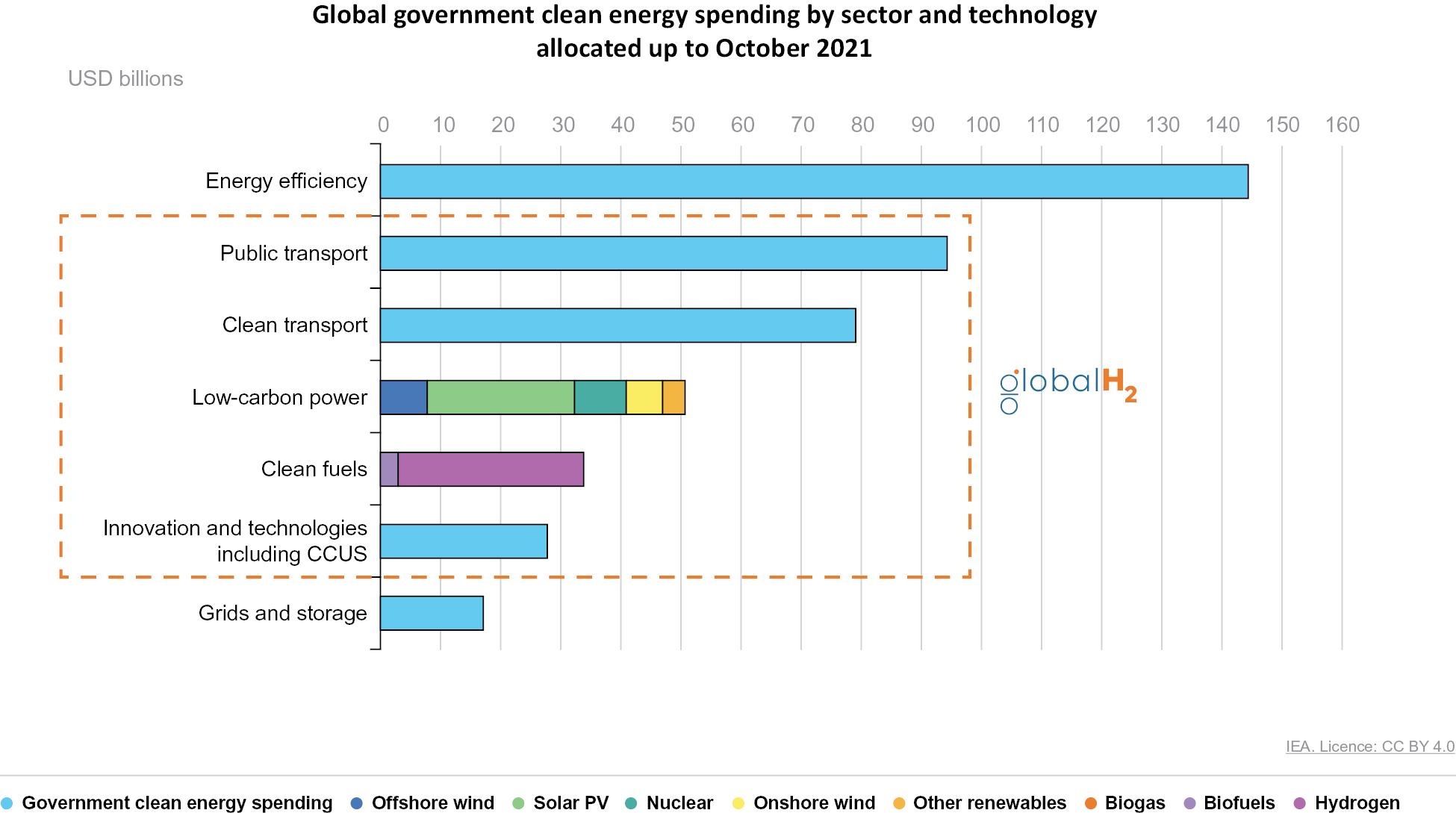

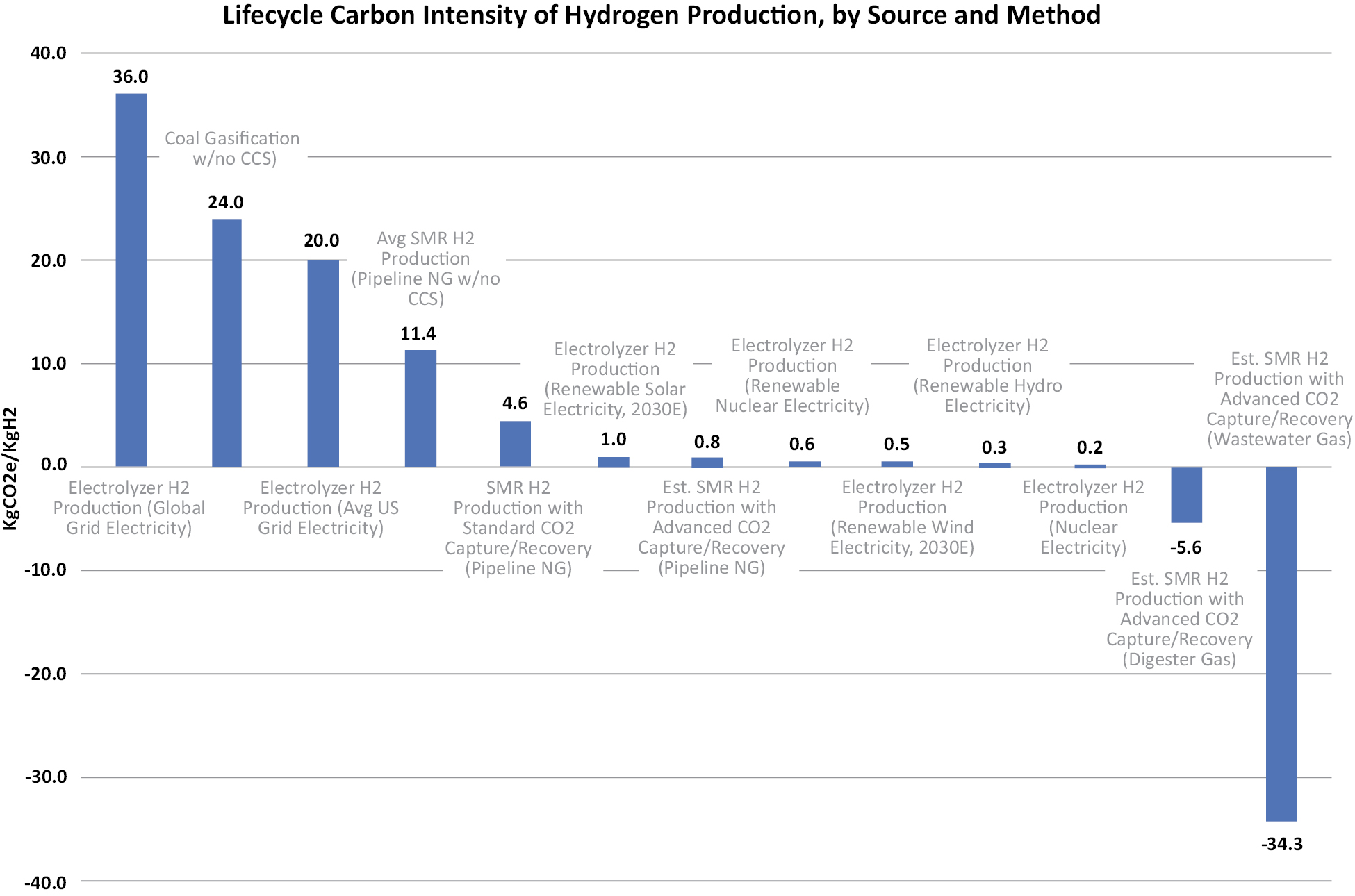

Global Gas is a nascent pure-play hydrogen and carbon recovery project developer and industrial gas supplier. Global Gas intends to offer customers reliable, low-carbon and clean hydrogen, pure carbon dioxide, and other gases generated from a variety of feedstocks. Global Gas’ planned activities involve (i) the sourcing, identification, evaluation and vetting of offtake customers seeking to purchase industrial gases, (ii) the securing of local feedstocks, equipment, and utilities, (iii) the planning and management of projects and (iv) the structuring and financing of projects. Global Gas was founded in 2023 by a team with over a decade of hydrogen experience and several decades of business development, mergers & acquisitions, and capital markets experience. Global Gas targets both privately- and publicly-funded hydrogen development and selected carbon recovery projects, including projects supported by local-, county-, state-, and national-level governments in North America, Western Europe, and Great Britain.

Global Gas intends to serve traditional industrial gas customers, and is particularly focused on plans to serve the rapidly growing hydrogen-as-energy-carrier market for use in hydrogen fuel-cell powered vehicles. Global Gas’ growth strategy is based on its developing ability to place modular generation, recovery, storage, and dispense solutions in closer geographic proximity to end customers — onsite in many cases — and its developing ability to produce and sell multiple outputs from a single feedstock input. Additionally, governments at all levels in North America and Western Europe have and are deploying substantial incentives to mitigate the impact of climate change and to decarbonize their economies. Global Gas believes it is well-placed to benefit as a developer of projects eligible for several of these incentives, such as the hydrogen tax production credits and the investment tax credits made available in the United States through the recently enacted Inflation Reduction Act of 2022 (the “IR Act”).

For a discussion of Global Gas, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Business Overview.” In selecting feedstock to generate industrial gases, we will primarily target renewable waste and will need to seek arrangements with owners of renewable waste feedstock, such as wastewater treatment plants, landfills, food waste processing facilities, and agricultural farms, to access their renewable waste feedstock. In addition to generating industrial gases from renewable waste feedstock, we plan to generate gases from non-renewable sources including pipeline natural gas. We will need to seek arrangement with owners of such non-renewable feedstock. On projects where a non-renewable, or high greenhouse gas output, energy source is used, as well as on selected other projects where such technology is required to produce clean hydrogen, we may deploy carbon recovery technology — more commonly known as carbon capture technology.

On the hydrogen side, we intend to serve traditional industrial gas customers, and are particularly focused on plans to serve the rapidly growing hydrogen-as-energy-carrier market, comprising heavy duty hauling transportation operators such as transit bus agencies, long haul truck fleet operators, truck leasing operators, and refuse collection truck operators, many of whom are considering deploying hydrogen fuel cell powertrain vehicles to decarbonize their fleets which currently runs almost exclusively on diesel. On the carbon dioxide side, we target both traditional industrial users of the gas, including food & beverage grade users such as brewers and beverage bottlers requiring carbonation, as well as emerging users such as the producers of green building materials.

Our growth strategy is based on developing our ability to place modular generation, recovery, storage, and dispensing solutions in closer geographic proximity to our end customers — onsite in many cases — and our ability to produce and sell multiple outputs from a single feedstock input. We hope that these plans, if successfully carried out, will allow us to produce clean hydrogen and carbon dioxide at a net cost normally seen only in larger scale plants and which supports competitive market prices for our end products. Additionally, governments at all levels in North America and Western Europe have and are deploying substantial incentives to mitigate the impact of climate change and to decarbonize their economies. We believe we are well-placed to

1

Table of Contents

benefit as a developer of projects eligible for several of these incentives, such as the hydrogen tax production credits and the investment tax credits made available in the United States through the recently enacted Inflation Reduction Act of 2022.

The mailing address of Global Gas is 99 Wall Street, Suite 436, New York, New York 10005, and its telephone number is (917) 203-4436.

Background

On December 21, 2023 (the “Closing Date”), Global Gas Corporation, a Delaware corporation (formerly known as Dune Acquisition Corporation) (prior to the Effective Time (as defined below), “Dune” and after the Effective Time, the “Company”), consummated the previously-announced business combination pursuant to that certain Unit Purchase Agreement, dated May 14, 2023 (as amended on August 22, 2023 and as further amended on November 24, 2023, the “Purchase Agreement”), by and among Dune, Global Gas Holdings LLC, a Delaware limited liability company and direct, wholly-owned subsidiary of Dune (“Holdings”), Global Hydrogen Energy LLC, a Delaware limited liability company (“Global Hydrogen”), and William Bennett Nance, Jr., Sergio Martinez and Barbara Guay Martinez (collectively, the “Sellers”), the equity holders of Global Hydrogen. William Bennett Nance, Jr., the Founder and Chief Executive Officer of Global Hydrogen, was also a director of Dune and, as of the Effective Time, is now the Chief Executive Officer and a director of the Company.

In connection with the closing of such business combination, the registrant changed its name from Dune Acquisition Corporation to Global Gas Corporation, and on December 22, 2023, the Company’s Class A Common Stock (as defined below) and warrants began trading on The Nasdaq Capital Market (“Nasdaq”) under the new trading symbols of “HGAS” and “HGASW,” respectively.

In accordance with the terms and subject to the conditions of the Purchase Agreement and the other transactions contemplated thereby (the “Business Combination”), at the closing of the Business Combination (the “Closing”) on December 21, 2023, (a) Dune contributed to Holdings all of its assets (excluding its interests in Holdings and the aggregate amount of cash proceeds required to satisfy redemptions by Dune’s public stockholders (“Stockholder Redemptions”)), and in exchange therefor, Holdings issued to Dune a number of common equity units of Holdings (“Holdings Common Units”) which equal the number of total shares of Class A common stock, par value $0.0001 per share (“Class A Common Stock”), of Dune issued and outstanding immediately after the Closing (giving effect to all Stockholder Redemptions) (such transactions, the “SPAC Contribution”) and (b) immediately after the SPAC Contribution, the Sellers transferred, conveyed, assigned and delivered all of the limited liability company equity interests of Global Hydrogen (“Global Hydrogen Units”) to Holdings in exchange for shares of Class B voting non-economic common stock, par value $0.0001 per share (“Class B Common Stock”), of Dune and Holdings Common Units (together with the SPAC Contribution, the “Combination Transactions”), as a result of which, (i) each issued and outstanding Global Hydrogen Unit immediately prior to the Combination Transactions is now held by Holdings, (ii) each Seller received an aggregate number of Holdings Common Units and shares of Class B Common Stock, in each case, equal to the number of Global Hydrogen Units held by such Seller, multiplied by the applicable exchange ratio, and (iii) Dune changed its name to Global Gas Corporation and the Company became the publicly traded reporting company. The effective time of the Business Combination on the Closing Date is referred to as the “Effective Time.”

The Business Combination was accomplished through what is commonly referred to as an “Up-C” structure, which is often used by partnerships and limited liability companies undertaking an initial public offering. The “Up-C” structure allowed the Sellers, who became equity holders of Holdings upon the consummation of the Combination Transactions, to retain their equity ownership in Holdings, an entity that is classified as a partnership for United States federal income tax purposes, in the form of Holdings Common Units after the Closing, and provides potential future tax benefits for both the Company and Holdings’ equity holders (other than the Company) when they ultimately exchange their Holdings Common Units.

In accordance with the terms and subject to the conditions of the Purchase Agreement, at the Closing, the issued and outstanding Global Hydrogen Units of each Seller were transferred, conveyed, assigned and delivered in exchange for (i) a number of shares of Class B Common Stock equal to the product of (x) the number of Global Hydrogen Units held by such Seller and (y) the exchange ratio determined by dividing (A) the quotient of

2

Table of Contents

$43,000,000 divided by the number of Global Hydrogen Units issued and outstanding immediately prior to the Closing by (B) $10.00 per share and (ii) a number of Holdings Common Units equal to the number of shares of Class B Common Stock received by such Seller pursuant to clause (i) hereof.

In connection with the Business Combination, on December 1, 2023, Dune and Global Hydrogen entered into a forward purchase agreement (the “Forward Purchase Agreement”) with each of Meteora Strategic Capital, LLC (“MSC”), Meteora Capital Partners, LP (“MCP”) and Meteora Select Trading Opportunities Master, LP (“MSTO” and, collectively with MSC and MCP, the “Meteora Entities”) for an OTC Equity Prepaid Forward Transaction. In connection with the Forward Purchase Agreement, Dune entered into a subscription agreement (the “Subscription Agreement”) with the Meteora Entities. Pursuant to the Subscription Agreement, the Meteora Entities agreed to subscribe for and purchase, and Dune agreed to issue and sell to the Meteora Entities, on the Closing Date, 681,220 shares of Class A Common Stock in the aggregate (the “PIPE Shares”). Pursuant to the Subscription Agreement, the Company gave certain registration rights to the Meteora Entities with respect to the PIPE Shares. The sale of the PIPE Shares was consummated concurrently with the Closing.

On February 5, 2024, Global Gas and the Meteora Entities entered into an amendment to the Forward Purchase Agreement (the “Forward Purchase Agreement Amendment”) which provides that Global Gas has the option, at its sole discretion, at any time up to 45 days prior to the valuation date, to request up to $5 million in Prepayment Shortfall (as defined in the Forward Purchase Agreement Amendment) via twenty separate written requests to the Meteora Entities in the amount of $250,000 each (each, an “Additional Shortfall Request”), provided that at the time of any Additional Shortfall Request (i) the Meteora Entities has recovered 110% of the prior Additional Shortfall Request, if any, via Shortfall Sales and (ii) the VWAP Price over the five trading days prior to such Additional Shortfall Request multiplied by the then current Number of Shares less Shortfall Sale Shares held by Seller is at least 2.625 times greater than such Additional Shortfall Request (in each case, as defined in the Forward Purchase Agreement Amendment). In addition, the Forward Purchase Agreement Amendment amends the section of the Forward Purchase Agreement regarding Prepayment Shortfall Consideration by eliminating the 180-day period following a Trade Date before Seller may commence selling Recycled Shares and by permitting such sales without payment by Seller of any Early Termination Obligation until such time as the proceeds from such sales equal 110% (instead of 100% as originally provided in the Forward Purchase Agreement) of the Prepayment Shortfall. Finally, the Forward Purchase Agreement Amendment amends the section of the Forward Purchase Agreement regarding Share Consideration by amending the holding period to equal the earlier of (i) Seller recovering 110% of the first Additional Shortfall Request and (ii) the three-month anniversary of the Business Combination (each term as defined in the Forward Purchase Agreement) (instead of just a three-month holding period).

On March 4, 2024, Global Gas and the Sellers entered into forfeiture agreements (the “Forfeiture Agreements”) with each of Sergio Martinez, Barbara Guay Martinez and William Bennett Nance, Jr., pursuant to which Sergio Martinez and Barbara Guay Martinez each forfeited 80,000 shares of Class B Common Stock and William Bennett Nance, Jr. forfeited 1,400,000 shares of Class B Common Stock (collectively, the “Forfeitures”). After the Forfeitures, the Sellers continue to hold an aggregate of 2,700,000 shares of Class B Common Stock.

The rights of holders of our Class A Common Stock and Warrants are governed by our second amended and restated certificate of incorporation (the “Amended and Restated Charter”), our amended and restated bylaws (the “Amended and Restated Bylaws”) and the Delaware General Corporation Law (the “DGCL”), and in the case of the Public Warrants and Private Placement Warrants, the Warrant Agreement dated as of December 17, 2020, between the Company and Continental Stock Transfer & Trust Company (“Continental”), as warrant agent. See the section entitled “Description of Securities.”

3

Table of Contents

Risk Factors Summary

An investment in our Class A Common Stock involves substantial risk. The occurrence of one or more of the events described in the section entitled “Risk Factors,” may have a material adverse effect on our business, cash flows, financial condition and results of operations. Principal factors and risks that could cause actual results to differ materially from those in the forward-looking statements include, among others, the following:

Risks Related to Global Gas’ Business and Industry

• Global Gas currently does not have any customers and has not generated any revenue. If Global Gas fails to implement its business strategy, its financial condition and results of operations could be adversely affected.

• Global Gas has a limited operating history which may make it difficult for investors to evaluate its current business and likelihood of success and viability.

• Much of Global Gas’ future business involves challenging engineering, procurement and construction phases that are complex and involve a number of challenges which may impede the progress of projects and lead to the incurrence of additional expenses.

• The future operation of Global Gas’ potential facilities inherently entails hazards that require continuous oversight and control. If these risks materialize, they could negatively impact Global Hydrogen’s business.

• Global Gas’ future success depends on its ability to retain its executive officers and to attract, retain, and motivate qualified personnel and manage its human capital.

• Global Gas currently has two full-time employees and will need to grow the size and capabilities of its organization. Global Gas may experience difficulties in managing this growth.

Risks Related to Regulation and Litigation

• Global Gas will be subject to extensive government regulation in the jurisdictions in which it does business. Regulations addressing, among other things, import/export restrictions, anti-bribery and corruption and taxes have the potential to negatively impact Global Gas’ financial condition, results of operation and cash flows.

• Global Gas expects to incur significant costs in its efforts to comply with relevant regulations.

Risks Related to Global Gas’ Products and Services

• Global Gas’ business will rely on a number of suppliers. These suppliers may encounter difficulties or interruptions for various reasons, which could delay or entirely halt their ability to provide Global Gas with the materials necessary for the contemplated operation of its business.

• The production, transport, and containment of hydrogen and certain other gases as contemplated by Global Gas’ future projects creates risk of adverse events which may harm its business.

• Global Gas may not be able to effectively compete with other actors in its industry.

• The demand for Global Gas’ products and services may not be as strong as it anticipates.

Risks Related to Cybersecurity and Data Privacy

• Global Gas’ business and operations would suffer in the event of computer system failures, cyber-attacks or deficiencies in its or third parties’ cybersecurity.

4

Table of Contents

Risks Related to Ownership of Global Gas’ Securities

• Nasdaq may delist Global Gas’ securities from trading on its exchange, which could limit investors’ ability to make transactions in Global Gas’ securities and subject Global Gas to additional trading restrictions.

• An active market of Global Gas’ securities may not be maintained, which would adversely affet the liquidity and price of Global Gas’ securities.

Risks Related to Finance, Accounting and Tax Matters

• Global Gas is a holding company and its only material asset is its interest in Holdings, and it will therefore be dependent upon distributions made by Holdings to pay taxes.

• Global Gas may need to raise additional funds, and these funds may not be available when needed. If Global Gas cannot raise additional funds when it needs them, its business, prospects, financial condition and operating results could be negatively affected.

• Global Gas’ financial results may vary significantly over time and could be affected by the financial conditions of its customers and other third parties.

Additional Information

Global Gas’ principal executive offices are located at 99 Wall Street, Suite 436, New York, New York 10005, and Global Gas’ telephone number is (917) 203-4436. Our website address is www.globalgas.co. Information contained on our website or connected thereto does not constitute part of, and is not incorporated by reference into, this prospectus or the registration statement of which it is a part.

5

Table of Contents

THE OFFERING

Issuer | | Global Gas Corporation |

Shares of Class A Common Stock offered by us | | 16,714,981 shares of Class A Common Stock issuable upon exercise of the Warrants and upon exchange of shares of Class B Common Stock and Holdings Common Units. |

Shares of Class A Common Stock offered by the Selling Securityholders | | Up to 12,543,720 shares of Class A Common Stock. |

Warrants Offered by the Selling Securityholders | | Up to 4,850,000 Private Placement Warrants. |

Shares of Class A Common Stock

outstanding | |

5,428,256 shares of Class A Common Stock (as of April 11, 2024).

|

Shares of Class B Common Stock

outstanding | |

2,700,000 shares of Class B Common Stock (as of April 11, 2024).

|

Fully-Diluted Shares of Class A Common Stock outstanding assuming exercise of all Warrants and exchange of all shares of Class B Common Stock and Holdings Common Units on a one-for-one basis | |

21,603,237 (based on total shares outstanding as of April 11, 2024).

|

Exercise Price of Warrants | | $11.50 per share for the Public Warrants and the Private Warrants described herein. On April 11, 2024, the last quoted sale price of our Class A Common Stock as reported on Nasdaq was $1.84 per share. Because, in the near term, the exercise prices of the Warrants are greater than the current market price of our Class A Common Stock, such Warrants are unlikely to be exercised and therefore the Company does not expect to receive any proceeds from such exercise of the Warrants in the near term. Whether any holders of Warrants determine to exercise such Warrants, which would result in cash proceeds to the Company, will likely depend upon the market price of our Class A Common Stock at the time of any such holder’s determination. |

Purchase Price of Securities | | The Class A Common Stock being registered for resale was issued to, purchased or will be purchased by the Selling Securityholders for the following consideration: (i) a purchase price of approximately $0.006 per share of Class A Common Stock for the 4,312,500 shares held by the Sponsor, (ii) for the Subscription Agreement, the 681,220 shares of Class A Common Stock were issued to the Meteora Entities as consideration for entering into a forward purchase agreement, (iii) the 2,700,000 shares of Class A Common Stock will be issued upon exchange of shares of Class B Common Stock and Holdings Common Units, which were issued as consideration to the Sellers pursuant to the Purchase Agreement and after giving effect to the Forfeitures, (iv) a purchase price of $1.00 per share was paid for a share of Private Placement Warrant for the 4,850,000 Private Placement Warrants issued to the Selling Securityholders. The shares of Class A Common Stock underlying the Warrants will be purchased, if at all, by such holders at an exercise price of $11.50 per share. |

6

Table of Contents

Use of Proceeds | | We will not receive any proceeds from the sale of shares of Class A Common Stock or Warrants by the Selling Securityholders. We will receive up to an aggregate of approximately $155.0 million from the exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash. We expect to use the net proceeds from the exercise of the Warrants forgeneral corporate purposes. See “Use of Proceeds.” |

Redemption | | The Warrants are redeemable in certain circumstances. See “Description of Securities — Warrants” for further discussion. |

Market for Common Stock and Warrants | | Our Class A Common Stock and Public Warrants are currently traded on Nasdaq under the symbols “HGAS” and “HGASW,” respectively. |

Risk Factors | | See “Risk Factors” and other information included in this prospectus for a discussion of factors you should consider before investing in our securities. |

For additional information concerning the offering, see “Plan of Distribution.”

7

Table of Contents

INFORMATION RELATED TO OFFERED SECURITIES

This prospectus relates to:

• the resale of 4,312,500 shares of Class A Common Stock purchased by the Sponsor, at an effective purchase price of approximately $0.006 per share;

• the resale of 681,220 shares of Class A Common Stock issued to the Meteora Entities pursuant to the Subscription Agreement;

• the resale of up to 8,624,981 shares of Class A Common Stock underlying the Public Warrants, exercisable at an exercise price of $11.50 per share, which expires on December 21, 2028;

• the resale of 4,850,000 Private Placement Warrants, purchased by the Sponsor in connection with the IPO at a purchase price of $1.00 per Private Placement Warrant, which expires on December 21, 2028;

• the resale of up to 4,850,000 shares of Class A Common Stock underlying the Private Placement Warrants, exercisable at an exercise price of $11.50 per share;

• the resale of up to 2,000,000 shares of Class A Common Stock that may be issuable upon the exchange of shares of the Class B Common Stock and Holdings Common Units issued to William Bennett Nance, Jr., as consideration pursuant to the Purchase Agreement and after giving effect to the Forfeitures;

• the resale of up to 350,000 shares of Class A Common Stock that may be issuable upon the exchange of shares of the Class B Common Stock and Holdings Common Units issued to Sergio Martinez, as consideration pursuant to the Purchase Agreement and after giving effect to the Forfeitures; and

• the resale of up to 350,000 shares of Class A Common Stock that may be issuable upon the exchange of shares of the Class B Common Stock and Holdings Common Units issued to Barbara Guay Martinez, as consideration pursuant to the Purchase Agreement and after giving effect to the Forfeitures.

The price per unit at which the shares of Class A Common Stock were sold in the IPO was $10.00 per share. However, the founder shares (which were converted to 4,312,500 shares of Class A Common Stock) were purchased at an effective price of approximately $0.006 per share, for an aggregate effective price of $25,000. Accordingly, the Class A Common Stock converted from the founder shares could be sold at a per-share price that is less than $10.00 and the holders can realize a significant profit from the sale of those securities that could not be realized by our other stockholders. On April 11, 2024, the closing price of our Class A Common Stock was $1.84 per share. Based on this closing price, the Sponsor could sell such 4,312,500 shares for an aggregate price of approximately $7.9 million. As such, the Sponsor may realize a positive rate of return on the sale of their shares of Class A Common Stock covered by this prospectus based on the current trading price of our Class A Common Stock and the effective purchase price for such shares. However, public securityholders may not experience a similar positive rate of return due to the differences in their purchase price and the current trading price of shares of our Class A Common Stock.

8

Table of Contents

The following table includes information relating to the shares of Class A Common Stock offered hereby, including the purchase price each Selling Securityholder paid for its securities, the potential profit relating to such securities, the date the Warrants are exercisable and the exercise price of the Warrants.

Offered Shares | | Number of

Shares | | Exercise

Price(1) | | Effective

Purchase

Price

per Share(1) | | Potential

Profit

per Share(1) | | Total

Potential

Profit(1) |

Class A Common Stock held by the Sponsor | | 4,312,500 | | | | | $ | 0.006 | | $ | 1.834 | | $ | 7,909,125 |

Class A Common Stock issued to Meteora Entities pursuant to the Subscription Agreement(2) | | 681,220 | | | | | | — | | $ | 1.840 | | $ | 1,253,445 |

Class A Common Stock issuable upon exercise of the Public Warrants | | 8,624,981 | | $ | 11.50 | | | — | | | * | | | * |

Private Placement Warrants issued to the Sponsor in connection with the IPO(3) | | 4,850,000 | | | | | $ | 1.00 | | | * | | | * |

Class A Common Stock issuable upon exercise of the Private Placement Warrants | | 4,850,000 | | $ | 11.50 | | | — | | | * | | | * |

Class A Common Stock issuable upon the exchange of shares of Class B Common Stock and Holdings Common Units issued to William Bennett Nance, Jr., as consideration pursuant to the Purchase Agreement(4) | | 2,000,000 | | | | | | — | | $ | 1.840 | | $ | 3,680,000 |

Class A Common Stock issuable upon the exchange of shares of Class B Common Stock and Holdings Common Units issued to Sergio Martinez, as consideration pursuant to the Purchase Agreement(5) | | 350,000 | | | | | | — | | $ | 1.840 | | $ | 644,000 |

Class A Common Stock issuable upon the exchange of shares of Class B Common Stock and Holdings Common Units issued to Barbara Guay Martinez, as consideration pursuant to the Purchase Agreement(6) | | 350,000 | | | | | | — | | $ | 1.840 | | $ | 644,000 |

9

Table of Contents

RISK FACTORS

Investing in our securities involves risks. Before you make a decision to buy our securities, in addition to the risks and uncertainties discussed above under “Cautionary Note Regarding Forward-Looking Statements,” you should carefully consider the specific risks set forth herein. If any of these risks actually occur, it may materially harm our business, financial condition, liquidity and results of operations. As a result, the market price of our securities could decline, and you could lose all or part of your investment. Additionally, the risks and uncertainties described in this prospectus, any prospectus supplement or in any document incorporated by reference herein or therein are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may become material and adversely affect our business.

Risks Related to Global Gas’ Business and Industry

Our limited operating history makes evaluating our business and future prospects difficult and may increase the risk of your investment.

You must consider the risks and difficulties we face as an early stage company with a limited operating history. If we do not successfully address these risks, our business, prospects, operating results and financial condition will be materially and adversely harmed. We have a very limited operating history on which investors can base an evaluation of our business, operating results and prospects. There are no assurances that we will be able to secure future business with potential customers. As an early stage company, it is difficult to predict our future revenues and appropriately budget for our expenses, and we have limited insight into trends that may emerge and affect our business. In the event that actual results differ from our estimates or we adjust our estimates in future periods, our operating results and financial position could be materially affected. Our performance and expectations depend on the successful implementation of management’s growth strategies and are based on assumptions and events over which we have only partial or no control, including, but not limited to, adverse economic conditions, regulatory developments, our ability to finance our contemplated operations, difficulties in engineering, delays in designs or materials provided by the customer or a third party, equipment and materials delivery delays, schedule changes, customer scope changes, delays related to obtaining regulatory permits and rights-of-way, inability to find adequate sources of labor in the locations where we are building new plants, weather-related delays, delays by customers’ contractors in completing their portion of a project, technical or transportation difficulties, cost overruns, supply difficulties, geopolitical risks and other factors. The assumptions underlying our expectations require the exercise of judgment and may not occur, and the expectations are subject to uncertainty due to the effects of economic, business, competitive, regulatory, legislative, and political or other changes.

Our success depends on our ability to obtain customers and implement our business strategy.

We currently do not have any customers and have not generated any revenue. If we fail to implement our business strategy, our financial condition and results of operations could be adversely affected. Our future financial performance and success depend in large part on our ability to successfully implement our business strategy. We cannot assure you that we will be able to successfully implement our business strategy or be able to improve our operating results. In particular, we cannot assure you that we will successfully negotiate and sign contracts with customers and suppliers nor can we assure you that we will be able to successfully execute our contracts if signed. Potential projects are added to the project development pipeline only after Global Gas has met with the potential customer, discussed the scope of the project and discussed the project’s feasibility, preliminary sizing and design. Implementation of our business strategy may be impacted by factors outside of our control, including competition, commodity price fluctuations, industry, legal and regulatory changes or developments and general economic and political conditions. Any failure to successfully implement our business strategy could adversely affect our financial condition and results of operations. We may, in addition, decide to alter or discontinue certain aspects of our business strategy at any time.

10

Table of Contents

Our business model has yet to be tested and any failure to commercialize our strategic plans would have an adverse effect on our operating results and business, harm our reputation and could result in substantial liabilities that exceed our resources.

Investors should be aware of the difficulties normally encountered by a new enterprise, many of which are beyond our control, including substantial risks and expenses in the course of establishing or entering new markets, organizing operations and undertaking marketing activities. The likelihood of our success must be considered in light of these risks, expenses, complications, delays and the competitive environment in which we operate. There is, therefore, nothing at this time upon which to base an assumption that our business plan will prove successful, and we may not be able to generate significant revenue, raise additional capital or operate profitably. We will continue to encounter risks and difficulties frequently experienced by early commercial stage companies, including scaling up our infrastructure and headcount, and may encounter unforeseen expenses, difficulties or delays in connection with our growth. In addition, as a result of the capital-intensive nature of our business, we can be expected to continue to sustain substantial operating expenses and may not generate sufficient revenues to cover expenditures. Any investment in our company is therefore highly speculative and could result in the loss of your entire investment.

Risks related to the approval, execution, and operation of our future projects may adversely affect our operations or financial results.

Much of our future business involves engineering, procurement and construction phases that may last several years and involve the investment of millions of dollars. These projects may be technically complex, are often reliant on significant interaction with government authorities and face significant financing, development, operational and reputational risks. These projects may also be subject to complex government approvals, as well as legal or regulatory challenges by government authorities or third parties. Delays in receiving required approvals or related to litigation could require us to delay or abandon certain projects, which may result in the incurrence of additional expense, the loss of invested proceeds, and reputational damage.

We may encounter difficulties in engineering, delays in designs or materials provided by the customer or a third party, equipment and materials delivery delays, schedule changes, customer scope changes, delays related to obtaining regulatory permits and rights-of-way, inability to find adequate sources of labor in the locations where we are building new plants, weather-related delays, delays by customers’ contractors in completing their portion of a project, technical or transportation difficulties, cost overruns, supply difficulties, financial difficulties suffered by our subcontractors or suppliers, geopolitical risks and other factors, many of which are beyond our control, that may impact our ability to complete a project within the original delivery schedule. In some cases, delays and additional costs may be substantial, and we may be required to cancel a project and/or compensate the customer for the delay. We may not be able to recover any of these costs. In addition, in some cases we may seek financing for large projects and face market risk associated with the availability and terms of such financing. These financing arrangements may require that we comply with certain performance requirements which, if not met, could result in default and restructuring costs or other losses. All of these factors could also negatively impact our reputation or relationships with our customers, suppliers and other third parties, any of which could adversely affect our ability to secure new projects in the future.

The future operation of our facilities inherently entails hazards that require continuous oversight and control, such as pipeline leaks and ruptures, fire, explosions, toxic releases, mechanical failures, vehicle accidents, or cyber incidents. If operational risks materialize, they could result in loss of life, damage to the environment, or loss of production, all of which could negatively impact our ongoing operations, reputation, financial results, and cash flows. In addition, our operating results are dependent on the continued operation of our production facilities and our ability to meet customer requirements, which depend, in part, on our ability to properly maintain and replace aging assets.

Global Gas’ management has limited experience in operating a public company.

Global Gas’ management has limited experience in the management of a publicly traded company. Global Gas’ management team may not successfully or effectively manage its transition to a public company that will be subject to significant regulatory oversight and reporting obligations under federal securities laws. Their limited experience in dealing with the increasingly complex laws pertaining to public companies could be a significant disadvantage in that it is likely that an increasing amount of their time may be devoted to these activities which will result in less

11

Table of Contents

time being devoted to the management and growth of the post-combination company. Global Gas may not have adequate personnel with the appropriate level of knowledge, experience and training in the accounting policies, practices or internal control over financial reporting required of public companies in the U.S. Any fault in Global Gas’ finance and accounting systems could impact its ability or prevent it from timely reporting its operating results, timely filing required reports with the SEC and complying with Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). The development and implementation of the standards and controls necessary for Global Gas to achieve the level of accounting standards required of a public company in the U.S. may require costs greater than expected. It is possible that Global Gas will be required to expand its employee base and hire additional employees to support its operations as a public company which will increase its operating costs in future periods.

We may have difficulty managing growth in our business, which could have a material adverse effect on our business, financial condition and results of operations and our ability to execute its business plan in a timely fashion.

Because of our small size, growth in accordance with our business plans, if achieved, will place a significant strain on our financial, technical, operational and management resources. If we expand our activities, developments and production, and increase the number of projects we are evaluating or in which we participate, there will be additional demands on our financial, technical and management resources. The failure to continue to upgrade our technical, administrative, operating and financial control systems or the occurrence of unexpected expansion difficulties could have a material adverse effect on our business, financial condition and results of operations and our ability to execute our business plan in a timely fashion.

An increase in energy costs, including as a result of the ongoing conflict between Russia and Ukraine, may materially adversely affect our business, financial condition, and results of operations.

Our results of operations may be affected by volatility in the cost and availability of energy, which is subject to global supply and demand and other factors beyond our control. The ongoing conflict between Russia and Ukraine, as well as the hostilities in the Middle East between Israel and Hamas, has impacted global energy markets, particularly in Europe, leading to high volatility and increasing prices for crude oil, natural gas and other energy supplies. Higher energy costs may result in increases in operating expenses at our potential manufacturing facilities, in the expense of shipping materials to our potential facilities, and in the expense of operating certain of our potential projects for which we may procure natural gas, all of which may in turn adversely affect our business, financial condition, and results of operations.

Our strategy to outsource various elements of the products and services we sell may subject us to the business risks of our suppliers and subcontractors, which could have a material adverse impact on our operations.

In areas where we will depend on third-party suppliers and subcontractors for outsourced equipment, products, components or services, we will be subject to the risk of customer dissatisfaction with the quality or performance of the equipment, products or services we sell due to supplier or subcontractor failure. Suppliers and subcontractors may not have the same incentives we do and may not allocate adequate or sufficient time and/or resources for performing services for us. In addition, business difficulties experienced by a third-party supplier or subcontractor could lead to the interruption of our ability to obtain outsourced equipment, products or services and ultimately our inability to supply equipment, products or services to our customers. Third-party supplier and subcontractor business interruptions may include, but are not limited to, work stoppages, union negotiations and other labor disputes. Current or future economic conditions could also impact the ability of suppliers and subcontractors to access credit and, thus, impair their ability to provide us quality products or services in a timely manner, or at all.

Cost overruns, delays, penalties or liquidated damages could negatively impact our results, particularly with respect to fixed-price contracts for our custom configured products.

We expect a significant portion of our net sales and earnings will be generated through fixed-price contracts for custom configured products. We expect most of these contracts will provide for penalties or liquidated damages for failure to timely perform our obligations under the contract, or require that we, at our own expense, correct and remedy to the satisfaction of the other party certain defects. Therefore, we expect to face the risk that cost overruns, delays, penalties or liquidated damages may exceed, erode or eliminate our expected profit margin, or cause us to record a loss on certain of our projects.

12

Table of Contents

Catastrophic events could disrupt our operations and/or our customers and suppliers and may have a significant adverse impact on our results of operations.

The occurrence of catastrophic events or natural disasters such as extreme weather, including hurricanes and floods; health epidemics; pandemics, such as COVID-19; and acts of war or terrorism, could impair our ability to produce and distribute its products to customers and could potentially expose us to third-party liability claims. In addition, such events could impact our customers and suppliers resulting in temporary or long-term outages and/or the limitation of supply of energy and other raw materials used in normal business operations.

The inability to attract and retain qualified personnel may adversely impact our business.

If we fail to attract, hire and retain qualified personnel, we may not be able to develop, market or sell our products or successfully manage our business. We are dependent upon a highly skilled, experienced and efficient workforce to be successful. The inability to attract and hire qualified individuals or the loss of key employees in very skilled areas could have a negative effect on our financial results.

We may be unable to successfully execute and operate our hydrogen production projects, and such projects may cost more and take longer to complete than we expect.

As part of our strategy, the Company may, in the future, develop and construct hydrogen production facilities at locations across the United States and Europe. Our ability to successfully complete and operate these projects is not guaranteed. The ability to complete these projects may impact our ability to meet and supplement the hydrogen demands for our products and services for prospective customers. The timing and cost to complete the construction of our hydrogen production projects are subject to a number of factors outside of our control and such projects may take longer and cost more to complete and become operational than we expect.

The viability and competitiveness of our potential hydrogen production facilities may depend, in part, upon favorable laws, regulations, and policies related to hydrogen production. Some of these laws, regulations, and policies are nascent, and there is no guarantee that they will be favorable to our projects. Additionally, any facilities we develop will be subject to numerous and new permitting, regulations, laws, and policies, many of which might vary by jurisdiction. Hydrogen production facilities are also subject to robust competition from well-established multinational companies in the energy industry. There is no guarantee that our hydrogen production strategy will be successful amidst this competitive environment.

We may enter into joint ventures which could impose certain restrictions on our operations in the future and could create risk related to our potential co-venturers.

In the future, we may enter into joint ventures. Depending on the terms of these potential ventures, we may be restricted in our ability to operate in certain areas or undertake certain courses of action. These potential arrangements may involve significant risks and uncertainties, including our ability to cooperate with our strategic partners, our strategic partners having interests or goals that are inconsistent with ours, and the potential that our strategic partners may be unable to meet their economic or other obligations to any future joint venture, which may negatively impact the expected benefits of any future joint venture and cause us to incur additional expense or suffer reputational damage. In addition, due to the nature of these potential arrangements, we may have limited ability to direct or influence the management of any future joint venture, which may limit our ability to assist and oversee the design and implementation of any future joint venture’s business as well as its accounting, legal, governance, human resources, information technology, and other administrative systems. This may expose us to additional risks and uncertainties because we may be dependent upon and subject to liability, losses, or reputational damage relating to systems, controls, and personnel that are not under our control.

In the future, if we develop or acquire proprietary intellectual property, protecting such intellectual property will be critical to our operations and we may suffer competitive harm from infringement on such rights.

If we develop or acquire new technologies, it will be critical that we protect our intellectual property assets against third-party infringement. Though we currently do not own any patents, we do own intellectual property related to our branding. If we develop or acquire intellectual property, there is a risk that our patent applications

13

Table of Contents

may not be granted, or we may not receive sufficient protection of our proprietary interests. We may also expend considerable resources in defending any future patents against third-party infringement. It may become critical that we protect our proprietary intellectual property interests to prevent competitive harm.

Current inflationary trends, economic downturn and weakness in the economy, market trends, and other conditions affecting the profitability and financial stability of our potential customers could negatively impact the growth of our business and the acquisition of customers.

The demand for our products and services is sensitive to the production activity, capital spending and demand for products and services of our potential customers worldwide. Recently, we have observed increased economic uncertainty in the United States and abroad, including inflation and higher interest rates. Impacts of such economic weakness include falling overall demand for goods and services, leading to reduced profitability, reduced credit availability, higher borrowing costs, reduced liquidity, volatility in credit, equity and foreign exchange markets, and bankruptcies. These developments may lead to supply chain disruption and transportation delays which may negatively impact our business and growth. In addition, as our potential customers react to global economic conditions and the potential for a global recession, they may reduce spending on the products and services we plan to provide, which may lead to our inability to attract customers and could limit our ability to grow our business and negatively affect our operating results and financial condition.

Risks Related to Regulations and Litigation

We will be subject to extensive government regulation in the jurisdictions in which we do business. Regulations addressing, among other things, import/export restrictions, anti-bribery and corruption and taxes have the potential to negatively impact our financial condition, results of operation and cash flows.

We will be subject to government regulation in the United States and in the foreign jurisdictions where we may conduct business. The application of laws and regulations to our business is sometimes unclear. Compliance with laws and regulations may involve significant costs or require changes in business practices that could result in reduced profitability. If there is a determination that we have failed to comply with applicable laws or regulations, we may be subject to penalties or sanctions that could adversely impact our reputation and financial results. Compliance with changes in laws or regulations can result in increased operating costs and require additional, unplanned capital expenditures. Export controls or other regulatory restrictions could prevent us from shipping our products to and from some markets or increase the cost of doing so. Changes in tax laws and regulations could affect the financial results of our businesses. Increasingly aggressive enforcement of anti-bribery and anti-corruption requirements, including the U.S. Foreign Corrupt Practices Act, the United Kingdom Bribery Act and the China Anti-Unfair Competition Law, could subject us to criminal or civil sanctions if a violation is deemed to have occurred. In addition, we may be subject to laws and sanctions imposed by the U.S. and other jurisdictions where we plan to do business that may prohibit us from doing business in certain countries, or restricting the kind of business that we may conduct. Such restrictions may provide a competitive advantage to competitors who are not subject to comparable restrictions or prevent us from taking advantage of growth opportunities.

Further, we cannot guarantee that our internal controls and compliance systems will always protect us from acts committed by employees, agents, business partners or that businesses that we acquire would not violate U.S. and/or non-U.S. laws, including the laws governing payments to government officials, bribery, fraud, kickbacks and false claims, pricing, sales and marketing practices, conflicts of interest, competition, export and import compliance, money laundering, and data privacy. Any such improper actions or allegations of such acts could damage our reputation and subject us to civil or criminal investigations in the U.S. and in other jurisdictions and related stockholder lawsuits, could lead to substantial civil and criminal, monetary and non-monetary penalties, and could cause us to incur significant legal and investigatory fees. In addition, governments may seek to hold us liable as a successor for violations committed by companies in which we invest or that we acquire.

14

Table of Contents

We will be subject to various environmental laws and regulations that could impose substantial costs upon us and cause delays in building production facilities.

Our operations will be subject to federal, state and local environmental laws and regulations, including laws relating to the use, handling, storage, disposal of and human exposure to hazardous materials. Environmental and health and safety laws and regulations can be complex, and we have limited experience complying with them. Moreover, we expect that we will be affected by future amendments to such laws or other new environmental and health and safety laws and regulations which may require us to change our operations, potentially resulting in a material adverse effect on its business, prospects, financial condition and operating results. These laws can give rise to liability for administrative oversight costs, cleanup costs, property damage, bodily injury, fines and penalties. Capital and operating expenses needed to comply with environmental laws and regulations can be significant, and violations may result in substantial fines and penalties, third-party damages, suspension of production or a cessation of our operations.

Contamination at properties we may own or operate may result in liability for us under environmental laws and regulations, including, but not limited to, the Comprehensive Environmental Response, Compensation and Liability Act, which can impose liability for the full amount of remediation-related costs without regard to fault, for the investigation and cleanup of contaminated soil and ground water, for building contamination and impacts to human health and for damages to natural resources. The costs of complying with environmental laws and regulations and any claims concerning noncompliance, or liability with respect to contamination in the future, could have a material adverse effect on our financial condition or operating results. We may face unexpected delays in obtaining the required permits and approvals in connection with our potential production facilities that could require significant time and financial resources and delay our ability to operate such facilities, which would adversely impact our business, prospects, financial condition and operating results.

Legislative, regulatory, societal and market efforts to address global climate change may impact our business and create financial risk.

In the production of hydrogen, we may use processes which capture greenhouse gases (“GHG”), such as carbon dioxide, which would otherwise be emitted. The technologies we employ for GHG capture may not successfully capture 100% of the GHG produced. Increased public concern and governmental action may result in more international, U.S. federal and/or regional requirements to reduce or mitigate the effects of GHG emissions or increased demand for technologies and projects to limit the impact of global climate change. Although uncertain, these developments could increase our costs related to consumption of electric power, hydrogen production and application of our gasification technology. Any legislation or governmental action that limits or taxes GHG emissions could negatively impact our growth, increase our operating costs, or reduce demand for certain of our products.

In addition, standards for tracking and reporting environmental, social and governance (“ESG”) matters continue to evolve. New laws, regulations, policies and international accords relating to ESG matters, including sustainability, climate change, human capital and diversity, are being developed and formalized in Europe, the United States, Asia and elsewhere, which may entail specific, target-driven frameworks and/or disclosure requirements. If our ESG practices do not meet evolving investor or other stakeholder expectations and standards, then our reputation or our attractiveness as an investment, business partner, acquirer, service provider or employer could be negatively impacted.

Costs and expenses resulting from compliance with environmental regulations may negatively impact our operations and financial results.

We will be subject to extensive federal, state, local and foreign environmental and safety laws and regulations concerning, among other things, emissions in the air, discharges to land and water and the generation, handling, treatment and disposal of hazardous waste and other materials. There is a risk of adverse environmental impact inherent in our manufacturing operations and in the transportation of our products. Future developments and more stringent environmental regulations may require us to make additional unforeseen environmental expenditures. In addition, laws and regulations may require significant expenditures for environmental protection equipment, compliance and remediation. These additional costs may adversely affect our financial results.

15

Table of Contents

We expect to incur costs to comply with these laws and regulations. Federal, state, and local governments are increasingly regulating and restricting the use of certain chemicals, substances, and materials. For example, laws, regulations, or other policy initiatives might address substances found within component parts to our products, in which event we would be required to comply with such requirements.

Our business may become subject to increased government regulation.

As hydrogen and other relevant products become more broadly available commercially, governments may impose new regulations. We do not know the extent to which any such regulations may impact our ability to manufacture, distribute, install and service our products. Any regulation of our products, whether at the federal, state, local or foreign level, including any regulations relating to the production, operation, installation, and servicing of our products may increase our costs and the price of our products, and noncompliance with applicable laws and regulations could subject us to investigations, sanctions, enforcement actions, fines, damages, civil and criminal penalties, or injunctions. Furthermore, certain business activities may require the Company to navigate a myriad of state- or local-level laws and regulations. If any governmental sanctions are imposed, our business, operating results, and financial condition could be materially adversely affected. In addition, responding to any action will likely result in a significant diversion of management’s attention and resources and an increase in professional fees. Enforcement actions and sanctions could harm our business, operating results and financial condition.

Risks Related to Global Gas’ Products and Services

Interruption in ordinary sources of raw material or energy supply or an inability to recover increases in energy and raw material costs from customers could result in lost sales or reduced profitability.

We expect feedstock used for hydrogen generation, such as biogas from wastewater treatment plants, landfills, renewable natural gas, and others, to be significant raw materials for our business. Additionally, we expect energy, including electricity, natural gas, and fuel for delivery trucks, to be a significant cost component of our business. A disruption in the supply of energy, components, or raw materials, whether due to market conditions, legislative or regulatory actions, public health issues, natural events, or other disruption, could prevent us from meeting any future contractual commitments and harm our business and financial results.

We may contract to pass-through cost increases in energy and raw materials to customers, but such cost pass-through results in declining margins, and cost variability can negatively impact our other operating results. For example, we may be unable to raise prices as quickly as costs rise, or competitive pressures may prevent full recovery of such costs. In addition, increases in energy or raw material costs that cannot be passed on to customers for competitive or other reasons may negatively impact our revenues and earnings. Even where costs are passed through, price increases can cause lower sales volume. Other economic factors outside of our control, including inflation and energy price fluctuations, may increase our costs and adversely affect our business.

Our ability to source parts and raw materials from our suppliers could be disrupted or delayed in our supply chain which could adversely affect our results of operations.