Q3 2024 Shareholder Letter UNLOCK THE SKIES™

STRONG LIQUIDITY POSITION Over $500M Of Cash & Cash Equivalents. We finished the quarter with our cash position being as strong as it has been over the last 18 months Quarterly Spend On Target. Our spending in Q3’24 remained nearly flat as compared to Q2’24 Additional Capital On The Horizon. Earlier this week we announced we are now seeking shareholder approval of up to ~$400M of additional capital from Stellantis to help scale the manufacturing of our Midnight aircraft** Grew Order Book. With the latest planned purchase from our new Japanese customer, our indicative order book is now $6B+* HIGHLIGHTS // 2 *Orders under the order book remain conditional, subject to the execution of further definitive agreements with each customer and the satisfaction of certain conditions. Order values represent the Company’s estimate based on an indicative $5M per aircraft price. This is only a prediction and actual results may differ materially due to a variety of factors. **The key terms of the contract manufacturing relationship with Stellantis are based on a memorandum of understanding that contemplates the parties to enter into future definitive agreements related thereto BUILDING PRODUCTION AIRCRAFT Our focus going into 2025 is on building piloted, type-design aircraft for use in testing and early commercial deployment. Our factory in Georgia is set to open in the next few weeks with aircraft production planned to begin in early 2025 and will ramp from there. JAPAN MARKET ENTRY In September, we entered into an agreement with Japan Airlines and Sumitomo Corporation’s joint venture, Soracle, that includes a planned purchase of up to $500M of aircraft with the goal of bringing air taxi service to some of the most congested cities in Japan.* CERTIFICATION MOMENTUM Since the FAA finalized Midnight’s airworthiness criteria in May, we are now nearing completion of Phase 3 of the FAA’s type certification process while continuing to rapidly advance Phase 4, the final phase to secure type certification. COMMERCIAL LAUNCH This quarter we established a consortium led by the Abu Dhabi Investment Office to launch commercial air taxi services in the UAE as early as Q4’25. It has made significant progress in establishing the regulatory pathway, infrastructure and flight operations plans necessary to enable our market entry. We are continuing to work closely with our key partners in the region on this initiative, such as Etihad Training and Falcon Aviation.

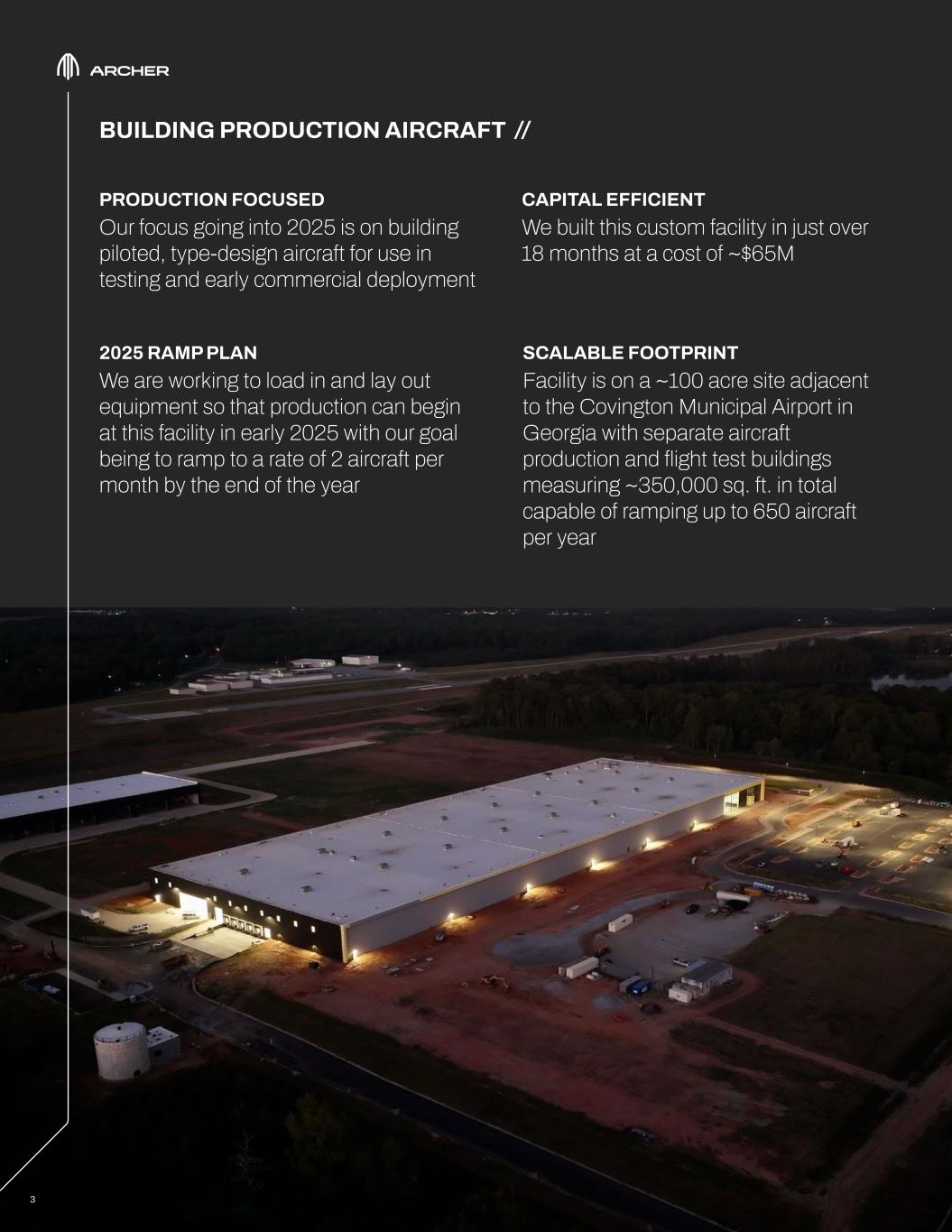

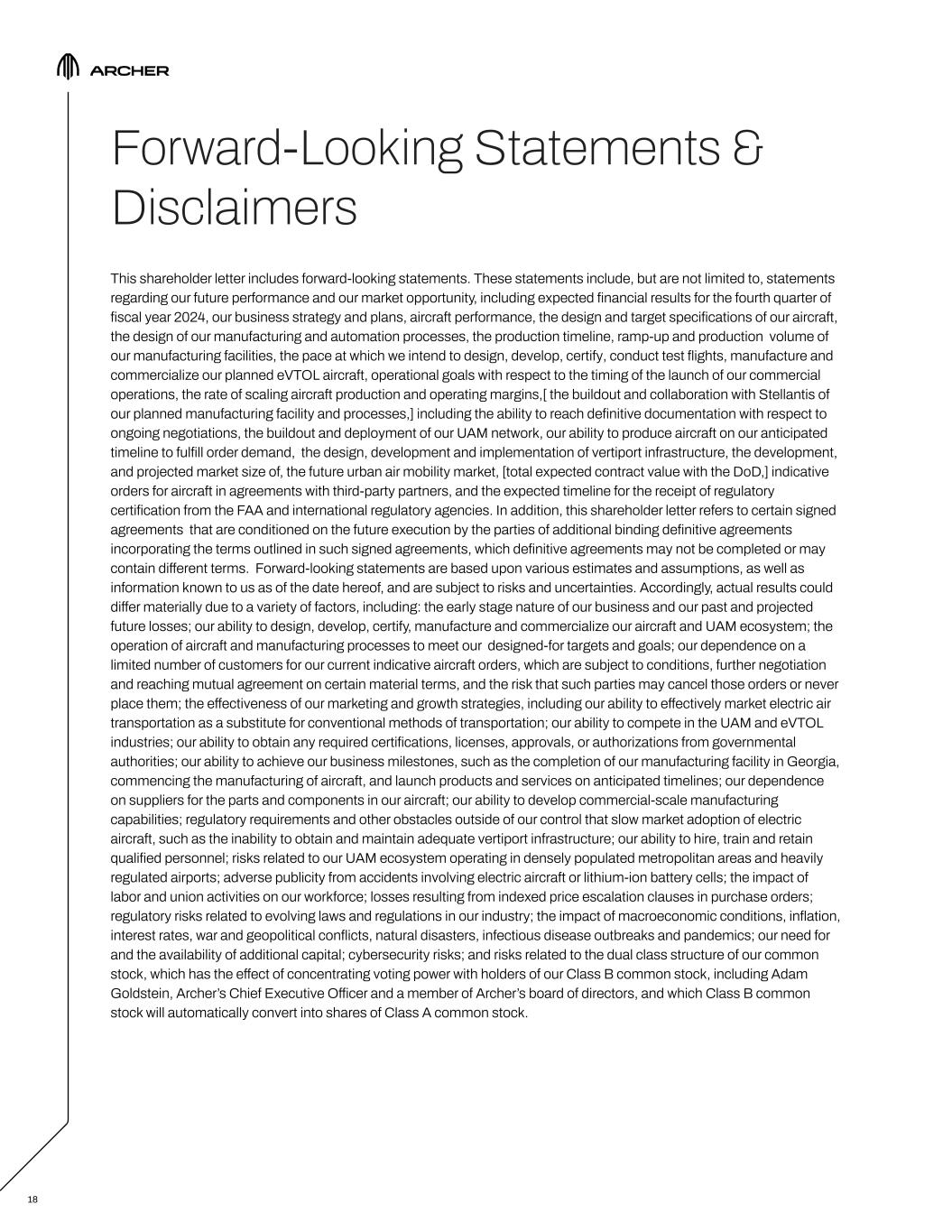

3 BUILDING PRODUCTION AIRCRAFT // SCALABLE FOOTPRINT Facility is on a ~100 acre site adjacent to the Covington Municipal Airport in Georgia with separate aircraft production and flight test buildings measuring ~350,000 sq. ft. in total capable of ramping up to 650 aircraft per year CAPITAL EFFICIENT We built this custom facility in just over 18 months at a cost of ~$65M PRODUCTION FOCUSED Our focus going into 2025 is on building piloted, type-design aircraft for use in testing and early commercial deployment 2025 RAMP PLAN We are working to load in and lay out equipment so that production can begin at this facility in early 2025 with our goal being to ramp to a rate of 2 aircraft per month by the end of the year

4 SCALING OUR MANUFACTURING //

5 COMMERCIAL LAUNCH // HIS EXCELLENCY SAIF MOHAMMED AL SUWAIDI DIRECTOR GENERAL UAE GENERAL CIVIL AVIATION AUTHORITY ADAM GOLDSTEIN FOUNDER & CEO ARCHER AVIATION Progressing Commercial UAE Launch Plans In The UAE With Consortium Partners Target Q4’2025 Entry Into Service ROYAL FAMILY SUPPORT GOVERNMENT COMMITMENT His Highness Sheikh Hamdan bin Mohammed bin Zayed Al Nahyan in Archer Midnight in Abu Dhabi REGULATORY PATHWAY Framework agreement with Abu Dhabi Investment Office led by His Excellency Badr Al Olama Close collaboration with UAE’s General Civil Aviation Authority PILOT TRAINING FLIGHT OPS & INFRASTRUCTURE Plans to recruit and train skilled Emirati pilots in partnership with local aviation leader, Etihad LOCAL ARCHER LEADERSHIP Operation ramp-up with our partner Falcon Aviation, founded by UAE Royal Family Dr. Talib Alhinai hired from Abu Dhabi Executive Office to lead Archer’s efforts in UAE Image of flight above depicts simulated operations Image depicts Midnight aircraft in Abu Dhabi

6 Japan Airlines & Sumitomo Corporation JV Announces Planned Order of Up to $500M of Midnight Aircraft JAPAN MARKET ENTRY // MOBILITY PARTNERSHIP Executives from JAL & Sumitomo’ Corporations JV, Soracle, signed an agreement with Archer in September to offer airport transfers and electric air taxi services in some of Japan’s largest cities, including Tokyo, Osaka and Nagoya. MIDNIGHT ORDER This partnership includes a planned order of up to $500M of Midnight aircraft by Soracle. In Q3’24, we received the first payment against this agreement.* REGULATORY COLLABORATION With the support of JAL and Sumitomo Corporation, who bring decades of in-country aviation experience, we have been working closely with the Japanese Civil Aviation Bureau to certify our aircraft in Japan. NIKHIL GOEL CHIEF COMMERCIAL OFFICER ARCHER AVIATION YUKIHIRO OTA CHIEF EXECUTIVE OFFICER SORACLE JV – JAPAN AIRLINES & SUMITOMO CORP *Orders under the order book remain conditional, subject to the execution of further definitive agreements with each customer and the satisfaction of certain conditions. Order values represent the Company’s estimate based on an indicative $5M per aircraft price. This is only a prediction and actual results may differ materially due to a variety of factors. We aim to enrich lives and society by creating more accessible air transportation services in Japan by leveraging the wealth of knowledge we have accumulated at Japan Airlines and Sumitomo Corporation.” “

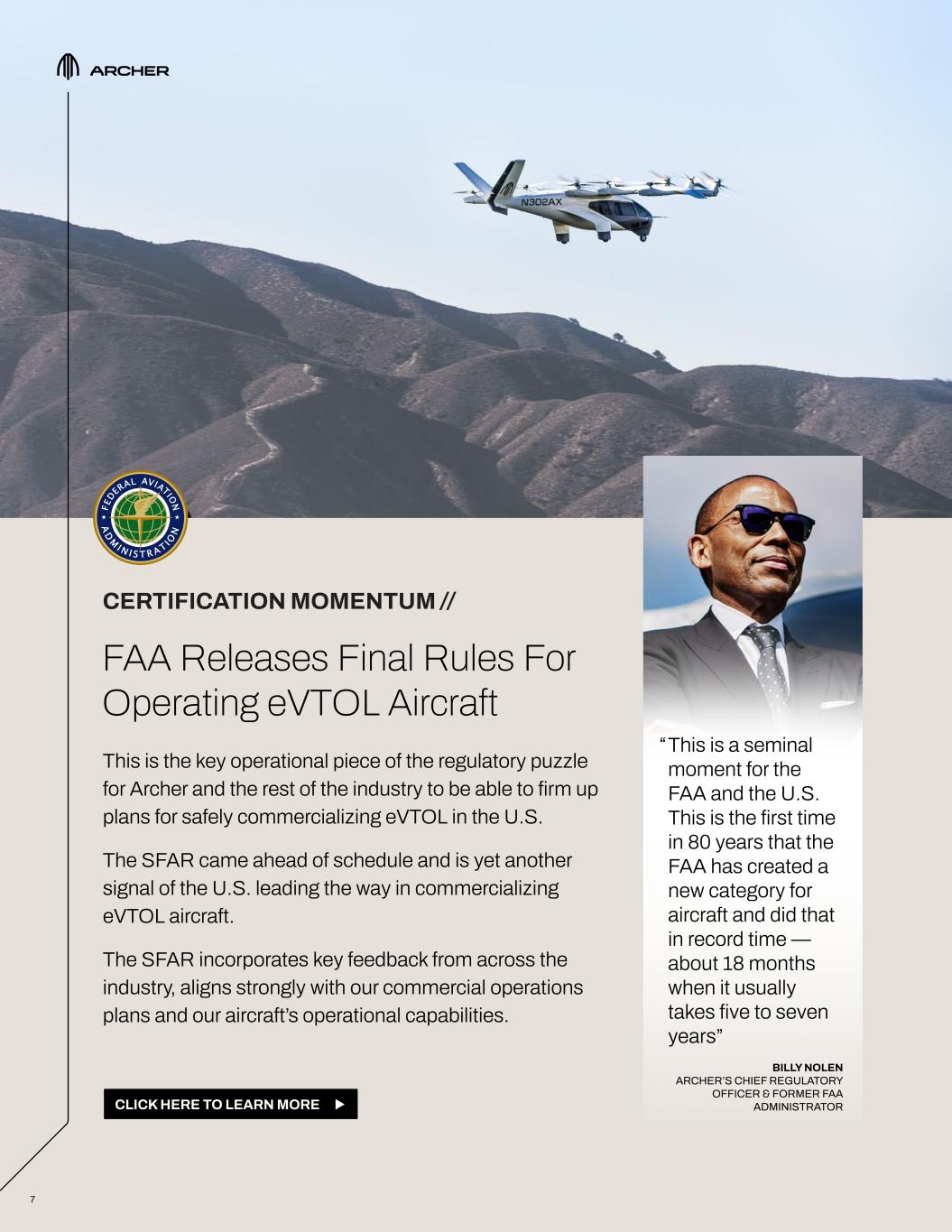

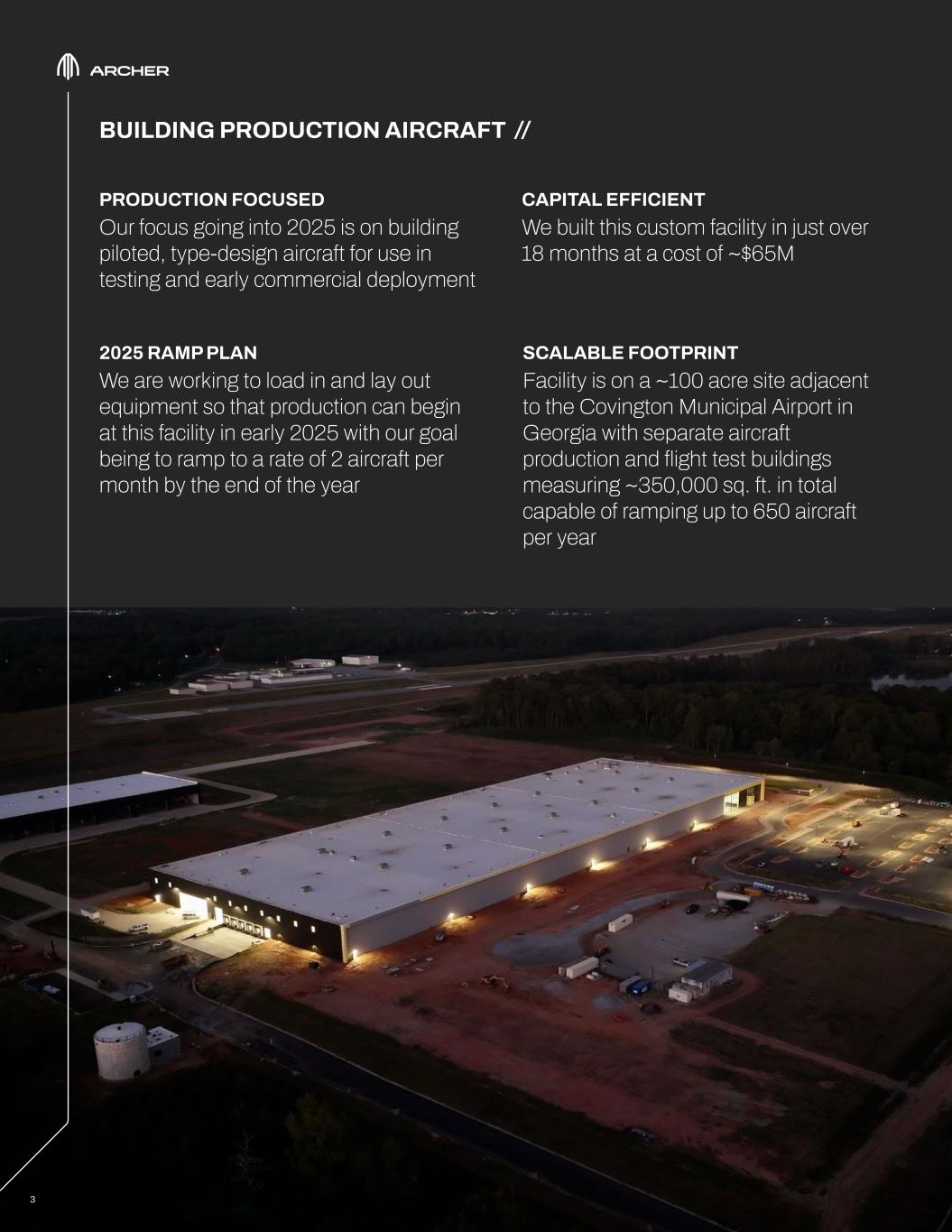

7 FAA Releases Final Rules For Operating eVTOL Aircraft This is the key operational piece of the regulatory puzzle for Archer and the rest of the industry to be able to firm up plans for safely commercializing eVTOL in the U.S. The SFAR came ahead of schedule and is yet another signal of the U.S. leading the way in commercializing eVTOL aircraft. The SFAR incorporates key feedback from across the industry, aligns strongly with our commercial operations plans and our aircraft’s operational capabilities. CERTIFICATION MOMENTUM // CLICK HERE TO LEARN MORE “This is a seminal moment for the FAA and the U.S. This is the first time in 80 years that the FAA has created a new category for aircraft and did that in record time — about 18 months when it usually takes five to seven years” BILLY NOLEN ARCHER’S CHIEF REGULATORY OFFICER & FORMER FAA ADMINISTRATOR

8 MEASURING OUR CERTIFICATION PROGRESS // The FAA outlines the process for type certification in Order 8110.4C, which defines the 4 phases that lead to type certification. Below we have reproduced a chart from page 18 of that order showing the activities to be performed by each phase and our current status in each of those phases. Since our Certification Basis was finalized in May, formally closing the FAA’s second phase, we’ve made tremendous progress with the FAA finalizing the means and methods of compliance in third phase. Specific topics that were finalized include means and methods of compliance for safety and development assurance, electric engines, batteries, high voltage systems and structural loads. With these activities finalized, we are now substantially complete with the compliance planning phase of the certification program. As we’ve discussed before, we are largely focused on the fourth phase of the certification program. We have now completed FAA SOI-1 and SOI-2 software audits with all of our external suppliers as well as several FAA audits of our internal developed software. At this point, we have FAA approval for ~12% of the total compliance verification documents in this final phase before type certification.

9 NOV 12 BAIRD GLOBAL INDUSTRIAL CONFERENCE Chicago, IL NOV 13 JP MORGAN EQUITIES OPPORTUNITY FORUM Miami, FL NOV 13-14 CO-MOTION Los Angeles, CA NOV 14 IBGAA INTERNATIONAL BUSINESS AVIATION CONFERENCE Straffan, IE NOV 19-20 AEROSPACE TECH WEEK Atlanta, GA NOV 20-21 BARCLAYS 15TH ANNUAL GLOBAL AUTO & MOBILITY TECH CONFERENCE New York, NY NOV 25-28 AIRTAXI WORLD CONGRESS London, UK DEC 4-5 REVOLUTION.AERO San Francisco, CA Today’s Webcast & Conference Call Details TIME 2 PM PT (5 PM ET) WEBCAST Accessible via our IR website (investors.archer.com) CONFERENCE 404-975-4839 (domestic) CALL +1 833-470-1428 (international) Access code: 286379 Upcoming Events

Q3 2024 Financial Review We reference several non-GAAP metrics in the financial discussion that follows. Unless otherwise noted or defined, our non-GAAP metrics are calculated by starting with the equivalent GAAP metric and subtracting non-cash stock-based compensation, non-cash warrant expenses, changes in fair value of warrants and expense taken in connection with the Boeing Wisk Agreements (as defined below). We believe these adjustments are appropriate to enhance the overall understanding of our underlying financial and operational performance. SUMMARY FINANCIALS (In millions; unaudited) 1) Amounts reflect charges related to the technology and dispute resolution agreements (the “Boeing Wisk Agreements”) reached on August 10, 2023, between us, Wisk Aero LLC and the Boeing Company. 2) Non-GAAP total operating expenses is a financial measure adjusting total operating expenses for warrant expenses, stock-based compensation, and expense related to the Boeing Wisk Agreements. 3) A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided below in the section titled “GAAP to Non-GAAP Reconciliation”. 4) Adjusted EBITDA is a financial measure adjusting net loss for other income (expense), net, interest income, net, income tax expense, depreciation and amortization expense, warrant expenses, stock-based compensation expense, and expense related to the Boeing Wisk Agreements. NET LOSS AND ADJUSTED EBITDA Our third quarter 2024 net loss represents investments required to achieve the key elements of our commercialization plan. We continued to invest in the design, development, test. certification and production activities for our aircraft. Further, we made payments to several of our supply chain partners for non-recurring engineering costs as they work to establish capabilities to manufacture certain components and subsystems for our aircraft at scale, made investments to build out our test and manufacturing facilities in San Jose, California and Covington, Georgia, and made investments in the people and infrastructure required to scale our operations. Net loss for the third quarter of 2024 was $115.3 million, which increased by $8.4 million from $106.9 million in the second quarter of 2024, primarily due to the non-cash decrease in other income (expense), net driven by the change in fair value of warrant liability, while quarter over quarter, GAAP operating expenses stayed relatively flat. Net loss for the quarter increased year-over-year by $63.7 million primarily due to the one-time non-cash credit of $59.1 million taken in the third quarter of 2023 for the forfeiture of a founder grant by a former officer, and due to the increase in spend to support the Midnight program, including our related test and manufacturing capabilities. 10 THREE MONTHS ENDED SEP 30, 2024 JUN 30, 2024 SEP 30, 2023 TOTAL OPERATING EXPENSES(1) $ 122.1 $ 121.2 $ 46.2 NET LOSS(1) (115.3) (106.9) (51.6) NON-GAAP TOTAL OPERATING EXPENSES(2)(3) 96.8 96.4 66.9 ADJUSTED EBITDA(3)(4) (93.5) (93.8) (64.8) CASH AND CASH EQUIVALENTS 501.7 360.4 461.4

11 For the third quarter of 2024, adjusted EBITDA loss also stayed relatively flat at $93.5 million as we continued to execute to our aircraft program development milestones and manufacturing ramp. Year over year, adjusted EBITDA loss increased by $28.7 million representing the investments we have made structurally in people related spend to support our current phase of development, testing efforts and manufacturing scale up, as well as increased spend with our suppliers for the non-recurring engineering costs and aircraft components necessary as we build and test additional aircrafts. TOTAL OPERATING EXPENSES Total GAAP operating expenses for the third quarter of 2024 were $122.1 million, which were slightly higher than the second quarter of 2024 by $0.9 million, primarily due to the $1.7 million prejudgment interest associated with the Boeing Wisk Agreements, partially offset by $1.4 million lower stock-based compensation for the quarter. Year over year, total GAAP operating expenses increased by $75.9 million due to the one-time non-cash credit of $59.1 million taken in the third quarter of 2023 for the forfeiture of a founder grant by a former officer, and due to the increase in spend to support our Midnight aircraft program and the build out of our test and manufacturing capabilities. Total non-GAAP operating expenses (which are GAAP operating expenses less stock-based compensation, warrant expenses and other one-time expenses, a reconciliation for which is provided in the financial statement section of this letter) for the third quarter of 2024 were $96.8 million, which increased slightly by $0.4 million over the second quarter of 2024. Total non-GAAP operating expenses increased $29.9 million year-over-year from the third quarter of 2023 due to reasons mentioned above. CASH & LIQUIDITY We ended Q3’24 with $501.7 million of cash and cash equivalents on our balance sheet and an additional $6.7 million of restricted cash. These ending cash balances represents the highest watermark for our quarter-end cash balances since the beginning of 2023. Furthermore, these ending cash balances increased by $141.3 million from the second quarter of 2024 and by $40.3 million from the third quarter of 2023. The increase in cash balances were enabled by the capital that was raised in the quarter. In Q3’24, we drew down on $55.0 million from the third tranche available under our forward equity purchase agreement with Stellantis and incrementally raised $171.7 million in equity financing, on a net basis, from our August 2024 PIPE (private investment in public equity) transaction and our ongoing ATM (at-the-market) program. We also received $31.7 million from our construction debt facility completing our total $65.0 million loan drawdown. Q4 2024 FINANCIAL ESTIMATES We anticipate total non-GAAP operating expenses of $95 million to $110 million for the fourth quarter of 2024. We have not reconciled our non-GAAP total operating expenses estimates because certain items that impact non-GAAP total operating expenses are uncertain or out of our control and cannot be reasonably predicted. In particular, stock-based compensation expense is impacted by the future fair market value of our common stock and other factors, all of which are difficult to predict, subject to frequent change, or not within our control. The actual amount of these expenses during 2024 will have a significant impact on our future GAAP financial results. Accordingly, a reconciliation of non-GAAP total operating expenses is not available without unreasonable effort.

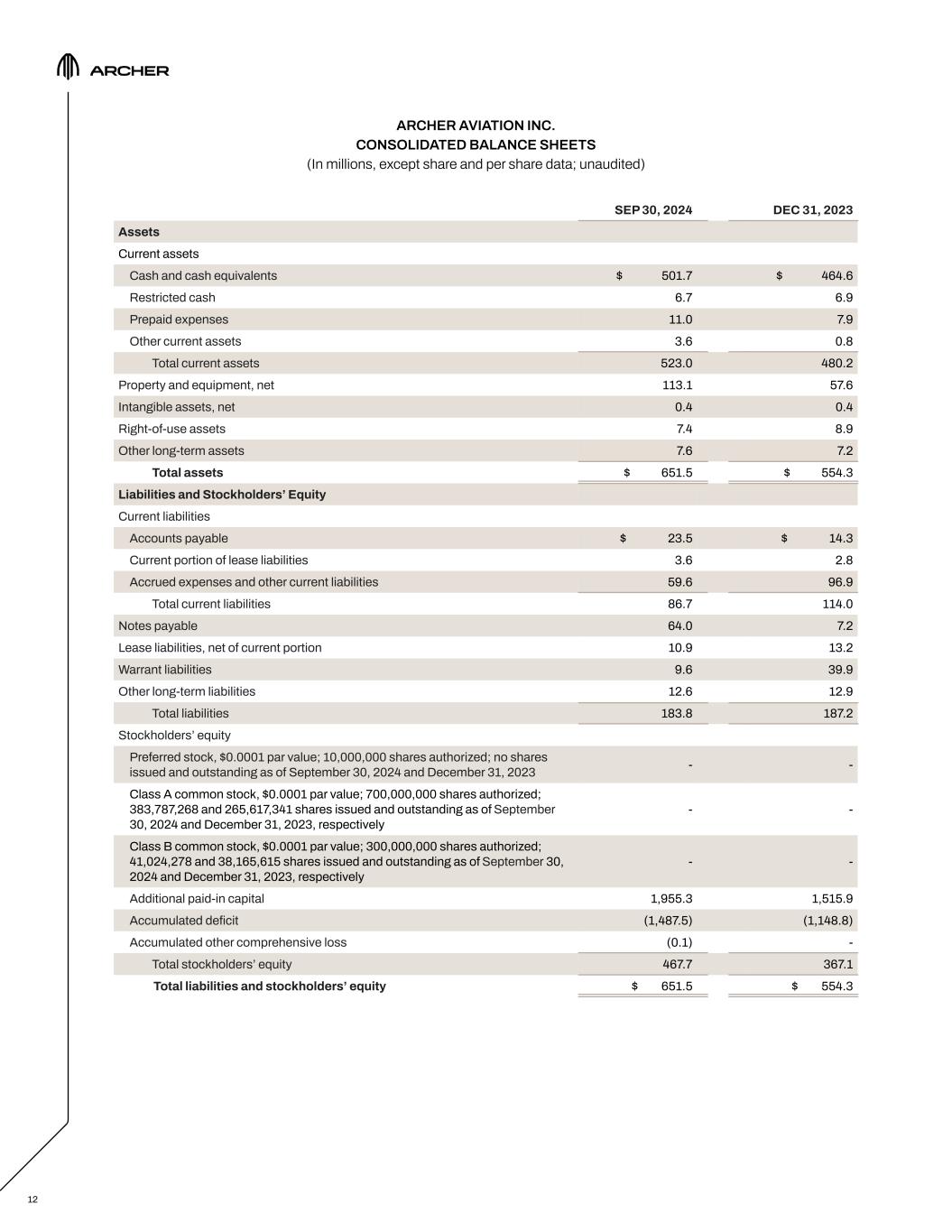

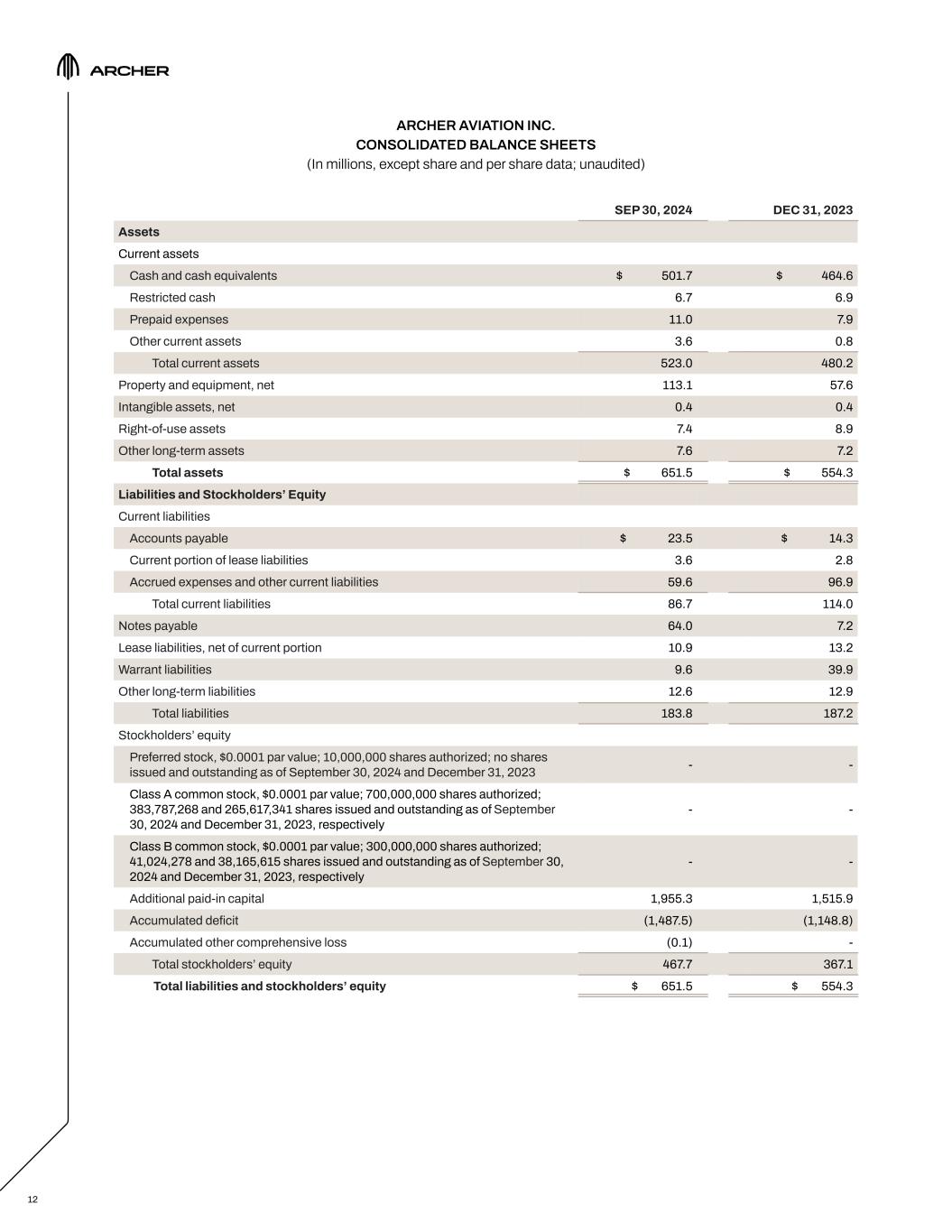

ARCHER AVIATION INC. CONSOLIDATED BALANCE SHEETS (In millions, except share and per share data; unaudited) 12 SEP 30, 2024 DEC 31, 2023 Assets Current assets Cash and cash equivalents $ 501.7 $ 464.6 Restricted cash 6.7 6.9 Prepaid expenses 11.0 7.9 Other current assets 3.6 0.8 Total current assets 523.0 480.2 Property and equipment, net 113.1 57.6 Intangible assets, net 0.4 0.4 Right-of-use assets 7.4 8.9 Other long-term assets 7.6 7.2 Total assets $ 651.5 $ 554.3 Liabilities and Stockholders’ Equity Current liabilities Accounts payable $ 23.5 $ 14.3 Current portion of lease liabilities 3.6 2.8 Accrued expenses and other current liabilities 59.6 96.9 Total current liabilities 86.7 114.0 Notes payable 64.0 7.2 Lease liabilities, net of current portion 10.9 13.2 Warrant liabilities 9.6 39.9 Other long-term liabilities 12.6 12.9 Total liabilities 183.8 187.2 Stockholders’ equity Preferred stock, $0.0001 par value; 10,000,000 shares authorized; no shares issued and outstanding as of September 30, 2024 and December 31, 2023 - - Class A common stock, $0.0001 par value; 700,000,000 shares authorized; 383,787,268 and 265,617,341 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively - - Class B common stock, $0.0001 par value; 300,000,000 shares authorized; 41,024,278 and 38,165,615 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively - - Additional paid-in capital 1,955.3 1,515.9 Accumulated deficit (1,487.5) (1,148.8) Accumulated other comprehensive loss (0.1) - Total stockholders’ equity 467.7 367.1 Total liabilities and stockholders’ equity $ 651.5 $ 554.3

ARCHER AVIATION INC. CONSOLIDATED STATEMENT OF OPERATIONS (In millions, except share and per share data; unaudited) 13 THREE MONTHS ENDED SEPTEMBER 30, 2024 2023 OPERATING EXPENSES Research and development $ 89.8 $ 67.8 General and administrative 32.3 (21.6) Total operating expenses 122.1 46.2 Loss from operations (122.1) (46.2) Other income (expense), net 1.4 (10.4) Interest income, net 5.5 5.1 Loss before income taxes (115.2) (51.5) Income tax expense (0.1) (0.1) Net loss $ (115.3) $ (51.6) Net loss per share, basic and diluted $ (0.29) $ (0.19) Weighted-average shares outstanding, basic and diluted 397,521,078 277,683,468

ARCHER AVIATION INC. CONSOLIDATED CONDENSED STATEMENT OF CASH FLOWS (In millions; unaudited) 14 NINE MONTHS ENDED SEPTEMBER 30, 2024 2023 Cash flows from operating activities Net loss $ (338.7) $ (348.8) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation, amortization and other 8.2 4.2 Debt discount and issuance cost amortization - 0.5 Stock-based compensation 84.9 24.8 Change in fair value of warrant liabilities and other warrant costs (30.3) 25.8 Gain on issuance of common stock (1.5) (3.6) Non-cash lease expense 2.2 3.1 Research and development warrant expense 6.1 13.1 General and administrative warrant expense 0.2 - Other warrant expense - 2.1 Technology and dispute resolution agreements expense 5.6 75.3 Accretion and amortization income of short-term investments - (2.3) Changes in operating assets and liabilities: Prepaid expenses (2.0) 5.9 Other current assets (2.8) 0.3 Other long-term assets (1.9) (0.1) Accounts payable 1.6 10.3 Accrued expenses and other current liabilities 5.8 (1.6) Operating lease right-of-use assets and lease liabilities, net (2.3) 2.8 Other long-term liabilities 0.7 0.6 Net cash used in operating activities (264.2) (187.6) Cash flows from investing activities Proceeds from maturities of short-term investments - 465.0 Purchase of property and equipment (57.8) (35.3) Net cash provided by (used in) investing activities (57.8) 429.7 Cash flows from financing activities Proceeds from issuance of debt 57.5 - Repayment of long-term debt - (7.5) Payment of debt issuance costs (0.6) - Payments for taxes related to net share settlement of equity awards - (3.5) Net proceeds from financing and issuance of common stock 302.0 165.3 Net cash provided by financing activities 358.9 154.3 Net increase in cash, cash equivalents, and restricted cash 36.9 396.4 Cash, cash equivalents, and restricted cash, beginning of period 471.5 72.3 Cash, cash equivalents, and restricted cash, end of period $ 508.4 $ 468.7

GAAP to Non-GAAP Reconciliation A reconciliation of total operating expenses to non-GAAP total operating expenses for the three months ended September 30, 2024, June 30, 2024, and September 30, 2023, respectively, are set forth below. RECONCILIATION OF OPERATING EXPENSES (In millions; unaudited) 1) Amounts include non-cash warrant costs, classified as research and development expenses, for the warrants issued to Stellantis in connection with certain services they are providing to the Company. 2) Amounts include stock-based compensation for options and restricted stock units issued to both employees and non-employees, including the grants issued to our founders in connection with the closing of the business combination. 3) Amounts reflect charges relating to the Boeing Wisk Agreements. 15 THREE MONTHS ENDED SEP 30, 2024 JUN 30, 2024 SEP 30, 2023 TOTAL OPERATING EXPENSES $ 122.1 $ 121.2 $ 46.2 Adjusted to exclude the following: Stellantis warrant expense (1) (2.0) (2.0) (4.4) Stock-based compensation (2) (21.4) (22.8) 27.4 Technology and dispute resolution agreements (3) (1.7) - (2.3) General and administrative warrant expense (0.2) - - NON-GAAP TOTAL OPERATING EXPENSES $ 96.8 $ 96.4 $ 66.9

16 GAAP to Non-GAAP Reconciliation (cont.) A reconciliation of net loss to Adjusted EBITDA for the three months ended September 30, 2024, June 30, 2024, and September 30, 2023, respectively, are set forth below. RECONCILIATION OF ADJUSTED EBITDA (In millions; unaudited) 1) Amounts include changes in fair value of the public and private warrants, which are classified as warrant liabilities, and gain on share issuance. 2) Amounts include non-cash warrant costs, classified as research and development expenses, for the warrants issued to Stellantis in connection with certain services they are providing to the Company. 3) Amounts include stock-based compensation for options and restricted stock units issued to both employees and non-employees, including the grants issued to our founders in connection with the closing of the business combination. 4) Amounts reflect charges related to the Boeing Wisk Agreements. THREE MONTHS ENDED SEP 30, 2024 JUN 30, 2024 SEP 30, 2023 NET LOSS $ (115.3) $ (106.9) $ (51.6) Adjusted to exclude the following: Other (income) expense, net (1) (1.4) (9.3) 10.4 Interest income,net (5.5) (5.1) (5.1) Income tax expense 0.1 0.1 0.1 Depreciation and amortization expense 3.3 2.6 2.1 Stellantis warrant expense (2) 2.0 2.0 4.4 Stock-based compensation (3) 21.4 22.8 (27.4) Technology and dispute resolution agreements(4) 1.7 - 2.3 General and administrative warrant expense 0.2 - - ADJUSTED EBITDA $ (93.5) $ (93.8) $ (64.8)

17 GAAP to Non-GAAP Reconciliation (cont.) NON-GAAP FINANCIAL MEASURES To supplement our condensed consolidated financial results prepared in accordance with GAAP, we use a number of non-GAAP financial measures to help us in analyzing and assessing our overall business performance, for making operating decisions and for forecasting and planning future periods. We consider the use of non-GAAP financial measures helpful in assessing our current financial performance, ongoing operations and prospects for the future as well as understanding financial and business trends relating to our financial condition and results of operations. While we use non-GAAP financial measures as a tool to enhance our understanding of certain aspects of our financial performance and to provide incremental insight into the underlying factors and trends affecting our performance, we do not consider these measures to be a substitute for, or superior to, the information provided by GAAP financial measures. Consistent with this approach, we believe that disclosing non-GAAP financial measures to the readers of our financial statements provides useful supplemental data that, while not a substitute for GAAP financial measures, can offer insight in the review of our financial and operational performance and enables investors to more fully understand trends in our current and future performance. In assessing our business during the third quarter ended September 30, 2024, we excluded items in the following general categories from one or more of our non-GAAP financial measures, certain of which are described below: – STOCK-BASED COMPENSATION EXPENSE We believe that providing non-GAAP measures excluding stock-based compensation expense, in addition to the GAAP measures, allows for better comparability of our financial results from period to period. We prepare and maintain our budgets and forecasts for future periods on a basis consistent with this non-GAAP financial measure. Further, companies use a variety of types of equity awards as well as a variety of methodologies, assumptions and estimates to determine stock-based compensation expense. We believe that excluding stock-based compensation expenses enhances our ability and the ability of investors to understand the impact of non-cash stock-based compensation on our operating results and to compare our results against the results of other companies. – WARRANT EXPENSE & GAINS OR LOSSES FROM REVALUATION OF WARRANTS Expense from our common stock warrants issued to Stellantis and vendors, which is recurring (but non-cash) and gains or losses from change in fair value of public and private warrants from revaluation will be reflected in our financial results for the foreseeable future. We exclude warrant expense and gains or losses from change in fair value for similar reasons to our stock-based compensation expense. – TECHNOLOGY AND DISPUTE RESOLUTION AGREEMENTS Amounts reflect charges relating to the Boeing Wisk Agreements. Each of the non-GAAP financial measures presented in this letter to shareholders should not be considered in isolation from, or as a substitute for, a measure of financial performance prepared in accordance with GAAP and are presented for supplemental informational purposes only. Further, investors are cautioned that there are inherent limitations associated with the use of each of these non-GAAP financial measures as an analytical tool. In particular, these non-GAAP financial measures have no standardized meaning prescribed by GAAP and are not based on a comprehensive set of accounting rules or principles and many of the adjustments to the GAAP financial measures reflect the exclusion of items that are recurring and may be reflected in our financial results for the foreseeable future. In addition, the non-GAAP measures we use may be different from non-GAAP measures used by other companies, limiting their usefulness for comparison purposes. We compensate for these limitations by providing specific information in the reconciliation included in this letter to shareholders regarding the GAAP amounts excluded from the non-GAAP financial measures. In addition, as noted above, we evaluate the non-GAAP financial measures together with the most directly comparable GAAP financial information. Investors are encouraged to review the reconciliations of these non-GAAP measures to their most directly comparable GAAP financial measures included in this letter to shareholders.

18 Forward-Looking Statements & Disclaimers This shareholder letter includes forward-looking statements. These statements include, but are not limited to, statements regarding our future performance and our market opportunity, including expected financial results for the fourth quarter of fiscal year 2024, our business strategy and plans, aircraft performance, the design and target specifications of our aircraft, the design of our manufacturing and automation processes, the production timeline, ramp-up and production volume of our manufacturing facilities, the pace at which we intend to design, develop, certify, conduct test flights, manufacture and commercialize our planned eVTOL aircraft, operational goals with respect to the timing of the launch of our commercial operations, the rate of scaling aircraft production and operating margins,[ the buildout and collaboration with Stellantis of our planned manufacturing facility and processes,] including the ability to reach definitive documentation with respect to ongoing negotiations, the buildout and deployment of our UAM network, our ability to produce aircraft on our anticipated timeline to fulfill order demand, the design, development and implementation of vertiport infrastructure, the development, and projected market size of, the future urban air mobility market, [total expected contract value with the DoD,] indicative orders for aircraft in agreements with third-party partners, and the expected timeline for the receipt of regulatory certification from the FAA and international regulatory agencies. In addition, this shareholder letter refers to certain signed agreements that are conditioned on the future execution by the parties of additional binding definitive agreements incorporating the terms outlined in such signed agreements, which definitive agreements may not be completed or may contain different terms. Forward-looking statements are based upon various estimates and assumptions, as well as information known to us as of the date hereof, and are subject to risks and uncertainties. Accordingly, actual results could differ materially due to a variety of factors, including: the early stage nature of our business and our past and projected future losses; our ability to design, develop, certify, manufacture and commercialize our aircraft and UAM ecosystem; the operation of aircraft and manufacturing processes to meet our designed-for targets and goals; our dependence on a limited number of customers for our current indicative aircraft orders, which are subject to conditions, further negotiation and reaching mutual agreement on certain material terms, and the risk that such parties may cancel those orders or never place them; the effectiveness of our marketing and growth strategies, including our ability to effectively market electric air transportation as a substitute for conventional methods of transportation; our ability to compete in the UAM and eVTOL industries; our ability to obtain any required certifications, licenses, approvals, or authorizations from governmental authorities; our ability to achieve our business milestones, such as the completion of our manufacturing facility in Georgia, commencing the manufacturing of aircraft, and launch products and services on anticipated timelines; our dependence on suppliers for the parts and components in our aircraft; our ability to develop commercial-scale manufacturing capabilities; regulatory requirements and other obstacles outside of our control that slow market adoption of electric aircraft, such as the inability to obtain and maintain adequate vertiport infrastructure; our ability to hire, train and retain qualified personnel; risks related to our UAM ecosystem operating in densely populated metropolitan areas and heavily regulated airports; adverse publicity from accidents involving electric aircraft or lithium-ion battery cells; the impact of labor and union activities on our workforce; losses resulting from indexed price escalation clauses in purchase orders; regulatory risks related to evolving laws and regulations in our industry; the impact of macroeconomic conditions, inflation, interest rates, war and geopolitical conflicts, natural disasters, infectious disease outbreaks and pandemics; our need for and the availability of additional capital; cybersecurity risks; and risks related to the dual class structure of our common stock, which has the effect of concentrating voting power with holders of our Class B common stock, including Adam Goldstein, Archer’s Chief Executive Officer and a member of Archer’s board of directors, and which Class B common stock will automatically convert into shares of Class A common stock.

19 Forward-Looking Statements & Disclaimers (cont.) The indicative operational goals referenced in this document reflect numerous estimates and assumptions with respect to general business, economic, regulatory, market and financial conditions and other future events, as well as matters specific to the our business, all of which are difficult to predict and many of which are beyond the our control including, among other things, the timing of the receipt of required certifications, licenses, approvals or authorizations from governmental authorities, the timing of the completion of the manufacturing facility in Georgia, the actual price per vehicle paid by customers and the costs of manufacturing the aircraft, consumer demand for our aircraft and the other matters described above. These operational goals should not be relied upon as being indicative of future economic performance or results. The inclusion of the operational goals in this document is not an admission or representation that such information is material. The assumptions and estimates underlying the operational goals are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual operating results to differ materially from those presented. There can be no assurance that these goals are indicative of our future performance or that actual results will not differ materially from those presented in the operational goals. Inclusion of the operational goals in this document should not be regarded as a representation by any person that the operational goals will be achieved. The information concerning our operational goals is subjective in many respects and thus is susceptible to multiple interpretations and periodic revisions based on actual experience and business developments. Additional risks and uncertainties that could cause actual results to differ from the results predicted are more fully detailed in our filings with the Securities and Exchange Commission (SEC), including our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, which are or will be available on our investor relations website at http://investors.archer.com and on the SEC website at www.sec.gov. All forward-looking statements contained herein are based on information available to us as of the date hereof and you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance, or achievements. We undertake no obligation to update any of these forward-looking statements for any reason after the date of this shareholder letter or to conform these statements to actual results or revised expectations, except as required by law. Undue reliance should not be placed on forward-looking statements.

TM Unlock The Skies