- PCT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

PureCycle (PCT) 8-KRegulation FD Disclosure

Filed: 9 Dec 24, 4:05pm

PureCycle Technologies, Inc. December 2024

Forward-Looking Statements This press release contains forward-looking statements, including statements about the continued expansion of PureCycle’s business plan, the expected time of commercial sales, the commercialization of Ironton operations, the expected increase in production of the Ironton operations, the planned compounding operations, the sourcing of materials, and planned future updates. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements generally relate to future events or PureCycle’s future financial or operating performance and may refer to projections and forecasts. Forward-looking statements are often identified by future or conditional words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements are based on the current expectations of PureCycle’s management and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of this prresentation. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” in each of PureCycle’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and PureCycle’s Quarterly Reports on Form 10-Q for various quarterly periods, those discussed and identified in other public filings made with the Securities and Exchange Commission by PureCycle and the following: PCT's ability to obtain funding for its operations and future growth and to continue as a going concern; PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s ultra-pure recycled (“UPR”) resin in food grade applications (including in the United States, Europe, Asia and other future international locations); PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPR resin and PCT’s facilities (including in the United States, Europe, Asia and other future international locations); expectations and changes regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives; the ability of PCT’s first commercial-scale recycling facility in Lawrence County, Ohio (the “Ironton Facility”) to be appropriately certified by Leidos, following certain performance and other tests, and commence full-scale commercial operations in a timely and cost-effective manner or at all; PCT’s ability to meet, and to continue to meet, the requirements imposed upon it and its subsidiaries by the funding for its operations, including the funding for the Ironton Facility; PCT’s ability to minimize or eliminate the many hazards and operational risks at its manufacturing facilities that can result in potential injury to individuals, disrupt its business (including interruptions or disruptions in operations at its facilities), and subject PCT to liability and increased costs; PCT’s ability to complete the necessary funding with respect to, and complete the construction of, (i) its first U.S. multi-line facility, located in Augusta, Georgia, and (ii) its first commercial-scale European plant located in Antwerp, Belgium, in a timely and cost-effective manner; PCT’s ability to procure, sort and process polypropylene plastic waste at its planned plastic waste prep facilities; PCT’s ability to maintain exclusivity under the Procter & Gamble Company license; the implementation, market acceptance and success of PCT’s business model and growth strategy; the success or profitability of PCT’s offtake arrangements; the ability to source feedstock with a high polypropylene content at a reasonable cost; PCT’s future capital requirements and sources and uses of cash; developments and projections relating to PCT’s competitors and industry; the outcome of any legal or regulatory proceedings to which PCT is, or may become, a party including the securities class action and putative class action cases; geopolitical risk and changes in applicable laws or regulations; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors, including interest rates, availability of capital, economic cycles, and other macro-economic impacts; turnover in employees and increases in employee-related costs; changes in the prices and availability of labor (including labor shortages), transportation and materials, including inflation, supply chain conditions and its related impact on energy and raw materials, and PCT’s ability to obtain them in a timely and cost-effective manner; any business disruptions due to political or economic instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine and the conflict in the Middle East); the potential impact of climate change on PCT, including physical and transition risks, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms; and operational risk. Except to the extent required by applicable law or regulation, PCT undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this Presentation or to reflect the occurrence of unanticipated events.

Why We Are Here

A New Era is About to Begin… Note: One metric ton equals 2,204 pounds. (1) The Facts, Plastic Oceans International (July 21, 2021). (2) Polypropylene Global Market Volume 2015-2029, Statista (May 23, 2022), data as of 2021. 830+ billion pounds of plastic produced each year(1) ~420 billion pounds of single use plastic produced each year(1) 170+ billion pounds of PP produced each year(2) 16 billion pounds of PP waste generated each year(3) 1.9 billion pounds of PP waste is incinerated each year(3) 0.1 billion pounds of PP waste is recycled each year(3) 4.4 billion pounds of unmet need to reach 2025 PCR Goals(4) 95 Companies eligible to report have pledged to the Ellen MacArthur Foundation(4) ~0.1 billion pounds per year of expected capacity at Ironton when fully operational Billions of pounds of PureCycle’s UPR resin could help solve this problem! Until Now (3) Advancing Sustainable Materials Management, U.S. Environmental Protection Agency | US EPA. (n.d.), data as of 2018. (4) Ellen MacArthur Foundation, The Global Commitment 2022 Progress Report.

Positioning for Significant Global Opportunity In 2023 Mechanical recycling generates 90% of the rPP & Bio volume, but sales are limited due to quality requirements We are actively trialing customer applications for film, fiber and injection molding; represents 85% of the market Current mechanically recycled PP supply struggles to meet product quality specifications for film and fiber; PureCycle has successfully produced both By 2030 PP demand is projected to increase to 239 billion lbs/yr 60 billion lbs of rPP/yr will be required to meet brand owner commitments by 2030 Source: Nexant, Roland Berger Injection Molding Fiber Film Other Global PP Demand in 2023 187 Billion Pounds; ~10% recycled Virgin rPP & Bio

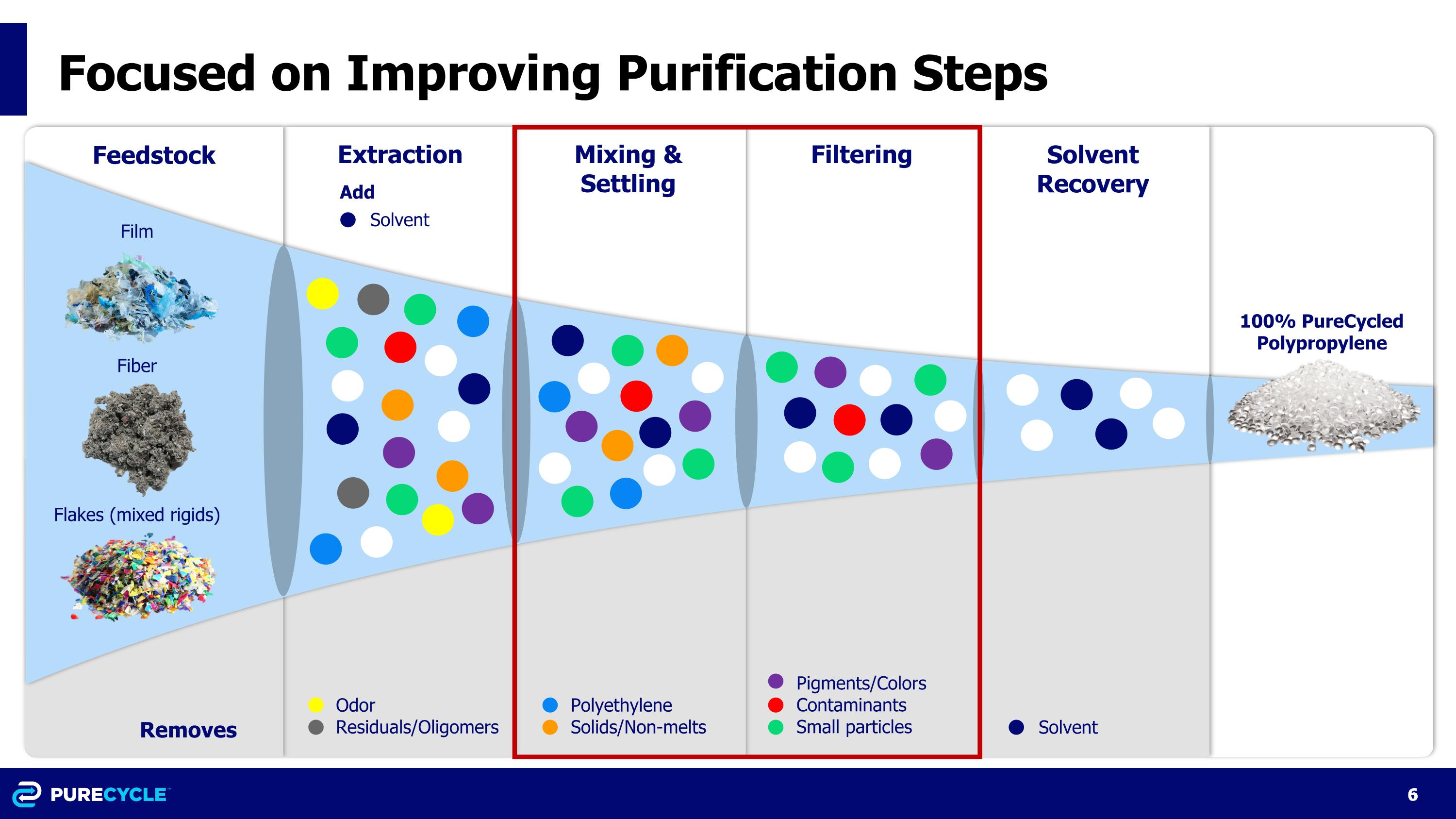

Focused on Improving Purification Steps Extraction Mixing & Settling Filtering Solvent Recovery Film Odor Residuals/Oligomers Polyethylene Solids/Non-melts Pigments/Colors Contaminants Small particles Solvent Solvent 100% PureCycled Polypropylene Feedstock Flakes (mixed rigids) Fiber Removes Add

PureCycle’s Recycling Advantage ✘ Mechanical recycling is limited by feedstock and higher costs, ultimately yielding a lower quality product than PureCycle’s UPR resin PureCycle’s unique, patented recycling process overcomes the limitations of mechanical and chemical recycling, yielding a low cost, high value and circular product Polypropylene Recycling Process Comparison Key Takeaways Mechanical Recycling(1) Chemical Recycling(2) Minimal Regulatory Risk ~ ✘ ✔ Pricing Premium ~ ✘ ✔ End-Use Applications Low-Value High-Value High-Value Low Cost / Energy Use ✔ ✘ ✔ Contaminant Free / Ultra Low Odor ✘ ✔ ✔ Potential Food Grade Applications ✘ ✔ ✔ LCA Score(4) / Environmental Impact ✔ ✘ ✔ Does Not Rely on Mass Balance ✔ ✘ ✔ Other Unpredictable economics and inferior quality due to limited ability to process various feedstocks Environmentally harmful and inefficient process leading to high levels of regulatory scrutiny, particularly in Europe Efficient, low-cost, high-yield process that can process many feedstock types and provides near-virgin quality UPR resin ✘ Chemical recycling has limited economic viability and requires massive amounts of energy, resulting in high levels of scrutiny and the European Commission advising against its use(3) Mechanical recycling refers to operations that aim to recover plastics waste via mechanical processes (i.e. grinding, washing, separating, drying, re-granulating and compounding). Chemical Recycling converts polymeric waste by changing its chemical structure to produce substances that are used as products or as raw materials for the manufacturing of products. “Chemical recycling should be seen as last resort, EU official says” Euractiv, 12/09/2020. See slide 14 for additional details on PureCycle’s Life Cycle Assessment.

PureCycle UPR Resin is a Sustainable Alternative to Virgin Polypropylene Resin Yellowness Index Value Opacity (Contrast Ratio) Clarity Odorless Contaminant Free Melt Flow Index (G/10 Min) Primary Input Material Pricing Premium PCT UPR Resin ≤ 20 <20% ✔ (better than virgin PP) ✔ (better than virgin PP) ✔ Variable by Feedstock (Plant 1: 5 – 55) Waste / Reclaimed PP ✔ Virgin PP Resin 0 <10% ✔ ✔ ✔ Polymer Grade Propylene ✘ < 1 to > 100

PureCycle LCA Outlook

Company Overview

Ironton Purification Facility

PureCycle at a Glance Note: One metric ton equals 2,204 pounds. (1) Received FDA LNO for Conditions of Use A-H for food grade post-consumer recycled feedstocks (2) Polypropylene Global Market Volume 2015-2029, Statista (May 23, 2022), data as of 2021. (3) Figures as of June 30, 2023. PureCycle Today Investment Highlights Validated technology: achieved first pellet production at the Ironton Plant in June 2023 PureCycle is commercializing a technology to convert polypropylene (“PP”) waste into a sustainable, circular product Leverages an innovative and scalable technology to transform waste PP into ultra-pure recycled (“UPR”) resin First mover advantage in addressing the massive 170+ billion pound annual PP waste problem driven by years of investment in R&D, testing and customer relationships(2) Aggressive, yet achievable, growth plan both in the US and internationally to enable one billion pounds of annual recycling capacity to be reached in 2027 Visibility into supply and demand pipelines with robust feedstock supply availability sourced from strategic locations as well as high-margin offtake agreements Attractive financial profile with previous successful financings, over $215 million in cash, cash equivalents and restricted cash, a $150 million undrawn revolving credit facility, anticipated high gross margins and stable cash flows at scale(3) Operational and execution-driven management team with decades of experience across global chemical, recycling and plastics industries Validated and scalable technology attracting support from blue-chip customers, partners and third parties including: Proven technology demonstrated by mechanical completion and pellet production at Ironton facility de-risks scale-up Facility Overview: First Facility: Commercially operating in Ironton, OH Second Facility: Under development in Augusta, GA Ironton Plant: achieved mechanical completion in April 2023 2 5 3 6 1 7 4 Received FDA Letter of No Objection (“LNO”) for UPR resin to be used for food grade applications(1) Proprietary and patented technology from global license partnership with P&G Note: One metric ton equals 2,204 pounds.

Leveraging Our First Commercial Operation To Scale Globally! IRONTON, OHIO AUGUSTA, GEORGIA DURHAM, NORTH CAROLINA DENVER, PENNSYLVANIA PORT OF ANTWERP, BELGIUM CENTRAL JAPAN1 GLOBAL EXPANSION SCALING THE FUTURE #1

PureCycle’s Process to Change Diversified Waste Feedstock to Ultra-Pure Recycled Resin Sort Film Fiber Rigids Wash Grind Shred Agglomerate Clean Shred Agglomerate Clean To further de-risk operations, PureCycle secures access to feedstock supply by investing in PreP infrastructure operations Feedstock Pre-Processing Steps (“PreP”) Purification Feedstock Offtake

PureCycle has FDA LNO for Conditions of Use High temperature heat-sterilized (e.g., over 212º F) Boiling water sterilized Hot filled or pasteurized above 150º F Hot filled or pasteurized below 150º F Refrigerated storage (no thermal treatment in the container) Frozen storage (no thermal treatment in the container) Frozen/refrigerated storage: Ready-prepared foods intended to be reheated in container at time of use Room temperature filled and stored (no thermal treatment in the container) A B C D E F G H * Received FDA LNO for Conditions of Use A-H for food grade post-consumer recycled feedstocks

Third Quarter 2024 Corporate Update

PCT Highlights Operations Achieved all three production milestones Significant progress on rates, uptime and reliability Current Ironton production is exclusively from PCR feedstock Co-product 2 (CP2) improvements implemented and recovery rates have reached up to 15K lbs/day Denver, PA PreP facility is online and producing high yield PP bales at designed rates Compounding operations are running reliably and producing multiple product grades Commercial Secured multiple new customer approvals for PCT resin in defined customer applications Continue to trial new applications for commercial ramp-up into 2025 Strong trial feedback for numerous customer applications in film, fiber and injection molding Margin opportunities for compounding operations continues to look positive Finance Sold $22.5MM of Ironton revenue bonds Raised $90MM through the sale of preferred and common equity as well as warrants Currently positioning company to begin financing growth initiatives with Ironton’s progress

PureCycle Manufacturing Update Ironton rPP Pellet Production (MM lbs) Key Improvements Feedstock sorting has significantly increased production capability Uptime and reliability are increasing due to proactive operational efforts Stronger Q3 performance despite significant time spent commissioning CP2 improvements Product quality improving with better recovery and removal of CP2 Before After

CP2 Upgrades Improve Final Product Quality & Circularity Performance Improvements Final PP product quality materially improved with more effective CP2 removal Compounding CP2 for customer trials and sales Originally modeled as a waste stream and now good market interest in this product Achieved rates up to 15K lbs/day with improving reliability CP2 Pellets

Denver, PA Bale Sortation Improved capability to upgrade mixed bales (#5 & #3-7) to approximately 90% to 95% PP Offsite Flake Sortation Improved PP concentration of ready-to-purify flake from approximately 75% to 95% Ironton Flake Sortation Planned start-up in Q4; expect to improve PP concentration of ready-to-purify flake to ~97% Sort Upgrades are Increasing Feedstock Flexibility We do not currently expect CP2 removal to be a production limit for Ironton in the future

Plant Improvements Should Enhance Margins CP2 Recovery Feedstock Type Availability Feedstock Cost Offtake Value Limited PIR, No CP2 Limited Highest Lower Limited PCR, Low CP2 Very Limited Higher Higher Limited PCR, High CP2 Prevalent Lower Lowest Improved PCR, High CP2 Prevalent Lower Highest Current Production

Based on Expected Avg PureFive™ Compounded Business Combo vs PureFive™ Volumes Lower Higher Higher Price Higher Lower Lower Feedstock Costs Lower Higher Higher Direct Processing Costs Lower Higher Higher Direct Margin Dollars Higher Lower Higher Profitability Should Improve with Compounding Notes Economics on non-compounded sales are developing inline with previous expectations, compounding improves overall outcomes Compounding enables PCT to meet specific customer requirements which broadens the customer base Price premiums vs virgin are lower which also increases total addressable market Outcome from compounding incrementally benefits direct margin dollars vs

Compounding has Expanded Our Product Portfolio Ironton Production Compounding Material <10 MFI Suitable for thermoforming and film applications Mid MFI Suitable for injection molding applications 30+ MFI Suitable for fiber and injection molding applications Available Inventory (MM lbs) Building inventory of multiple grades to serve numerous customer applications 2.5 10-20 MFI

Film Packaging Product Formulation/Design Compounding Development First Customer Approval Inventory Build Commercial Sales Q4-24 Q4 Q1-25 Q1 Q2 Fiber Product Formulation/Design Compounding Development First Customer Approval Inventory Build Commercial Sales Q3-24 Q3/Q4 Q3 Q3/Q4 Q4 Road Map to Sales by Product Segment Injection Molding Automotive Product Formulation/Design Compounding Development/Trials First Customer Approval Inventory Build Commercial Sales Q2-24 Q4 w Q4/Q1 Q1 Q1 Injection Molding Packaging Product Formulation/Design PureCycle / P&G Compounding Development Inventory Build First Application Production Commercial Sales Q3-24 Q4 1 Q1-25 Q2/Q3 Q2/Q3 2 producers have approved our resin for customer applications Note: Reflects PureCycle’s fiscal quarters PCT Anticipated timing

Products Made from PureCycle Pellets

Summary

Summary Ongoing customer trials - expect reportable sales in Q1 2025 Active trials across the automotive, consumer goods, textiles and home furnishings markets Customer trials have their own unique processes and timing to commercialization PCT resin is uniquely suited for fiber and film market We expect commercial sales to gain increasing momentum in 2025 Production improving - continue to rate test Ironton purification facility Producing good quality product at various rates that meet customers’ varying product requirements Confident in Ironton operations at prior milestone rates Core technology has been proven at scale and prior reliability challenges have been minimized Continuing focus on improving operational reliability and uptime Optimizing operations with new feeds, different rate profiles, and new customer requirements Poised for strong growth through expansion - key 2025 priority Continue to integrate Ironton learnings into future design platforms Continue to improve internal project management process to help facilitate growth Establishing strong growth platform through Augusta / Antwerp / Joint ventures

PureCycle Technologies, Inc.