Central Georgia Cancer Care, P.C.

Financial Statements

As of and for the Year Ended December 31, 2023

Page(s)

Report of Independent Auditors................................................... 1-2

Financial Statements

Balance Sheet......................................................................................3

Statement of Operations......................................................................4

Statement of Shareholders’ Equity..................................................…5

Statement of Cash Flows.....................................................................6

Notes to Financial Statements...........................................................7

INDEPENDENT AUDITOR’S REPORT

Central Georgia Cancer Care, P.C.

Macon, Georgia

Opinion

We have audited the financial statements of Central Georgia Cancer Care, P.C. (the Company), which comprise the balance sheet as of December 31, 2023, and the related statements of operations, stockholders’ equity and cash flows for the year then ended, and the related notes to the financial statements.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of Central Georgia Cancer Care, P.C. as of December 31, 2023, and the results of its operations, changes in stockholders’ equity, and cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with GAAS, we:

•Exercise professional judgment and maintain professional skepticism throughout the audit.

•Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

•Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed.

•Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements.

•Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control–related matters that we identified during the audit.

McNAIR, McLEMORE, MIDDLEBROOKS & CO., LLC

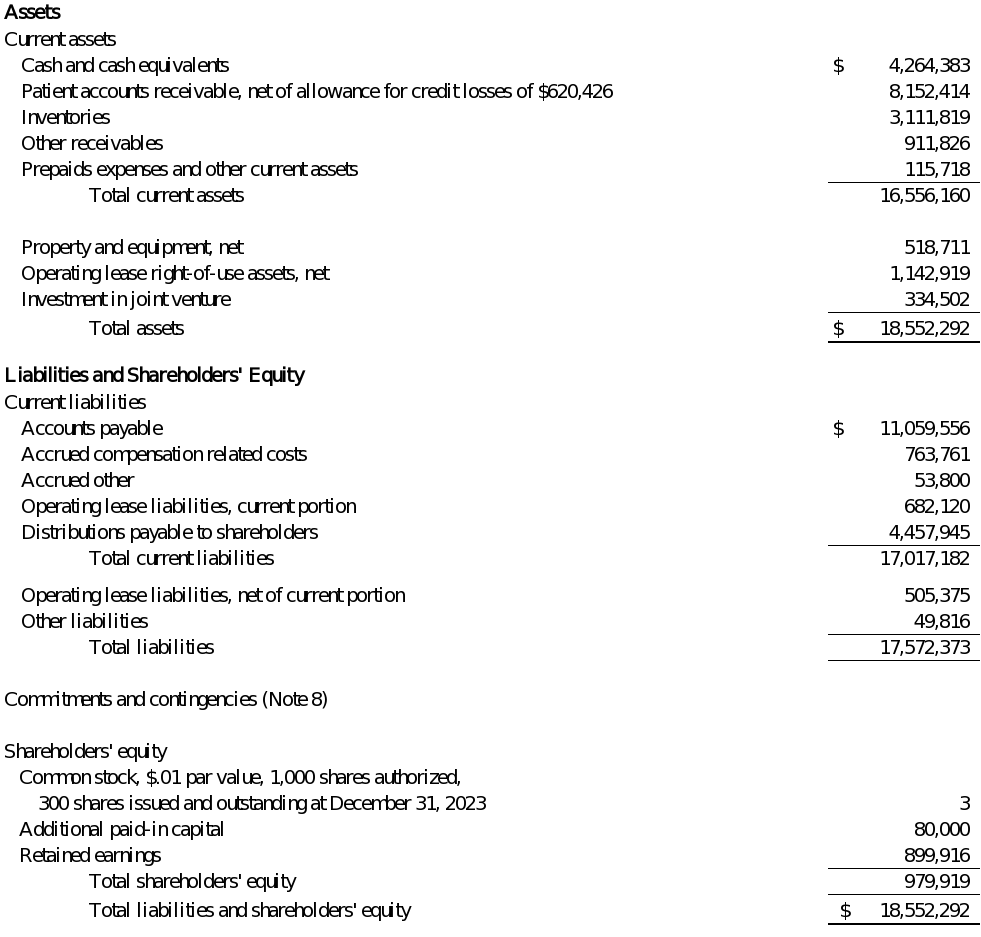

Balance Sheet

The accompanying notes are an integral part of these financial statements.

3

Statement of Operations

The accompanying notes are an integral part of these financial statements.

4

Statement of Shareholders’ Equity

The accompanying notes are an integral part of these financial statements.

5

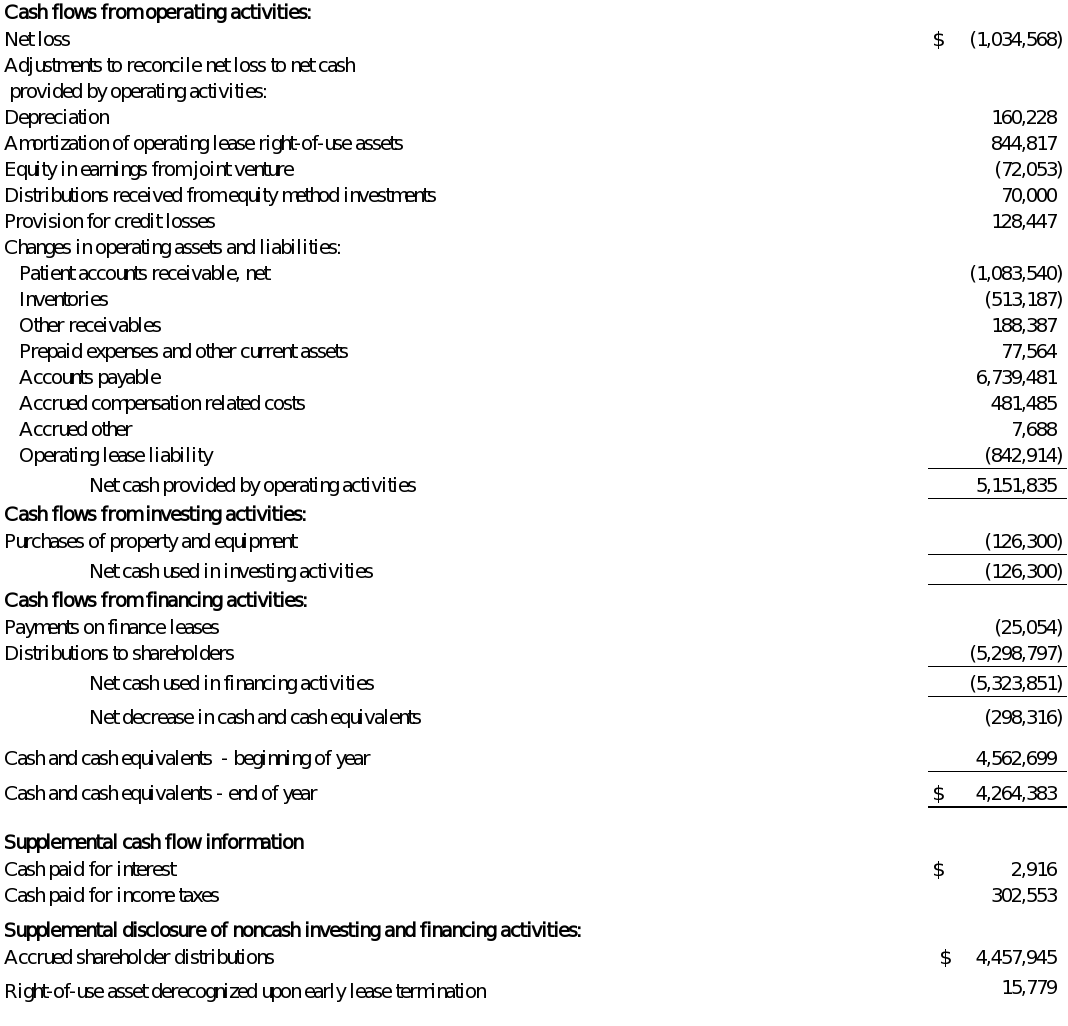

Statement of Cash Flows

The accompanying notes are an integral part of these financial statements.

6

Notes to Financial Statements

1.Business Organization and Basis of Presentation

Business

Central Georgia Cancer Care, P.C. (“CGCC”, or the “Company”) was originally incorporated under the Georgia Business Corporation Code on April 17, 2000 as a professional corporation as Macon Hematology & Oncology Associates, P.C. The Company changed its name to Central Georgia Hematology & Oncology Associates, P.C., effective May 11, 2000 and changed to its current name effective October 6, 2005. The Company provides treatment options to patients for cancer and blood disorders from its two practice locations in Macon, Georgia and Warner Robins, Georgia.

Basis of Presentation

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

2.Summary of Significant Accounting Policies

Accounting Estimates and Assumptions

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates.

Comprehensive Income

A separate statement of comprehensive income is required, however, as net income is the only component of comprehensive income, the Company elected not to include a separate statement of comprehensive income because it would not be meaningful to the users of the financial statements.

Revenue Recognition

Revenue is recognized under Accounting Standards Update (“ASU”) 2014-09 Revenue from Contracts with Customers (“Topic 606”). The Company determines the transaction price based upon standard charges for goods and services with anticipated consideration due from patients, third-party payors (including health insurers and government agencies) and others. The Company’s revenue is primarily derived from patient service revenues, which encompass oncology services and infused drugs provided during patient visits and the dispensing of pharmacy prescriptions. Performance obligations for the Company’s services provided to patients and most procedures, are satisfied over the time of visit which is the same day services are performed. Performance obligations relating to pharmacy revenue are considered fully satisfied at a point in time upon the customer taking possession of the prescription. Accordingly, the Company does not anticipate a significant amount of revenue from performance obligations satisfied (or partially satisfied) in previous periods, and any such revenue recognized during the year ended December 31, 2023 was immaterial. Additionally, the Company does not anticipate a significant amount of revenue from performance obligations satisfied (or partially satisfied) as of December 31, 2023. Approximately $71,900,000 of the Company’s patient service revenues are generated from services performed during patient visits with the remainder primarily generated from the dispensing of pharmacy prescriptions for the year ended December 31, 2023.

As patient services are performed and prescriptions are dispensed, timely billing occurs for services rendered and prescriptions dispensed less discounts provided to uninsured patients and contractual adjustments to third-party payors based upon prospectively determined rates and discounted charges. Payment is requested at the time of service for self-paying patients and for patients covered by third-party payors that are responsible for paying deductibles and coinsurance.

The Company monitors revenue and receivables to prepare estimated contractual allowances for the anticipated differences between billed and reimbursed amounts. Payments from third-party payors and Government programs including Medicare and Medicaid may be subject to audit and other retrospective adjustments. Such amounts are considered on an estimated basis when net patient revenue is recorded and are adjusted as final adjustments are determined. For the year ended December 31, 2023, such resulting historic adjustments have been immaterial to the financial statements.

In assessing who is the principal in providing patient services and pharmacy prescriptions, the Company considers who controls the provision of services and prescriptions. The Company has determined they are acting as a principal in these relationships as the Company controls the goods or services prior to them being transferred to the ultimate customer.

Cost of Revenue

Cost of services primarily includes chemotherapy drug costs, clinician salaries and benefits, and medical supplies. Clinicians include oncologists, advanced practice providers such as physician assistants and nurse practitioners, registered nurses and pharmacy and lab personnel and other outside services..

Cash and Cash Equivalents

The Company considers all highly liquid investments with a maturity of three months or less when purchased to be cash equivalents. Cash and cash equivalents include cash or deposits with financial institutions and deposits in highly liquid money market securities. Deposits with financial institutions are insured by the Federal Deposit Insurance Corporation up to certain defined limits. Bank deposits at times may exceed federally insured limits. The Company has not experienced any losses in these accounts.

Patient Accounts Receivable, net

Patient accounts receivable consist of amounts due from third-party payors, including Medicare, Medicaid, managed care providers and commercial providers along with self-pay customers which includes the patient responsibility portion for patients with insurance. Patient accounts receivable are carried at the amount of consideration the Company expects to collect based on the historical collection rate which takes into consideration any allowance for credit losses. The Company utilizes a historical loss rate method, adjusted for any changes in economic conditions or risk characteristics, to estimate its expected credit losses each period. When developing an estimate of expected credit losses, the Company considers all available relevant information regarding the collectability of cash flows, including historical information, current conditions, and reasonable and supportable forecasts of future economic conditions over the contractual life of the receivable. The historical loss rate method considers past write-offs of trade accounts receivable over a period commensurate with the initial term of the Company’s contracts with its customers. The Company recognizes the allowance for credit losses at inception and reassesses periodically based on management’s expectation of the asset’s collectability. The Company’s patient accounts receivable are short-term in nature and written off only when all collection attempts have failed. The Company recorded $620,426 as an

allowance for credit losses as of December 31, 2023 which represents an increase of $128,447 from the balance at adoption of CECL due to additional provisions for credit losses in 2023.

Concentrations of patient accounts receivable, net of allowances for contractual discounts and credit losses, as of December 31, 2023, are as follows:

The patients accounts receivable, net balance was $7,197,321 as of January 1, 2023 and $8,152,414 as of December 31, 2023.

Inventories

Inventories, consisting primarily of pharmaceuticals finished goods, are valued at the lower of cost or net realizable value, with cost being determined on a first-in, first-out basis. Obsolescence for inventories is estimated based on expiration dates and slow-moving inventory. No obsolescence allowances have been recorded as of December 31, 2023. If the Company determines that an item is obsolete, or the expected net realizable value upon sale is lower than the currently recorded cost, a write-down is recorded and charged to cost of revenue to reduce the inventory to its net realizable value and a new cost basis is established.

Other Receivables

Other receivables consist primarily of rebates on drug purchases made in the current period which are offered as an incentive by the distributor and/or manufacturer and are not yet paid as of year-end.

Property and Equipment

Property and equipment are recorded at cost and depreciated using the straight-line method over the estimated useful lives of the assets. A summary of the lives used for computing depreciation is as follows:

Maintenance and repairs that do not improve service potential or extend economic life are expensed as incurred. Expenditures for major improvements and additions are capitalized. Long-lived assets to be held and used are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset group may not be recoverable. In assessing long-lived assets for impairment, assets are grouped with other assets and liabilities at the lowest level for which identifiable cash flows are largely

independent of the cash flows of other assets and liabilities. Recoverability is measured by a comparison of the carrying amount of an asset group to the undiscounted future net cash flows expected to be generated by the asset group. If estimated future undiscounted cash flows are not sufficient to recover the carrying value of the assets, impairment is measured by comparing the carrying amount of the assets to the estimated fair value, obtained through appraisal or market quotations, or discounted future net cash flow estimates. The Company did not recognize any long-lived asset impairments during 2023.

Leases

The Company’s lease portfolio primarily consists of office and equipment leases for its practice facilities. The Company determines if an arrangement is a lease at inception. Right-of-use assets represent the right to use the underlying assets for the lease term, and the lease liabilities represent the obligation to make lease payments arising from the leases. Right-of-use assets and liabilities are recognized at commencement date based on the present value of future lease payments over the lease term, which includes only payments that are fixed and determinable at the time of commencement. As the Company’s operating leases do not generally provide an implicit rate, the incremental borrowing rate is used based on the information available at commencement date in determining the present value of lease payments. The incremental borrowing rate for a lease is the rate of interest the Company would have to pay on a collateralized basis to borrow an amount equal to the lease payments under similar terms. Lease payments included in the measurement of the operating lease right-of-use (“ROU”) assets and lease liabilities are comprised of fixed payments, variable payments that depend on an index or rate, and the exercise price of a lessee option to purchase the underlying asset if the lessee is reasonably certain to exercise. Finance leases are included in property and equipment on the Balance Sheet.

The Company elected not to recognize operating lease ROU assets and lease liabilities for all short-term leases (leases with an initial lease term of 12 months or less). The Company recognizes the lease payments associated with short-term leases as an expense over the lease term. Certain of the lease arrangements contain lease and non-lease components and the Company has elected the practical expedient to combine these components.

The operating lease ROU assets are initially measured at cost, which comprises the initial amount of the lease liability adjusted for lease payments made at or before the lease commencement date, plus any initial direct costs incurred less any lease incentives received. The operating lease ROU assets are subsequently measured throughout the lease term at the carrying amount of the lease liability, plus initial direct costs, plus (minus) any prepaid (accrued) lease payments, less the unamortized balance of lease incentives received. Lease expense for lease payments is recognized on a straight-line basis over the lease term. The operating lease liabilities are initially measured at the present value of the unpaid lease payments at the lease commencement date.

Income Taxes

The Company, with shareholders’ consent, has elected to be taxed as an "S Corporation" under the provisions of the Internal Revenue Code and comparable state income tax law. As an “S Corporation” the Company is generally not subject to corporate income taxes and the Company's net income or loss is reported on the individual tax return of the shareholder of the Company. The Company and its shareholders have agreed that the Company will provide for and pay any state income taxes as they arise on behalf of the shareholders. As such, the provision for income taxes included in the Statement of Operations represents only state income taxes.

Accounting for uncertainty in income taxes prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken, or expected to be taken, in a tax return. Management has evaluated its tax positions and has concluded that the Company has taken no uncertain tax positions that could require adjustment or disclosure in the financial statements to comply with provisions set forth in Accounting Standards Codification (“ASC”) Topic 740, Income Taxes. The Company files income tax returns in the U.S. and the state of Georgia. The Company is no longer subject to U.S. federal, state, and local income tax examinations by tax authorities for years before 2021.

Advertising Costs

Advertising costs are expensed as incurred. Advertising costs for the year ended December 31, 2023 were $136,121. All advertising costs are included within general and administrative expenses in the Statement of Operations.

Investment in Joint Venture

The Company uses the equity method of accounting to record transactions associated with its joint venture when the Company shares in joint control of the investee. Investment in joint venture is not consolidated but is recorded in investment in joint venture in the Company’s Balance Sheet. The Company recognizes its portion of the investee’s results in equity in earnings from joint venture in its Statement of Operations.

The Company evaluates all distributions received from its equity method investments using the nature of distribution approach. Under this approach, the Company evaluates the nature of activities of the investee that generated the distribution. The distributions received are either classified as a return on investment, which is presented as a component of operating activities on the Company’s Statement of Cash Flows, or as a return of investment, which is presented as a component of investing activities on the Company’s Statement of Cash Flows.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash and accounts receivable. Although certain cash accounts exceed the federally insured deposit amount, management has not previously experienced nonperformance by any financial institution.

Fair Value of Financial Instruments

Fair value is the price that would be received to sell an asset or paid to transfer a liability in the principal or most advantageous market in an orderly transaction between market participants on the measurement date. The carrying values of cash and cash equivalents, receivables, accounts payable and other current liabilities approximate fair value due to their short-term nature.

Accounting guidance establishes a three-level hierarchy, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The valuation hierarchy is based upon the transparency of inputs to the valuation of an asset or liability on the measurement date. The three levels are defined as follows:

Level 1 Inputs to the valuation methodology are quoted prices (unadjusted) for an identical asset or liability in an active market.

Level 2 Inputs to the valuation methodology include quoted prices for a similar asset or liability in an active market or model-derived valuations in which all significant inputs are observable for substantially the full term of the asset or liability.

Level 3 Inputs to the valuation methodology are unobservable and significant to the fair value measurement of the asset or liability.

As of December 31, 2023, there were no Level 3 financial instruments.

Recently Adopted Accounting Pronouncements

In June 2016, the FASB issued ASU 2016-13, ‘‘Financial Instruments-Credit Losses’’ (“ASU 2016- 13”). ASU 2016-13 requires entities to report ‘‘expected’’ credit losses on financial instruments and other commitments to extend credit rather than the current ‘‘incurred loss’’ model. These expected credit losses for financial assets held at the reporting date are to be based on historical experience, current conditions, and reasonable and supportable forecasts. This ASU requires enhanced disclosures relating to significant estimates and judgments used in estimating credit losses, as well as the credit quality. ASU 2016-13 is effective for the Company for annual reporting periods beginning after December 15, 2022. The Company adopted ASU 2016-13 effective January 1, 2023 using the modified retrospective approach and revised its accounting policies and processes to facilitate this approach. The impact of the adoption was to reduce beginning retained earnings by $491,979.

Recently Issued Accounting Pronouncements

There were no recently issued accounting pronouncements during the year ended December 31, 2023 which materially impacted the Company’s financial reporting and disclosures.

3.Property and Equipment, Net

Property and equipment, net, consisted of the following at December 31, 2023:

For the year ended December 31, 2023, depreciation expense was $160,228, and is included as a separate line within costs and expenses in the Statement of Operations.

5.Line of Credit

The Company has a revolving line of credit with a bank in the amount of $1,520,000 which provides for borrowings at the bank’s prime rate. There were no borrowings during 2023 on the line of credit and no balance was outstanding at December 31, 2023. The line of credit expires on November 15, 2024 and is secured by substantially all assets of the Company.

6.Investment in Joint Venture

On June 22, 2010, the Company entered into an Operating Agreement (the “Joint Venture Agreement”) with Radiology Associates of Macon, P.C. to invest in a CT (“Computed Tomography”) scanner. Each company has a 50/50 equity interest in RAM-CGCC, LLC (“RAM-CGCC”), which was specifically formed to operate and execute the joint venture.

RAM-CGCC meets the accounting definition of a joint venture where neither party has control of the joint venture entity and both parties have joint control over the decision-making process in RAM-CGCC. As such, the Company uses the equity method of accounting to account for its share of the investment in RAM-CGCC. The Company’s share of earnings in RAM-CGCC for the year ended December 31, 2023 was $72,053 and is included in equity in earnings from joint venture on the Statement of Operations.

In January 2016, the Company entered into lease agreements for its two locations with RAM-CGCC to lease equipment and location space. The initial term was for twelve months and automatically renews annually unless either party provides 90 days written notice. Total rent expense under the lease agreement for the year ended December 31, 2023 was $278,664 and is included in cost of revenue in the Statement of Operations.

7.Leases

The Company currently leases office facilities and equipment for its practices under noncancelable operating and finance lease agreements expiring on various dates through 2028. Certain of the leases contain renewal options which are exercisable at the Company’s discretion. These renewal options are considered in determining the lease term if it is reasonably certain that the Company will exercise such options. Additionally, the Company leases certain other office and medical equipment under month-to-month lease agreements.

Right-of-use assets and lease liabilities consist of the following at December 31, 2023:

The components of lease costs recognized in the Statement of Operations consist of the following for the year ended December 31, 2023 and are included in general and administrative expenses unless otherwise noted:

The weighted-average remaining lease term as of December 31, 2023 was 1.72 years for operating leases and 4.10 years for finance leases. The weighted-average discount rate as of December 31, 2023 was 4.13% for operating leases and 5.57% for finance leases.

The cash paid for amounts included in the measurement of lease liabilities for the year ended December 31, 2023 is as follows:

The following table reconciles the undiscounted cash flows expected to be paid in each of the next five years recorded in the Balance Sheet for operating and finance leases as of December 31, 2023:

8.Commitments and Contingencies

The Company, through its arrangements with certain contracts, is subject to the Medicare and Medicaid fraud and abuse laws which prohibit, among other things, any false claims, or any bribe, kick-back or rebate in return for the referral of Medicare and Medicaid patients. Violation of these prohibitions may result in civil and criminal penalties and exclusion from participation in the Medicare and Medicaid programs. Management has implemented policies and procedures they believe will assure that the Company is in substantial compliance with these laws. From time to time, the Company may receive requests for information from government agencies pursuant to their regulatory or investigational authority. Such requests can include subpoenas or demand letters for documents to assist the government in audits or investigations. Management believes that the outcome of any of these investigations would not have a material adverse effect on the Company. Laws and regulations governing the Medicare program are complex and subject to interpretation. The Company believes that it is complying in all material respects with all applicable laws and regulations and is not aware of any pending or threatened investigations involving allegations of potential wrongdoing that would have a material effect on the Company’s financial statements. Compliance with such laws and regulations can be subject to future government review and interpretation, as well as significant regulatory action including fines, penalties, and exclusion from the Medicare Program.

The Company is subject to various legal proceedings and claims arising in the normal course of its business. In the opinion of management, the amount of the ultimate liability, if any, with respect to these lawsuits and claims will not have a material effect on the financial statements of the Company.

9.Professional Liability Insurance

The Company has purchased claims-made professional liability insurance coverage through May 31, 2024, covering up to $3,000,000 per incident and $5,000,000 million in annual aggregate for each physician and covering up to $1,000,000 million per incident and $3,000,000 million in the aggregate for each advanced practice provider. The policy does not require a deductible per incident.

10.Concentration Risk

The Company’s purchases from one vendor as a percentage of cost of revenue were approximately 89% for the year ended December 31, 2023. As of December 31, 2023, the vendor accounted for approximately 99.6% of accounts payable.

11.Employee Benefits

The Company sponsors a defined contribution 401(k) profit sharing plan (the “Plan”) pursuant to which employees can elect to defer a portion of their compensation for funding of retirement investments. The Plan covers substantially all of its employees and contributions can be made up to the maximum allowed by law. Employer matching and profit-sharing contributions are discretionary. For the year ended December 31, 2023, total employer 401(k) matching and profit-sharing compensation expense was $224,503. Effective October 31, 2024, the Plan was terminated (See Note 12).

12.Subsequent Events

In preparing these financial statements, the Company has evaluated events and transactions for potential recognition or disclosure through December 19, 2024, the date the financial statements were available to be issued.

•Effective April 1, 2024, the shareholders of the Company entered into an Asset Purchase Agreement (“APA”) to sell certain clinical and non-clinical assets and the business of CGCC to subsidiaries of AON, Inc. for approximately $13,300,000 in the form of cash of $6,900,000 and a promissory note of $6,400,000 payable over a five-year period.

•In connection with the above transaction, pursuant to the lessor’s early termination rights under one of the Company’s facility leases, an operating lease on such facility was early terminated effective May 2, 2025.

•Effective October 31, 2024, the Company terminated its defined contribution 401(k) profit sharing plan as the Company employees were able to participate in the AON, Inc. plan in connection with the above acquisition. The Company has incurred no additional liabilities as a result of its termination of the above plan.

•On February 15, 2024, the Company borrowed $800,000 against its line of credit as discussed in Note 5. The borrowings were repaid on February 28, 2024.