Milliman Variable Insurance Trust

Structured Outcome Funds

Annual Report

December 31, 2022

The following series of Milliman Variable Insurance Trust are presented in this annual report:

Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund – Jan/Jul

Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund – Feb/Aug

Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund – Mar/Sep

Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund – Apr/Oct

Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund – May/Nov

Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund – Jun/Dec

Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund – Jan/Jul

Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund – Feb/Aug

Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund – Mar/Sep

Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund – Apr/Oct

Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund – May/Nov

Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund – Jun/Dec

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund – Jan

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund – Feb

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund – Mar

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund – Apr

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund – May

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund – Jun

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund – Jul

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund – Aug

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund – Sep

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund – Oct

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund – Nov

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund – Dec

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund – Jan

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund – Feb

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund – Mar

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund – Apr

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund – May

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund – Jun

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund – Jul

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund – Aug

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund – Sep

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund – Oct

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund – Nov

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund – Dec

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund – Jan

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund – Feb

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund – Mar

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund – Apr

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund – May

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund – Jun

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund – Jul

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund – Aug

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund – Sep

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund – Oct

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund – Nov

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund – Dec

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund – Jan

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund – Feb

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund – Mar

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund – Apr

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund – May

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund – Jun

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund – Jul

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund – Aug

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund – Sep

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund – Oct

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund – Nov

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund – Dec

Milliman 1-Year Buffered S&P 500 & MSCI EAFE with Stacker Cap Outcome Fund – Jan

Milliman 1-Year Buffered S&P 500 & MSCI EAFE with Stacker Cap Outcome Fund – Feb

Milliman 1-Year Buffered S&P 500 & MSCI EAFE with Stacker Cap Outcome Fund – Mar

Milliman 1-Year Buffered S&P 500 & MSCI EAFE with Stacker Cap Outcome Fund – Apr

Milliman 1-Year Buffered S&P 500 & MSCI EAFE with Stacker Cap Outcome Fund – May

Milliman 1-Year Buffered S&P 500 & MSCI EAFE with Stacker Cap Outcome Fund – Jun

Milliman 1-Year Buffered S&P 500 & MSCI EAFE with Stacker Cap Outcome Fund – Jul

Milliman 1-Year Buffered S&P 500 & MSCI EAFE with Stacker Cap Outcome Fund – Aug

Milliman 1-Year Buffered S&P 500 & MSCI EAFE with Stacker Cap Outcome Fund – Sep

Milliman 1-Year Buffered S&P 500 & MSCI EAFE with Stacker Cap Outcome Fund – Oct

Milliman 1-Year Buffered S&P 500 & MSCI EAFE with Stacker Cap Outcome Fund – Nov

Milliman 1-Year Buffered S&P 500 & MSCI EAFE with Stacker Cap Outcome Fund – Dec

Milliman 6-Year Buffered S&P 500 with Par Up Outcome Fund – Jan (I)

Milliman 6-Year Buffered S&P 500 with Par Up Outcome Fund – Apr (I)

Milliman 6-Year Buffered S&P 500 with Par Up Outcome Fund – Jul (I)

Milliman 6-Year Buffered S&P 500 with Par Up Outcome Fund – Oct (I)

Milliman 6-Year Parred Down S&P 500 with Par Up Outcome Fund – Jan (I)

Milliman 6-Year Parred Down S&P 500 with Par Up Outcome Fund – Apr (I)

Milliman 6-Year Parred Down S&P 500 with Par Up Outcome Fund – Jul (I)

Milliman 6-Year Parred Down S&P 500 with Par Up Outcome Fund – Oct (I)

Milliman 6-Month Buffered S&P 500 with Trigger Outcome Fund – Apr/Oct

Milliman 6-Month Buffered S&P 500 with Trigger Outcome Fund – May/Nov

Milliman 6-Month Buffered S&P 500 with Trigger Outcome Fund – Jun/Dec

TABLE OF CONTENTS

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

About the Milliman Structured Outcome Funds

The Milliman Variable Insurance Trust (“MVIT”) has a suite of structured outcome Funds that seek to provide exposure to the S&P 500 Price Index (“S&P 500”) prior to taking into account any fees or expenses or the performance of any fixed income exposure included in a fund’s portfolio, while providing a combination of two options strategies, as described in a fund’s prospectus, which are designed to produce certain pre-determined outcomes over a six-month, one-year or six-year period, as specified in a fund’s name. This annual report relates only to the series of MVIT specified above (each, a “Fund,” and collectively, the “Funds”).

Each Fund currently offers only Class 3 shares, and only to insurance company separate accounts Funding variable annuity contracts and variable life insurance policies and other qualified investors. There are a variety of strategies that are offered in the MVIT. Strategies and Funds are listed below, accompanied by more detail on the attributes pertaining to each specific Fund strategy.

Glossary of Terms

S&P 500 Price Index – A market capitalization weighted benchmark index which tracks the price performance of 500 of the largest publicly traded stocks listed on U.S. exchanges.

Nasdaq 100 Price Index (“Nasdaq”) – A market capitalization weighted benchmark index which tracks the price performance of 100 of the largest non-financial companies listed on the Nasdaq stock exchange.

Russell 2000 Price Index (“Russell”) – A market capitalization weighted benchmark index which tracks the price performance of the 2000 smallest companies listed on the Russell 3000 index (tracks performance of the 3000 largest U.S. listed stocks). The Russell 2000 is widely accepted as a benchmark index for small-mid capitalization stocks.

MSCI EAFE Price Index (“EAFE”) – A market capitalization weighted benchmark index which tracks the price performance of the international developed equity market (excluding U.S. and Canada). The Index is focused on companies in Europe, Australia, the Middle East, and Asia.

Buffer Strategy – Designed to provide a cushion against a specified percentage of losses in the Fund’s S&P 500 Price Index exposure (the “Buffer”) if the S&P 500 Price Index experiences losses during the Outcome Period.

Floor Strategy – Designed to limit losses in the Fund’s S&P 500 Price Index exposure to a specified percentage (the “Floor”) if the S&P 500 Price Index experiences losses during the Outcome Period.

Par Up Strategy – Designed to provide participation in the gains of the S&P 500 Price Index at a declared participation rate (the “Par Up Rate”) if the S&P 500 Price Index experiences gains during the Outcome Period.

Par Down Strategy – Designed to limit losses in the Fund’s S&P 500 Price Index exposure at a declared participation rate (the “Par Down Rate”) if the S&P 500 Price Index experiences losses during the Outcome Period.

Spread Strategy – Designed to provide participation in the gains of the S&P 500 Price Index if the S&P 500 Price Index experiences gains during the Outcome Period that exceed a declared spread (the “Spread”).

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

Stacker Cap Strategy – Designed to provide participation in the gains of the S&P 500 Price Index up to a declared cap (the “Cap”) if the S&P 500 Price Index experiences gains during the Outcome Period plus additional gains equal to any upside market performance of a secondary market Index up to a declared cap if that secondary market Index experiences gains during the Outcome Period. The Cap is expressed as a combined number for both the S&P 500 Price Index and the secondary index and is split evenly between them.

Trigger Strategy – Designed to produce a fixed rate of return that is only “triggered” (i.e., paid to the Fund) if the value of the S&P 500 Price Index or a corresponding exchange-traded Fund (“ETF”) is unchanged or increases over the Outcome Period (the “Trigger Rate”).

Outcome Period – The outcome period begins on the day Milliman transacts in the FLEX Options and ends on the day those FLEX Options expire.

Collateral Portfolio – A portfolio comprised of fixed income securities, including money market funds and other interest-bearing instruments, cash, ETFs that primarily invest in any of the foregoing instruments, and options on ETFs and options box spreads, as described in a Fund’s prospectus.

Market Environment

2022 was a challenging year for investors, as markets factored in the increasing likelihood of a global recession. The uncertain environment led to a rise in volatility and pushed stocks down for most of the year, but also created a repeating zig-zag pattern of bear-market rallies followed by further declines, as investors navigated the cycles of economic data and interest rate decisions. Inflation reached 40-year highs, causing central banks to raise rates to their highest levels in decades. The Federal Reserve raised the Fed Funds Rate by 425 basis points (bps), the largest net calendar increase since 1972. Meanwhile, the conflict in Ukraine and China’s zero COVID policy put stress on supply chains, further exacerbating inflation and volatility. Stocks and bonds declined together for the first time in decades.

Growth stocks were disproportionally affected by the rate increases and the Nasdaq was one of the worst performers for the year amongst the most commonly followed equity benchmarks, down over 32%. Small cap stocks also underperformed large cap stocks during 2022 – Russell fell 21.56% for the year, a larger loss than the S&P 500’s -19.44% (both are expressed as changes in price, excluding dividends). Developed international markets outperformed domestic indices, as the EAFE declined only 16.79% for the year (also on a price return basis). This was due in large part to the UK’s outperformance through an evolving political landscape that ultimately led markets to regained confidence in the final quarter.

The combination of low treasury yields and the steep rate change over 2022 caused fixed income markets to experience declines, especially bonds with long durations. The iShares iBoxx $ Investment Grade Corporate Bond ETF (“LQD”) with a medium-term duration, decreased by 18.01%, while the ultra-long iShares 20+ Year Treasury Bond ETF (“TLT”) saw a decrease of 31.41% (both in total return terms). Over the course of 2022, the Bloomberg US Aggregate Bond Index suffered a total return loss of 13.01%, completing its worst calendar year on record since its inception in 1976 and marking only the fifth time ever that the index experienced a negative calendar year return.

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund Series

Strategy and Benchmark Composition

The 6-Month Buffered S&P 500 with Par Up Outcome Strategy seeks to provide exposure to the S&P 500, while providing a Buffer against the first 10% of losses associated with S&P 500 performance and participating in S&P 500 gains at a declared Par Up Rate, prior to taking into account any fees or expenses or the performance of any fixed income exposure included in a Fund’s portfolio, over a six-month period.

Prior to taking into account any fees or expenses or the performance of the Collateral Portfolio, a “Buffer-Par” Strategy targets the following outcome return profiles depending on the market environment over the Outcome Period: A “Below Buffer Range” strategy zone indicates the Fund is beyond the protection of the Buffer, and targets 1:1 downside exposure to the S&P 500 beyond the 10% buffered loss. A “Within Buffer” strategy zone has a target outcome of 0%. An “Upside Participation” strategy zone targets upside exposure to the S&P 500 at the Par Up Rate declared at the start of an Outcome Period.

Fund Performance

Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Jan/Jul

The Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Jan/Jul returned -21.60% from its inception on January 10, 2022 to the end of the year, compared to the S&P 500’s 17.79% decline in price during the period.

During the reporting period, the Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Jan/Jul’s completed Outcome Period was from January 10, 2022, to July 11, 2022. During this period, the Fund was down 16.00% compared to the S&P 500, which was down 17.47%. A breakdown of the Fund performance attributes equity performance of -7.96% and fixed income performance of -8.04%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. The Par Up Rate for this Outcome Period was 71.43%. The Outcome Period ended in the “Below Buffer Range” strategy zone.

During the reporting period, the Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Jan/Jul commenced a new Outcome Period, which started on July 11, 2022. As of December 31, 2022, the Fund was down 6.67% compared to the S&P 500, which was down 0.39%. A breakdown of the Fund performance attributes equity performance of 0.23% and fixed income performance of -6.89%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 71.43% and the Fund’s strategy zone was “Within Buffer”.

Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Feb/Aug

The Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Feb/Aug returned -18.00% from its inception on February 10, 2022 to the end of the year, compared to the S&P 500’s 14.76% decline in price during the period.

During the reporting period, the Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Feb/Aug’s completed Outcome Period was from February 10, 2022, to August 10, 2022. During this period, the Fund was down 8.30% compared to the S&P 500, which was down 6.52%. A breakdown of the Fund performance

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

attributes equity performance of -0.49% and fixed income performance of -7.81%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. The Par Up Rate for this Outcome Period was 77.27%. The Outcome Period ended in the “Within Buffer” strategy zone.

During the reporting period, the Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Feb/Aug commenced a new Outcome Period, which started on August 10, 2022. As of December 31, 2022, the Fund was down 10.58% compared to the S&P 500, which was down 8.81%. A breakdown of the Fund performance attributes equity performance of -2.67% and fixed income performance of -7.91%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 75.68% and the Fund’s strategy zone was “Within Buffer”.

Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Mar/Sep

The Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Mar/Sep returned -13.59% from its inception on March 10, 2022 to the end of the year, compared to the S&P 500’s 9.86% decline in price during the period.

During the reporting period, the Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Mar/Sep’s completed Outcome Period was from March 10, 2022, to September 12, 2022. During this period, the Fund was down 8.20% compared to the S&P 500, which was down 3.50%. A breakdown of the Fund performance attributes equity performance of -0.50% and fixed income performance of -7.70%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. The Par Up Rate for this Outcome Period was 79.17%. The Outcome Period ended in the “Within Buffer” strategy zone.

During the reporting period, the Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Mar/Sep commenced a new Outcome Period, which started on September 12, 2022. As of December 31, 2022, the Fund was down 5.87% compared to the S&P 500, which was down 6.59%. A breakdown of the Fund performance attributes equity performance of -2.39% and fixed income performance of -3.49%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 80.00% and the Fund’s strategy zone was “Within Buffer”.

Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Apr/Oct

The Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Apr/Oct returned -11.91% from its inception on April 11, 2022 to the end of the year, compared to the S&P 500’s 12.99% decline in price during the period.

During the reporting period, the Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Apr/Oct’s completed Outcome Period was from April 11, 2022, to October 11, 2022. During this period, the Fund was down 16.80% compared to the S&P 500, which was down 18.67%. A breakdown of the Fund performance attributes equity performance of -9.18% and fixed income performance of -7.62%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. The Par Up Rate for this Outcome Period was 77.27%. The Outcome Period ended in the “Below Buffer Range” strategy zone.

During the reporting period, the Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Apr/Oct’s commenced a new Outcome Period, which started on October 11, 2022. As of December 31, 2022, the Fund was up 5.88% compared to the S&P 500, which was up 6.98%. A breakdown of the Fund performance

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

attributes equity performance of 5.64% and fixed income performance of 0.24%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a positive contribution. As of December 31, 2022, the Par Up Rate for this Outcome Period was 75.86% and the Fund’s strategy zone was “Upside Participation”.

Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - May/Nov

The Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - May/Nov returned -8.95% from its inception on May 10, 2022 to the end of the year, compared to the S&P 500’s 4.04% decline in price during the period.

During the reporting period, the Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - May/Nov’s completed Outcome Period was from May 10, 2022, to November 10, 2022. During this period, the Fund was down 8.30% compared to the S&P 500, which was down 1.12%. A breakdown of the Fund performance attributes equity performance of -0.50% and fixed income performance of -7.80%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. The Par Up Rate for this Outcome Period was 76.67%. The Outcome Period ended in the “Within Buffer” strategy zone.

During the reporting period, the Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - May/Nov commenced a new Outcome Period, which started on November 10, 2022. As of December 31, 2022, the Fund was down 0.70% compared to the S&P 500, which was down 2.95%. A breakdown of the Fund performance attributes equity performance of -0.59% and fixed income performance of -0.11%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a small detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 81.48% and the Fund’s strategy zone was “Within Buffer”.

Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Jun/Dec

The Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Jun/Dec returned -4.29% from its inception on June 10, 2022 to the end of the year, compared to the S&P 500’s 1.57% decline in price during the period.

During the reporting period, the Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Jun/Dec’s completed Outcome Period was from June 10, 2022, to December 12, 2022. During this period, the Fund was down 2.40% compared to the S&P 500, which was up 2.30%. A breakdown of the Fund performance attributes equity performance of 1.16% and fixed income performance of -3.56%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. The Par Up Rate for this Outcome Period was 72.00%. The Outcome Period ended in the “Upside Participation” strategy zone.

During the reporting period, the Milliman 6-Month Buffered S&P 500 with Par Up Outcome Fund - Jun/Dec commenced a new Outcome Period, which started on December 12, 2022. As of December 31, 2022, the Fund was down 1.93% compared to the S&P 500, which was down 3.79%. A breakdown of the Fund performance attributes equity performance of -1.44% and fixed income performance of -0.49%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 82.14% and the Fund’s strategy zone was “Within Buffer”.

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund Series

Strategy and Benchmark Composition

The 6-Month Parred Down S&P 500 with Par Up Outcome Strategy seeks to provide exposure to the S&P 500, while limiting losses to 50% of the losses associated with S&P 500 performance and participating in S&P 500 gains at a declared Par Up Rate, prior to taking into account any fees or expenses or the performance of any fixed income exposure included in a Fund’s portfolio, over a six-month period.

Prior to taking into account any fees or expenses or the performance of the Collateral Portfolio, a “Par-Par” Strategy targets the following outcome return profiles depending on the market environment over the Outcome Period: A “Downside Participation” strategy zone indicates the Fund targets 50% downside exposure to the S&P 500. An “Upside Participation” strategy zone targets upside exposure to the S&P 500 at the Par Up Rate declared at the start of the Outcome Period.

Fund Performance

Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Jan/Jul

The Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Jan/Jul returned -23.00% from its inception on January 10, 2022 to the end of the year, compared to the S&P 500’s 17.79% decline in price during the period.

During the reporting period, the Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Jan/Jul’s completed Outcome Period was from January 10, 2022, to July 11, 2022. During this period, the Fund was down 16.90% compared to the S&P 500, which was down 17.47%. A breakdown of the Fund performance attributes equity performance of -9.23% and fixed income performance of -7.67%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. The Par Up Rate for this Outcome Period was 66.67%. The Outcome Period ended in the “Downside Participation” strategy zone.

During the reporting period, the Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Jan/Jul commenced a new Outcome Period, which started on July 11, 2022. As of December 31, 2022, the Fund was down 7.34% compared to the S&P 500, which was down 0.39%. A breakdown of the Fund performance attributes equity performance of -0.45% and fixed income performance of -6.89%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 70.00% and the Fund’s strategy zone was “Downside Participation”.

Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Feb/Aug

The Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Feb/Aug returned -22.46% from its inception on February 10, 2022 to the end of the year, compared to the S&P 500’s 14.76% decline in price during the period.

During the reporting period, the Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Feb/Aug’s completed Outcome Period was from February 10, 2022, to August 10, 2022. During this period, the Fund was down 11.10% compared to the S&P 500, which was down 6.52%. A breakdown of the Fund performance

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

attributes equity performance of -3.75% and fixed income performance of -7.35%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. The Par Up Rate for this Outcome Period was 72.73%. The Outcome Period ended in the “Downside Participation” strategy zone.

During the reporting period, the Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Feb/Aug commenced a new Outcome Period, which started on August 10, 2022. As of December 31, 2022, the Fund was down 12.77% compared to the S&P 500, which was down 8.81%. A breakdown of the Fund performance attributes equity performance of -5.00% and fixed income performance of -7.77%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 75.00% and the Fund’s strategy zone was “Downside Participation”.

Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Mar/Sep

The Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Mar/Sep returned -16.40% from its inception on March 10, 2022 to the end of the year, compared to the S&P 500’s 9.86% decline in price during the period.

During the reporting period, the Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Mar/Sep’s completed Outcome Period was from March 10, 2022, to September 12, 2022. During this period, the Fund was down 9.80% compared to the S&P 500, which was down 3.50%. A breakdown of the Fund performance attributes equity performance of -2.25% and fixed income performance of -7.55%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. The Par Up Rate for this Outcome Period was 72.73%. The Outcome Period ended in the “Downside Participation” strategy zone.

During the reporting period, the Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Mar/Sep commenced a new Outcome Period, which started on September 12, 2022. As of December 31, 2022, the Fund was down 7.32% compared to the S&P 500, which was down 6.59%. A breakdown of the Fund performance attributes equity performance of -3.77% and fixed income performance of -3.54%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 77.27% and the Fund’s strategy zone was “Downside Participation”.

Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Apr/Oct

The Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Apr/Oct returned -13.14% from its inception on April 11, 2022 to the end of the year, compared to the S&P 500’s 12.99% decline in price during the period.

During the reporting period, the Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Apr/Oct’s completed Outcome Period was from April 11, 2022, to October 11, 2022. During this period, the Fund was down 17.30% compared to the S&P 500, which was down 18.67%. A breakdown of the Fund performance attributes equity performance of -9.85% and fixed income performance of -7.45%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. The Par Up Rate for this Outcome Period was 72.73%. The Outcome Period ended in the “Downside Participation” strategy zone.

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

During the reporting period, the Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Apr/Oct commenced a new Outcome Period, which started on October 11, 2022. As of December 31, 2022, the Fund was up 5.03% compared to the S&P 500, which was up 6.98%. A breakdown of the Fund performance attributes equity performance of 4.88% and fixed income performance of 0.14%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a positive contribution. As of December 31, 2022, the Par Up Rate for this Outcome Period was 72.73% and the Fund’s strategy zone was “Upside Participation”.

Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - May/Nov

The Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - May/Nov returned -9.80% from its inception on May 10, 2022 to the end of the year, compared to the S&P 500’s 4.04% decline in price during the period.

During the reporting period, the Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - May/Nov’s completed Outcome Period was from May 10, 2022, to November 10, 2022. During this period, the Fund was down 8.90% compared to the S&P 500, which was down 1.12%. A breakdown of the Fund performance attributes equity performance of -1.06% and fixed income performance of -7.84%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. The Par Up Rate for this Outcome Period was 70.83%. The Outcome Period ended in the “Downside Participation” strategy zone.

During the reporting period, the Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - May/Nov commenced a new Outcome Period, which started on November 10, 2022. As of December 31, 2022, the Fund was down 0.99% compared to the S&P 500, which was down 2.95%. A breakdown of the Fund performance attributes equity performance of -1.06% and fixed income performance of 0.07%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a positive contribution. As of December 31, 2022, the Par Up Rate for this Outcome Period was 81.82% and the Fund’s strategy zone was “Downside Participation”.

Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Jun/Dec

The Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Jun/Dec returned -4.53% from its inception on June 10, 2022 to the end of the year, compared to the S&P 500’s 1.57% decline in price during the period.

During the reporting period, the Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Jun/Dec’s completed Outcome Period was from June 10, 2022, to December 12, 2022. During this period, the Fund was down 2.50% compared to the S&P 500, which was up 2.30%. A breakdown of the Fund performance attributes equity performance of 1.13% and fixed income performance of -3.63%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. The Par Up Rate for this Outcome Period was 70.83%. The Outcome Period ended in the “Upside Participation” strategy zone.

During the reporting period, the Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Jun/Dec commenced a new Outcome Period, which started on December 12, 2022. As of December 31, 2022, the Fund was down 2.08% compared to the S&P 500, which was down 3.79%. A breakdown of the Fund performance attributes equity performance of -1.65% and fixed income performance of -0.43%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 79.17% and the Fund’s strategy zone was

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

“Downside Participation”.

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund Series

Strategy and Benchmark Composition

The 1-Year Buffered S&P 500 with Spread Outcome Strategy seeks to provide exposure to the S&P 500, while providing a Buffer against the first 10% of losses associated with S&P 500 performance and participating in S&P 500 gains that exceed a declared Spread, prior to taking into account any fees or expenses or the performance of any fixed income exposure included in a Fund’s portfolio, over a one-year period.

Prior to taking into account any fees or expenses or the performance of the Collateral Portfolio, a “Buffer-Spread” Strategy targets the following outcome return profiles depending on the market environment over the Outcome Period: A “Below Buffer Range” strategy zone indicates the Fund is beyond the protection of the Buffer and targets 1:1 downside exposure to the S&P 500 beyond the 10% buffered loss. A “Within Buffer” strategy zone has a target outcome of 0%. A “Partial Spread Remaining” strategy zone indicates the Fund has to overcome the spread before participating in S&P 500 gains. An “Upside Above Spread” strategy zone targets 1:1 upside exposure to the S&P 500 beyond the Spread declared at the start of the Outcome Period.

Fund Performance

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Jan

During the reporting period, the Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Jan’s Outcome Period start date was January 10, 2022. As of December 31, 2022, the Fund was down 15.90% compared to the S&P 500, which was down 17.79%. A breakdown of the Fund performance attributes equity performance of -8.73% and fixed income performance of -7.17%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Spread for this Outcome Period was 1.83% and the Fund’s strategy zone was “Below Buffer Range”.

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Feb

During the reporting period, the Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Feb’s current Outcome Period start date was February 10, 2022. As of December 31, 2022, the Fund was down 12.80% compared to the S&P 500, which was down 14.76%. A breakdown of the Fund performance attributes equity performance of -6.09% and fixed income performance of -6.71%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Spread for this Outcome Period was 2.65% and the Fund’s strategy zone was “Below Buffer Range”.

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Mar

The Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Mar’s current Outcome Period start date was March 10, 2022. As of December 31, 2022, the Fund was down 11.70% compared to the S&P 500, which was down 9.86%. A breakdown of the Fund performance attributes equity performance of -4.09% and fixed income performance of -7.61%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Spread for this Outcome Period was 1.86% and the Fund’s strategy zone was “Within Buffer”.

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Apr

The Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Apr’s current Outcome Period start date was April 11, 2022. As of December 31, 2022, the Fund was down 12.53% compared to the S&P 500, which was down 12.99%. A breakdown of the Fund performance attributes equity performance of -6.30% and fixed income performance of -6.23%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Spread for this Outcome Period was 1.90% and the Fund’s strategy zone was “Below Buffer Range”.

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - May

The Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - May’s current Outcome Period start date was May 10, 2022. As of December 31, 2022, the Fund was down 6.37% compared to the S&P 500, which was down 4.04%. A breakdown of the Fund performance attributes equity performance of -1.70% and fixed income performance of -4.67%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Spread for this Outcome Period was 2.12% and the Fund’s strategy zone was “Within Buffer”.

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Jun

The Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Jun’s current Outcome Period start date was June 10, 2022. As of December 31, 2022, the Fund was down 4.23% compared to the S&P 500, which was down 1.57%. A breakdown of the Fund performance attributes equity performance of -0.10% and fixed income performance of -4.13%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Spread for this Outcome Period was 2.30% and the Fund’s strategy zone was “Within Buffer”.

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Jul

The Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Jul’s current Outcome Period start date was July 11, 2022. As of December 31, 2022, the Fund was down 2.98% compared to the S&P 500, which was down 0.39%. A breakdown of the Fund performance attributes equity performance of 0.86% and fixed income performance of -3.84%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Spread for this Outcome Period was 2.31% and the Fund’s strategy zone was “Within Buffer”.

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Aug

The Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Aug’s current Outcome Period start date was August 10, 2022. As of December 31, 2022, the Fund was down 9.72% compared to the S&P 500, which was down 8.81%. A breakdown of the Fund performance attributes equity performance of -5.49% and fixed income performance of -4.22%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Spread for this Outcome Period was 2.25% and the Fund’s strategy zone was “Within Buffer”.

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Sep

The Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Sep’s current Outcome Period start date was September 12, 2022. As of December 31, 2022, the Fund was down 6.51% compared to the S&P 500, which was down 6.59%. A breakdown of the Fund performance attributes equity performance of -4.48% and fixed income performance of -2.03%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Spread for this Outcome Period was 2.84% and the Fund’s strategy zone was “Within Buffer”.

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Oct

The Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Oct’s current Outcome Period start date was October 10, 2022. As of December 31, 2022, the Fund was up 6.27% compared to the S&P 500, which was up 6.29%. A breakdown of the Fund performance attributes equity performance of 5.66% and fixed income performance of 0.61%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a positive contribution. As of December 31, 2022, the Spread for this Outcome Period was 2.75% and the Fund’s strategy zone was “Upside Above Spread”.

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Nov

The Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Nov’s current Outcome Period start date was November 10, 2022. As of December 31, 2022, the Fund was down 1.82% compared to the S&P 500, which was down 2.95%. A breakdown of the Fund performance attributes equity performance of -2.20% and fixed income performance of 0.39%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a positive contribution. As of December 31, 2022, the Spread for this Outcome Period was 2.96% and the Fund’s strategy zone was “Within Buffer”.

Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Dec

The Milliman 1-Year Buffered S&P 500 with Spread Outcome Fund - Dec’s current Outcome Period start date was December 12, 2022. As of December 31, 2022, the Fund was down 3.21% compared to the S&P 500, which was down 3.79%. A breakdown of the Fund performance attributes equity performance of -3.20% and fixed income performance of -0.01%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a small detraction. As of December 31, 2022, the Spread for this Outcome Period was 3.20% and the Fund’s strategy zone was “Within Buffer”.

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund Series

Strategy and Benchmark Composition

The 1-Year Floored S&P 500 with Par Up Strategy seeks to provide exposure to the S&P 500, while limiting losses associated with S&P 500 performance to 10% and participating in S&P 500 gains at a Par Up Rate, prior to taking into account any fees or expenses or the performance of any fixed income exposure included in a Fund’s portfolio, over a one-year period.

Prior to taking into account any fees or expenses or the performance of the Collateral Portfolio, a “Floor-Par”

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

Strategy targets the following outcome return profiles depending on the market environment over the Outcome Period: A “Floor Reached” strategy zone indicates the Fund has reached the Floor and has a target outcome of -10%. A “Downside Before Floor” strategy zone targets 1:1 downside exposure to the S&P 500 up to the Floor. An “Upside Participation” strategy zone targets upside exposure to the S&P 500 at the Par Up Rate declared at the start of the Outcome Period.

Fund Performance

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Jan

During the reporting period, the Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Jan’s Outcome Period start date was January 10, 2022. As of December 31, 2022, the Fund was down 18.10% compared to the S&P 500, which was down 17.79%. A breakdown of the Fund performance attributes equity performance of -10.97% and fixed income performance of -7.13%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 52.38% and the Fund’s strategy zone was “Floor Reached”.

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Feb

During the reporting period, the Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Feb’s Outcome Period start date was February 10, 2022. As of December 31, 2022, the Fund was down 17.00% compared to the S&P 500, which was down 14.76%. A breakdown of the Fund performance attributes equity performance of -10.28% and fixed income performance of -6.72%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 59.09% and the Fund’s strategy zone was “Floor Reached”.

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Mar

The Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Mar’s current Outcome Period start date was March 10, 2022. As of December 31, 2022, the Fund was down 14.90% compared to the S&P 500, which was down 9.86%. A breakdown of the Fund performance attributes equity performance of -7.44% and fixed income performance of -7.46%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 60.87% and the Fund’s strategy zone was “Downside before Floor”.

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Apr

The Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Apr’s current Outcome Period start date was April 11, 2022. As of December 31, 2022, the Fund was down 14.80% compared to the S&P 500, which was down 12.99%. A breakdown of the Fund performance attributes equity performance of -8.55% and fixed income performance of -6.25%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 58.33% and the Fund’s strategy zone was “Floor Reached”.

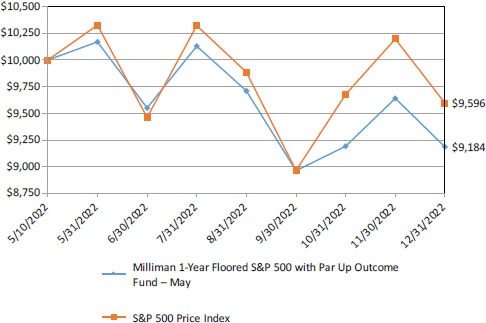

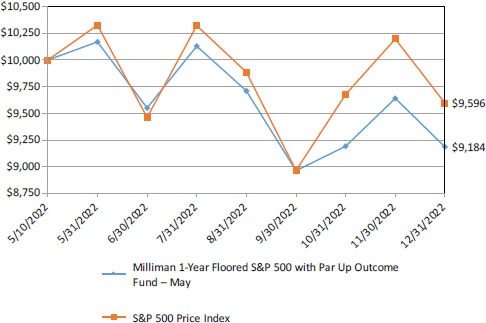

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - May

The Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - May’s current Outcome Period start date

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

was May 10, 2022. As of December 31, 2022, the Fund was down 8.16% compared to the S&P 500, which was down 4.04%. A breakdown of the Fund performance attributes equity performance of -3.29% and fixed income performance of -4.87%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 60.00% and the Fund’s strategy zone was “Downside Before Floor”.

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Jun

The Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Jun’s current Outcome Period start date was June 10, 2022. As of December 31, 2022, the Fund was down 5.62% compared to the S&P 500, which was down 1.57%. A breakdown of the Fund performance attributes equity performance of -1.80% and fixed income performance of -3.81%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 60.00% and the Fund’s strategy zone was “Downside Before Floor”.

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Jul

The Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Jul’s current Outcome Period start date was July 11, 2022 As of December 31, 2022, the Fund was down 4.81% compared to the S&P 500, which was down 0.39%. A breakdown of the Fund performance attributes equity performance of -0.77% and fixed income performance of -4.04%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 60.00% and the Fund’s strategy zone was “Downside Before Floor”.

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Aug

The Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Aug’s current Outcome Period start date was August 10, 2022. As of December 31, 2022, the Fund was down 9.31% compared to the S&P 500, which was down 8.81%. A breakdown of the Fund performance attributes equity performance of -5.22% and fixed income performance of -4.09%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 65.22% and the Fund’s strategy zone was “Downside Before Floor”.

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Sep

The Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Sep’s current Outcome Period start date was September 12, 2022. As of December 31, 2022, the Fund was down 5.80% compared to the S&P 500, which was down 6.59%. A breakdown of the Fund performance attributes equity performance of -3.68% and fixed income performance of -2.12%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 66.67% and the Fund’s strategy zone was “Downside Before Floor”.

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Oct

The Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Oct’s current Outcome Period start date was October 10, 2022. As of December 31, 2022, the Fund was up 3.52% compared to the S&P 500, which was up 6.29%. A breakdown of the Fund performance attributes equity performance of 2.98% and fixed income performance of 0.53%, which includes Fund fees and expenses. Equity performance was within expectation and

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

the Collateral Portfolio was a positive contribution. As of December 31, 2022, the Par Up Rate for this Outcome Period was 62.96% and the Fund’s strategy zone was “Upside Participation”.

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Nov

The Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Nov’s current Outcome Period start date was November 10, 2022. As of December 31, 2022, the Fund was down 0.92% compared to the S&P 500, which was down 2.95%. A breakdown of the Fund performance attributes equity performance of -1.18% and fixed income performance of 0.26%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a positive contribution. As of December 31, 2022, the Par Up Rate for this Outcome Period was 76.00% and the Fund’s strategy zone was “Downside Before Floor”.

Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Dec

The Milliman 1-Year Floored S&P 500 with Par Up Outcome Fund - Nov’s current Outcome Period start date was December 12, 2022. As of December 31, 2022, the Fund was down 1.81% compared to the S&P 500, which was down 3.79% A breakdown of the Fund performance attributes equity performance of -1.71% and fixed income performance of -0.09%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a small detraction. As of December 31, 2022, the Par Up Rate for this Outcome Period was 74.19% and the Fund’s strategy zone was “Downside Before Floor”.

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund Series

Strategy and Benchmark Composition

The 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Strategy seeks to provide exposure to the S&P 500, while providing a Buffer against the first 10% of losses associated with S&P 500 performance and participating in S&P 500 gains up to a declared Cap, prior to taking into account any fees or expenses or the performance of any fixed income exposure included in a Fund’s portfolio, over a one-year period. The 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Strategy also seeks to provide upside exposure to the Nasdaq up to a declared Cap, prior to taking into account any fees or expenses or the performance of any fixed income exposure included in a Fund’s portfolio, over the same period.

Prior to taking into account any fees or expenses or the performance of the Collateral Portfolio, a “Buffer-Stacker” Strategy targets the following outcome return profiles depending on the market environment over the Outcome Period: A combination of a primary and secondary zone indicates the target outcome of the Fund. A “Below Buffer Range” primary strategy zone indicates the Fund is beyond the protection of the Buffer and targets 1:1 downside exposure to the S&P 500 beyond the 10% buffered loss. A “Within Buffer” primary strategy zone has a target outcome of 0%. An “Upside Below Cap” primary strategy zone targets 1:1 upside exposure to the S&P 500 up to the declared Cap determined at the start of the Outcome Period. The “Capped Upside” primary strategy zone indicates the S&P 500 has reached its declared Cap. A “Below Contribution Range” secondary strategy zone is declared if the Nasdaq is experiencing negative returns. An “Upside Below Cap” secondary strategy zone targets upside 1:1 exposure to the Nasdaq up to the declared Cap. Lastly, a “Capped Upside” secondary strategy zone indicates the Nasdaq has reached the declared Cap.

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

Fund Performance

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Jan

During the reporting period, the Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Jan’s Outcome Period start date was January 10, 2022. As of December 31, 2022, the Fund was down 15.70% compared to the S&P 500, which was down 17.79% and the Nasdaq, which was down 29.94%. A breakdown of the Fund performance attributes equity performance of -8.73% and fixed income performance of -6.97%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 11.34%, evenly split between S&P 500 and Nasdaq, and the Fund’s primary and secondary strategy zones were “Below Buffer Range” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Feb

During the reporting period, the Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Feb’s Outcome Period start date was February 10, 2022. As of December 31, 2022, the Fund was down 12.80% compared to the S&P 500, which was down 14.76% and the Nasdaq, which was down 25.61%. A breakdown of the Fund performance attributes equity performance of -6.03% and fixed income performance of -6.77%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 12.20%, evenly split between S&P 500 and Nasdaq, and the Fund’s primary and secondary strategy zones were “Below Buffer Range” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Mar

The Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Mar’s current Outcome Period start date was March 10, 2022. As of December 31, 2022, the Fund was down 11.70% compared to the S&P 500, which was down 9.86% and the Nasdaq, which was down 19.51%. A breakdown of the Fund performance attributes equity performance of -3.83% and fixed income performance of -7.87%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 15.40%, evenly split between S&P 500 and Nasdaq, and the Fund’s primary and secondary strategy zones were “Within Buffer” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Apr

The Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Apr’s current Outcome Period start date was April 11, 2022. As of December 31, 2022, the Fund was down 12.82% compared to the S&P 500, which was down 12.99% and the Nasdaq, which was down 21.80%. A breakdown of the Fund performance attributes equity performance of -6.18% and fixed income performance of -6.64%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 14.00%, evenly split between S&P 500 and Nasdaq, and the Fund’s primary and secondary strategy zones were “Below Buffer Range” and “Below Contribution Range”, respectively.

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - May

The Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - May’s current Outcome Period start date was May 10, 2022. As of December 31, 2022, the Fund was down 5.16% compared to the S&P 500, which was down 4.04% and the Nasdaq, which was down 11.39%. A breakdown of the Fund performance attributes equity performance of -0.25% and fixed income performance of -4.92%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 16.00%, evenly split between S&P 500 and Nasdaq, and the Fund’s primary and secondary strategy zones were “Within Buffer” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Jun

The Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Jun’s current Outcome Period start date was June 10, 2022. As of December 31, 2022, the Fund was down 2.62% compared to the S&P 500, which was down 1.57% and the Nasdaq, which was down 7.55%. A breakdown of the Fund performance attributes equity performance of 1.83% and fixed income performance of -4.45%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 17.24%, evenly split between S&P 500 and Nasdaq, and the Fund’s primary and secondary strategy zones were “Within Buffer” and “Below Contribution Range”, respectively.

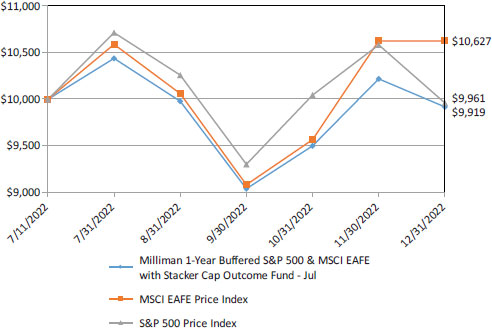

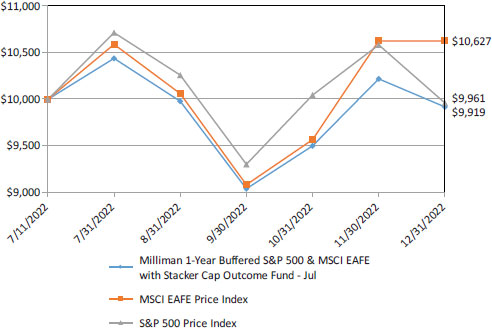

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Jul

The Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Jul’s current Outcome Period start date was July 11, 2022. As of December 31, 2022, the Fund was down 2.62% compared to the S&P 500, which was down 0.39% and the Nasdaq, which was down 7.76%. A breakdown of the Fund performance attributes equity performance of 1.70% and fixed income performance of -4.32%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 16.90%, evenly split between S&P 500 and Nasdaq, and the Fund’s primary and secondary strategy zones were “Within Buffer” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Aug

The Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Aug’s current Outcome Period start date was August 10, 2022. As of December 31, 2022, the Fund was down 9.81% compared to the S&P 500, which was down 8.81% and the Nasdaq, which was down 18.23%. A breakdown of the Fund performance attributes equity performance of -4.70% and fixed income performance of -5.11%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 16.02%, evenly split between S&P 500 and Nasdaq, and the Fund’s primary and secondary strategy zones were “Within Buffer” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Sep

The Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Sep’s current Outcome Period

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

start date was September 12, 2022. As of December 31, 2022, the Fund was down 5.91% compared to the S&P 500, which was down 6.59% and the Nasdaq, which was down 14.13%. A breakdown of the Fund performance attributes equity performance of -3.11% and fixed income performance of -2.80%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 16.78%, evenly split between S&P 500 and Nasdaq, and the Fund’s primary and secondary strategy zones were “Within Buffer” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Oct

The Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Oct’s current Outcome Period start date was October 10, 2022. As of December 31, 2022, the Fund was up 5.09% compared to the S&P 500, which was up 6.29% and the Nasdaq, which was up 0.12%. A breakdown of the Fund performance attributes equity performance of 4.62% and fixed income performance of 0.47%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a positive contribution. As of December 31, 2022, the Cap for this Outcome Period was 20.42%, evenly split between S&P 500 and Nasdaq, and the Fund’s primary and secondary strategy zones were both “Upside Below Cap”.

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Nov

The Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Nov’s current Outcome Period start date was November 10, 2022. As of December 31, 2022, the Fund was down 1.22% compared to the S&P 500, which was down 2.95% and the Nasdaq, which was down 5.74%. A breakdown of the Fund performance attributes equity performance of -0.79% and fixed income performance of -0.43%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 17.96%, evenly split between S&P 500 and Nasdaq, and the Fund’s primary and secondary strategy zones were “Within Buffer” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Dec

The Milliman 1-Year Buffered S&P 500 & Nasdaq with Stacker Cap Outcome Fund - Dec’s current Outcome Period start date was December 12, 2022. As of December 31, 2022, the Fund was down 2.71% compared to the S&P 500, which was down 3.79% and the Nasdaq, which was down 6.55%. A breakdown of the Fund performance attributes equity performance of -1.83% and fixed income performance of -0.87%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 17.78%, evenly split between S&P 500 and Nasdaq, and the Fund’s primary and secondary strategy zones were “Within Buffer” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund Series

Strategy and Benchmark Composition

The 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Strategy seeks to provide exposure to the S&P 500, while providing a Buffer against the first 10% of losses associated with S&P 500 performance and participating in S&P 500 gains up to a declared Cap, prior to taking into account any fees or expenses or

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

the performance of any fixed income exposure included in a Fund’s portfolio, over a one-year period. The 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Strategy also seeks to provide upside exposure to the Russell up to a declared Cap, prior to taking into account any fees or expenses or the performance of any fixed income exposure included in a Fund’s portfolio, over the same period.

Prior to taking into account any fees or expenses or the performance of the Collateral Portfolio, a “Buffer-Stacker” Strategy targets the following outcome return profiles depending on the market environment over the Outcome Period: A combination of a primary and secondary zone indicates the target outcome of the Fund. A “Below Buffer Range” primary strategy zone indicates the Fund is beyond the protection of the Buffer and targets 1:1 downside exposure to the S&P 500 beyond the 10% buffered loss. A “Within Buffer” primary strategy zone has a target outcome of 0%. An “Upside Below Cap” primary strategy zone targets 1:1 upside exposure to the S&P 500 up to the declared Cap determined at the start of the Outcome Period. The “Capped Upside” primary strategy zone indicates the S&P 500 has reached its declared Cap. A “Below Contribution Range” secondary strategy zone is declared if the Russell is experiencing negative returns. An “Upside Below Cap” secondary strategy zone targets 1:1 upside exposure to the Russell up to the declared Cap. Lastly, a “Capped Upside” secondary strategy zone indicates the Russell has reached the declared Cap.

Fund Performance

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Jan

During the reporting period, the Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Jan’s Outcome Period start date was January 10, 2022. As of December 31, 2022, the Fund was down 15.80% compared to the S&P 500, which was down 17.79% and the Russell, which was down 18.88%. A breakdown of the Fund performance attributes equity performance of -8.73% and fixed income performance of -7.07%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 11.88%, evenly split between S&P 500 and Russell, and the Fund’s primary and secondary strategy zones were “Below Buffer Range” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Feb

During the reporting period, the Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Feb’s Outcome Period start date was February 10, 2022. As of December 31, 2022, the Fund was down 12.80% compared to the S&P 500, which was down 14.76% and the Russell, which was down 14.13%. A breakdown of the Fund performance attributes equity performance of -5.99% and fixed income performance of -6.81%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 12.00%, evenly split between S&P 500 and Russell, and the Fund’s primary and secondary strategy zones were “Below Buffer Range” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Mar

The Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Mar’s current Outcome Period start date was March 10, 2022. As of December 31, 2022, the Fund was down 11.50% compared to the S&P 500, which was down 9.86% and the Russell, which was down 12.45%. A breakdown of the Fund performance attributes equity performance of -3.56% and fixed income performance of -7.94%, which includes

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 15.41%, evenly split between S&P 500 and Russell, and the Fund’s primary and secondary strategy zones were “Within Buffer” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Apr

The Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Apr’s current Outcome Period start date was April 11, 2022. As of December 31, 2022, the Fund was down 12.09% compared to the S&P 500, which was down 12.99% and the Russell, which was down 11.06%. A breakdown of the Fund performance attributes equity performance of -5.41% and fixed income performance of -6.68%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 14.16%, evenly split between S&P 500 and Russell, and the Fund’s primary and secondary strategy zones were “Below Buffer Range” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - May

The Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - May’s current Outcome Period start date was May 10, 2022. As of December 31, 2022, the Fund was down 2.56% compared to the S&P 500, which was down 4.04% and the Russell, which was down 0.03%. A breakdown of the Fund performance attributes equity performance of 2.33% and fixed income performance of -4.90%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 16.72%, evenly split between S&P 500 and Russell, and the Fund’s primary and secondary strategy zones were “Within Buffer” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Jun

The Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Jun’s current Outcome Period start date was June 10, 2022. As of December 31, 2022, the Fund was down 1.62% compared to the S&P 500, which was down 1.57% and the Russell, which was down 2.17%. A breakdown of the Fund performance attributes equity performance of 2.88% and fixed income performance of -4.50%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 17.22%, evenly split between S&P 500 and Russell, and the Fund’s primary and secondary strategy zones were “Within Buffer” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Jul

The Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Jul’s current Outcome Period start date was July 11, 2022. As of December 31, 2022, the Fund was down 1.12% compared to the S&P 500, which was down 0.39% and the Russell, which was up 1.69%. A breakdown of the Fund performance attributes equity performance of 3.31% and fixed income performance of -4.43%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 16.90%, evenly split between S&P 500 and Russell, and the Fund’s primary and secondary strategy zones were “Within Buffer” and “Upside Below Cap”, respectively.

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Aug

The Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Aug’s current Outcome Period start date was August 10, 2022. As of December 31, 2022, the Fund was down 8.61% compared to the S&P 500, which was down 8.81% and the Russell, which was down 10.56%. A breakdown of the Fund performance attributes equity performance of -3.57% and fixed income performance of -5.03%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 16.00%, evenly split between S&P 500 and Russell, and the Fund’s primary and secondary strategy zones were “Within Buffer” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Sep

The Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Sep’s current Outcome Period start date was September 12, 2022. As of December 31, 2022, the Fund was down 4.91% compared to the S&P 500, which was down 6.59% and the Russell, which was down 7.60%. A breakdown of the Fund performance attributes equity performance of -2.07% and fixed income performance of -2.84%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 16.80%, evenly split between S&P 500 and Russell, and the Fund’s primary and secondary strategy zones were “Within Buffer” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Oct

The Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Oct’s current Outcome Period start date was October 10, 2022. As of December 31, 2022, the Fund was up 5.59% compared to the S&P 500, which was up 6.29% and the Russell, which was up 4.10%. A breakdown of the Fund performance attributes equity performance of 5.18% and fixed income performance of 0.41%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a positive contribution. As of December 31, 2022, the Cap for this Outcome Period was 20.40%, evenly split between S&P 500 and Russell, and the Fund’s primary and secondary strategy zones were both “Upside Below Cap”.

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Nov

The Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Nov’s current Outcome Period start date was November 10, 2022. As of December 31, 2022, the Fund was down 1.11% compared to the S&P 500, which was down 2.95% and the Russell, which was down 5.71%. A breakdown of the Fund performance attributes equity performance of -0.66% and fixed income performance of -0.45%, which includes Fund fees and expenses. Equity performance was within expectation and the Collateral Portfolio was a detraction. As of December 31, 2022, the Cap for this Outcome Period was 18.56%, evenly split between S&P 500 and Russell, and the Fund’s primary and secondary strategy zones were “Within Buffer” and “Below Contribution Range”, respectively.

Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Dec

The Milliman 1-Year Buffered S&P 500 & Russell 2000 with Stacker Cap Outcome Fund - Dec’s current Outcome Period start date was December 12, 2022. As of December 31, 2022, the Fund was down 2.41% compared to the S&P 500, which was down 3.79% and the Russell, which was down 3.15%. A breakdown of the Fund

Milliman Variable Insurance Trust

Management Discussion of Fund Performance

December 31, 2022 (Unaudited)