UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

| RADIUS HEALTH, INC. |

(Name of Registrant as Specified in Its Charter) |

| |

VELAN CAPITAL PARTNERS LP VELAN CAPITAL HOLDINGS LLC VELAN CAPITAL INVESTMENT MANAGEMENT LP VELAN CAPITAL MANAGEMENT LLC Adam Morgan BALAJI VENKATARAMAN REPERTOIRE MASTER FUND LP REPERTOIRE HOLDINGS LLC REPERTOIRE PARTNERS LP REPERTOIRE PARTNERS GP LLC DEEPAK SARPANGAL ERIC J. ENDE R. JOHN FLETCHER CYNTHIA L. FLOWERS ANN MACDOUGALL |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 18, 2022

VELAN CAPITAL PARTNERS LP AND REPERTOIRE MASTER FUND LP

___________________, 2022

Dear Fellow Radius Stockholder:

Velan Capital Partners LP, Repertoire Master Fund LP and the other participants in this solicitation (collectively, the “Velan-Repertoire Group” or “we”) are the beneficial owners of an aggregate of 3,143,000 shares of common stock, par value $0.0001 per share (the “Common Stock”), of Radius Health, Inc., a Delaware corporation (“Radius” or the “Company”), representing approximately 6.6% of the outstanding shares of Common Stock. For the reasons set forth in the attached Proxy Statement, we strongly believe the Board of Directors of the Company (the “Board”) will benefit from the addition of directors who collectively possess the relevant skill sets and a shared objective of enhancing value for the benefit of all Radius stockholders. We are seeking your support for the election of our three (3) nominees as Class II directors at the 2022 annual meeting of stockholders scheduled to be held at [_________], on [________], 2022 at [_:__ _.m., local time] (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”). We are seeking representation on the Board because we believe that meaningful and expeditious changes are necessary to properly harness opportunities available for value creation and bridge the valuation gap that has persisted under the leadership of the incumbent Board. The individuals that we have nominated are highly-qualified, independent director candidates with demonstrated track records of success who will be committed to maximizing long-term value for all stockholders and other key stakeholders. We believe a reconstituted Board that includes our nominees will have the expertise and impartiality required to realize the Company’s significant value potential.

We believe there is significant value to be realized at Radius. However, we are concerned that the current Board is not taking the appropriate actions to address the key issues facing the Company, which, in our view, include the Company’s dismal share price underperformance, poor corporate governance and lack of effective corporate oversight, execution failures with respect to certain of the Company’s underappreciated assets, inefficient financial management and misguided corporate strategy. Given what we view as the Company’s apparent inability to streamline and maximize stockholder value, we believe that the Board must be significantly reconstituted to enable stockholders, the true owners of Radius, to realize the latent value of Radius. The Company currently has a classified Board of eight (8) directors divided into three (3) classes. The terms of three (3) Class II directors expire at the Annual Meeting. [If it remains the case that the terms of only three (3) directors will expire at the Annual Meeting, we will withdraw one (1) of our four (4) nominees.] Through the attached Proxy Statement and enclosed WHITE proxy card, we are soliciting proxies to, among other matters described in the Proxy Statement, elect our three (3) nominees as Class II directors in opposition to the Company’s director nominees. Accordingly, the enclosed WHITE proxy card may only be voted for our nominees and does not confer voting power with respect to any of the Company’s director nominees. You can only vote for the Company’s director nominees by signing and returning a proxy card provided by the Company. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s nominees. There is no assurance that any of the Company’s nominees will serve as directors if all or some of our nominees are elected. If elected, our nominees will constitute a minority on the Board and there can be no guarantee that our nominees will be able to implement any actions that they may believe are necessary to unlock stockholder value.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed WHITE proxy card today. The attached Proxy Statement and the enclosed WHITE proxy card are first being mailed to stockholders on or about ____________, 2022.

If you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating and returning a later dated WHITE proxy card or by voting in person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please contact Okapi Partners LLC, which is assisting us, at its address and toll-free numbers listed below.

| | Thank you for your support, |

| | |

| | /s/ Adam Morgan and Deepak Sarpangal |

| | |

| | Adam Morgan and Deepak Sarpangal |

| | Velan Capital Partners LP and Repertoire Master Fund LP |

If you have any questions, require assistance in voting your WHITE proxy card, or need additional copies of the Velan-Repertoire Group’s proxy materials, please contact:

Okapi Partners LLC 1212 Avenue of the Americas, 24th Floor New York, New York 10036 Stockholders may call toll-free: (877) 629-6357 Banks and brokers call: (212) 297-0720 E-mail: info@okapipartners.com |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 18, 2022

ANNUAL MEETING OF STOCKHOLDERS

OF

RADIUS HEALTH, INC.

_________________________

PROXY STATEMENT

OF

VELAN CAPITAL PARTNERS LP AND REPERTOIRE MASTER FUND LP

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE PROXY CARD TODAY

Velan Capital Partners LP (“Velan LP”), Velan Capital Holdings LLC (“Velan GP”), Velan Capital Investment Management LP (“Velan Capital”), Velan Capital Management LLC (“Velan IM GP”), Adam Morgan, Balaji Venkataraman (together with Velan LP, Velan GP, Velan Capital, Velan IM GP and Mr. Morgan, “Velan”), Repertoire Master Fund LP (“Repertoire Master”), Repertoire Holdings LLC (“Repertoire Holdings”), Repertoire Partners LP (“Repertoire Partners”), Repertoire Partners GP LLC (“Repertoire GP”) and Deepak Sarpangal (together with Repertoire Master, Repertoire Holdings, Repertoire Partners and Repertoire GP, “Repertoire” and collectively with Velan, the “Velan-Repertoire Group” or “we”) are significant stockholders of Radius Health, Inc., a Delaware corporation (“Radius” or the “Company”), who, together with the other participants in this solicitation, beneficially own an aggregate of 3,143,000 shares of common stock, par value $0.0001 per share (the “Common Stock”), of the Company, representing approximately 6.6% of the outstanding shares of Common Stock. We believe that the Board of Directors of the Company (the “Board”) must be meaningfully reconstituted to ensure that the Board takes the necessary steps for the Company’s stockholders to realize the maximum value of their investments. We have nominated directors who have strong, relevant backgrounds and who are committed to fully exploring all opportunities to unlock stockholder value. We are seeking your support at the 2022 annual meeting of stockholders scheduled to be held at [_________], on [________], 2022 at [_:__ _.m., local time] (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following:

| 1. | To elect the Velan-Repertoire Group’s three (3) director nominees, [Eric J. Ende, R. John Fletcher, Cynthia L. Flowers and Ann MacDougall] (each a “Nominee” and collectively, the “Nominees”), to the Board as Class II directors to serve until the 2025 annual meeting of stockholders and until their respective successors are duly elected and qualified; |

| 2. | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022; |

| 3. | To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers; and |

| 4. | To transact such other business as may properly come before the Annual Meeting. |

This Proxy Statement and the enclosed WHITE proxy card are first being mailed to stockholders on or about [____________], 2022.

As of the date hereof, the participants in this solicitation collectively own 3,143,000 shares of Common Stock (the “Velan-Repertoire Group Shares”). We intend to vote such shares FOR the election of the Nominees, FOR the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 and [FOR / AGAINST] the approval, on a non-binding advisory basis, of the compensation of the Company’s named executive officers, as described herein.

The Company has set the close of business on [_______], 2022 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 22 Boston Wharf Road, 7th Floor, Boston, Massachusetts 02210. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were [_______] shares of Common Stock outstanding and entitled to vote at the Annual Meeting.

THIS SOLICITATION IS BEING MADE BY THE VELAN-REPERTOIRE GROUP AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH THE VELAN-REPERTOIRE GROUP IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED WHITE PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

THE VELAN-REPERTOIRE GROUP URGES YOU TO SIGN, DATE AND RETURN THE WHITE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED WHITE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our WHITE proxy card are available at

www.[_____________________].com

IMPORTANT

Your vote is important, no matter how few shares of Common Stock you own. The Velan-Repertoire Group urges you to sign, date, and return the enclosed WHITE proxy card today to vote FOR the election of the Nominees and in accordance with the Velan-Repertoire Group’s recommendations on the other proposals on the agenda for the Annual Meeting.

| · | If your shares of Common Stock are registered in your own name, please sign and date the enclosed WHITE proxy card and return it to the Velan-Repertoire Group, c/o Okapi Partners LLC (“Okapi Partners”), in the enclosed postage-paid envelope today. |

| · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy materials, together with a WHITE voting form, are being forwarded to you by your broker or bank. As a beneficial owner, if you wish to vote, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our three (3) Nominees only on our WHITE proxy card. So please make certain that the latest dated proxy card you return is the WHITE proxy card.

If you have any questions, require assistance in voting your WHITE proxy card, or need additional copies of the Velan-Repertoire Group’s proxy materials, please contact Okapi Partners at the phone numbers listed below.

Okapi Partners LLC 1212 Avenue of the Americas, 24th Floor New York, New York 10036 Stockholders may call toll-free: (877) 629-6357 Banks and brokers call: (212) 297-0720 E-mail: info@okapipartners.com |

BACKGROUND TO SOLICITATION

The following is a chronology of material events leading up to this proxy solicitation:

| · | In early 2020, Velan and Repertoire became interested in a potential investment in the Company and began conducting investment due diligence with respect to the Company. |

| · | On March 4, 2020, Deepak Sarpangal, the Founder and Managing Partner of Repertoire Partners (who was also a Co-Managing Member of the former general partner of Velan Capital from December 2019 to September 2020), met with Jesper Hoeiland, then the Company’s President, Chief Executive Officer and a director, Jose (Pepe) Carmona, then the Company’s Chief Financial Officer and Treasurer, and Elhan Webb, then the Company’s Head of Investor Relations and External Communications, at the Cowen Health Care Conference in Boston, Massachusetts. The parties discussed the Company generally. |

| · | On March 25, 2020, Mr. Sarpangal met telephonically with Mr. Carmona and Ms. Webb. The parties discussed the Company generally. |

| · | In April 2020, Velan made its initial investment in the Company due to its belief that the Company’s shares were deeply undervalued. |

| · | On April 28, 2020, the Company announced that G. Kelly Martin was appointed as the Company’s President, Chief Executive Officer and a director, effective immediately, succeeding Mr. Hoeiland. |

| · | In July 2020, Repertoire made its initial investment in the Company due to its belief that the Company’s shares were deeply undervalued. |

| · | On August 10, 2020, representatives of Velan and Repertoire met telephonically with Mr. Carmona and Ms. Webb. The parties discussed the Company generally. |

| · | On September 10, 2020, representatives of Velan and Repertoire met telephonically with Mr. Carmona and Ms. Webb. The parties discussed the Company generally. |

| · | On September 24, 2020, the Company announced the appointment of Dan Dolan as the Company’s Principal Financial Officer, Principal Accounting Officer and Treasurer, effective immediately, succeeding Mr. Carmona. |

| · | Later on September 24, 2020, representatives of Velan and Repertoire met telephonically with Mr. Martin and Ms. Webb to discuss organizational changes within the Company’s finance function, including Mr. Carmona’s departure, and other matters concerning the Company. |

| · | On November 5, 2020, Mr. Sarpangal met telephonically with Salvador Grausso, the Company’s Chief Commercial Officer, Peter Schwartzman, Vice President of the Company’s Capital, Strategy and Transactions (CST) Group, Mr. Dolan and Ms. Webb. The parties discussed the Company’s recent earnings report. |

| · | On November 19, 2020, Mr. Dolan emailed Mr. Sarpangal to inform him that, as the Principal Financial Officer, he would be taking over the investor relations responsibilities from Ms. Webb following her departure the previous week. |

| · | Also on November 19, 2020, Mr. Sarpangal emailed Messrs. Dolan and Schwartzman raising concerns about the Company’s apparent inclination to refinance its existing convertible debt. Mr. Sarpangal expressed Repertoire’s view that the existing convertible debt was attractive financing. |

| · | On November 23, 2020, Mr. Sarpangal met telephonically with Messrs. Dolan and Schwartzman to discuss the Company’s capital structure and financing considerations. |

| · | On December 18, 2020, the Company announced the appointment of James Chopas as the Company’s Principal Financial Officer, Principal Accounting Officer and Treasurer, effective December 15, 2020, succeeding Mr. Dolan. |

| · | On March 8, 2021, Mr. Sarpangal met telephonically with Ethan Holdaway, the Company’s Head of Investor Relations, and Mr. Schwartzman. The parties discussed the Company’s $175 million credit financing transaction and acquisition of the RAD011 orphan disease program. |

| · | On August 26, 2021, the Company announced that Mr. Chopas tendered his resignation on August 23, 2021, effective as of August 26, 2021. The Company also announced that the Board appointed Steven Helwig to succeed Mr. Chopas as the Company’s interim Principal Financial Officer, interim Principal Accounting Officer and interim Treasurer. |

| · | On January 10, 2022, Mr. Sarpangal met telephonically with Messrs. Holdaway and Schwartzman. The parties discussed the Company generally. |

| · | On February 15, 2022, Velan Capital and Repertoire Partners entered into a Group Agreement (the “Group Agreement”), which sets forth certain agreements among the parties with respect to their intention to jointly coordinate their activities with respect to the Company. |

| · | On March 1, 2022, representatives of the Velan-Repertoire Group had a call with representatives of the Company, including, among others, Messrs. Martin, Holdaway and Schwartzman. During the call, the Velan-Repertoire Group notified the Company that it would be filing a Schedule 13D with respect to the Company in a few days and expressed a desire to further discuss matters related to the Company’s governance, management and strategy in a constructive manner. |

| · | On March 7, 2022, the Velan-Repertoire Group filed a Schedule 13D disclosing aggregate beneficial ownership of approximately 5.8% of the outstanding shares of Common Stock and aggregate economic exposure to approximately 8.2% of the outstanding shares of Common Stock. |

| · | Also on March 7, 2022, Mr. Sarpangal emailed Messrs. Martin, Holdaway and Schwartzman in furtherance of maintaining constructive discussions. Mr. Sarpangal noted the upcoming March 11th nomination deadline in connection with the Annual Meeting and explained that the Velan-Repertoire Group would be happy to continue with a private dialogue and hold off on delivering nominations if the Company extended the nomination deadline. |

| · | On March 10, 2022, Owen Hughes, Chairman of the Board, emailed the Velan-Repertoire Group to coordinate a call with him, director Catherine Friedman and the Company’s in-house legal counsel. The parties had multiple calls during the day. The Velan-Repertoire Group communicated its desire to maintain a private and constructive dialogue, and suggested that the nomination deadline be delayed to avoid mandatory public disclosure of its nominations due to its status as a Schedule 13D filer. Mr. Hughes proposed to delay the nomination deadline and have the parties continue their discussions under the protection of a confidentiality agreement (“NDA”). The Velan-Repertoire Group agreed in principle to this approach with the understanding that the nomination deadline would be extended to enable the parties to effectively negotiate the terms of the NDA. |

| · | Next on March 10, 2022, the Velan-Repertoire Group’s legal counsel (“Group Counsel”) had a call with Kim Clarke, the Company’s General Counsel, and the Company’s outside legal counsel (“Company Counsel”). The parties discussed the proposed extension of the nomination deadline and NDA. Group Counsel made clear the Velan-Repertoire Group’s position that the nomination deadline would need to be extended prior to the negotiation and execution of an NDA given the March 11th nomination deadline. |

| · | Later on March 10, 2022, Ms. Clarke emailed Group Counsel explaining that the Company wants an executed NDA before extending the nomination deadline. The Velan-Repertoire Group believed that the Company was attempting to run out the clock on the nomination window and was concerned that the NDA may include onerous and unsatisfactory provisions given the Company’s unwillingness to extend the nomination deadline prior to the execution of the NDA. |

| · | Subsequently on March 10, 2022, Group Counsel responded to Ms. Clarke’s email informing her that the Company’s proposed approach does not work for the Velan-Repertoire Group and that it intended to submit director nominations tomorrow, and then discussions could be picked up thereafter once its rights were preserved. |

| · | On March 11, 2022, the Velan-Repertoire Group delivered a letter to the Company (the “Nomination Letter”), in accordance with its Amended and Restated Bylaws (the “Bylaws”), nominating Dr. Eric J. Ende, R. John Fletcher, Cynthia L. Flowers and Ann MacDougall for election to the Board at the Annual Meeting. In the Nomination Letter, the Velan-Repertoire Group stated its belief that the terms of three Class II directors currently serving on the Board expire at the Annual Meeting, and, if this remains the case, the Velan-Repertoire Group intends to withdraw one of its Nominees. |

| · | On March 15, 2022, the Velan-Repertoire Group filed an amendment to its Schedule 13D disclosing the delivery of the Nomination Letter. |

| · | On March 16, 2022, the Company announced the appointment of Mike Conley as the Company’s Vice President, Chief Financial Officer and Treasurer, effective as of March 15, 2022. |

| · | On March 25, 2022, Company Counsel contacted Group Counsel and the parties discussed the situation. Company Counsel inquired whether the Velan-Repertoire Group would make one or two of its candidates available for interviews, while clarifying that the Company does not know which candidates it would like to interview yet. |

| · | Subsequently on March 25, 2022, Group Counsel informed Company Counsel that the Velan-Repertoire Group is happy to make its candidates available for interviews once a settlement framework is in place. |

| · | On April 18, 2022, the Velan-Repertoire Group filed an amendment to its Schedule 13D disclosing a reorganization of certain Velan entities and aggregate beneficial ownership of approximately 6.6% of the outstanding shares of Common Stock and aggregate economic exposure to approximately 9.1% of the outstanding shares of Common Stock. |

| · | Also on April 18, 2022, the Velan-Repertoire Group filed this preliminary proxy statement. |

REASONS FOR THE SOLICITATION

WE BELIEVE THAT THE BOARD MUST BE MEANINGFULLY RECONSITUTED TO ENABLE STOCKHOLDERS TO REALIZE RADIUS’ SIGNIFICANT VALUE POTENTIAL

Collectively, as one of the largest stockholders of Radius, the Velan-Repertoire Group is very concerned by the incumbent Board’s record of presiding over material value erosion over nearly every relevant measurable period. In our view, the significant value destruction at the Company is underpinned by:

| 1) | Dismal share price performance; |

| 2) | Poor corporate governance and lack of effective corporate oversight; |

| 3) | Suboptimal commercial execution driven by a lack of focus on TYMLOS; |

| 4) | Misguided and neglected corporate strategy; |

| 5) | Inefficient financial management with a significant accumulated deficit; and |

| 6) | An apparent inability to streamline and maximize stockholder value. |

As experienced investment firms with domain expertise across multiple healthcare and financial verticals and members who have founded, sponsored and successfully operated multiple pharmaceutical companies/divisions, we can readily identify the large disparity between the current reality and the tremendous upside potential that is trapped in the Company’s shares. We believe that meaningful and expeditious changes are necessary to properly harness opportunities available for value creation and bridge the valuation gap that has persisted under the leadership of the incumbent Board.

We believe there is a clear solution to the issues at hand: implement governance and leadership enhancements by electing a slate of highly-qualified, independent directors with demonstrated track records of success (industry and financial) who will be committed to maximizing long-term value for all stockholders and other key stakeholders. We believe a reconstituted Board that includes our Nominees will have the expertise and impartiality required to optimize and realize the latent value of Radius.

Dismal Share Price Performance Under the Incumbent Board

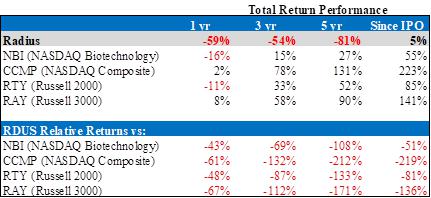

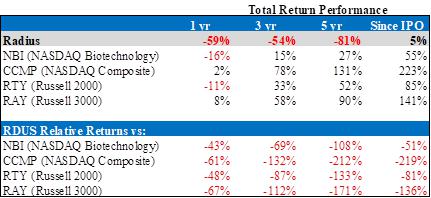

The Company has a classified Board such that only directors Catherine J. Friedman, Jean-Pierre Garnier and Andrew C. von Eschenbach are up for election at the Annual Meeting. When Ms. Friedman (2015) and Drs. Garnier (2015) and von Eschenbach (2021) joined the Board, Radius’ share price was significantly higher than it is today. Unfortunately, Radius’ share price underperformance is not just isolated to these directors’ tenures; instead, Radius has underperformed over nearly every relevant measurable period since becoming public on both an absolute basis and when compared to relevant indices and the broader market.

Source: Bloomberg, calculated as of March 7, 2022 (representing the unaffected price on the day we filed our initial Schedule 13D). IPO June 6, 2014.

It is evident to us that the significant destruction of stockholder value that has persisted over the near and long term under the leadership of the incumbent Board warrants an overhaul in the boardroom.

Furthermore, the following graph pulled directly from the Company’s Form 10-K for fiscal 2021 helps crystalize the staggering loss of value experienced by stockholders since Ms. Friedman and Dr. Garnier joined the Board in 2015.

Poor Corporate Governance and Lack of Effective Corporate Oversight

We are concerned with the poor corporate governance that severely limits the ability of stockholders to seek effective change at Radius. The Board is classified into three separate classes, meaning its directors are only subject to re-election by stockholders once every three years. In our view, the ability of stockholders to select directors each year is an important check on the performance of the Board and is critical in allowing stockholder input on the direction and state of the Company and ensuring the best individuals are on the Board to oversee their investment. To the contrary, the Board’s current classified structure, in our view, impedes stockholders’ ability to regularly and effectively evaluate the performance of the Company’s directors and insulates and entrenches the incumbents despite their apparent lapses in oversight.

Further, stockholders are prohibited from calling special meetings or acting by written consent, which means that stockholders cannot seek Board change between annual meetings. In addition, certain stockholder-unfriendly provisions in the Charter and all Bylaw provisions may only be amended by a prohibitively high supermajority vote of two-thirds of all outstanding shares. We believe it is contrary to good corporate governance practices for the Board to utilize the Company’s corporate machinery to insulate itself from the Company’s stockholders. We are not alone in our assessment as leading independent proxy advisory firm Institutional Shareholder Services Inc. has consistently recommended AGAINST the election of the Company’s director nominees for at least the past three annual meetings, including with respect to Ms. Friedman and Dr. Garnier the last time they were up for election in 2019.

We believe that the foregoing corporate governance practices have undermined accountability in the boardroom and for management. We also find it disconcerting that the incumbent Board is highly inter-connected with multiple current and past relationships, which we are concerned could jeopardize the Board’s ability to independently and effectively oversee management. Specifically, since G. Kelly Martin became President and Chief Executive Officer in April 2020, the Board has added three “independent” directors – Sean Murphy, Machelle Sanders and Dr. von Eschenbach – all of whom previously worked with Mr. Martin or Chairman Owen Hughes.

Suboptimal Commercial Execution Driven by a Lack of Focus on TYMLOS

It is apparent to us that Radius’ Board and management team have been unable to successfully maximize the full potential of TYMLOS. Our conversations with medical experts lead us to believe that TYMLOS has a differentiated safety profile with similar efficacy to FORTEO, but that patient access continues to be a major challenge for its commercial ramp. This issue is compounded by the fact that conversion rates for getting patients on drug as well as patient duration of therapy are suboptimal. TYMLOS was launched almost five years ago; yet, in our view, it remains an underappreciated asset despite its potential to be a significant cash flow producer for Radius and its stockholders.

Misguided and Neglected Corporate Strategy

Five years ago, in 2017, Ms. Friedman and Dr. Garnier represented two of the three members of the Company’s Strategy Committee, which was focused on long-term business strategy including potential strategic transactions and business development opportunities. Unfortunately, it appears that Ms. Friedman and Dr. Garnier did not take this committee seriously – the committee met zero times in 2017 despite it being their first year on the committee. Over the next three years, the Strategy Committee would only meet nine times before it was dissolved in October 2020.1 We find it appalling that the Strategy Committee was of so little importance to Ms. Friedman and Dr. Garnier. By comparison, the Compensation Committee (of which Ms. Friedman and Dr. Garnier are members) met 20 times over the same time period. Notably, the Strategy Committee was dissolved before the Company’s acquisition of RAD011, which the Company proclaims as a lead pipeline asset worthy of an R&D day in April 2022.

When Mr. Martin joined the Company, it looked much different than it does today. Radius announced its acquisition of a synthetic cannabidiol (CBD) oral solution, RAD011, from Benuvia Therapeutics in January 2021. The asset has a contentious history since Benuvia Therapeutics acquired the CBD asset in August 2019 out of the Insys Therapeutics bankruptcy. Radius has pivoted to investing in the RAD011 program and the lead indication is focused on Prader-Willi Syndrome (PWS). We acknowledge that within the PWS market, there is an unmet medical need to treat hyperphagia; however, we believe that the likelihood of success in a timely fashion and at a reasonable cost is very low given the paucity of data from the phase II study. The Company plans to commit significant resources to this endeavor, which we view as financially irresponsible given the challenges within PWS. Even if Radius were to pivot RAD011 to focus on Angelman Syndrome, we view the cost required from an R&D standpoint and time to reach market as an unfavorable risk/reward profile.

1 Radius filings.

We find it concerning that what was once a company grounded in its endocrinology expertise when Mr. Martin joined has now shifted to neurology with RAD011, which in our view is a suboptimal asset with minimal value. This asset suits his background given more than the decade he spent at Elan Corporation plc working on neurodegenerative diseases. Additionally, Mr. Martin has been Chairman of Wren Therapeutics (a neurodegenerative company) since 2018, and two other Radius directors (Chairman Hughes and Dr. von Eschenbach) are also directors of Wren Therapeutics. In our view, it seems that the Board has positioned the Company to suit Mr. Martin’s interests at the expense of the Company’s best interests. We believe the Board has misguided the Company by shifting focus to RAD011. We wonder if this may have been avoided had the Strategy Committee not been dissolved before the acquisition and subsequent strategic pivot.

Inefficient Financial Management with a Significant Accumulated Deficit

Based on the Company’s Form 10-K for fiscal 2021, Radius had an eye-popping accumulated deficit of $1.4 billion. We believe change is urgently needed today to refocus the Company in a new direction beyond being known as a loss leader. Radius is planning to commit tens of millions of dollars towards RAD011 and burn cash on what we view as having an unfavorable risk/reward profile.

The Company has over $330 million in total debt obligations with future minimum payments due as soon as 2023. A sense of urgency is needed today to reposition the operating profile of the business to meet future obligations and optimize the capital structure for strength. The following tables are summarized from the Company’s Form 10-K for fiscal 2021.

Apparent Inability to Streamline and Maximize Stockholder Value

While we understand that some costs will roll off with R&D and due to the business adjustment in January 2022, we believe there is significant room for improvement in the corporate structure. Furthermore, Radius needs to take the necessary steps to maximize stockholder value and see those steps through. Based on the financial guidance provided by the Company, it is anticipated that Radius will become barely profitable when TYMLOS is producing more than $200 million in annual net sales (and despite ~90% gross margins).

We question why the Company continues to squander TYMLOS’ cash flow potential and is pursuing a risky development platform that generated minimal interest during the Insys Therapeutics bankruptcy process, and, in our view, has minimal overlap with TYMLOS’ primary call point. With a renewed strategy for TYMLOS and a strategic change by pivoting to true adjacencies rather than RAD011, Radius can streamline cost containment to generate significant cash flow. We believe Radius can reach $100+ million of adjusted EBITDA by successfully executing on such a pivot. In our view, the Board must be reconstituted for stockholders to realize the significant value potential of the Company.

We Believe We Have a Superior Path Forward

For the reasons set forth above, we believe the current Board has failed to act in the best interest of stockholders and to maximize value. Given the significant destruction of stockholder value overseen by the incumbent Board, we believe it must be reconstituted to facilitate a turnaround of the Company with a new strategic direction. We have nominated highly-qualified candidates who we believe are capable of applying their collective experience and knowledge to help guide the Company on a value creating path of commercial and financial success. We believe significant opportunities exist to unlock substantial value at Radius and look forward to the prospect of our Nominees helping the Company capitalize on these opportunities. If elected, our Nominees are prepared to help Radius conduct a strategic review and execute a plan that prioritizes the following initiatives:

| (1) | Reinvigorate TYMLOS Commercialization – focus on commercialization efforts to improve access, increase patient conversion rates and prolong duration of therapy. We believe that TYMLOS is a differentiated and durable asset in the marketplace with true demand from a patient and demographic standpoint. Our Nominees will look for strategic ways to ramp commercial revenue and drive growth outlook to unlock the full potential of this asset. We believe TYMLOS can produce significant cash flow for the Company in order to create optionality from a capital structure and business development standpoint in the future. |

| (2) | Define Path to Monetizing Elacestrant – establish a clear strategy to monetize the Elacestrant license / royalty cash flow and harvest significant value out of the asset before or after a potential approval scenario. We believe that having an effective plan to monetize this asset will help the Company pivot its capital structure in a new direction going forward. We see an opportunity for Radius to generate capital from a non-core asset, optimize the capital structure and not disrupt the core business from a capital deployment standpoint. We have prior experiences with royalty transactions, and we know that these types of deals are in high demand and have competitive processes that can generate great returns for the companies selling such royalty rights. |

| (3) | Consider Shutting Down RAD011 and Revisiting Strategic Course – work with Radius’ management and conduct a thorough review of the work completed to date and supporting data for this asset. We believe our Nominees possess the product development experience and decision-making foresight to arrive at a clear risk/reward perspective based on the market opportunities. In our view, Radius will unlock significant stockholder value by focusing on true synergistic areas to TYMLOS and avoiding further cash burn on programs with low probability-weighted expected returns. |

| (4) | Financial Management Optimization and Cost Containment – conduct a thorough review of all overhead and administrative spending as well as non-core projects with the goal of reducing spend to conserve capital for product commercialization. We are confident that our Nominees have the commercial expertise to help drive an improvement in productivity and increase the sales per overall employee metric to that of similar companies. In addition, our Nominees will help craft a strategy to establish a clear plan to properly manage the Company’s debt obligations to optimize the capital structure. |

We firmly believe that our Nominees possess the experience, expertise, independence and track records of success needed to maximize value for Radius’ stockholders. Our Nominees bring strong pharmaceutical and financial experience and deep knowledge of effective corporate governance practices. If elected, our Nominees are committed to taking actions to increase value for all Radius stockholders. With improved leadership and oversight, we believe the future can be bright for Radius and its stakeholders.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Company currently has a classified Board of eight (8) directors divided into three (3) classes. The directors in each class are elected for staggered terms of three (3) years so that the term of office of one (1) class of directors expires at each annual meeting of stockholders. We believe that the terms of three (3) Class II directors expire at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our three (3) Nominees, [Eric J. Ende, R. John Fletcher, Cynthia L. Flowers and Ann MacDougall], in opposition to the Company’s three (3) Class II director nominees, for terms ending at the 2025 annual meeting of stockholders. [If it remains the case that the terms of only three (3) directors will expire at the Annual Meeting, we will withdraw one (1) of our four (4) Nominees.] Your vote to elect the Nominees will have the legal effect of replacing three (3) incumbent directors of the Company with the Nominees. If elected, the Nominees will represent a minority of the members of the Board, and therefore it is not guaranteed that they will be able to implement any actions that they may believe are necessary to enhance stockholder value. There is no assurance that any incumbent director will serve as a director if our Nominees are elected to the Board. You should refer to the Company’s proxy statement for the names, background, qualifications and other information concerning the Company’s nominees.

THE NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five (5) years of each of the Nominees. The nominations were made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to conclude that the Nominees should serve as directors of the Company are set forth above in the section entitled “Reasons for the Solicitation” and below. This information has been furnished to us by the Nominees. All of the Nominees are citizens of the United States of America.

[Dr. Eric J. Ende, age 53, currently serves as the President of Ende BioMedical Consulting Group, Inc., a privately-held consulting company which is focused on helping life sciences companies raise capital, identify licensing partners, and optimize corporate structure as well as analyzing both private and public investment opportunities for clients within the life sciences industry, a position he has held since 2009. Dr. Ende has also served on the board of directors of each of NeuBase Therapeutics, Inc. (NASDAQ: NBSE), a biopharmaceutical company, since January 2022, Avadel Pharmaceuticals plc (NASDAQ: AVDL), a specialty pharmaceutical company, since December 2018, where he chairs the Nominating and Corporate Governance Committee and serves on the Audit and Compensation Committees, and Matinas BioPharma Holdings, Inc. (NYSE AMERICAN: MTNB), a clinical-stage biopharmaceutical company, since April 2017, where he chairs the Compensation Committee and serves on the Audit and Nominating and Corporate Governance Committees. Dr. Ende has also served on the Technology Transfer Committee of Mount Sinai Innovation Partners, which develops Mount Sinai discoveries and innovations, since March 2015. Dr. Ende served on the board of directors of Progenics Pharmaceuticals, Inc. (formerly NASDAQ: PGNX), a biopharmaceutical company, from November 2019 until it was acquired by Lantheus Holdings, Inc. in June 2020, where he chaired the Compensation Committee and served on the Audit and Science Committees. From January 2015 to October 2016, he served as Chairman of the Unsecured Creditor’s Committee in the bankruptcy of Egenix, Inc. Dr. Ende also previously served on the board of directors of Genzyme Corp. (formerly NASDAQ: GENZ), a biotechnology company, from 2010 until it was acquired by Sanofi-Aventis in 2011. Earlier in his career, he served as the senior biotechnology analyst at Merrill Lynch, from 2002 until 2008; as the senior biotechnology analyst at Bank of America Securities from 2000 through 2002; and as a biotechnology analyst at Lehman Brothers from 1997 to 2000. During Dr. Ende’s career as a biotechnology analyst, he was named to Institutional Investor’s All-America Equity Research Team six times as well as to The Greenwich Survey list of top analysts. Dr. Ende received a Master’s in Business Administration in Finance and Accounting from NYU - Stern Business School, a Doctor of Medicine degree from Mount Sinai School of Medicine in 1994, and a Bachelor’s of Science degree in Biology and Psychology from Emory University in 1990.

The Velan-Repertoire Group believes that Dr. Ende is qualified to serve on the Board due to his over 20 years of experience in the pharmaceutical and life sciences industries, including as President of Ende BioMedical Consulting Group and as a biotechnology analyst, and his prior public company board experience.

R. John Fletcher, age 76, founded Fletcher Spaght Inc., a strategy consulting and venture capital firm, in 1983 and as its managing partner emeritus, remains active with the company, advising both the consulting practice and venture capital activities, with analytical insights and creative solutions derived from his years of experience with clients, portfolio companies and the investment community. Since 2001, Mr. Fletcher has also served as the Managing Partner of Fletcher Spaght Ventures, a venture capital fund. Prior to founding Fletcher Spaght, Mr. Fletcher served as a senior manager at The Boston Consulting Group, advising a broad range of companies in healthcare and high technology industries. Mr. Fletcher currently serves on the board of directors of ClearPoint Neuro, Inc. (NASDAQ: CLPT) (f/k/a MRI Inventions, Inc.) (“Clearpoint”), a global therapy-enabling platform company, since May 2017, and as Chairman of ClearPoint’s board of directors, since February 2021. Mr. Fletcher has served as a member of the Audit and Corporate Governance and Nominating Committees of ClearPoint, since October 2017, and chaired the Corporate Governance and Nominating Committee, from May 2018 to April 2021. Mr. Fletcher also serves as Chairman of the boards of directors of Vyant Bio, Inc. (NASDAQ: VYNT) (f/k/a Cancer Genetics, Inc.) (“Vyant”), a drug discovery and preclinical oncology and immuno-oncology company, since the completion of its merger with StemoniX, Inc. in March 2021. Mr. Fletcher served as a director of StemoniX, Inc., from October 2020 to March 2021, and now serves on Vyant’s Audit and Nominating and Governance Committees, since March 2021; Repro Med Systems, Inc. (d/b/a KORU Medical Systems) (NASDAQ: KRMD), a proprietary portable and innovative medical devices manufacturing company, which he joined as a member of the board of directors in May 2019 and has served as Chairman, since September 2019, as a member of the Audit Committee, from May 2019 to April 2021, and as a member of the Nominating and Corporate Governance Committee, since March 2022; and Metabolon, Inc., a health technology company, where he joined the board of directors in April 2017 and currently serves as Chairman. Mr. Fletcher also served on the boards of directors of Cheetah Medical, Inc., a biomedical products company, from 2018 until its acquisition by Baxter International Inc. in October 2019. Mr. Fletcher previously served as a director of Axcelis Technologies, Inc. (NASDAQ: ACLS), a semiconductor chip company, from 2003 to May 2021, where he served on the served as Chairman of the board of directors, from 2015 to May 2021, chaired the Compensation Committee, from 2015 to May 2020, and served as a member thereof, from 2006 to May 2021, as a member of the Audit Committee, from 2004 to 2014, and again from February 2017 to May 2021, and as a member of the Technology and New Product Development Committee, from 2014 until February 2017. Mr. Fletcher served on the board of directors of Spectranetics Corporation (formerly NASDAQ: SPNC) (“Spectranetics”), a medical device company, from 2002 to August 2017, where he served on the Audit Committee, from 2014 to August 2017, and served on the Nominating and Corporate Governance Committee, from 2012 to August 2017. Mr. Fletcher served as Chairman of the board of directors of Spectranetics, from 2010 to June 2017, during its turnaround and subsequent sale to Philips N. V. For this work, he was selected as 2018 Director of the Year by the National Association of Corporate Directors. From 2005 to 2009, Mr. Fletcher served as a director of Panacos Pharmaceuticals Inc., a biotechnology company focused on therapeutic solutions for infectious disease; from 1991 until 2011, he served as a director of AutoImmune, Inc., a biotechnology company that develops orally-administered pharmaceutical products; and from 2011 until 2012, he served as a director of Marina Biotech, Inc., a biotechnology company focused on RNA-based therapeutics. Mr. Fletcher’s past board experience also includes Fischer Imaging Corp., NMT Medical Inc., Quick Study Radiology Inc., GlycoFi, Inc., Pilot Software, Inc. and XVionics, Inc. Mr. Fletcher is Chairman Emeritus of the Corporate Collaboration Council at the Thayer School of Engineering/Tuck School of Business at Dartmouth College and serves on the Board of Advisors of Beth Israel Deaconess Medical Center and the Whitehead Institute at MIT. Mr. Fletcher received his MBA from Southern Illinois University, his BBA in Marketing from George Washington University and his MS in International Finance from Carnegie Mellon University. He is an instructor for courses in international business and was a PhD Candidate at the Wharton School of the University of Pennsylvania. Mr. Fletcher was a Captain and jet pilot instructor in the US Air Force.

The Velan-Repertoire Group believes Mr. Fletcher’s more than 35 years of healthcare and medical device experience, as well as his more than 30 years of strategy and financing experience across the pharmaceutical and healthcare industry, make him well qualified to serve on the Board.

Cynthia L. Flowers, age 62, currently serves as a Principal of EIR Advisory LLC, a life sciences strategic advisory and investment firm, since May 2018. Ms. Flowers served as the President and Chief Executive Officer of the North America division of Ipsen Biopharmaceuticals, Inc. (“Ipsen”), a biopharmaceutical company, from 2014 to November 2017. From 2011 to 2013, Mr. Flowers served on a consulting basis in interim executive and advisory roles for a number of biotech and specialty pharmaceutical companies. From 2008 to 2010, Ms. Flowers served as President of the North American division of Eisai Co., Ltd. (TYO: 4523), a global pharmaceutical company based in Japan. Ms. Flowers served as Vice President and General Manager of U.S. Oncology at Amgen Inc. (NASDAQ: AMGN) (“Amgen”), a biopharmaceutical company, from 2005 to 2008, and as Amgen’s Executive Director of the U.S. Oncology Business Unit, from 2003 to 2005. She also previously held multiple commercial roles at Johnson & Johnson (NYSE: JNJ), a multinational medical devices, pharmaceuticals and consumer-packaged goods company, and at its pharmaceuticals subsidiary, Janssen Pharmaceutica, Inc., from 1985 to 2003. Ms. Flowers began her career as an oncology and critical care nurse. Ms. Flowers currently serves on the boards of directors of Hikma Pharmaceuticals plc (LSE: HIK), a multinational generics company focused on oncology injectables, since June 2019, Caladrius Biosciences Inc. (NASDAQ: CLBS), a clinical stage-stage biopharmaceutical company targeting cardiovascular and autoimmune diseases, since November 2018, and G1 Therapeutics Inc. (NASDAQ: GTHX), a clinical stage biopharmaceutical company focused in oncology, since June 2018. Ms. Flowers has also served on the boards of directors of Relevate Health, LLC, a healthcare digital marketing agency, since March 2021, and EternaTear Inc., an eyecare company engaged in the production of artificial tear products, since July 2020. Ms. Flowers previously served on the boards of directors of Nanoform Finland PLC (HEL: NANOFH), a nanoparticle manufacturing company, from September 2020 to June 2021, and Kadmon Holdings, Inc. (formerly NYSE: KDMN), a clinical stage biopharmaceutical company, from January 2019 until its acquisition by Sanofi S.A. in November 2021. She currently serves as a Wharton Business School Leadership Advisor and has previously held positions on numerous other corporate and non-profit boards, including the Women’s Leadership Advisory Board at Harvard University’s John F. Kennedy School of Government, The Eshelman Innovation Fund, the Sarah Cannon Oncology Research Institute, CenterLight Health Systems and Amerifit Inc. Ms. Flowers received her B.S.N. from the University of Delaware and her Executive M.B.A. from the Wharton School of the University of Pennsylvania.

The Velan-Repertoire Group believes Ms. Flowers’ experience in the life sciences, biotechnology and pharmaceutical industries, public company board experience and her knowledge of strategic and operational leadership priorities and corporate development matters make her well-qualified to serve on the Board.

Ann MacDougall, age 68, currently serves as the Chief Executive Officer of The Dunollie Fund, a family impact investment fund that she co-founded in January 2018. She has served as a Senior Advisor to Encore.org (“Encore”), a national non-profit that promotes second act careers, since November 2017, and previously served as Encore’s President, from January 2014 through October 2017. In 2013, Ms. MacDougall was a Fellow at the Harvard University Advanced Leadership Initiative. Prior to that, she held several senior roles at Acumen Fund (“Acumen”), a global impact investment fund focused on goods and services for low-income consumers, including most recently as Acumen’s Chief Operating Officer, from 2007 to 2012. Prior to Acumen, Ms. MacDougall had a long career as a Partner managing legal matters at PricewaterhouseCoopers LLP (“PwC”), a global accounting firm, from 1994 to 2007, including as U.S. General Counsel and member of the 10-person U.S. Management Committee and stint in Paris as PwC’s Global Deputy General Counsel. Ms. MacDougall currently serves on the boards of directors of Opiant Pharmaceuticals, Inc. (NASDAQ: OPNT), a specialty pharmaceutical company focused on addiction and overdose, since May 2016, where she chairs the Compensation Committee, serves as a member of Nominating and Corporate Governance Committee and has served on the Audit Committee, and Alopexx, Inc., a clinical stage biotechnology company which has filed an S-1 Registration Statement to be listed on The Nasdaq Capital Market, since August 2021, where she serves as a Director Nominee, Nominee Chair of the Compensation Committee and Nominating and Governance Committee and a Nominee for the Audit Committee; and Atmos XR, Inc., a private Internet of Things (IoT) company, since October 2017. She is also an advisor to Nuvo Assets Inc., a rare earths and metals company, since May 2021, and is on the Investment Committee of the Builders Fund, a growth-stage impact investment fund, since September 2020. Ms. MacDougall has also served on the board of directors of Progenics Pharmaceuticals, Inc. (formerly NASDAQ: PGNX), a biopharmaceutical company, from November 2019 until it was acquired by Lantheus Holdings, Inc. in June 2020, where she served as interim chair of the board of directors, chaired the Nominating and Corporate Governance Committee and served on the Compensation Committee. In her volunteer capacity, Ms. MacDougall serves on the Audit Committee of the Lycée Français de New York and as board member and chair of the Governance Committee of Strong Minds, a non-profit tackling mental illness in Africa. She is on the Advisory Boards of Global Citizen Year, a U.S. education non-profit organization; Equality Now, a global women’s rights non-organization; The Harvard Advanced Leadership Coalition; and the Global Leadership Council of the World Research Institute, a sustainability research group working with governments and large companies across the world. Ms. MacDougall earned her B.A. in Theatre at Tufts University and her J.D. at Brooklyn Law School.

The Velan-Repertoire Group believes Ms. MacDougall’s management, operational, governance, Environment, Social and Governance and legal experience and her prior experience on the boards and governance, audit and compensation committees of pharmaceutical companies well qualifies her to serve on the Board.]

[The principal business address of Dr. Ende is 102 Via Palacio, Palm Beach Gardens, Florida 33418. The principal business address of Mr. Fletcher is c/o Fletcher Spaght Inc., 75 State Street, Boston, Massachusetts 02109. The principal business address of Ms. Flowers is c/o EIR Advisory LLC, 619 Owl Way, Sarasota, Florida 34236. The principal business address of Ms. MacDougall is 610 West End Avenue, #8D, New York, New York 10024.]

As of the date hereof, the Nominees do not directly or indirectly own, beneficially or of record, any securities of the Company and have not entered into any transactions in securities of the Company during the past two years.

Each of the Nominees may be deemed to be a member of a “group” with the other participants in this solicitation for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and such group may be deemed to beneficially own the 3,143,000 shares of Common Stock owned in the aggregate by all of the participants. Each participant disclaims beneficial ownership of the shares of Common Stock that he, she or it does not directly own.

Velan, Repertoire and the Nominees (collectively, the “Group”) entered into a Joint Filing and Solicitation Agreement on March 11, 2022, as amended on April 18, 2022, pursuant to which, among other things, (i) the Group agreed to solicit proxies for the election of the Nominees, or any other person(s) nominated by Velan and/or Repertoire, to the Board at the Annual Meeting, (ii) each of the Nominees agreed not to undertake or effect any purchase, sale, acquisition or disposition of any securities of the Company without the prior written consent of Velan and Repertoire and (iii) Velan and Repertoire agreed to bear all approved expenses incurred in connection with the Group’s activities pro rata based on the number of shares of the Company owned by Velan and Repertoire.

Velan LP and Repertoire Master have entered into indemnification letter agreements (the “Indemnification Agreements”) with each of the Nominees pursuant to which Velan and Repertoire agreed to indemnify the Nominees against claims arising from the solicitation of proxies from the Company’s stockholders in connection with the Annual Meeting and any related transactions. The Indemnification Agreements do not extend to any potential claims made against the Nominees in their respective capacities as directors, if elected.

Each Nominee has granted Adam Morgan, Balaji Venkataraman and Deepak Sarpangal a power of attorney to execute certain filings with the Securities and Exchange Commission (the “SEC”) and other documents in connection with the solicitation of proxies at the Annual Meeting.

The Velan-Repertoire Group believes that each Nominee presently is, and if elected as a director of the Company, each of the Nominees would be, an “independent director” within the meaning of (i) applicable NASDAQ listing standards applicable to board composition, including Rule 5605(a)(2), (ii) Section 301 of the Sarbanes-Oxley Act of 2002 and (iii) the Company’s Corporate Governance Guidelines (as available on the Company’s website as of the date hereof). Notwithstanding the foregoing, the Velan-Repertoire Group acknowledges that no director of a NASDAQ listed company qualifies as “independent” under the NASDAQ listing standards unless the board of directors affirmatively determines that such director is independent under such standards. Accordingly, the Velan-Repertoire Group acknowledges that if any Nominee is elected, the determination of such Nominee’s independence under the NASDAQ listing standards ultimately rests with the judgment and discretion of the Board. No Nominee is a member of the Company’s compensation, nominating or audit committee that is not independent under any such committee’s applicable independence standards.

Other than as stated herein, there are no arrangements or understandings between the members of the Group or any other person or persons pursuant to which the nomination of the Nominees described herein is to be made, other than the consent by each Nominee to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. Other than as stated herein, none of the Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceeding.

We do not expect that any of the Nominees will be unable to stand for election, but, in the event any Nominee is unable to serve or for good cause will not serve, the shares of Common Stock represented by the enclosed WHITE proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under the Bylaws and applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any changes to the Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, we would identify and properly nominate such substitute nominee(s) in accordance with the Bylaws and shares of Common Stock represented by the enclosed WHITE proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting.

WE STRONGLY URGE YOU TO VOTE “FOR” THE ELECTION OF THE NOMINEES ON THE ENCLOSED WHITE PROXY CARD.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company’s proxy statement, the Audit Committee of the Board has appointed Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022. The Company is submitting the appointment of Deloitte & Touche LLP for ratification by the stockholders at the Annual Meeting.

As disclosed in the Company’s proxy statement, stockholder approval is not required to appoint Deloitte & Touche LLP as the Company’s independent registered public accounting firm, but the Company is submitting the appointment of Deloitte & Touche LLP to stockholders for ratification as a matter of good corporate governance. The Company has disclosed that if stockholders do not ratify the appointment, the Audit Committee would consider this fact when it appoints the independent auditors for the fiscal year ending December 31, 2023. The Company has further disclosed that, even if the stockholders ratify the appointment, the Audit Committee retains the discretion to appoint a different independent auditor at any time if it determines that such a change would be in the best interests of the Company and its stockholders.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THE RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2022 AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

PROPOSAL NO. 3

NON-BINDING ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

As discussed in further detail in the Company’s proxy statement, the Company is asking stockholders to approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers. This proposal, commonly known as a “say-on-pay” proposal, is required by Section 14A of the Exchange Act and gives the Company’s stockholders the opportunity to express their views on the compensation of the Company’s named executive officers. The vote on the say-on-pay proposal is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the Company’s compensation philosophy, policies and practices for named executive officers as described in the Company’s proxy statement. Accordingly, the Board is asking stockholders to vote for the following resolution:

“RESOLVED, that the Company’s stockholders approve, by a non-binding advisory vote, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the 2022 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the compensation tables and narrative discussion.”

As disclosed in the Company’s proxy statement, the stockholder vote on the say-on-pay proposal is advisory, and therefore not binding on the Company, the Board or the Compensation Committee of the Board (the “Compensation Committee”). However, the Company has disclosed that the Board and the Compensation Committee value the opinions of the Company’s stockholders and will take into consideration the advisory vote results when making decisions regarding executive compensation.

[WE MAKE NO RECOMMENDATION] WITH RESPECT TO THE ADVISORY VOTE ON EXECUTIVE COMPENSATION AND INTEND TO VOTE OUR SHARES “[FOR / AGAINST]” THIS PROPOSAL.

VOTING AND PROXY PROCEDURES

Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares. Stockholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares after the Record Date. Based on publicly available information, the Velan-Repertoire Group believes that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the Common Stock.

Shares of Common Stock represented by properly executed WHITE proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Nominees, FOR the ratification of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 and [FOR / AGAINST] the advisory vote on executive compensation.

Based on publicly available information, we believe the current Board intends to nominate three (3) candidates for election as Class II directors at the Annual Meeting. This Proxy Statement is soliciting proxies to, among other matters described herein, elect only our three (3) Nominees as Class II directors and not any of the Company’s director nominees. Accordingly, the enclosed WHITE proxy card may only be voted for the Nominees and does not confer voting power with respect to the Company’s nominees. As explained below, the Company has a plurality vote standard for contested director elections so the three (3) nominees for director receiving the highest vote totals will be elected as directors of the Company. The participants in this solicitation intend to vote the Velan-Repertoire Group Shares in favor of the Nominees. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s nominees.

While we currently intend to vote all of the Velan-Repertoire Group Shares in favor of the election of the Nominees, we reserve the right to vote some or all of the Velan-Repertoire Group Shares for some or all of the Company’s director nominees, as we see fit, in order to achieve a Board composition that we believe is in the best interest of all stockholders. We would only intend to vote some or all of the Velan-Repertoire Group Shares for some or all of the Company’s director nominees in the event it were to become apparent to us, based on the projected voting results at such time, that less than all of the Nominees would be elected at the Annual Meeting and that by voting the Velan-Repertoire Group Shares we could help elect the Company nominees that we believe are the most qualified to serve as directors and thus help achieve a Board composition that we believe is in the best interest of all stockholders. Stockholders should understand, however, that all shares of Common Stock represented by the enclosed WHITE proxy card will be voted at the Annual Meeting as marked.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business at the meeting. For the Annual Meeting, the presence, in person or by proxy, of a majority in voting power of the shares of Common Stock issued and outstanding and entitled to vote at the Annual Meeting will constitute a quorum at the Annual Meeting.

Abstentions or withheld votes are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes” also are counted as present and entitled to vote for purposes of determining a quorum. However, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”). Under applicable rules, your broker will not have discretionary authority to vote your shares at the Annual Meeting on any of the proposals.

If you are a stockholder of record, you must deliver your vote by mail, attend the Annual Meeting in person and vote, vote by Internet or vote by telephone in order to be counted in the determination of a quorum.

If you are a beneficial owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum. Brokers do not have discretionary authority to vote on any of the proposals at the Annual Meeting. Accordingly, unless you vote via proxy card or provide instructions to your broker, your shares of Common Stock will count for purposes of attaining a quorum, but will not be voted on the proposals.

VOTES REQUIRED FOR APPROVAL

Election of Directors ─ The Company has adopted a majority vote standard for uncontested director elections and a plurality vote standard for contested director elections. As a result of our nomination of the Nominees, the director election at the Annual Meeting will be contested, therefore the three (3) candidates receiving the highest number of “FOR” votes will be elected. Withhold votes and broker non-votes will have no effect on the outcome of the election of directors.

Ratification of Appointment of Accounting Firm ─ According to the Company’s proxy statement, assuming that a quorum is present, approval of the ratification of the appointment of Deloitte & Touche LLP requires the affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) by the holders entitled to vote on the proposal. The Company has indicated that abstentions and broker non-votes will have no effect on the proposal.

Non-Binding Advisory Vote on Executive Compensation ─ According to the Company’s proxy statement, although the vote is non-binding, assuming that a quorum is present, approval of the advisory vote on the compensation of the Company’s named executive officers requires the affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) by the holders entitled to vote on the proposal. The Company has indicated that abstentions and broker non-votes will have no effect on the proposal.

Under applicable Delaware law, none of the holders of Common Stock is entitled to appraisal rights in connection with any matter to be acted on at the Annual Meeting. If you sign and submit your WHITE proxy card without specifying how you would like your shares voted, your shares will be voted in accordance with the Velan-Repertoire Group’s recommendations specified herein and in accordance with the discretion of the persons named on the WHITE proxy card with respect to any other matters that may be voted upon at the Annual Meeting.

REVOCATION OF PROXIES

Stockholders of the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although, attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered either to the Velan-Repertoire Group in care of Okapi Partners at the address set forth on the back cover of this Proxy Statement or to the Company at 22 Boston Wharf Road, 7th Floor, Boston, Massachusetts 02210 or any other address provided by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to the Velan-Repertoire Group in care of Okapi Partners at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the shares entitled to be voted at the Annual Meeting. Additionally, Okapi Partners may use this information to contact stockholders who have revoked their proxies in order to solicit later dated proxies for the election of the Nominees.

IF YOU WISH TO VOTE FOR THE ELECTION OF THE NOMINEES TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED WHITE PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by the Velan-Repertoire Group. Proxies may be solicited by mail, facsimile, telephone, telegraph, Internet, in person and by advertisements.

The Velan-Repertoire Group has entered into an agreement with Okapi Partners for solicitation and advisory services in connection with this solicitation, for which Okapi Partners will receive a fee not to exceed $[_____], together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. The Velan-Repertoire Group will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. The Velan-Repertoire Group has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of Common Stock they hold of record. The Velan-Repertoire Group will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. In addition, directors, officers, members and certain other employees of the Velan-Repertoire Group may solicit proxies as part of their duties in the normal course of their employment without any additional compensation. The Nominees may make solicitations of proxies but, except as described herein, will not receive compensation for acting as director nominees. It is anticipated that Okapi Partners will employ approximately [____] persons to solicit stockholders for the Annual Meeting.

The entire expense of soliciting proxies is being borne by the Velan-Repertoire Group. Costs of this solicitation of proxies are currently estimated to be approximately $[___________] (including, but not limited to, fees for attorneys, solicitors and other advisors, and other costs incidental to the solicitation). The Velan-Repertoire Group estimates that through the date hereof its expenses in connection with this solicitation are approximately $[___________]. To the extent legally permissible, if the Velan-Repertoire Group is successful in its proxy solicitation, the Velan-Repertoire Group intends to seek reimbursement from the Company for the expenses it incurs in connection with this solicitation. The Velan-Repertoire Group does not intend to submit the question of such reimbursement to a vote of security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION