As filed with the Securities and Exchange Commission on January 23, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Pinstripes Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 5810 | 86-2556699 |

(State or other Jurisdiction of

Incorporation or Organization) | (Primary Standard Industrial

Classification Code Number) | (I.R.S. Employer

Identification Number) |

1150 Willow Road

Northbrook, IL 60062

Telephone: (847) 480-2323

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Dale Schwartz

Chief Executive Officer

1150 Willow Road

Northbrook, IL 60062

Telephone: (847) 757-3812

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Mark D. Wood, Esq.

Elizabeth C. McNichol, Esq.

Katten Muchin Rosenman LLP

525 W. Monroe Street

Chicago, IL 60661

Tel: (312) 902-5200

Approximate date of commencement of proposed sale of the securities to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| | | | | |

| PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION | DATED JANUARY 23, 2024 |

Pinstripes Holdings, Inc.

Up to 23,985,000 Shares of Pinstripes Holdings Class A Common Stock Issuable Upon Exercise of Warrants

This prospectus relates to the issuance by Pinstripes Holdings, Inc., a Delaware corporation (“Pinstripes Holdings,” “we,” “us,” or “our”) of shares of Class A common stock, par value $0.0001 per share (“Pinstripes Holdings Class A Common Stock”) upon exercise of (i) 12,075,000 warrants the (“Public Warrants”) originally issued in the initial public offering of Pinstripes Holdings (formerly known as Banyan Acquisition Corporation (“Banyan”)) and (ii) 11,910,000 warrants (the “Private Placement Warrants” and, together with the Public Warrants, the “Warrants”) purchased by Banyan Acquisition Sponsor LLC (the “Sponsor”) and the underwriters of the initial public offering of Banyan in a private placement simultaneously with the closing of the initial public offering.

We are registering the issuance of shares of Pinstripes Holdings Class A Common Stock issuable upon the exercise of the Warrants as required by that certain Warrant Agreement, dated as of January 19, 2022 (the “Warrant Agreement”), entered into by and between Banyan and Continental Stock Transfer & Trust Company.

The exercise price of the Warrants is $11.50 per share, which exceeds the trading price of the Pinstripes Holdings Class A Common Stock as of the date of this prospectus. Although we will receive the proceeds from any exercise of the Warrants for cash, we believe that, for so long as the Warrants are “out of the money,” the holders thereof are not likely to exercise the Warrants.

We will bear all costs, expenses and fees in connection with the registration of the shares of Pinstripes Holdings Class A Common Stock underlying the Warrants.

You should read this prospectus and any prospectus supplement or amendment carefully before you invest in our securities.

Pinstripes Holdings Class A Common Stock and Public Warrants are listed on the New York Stock Exchange under the ticker symbols “PNST” and “PNST WS”. On January 22, 2024, the closing price of Pinstripes Holdings Class A Common Stock was $4.46 per share and the closing price of the Warrants was $0.39 per Warrant.

We are an “emerging growth company,” as that term is defined under the federal securities laws and, as such, are subject to certain reduced public company reporting requirements.

Investing in our securities involves risks that are described in the “Risk Factors“ section beginning on page 7 of this prospectus. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is January , 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus. No one has been authorized to provide you with information that is different from that contained in this prospectus. This prospectus is dated as of the date set forth on the cover hereof. You should not assume that the information contained in this prospectus is accurate as of any date other than that date.

For investors outside of the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our securities and the distribution of this prospectus outside the United States.

We may also provide a prospectus supplement or post-effective amendment to this registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the section of this prospectus entitled “Where You Can Find More Information.” You should assume that the information appearing in this prospectus or any prospectus supplement is accurate only as of the date on the front of those documents, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below in the section entitled “Where You Can Find More Information.”

On December 29, 2023 (the “Closing Date”), we consummated the previously announced business combination (the “Closing”) pursuant to the Business Combination Agreement, dated as of June 22, 2023 (as amended and restated as of September 26, 2023 and November 22, 2023, the “Business Combination Agreement”), by and among Banyan, Panther Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of Banyan (“Merger Sub”), and Pinstripes, Inc., a Delaware corporation (“Pinstripes”). On the Closing Date, Merger Sub merged with and into Pinstripes (the “Merger”), with Pinstripes surviving the Merger as a wholly-owned subsidiary of Banyan.

CERTAIN DEFINED TERMS

“2023 EIP Plan” means the Pinstripes Holdings, Inc. 2023 Omnibus Equity Incentive Plan.

“2024 EBITDA” means the Consolidated Net Income of the Company for the EBITDA Earnout Period, adjusted by adding thereto or (subtracting) therefrom, in each case only to the extent (and in the same proportion) deducted in determining such Consolidated Net Income and without duplication by (a) the total consolidated interest expense (net of interest income) of the Company for the EBITDA Earnout Period determined on a consolidated basis in accordance with GAAP, (b) the amortization expense of the Company for the EBITDA Earnout Period, determined on a consolidated basis in accordance with GAAP, (c) the depreciation expense of Pinstripes Holdings for the EBITDA Earnout Period, determined on a consolidated basis in accordance with GAAP, (d) the tax expense (benefit) of the Company, for the EBITDA Earnout Period, determined on a consolidated basis in accordance with GAAP, and (e) all non-cash losses (net of gains) or charges resulting from any (i) application of purchase accounting, (ii) changes in the fair value of liabilities relating to Listed Warrants or other mark-to-market adjustments, (iii) non-cash expenses (benefits) arising from grants of equity appreciation rights, equity options, restricted equity or any other equity-based compensation or equity-based incentive plan of the Company, (iv) non-cash impairment of goodwill and other long-term intangible assets, (v) unrealized non-cash losses (gains) under swap or similar contracts, (vi) unrealized noncash losses (gains) due to fluctuations in currency values, or (vii) non-cash losses (gains) resulting from any impairment of assets, in each case, for the EBITDA Earnout Period, determined on a consolidated basis in accordance with GAAP.

“A&R Registration Rights Agreement” means the Amended and Restated Registration Rights Agreement into by and among the Company, the Sponsor Holders, and certain other Company equityholders at Closing.

“AMR Report” means the U.S. Corporate Event Market by Event Type (Conference/Seminar, Trade Shows/Exhibitions, Incentive Programs, Company Meetings, and Others), and Industry (Banking and Financial Sector, Information Technology, Real Estate and Infrastructure, Automotive, Insurance, and Others): Global Opportunity Analysis and Industry Forecast 2021-2030 report prepared by Allied Market Research.

“Banyan” means Banyan Acquisition Corporation, a Delaware corporation, prior to the consummation of the Business Combination.

“Banyan Class A Common Stock” means the Class A common stock, par value $0.0001 per share, of Banyan, outstanding prior to the consummation of the Business Combination.

“Banyan Class B Common Stock” means the Class B common stock, par value $0.0001 per share, of Banyan, outstanding prior to the consummation of the Business Combination.

“Banyan Common Stock” means, collectively, the Banyan Class A Common Stock and the Banyan Class B Common Stock.

“Brookfield” means Norwalk Land Development, LLC and its affiliates.

“Business Combination” means the transactions consummated pursuant to the Business Combination Agreement, including the Merger.

“Business Combination Agreement” means the Business Combination Agreement, dated as of June 22, 2023, as amended and restated on September 26, 2023 and on November 22, 2023, by and among Banyan, Merger Sub and Pinstripes.

“Bylaws” mean the Amended and Restated Bylaws of the Company, in effect following the Business Combination.

“Change of Control” means any transaction or series of transactions (a) constituting a merger, consolidation, reorganization or other business combination or equity or similar investment, however effected, following which either (i) the members of the board of directors of the Company immediately prior to such merger, consolidation, reorganization or other business combination or equity or similar investment do not constitute at least a majority of

the board of directors of the company surviving the combination or, if the surviving company is a subsidiary, the ultimate parent thereof or (ii) the voting securities of the Company immediately prior to such merger, consolidation, reorganization or other business combination or equity or similar investment do not continue to represent or are not converted into fifty percent or more of the combined voting power of the then outstanding voting securities of the person resulting from such combination or, if the surviving company is a subsidiary, the ultimate parent thereof; or (b) the result of which is a sale of fifty percent or more of the assets of the Company to any person.

“Charter” means the Second Amended and Restated Certificate of Incorporation of the Company.

“Closing” means the closing of the Business Combination.

“Closing Date” means December 29, 2023.

“Code” means the Internal Revenue Code of 1986, as amended.

“Consolidated Net Income” means, for the EBITDA Earnout Period, the consolidated net income (or loss) of the Company determined on a consolidated basis in accordance with GAAP. For the avoidance of doubt, the revenue recognition policies and practices utilized by Pinstripes as of the date of the Second A&R Business Combination Agreement shall be utilized for purposes of determining Consolidated Net Income.

“DGCL” means the Delaware General Corporation Law, as amended.

“Director Designation Agreement” means the director designation agreement dated as of the Closing Date, by and between the Company and Dale Schwartz.

"Earnout Shares” means the 2,500,000 shares designated as Pinstripes Holdings Series B-1 Common Stock and 2,500,000 shares designated as Pinstripes Holdings Series B-2 Common Stock, which shares are subject to the vesting and forfeiture conditions and restrictions on transfer set forth in the Charter.

“Earnout Period” means the period commencing five months after the Closing Date and ending on the fifth anniversary of the Closing Date.

“EBITDA Earnout Period” means the period starting on January 8, 2024 and ending on January 5, 2025.

“EBITDA Earnout Shares” means the 4,000,000 shares designated as Pinstripes Holdings Series B-3 Common Stock, which shares are subject to the vesting and forfeiture conditions on transfer set forth in the Charter.

“Effective Time” means the effective time of the Merger.

“ESPP” means the Pinstripes Holdings, Inc. 2023 Employee Stock Purchase Plan.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“Full-Service Restaurants: Global Strategic Business Report” means the Global Full-Service Restaurants market trends (2022 – 2030) report prepared by Global Industry Analysts Inc.

“GAAP” means U.S. generally accepted accounting principles.

“HBC US Holdings” means Hudson’s Bay Company and its affiliates.

“IAAPA Report” means the 2019 to 2023 Global Theme and Amusement Park Outlook Report prepared by the International Association of Amusement Parks Attractions.

“IBISWorld Weddings Report” means the Wedding Services in the US industry trends (2018 – 2023) report prepared by IBISWorld.

“IPO” means Banyan’s initial public offering of its units, common stock and warrants pursuant to a registration statement on Form S-1 declared effective by the SEC on January 19, 2022 (SEC File Nos. 333-258599 and 333-262248).

“IPO Letter Agreement” means the letter agreement, dated January 19, 2022, by and among Banyan, the Sponsor and other parties thereto.

“IPO Underwriters” means BTIG, LLC and I-Bankers Securities, Inc.

“Lockup Agreement” means the lockup agreement, dated June 22, 2023, and entered into concurrently with the execution and delivery of the Business Combination Agreement, by and among Banyan, Pinstripes and certain security holders of Pinstripes.

“Macerich” means Macerich HHF Broadway Plaza LLC and its affiliates.

“Merger” means the merger of Merger Sub with and into Pinstripes, with Pinstripes being the surviving entity and continuing as a direct, wholly owned subsidiary of Pinstripes Holdings.

“Merger Sub” means Panther Merger Sub Inc., a Delaware corporation and direct, wholly-owned subsidiary of Banyan.

“Middleton Series I Investors” means, collectively, Middleton Pinstripes Investor LLC, a Delaware limited liability company, and Middleton Pinstripes Investor SBS LLC, a Delaware limited liability company. The Middleton Series I Investors are affiliates of Middleton Partners, an investment firm of which Keith Jaffee, who was Banyan’s Chief Executive Officer, is the Chairman.

“NYSE” means the New York Stock Exchange.

“Oaktree Warrants” means the warrants issued by the Company to Oaktree Capital Management, L.P., in connection with the closing of the Business Combination and the Oaktree Tranche 1 Loan.

“Oaktree Loan Agreement” means the loan agreement, dated as of December 29, 2023, by and among Pinstripes, Pinstripes Holdings, Oaktree Fund Administration, LLC, as agent and the lenders party thereto.

“Oaktree Tranche 1 Loan” means the $50.0 million loan pursuant to the Oaktree Loan Agreement.

“O’Connor/LaSalle” means LaSalle Investment Management and its affiliates.

“Pinstripes” means Pinstripes, Inc., a Delaware corporation.

“Pinstripes Common Stock” means the Common Stock, par value $0.01 per share, of Pinstripes outstanding prior to the Business Combination.

“Pinstripes Convertible Notes” means (a) the Convertible Note, dated June 4, 2021, by and between Pinstripes and Fashion Square Eco LP (as amended), and (b) the Convertible Note, dated June 4, 2021, by and between Pinstripes and URW US Services, Inc. (as amended) outstanding prior to the Business Combination.

“Pinstripes Holdings” refers to Banyan following the Closing of the Business Combination, including its name change from Banyan to “Pinstripes Holdings, Inc.”

“Pinstripes Holdings Board” means the board of directors of Pinstripes Holdings subsequent to the completion of the Business Combination.

“Pinstripes Holdings Common Stock” means Pinstripes Holdings Class A Common Stock and Pinstripes Holdings Class B Common Stock, collectively.

“Pinstripes Holdings Class A Common Stock” means Pinstripes Holdings’ Class A common stock, par value $0.0001 per share.

“Pinstripes Holdings Class B Common Stock” means the Pinstripes Holdings Series B-1 Common Stock, the Pinstripes Holdings Series B-2 Common Stock and the Pinstripes Holdings Series B-3 Common Stock.

“Pinstripes Holdings Series B-1 Common Stock” means Pinstripes Holding’s Series B-1 common stock, par value $0.0001 per share, which are subject to vesting and forfeiture conditions set forth in the Charter.

“Pinstripes Holdings Series B-2 Common Stock” means Pinstripes Holding’s Series B-2 common stock, par value $0.0001 per share, which are subject to vesting and forfeiture conditions set forth in the Charter.

“Pinstripes Holdings Series B-3 Common Stock” means Pinstripes Holdings’ Series B-3 common stock, par value $0.0001 per share, which are subject to vesting and forfeiture conditions set forth in the Charter.

“Pinstripes Option” means each option to purchase Pinstripes Common Stock outstanding prior to the Business Combination.

“Pinstripes Preferred Stock” means, collectively, shares of preferred stock, par value $0.01 per share, of Pinstripes designated as “Series A Preferred Stock,” “Series B Preferred Stock,” “Series C Preferred Stock,” “Series D-1 Preferred Stock,” “Series D-2 Preferred Stock,” “Series E Preferred Stock,” “Series F Convertible Preferred Stock,” “Series G Convertible Preferred Stock,” “Series H Convertible Preferred Stock” and “Series I Convertible Preferred Stock” authorized pursuant to the Pinstripes Charter and outstanding prior to the Business Combination.

“Pinstripes Stockholders” means, collectively, the holders of Pinstripes Common Stock and Pinstripes Preferred Stock immediately prior to the consummation of the Business Combination.

“Private Placement Warrants” means the warrants issued to the Sponsor and the IPO Underwriters in a private placement simultaneously with the closing of the IPO.

“Public Warrants” means the warrants sold as part of the units in the IPO (whether they were purchased in the IPO or thereafter in the open market).

“Public Shares” means Banyan Class A Common Stock sold in the IPO (whether they were purchased in the IPO or thereafter in the open market).

“PWC Report” means the Global Entertainment & Media Outlook: 2019 – 2023 prepared by Pricewaterhouse Coopers.

“SEC” means the United States Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“Security Holder Support Agreement” means the security holder support agreement, dated as of June 22, 2023, and entered into concurrently with the execution and delivery of the Business Combination Agreement, by and among Banyan, Pinstripes and certain security holders of Pinstripes.

“Series I Amount” means the aggregate $21,266,200 investment from the Middleton Series I Investors in Pinstripes, Inc.

“Series I Financing” means the aggregate $21,266,200 investment from the Middleton Series I Investors in Pinstripes, Inc. in exchange for an aggregate of 850,648 shares of Pinstripes’ Series I Convertible Preferred Stock.

“Silverview Warrants” means, collectively, that certain (a) Warrant No. 25, exercisable into up to 258,303 shares of Pinstripes Common Stock, issued to Silverview Special Situations Lending Corporate Warrants LP on March 7, 2023, and (b) Warrant No. 26, exercisable into up to 8,697 shares of Pinstripes Common Stock, issued to Spearhead Insurance Solutions IDF, LLC — Series SCL on March 7, 2023.

“Simon Property Group” means Simon Property Group, L.P.

“Special Meeting” refers to the special meeting of Banyan stockholders where holders of Banyan Common Stock were asked to, among other things, approve the Business Combination and adopt the Business Combination Agreement.

“Sponsor” means Banyan Acquisition Sponsor LLC, a Delaware limited liability company.

“Sponsor Holders” means, collectively, the Sponsor, George Courtot, Bruce Lubin, Otis Carter, Kimberley Annette Rimsza, Matt Jaffee and Brett Biggs.

“Sponsor Letter Agreement” means the letter agreement, dated June 22, 2023, as amended on December 22, 2023.

“Subsidiary” means, with respect to a Person, any corporation or other organization (including a limited liability company or a partnership), whether incorporated or unincorporated, of which such Person directly or indirectly owns or controls a majority of the securities or other interests having by their terms ordinary voting power to elect a majority of the board of directors or others performing similar functions with respect to such corporation or other organization or any organization of which such Person or any of its direct or indirect subsidiaries is, directly or indirectly, a general partner or managing member.

“Oaktree Tranche 1 Loan” means the $50.0 million loan pursuant to the Oaktree Loan Agreement.

“Transaction” means the transactions contemplated by the Business Combination Agreement.

“Transaction Agreements” means the Business Combination Agreement, the Sponsor Letter Agreement, the Security Holder Support Agreement, the Lockup Agreement, the Director Designation Agreement, the A&R Registration Rights Agreement, the Charter, the Bylaws and all the agreements, documents, instruments and certificates entered into in connection therewith and any and all exhibits and schedules thereto.

“Transfer Agent” means Continental Stock Transfer & Trust Company.

“Underwriters” means the underwriters of the IPO.

“Vesting Shares” means the 1,830,000 of the shares of Banyan Common Stock held by the Sponsor Holders that are subject to vesting and forfeiture conditions, of which 915,000 shares are designated as Pinstripes Holdings Series B-1 Common Stock and 915,000 shares are designated as Pinstripes Holdings Series B-2 Common Stock upon the Closing.

“Warrant Agreement” means the Warrant Agreement, dated January 19, 2022, by and between Banyan and Continental Stock Transfer & Trust Company, as warrant agent.

“Westfield” means Westland Garden State Plaza Limited Partnership and Westfield Topanga Owner LLC and their affiliates.

TRADEMARKS

This prospectus includes the trademarks of Pinstripes Holdings such as “Pinstripes,” which are protected under applicable intellectual property laws and are the property of Pinstripes Holdings or its subsidiaries. This prospectus also contains trademarks, service marks, trade names and copyrights of other entities, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names. The Company does not intend its use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of it by, any other companies.

MARKET AND INDUSTRY INFORMATION

This prospectus includes market and industry data and forecasts that the Company has derived from publicly available information, various industry publications, other published industry sources, the Company’s internal data and estimates and assumptions made by the Company based on such sources. Industry publications and other published industry sources generally indicate that the information contained therein was obtained from sources believed to be reliable.

Although the Company believes that these third-party sources are reliable, neither the Company nor any of its affiliates or representatives guarantees the accuracy or completeness of this information, and neither the Company nor any of its affiliates or representatives has independently verified this information. Some market data and statistical information are also based on the Company’s good faith estimates, which are derived from the Company’s management’s knowledge of its industry and such independent sources referred to above. Certain market, ranking and industry data included elsewhere in this prospectus, including the size of the Company’s total addressable market, are based on estimates of the Company’s management. These estimates have been derived from the Company’s management’s knowledge and experience in the markets in which it operates, as well as information obtained from surveys, reports by market research firms, the Company’s customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which the Company operates and have not been verified by independent sources. References herein to the Company being a leader in a market or product category refer to the Company’s belief that it is a best-in-class experiential dining and entertainment brand, unless the context otherwise requires.

The Company’s internal data and estimates are based upon information obtained from trade and business organizations and other contacts in the markets in which the Company operates and the Company’s management’s understanding of industry conditions. Although the Company believes that such information is reliable, the Company has not had this information verified by any independent sources. The estimates and market and industry information provided in this prospectus are subject to change based on various factors, including those described in the section entitled “Risk Factors — Risks Related to Our Business and Operations” and elsewhere in this prospectus.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this prospectus and the documents incorporated by reference herein are “forward-looking statements” that reflect our current views with respect to future events and financial performance, business strategies, expectations for our business and any other statements of a future or forward-looking nature, constitute “forward-looking statements” for the purposes of federal securities laws. These forward-looking statements include statements about the anticipated benefits of the Business Combination and our financial conditions, results of operations, earnings outlook and prospects. Forward-looking statements appear in a number of places in this prospectus including, without limitation, in the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Pinstripes Holdings” and “Information About Pinstripes Holdings”.

In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements contained in this prospectus are based on our current expectations and beliefs concerning future developments and their potential effects on us. You should not place undue reliance on these forward-looking statements in deciding how to grant your proxy or instruct how your vote should be cast or vote your shares on the proposals set forth in this prospectus. We cannot assure you that future developments affecting the Company will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Some factors that could cause actual results to differ include, but are not limited to:

•our ability to recognize the anticipated benefits of the Business Combination;

•risks related to the uncertainty of the projected financial information with respect to the Company;

•the risks related to our current growth strategy and our ability to successfully open and integrate new locations;

•risks related to our substantial indebtedness;

•the risks related to the capital intensive nature of our business, our ability to attract new customers and retain existing customers and the impact of the COVID-19 pandemic, including the resulting labor shortage and inflation, on us;

•our success in retaining or recruiting, or changes required in our officers, key employees or directors in operating as a public company;

•our ability to maintain the listing of Pinstripes Holdings Class A Common Stock and Warrants on the NYSE;

•geopolitical risk and changes in applicable laws or regulations;

•the possibility that we may be adversely affected by other economic, business, and/or competitive factors;

•our estimates of expenses and profitability;

•operational risk;

•the possibility that the COVID-19 pandemic, or another major disease, disrupt our business;

•litigation and regulatory enforcement risks, including the diversion of management time and attention and the additional costs and demands on our resources; and

•other risks and uncertainties indicated in this prospectus, including those under the heading “Risk Factors”, and other filings that have been made or will be made with the SEC by the Company, as applicable.

The foregoing list of factors is not exhaustive and additional factors may cause actual results to differ materially from current expectations. We caution you that the foregoing list may not contain all of the forward-looking statements made in this prospectus. Should one or more of these risks or uncertainties materialize, or should any of the assumptions made by us prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. In addition, there may be additional risks that we presently does not know or that we currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements.

All subsequent written and oral forward-looking statements concerning matters addressed in this prospectus and attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this prospectus. We do not give any assurance that we will achieve our expectations. Investors and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which only speak as of the date made, are not a guarantee of future performance and are subject to a number of uncertainties, risks, assumptions and other factors, many of which are outside of our control. Except to the extent required by applicable law or regulation, we expressly disclaim any obligation and undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events. Stockholders should be aware that the occurrence of the events described in the section titled “Risk Factors” and elsewhere in this prospectus may adversely affect the Company.

PROSPECTUS SUMMARY

This summary highlights selected information from this prospectus and does not contain all of the information that is important to you. You should read this entire document and the other documents to which we refer before you decide to invest in our securities. Unless the context indicates otherwise, references in this prospectus to the “Company,” “Pinstripes Holdings,” “we,” “us,” “our” and similar terms refer to Pinstripes Holdings, Inc. (f/k/a Banyan Acquisition Corporation) and its consolidated subsidiaries after the consummation of the Business Combination. References to “Banyan” refer to the predecessor company prior to the consummation of the Business Combination.

About Pinstripes Holdings

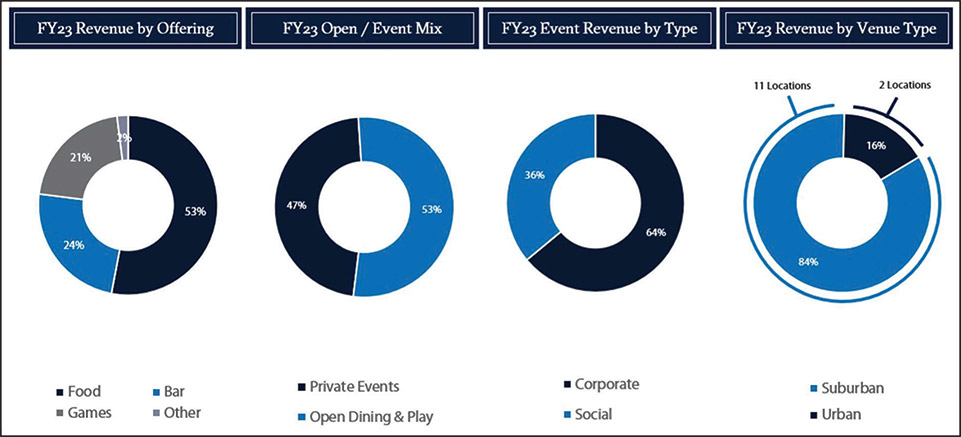

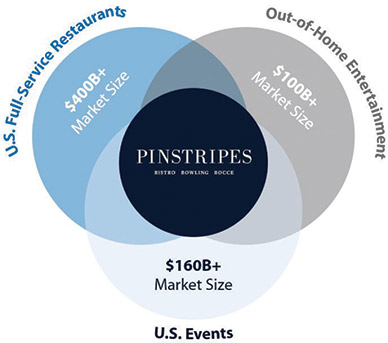

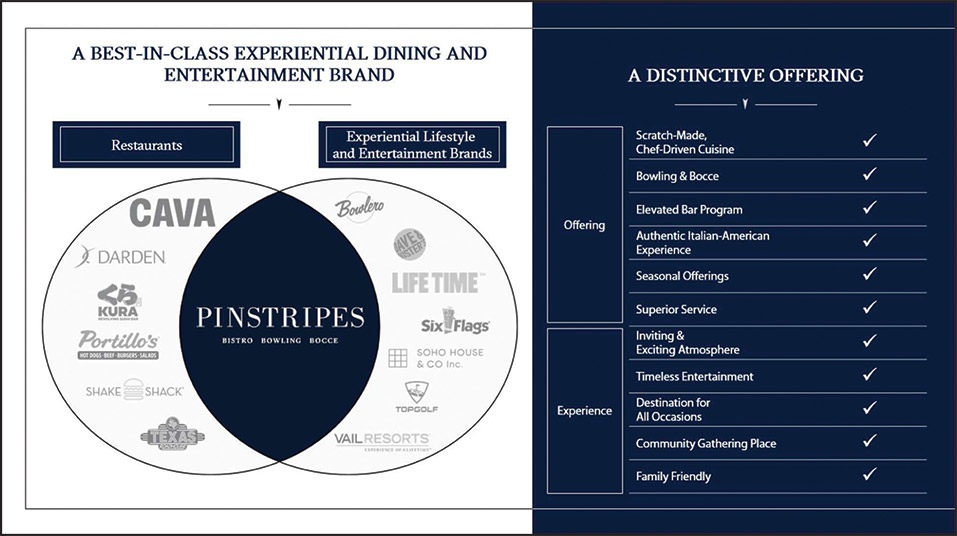

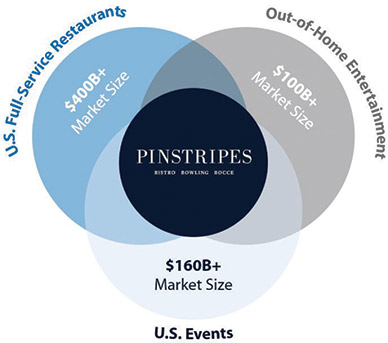

Pinstripes Holdings is an experiential dining and entertainment concept combining exceptional Italian-American cuisine with bowling, bocce, and private events. Our large-format community venues offer a winning combination of sophisticated fun for the consumer longing for human connectedness across generations, and we deliver a broad range of experiences, from a 300-person wedding in one of our many event spaces, to an intimate date night for two in one of our dining rooms, to a birthday party on our bowling lanes or bocce courts. This ability to offer curated and engaging experiences across a broad range of occasions enables us to generate revenue from numerous sources, including dining, bowling and bocce and private events and off-site events and catering.

As of January 5, 2024, we owned and operated 15 restaurants in nine states and Washington D.C., and employed approximately 2,000 PinMembers. We are highly disciplined in our site selection process, and we design and construct large-format locations that are each 26,000 to 38,000 square feet of interior space, plus additional outdoor patio space that includes outdoor dining, bocce courts, fire-pits and decorative fountains. Each location can host over 900 guests at a time, with dining capacity of approximately 300 guests, bar capacity of 75 guests, 11 to 20 bowling lanes, 6 to 12 indoor/outdoor bocce courts and multiple private event spaces that can accommodate groups of 20 to 1,000 guests. Our locations generated average unit volumes (“AUV”), as further defined below, of $8.6 million for the fiscal year ended April 30, 2023, demonstrating the scale of our operating model and ability to tailor our space in bespoke ways. Our overall revenue growth over the past few years has primarily been driven by increases in same store sales and is expected in the future to be primarily driven by revenues from new location openings and increases in same store sales.

Recent Developments

Business Combination

On the Closing Date we consummated the previously announced Business Combination pursuant to the Business Combination Agreement. On the Closing Date, Merger Sub merged with and into Pinstripes (the “Merger”), with Pinstripes surviving the Merger as a wholly-owned subsidiary of Banyan.

In connection with the Business Combination, among other things, (i) Banyan was renamed “Pinstripes Holdings, Inc.,” (ii) each of the then-issued and outstanding shares of Banyan Class A Common Stock, other than the Vesting Shares, continued as a share of Pinstripes Holdings Class A Common Stock, (iii) each of the then-issued and outstanding shares of Banyan Class B Common Stock, other than the Vesting Shares, converted, on a one-for-one basis, into a share of Pinstripes Holdings Class A Common Stock, (iv) 915,000 of the Vesting Shares held by the Sponsor Holders converted, on a one-for-one basis, into shares of Pinstripes Holdings Series B-1 Common Stock and 915,000 of the Vesting Shares converted, on a one-for-one basis, into shares of Pinstripes Holdings Series B-2 Common Stock, (v) each then-issued and outstanding whole warrant exercisable for one share of Banyan Class A Common Stock become exercisable for one share of Pinstripes Holdings Class A Common Stock at an exercise price of $11.50 per share on the terms and conditions set forth in the Warrant Agreement, and (vi) the Sponsor Holders forfeited an aggregate of 1,018,750 shares of Banyan Common Stock, which were re-issued as Pinstripes Holdings Class A Common Stock to certain investors in Banyan who agreed not to redeem their respective shares of Banyan Class A Common Stock in connection with Banyan’s extension meeting held on April 21, 2023 and also forfeited an additional aggregate of 1,242,975 shares of Banyan Common Stock as discussed further below. Additionally, the public units of Banyan automatically separated into the component securities upon consummation of the Business Combination and, as a result, no longer traded as a separate security.

Immediately prior to the effective time of the Business Combination (the “Effective Time”), each outstanding share of Pinstripes preferred stock (other than the Series I Convertible Preferred Stock, as defined below) automatically converted into shares of Pinstripes common stock, par value $0.01 per share (“Pinstripes Common Stock”), in accordance with the governing documents of Pinstripes, and each warrant and convertible note of Pinstripes was automatically exercised for, or converted into, shares of Pinstripes Common Stock. At the Effective Time, each share of Pinstripes Common Stock (including as a result of the warrant exercises and convertible note conversions specified above, but excluding any dissenting shares and cancelled treasury stock and shares of Pinstripes Common Stock issued in connection with the conversion of the Series I Convertible Preferred Stock (as defined below) of Pinstripes), was automatically cancelled and extinguished and converted into the right to receive shares of Pinstripes Holdings Class A Common Stock, determined in accordance with the Business Combination Agreement, at an exchange ratio of approximately 1.85 shares of Class A Common Stock for each share of Pinstripes Common Stock (the “Exchange Ratio”). In addition, the holders of the outstanding shares of Pinstripes Common Stock immediately prior to the closing of the Business Combination (excluding holders of common stock issued in connection with the conversion of the Series I Convertible Preferred Stock of Pinstripes) received an aggregate of 2,500,000 shares of Series B-1 Common Stock, 2,500,000 shares of Series B-2 Common Stock and 4,000,000 shares of Series B-3 Common Stock, in each case, pro rata based upon each such holder’s entitlement to consideration in connection with the Merger. The Pinstripes Holdings Class B Common Stock is subject to the vesting and forfeiture conditions and restrictions on transfer as implemented in the Charter and as further described in “Description of Securities.” In addition, the Sponsor Holders forfeited 1,242,975 shares of Banyan Common Stock, which shares were re-issued to holders of shares of Pinstripes Common Stock outstanding immediately prior to the Closing as Pinstripes Holdings Class A Common Stock, pro rata based upon each such holder’s entitlement to consideration in connection with the Merger. Further, each option (whether vested or unvested) to purchase shares of Pinstripes Common Stock that was outstanding as of immediately prior to the Effective Time was converted into an option to purchase a number of Pinstripes Holdings Class A Common Stock based on the Exchange Ratio.

Each outstanding share of Pinstripes Common Stock received upon conversion of Series I Convertible Preferred Stock of Pinstripes (the “Series I Convertible Preferred Stock”), including accrued dividends thereon, was automatically cancelled and extinguished and converted into the right to receive shares of Pinstripes Holdings Class A Common Stock determined in accordance with the Business Combination Agreement, based on an exchange ratio of approximately 2.6 shares of Pinstripes Holdings Class A Common Stock for each share of Pinstripes Common Stock. In addition, the Sponsor Holders forfeited 507,025 shares of Banyan Common Stock, which shares were re-issued to holders of the Series I Convertible Preferred Stock as Pinstripes Holdings Class A Common Stock, pro rata based upon each such holder’s entitlement to consideration in connection with the Merger.

Also on December 29, 2023, immediately following consummation of the Business Combination, Pinstripes Holdings and the registrant entered into the Oaktree Loan Agreement with Oaktree Fund Administration, LLC, as agent (the “Agent”) and the lenders party thereto (the “Lenders), providing for the Oaktree Tranche 1 Loan. In connection with the closing of the Oaktree Tranche 1 Loan, the Lenders were granted the Oaktree Warrants. Also on December 29, 2023, immediately following the consummation of the Business Combination, Pinstripes borrowed an additional $5.0 million under the Loan Agreement, dated as of March 7, 2023 by and among Pinstripes Holdings, Inc., Silverview Credit Partners LP, and other institutional investors from time to time (as amended, supplemented, amended and restated or otherwise modified from time to time, the “Silverview Loan Agreement”).

The Pinstripes Holdings Class A Common Stock and Public Warrants commenced trading on the New York Stock Exchange (the “NYSE”) under the symbols “PNST” and “PNST WS,” respectively, on January 2, 2024.

The Business Combination has been accounted for as a reverse recapitalization in accordance with GAAP. Under this method of accounting, Banyan was treated as the acquired company and Pinstripes was treated as the acquirer for financial reporting purposes. Accordingly, for accounting purposes, the financial statements of Pinstripes Holdings represent a continuation of the financial statements of Pinstripes, with the Business Combination treated as the equivalent of Pinstripes issuing stock for the historical net assets of Banyan, accompanied by a recapitalization. The net assets of Banyan were stated at fair value, which approximated historical cost, with no goodwill or other intangible assets recorded. Operations prior to the Business Combination are those of Pinstripes.

The rights of holders of Pinstripes Holdings Class A Common Stock and Pinstripes Holdings Class B Common Stock are governed by our Charter, our Bylaws, and the DGCL.

Corporate Information

Pinstripes was founded in 2007. Banyan was incorporated on March 10, 2021 for the purpose of consummating a business combination. Banyan completed its initial public offering of its units, common stock and warrants pursuant to a registration statement on Form S-1 declared effective by the SEC on January 19, 2022 (SEC File Nos. 333-258599 and 333-262248).

Pinstripes Holdings, Inc. is a Delaware corporation. Our principal executive offices are located at 1150 Willow Road Northbrook, IL 60062 and our telephone number at that address is (847) 480-2323. Our website is located at www.pinstripes.com. We do not incorporate the information contained on, or accessible through, our corporate website into this prospectus, and you should not consider it part of this prospectus. We have included our website address only as an inactive textual reference and do not intend it to be an active link to our website.

Emerging Growth Company

The Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) contains provisions that, among other things, relax certain reporting requirements for qualifying public companies for up to five years or until we are no longer an emerging growth company. We qualify as an “emerging growth company” and under the JOBS Act are allowed to comply with new or revised accounting pronouncements based on the effective date for private (not publicly traded) companies. We have elected not to opt out of such extended transition period, and as a result, we may not comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. As a result, the consolidated financial statements may not be comparable to those of companies that comply with new or revised accounting pronouncements as of public company effective dates.

We will remain an emerging growth company until the earlier of (1) the last day of the first fiscal year (a) following the fifth anniversary of the completion of Banyan’s IPO, (b) in which we have total annual gross revenue of at least $1.235 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of the Pinstripes Holdings Class A Common Stock that is held by non-affiliates equals or exceeds $700 million as of the end of that year’s second fiscal quarter, and (2) the date on which we have issued more than $1.00 billion in non-convertible debt securities during the prior three-year period.

THE OFFERING

| | | | | | | | |

Issuer | | Pinstripes Holdings, Inc. (f/k/a Banyan Acquisition Corporation). |

| | |

| Issuance of Pinstripes Class A Common Stock |

| | |

| Shares of Pinstripes Holdings Class A Common Stock offered | | Up to (i) 12,075,000 shares of Pinstripes Holdings Class A Common Stock issuable upon exercise of Public Warrants and (ii) 11,910,000 shares of Pinstripes Class A Common Stock issuable upon exercise of Private Placement Warrants. |

| | |

| Shares of Pinstripes Holdings Class A Common Stock outstanding prior to exercise of Warrants | | 39,918,036 shares as of the close of business on January 22, 2024. |

| | |

| Shares of Pinstripes Holdings Class A Common Stock outstanding assuming exercise of all Warrants | | 63,903,036 shares (based on total shares outstanding as of the close of business on January 22, 2024). |

| | |

| Exercise price of Warrants | | $11.50 per share, subject to adjustment as described herein. |

| | |

| Use of proceeds | | We will receive any proceeds from the exercise of the Warrants for cash, but not from the sale of the shares of Common Stock issuable upon such exercise. We expect to use the net proceeds from the exercise of the Warrants, if any, to facilitate the further growth of our business, including through the development of additional locations, and for general corporate purposes. We believe the likelihood that Warrant holders will exercise their Warrants, and therefore the amount of cash proceeds that we would receive, is dependent upon the trading price of the Pinstripes Holdings Class A Common Stock. As of the date of this prospectus, the trading price of the Pinstripes Holdings Class A Common Stock is substantially less than the $11.50 per share exercise price of the Warrants. For so long as the Warrants are “out of the money,” we believe holders of the Warrants will be unlikely to exercise their Warrants. There can be no assurance that the Warrants will be “in the money” prior to expiring, and thus we may never receive any proceeds from the exercise of such Warrants. Further, to the extent that the Warrants are exercised but on a “cashless basis,” the amount of cash we would receive from the exercise of Warrants, if any, would decrease. The Private Placement Warrants are exercisable on a cashless basis at any time and the Public Warrants are exercisable on a cashless basis in certain limited circumstances. See the section titled “Use of Proceeds.” |

| | |

| Risk Factors | | See “Risk Factors” and the other information included in this prospectus for a discussion of factors you should consider before investing in our securities. |

| | |

| NYSE Ticker Symbols | | “PNST” and “PNST WS,” for Pinstripes Holdings Class A Common Stock and the Warrants, respectively. |

SUMMARY RISK FACTORS

Summary of Risk Factors

You should consider all the information contained in this prospectus in deciding how to vote for the proposals presented in this prospectus. These risks are discussed more fully in the section entitled “Risk Factors” following this summary. If any of these risks actually occur, our business, financial condition or results of operations would likely be materially adversely affected. These risks include, but are not limited to, the following:

•the experiential dining and entertainment market in which we operate is highly competitive;

•our long-term success is highly dependent on our ability to successfully identify and secure appropriate locations and timely develop and expand our operations in existing and new markets;

•disruptions or delays we may encounter in the expansion and construction of our facilities;

•we may not be able to renew real property leases on favorable terms, or at all, and our landlords may not meet their financial obligations to us, either of which may require us to close a location or relocate;

•our business may be adversely impacted by changes in consumer discretionary spending and general economic conditions in our markets or declines in the popularity of bowling and bocce;

•shortages or interruptions in the supply or delivery of food products;

•increased labor costs or shortages;

•the COVID-19 pandemic has disrupted, and future pandemics or natural disasters may disrupt, our business, results of operations and financial condition;

•we may not achieve our target development goals, aggressive development could cannibalize existing sales and new locations may not be successful or profitable;

•food safety and food-borne illness concerns may have an adverse effect on our business;

•damage to our reputation could negatively impact our business, financial condition and results of operations;

•our dependence on a small number of suppliers for the majority of our food ingredients;

•we depend on key executive management;

•our management has identified material weaknesses in its internal control over financial reporting and may identify additional material weaknesses in the future;

•we are subject to many federal, state and local laws with which compliance is both costly and complex;

•a liquid and established trading market may not develop for the Pinstripes Holdings Class A Common Stock;

•pursuant to the Director Designation Agreement, Dale Schwartz, our Chairman and Chief Executive Officer, has the right to designate a specified number of directors (initially four of seven) to the Pinstripes Holdings Board and will retain certain other governance rights so long as he continues to beneficially own a certain number of shares of Pinstripes Holdings Class A Common Stock;

•if we are unable to satisfy our obligations as a public company, we would face possible delisting, which would result in a limited public market for our securities;

•we have a substantial amount of indebtedness;

•the Company is an “emerging growth company” within the meaning of the Securities Act, and this could make our securities less attractive to investors;

•a portion of our total outstanding shares are restricted from immediate resale but may be sold into the market in the near future; and

•the Company’s business and operations could be negatively affected if it becomes subject to any securities litigation or stockholder activism.

You should carefully consider the risks described below, together with all of the other information included in this prospectus, before making an investment decision. The occurrence of one or more of the events or circumstances described in these risk factors, alone or in combination with other events or circumstances may have an adverse effect on our business, cash flows, financial condition and results of operations. You should also carefully consider the following risk factors in addition to the other information included in this prospectus, including matters addressed in the section entitled “Cautionary Note Regarding Forward-Looking Statements.” We may face additional risks and uncertainties that are not presently known to them, or that they currently deem immaterial, which may also impair their respective businesses or financial condition.

RISK FACTORS

You should carefully consider the risks described below, together with all of the other information included in this prospectus, before making an investment decision. Unless the context otherwise requires, any reference in the below subsection of this prospectus to the “Company,” “we,” “us,” “our” and “Pinstripes” refers to Pinstripes, Inc. and its consolidated subsidiaries prior to the consummation of the Business Combination and to Pinstripes Holdings following the consummation of the Business Combination. The occurrence of one or more of the events or circumstances described in these risk factors, alone or in combination with other events or circumstances, may adversely affect the ability of Pinstripes Holdings to realize the anticipated benefits of the Business Combination, and may have an adverse effect on the business, cash flows, financial condition and results of operations of Pinstripes Holdings. You should also carefully consider the following risk factors in addition to the other information included in this prospectus, including matters addressed in the section entitled “Cautionary Note Regarding Forward-Looking Statements.” We may face additional risks and uncertainties that are not presently known to us, or that we currently deem immaterial, which may also impair our businesses or financial condition.

Risks Related to Our Business and Operations

Our market is highly competitive. We may not be able to compete favorably in the highly competitive out-of-home and home-based entertainment and dining markets, which could adversely affect our business, results of operations and financial condition.

The experiential dining and entertainment market in which we operate is highly competitive. A substantial number of national and regional chains and independently owned restaurants and entertainment providers compete with us for customers, locations and qualified management and other staff. We also compete for corporate events, social events and other engagements, such as weddings and birthday parties, at our locations. Competitors include (i) providers of out-of-home entertainment, including other dining and entertainment businesses; (ii) other localized attraction facilities, including movie theaters, sporting events, bowling alleys, pickleball courts and nightclubs; and (iii) other private events venues, such as hotels and banquet facilities. Many of the entities operating these businesses are larger and have significantly greater financial resources, a greater number of locations, have been in business longer, have greater name recognition and are better established in the markets where our locations are situated or are planned to be situated. As a result, they may be able to invest greater resources than we can in attracting customers and succeed in attracting customers who would otherwise come to our locations. We also face competition from local establishments that offer entertainment experiences similar to ours and restaurants that are highly competitive with respect to price, quality of service, location, ambience and type and quality of food. Any efforts we may undertake to expand our entertainment offerings in order to increase our competitiveness in the out-of-home entertainment market may not be successful. We also face competition from increasingly sophisticated home-based forms of entertainment, such as internet and video gaming, home movie delivery and home food delivery. Our failure to compete favorably in these competitive markets could adversely affect our business, results of operations and financial condition.

Our long-term growth is dependent on our ability to successfully identify and secure appropriate locations and timely develop and expand our operations in existing and new markets.

One of the key means of achieving our growth strategies will be through opening and operating new locations in the United States on a profitable basis for the foreseeable future. As of January 22, 2024, we had 15 existing operational locations, and we currently plan to open four new locations in the remainder of fiscal 2024. To accomplish these goals, we must identify appropriate markets where we can enter or expand, taking into account numerous factors such as the location of our current locations, demographics, traffic patterns and information gathered from our experience. We may not be able to open our planned new locations within budget or on a timely basis, if at all, given the uncertainty of these factors, which could adversely affect our business, financial condition and results of operations. Additionally, as we operate more locations, our rate of expansion relative to the size of our location base will eventually decline.

The number and timing of new locations opened during any given period may be negatively impacted by a number of factors including, without limitation:

•the identification and availability of attractive sites for new locations and the ability to negotiate suitable lease terms;

•recruitment and training of qualified personnel in local markets;

•our ability to obtain all required governmental permits, including zonal approvals, on a timely basis;

•our ability to control construction and development costs of new locations;

•competition in new markets, including competition for appropriate sites;

•failure of the landlords and real estate developers to timely deliver real estate to us;

•the proximity of potential sites to an existing locations, and the impact of cannibalization on future growth; and

•the cost and availability of capital to fund construction costs and pre-opening expenses.

Further, we may not correctly analyze the suitability of a location or anticipate all of the challenges imposed by expanding our operations, and the lack of development and overall decrease in commercial real estate due to the current macroeconomic downturn may lead to increased costs for commercial real estate. In addition, as has happened when other experiential dining and entertainment concepts have tried to expand, we may find that our concept has limited appeal in new markets or we may experience a decline in the popularity of our concept in the markets in which we operate. If we don’t timely open new locations, including those under construction and scheduled to open in the remainder of fiscal year 2024, or if we are unable to otherwise expand in existing markets or profitably penetrate new markets, our ability to meet our growth expectations or otherwise increase our revenues and profitability may be materially harmed or we may face losses.

We may encounter disruptions or delays in the construction of our facilities, which may impair our ability to grow.

We are subject to several risks in connection with the construction of our facilities, including the availability and performance of engineers and contractors, suppliers, and consultants, the availability of funding and the receipt of required governmental approvals, licenses and permits, which could be delayed. We have previously experienced delays related to the opening of certain of our existing locations and it is possible we may experience similar delays in the future. As of January 22, 2024, we have four locations under construction and planned for opening through fiscal 2024. Any delay in the performance of any one or more of the contractors, suppliers, consultants, or other persons on whom we are dependent in connection with our construction activities, a delay in or failure to receive the required governmental approvals, licenses and permits in a timely manner or on reasonable terms, or a delay in or failure in connection with the completion and successful operation of the operational elements in connection with construction could delay and negatively affect our ability to meet our growth expectations or otherwise increase our revenues and profitability. In addition, certain of our construction contracts and leases contain co-tenancy provisions that may limit our ability to open newly constructed locations if construction related to our co-tenants’ facilities has not finished. Our forecasts currently anticipate higher revenues in the first and second years of operations for certain of our locations under construction compared to our historical first and second year revenues following the openings of our existing locations, due to the forecasted foot traffic we expect to have at such locations and the anticipation that the new locations will allow us to operate outdoors all year around.

There can be no assurance that current or future construction plans implemented by us will be successfully completed on time, within budget and without design defect, that the necessary personnel and equipment will be available in a timely manner or on reasonable terms to complete construction projects successfully, that we will be able to obtain all necessary governmental approvals, licenses and permits, or that the completion of the construction, the start-up costs and the ongoing operating costs will not be significantly higher than anticipated by us. Any of the foregoing factors could adversely impact our operations and financial condition.

Fixed rental payments account for a significant portion of our operating expenses, which increases our vulnerability to general adverse economic and industry conditions and could limit our operating and financial flexibility.

Payments under our operating leases account for a significant portion of our operating expenses. For example, total rental payments under operating leases were approximately $25.5 million, or 23% of our total revenues in fiscal 2023 and were $11.8 million, or 24% of our total revenues, in the first twenty-four weeks of fiscal 2024. In addition, as of January 17, 2024, we were a party to operating leases requiring future minimum lease payments of approximately $121.2 million in the aggregate through the next five years and approximately $128 million in the aggregate thereafter. We expect that we will lease any new locations we open under operating leases. Our substantial operating lease obligations could have significant negative consequences, including:

•increasing our vulnerability to general adverse economic and industry conditions;

•limiting our ability to obtain additional financing;

•requiring a substantial portion of our available cash to be applied to pay our rental obligations, thus reducing cash available for other purposes;

•limiting our flexibility in planning for or reacting to changes in our business or the industry in which we compete; and

•placing us at a disadvantage with respect to our competitors.

We depend on cash flow from operations to pay our lease obligations and to fulfill our other cash needs. If our business does not generate sufficient cash flow from operating activities and sufficient funds are not otherwise available to us from borrowings under bank loans or from other sources, we may not be able to service our operating lease obligations, grow our business, respond to competitive challenges or fund our other liquidity and capital needs.

We may not be able to renew real property leases on favorable terms, or at all, and our landlords may not meet their financial obligations to us, either of which may require us to close a location or relocate and could adversely affect our business, results of operations and financial condition.

All locations operated by us as of January 22, 2024 are operated on leased property. The leases typically provide for a base rent plus costs associated with maintenance and taxes and, in some instances, provide for the respective landlord to receive a percentage of the gross receipts above a certain threshold earned at the location governed by such lease. In the event we decide not to renew a lease at a specific location, prior written notice to the landlord is required pursuant to the timeframes prescribed in our various leases. A decision not to renew a lease for a location could be based on a number of factors, including an assessment of the area in which the location is situated and the nature and quality of nearby tenants. In addition, macroeconomic conditions, among other factors, may cause our landlords to be unable to obtain financing or remain in good standing under their existing financing arrangements, resulting in failures to pay required tenant improvement allowances or satisfy other lease covenants to us. We may choose not to renew, or may not be able to renew, certain of such existing leases, including if the capital investment then required to maintain the location is not justified by the return on the required investment. If we are not able to renew the leases at rents that allow such locations to remain profitable as their terms expire, the number of such locations may decrease, resulting in lower revenue from operations, or we may relocate a location (with the precise destination of such new location potentially being subject to restrictive covenants or non-compete provisions contained in certain leases), which could subject us to construction and other costs and risks, including, without limitation, the accelerated repayment of the outstanding balances of any applicable promissory notes or landlord-provided allowances and/or loans. In either case, our business, results of operations and financial condition could be adversely affected.

Increased food commodity and energy costs could decrease our location-level operating profit margins or cause us to limit or otherwise modify our menu, which could adversely affect our business, results of operations and financial condition.

Our profitability depends in part on our ability to anticipate and react to changes in the price and availability of food commodities. Prices may be affected due to market changes, increased competition, the general risk of inflation, shortages or interruptions in supply due to weather, disease or other conditions beyond our control, or other reasons. For example, since 2020, food and other commodity prices have been increasing at a rate higher than that of the recent historical inflation rate. Among other factors, COVID-19 and Russia’s invasion of Ukraine have caused significant supply chain disruptions, which have resulted in changes in the price or availability of certain food products. Other events could increase commodity prices or cause shortages that could affect the cost and quality of the items we buy or require us to further raise prices or limit our menu options. Additionally, the commodity markets will likely continue to increase over time if global warming trends continue and may also become volatile due to climate change and climate conditions, all of which are beyond our control and, in many instances, are extreme and unpredictable (such as more frequent and/or severe fires and hurricanes). Increases in commodity costs, combined with other more general economic and demographic conditions, could impact our pricing and negatively affect our location sales and location-level operating profit margins. From time to time, competitive conditions could limit our menu pricing flexibility. In addition, macroeconomic conditions could make additional menu price increases imprudent. There can be no assurance that future cost increases can be offset by increased menu prices or that increased menu prices will be fully absorbed by our customers without any resulting change to their visit frequencies or purchasing patterns. In addition, there can be no assurance that we will generate same location sales growth in an amount sufficient to offset inflationary or other cost pressures.

Our profitability also is adversely affected by increases in the price of utilities, such as natural gas, electric, and water, whether as a result of inflation, shortages or interruptions in supply, or otherwise. Our ability to respond to increased costs by increasing prices or by implementing alternative processes or products will depend on our ability to anticipate and react to such increases and other more general economic and demographic conditions, as well as the responses of our competitors and customers. All of these changes may be difficult to predict, and many of these risks beyond our control. Any resulting increased costs for food commodities or energy could adversely affect our business, results of operations and financial condition.

Changes in the cost of labor could harm our business.

Increases in wage and benefits costs, including as a result of increases in minimum wages and other governmental regulations affecting labor costs, may significantly increase our labor costs and operating expenses and make it more difficult to fully staff our restaurants. From time to time, legislative proposals are made to increase the minimum wage at the United States federal, state, and local levels, such as recent minimum wage increases in Cook County, Illinois and the City of Chicago, which came effective July 1, 2023, and California Assembly Bill No. 257, the Fast Food Accountability and Standards Recovery Act, which passed in September 2022 and which proposes to create a council to set, among other things, minimum wages and working condition standards in the broadly defined fast food industry. Other measures, such as the proposed New York State Assembly Bill No. A1710A, seek to phase out the usage of a subminimum wage for restaurant workers. Because we employ a large workforce, any wage increases and/or expansion of benefits mandates will have a particularly significant impact on our labor costs. In addition, our suppliers, distributors, and business partners may be similarly impacted by wage and benefit cost inflation. For example, New York City recently instituted an increase in the minimum wage for delivery workers that deliver on behalf of third-party food delivery services, which is currently being challenged by certain third-party delivery apps. If such trends continue, our suppliers, distributors, and business partners may increase their prices for goods and services in order to offset their increasing labor costs.

In addition, Chicago has implemented a “fair workweek” ordinance, which requires food service employers to provide employees with specified notice in scheduling changes and pay premiums for changes made to employees’ schedules, among other requirements. Similar legislation may be enacted in other jurisdictions in which we operate, and in jurisdictions where we may enter in the future, and such regulatory structures, in turn, could result in missed corporate opportunities due to diverted management attention, as well as increased costs, both in terms of ongoing

compliance and resolution of alleged violations. Such regulations are often complex to administer and have evolved over time and may continue to do so.

Our inability to identify qualified individuals for our workforce could slow our growth and adversely impact our ability to operate our locations.

We believe that our success depends in part upon our ability to attract, motivate and retain a sufficient number of qualified managers and team members to meet the needs of our existing locations and to staff new locations. A sufficient number of qualified individuals to fill these positions and qualifications may be in short supply in some geographic areas. Competition in those areas for qualified team members could require us to pay higher wages and provide greater benefits, especially in times of robust regional or national economic conditions. Any inability to recruit and retain qualified individuals may result in higher turnover and increased labor costs and could compromise the quality of our service, all of which could adversely affect our business, results of operations and financial condition. Any such inability could also delay the planned openings of new locations and could adversely impact our existing locations. Any such inability to retain or recruit qualified team members, increased costs of attracting qualified employees or delays in locations openings could adversely affect our business, results of operations and financial condition.

The COVID-19 pandemic created staffing complexities for us and other restaurant operators and, on March 15, 2020, as a result of the pandemic, all operations at our locations were temporarily suspended. We have since reopened all of our locations in a new environment, filled with increased complexity for our employees and managers, a decreased applicant pool for all positions, safety concerns and ongoing staff call-outs and exclusions due to illness. Despite the removal of COVID-19 restrictions, there remains an aggressive competition for talent, wage inflation and pressure to improve benefits and workplace conditions to remain competitive, and the pandemic perpetuated an ongoing labor shortage and heightened labor relations issues. Due to future pandemics or natural disasters, we could experience a further shortage of labor and decrease in the pool of available qualified talent for key functions. Our existing wages and benefits programs, combined with the challenging conditions remaining after the COVID-19 pandemic, the volatile macroeconomic environment and the highly competitive wage pressure resulting from the current labor shortage, may be insufficient to attract and retain the best talent.

Furthermore, maintaining appropriate staffing and hiring and training new staff requires precise workforce planning, which has become more complex due to, among other things:

•significant staffing and hiring issues in the restaurant industry throughout the country, which were exacerbated by the COVID-19 pandemic;

•laws related to wage and hour violations or predictive scheduling, such as “fair workweek” or “secure scheduling” ordinances in certain geographic areas where we operate;

•low levels of unemployment, which has resulted in aggressive competition for talent, wage inflation, and pressure to improve benefits and workplace conditions to remain competitive; and

•the so-called “great resignation” trend.

Our failure to recruit and retain new employees in a timely manner or higher employee turnover levels all could affect our ability to open new locations and grow sales at existing locations, and we may experience higher than projected labor costs.

The COVID-19 pandemic had a material adverse impact on our business, results of operations, liquidity and financial condition. Future outbreaks of COVID-19, other contagious diseases or other adverse public health developments in the United States or worldwide could have similar impacts on our business.

The COVID-19 pandemic had a material adverse impact on our business and results of operations in fiscal 2020 and 2021. At the peak of the COVID-19 outbreak in fiscal 2021, as a result of the pandemic, all operations at our locations were temporarily suspended. As our locations re-opened following approximately four months of closure, we experienced comparable store sales declines and reduced revenues compared to pre-pandemic operations due to