File Pursuant to Rule 253(g)(2)

File No. 024-12524

Offering Circular Dated December 23, 2024

RoyaltyTraders LLC dba SongVest

1053 East Whitaker Mill Rd., Suite 115

Raleigh, NC 27604

(919) 324-2945

www.songvest.com

Best Efforts Offering of Royalty Share Units

RoyaltyTraders LLC dba SongVest, a Delaware limited liability company (which we refer to as “SongVest”, “we,” “us,” “our” or “our company”), is offering, on a best efforts basis, units (the “Royalty Share Units”) representing the right to a portion of specified royalty sharing agreements (each, a “Royalty Share Agreement”) identified in the “Royalty Share Offering Table” beginning on page iii. The Royalty Share Units will be made available for purchase via the web-based investment platform www.songvest.com, (the “SongVest Platform”), which is owned and operated by our affiliate RT2, LLC, (“RT2”), a Delaware limited liability company which is under common control with our company.

All of the Royalty Share Units of our company offered hereunder may collectively be referred to in this Offering Circular as the “Royalty Share Units” and each, individually, as a “Royalty Share Unit.” The Royalty Share Agreements described above may collectively be referred to in this Offering Circular as the “Royalty Share Agreements” and each, individually, as a “Royalty Share Agreement.” Finally, the offerings of the Royalty Share Units may collectively be referred to in this Offering Circular as the “offerings” and each, individually, as an “offering.” See “Securities Being Offered” for additional information regarding the Royalty Share Units.

The Royalty Share Units represent the contractual right to receive a portion of any royalty stream from the music portfolio underlying Royalty Share Agreements. SongVest will enter into Royalty Share Agreements with music portfolio owners to obtain rights to the music portfolio which, once the purchase option is executed, will result in SongVest receiving all of, or a portion of the royalties generated by that portfolio. Investors will acquire Royalty Share Units from SongVest to receive a pro rata portion of what SongVest has received (net of SongVest’s Administrative Fee) based on the number of Royalty Share Units that investor holds compared to the outstanding number of Royalty Share Units for that asset. Purchasing the Royalty Share Units does not confer to the investor any ownership in our company or the underlying music portfolio.

There will be a separate closing with respect to each offering. The closing of an offering will occur on the earliest to occur of (i) the date subscriptions for the number of Royalty Share Units offered for a Royalty Share Agreement have been accepted or (ii) a date determined by our company in its sole discretion, provided that subscriptions for the number of Units offered for a Royalty Share Agreement have been accepted. If closing has not occurred, an offering shall be terminated upon (i) the date which is one year from the date such Offering Circular or amendment thereof, as applicable, is qualified by the U.S. Securities and Exchange Commission, or the Commission, or (ii) any date on which our company elects to terminate the offering for a particular Royalty Share in its sole discretion. No securities are being offered by existing securityholders.

Each offering is being conducted on a “best efforts” basis pursuant to Tier 2 of Regulation A promulgated under the Securities Act of 1933, as amended. The subscription funds advanced by prospective investors as part of the subscription process will be held in a non-interest bearing escrow account with North Capital Private Securities Corporation and will not be commingled with the operating account of our company until, if and when there is a closing with respect to that investor group. Our company will be permitted to purchase Royalty Share Units alongside investors in offerings of series of Royalty Share Units conducted by our company at its discretion. The company will not use the proceeds raised from an offering for such purposes – rather, the company would use its own, separate cash reserves to purchase such Royalty Share Units.

| | | Price to

public | | | Broker-Dealer

discount and

commissions(1) | | | Proceeds to

Issuer(5) | |

| “No Scrubs – TLC Version” Royalty Share Asset* | | | | | | | | | | | | |

| Per Royalty Share Unit | | $ | 120.00 | | | $ | 1.20 | | | $ | 118.80 | |

| Total Minimum(3) | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| Total Maximum(3) | | $ | 61,440.00 | | | $ | 614.40 | | | $ | 60,826.00 | |

| “Creep – TLC Version” Royalty Share Asset* | | | | | | | | | | | | |

| Per Royalty Share Unit | | $ | 120.00 | | | $ | 1.20 | | | $ | 118.80 | |

| Total Minimum(3) | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| Total Maximum(3) | | $ | 76,200.00 | | | $ | 762.00 | | | $ | 75,438.00 | |

| “Beyonce’s Radio” Royalty Share Asset* | | | | | | | | | | | | |

| Per Royalty Share Unit | | $ | 36.00 | | | $ | 0.36 | (2) | | $ | 35.64 | |

| Total Minimum(3) | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| Total Maximum(3) | | $ | 38,880.00 | | | $ | 388.80 | | | $ | 38,491.00 | |

| “Anything At All – 2024 Version” Royalty Share Asset* | | | | | | | | | | | | |

| Per Royalty Share Unit | | $ | 63.00 | | | $ | 0.63 | (2) | | $ | 62.37 | |

| Total Minimum(3) | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| Total Maximum(3) | | $ | 63,000.00 | | | $ | 630.00 | | | $ | 62,370.00 | |

| “A Kind of Magic” Royalty Share Asset* | | | | | | | | | | | | |

| Per Royalty Share Unit | | $ | 98.00 | | | $ | 0.98 | (2) | | $ | 97.02 | |

| Total Minimum(3) | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| Total Maximum(3) | | $ | 139,062.00 | | | $ | 1,390.62 | | | $ | 137,671.00 | |

| “Under Pressure” Royalty Share Asset* | | | | | | | | | | | | |

| Per Royalty Share Unit | | $ | 98.00 | | | $ | 0. 98 | (2) | | $ | 97.02 | |

| Total Minimum(3) | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| Total Maximum(3) | | $ | 157,486.00 | | | $ | 1,574.86 | | | $ | 155,911.00 | |

| “I Want it All” Royalty Share Asset* | | | | | | | | | | | | |

| Per Royalty Share Unit | | $ | 98.00 | | | $ | 0. 98 | (2) | | $ | 97.02 | |

| Total Minimum(3) | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| Total Maximum(3) | | $ | 164,444.00 | | | $ | 1,644.44 | | | $ | 162,800.00 | |

| “The Show Must Go On” Royalty Share Asset* | | | | | | | | | | | | |

| Per Royalty Share Unit | | $ | 98.00 | | | $ | 0. 98 | (2) | | $ | 97.02 | |

| Total Minimum(3) | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| Total Maximum(3) | | $ | 123,774.00 | | | $ | 1,237.74 | | | $ | 122,536.00 | |

| “Bohemian Rhapsody Soundtrack” Royalty Share Asset* | | | | | | | | | | | | |

| Per Royalty Share Unit | | $ | 98.00 | | | $ | 0. 98 | (2) | | $ | 97.02 | |

| Total Minimum(3) | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| Total Maximum(3) | | $ | 64,484.00 | | | $ | 644.84 | | | $ | 63,839.00 | |

| “Cainon Lamb (Beyonce’s Countdown and More)” Royalty Share Asset | | | | | | | | | | | | |

| Per Royalty Share Unit | | $ | 72.00 | | | $ | 0.72 | (2) | | $ | 71.28 | |

| Total Minimum(3) | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| Total Maximum(3) | | $ | 37,152.00 | | | $ | 371.52 | | | $ | 36,780.00 | |

| “Justin Bieber’s Rockin’ Around the Christmas Tree” Royalty Share Asset* | | | | | | | | | | | | |

| Per Royalty Share Unit | | $ | 37.80 | | | $ | 0.38 | (2) | | $ | 37.42 | |

| Total Minimum(3) | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| Total Maximum(3) | | $ | 108,864.00 | | | $ | 1,088.64 | | | $ | 107,775.00 | |

| “Young Thug – Best Friend” Royalty Share Asset* | | | | | | | | | | | | |

| Per Royalty Share Unit | | $ | 36.00 | | | $ | 0.36 | (2) | | $ | 35.64 | |

| Total Minimum(3) | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| Total Maximum(3) | | $ | 19,872.00 | | | $ | 198.72 | | | $ | 19,673.00 | |

| Totals | | | | | | | | | | | | |

| Total Minimum(3) | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| Total Maximum(3) | | $ | 1,054,658.00 | | | $ | 10,546.58 | | | $ | 1,044,111.42 | |

| * | A “second-price” auction was utilized to help our company determine the Royalty Share Unit price for this series being offered by our company, which was conducted during “testing the waters” period under Rule 255 of Regulation A. See “Plan of Distribution and Selling Securityholders – Price Discovery” for further information on how our company determined the offering price per share for this series of Royalty Share Units. There is no obligation for any person who indicated interest as part of the auction process to invest in the Royalty Share Units. |

| (1) | We have engaged Dalmore Group, LLC, member FINRA/SIPC (“Dalmore”) to perform administrative and technology related functions in connection with this offering, but not for underwriting or placement agent services. Compensation to Dalmore includes a 1% commission payable to Dalmore for proceeds raised, as well as a one-time due diligence fee of $5,000 and one-time consulting fee of $10,000 payable by our company to Dalmore. |

| (2) | For this offering, we intend to use a portion of our Sourcing Fee to pay the 1% commission and all expenses payable to Dalmore and our transfer agent. |

| (3) | Because these are best efforts offerings, the actual public offering amounts and proceeds to us are not presently determinable and may be substantially less than each total maximum offering set forth above. Further, for each offering set forth above with a minimum offering amount, we will only close on investments and accept funds from investors if we have raised that minimum offering amount set forth above for that particular offering. Investors’ funds will be placed in an escrow account until the applicable minimum offering is met. Escrowed funds will be invested only in investments permissible under SEC Rule 15c2-4 (See Notice 84-7). In the event the minimum offering amount is not met, all investors’ funds will be promptly returned to each subscriber in accordance with SEC Rule 10b-9. |

In the event that the company becomes a reporting company under the Securities Exchange Act of 1934, the company intends to take advantage of the provisions that relate to “Emerging Growth Companies” under the JOBS Act of 2012. See “Ongoing Reporting and Supplements to this Offering Circular.”

An investment in our Royalty Share Units involves a high degree of risk. See “Risk Factors” on page 7 for a description of some of the risks that should be considered before investing in our Royalty Share Units.

Generally, no sale may be made to you in any offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

THE U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF ANY OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

We are offering to sell, and seeking offers to buy, our Royalty Share Units only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of our Royalty Share Units. Neither the delivery of this Offering Circular nor any sale or delivery of our Royalty Share Units shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

This Offering Circular is following the Offering Circular format described in Part II (a)(1)(i) of Form 1-A.

TABLE OF CONTENTS

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this Offering Circular includes some statements that are not historical and that are considered “forward-looking statements.” Such forward-looking statements include, but are not limited to, statements regarding our development plans for our business; our strategies and business outlook; anticipated development of our company, our manager, our company, our affiliates, and the SongVest Platform; and various other matters (including contingent liabilities and obligations and changes in accounting policies, standards and interpretations). These forward-looking statements express our manager’s expectations, hopes, beliefs, and intentions regarding the future. In addition, without limiting the foregoing, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates”, “believes”, “continue”, “could”, “estimates”, “expects”, “intends”, “may”, “might”, “plans”, “possible”, “potential”, “predicts”, “projects”, “seeks”, “should”, “will”, “would” and similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Offering Circular are based on current expectations and beliefs concerning future developments that are difficult to predict. Neither we nor our manager can guarantee future performance, or that future developments affecting our company, our manager, our affiliates, or the SongVest Platform will be as currently anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

All forward-looking statements attributable to us are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties, along with others, are also described below under the heading “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of the parties’ assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

ROYALTY SHARE UNITS OFFERING TABLE

The table below shows key information related to the offering of each series of Royalty Share Units under this Offering Statement. Please also refer to “The Underlying Portfolio” and “Use of Proceeds” sections for further details.

| Royalty Share Unit Name | | Underlying Portfolio(s) | | Offering

Price per

Unit | | | Minimum

Offering

Amount(2) | | | Maximum

Offering

Amount(2) | | | Maximum

Units | | Opening Date | | | Closing Date | | Final Amount Sold ($) | | | Distributions Paid

($) | | | Status(4) | |

| “No Scrubs – TLC Version” | | “No Scrubs – TLC Version” Sound Recording Owner’s Share | | $ | 120 | | | $ | - | | | $ | 61,440 | | | | 512 | | | N/A | | | | N/A | | | N/A | | | | N/A | | | Not Yet Qualified | |

| “Creep – TLC Version” | | “Creep – TLC Version” Sound Recording Owner’s Share | | $ | 120 | | | $ | - | | | $ | 76,200 | | | | 635 | | | N/A | | | | N/A | | | N/A | | | | N/A | | | Not Yet Qualified | |

| “Beyonce’s Radio” | | “Beyonce’s Radio” Producer’s Share | | $ | 36 | | | $ | - | | | $ | 38,880 | | | | 1,080 | | | N/A | | | | N/A | | | N/A | | | | N/A | | | Not Yet Qualified | |

| “Canion Lamb (Beyonce’s Countdown and More)” | | “Beyonce’s Countdown and More” Writer’s Share | | $ | 72 | | | $ | - | | | $ | 37,152 | | | | 516 | | | N/A | | | N/A | | | N/A | | | | N/A | | | Not Yet Qualified | |

| “Justin Bieber’s Rockin’ Around the Christmas Tree” | | “Rockin’ Around the Christmas Tree” Producer’s Share | | $ | 37.80 | | | $ | - | | | $ | 108,864 | | | | 2,880 | | | N/A | | | N/A | | | N/A | | | | N/A | | | Not Yet Qualified | |

| “Young Thug – Best Friend” | | “Best Friend” Writer’s Share | | $ | 36 | | | $ | - | | | $ | 19,872 | | | | 552 | | | N/A | | | N/A | | | N/A | | | | N/A | | | Not Yet Qualified | |

| “Under Pressure” | | “Under Pressure” Producer’s Share | | $ | 98 | | | $ | - | | | $ | 157,486 | | | | 1,607 | | | N/A | | | N/A | | | N/A | | | | N/A | | | Not Yet Qualified | |

| “I Want It All” | | “I Want It All Producer’s Share | | $ | 98 | | | $ | - | | | $ | 164,444 | | | | 1,678 | | | N/A | | | N/A | | | N/A | | | | N/A | | | Not Yet Qualified | |

| “The Show Must Go On” | | “The Show Must Go On” Producer’s Share | | $ | 98 | | | $ | - | | | $ | 123,774 | | | | 1,263 | | | N/A | | | N/A | | | N/A | | | | N/A | | | Not Yet Qualified | |

| “Bohemian Rhapsody Soundtrack” | | “Bohemian Rhapsody Soundtrack” Producer’s Share | | $ | 98 | | | $ | - | | | $ | 64,484 | | | | 658 | | | N/A | | | N/A | | | N/A | | | | N/A | | | Not Yet Qualified | |

| “A Kind of Magic” | | “A Kind of Magic” Producer’s Share | | $ | 98 | | | $ | - | | | $ | 139,062 | | | | 1,419 | | | N/A | | | N/A | | | N/A | | | | N/A | | | Not Yet Qualified | |

| “Anything At All – 2024 Version” | | “Anything At All – 2024 Version” Sound Recording Owner’s Share | | $ | 63 | | | $ | - | | | $ | 63,000 | | | | 1,000 | | | N/A | | | N/A | | | N/A | | | | N/A | | | Not Yet Qualified | |

| (1) | The offering price per Royalty Share Unit for this offering was determined by our company. To assist in this determination, our company utilized a “second-price” auction during the testing the waters period under Rule 255 of Regulation A. |

| (2) | The Minimum Offering Amount is the minimum amount of proceeds our company must raise in order to close on investments in the applicable offering. The Maximum Offering Amount includes the cost to acquire the 100% of the Music Royalty Asset set forth in the “Underlying Portfolio(s)” column in the table above, and, as applicable, the Minimum Offering Amount represents the cost to a smaller percentage of that Music Royalty Asset (as set forth in the applicable Royalty Share Agreement). Each of the minimum and maximum offering amounts (with the exception of the “TLC” offerings) also includes the Sourcing Fee. |

| (3) | Represents total distributions paid to holders of Royalty Share Units as of the date of this offering circular. |

| (4) | In this column, “Not Yet Qualified” indicates offerings submitted for review to the SEC under this offering statement, but that have not yet been qualified by the SEC. |

The company previously offered is Royalty Share Units pursuant to an offering statement on Form 1-A (File No. 024-11532), in which the Royalty Share Units set forth in the table below were offered and sold. On September 27, 2024, this offering was terminated.

| Royalty Share Unit Name | | Underlying Portfolio(s) | | Offering

Price per

Unit | | | Minimum

Offering

Amount(2) | | | Maximum

Offering

Amount(2) | | | Maximum

Units | | | Opening

Date | | Closing

Date | | Final

Amount Sold

($) | | | Distributions

Paid(3) | |

| “Hit The Quan” | | “Hit the Quan” Producer’s Share | | $ | 16.00 | (1) | | $ | 31,200 | | | $ | 31,200 | | | | 1,950 | | | September 30, 2021 | | February 22, 2022 | | $ | 31,200 | | | $ | 16,054.09 | |

| “Sanguine Paradise” | | “Sanguine Paradise” Writer’s Share | | $ | 250.00 | (1) | | $ | 47,500 | | | $ | 158,000 | | | | 632 | | | February 9, 2022 | | N/A | | | N/A | | | | N/A | |

| “Gang Forever” | | “Gang Forever” Artist’s Share | | $ | 250.00 | (1) | | $ | 57,000 | | | $ | 190,000 | | | | 760 | | | February 9, 2022 | | N/A | | | N/A | | | | N/A | |

| “3 Headed Goat” | | “3 Headed Goat” Writer’s Share | | $ | 250.00 | (1) | | $ | 161,500 | | | $ | 537,750 | | | | 2,151 | | | February 9, 2022 | | N/A | | | N/A | | | | N/A | |

| “Chippass” | | “Chippass” Record Label’s Share | | $ | 250.00 | (1) | | $ | 13,750 | | | $ | 27,750 | | | | 111 | | | September 13, 2022 | | October 13, 2022 | | $ | 27,750 | | | $ | 6,033.96 | |

| “DJ Fresh” | | “DJ Fresh” Record Label’s Share & Writer’s Share | | $ | 300.00 | (1) | | $ | 39,600 | | | $ | 79,200 | | | | 264 | | | September 13, 2022 | | N/A | | | N/A | | | | N/A | |

| “Runnin’ (Lose It All)” | | “Runnin’ (Lose It All)” Writer’s Share & Publisher’s Share | | $ | 250.00 | (1) | | $ | 133,250 | | | $ | 266,500 | | | | 1,066 | | | November 22, 2022 | | N/A | | | N/A | | | | N/A | |

| “Fear No More” | | “Fear No More” Writer’s Share | | $ | 100.00 | (1) | | $ | 7,700 | | | $ | 14,000 | | | | 140 | | | November 22, 2022 | | December 22, 2022 | | $ | 14,000 | | | $ | 1,625.40 | |

| “Cross Me” | | “Cross Me” Writer’s Share | | $ | 100.00 | (1) | | $ | 11,500 | | | $ | 21,500 | | | | 215 | | | November 22, 2022 | | February 6, 2023 | | $ | 12,300 | | | $ | 1,344.44 | |

| “YoungBoy NBA – Drawing Symbols” | | “YoungBoy NBA – Drawing Symbols” Writer’s Share | | $ | 100.00 | (1) | | $ | 7,700 | | | $ | 13,800 | | | | 138 | | | January 3, 2023 | | N/A | | | N/A | | | | N/A | |

| “Onyx, Travis Scott, The Notorious B.I.G. & More” | | “Onyx, Travis Scott, The Notorious B.I.G. & More” Writer’s Share (excluding Performance) & Publisher’s Share | | $ | 150.00 | (1) | | $ | 33,000 | | | $ | 64,500 | | | | 430 | | | January 3, 2023 | | February 2, 2023 | | $ | 64,500 | | | $ | 12,637.70 | |

| “Young L” | | “Young L” Writer’s Share & Co-Publisher’s Share | | $ | 103.00 | (1) | | $ | 10,197 | | | $ | 20,394 | | | | 198 | | | March 6, 2023 | | March 13, 2023 | | $ | 20,394 | | | $ | 4,445.10 | |

| “Cainon Lamb” | | “Cainon Lamb” Writer’s Share | | $ | 150.00 | (1) | | $ | 86,250 | | | $ | 171,000 | | | | 1,140 | | | March 6, 2023 | | April 30, 2023 | | $ | 104,400 | | | $ | 11,741.52 | |

| “Erik Cain” | | “Erik Cain” Sound Recording Owner’s Share | | $ | 100.00 | (1) | | $ | 15,700 | | | $ | 29,800 | | | | 298 | | | March 6, 2023 | | March 24, 2023 | | $ | 29,800 | | | $ | 4,514.70 | |

| “No Scrubs – TLC Version” | | “No Scrubs – TLC Version” Sound Recording Owner’s Share | | $ | 100.00 | (1) | | | N/A | | | $ | 130,000 | | | | 1,300 | | | August 28, 2023 | | September 21, 2024 | | $ | 78,800 | | | $ | 2,710.05 | |

| “Creep – TLC Version” | | “Creep – TLC Version” Sound Recording Owner’s Share | | $ | 100.00 | (1) | | | N/A | | | $ | 105,000 | | | | 1,050 | | | August 28, 2023 | | September 21, 2024 | | $ | 41,500 | | | $ | 609.00 | |

| “Diggin On You – TLC Version” | | “Diggin On You – TLC Version” Sound Recording Owner’s Share | | $ | 110.00 | (1) | | | N/A | | | $ | 22,000 | | | | 200 | | | August 28, 2023 | | July 31, 2024 | | $ | 22,000 | | | $ | 710.00 | |

| “Swish Swish” | | “Swish Swish” Writer’s Share & Publisher’s Share | | $ | 100.00 | | | $ | 18,200 | | | $ | 36,300 | | | | 363 | | | December 6, 2023 | | January 16, 2024 | | $ | 36,600 | | | $ | 1,081.74 | |

| “Allstar JR 3 Macs” | | “Allstar JR 3 Macs” Sound Recording “Shaudie Man STEP” Owner’s Share | | $ | 50.00 | | | $ | 36,550 | | | $ | 73,100 | | | | 1,462 | | | N/A | | N/A | | | N/A | | | | N/A | |

| “Shaudie Man STEP” | | Sound Recording Owner’s Share | | $ | 50.00 | | | $ | 19,950 | | | $ | 39,900 | | | | 798 | | | N/A | | N/A | | | N/A | | | | N/A | |

| “Willie Taylor Soakin Wet” | | “Willie Taylor Soakin Wet” Sound Recording Owner’s Share | | $ | 50.00 | | | $ | 19,750 | | | $ | 39,500 | | | | 790 | | | N/A | | N/A | | | N/A | | | | N/A | |

| “Beyonce’s Radio” | | “Beyonce’s Radio” Producer’s Share | | $ | 30.00 | | | $ | 16,200 | | | $ | 32,400 | | | | 1,080 | | | July 12, 2024 | | N/A | | | N/A | | | | N/A | |

| Bullet Boys – I Know There’s Something Going On | | “I Know There’s Something Going On” Sound Recording Owner’s Share | | $ | 50.00 | | | $ | 15,150 | | | $ | 30,250 | | | | 605 | | | July 12, 2024 | | N/A | | | N/A | | | | N/A | |

| Bullet Boys– Smooth Up In Ya – 2024 Version | | “Smooth Up” Sound Recording Owner’s Share | | $ | 60.00 | | | $ | 18,180 | | | $ | 36,300 | | | | 605 | | | July 12, 2024 | | N/A | | | N/A | | | | N/A | |

| “Canion Lamb (Beyonce’s Countdown and More)” | | “Beyonce’s Countdown and More” Writer’s Share | | $ | 60.00 | | | $ | 35,160 | | | $ | 70,260 | | | | 1,171 | | | July 12, 2024 | | September 21, 2024 | | $ | 39,300 | | | | N/A | |

| “Justin Bieber’s Rockin’ Around the Christmas Tree” | | “Rockin’ Around the Christmas Tree” Producer’s Share | | $ | 31.50 | | | $ | 47,250 | | | $ | 94,500 | | | | 3,000 | | | July 12, 2024 | | N/A | | | N/A | | | | N/A | |

| “Young Thug – Best Friend” | | “Best Friend” Writer’s Share | | $ | 30.00 | | | $ | 8,280 | | | $ | 16,560 | | | | 552 | | | July 12, 2024 | | N/A | | | N/A | | | | N/A | |

| (1) | The offering price per Royalty Share Unit for this offering was determined by our company. To assist in this determination, our company utilized a “second-price” auction during the testing the waters period under Rule 255 of Regulation A. |

| (2) | The Minimum Offering Amount is the minimum amount of proceeds our company had to raise in order to close on investments in the applicable offering. The Maximum Offering Amount includes the cost to acquire the 100% of the Music Royalty Asset set forth in the “Underlying Portfolio(s)” column in the table above, and, as applicable, the Minimum Offering Amount represents the cost to a smaller percentage of that Music Royalty Asset (as set forth in the applicable Royalty Share Agreement). Each of the minimum and maximum offering amounts (with the exception of the “Hit the Quan” and “TLC” offerings) also includes the Sourcing Fee. |

| (3) | Represents total distributions paid to holders of Royalty Share Units as of the date of this offering circular. |

SUMMARY

The following summary is qualified in its entirety by the more detailed information appearing elsewhere in this Offering Circular. You should read the entire Offering Circular and carefully consider, among other things, the matters set forth in the section captioned “Risk Factors.” You are encouraged to seek the advice of your attorney, tax consultant, and business advisor with respect to the legal, tax, and business aspects of an investment in our Royalty Share Units. All references in this Offering Circular to “$” or “dollars” are to United States dollars.

The Company

Overview

Revenue generated in the music industry is expected to grow in the foreseeable future. A June 2019 Goldman Sachs equity research report forecasted that the recorded music market will hit $45 billion by 2030, driven by 1.15 billion users paying for music-streaming subscriptions and 40% penetration in developed markets such as the U.S. Despite this optimistic outlook, many record labels continue to seek alternative methods of financing while optimizing their digital marketing strategy in the music streaming economy. Further, while donation crowdfunding platforms like Kickstarter, and investment platforms like Royalty Exchange have seen some success in providing opportunities to invest in music to the public, investors and music fans still have limited access to investing in music royalty assets. Even those who do have access to top quality music royalty assets are faced with high fees, lack of transparency, and significant operational overheads. With high transactional costs and low transaction volumes, investors in music assets often suffer from illiquidity, resulting in long holding periods that make such investments inaccessible and unattractive for many investors.

We believe our offerings of Royalty Share Units offers a solution to this problem by allowing the public to acquire a portion of music royalties generated by their favorite artists’ albums. The Royalty Share Units allow investors to invest in the royalty streams from compositions by their favorite artists and get royalty distributions related to those assets. Our Royalty Share Units will be offered exclusively via the SongVest Platform – a platform that combines crowdfunding, investing, and a social network involving fans to create a robust online marketplace where the public can acquire Royalty Share Units related to their favorite artists’ music.

We plan to use the proceeds from these offerings of Royalty Share Units to acquire, hold and manage royalty interests derived from intellectual property created in the media industry (“Music Royalty Assets”). Music Royalty Assets are passive (non-operating) interests in media catalogs (collections of work) that provide the right to revenue produced from the catalog. As it relates to music catalogs, this includes revenue generated from streaming, downloads, physical album sales and other forms of usage by movies, television and advertisements. The Royalty Share Units being offered represent the right to a share of revenues flowing from the royalties generated by a particular Music Royalty Asset, which are acquired through Royalty Share Agreements that we enter into with the owners of those Music Royalty Assets.

We intend to acquire Music Royalty Assets ranging in price anywhere from $20,000 to $250,000. Some assets may also be below or above this range. Our mission is to democratize wealth accumulation by providing access, liquidity and transparency to investments in Music Royalty Assets.

Our company may charge a “Sourcing Fee” for Music Royalty Assets acquired using the proceeds from our offerings (the “Sourcing Fee”). The Sourcing Fee will be a percentage of the purchase price of the Music Royalty Asset set forth in the applicable Royalty Share Agreement for each offering, and will generally be set based on the level of difficulty and costs related to sourcing the particular Music Royalty Asset related to the series of Royalty Share Units. The Sourcing Fee will be determined for each offering in the sole discretion of our manager, and may be waived by our manager. Additionally, our company will receive an “Administrative Fee” of up to 10% of value of the value of the royalty payments collected by our company to be distributed to holders of the Royalty Share Units, as compensation for managing the Music Royalty Assets (and corresponding Royalty Share Agreements). The amount of the Administrative Fee will be determined by the company for each series of Royalty Share Units on an individual basis, and will only be received by our company if distributions are made to Royalty Share Unit holders. If no distributions are made, no Administrative Fees will be received by our company.

History and Structure

Our company is a limited liability company formed on March 18, 2021 pursuant to the Delaware Limited Liability Company Act, or the LLC Act.

From inception through October 2024, our operations were focused on both the offering and sale of Royalty Share Units, as well as the operation of the SongVest Platform, which allows investors to pick and invest in the royalty streams from compositions by artists, and receive royalty distributions from those assets. Additionally, the SongVest Platform allows investors to impact the success of artists with their albums. Record labels are provided with tools and strategies enabled by the SongVest Platform, such as email marketing, to collectively promote albums, potentially furthering the success of a release, and generating more revenue.

In October 2024, our company underwent a restructuring, whereby we became a wholly-owned subsidiary of SAJA LLC, a newly-formed Delaware limited liability company, and certain aspects of our operations – primarily, the ownership and operation of the SongVest Platform – were transferred into a newly-formed sister entity, RT2, which is also a wholly-owned subsidiary of SAJA LLC. Both our company and RT2 are managed by SAJA LLC. As a result of this restructuring, our company’s sole business operation is the acquisition of Music Royalty Assets and making offers and sales of related Royalty Share Units. See “Interest of Management and Others in Certain Transactions” for more information on this restructuring, as well as for a description of certain agreements we entered into in connection with this restructuring.

Manager

Our company is managed by SAJA LLC, a Delaware limited liability company formed on October 3, 2024 (“SAJA”), which also owns 100% of our company. Throughout this Offering Circular, we refer to SAJA as the “manager”.

The manager has identified the Music Royalty Assets that the proceeds of the offerings described in this Offering Circular will be used to purchase, and generally is responsible for the day-to-day operations of our company.

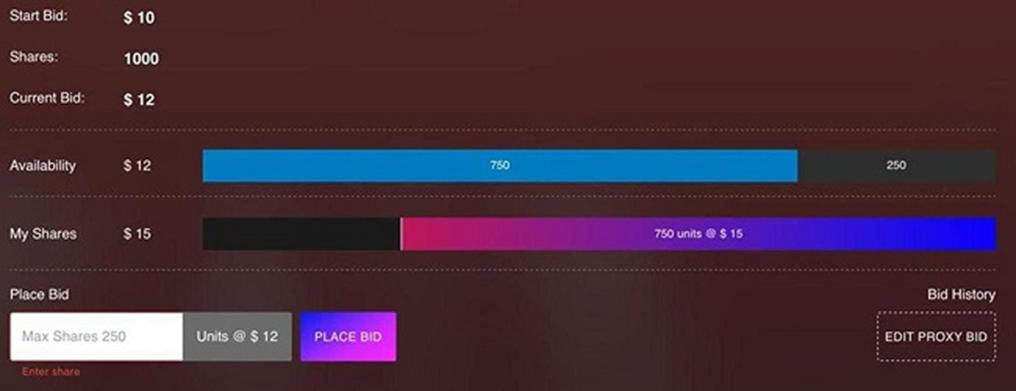

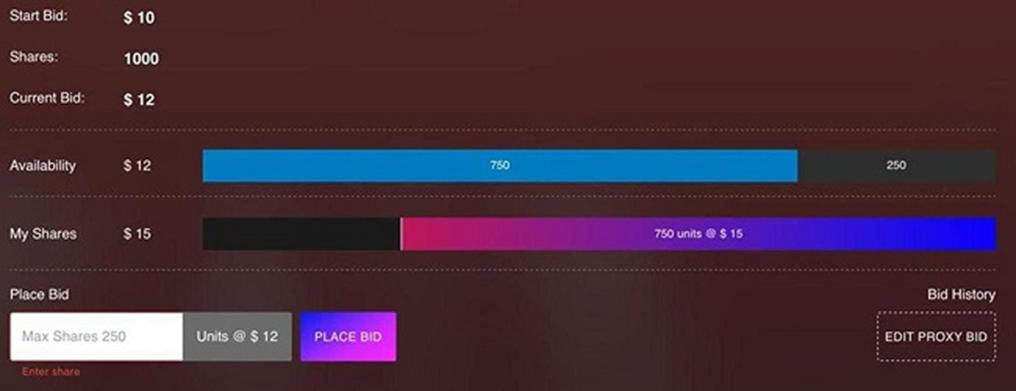

Price Discovery

To determine the per Royalty Share Unit price for each series of such units, we may utilize the SongVest Platform to conduct a “second-price” auction during a testing the waters period under Rule 255 of Regulation A. On the SongVest Platform, a page will display the projected number of Royalty Share Units to be offered in a particular series’ offering in an auction environment. Each bidder can bid for as many or as few Royalty Share Units as they are willing to pay for, subject to a minimum bid size of one Royalty Share Unit. However, all winning test bidders have a projected payment based only on the lowest qualifying (successful) bid. The bid price will only increment higher when all Royalty Share Units of the next bid increment are completely bid out. Then the process repeats itself for the next round of bidding. If there are more successful bids than Royalty Share Units available, priority goes to the bidders whose bids are the highest and then to bidders who submitted their bids first in time. In order to beat a competing bidder, a bidder must bid a higher price per Royalty Share Unit than the other bidder(s), regardless of the number of Royalty Share Units that are being bid for. Bidding is conducted in $1.00 increments.

Any bids submitted in the “second-price” auction described above will only be non-binding indications of interest as required by Rule 255 of Regulation A. No commitments to invest or funds will be accepted prior to qualification of a series of Royalty Share Units. The “second-price” auction is solely being used to gauge interest and to help guide our company in determining a price for a particular offering of Royalty Share Units. Any person who indicated interest as part of the auction process has no obligation to invest or respond to the company’s solicitations following qualification of the offering as the price determined by the auction. Our company has ultimate discretion as to what price will be set for all Royalty Share Units that it offers, and has no obligation to set a particular price based on the results of such an auction. We may also forego conducting a second-price auction altogether, and determine the price for our Royalty Share Units internally.

Distributions

The Royalty Share Units provide investors with the pro rata right to cash flow (consisting of music royalties) generated pursuant to a particular Royalty Share Agreement, following the deduction of Administrative Fees by our company. As royalties are paid to our company pursuant to a Royalty Share Agreement, we will place all those royalties in a designated bank account. Each quarter, all royalties received by our company pursuant to that Royalty Share Agreement will be distributed to the applicable Royalty Share Unitholders on a pro rata basis, after deducting the Administrative Fee. For the terms of each series of Royalty Share Unit being offered by our company, see the “Securities Being Offered” section of this Offering Circular.

The Offerings

| Securities being offered: | | We are offering the number of Royalty Share Units of each series at a price per interest set forth in the “Series Offering Table” section above. Each series of Royalty Share Units relates to a different Music Royalty Asset, and has its own terms. See “Securities Being Offered” for further details. The Royalty Share Units are investment contracts which make royalty share payments based on the flow of royalties from a particular Music Royalty Asset, which is governed by the terms of the applicable Royalty Share Agreement relating to the Music Royalty Asset. The Royalty Share Units do not have any voting rights, and do not represent any ownership interest in our company. The purchase of a particular series of Royalty Share Units is an investment only in that particular Music Royalty Asset of our company and does not create any rights to royalty payments from any other Music Royalty Asset. The Royalty Share Agreements are structured as a purchase option, which gives us the right, but not the obligation to purchase a specific Music Royalty Asset subject to the agreement through the proceeds of the unit series offering related to that Music Royalty Asset. |

| | | |

| Minimum subscription: | | The minimum subscription by an investor is one (1) Royalty Share Unit. The per Royalty Share Unit price will vary by series. |

| | | |

| Broker: | | We have entered into an agreement with the Dalmore Group, LLC (the “Broker”), which is acting as our executing broker in connection with each offering. The Broker is a broker-dealer which is registered with the Commission and will be registered in each state where each offering will be made prior to the launch of such offering and with such other regulators as may be required to execute the sale transactions and provide related services in connection with each offering. The Broker is a member of Financial Industry Regulatory Authority, Inc., or FINRA, and the Securities Investor Protection Corporation, or SIPC. |

| | | |

| Restrictions on investment: | | Each investor must be a “qualified purchaser.” See “Plan of Distribution and Selling Securityholders—Investor Suitability Standards” for further details. Our manager may, in its sole discretion, decline to admit any prospective investor, or accept only a portion of such investor’s subscription, regardless of whether such person is a “qualified purchaser.” Furthermore, our manager anticipates only accepting subscriptions from prospective investors located in states where the Broker is registered. Generally, no sale may be made to you in any offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(c) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov. |

| | | |

| Escrow account: | | For any offering with a minimum, the subscription funds advanced by prospective investors as part of the subscription process will be held in a non-interest-bearing escrow account with North Capital Private Securities Corporation, the “Escrow Agent”, and will not be commingled with the operating account of any series of units until, if and when there is a closing with respect to that investor group. |

| | | When the Escrow Agent has received instructions from our manager that an offering will close and the investor’s subscription is to be accepted (either in whole or part), then the Escrow Agent shall disburse such investor’s subscription proceeds in its possession to the account of the particular series of units. If any offering is terminated without a closing, or if a prospective investor’s subscription is not accepted or is cut back due to oversubscription or otherwise, such amounts placed into escrow by prospective investors will be returned promptly to them without interest. Any costs and expenses associated with a terminated offering will be borne by our manager. |

| Offering period: | | There will be a separate closing with respect to each offering. The closing of an offering will occur on the earliest to occur of (i) the date subscriptions for the number of Royalty Share Units offered for a series have been accepted or (ii) a date determined by our manager in its sole discretion, provided that, if a minimum offering amount has been established, subscriptions for the minimum number of Royalty Share Units offered for that series have been accepted. If closing has not occurred, an offering shall be terminated upon (i) the date which is one year from the date such Offering Circular or amendment thereof, as applicable, is qualified by the Commission, which period may be extended with respect to a particular series by an additional six months by our manager in its sole discretion, or (ii) any date on which our manager elects to terminate the offering for a particular series of units in its sole discretion. No securities are being offered by existing securityholders. |

| Use of proceeds: | | The proceeds received in an offering will be applied in the following order of priority of payment: |

| | | | |

| | | | ● | Acquisition Cost of the Music Royalty Asset: Actual cost of the underlying Music Royalty Asset related to a series of Royalty Share Units; |

| | | | |

| | | | ● | Offering Expenses: In general, these costs include actual fees, costs and expenses incurred in connection with an offering, including legal, accounting, escrow, underwriting, filing and compliance costs, as applicable, related to a specific offering; |

| | | | |

| | | | ● | Acquisition Expenses: In general, these include costs associated with the acquisition of the Music Royalty Assets related to a series of Royalty Share Units, such as due diligence costs (i.e. lien searches, confirming sellers have valid royalty rights, etc.) and legal costs (in connection with contract drafting, etc.). |

| | | | |

| | | | ● | Sourcing Fee: We will be paid a Sourcing Fee from the proceeds of each offering as compensation for sourcing each Music Royalty Asset, which will be a percentage of the consideration being paid for the “purchase price” for the Music Royalty Asset set forth in the applicable Royalty Share Agreement for each offering; provided that such Sourcing Fee may be waived by the company, at the discretion of our manager. |

| | | | |

| | | Our company bears all offering expenses and acquisition expenses described above on behalf of each series of Royalty Share Units that are offered by the company and will be reimbursed from the proceeds of each offering for certain offering expenses, but not for acquisition expenses or certain offering expenses (such as legal costs, etc.). See “Use of Proceeds to Issuer” and “Plan of Distribution and Selling Securityholders—Fees and Expenses” sections for further details. |

| Risk factors: | | Investing in our Royalty Share Units involves risks. See the section entitled “Risk Factors” in this Offering Circular and other information included in this Offering Circular for a discussion of factors you should carefully consider before deciding to invest in our Royalty Share Units. Certain risks investors should consider include: |

| | | | |

| | | | ● | We are an early-stage company with a limited track record and a limited operating history from which you can evaluate our company or the investment opportunities we are providing in this offering. |

| | | | | |

| | | | ● | Our auditor has issued a “going concern” opinion in the financial statements included with this offering circular. We currently are not generating sufficient revenue to carry out our planned business operations. We expect our operations to continue to consume substantial amounts of cash. |

| | | | | |

| | | | ● | We expect that, in order to maintain and grow our operations, we will need to promote multiple Royalty Share Unit offerings. There can be no assurance that we will be able to promote enough offerings to sustain our business model. |

| | | | | |

| | | | ● | There are few businesses that have pursued a strategy or investment objective similar to ours, which may make it difficult for our company and Royalty Share Units to gain market acceptance. |

| | | | ● | We are substantially reliant on our ability to utilize the SongVest Platform. |

| | | | ● | Our success depends in large part upon our manager and its ability to execute our business plan. |

| | | | | |

| | | | ● | In the event a royalty holder breaches the terms of a Royalty Share Agreement, we would have limited recourse and due to that we may not be able to collect the royalties the royalty holder represented and may not be able to get the funds paid to the royalty holder back to reimburse the investors. |

| | | | ● | Potential breach of the security measures of the SongVest Platform could have a material adverse effect on our company. |

| | | | | |

| | | | ● | We may encounter limitations on the effectiveness of our internal controls and a failure of our internal controls to prevent error or fraud may harm our business and holders of Royalty Share Units. |

| | | | | |

| | | | ● | Income generated by music royalty rights may be reduced if the recorded music industry fails to grow or streaming revenue fails to grow at a sufficient rate to offset download and physical sales declines. |

| | | | | |

| | | | ● | Changes in technology may affect our ability to receive payments from music royalty rights. |

| | | | | |

| | | | ● | Failure to obtain, maintain, protect and enforce our intellectual property rights could substantially harm our business, operating results and financial condition. |

| | | | ● | Digital piracy may lead to decreased sales in the recorded music industry and affect our ability to receive income from music royalty rights. |

| | | | | |

| | | | ● | Sellers of the Music Royalty Assets do not owe any fiduciary duties to us or our investors, and they have no obligation to enhance the value of the underlying music royalty rights or disclose information to our investors. |

| | | | | |

| | | | ● | Any amounts paid to holders of a particular series of Royalty Share Units will only reflect the royalty performance of the underlying Music Royalty Asset. |

| | | | | |

| | | | ● | There is currently no public trading market for our Royalty Share Units; there can be no assurance that any trading market will develop. |

| | | | | |

| | | | ● | If a market ever develops for our Royalty Share Units, the market price and trading volume may be volatile. |

| | | | | |

| | | | ● | There may be state law restrictions on an investor’s ability to sell its Royalty Share Units making it difficult to transfer, sell or otherwise dispose of our Royalty Share Units. |

| | | | | |

| | | | ● | Investors in this offering may not be entitled to a jury trial with respect to claims arising under the subscription agreement, which could result in less favorable outcomes to the plaintiff(s) in any action under subscription agreement. |

| | | | | |

| | | | ● | Our subscription agreement has a forum selection provisions that requires that certain disputes be resolved in a court in the State of North Carolina, regardless of convenience or cost to shareholders. |

RISK FACTORS

The Royalty Share Units offered hereby are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose their entire investment. There can be no assurance that our investment objectives will be achieved or that a secondary market would ever develop for our Royalty Share Units, whether via the SongVest Platform, via third party registered broker-dealers or otherwise. The risks described in this section should not be considered an exhaustive list of the risks that prospective investors should consider before investing in our Royalty Share Units. Prospective investors should obtain their own legal and tax advice prior to making an investment in our Royalty Share Units and should be aware that an investment in our Royalty Share Units may be exposed to other risks of an exceptional nature from time to time. The following considerations are among those that should be carefully evaluated before making an investment in our Royalty Share Units.

Risks Related to the Structure, Operation and Performance of our Company

We are an early-stage company with a limited track record and a limited operating history from which you can evaluate our company or the investment opportunities we are providing in this offering.

Our company was recently formed and has primarily generated revenues to date from operations that are secondary to our company’s primary plan of operations (which is the acquiring and managing of Music Royalty Assets) and further, which our company no longer engages in as result of our October 2024 restructuring. With respect to acquiring and managing Music Royalty Assets, our company has limited operating history upon which prospective investors may evaluate its performance. No guarantee can be given that our company will successfully employ the Music Royalty Assets to create a return for investors.

Our auditor has issued a “going concern” opinion in the financial statements included with this offering circular. We currently are not generating sufficient revenue to carry out our planned business operations. We expect our operations to continue to consume substantial amounts of cash.

Our company’s audited financials indicate substantial doubt about our company’s ability to continue as a going concern. Our company reported net losses during the years ended December 31, 2023 and 2022, and reported negative cash flows from operations during the years ended December 31, 2023 and 2022. We expect that, until we acquire a sufficient amount of Music Royalty Assets, we will not be generating sufficient revenue to carry out our planned operations. In order to generate sufficient revenues to carry out our plan of operations and cover our expenses, including the expenses of our offerings, we believe we will need to continue to acquire Music Royalty Assets until we reach a sufficient scale. We expect that our costs may increase as we continue identifying and negotiating with artists and record labels and entering into new Royalty Share Agreements and thereby incurring more costs. Further, the Music Royalty Assets we license may still be in development (such as an incomplete music album from an artist) and therefore may not be generating sales when we acquire such assets. If a lack of available capital means that we are unable to expand our operations or otherwise take advantage of business opportunities, our business, financial condition and results of operations could be adversely affected.

We expect that, in order to maintain and grow our operations, we will need to promote multiple Royalty Share Unit offerings. There can be no assurance that we will be able to promote enough offerings to sustain our business model.

Although SongVest already has a pipeline of royalty holders to seed our company with offerings, we will need to have a continuous pipeline of offerings that allow us to achieve certain economies of scale in regard to marketing, distribution and other functions. However, we may fail to have a sufficient pipeline of offerings to support our business model and we may fail to achieve economies of scale. There can be no assurance that we will be able to have a sufficient number of successful offerings to achieve revenues that exceed our costs and margins that justify our continued operations.

There are few businesses that have pursued a strategy or investment objective similar to ours, which may make it difficult for our company and Royalty Share Units to gain market acceptance.

We believe that few other companies crowd fund Music Royalty Assets or propose to run a platform for crowd funding Music Royalty Assets. Our company and our Royalty Share Units may not gain market acceptance from potential investors, potential asset sellers or service providers within the music industry. This could result in an inability of our manager to operate the Music Royalty Assets profitably. This could impact the issuance of further series of Royalty Share Units and additional Music Royalty Assets being acquired by us. This would further inhibit market acceptance of our company and if we do not acquire any additional Music Royalty Assets in a timely manner, it will be difficult for us to establish a sustainable business strategy and gain market acceptance.

We are substantially reliant on our ability to utilize the SongVest Platform.

Our strategy for offering and selling Royalty Share Units is substantially dependent on our ability to utilize the SongVest Platform. In October 2024, we entered into a Services Agreement with RT2, our affiliate and owner of the SongVest Platform, which provides us with access to, and use of the SongVest Platform to facilitate a number of functions related to our Royalty Share Unit offerings, including “testing the waters” communications, marketing, “second price” auctions, as hosting our offerings, as well as processing subscriptions. While both our company and RT2 is owned and managed by SAJA, if for any reason our Services Agreement were cancelled and we were no longer able to utilize the SongVest Platform, we would likely experience a significant material adverse effect as a result, and would likely have to expend significant financial and management resources towards finding an alternative platform to support our offerings – and we may ultimately be unsuccessful in pivoting away from the SongVest Platform.

Our success depends in large part upon our manager and its ability to execute our business plan.

The successful operation of our company is in part dependent on the ability of our manager to enter into Royalty Share Agreements for Music Royalty Assets. The success of our company (and therefore, each series of Royalty Share Units) will be highly dependent on the expertise and performance of our manager, its expert network and other investment professionals (which include third party experts) to source, acquire and manage the Music Royalty Assets. The loss of the services of one or both members of the manager could have a material adverse effect on the Music Royalty Assets, in particular, their ongoing management and ability to provide value for the holders of the series Royalty Share Units.

In the event a royalty holder breaches the terms of a Royalty Share Agreement, we would have limited recourse and due to that we may not be able to collect the royalties the royalty holder represented and may not be able to get the funds paid to the royalty holder back to reimburse the investors.

Each Royalty Share Agreement will be between a royalty holder and SongVest. Holders of our Royalty Share Units will have no rights under any Royalty Share Agreement, whether as third-party beneficiaries or otherwise. In the event that we terminate any Royalty Share Agreement due to a material breach by a royalty holder – for example, if the royalties they represent they owned were in fact not theirs to assign royalty income rights to – we will likely not make any royalty payments to holders of the relevant Royalty Share Units.

We intend to enforce all contractual obligations to the extent we deem necessary and in the best interests of our company and holders of Royalty Share Units. However, the royalty holder who misrepresents the royalties they have assigned in the Royalty Share Agreement may not return some or all of the payments they received as part of the sale of the Music Royalty Asset to SongVest, which means that Royalty Share Unit holders may not receive some or all of the investment they made in those units.

Potential breach of the security measures of the SongVest Platform could have a material adverse effect on our company.

The highly automated nature of the SongVest Platform through which potential investors bid during the testing the waters phase, or acquire Royalty Share Units may make it an attractive target and potentially vulnerable to cyber-attacks, computer viruses, physical or electronic break-ins or similar disruptions. The SongVest Platform processes certain confidential information about investors, and while there are measures in place to protect confidential information and maintain appropriate cybersecurity of the SongVest Platform, there can be no guarantee that such measures will be sufficient to prevent a cybersecurity breach of the data of the SongVest Platform. Any accidental or willful security breaches or other unauthorized access to the SongVest Platform could cause confidential information to be stolen and used for criminal purposes or have other harmful effects. Security breaches or unauthorized access to confidential information could also expose RT2, LLC or our shared parent company and manager to liability related to the loss of the information or time-consuming and expensive litigation. It could also expose us to negative publicity, or loss of the proprietary nature of our manager’s and our affiliates’ trade secrets. If security measures are breached because of third-party action, employee error, malfeasance or otherwise, or if design flaws in the SongVest Platform software are exposed and exploited, the relationships between our company, investors, users and the asset sellers could be severely damaged, and our company could incur liability or have its attention significantly diverted from utilization of the Music Royalty Assets, which could have a material negative impact on the value and payments available for the Royalty Share Units.

Because techniques used to sabotage or obtain unauthorized access to systems change frequently and generally are not recognized until they are launched against a target, we, the third-party hosting used by the SongVest Platform and other third-party service providers may be unable to anticipate these techniques or to implement adequate preventative measures. In addition, federal regulators and many federal and state laws and regulations require companies to notify individuals of data security breaches involving their personal data. These mandatory disclosures regarding a security breach are costly to implement and often lead to widespread negative publicity, which may cause investors, the asset sellers or service providers within the industry, including insurance companies, to lose confidence in the effectiveness of the secure nature of the SongVest Platform. Any security breach, whether actual or perceived, could harm our reputation and that of the SongVest Platform, which is an integral part of our business and offering ecosystem. This could impair our ability to achieve our objectives of acquiring additional Music Royalty Assets through the issuance of further series of Royalty Share Units and monetizing them together with existing assets through revenue generating events and leasing opportunities.

We may encounter limitations on the effectiveness of our internal controls and a failure of our internal controls to prevent error or fraud may harm our business and holders of Royalty Share Units.

Because we operate with minimal employees, we may encounter limitations on the effectiveness of our internal controls over financial reporting, public disclosures and other matters. For example, as a result of our staffing, our processing of financial information may suffer from a lack of segregation of duties, such that journal entries and account reconciliations are not reviewed by someone other than the preparer. If we encounter limitations on the effectiveness of our internal controls and are unable to remediate them, we may not be able to report our financial results accurately, prevent fraud or file our periodic reports as a Regulation A reporting company in an accurate, complete and timely manner. This could harm our business and holders of Royalty Share Units.

Risks Related to the Music Industry

Income generated by music royalty rights may be reduced if the recorded music industry fails to grow or streaming revenue fails to grow at a sufficient rate to offset download and physical sales declines.

Legal digital music has rapidly grown since 2003, and revenue from music downloads and streaming services have emerged, with streaming revenue experiencing multi-year growth and currently accounting for more than 50% of the overall revenue in the recorded music business. According to the International Federation of the Phonographic Industry (“IFPI”) 2024 Global Music Report, global recorded music market grew by 10.2% in 2023, reaching $28.6 billion in revenue. Streaming continues to dominate, with total streaming revenues rising to $19.3 billion, representing 67.3% of the total market. Subscription-based streaming grew by 11.2%, making up nearly 48.9% of the global market, with over 667 million users of paid subscription accounts.

This is a significant update from 2022, where streaming revenues accounted for $17.5 billion, or 67% of total global recorded music revenues, showing a continued upward trend in digital music consumption

There can be no assurances that this growth pattern will persist or that digital revenue will grow at a rate sufficient to offset declines in physical sales, or that changes in streaming models will not negatively impact income generated from our music royalty rights. A declining recorded music industry is likely to lead to reduced levels of revenue and operating income generated by the recorded music business. There are also a variety of factors that could cause the prices in the recorded music industry to be reduced. They are, among others, consumption during a global pandemic and fear for economic downturns, price competition from the sale of motion pictures and videogames in physical and digital formats, the negotiating leverage of mass merchandisers, big-box retailers and distributors of digital music, the increased costs of doing business with mass merchandisers and big-box retailers as a result of complying with operating procedures that are unique to their needs and any associated changes.

Changes in technology may affect our ability to receive payments from music royalty rights.

The recorded music business is dependent in part on technological developments, including access to and selection and viability of new technologies, and is subject to potential pressure from competitors as a result of their technological developments. For example, the recorded music business may be further adversely affected by technological developments that facilitate the piracy of music, such as Internet peer-to-peer filesharing activity, by an inability to enforce intellectual property rights in digital environments, and by a failure to develop successful business models applicable to a digital environment. The recorded music business also faces competition from other forms of entertainment and leisure activities, such as cable and satellite television, motion pictures, and videogames, whether in physical or digital formats. The new digital business, including the impact of ad-supported music services, some of which may be able to avail themselves of “safe harbor” defenses against copyright infringement actions under copyright laws, may also limit the recorded music industry’s ability to receive income from music royalty rights. Due to such “safe harbor” defenses, revenue from ad-supported music services may not fully reflect increases in consumption of recorded music. In addition, the recorded music industry is currently dependent on a small number of leading digital music services, which allows such services to significantly influence the prices that can be charged in connection with the distribution of digital music. It is possible that the share of music sales by a small number of leading mass-market retailers, as well as online retailers and digital music services, will continue to grow, which could further increase their negotiating leverage and put pressure on prices, ultimately decreasing the income we will receive from music royalty rights.

Failure to obtain, maintain, protect and enforce our intellectual property rights could substantially harm our business, operating results and financial condition.

The success of our company depends on our ability to obtain, maintain, protect and enforce our rights under each Royalty Share Agreement. The measures that we take to obtain, maintain, protect and enforce our rights, including, if necessary, litigation or proceedings before governmental authorities and administrative bodies, may be ineffective, expensive and time-consuming and, despite such measures, we may not be able to enforce royalty collection on our Music Royalty Assets. Additionally, changes in law may be implemented, or changes in interpretation of such laws may occur, that may affect our ability to obtain, maintain, protect or enforce rights to our Music Royalty Assets. Moreover, with music royalty rights, it is possible that despite our due diligence efforts there could be successful challenges by third parties to the ownership of a particular copyright or royalty stream or, if acquired as a group of assets, the entire group in which case the value of the asset(s) might be significantly less valuable, or have no value. Failure to obtain, maintain, protect or enforce our rights could harm our brand or brand recognition and adversely affect our business, financial condition and results of operation.

Digital piracy may lead to decreased sales in the recorded music industry and affect our ability to receive income from music royalty rights.

The combined effect of the decreasing cost of electronic and computer equipment and related technology such as the conversion of music into digital formats have made it easier for consumers to obtain and create unauthorized copies of music recordings in the form of, for example, MP3 files. For example, a 2023 IFPI “Engaging with Music” report indicates that online music piracy remains a significant issue globally, with 29% of music consumers admitting to engaging in some form of copyright infringement. Stream-ripping continues to be the dominant form of piracy, representing 26% of illegal activity, with its prevalence especially high among younger demographics—43% of people aged 16-24 reported using stream-ripping services. The main motivation for piracy remains the desire to avoid paying for music subscriptions, as 55% of stream-rippers stated this as their reason. Such piracy will have a negative effect on revenues attributable to music royalty rights we acquire. In addition, while growth of music-enabled mobile consumers offers new opportunities for growth in the music industry, it also opens the market up to risks from behaviors such as “sideloading” and mobile app-based downloading of unauthorized content. As the business shifts to streaming music or access models, piracy in these models is increasing. For example, the practice of “stream-ripping,” where websites or software programs enable end-users to obtain an unauthorized copy of the audio file associated with a music video, is a growing practice among young people and in parts of the world with high mobile data costs. The impact of digital piracy on legitimate music sales and subscriptions is hard to quantify but we believe that illegal filesharing and other forms of unauthorized activity has a substantial negative impact on music sales and on the royalty income that we may receive, including royalties derived from music royalty rights. The music industry is working to control this problem in a variety of ways including by litigation, by lobbying governments for new, stronger copyright protection laws and more stringent enforcement of current laws, through graduated response programs achieved through cooperation with Internet service providers and legislation being advanced or considered in many countries, through technological measures and by enabling legitimate new media business models. However, we do not know whether such measures will be effective, and if such measures are not effective, our royalty income derived from our music royalty rights may decrease.

Sellers of the Music Royalty Assets do not owe any fiduciary duties to us or our investors, and they have no obligation to enhance the value of the underlying music royalty rights or disclose information to our investors.

The intellectual property owners have no obligation to enhance the value of the underlying music royalty rights we may acquire. For example, the recording artist may decide to retire which may have the effect of decreasing future royalty income on the music. Furthermore, neither the recording artist nor the intellectual property rights owner owe any fiduciary duties to us or our investors. Our investors will have no recourse directly against the recording artist or the intellectual property rights owner, either under the agreement to purchase the music royalty rights or under state or federal securities laws.

Risks Related to the Offerings and Ownership of our Royalty Share Units

Any amounts paid to holders of a particular series of Royalty Share Units will only reflect the royalty performance of the underlying Music Royalty Asset.

Investors are acquiring Royalty Share Units which reflect the royalty performance only of the Music Royalty Asset associated with those units. As such, investors will not receive the benefit of diversification in assets or share in the performance of other Music Royalty Assets relating to other series.

There is currently no public trading market for our Royalty Share Units; there can be no assurance that any trading market will develop.

There is currently no public trading market for any series of our Royalty Share Units, and an active market may not develop or be sustained. If an active public trading market for our Royalty Share Units does not develop or is not sustained, it may be difficult or impossible for investors to resell their Royalty Share Units at any price. Even if a public market does develop, the market price could decline below the amount an investor paid for their Royalty Share Units.

If a market ever develops for our Royalty Share Units, the market price and trading volume may be volatile.

If a market develops for our Royalty Share Units, the market price of our Royalty Share Units could fluctuate significantly for many reasons, including reasons unrelated to our performance, such as reports by industry analysts, investor perceptions, or announcements by our competitors regarding their own performance, as well as general economic and industry conditions. For example, to the extent that other companies, whether large or small, within our industry experience declines in their share price, the value of our Royalty Share Units may decline as well.

In addition, fluctuations in operating results of a particular series of Royalty Share Units or the failure of operating results to meet the expectations of investors may negatively impact the price of our securities. Operating results may fluctuate in the future due to a variety of factors that could negatively affect revenues or expenses in any particular reporting period, including vulnerability of our business to a general economic downturn; changes in the laws that affect our operations; competition; compensation related expenses; application of accounting standards; seasonality; and our ability to obtain and maintain all necessary government certifications or licenses to conduct our business.

There may be state law restrictions on an investor’s ability to sell its Royalty Share Units making it difficult to transfer, sell or otherwise dispose of our Royalty Share Units.

Each state has its own securities laws, often called “blue sky” laws, which (1) limit sales of securities to a state’s residents unless the securities are registered in that state or qualify for an exemption from registration and (2) govern the reporting requirements for broker-dealers and stock brokers doing business directly or indirectly in the state. Before a security is sold in a state, there must be a registration in place to cover the transaction, or it must be exempt from registration. Also, the broker must be registered in that state. We do not know whether the Royalty Share Units being offered under this Offering Circular will be registered, or exempt, under the laws of any states. A determination regarding registration will be made by the broker-dealers, if any, who agree to serve as the market-makers for our Royalty Share Units. There may be significant state blue sky law restrictions on the ability of investors to sell, and on purchasers to buy, our Royalty Share Units. Investors should consider the resale market for our Royalty Share Units to be limited. Investors may be unable to resell their Royalty Share Units, or they may be unable to resell them without the significant expense of state registration or qualification.

Investors in this offering may not be entitled to a jury trial with respect to claims arising under the subscription agreement, which could result in less favorable outcomes to the plaintiff(s) in any action under subscription agreement.

Those persons who want to invest in our Royalty Share Units must sign a subscription agreement for the particular series of Royalty Share Units, which will contain representations, warranties, covenants, and conditions customary for offerings of this type. Under Section 6 of our subscription agreement, investors waive the right to a jury trial of any claim they may have against our company arising out of or relating to the subscription agreement. This includes legal actions that include claims based on federal securities laws.

If we opposed a jury trial demand based on the waiver, a court would determine whether such waiver was enforceable based on the facts and circumstances of that case in accordance with the applicable state and federal law. To our knowledge, the enforceability of a contractual pre-dispute jury trial waiver in connection with claims arising under the federal securities laws has not been finally adjudicated by a federal court. In determining whether to enforce a contractual pre-dispute jury trial waiver provision, courts will generally consider whether the visibility of the jury trial waiver provision within the agreement is sufficiently prominent such that a party knowingly, intelligently and voluntarily waived the right to a jury trial. We believe that this is the case with respect to the subscription agreement. You should consult legal counsel regarding the jury waiver provision before investing in this offering.

If you bring a claim against our company in connection with matters arising under the subscription agreement, including claims under federal securities laws, you may not be entitled to a jury trial with respect to those claims, which may have the effect of limiting and discouraging lawsuits against our company. If a lawsuit is brought against our company under the subscription agreement, it may be heard only by a judge or justice of the applicable trial court, which would be conducted according to different civil procedures and may result in different outcomes than a trial by jury would have had, including results that could be less favorable to the plaintiff(s) in such an action.

Nevertheless, if this jury trial waiver provision is not permitted by applicable law, an action could proceed under the terms of the subscription agreement with a jury trial. No condition, stipulation or provision of the subscription agreement serves as a waiver by our company of compliance with any substantive provision of the federal securities laws and the rules and regulations promulgated under those laws.

In addition, when the Royalty Share Units are transferred, the transferee is required to agree to all the same conditions, obligations and restrictions applicable to the Royalty Share Units of the transferor that were in effect immediately prior to the transfer, including but not limited to those in the subscription agreement.

Our subscription agreement has a forum selection provisions that requires that certain disputes be resolved in a court in the State of North Carolina, regardless of convenience or cost to shareholders.

Under our subscription agreement, subscribers are required to resolve disputes related to the subscription agreement in a competent court located in the State of North Carolina. The forum selection provision in our subscription agreement applies to all actions or proceedings relating to the subscription agreement. This forum selection provision does not apply to claims brought under federal securities law.

The forum selection provision in our subscription agreement may limit subscribers’ ability to obtain a favorable judicial forum for disputes with our company, which may discourage lawsuits against the company. The requirement that any action be heard in a competent court in the State of North Carolina, may also create additional expense for any person contemplating an action against our company, or limit the access to information to undertake such an action, further discouraging lawsuits.

It is also possible that, notwithstanding the forum selection clause included in our subscription agreement, a court could rule that such provision is inapplicable or unenforceable. Alternatively, if a court were to find the provision inapplicable to, or unenforceable in, an action, we may incur additional costs associated with resolving such matters in other jurisdictions, which could adversely affect our business, financial condition or results of operations.