UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report: September 29, 2021

Commission File Number: 001-40851

Procaps Group, S.A.

(Exact name of Registrant as specified in its charter)

| Not applicable | | Grand Duchy of Luxembourg |

| (Translation of Registrant’s name into English) | | (Jurisdiction of incorporation or organization) |

9 rue de Bitbourg, L-1273

Luxembourg

Grand Duchy of Luxembourg

R.C.S. Luxembourg: B253360

Tel : +356 7995-6138

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which

registered |

| Ordinary Shares | | PROC | | The Nasdaq Stock Market LLC |

| Warrants | | PROCW | | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or ordinary shares as of the close of the period covered by the shell company report: 112,824,183 ordinary shares and 23,375,000 warrants to purchase ordinary shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Emerging growth company | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting over Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| US GAAP ☐ | International Financial Reporting Standards as issued ☒ | Other ☐ |

| | by the International Accounting Standards Board ® | |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☐

PROCAPS GROUP, S.A.

TABLE OF CONTENTS

Cautionary Note Regarding Forward-Looking Statements

This Shell Company Report on Form 20-F (including information incorporated by reference herein, the “Report”) contains or may contain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve significant risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements include information about our possible or assumed future results of operations or our performance. Words such as “expects,” “intends,” “plans,” “believes,” “anticipates,” “estimates,” and variations of such words and similar expressions are intended to identify the forward-looking statements. References to “Procaps” contained herein refer to Crynssen Pharma Group Limited. Forward-looking statements in this Report may include, for example, statements about:

| ● | the benefits of the Business Combination; |

| ● | the financial performance of Procaps Group, S.A. (the “Company”) following the Business Combination; |

| ● | the ability to maintain the listing of the Ordinary Shares or Warrants on Nasdaq, following the Business Combination; |

| ● | changes in Procaps’ strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects and plans; |

| ● | Procaps’ ability to develop and launch new products and services; |

| ● | Procaps’ ability to successfully and efficiently integrate future acquisitions or execute on dispositions; |

| ● | The availability of raw materials used in Procaps’ products and its ability to source such raw materials, or find adequate substitutes, in a cost-effective manner; |

| ● | Procaps’ product development timeline and estimated R&D (as defined below) costs; |

| ● | developments and projections relating to Procaps’ competitors and industry; |

| ● | Procaps’ expectations regarding its ability to obtain and maintain intellectual property protection and not infringe on the rights of others; |

| ● | the impact of the COVID-19 pandemic on Procaps’ business; |

| ● | changes in applicable laws or regulations; and |

| ● | the outcome of any known and unknown litigation and regulatory proceedings. |

These forward-looking statements are based on information available as of the date of this Report, and current expectations, forecasts and assumptions involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include:

| ● | the ability to maintain the listing of the Ordinary Shares on Nasdaq following the Business Combination; |

| ● | our ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition and the ability of Procaps to grow and manage growth profitably following the Business Combination; |

| ● | costs related to the Business Combination; |

| ● | changes in applicable laws or regulations; |

| ● | any identified material weaknesses in Procaps’ internal control over financial reporting which, if not corrected, could adversely affect the reliability of Procaps’ and the Company’s financial reporting; |

| ● | the effects of the COVID-19 pandemic on Procaps’ business; |

| ● | the ability to implement business plans, forecasts, and other expectations after the completion of the Business Combination, and identify and realize additional opportunities; |

| ● | the risk of failure in the development of new pharmaceutical products and the costs involved; |

| ● | the risk that delays in regulatory reviews and approvals of new products could delay Procaps’ ability to market such products, and that post-approval requirements, including additional clinical trials, could result in increased costs; |

| ● | the risk associated with fluctuations in the costs, availability, and suitability of the components of the products Procaps manufactures, including active pharmaceutical ingredients, excipients, purchased components, and raw materials; |

| ● | the risk of a change in demand for Procaps products and services, consumer preferences and the possibility of rapid technological change in the highly competitive industry in which Procaps operates; |

| ● | the risk that changes to price control regulations could negatively affect Procaps’ margins and its ability to pass on cost increases to its customers; |

| ● | the risks associated with the effect of Procaps’ products on Procaps’ customers and potential exposure to product and other liability risks; |

| ● | the risk of disruption at any of Procaps’ manufacturing facilities; |

| ● | the risks associated with exchange rate volatility of the currencies in which Procaps does business; |

| ● | the risk of any breach, disruption or misuse of Procaps’, or Procaps’ external business partners’, information systems or cyber security efforts; |

| ● | the risk of changes in market access or healthcare reimbursement for, or public sentiment towards Procaps’, or its customers’, products, or other changes in applicable policies regarding the healthcare industry; |

| ● | the risk that Procaps, or its customers, is unable to secure or protect its intellectual property or that Procaps, or its customers, may infringe on the intellectual property rights of others; and |

| ● | the possibility that Union or Procaps may be adversely affected by other economic, business, and/or competitive factors. |

The risk factors and cautionary language referred to or incorporated by reference in this Report provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described in our forward-looking statements, including among other things, the items identified in the section entitled “Risk Factors” of Amendment No. 2 of the Company’s Registration Statement on Form F-4 (333-257222) filed with the Securities and Exchange Commission (the “SEC”) on August 17, 2021 (the “Form F-4”), which are incorporated by reference into this Report.

Explanatory Note

On September 29, 2021 (the “Closing Date”), the Company consummated the transactions contemplated by that previously announced business combination agreement dated as of March 31, 2021, by and among Union Acquisition Corp. II, a Cayman Islands exempted company limited by shares with registration number 345887 (“Union” or the “SPAC”), Crynssen Pharma Group Limited, a private limited liability company registered and incorporated under the laws of Malta and, particularly, the Companies Act Cap. 386 with company registration number C 59671 (“Procaps”), the Company and OZLEM Limited, an exempted company incorporated under the laws of the Cayman Islands with registration number 373625 (“Merger Sub”), as amended by that certain amendment No. 1 to the business combination agreement dated as of September 29, 2021, by and among Union, Procaps, the Company and Merger Sub (the “Business Combination Agreement”). Capitalized terms used in this section but not otherwise defined herein have the meanings given to them in the Business Combination Agreement.

On the Closing Date, pursuant to the Business Combination Agreement:

| ● | Merger Sub merged with and into SPAC, with SPAC surviving such merger and becoming a direct wholly-owned subsidiary of the Company (the “Merger”) and, in the context of the Merger, (a) all ordinary shares of SPAC, par value $0.0001 per share (the “SPAC Ordinary Shares”) outstanding were exchanged with the Company for ordinary shares of the Company, nominal value $0.01 per share (the “Ordinary Shares”) pursuant to a share capital increase of the Company, (b) each warrant entitling the holder to purchase one SPAC Ordinary Share (as contemplated under the warrant agreement, by and between Union and Continental Stock Transfer & Trust Company (“Continental”) dated as of October 17, 2019 (the “SPAC Warrant Agreement”)), at an exercise price of $11.50 per SPAC Ordinary Share (the “SPAC Warrants”), became warrants of the Company (the “Warrants”) exercisable for Ordinary Shares, on substantially the same terms as the SPAC Warrants, and (c) the Company entered into an assignment, assumption and amendment agreement with SPAC and Continental, as warrant agent, to amend and assume SPAC’s obligations under the SPAC Warrant Agreement to give effect to the conversion of SPAC Warrants to Warrants; |

| ● | immediately following the consummation of the Merger and prior to the Exchange (as defined below), the Company redeemed all 4,000,000 redeemable A shares of the Company, nominal value $0.01 per share (the “Redeemable A Shares”), held by Procaps as a result of the incorporation of the Company at their nominal value; |

| ● | immediately following the consummation of the Merger and the redemption of all the Redeemable A Shares, pursuant to those certain individual contribution and exchange agreements, each dated as of March 31, 2021, as amended, and entered into by and among the Company, Procaps and each of the shareholders of Procaps prior to the Business Combination (the “Procaps Shareholders”), each of the Procaps Shareholders, contributed its respective ordinary shares of Procaps, with a nominal value of $1.00 per share, together representing the entire share capital of Procaps on a fully diluted basis (the “Procaps Ordinary Shares”), to the Company in exchange for Ordinary Shares, and, in the case of International Finance Corporation (“IFC”), for Ordinary Shares and 4,500,000 redeemable B shares of the Company, nominal value $0.01 per share (the “Redeemable B Shares”), which were subscribed for by each such Procaps Shareholder (such contributions and exchanges of Procaps Ordinary Shares for Ordinary Shares and, in the case of IFC, Ordinary Shares and Redeemable B Shares, collectively, the “Exchange”); |

| ● | as a result of the Exchange, Procaps become a direct wholly-owned subsidiary of the Company and the Procaps Shareholders became holders of issued and outstanding Ordinary Shares and, in the case of IFC, Ordinary Shares and Redeemable B Shares; and |

| ● | immediately following the Exchange, the Company redeemed 4,500,000 Redeemable B Shares from IFC for a total purchase price of $45,000,000 in accordance with that certain share redemption agreement entered into by and between the Company and IFC on March 31, 2021, as amended. |

In connection with the execution of the Business Combination Agreement, Union entered into separate subscription agreements with a number of investors (collectively, the “Subscribers”), pursuant to which the Subscribers agreed to subscribe for and purchase, and Union agreed to sell to the Subscribers, an aggregate of 10,000,000 SPAC Ordinary Shares, for a purchase price of $10.00 per share and an aggregate purchase price of $100,000,000, which SPAC Ordinary Shares were automatically exchanged with the Company for Ordinary Shares at the effective time of the Merger.

Certain amounts that appear in this Report may not sum due to rounding.

DEFINED Terms

In this Report:

“1915 Law” means the Luxembourg law of August 10, 1915 on commercial companies, as amended.

“Adjournment Proposal” means the proposal by ordinary resolution to, if necessary, adjourn the Extraordinary General Meeting to a later date as necessary.

“Board” means the Board of Directors of the Company.

“Business Combination” means the transactions contemplated by the Business Combination Agreement, including the Merger and the Exchange.

“Business Combination Agreement” means the Business Combination Agreement, dated as of March 31, 2021, as amended by Amendment No. 1 to Business Combination Agreement dated September 29, 2021, by and among Union, Procaps, the Company and Merger Sub.

“Business Combination Proposal” means the proposal by ordinary resolution to approve the adoption of the Business Combination Agreement and the Business Combination.

“Closing” means the consummation of the Business Combination.

“Closing Date” means September 29, 2021.

“Company” means Procaps Group, S.A., a public limited liability company (société anonyme) governed by the laws of the Grand Duchy of Luxembourg, having its registered office at 9, rue de Bitbourg, L-1273 Luxembourg, Grand Duchy of Luxembourg, and registered with the Luxembourg Trade and Companies’ Register (Registre de Commerce et des Sociétés, Luxembourg) under number B 253360.

“Exchange Agreements” mean those certain individual Contribution and Exchange Agreements, each dated as of March 31, 2021, and entered into by and among the Company, Procaps and each of the Procaps Shareholders.

“Executive Management” means members of the executive management team of the Company.

“IFC Redemption Agreement” means that certain Share Redemption Agreement entered into by and between Holdco and IFC on March 31, 2021, pursuant to which Holdco shall redeem 6,000,000 Holdco Redeemable B Shares from IFC for a total purchase price of $60,000,000 in accordance with the terms thereunder.

“IFRS” means the International Financial Reporting Standards as issued by the International Accounting Standards Board.

“IPO” means Union’s initial public offering of units, consummated on October 22, 2019.

“Merger” means the merging of Merger Sub with and into Union pursuant to the laws of the Cayman Islands, with Union surviving the Merger as a wholly owned subsidiary of the Company.

“Merger Proposal” means the proposal by special resolution to approve and confirm the Plan of Merger.

“Merger Sub” means OZLEM Limited, an exempted company incorporated under the laws of the Cayman Islands with registration number 373625.

“Nasdaq” means the Nasdaq Capital Market, the Nasdaq Global Market or the Nasdaq Global Select Market, as may be applicable.

“Nasdaq Proposal” means the proposal by ordinary resolution to approve, for purposes of complying with applicable listing rules of Nasdaq, the issuance of SPAC Ordinary Shares in connection with the PIPE, consisting of more than 20% of the current total issued and outstanding SPAC Ordinary Shares.

“Ordinary Share” means the ordinary shares of the Company, each having a nominal value in U.S. dollars of $0.01 per share.

“PIPE” or “PIPE Investment” means the private placement pursuant to which certain investors purchased SPAC Ordinary Shares, for a purchase price of $10.00 per share, which were exchanged into Ordinary Shares in connection with the Closing.

“Plan of Merger” means the Plan of Merger, in the form attached to the F-4 as Annex B thereto.

“Private Placement Warrants” means the warrants to purchase SPAC Ordinary Shares purchased in a private placement in connection with the IPO.

“Procaps” means Crynssen Pharma Group Limited, a private limited liability company registered and incorporated under the laws of Malta and, particularly, the Companies Act Cap. 386 with company registration number C 59671. “Redeemable B Shares” means the redeemable B shares of the Company, each having a nominal value in U.S. dollars of $0.01 per share, issued to IFC upon consummation of the Exchange.

“Registration Rights and Lock-Up Agreement” means that certain Registration Rights and Lock-Up Agreement to be entered into in connection with the Closing by and among the Initial Shareholders and the Procaps Shareholders, substantially in the form attached to the Business Combination Agreement as Exhibit A.

“SEC” means the U.S. Securities and Exchange Commission.

“SPAC” or “Union” means Union Acquisition Corp. II, a Cayman Islands exempted company limited by shares with registration number 345887.

“SPAC Ordinary Shares” means the SPAC’s ordinary shares, par value $0.0001 per share.

“SPAC Warrants” means warrants to purchase SPAC Ordinary Shares as contemplated under the SPAC Warrant Agreement, with each warrant exercisable for the number of SPAC Ordinary Shares stated in the applicable SPAC Warrant at an exercise price per SPAC Ordinary Share of $11.50.

“Sponsors” means Union Group International Holdings Limited and Union Acquisition Associates II, LLC.

“Trust Account” means the trust account that holds a portion of the proceeds of the IPO and the simultaneous sale of the Private Placement Warrants.

“Warrants” means the former SPAC Warrants converted into a right to acquire one Ordinary Share on substantially the same terms as were in effect prior to the Merger and the Exchange under the terms of the Warrant Agreement.

“Warrant Amendment” means that certain Assignment, Assumption and Amendment Agreement entered into on the Closing Date by and among the Company, SPAC and Continental, as warrant agent, pursuant to which the SPAC’s obligations under the SPAC Warrant Agreement were amended and the Company assumed such obligations to give effect to the conversion of SPAC Warrants to Warrants .

PART I

Item 1. Identity of Directors, Senior Management and Advisers

A. Directors and Senior Management

The members of our Executive Management and the Company’s Board upon the consummation of the Business Combination are set forth in the Form F-4, in the section entitled “Management of Holdco after the Business Combination,” which is incorporated herein by reference. Immediately prior to the Closing, on the Closing Date, Procaps, the sole shareholder of the Company, appointed all of the director nominees referenced in the Form F-4 as directors of the Company, effective immediately. Unless otherwise indicated in Item 7-A below, business address for each of Company’s directors and members of Executive Management is Calle 80 No. 78B-201, Barranquilla, Atlántico, Colombia.

B. Advisors

Greenberg Traurig, P.A., 333 S.E. 2nd Avenue, Miami, Florida 33131 and Arendt & Medernach SA, 41A avenue JF Kennedy L-2082 Luxembourg, have acted as U.S. and Luxembourg counsel, respectively for the Company and will act as counsel to the Company following the Closing.

C. Auditors

WithumSmith+Brown, PC acted as Union’s independent auditor for the year ended September 30, 2020 and the period from December 6, 2018 (inception) through September 30, 2019.

Deloitte & Touche Ltda. acted as Procaps’ independent registered public accounting firm for the years ended December 31, 2019 and 2020.

In connection with the consummation of the Business Combination, the Company intends to retain Deloitte & Touche Ltda, Procaps’ previous auditor, as the Company’s independent registered public accounting firm following the Closing.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

A. Selected Financial Data

Prior to the Business Combination, the Company had no material assets and did not operate any business. Following and as a result of the Business Combination, the business of the Company is conducted through Procaps, the Company’s direct, wholly-owned subsidiary, and Procaps’ subsidiaries.

Union

Selected financial information regarding Union is included in the Form F-4 in the section entitled “Selected Historical Financial Data of Union”, which is incorporated herein by reference.

Procaps

Selected financial information regarding Procaps is included in the Form F-4 in the section entitled “Selected Historical Financial Data of Procaps,” which is incorporated herein by reference.

B. Capitalization and Indebtedness

The following table sets forth the capitalization of the Company on an unaudited pro forma consolidated basis as of December 31, 2020, after giving effect to the Business Combination.

| As of December 31, 2020 (pro forma for Business Combination and PIPE financing) | | (in thousands of USD) | |

| Cash and cash equivalents | | | 80,013 | |

| Trade and other receivables, net | | | 96,493 | |

| Inventories, net | | | 64,284 | |

| Other current assets | | | 19,792 | |

| Total current assets | | | 260,582 | |

| Total non-current assets | | | 174,836 | |

| Total assets | | | 435,418 | |

| | | | | |

| Total current liabilities | | | 239,628 | |

| Total non-current liabilities | | | 160,815 | |

| Total liabilities | | | 400,443 | |

| | | | | |

| Share capital (Company) | | | 1,128 | |

| Additional paid-in capital | | | 461,073 | |

| Reserves | | | 39,897 | |

| Accumulated deficit | | | (443,479 | ) |

| Accumulated other comprehensive loss | | | (24,421 | ) |

| Equity (deficit) attributable to owners of the company | | | 34,198 | |

| Non-controlling interest | | | 777 | |

| Total equity (deficit) | | | 34,975 | |

| Total equity and liabilities | | | 435,418 | |

On April 16, 2021, in connection with the vote to approve the amendment to the then current amended and restated articles of association of Union to extend the date by which Union was required consummate its initial business combination from April 22, 2021 to October 22, 2021, certain shareholders of Union exercised their right to redeem 6,446,836 SPAC Ordinary Shares for cash at a redemption price of approximately $10.07 per share, for an aggregate redemption amount of approximately $64.9 million.

Prior to the Closing, on September 22, 2021, in connection with the vote to approve the Business Combination Proposal, the Merger Proposal, the Nasdaq Proposal and the Adjournment Proposal at Union’s extraordinary general meeting, certain shareholders of Union exercised their right to redeem 7,657,670 SPAC Ordinary Shares for cash at a redemption price of approximately $10.19 per share, for an aggregate redemption amount of approximately $78.0 million.

On September 29, 2021, the Company, Procaps, Union, and Merger Sub entered into that certain Amendment No. 1 to Business Combination Agreement (the “Amendment to the BCA”), pursuant to which, among other things, the Company, Procaps, Union, and Merger Sub agreed to (i) reduce the number of Redeemable B Shares to be issued to IFC in the Exchange by 1,500,000 and increase the number of Ordinary Shares to be issued to IFC in the Exchange by 1,500,000, and (ii) increase the “SPAC Transaction Expenses Cap” to $16,650,000 and reduce the amount of minimum cash, required under Section 9.03(e) of the Business Combination Agreement to be held by the SPAC (either in or outside the Trust Account) at Closing, to $160,000,000.

Concurrently with the execution and delivery of the Amendment to the BCA, the Company, Procaps and IFC entered into an amendment to IFC’s Exchange Agreement, and the Company and IFC entered into an amendment to the IFC Redemption Agreement, pursuant to which the parties thereto agreed to the reduction in the number of Redeemable B Shares issued to IFC in the Exchange and the increase in the number of Ordinary Shares issued to IFC in the Exchange as described above, and the Company and IFC agreed that the Company would redeem 4,500,000, instead of 6,000,000, Redeemable B Shares from IFC at a price of $10.00 per Redeemable B Share, immediately following the Closing.

Additionally, the Sponsors entered into a share forfeiture agreement on September 29, 2021, by and among the Sponsors, the Company, Procaps and Union (the “Share Forfeiture Agreement”, pursuant to which, the Sponsors forfeited a combined 700,000 SPAC Ordinary Shares prior to the consummation of the Business Combination.

C. Reasons for the Offer and Use of Proceeds`

Not applicable.

D. Risk Factors

The risk factors associated with the Company are described in the Form F-4 in the section entitled “Risk Factors” and are incorporated herein by reference.

Item 4. Information on the Company

A. History and Development of the Company

The Company was incorporated under the laws of the Grand Duchy of Luxembourg on March 29, 2021, as a public limited liability company (société anonyme) solely for the purpose of effectuating the Business Combination, which was consummated on September 29, 2021. See “Explanatory Note” for further details of the Business Combination. See also a description of the material terms of the Business Combination as described in the Form F-4 in the section entitled, “The Business Combination.” The Company owns no material assets other than its interests in Procaps acquired in the Business Combination and does not operate any business. Procaps is a private limited liability company registered and incorporated under the laws of Malta and, particularly, the Companies Act Cap. 386 with company registration number C 59671. See Item 5 for a discussion of Procaps’s principal capital expenditures and divestitures for the year ended December 31, 2020. There are no other material capital expenditures or divestitures currently in progress as of the date of this Report.

The mailing address of the Company’s principal executive office is 9 rue de Bitbourg, L-1273, Luxembourg, Grand Duchy of Luxembourg, and its telephone number is +356 7995-6138. The Company’s principal website address is www.procapsgroup.com. The information contained on, or accessible through, the Company’s websites is not incorporated by reference into this Report, and you should not consider it a part of this Report.

The Company is subject to certain of the informational filing requirements of the Exchange Act. Since the Company is a “foreign private issuer”, the officers, directors and principal shareholders of the Company are exempt from the reporting and “short-swing” profit recovery provisions contained in Section 16 of the Exchange Act with respect to their purchase and sale of Ordinary Shares. In addition, the Company is not required to file reports and financial statements with the SEC as frequently or as promptly as U.S. public companies whose securities are registered under the Exchange Act. However, the Company is required to file with the SEC an Annual Report on Form 20-F containing financial statements audited by an independent accounting firm. On August 30, 2021, the Company and Union furnished to its shareholders a proxy statement relating to the Business Combination. The SEC also maintains a website at http://www.sec.gov that contains reports and other information that the Company files with or furnishes electronically to the SEC.

The website address of the Company is https://www.procapsgroup.com. The information contained on the website does not form a part of, and is not incorporated by reference into, this Report.

B. Business Overview

Prior to the Business Combination, the Company did not conduct any material activities other than those incidental to its formation and the matters contemplated by the Business Combination Agreement, such as the making of certain required securities law filings and the establishment of certain subsidiaries. Upon the Closing, the Company became the direct parent of Procaps, and conducts its business through Procaps and Procaps’ subsidiaries.

Information regarding the business of Procaps is included in the Form F-4 in the sections entitled “Business of Procaps and Certain Information about Procaps” and “Procaps Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which are incorporated herein by reference.

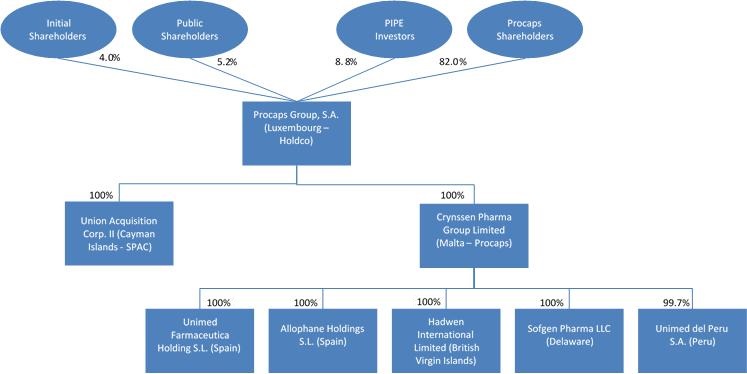

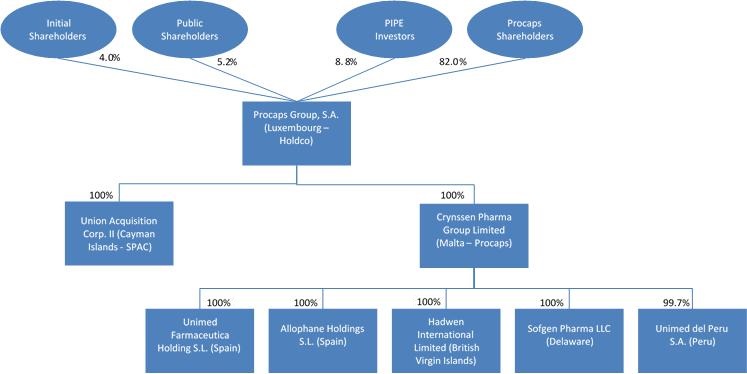

C. Organizational Structure

The following diagram shows the ownership percentages (excluding the impact of the shares underlying the Warrants) and structure of the Company immediately following the consummation of the Business Combination.

| (1) | The diagram above only shows selected subsidiaries of Procaps. |

D. Property, Plants and Equipment

Information regarding the facilities of Procaps is included in the form F-4 in the section entitled “Business of Procaps and Certain Information about Procaps—Manufacturing Facilities” and is incorporated herein by reference.

Item 4A. Unresolved Staff Comments

None / Not applicable.

Item 5. Operating and Financial Review and Prospects

Following and as a result of the Business Combination, the business of the Company is conducted through Procaps, the Company’s direct, wholly-owned subsidiary, and Procaps’ subsidiaries.

The discussion and analysis of the financial condition and results of operation of Procaps is included in the Form F-4 in the section entitled “Procaps Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which is incorporated herein by reference.

Recent Developments

Launch of Senior Notes Offering

On September 9, 2021, Procaps announced the launch of a private offering of an aggregate principal amount of $115 million of senior notes bearing interest at a fixed rate of 4.75% (the “Senior Notes”), of Procaps, S.A., a subsidiary of Procaps, in a private placement transaction. The Senior Notes will be senior unsecured obligations of Procaps, S.A. and unconditionally guaranteed by the Company, Procaps and certain subsidiary guarantors.

The Senior Notes are expected to be issued in a single tranche, with a final maturity of 10 years and amortization payments starting on the sixth anniversary of the closing of the transaction. Procaps intends to use the net proceeds from the issuance of the Senior Notes primarily to repay existing debt, as well as for general corporate purposes. The financing is expected to be leverage-neutral at closing, from a net debt perspective, which is expected to occur on or about October 2021, subject to customary closing conditions.

2021 Colombia Tax Reform

On September 14, 2021, Colombia’s President approved the Social Investment Law (Ley de Inversión Social, or the “2021 Colombian Tax Reform”), which includes certain tax measures intended to generate additional tax revenues to fund social programs for purposes of mitigating the impact of the COVID-19 Pandemic. The 2021 Colombian Tax Reform will take effect beginning in 2022, and, among other things:

| (i) | includes a corporate tax rate increase from 30% to 35% for both domestic and foreign entities, permanent establishments and branches; |

| (ii) | continues to limit the amount of turnover tax that taxpayers may claim as a corporate income tax credit to 50% by repealing a previously enacted law change that would have allowed taxpayers to claim 100% of the turnover tax effectively paid as an income tax credit; |

| (iii) | increases the carry forward period of profits subject to taxation at the corporate level exceeding the profits recorded in the company’s accounting records in the same year, from 5 to 10 years for taxpayers engaged in concession and public-private agreements; |

| (iv) | establishes a new normalization tax (i.e., tax amnesty) applicable to income taxpayers that did not declare certain assets or claimed non-existent liabilities for tax purposes, taxing such amounts at a rate of 17%, as of January 1, 2022.; and |

| (v) | eliminates the value added tax (“VAT”) exclusion for imports of goods with a value of $200 or less that enter Colombia through postal services. The exclusion, however, continues for imports from countries with which Colombia has signed a free trade agreement, by virtue of which the non-collection of VAT has been expressly agreed. For imports from countries with a free trade agreement with Colombia, the exclusion will not apply if the imports are for commercial purposes. |

The Company is evaluating the potential impact of 2021 Colombia Tax Reform on its business, financial condition and results of operations. The Company cannot anticipate the impact that the 2021 Colombia Tax Reform may have, nor the measures that could be adopted by the current administration in order to meet its financial obligations, which might negatively affect Colombian’s economy and, in turn, the Company’s business, financial condition and results of operations.

Item 6. Directors, Senior Management and Employees

A. Directors and Executive Officers

The members of our Executive Management and the Company’s Board upon the consummation of the Business Combination are set forth in the Form F-4, in the section entitled “Management of Holdco after the Business Combination,” which is incorporated herein by reference. Immediately prior to the Closing, on the Closing Date, Procaps, the sole shareholder of the Company, appointed all of the director nominees referenced in the Form F-4 as directors of the Company, effective immediately. The biographies of our Executive Management and the directors of the Company are set forth in the Form F-4, in the sections titled, “Management of Procaps,” “Business of Union and Certain Information about Union — Directors and Executive Officers,” and “Management of Holdco after the Business Combination,” which are incorporated herein by reference.

B. Compensation

Information pertaining to the compensation of the directors and members of Executive Management of the Company is set forth in the Form F-4, in the sections entitled “Management of Holdco after the Business Combination—Compensation of Directors and Officers,” ”Management of Procaps — Procaps Executive Officer and Senior Management Team Compensation” and “Management of Procaps —Director Compensation,” which are incorporated herein by reference.

Additionally, immediately prior to the Closing, Procaps, the sole shareholder of the Company, approved the following compensation for the directors of the Company. Each director of the Company will receive compensation in the amount of $56,000 per annum except for (i) any director who is an officer or employee of the Company, and (ii) Mr. Weinstein who will receive compensation in the amount of $150,000 per annum which amount includes all services which Mr. Weinstein provides to the Company.

C. Board Practices

Information pertaining to the Board practices following the Closing is set forth in the Form F-4, in the sections entitled “Management of Holdco after the Business Combination,” which is incorporated herein by reference.

Following consummation of the Business Combination, the directors have been assigned committee membership as follows, to serve for a term of one year, to be appointed by the general meeting of shareholders:

| Director | | Committees |

| Ruben Minski | | Mergers and Acquisitions |

| Jose Minski | | - |

| Alejandro Weinstein | | Mergers and Acquisitions (Chair) |

| Luis Fernando Castro | | Compensation (Chair), Nominating (Chair) and Audit |

| Daniel W. Fink | | Audit |

| Kyle P Bransfield | | Mergers and Acquisitions |

| David Yanovich | | Compensation, Nominating and Audit (Chair) |

As a foreign private issuer, we are permitted to follow certain Luxembourg corporate governance practices in lieu of certain listing rules of The Nasdaq Stock Market, or Nasdaq Listing Rules. We plan to follow the corporate governance requirements of the Nasdaq Listing Rules, except that we intend to follow Luxembourg practice with respect to quorum requirements for shareholder meetings in lieu of the requirement under Nasdaq Listing Rules that the quorum be not less than 33 1/3% of the outstanding voting shares. Under our articles of association, at an ordinary general meeting, there is no quorum requirement and resolutions are adopted by a simple majority of validly cast votes. In addition, under our articles of association, for any resolutions to be considered at an extraordinary general meeting of shareholders, the quorum shall be at least one half of our issued share capital unless otherwise mandatorily required by law.

D. Employees

Following and as a result of the Business Combination, the business of the Company is conducted through Procaps, the Company’s direct, wholly-owned subsidiary and Procaps’ subsidiaries.

Information pertaining to Procaps’s employees is set forth in the Form F-4, in the section entitled “Business of Procaps and Certain Information about Procaps — Employees,” which is incorporated herein by reference.

E. Share Ownership

Information about the ownership of the Ordinary Shares by the Company’s directors and members of Executive Management upon consummation of the Business Combination is set forth in Item 7.A of this Report.

Item 7. Major Shareholders and Related Party Transactions

A. Major Shareholders

The following table sets forth information regarding the beneficial ownership of the Ordinary Shares as of September 29, 2021 immediately following the consummation of the Business Combination by:

| ● | each person known by us to be the beneficial owner of more than 5% of the Ordinary Shares; |

| ● | each of our directors and members of Executive Management; and |

| ● | all our directors and members of Executive Management as a group. |

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security, and includes shares underlying warrants, as applicable, that are currently exercisable or convertible or exercisable or convertible within 60 days. Ordinary Shares that may be acquired within 60 days of September 29, 2021 pursuant to the exercise of Warrants are deemed to be outstanding for the purpose of computing the percentage ownership of such holder but are not deemed to be outstanding for computing the percentage ownership of any other person or entity shown in the table.

Unless otherwise indicated, we believe that all persons named in the table below have sole voting and investment power with respect to the Ordinary Shares beneficially owned by them.

| Name and Address of Beneficial Owner | | Amount and

Nature of

Beneficial

Ownership | | | Approximate

Percentage of

Outstanding

Shares | |

| Ruben Minski(1) | | | 31,338,454 | (11) | | | 27.7 | % |

| Jose Minski(2) | | | 17,960,146 | (12) | | | 15.9 | % |

| Alexandre Weinstein(3) | | | 15,877,516 | (13) | | | 14.0 | % |

| Kyle P. Bransfield(4) | | | 2,097,500 | (14) | | | 1.9 | % |

| Daniel W. Fink(5) | | | 75,000 | | | | * | |

| All directors and executive officers as a group (five individuals) | | | 67,348,616 | | | | 59.7 | % |

| Five Percent Holders: | | | | | | | | |

| Sognatore Trust(6) | | | 31,338,454 | | | | 27.8 | % |

| Simphony Trust(7) | | | 17,960,146 | | | | 15.9 | % |

| Deseja Trust(8) | | | 17,960,146 | (15) | | | 15.9 | % |

| Hoche Partners Pharma Holding S.A.(9) | | | 15,877,516 | | | | 14.1 | % |

| International Finance Corporation(10) | | | 9,492,427 | | | | 8.4 | % |

Notes: —

| (1) | The business address of Mr. Ruben Minski is Calle 80 No. 78B-201, Barranquilla, Atlántico, Colombia. |

| (2) | The business address of Mr. Jose Minski is 21500 Biscayne Boulevard, Suite 600, Aventura, Florida 33180. |

| (3) | The business address of Mr. Weinstein is Calle 80 No. 78B-201, Barranquilla, Atlántico, Colombia. |

| (4) | The business address of Mr. Bransfield is 1425 Brickell Ave., #57B, Miami, Florida 33131. |

| (5) | The business address of Mr. Fink is 1425 Brickell Ave., #57B, Miami, Florida 33131. |

| (6) | The business address of the Sognatore Trust is Oficina 503A-02, Edificio Quantum (500) Ruta 8 km. 17.500 Zonamérica, Montevideo, Uruguay. |

| (7) | The business address of the Simphony Trust is 29 Bancroft Mills Road, Wilmington, Delaware 19806. |

| (8) | The business address of the Deseja Trust is 29 Bancroft Mills Road, Wilmington, Delaware 19806. |

| (9) | The business address of Hoche Partners Pharma Holding S.A. is 3A, Val Ste Croix, L-1371 Luxembourg, Grand Duchy of Luxembourg. |

| (10) | The business address of the International Finance Corporation is 2121 Pennsylvania Avenue, NW, Washington DC, 20433. |

| (11) | Represents shares held by the Sognatore Trust, which holds shares for Bricol International Corp., a company wholly owned by Mr. Ruben Minski, as beneficiary. Includes 4,875,868 Ordinary Shares held in escrow subject to release pursuant to the terms of the Transaction Support Agreement. |

| (12) | Represents shares held by the Simphony Trust, which holds shares for Mr. Jose Minski as beneficiary. Includes 2,794,372 Ordinary Shares held in escrow subject to release pursuant to the terms of the Transaction Support Agreement. |

| (13) | Represents shares held by Hoche Partners Pharma Holding S.A., an entity controlled by Mr. Weinstein. |

| (14) | Includes shares held by Union Acquisition Associates II, LLC, an entity controlled by Mr. Bransfield, and PENSCO Trust Company, which holds shares for Mr. Bransfield as beneficiary. Includes 625,000 Ordinary Shares held in escrow subject to release pursuant to the terms of the Transaction Support Agreement. |

| (15) | Includes 2,794,372 Ordinary Shares held in escrow subject to release pursuant to the terms of the Transaction Support Agreement. |

B. Related Party Transactions

Information pertaining to related party transactions is set forth in the Form F-4, in the section entitled “Certain Procaps Relationships and Related Person Transactions,” which is incorporated herein by reference.

C. Interests of Experts and Counsel

None / Not applicable.

Item 8. Financial Information

A. Consolidated Statements and Other Financial Information

See Item 18 of this Report for consolidated financial statements and other financial information.

Information regarding legal proceedings involving the Company and Procaps is included in the Form F-4 in the sections entitled “Business of Procaps and Certain Information about Procaps—Legal Proceedings” and “Business of Union and Certain Information about Union—Legal Proceedings”, respectively, and is incorporated herein by reference.

B. Significant Changes

None / Not Applicable.

Item 9. The Offer and Listing

A. Offer and Listing Details

Nasdaq Listing of Ordinary Shares and Warrants

The Ordinary Shares and Warrants are listed on Nasdaq Global Market under the symbols “PROC” and “PROCW”, respectively. Holders of Ordinary Shares and Warrants should obtain current market quotations for their securities.

Lock-Up Agreements

Information regarding the lock-up restrictions applicable to the Ordinary Shares is included in the Form F-4 in the section entitled “Certain Agreements Related to the Business Combinations—Registration Rights and Lock-Up Agreement” and is incorporated herein by reference.

Transaction Support Agreement

Information regarding the restrictions applicable to the Ordinary Shares is included in the Form F-4 in the section entitled “Certain Agreements Related to the Business Combinations—Transaction Support Agreement” and is incorporated herein by reference.

Share Forfeiture Agreement

The Sponsors entered into the Share Forfeiture Agreement pursuant to which the Sponsors forfeited a combined 700,000 SPAC Ordinary Shares prior to the consummation of the Business Combination.

B. Plan of Distribution

Not applicable.

C. Markets

The Ordinary Shares and Warrants are listed on Nasdaq Global Market under the symbols “PROC” and “PROCW,” respectively.

D. Selling Shareholders

Not applicable.

E. Dilution

Not applicable.

F. Expenses of the Issue

Not applicable.

Item 10. Additional Information

A. Share Capital

The Company is authorized to issue 800,000,000 Ordinary Shares, 4,000,000 Redeemable A Shares and 4,500,000 Redeemable B Shares.

As of September 29, 2021, subsequent to the Closing of the Business Combination, there were 112,824,183 Ordinary Shares outstanding and issued, 4,000,000 Redeemable A Shares issued and held in treasury by the Company and 4,500,000 Redeemable B Shares issued and held in treasury by the Company. There were also 23,375,000 Warrants outstanding, each entitling the holder to purchase one Ordinary Share at an exercise price of $11.50 per share.

B. Memorandum and Articles of Association

The amended and restated articles of association of the Company dated as of September 29, 2021 are included as Exhibit 1.1 to this Report. The description of the articles of association of the Company contained in the Form F-4 in the section entitled “Description of Holdco’s Securities” is incorporated herein by reference.

C. Material Contracts

Material Contracts Relating to the Business Combination

Business Combination Agreement

The description of the Business Combination Agreement is included in the Form F-4 in the section entitled “The Business Combination Agreement” which is incorporated herein by reference.

On September 29, 2021, the Company, Procaps, Union, and Merger Sub entered into the Amendment to the BCA, pursuant to which, among other things, the Company, Procaps, Union, and Merger Sub agreed to (i) reduce the number of Redeemable B Shares to be issued to IFC in the Exchange by 1,500,000 and increase the number of Ordinary Shares to be issued to IFC in the Exchange by 1,500,000, and (ii) increase the “SPAC Transaction Expenses Cap” to $16,650,000 and reduce the amount of minimum cash, required under Section 9.03(e) of the Business Combination Agreement to be held by the SPAC (either in or outside the Trust Account) at Closing, to $160,000,000.

Other Agreements

The description of other material agreements relating to the Business Combination is included in the Form F-4 in the section entitled “Certain Agreements Related to the Business Combination” which is incorporated herein by reference.

Amendments to IFC Exchange Agreement and IFC Redemption Agreement

Concurrently with the execution and delivery of the Amendment to the BCA, the Company, Procaps and IFC entered into an amendment to IFC’s Exchange Agreement, and the Company and IFC entered into an amendment to the IFC Redemption Agreement, pursuant to which the parties thereto agreed to reduce the number of Redeemable B Shares issued to IFC in the Exchange by 1,500,000 and increase in the number of Ordinary Shares issued to IFC in the Exchange by 1,500,000, and the Company and IFC agreed that the Company would redeem 4,500,000, instead of 6,000,000, Redeemable B Shares from IFC at a price of $10.00 per Redeemable B Share, immediately following the Closing.

Share Forfeiture Agreement

The Sponsors entered into the Share Forfeiture Agreement pursuant to which the Sponsors forfeited a combined 700,000 SPAC Ordinary Shares prior to the consummation of the Business Combination.

D. Exchange Controls

There are no foreign exchange controls or foreign exchange regulations under the currently applicable laws of the Grand Duchy of Luxembourg.

E. Taxation

Information pertaining to tax considerations related to the Business Combination is set forth in the Form F-4, in the sections entitled “Material Luxembourg Income Tax Considerations” and “Material U.S. Federal Income Tax Considerations,” which are incorporated herein by reference.

F. Dividends and Paying Agents

The Company has never declared or paid any cash dividends and has no plan to declare or pay any dividends on Ordinary Shares in the foreseeable future. The Company currently intends to retain any earnings for future operations and expansion.

From the annual net profits of the Company, at least 5% shall each year be allocated to the reserve required by applicable laws (the “Legal Reserve”). That allocation to the Legal Reserve will cease to be mandatory as soon and as long as the aggregate amount of the Legal Reserve amounts to 10% of the amount of the share capital of the Company. The general meeting of shareholders shall resolve how the remainder of the annual net profits, after allocation to the Legal Reserve, will be disposed of by allocating the whole or part of the remainder to a reserve or to a provision, by carrying it forward to the next following financial year or by distributing it, together with carried forward profits, distributable reserves or share premium to the shareholders in proportion to the number of Ordinary Shares they hold in the Company.

The Board may resolve that the Company pay out an interim dividend to the shareholders, subject to the conditions of article 461-3 of the 1915 Law and the Company’s articles of association. The Board shall set the amount and the date of payment of the interim dividend.

Any share premium, assimilated premium or other distributable reserve may be freely distributed to the shareholders subject to the provisions of the 1915 Law and the Company’s articles of association. The dividend entitlement lapses upon the expiration of a five-year prescription period from the date of the dividend distribution. The unclaimed dividends return to the Company’s accounts.

G. Statement by Experts

Not applicable.

H. Documents on Display

We are subject to certain of the informational filing requirements of the Exchange Act. Since we are a “foreign private issuer,” our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions contained in Section 16 of the Exchange Act, with respect to their purchase and sale of our equity securities. In addition, we are not required to file reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act. However, we are required to file with the SEC an Annual Report on Form 20-F containing financial statements audited by an independent accounting firm. We will also furnish to the SEC, on Form 6-K, unaudited financial information with respect to our first two fiscal quarters. Information filed with or furnished to the SEC by us will be available on our website. On August 30, 2021, the Company and Union furnished to its shareholders a proxy statement relating to the Business Combination. The SEC also maintains a website at http://www.sec.gov that contains reports and other information that we file with or furnish electronically with the SEC.

I. Subsidiary Information

Not applicable.

Item 11. Quantitative and Qualitative Disclosures about Market Risk

The information set forth in the section entitled “Procaps Management’s Discussion and Analysis of Financial Condition and Results of Operations—Quantitative and Qualitative Disclosures about Market Risk” in the Form F-4 is incorporated herein by reference.

Item 12. Description of Securities Other than Equity Securities

Not applicable.

PART II

Not applicable.

PART III

Item 17. Financial Statements

See Item 18.

Item 18. Financial Statements

The condensed unaudited financial statements of Union are incorporated by reference to pages F-2 to F-19 in the Form F-4.

The audited financial statements of Union are incorporated by reference to pages F-20 to F-42 in the Form F-4.

The audited consolidated financial statements of Procaps are incorporated by reference to pages F-43 to F-96 in the Form F-4.

The unaudited pro forma condensed combined financial information of the Company is filed as Exhibit 99.1 hereto and incorporated herein by reference.

Item 19. Exhibits

EXHIBIT INDEX

| Exhibit No. | | Description |

| 1.1 * | | Amended and Restated Articles of Association of the Company, dated as of September 28, 2021. |

| 2.1 | | Specimen Ordinary Share Certificate of Procaps Group, S.A. (incorporated by reference to Exhibit 4.1 to the Registration Statement on Form F-4/A filed August 17, 2021 (file no. 333-. 333-257222)). |

| 2.2 | | Specimen Warrant Certificate of Procaps Group, S.A. (incorporated by reference to Exhibit A of Exhibit 4.4 to the Registration Statement on Form F-4/A filed August 17, 2021 (file no. 333-. 333-257222)). |

| 2.3 | | Warrant Agreement, dated October 17, 2019, by and between Union Acquisition Corp. II and Continental Stock Transfer & Trust Company, as warrant agent (incorporated by reference to Exhibit 4.1 to Union Acquisition Corp. II’s Form 8-K, File No. 001-39089, filed with the SEC on October 21, 2019). |

| 2.4 | | Form of Subscription Agreement for Private Warrants Being Purchased by Officers, Directors and Affiliates (incorporated by reference to Exhibit 10.6 to Union Acquisition Corp. II’s Form S-1/A, File No. 333-233988, filed with the SEC on October 8, 2019). |

| 2.5 * | | Assignment, Assumption and Amendment Agreement with respect to the Warrant Agreement between Union Acquisition Corp. II, Procaps Group, S.A. and Continental Stock Transfer & Trust Company, dated as of September 29, 2021. |

| 4.1 # | | Business Combination Agreement, dated as of March 31, 2021, by and among Union Acquisition Corp. II, Crynssen Pharma Group Limited, Procaps Group, S.A. and OZLEM Limited (incorporated by reference to Exhibit 2.1 to Union Acquisition Corp. II’s Form 8-K/A, File No. 001-39089, filed with the SEC on April 2, 2021). |

| 4.2 # * | | Amendment No. 1 to Business Combination Agreement, dated as of September 29, 2021, by and among Union Acquisition Corp. II, Crynssen Pharma Group Limited, Procaps Group, S.A. and OZLEM Limited. |

| 4.3 | | Form of Contribution and Exchange Agreement (incorporated by reference to Exhibit 10.1 to Union Acquisition Corp. II’s Form 8-K/A, File No. 001-39089, filed with the SEC on April 2, 2021). |

| 4.4 | | Form of Subscription Agreement (incorporated by reference to Exhibit 10.2 to Union Acquisition Corp. II’s Form 8-K/A, File No. 00139089, filed with the SEC on April 2, 2021).The |

| 4.5 | | Transaction Support Agreement, dated as of March 31, 2021 by and between Crynssen Pharma Group Limited, Procaps Group, S.A., Union Group International Holdings Limited, Union Acquisition Associates II, LLC, Union Acquisition Corp. II and investors in Union Acquisition Corp. II and Crynssen Pharma Group Limited (incorporated by reference to Exhibit 10.3 to Union Acquisition Corp. II’s Form 8-K/A, File No. 00139089, filed with the SEC on April 2, 2021). |

| 4.6 | | Registration Rights Agreement, dated as of October 17, 2019, by and between Union Acquisition Corp. II and Union Acquisition Corp. II’s Initial Shareholders (incorporated by reference to Exhibit 10.3 to Union Acquisition Corp. II’s Form 8-K, File No. 001-39089, filed with the SEC on October 21, 2019). |

| 4.7 * | | Registration Rights and Lock-Up Agreement, dated September 29, 2021, by and between Procaps Group, S.A., Union Group International Holdings Limited, Union Acquisition Associates II, LLC and the persons and entities listed on Exhibit A thereto. |

| 4.8 * | | Nomination Agreement, dated September 29, 2021, by and between Procaps Group, S.A., Union Group International Holdings Limited, Union Acquisition Associates II, LLC, and the persons and entities listed on Exhibit A thereto. |

| 4.9 * | | Share Forfeiture Agreement, dated as of September 29, 2021, by and among Union Acquisition Corp. II, Crynssen Pharma Group Limited, Procaps Group, S.A., Union Acquisition Associates II, LLC and Union Group International Holdings Limited. |

| 99.1 * | | Unaudited pro forma condensed combined financial information of the Company. |

| # | Certain schedules, annexes and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K, but will be furnished supplementally to the SEC upon request. |

SIGNATURES

The registrant hereby certifies that it meets all of the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this report on its behalf.

| PROCAPS GROUP, S.A. |

| | |

| September 30, 2021 | By: | /s/ Ruben Minski |

| | Name: | Ruben Minski |

| | Title: | Chief Executive Officer. |

16