UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 15, 2023 (September 15, 2023)

FORBION EUROPEAN ACQUISITION CORP.

(Exact Name of Registrant as Specified in its Charter)

| | | | |

| Cayman Islands | | 001-41148 | | N/A |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | |

4001 Kennett Pike, Suite 302 Wilmington, Delaware | | 19807 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: +1 732 838-4533

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Class A ordinary shares, par value $0.0001 per share | | FRBN | | The Nasdaq Stock Market LLC |

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 | | FRBNW | | The Nasdaq Stock Market LLC |

| Units, each consisting of one Class A ordinary share and one-third of one redeemable warrant | | FRBNU | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure |

On September 15, 2023, Forbion European Acquisition Corp. (“FEAC”) and enGene Inc. (“enGene”) released an investor presentation that will be used by FEAC and enGene with respect to the proposed business combination (the “Business Combination”) among FEAC, enGene and enGene Holdings Inc. (the “Investor Presentation”).

A copy of the Investor Presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K (the “Current Report”).

The information in this Item 7.01 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward-Looking Statements

The information in this Current Report includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding FEAC’s management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this Current Report may include, for example, statements regarding FEAC’s ability to consummate the proposed Business Combination.

All forward-looking statements are based on estimates and assumptions that, while considered reasonable by FEAC and its management are inherently uncertain and are inherently subject to risks, variability and contingencies, many of which are beyond FEAC’s control. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and should not be relied on by an investor as, a guarantee, assurance, prediction or definitive statement of a fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of FEAC. All forward-looking statements are subject to risks, uncertainties and other factors that may cause actual results to differ materially from those that we expected and/or those expressed or implied by such forward-looking statements. These risks and uncertainties include the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreements with respect to the proposed Business Combination; the outcome of any legal proceedings that may be instituted against FEAC following this Current Report; the inability to complete the proposed Business Combination due to the failure to obtain approval of the shareholders of FEAC, or to satisfy other conditions to closing; changes to the proposed structure of the proposed Business Combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the proposed Business Combination; the ability of the combined company to meet stock exchange listing standards following the consummation of the proposed Business Combination, the combined company’s ability to raise additional capital to fund its produce development activity, and its ability to maintain key relationships and to attract and retain talented personnel; costs related to the proposed Business Combination; changes in applicable laws or regulations; the possibility that the combined company may be adversely affected by changes in domestic and foreign business, market, financial, political, legal conditions and laws and regulations; the inability of the parties to successfully or timely consummate the proposed Business Combination, including the risk that any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed Business Combination; or other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements and Risk Factor Summary” in FEAC’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, or other documents filed or to be filed from time to time by FEAC with the SEC.

Any forward-looking statement speaks only as of the date on which it was made. FEAC anticipates that subsequent events and developments will cause FEAC’s assessments to change. While FEAC may elect to update these forward-looking statements at some point in the future, FEAC specifically disclaims any obligation to do so, unless required by applicable law. Nothing in this Current Report should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made.

FEAC disclaims any and all liability for any loss or damage (whether foreseeable or not) suffered or incurred by any person or entity as a result of anything contained or omitted from this Current Report and such liability is expressly disclaimed.

Participants in the Solicitation

FEAC and its directors, managers, executive officers, other members of management and employees may be deemed participants in the solicitation of proxies from FEAC’s shareholders with respect to the proposed Business Combination under the rules of the SEC. FEAC’s investors and security holders may obtain more detailed information regarding the names and interests in the proposed Business Combination of FEAC’s directors and officers, without charge, in FEAC’s filings with the SEC, including, when filed with the SEC, the preliminary proxy statement/prospectus and the amendments thereto, the definitive proxy statement/prospectus, and other documents filed with the SEC.

No Offer or Solicitation

This Current Report is not a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination and does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | |

Exhibit

No. | | Description |

| |

| 99.1 | | Presentation entitled “enGene – Corporate Presentation” |

| |

| 104 | | Cover Page Interactive Data File - the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 15, 2023

| | |

| FORBION EUROPEAN ACQUISITION CORP. |

| |

| By: | | /s/ Jasper Bos |

| | Jasper Bos |

| | Chief Executive Officer |

Exhibit 99.1 Corporate Presentation September 2023

Disclaimers Disclaimer This investor presentation (this “Presentation”) is being made in connection with a potential business combination (the “Business Combination”) between Forbion European Acquisition Corp. (“FEAC”) and enGene, Inc. (“enGene”). Leerink Partners LLC ( Leerink ) is acting as lead capital markets advisor to FEAC and UBS Securities LLC ( UBS and together with Leerink, the Placement Agents ) is acting as lead financial advisor and capital markets advisor to FEAC. Leerink is acting as the lead placement agent and UBS is acting as co-placement agent to FEAC in connection with the PIPE commitments. This Presentation is for informational purposes only to assist interested parties in making their own evaluation with respect to an investment in connection with the Business Combination. You should not construe the contents of this Presentation as legal, tax, accounting or investment advice or recommendation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision. The information contained herein does not purport to be all-inclusive and none of FEAC, enGene, the Placement Agents or their respective representatives or affiliates makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. None of FEAC, enGene or the Placement Agents has verified, or will verify, any part of this Presentation. You should make your own independent investigations and analyses of enGene and your own assessment of all information and material provided, or made available, by FEAC, enGene or any of their respective directors, officers, employees, affiliates, agents, advisors or representatives. The Placement Agents, FEAC and enGene reserve the right to update or supplement the information provided in this Presentation. By its acceptance hereof, each recipient agrees that neither it nor its agents, representatives, directors, or employees will copy, reproduce, or distribute to others this Presentation, in whole or in part, at any time without the prior written consent of FEAC, enGene and the Placement Agents and that it will, use this Presentation for the sole purpose of evaluating a possible acquisition of Securities and for no other purpose. Any unauthorized distribution or reproduction of any part of this Presentation may result in a violation of the U.S. Securities Act of 1933, as amended (the “Securities Act”). To the fullest extent permitted by law, the recipient expressly acknowledges, understands and agrees that in no circumstances will the Placement Agents, FEAC, enGene, or any of their respective stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable, and the recipient shall not seek to sue or otherwise hold any such entity or person liable, for any direct, indirect or consequential damage, loss or loss of profit (whether foreseeable or not) incurred by any entity or person as a result of the use of this Presentation, its contents, its omissions, reliance on the information contained within it or on opinions communicated in relation thereto or otherwise arising in connection therewith. Cautionary Statement Regarding Forward-Looking Statements This Presentation contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed Business Combination. Forward-looking statements may be identified by the use of the words such as “plan”, “forecast”, “intend”, “development”, “expect”, “anticipate”, “become”, “believe”, “continue”, “could”, “estimate”, “expect”, “intends”, “may”, “might”, “plan”, “possible”, “project”, “should”, “would”, “strategy”, “future”, “potential”, “opportunity”, “target”, “term”, “will”, “would”, “will be” or similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics, projections of market opportunity and market share, expectations and timing related to commercial product launches as well as the expected terms, timing, completion and effects of the proposed Business Combination. These forward-looking statements are based on various estimates and assumptions, whether or not identified in this Presentation, and on the current expectations of enGene’s and FEAC’s management, are not predictions of annual performance, and are subject to risks and uncertainties. These forward-looking statements are subject to a number of risks and uncertainties, including but not limited to, those summarized under “Risk Factors” in the Appendix. The summary of Risk Factors is not exhaustive. You should carefully consider the such factors and the other risks and uncertainties described in the “Risk Factors” section of the Registration Statement on Form S-4 (Reg. No. 333- 273851) filed by enGene Holdings Inc. (“Newco”) (as amended, the “Registration Statement”), as well as other documents if and when filed by enGene, Newco or FEAC from time to time with the United States Securities and Exchange Commission (the “SEC”). If any of these risks materialize or our assumptions prove incorrect, actual events and results could differ materially from those contained in the forward-looking statements. There may be additional risks that neither enGene nor FEAC presently know or that enGene and FEAC currently believe are immaterial that could also cause actual events and results to differ. In addition, forward-looking statements reflect enGene’s and FEAC’s expectations, plans, or forecasts of future events and views as of the date of this Presentation. enGene and FEAC anticipate that subsequent events and developments will cause enGene’s and FEAC’s assessments to change. While enGene and FEAC may elect to update these forward-looking statements at some point in the future, enGene and FEAC specifically disclaim any obligation to do so, unless required by applicable law. These forward-looking statements should not be relied upon as representing enGene’s and FEAC’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements contained herein Participants in the Solicitation FEAC, enGene, Newco and their respective directors, managers, executive officers, other members of management and employees may be deemed participants in the solicitation of proxies from FEAC’s shareholders with respect to the proposed business combination under the rules of the SEC. FEAC’s investors and security holders may obtain more detailed information regarding the names and interests in the proposed business combination of FEAC’s directors and officers, without charge, in the Registration Statement and in FEAC’s filings with the SEC, including the preliminary proxy statement/prospectus and the amendments thereto, the definitive proxy statement/prospectus, and other documents filed with the SEC. Such information with respect to enGene’s and Newco’s directors and executive officers will also be included in the proxy statement/prospectus. 2

Disclaimers continued Intellectual Property This Presentation contains trademarks, service marks, trade names, copyrights, and products of enGene and other companies, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names, copyrights, or products in this Presentation is not intended to, and does not, imply a relationship with FEAC or enGene, or an endorsement of or sponsorship by FEAC or enGene. Solely for convenience, the trademarks, service marks, and trade names referred to in this Presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that FEAC or enGene will not assert, to the fullest extent permitted under applicable law, their rights or the right of the applicable licensor in such trademarks, service marks and trade names. Industry and Market Data This Presentation relies on and refers to certain information and statistics based on estimates by enGene’s management and/or obtained from third party sources which enGene believes to be reliable. Neither FEAC nor enGene has independently verified the accuracy or completeness of any such third party information, which involves elements of subjective judgment and analysis that may or may not prove to be accurate. None of FEAC, enGene, their respective affiliates, the Placement Agents or any third parties that provide information to enGene, FEAC, or their respective affiliates, such as market research firms, guarantees the accuracy, completeness, timeliness, or availability of any information. None of FEAC, enGene, their respective affiliates, the Placement Agents, or any third parties that provide information to FEAC, enGene, and their respective affiliates, such as market research firms, is responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or the results obtained from the use of such content. FEAC and enGene may have supplemented such information where necessary, taking into account publicly available information about other industry participants and enGene management’s best view as to information that is not publicly available. None of FEAC, enGene, their respective affiliates, or the Placement Agents give any express or implied warranties with respect to the information included herein, including, but not limited to, any warranties regarding its accuracy or of merchantability or fitness for a particular purpose or use, and they expressly disclaim any responsibility or liability for direct, indirect, incidental, exemplary, compensatory, punitive, special, or consequential damages, costs, expenses, legal fees, or losses (including lost income or profits and opportunity costs) in connection with the use of the information herein. Lead Program (EG-70/detalimogene voraplasmid) The lead program described herein is an investigational drug therapy that has not been subject to testing designed to demonstrate that the therapy is effective in humans or to provide a basis to predict in advance whether an adequate level of efficacy in humans will be demonstrated in further testing. Although deemed sufficient to permit further testing, the limited, early Phase 1 testing to date is not a sufficient basis on which to predict efficacy. Although the FDA has indicated that the authorized Phase 2 portion of the current LEGEND study may potentially support BLA approval, that outcome will depend entirely on the results of Phase 2 tests, none of which are expected to be available until at least 2025. No Offer or Solicitation This Presentation is not a proxy statement or solicitation or a proxy, consent or authorization with respect to any securities or in respect of the proposed business combination and shall not constitute an offer to sell or exchange, or a solicitation of an offer to buy or exchange, the securities of enGene, FEAC or the combined company, nor shall there be any sale of securities in any jurisdiction in which such offer. solicitation, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Additional Information about the Business Combination and Where to Find It In connection with the business combination agreement and the proposed transaction, Newco, which will be the surviving public company of the business combination, has filed with the SEC the Registration Statement, which includes a preliminary proxy statement/prospectus, and this Presentation is not intended to be, and is not, a substitute for the proxy statement/prospectus or any other document that Newco or FEAC has filed or may file with the SEC in connection with the proposed business combination. After the registration statement on Form S-4 has been declared effective, the definitive proxy statement/prospectus will be mailed to shareholders of FEAC as of a record date to be established for voting on the proposed business combination and the other proposals regarding the proposed business combination set forth in the proxy statement/prospectus. Before making any voting or investment decision, investors and shareholders of FEAC are urged to carefully read the entire proxy statement/prospectus, when available, as well as any amendments or supplements thereto, because they will contain important information about the proposed business combination. FEAC investors and shareholders will also be able to obtain copies of the preliminary and definitive proxy statements/prospectuses, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: Forbion European Acquisition Corp., Gooimeer 2-35, 1411 DC Naarden, The Netherlands, Attention: Cyril Lesser. THE SECURITIES DESCRIBED HEREIN HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING, AN INVESTMENT IN THE SECURITIES OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE IN THE UNITED STATES. 3

enGene overview

enGene: moving genetic medicine into the mainstream • Highly differentiated pivotal-stage lead program for NMIBC, specifically designed for community urology clinics • Potential multi-billion dollar market opportunity, initial entry via BCG-resistant NMIBC market • Non-viral, polymeric nanoparticle with streamlined, scalable manufacturing and low COGS • Near-term value inflection points including mid-2024 Phase 2 interim efficacy data and 2025 BLA NMIBC = Non-muscle invasive bladder cancer; BCG = Bacillus Calmette-Guerin; BLA = Biologics License Application; COGS = Cost of Goods Sold 5 Expected timelines and anticipated milestones reflect enGene management's current estimate and are subject to change.

enGene platform: localized, non-viral delivery of genetic medicines to mucosal tissues and surfaces Mucosal tissues are underserved by Product platform tailored for streamlined, traditional gene therapy yet can be tissue-specific administration accessed via local administration Nasopharynx Carcinoma Rhinitis Mucosal vaccines Respiratory Tract Cystic Fibrosis Asthma COPD Lung cancer Gastrointestinal Tract Colorectal cancer Inflammatory Bowel Disease Short Bowel Syndrome Lyophilized Drug Product Reconstituted at Point of Care Familial Adenomatous Polyposis No special handling required and instilled into target organ Bladder (lead tissue of focus) Cancer 6

DDX platform turns mucosal tissues into payload production factories to drive local expression of therapeutic cargos Dually Derivatized Oligochitosan (DDX) • Non-immunogenic nanoparticle • Functionalized oligomeric chitosan • Proprietary to enGene with strong IP portfolio Non-viral plasmid-based therapies • Large capacity (>15kb) • Complex cargos (EG-70 – multiple genes) • Rapid iteration for new drug substances 7

Advancing genetic medicine into the mainstream through clear advantages and differentiation Clinically Tested Scaled and Scalable Designed for Use in Local Administration for Repeat Dosing Manufacturing Community Clinics Organ Localized Disease • Does not require pre-wash or • Consistent protein • Low COGS GMP manufacturing • No -80ºC cold chain storage • Well-defined biodistribution detergent co-administration expression across repeat compared to viral vectors requirements administrations • Localizes powerful biology; • Long-term stability in standard • No BSL2/2+ equipment or minimal systemic toxicity risk • No vector-based immune fridges/freezers specialized preparation needed responses observed • Favourable safety observed to • Current scale supports • No handling/exposure risk to clinically to date date commercial launch caregivers, patients, families • Designed to slot into SoC (e.g., lead product administered analogously to BCG) Moves beyond single-dose Enables use beyond academic centers; applications in liver and muscle supports US commercialization 8

Multiple near-term clinical milestones Therapeutic Area and Program Administration Discovery IND-Enabling Phase 1/2 Phase 3 Anticipated Milestones ONCOLOGY Phase 2 FPI (1H2023) Fast Track Designation; ** BCG-unresponsive NMIBC N/A Intravesical 68% CR rate at 3-months Phase 2 interim efficacy (Mid 2024) BLA (Mid 2025) EG-70 (detalimogene Phase 2 FPI (2H2023) BCG-naïve NMIBC voraplasmid) Intravesical Phase 2 interim efficacy (2H2024) GU/GYN Development candidate (1H2024) Direct Application tumors IND (2H2024) RESPIRATORY Development candidate (1H2024) Cystic † IND (1H2025) EG-i08 Inhalation Fibrosis Phase 1 FPI (2H2025) Expected timelines and anticipated milestones reflect enGene management's current estimate and are subject to change. ** The FDA has cleared enGene to initiate the pivotal, Phase 2 portion of LEGEND for BCG-unresponsive NMIBC † Cystic fibrosis program has been partially funded by CF foundation and is subject to multifactor go/no-go assessment involving technical review and assessment of 9 grant support availability;

EG-70 (detalimogene voraplasmid): addressing unmet needs in NMIBC

Potential multi-billion dollar market opportunity in NMIBC NMIBC remains a substantial unmet medical need 2 • Highest cost of all cancers to treat • >82K new diagnoses of bladder cancer per year in • 50% of patients fail BCG, only 1 USA, with 16K deaths approved first-line treatment • BCG shortage has created a • Radical cystectomy is standard to public health crisis and prevent muscle invasion after BCG unmet need across the care failure continuum • Avoiding cystectomy is goal of • Potential near-term enGene therapy in BCG-unresponsive market entry via NMIBC, per FDA guidance BCG-unresponsive NMIBC • Community urologists typically treat NMIBC, not oncologists; specialized product requirements 1 2 11 SEER database, 2023 figure; Mossanen and Gore, Curr Opin Urol 2014

EG-70: Urologist-friendly non-viral dual-immune activator for NMIBC designed to slot into the standard of care RIG-I agonists: • NK cell stimulation and suppressor cell attenuation promotes tumor killing environment • Clinical data with innate immune activators support biological rationale • Stimulate T cell recruitment and neo-antigen presentation IL-12: • Polarization, proliferation, and activation of T cells increases tumor killing • Promotes immunological memory • Strong efficacy in oncology with dose-limiting toxicities when systemically administered (lyophilized powder) 12

EG-70 in NMIBC Patients Who Are BCG-Unresponsive and High- Risk NMIBC Patients Who Have Been Incompletely Treated With BCG or Are BCG-Naïve NCT04752722 We would like to thank the patients, their families, and all staff at participating sites

FDA guidance: Use of a single-arm, open-label design is appropriate for approval for BCG-unresponsive NMIBC • Clearly defined patient population and entry criteria for BCG-unresponsive NMIBC provided by guidance • Approval based on complete response rate, duration of response, and safety • Pivotal Phase 2 design is consistent with FDA guidance 14

Phase 1/2 combined registrational study design and fast track designation support BLA submission in mid-2025 Phase 1 – Primary, Secondary Endpoints Completed Phase 2 – Interim Data Mid-2024 N = <24 N ~100 : Patients: Patients High-risk NMIBC failed BCG, with Cis High-risk NMIBC failed BCG, with Cis * EG-70 Dosing: EG-70 Dosing: 2 or 4 doses in 12-week cycle RP2D for 4 cycles Cohorts: 3+3 dose escalation (4 dose levels) Cohorts: Single-arm, open label : Endpoints: Endpoints 1° - Safety; 2° - Efficacy 1° - CR** rate at 12-months; 2° - safety and durability *RP2D is Recommended Phase 2 Dose; ** CR is complete response 15 Expected timelines and anticipated milestones reflect enGene management's current estimate and are subject to change.

Data from ongoing Phase 1: 68% complete response rate at 3-months Data cutoff 8.22.2023; **E means ‘expansion’; † , Patient or physician declined to continue on investigational agent to pursue other modes of treatment (e.g., surgery) † † , One additional patient was dosed in this group but later deemed by the independent DSMB to be ineligible and excluded from ‘efficacy set’ Note: As further specified in the “Risk Factors” section, this slide may include preliminary data from our clinical trials that may change as more patient data become 16 available and are subject to audit and verification procedures that could result in material changes in the final data.

Data from ongoing Phase 1: 68% complete response rate at 3-months Data cutoff 8.22.2023; **E means ‘expansion’; † , Patient or physician declined to continue on investigational agent to pursue other modes of treatment (e.g., surgery) † † , One additional patient was dosed in this group but later deemed by the independent DSMB to be ineligible and excluded from ‘efficacy set’ Note: As further specified in the “Risk Factors” section, this slide may include preliminary data from our clinical trials that may change as more patient data become 17 available and are subject to audit and verification procedures that could result in material changes in the final data.

EG-70 proof-of-mechanism: Urine and plasma analysis demonstrates organ-localized production of IL-12 Urine IL-12 in Phase 1 dose-escalation 1000 Dose Level 1 Dose Level 2 Dose Level 3 100 Dose response, localized to the bladder • No clinically significant IL-12 detected in 10 plasma • Urine IL-12 levels in dose level 2 are an order of 1 magnitude higher than dose level 1 • No further increases in IL-12 production with dose level 3 0.1 1 3 8 10 15 43 64 Treatment Day st nd 1 dose 2 dose *Slide reflects all data available as of November 2022. Urine collected prior to dosing 18

EG-70’s safety profile allowed dose selection based on efficacy and biomarkers – not toxicity (no DLTs observed) Grade 1 AEs Grade 2 AEs Grade 3 AEs Grade 4 AEs Grade 5 AEs (mild) (moderate) (severe) (life-threatening) (result in death) Aggregate Data 99 29 4 0 0 (N, all dose-levels) • UTI (17%) • Renal failure* • Hematuria (8%) • Urinary tract • Pneumonia** • Dysuria (6%) infection- • Pneumonitis** • Arthalgia (4%) enterococcal (3%) • Meniscus injury** • Contusion (4%) • Micturition • Constipation (3%) Most commonly - - urgency (7%) • Flank pain (3%) reported AEs (%) • Micturition urgency (3%) • Pyrexia (3%) • Fatigue (3%) • Reported AEs to-date are largely consistent with instrumentation/intravesical administration • No corelation between dose and grade or number of AEs Data cutoff 08.22.2023; DLTs = Dose limiting toxicities *Patient had a history of renal failure – enrollment criteria for Phase 2 amended to exclude history of renal failure; 19 ** Deemed Not Related to study drug

Urologists play a central role in the multi-year patient journey from diagnosis onward, with the goal of avoiding radical cystectomy Urology Referral and Diagnosis High-grade NMIBC with carcinoma in situ (CIS): Begin intravesical therapies Treatment: Surveillance: Exhaustion of intravesical options, Every 3-months until relapse currently beginning with BCG Available Intravesical therapies have failed; tumor has recurred. ~2-years have elapsed. Surgery: Medical Oncology Referral: Radical cystectomy iv pembro or pembro combo 20

Patient / clinician-friendly profile ideal for community urology clinics Product Attribute EG-70 CG0070+DDM Adstiladrin TAR-200 Does not require repeated burdensome placement and ü ü X ü removal of indwelling intravesical device Active ingredient not used in earlier lines of therapy ü ü X ü Common storage conditions (no -80C requirement) X X ü ü No required detergent bladder wash steps ü ü X ü No special handling requirements ü X X ü Mechanism supportive of longer-term repeat dosing ü X X ü 21

EG-70’s patient- and clinician-friendly profile potentially makes it ideal for use in community urology clinics Designed to slot into standard of care: Requires no shift in practice for ✓ community urologists Non-viral, lyophilized drug product: No heightened exposure risks to clinicians, ✓ ◦ staff, or patient families; no BSL2 hood or -80 C storage required ✓ Potential for compelling efficacy profile Favorable safety profile based on available data: Does not require non- ✓ urological or specialized patient care team (e.g., medical oncology team) 22

LEGEND study will act as launchpad for an expansive EG-70 franchise • Potent yet local immune system stimulation • Stimulation of adaptive and innate immune system via dual IL-12/RIG-I activation • Strong preclinical evidence of immunological memory Intermediate st • Favorable safety profile based on available BCG-unresponsive 1 line Other GU and locally NMIBC NMIBC* data (IND-package and clinical data) cancers advanced (>60k pts/yr) (60k pts/yr) bladder cancer • Flexible formulation amenable to multiple routes of administration • IP fortress through at least 2040 *Potential launch dates and indications are illustrative of EG-70’s potential; 23 *FDA has suggested including 1L patients in our study – use in 1L BCG-naïve patients would double the potential addressable patient population

Combination: Pro forma valuation and ownership Illustrative Pro Forma Valuation Transaction Overview (mm, except per share values) • Forbion European Acquisition Corp. to combine with enGene at an Share Price $10.25 (1) implied $90 mm pre-money equity value (5) (2) Pro Forma Shares Outstanding 33.6 • $136 mm in Trust ; $20 mm included from SPAC sponsor • $115 mm transaction financing, includes $20 mm committed from Equity Value $344 SPAC sponsor via FPA, $56.4 mm via convertible bridge financing, and ~$1.7 mm via non-redemption agreement (NRA) (6) Net Cash (194) Enterprise Value $150 Sources of Funds ($ mm) Uses of Funds ($ mm) Pro Forma Ownership (Assuming No Redemptions) (2) Cash in Trust $136 Cash to Balance Sheet $226 (7) Sellers’ Rollover Equity Transaction (4) 113 Rollover Equity 97 (8) SPAC Sponsor (3) Financing enGene PIPE Investors (excl. SPAC sponsor shares) Illustrative Transaction Rollover Equity 97 23 Fees & Expenses SPAC Shares (excl. SPAC sponsor shares) Total Sources Total Uses $346 $346 1. Excludes aggregate exercise price of options and excludes a $18.4 mm convertible bridge financing into enGene prior to the signing, bringing the total Equity Value of EnGene to $110.2 mm. 2. $135.8 mm held in the Trust Account as of June 30, 2023. Assumes that none of the FEAC Class A Shares are redeemed in connection with the Business Combination. Excludes interest earned in the Trust Account; the actual amount of cash in the Trust Account is subject to change depending on actual interest earned. 3. Excludes the $1.7 million non-redemption commitment from a FEAC Shareholder that is the beneficial owner of 166,665 FEAC Class A Shares as part of the $115 million transaction financing that is comprised of (i) the PIPE Financing ($56.9 million), (ii) the Convertible Bridge Financing ($56.4 million) and (iii) the non-redemption commitment ($1.7 million). 4. Rollover equity refers to equity of enGene Shareholders and includes the aggregate exercise price of its stock options outstanding as of July 31, 2023. 5. Share count includes ~6.69 mm seller rollover shares, 12.65 mm FRBN public shares (assumes no redemptions and includes 2.0 mm shares held by SPAC sponsor and ~0.17 mm shares subject to an NRA), ~10.62 mm PIPE shares and ~1.79 mm additional shares issued in connection with the PIPE, and ~1.37 mm founder shares, and excludes impact of ~4.22 mm FRBN public warrants, 5.46 mm additional warrants issued in connection with the PIPE, ~0.73 mm sponsor warrants and ~2.60 mm unallocated ESOP. 6. Based on enGene’s $69.6 mm debt balance and $37.6 mm cash balance as of 07/31/23 assuming no redemptions. 7. Excludes enGene options and unallocated ESOP 8. Includes 60,000 founder shares transferred to FRBN board members.

World-class leadership and investors enGene Leadership Team Selected Investors JASON HANSON, JD ANTHONY CHEUNG, Ph.D JAMES SULLIVAN, Ph.D Chief Executive Officer Chief Technology Officer Chief Scientific Officer Chief Executive Officer, Ohana Co-founder, enGene (CEO through 2018) VP, Pulmonary Discovery, Translate Bio Founding Director, Mythic Therapeutics Co-inventor on all key enGene patents Executive Director, Sana Biotechnology EVP & Chief Strategy Officer, Nuvasive Former Committee Member, ASGCT Industry Director, R&D, Vertex Pharmaceuticals Liaison Committee (2008-2014) Chief Operating Officer, Medicis EY Entrepreneur of the Year Finalist (2017) Corporate VP, GE and GE Healthcare ALEX GRASSIN RICHARD BRYCE, MBChB, MRCGP, ALEX NICHOLS, Ph.D MFPM Interim Chief Financial Officer President and Chief Operating Officer Chief Medical Officer CFO, Aleva Neurotherapeutics Co-Founder and CEO, Mythic Therapeutics CFO / VP Finance, Genkyotex CMO, Rain Oncology Co-Founder, Cogen Controller, Alexion Chief Medical & Scientific Officer, Puma Associate, Flagship Pioneering Biotechnology Senior Director - Clinical Science, Onyx Pharmaceuticals 25

Summary • Highly differentiated pivotal-stage lead program for NMIBC, specifically designed for community urology clinics • Potential multi-billion dollar market opportunity, initial entry via BCG-resistant NMIBC market • Non-viral, polymeric nanoparticle with streamlined, scalable manufacturing and low COGS • Near-term value inflection points including mid-2024 Phase 2 interim efficacy data and 2025 BLA NMIBC = Non-muscle invasive bladder cancer; BCG = Bacillus Calmette-Guerin; BLA = Biologics License Application; COGS = Cost of Goods Sold 26 Expected timelines and anticipated milestones reflect enGene management's current estimate and are subject to change.

Corporate Presentation September 2023

Appendix

Checkpoint inhibitors – not the first choice in NMIBC due to toxicity “With Grade 3 and 4 AEs at 13%, a patient is just as likely to have an autoimmune SAE as a durable CR” -Max Kates, MD, Director Bladder Cancer Program Johns Hopkins Medicine, on Keytruda (pembrolizumab) use in NMIBC Patients, n (%) Treatment N=96 1 Keytruda Complete Response rate at 12-months 17 (18%) 1 Keytruda SAEs (≥ Grade 3 AE) 13 (14%) 2 Radical Cystectomy (≥ Grade 3 complications) 153/1142 (13%) 1 2 Keytruda or Radical Cystectomy Mortality (within 12-months) 1% Sources: 1. Balar et al. Lancet Oncology 2021; 2. Donat et al. European Urology 2009 29

EG-70 preclinical and CMC data

Multiple MoA of EG-70 result in profound antitumor efficacy in mouse model Bioluminescence Experimental Design Survival (bladder tumor luciferase) Induction – 9 days Treatment Monitoring ns 10 10 Sham – 1% Mannitol 9 10 8 10 mEG-70 (5µg DNA/mL) 7 10 Luc-MB49 Cells 6 10 mEG-70 (20µg DNA/mL) 5 10 Instilled to induce orthotopic 4 10 bladder cancer mEG-70 (80µg DNA/mL) 3 10 2 10 1 10 Day 28: 0 Day 1: Day 10: Day 17: 10 Bioluminescen Luc-MB49 instillation IVI Tx IVI Tx Naive Sham 5 20 80 ce mEG-70 (µg pDNA) Naïve Control Animals mEG-70 reduces tumor burden and mediates long-term survival in an orthotopic murine model bladder cancer – extends preclinical validation to advanced disease Bioluminescence: n=16-19/group; bioluminescence data are geometric mean +/- 95% CI; One-way ANOVA; representative images from IVIS imaging; Survival: n=12/group, Log-rank (Mantel-Cox) 31 IVI: intravesical Bioluminescence Total Flux [p/s]

EG-70 cured animals are protected from re-challenge: demonstrates generation of antigen specific anti-tumor immunity Treatment with mEG-70 results in long-lasting anti-tumor response as demonstrated by protection from tumor re-challenge 32 Quantifiable total flux signal below background radiance

Depletion of helper T cells results in loss of anti-tumor activity Study MB49-Luc IVI IVI Termination instillation Tx1 Tx2 FACS to confirm depletion (blood) Study timeline -3 -2 -1 1 3 6 10 13 17 20 24 27 29 Anti-mouse CD4/CD8α intraperitoneal injection CD4 depleted animals Bladder weight Survival Depletion of CD4 T cells results in loss of mEG-70-mediated anti-tumor activity 33 Bladder weight data: Mean ± SEM, *p<0.05, unpaired t test; Survival: *p<0.05, Log-rank (Mantel-Cox) test IN IN INT T T0 0 02 2 2---409 429 429

EG-70 induces dose-dependent target engagement in bladders of tumor-bearing mice Ifnb Ifna2 Ddx58 Irf7 Isg15 Cxcl10 Ifit1 Ccl5 Tnfa Ifng Strong dose-dependent induction of RIG-I and IL-12 signaling in bladders of tumor-bearing mice treated with EG-70 n=8/group; data are mean +/- SEM; Mann Whitney t-test; 34 tumor bearing mice treated with indicated doses of mEG-70; bladder harvested 24h post-administration for Taqman qPCR of bladder tissue lysates INT02-348

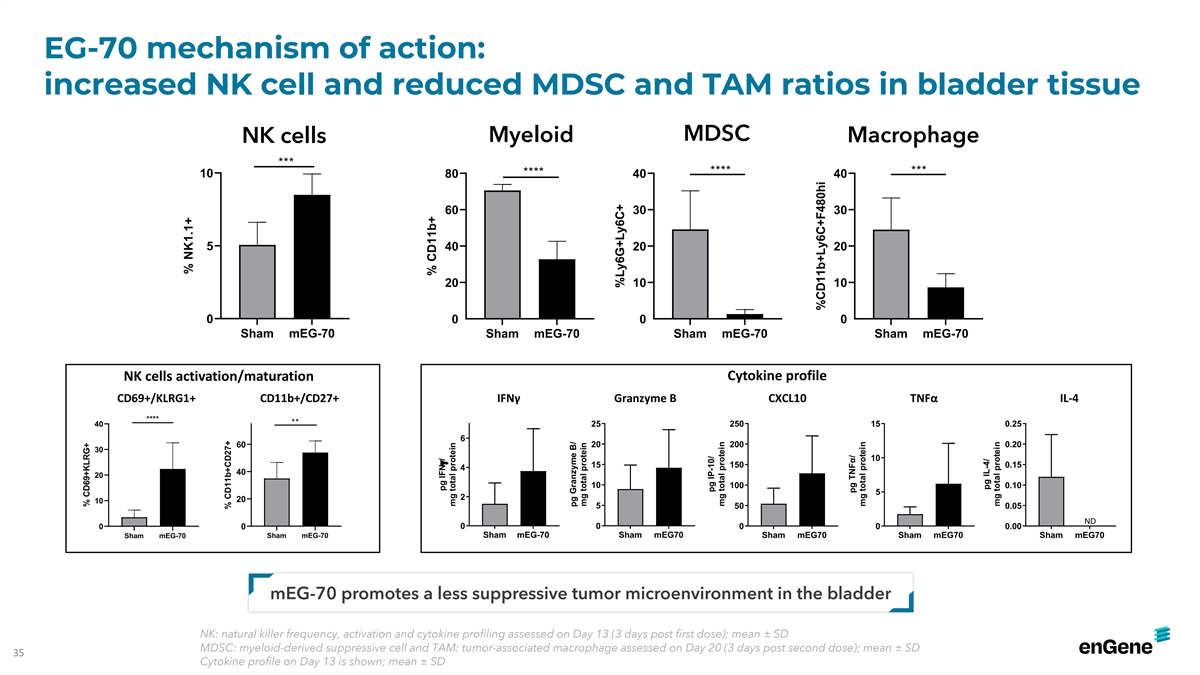

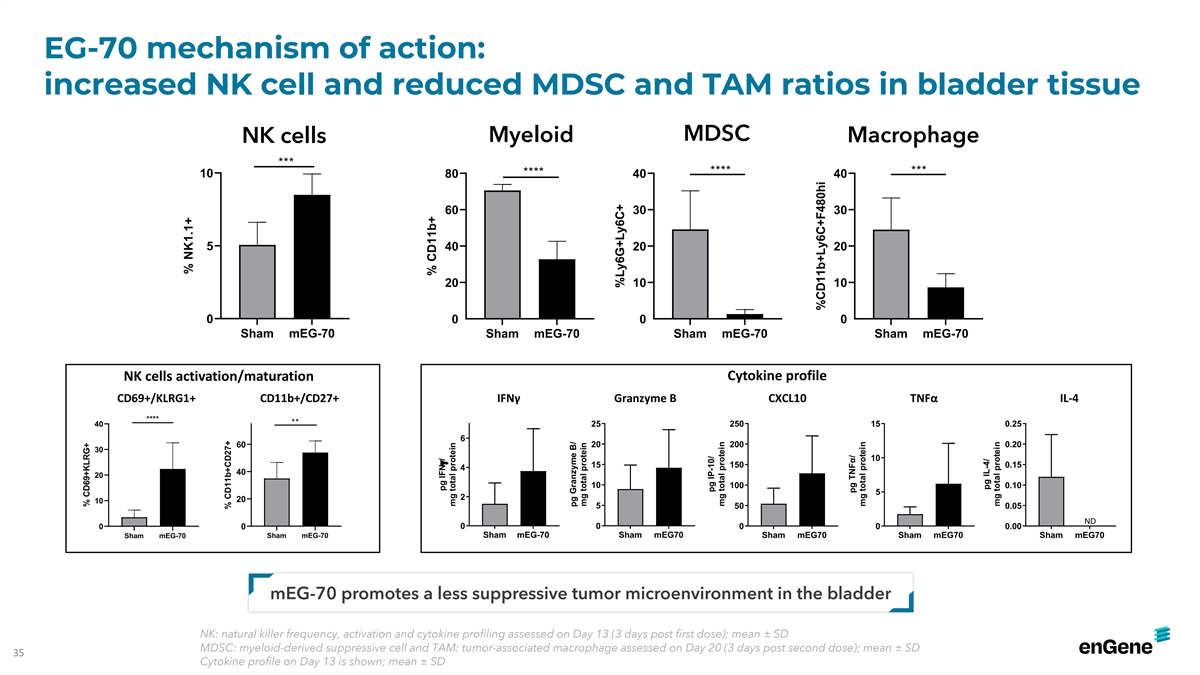

EG-70 mechanism of action: increased NK cell and reduced MDSC and TAM ratios in bladder tissue MDSC NK cells Myeloid Macrophage *** **** *** **** 10 80 40 40 60 30 30 5 40 20 20 20 10 10 0 0 0 0 Sham mEG-70 Sham mEG-70 Sham mEG-70 Sham mEG-70 Cytokine profile NK cells activation/maturation CD69+/KLRG1+ CD11b+/CD27+ IFNγ Granzyme B CXCL10 TNFα IL-4 **** ** 40 25 250 15 0.25 6 60 20 200 0.20 30 10 15 150 0.15 4 40 20 10 100 0.10 5 2 20 10 5 50 0.05 ND 0 0 0 0 0 0 0.00 Sham mEG-70 Sham mEG70 Sham mEG-70 Sham mEG-70 Sham mEG70 Sham mEG70 Sham mEG70 mEG-70 promotes a less suppressive tumor microenvironment in the bladder NK: natural killer frequency, activation and cytokine profiling assessed on Day 13 (3 days post first dose); mean ± SD MDSC: myeloid-derived suppressive cell and TAM: tumor-associated macrophage assessed on Day 20 (3 days post second dose); mean ± SD 35 Cytokine profile on Day 13 is shown; mean ± SD % CD69+KLRG+ % NK1.1+ % CD11b+CD27+ % CD11b+ pg IFNg/ mg total protein pg Granzyme B/ mg total protein %Ly6G+Ly6C+ pg IP-10/ mg total protein %CD11b+Ly6C+F480hi pg TNFα/ mg total protein pg IL-4/ mg total protein

EG-70 mechanism of action: T-cell recruitment and infiltration into tumor microenvironment CD4 CD8 CD4 CD8 **** **** 15 25 30 30 *** **** 20 10 20 20 Bladder 15 Lymph node 10 5 10 10 5 0 0 0 0 Sham mEG-70 Sham mEG-70 Sham mEG-70 Sham mEG-70 CD3 H&E CD4 CD8 Sham mEG-70 mEG-70 promotes an anti-tumor adaptive immune cell response 36 T cells assessed on Day 23 (6 days post second dose), mean ± SD; IHC performed on bladder tissue collected on Day 22 (5 days post second dose) % CD4+ % CD8+ % CD4+ % CD8+

EG-70 induces strong target engagement of RIG-I and IL-12 signaling: biomarkers translate across species Ifng Ifnb1 Irf7 Tnfa Mouse Non-human primate Empty EG-70 Empty EG-70 Empty EG-70 Empty EG-70 Vector Vector Vector Vector Mouse data: n=8/group; data are mean +/- SEM; Mann Whitney t-test; tumor bearing mice; bladders collected 24h post-administration for Taqman qPCR of bladder tissue lysates NHP data: EG-70 or empty vector control; intravesival administration; tissue collected 48 h post-administration; mean ± SEM, fold change vs empty vector control; Tbp used as internal control gene; representative of 1 animal per treatment group, with 5 pieces of bladder tissue per animal 37 INT02-348

EG-70 Preclinical Profile: profound efficacy coupled to a remarkably clean safety profile Toxicology studies did not reveal a maximum tolerated dose (MTD) • Mice - no adverse findings attributable to mEG-70 • Monkeys - very well-tolerated with no systemic findings; • Local findings limited to transient mild inflammation consistent with intravesical administrations • All changes showed reversibility Biodistribution - payloads are circumscribed to bladder as intended and designed • Bladder: plasmid DNA found at sustained levels in bladder tissue and urine • Blood: Transient plasmid DNA in the NHP blood 24 to 48 hours after dosing; regressed to zero rapidly • Non-target tissues: no significant levels detected No Adverse Events Limit (NOAEL) was the highest dose tested – maximum feasible dose • Enabled pharmacologically active dose in mice and in NHPs to be the starting dose for Phase 1 EG-70 is a potentially powerful anti-tumor agent that is well-tolerated preclinically, with no observed MTD 38

Additional lung program detail

enGene’s DDX platform versatility creates potential for partnerships around new indication spaces CFTR mRNA expression in mouse lung Membrane depolarization in HEK293 cells transfected with CFTR construct and a dose-response of CFTR channel inhibitor 5 10 1000 4 10 800 hCFTR hCFTR 3 10 hCFTR + DMSO (ctrl) hCFTR - DMSO ctrl 600 2 hCFTR + 20µM Inh-172 +10µM FSK 10 hCFTR +50uM Inh-172 10uM FSK 400 hCFTR + 50µM Inh-172 hCFTR + 20uM Inh-172 1 10 GFP ctrl 200 GFP ctrl 0 10 0 50 100 150 200 -1 10 -200 Read Naive CFTR-1 CFTR-2 C125 C125 Biologically active CFTR construct validates EG-i08 drug substance; formulation compatibility with state-of-the-art vibrating mesh nebulizer confirmed n=2-8 animals/group; data are mean +/- SD; intratracheal delivery of 50µL of suspension at C125 (125µg DNA/mL) HEK293 cells transfected with hCFTR constructs or GFP control; membrane depolarization measured 48h post-transfection; CFTR inhibitor (inh-172) used as control; 40 Forskolin (FSK) treatment conducted after baseline readings Copy Number RFU

enGene’s DDX platform versatility creates potential for partnerships around new indication spaces DNA copies in mouse lung Cell-type transfection in mouse lung 8 10 7 10 6 10 5 10 4 10 3 10 2 Pneumocytes type 1 10 1 10 0 10 -1 10 Dose (µg DNA/mL) 0 0.125 1.25 12.5 125 1000 RNA copies in mouse lung 6 10 5 10 4 10 3 10 Pneumocytes type 2 2 10 1 10 0 10 -1 10 0 0.125 1.25 12.5 125 1000 Dose (µg DNA/mL) Dose-responsive transfection and expression in the deepest regions of the mouse airway n=8 animals/group; data are mean +/- SEM; intratracheal administration of 50µL of suspension at the indicated doses; Emr1 - EGF-like module-containing mucin-like 41 hormone receptor-like 1 (F4/80); Pdpn - Podoplanin; Sftpc - Surfactant protein C; Zoomed images from originals taken at 20X magnification Copy Number Copy Number

Risk factors

Risk factors Key Risks Relating to enGene Inc. Certain factors may have a material adverse effect on our business, financial condition, and results of operations. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business and results of operations. If any of the following risks actually occurs, our business, financial condition, results of operations, and future prospects could be adversely affected. In this section, “we”, “our” and words to similar effect refer, for periods prior to the completion of the business combination, if any, to enGene Inc., and for periods following any business combination, to the combined company resulting therefrom. Risks Relating to Our Business • The sizes of the markets and forecasts of market growth for the demand of our novel gene therapy platform, product candidates and other key potential success factors are based on a number of complex assumptions and estimates, and may be inaccurate. • We expect to make significant investments in our continued research and development of EG-70, a novel non-viral gene therapy for the purpose of stimulating the adaptive immune system, EG-i08, a pulmonary program, and other new product candidates and gene therapies and services, which may not be successful, and if they are not successful, we may not be able to achieve or sustain profitability in the future. As an organization, we do not have any experience in any such new lines of business, and failure to identify other product candidates and/or execute on the expansion of our business would adversely affect our business and results of operations. • We have incurred net losses in every year since our inception and anticipate that we will continue to incur net losses in the foreseeable future. • Our recurring losses from operations and negative cash flows from operating activities raise substantial doubt about our ability to continue as a going concern. • We identified material weaknesses in our internal control over financial reporting. If we are unable to remedy these material weaknesses, or if we fail to establish and maintain effective internal controls, we may be unable to produce timely and accurate financial statements, and we may determine that our internal control over financial reporting is not effective, which could adversely impact our investors’ confidence and the price of our common shares. • To date, we have not generated any product revenue, have a history of losses and will need to raise additional capital to fund our operations. If we fail to obtain necessary financing, we will not be able to complete the development and commercialization of our product candidates. • We face significant competition from other biotechnology and pharmaceutical companies, which may result in our competitors discovering, developing or commercializing products before us or more successfully than we do. Our business and results of operations could be adversely affected if we fail to compete effectively. • The genetic medicine field is relatively new and evolving rapidly. Because of our limited technical, financial and human resources, we are focusing our research and development efforts on our gene therapy platform and our therapeutic product candidates among many potential options. As a result, we may forego or delay pursuit of other gene therapy technologies or other therapeutic product candidates that provide significant advantages over our platform, which could materially harm our business and results of operations. • Our gene therapy platform is based on novel technologies that are unproven, which makes it difficult to predict the time and cost of development and of subsequently obtaining regulatory approval, if at all. • Development of new therapeutics involves a lengthy and expensive process, with an uncertain outcome. We may incur additional costs, fail to replicate the positive results from our earlier preclinical or clinical studies of our product candidates in later preclinical studies and any clinical trials or experience delays in completing or ultimately be unable to complete, the development and commercialization of any product candidates. • Our use of third parties to manufacture, develop and test our therapeutic product candidates for preclinical studies and clinical trials increases the risk that we will not have sufficient quantities of our product candidates or products, or necessary quantities of such materials on time or at an acceptable cost. 43

Risk factors continued • Our most advanced product candidates are complex to manufacture and we may encounter difficulties in production, particularly with respect to scaling our manufacturing capabilities. If we or any of our third-party manufacturers with whom we contract encounter these types of difficulties, our ability to provide supply of our product candidates for clinical trials or our products for patients, if approved, could be delayed or stopped, or we may be unable to maintain a commercially viable cost structure. • The market opportunities for our product candidates may be limited to a small group of patients who are ineligible for or have failed prior treatments and our estimates of the prevalence of our target patient populations may be inaccurate. • We rely on our senior management team and key personnel, and our business could be harmed if we are unable to attract and retain personnel necessary for our success. • Our research and development initiatives, manufacturing processes and business depend on our ability to attract and retain highly skilled scientists and other specialized individuals. We may not be able to attract or retain such qualified scientists and other specialized individuals in the future due to the competition for qualified personnel among life science and technology businesses. • Nearly all aspects of our activity and our products and services are subject to extensive regulation by various U.S. federal and state agencies and regulatory bodies in non-U.S. jurisdictions, and compliance with existing or future regulations could result in unanticipated expenses or limit our ability to offer our products and services. Once developed, our gene therapy platform and therapeutic product candidates will require regulatory approval, which is a lengthy, expensive, and inherently unpredictable process with uncertain outcomes and cost and the potential for substantial delays. We cannot give any assurance whether or when our product candidates will receive regulatory approval, which is necessary before they can be commercialized. • We cannot predict whether or when we will obtain regulatory approval to commercialize a product candidate we may develop in the United States or any other jurisdiction and any such approval may be for a narrower indication than we seek. • If we are not able to obtain or if there are delays in obtaining required regulatory approvals for our product candidates, we will not be able to commercialize or will be delayed in commercializing our product candidates and our ability to generate revenue will be adversely affected. Even if we eventually gain approval for any of our product candidates, we may be unable to commercialize them. • We may not obtain or maintain regulatory approval in all jurisdictions in which such approval may be required. Obtaining and maintaining regulatory approval of our product candidates in one jurisdiction does not mean that we will obtain and/or maintain regulatory approval of our product candidates in other jurisdictions, while a failure or delay in obtaining or maintaining regulatory approval of our product candidates in one jurisdiction may have a material adverse effect on the regulatory approval or maintenance process in other jurisdictions. • Even if we receive regulatory approval of any product candidates or therapies, we will be subject to ongoing regulatory obligations, reporting requirements and continued regulatory review, which may result in significant additional expenses. If we fail to comply with regulatory requirements or experience unanticipated problems with our product candidates, we may be subject to substantial penalties, fines, delays, suspensions, refusals and withdrawals of approvals. • Changes in regulatory requirements could result in delays or discontinuation of development of our product candidates or therapies, or unexpected costs in obtaining or maintaining regulatory approval, and thereby adversely affect our business and results of operations. • Our contract manufacturers are subject to significant regulation with respect to the manufacturing of our current and future product candidates. The manufacturing facilities on which we rely may not meet or continue to meet regulatory requirements and/or may have limited capacity. • Any product candidates we develop may become subject to unfavorable or unprofitable third-party coverage and reimbursement practices, as well as pricing regulations. • Drug marketing, price controls and reimbursement regulations may materially affect our ability to market and receive coverage for our product candidates, if approved, in the European Union, the United Kingdom, Japan and other non-U.S. jurisdictions. • We are an international organization and we plan to expand operations internationally where we have limited operating experience and where we may be subject to increased regulatory risks and local competition. If we are unsuccessful in any efforts to expand internationally, our business and results of operations may be adversely affected. 44

Risk factors continued • Global economic uncertainty, changes in geopolitical conditions and weakening product demand caused by political instability, changes in trade agreements and disputes, such as the conflict between Russia and Ukraine and other macroeconomic factors, could adversely affect our business and results of operations. • If we are unable to obtain and maintain, enforce and defend patent protection for any product candidates we develop or for our novel gene therapy platform, or if the scope of the patent protection obtained is not sufficiently broad, our competitors or other third parties could develop and commercialize products or technology similar or identical to ours and our ability to successfully commercialize any product candidates we may develop and our technology may be adversely affected. • Issued patents covering our product candidates or gene therapy platform could be found invalid or unenforceable if challenged in court or before administrative bodies in the United States or other jurisdictions. • We may be involved in legal proceedings in relation to intellectual property rights and to protect or enforce our patents or the patents of our licensors, which could be expensive, time-consuming and unsuccessful. • We will need to grow the size of our organization, both organically and through acquisitions, and we may experience difficulties identifying and hiring the right employees and successfully managing this growth • Acquisitions, collaborations or other strategic partnerships may increase our capital requirements, dilute our shareholders, cause us to incur debt or assume contingent liabilities and subject us to other risks. • Because we are a Canadian company, shareholder protections differ from shareholder protections in the United States and elsewhere, and we are subject to a variety of additional risks that may negatively impact our operations. • The Proposed Articles to be in effect following the consummation of the Business Combination and certain Canadian legislation contain provisions that may have the effect of delaying, preventing or making undesirable an acquisition of all or a significant portion of our shares or assets or preventing a change in control. Risks Related to the Business Combination • FEAC may not have sufficient funds outside the Trust Account (as defined in the Registration Statement) to fund its working capital requirements pending the consummation of the Business Combination. • Since Forbion Growth Sponsor FEAC I B.V. (the “Sponsor”), its parent Forbion Growth Opportunities Fund I Cooperatief U.A (“FGOF”) and FEAC’s directors and executive officers have interests that are different from, or in addition to (and which may conflict with), the interests of FEAC’s other shareholders, a conflict of interest may exist in determining whether the Business Combination is appropriate as FEAC’s initial business combination. Such interests include that the Sponsor may lose its entire investment if a Business Combination is not completed, and that the Sponsor, FGOF and certain of FEAC’s directors will benefit from the completion of a Business Combination and may be incentivized to complete the Business Combination, even if it is with a less favorable target company or on less favorable terms to FEAC shareholders, rather than liquidate FEAC. • Forbion Capital Fund III, an affiliate of Forbion, the Sponsor and FGOF is a significant shareholder of enGene and an investor in both of enGene’s Amended 2022 Convertible Notes and the 2023 Convertible Notes (each as defined in the Registration Statement), and as a result, a conflict of interest may exist in determining whether the Business Combination is appropriate as FEAC’s initial business combination. • The Business Combination may be completed even though material adverse effects may result from the public announcement or completion of the proposed Business Combination, general business or economic conditions, industry-wide changes, and other causes. • The ability to successfully effect the Business Combination and to be successful thereafter will be dependent upon the efforts of key personnel, some of whom may be from FEAC and enGene, and some of whom may join the combined company following the Business Combination. The loss of key personnel or the hiring of ineffective personnel after the Business Combination could negatively impact the operations and profitability of the combined company. • FEAC and enGene could be a target of securities class action and derivative lawsuits, which could result in substantial costs and may delay or prevent the Business Combination from being completed. • FEAC has identified a material weakness in its internal control over financial reporting. If FEAC and, following the Business Combination, the combined company, is unable to develop and maintain an effective system of internal control over financial reporting, FEAC and, following the Business Combination, the combined company, may not be able to accurately report its financial results in a timely manner, meet reporting obligations, prevent fraud and/or file periodic reports in a timely manner, which may adversely affect investor confidence in FEAC or the combined company, as applicable, and materially and adversely affect FEAC’s or the combined company’s, as applicable, business and operating results. 45

Risk factors continued Risks Related to Being a Public Company • The combined company’s management team is expected to have limited experience managing a public company, and the additional requirements for public companies may strain resources and divert management’s attention. • There are risks to FEAC shareholders related to becoming shareholders of enGene through the Business Combination rather than through an underwritten public offering, including no independent due diligence review by an underwriter. • Nasdaq may not list the combined company’s securities on its exchange, in which event, if not waived by the parties to the Business Combination Agreement as one of the closing conditions thereof, FEAC would not be able to consummate the Business Combination with enGene. If the combined company’s securities are listed, the combined company may be unable to satisfy listing requirements in the future, which could limit investors’ ability to effect transactions in the combined company’s securities and subject it to additional trading restrictions. 46