As filed with the U.S. Securities and Exchange Commission on January 19, 2024

Registration No. 333-[●]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Alternus Clean Energy, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | | 000-41306 | | 87-1431377 |

(State or Other Jurisdiction of Incorporation or Organization) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

360 Kingsley Park Drive, Suite 250

Fort Mill, South Carolina

(803) 280-1468

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Taliesin Durant

Chief Legal Officer

360 Kingsley Park Drive, Suite 250

Fort Mill, South Carolina

Tel: (803) 280-1468

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Ross D. Carmel, Esq.

Jeffrey P. Wofford, Esq.

Sichenzia Ross Ference Carmel LLP

1185 Avenue of the Americas, 31st Floor

New York, NY 10036

Tel: (212) 930-9700

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| Non-accelerated filer | | ☒ | | Smaller reporting company | | ☒ |

| | | | | Emerging growth company | | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION | | DATED JANUARY 19, 2024 |

Alternus Clean Energy, Inc.

Up to 68,872,901 shares of common stock

Up to 845,000 shares of common stock issuable upon the exercise of Warrants

Warrants to purchase up to 445,000 shares of common stock

This prospectus relates to the offer and sale from time to time by the selling securityholders named in this prospectus or their permitted transferees (the “selling securityholders”) of (i) up to 69,717,901 shares of our common stock, $0.0001 par value per share (the “common stock”) consisting of: (a) up to 57,500,000 shares of our common stock issued to Alternus Energy Group Plc., our majority stockholder (“AEG”), pursuant to the Business Combination Agreement (as defined below) at an equity consideration value of $10.00 per share; (b) up to 7,666,667 shares of our common stock (2,555,556 of which are subject to vesting upon the occurrence of certain events) issued to Clean Earth Acquisitions Sponsor LLC (the “Sponsor”) upon conversion on a 1-for-1 basis of 7, 666,667 Founder Shares (as defined below) held by the Sponsor on the closing date of the Business Combination (as defined below) (the “Closing Date”); (c) up to an aggregate of 1,496,234 shares of common stock issued to the Meteora Entities (as defined below) in connection with the closing of the Business Combination (the “Closing”) pursuant to a forward purchase agreement; (d) up to 1,320,000 shares of common stock to be issued to Wissam Anastas (“WA”) pursuant to the conversion of a convertible note at a price of $0.73; (e) up to 890,000 shares of common stock issued to the Sponsor in a private placement as part of units (the “Sponsor Units”) at a price of $10.00 per Sponsor Unit, each Sponsor Unit comprising one share of common stock and one one-half of one warrant (f) up to 445,000 shares of common stock issuable upon the exercise of warrants (the “Sponsor Warrants”) with an exercise price of $11.50 issued to the Sponsor as part of the Sponsor Units; (g) up to 300,000 shares of common stock issuable upon the exercise of warrants (the “SCM Tech 1 Warrants”) issued to SCM Tech, LLC with an exercise price of $0.01 per share; and (h up to 100,000 shares of common stock issuable upon the exercise of warrants (the “SCM Tech 2 Warrants” and together with the SCM Tech 1 Warrants, the “SCM Tech Warrants”) issued to SCM Tech, LLC with an exercise price of $11.50 per share; and (ii) up to 445,000 Sponsor Warrants. The Sponsor Warrants, and the SCM Tech Warrants are referred to herein as, the “Warrants”).

The selling securityholders may offer, sell or distribute all or a portion of the securities hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of these securities, except with respect to amounts received by us upon exercise of the Warrants for cash. We believe the likelihood that warrant holders will exercise their Warrants for cash and therefore the amount of cash proceeds that we would receive, is dependent upon the trading price of our common stock. If the market price for our common stock is less than the exercise price of the Warrants (on a per share basis), we believe that it will be unlikely that holders will exercise their Warrants. There is no assurance that the warrants will be “in-the-money” prior to their expiration. The exercise price of the Warrants, other than the SCM Tech 1 Warrants, is $11.50 per share and the exercise price of our SCM Tech 1 Warrants is $0.01. If the trading price for our common stock is less than the exercise price of any of our Warrants, meaning such Warrants are “out of the money,” we believe the holders of such Warrants will be unlikely to exercise such Warrants on a cash basis. In addition, the Warrants may be exercised on a cashless basis. To the extent such Warrants are exercised on a cashless basis, we would not receive any cash from such exercise and the total amount of cash that we would receive from the exercise of the Warrants will decrease. We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The selling securityholders will bear all commissions and discounts, if any, attributable to their sale of shares of common stock or Warrants. See the section titled “Plan of Distribution.”

Our common stock is listed on The Nasdaq Stock Market LLC (“Nasdaq”) under the symbol “ALCE”. On January 18, 2023, the last reported sales price of our common stock was $1.15 per share.

AEG, has voting control over approximately 72.1% of our voting power of our outstanding voting stock and therefore we currently meet the definition of a “controlled company” under the corporate governance standards for Nasdaq listed companies and for so long as we remain a controlled company under this definition, we are eligible to utilize certain exemptions from the corporate governance requirements of Nasdaq.

We are an “emerging growth company” as defined under U.S. federal securities laws and, as such, have elected to comply with reduced public company reporting requirements. This prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described in the section titled “Risk Factors” beginning on page 8 of this prospectus, and under similar headings in any amendments or supplements to this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Prospectus dated [*], 2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf registration process, the selling securityholders may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale by such selling securityholders of the securities offered by them described in this prospectus, except with respect to amounts received by us upon the exercise of the Warrants for cash.

Neither we nor the selling securityholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the selling securityholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the selling securityholders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the sections of this prospectus titled “Where You Can Find More Information.”

On October 12, 2022, Clean Earth Acquisitions Corp., a Delaware corporation (“Clean Earth”), entered into a Business Combination Agreement, as amended by that certain First Amendment to the Business Combination Agreement, dated as of April 12, 2023 (the “First BCA Amendment”) (as amended by the First BCA Amendment, the “Initial Business Combination Agreement”), and as amended and restated by that certain Amended and Restated Business Combination Agreement, dated as of December 22, 2023 (the “A&R BCA”) (the Initial Business Combination Agreement, as amended and restated by the A&R BCA, the “Business Combination Agreement”), by and among Clean Earth, AEG and the Sponsor. On December 22, 2023, in accordance with the Business Combination Agreement, the Closing occurred, pursuant to which Clean Earth issued and transferred 57,500,000 shares of Class A common stock of Clean Earth, par value $0.0001 per share, to AEG, and AEG transferred to Clean Earth, and Clean Earth received from AEG, all of the issued and outstanding equity interests in the Acquired Subsidiaries (as defined in the Business Combination Agreement) (the “Equity Exchange,” and together with the other transactions contemplated by the Business Combination Agreement, the “Business Combination”). In connection with the Closing, Clean Earth changed its name to “Alternus Clean Energy Inc.”

Unless otherwise stated or unless the context otherwise requires, references in this prospectus to (1) “AEG” refers to Alternus Energy Group Plc, a public limited company incorporated under the laws of Ireland and our majority stockholder, (2) “Clean Earth” refers to Clean Earth Acquisitions Corp, a Delaware corporation and our legal predecessor, prior to Business Combination, and (3) “Alternus,” the “Company,” “Registrant,” “we,” “us” and “our” refers to Alternus Clean Energy, Inc., formerly known as Clean Earth Acquisitions Corp., and where appropriate, our wholly owned subsidiaries.

TRADEMARKS

This prospectus contains references to our trademarks, trade names and service marks. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks, trade names and service marks. Other trademarks, trade names and service marks appearing in this prospectus (or documents we have incorporated by reference) are the property of their respective holders. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. Forward-looking statements convey management’s expectations as to the future of Alternus, and are based on management’s beliefs, expectations, assumptions and such plans, estimates, projections and other information available to management at the time Alternus makes such statements. Forward-looking statements include all statements that are not historical facts and may be identified by terminology such as the words “outlook,” “believe,” “expect,” “potential,” “goal,” “continues,” “may,” “will,” “should,” “could,”, “would”, “seeks,” “approximately,” “projects,” predicts,” “intends,” “plans,” “estimates,” “anticipates” “future,” “guidance,” “target,” or the negative version of these words or other comparable words, although not all forward-looking statements may contain such words. The forward-looking statements contained in this prospectus may include statements related to Alternus’ revenues, earnings, taxes, cash flow and related financial and operating measures, and expectations with respect to future operating, financial and business performance, and other anticipated future events and expectations that are not historical facts.

We caution you that our forward-looking statements involve known and unknown risks, uncertainties and other factors, including those that are beyond our control, which may cause the actual results, performance or achievements to be materially different from the future results. Factors that could cause our actual results to differ materially from those contemplated by its forward-looking statements include:

| ● | the risk that the Business Combination disrupts our current plans and operations as a result of the announcement and consummation of the Business Combination transactions; |

| ● | our ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition and our ability to grow and manage growth profitably following the Business Combination; |

| ● | changes in applicable laws or regulations; |

| ● | the impact of the COVID-19 pandemic; |

| ● | a financial or liquidity crisis; |

| ● | the effects of inflation and changes in interest rates; |

| ● | a financial or liquidity crisis; geopolitical factors, including, but not limited to, the Russian invasion of Ukraine and the Israel-Hamas war; |

| ● | the risk of global and regional economic downturns; |

| ● | the projected financial information, anticipated growth rate, and our market opportunity; |

| ● | foreign currency, interest rate, exchange rate and commodity price fluctuations; |

| ● | various environmental requirements; |

| ● | retention or recruitment of executive and senior management and other key employees; |

| ● | the possibility that Alternus may be adversely affected by other economic, business, and/or competitive factors; |

| ● | our ability to maintain an effective system of internal controls over financial reporting; |

| ● | our ability to manage its growth effectively; |

| ● | our ability to achieve and maintain profitability in the future; |

| ● | our ability to access sources of capital to finance operations and growth; |

| ● | the success of strategic relationships with third parties; |

| ● | the impact of reduction, modification or elimination of government subsidies and economic incentives (including, but not limited to, with respect to solar parks); |

| ● | the impact of decreases in spot market prices for electricity; |

| ● | dependence on acquisitions for our growth; |

| ● | inherent risks relating to acquisitions and our ability to manage its growth and changing business; |

| ● | risks relating to developing and managing renewable solar projects; |

| ● | risks relating to photovoltaic plant quality and performance; |

| ● | risks relating to planning permissions for solar parks and government regulation; |

| ● | Alternus’ need for significant financial resources (including, but not limited to, for growth in its business); |

| ● | the need for financing in order to maintain future profitability; |

| ● | the lack of any assurance or guarantee that we can raise capital or meet its funding needs; |

| ● | our limited operating history; and |

| ● | other risks and uncertainties described in this prospectus, including those under “Risk Factors”. |

We undertake no obligations to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this registration statement or to reflect the occurrence of unanticipated events, other than as required by law. The foregoing factors and others described under “Risk Factors” should not be construed as exhaustive. There are other factors that may cause our actual results to differ materially from the forward-looking statements contained in this prospectus. Moreover, new risks emerge from time to time and it is not possible for us to predict all such risks. We cannot assess the impact of all risks on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, you should not place undue reliance on forward-looking statements as a prediction of actual results. We urge you to read the sections of this prospectus entitled “Prospectus Summary,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” for a more complete discussion of the factors that could affect their respective future performance and the industry in which we operate.

CAUTIONARY NOTE REGARDING MARKET AND INDUSTRY DATA

Unless otherwise indicated, information contained in this prospectus concerning our company, our business, the services we provide and intend to provide, our industry and our general expectations concerning our industry are based on management’s estimates. Such estimates are derived from publicly available information released by third party sources, as well as data from our internal research, and reflect assumptions made by us based on such data and our knowledge of the industry, which we believe to be reasonable. The industry publications and third-party studies generally state that the information that they contain has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that each of these publications and third-party studies is reliable, we have not independently verified the market and industry data obtained from these third-party sources. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as to the other forward-looking statements in this prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in our forecasts or estimates or those of independent third parties. While we believe our internal research is reliable and the definition of our market and industry are appropriate, neither such research nor these definitions have been verified by any independent source.

Certain information in the text of this registration statement is contained in industry publications, government websites, and reports or data compiled by a third party. The sources of these industry publications and data are provided below:

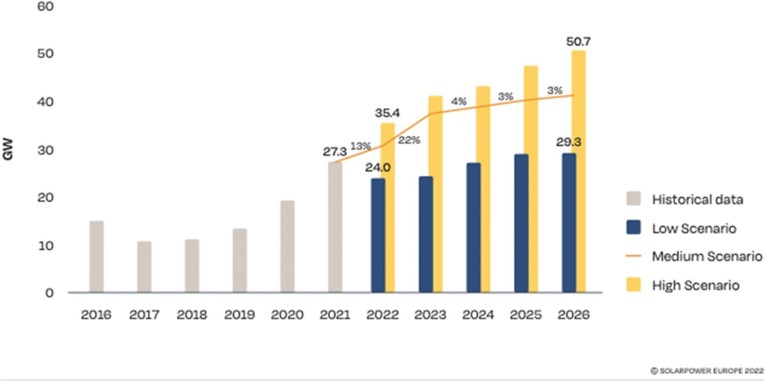

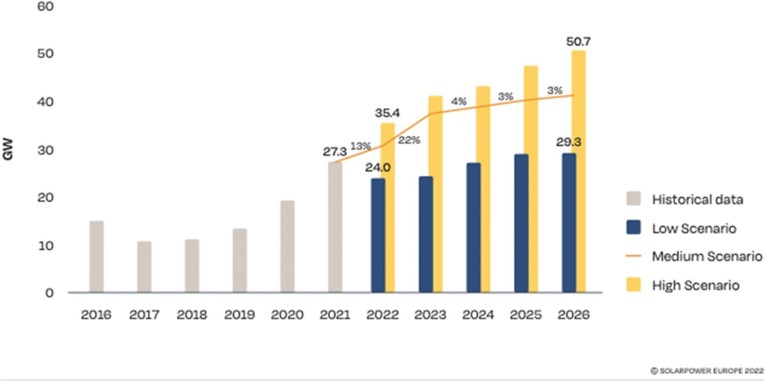

| ● | Solar Power Europe: Global Market Outlook For Solar Power 2019 – 2023; |

| ● | Solar Power Europe: Global Market Outlook For Solar Power 2018 – 2022; |

| ● | European Commission: Jäger-Waldau, A., PV Status Report 2018, EUR 29463 EN, Publications Office of the European Union, Luxembourg, 2018, ISBN 978-92-79-97465-6, doi:10.2760/826496, JRC113626; |

| ● | European Commission: Renewable Energy Progress Report – 09.04.2019; |

| ● | European Commission: Eurostats for Renewable Energy; |

| ● | World Economic Forum: www.weforum.org; |

| ● | PV Magazine: www.pv-magazine.com; |

| ● | ANRE – Romanian Energy Regulatory Authority: www.anre.ro; |

| ● | OPCOM – Exchange Market for Energy in Romania: www.opcom.ro; |

| ● | German Federal Ministry for Economic Affairs and Energy: www.bmwi.de; |

| ● | Gestore dei Servizi Energetici (Italian Energy Services Manager): www.gse.it; |

| ● | Netherlands Enterprise Agency: www.rvo.nl; |

| ● | CBS Statistics Netherlands: www.cbs.nl; and |

| ● | Res-Legal – Legal sources on Renewable Energy: www.res-legal.eu. |

CERTAIN TERMS USED IN THIS REGISTRATION STATEMENT

Unless otherwise indicated or the context otherwise requires, references in this registration statement to the terms below will have the following meanings:

| ● | “AEG” means Alternus Energy Group Plc, a company incorporated under the laws of Ireland; |

| ● | “Business Combination” means the business combination by and among Clean Earth, the Sponsor and AEG pursuant to the Business Combination Agreement entered into on October 12, 2022, as amended by that certain First Amendment to the Business Combination Agreement, dated as of April 12, 2023 (the “First BCA Amendment”) (as amended by the First BCA Amendment, the “Initial Business Combination Agreement”), and as amended and restated by that certain Amended and Restated Business Combination Agreement, dated as of December 22, 2023 (the “A&R BCA”) (the Initial Business Combination Agreement, as amended and restated by the A&R BCA, the “Business Combination Agreement”); |

| ● | “Clean Earth” means Clean Earth Acquisitions Corp., a Delaware corporation; |

| ● | “Closing” means the closing of Business Combination; |

| ● | “Closing Date” means December 22, 2023, the date and time on which the Closing occurred. |

| ● | “EPC” means engineering, procurement, and construction services; |

| ● | “€” and “Euro” mean the legal currency of the European Union; |

| ● | “FiT” means feed-in tariff(s); |

| ● | “Founder Shares” means the 5,750,000 shares of Clean Earth’s Class B common stock, par value $0.0001 per share (“CLIN Class B Common Stock”), that on August 17, 2021, the Sponsor purchased for $25,000, or approximately $0.004 per share, to cover certain of the offering costs in connection with the IPO. On February 7, 2022, Clean Earth effected a 1:1.33333339 stock split of its CLIN Class B Common Stock, resulting in the Sponsor holding 7,666,667 Founder Shares; |

| ● | “IPO” means the initial public offering of Clean Earth; |

| ● | “IPP” means independent power producer and refer to our business where we own and operate solar parks and derive revenue from selling electricity to the power grid; |

| ● | “kWh” means kilowatt hour(s); |

| ● | “Meteora Entities” means collectively, Meteora Capital Partners, LP, Meteora Select Trading Opportunities Master, LP and Meteora Strategic Capital, LLC. |

| ● | “MWh” means megawatt hour(s); |

| ● | “MWp" means megawatt peak; |

| ● | “O&M” means operations and maintenance services provided for commercially operating solar parks; |

| ● | “Private Units” means the 890,000 private units purchased from Clean Earth by the Sponsor in connection with the closing of the IPO at a price of $10.00 per private unit, for an aggregate purchase price of $8,900,000. Each private unit consists of one share of common stock and one-half of one warrant; |

| ● | “PV” means photovoltaic; |

| ● | “RON” means the legal currency of Romania; |

| ● | “Industrial” (whether capitalized or not) = <1000 kW; |

| | ● | “Solis” means Solis Bond Company DAC, a company incorporated under the laws of Ireland and indirect wholly owned subsidiary of the Company; |

| | ● | “Solis Bond” means the 3-year senior secured green bonds which were issued by Solis in January 2021, in the maximum amount of $242 million (€200 million) with a stated coupon rate of 6.5% + EURIBOR and quarterly interest payments; |

| ● | “Sponsor” means Clean Earth Acquisitions Sponsor LLC, a Delaware limited liability company; |

| ● | “Subsidiary” means, with respect to a person, a corporation or other entity of which more than 50% of the voting power of the equity securities or equity interests is owned, directly or indirectly, by such person; |

| ● | “Transactions” means, collectively, the business combination and the other transactions contemplated by the Business Combination Agreement; |

| ● | “Utility-scale” (whether capitalized or not) = >1000 kW, ground-mounted; and |

| ● | “watt” or “W” mean the measurement of total electrical power, where “kilowatt” or “kW” means one thousand watts, “megawatts” or “MW” means one million watts and “gigawatt” or “GW” means one billion watts. |

PROSPECTUS SUMMARY

This summary highlights some information contained elsewhere in this prospectus, and it may not contain all of the information important to making an investment decision. Therefore, before investing in our securities, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes thereto and the information set forth in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Unless otherwise indicated or the context otherwise requires, references in this prospectus to the “company,” “we,” “us,” “our,” “Alternus,” and other similar terms refer to Alternus Clean Energy, Inc., formerly known as Clean Earth Acquisitions Corp., and where appropriate, our wholly owned subsidiaries.

The Company

Overview

We are an independent clean energy producer that develops, installs, and operates a diverse portfolio of utility scale solar PV parks in North America and Europe, as long-term owners. You may also hear the term IPP, or independent power producer, to describe similar companies, however we want to focus on the clean nature of the energy generated from the solar parks we own and operate.

As a long-term owner operator, we focus on ensuring that the projects we develop and install for our own use, are designed to deliver the most efficient operating results over the full project lifetime, which averages over 30 years. The solar parks benefit from long-term government offtake contracts and/or Power Purchase Agreements (“PPAs”) with investment grade off-takers with terms of 15 – 20 years, plus energy sales to local power grids, typically for 5 to 15 years at a time during the full life of the projects.

Having started in early 2016 with two solar parks and a 6 MWp capacity and approximately $1 million a year in revenues, as of January 2024, we have approximately 48 operating parks, a total of 157.9 MWp in operation and circa $30 million in recurring annual revenues. This reflects over $400 million in future lifetime revenues remaining from these parks, of which $172 million is contracted with a weighted average contract life remaining of between 8 and 9 years. These lifetime revenues are based on current levels of megawatt hours (MWh) of clean energy produced from the operating portfolio, multiplied by the contracted rates per MWh that are contracted and/or by the rates per MWh received from sales of the uncontracted portion of the energy to local energy markets, over the expected remaining operational lifetime of each. The time horizon used to determine $400 million of future lifetime revenues assets is a period from the present until the end of 2052. During this period, currently owned and operating assets only, are expected to generate cumulative revenues of approximately $400 million, approximately $60 million of cumulative Net Operating Income after taxes, and approximately $0.77 cumulative earnings per share (based on 77,705,752 outstanding during the same period).

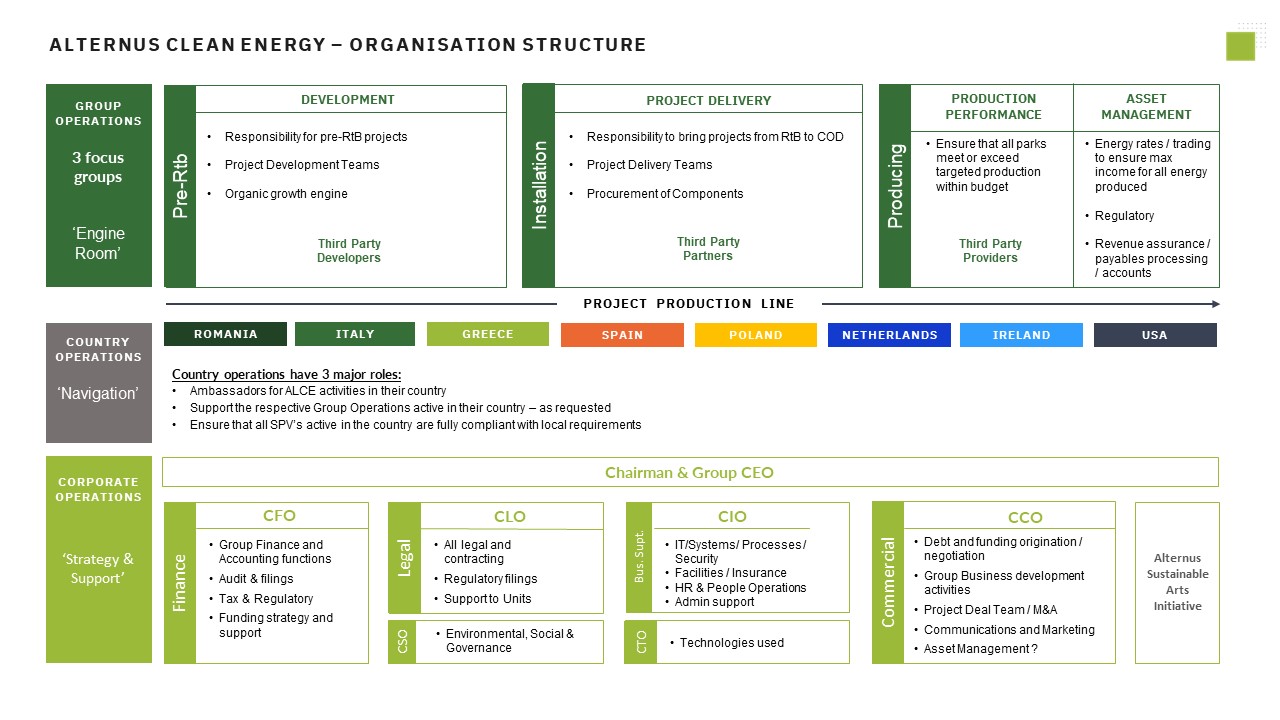

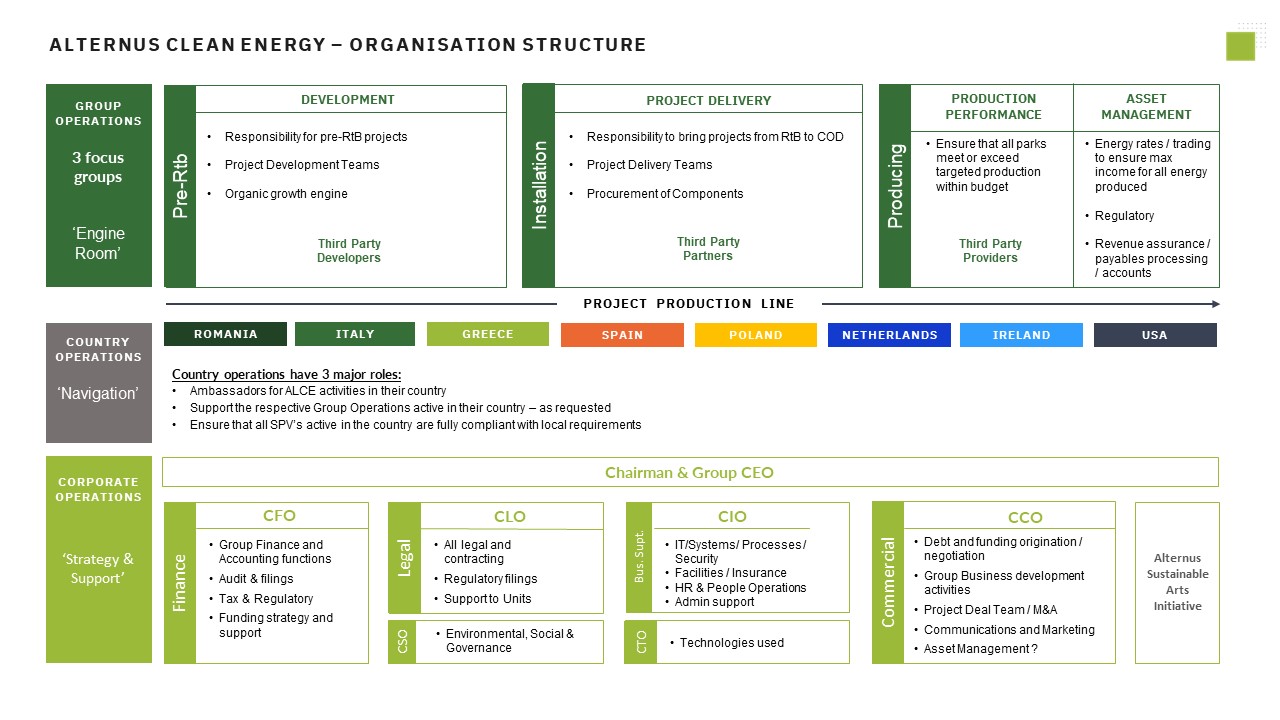

Business Model

We operate across all key segments of the solar project development life cycle from ‘greenfield’ planning and permitting applications phase, installation and long-term revenue and margin generation from sales of energy to customers. This integration of activities under one common ownership and management creates a ‘production line’ of new projects supporting organic growth in the business going forward. This business model is designed to lock in lasting shareholder value by significantly reducing capex for newly developed projects, and lowering acquisition costs for purchased projects when acquired pre-operation from other developers in the market. This is because our model is to retain the value created at each phase rather than otherwise paying this out to third parties if acquiring projects further along the value chain. The value creation at each stage results from the de-risking of the projects as they get closer to operation and as a result, attract higher prices from buyers at the later stages as the risk declines.

This method of operation is designed to bring the value created during the development cycle directly to us, thereby reducing equity requirements to build out a larger portfolio, as the margins captured can be reinvested in future growth. In addition, it provides greater certainty of future revenue streams as the projects owned today reach planned operation dates in the future. This is what drives the stair step revenue growth in the business. As of January 19, 2024, we own 649MW of projects in the development phase, 60% of which are expected to reach full operation and revenue generation over the next few years, in line with industry norms.

We also work closely with a cultivated network of local and international project development partners that provide a continuous pipeline of new projects for acquisition and construction.

We believe that a benefit of being a long-term owner of these projects is the stairstep long-term recurring income created from the stable and predictable income streams as the cumulative operational portfolio grows. Every time we add a new project into the portfolio, we get a potential lift in long-term incomes that then accumulates each time. Other participants in our market sometimes ‘build-to-sell’ the projects they develop and/or install, making their annual numbers more one-off and volatile. Our business model is designed to steadily add long-term income, locking in sustainable returns and value for shareholders as we stair step up growth.

Corporate Information

We were originally known as Clean Earth Acquisitions Corp. Following the approval of the Initial Business Combination Agreement and the transactions contemplated thereby at the special meeting of the stockholders of Clean Earth held on December 4, 2023 (the “Special Meeting”), we consummated the Business Combination. In connection with the Closing, we changed our name from Clean Earth Acquisition Corp. to Alternus Clean Energy, Inc.

Our principal executive offices are located at 360 Kingsley Park Drive, Suite 250, Fort Mill, South Carolina 29715. Our main telephone number is (803) 280-1468. Our website is https://alternusenergy.com. The information contained on, or that can be accessed through, our website is not incorporated by reference and is not a part of this prospectus. “Alternus” and our other registered and common law trade names, trademarks and service marks are property of Alternus Clean Energy, Inc. or our affiliates, as applicable. This prospectus contains additional trade names, trademarks and service marks of others, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols.

Recent Developments

Solis Bond Extension. Our subsidiary, Solis, breached three financial covenants under its bond terms and has received a waiver from its bondholders, which extended the date on which Solis must repay its bonds to September 30, 2023. On October 16, 2023, the Solis bondholders approved resolutions to further extend the temporary waiver to December 16, 2023. On January 3, 2024, the Solis bondholders approved resolutions to further extend the temporary waivers and the maturity date of the Solis Bonds until January 31, 2024, with the right to further extend to February 29, 2024 at the Solis Bond trustee’s discretion.

The Business Combination. On October 12, 2022, Clean Earth entered into the Business Combination Agreement with AEG and the Sponsor, in its capacity as representative of Clean Earth and solely for purposes of certain sections of the Business Combination Agreement. Pursuant to the Business Combination Agreement, among other things and subject to the terms and conditions contained therein, we purchased from AEG the Acquired Subsidiaries (as defined in the Business Combination Agreement). Following the consummation of the Business Combination on December 22, 2023, we own all of the equity interests formerly owned by AEG in the Acquired Subsidiaries.

The Business Combination Agreement required that AEG complete a restructuring prior to the Closing. Pursuant to the restructuring, prior to execution of the Business Combination Agreement, all of AEG’s interests in one of its holding company subsidiaries, AEG MH 01 Limited, was contributed to a newly organized Luxembourg entity, Alternus Lux 01 S.à.r.l (“Alternus Lux”) and prior to Closing, AEG contributed to Alternus Lux all of the shares of two other of its holding companies, Solis Bond Company Designated Activity Company and AEG JD 02 Limited. As a result, at the Closing, we directly owned all of the interests in Alternus Lux and Alternus Energy Americas Inc. . For a more detailed description of the Business Combination see our Proxy Statement filed on Schedule 14A with the SEC on November 13, 2023.

Sale of Subsidiaries in Poland. On December 22, 2023, Solis and SINO-CEE Fund II (“Sino”) executed a Share Transfer Agreement (the “Poland SPA") which provides for the sale of 100% of the share capital in 6 separate entities, each of which are wholly owned by Solis and which, in the aggregate, hold a portfolio of 5 plants in Poland with an aggregate capacity of 88.5 MWp. In exchange, Sino-Cee Fund II will pay Solis a Purchase Price (as defined in the Poland SPA) of approximately €54.4 million (approximately $59 million), after adjustment in accordance with the Poland SPA. The Company expects the closing of the Poland SPA to occur no later than January 31, 2024, or such later date as the Parties to the Poland SPA may agree in writing.

Sale of Subsidiaries in Italy. On December 28, 2023, Solis entered into a Share Purchase Agreement (the “Italy SPA”) by and among Solis and Undo S.r.l., a company incorporated under the laws of Italy (“Undo”). Pursuant to the Italy SPA, among other things, Solis sold to the Undo, and Undo purchased from Solis, 100% of the share capital in 11 separate entities, each of which were wholly owned by Solis and which, in the aggregate, held a portfolio of 13 photovoltaic plants in Italy with an aggregate capacity of 10.5 MWp. In exchange, Undo paid to Solis a Purchase Price (as defined in the Italy SPA) of approximately €17.70 million (approximately $19.65 million), subject to the terms and conditions of the Italy SPA.

Sale of Blue Sky Energy. Also on December 28, 2023, AEG JD 02 Limited (“JD 02"), a private company limited by shares incorporated under the laws of Ireland and indirect wholly owned subsidiary of the Company, entered into a Share Purchase Agreement (the “RTHA SPA” and together with the Italy SPA, the “SPAs”) by and among JD 02 and Theia Investment (Netherlands) 1 B.V., a private limited liability company under the laws of the Netherlands (“Theia”). Pursuant to the RTHA SPA, among other things, JD 02 will sell to Theia, and Theia will purchase from JD 02, 100% of the share capital of Blue Sky Energy I B.V., a wholly owned subsidiary of JD 02, which holds and operates a 13.6 MWp solar park at Rotterdam Airport. In exchange, Theia will pay JD 02 a Purchase Price (as defined in the RTHA SPA) of approximately €2.84 million (approximately $3.15 million), after adjustment in accordance with the RTHA SPA, and subject to meeting all of the conditions precedent and the terms and conditions of the RTHA SPA. The Company expects the closing of the RTHA SPA to occur in the first quarter of 2024.

AVG Settlement. On January 11, 2024 the Company entered into that certain Settlement Agreement (the “Settlement Agreement”) by and among the Company, AEG, Nordic ESG and Impact Fund SCSp, a special limited partnership formed under the laws of Luxembourg (“AVG”), and AVG Group S.a.r.l., a private limited liability company formed under the laws of Luxembourg and the general partner of AVG (“GP,” and together with the Company, AEG and AVG, the “Parties”). Reference is made to that certain convertible note (the “AVG Note”) dated March 22, 2021, previously issued by AEG to GP, in its capacity as general partner and nominee of AVG, in the original principal amount of €8 million (approximately $8.7 million). The AVG Note carried a fixed interest rate of 10%, had a maturity date of March 9, 2024, and was payable in cash pursuant to the terms and conditions of the AVG Note. As of January 11, 2024, the full original principal amount remained outstanding, plus interest and expenses, totaling approximately $10 million.

Pursuant to the Settlement Agreement, among other things and subject to certain limitations set forth in the Settlement Agreement, the Company issued to AVG, and AVG accepted from the Company as full and final settlement of the AVG Note, including accrued interest and settlement costs, and any disputes between the Parties, 7,765,000 shares of common stock. Further, as consideration for and upon the delivery of the 7,765,000 shares of common stock, the Parties agreed (i) that the AVG Note shall be deemed, and AVG and AEG shall take all further action necessary to cause the AVG Note to be, cancelled and extinguished, and all outstanding indebtedness and other obligations of AEG thereunder shall be deemed satisfied, released and discharged in full, (ii) to certain mutual releases from, among other things, debts, liabilities, causes of action and all obligations whatsoever between AVG and AEG in connection with the AVG Note.

Sale of Zonnepark Rilland. On January 16, 2024, Solis entered into a Share Purchase Agreement (the “Rilland SPA”) by and among Solis and Theia Investment (Netherlands) 1 B.V., a private limited liability company formed under the laws of the Netherlands (“Theia”). Pursuant to the Rilland SPA, among other things, Solis will sell to the Theia, and Theia will purchase from Solis, 100% of the share capital in Zonnepark Rilland B.V., a private limited liability company formed under the laws of the Netherlands (“SPV”), which developed and operates a solar park located in Rilland, Netherlands, with a maximum total production capacity of approximately 11.8 MWp. In exchange, Theia will pay to Solis a Purchase Price (as defined in the Rilland SPA) of approximately €9.7 million (approximately $10.5 million), inclusive of, and which may be further subject to, adjustments pursuant to the terms and conditions of the Rilland SPA, and subject to meeting all of the conditions precedent and other applicable terms of the Rilland SPA. The Company expects the closing of the Rilland SPA to occur no later than February 28, 2024, or such later date as the Parties to the Rilland SPA may agree in writing.

Controlled Company Status

AEG owns approximately 72.1% of the voting power of our outstanding common stock. As a result, we are a “controlled company” under the Nasdaq Capital Market’s governance standards, defined as a company of which more than 50% of the voting power is held by an individual, group or another company. As a “controlled company,” we are permitted to rely on certain exemptions from corporate governance rules, including:

| | ● | an exemption from the rule that a majority of our board of directors must be independent directors; |

| | ● | an exemption from the rule that the compensation of our chief executive officer must be determined or recommended solely by independent directors; and |

| | ● | an exemption from the rule that our director nominees must be selected or recommended solely by independent directors. |

Although we do not currently rely on the “controlled company” exemption under the Nasdaq listing rules, we could elect to rely on this exemption in the future. If we elect to rely on the “controlled company” exemption, a majority of the members of our board of directors might not be independent directors and our nominating and corporate governance and compensation committees might not consist entirely of independent directors. As a result, you will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements.

Risk Factors Summary

Investing in our securities involves substantial risk. The risks described under the heading “Risk Factors” immediately following this summary may cause us to not realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the more significant challenges include the following:

| ● | our stock price may be volatile and may decline regardless of its operating performance; |

| ● | we may be unable to maintain the listing of our securities on Nasdaq in the future; |

| ● | future sales of shares by existing stockholders could cause our stock price to decline; |

| ● | the shares of common stock being offered in this prospectus represent a substantial percentage of our outstanding common stock, and the sales of such shares, or the perception that these sales could occur, could cause the market price of our common stock to decline significantly; |

| ● | the Warrants may not be exercised at all or may be exercised on a cashless basis and we may not receive any cash proceeds from the exercise of the Warrants; |

| ● | we may issue additional shares of common stock or other equity securities without your approval, which would dilute your ownership interests and may depress the market price of our common stock. |

| ● | supply chain challenges due to forces beyond our control; |

| ● | our need to raise additional capital; |

| ● | our ability to retain key management personnel; |

| ● | the dilution of our shares as a result of the issuance of additional shares in connection with financing arrangements; |

| ● | the volatility of our stock price; |

| ● | limited trading volume and price fluctuations of our stock; |

| ● | the immediate and substantial dilution of the net tangible book value of our Shares; |

| ● | our ability to meet the initial or continuing listing requirements of the Nasdaq Capital Market; |

| ● | unanticipated changes in project plans or defective or late execution; |

| ● | difficulties in obtaining and maintaining governmental permits, licenses, and approvals required by existing laws and regulations or additional regulatory requirements not previously anticipated; |

| ● | potential challenges from local residents, environmental organizations, and others who may not support the project; |

| ● | uncertainty in the timing of grid connection; |

| ● | the inability to procure adequate financing with acceptable terms; |

| ● | unforeseeable engineering problems, construction or unexpected delays, and contractor performance shortfalls; |

| ● | labor, equipment, and materials supply delays, shortages or disruptions, or work stoppages; |

| ● | adverse weather, environmental and geological conditions, force majeure, and other events outside of the Company’s control; |

| ● | the ongoing COVID-19 pandemic; |

| ● | cost overruns, due to any one or more of the foregoing factors: |

| ● | We are a “controlled company” within the meaning of Nasdaq rules and the rules of the SEC. As a result, we qualify for, and currently and may in the future rely on, certain exemptions from Nasdaq’s corporate governance requirements that provide protection to shareholders of other companies; |

| ● | Our stock price may be volatile and may decline regardless of its operating performance; |

| ● | We may be unable to maintain the listing of our securities on Nasdaq in the future; |

| ● | An active trading market for our common stock may not be sustained; |

| ● | The shares of common stock being offered in this prospectus represent a substantial percentage of our outstanding common stock, and the sales of such shares, or the perception that these sales could occur, could cause the market price of our common stock to decline significantly; |

| ● | We may issue additional shares of common stock or other equity securities without your approval, which would dilute your ownership interests and may depress the market price of our common stock; |

| ● | If securities or industry analysts either do not publish research about us or publish inaccurate or unfavorable research about us, our business, or its market, or if they change their recommendations regarding our common stock adversely, the trading price or trading volume of our common stock could decline; |

| ● | Delaware law and provisions in our certificate of incorporation and bylaws could make a merger, tender offer, or proxy contest difficult, thereby depressing the trading price of our common stock; |

| ● | Our certificate of incorporation provides that the Court of Chancery of the State of Delaware will be the exclusive forum for substantially all disputes between us and our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers or employees; |

| ● | We do not intend to pay dividends for the foreseeable future; |

| ● | We will incur increased costs and obligations as a result of being a public company; |

| ● | The requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain qualified board members; and |

| ● | If we fail to establish and maintain proper and effective internal control over financial reporting, as a public company, our ability to produce accurate and timely financial statements could be impaired, investors may lose confidence in our financial reporting and the trading price of our common stock may decline. |

Inflation Risk

We do not believe that inflation has had a material effect on our business, results of operations, or financial condition. Nonetheless, if our costs were to become subject to significant inflationary pressures, we may not be able to fully offset such higher costs. Our inability or failure to do so could harm our business, results of operations, or financial condition.

Implications of Being an “Emerging Growth Company”

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act; (ii) the last day of the fiscal year in which we have total annual gross revenues of $1.235 billion or more; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under applicable SEC rules. We expect that we will remain an emerging growth company for the foreseeable future, but cannot retain our emerging growth company status indefinitely and will no longer qualify as an emerging growth company on or before the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are applicable to other public companies that are not emerging growth companies.

These exemptions include:

| | ● | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| | ● | not being required to comply with the requirement of auditor attestation of our internal controls over financial reporting; |

| | ● | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| | ● | reduced disclosure obligations regarding executive compensation; and |

| | ● | not being required to hold a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We have taken advantage of certain reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

An emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves of this extended transition period and, as a result, we will not be required to adopt new or revised accounting standards on the dates on which adoption of such standards is required for other public reporting companies.

We are also a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies.

The Offering

| Common Stock Offered by the Selling securityholders | 69,717,901 shares of common stock, consisting of: |

| | ● | up to 57,500,000 shares of our common stock issued to AEG, pursuant to the Business Combination Agreement; |

| | ● | up to 7,666,667 shares of our common stock issued to the Sponsor on the Closing Date of the Business Combination; |

| | ● | up to 1,496,234 shares of common stock issued to the Meteora Entities pursuant to a forward purchase agreement ; |

| | ● | up to 1,320,000 shares of common stock to be issued to Wissam Anastas pursuant to a convertible note at a price of $0.73; |

| | ● | up to 890,000 shares of common stock issued to the Sponsor in the private placement of the Sponsor Units; |

| | ● | up to 445,000 shares of common stock issuable upon the exercise of the Sponsor Warrants; |

| | ● | up to 300,000 shares of common stock issuable upon the exercise of the SCM Tech 1 Warrants; and |

| | ● | up to 100,000 shares of common stock issuable upon the exercise of the SCM Tech 2 Warrants. |

| Price | | The selling securityholders may sell their shares of common stock at prevailing market or privately negotiated prices, including in one or more transactions that may take place by ordinary broker’s transactions, privately negotiated transactions or through sales to one or more dealers for resale. |

| | | |

| Warrants offered by the selling securityholders | | Up to 445,000 Sponsor Warrants |

| | | |

| Terms of the offering | | The selling securityholders will determine when and how they will dispose of the securities registered for resale under this prospectus. |

| | | |

| Lock-Up Agreement | | AEG is subject to certain restrictions on transfer until the termination of applicable lock-up periods. See the sections titled “Certain Relationships and Related Party Transactions — Lock-Up Agreement.” |

| | | |

Use of Proceeds | | We will not receive any proceeds from the sale of common stock by the selling securityholders participating in this offering. The selling securityholders will receive all of the net proceeds from the sale of their respective shares of common stock in this offering. |

| Trading Symbols | | Our common stock is listed on the Nasdaq under the symbol “ALCE”. |

Risk Factors | | See “Risk Factors” beginning on page 8 of this prospectus for a discussion of factors that you should carefully consider before deciding to invest in our common stock. |

| Plan of Distribution | | For additional information concerning the offering, see “Plan of Distribution.” |

RISK FACTORS

Investing in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties described below together with all of the other information contained in this prospectus, including the risks and uncertainties discussed above under “Special Note Regarding Forward-Looking Statements,” our financial statements and related notes appearing at the end of this prospectus and in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding to invest in our securities. If any of the events or developments described below were to occur, our business, prospects, operating results and financial condition could suffer materially, the trading price of our common stock could decline, and you could lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

Risks Related to Our Business and Industry

Our limited operating history may not serve as an adequate basis to judge our future prospects and results of operations.

We were founded in 2019, and therefore, have limited operating history. Since inception, we have experienced net losses and have not achieved profitability. For the period ended September 30, 2023 we had a net loss of $26,112. For the years ended December 31, 2022 and 2021, we had net losses of $36,283,804 and $18,932,731, respectively. We expect to incur additional losses as we implement our strategy of expanding business operations in North America and Europe and other select geographies. Our rapidly evolving business and, in particular, our relatively limited operating history may not be an adequate basis for evaluating our business prospects and financial performance. Thus, it is difficult to predict the future results of operations. There can be no guarantee that we will ever achieve profitability.

We cannot assure you that we will achieve or maintain profitability and our auditor has expressed substantial doubt about our ability to continue as a going concern.

We will need to raise additional working capital to continue our normal and planned operations. We will need to generate and sustain significant revenue levels in future periods in order to become profitable, and, even if we do, we may not be able to maintain or increase our level of profitability. In addition, as a public company, we will incur accounting, legal and other expenses. These expenditures will make it necessary for us to continue to raise additional working capital. Our efforts to grow our business may be costlier than we expect, and we may not be able to generate sufficient revenue to offset our increased operating expenses. We may incur significant losses in the future for a number of reasons, including unforeseen expenses, difficulties, complications and delays and other unknown events. Accordingly, substantial doubt exists about our ability to continue as a going concern and we cannot assure you that we will achieve sustainable operating profits as we continue to expand our business, and otherwise implement our growth initiatives.

The financial statements included with this registration statement have been prepared on a going concern basis. We may not be able to generate profitable operations in the future and/or obtain the necessary financing to meet our obligations and pay liabilities arising from normal business operations when they come due. The outcome of these matters cannot be predicted with any certainty at this time. These factors raise substantial doubt that we will be able to continue as a going concern. We plan to continue to provide for our capital needs through sales of our securities and/or other financing activities. Our financial statements do not include any adjustments to the amounts and classification of assets and liabilities that may be necessary should we be unable to continue as a going concern.

Our substantial indebtedness could adversely affect our business, financial condition and results of operations.

We believe that our substantial indebtedness will increase as an independent power producer (“IPP”). As of September 30, 2023 We had $194 million in outstanding short-term borrowing and $11.5 million in outstanding long-term bank borrowing. It is likely that we will continue to be highly leveraged. The degree to which we remain leveraged could have important consequences to stockholders of the Company, including, but not limited to:

| ● | making it more difficult for the Company to satisfy its obligations with respect to its other debt and liabilities; |

| ● | increasing the Company’s vulnerability to, and reducing its flexibility to respond to, general adverse economic and industry conditions; |

| ● | requiring the dedication of a substantial portion of the cash flow of the Company from operations to the repayment of principal of, and interest on, indebtedness, thereby reducing the availability of such cash flow and limiting the ability to obtain additional financing to fund working capital, capital expenditures, acquisitions, joint ventures or other general corporate purposes, such as payments to suppliers for PV modules and balance-of-system components and contractors for design, engineering, procurement, and construction services; |

| ● | limiting the Company’s flexibility in planning for, or reacting to, changes in its business and the competitive environment and the industry in which it operates; and |

| ● | placing the Company at a competitive disadvantage as compared to its competitors, to the extent that they are not as highly leveraged. |

If the Company incurs new debt or other obligations, the related risks the Company now faces, as described in this risk factor and elsewhere in these “Risk Factors,” could intensify.

Our business as an independent power producer requires significant financial resources, and our growth prospects and future profitability depends to a significant extent on the availability of additional funding options with acceptable terms. If we do not successfully undertake subsequent financing plan(s), it may have to sell certain of its solar parks.

Our principal resources of liquidity to date have been cash from its operations and borrowings from banks and its shareholders. We have leveraged bank facilities in certain countries in order to meet working capital requirements for its activities. Our principal use of cash has been for pipeline development, working capital, and general corporate purposes.

We will require significant amounts of cash to fund the acquisition, development, installation, and construction of our projects and other aspects of our operations. We may also require additional cash due to changing business conditions or other future developments, including any investments or acquisitions it may decide to pursue in order to remain competitive. Historically, we have used bank loans, bridging loans, and third-party equity contributions to fund its project acquisition and development. We expect to seek to expand our business with third-party financing options, including bank loans, equity partners, financial leases, and securitization. However, it cannot be guaranteed that we will be successful in locating additional suitable sources of financing in the time periods required or at all, or on terms or at costs that it finds attractive or acceptable, which may render it impossible for us to fully execute our growth plan.

Any debt financing may require restrictive covenants and additional funds may not be available on terms commercially acceptable to us, vis-à-vis acquired assets and subsidiaries. Failure to manage discretionary spending and raise additional capital or debt financing as required may adversely impact our ability to achieve our intended business objectives.

We are a holding company that relies on distributions and other payments, advances and transfers of funds from our subsidiaries to meet our obligations.

We have no direct operations and derive all our revenue and cash flow from our subsidiaries. Because we conduct our operations through subsidiaries, we depend on those entities for payments or distributions in order to meet our obligations. The deterioration of the earnings from, or other available assets of, our subsidiaries for any reason could limit or impair their ability to pay us and adversely affect our operations.

The reduction, modification or elimination of government subsidies and economic incentives may reduce the economic benefits of existing solar parks and the opportunities to develop or acquire suitable new solar parks.

Government subsidies and incentives have primarily been in the form of FiT price support schemes, tax credits, net metering, and other incentives to end-users, distributors, system integrators and manufacturers of solar energy products. The availability and size of such subsidies and incentives depend, to a large extent, on political and policy developments relating to environmental concerns in a given country. Changes in policies could lead to a significant reduction in, or discontinuation of, the support for renewable energies in such country, which could, in turn, have a material adverse effect on our business, financial condition, results of operations, and prospects.

Decreases in the spot market price of electricity could harm our revenue and reduce the competitiveness of solar parks in grid-parity markets.

The price of electricity from our solar parks is fixed through PPAs or FiTs for a majority of its owned capacity. A FiT is a policy designed to support the development of renewable energy sources by providing a guaranteed, above-market price for producers. FiTs usually involve long-term contracts, anywhere from 15 to 20 years, whereas the PPAs that currently provide the additional revenue are typically renewed and may be terminated annually. In countries where the price of electricity is sufficiently high such that solar parks can be profitably developed without the need for government price supports, solar parks may choose not to enter into PPAs and would instead sell based on the spot market price of electricity. Revenue for our solar parks in Italy and Romania could fluctuate with the electricity spot market after the expiration of any PPA, unless it is renewed. The market price of electricity can be subject to significant fluctuations.

Decreases in the spot price of electricity in such countries could render PV energy less competitive compared to other forms of electricity. Thus, the spot market price of electricity may have a material adverse effect on our business, results of operations, cash flows, and financial condition.

Our power purchase agreements may not be successfully completed.

Payments by power purchasers under a PPA may provide the majority of a Subsidiary’s or a project’s cash flows. There can be no assurance that any or all of the power purchasers will fulfill their obligations under their PPAs or that a power purchaser will not become bankrupt, or that upon any such bankruptcy, its obligations under its respective PPA will not be rejected by a bankruptcy trustee. There are also additional risks relating to PPAs, including the occurrence of events beyond the control of a power purchaser that may excuse it from its obligation to accept and pay for the delivery of energy generated by the project company’s plant. The failure of a power purchaser to fulfill its obligations under any PPA or the termination of any PPA may have a material adverse effect on the respective project or project company and therefore on us.

The seasonality of our Subsidiaries’ operations may materially affect our business, results of operations, cash flow, and financial condition.

The energy production industry is subject to seasonal variations as well as other significant events. For instance, the amount of electricity and revenues generated by our solar generation facilities is dependent in part, on the amount of sunlight, or irradiation, where the assets are located. Due to shorter daylight hours in winter months, there is less irradiation and the generation produced by these facilities will vary depending on the season.

The seasonality of our energy production may create increased demands on liquidity during periods when cash generated from operating activities are lower and we may also require additional equity or debt financing to maintain its solvency, which may not be available when required or available on commercially favorable terms. Thus, the Company may struggle to maintain sufficient financial liquidity to absorb the impact of seasonal variations in energy productions. Other significant events and seasonal variations may adversely affect the Company’s business, results of operations, cash flow, and financial condition.

The acquisition of renewable energy facilities or of companies that own and operate renewable energy facilities is subject to substantial risk.

A significant part of our business model has been to acquire new renewable energy facilities and companies that own and operate renewable energy facilities. Acquisition of renewable energy facilities or of companies that own and operate renewable energy facilities is subject to substantial risk. While we believe that we have performed adequate due diligence on prospective acquisitions, we may not have been able to discover all potential operational deficiencies in such renewable energy facilities. In addition, our expectations for the operating performance of newly constructed renewable energy facilities as well as those under construction are based on assumptions and estimates made without the benefit of an operating history.

If we consummate any future acquisition, in line with our business model, our capitalization and results of operations may change significantly, and shareholders will generally not have the opportunity to evaluate the economic, financial and other relevant information that we consider in determining the application of these funds and other resources. As a result, the consummation of acquisitions may have a material adverse effect on the our business, financial condition, results of operations and cash flows.

Further, we may not be able to successfully integrate acquired businesses and, where desired, their product portfolios, and therefore the Company may not be able to realize the intended benefits of such acquisitions. The failure to integrate acquired businesses effectively may adversely impact the our business, results of operations or financial condition.

The delay between making significant upfront investments in solar parks and receiving revenue could materially and adversely affect our liquidity, business and results of operations.

There are generally multiple months between the initial significant upfront investments in solar parks, solar park development and obtaining permits to build solar parks which we expect to own and operate and when we begin to receive revenues from the sale of electricity generated by such solar parks after grid connection. Historically, we have relied on third-party equity contribution, bridging and bank loans to pay for costs and expenses incurred during project development, especially to third parties for PV modules and balance-of-system components and EPC and O&M services. Such investments may be non-refundable. Solar parks typically generate revenue only after becoming commercially operational and once they are able to sell electricity to the power grid. Between our initial investments in the development of solar parks (through its model of working with local developers) and their connection to the transmission grid, there may be adverse developments impacting such solar parks. The timing gap between its upfront investments and actual generation of revenue, or any added delay due to unforeseen events, could put strains on our liquidity and resources and materially and adversely affect its profitability and results of operations.

We may experience delays related to developing and maintaining renewable energy projects.

Development of solar power projects can take many months or years to complete and may be delayed for reasons beyond its control. Development usually requires a company to make some up-front payments for, among other things, land/rooftop use rights and permitting in advance of commencing construction, and revenue from these projects may not be recognized for several additional months following contract signing. Furthermore, we may become constrained in our ability to simultaneously fund other investments in such projects.

Development, operation and maintenance of renewable energy projects and related infrastructure expose us to numerous risks, including construction, environmental, regulatory, permitting, commissioning, start-up, operating, economic, commercial, political and financial risks. This involves risks of failure to obtain or substantial delays in obtaining: (i) regulatory, environmental or other approvals or permits; (ii) financing; (iii) leasing; and (iv) suitable equipment supply, operating and off-take contracts. Moreover, renewable energy assets are subject to energy regulation and require governmental licenses and approval for their operation. The failure to obtain, maintain or comply with the licenses and approvals relating to our assets and the resulting costs, fines and penalties, could materially and adversely affect our ability to operate the assets. Renewable energy projects also require significant expenditure before the assets begin to generate income and often require long-term investment to enable projects to generate expected levels of income. The development of solar power projects also requires significant management attention to negotiate the terms of engagement and monitor the progress of the projects which may divert management’s attention from other matters.

Solar project development is challenging and may ultimately not be successful and miscalculations in planning a project may negatively affect engineering procurement and construction (“EPC”) prices, all of which could increase the costs, delay or cancel a project, and have a material adverse effect on its business, financial condition, results of operations and profit margins.

The development of solar projects involves numerous risks and uncertainties and requires extensive research, planning and due diligence. We may be required to incur significant amounts of capital expenditure for land/rooftop use rights, interconnection rights, preliminary engineering, permits, legal and other expenses before we can determine whether a solar power project is economically, technologically or otherwise feasible. Success in developing a solar power project is contingent upon, among other things:

| ● | securing investment or development rights; |

| ● | securing suitable project sites, necessary rights of way, satisfactory land/rooftop use or access rights in the appropriate locations with capacity on the transmission grid and related permits, including completing environmental assessments and implementing any required mitigation measures; |

| ● | rezoning land, as necessary, to support a solar power project; |

| ● | negotiating satisfactory EPC agreements; |

| ● | negotiating and receiving required permits and approvals for project development from government authorities on schedule; |

| ● | completing all required regulatory and administrative procedures needed to obtain permits and agreements; |

| ● | procuring rights to interconnect the solar power project to the electric grid or to transmit energy; |

| ● | paying interconnection and other deposits, some of which are non-refundable; |

| ● | signing grid connection and dispatch agreements, power purchase agreements, or PPAs, or other arrangements that are commercially acceptable, including adequate for providing financing; |

| ● | obtaining project financing, including debt financing and own equity contribution; |

| ● | negotiating favorable payment terms with suppliers; and |

| ● | completing construction on schedule in a satisfactory manner. |

Successful completion of a particular solar project may be adversely affected by numerous factors, including without limitation:

| ● | unanticipated changes in project plans or defective or late execution; |

| ● | difficulties in obtaining and maintaining governmental permits, licenses and approvals required by existing laws and regulations or additional regulatory requirements not previously anticipated; |

| ● | potential challenges from local residents, environmental organizations, and others who may not support the project; |

| ● | uncertainty in the timing of grid connection; |

| ● | the inability to procure adequate financing with acceptable terms; |

| ● | unforeseeable engineering problems, construction or other unexpected delays and contractor performance shortfalls; |

| ● | labor, equipment and materials supply delays, shortages or disruptions, or work stoppages; |

| ● | adverse weather, environmental and geological conditions, force majeure and other events outside of owner’s control; and |

| ● | cost overruns, due to any one or more of the foregoing factors. |

Accordingly, some of the solar power projects in our pipeline may not be completed or even proceed to construction. If several solar power projects are not completed, our business, financial condition and results of operations could be materially and adversely affected.

Development activities may be subject to cost overruns or delays, which may materially and adversely affect our financial results and results of operations.