As filed with the U.S. Securities and Exchange Commission on July 25, 2024.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FENBO HOLDINGS LIMITED

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| Cayman Islands | | 3634 | | Not Applicable |

(State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer Identification No.) |

Unit J, 19/F, World Tech Centre

95 How Ming Street

Kwun Tong

Kowloon, Hong Kong

Telephone: +(852) 2343-3328

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Schlueter & Associates, P.C.

5655 South Yosemite Street, Suite 350

Greenwood Village, CO 80111

Telephone: (303) 292-3883

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Henry F. Schlueter, Esq. Celia Velletri, Esq. Schlueter & Associates, P.C. 5655 South Yosemite Street, Suite 350 Greenwood Village, CO 80111 Telephone: (303) 292-3883 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | Subject to Completion, dated July 25, 2024 |

$5,000,000

Up to [●] Ordinary Shares

Up to [●] Pre-Funded Warrants to Purchase Up to [●] Ordinary Shares

Up to [●] Warrants to Purchase Up to [●] Ordinary Shares

Up to [●] Placement Agent Warrants to Purchase Up to [●] Ordinary Shares

Up to [●] Ordinary Shares Underlying the Warrants, Pre-Funded Warrants and Placement Agent Warrants

Fenbo Holdings Limited

We are offering, on a reasonable best efforts basis, up to [●] ordinary shares, US$0.0001 par value per share (“Ordinary Shares), of Fenbo Holdings Limited (“FHL” or the “Company”) together with warrants (“Warrants”, and each a “Warrant”) to purchase up to [●] Ordinary Shares, at an assumed combined public offering price of US$[●] per Ordinary Share and accompanying Warrant, which is equal to the closing price of our Ordinary Shares on the Nasdaq Capital Market (the “Nasdaq Capital Market” or “Nasdaq”) on [●], 2024. Each Ordinary Share and accompanying Warrant is immediately separable and will be issued separately in this offering but must be purchased together in this offering, with each Ordinary Share that we sell in this offering being accompanied by one Warrant. Each Warrant offered hereby will have an assumed exercise price of $[●] (representing [●]% of the assumed combined offering price per Ordinary Share and accompanying Warrant, which is equal to the closing price of our Ordinary Shares on the Nasdaq Capital Market on [●], 2024), will be exercisable upon issuance and will expire [●] years from the initial date of issuance. The aggregate initial offering price of all securities sold by us under this prospectus will not exceed $5,000,000.

We are also offering to certain purchasers whose purchase of Ordinary Shares in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Ordinary Shares immediately following the consummation of this offering, the opportunity to purchase, if any such purchaser so chooses, pre-funded warrants (the “Pre-Funded Warrants”, and each a “Pre-Funded Warrant”) to purchase Ordinary Shares, in lieu of Ordinary Shares that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Ordinary Shares. Each Pre-Funded Warrant will be exercisable for one Ordinary Share. The purchase price of each Pre-Funded Warrant is $[●] (which is equal to the assumed combined public offering price per Ordinary Share and accompanying Warrant to be sold in this offering minus $0.001, the exercise price per Ordinary Share of each Pre-Funded Warrant). The Pre-Funded Warrants are immediately exercisable (subject to the beneficial ownership limitations) and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. For each Pre-Funded Warrant we sell (without regard to any limitation on exercise set forth therein), the number of Ordinary Shares we are offering will be decreased on a one-for-one basis. The Pre-Funded Warrants and accompanying Warrants are immediately separable and will be issued separately in this offering but must be purchased together in this offering, with each Pre-Funded Warrant that we sell in this offering being accompanied by one Warrant. This offering also relates to the Ordinary Shares issuable upon the exercise of the Warrants, the Pre-Funded Warrants, and the Placement Agent Warrants (as defined below). See “Description of Securities” for more information.

We refer to the Ordinary Shares, the Warrants, and the Pre-Funded Warrants, if any, to be issued in this offering, collectively, as the “Securities.”

The assumed combined offering price per (i) Ordinary Share and accompanying Warrant of $[●], and (ii) Pre-Funded Warrant and accompanying Warrant of $[●], used throughout this prospectus has been included for illustration purposes only, and may not be indicative of the final offering price. The actual combined public offering price may differ materially from the assumed combined price used in this prospectus and will be determined by negotiations between us and the investors in the offering, in consultation with the Placement Agent (as defined below), based on, among other things, market conditions at the time of pricing and may be at a discount to the current market price of our Ordinary Shares, and may not be indicative of prices that will prevail in the trading market.

Our Ordinary Shares are listed on the Nasdaq Capital Market under the symbol “FEBO”. On July 24, 2024, the last reported sales price of the Ordinary Shares on the Nasdaq Capital Market was $11.02. There is no established trading market for the Warrants or the Pre-Funded Warrants, and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the Warrants or Pre-Funded Warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the Warrants and Pre-Funded Warrants will be limited.

We have engaged [●] (the “Placement Agent”), to act as our exclusive placement agent in connection with this offering. The Placement Agent has agreed to use its reasonable best efforts to arrange for the sale of the Securities offered by this prospectus. The Placement Agent is not purchasing or selling any of the Securities we are offering, and the Placement Agent is not required to arrange the purchase or sale of any specific number of Securities or dollar amount. We have agreed to pay to the Placement Agent the Placement Agent fees set forth in the table below, which assumes that we sell all of the Securities offered by this prospectus. We have also agreed to issue to the Placement Agent, or its designees, as compensation in connection with this offering, warrants to purchase up to [●] Ordinary Shares (the “Placement Agent Warrants”). There is no minimum number of Securities or amount of proceeds required as a condition to closing in this offering. Because there is no minimum offering amount required as a condition to closing this offering, we may sell fewer than all of the Securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do not sell an amount of Securities sufficient to pursue our business goals described in this prospectus. In addition, because there is no escrow trust or similar arrangement and no minimum offering amount, investors could be in a position where they have invested in our company, but we are unable to fulfill all of our contemplated objectives due to a lack of interest in this offering. Further, any proceeds from the sale of Securities offered by us will be available for our immediate use, despite uncertainty about whether we would be able to use such funds to effectively implement our business plan. See the section entitled “Risk Factors” for more information. We will bear all costs associated with the offering. See “Plan of Distribution” on page 119 of this prospectus for more information regarding these arrangements.

This offering will terminate on [●], 2024 unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date. We will have one closing for all the Securities purchased in this offering. The combined public offering price per Ordinary Share (or Pre-Funded Warrant in lieu thereof) and accompanying Warrant will be fixed for the duration of this offering. We will deliver the Securities to be issued in connection with this offering delivery versus payment or receipt versus payment, as the case may be, upon receipt of investor funds received by us.

FHL is a holding company incorporated in the Cayman Islands with no material operations of its own. We conduct our operations in Hong Kong through our subsidiaries, Fenbo Industries Limited (“FIL”), and Able Industries Ltd. (“AIL”), both incorporated in Hong Kong, and in China through Fenbo Plastic Products Factory (Shenzhen) Ltd. (“FPPF”) incorporated in the People’s Republic of China (“China” or the “PRC”) (FIL, AIL and FPPF, collectively, the “Operating Subsidiaries”). We directly hold equity interests in our Operating Subsidiaries in China and Hong Kong, and we do not currently use a variable interest entity (“VIE”) structure.

Investors are cautioned that the Securities they are buying are securities of FHL, a Cayman Islands holding company, and not securities of the Operating Subsidiaries. Investors in this offering will not directly hold equity interests in the Operating Subsidiaries.

Since our business operations are conducted in China and Hong Kong through our Operating Subsidiaries, the Chinese government may exercise significant oversight and discretion over the conduct of our business in China and Hong Kong and may intervene in or influence our Operating Subsidiaries’ operations at any time, which could result in a material change in their operations and/or the value of our Ordinary Shares.

China and PRC shall refer to the People’s Republic of China, including Hong Kong, Macau, and Taiwan; however, the only time such jurisdictions are not included in the definition of the PRC and China in this prospectus is when we make reference to the specific laws that have been adopted by the PRC.

We are an “Emerging Growth Company” and a “Foreign Private Issuer” under applicable U.S. federal securities laws and, as such, are eligible for reduced public company reporting requirements. Please see “Implications of Being an Emerging Growth Company” and “Implications of Being a Foreign Private Issuer” on page 15 of this prospectus for more information.

Investing in our Securities involves significant risks. The risks could result in a material change in the value of the Securities we are registering for sale including the risk of losing your entire investment or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. See “Risk Factors” beginning on page 19 of this prospectus to read about factors you should consider before buying our Securities.

We are subject to legal and operational risks associated with having certain of our Operating Subsidiaries’ operations in China, including risks related to the legal, political and economic policies of the Chinese government, the relations between China and Hong Kong and China and the United States, or Chinese or United States regulations, which risks could result in a material change in our operations and/or cause our Ordinary Shares to significantly decline in value or become worthless and affect our ability to offer or continue to offer securities to investors. Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. We may be subject to these regulatory actions or statements. Although we have not engaged in any monopolistic behavior, our business does involve the collection of user data and may implicate cybersecurity reviews. We currently expect that these new regulations may have an impact on our Operating Subsidiaries or this offering.

On February 17, 2023, with the approval of the State Council, the China Securities Regulatory Commission (the “CSRC”) promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (“Trial Measures”), and five supporting guidelines, which came into effect on March 31, 2023. Pursuant to the Trial Measures, domestic companies that seek to offer or list securities overseas, both directly and indirectly, shall complete filing procedures with the CSRC pursuant to the requirements of the Trial Measures within three working days following their submission of initial public offerings or listing applications. Subsequent securities offerings of an issuer in the same overseas market where it has previously offered, and listed securities must be filed with the CSRC within three business days after the offering is completed. If a domestic company fails to complete the required filing procedures or conceals any material fact or falsifies any major content in its filing documents, such domestic company may be subject to administrative penalties, such as an order to rectify, warnings and fines, and its controlling shareholders, actual controllers, the person directly in charge and other directly liable persons may also be subject to administrative penalties, such as warnings and fines.

As of the date of this prospectus, we have not received any formal inquiry, notice, warning, sanction, or objection from the CSRC with respect to the listing of our Ordinary Shares. We have been advised by the Alpha Law Firm, our PRC counsel, that, in its opinion, the filing requirements under the Trial Measures do not apply to the Company since: (i) the revenue, total profit, total assets or net assets of FPPF was less than 50% of that of the Company in total for the fiscal years ended December 31, 2023 and 2022; and (ii) the majority of senior management are non-PRC citizens and reside in Hong Kong.

However, there can be no assurance that the relevant PRC governmental authorities, including the CSRC, would reach the same conclusion as us, or that the CSRC or any other PRC governmental authorities would not promulgate new rules or new interpretation of current rules (with retrospective effect) to require us to obtain CSRC or other PRC governmental approvals for our recent IPO or this offering. If we inadvertently concluded that such approvals were or are not required, our ability to offer or continue to offer our Securities to investors could be significantly limited or completed hindered, which could cause the value of our Ordinary Shares to significantly decline or become worthless. We may also face sanctions by the CSRC, the Cyberspace Administration of China or other PRC regulatory agencies. These regulatory agencies may impose fines, penalties, limit our operations in China, or take other actions that could have a material adverse effect on our business, financial condition, results of operations and prospects, as well as the trading price of our Securities. See “Risk Factors” beginning on page 19 of this prospectus for a discussion of these legal and operational risks and other information that should be considered before making a decision to purchase our Securities.

Although Hong Kong is a Special Administrative Region and a dependency of the PRC, it has enacted its own laws pertaining to data security and anti-monopoly concerns. Hong Kong enacted the Personal Data (Privacy) Ordinance (the “PDPO”) to ensure an adequate level of data protection to retain its status as an international trading center and to give effect to human rights treaty obligations. Moreover, Hong Kong has also enacted a similar piece of legislation regulating competition in the market (the “Competition Ordinance”). The Competition Ordinance prohibits: (i) anti-competitive agreements and concerted practices; and (ii) abuse of power with the object or effect of preventing, restricting or distorting competition in Hong Kong. If we were to be found in violation of either of these laws, our Hong Kong Operating Subsidiaries’ operations may be restricted, and they may be required or elect to make changes to their operations in Hong Kong so as to be in accordance with the PDPO and/or the Competition Ordinance. Moreover, Hong Kong authorities may take other action against us, such as imposing taxes or other penalties, which could materially affect our financial results. Thus, our revenue and business operations in Hong Kong would be adversely affected.

In addition, the Holding Foreign Companies Accountable Act (the “HFCAA”), which prohibits foreign companies from listing their securities on U.S. exchanges if the company’s auditor has been unavailable for Public Company Accounting Oversight Board (United States) (“PCAOB”) inspection or investigation for three consecutive years, became law in December 2020. On December 16, 2021, the PCAOB issued a determination (the “Determination Report”) that the PCAOB is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong because of positions taken by authorities in those jurisdictions, and the PCAOB included in the Determination Report a list of the accounting firms that are headquartered in the PRC or Hong Kong. On December 15, 2022, the PCAOB announced that it has secured complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate the previous 2021 Determination Report to the contrary. The U.S. Securities and Exchange Commission (the “SEC”) adopted final amendments to its rules to implement the HFCAA, which went into effect on January 20, 2022. As part of the SEC’s final rules, identified issuers will need to provide additional disclosures in subsequent filings that prove the issuer is not owned or controlled by a governmental authority in the foreign jurisdiction of the audit firm identified by the PCAOB in the Determination Report. The Determination Report includes our auditor, Centurion ZD CPA & Co., which is based in Hong Kong, is registered with the PCAOB, is subject to PCAOB inspection and was last inspected in May 2023. In the event that it is later determined that the PCAOB is unable to inspect or investigate completely our auditor or our work papers because of a position taken by an authority in a foreign jurisdiction, then such lack of inspection could cause our securities to be delisted from the applicable stock exchange. The delisting of our Ordinary Shares, or the threat of their being delisted, may materially and adversely affect the value of your investment.

Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”), which was enacted on December 29, 2022, and amended the HFCAA to require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three.

On August 26, 2022, the CSRC, the Ministry of Finance of the PRC (the “MOF”), and the PCAOB signed a Statement of Protocol (the “Protocol”) to allow the PCAOB to inspect and investigate completely registered public accounting firms headquartered in mainland China and Hong Kong, consistent with the HFCAA. Pursuant to the fact sheet with respect to the Protocol disclosed by the SEC, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC.

On December 15, 2022, the PCAOB Board determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB Board will consider the need to issue a new determination. On December 29, 2022, the AHFCAA was enacted, which amended the HFCA Act by decreasing the number of non-inspection years from three years to two, thus reducing the time period before our Ordinary Shares may be prohibited from trading or delisted. Notwithstanding the foregoing, in the event it is later determined that the PCAOB is unable to inspect or investigate completely our auditor, then such lack of inspection could cause our securities to be delisted from the stock exchange. See “Risk Factors — Risks Related to Doing Business in the People’s Republic of China and Hong Kong — Although the audit report included in this prospectus is prepared by U.S. auditors who are currently inspected by the PCAOB, there is no guarantee that future audit reports will be prepared by auditors inspected by the PCAOB and, as such, in the future, investors may be deprived of the benefits of such inspection. Furthermore, trading in our securities may be prohibited under the HFCA Act if the SEC subsequently determines our audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely, and as a result, U.S. national securities exchanges, such as the Nasdaq Capital Market, may determine to delist our securities. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which was enacted on December 29, 2022, amending the HFCA Act and requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time before the securities may be prohibited from trading or delisted.”

As a holding company, we will rely on dividends and other distributions on equity paid by our Hong Kong or PRC Operating Subsidiaries for our cash and financing requirements. If our Hong Kong and PRC Operating Subsidiaries incur debt on their own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to us. Moreover, to the extent cash is in our PRC Operating Subsidiary, there is a possibility that the funds may not be available to fund our operations or for other uses outside the PRC due to interventions or the imposition of restrictions and limitations by the PRC government on the ability to transfer cash. However, none of our Operating Subsidiaries have paid any dividends or other distributions to us as of the date of this prospectus. In the future, cash proceeds raised from overseas financing activities, including this offering, may be transferred by us to our PRC or Hong Kong Operating Subsidiaries via capital contribution or shareholder loans, as the case may be. As of the date of this prospectus, we have not paid any dividends or made any distributions to any U.S. investors.

On December 7, 2023, we transferred US$4 million to Fenbo Industries to repay IPO and other expenses totaling approximately US$2.1 million paid by Fenbo Industries on our behalf. Other than this fund transfer, as of the date of this prospectus, there have been no other cash flows between us and any of our subsidiaries or Operating Subsidiaries. The transfer of funds among companies is subject to the Provisions of the Supreme People’s Court on Several Issues Concerning the Application of Law in the Trial of Private Lending Cases (2020 Revision), (the “Provisions on Private Lending Cases”), which was implemented on August 20, 2020, to regulate the financing activities between natural persons, legal persons, and unincorporated organizations. The Provisions on Private Lending Cases do not prohibit using cash generated from one subsidiary to fund another subsidiary’s operations. We have not been notified of any other restriction which could limit our PRC Operating Subsidiary’s ability to transfer cash between subsidiaries. We intend to conduct regular review and management of all of our subsidiaries’ and Operating Subsidiaries’ cash transfers and report to our Board of Directors.

Upon completion of this offering, our issued and outstanding shares will consist of [●] Ordinary Shares, assuming all shares offered are sold. As of the date of this prospectus, Luxury Max Investments Limited, a British Virgin Islands company (“LMIL”) owns 72.3% of our Ordinary Shares. We are a controlled company as defined under Nasdaq Marketplace Rule 5615(c) because, Mr. Li Kin Shing, our controlling shareholder, and Executive Director, through his ownership of 100% of the outstanding shares of LMIL, owns 72.3% of our total issued and outstanding Ordinary Shares, representing 72.3% of the total voting power, and will own [●]% of our total issued and outstanding Ordinary Shares, representing [●]% of the total voting power, following completion of this offering, assuming all shares offered are sold, no Pre-Funded Warrants are sold and no Warrants are exercised. Please see “Implications of Being a ‘Controlled Company’” on page [●] of this prospectus for more information.

Neither the United States Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | Per Ordinary Share and Accompanying

Warrant | | | Per Pre-Funded Warrant and Accompanying Warrant | | | Total(1) | |

| | | | | | | | | | |

| Public offering price | | $ | | | | $ | | | | $ | | |

| Placement Agent fees(2) | | $ | | | | $ | | | | $ | | |

| Proceeds before expenses to us(3) | | $ | | | | $ | | | | $ | | |

| (1) | Assumes no exercise of the Warrants or sale of Pre-Funded Warrants. |

| (2) | We have also agreed to pay a management fee equal to [●]% of the gross proceeds raised in the offering and for certain of the Placement Agent’s offering-related expenses. In addition, we have agreed to issue the Placement Agent, or its designees, as compensation in connection with this offering, the Placement Agent Warrants to purchase a number of Ordinary Shares equal to [●]% of the aggregate number of Ordinary Shares being offered (including the Ordinary Shares issuable upon the exercise of any Pre-Funded Warrants being offered), at an exercise price of $[●] per Ordinary Share, which represents [●]% of the public offering price per Ordinary Share. See “Plan of Distribution” for a complete description of the compensation arrangements for the Placement Agent. |

| (3) | Because there is no minimum number of Securities or amount of proceeds required as a condition to closing in this offering, the actual public offering amount, Placement Agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above. We estimate the total expenses of this offering payable by us, excluding the Placement Agent fees and expenses, will be approximately $[●]. For more information, see “Plan of Distribution.” |

We expect to deliver the Securities offered hereby against payment in New York, New York on or about [●], 2024, subject to satisfaction of customary closing conditions.

You should rely only on information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. Neither the delivery of this prospectus nor the sale of our Securities means that the information contained in this prospectus, or any free writing prospectus is correct after the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our Securities in any circumstances under which the offer or solicitation is unlawful or in any state or other jurisdiction where the offer is not permitted. The information contained in this prospectus is accurate only as of its date regardless of the time of delivery of this prospectus or of any sale of our Securities.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the securities offered hereby, or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us.

For investors outside the United States: Neither we nor the Placement Agent have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

The date of this prospectus is ____, 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”). You should rely only on the information contained in this prospectus, any related prospectus supplement, or in any free writing prospectus we may authorize to be delivered or made available to you.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed, or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below. You should read this prospectus in its entirety before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the section of the prospectus entitled “Where You Can Find Additional Information.”

Neither the Company nor the Placement Agent has authorized anyone to provide you with any information or to make any representations other than as contained in this prospectus or in any related free writing prospectus. Neither the Company nor the Placement Agent take responsibility for, or provide any assurance about the reliability of, any information that others may give you. This prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: neither the Company nor the Placement Agent has done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Securities and the distribution of this prospectus outside the United States.

We obtained statistical data, market data and other industry data and forecasts used in this prospectus from market research, publicly available information, and industry publications. While we believe that the statistical data, industry data, forecasts and market research are reliable, we have not independently verified the data.

PRESENTATION OF FINANCIAL INFORMATION

Basis of Presentation

Unless otherwise indicated, all financial information contained in this prospectus is prepared and presented in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP” or “GAAP”).

Certain amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, amounts, percentages and other figures shown as totals in certain tables or charts may not be the arithmetic aggregation of those that precede them and amounts, and figures expressed as percentages in the text may not total 100% or, when aggregated, may not be the arithmetic aggregation of the percentages that precede them.

Financial Information in U.S. Dollars

Our reporting currency is the Hong Kong dollar. For the purpose of presenting these financial statements of our Operating Subsidiary, FPPF, using RMB as functional currency, the Company’s assets and liabilities are expressed in Hong Kong dollars at the exchange rate on the balance sheet date, which is 0.9126, 0.8866 and 0.8176 as of December 31, 2023, December 31, 2022 and December 31, 2021, respectively; shareholders’ equity accounts are translated at historical rates, and income and expense items are translated at the average exchange rate during the period, which is 0.9070, 0.8642 and 0.8292 for the years ended December 31, 2023, December 31, 2022 and 2021, respectively.

This prospectus also contains translations of Hong Kong dollars into U.S. dollars for the convenience of the reader. Unless otherwise stated, all translations of Hong Kong dollars into U.S. dollars were made at US$0.12803 to HK$1, the exchange rates set forth in the statistical releases of the Federal Reserve Board on December 29, 2023. We make no representation that the Hong Kong dollar or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or Hong Kong dollars, as the case may be, at any particular rate or at all.

MARKET AND INDUSTRY DATA

Certain market data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, reports of governmental and international agencies and industry publications and surveys. Industry publications and third-party research, surveys and reports generally indicate that their information has been obtained from sources believed to be reliable. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that relate to our current expectations and views of future events. These forward-looking statements are contained principally in the sections entitled “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Industry Overview” and “Business.” These statements relate to events that involve known and unknown risks, uncertainties, and other factors, including those listed under “Risk Factors,” which may cause our actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “believe,” “plan,” “expect,” “intend,” “should,” “seek,” “estimate,” “will,” “aim” and “anticipate,” or other similar expressions, but these are not the exclusive means of identifying such statements. All statements other than statements of historical fact included in this document, including those regarding future financial position and results, business strategy, plans and objectives of management for future operations (including development plans and dividends) and statements on future industry growth are forward-looking statements. In addition, we and our representatives may from time to time make other oral or written statements that are forward-looking statements, including in our periodic reports that we will file with the SEC, other information sent to our shareholders and other written materials.

These forward-looking statements are subject to risks, uncertainties, and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Risk Factors” and in this section of the prospectus.

Important factors that could cause our actual results to differ materially from those in the forward-looking statements include, but are not limited to, regional, national, or global political, economic, business, competitive, market and regulatory conditions and the following:

| | ● | our Operating Subsidiaries’ business strategies, operating plans, and business prospects; |

| | | |

| | ● | our Operating Subsidiaries’ capital commitment plans and funding requirements; |

| | | |

| | ● | our ability to effectuate and manage our Operating Subsidiaries’ planned business expansion; |

| | | |

| | ● | our Operating Subsidiaries’ ability to attract customers and maintain customer loyalty; |

| | | |

| | ● | our Operating Subsidiaries’ ability to retain senior management team members and recruit qualified and experienced new team members; |

| | | |

| | ● | our Operating Subsidiaries’ ability to maintain their competitiveness and operational efficiency; |

| | | |

| | ● | our Operating Subsidiaries’ prospective financial conditions; |

| | | |

| | ● | general economic market and business and financial conditions in Hong Kong, the PRC and globally; |

| | | |

| | ● | laws, regulations, and rules for the personal care electric appliance industry in Hong Kong, the PRC and globally; |

| | | |

| | ● | future trends, developments, and conditions in the personal care electric appliance industry in Hong Kong, the PRC and globally; |

| | | |

| | ● | certain statements in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” with respect to trends in prices, volumes, and operations; |

| | | |

| | ● | our ability to execute strategies for our Operating Subsidiaries; |

| | |

| | ● | changes in the need for capital and the availability of financing and capital to fund those needs; |

| | |

| | ● | our ability to anticipate and respond to changes in the markets in which our Operating Subsidiaries operate, and to client demands, trends and preferences; |

| | |

| | ● | exchange rate fluctuations, including fluctuations in the exchange rates of currencies that are used in our Operating Subsidiaries’ business; |

| | | |

| | ● | changes in interest rates or rates of inflation; |

| | | |

| | ● | legal, regulatory, and other proceedings arising out of our Operating Subsidiaries’ operations; and |

| | | |

| | ● | other factors that are described in “Risk Factors.” |

The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. Except as required by law, we undertake no obligation to update nor revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results or performance may be materially different from what we expect.

This prospectus contains certain data and information that we obtained from various research and other publications. Statistical data in these publications also include projections based on a number of assumptions. The markets for personal care electric appliances / hair styling products may not grow at the rate projected by such market data, or at all. Failure of our industry to grow at the projected rate may have a material and adverse effect on our business and the market price of our Ordinary Shares. Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

DEFINITIONS

“AIL” means Able Industries Ltd., a private company limited by shares incorporated on November 7, 2005, under the laws of Hong Kong and one of our Operating Subsidiaries conducting business operations in Hong Kong.

“Articles of Association” means the memorandum and articles of association of our Company adopted on September 30, 2022, and as further supplemented, amended, or otherwise modified from time to time, a copy of which is filed as Exhibit 3.1 to our Registration Statement filed with the SEC on September 11, 2023.

“Business Day” means a day (other than a Saturday, Sunday, or public holiday in the U.S.) on which licensed banks in the U.S. are generally open for normal business to the public.

“BVI” means the British Virgin Islands.

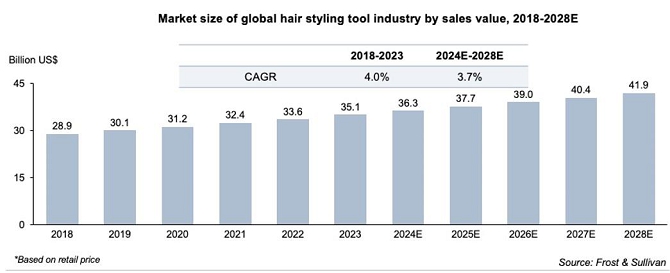

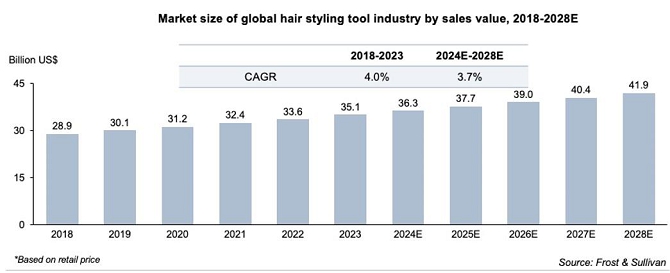

“CAGR” means compound annual growth rate.

“Companies Act” means the Companies Act (as revised) of the Cayman Islands, as amended, supplemented and/or otherwise modified from time to time.

“Companies Ordinance” means the Companies Ordinance (Chapter 622 of the laws of Hong Kong) as amended, supplemented, or otherwise modified.

“Controlling Shareholder” means for the purposes of our Company, Mr. Li Kin Shing, individually, and Luxury Max Investments Limited, a British Virgin Islands company, as a group, where the context requires.

“COVID-19” means the Coronavirus Disease 2019.

“EIT Law” or “EIT Rules” means the Enterprise Income Tax Law of the People’s Republic of China.

“EU” means the European Union.

“Exchange Act” means the United States Securities Exchange Act of 1934, as amended.

“FHL” or “Company” means Fenbo Holdings Limited, an exempted company limited by shares incorporated on September 30, 2022, under the laws of the Cayman Islands.

“FIL” means Fenbo Industries Ltd., a private company limited by shares incorporated on June 17, 1993, under the laws of Hong Kong and one of our Operating Subsidiaries conducting business operations in Hong Kong.

“FPPF” means Fenbo Plastic Products Factory (Shenzhen) Ltd., a limited liability company incorporated on October 19, 2010, under the laws of the PRC, which is our Operating Subsidiary conducting business operations in the PRC.

“Group,” “our Group,” “we,” “us,” or “our” means the Company and its subsidiaries or any of them, or where the context so requires, in respect of the period before the Company became the holding company of its present subsidiaries, such subsidiaries as if they were subsidiaries of the Company at the relevant time or the businesses which have since been acquired or carried on by them or, as the case may be, their predecessors.

“Hong Kong dollars” or “HKD” or “HK$” means Hong Kong dollars, the lawful currency of Hong Kong.

“Hong Kong Operating Subsidiaries” means FIL and AIL.

“Independent Third Party” means a person or company who or which is independent of and is not a 5% owner of, does not control and is not controlled by or under common control with any 5% owner and is not the spouse nor descendant (by birth or adoption) of any 5% owner of the Company.

“Initial Public Offering” or “IPO” refers to the closing on December 1, 2023 of our initial public offering of 1,000,000 Ordinary Shares at a public offering price of $5.00 for total gross proceeds of $5,000,000. On November 30, 2023, we commenced the listing of our Ordinary Shares on the Nasdaq Capital Market under the ticker symbol “FEBO”.

“LMIL” means Luxury Max Investments Limited, a British Virgin Islands company incorporated on October 21, 2022, which is a holding company not conducting any business operations but owning 8,000,000 shares (72.32%) of the total issued and outstanding shares of the Company, and whose total issued, and outstanding shares are owned by Mr. Li Kin Shing, a Controlling Shareholder and Executive Director of the Company.

“Nasdaq Market” means an online global electronic marketplace for buying and selling securities, which operates 25 markets, 1 clearinghouse and 5 central securities depositories in the United States and Europe.

“Operating Subsidiaries” means FIL, AIL and FPPF.

“PRC” or “China” means the People’s Republic of China, excluding, for the purposes of this prospectus only, Hong Kong, the Macau Special Administrative Region of the People’s Republic of China and Taiwan.

“PRC Operating Subsidiary” means FPPF.

“Principal Shareholder” means LMIL, a British Virgins Islands company beneficially owned 100% by Mr. Li Kin Shing, our Executive Director.

“Reorganization” means the reorganization arrangements undertaken by our Group in preparation for the listing on the Nasdaq Market, which are described in more detail in “History and Corporate Structure” in this prospectus.

“RLHL” means Rich Legend Holdings Limited, a BVI business company limited by shares incorporated on October 21, 2022, under the laws of the BVI and the holding company of our Operating Subsidiaries.

“RMB” means Renminbi, the lawful currency of the PRC.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“SEC” or “Securities and Exchange Commission” means the United States Securities and Exchange Commission.

“US$,” “$” or “USD” means United States dollar(s), the lawful currency of the United States.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you, and we urge you to read this entire prospectus carefully, including the “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and our consolidated financial statements and notes to those statements, included elsewhere in this prospectus, before deciding to invest in our Securities. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.” Unless otherwise stated, all references to “us,” “our,” “we,” the “Company,” and similar designations refer to Fenbo Holdings Limited, a Cayman Islands exempted company limited by shares.

Overview and Corporate History

FHL, incorporated on September 30, 2022, under the laws of the Cayman Islands, is the holding company of our Operating Subsidiaries, AIL, FIL and FPPF. Through our Operating Subsidiaries, we represent over 30 years of experience producing personal care electric appliances (principally electrical hair styling products) and toy products to overseas markets. Our operating history began in 1993 when FIL was founded in Hong Kong by Mr. Li Kin Shing as a toy manufacturer and distributor. As the toy market deteriorated, he founded AIL in 2005 in Hong Kong, and shifted our operations to the manufacturing and sales of personal care electric appliances. Our manufacturing subsidiary, FPPF, located in Guangdong, PRC, was formed in the PRC on October 19, 2010, and is capable of producing over three million units per year. We currently act as both an original equipment manufacturer (“OEM”) and original design manufacturer (“ODM”).

Since 2006, the Company has served as an OEM for Spectrum Brands, a global home essential company, and its sole customer, producing electrical hair styling products, under the “Remington” brand which Spectrum Brands has the right of the use of, and which are currently sold to Europe, United States and Latin America.

The use of a variable interest entity (“VIE”) to circumvent restrictions on foreign ownership is a longstanding industry practice and well known to officials and regulators in China; however, VIEs are not formally recognized under Chinese law. Recently, the government of China provided new guidance to and placed restrictions on China-based companies raising capital offshore, including through VIE structures. Although the China Securities Regulatory Commission published that they do not object to the use of VIE structures for Chinese companies to raise capital from non-Chinese investors, there is no guarantee that the Chinese government or a Chinese regulator will not otherwise interfere with the operation of VIE structures. We do not utilize a VIE structure.

Reorganization

Effective November 18, 2022, our Group completed a reorganization to consolidate its business operations in Hong Kong and the PRC into an offshore corporate holding structure to expand our manufacturing and sales operations and in anticipation of listing on a recognized securities market. The Company was incorporated on September 30, 2022. For details, please refer to the section headed “History and Corporate Structure” on page 67 of this prospectus.

The major steps of the Reorganization were as follows:

| | (i) | incorporation on September 30, 2022, of Fenbo Holdings Limited in the Cayman Islands as an exempted company with limited liability with an authorized share capital of $30,300.00 consisting of 303,000,000 shares of a nominal or par value of US$0.0001 each; at incorporation, one Ordinary Share was issued as fully paid to the nominee of the secretarial company engaged by us, and such share was subsequently transferred to Mr. Li Kin Shing on the same day; an additional 9,999 Ordinary Shares were allotted and issued to Mr. Li Kin Shing on November 14, 2022; on November 15, 2022, LMIL acquired 10,000 Ordinary Shares, representing the entire issued share capital of FHL in consideration for 1 share, credited as fully paid, issued by LMIL to Mr. Li Kin Shing; |

| | (ii) | incorporation on October 21, 2022, of RLHL as a limited liability company in the BVI authorized to issue a maximum of 50,000 shares with a par value of US$1.00 each; at incorporation, one share was issued as fully paid to the initial subscriber and transferred to Mr. Li Kin Shing on the same day; |

| | | |

| | (iii) | on November 17, 2022, RLHL acquired 1,999,999 shares and one (1) share in the issued share capital of FIL from Mr. Li Kin Shing and Mr. Li Siu Lun Allan, representing in aggregate its entire issued share capital, at a consideration of 5 shares, credited as fully paid, issued by RLHL and a cash consideration of HK$100, respectively; upon completion of the acquisition, FIL and FPPF became indirect wholly owned subsidiaries of the Company; |

| | (iv) | on November 17, 2022, RLHL acquired the entire issued share capital of AIL from Mr. Li Kin Shing, at a consideration of 4 shares, credited as fully paid, issued by RLHL; upon completion of the acquisition AIL became an indirect wholly owned subsidiary of the Company; and |

| | | |

| | (v) | on November 18, 2022, FHL acquired the entire issued share capital of RLHL from Mr. Li Kin Shing in consideration for the issuance and allotment of 9,990,000 Ordinary Shares of the Company at a par value of US$0.0001 each to LMIL. |

Following the Reorganization, on August 11, 2023, LMIL completed a private placement of an aggregate of 2,000,000 Ordinary Shares owned by it at a price of $2.50 per share to: Yuk Tong Lam (500,000 Ordinary Shares), Majestic Dragon Investment Co. Limited (500,000 Ordinary shares), Top Dragon International Limited (300,000 Ordinary Shares), Smart Tech Group Limited (300,000 Ordinary Shares), and Power Ocean Ventures Limited (400,000 Ordinary Shares).

Therefore, as a result of the Reorganization and the private placement, as of the date of this prospectus: (i) LMIL which is 100% owned by Mr. Li Kin Shing, owns 8,000,000 Ordinary Shares, representing 72.32% of our Company, (ii) our Company is a holding company and owns 100% of RLHL, (iii) RLHL owns 100% of FIL and AIL and (iv) FIL owns 100% of FPPF. We do not utilize a VIE structure.

Purchasers in this offering are buying shares of the Company, whereas all of our operations are conducted through our Operating Subsidiaries. At no time will the Company’s shareholders directly own shares of the Operating Subsidiaries.

We are and will be a “controlled company” as defined under the Nasdaq Stock Market Rules because, immediately after the completion of this offering, our Controlling Shareholder, will own [●]% of our total issued and outstanding Ordinary Shares, representing [●]% of the total voting power. Please see “-Implications of Being a ‘Controlled Company’” below for more information.

Initial Public Offering

On December 1, 2023, we closed on our Initial Public Offering of 1,000,000 Ordinary Shares at a price of $5.00 per share and on January 16, 2024 the representative of the underwriters in the IPO partially exercised the over-allotment option to purchase an additional 62,500 Ordinary Shares at the IPO price of $5.00 per share. In addition, certain selling shareholders sold an aggregate of 2,000,000 Ordinary Shares in the IPO. The gross proceeds of the IPO to us, before underwriting discounts and commissions and estimated offering expenses, were approximately $5,312,500 (including the partial exercise of the over-allotment option). We did not receive any of the proceeds from the sale of Ordinary Shares by the selling shareholders. On November 30, 2023, we commenced the listing of our Ordinary Shares on the Nasdaq Capital Market under the ticker symbol “FEBO”.

Business of the Operating Subsidiaries

Our mission is to be an industry leader in providing personal care electric appliances.

Competitive Strengths

We believe the following competitive strengths differentiate us from our competitors:

| | ● | Long term and stable relationship with “Spectrum Brands”, a diversified global branded consumer products and home essentials company, which owns the right to use the Remington trademark for personal care products and our sole customer for whom we develop, and supply products sold under the Remington brand (see “Risk Factors — Risks Related to Our Operating Subsidiaries’ Business Operations); |

| | ● | R&D department with substantial industry experience and market awareness permitting it to anticipate market changes and proactively develop innovative and trendy products; |

| | ● | Stringent adherence to quality control; and |

| | ● | Management members that have decades of operating history, deep industry knowledge, proven track records, and established presence in the industry. |

Our Strategies

We intend to pursue the following strategies to further expand our business:

| | ● | Upgrade and expand our existing production capacity, and capability by purchasing and installing new equipment, such as our plastic injection molding production line and other ancillary equipment in the SZ Factory. |

| | ● | Strengthen and reinforce our engineering, research, and product development capabilities by recruiting additional engineers and/or research and development personnel which will better position us to expand the range of product / models and lines available for our current sole customer and potential future ODM and OBM customers. |

| | ● | Penetrate and further expand into existing and new geographic markets by enhancing our sales and marketing efforts and establishing new subsidiary or representative offices and in new or existing geographical markets such as United States to (i) strengthen our support services to our sole existing customer, Spectrum Brands, to provide a more timely response to their requirements thus solidifying our relationship and potentially resulting in our engagement by Spectrum Brands for additional products; and (ii) explore cooperative opportunities with other potential new customers, thereby capturing new sales opportunities and expanding our market share. |

REGULATORY APPROVAL OF THE PRC

Permission Required from Hong Kong and Chinese Authorities

As of the date of this prospectus, neither we nor our Operating Subsidiaries are required to obtain any permission or approval from the Hong Kong authorities to operate our business or issue our Ordinary Shares to foreign investors. We are also not required to obtain permissions or approvals from any PRC authorities before listing in the U.S. and to issue our Ordinary Shares to foreign investors, including the CSRC or the Cyberspace Administration of China (“CAC”).

However, in the event that (i) the PRC government expanded the categories of industries and companies whose foreign securities offerings are subject to review by the CSRC or the CAC and that we are required to obtain such permissions or approvals; or (ii) we inadvertently concluded that relevant permissions or approvals were not required or that we did not receive or maintain relevant permissions or approvals required, any action taken by the PRC government could significantly limit or completely hinder the operations of our Operating Subsidiaries and our ability to offer or continue to offer securities to investors and could cause the value of our Ordinary Shares to significantly decline or become worthless.

RECENT REGULATORY DEVELOPMENT IN CHINA

Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in certain areas in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a VIE structure, adopting new measures to extend the scope of cybersecurity reviews and expanding the efforts in anti-monopoly enforcement.

On July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued a document to crack down on illegal activities in the securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws. On December 24, 2021, the CSRC, together with other relevant government authorities in China issued the Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (the “Administration Provisions”), and the Administrative Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies (the “Measures”).

Furthermore, on July 10, 2021, the CAC issued a revised draft of the Cybersecurity Review Measures (“Revised Draft”), which required that, among others, in addition to Critical Information Infrastructure Operator (“CIIO”), any Data Processing Operator (“DPO”) controlling personal information of no less than one million users that seeks to list in a foreign stock exchange should also be subject to cybersecurity review, and further listed the factors to be considered when assessing the national security risks of the relevant activities. On December 28, 2021, the CAC, the National Development and Reform Commission (“NDRC”), and several other administrations jointly issued the revised Measures for Cybersecurity Review, or the “Revised Review Measures”, which became effective and replaced the existing Measures for Cybersecurity Review on February 15, 2022. According to the Revised Review Measures, if an “online platform operator” that is in possession of personal data of more than one million users intends to list in a foreign country, it must apply for a cybersecurity review. Based on a set of Q&As published on the official website of the State Cipher Code Administration in connection with the issuance of the Revised Review Measures, an official of the said administration indicated that an online platform operator should apply for a cybersecurity review prior to the submission of its listing application with non-PRC securities regulators. Moreover, the CAC released the draft of the Regulations on Network Data Security Management in November 2021 for public consultation, which among other things, stipulates that a data processor listed overseas must conduct an annual data security review by itself or by engaging a data security service provider and submit the annual data security review report for a given year to the municipal cybersecurity department before January 31 of the following year. Given the recency of the issuance of the Revised Review Measures, there is a general lack of guidance, and substantial uncertainties exist with respect to their interpretation and implementation.

Given the nature of our Operating Subsidiaries’ business, we believe this risk is not significant. Our Operating Subsidiaries do not have any customers in China and are not CIIOs nor a DPO as defined in the Revised Review Measures. We do not currently expect the Revised Review Measures to have an impact on our Operating Subsidiaries’ business, operations or this offering as we do not believe that our Operating Subsidiaries are deemed to be operators of critical information infrastructure or data processors controlling personal information of no less than one million users, that are required to file for cybersecurity review before listing in the U.S. since (i) FIL and AIL are incorporated and operating in Hong Kong and the Revised Review Measures remain unclear whether they shall be applicable to a Hong Kong company; (ii) FIL’s subsidiary in mainland China is directly owned, does not use a VIE structure and its sole customer is; (iii) as of the date of this prospectus, none of the Operating Subsidiaries have collected any personal information of PRC individuals; and (iv) as of the date of this prospectus, none of the Operating Subsidiaries have been informed by any PRC governmental authority of any requirement that they file for a cybersecurity review. Therefore, we believe that our Operating Subsidiaries are not covered by the permission and requirements from the CSRC or the CAC.

Nevertheless, since these statements and regulatory actions are new, it is highly uncertain how soon the legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated. If the Revised Review Measures are adopted into law in the future and if any of the Operating Subsidiaries are deemed an “operator of critical information infrastructure” or a “data processor” controlling personal information of no less than one million users, the listing of our Ordinary Shares on U.S. exchanges could be subject to CAC’s cybersecurity review. If we become subject to the CAC or any other governmental agency, we cannot assure you that we will be able to list our Ordinary Shares on U.S. exchanges, or continue to offer securities to investors, which would materially affect the interest of the investors and cause significantly depreciation of the price of our Ordinary Shares or render them worthless.

On February 17, 2023, with the approval of the State Council, the CSRC promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (“Trial Measures”), and five supporting guidelines, which came into effect on March 31, 2023. Pursuant to the Trial Measures, domestic companies that seek to offer or list securities overseas, both directly and indirectly, shall complete filing procedures with the CSRC pursuant to the requirements of the Trial Measures within three working days following their submission of initial public offerings or listing applications. Subsequent securities offerings of an issuer in the same overseas market where it has previously offered, and listed securities must be filed with the CSRC within three business days after the offering is completed. If a domestic company fails to complete the required filing procedures or conceals any material fact or falsifies any major content in its filing documents, such domestic company may be subject to administrative penalties, such as an order to rectify, warnings and fines, and its controlling shareholders, actual controllers, the person directly in charge and other directly liable persons may also be subject to administrative penalties, such as warnings and fines.

As of the date of this prospectus, (1) we and our PRC Subsidiary have received from PRC authorities all requisite licenses, permissions or approvals needed to engage in the businesses currently conducted in China, and no permission or approval has been denied, and (2) we have not received any formal inquiry, notice, warning, sanction, or objection from the CSRC with respect to the listing of our Ordinary Shares, and, in the opinion of our PRC legal counsel, the Alpha Law Firm, the filing requirements under the Trial Measures do not apply to the Company since: (i) the revenue, total profit, total assets or net assets of FPPF was less than 50% of that of the Company in total for the fiscal years ended December 31, 2023 and 2022, and (ii) the majority of senior management are non-PRC citizens and reside in Hong Kong.

However, there can be no assurance that the relevant PRC governmental authorities, including the CSRC, would reach the same conclusion as us, or that the CSRC, CAC or any other PRC governmental authorities would not promulgate new rules or new interpretation of current rules (with retrospective effect) to require us to obtain CSRC, CAC, or other PRC governmental approvals for our recent IPO or this offering. If we inadvertently concluded that such approvals were or are not required, our ability to offer or continue to offer our Securities to investors could be significantly limited or completed hindered, which could cause the value of our Ordinary Shares to significantly decline or become worthless. We may also face sanctions by the CSRC, the CAC or other PRC regulatory agencies. These regulatory agencies may impose fines, penalties, limit our operations in China, or take other actions that could have a material adverse effect on our business, financial condition, results of operations and prospects, as well as the trading price of our Securities. See “Risk Factors” beginning on page 19 for a discussion of these legal and operational risks and other information that should be considered before making a decision to purchase our Securities.

HOLDING FOREIGN COMPANIES ACCOUNTABLE ACT (the “HFCA Act or the “HFCAA”)

The HFCA Act was enacted on December 18, 2020. The HFCA Act states if the SEC determines that a company has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years beginning in 2021, the SEC shall prohibit the company’s shares from being traded on a national securities exchange or in the over-the-counter trading market in the United States.

On March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements of the HFCA Act. A company will be required to comply with these rules if the SEC identifies it as having a “non-inspection” year under a process to be subsequently established by the SEC. The SEC is assessing how to implement other requirements of the HFCA Act, including the listing and trading prohibition requirements described above.

On June 22, 2021, the U.S. Senate passed a bill, enacted on December 29, 2022, which amended the HFCAA to require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three consecutive years.

On December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure requirements in the HFCA Act. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that PCAOB is unable to inspect or investigate completely because of a position taken by an authority in foreign jurisdictions (“Commission-Identified Issuers”). The final amendments require Commission-Identified Issuers to submit documentation to the SEC establishing that, if true, it is not owned or controlled by a governmental entity in the public accounting firm’s foreign jurisdiction. The amendments also require that a Commission-Identified Issuer that is a “foreign issuer,” as defined in Exchange Act Rule 3b-4, provide certain additional disclosures in its annual report for itself and any of its consolidated foreign operating entities. Further, the release provides notice regarding the procedures the SEC has established to identify issuers and to impose trading prohibitions on the securities of certain Commission-Identified Issuers, as required by the HFCA Act. The SEC will identify Commission-Identified Issuers for fiscal years beginning after December 18, 2020. A Commission-Identified Issuer will be required to comply with the submission and disclosure requirements in the annual report for each year in which it was identified. If a registrant is identified as a Commission-Identified Issuer based on its annual report for the fiscal year ended December 31, 2021, the registrant will be required to comply with the submission or disclosure requirements in its annual report filing covering the fiscal year ended December 31, 2022. The final amendments became effective on January 10, 2022.

On December 16, 2021, the PCAOB issued a report on its determinations that it was unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in Mainland China and in Hong Kong, because of positions taken by PRC authorities in those jurisdictions. The PCAOB made its determinations pursuant to PCAOB Rule 6100, which provides a framework for how the PCAOB fulfills its responsibilities under the HFCA Act. The report further listed in its Appendix A and Appendix B, Registered Public Accounting Firms Subject to the Mainland China Determination and Registered Public Accounting Firms Subject to the Hong Kong Determination, respectively. Our auditor is headquartered in Hong Kong, appears as part of the report, and is listed under its Appendix B: Registered Public Accounting Firms Subject to the Hong Kong Determination.

On August 26, 2022, the PCAOB signed a Statement of Protocol (the “SOP”) Agreement with the CSRC and China’s Ministry of Finance. The SOP, together with two protocol agreements governing inspections and investigations (together, the “SOP Agreements”), establish a specific, accountable framework to make possible complete inspections and investigations by the PCAOB of audit firms based in mainland China and Hong Kong, as required under U.S. law. Under the SOP Agreements the PCAOB shall have independent discretion to select any firms for inspection or investigation and has the unfettered ability to retain any information as needed. If the PCAOB continues to be prohibited from conducting complete inspections and investigations of PCAOB-registered public accounting firms in mainland China and Hong Kong, the PCAOB is likely to determine by the end of 2022 that positions taken by authorities in the PRC obstructed its ability to inspect and investigate registered public accounting firms in mainland China and Hong Kong completely, then the companies audited by those registered public accounting firms would be subject to a trading prohibition on U.S. markets pursuant to the Holding Foreign Companies Accountable Act. See “Risk Factors — Risks Relating to Doing Business in the People’s Republic of China and Hong Kong — Although the audit report included in this prospectus is prepared by U.S. auditors who are currently inspected by the PCAOB, there is no guarantee that future audit reports will be prepared by auditors inspected by the PCAOB and, as such, in the future, investors may be deprived of the benefits of such inspection. Furthermore, trading in our securities may be prohibited under the HFCA Act if the SEC subsequently determines our audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely, and as a result, U.S. national securities exchanges, such as the Nasdaq Capital Market, may determine to delist our securities. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which was enacted on December 29, 2022, amending the HFCA Act and requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time before the securities may be prohibited from trading or delisted.” on page 24. We cannot assure you whether Nasdaq or other regulatory authorities will apply additional or more stringent criteria to us. Such uncertainty could cause the market price of our Ordinary Shares to be materially and adversely affected.

Our auditor, Centurion ZD CPA & Co. (“Centurion ZD”), the independent registered public accounting firm that issues the audit report included in this prospectus, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess Centurion ZD’s compliance with applicable professional standards. Centurion ZD is headquartered in Hong Kong and has been inspected by the PCAOB on a regular basis, with the last inspection in May 2023.

Implications of Being a Holding Company - Transfers of Cash to and from Our Subsidiaries