Exhibit 99.1

358 South Main Street

Burlington, North Carolina 27215

United States

Adam Schechter

Chairman, President and Chief Executive Officer

, 2023

Dear Fellow Labcorp Stockholder:

We are pleased to inform you that the board of directors of Laboratory Corporation of America® Holdings (“Labcorp”) has approved the spinoff to stockholders of our Clinical Development and Commercialization Services business. The Clinical Development and Commercialization Services business will be transferred to Fortrea Holdings Inc. (“Fortrea”), a newly incorporated Delaware corporation, and its shares will be distributed to Labcorp stockholders on , 2023 as a pro rata distribution intended to be tax-free to our stockholders for U.S. federal income tax purposes, except to the extent of any cash received in lieu of fractional shares.

Fortrea will be a leading global contract research organization providing comprehensive phase I through IV biopharmaceutical product and medical device services, patient access solutions and other enabling sevices to pharmaceutical, biotechnology and medical device organizations. Its common stock will be listed on The Nasdaq Stock Market LLC under the symbol “FTRE.”

As a Labcorp stockholder, you will receive one share of Fortrea common stock for every share of Labcorp common stock you hold as of the record date.

Stockholder approval of the distribution is not required, nor are you required to take any action to receive your Fortrea common shares.

Following completion of the spinoff, Labcorp common shares will continue to trade on the New York Stock Exchange under the symbol “LH” and Labcorp will remain a global leader advancing healthcare through science, innovation and technology with deep scientific expertise, vast health data and insights, and an extensive, advanced global laboratory network.

We invite you to learn more about Fortrea and the spinoff by reviewing the enclosed information statement, which contains important information about Fortrea, including financial information.

Thank you for your continued support of Labcorp and your future support of Fortrea.

| | |

| Sincerely, |

|

| Adam Schechter |

| Chairman, President and Chief Executive Officer |

| Laboratory Corporation of America Holdings |

Enclosure

8 Moore Drive

Durham, NC 27709

United States

Thomas Pike

Chairman and Chief Executive Officer

, 2023

Dear Future Fortrea Stockholder:

I am excited to welcome you as a future stockholder of Fortrea Holdings Inc. (“Fortrea”). Fortrea will hold Labcorp’s Clinical Development and Commercialization Services business, and will be a leading global contract research organization providing phase I through IV biopharmaceutical product and medical device services, patient access solutions and other enabling services to global pharmaceutical, biotechnology and medical device organizations.

Following the spinoff, Fortrea will be positioned to:

•capitalize on growth opportunities across phases I through IV clinical trials and extend its leadership in oncology, cell and gene therapy, rare disease, and other emerging therapeutic areas;

•increase agility with large pharmaceutical and biotechnology clients, ranging from industry leaders to emerging organizations, to better serve customers and advance life-saving therapies;

•utilize access to Labcorp’s vast health and clinical data set through an arrangement which will enable it to provide enhanced trial execution and a differentiated value proposition;

•continue to invest in capabilities, technologies, diverse talent and innovation to enhance trial execution and better serve all of its customers; and

•implement a capital structure that is tailored to support its growth strategy and enhance stakeholder value.

Fortrea’s common stock will be listed on The Nasdaq Stock Market LLC under the symbol “FTRE.”

We look forward to our future as an independent, publicly traded company and to your support as a stockholder of Fortrea.

| | |

| Sincerely, |

|

| Thomas Pike |

| Chairman and Chief Executive Officer |

| Fortrea Holdings Inc. |

Enclosure

Information contained herein is subject to completion or amendment. A Registration Statement on Form 10 relating to these securities has been filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended.

Subject to Completion, dated May 15, 2023

INFORMATION STATEMENT

Fortrea Holdings Inc.

Shares of Common Stock

Laboratory Corporation of America® Holdings (“Labcorp”) is sending this information statement to its stockholders in connection with the pro rata distribution of all the outstanding shares of Fortrea Holdings Inc.’s (“Fortrea”) common stock to holders of Labcorp’s common stock. As of the date of this information statement, Labcorp wholly owns Fortrea.

On July 28, 2022, Labcorp announced a plan to pursue a separation of its Clinical Development and Commercialization Services business from Labcorp through a spinoff (the “spinoff”). Holders of Labcorp’s common stock will be entitled to receive one share of Fortrea common stock for every share of Labcorp common stock owned as of 5:00 p.m., Burlington, North Carolina time, on the record date, , 2023. The distribution date for the spinoff will be , 2023 (the “distribution date”). After the spinoff, Fortrea will be an independent, publicly traded company. The spinoff is intended to be tax-free to Labcorp and its stockholders for U.S. federal income tax purposes, except, in the case of stockholders, to the extent of any cash received in lieu of fractional shares.

You will not be required to pay anything for the Fortrea common stock that will be distributed to you or to surrender or exchange your Labcorp common stock to receive Fortrea common stock in the spinoff. The spinoff will not affect the number of shares of Labcorp common stock that you hold. Immediately following the spinoff, your proportionate interest in Fortrea will be identical to your proportionate interest in Labcorp (as adjusted for any fractional shares). Fortrea common stock will be issued in book-entry form only, which means that no physical stock certificates will be issued. No approval by Labcorp stockholders of the spinoff is required or is being sought. You are not being asked for a proxy and you are requested not to send a proxy.

As discussed under “The Spinoff—Trading of Labcorp Common Stock After the Record Date and Prior to the Distribution,” if you sell your Labcorp common stock in the “regular way” market after the record date and before or on the distribution date, you will be selling your right to receive Fortrea common stock in connection with the spinoff. You are encouraged to consult with your financial advisor regarding the specific implications of selling your Labcorp common stock before or on the distribution date.

There is no current trading market for Fortrea common stock. However, we expect that a limited market, commonly known as a “when-issued” trading market, for Fortrea common stock will begin on or about , 2023, and we expect that “regular way” trading of Fortrea common stock will begin the first day of trading after the distribution date. We have applied to list Fortrea common stock on The Nasdaq Stock Market LLC (“NASDAQ”) under the symbol “FTRE.” The spinoff is contingent upon the acceptance of the Fortrea common stock for listing on a national securities exchange approved by Labcorp, such as NASDAQ, subject to official notice of issuance.

In reviewing this information statement, you should carefully consider the matters described under the caption “Risk Factors ” beginning on page 26 of this information statement. Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Labcorp first mailed this information statement to its stockholders on or about , 2023.

The date of this information statement is , 2023.

Table of Contents

Presentation of Information

Unless we otherwise state or the context otherwise indicates, all references in this information statement to “Fortrea,” “us,” “our,” or “we” mean Fortrea Holdings Inc. and its subsidiaries, and all references to “Labcorp” mean Laboratory Corporation of America® Holdings and its subsidiaries, other than, for all periods following the spinoff, Fortrea. When referenced individually, the Clinical Development and Commercialization Services business will refer to the business pre-spinoff, and Fortrea will refer to the business post-spinoff, unless the context otherwise specifies.

The term “GAAP” refers to generally accepted accounting principles in the United States of America (the “U.S.”).

The transaction in which Fortrea will be separated from Labcorp and become an independent, publicly traded company is referred to in this information statement as the “spinoff” and the “separation.” The pro rata distribution of Fortrea common stock to stockholders of Labcorp to affect to the spinoff is referred to in this information statement as the “distribution.”

This information statement is being sent solely to provide information to Labcorp stockholders who will receive Fortrea common stock in connection with the spinoff. It is not provided as an inducement or encouragement to buy or sell any securities. You should not assume that the information contained in this information statement is accurate as of any date other than the date set forth on the cover. Changes to the information contained in this information statement may occur after that date, and we undertake no obligation to update the information contained in this information statement, unless we are so required by applicable securities laws.

Trademarks and Copyrights

We use various trademarks, service marks, trade names, and brand names, such as Fortrea, endpoint, FSPx, and Xcellerate, that we deem particularly important to the advertising activities and operation of our business, and some of these marks are registered or pending registration in the U.S. and, in some cases, other jurisdictions. This information statement may also refer to the brand names, trademarks, or service marks of other companies. All logos, trademarks, service marks, trade names, brand names, and copyrights cited in this information statement are the property of their respective holders. For convenience, we may not include the SM, ®, ™ or © symbols, but such omission is not meant to indicate that we would not protect our intellectual property rights to the fullest extent allowed by law.

Market and Industry Data

This information statement includes estimates regarding market and industry data and forecasts, which are based on publicly available information, industry publications and surveys, reports from government agencies, reports by market research firms, and our own estimates based on our management's knowledge of, and experience in, the markets in which we compete. This information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process, and other limitations and uncertainties inherent in surveys of market size. Furthermore, all of this information involves a variety of assumptions, limitations, and methodologies and is inherently subject to uncertainties, and therefore you are cautioned not to give undue weight to these estimates.

QUESTIONS AND ANSWERS ABOUT THE SPINOFF

| | | | | |

| Q: | What is the spinoff? |

| | |

| A: | The spinoff is the method by which Fortrea will separate from Labcorp. To complete the spinoff, Labcorp will distribute, pro rata and as a dividend to its stockholders, all of the shares of Fortrea common stock that it owns. Following the spinoff, we will be an independent, publicly traded company, and Labcorp will not retain any ownership interest in us. You do not have to pay any consideration or give up any portion of your Labcorp common stock to receive our common stock in the spinoff. |

| | |

| Q: | What is the expected date for the completion of the spinoff? |

| |

| A: | The completion and timing of the spinoff are dependent on a number of conditions, but if the conditions are timely met, we expect the spinoff to be completed on , 2023. See “The Spinoff—Spinoff Conditions and Termination.” |

| |

| Q: | What are the reasons for the spinoff? |

| |

| A: | Labcorp’s Clinical Development and Commercialization Services business operates largely autonomously, although it and Labcorp have benefited by sharing executive management and some overhead costs. Among other benefits, the spinoff is expected to provide each of Labcorp and Fortrea with strengthened strategic flexibility and operational focus to pursue specific market opportunities and better meet customer needs, focused capital structures and capital allocation strategies to drive innovation and growth, a more targeted investment opportunity for different investor bases, the ability to align its particular incentive compensation with its financial performance, and an improved ability to use its equity as consideration for beneficial acquisitions. Labcorp expects that the spinoff will result in enhanced long-term performance of the businesses held by both Labcorp and Fortrea. For more information, see “The Spinoff—Reasons for the Spinoff.” |

| |

| Q: | What is the Company? |

| |

| A: | The Company is a Delaware corporation that was formed on January 31, 2023 for the purpose of holding the Fortrea businesses following the spinoff. Prior to the transfer by Labcorp of these businesses, which will occur in connection with the spinoff, we will have had no operations other than those incidental to our formation or undertaken in preparation for the spinoff. |

| |

| Q: | Who will manage Fortrea after the separation? |

| |

| A: | We will benefit from an experienced leadership team after the separation. Thomas Pike, who served as President and Chief Executive Officer of the Drug Development, Clinical Development and Commercialization Services business unit of Labcorp since January 2023, will serve as our Chief Executive Officer bringing his 30+ years of industry experience to the job. Jill McConnell, the Chief Financial Officer of the Drug Development, Clinical Development and Commercialization Services business unit of Labcorp, will be appointed as our Chief Financial Officer in connection with the spinoff. Additionally, Mark Morais, Chief Operating Officer and President Clinical Operations and Commercial Solutions of the Drug Development, Clinical Development and Commercialization Services business unit of Labcorp, will serve as our Chief Operating Officer and President, Clinical Services.

Mr. Pike will serve as Chairman of our board of directors. We will also benefit from the knowledge, experience, and skills of our full board of directors and officers. For more information regarding our management team and our board of directors following the separation, see “Management.” |

| |

| Q: | What is being distributed in the spinoff? |

| |

| A: | Labcorp will distribute one share of Fortrea common stock for every share of Labcorp common stock outstanding as of the record date for the spinoff. The number of Labcorp shares you own and your proportionate interest in Labcorp will not change as a result of the spinoff. Immediately following the spinoff, your proportionate interest in Fortrea will be identical to your proportionate interest in Labcorp (as adjusted for any fractional shares). |

| |

| | | | | |

| Q: | What is the record date for the spinoff, and when will the spinoff occur? |

| |

| A: | The record date is , 2023, and ownership is determined as of 5:00 p.m., Burlington, North Carolina time, on that date. Fortrea common stock will be distributed on the distribution date, , 2023. |

| |

| Q: | Can Labcorp decide to cancel the spinoff even if all the conditions have been met? |

| |

| A: | Yes. The spinoff is subject to the satisfaction or waiver by Labcorp, at the direction of its board of directors, of certain conditions, including, among others, approval of the Labcorp board of directors, declaration of the effectiveness of our registration statement on Form 10 of which this information statement is a part, and receipt of (i) a private letter ruling from the U.S. Internal Revenue Service (the “IRS”) regarding certain U.S. federal income tax matters relating to the spinoff and certain related transactions (which Labcorp has received) and (ii) an opinion of tax counsel regarding the qualification of the spinoff and certain related transactions as generally tax-free, for U.S. federal income tax purposes, under Sections 355 and 368(a)(1)(D) of the Internal Revenue Code of 1986, as amended (the “Code”). See “The Spinoff—Spinoff Conditions and Termination.” Even if all the conditions are met, Labcorp has the right not to complete the spinoff if, at any time prior to the distribution, the board of directors of Labcorp determines, in its sole and absolute discretion, that the spinoff is not in the best interests of Labcorp or its stockholders, that a sale or other alternative is in the best interests of Labcorp or its stockholders, or that market conditions or other circumstances are such that it is not advisable to separate the Fortrea business from Labcorp at that time. In the event Labcorp, at the direction of its board of directors, amends, modifies, or abandons the spinoff, Labcorp will notify its stockholders in a manner reasonably calculated to inform them of such modifications or abandonment with a press release, Current Report on Form 8-K, or other similar means. |

| |

| Q: | Can Labcorp waive conditions and still proceed with the spinoff? |

| |

| Yes. Labcorp may waive conditions to the spinoff in its sole discretion and proceed with the spinoff even if such conditions have not been met. If the spinoff is completed and the Labcorp board of directors waived any such condition, such waiver could have a material adverse effect on (i) Fortrea’s and Labcorp’s respective business, financial condition or results of operations, (ii) the trading price of Fortrea’s common stock, (iii) the ability of stockholders to sell their Fortrea shares after the distribution, including, without limitation, as a result of (a) illiquid trading if Fortrea common stock is not accepted for listing or (b) litigation relating to any injunctions sought to prevent the consummation of the spinoff or (iv) the tax consequences of the spinoff. In the event Labcorp, at the direction of its board of directors, waives a material condition or amends or modifies the spinoff or the ancillary agreements entered into thereto, Labcorp will evaluate the applicable facts and circumstances at that time and make such additional disclosure and take such other actions as Labcorp determines to be necessary and appropriate in accordance with applicable law. |

| |

| Q: | As a holder of Labcorp common stock as of the record date, what do I have to do to participate in the spinoff? |

| |

| A: | You are not required to take any action to participate in the spinoff, although you are urged to read this entire document carefully. You will receive one share of Fortrea common stock for every share of Labcorp common stock held as of the record date and retained through the distribution date. You may also participate in the spinoff if you purchase Labcorp common stock in the “regular way” market after the record date and retain your Labcorp common stock through the distribution date. See “The Spinoff—Trading of Labcorp Common Stock After the Record Date and Prior to the Distribution.” |

| |

| | | | | |

| Q: | If I sell my shares of Labcorp common stock before or on the distribution date, will I still be entitled to receive shares of Fortrea common stock in the spinoff? |

| |

| A: | If you own shares of Labcorp common stock on the record date and hold such shares through the distribution date, you will receive one share of Fortrea common stock for every share of Labcorp common stock held as of the record date and retained through the distribution date. However, if you sell shares of Labcorp common stock after the record date and before or on the distribution date, you will also be selling your right to receive shares of Fortrea common stock in connection with the spinoff. See “The Spinoff—Trading of Labcorp Common Stock After the Record Date and Prior to the Distribution.” You are encouraged to consult with your financial advisor regarding the specific implications of selling your Labcorp common stock before or on the distribution date. |

| |

| Q: | How will fractional shares be treated in the spinoff? |

| |

| A: | Any fractional shares of common stock otherwise issuable to you will be sold on your behalf, and you will receive a cash payment with respect to that fractional share. For an explanation of how the cash payments for fractional shares will be determined, see “The Spinoff—Treatment of Fractional Shares.” |

| |

| Q: | Will the spinoff affect the trading price of my Labcorp common stock? |

| |

| A: | Yes, the trading price of Labcorp common stock immediately following the spinoff is expected to be lower than immediately prior to the spinoff because the trading price of Labcorp’s common stock will no longer reflect the value of Fortrea and Labcorp. However, we cannot provide you with any guarantees as to the prices at which the Labcorp common stock or Fortrea common stock will trade following the spinoff. |

| |

| Q: | Will my Labcorp common stock continue to trade on a stock market? |

| |

| A: | Yes, Labcorp common stock will continue to be listed on NYSE under the symbol “LH.” |

| |

| Q: | What are the U.S. federal income tax consequences to me of the distribution of shares of Fortrea common stock pursuant to the spinoff? |

| |

| A: | Labcorp has received a private letter ruling (the “IRS Ruling”) from the IRS on certain issues relevant to

the qualification of the spinoff and certain related transactions as tax-free under Sections

368(a)(1)(D) and 355 of the Code, based on certain facts and representations set forth in such request.

The IRS Ruling does not address all of the requirements for tax-free treatment of the spinoff, and the

spinoff is conditioned upon, among other things, Labcorp’s receipt of an opinion of tax counsel regarding the qualification of the spinoff and certain related transactions as generally tax-free, for U.S. federal income tax purposes, under Sections 355 and 368(a)(1)(D) of the Code. Assuming that the spinoff so qualifies, for U.S. federal income tax purposes, you will not recognize any gain or loss, and no amount will be included in your income in connection with the spinoff, except to the extent of any cash received in lieu of fractional shares. See “The Spinoff—Material U.S. Federal Income Tax Consequences of the Spinoff.” You should consult your tax advisor as to the particular consequences of the spinoff and related transactions to you, including the applicability and effect of any U.S. federal, state and local tax laws, as well as any foreign tax laws. |

| |

| | | | | |

| Q: | When will I receive my shares of Fortrea common stock? Will I receive a stock certificate for my shares of Fortrea common stock distributed as a result of the spinoff? |

| |

| A: | Registered holders of Labcorp common stock who are entitled to participate in the spinoff will receive a book-entry account statement reflecting their ownership of Fortrea common stock, which means that no physical stock certificates will be issued. For additional information, registered stockholders in the U.S., Canada, or Puerto Rico should contact Labcorp’s transfer agent, American Stock Transfer & Trust Company, at (800) 937-5449 or through email at help@astfinancial.com. Stockholders located outside the U.S., Canada, and Puerto Rico may call +1 (718) 921-8137. If you would like to receive physical certificates evidencing your shares of Fortrea common stock, please contact Fortrea’s transfer agent. See “The Spinoff—When and How You Will Receive Fortrea Shares.” |

| |

| Q: | What if I hold my shares of common stock through a broker, bank, or other nominee? |

| |

| A: | Labcorp stockholders who hold their shares of common stock through a broker, bank, or other nominee will have their brokerage account credited with shares of Fortrea common stock. For additional information, those stockholders should contact their broker, bank, or other nominee directly. |

| |

| Q: | What if I have stock certificates reflecting my shares of Labcorp common stock? Should I send them to the transfer agent or to Labcorp? |

| |

| A: | You should not send your stock certificates to the transfer agent or to Labcorp. You should retain your Labcorp stock certificates. |

| |

| Q: | Will Fortrea incur any debt or enter into any financing arrangements prior to or at the time of the spinoff? |

| |

| A: | In connection with the spinoff, we expect to incur indebtedness in an aggregate principal amount of approximately $1,640 million, which we expect to consist of borrowings under senior secured term loan facilities and senior secured notes. We also expect to enter into a $450 million senior secured revolving credit facility, which we do not expect to borrow under prior to the spinoff, and an accounts receivable purchase program (“ARPP”), which we also do not expect to take advantage of, other than in a testing capacity, prior to the spinoff. The ARPP establishes a receivables purchase facility that provides for up to approximately $80 million in funding based on the availability of certain eligible receivables and the satisfaction of certain conditions.

We expect to use the proceeds from these debt and other financing transactions to make an expected $1,605 million cash distribution to Labcorp as partial consideration for the assets that will be contributed to us in connection with the spinoff. After giving effect to such payment and approximately $35 million of associated fees and expenses incurred in connection with the entry into the above, we expect to begin operations as an independent company with a cash balance of approximately $120 million. The cash benefit to Labcorp of the dividend offset by the operating cash at spin is expected to be $1,485 million.

Our capital structure remains under review and will be finalized prior to the spinoff. See “Capitalization,” “Unaudited Pro Forma Combined Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity, Capital Resources and Financial Position” and “Description of Certain Indebtedness and Other Financing.” |

| |

| Q: | Are there risks to owning common stock of Fortrea? |

| |

| A: | Yes. Ownership of Fortrea common stock is subject to both general and specific risks relating to Fortrea’s business, the industry in which it operates, its ongoing contractual relationships with Labcorp, and its status as a separate, publicly traded company. Ownership of Fortrea common stock is also subject to risks relating to the spinoff. See “Risk Factors.” |

| |

| | | | | |

| Q: | What will govern my rights as a Fortrea stockholder? |

| |

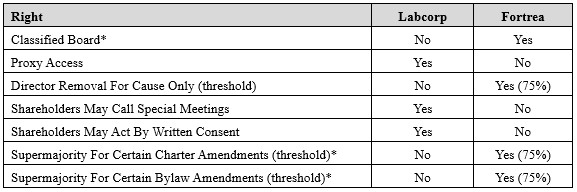

| A: | Your rights as a Fortrea stockholder will be governed by Delaware law, as well as our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws. Below please find a table that outlines the specific material differences between the rights of the holders of Labcorp’s common stock and Fortrea’s common stock at the time of the distribution:

Other than the material differences outlined above, at the time of the distribution, we expect that there will be no other material differences between the rights of the holders of Labcorp’s common stock and the holders of Fortrea’s common stock. For additional details regarding the Fortrea stock and Fortrea stockholder rights, including the fact that rights denoted with a “*” will expire at the annual meeting of stockholders to be held in 2028, see “Description of Capital Stock.” |

| |

| Q: | Does Fortrea intend to pay cash dividends? |

| |

| A: | We do not currently expect to declare or pay dividends on our common stock for the foreseeable future. Instead, we intend to retain earnings for use in the operation and expansion of our business. Any future payment of dividends will be at the discretion of our board of directors and will depend upon various factors then existing, including earnings, financial condition, results of operations, capital requirements, level of indebtedness, contractual restrictions with respect to payment of dividends, restrictions imposed by applicable law, general business conditions, and other factors that our board of directors may deem relevant. See “Dividend Policy.” |

| |

| Q: | Will Fortrea common stock trade on a stock market? |

| |

| A: | Yes. Currently, there is no public market for our common stock. We have applied to list our common stock on NASDAQ under the symbol “FTRE.” We cannot predict the trading price for our common stock when such trading begins. |

| |

| | | | | |

| Q: | What will happen to Labcorp stock options, restricted stock, performance stock unit awards, restricted stock units, and deferred stock unit awards? |

| |

| A: | Generally, outstanding Labcorp equity awards held by employees of Fortrea will be converted into Fortrea equity awards, and outstanding Labcorp equity awards held by employees of Labcorp will remain Labcorp equity awards. As of the distribution date, (i) the exercise price and number of options subject to each outstanding Labcorp stock option award will be adjusted in a manner intended to provide the same value from immediately before the spinoff to immediately after the spinoff, (ii) each restricted stock unit award that is held immediately prior to the spinoff by any employee of Fortrea will be converted into a respective restricted stock unit award denominated in shares of our common stock; and (iii) each outstanding performance share award that is held immediately prior to the spinoff by any employee of Fortrea will be treated as follows: (a) performance share awards for the 2021 to 2023 performance period will be converted into time-based restricted stock units denominated in shares of our common stock based on projected achievement of performance goals as determined by the Compensation and Human Capital Committee (the “Labcorp Compensation Committee”) of Labcorp’s board of directors immediately prior to the spinoff; (b) performance share awards for the 2022 to 2024 performance period will be converted into awards denominated in shares of our common stock, with 50% of the target number being converted into time-base restricted stock units based on actual achievement of performance goals as determined by the Labcorp Compensation Committee immediately prior to the spinoff and the remaining 50% of the target number being converted into performance shares of Fortrea subject to the achievement of performance criteria established by Fortrea in its discretion; and (c) performance share awards for the 2023 to 2025 performance period shall be converted into performance shares of Fortrea subject to the achievement of performance criteria established by Fortrea in its discretion. Each of our converted awards will generally be subject to the same terms, vesting conditions and other restrictions that applied to the original Labcorp award immediately before the spinoff except that performance-vesting conditions applicable to performance share awards will be adjusted as described in the preceding sentence. For further information regarding the treatment of equity awards in the spinoff, see “The Spinoff—Stock-Based Plans—Treatment of Equity-Based Compensation.” |

| |

| Q: | What will the relationship between Labcorp and Fortrea be following the spinoff? |

| |

| A: | In connection with the spinoff, we and Labcorp will enter into a separation and distribution agreement that will contain key provisions relating to the separation of our business from Labcorp, the transfer of Labcorp’s Clinical Development and Commercialization Services business to us, and the distribution of our common stock. In addition, we and Labcorp will enter into several agreements to govern our relationship following the distribution, including a tax matters agreement, an employee matters agreement, a transition services agreement, lease agreements and other agreements governing ongoing commercial relationships. See “Relationship with Labcorp After the Spinoff—Agreements Between Labcorp and Us.” |

| |

| Q: | Will I have appraisal rights in connection with the spinoff? |

| |

| A: | No. Holders of Labcorp common stock are not entitled to appraisal rights in connection with the spinoff. |

| |

| Q: | Who is the transfer agent for your shares of common stock? |

| |

| A: | American Stock Transfer & Trust Company. |

| |

| Q: | Who is the distribution agent for the spinoff? |

| |

| A: | American Stock Transfer & Trust Company. |

| |

| | | | | |

| Q: | Whom can I contact for more information? |

| |

| A: | If you have questions relating to the mechanics of the distribution of Fortrea common stock, you should contact the distribution agent: |

| |

| By Mail, Overnight Courier or Hand-Delivery to: |

| |

| American Stock Transfer & Trust Company

Shareholder Services

6201 Fifteenth Avenue

Brooklyn, NY 11219 |

| |

| By Phone or Email: |

| |

| Telephone: (800) 937-5449

Outside the U.S., Canada and Puerto Rico: +1 (718) 921-8137

Email: help@astfinancial.com |

| |

| Before the spinoff, if you have questions relating to the spinoff, you should contact Labcorp at: |

| |

| Laboratory Corporation of America Holdings

358 South Main Street

Burlington, North Carolina 27215

Attention: Chas Cook, VP Investor Relations

Telephone: +1 (336) 436-5076 |

| |

| After the spinoff, if you have questions relating to Fortrea, you should contact Fortrea at: |

| |

| Fortrea Holdings Inc.

8 Moore Drive

Durham, NC 27709

Attention: Hima Inguva, SVP of Investor Relations, Corporate Development and Competitive Intelligence

Telephone: +1 (877) 495-0816 |

SUMMARY

The following is a summary of some of the information contained in this information statement. It does not contain all the details concerning Fortrea or the spinoff, including information that may be important to you. We urge you to read this entire document carefully, including “Risk Factors” and “Unaudited Pro Forma Combined Financial Information” and the combined financial statements and the notes to those financial statements included elsewhere in this information statement.

Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement assumes the completion of the separation of Fortrea from Labcorp and the related distribution of our common stock.

Our Business

We are a leading global contract research organization (“CRO”) providing comprehensive phase I through IV biopharmaceutical product and medical device services, patient access solutions and other enabling services. For over 30 years, we have provided our global pharmaceutical, biotechnology, and medical device customers with clinical pharmacology, clinical development, and other service capabilities. In addition, we offer our customers highly flexible delivery models that include Full Service, Functional Service Provider (“FSP”), and Hybrid structures. We believe we are well positioned to leverage our global scale, access to clinical data-driven insights, industry network, and decades of experience to bring customers tailored solutions. Fortrea intends to capitalize on the global demand for clinical development services across a diverse set of therapeutic areas.

Our team of more than 19,000 staff conducts operations in 90 countries and delivers a broad range of clinical development solutions and other services for our customers. Our services streamline the biopharmaceutical product and medical device development process. Additionally, we successfully utilize enabling technologies to optimize processes and evolve with a dynamic marketplace.

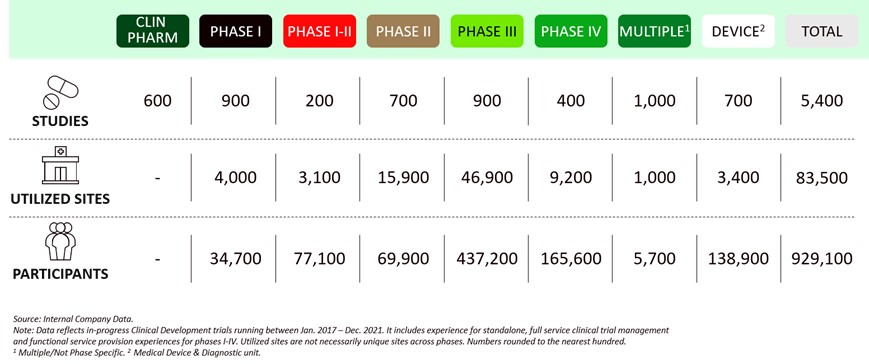

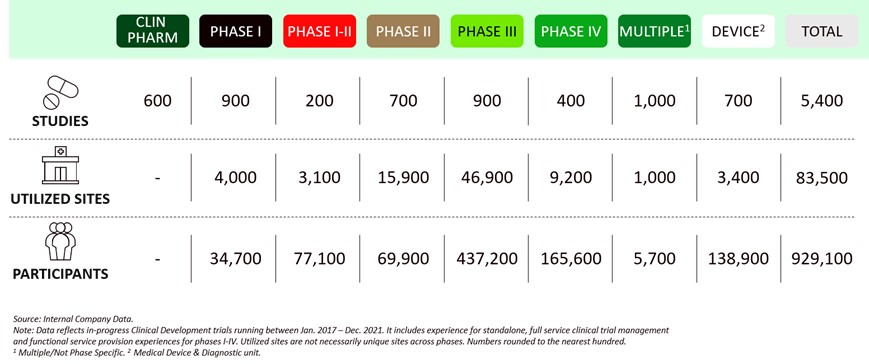

Figure 1: Fortrea’s clinical experience over the past five years

Over the last five years, we have completed over 5,400 studies utilizing approximately 83,500 sites spanning 929,100 participants. These studies encompass more than 20 therapeutic areas and every phase of clinical trials. As the volume of clinical development spend outsourced to CROs continues to grow, we are bringing together global scale, deep scientific expertise, and a comprehensive suite of solutions to better serve our customers.

In sum, Fortrea combines decades of domain expertise with the nimbleness required to meet market demand for adaptable engagements with large and small customers. We intend to differentiate this pairing of technical expertise with innovative solutions that provide access to unique clinical data assets. Our relationship with Labcorp and other

leading third parties provides Fortrea with actionable and data-driven insights that accelerate investigator and patient recruitment. Further, this key differentiator positions Fortrea to enhance clinical trial diversity while streamlining protocol development processes. We seek to apply creativity and experience to every challenge, and our core competencies create efficiencies to deliver life-changing solutions faster.

Services

Our expertise in the biopharmaceutical product and medical device development process has driven us to design service offerings to better meet the needs of customers. We have a robust customer base across pharmaceutical, biotechnology, and medical device organizations. We manage our business in two reporting segments — Clinical Services and Enabling Services. Our Clinical Services segment brings solutions to market which include clinical pharmacology and comprehensive clinical development capabilities. Our Enabling Services segment provides patient access and technology solutions which can be deployed across any of our global solutions depending on the scope of our customers’ needs. This comprehensive platform provides our customers with efficient processes across delivery models.

Clinical Services Segment:

•Clinical Pharmacology. Our capabilities and solutions support early-phase studies in normal healthy volunteers, special populations, and patient populations across a spectrum of diseases. We deliver critical services to our customers including first-in-human trials (“FIH”), single ascending dose escalation studies (“SAD”), multiple ascending dose escalation studies (“MAD”), radiolabeled human absorption, metabolism, and excretion pharmacokinetics studies (“AME”), drug-drug interaction (“DDI”), hepatic and renal impairment, food effect, QTc interval, and other study types. In addition, we conduct phase Ib hybrid studies that move from normal healthy volunteer into patient populations, providing early insights into pharmacodynamics and signals of therapeutic effectiveness. We have developed a multi-national infrastructure of phase I facilities in both the U.S. and the United Kingdom (“U.K.”). This infrastructure is part of an integrated platform designed to enable consistent execution of complex early-phase clinical trials. This includes project management, comprehensive monitoring, pharmacokinetic analysis, and biometrics. Over the past five years, we have conducted more than 600 clinical pharmacology studies.

•Clinical Development. We are a leading full-service provider of phase I through IV clinical studies with a flexible approach to serving our customers. Clinical Development is Fortrea’s largest offering in terms of annual revenue contribution, and has been for the last five years. Services include, but are not limited to, regulatory affairs, protocol design, operational planning, study and site start up, patient recruitment, project management, comprehensive monitoring, data management and biostatistics, pharmacovigilance, medical writing, and mobile clinical services. Our service offerings are supported by technological innovations such as digital and decentralized clinical trial capabilities. We focus on rapidly expanding research areas such as oncology, rare diseases, and cell and gene therapies. Additionally, we have deep scientific expertise in a broad spectrum of therapeutic areas and diseases, such as cardiovascular, renal, central nervous system (“CNS”) and neurodegenerative, autoimmune, metabolic, infectious disease, dermatology, ophthalmology, immunology, inflammation, respiratory, nephrology, rheumatology, women's health, and nonalcoholic steatohepatitis (“NASH”), among others. Over the past five years, we have conducted 4,100 phase I through IV clinical trial projects. Clinical development is enhanced by our pharmacology learnings, which we apply to future clinical programs. We also have a significant medical device and diagnostics offering, and have conducted over 700 clinical trials in this area. We believe Fortrea is poised to capture additional market share in the large and expanding development market. .

We offer our customers a tailored approach to clinical trial solutions through the use of three delivery models: Full Service, FSP, and Hybrid.

◦Full Service. Integrates multiple disciplines from our service offering to comprehensively support our customers in their development programs across key geographies. Our service offering integrates protocol design and operational planning, site start-up and patient recruitment, project and program management, comprehensive site monitoring, centralized monitoring and medical

data review, clinical and biometrics services, medical writing, and mobile clinical services. Our project-centric approach utilizes dynamic team resourcing with agile role-based structures. This approach allows for more adaptability to trial types with customer-tailored designs.

◦Functional Service Provider. Offers customers experienced personnel to perform targeted activities throughout their development programs. This approach reduces our customers’ need to recruit and train dedicated internal resources which saves on cost and time and enables flexibility. Our service offering delivers comprehensive, strategic solutions designed to adapt to the level of customer control and infrastructure. Our FSP team can provide dedicated offerings in clinical operations, clinical data management, biostatistics, statistical programming, pharmacovigilance, mobile clinical services, and medical writing, among other customized solutions.

◦Hybrid. Provides the project-centric approach of a Full Service model while integrating FSP models, to varying degrees on large portfolios with therapeutic similarities, to drive efficiencies and enhance sponsor control for clinical development. Our ability to tailor our services to customer needs demonstrates the flexibility we can offer customers across the industry value chain. Fortrea offers this flexibility at a global scale and we expect to position our team as a partner of choice for customers that require a tailored approach

•Consulting Services. We provide consulting services that include product development strategy, protocol development, regulatory advisory, patient access guidance, and medical affairs advisory. This solution supports critical decision points in the lifecycle of our customers’ products. Further, this spinoff gives Fortrea ample opportunity to expand customer relationships that bolt on additional services in our portfolio.

Enabling Services Segment:.

•Patient Access. Fortrea has established a comprehensive portfolio of services to optimize patient support, adherence, and product access. We provide solutions for co-pay, reimbursement and affordability assistance, real-time analytics and market access consulting. Our team operates on behalf of biopharmaceutical product and medical device manufacturers by employing highly trained agents within contact centers and field-based teams. Our field reimbursement specialists enable healthcare practitioners in the United States to navigate product access for their patients. Our nurse-educator staffed call centers provide customized patient support programs designed to address barriers to product use and adherence. We have our non-commercial specialty pharmacy solution providing cold chain storage and specialty prescription dispensing on behalf of biopharmaceutical customers. Our priority is to help patients gain access to treatments on behalf of our customers.

•Technology Solutions. We provide our customers access to products that support critical decision points in the lifecycle of their assets. Endpoint Clinical (“Endpoint”) provides comprehensive randomization and trial supply management (“RTSM”) technology solutions. Our Interactive Response Technology (“IRT”) and clinical supplies management solution, streamlines complex randomization and trial supply methods, refines and improves drug supply management, and simplifies site, study and subject administration. Our flexible RTSM technology enables customers to manage a broad range of standard and complex randomization methods, supporting complex trial designs. We believe these products optimize the supply chain and minimize operational costs, while supporting timely and accurate patient dosing. We have invested in direct-to-patient technology that provides comprehensive decentralized clinical trial (“DCT”) capabilities supporting electronic solutions and telemedicine to augment trial experiences by decreasing the burden of participation for patients. We also offer a suite of technology and data to deliver insights that enable development and oversight in the effort to maximize trial outcomes. These tools include modules focused on study design optimization; extensive risk, issue, and quality management; centralized data and medical review; diversity and inclusion study insights; clinical monitoring and study oversight.

Industry

CROs provide services to assist in phase I through phase IV clinical trials and commercialization to accelerate the development and reach of safe, effective medical therapies and devices. Developing new biopharmaceutical products and medical devices for the treatment of human disease is a complex, costly, and lengthy process. Prior to commercialization, a biopharmaceutical product or medical device must undergo extensive pre-clinical and clinical testing as well as regulatory review to demonstrate an acceptable benefit-risk profile by regulatory authorities. As a result, bringing a new biopharmaceutical product or medical device to market can take up to 12 years and costs $2.5 billion or more on average.1

The biopharmaceutical product development process consists of three stages: pre-clinical, clinical, and commercialization. The pre-clinical process is the stage of research that begins prior to clinical studies and collects data on the feasibility, efficacy, and safety of drugs through experiments outside of the human body. The clinical stage is the most time-consuming and expensive part of the drug development process. During this stage, the product candidate undergoes a series of tests on humans. In phase I, small groups of study volunteers are exposed to ascending doses of the experimental product in order to assess safety and to determine the distribution of drug and maximally tolerated dose. Preliminary assessment of the relationships between dosage, safety, and effectiveness follow in phase II before expanding to larger trials, phase III, to formally test effectiveness and safety in the target population. Phase IV, or post-approval trials, involves monitoring or verifying the risks and benefits of a drug product.

The clinical development market is a large, attractive and growing market. Clinical development spend by the pharmaceutical and biotechnology industry was estimated at $100 billion in 20222. Of this, we estimate the current addressable market for Fortrea to be $35 billion. Over the next several years, pharmaceutical and biotechnology companies are projected to increase research and development (“R&D”) investment, grow their pipelines, and outsource more programs to CROs. We believe these underlying market trends represent a significant opportunity for us.

In addition to the growth in R&D expenses, an increase in outsourcing has also supported the growth of the CRO sector. Global pharmaceutical and biotechnology companies are a major driver of this growth as they continue to outsource a significant amount of the biopharmaceutical product development process as they seek therapeutic diversity for their pipelines, target diverse global populations, and require deep scientific research. We believe there are three key trends affecting our end markets and believe that such trends will continue creating an increased demand for our services:

•Increasing Pharmaceutical and Biotechnology R&D Spend. Growing R&D investment will help propel the CRO market as new indications are discovered, resulting in a greater demand for clinical trials. Over the past decade, we have seen the biopharma industry leverage science, technology, and artificial intelligence (“AI”) to advance the level of understanding of the pathogenesis of human disease, and to identify new therapeutic targets and treatments. Despite a relative downturn in 2022 compared to 2020 and 2021, over the medium to longer term we expect the biotechnology funding to be strong.

•Elevated Outsourcing Levels. As large biopharmaceutical companies seek to reduce the cost and time to develop biopharmaceutical products, they have increasingly relied on CROs for services to preserve flexibility and reduce costs associated with clinical trials and improve time to market. According to multiple industry investment sources, the CRO market is expected to grow more slowly for the next two years, at approximately 3-5%, returning to a growth rate of 6-9% in the longer term. The growth is driven by low single-digit percentile growth from large pharmaceutical companies, double-digit percentile growth from smaller biotechnology companies, and a continued drive for more outsourcing generally.

•Expanding Scope of Capabilities. CROs have successfully expanded the scope of services they are able to offer pharmaceutical, biotechnology, and medical device companies, increasing the addressable market that

1 Geoffrey Levitt testimony before Senate Judiciary Committee July 31, 2021

2 Simoens S and Huys I (2021) R&D Costs of New Medicines: A Landscape Analysis: Front. Med. 8:760762. doi: 10.3389/fmed.2021.760762 and 2022 Pharma R&D Spend. Evaluate Ltd.

they serve. Examples include the expansion of decentralized clinical trial services, global logistics, and management of highly complex biologics, and cell and gene therapy trials. The need for biopharmaceutical companies to expand the commercial potential of their products internationally has been a catalyst for the increasingly global nature of clinical trials. CROs that can capitalize on extensive datasets to inform decisions and increase efficiency in international clinical trials have benefited from these changing dynamics. As R&D pipelines continue to prioritize biologics and advanced therapies, such as cell and gene therapies, additional complex clinical trial capabilities will also be required from CROs. We are built to handle this increased complexity and global demand that underpin these industry tailwinds.

Despite the large, attractive and growing market that Fortrea operates in, our business is subject to a number of risks inherent to our industry, including our customers’ ability to access sufficient funding to complete clinical trials, our ability to generate net new business awards or our new business awards being delayed, terminated, reduced in scope, or failing to go to contract, and our ability to contract with suitable investigators and recruit and enroll patients for clinical trials, among others. Any number of these factors could impact our business, and there is no guarantee that our historical performance will be predictive of future operational and financial performance. For a description of the challenges we face and the risks and limitations that could harm our prospects, see “Cautionary Statement Concerning Forward-Looking Statements,” “—Summary of Risk Factors” and “Risk Factors” included elsewhere in this information statement.

Competitive Strengths

We believe we are strategically positioned to serve the pharmaceutical, biotechnology, and medical device industries. Our credibility and reputation in the market is a direct result of our multi-decade track record of operational execution, and effective flexible solutions. Our competitive strengths include:

Extensive History as a Market Leader Across Clinical Development

We have over 30 years of experience providing clinical development services to the pharmaceutical, biotechnology, and medical device industries. We have conducted 4,100 trials across all phases of clinical development in 90 countries in the last five years. We have an extensive history as a leading organization with a differentiated service offering. We believe that our commitment to continuous services and technology innovations combined with Fortrea’s customizable approach and experience across more than 20 therapeutic areas will enable us to continue to differentiate ourselves from peers in the CRO industry.

Large and Diversified Customer Base

We have a balanced and diverse customer mix serving large and mid-tier pharmaceutical, biotechnology, and medical device organizations. As of the fiscal year ended 2022, no single customer represented more than 10% of our revenue. We seek to be the partner of choice for innovative biotechnology companies. In 2022, 54% of our revenue came from leading pharmaceutical customers, which is up from 50% the prior year. We believe our customer base positions us at the forefront of innovation in healthcare and allows us to help our customers efficiently bring the best therapeutic solutions to patients.

Global and Stable Customer Relationships

Our scale and expertise are key competitive advantages that make us a multi-dimensional partner for our customers. Our top 20 customers have consistently represented approximately 60% of total revenue for 2022, 2021, and 2020. Additionally, most of our customers use us for more than one service. On average, our customers leverage three or more of our services. We believe that our global capabilities and expertise are considered a differentiator by our top customers. With a portfolio of projects that extend over multiple years, our longer-term contract durations give us confidence and visibility into our future revenues.

Access to Actionable Clinical Data and Insights

Access to data is foundational to any CRO and we believe our arrangement with Labcorp and other continuing strategic engagements will be differentiated by the quality of insights our data can provide. We intend to continue to

prioritize actionable data as we further scale our data repositories. We believe that we have the opportunity to optimize the clinical development process through accelerating the recruitment, increasing the diversity and improving the retention of patients.

Through our unique relationship with Labcorp, we (i) have access to one of the largest sets of global clinical trial data, which enables us to progress clinical trials forward more efficiently and (ii) are able to leverage Labcorp’s world-class diagnostics network that performs over 600 million tests per year. Those test results help researchers, medical professionals, and patients make important health decisions and provide insights that help identify individuals who might benefit from enrolling in specific drug trials. Our initial two-year access to extensive health and clinical data provides strategic flexibility and operational direction to efficiently meet our customers’ needs.

Expertise Across Rapidly Expanding Therapeutic Areas

We believe that our focus and expertise across rapidly growing scientific areas provide us with advantages over our competitors. Fortrea’s expertise spans oncology, CNS and neurodegenerative disease, cardiovascular, renal, NASH, rare disease, cell and gene therapy, and many more. These scientific areas represent the majority of the industry’s drug development pipelines.

Oncology makes up a large portion of our business and continues to grow. Through 2021, we have completed over 1,200 oncology clinical trials and serviced over 210,000 patients in nine primary indications. Oncology new business awards have grown 55% in 2022, year-over-year. In addition to Fortrea’s success in oncology, science, innovation, and technology, we plan to leverage our capabilities to successfully capture additional market share across high-growth therapeutic areas such as CNS and neurodegenerative disease, cell and gene therapy, cardiovascular, renal, NASH, rare disease, and more.

Growth Strategy

Our growth strategy aligns with both our management team’s key focus areas and our customers' priorities. As a public company, Fortrea plans to:

Increase Effectiveness Through Site Support Strategies and Services

Investigator sites have traditionally been a challenging part of the predictability and speed associated with clinical research. Recently with COVID-19, global political challenges, and the proliferation of technology choices, site productivity and effectiveness, as well as investigator participation, are a major challenge to the industry. More positively, many sites and technology start-ups are innovating around data, electronic medical records, and technology. Further, there are also site management organizations emerging that have adopted the concept of using participants’ homes and “third places” in studies to improve the patient experience.

Fortrea will leverage a combination of technologies, data, and services to better understand the augmented services that sites need to select trials, identify and enroll patients, and conduct and close out studies. These include the administrative and clinical support, tools, data and analysis to enable sites to be more productive, helping overcome challenges with disparate technologies, complex protocols and resource constraints at sites. Fortrea also plans to establish relationships with key innovators. Existing expertise and tools will be consolidated, and further investment in key areas will take place.

Improve Data Driven Site Selection and Patient Centric Recruitment Strategies

We have developed a unique approach of establishing high-value site relationships to support scientific engagement and reduce the time and cost for our customers to develop products. The third-party clinical sites we work with include healthcare systems, dedicated research networks, large group practices, consortiums, and governmental coordinating bodies that represent multiple research partners around the globe. We leverage data-driven approaches to target sites that align with our business needs. These target sites focus on accelerating patient recruitment, efficiently executing trials, and enhancing our site experience while demonstrating partner superiority in speed, recruitment, and quality.

We are committed to increasing the diversity of patient populations within clinical trials and we have developed a holistic strategy that is focused on partnering with customers, sites, investigators, and communities to address this commitment. Through these collaborations and by utilizing innovative solutions to support the diversity plans expected by global regulatory authorities, we will further strengthen our reputation as a strategic partner of choice.

Pursue “Ideal Scale” to Support the Research Requirements of our Customers

The landscape for clinical trials is evolving, both with changes to global business practices, and the commercialization strategies of our clients. While the number of novel therapies is increasing, the markets willingness to approve, pay for and distribute therapies is changing. At the same time, global geographic realities have impacted the locations where clinical trials can be conducted. In certain countries, such as the U.S., the need for inclusion of underrepresented minorities and other related goals have become paramount. Today, we have relationships in over 90 countries including all of the major pharmaceutical and biotechnology markets. Notably, Fortrea’s more than 18,000 employees are strategically balanced throughout the world. This is evidenced by our employee breakdown by region, which is as follows: 35% in the Americas, 26% in EMEA, and 39% in Asia-Pacific. At our size, we believe we are more efficient in decision making to positively impact processes and technologies. We will continue to strategically invest in new markets that synergize with our customers’ needs, and the demand of the global clinical trial landscape.

Align with Innovators Through Selective Investment in Technology for Speed and Simplification

The last decade has seen a substantial improvement in technology supporting clinical research, as well as an increase in both access to and analysis of relevant data. The past decade has seen the wider availability of electronic medical record data, use of natural language processing for handwritten notes, and the integration of genetic, pathology and other data into key decision processes. Fortrea has invested in technology and utilized in-house and Labcorp data to be more effective in the conduct of trials, related services and certain commercial areas. Our executive team maintains relationships with top technology and data vendors in the industry and will use its “ideal scale” to help bring innovations to sites and sponsors. At the same time, we will continue to invest in selective technologies to improve process cycle time and simplify the increasingly complex protocols for both sites and our employees

Over the last five years, we have significantly invested in our platform to advance all facets of our clinical development services, key technologies, and data utilization to better serve our customers. These investments include artificial intelligence and machine learning, full service and programmatic development models, data visualization, a full suite of biometric services and clinical data management globally across all phases and delivery models, and decentralized clinical trial capabilities, among others. Looking ahead, we will continue to invest in our capabilities, therapeutic expertise, and ability to generate insights through data and analytics. Our goal is to reduce cost and increase efficiency of clinical trial execution to enhance the quality of our offerings for our customers. We will support our customers in the development of innovative, life-changing biopharmaceutical products, and medical devices while remaining a global leader in clinical trial design and execution.

Become the Partner of Choice for Sponsor Companies and Service Providers

The challenges of clinical research are too complex to be solved by a single company. CROs now have therapeutic and logistical expertise at scale, as do some but not all pharmaceutical, biotechnology, and medical device companies. Increased and early sharing of development and pipeline goals, protocols and issues by all parties combined with strong relationship and program management increase efficiency and promote the adoption of innovative delivery models. Further, our service provider relationships support customers through custom capabilities to bring new products to market with a focus on speed and cost efficiency. Pharmaceutical, biotechnology, and medical device companies seek CRO providers that focus on their core competencies to complement their entire molecule development strategy. For example, we have formed a two-year strategic relationship with Labcorp to develop opportunities where a joint offering of services could be presented to pharmaceutical, biotechnology and medical device customers. These combined solutions utilize services that include de-identified patient and site performance data, patient recruitment and engagement offerings, and central laboratory and bioanalysis services.

Create an Inclusive Culture of Careers with Meaning as a Competitive Advantage

CROs as well as pharmaceutical, biotechnology and medical device sponsors and investigator sites have been impacted by turnover in rapidly growing markets. Recently, this has been compounded by the increased turnover in global employment markets, remote hiring and work, and shortages in related professions such as nursing and computer science. We have a five-part strategy to improve the attractiveness of working at our organization for a longer duration or a career. The focus areas are: Meaningful Work; 360 Degree Relationships; Quality Interactions; Career Mobility; and Respect for the Individual. In a program such as this, execution is paramount. We have an execution program we believe will deliver results, inclusive of global, early talent development academies and diversity focused and career development employee resource groups. This will be supported by investments in process and technology that benefit both our workforce and customers.

Expand Expertise in Existing and Novel Therapeutic Areas

We believe that our therapeutic expertise across all clinical phases of drug development is critical to the proper design and management of clinical trials. Our expertise helps us deliver enhanced value to our customers through a reduction in the cost and time to bring drugs and devices to market. We have significant expertise in several of the rapidly-growing scientific areas including oncology, CNS and neurodegenerative disease, cardiovascular, renal, NASH, rare disease, cell and gene therapy, and several emerging therapeutic areas. The oncology market remains an area of unmet medical need that receives significant investment in R&D. As part of our mission to drive value for customers, we will continue to try to capitalize on the expansion of opportunities in such key areas as oncology, CNS and neurodegenerative, NASH, and autoimmune. While Fortrea has significant expertise and experience in these scientific areas, we are confident that there is ample opportunity for future growth.

Enhance Agile Approach and Project Centric Service Offering

Our agile approach to serving our customers is a distinct advantage for us when we go to market. We believe that our flexible approach has been a key element of our ability to win new customers and retain existing customers across all of our business segments. Fortrea’s model is informed by continuous external stakeholder market research. Our analysis highlighted that customers are seeking a partnership rooted in trust and transparency demonstrating the agility and flexibility to meet their individual needs while delivering speed to market and creative solutions. We expect biotechnology companies to increasingly choose CROs that provide highly flexible offerings to meet the changing drug development landscape. In addition, large pharmaceutical companies continue to look for adaptable solutions to conform to customized partner-driven approaches. As the demand for novel solutions increases, we expect that our existing flexible approach to serving our customers will enable us to further grow as an organization.

Build on Strengths in Clinical Pharmacology

We are a market leader in clinical pharmacology studies, including highly specialized human Absorption, Metabolism, and Excretion studies. We are committed to growing our clinical pharmacology business through the expansion of our existing clinics and through our new state-of-the-art facility in Leeds, U.K. We have integrated technology and artificial intelligence successfully within our clinic scheduling process to optimize the utilization of bed-space and have implemented bedside data capture technology. We are also focused on optimizing delivery in more complex hybrid study designs that include both healthy volunteers and patients through the utilization of our own clinics in combination with an expanded global site network.

Competition

Our operations in the drug development services industry involve high levels of competition, consisting of hundreds of small, limited-scope service providers and a smaller number of large full-service drug development companies. While the industry has seen an increasing level of consolidation over the past several years, primarily driven by the larger full-service providers, it remains highly fragmented.

Our main competition consists of these small and large CROs, as well as in-house departments of pharmaceutical, biotechnology, and medical device companies and, to a lesser extent, select universities and teaching hospitals and site management organizations. Our services have periodically experienced heightened

competition, including competition among CROs for both customers and potential acquisitions. We believe that our significant therapeutic expertise, global reach, integrated model, customer service strategies, access to data, and operational strengths differentiate us from our competitors across all of our segments.

Our major competitors include IQVIA, ICON, Parexel, PPD, a subsidiary of Thermo Fisher Scientific Inc., Medpace Holdings, and Syneos Health. We believe our success with customers has been rooted in transparent partnerships that offer agile solutions and support speed to market. We believe we are positioned to be more flexible and customer focused than our larger competition while offering the global scale that our smaller competition lacks.

Backlog and Net New Business

Our backlog represents anticipated revenue for work not yet completed or performed under executed contracts and other forms of written confirmation, where there is sufficient or reasonable certainty about the customer’s ability and intent to fund and commence the services within twelve months. We adjust backlog for foreign currency fluctuations and exclude from backlog revenue that has been recognized as revenue in our statements of operations. Our backlog was $8.6 billion, $8.1 billion, and $8.9 billion at December 31, 2022 and 2021 and March 31, 2023, respectively.

We add net new business to backlog based on the aforementioned criteria. Additionally, each period we evaluate previously awarded projects to adjust for modifications, cancellations, foreign currency fluctuations, and other items. Net new business varies from period to period depending on numerous factors, including customer award volume, sales performance, and overall health of the biopharmaceutical industry, among others. While customers with whom we have had long-standing relationships have continued to award new orders to us, we have experienced some fluctuations in our net new business award levels over the last few quarters driven, we believe, by recent macroeconomic factors affecting the industry and customer hesitation ahead of the spinoff. Some clients have indicated that they are waiting until after the spinoff is complete to award new business. Our net new business awards were $3.7 billion, $3.4 billion and $3.7 billion for the years ended December 31, 2022, 2021 and 2020, respectively and $3.8 billion and $3.4 billion for the trailing twelve months ended March 31, 2023 and 2022, respectively.

We do not believe that, as a sole measure, our backlog and net new business are consistent indicators of future revenue because they have been, and likely will continue to be, affected by a number of factors, including the variable size and duration of projects, many of which are performed over several years, and changes to the scope of work during the course of projects. Additionally, projects may be canceled or delayed by the customer or regulatory authorities. We generally do not have a contractual right to the full amount of the contract award reflected in our backlog. If a customer cancels a contract, we generally will be reimbursed for the costs we have incurred. For more information about risks related to our backlog see “Risk Factors—Risks Related to Our Business—Our backlog might not be indicative of our future revenues, and we might not realize all of the anticipated future revenue reflected in our backlog.”

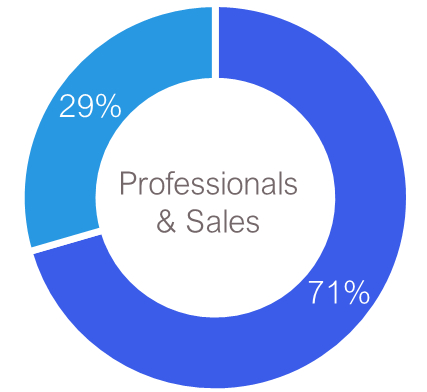

Sales, Customer Service, and Marketing

Our global sales and customer service organization provides dedicated customer coverage across pharmaceutical, biotechnology, and medical devices industries. This includes a range of solutions such as, but not limited to, clinical trials, biomarkers, technology services, and other services. Our total staff base of more than 19,000 includes a highly focused, experienced, and trained team of professional business development and customer facing representatives and support staff working on securing, servicing, and expanding business from both new and existing customers.

Our approach to sales and marketing involves the collaboration of scientific, operational, and technical staff with our business development, customer facing project personnel, and senior leadership teams. We embed our scientific team and project personnel from the beginning of the sales process when we first engage potential customers. They remain embedded across the lifecycle of the sale and throughout the life of the project, program or partnership. This strategy allows us to consult collaboratively with our customers throughout the lifecycle of our engagement.

Our marketing efforts support the activities of our business development and customer facing staff. Our global marketing initiatives include integrated, digitally enabled, omni-channel campaigns and communication programs designed to help customers research our services, understand our differentiation, and learn more about our capabilities. We provide our perspective on current industry challenges and developments to create an ongoing dialogue with our current and prospective customers and to promote our scientific expertise, differentiated service offerings, quality, and technology.

Corporate Information

Fortrea was incorporated in Delaware on January 31, 2023. The current address of Fortrea’s principal executive offices is 8 Moore Drive, Durham, North Carolina 27709. Fortrea can be contacted by calling (877) 495-0816. Fortrea maintains an internet site at www.fortrea.com. Fortrea’s website and the information contained therein or connected thereto are not incorporated into this information statement or the registration statement of which this information statement forms a part, or in any other filings with, or any information furnished or submitted to, the SEC.

Reason for Furnishing this Information Statement

This information statement is being furnished solely to provide information to Labcorp stockholders who will receive Fortrea common stock in the spinoff. It is not to be construed as an inducement or encouragement to buy or sell any of our securities. We believe that the information contained in this information statement is accurate as of the date set forth on the cover. Changes may occur after that date and neither we nor Labcorp undertake any obligation to update the information, except to the extent so required by applicable securities laws.

Summary of Risk Factors

An investment in us is subject to a number of risks, including risks related to the spinoff, our business and the industry in which we operate, laws and regulations, technology and cybersecurity, the securities market and our common stock. Set forth below is a summary of some, but not all, of these risks. Please see “Risk Factors” for a more detailed description of these and other risks.

Risks Relating to the Spinoff

•We may not realize the potential benefits from the spinoff.

•We have no history operating as an independent public company. We will incur additional expenses to create or supplement the corporate infrastructure necessary to operate as an independent public company and we will experience increased ongoing costs in connection with being an independent public company.

•Our historical combined and pro forma financial information are not necessarily indicative of our future financial condition, results of operations, or cash flows nor do they reflect what our financial condition, results of operations, or cash flows would have been as an independent public company during the periods presented.

•As an independent, publicly traded company, we may not enjoy the same benefits that we did as a part of Labcorp.

•If the spinoff and certain related transactions fail to qualify under Sections 355 and 368(a)(1)(D) of the Code, Labcorp and its stockholders could incur significant tax liabilities, and we could be required to indemnify Labcorp for taxes that could be material pursuant to indemnification obligations under the tax matters agreement.

•We might not be able to engage in certain transactions and equity issuances following the spinoff.

Risks Relating to Our Business

•If we do not generate a large number of net new business awards, or if net new business awards are delayed, terminated, reduced in scope, or fail to go to contract, our business, financial condition, results of operations, or cash flows may be materially adversely affected.

•If we are unable to contract with suitable investigators and recruit and enroll patients for clinical trials, our business might suffer.

•The COVID-19 pandemic and associated economic repercussions have adversely impacted our business and results of operations, and are expected to continue to do so.

•Our customer or therapeutic area concentration may have a material adverse effect on our business, financial condition, results of operations or cash flows.