As filed with the Securities and Exchange Commission on June 24, 2024.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Birkenstock Holding plc

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| | |

Jersey | 3140 | Not Applicable |

(State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

incorporation or organization) | Classification Code Number) | Identification No.) |

1-2 Berkeley Square

London W1J 6EA

United Kingdom

+44 1534 835600

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

Tel: +1 302 738-6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Joshua N. Korff, P.C. Ross M. Leff, P.C. Zoey Hitzert Kirkland & Ellis LLP 601 Lexington Avenue New York, NY 10022 +1 212 446-4800 | Guy Coltman Carey Olsen Jersey LLP 47 Esplanade, St Helier Jersey JE1 0BD, Channel Islands +44 (0)1534 888900 | Marc D. Jaffe Ian D. Schuman Adam J. Gelardi Latham & Watkins LLP 1271 Avenue of the Americas New York, NY 10020 +1 212 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling shareholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject To Completion, Dated June 24, 2024

Preliminary Prospectus

14,000,000 Ordinary Shares

Birkenstock Holding plc

The selling shareholder identified in this prospectus is offering 14,000,000 ordinary shares, no par value, of Birkenstock Holding plc (the “Company”). The underwriters may also purchase up to 2,100,000 ordinary shares from the selling shareholder within 30 days of the date of this prospectus. We will not receive any of the proceeds from the sale of the ordinary shares by the selling shareholder.

Our ordinary shares are listed on the New York Stock Exchange (the “NYSE”) under the symbol “BIRK.” On June 21, 2024, the last reported share price of our ordinary shares as reported on the NYSE was $61.47 per share.

Following the offering and the distribution of ordinary shares to the managers described herein, BK LC Lux MidCo S.à r.l. (“MidCo”), an entity affiliated with L Catterton and the selling shareholder, will beneficially own approximately 73.2% of our ordinary shares (or 72.1% if the underwriters exercise in full their option to purchase additional ordinary shares from the selling shareholder). As a result, we will continue to be a “controlled company” under the corporate governance rules of the NYSE applicable to listed companies, and therefore are permitted to elect not to comply with certain corporate governance requirements thereunder.

Investing in our ordinary shares involves risks. See “Risk Factors” beginning on page 30 of this prospectus and the section entitled “Risk Factors” in our Annual Report on Form 20-F for the fiscal year ended September 30, 2023 (the “2023 Annual Report”) incorporated by reference in this prospectus.

| | | | |

| | Per

ordinary share | | Total |

Public offering price | | $ | | $ |

Underwriting discounts and commissions(1) | | $ | | $ |

Proceeds, before expenses, to the selling shareholder | | $ | | $ |

(1)We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting” for a description of all compensation payable to the underwriters.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ordinary shares against payment in New York, New York on or about , 2024.

| | | | | | | | | | | |

Joint Bookrunners |

Goldman Sachs & Co. LLC | | J.P. Morgan |

| | | | |

|

| | | | | |

The date of this prospectus is , 2024.

Neither we, the selling shareholder nor the underwriters have authorized anyone to provide any information or to make any representations other than the information contained or incorporated by reference in this prospectus, any amendment or supplement to this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we may have referred you. We, the selling shareholder and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the selling shareholder and the underwriters have not authorized any other person to provide you with different or additional information. Neither we, the selling shareholder nor the underwriters are making an offer to sell the ordinary shares in any jurisdiction where the offer or sale is not permitted. This offering is being made in the United States and elsewhere solely on the basis of the information contained or incorporated by reference in this prospectus. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus and the information in the documents incorporated by reference in this prospectus is accurate only as of the date of such document, regardless of the time of delivery of this prospectus or any sale of the ordinary shares. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy these ordinary shares in any circumstances under which such offer or solicitation is unlawful.

For investors outside the United States: Neither we, the selling shareholder nor any of the underwriters have done anything that would permit this offering or the possession or distribution of this prospectus in any jurisdiction where action for those purposes is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, this offering of ordinary shares and the distribution of this prospectus outside the United States.

Our Company is a Jersey public limited company, and we are a “foreign private issuer” under the rules of the SEC. As a foreign private issuer, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as domestic registrants whose securities are registered under the Exchange Act. Moreover, a number of our directors and executive officers are not residents of the United States, and all or a substantial portion of the assets of such persons are located outside the United States. As a result, it may not be possible for investors to effect service of process within the United States upon us or upon such persons or to enforce against them judgments obtained in U.S. courts, including judgments in actions predicated upon the civil liability provisions of the federal or state securities laws of the United States. We have been advised by our legal counsel in Jersey that it is uncertain as to whether the courts of Jersey would entertain original actions based on U.S. federal or state securities laws or enforce judgments from U.S. courts against us or our officers and directors which originated from actions alleging civil liability under U.S. federal or state securities laws. See “Enforcement of Judgments” for additional information.

Jersey Regulatory Matters

The JFSC has given, and has not withdrawn, its consent under Article 2 of the Control of Borrowing (Jersey) Order 1958 to the issue of our ordinary shares. The JFSC is protected by the Control of Borrowing (Jersey) Law 1947 against any liability arising from the discharge of its functions under that law.

A copy of this prospectus has been delivered to the Jersey Registrar of Companies in accordance with Article 5 of the Companies (General Provisions) (Jersey) Order 2002 and the Jersey Registrar of Companies has given, and has not withdrawn, its consent to the circulation of this prospectus.

It must be understood that, in giving these consents (once received), neither the Jersey Registrar of Companies nor the JFSC takes any responsibility for the financial soundness of the Company or for the correctness of any statements made, or opinions expressed, with regard to it. If you are in any doubt about the contents of this prospectus, you should consult your stockbroker, bank manager, solicitor, accountant or other financial adviser.

The price of securities and the income from them can go down as well as up.

The directors of the Company have taken all reasonable care to ensure that the facts stated in this prospectus are true and accurate in all material respects, and that there are no other facts the omission of which

would make misleading any statement in this prospectus, whether of facts or opinion. All the directors of the Company accept responsibility accordingly.

Our company secretary is Gen II Corporate Services (Jersey) Limited, whose current business address is 47 Esplanade, St Helier, Jersey JE1 0BD, Channel Islands. Our registered office is 47 Esplanade, St Helier, Jersey JE1 0BD, Channel Islands and our register of members is kept at 13 Castle Street, St Helier, JE1 1ES.

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Certain Definitions

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “BIRKENSTOCK Group,” “Birkenstock,” the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to Birkenstock Holding plc, together with all of its subsidiaries. References to the “selling shareholder” or “MidCo” are to BK LC Lux MidCo S.à r.l., a société à responsabilité limitée incorporated under the laws of the Grand Duchy of Luxembourg.

References to “Euro” or “€” means the currency of the member states of the European Monetary Union that have adopted or that adopt the single currency in accordance with the treaty establishing the European Community, as amended by the Treaty on European Union. All references to “U.S. Dollars,” “Dollars,” “USD” or “$” are to the legal currency of the United States. All references to “Canadian Dollars” are to the legal currency of Canada. In this prospectus, unless otherwise noted, amounts that are converted from Euro to U.S. Dollars are converted at an exchange rate of $1.0811 per €1, the exchange rate as of March 28, 2024, and at an exchange rate of $1.0804 per €1, the average exchange rate for the six months ended March 31, 2024.

Financial Statements

We maintain our books and records in Euros and prepare our consolidated financial statements in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”).

Birkenstock GmbH & Co. KG is the accounting predecessor of BK LC Lux Finco 2 S.à r.l., subsequently renamed Birkenstock Holding Limited on July 12, 2023, for financial reporting purposes. Birkenstock Holding Limited was converted to a Jersey public limited company and subsequently renamed Birkenstock Holding plc on October 4, 2023. The Company’s financial statement presentation in this prospectus and our 2023 Annual Report distinguishes the Company’s presentations into two distinct periods, the period up to and including April 30, 2021, the Transaction’s closing date (labeled “Predecessor”), and the period after that date (labeled “Successor”) and are further distinguished as follows: the Successor periods represent fiscal 2023 (“2023 Successor Period”), fiscal 2022 (“2022 Successor Period”) and the period from May 1, 2021 through September 30, 2021 (“2021 Successor Period” and, collectively with the 2023 Successor Period and the 2022 Successor Period, the “Successor Periods”) and the Predecessor period represents the period from October 1, 2020 through April 30, 2021 (the “Predecessor Period”). The Predecessor Period and the Successor Periods (together, the “audited consolidated financial statements”) have been separated by a vertical black line on the consolidated financial statements to highlight the fact that the financial information for such periods has been prepared under two different cost bases of accounting. The audited consolidated financial statements of the Company included in our 2023 Annual Report are incorporated by reference in this prospectus.

The audited consolidated financial statements prepared in accordance with IFRS have been audited by EY GmbH & Co. KG Wirtschaftsprüfungsgesellschaft (formerly Ernst & Young GmbH Wirtschaftsprüfungsgesellschaft), as stated in their report incorporated by reference in this prospectus.

The Company’s unaudited interim condensed consolidated financial statements as of and for the six months ended March 31, 2024 and March 31, 2023 (the “unaudited interim condensed consolidated financial statements” and, together with the audited consolidated financial statements, the “consolidated financial statements”) have also been presented and are incorporated by reference in this prospectus.

Financial information for fiscal 2020 is derived from our consolidated financial statements filed with the United States Securities and Exchange Commission (the "SEC") in our registration statement on Form F-1 dated October 4, 2023. We also present revenues for the years ended September 30, 2014 to 2019, which information has been derived from the consolidated financial statements of Birkenstock GmbH & Co. KG for such periods presented, each prepared in accordance with German GAAP. The consolidated financial statements of Birkenstock GmbH & Co. KG for fiscal 2014 to fiscal 2017 do not include Birkenstock USA LP, which was not consolidated with Birkenstock GmbH & Co. KG until fiscal 2018. Therefore, the revenues presented for fiscal 2014 to fiscal 2017 consist of reported revenues for Birkenstock GmbH & Co. KG plus revenues for Birkenstock USA LP derived from management reporting. There are no significant differences in revenues recognized under German GAAP and IFRS.

Our fiscal year ends September 30. References to “fiscal 2023” or “FY 2023” refer to the fiscal year ended September 30, 2023, and references to other fiscal years follow the same convention. Our financial information should be read in conjunction with “Operating and Financial Review and Prospects” in our 2023 Annual Report and our consolidated financial statements, including the notes thereto, each incorporated by reference in this prospectus.

Basis of Consolidation

The accompanying consolidated financial statements include the accounts of the Company and its subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Rounding

We have made rounding adjustments to some of the figures included or incorporated by reference in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them. With respect to financial information set out in this prospectus, a dash (“—”) signifies that the relevant figure is not available or not applicable, while a zero (“0.0”) signifies that the relevant figure is available but is or has been rounded to zero.

INDUSTRY AND MARKET DATA

Certain information used in this prospectus contains statistical data, estimates and forecasts concerning the industry in which we operate that are based on external service providers (for which data is not publicly available), other publicly available information and independent industry publications, as well as our internal sources and general knowledge of, and expectations concerning, the industry. Our internal sources include the Consumer Survey. All Consumer Survey figures included are provided as of May 2023 and are based on the responses of our customers who elected to participate in the surveys. In the Consumer Survey, we calculate our NPS based on respondents’ indications of their likelihood to recommend BIRKENSTOCK on a scale from 0 to 10. Responses of 9 or 10 are considered “promoters” and responses of 6 or less are considered “detractors.” We then subtract the percentage respondents who are detractors from the percentage of respondents.

Within this prospectus, we reference information and statistics regarding the Apparel and Footwear industry. We have obtained this information and statistics from various independent third-party sources, including independent industry publications, reports by market research firms and other independent sources. Some data and other information contained in this prospectus are also based on management’s estimates and calculations, which are derived from our review and interpretation of internal surveys and independent sources. Data regarding the industries in which we compete and our market position and market share within these industries are inherently imprecise and are subject to significant business, economic and competitive uncertainties beyond our control, but we believe they generally indicate size, position and market share within this industry. While we believe such information is reliable, we have not independently verified any third-party information. While we believe our internal company research and estimates are reliable, such research and estimates have not been verified by any independent source. In addition, assumptions and estimates of our and our industries’ future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause our future performance to differ materially from our assumptions and estimates. As a result, you should be aware that market, ranking and other similar industry data included in this prospectus, and estimates and beliefs

based on that data, may not be reliable. Neither we, the selling shareholder nor the underwriters can guarantee the accuracy or completeness of any such information contained in this prospectus.

Some of the information herein has also been extrapolated from market data, reports, surveys and studies using our experience and internal estimates. Elsewhere in this prospectus, statements regarding the industry in which we operate, our position in this industry and the size of certain markets are based solely on our experience, internal studies, estimates and surveys and our own investigation of market conditions.

TRADEMARKS AND TRADE NAMES

We own or have rights to various trademarks, trade names or service marks that we use in connection with our business, including “BIRKENSTOCK,” “Birko-Flor,” “Birki,” “Birk” and “Papillio,” among others, and our other registered and common law trade names, trademarks and service marks, including our corporate logo. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without the ™ and ® symbols, but we will assert, to the fullest extent under applicable law, rights to such trademarks, service marks and trade names.

CERTAIN DEFINITIONS

The following is a summary of certain defined terms and concepts that we use throughout this prospectus:

•AB-Beteiligungs GmbH refers to AB-Beteiligungs GmbH, an entity controlled by Alexander Birkenstock, one of our controlling shareholders prior to the Transaction;

•ABL Facility refers to the multicurrency asset-based loan facility established by the ABL Facility Agreement;

•ABL Facility Agreement refers to the asset-based-loan facility agreement entered into on April 28, 2021 by Birkenstock Group B.V. & Co. KG, Birkenstock US BidCo, Inc. and Birkenstock Limited Partner S.à r.l.;

•APMA refers to the Asia-Pacific, Middle East and Africa region;

•ASP refers to average selling price;

•B2B refers to business-to-business;

•CAGR refers to compound annual growth rate;

•Code refers to the Internal Revenue Code of 1986;

•Consumer Survey refers to a series of general branding and marketing internal surveys with approximately 70,000 participants conducted in May 2023 to determine the demographics and habits of our consumers;

•DTC refers to direct-to-consumer;

•EU refers to the European Union;

•EVA refers to ethylene-vinyl acetate;

•Exchange Act refers to the Securities Exchange Act of 1934, as amended;

•German GAAP refers to the German Commercial Code;

•HMRC refers to HM Revenue & Customs;

•Incremental Senior Term Facilities refers to incremental facilities which may also be established under the Senior Term Facilities Agreement from time to time (including by way of an increase to any existing facilities or the establishment of new facilities);

•IPO refers to the Company’s initial public offering that closed on October 13, 2023;

•IRS refers to the U.S. Internal Revenue Service;

•Jersey Companies Law refers to the Companies (Jersey) Law 1991, as amended;

•JFSC refers to the Jersey Financial Services Commission;

•L Catterton refers to a U.S.-headquartered and consumer-focused investment firm that acquired a majority stake in BIRKENSTOCK through affiliated entities in 2021;

•ManCo refers to BK LC ManCo GmbH & Co. KG, an indirect parent entity of our Company;

•MidCo refers to BK LC Lux MidCo S.à r.l., an entity affiliated with L Catterton;

•Notes refers to the €430.0 million in aggregate principal amount of 5.25% Senior Notes due 2029 issued by Birkenstock Financing S.à r.l. on April 29, 2021;

•NPS refers to Net Promoter Score;

•Order refers to the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005;

•PFIC refers to a passive foreign investment company under the Code;

•Principal Shareholder refers to L Catterton and its affiliates, which include MidCo;

•PU refers to polyurethane;

•RSP refers to retail sales price;

•SDRT refers to UK stamp duty reserve tax;

•SEC refers to the United States Securities and Exchange Commission;

•Securities Act refers to the Securities Act of 1933, as amended;

•Senior Credit Facilities refers to the Senior Term Facilities and Incremental Senior Term Facilities when taken together;

•Senior Term Facilities Agreement refers to the senior facilities agreement entered into by Birkenstock Limited Partner S.à r.l. on April 28, 2021;

•Shareholders’ Agreement refers to the shareholders’ agreement entered into with MidCo on October 13, 2023;

•Tax Law refers to the Income Tax (Jersey) Law 1961 (as amended);

•Term and Revolving Facilities Agreement refers to the term and revolving facilities agreement entered into by Birkenstock Limited Partner S.à r.l., as company, Birkenstock Group B.V. & Co. KG and Birkenstock US BidCo Inc., as borrowers, the other loan parties thereto, Goldman Sachs Bank USA, as agent and security agent, and the lenders party thereto on May 28, 2024;

•Transaction refers to Birkenstock Holding plc’s acquisition of the shares and certain assets that comprised the BIRKENSTOCK Group;

•U.S. refers to the United States of America;

•U.S. GAAP refers to U.S. generally accepted accounting principles;

•USD Term Loan refers to our USD-denominated term loans under the Senior Term Facilities Agreement;

•UK refers to the United Kingdom; and

•Vendor Loan refers to the loan agreement with AB-Beteiligungs GmbH.

SUMMARY

This summary highlights information contained elsewhere in this prospectus and incorporated by reference herein. This summary may not contain all the information that may be important to you, and we urge you to read this entire prospectus and the documents incorporated by reference herein carefully, including the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in this prospectus, the sections entitled “Risk Factors,” “Business” and “Operating and Financial Review and Prospects” in our 2023 Annual Report incorporated by reference in this prospectus and our consolidated financial statements and notes to those consolidated financial statements incorporated by reference in this prospectus, before deciding to invest in our ordinary shares.

Who We Are

BIRKENSTOCK is a revered global brand rooted in function, quality and tradition dating back to 1774. We are guided by a simple, yet fundamental insight: human beings are intended to walk barefoot on natural, yielding ground, a concept we refer to as “Naturgewolltes Gehen.” Our purpose is to empower all people to walk as intended by nature. The legendary BIRKENSTOCK footbed represents the best alternative to walking barefoot, encouraging proper foot health by evenly distributing weight and reducing pressure points and friction. We believe our function-first approach is universally relevant; all humans — anywhere and everywhere — deserve to walk in our footbed.

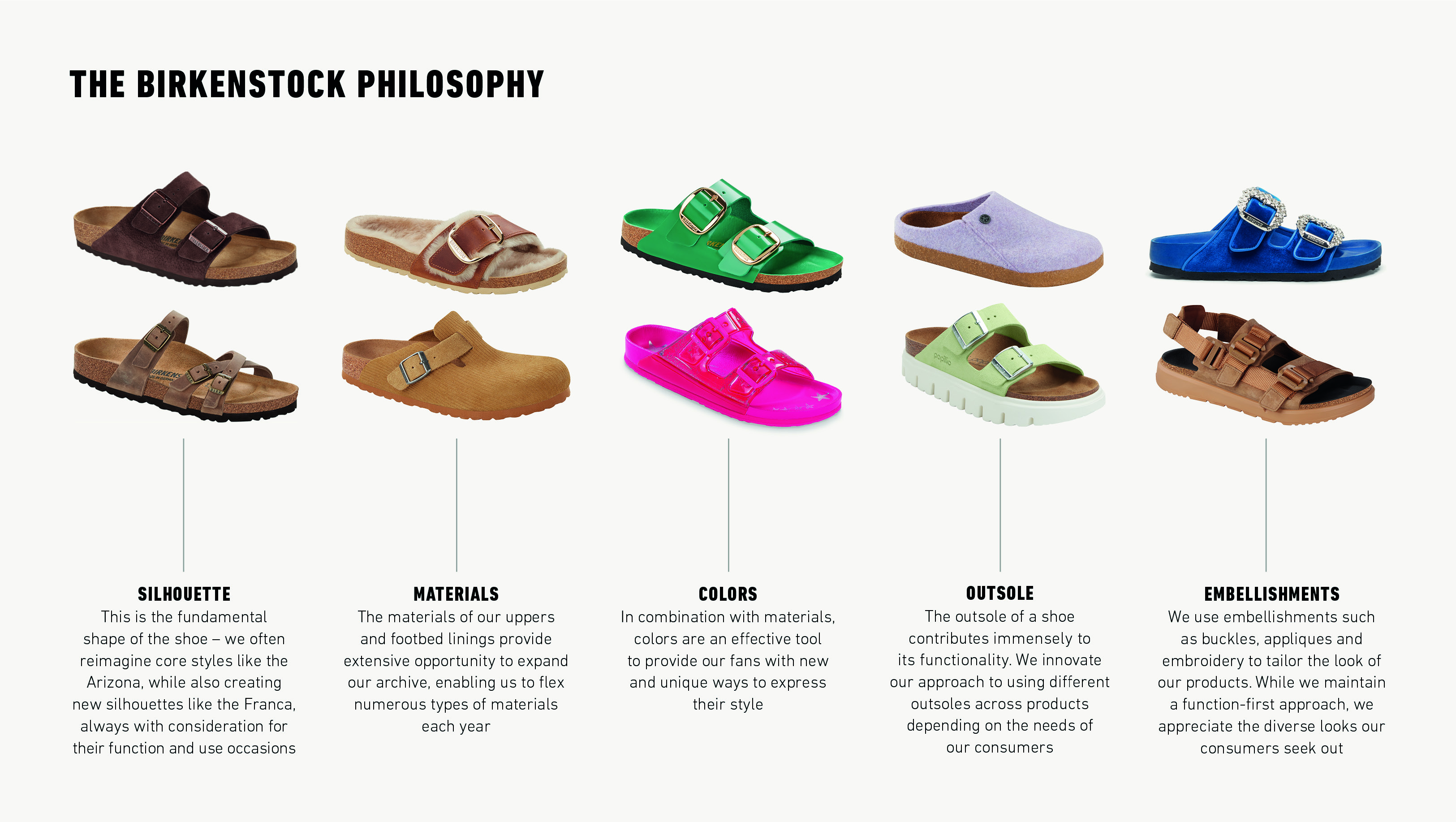

From this insight, we have developed a broad, unisex portfolio of footbed-based products, anchored by our iconic Core Silhouettes, the Madrid, Arizona, Boston, Gizeh and Mayari. While these silhouettes drive consistent, high-visibility revenues and represent a significant portion of our overall business, we also continue to expand our extensive archive by extending our existing silhouettes and launching new styles. This expands our reach across price points, usage occasions and product categories. We incorporate distinctive design elements and develop new materials to create newness while staying true to our heritage and uncompromising quality standards.

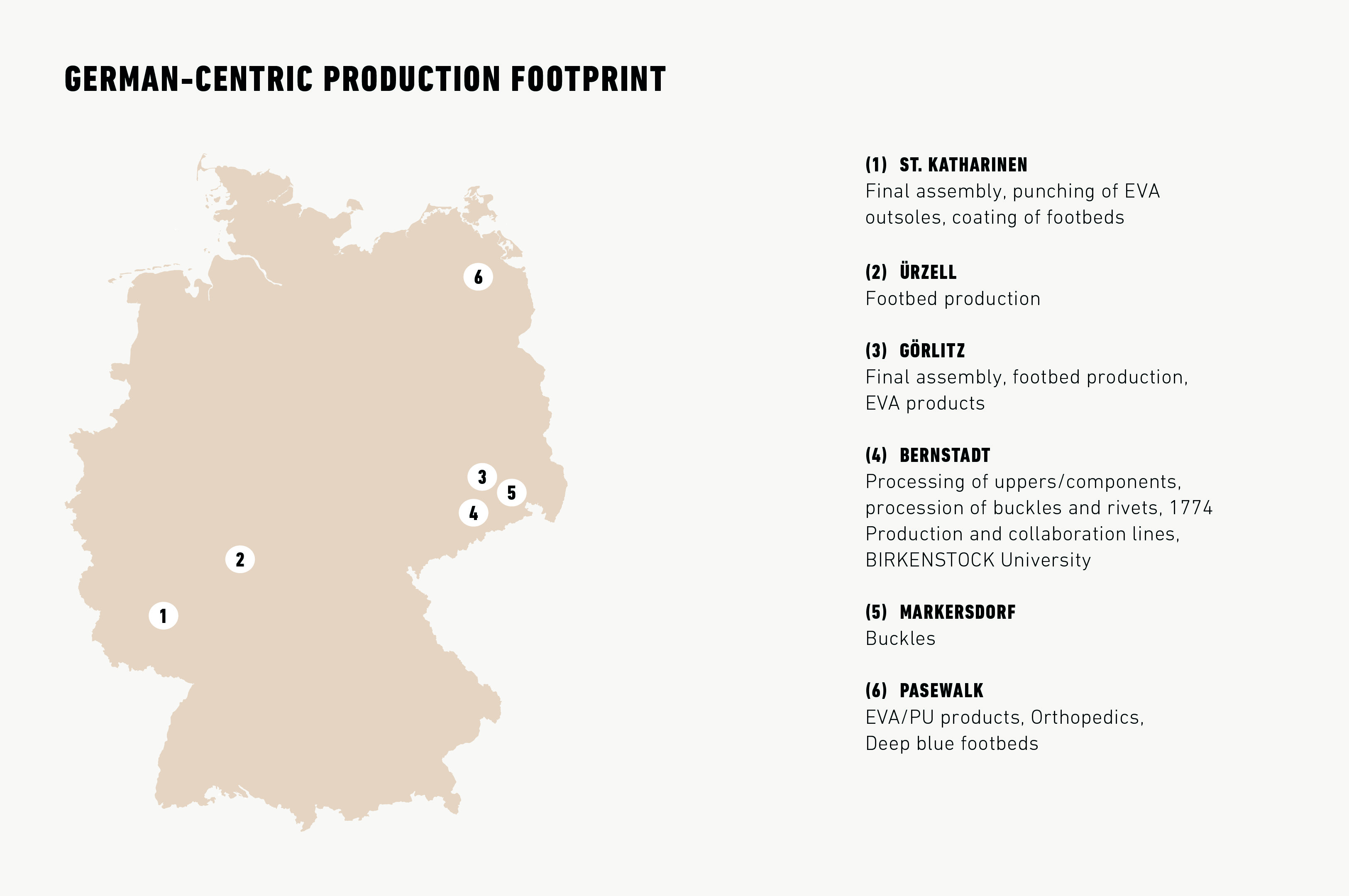

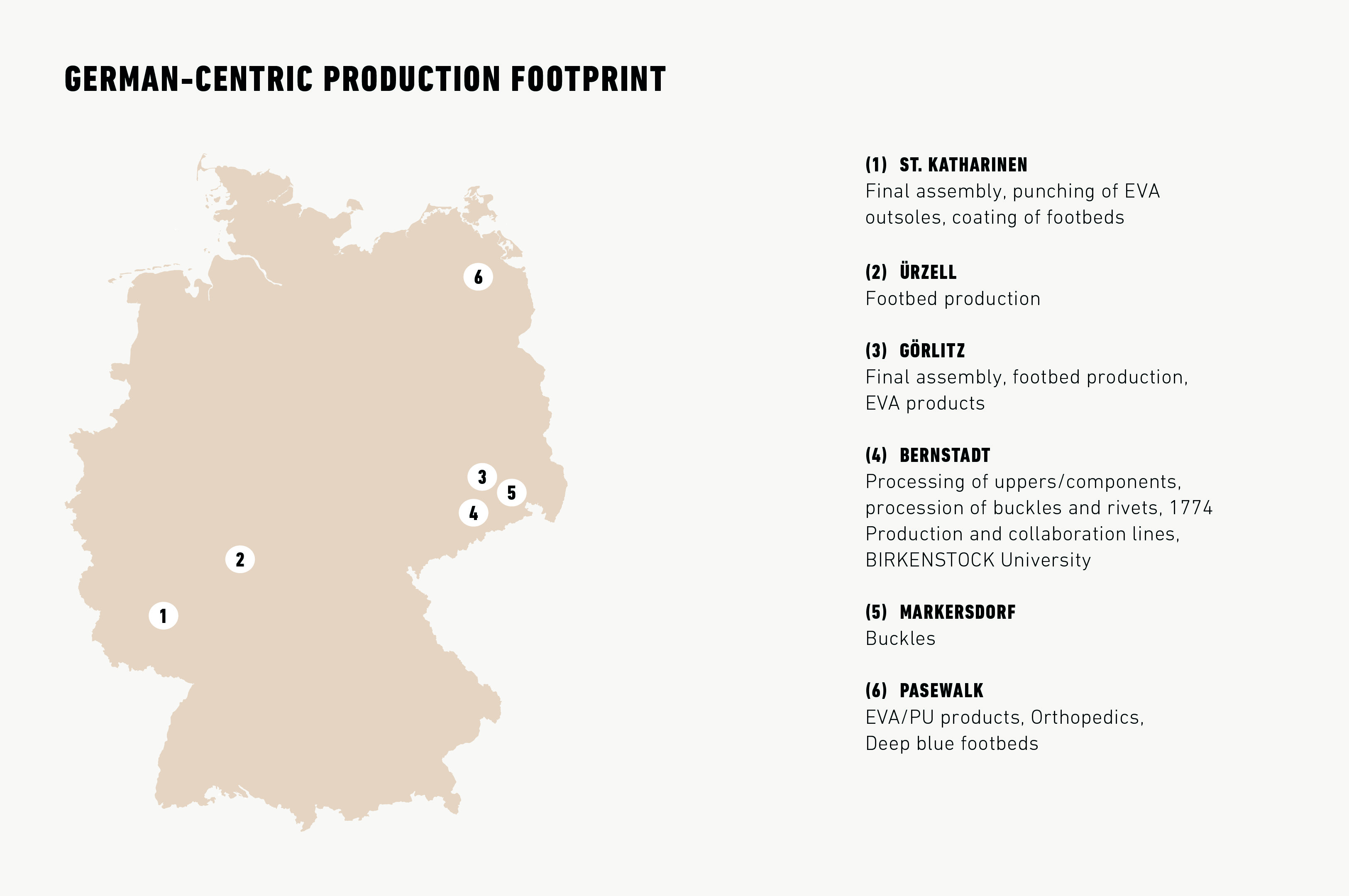

We are German made. Our production capabilities reflect centuries-old traditions of craftsmanship and commitment to using only the highest quality materials. To ensure each product meets our rigorous quality standards, we operate a vertically integrated manufacturing base and produce all our footbeds in Germany. In addition, we assemble the vast majority of our products in Germany and produce the remainder elsewhere in the EU. We maintain strict control over our entire supply chain, responsibly sourcing materials that originate mainly from Europe.

As described by our Chief Executive Officer, Oliver Reichert, “Consumers buy our products for a thousand wrong reasons, but they all come back for the same reason:” for our functional proposition, enduring commitment to quality and the rich tradition of our Company which enables us to establish meaningful emotional connections with our consumers. The deep trust we create allows us to enjoy long-lasting relationships with our consumers — oftentimes spanning decades — as evidenced by findings from the Consumer Survey that revealed the average BIRKENSTOCK consumer in the U.S. owns 3.6 pairs. Through the strong reputation and universal appeal of our brand — enabling extensive word-of-mouth exposure and outsized earned media value — we have efficiently built a growing global fanbase of millions of consumers that uniquely transcends geography, gender, age and income.

We reach these consumers around the world through a multi-channel “engineered distribution” model, which balances the growing demand for our products and our constrained supply capacity to create scarcity in the market. We strategically allocate our products between our wholesale partners in the B2B channel, which we have been optimizing in recent years, and our rapidly growing DTC channel. As a result, we drive consistently robust revenue growth and operating margins, achieve excellent sell-through rates and deepen our direct connections with our consumers. In fiscal 2023, we generated revenues of €1,491.9 million, gross profit margin of 62.1%, net profit of €75.0 million, Adjusted net profit of €207.2 million, net profit margin of 5.0%, Adjusted net profit margin of 13.9%, Adjusted EBITDA of €482.7 million and Adjusted EBITDA margin of 32.4%, while selling 30.7 million units.

What We Stand For

Our core values of Function, Quality and Tradition influence everything we do and underpin our brand’s deep cultural relevance that has stood the test of time. For decades, BIRKENSTOCK has attracted independent thinkers and transcended prevailing style norms, remaining committed to our values, even as the global zeitgeist has evolved around and moved toward us. In the 1960s and 1970s, the global peace movement and hippies adopted BIRKENSTOCK, wearing our Madrid, Arizona and Boston, as part of their celebration of freedom and free-spiritedness. In the 1980s, the green movement adopted BIRKENSTOCK, proudly wearing our products for our ethical approaches to production and consumption. In the 1990s, inspired by the feminism movement, more women wore BIRKENSTOCKs to free themselves from long-standing fashion norms that required wearing painful high heels and other constricting footwear. Today, consumers turn to BIRKENSTOCK in their search for healthy, high-quality products and as a rejection of formal dress culture. By remaining true to our values of Function, Quality and Tradition, BIRKENSTOCK has endured across generations.

Function

Our proprietary footbed — the result of successive innovations, beginning in the late 19th century with the invention of the contoured shoe last, which reflects the anatomy of the human foot — represents the foundation of our brand and products. The functional nature of and growing usage occasions for BIRKENSTOCK products enable the universality of our brand, allowing us to serve every human regardless of geography, gender, age and income. At its core, the BIRKENSTOCK footbed promotes “Naturgewolltes Gehen”:

Every foot employs 26 bones, 33 muscles and over 100 tendons and ligaments in walking. Improper footwear can cause friction, pain, injury and poor posture, among other ailments. Our anatomically shaped BIRKENSTOCK footbed provides natural support and stimulation, promoting even weight distribution, fully supported arches and no unnatural pressure points from heel to toe. Orthopedic theory suggests the benefits of walking barefoot on natural yielding ground are far reaching, including pain reduction in the foot and throughout the body, improved mobility, and natural posture, since the foot is kept in its natural state. By mimicking the effects of natural yielding ground (“footprint in the sand”), the “System Birkenstock” leans on the benefits of this phenomenon, attempting to enable

walking as intended by nature. The inherent functionality of our products enables BIRKENSTOCK to serve a distinct purpose for consumers.

As illustrated below, the Original BIRKENSTOCK footbed is comprised of several distinctive components:

Quality

We believe how things are made matters as much as the product itself. We build BIRKENSTOCK products to be long-lasting, durable and repairable, a distinctive approach in the market today. We never compromise on material quality; for example, our uppers are made of leathers of the highest quality (i.e., 2.8-3.0 mm thick leather). Our materials and components are primarily sourced from suppliers in Europe and processed under the highest environmental and social standards in the industry by operating state-of-the-art scientific laboratories for materials testing. Furthermore, by vertically integrating our manufacturing operations in the EU — one of the safest and most regulated manufacturing environments in the world — we maintain a high degree of control over the quality and craftsmanship of our products, ensuring a consistent consumer experience.

Consumers recognize BIRKENSTOCK for its superior product quality. According to the Consumer Survey, we outperform our peers — on a statistically significant level — on measures of material quality, construction and craftsmanship, as well as durability. As a result, the loyalty of BIRKENSTOCK consumers is unparalleled, with some consumers keeping pairs for multiple decades through careful maintenance and repair.

Tradition

Honoring our heritage represents the cornerstone of our culture. We feel a profound responsibility to protect and live up to our treasured tradition — built over the last two and a half centuries — of crafting functional, high-quality products. This deep respect for our history continuously guides our actions, compelling us to emphasize our values across all aspects of our business.

While our family tradition of shoemaking can be traced back to 1774, the evolution of our brand gained momentum in the early 20th century with our development of the footbed in 1902. We invented the word “Fussbett,” or “footbed,” and this discovery laid the groundwork for what became the “System Birkenstock,” a doctrine and practice of orthopedic principles, built around “Naturgewolltes Gehen,” that still guides us today. The footbed remains the guiding principle for everything we do and the platform we use to explore new product categories. It reminds us to develop products that make our consumers’ lives better, embedding function, quality and purpose in everything we make. The philosophy of the “System Birkenstock” grounds our approach to shoemaking to this day.

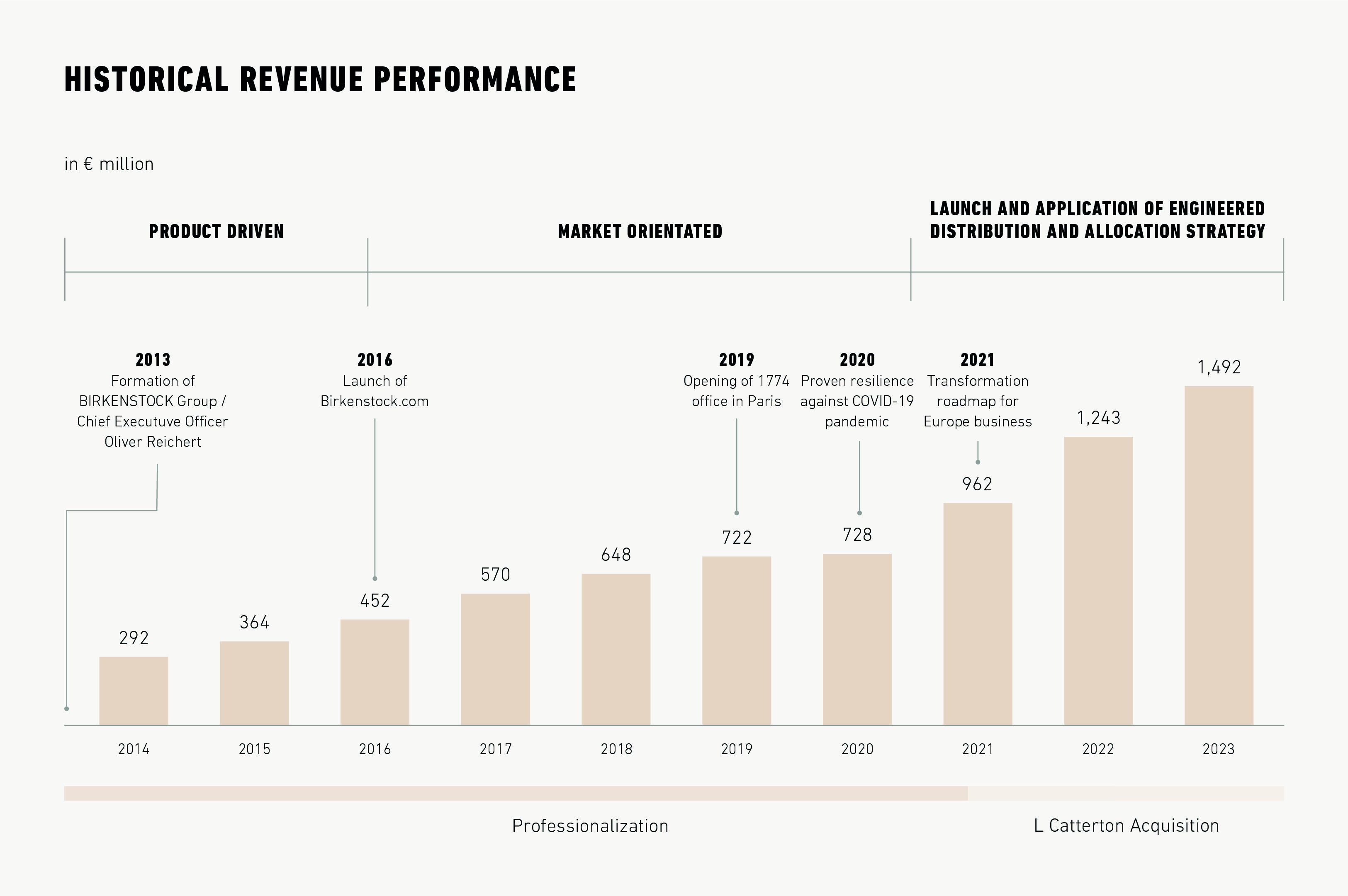

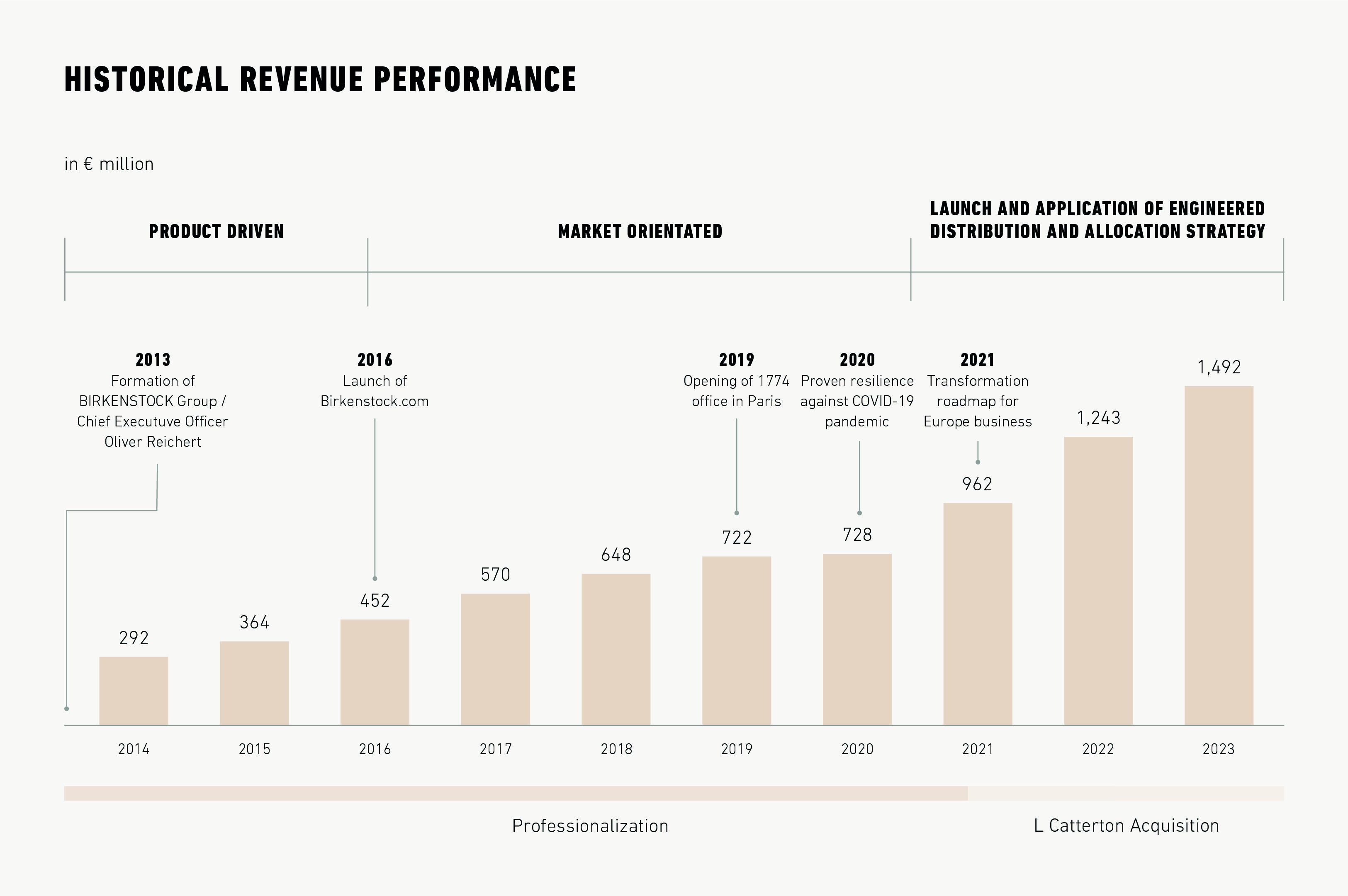

Where We Are Today

Over a decade ago, the Birkenstock family brought in its first outside management team, commencing the present era of BIRKENSTOCK. Under the leadership and vision of Oliver Reichert, first as a General Manager in 2009 and then as the Chief Executive Officer beginning in 2013, we have transformed our business from a family-owned, production-oriented company into a global, professionally managed enterprise committed to growing our brand. In the current era, we have built on our legacy while continuing to revolutionize processes and strategies to unleash our global potential, growing revenues at a 20% CAGR from fiscal 2014 to fiscal 2023.

Note: See “Presentation of Financial and Other Information — Financial Statements.”

We use a highly intentional “celebrate the archive, build the archive” approach to product architecture and innovation across our expanding portfolio of over 700 silhouettes. We incorporate our legendary footbed across all silhouettes, several of which have developed significant global recognition and acclaim of their own. Our top five silhouettes collectively generated over 75% of our annual revenues in fiscal 2023. We continually reinterpret or “celebrate” these timeless, iconic silhouettes through makeovers and adaptations, enabling us to drive consistent, recurring growth with minimal risk. Alongside our classics, we have built our extensive archive by innovating new silhouettes; nine of the top 20 products in fiscal 2023 represent new styles that we have introduced since fiscal 2017. In particular, we have focused on expanding our closed-toe silhouette assortment — which represented over 25% of revenues in fiscal 2023 — to enable us to address additional usage occasions as well as balance seasonality.

Our commitment to creating functional, purpose-driven products with the highest integrity has enabled us to build a strong brand reputation with universal appeal. In addition, powerful secular trends — an increased focus on health, the casualization of daily life, the breakthrough of modern feminism and the rise of purpose-led, conscious consumption — have converged around BIRKENSTOCK and will continue to fuel our brand relevance and reach for the next 250 years. We strive to match our universal appeal with democratic access to products; we offer our adults unisex products across a broad range of prices, from a retail entry price point of €45 for our EVA styles to over €1,600 for our highest-end collaborations.

The deep connections we build with our diverse, global fan base engender profound trust, high levels of loyalty and unparalleled word-of-mouth endorsement. In a recent Consumer Survey, approximately 70% of our existing U.S. consumers indicated they had purchased at least two pairs of BIRKENSTOCKs, with the average U.S. consumer owning 3.6 pairs. In that same Consumer Survey, nearly 90% of recent purchasers indicated a desire to purchase again and over 40% of consumers indicated they did not even consider another brand when last purchasing BIRKENSTOCK, a testament to our category ownership.

Given the increasing relevance and strength of our brand, demand for our products has historically exceeded supply. As a consequence, we have spent the past decade refining our engineered distribution model through which we mindfully and strategically allocate product across channels and regions. We have consolidated control over our brand globally by converting distributor markets, rationalizing wholesale distribution to focus on strategic accounts that support our brand positioning and reach, and investing in our DTC business, which has grown at a 40% CAGR between 2018 and 2023. We allocate our finite production capacity globally, creating scarcity in the market and facilitating strong control over our brand, as well as predictable, consistent growth. We stick to this strategy with great discipline, even when expanding production capacity. Our strongest, most developed regions are the Americas and Europe, which represented 54% and 35% of revenues in fiscal 2023, respectively. Our APMA region has demonstrated considerable growth potential, which historically has not been fully realized because of deliberate decisions to prioritize the Americas and Europe due to finite supply. The expansion of our production capacity provides us with the bandwidth necessary to serve our customers and meet the demand for our products in underpenetrated markets and categories.

Recent Financial Performance

Our powerful business model and consistent execution have delivered continuous top-line growth and an expanding margin profile. Our financial performance reflects the strong demand for our brand and the benefits of our engineered distribution model that delivers the right product for the right channel at the right price point. This approach enables us to enjoy a rare combination of consistent, predictable growth and high levels of profitability, providing us with significant flexibility to invest in our operations and growth initiatives.

This strategy has resulted in:

•Revenues increasing from €962.0 million in fiscal 2021 to €1,491.9 million in fiscal 2023, a 25% two-year CAGR;

•Number of units sold increasing at a 4% two-year CAGR between fiscal 2021 and fiscal 2023;

•ASP increasing at a 19% two-year CAGR between fiscal 2021 and fiscal 2023;

•DTC penetration increasing from 34.0% of revenues in fiscal 2021 to 40.0% of revenues in fiscal 2023;

•Gross profit margin expanding from 45.4% in fiscal 2021 to 62.1% in fiscal 2023;

•Adjusted gross profit margin expanding from 57.0% in fiscal 2021 to 62.1% in fiscal 2023;

•Net profit decreasing from €81.8 million in fiscal 2021 to €75.0 million in fiscal 2023, with net profit margin contracting by 4.0 percentage points from 9.0% in fiscal 2021 to 5.0% in fiscal 2023;

•Adjusted net profit increasing at a 15.1% two-year CAGR from €156.5 million in fiscal 2021 to €207.2 million in fiscal 2023, with Adjusted net profit margin contracting by 2.1 percentage points from 16.0% in fiscal 2021 to 13.9% in fiscal 2023; and

•Adjusted EBITDA growing at a 28.5% two-year CAGR from €292.3 million in fiscal 2021 to €482.7 million in fiscal 2023, with Adjusted EBITDA margin expanding 2.4 percentage points from 30.0% in fiscal 2021 to 32.4% in fiscal 2023.

This strategy has also yielded strong results in the most recent six months ended March 31, 2024, where we have observed:

•Revenues increasing from €644.2 million for the six months ended March 31, 2023 to €784.2 million for the six months ended March 31, 2024, a 22% increase;

•DTC penetration increasing from 34.1% of revenues for the six months ended March 31, 2023 to 35.5% of revenues for the six months ended March 31, 2024;

•Gross profit margin contracting from 60.4% for the six months ended March 31, 2023 to 58.2% for the six months ended March 31, 2024;

•Net profit increasing from €40.2 million for the six months ended March 31, 2023 to €64.5 million for the six months ended March 31, 2024 with net profit margin expanding by 2.0 percentage points from 6.2% for the six months ended March 31, 2023 to 8.2% for the six months ended March 31, 2024;

•Adjusted net profit decreasing by 7.7% from €101.6 million for the six months ended March 31, 2023 to €93.7 million for the six months ended March 31, 2024, with Adjusted net profit margin contracting by 3.8 percentage points from 15.8% for the six months ended March 31, 2023 to 12.0% for the six months ended March 31, 2024; and

•Adjusted EBITDA increasing by 8.6% from €224.4 million in the six months ended March 31, 2023 to €243.7 million for the six months ended March 31, 2024, with Adjusted EBITDA margin contracting by 3.7 percentage points from 34.8% for the six months ended March 31, 2023 to 31.1% for the six months ended March 31, 2024.

Note: See “Presentation of Financial and Other Information — Financial Statements.” Adjusted Gross Profit and Adjusted EBITDA are non-IFRS measures. For reconciliations to the most directly comparable IFRS measure, see “Summary Consolidated Financial Information—Non-IFRS Financial Measures."

Our Addressable Market

Inspired by “Naturgewolltes Gehen,” we construct our products to empower all humans to walk as nature intended. We believe this function-first ethos limits the reach of our products only by the global population.

Our core opportunity lies in deploying our iconic footbed across the broader footwear market globally, including in our largest markets of North America and Europe, as well as newer markets in Asia and the Middle East. Beyond geographical expansion, significant market share opportunity exists in our established and new product categories.

Global Footwear Market

The global footwear industry is a large and fragmented market. We believe there is ample whitespace to continue growing the BIRKENSTOCK brand. We expect to capture market share globally, particularly in Asia Pacific, where we are meaningfully underpenetrated.

We believe we are uniquely positioned to win share in the large and growing global footwear market given our commitment to delivering superior orthopedic functionality in support of the following key enduring consumer megatrends:

Growing Preference for Healthy Products

Consumers prioritize purchases that benefit their overall health as they become aware of the negative effects of wearing unsupportive footwear. Our footbed-based products meet inherent consumer demand through their functionality and encouragement of the natural walking motion and proper foot health.

Casualization Across Usage Occasions

Over the last generation, the use of formal footwear has declined as a result of the ongoing shift towards casual dress and rise of sneaker culture, both trends accelerated by COVID-19. We find ourselves at a nexus of these changing consumer behaviors as consumers increasingly free themselves from long-standing fashion norms, seeking more functional footwear and apparel choices across usage occasions. This enduring trend also coincides with the shift towards healthy products as consumers seek alternatives to traditional work and other non-casual footwear options that do not promote or negatively impact foot health.

Breakthrough of Modern Feminism

The ongoing evolution and expansion of the role of women in society continues to drive meaningful shifts in their preferences in footwear and apparel. While trends in fashion come and go, we believe women’s increasing preference for functional apparel and footwear has and will prove secular in nature. As a brand that has long stood for functionality, we believe this ongoing tailwind will continue to drive relevance and growth for the BIRKENSTOCK brand.

Appreciation and Affinity for Heritage and Craftsmanship

We believe consumers increasingly value brands that have rich traditions, have clarity in their purpose and take significant responsibility for their operations. We have observed these trends across various consumer industries, including luxury leather goods and ready-to-wear clothing, watches and personal care products, among others. We believe BIRKENSTOCK’s functional, purpose-led brand, uncompromising commitment to quality and centuries-old crafting traditions align well with the ongoing shift towards brands with authentic heritages and craftsmanship.

Our Competitive Strengths

We believe the following strengths are central to the power of our brand and business model:

Purpose Brand Built Around our Legendary Footbed and Products

An Orthopedic Tradition

The heart of our brand is the footbed, which forms the core of our own orthopedic methodology, the “System Birkenstock.” The benefits of our system are supported by decades of research, podiatrist recommendations and consumer loyalty. Our purpose to empower all people to walk as intended by nature has created an enduring connection with our consumers, who recognize us for functionality, craftsmanship, German engineering,

uncompromising quality and a differentiated product experience. This authentic connection with our consumers positions BIRKENSTOCK at the center of a shift toward conscious, responsible and health-oriented consumption instead of “fast fashion” or trend-chasing.

Much of our success can be traced back to our long history of product innovations, including the contoured shoe last, footbed and footbed sandal. We outline our groundbreaking innovations below:

Category-Defining, Universally Relevant Silhouettes

While these innovations started orthopedically in nature, we have since launched several distinctive, instantly recognizable silhouettes that blend the functionality of our legendary footbed with timeless aesthetics. Many of these silhouettes — including our Core Silhouettes, the Madrid, Arizona, Boston, Gizeh and Mayari — have come to define and become synonymous with their respective categories, resulting in a distinct competitive advantage for our brand. All but one — the Mayari — have been in the market for over 40 years and continue to attract significant attention today. From the beginning, these silhouettes have been conceptualized, promoted and sold as unisex products, further supporting our fundamental purpose and driving mass appeal of the brand. These top selling models undergo regular seasonal makeovers and serve as the “canvas” for many of our collaborations created within our 1774 premium line, generating newness while allowing us to celebrate this core collection. Our Core Silhouettes have demonstrated consistent, recurring double-digit growth.

Proven Innovation Strategy

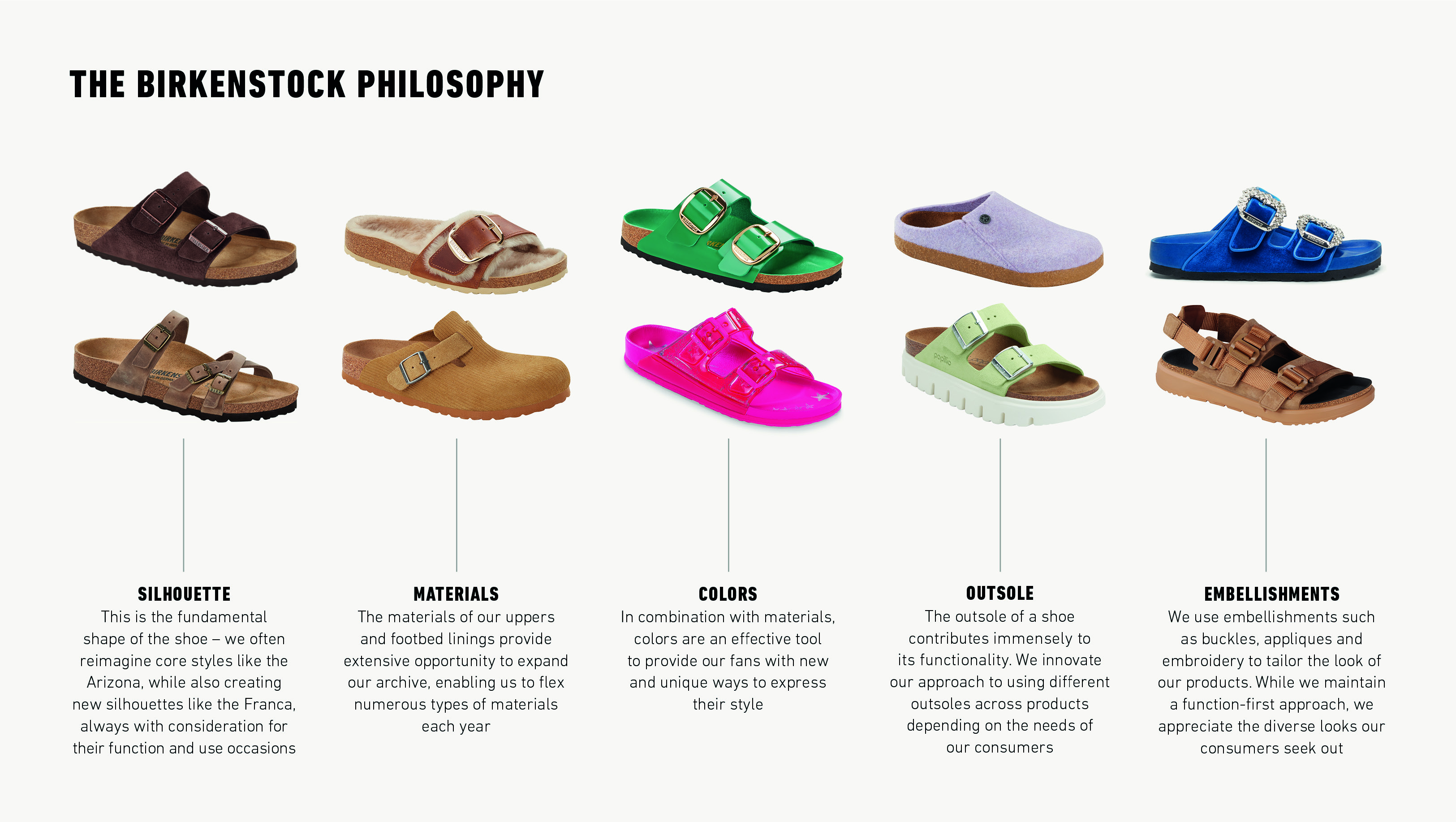

We have developed an extensive archive of over 700 silhouettes through our differentiated innovation engine. We approach product innovation through two primary lenses: (1) “celebrating the archive” by utilizing distinct design elements to modify existing silhouettes and introduce newness in a low-risk manner and (2) “building the archive” by leveraging our footbed as the development platform, enabling us to create new products from the “inside-out.”

Our approach leverages our product archive, market insights and whitespace analysis to identify areas where we can create trends from within and export those to the market through a proven roadmap of product development, demand creation and engineered distribution.

Celebrate the Archive

We routinely update our Core Silhouettes and other existing silhouettes by adjusting parameters such as color, materials and other details (e.g., buckles) to create newness and strategically extend their reach. For example, we have expanded the Arizona silhouette across price points and usage occasions, adding a water-friendly variant utilizing EVA, while also broadening the Arizona’s appeal through collaborations. This approach continuously infuses the brand with newness while undertaking minimal risk. As a result, revenues from the Arizona silhouette have grown at a CAGR of over 20% between fiscal 2018 and 2023.

Build the Archive

We also consistently build our archive by introducing new silhouettes developed around our celebrated footbed. Given the functional nature of our products and the loyalty BIRKENSTOCK consumers have for their footbeds, we have successfully expanded our assortment across new silhouettes and product categories. The success of this approach can be seen in the popularity of our recent launches; new silhouettes introduced since fiscal 2017 represented nine of the top 20 selling products in fiscal 2023. Furthermore, we have focused on the significant opportunity in closed-toe silhouettes, which have grown to over 25% of revenues in fiscal 2023, supported beyond our classic Boston by silhouettes such as the Zermatt, Buckley and Bend. This approach has enabled us to expand our brand reach across seasons and usage occasions, as well as drive growth through higher ASPs. Launched in 2020, the Bend sneaker exemplifies the success of our approach to building the archive in new, strategically important categories, with Bend revenues growing over one-third between fiscal 2022 and 2023.

Go-Forward Product Strategy

Looking ahead, we will continue to grow our Core Silhouette collections through low-risk newness while also deploying our footbed across more product categories and usage occasions. Specifically, we expect to refine existing silhouettes and create new silhouettes that incorporate new materials and production techniques, such as PU direct injection, to specifically address identified consumer needs and broaden our product range across usage occasions. For example, our PU technology will enable extensive innovation in outsoles, allowing us to create products tailored for active and outdoor and professional usage occasions. To further strengthen our innovation capabilities and extend our functional leadership, we formed a dedicated biomechanics team and created a laboratory for new technical and materials innovations in 2018.

Global Fan Community Enabling Efficient Demand Creation

Broad and Democratic Fan Base

We serve a global community of millions of highly engaged consumers, who we attract with our function-first collection of high-quality footwear. Our fans, many of whom have been with us for decades, are enthusiastic, loyal, quality seekers across all aspects of society, including doctors, chefs, adventurers, professional athletes and models on the runways of Paris Fashion Week. We attract a diverse range of consumers that transcends geography, gender, age and income.

Source: Consumer Survey; geographical split based on share of fiscal 2022 revenues

Our holistic approach to foot health serves as the foundation for a globally accessible, relevant and democratized brand experience that serves a broad consumer base across usage occasions and price points. We have demonstrated success across a broad price range, from our EVA styles, which have a RSP starting at €45, to our 1774 collection styles and collaborations, which have a RSP of upwards of €1,600.

Unparalleled Consumer Engagement and Loyalty

Our diverse set of consumers discover our brand in many ways, sometimes not immediately for the inherent orthopedic benefits, but become loyal fans through their continued use of our products. According to the Consumer

Survey, the average BIRKENSTOCK consumer in the U.S. owns 3.6 pairs of our product today, reflecting the enthusiasm with which consumers engage with our brand. In addition, 86% of recent BIRKENSTOCK purchasers indicated a desire to purchase again. Anecdotally, “Birkenstories” of obsessive fan loyalty are plentiful, with grandparents passing on the tradition of BIRKENSTOCK to future generations and others building collections of BIRKENSTOCKs over time.

Efficient Demand Creation

The deep connection consumers feel with our beloved brand leads to significant word-of-mouth exposure and extensive, high-quality earned media, enabling highly efficient marketing spend. According to the Consumer Survey, nearly 90% of BIRKENSTOCK buyers come to us through unpaid channels, with the top three sources of awareness being: (1) heard about it from a friend, (2) saw someone wearing it and (3) growing up with it. Our consumers’ love for BIRKENSTOCK and their strong desire to organically promote the brand are further demonstrated by our NPS of 55%.

Furthermore, we amplify BIRKENSTOCK in the cultural zeitgeist through calculated demand creation strategies, including through creative content developed by our content house as well as through strategic product collaborations led by our 1774 office in Paris. Our unique brand, iconic footbed and instantly recognizable aesthetics have generated significant unsolicited attention from well-known brands seeking to collaborate with us. This has enabled us to partner with diverse brands such as Rick Owens, Stüssy, DIOR and Manolo Blahnik to create products that activate specific consumer groups and markets for BIRKENSTOCK. We benefit from the unpaid advocacy and support that is the natural byproduct of celebrities, public figures and other influential fans who are frequently seen wearing our products.

Engineered Distribution Approach

Complementary Multi-Channel Strategy

We optimize growth and profitability through a complementary, multi-channel distribution strategy for DTC and B2B. We operate our channels synergistically, utilizing the B2B channel to facilitate brand accessibility while fully engaging consumers in our DTC channel, which offers our complete product range and access to our most desired and unique silhouettes. Across both channels, we execute a strategic allocation and product segmentation process, often down to the single door level, to ensure we sell the right product in the right channel at the right price point. This approach employs key levers such as the expansion of our DTC channel, market conversions from third-party distributors, optimization of our wholesale partner network, increased overall share of premium products and strategic pricing. This process allows us to manage the finite nature of our production capacity, with a rigorous focus on control of our brand image and on profitability. As a result, we drive top-line growth and protect margins, prevent brand dilution and deepen our connection to consumers.

We pioneered this engineered distribution model in our U.S. market, ultimately helping drive a 31% revenue CAGR in the U.S. between fiscal 2014 and fiscal 2023. This transformative approach now serves as a blueprint for all our regions, where we have strategically converted from third-party distributors to owned distribution, accelerated DTC penetration, strategically expanded our retail footprint and increased our share of closed-toe and other high ASP products. Building on our success in the U.S., we have taken back distribution in key markets, including the UK, France, Canada, Japan and South Korea, reducing the share of business in third-party distribution from 32% of revenues in fiscal 2018 to 13% in fiscal 2023. Our strongest, most developed regions are the Americas, which accounted for 54% of revenues in fiscal 2023, and Europe, which accounted for 35% of revenues, while APMA represented 10% of revenues.

Balanced Shift Towards DTC

Our DTC footprint promotes direct consumer relationships and provides access to BIRKENSTOCK in its purest form. We have grown DTC revenues at a 40% CAGR between 2018 and 2023 as part of our strategy to increase DTC penetration. Our DTC channel enables us to express our brand identity, engage directly with our global fan base,

capture real-time data on customer behavior and provide consumers with unique product access to our most distinctive styles. Additionally, our increasing levels of organic demand creation, together with higher ASPs, support an attractive profitability outlook in the DTC channel, which reached a 40% share of revenues in fiscal 2023, up from 18% in fiscal 2018.

Since 2016, we have invested significantly in our online platform to support the penetration of our DTC channel, establishing our own e-commerce sites in more than 30 countries with ongoing expansion into new markets. In addition, as of March 31, 2024, we operated a network of approximately 57 owned retail stores, complementing our e-commerce channel with the live experience of our best product range. The largest concentration of our retail locations is in Germany, where we operated 21 locations. We have recently embarked on a disciplined strategy of opening new retail stores and store formats to grow our brand awareness and give consumers a 360 degree brand experience. Our latest openings are Miami, Soho and Brooklyn in New York City, Venice Beach in Los Angeles, London, Cologne, Tokyo, Singapore, Mumbai and Delhi.

Intentional Wholesale Partnerships

Our wholesale strategy is defined by intentionality in partner selection, identifying the best partners in each segment and price point. We segment our wholesale product line availability into specific retailer quality tiers, ensuring we allocate the right product to the right channel for the right consumer. For example, we limit access to our premium 1774 and certain collaboration products to a curated group of brand partners.

For our wholesale partners, we are a “must carry” brand based on the enthusiasm with which our consumers pursue our products. We believe that the BIRKENSTOCK brand is consistently amongst the top performers in sell-through in our core categories at most of our retail partners. We generate significantly more demand from existing and prospective wholesale customers than we can supply, putting us in an enviable position where we can create scarcity in the market and obtain consistently favorable economic terms on wholesale distribution. The early placement of wholesale orders approximately six months in advance greatly aids in our production planning and allocation. In addition, sell-through transparency from important wholesalers provides real-time insight into the overall market and inventory dynamics.

During fiscal 2023, we worked with approximately 6,000 carefully selected wholesale partners in over 85 countries, ranging from orthopedic specialists to major department stores, to high-end fashion boutiques. As of March 31, 2024, our strategic partners also operated approximately 260 mono-brand stores to provide our consumers a multi-channel experience in select markets.

Vertically Integrated Manufacturing

A key differentiator of BIRKENSTOCK is our vertically integrated manufacturing which creates strong competitive and operational advantages in an industry that has largely been offshoring production since the 1980s. During fiscal 2023, we assembled the vast majority of our overall products and produced 100% of our footbeds in our factories in Germany, with supplemental component manufacturing in Portugal. These facilities are critical to delivering the high-quality products our brand promises and our consumers expect. With nearly every silhouette requiring over 50 hands to complete, our skilled workers ensure we complete production in rigorous accordance with centuries-old know-how and craftsmanship. Inside our factories, most of our machines and automation are custom-made and cannot be found anywhere else in the world. For example, if no standard equipment is available on the market to fulfill these goals, we design and build our own proprietary machines with hand-picked suppliers.

Our approach to owned manufacturing ensures we produce our products to the highest quality standards, that we remain deliberate in the environmental resources we use and that we invest appropriately in innovation to support the brand’s continued growth. Our consumers can take comfort in that we engineer and produce 100% of our footwear in the EU, one of the safest and most regulated markets in the world. Furthermore, we source most of our raw materials from across Europe in compliance with strict quality, social and environmental standards based on industry best practices. We believe this vertical integration creates a unique degree of strategic control, further

supported by robust contingency measures and the benefits of sourcing redundancy and diversity across multi-supplier relationships to ensure continuity of operations and flow of product.

We have recently expanded, and continue to expand, our owned manufacturing footprint globally. Our newest factory in Pasewalk, Germany began operations in September 2023, expanding our popular EVA and PU product capacity while freeing up incremental capacity for cork latex products in our other factories to further meet the strong demand for our brand. We are currently expanding our component manufacturing facility in Arouca, Portugal as well as our manufacturing facility in Görlitz, Germany. Between October 1, 2021 and the end of fiscal 2024, we will have spent approximately €180 million in expanding our production capacity. We expect to double our production capacity versus fiscal 2022 over the next several years as the result of our investments, including expected capital expenditures of approximately €100 million for fiscal 2024. We expect capital expenditures will continue to decline in absolute terms over the next several years. We remain committed to our policy that all footbed production and engineering take place in Germany and that all final assembly occurs in the EU to ensure the highest quality products are manufactured according to centuries-long tradition.

Passionate and Proven Management Team

Our brand’s ethos is rooted in an enduring commitment to the highest standards of corporate citizenship that encompasses a dedication to our employees and to the highest quality and broad support of innovation and creativity. Our leadership team remains committed to supporting a centuries-old legacy of aligning our corporate ethos to actions that support positive social, economic and environmental outcomes for both the localities in which we operate and our global community.

We benefit from the industry expertise and know-how of our passionate, experienced, visionary and proven senior management team led by Oliver Reichert, our Chief Executive Officer; Dr. Erik Massmann, our Chief Financial Officer; Markus Baum, our Chief Product Officer; Klaus Baumann, our Chief Sales Officer; David Kahan, our President Americas; Mehdi Nico Bouyakhf, our President Europe; Jochen Gutzy, our Chief Communications Officer; Christian Heesch, our Chief Legal Officer; and Mark Jensen, our Chief Technical Operations Officer who together have an average of more than 20 years of industry experience. The executive leadership team is executing on a bold vision

to continue to unlock the power and significance of BIRKENSTOCK, which, through fiscal 2023, has grown revenues at a 20% CAGR since fiscal 2014, after Oliver Reichert took over as Chief Executive Officer. This has been accomplished while significantly expanding profitability through greater control over our brand, increased DTC share and operational efficiencies.

For a description of the challenges we face and the limitations of our business and operations, see “—Risk Factors Summary” and “Risk Factors.”

Our Growth Strategies

We believe we have only just begun to unlock the power of our profound transformation and realize the full global potential of BIRKENSTOCK. We estimate our share of the massive €340 billion global footwear industry to be less than one percent, presenting substantial opportunity for further growth. We believe we are well-positioned to significantly expand our market share and drive sustainable growth and profitability through the following pillars, each of which represents a continuation of the proven strategies we have been executing over the past decade.

Expand and Enhance the Product Portfolio

We will continue to expand our product archive through our “celebrate and build” approach to innovation, entering into new usage occasions while investing in categories we serve today through new and innovative offerings. We intend to diversify our product portfolio, strengthen loyalty with consumers who already love BIRKENSTOCK, drive higher penetration in our existing markets and channels and expand our reach and appeal across new consumers, geographies and usage occasions. Through the broad application of the BIRKENSTOCK footbed, we intend to develop our product offering through the following strategies:

•Drive the Core Through “Inside-out” Innovation: We will continue to incorporate our legendary footbed as the central functional element in our proven product formula as we celebrate and build our archive. We will renew existing silhouettes and introduce new ones by strategically using aesthetics, construction, design and materials updates that flex elements across uppers, outer soles, buckle details and other embellishments to deliver innovative functionality and renewed purpose. In doing so, we will continue to broaden and deepen our product assortment across price bands, building on the success of our opening price point EVA line as well as collaborations through our 1774 line. “Inside-out” innovation drives growth across our product portfolio:

•Strengthen Year-Round Product Mix with Closed-Toe Offerings: We will continue to diversify into closed-toe silhouettes (clogs and shoes), enabling the brand to serve different usage occasions for consumers, balance seasonality and drive growth and profitability through higher ASPs. We have made substantial progress in this strategic effort, as demonstrated by expansion in the share of closed-toe products, which accounted for over 25% of total revenues in fiscal 2023.

•Develop Presence in Underpenetrated Categories: We intend to drive business by staying true to our orthopedic heritage and creating highly functional products across a variety of usage occasions, including professional, active and outdoor, kids, home and orthopedic. We have already achieved promising success with our recent offerings in these expansionary categories, such as our outdoor products where we have created new silhouettes by using PU direct injection technology to develop water-friendly and high-grip outsoles. Additionally, our use of EVA similarly expands our portfolio by creating products suitable for use in and around water. These developments broaden our potential product range across usage occasions by creating highly functional, water ready, anti-slip outsoles and more rugged constructions. This approach continues to support a strong pipeline of new products that is expected to accelerate growth:

•Leverage our Brand in Function-led, Non-Footwear Categories: We will leverage our functional expertise, brand equity and trust from our consumers to extend the BIRKENSTOCK brand into non-footwear categories. We are launching a new, highly functional prestige shoe care and footcare line made in Germany exclusively from materials of natural origin and rooted in our deep heritage in foot health. We have also extended our brand’s heritage in health into the sleep category, introducing a range of BIRKENSTOCK sleep systems that leverage our core expertise in orthopedic research and functional product design.

Drive Engineered Distribution on a Global Scale

We will continue to leverage our engineered distribution approach to strategically allocate our production capacity across channels, regions and categories in a manner that supports our continued success. Specifically, we aim to drive growth across regions by continuing to operate our proven playbook in the U.S. and Europe, where we have significantly grown our DTC channel while optimizing our B2B presence with wholesale partners who support our brand positioning.

Our DTC channel has expanded from 18% of revenues in fiscal 2018 to 40% of revenues in fiscal 2023. We expect that future DTC growth will be fueled by both e-commerce and retail. In e-commerce, our growth will be supported by new online store openings and new customer attraction, and fueled by increased member growth. In retail, we plan to pursue disciplined, strategic additions to our retail footprint given our relatively limited presence today of approximately 57 owned stores, 21 of which are in Germany. We expect DTC penetration will increase slightly in the coming years as we balance DTC growth with continued expansion with new and existing strategic wholesale partners globally.

We have extensive whitespace to grow within and outside of our largest geographies, the U.S. and Europe. We believe there are still sizable growth opportunities in key developed markets where the brand has a presence but remains significantly underpenetrated, including the UK, France, Southern Europe and Canada.

As we ramp up our production capacity, we will unlock the large growth potential of the APMA region, which has generated significant latent demand that we have been unable to fulfill in recent years given more limited supply. Our targeted growth strategies will build upon our growing popularity in the region’s emerging markets, including China and India, where our brand is nascent, and in countries such as South Korea, Australia and New Zealand, where we have a more established presence and brand awareness.

Educate Fans on Our Brand Purpose and Grow the BIRKENSTOCK Fan Base

We will continue to educate consumers globally about the advantages of BIRKENSTOCK products. We believe consumers become evangelists for our brand when they experience the merits of our superior functional design. The function of our products and the power of our brand has enabled us to build our Company largely through organic, unpaid sources, including word-of-mouth, repeat buying, earned media, high profile influencer support and our 1774 collaborations office. These organic factors support a virtuous cycle of consumer consideration, trial, conversion, repeat purchase and recommendation. Our recently established BIRKENSTOCK content house was created to produce powerful stories of BIRKENSTOCK’s craftsmanship, fan love and other core values across various social media platforms, providing powerful organic vehicles to engage with and attract new fans. We will further engage with our loyal fanbase through new formats in community activations and retail, strengthening our fan engagement through the introduction of temporary and ambassador led retail concepts, focusing on a small footprint of stores operated in partnership with local entrepreneurs who will serve as brand ambassadors by virtue of their professions, pursuits or social media presences. Additionally, our newly launched BIRKENSTOCK membership program, which offers exclusive access to products and other unique benefits, will serve as a principal tool for driving increased engagement with new and existing consumers in the future.

While our brand has achieved substantial traction globally and those who have experienced our products demonstrate strong loyalty, our presence remains relatively nascent in many of our markets. Our brand awareness outside of Germany and the United States remains well below that of our most established markets and of other leading footwear brands, providing us with a clear runway for growth. According to the Consumer Survey, aided brand awareness, which we define as consumer awareness about the brand when specifically asked about the brand, in the United States is 68%. We believe increasing consumer awareness of our brand, the functional benefits of our products and our constantly evolving product offering will generate substantial growth as we introduce new consumers to our brand and convert those who are aware of the brand into consumers.

Invest in and Optimize the Company to Support the Next Generation of Growth

We will continue to invest in our people and our manufacturing and supply chain to support future growth. We will also seek operational improvements to drive efficiencies and increase the speed and flexibility of our operations.

•Optimize and Expand our Production Capacity: We will further optimize our current production footprint by introducing automation where appropriate, while also strategically expanding capacity by investing in new

facilities. We are currently making investments that will increase our capacity and extend our capabilities, as evidenced by our new facility in Pasewalk, Germany, which began operations in September 2023.

•Expand our Owned and Third-Party Logistics Infrastructure: We will strengthen our owned and operated fulfillment centers while adding significant through-put via third-party partners. We will continue to invest in expanding our outbound capacity by adding incremental logistics capabilities in the U.S. and other key markets. This will also allow us to optimize our current logistics infrastructure to better service our growing business, while lowering operational costs.

•Drive Operational Efficiencies: We have invested ahead of our growth in all areas of the business, including product creation and manufacturing, multi-channel distribution and corporate infrastructure. As we continue our growth trajectory, we plan to leverage these investments, realize economies of scale and optimize efficiency in our business.

Recent Developments

On May 28, 2024, Birkenstock Limited Partner S.à r.l., as the company, Birkenstock Group B.V. & Co. KG and Birkenstock US BidCo Inc., as borrowers, and the other loan parties thereto entered into the Term and Revolving Facilities Agreement with Goldman Sachs Bank USA, as agent and security agent, and the lenders party thereto, which includes a Euro denominated term loan facility (the “New EUR Term Loan”) in an aggregate principal amount of €375.0 million and a USD denominated term loan facility in an aggregate principal amount equal to $280.0 million (the “New USD Term Loan” and together with the New EUR Term Loan, the “New Term Loans”). A euro denominated multicurrency revolving facility in an aggregate principal amount of €225.0 million was established alongside the New Term Loans under the Term and Revolving Facilities Agreement (the “Revolving Facility” and together with the New Term Loans, the “Term and Revolving Facilities”). The Term and Revolving Facilities have an original maturity of February 28, 2029 and the proceeds of the New Term Loans will be applied towards refinancing in full the term loans under the Senior Term Facilities Agreement. The Senior Term Facilities Agreement will be fully cancelled upon the refinancing thereof, which is expected to take place in the Company's fourth quarter ending September 30, 2024 (the date of such refinancing being, the “Refinancing Date”). The ABL Facility will also be cancelled on the Refinancing Date. The Revolving Facility may be drawn on and from the Refinancing Date and is available for utilization until January 26, 2029.

Corporate Structure

A simplified organizational chart showing certain legal entities within our corporate structure is set forth below (all subsidiaries are, directly or indirectly, 100% owned by Birkenstock Holding plc):

Corporate Information

Birkenstock Holding plc was formed on February 19, 2021 as BK LC Lux Finco 2 S.à r.l., a Luxembourg private limited liability company. On April 25, 2023, we changed our name from BK LC Lux Finco 2 S.à r.l. to Birkenstock Group Limited and converted (by way of re-domiciliation) the legal form of our Company to a Jersey private company. On July 12, 2023, we changed our name from Birkenstock Group Limited to Birkenstock Holding Limited. On October 4, 2023, we changed the legal status of our Company to a Jersey public limited company and our name from Birkenstock Holding Limited to Birkenstock Holding plc.