UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| |

☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2024

OR

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| |

☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from __________ to __________

Commission file number: 001-41836

Birkenstock Holding plc

(Exact name of Registrant as specified in its charter)

n/a

(Translation of Registrant's name into English)

Jersey

(Jurisdiction of incorporation or organization)

1-2 Berkeley Square

London W1J 6EA. United Kingdom

(Address of principal executive offices)

Dr. Johannes Liefke

Director Legal Affairs

1-2 Berkeley Square

London W1J 6EA. United Kingdom

Tel: +44 1534 835600

ir@birkenstock-holding.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Ordinary shares, no par value | BIRK | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act. None.

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None.

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. 187,829,202 ordinary shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Note—Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | |

Large Accelerated Filer | ☐ | | Accelerated Filer | ☐ | | Non-Accelerated Filer | ☒ |

| | | | | | Emerging growth company | ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Certain Definitions

Unless otherwise indicated or the context otherwise requires, all references in this Annual Report on Form 20-F (this “Annual Report”) to “BIRKENSTOCK Group,” “Birkenstock,” the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to Birkenstock Holding plc, together with all of its subsidiaries. References to the “selling shareholder” or “MidCo” are to BK LC Lux MidCo S.à r.l., a société à responsabilité limitée incorporated under the laws of the Grand Duchy of Luxembourg.

References to “Euro” or “€” means the currency of the member states of the European Monetary Union that have adopted or that adopt the single currency in accordance with the treaty establishing the European Community, as amended by the Treaty on European Union. All references to the “British Pound,” “GBP” or “£” are to the legal currency of the United Kingdom and Crown dependencies, including Jersey. All references to “U.S. Dollars,” “Dollars,” “USD” or “$” are to the legal currency of the United States. All references to “Canadian Dollars” or “CAD” are to the legal currency of Canada. All references to “Japanese Yen” or “JPY” are to the legal currency of Japan. In this Annual Report, unless otherwise noted, amounts that are converted from Euro to U.S. Dollars are converted at an exchange rate of $1.08 per €1 and $1.07 per €1, the exchange rate as of September 30, 2024 and for the fiscal year ended September 30, 2024, respectively.

The following is a summary of certain other defined terms and concepts that we use throughout this Annual Report:

•AB-Beteiligungs GmbH refers to AB-Beteiligungs GmbH, an entity controlled by Alexander Birkenstock, one of our controlling shareholders prior to the Transaction;

•ABL Facility refers to the multicurrency asset-based loan facility, which was established by the ABL Facility Agreement and canceled on August 2, 2024;

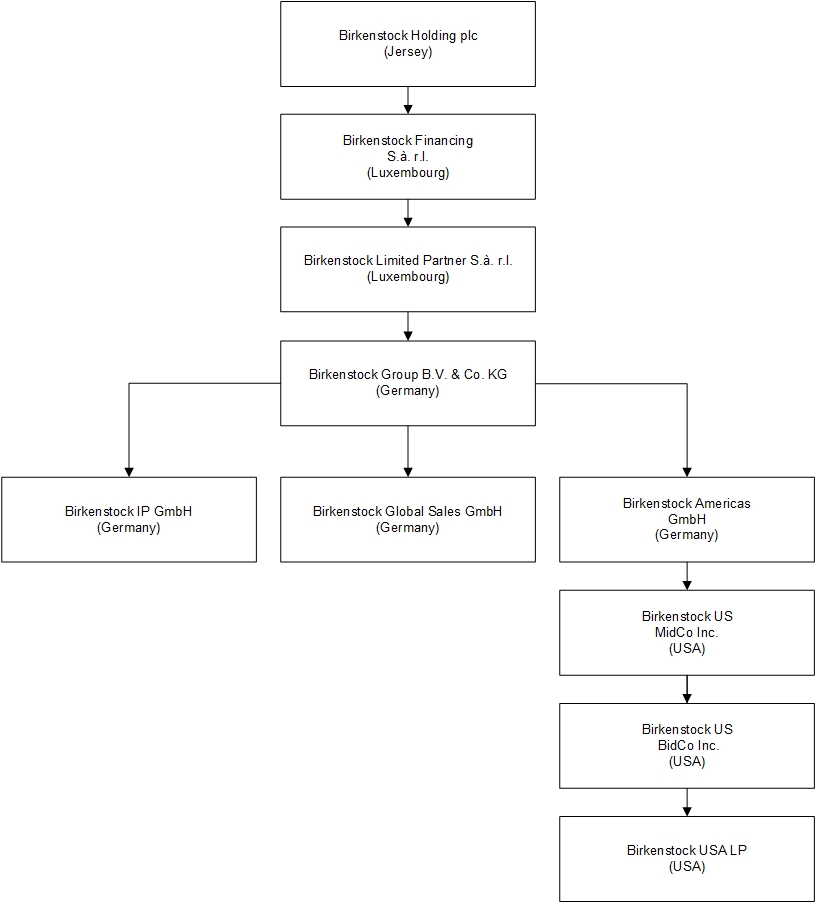

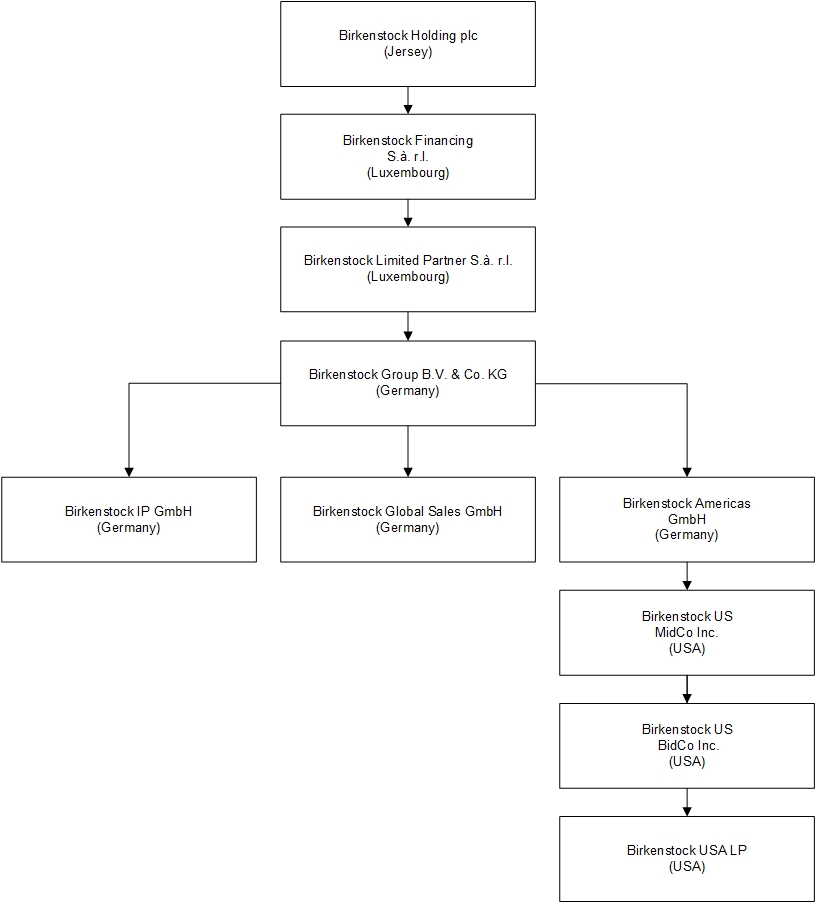

•ABL Facility Agreement refers to the asset-based-loan facility agreement entered into on April 28, 2021 by Birkenstock Group B.V. & Co. KG, Birkenstock US BidCo, Inc. and Birkenstock Limited Partner, as amended on May 2, 2023 and canceled in full on August 2, 2024;

•APAC refers to Asia-Pacific;

•APMA refers to Asia-Pacific, Middle East and Africa;

•ASP refers to average selling price. For fiscal 2024 onwards, ASP is calculated by dividing our total revenue from sales of footwear pairs by the number of footwear pairs sold. In previous periods, ASP was calculated by dividing our total revenue by our total number of units of all products sold. The difference between these two methods is immaterial;

•B2B refers to business-to-business;

•Birkenstock Financing refers to Birkenstock Financing S.à r.l.;

•Birkenstock Limited Partner refers to Birkenstock Limited Partner S.à r.l.;

•CB Beteiligungs GmbH & Co. KG refers to CB Beteiligungs GmbH & Co. KG, an entity controlled by Christian Birkenstock, one of our controlling shareholders prior to the Transaction;

•CGU refers to cash generating unit;

•DTC refers to direct-to-consumer;

•EEA refers to the European Economic Area;

•EMEA refers to Europe, Middle East and Africa;

•ESG refers to environmental, social and governance;

•EU refers to the European Union;

•EURIBOR refers to Euro Interbank Offered Rate;

•EVA refers to ethylene-vinyl acetate;

•Exchange Act refers to the Securities Exchange Act of 1934, as amended;

•GDPR refers to the EU General Data Protection Regulation;

•HMRC refers to HM Revenue & Customs;

•IFRS refers to the International Financial Reporting Standards as issued by the International Accounting Standards Board;

•IP refers to intellectual property;

•IPO refers to the Company’s initial public offering that closed on the IPO Date;

•IPO Date refers to October 13, 2023;

•IRS refers to the U.S. Internal Revenue Service;

•Jersey Companies Law refers to the Companies (Jersey) Law 1991, as amended;

•JFSC refers to the Jersey Financial Services Commission;

•L Catterton refers to a U.S.-headquartered and consumer-focused investment firm that acquired a majority stake in BIRKENSTOCK through affiliated entities in 2021;

•ManCo refers to BK LC ManCo GmbH & Co. KG, an indirect parent entity of the Company;

•MidCo refers to BK LC Lux MidCo S.à r.l., an entity affiliated with L Catterton;

•New EUR Term Loan refers to the Euro-denominated senior term loan facilities in the original aggregate principal amount of €375.0 million under the Term and Revolving Facilities Agreement;

•New Term Loan refers to the New EUR Term Loan and the New USD Term Loan, collectively;

•New USD Term Loan refers to the USD-denominated senior term loan facilities in the original aggregate principal amount of $280.0 million under the Term and Revolving Facilities Agreement;

•Notes or Senior Notes refers to the €430.0 million in aggregate principal amount of 5.25% Senior Notes due 2029 issued by Birkenstock Financing on April 29, 2021;

•Original EUR Term Loan refers to the Euro-denominated senior term loan facilities in the original aggregate principal amount of €375.0 million under the Senior Term Facilities Agreement, which were repaid in full on August 2, 2024;

•Original Term Loan refers to the Original EUR Term Loan and the Original USD Term Loan, collectively;

•Original USD Term Loan refers to the USD-denominated senior term loan facilities in the original aggregate principal amount of $850.0 million under the Senior Term Facilities Agreement, which were repaid in full on August 2, 2024;

•PFIC refers to a passive foreign investment company under the Code;

•Predecessor Shareholders refer to AB-Beteiligungs GmbH and CB Beteiligungs GmbH & Co. KG, collectively;

•Principal Shareholder refers to L Catterton and its affiliates, which include MidCo;

•Privacy Laws refers to laws relating to information security, and privacy/data protection, including but not limited to the General Data Protection Regulation (“GDPR”), the United Kingdom General Data Protection Regulation (“UK GDPR”), federal and state privacy laws of the United States, such as the California Consumer Privacy Act (“CCPA”) as amended by the California Privacy Rights Act (“CPRA”), federal and provincial privacy laws of Canada, such as the Personal Information Protection and Electronic Documents Act ("PIPEDA"), and other applicable data protection and privacy laws across various markets when taken together;

•PU refers to polyurethane;

•QEF Election refers to a qualified electing fund election;

•Registration Rights Agreement refers to the registration rights agreement entered into with MidCo on October 13, 2023;

•Revolving Credit Facility refers to the Euro-denominated multicurrency revolving credit facility in the aggregate principal amount of €225.0 million under the Term and Revolving Facilities Agreement;

•SCCs refer to standard contractual clauses approved by the European Commission;

•SDRT refers to UK stamp duty reserve tax.;

•SEC refers to the United States Securities and Exchange Commission;

•Securities Act refers to the Securities Act of 1933, as amended;

•Senior Term Facilities Agreement refers to the senior facilities agreement entered into by Birkenstock Limited Partner on April 28, 2021, as amended on April 28, 2023 and canceled in full on August 2, 2024;

•Shareholders’ Agreement refers to the shareholders’ agreement entered into with MidCo on October 13, 2023;

•SOFR refers to the Secured Overnight Financing Rate;

•Tax Law refers to the Income Tax (Jersey) Law 1961 (as amended);

•Term and Revolving Facilities Agreement refers to the term and revolving facilities agreement entered into by Birkenstock Limited Partner S.à r.l., as company, Birkenstock Group B.V. & Co. KG

and Birkenstock US BidCo Inc., as borrowers, the other loan parties thereto, Goldman Sachs Bank USA, as agent and security agent, and the lenders party thereto on May 28, 2024;

•The Code refers to the Internal Revenue Code of 1986;

•TRA or Tax Receivable Agreement refers to the tax receivable agreement entered into with MidCo on October 10, 2023;

•TRA Participants refers to our pre-IPO owner, MidCo, any transferee holder(s) of rights under the TRA and any successor(s) thereto;

•TRA Tax Attributes refers, collectively, to payments required to be made to the TRA Participants under the TRA equal to 85% of the savings, if any, in (a) U.S. federal, state or local income tax, and (b) German income tax and trade tax, in each case, that we actually realize (or are deemed to realize in certain circumstances, including as a result of certain assumptions) as a result of (i) certain U.S. tax attributes, principally including amortization and depreciation deductions (and the reduction of taxable gain attributable to tax basis in certain assets) and carryforwards of disallowed interest expense under Section 163(j) of the Code, and (ii) certain German tax attributes, principally including amortization deductions (and the reduction of taxable gain attributable to tax basis in certain assets), in the case of clause (i) and (ii), available to the Company and its subsidiaries on the IPO Date (calculated by assuming that the taxable year of the relevant member of the BIRKENSTOCK Group ended at the end of the IPO Date);

•Transaction refers to Birkenstock Holding plc’s acquisition of the shares and certain assets that comprised the BIRKENSTOCK Group on April 30, 2021;

•U.S. refers to the United States of America;

•U.S. GAAP refers to U.S. generally accepted accounting principles;

•UK refers to the United Kingdom;

•UK Addendum refers to the UK international data transfer addendum to the SCCs;

•UK GDPR refers to the UK General Data Protection Regulation;

•UKIDTA refers to the UK International Data Transfer Agreement; and

•Vendor Loan refers to the loan agreement entered into by the Company and AB-Beteiligungs GmbH in connection with the Transaction.

Financial Statements

We maintain our books and records in Euro and prepare our consolidated financial statements in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”).

Birkenstock GmbH & Co. KG is the accounting predecessor of BK LC Lux Finco 2 S.à r.l., subsequently renamed Birkenstock Holding Limited on July 12, 2023, for financial reporting purposes for periods prepared before the Transaction. Birkenstock Holding Limited was converted to a Jersey public limited company and subsequently renamed Birkenstock Holding plc on October 4, 2023.

Our fiscal year ends September 30. References to “fiscal 2024” or “FY 2024” refer to the fiscal year ended September 30, 2024, and references to other fiscal years follow the same convention.

Rounding

We have made rounding adjustments to some of the figures included in this Annual Report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them. With respect to financial information set out in this Annual Report, a dash (“—”) signifies that the relevant figure is not available or not applicable, while a zero (“0.0”) signifies that the relevant figure is available but is or has been rounded to zero.

Trademarks and Trade Names

We own or have rights to various trademarks, trade names or service marks that we use in connection with our business, including “BIRKENSTOCK,” “Birko-Flor,” “Birki,” “Birk” and “Papillio,” among others, and our other registered and common law trade names, trademarks and service marks, including our corporate logo. Solely for convenience, some of the trademarks, service marks and trade names referred to in this Annual Report are listed without the ™ and ® symbols, but we will assert, to the fullest extent under applicable law, rights to such trademarks, service marks and trade names.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains statements that constitute forward-looking statements. Many of the forward-looking statements contained in this Annual Report can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate” and “potential,” among others. Forward-looking statements provide our current expectations, intentions or forecasts of future events. Forward-looking statements include statements about expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not statements of historical fact. Words or phrases such as “aim,” “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would” or similar words or phrases, or the negatives of those words or phrases, may identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Our actual results could differ materially from those expected in our forward-looking statements for many reasons, including the factors described in “Item 3. Key Information—D. Risk Factors.” In addition, even if our actual results are consistent with the forward-looking statements contained in this Annual Report, those results or developments may not be indicative of results or developments in subsequent periods. For example, factors that could cause our actual results to vary from projected future results include, but are not limited to:

•our dependence on the image and reputation of the BIRKENSTOCK brand;

•the intense competition we face from both established companies and newer entrants into the market;

•our ability to execute our DTC growth strategy and risks associated with our e-commerce platforms;

•our ability to adapt to changes in consumer preferences and attract new customers;

•harm to our brand and market share due to counterfeit products;

•our ability to successfully operate and expand retail stores;

•losses and liabilities arising from leased and owned real estate;

•risks related to our non-footwear products;

•failure to realize expected returns from our investments in our businesses and operations;

•our ability to adequately manage our acquisitions, investments or other strategic initiatives;

•our ability to manage our operations at our current size or manage future growth effectively;

•risks related to global or regional health events;

•our dependence on third parties for our sales and distribution channels;

•risks related to the conversion of wholesale distribution markets to owned and operated markets and risks related to productivity or efficiency initiatives;

•operational challenges related to the distribution of our products;

•deterioration or termination of relationships with major wholesale partners;

•seasonality, weather conditions and climate change;

•adverse events influencing the sustainability of our supply chain or our relationships with major suppliers or increases in raw materials or labor costs;

•our ability to effectively manage inventory;

•unforeseen business interruptions and other operational problems at our production facilities, as well as disruptions to our shipping and delivery arrangements;

•failure to attract and retain key employees and deterioration of relationships with employees, employee representative bodies and stakeholders;

•risks related to our intellectual property rights;

•risks related to regulations governing the use and processing of personal data as well as disruption and security breaches affecting information technology systems;

•natural disasters, public health crises, political crises, civil unrest and other catastrophic events beyond control;

•economic conditions impacting consumer spending, such as inflation;

•currency exchange rate fluctuations;

•risks related to litigation, compliance and regulatory matters;

•risks and costs related to corporate responsibility and ESG matters;

•inadequate insurance coverage, or increased insurance costs;

•risks related to our amount of indebtedness, its restrictive covenants and our ability to repay our debt;

•risks related to our status as a foreign private issuer and as a “controlled company” within the meaning of the NYSE rules;

•our ability to remediate material weaknesses identified in our internal control over financial reporting; and

•other factors discussed under “Item 3. Key Information—D. Risk Factors.”

Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

In addition to the other information contained in this Annual Report and in other documents we file with or furnish to the SEC, the following risk factors should be considered in evaluating our business. Our business, financial condition and results of operations could be materially adversely affected as a result of any of these risks.

Summary of Risk Factors

The following is a summary of the more significant risk factors associated with an investment in our ordinary shares, which are more fully described below:

•our dependence on the image and reputation of the BIRKENSTOCK brand;

•the intense competition we face from both established companies and newer entrants into the market;

•our ability to execute our DTC growth strategy and risks associated with our e-commerce platforms;

•our ability to adapt to changes in consumer preferences and attract new customers;

•harm to our brand and market share due to counterfeit products;

•our ability to expand retail stores and our dependence on favorable lease terms, brand awareness and the ability to hire adequate staff to successfully operate such retail stores;

•failure to realize expected returns from our investments in our businesses and operations;

•risks related to business, economic, market and political conditions;

•risks related to global or regional health events;

•our dependence on third parties for our sales and distribution channels, as well as deterioration or termination of relationships with major wholesale partners;

•adverse events influencing the sustainability of our supply chain or our relationships with major suppliers, or increases in raw materials or labor costs;

•our ability to effectively manage inventory;

•unforeseen business interruptions and other operational problems at our production facilities, as well as disruptions to our shipping and delivery arrangements;

•failure to attract and retain key employees and deterioration of relationships with employees, employee representative bodies and stakeholders;

•adequate protection, maintenance and enforcement of our trademarks and other intellectual property rights;

•regulations governing the use and processing of personal data, as well as disruption and security breaches affecting information technology systems;

•risks related to international markets;

•material weaknesses identified in our internal control over financial reporting and our ability to remediate such material weaknesses;

•compliance with existing laws and regulations or changes in such laws and regulations;

•risks related to our amount of indebtedness, its restrictive covenants and our ability to repay our debt;

•control by our Principal Shareholder whose interests may conflict with ours or yours in the future; and

•our status as a foreign private issuer and as a “controlled company” within the meaning of the NYSE rules.

Risks Related to Our Business, Brand, Products and Industry

Our success is dependent on the strength of our premium brand; if we are unable to maintain and enhance the value and reputation of our brand and/or counter any negative publicity, we may be unable to sell our products, which would harm our business and could materially adversely affect our business, financial condition and results of operations.

Our business and financial performance is largely dependent on the image, perception and recognition of the BIRKENSTOCK brand, which, in turn, depends on many factors such as the distinctive character and quality of our products and product design, the image and presentation of our online and retail stores, our social media and content distribution activities, public relations and marketing and our general corporate and market profile, which can be, and have been from time to time, adversely affected for reasons within and outside our control. For example, our products can be actively or mistakenly presented in a specific context not related to our brand (e.g., ethically, religiously, politically); we could experience, and have experienced from time to time, customer dissatisfaction through our customer service in our DTC or B2B channels; we could have, and have had from time to time, issues with our suppliers, such as quality control problems, affecting the quality of our products or our reputation; and we could be, and have been from time to time, the subject of negative publicity, including inaccurate adverse information.

Our brand value also depends on our ability to maintain positive consumer perception of our corporate integrity and culture, including with regard to the sustainability of our products. Negative claims or publicity involving us or our products, the third-party brands we partner with for collaborations or the production methods of any of our suppliers or the materials we or they source or use could seriously damage our reputation and brand image, regardless of whether such claims or publicity are accurate. In addition, we have been increasing our online presence through our expanding e-commerce business. Our social media presence amplifies consumer engagement with the BIRKENSTOCK brand; however, it reduces our control over brand perception due to the proliferation of consumer comments and hashtags and, thus, our brand could become associated with content that is not aligned with our values. Customers may provide feedback and public commentary about our products and other aspects of our business online through social media platforms and any negative information concerning us, whether accurate or not, may cause harm to our brand without affording us an opportunity for redress or correction. Social media influencers or other endorsers of our products could engage in behavior that reflects poorly on our brand, the occurrence of which is beyond our control, and their behavior may be attributed to or associated with us or otherwise adversely affect us. In connection with, and subsequent to, our IPO, we experienced a significant growth in media coverage. Our brand reputation could be harmed if it becomes associated with negative media, such as if we or our senior executives were to take positions on social or other issues that may be unpopular with some consumers, which may impact our ability to attract or retain customers. Our brand reputation could also be harmed if we experience a cyber-attack or loss of consumer data. Adverse publicity could undermine consumer confidence in the BIRKENSTOCK brand and reduce demand for our products, even if such publicity is unfounded. Moreover, our transformation from a historically family-owned German company to a publicly held company listed on a U.S. stock exchange may negatively impact our reputation. Any failure to maintain favorable brand recognition could have a material adverse effect on our business, financial condition and results of operations.

We face intense competition from both established companies and newer entrants into the market, and our failure to compete effectively could have a negative impact on our revenues and our reputation.

The footwear, skincare, accessories and sleep system industries are very competitive, and we expect to continue to face intense competitive pressures. Competitive factors that affect our market position include our ability to predict and respond to changing consumer preferences, trends and tastes in a timely manner (see also “—Our business is subject to changes in consumer preferences, and if we are unsuccessful in adapting to any such changes, it may adversely impact our business.”), our ability to continue marketing and developing new products that appeal to consumers, our ability to accurately predict customer demand and ensure product availability, the strength and recognition of the BIRKENSTOCK brand, our ability to price our products competitively, our ability to manage the impact of the rapidly changing retail environment and the expansion of our online presence, our ability to adapt to changes in technology, and our marketing and content distribution efforts.

Our competitors may have significantly greater financial resources, more developed consumer and customer bases or more appealing products, more comprehensive product lines and greater distribution capabilities, and may spend substantially more on product advertising, marketing and endorsements. Our competitors may also own more recognized brands, implement more effective marketing campaigns, adopt more aggressive pricing policies, make more attractive offers to potential employees and distribution partners, have a larger online presence or respond more quickly to changes in consumer preferences. Some of our competitors may be better able to take advantage of market opportunities and withstand market downturns better than we can. For example, we face competition from established competitors in Asia and the Middle East, where we are a relatively new market entrant. Additionally, the general availability of offshore footwear manufacturing capacity and changes in technology allow for rapid expansion by competitors and new entrants in the footwear market. The majority of our branded peers have outsourced large parts of their value chain to third-party manufacturers in Asia, which may enable competitors to sustain more aggressive pricing policies compared to ours. We may be unable to compete successfully in the future, and increased competition may result in price reductions, reduced gross profit margins, loss of market share and an inability to generate cash flows that are sufficient to maintain or expand our development, which could have a material adverse effect on our business, financial condition and results of operations. See also “—Counterfeit or

“knock-off” products, as well as products that are “inspired-by-BIRKENSTOCK,” may siphon off demand we have created for our brand, and may result in customer confusion, harm to our brand, a loss of our market share or a decrease in our results of operations.”

If we are unable to effectively execute our DTC growth strategy, or if we encounter certain risks and uncertainties associated with our e-commerce platforms, our business may be harmed.

Our DTC channel consists of our e-commerce sites and a network of owned retail stores. Since 2016, we have significantly expanded our DTC channel through the expansion of e-commerce, particularly in the United States. With our DTC channel representing 40% of our revenues for the fiscal year ended September 30, 2024, one of our strategies is to increase the proportion of our revenues from e-commerce mid- to long-term.

The success of our e-commerce business depends, in part, on our ability to offer attractive, reliable, secure and user-friendly online platforms for consumers across our markets, including by continuing to invest in our digital infrastructure and digital team. However, our e-commerce business also depends on factors over which we have limited control, including changing consumer preferences and buying trends. Any failure by us, or by any of our third-party digital partners, to provide attractive, reliable, secure and user-friendly online platforms could negatively impact the shopping experience of consumers, resulting in reduced website traffic, diminished loyalty to the BIRKENSTOCK brand and lost revenues.

We are also subject to certain additional risks and uncertainties associated with our e-commerce platforms, including changes in required technology interfaces, website downtime and other technical failures, costs and technical issues from website software upgrades, data and system security, computer viruses and changes in applicable international, federal and state regulations. We also must keep up-to-date with competitive technology trends, including, among other things, the use of new or improved technology, creative user interfaces and other e-commerce marketing tools, such as paid and unpaid search, and mobile applications, which may increase our costs and which may not succeed in increasing revenues or attracting consumers. In addition, the use of credit and debit cards in our online platform, which are handled by external service providers, are subject to rules relating to the processing of credit card payments.

Any of these risks could have a material adverse effect on our business, financial condition and results of operations. See also “—Risks Related to Intellectual Property, Information Technology and Data Security and Privacy—Our operations, products, systems and services rely on complex IT systems and networks that are subject to the risk of disruption and security breaches.”

Our business is subject to changes in consumer preferences, and if we are unsuccessful in adapting to any such changes, it may adversely impact our business.

Our continued success depends in part on the continued attractiveness of the design, styling, production, merchandising and pricing of our products to consumers. Our products must appeal to a consumer base whose preferences cannot be predicted with certainty and are subject to change as our industry is subject to sudden shifts in consumer trends and spending. Consumers also increasingly focus on ESG matters when making purchasing decisions. It is possible that consumer preferences will continue to change based on evolving ethical or social standards, such that certain of our products may potentially become less desirable to certain consumers. Uncertainty in global economic conditions may also result in unpredictable consumer spending trends.

As much of our business is highly concentrated on a single, discretionary product category, footwear, we are vulnerable to changes in consumer preferences that could harm our revenues, profitability and financial condition. We have experienced, and may continue to experience, fluctuations in consumer demand for our products, and our success depends in large part on our ability to develop, market and deliver innovative and stylish products at a pace, intensity and price competitive with other brands in the markets in which we sell our products. Failure on our part to adequately predict and respond timely to consumer demand and market conditions and to regularly and rapidly develop innovative and stylish products and update core

products could limit revenue growth, adversely affect consumer acceptance of our products, harm our competitive position and, if consumer demand for our footwear or other products decreases in the future, our business, financial condition and results of operations could be materially adversely affected.

Our future growth may depend on our marketing efforts, and any failure in our ability to increase or enhance our marketing position could adversely affect demand for our products.

Our success and future growth depends on our ability to attract and retain consumers, which in part may depend on the effectiveness and efficiency of our marketing efforts, including our ability to continue to improve brand awareness, identify the most effective brand messaging and efficient levels of spending in each market, determine the appropriate creative messages and media mix for marketing and promotional expenditure and effectively manage marketing costs. In particular, we may need to increase our marketing spend in order to take advantage of growth opportunities in our growth markets, particularly in Asia and the Middle East. We may also be required to increase marketing spend in order to develop our e-commerce business consistent with our strategy. Any factors adversely affecting our ability to increase or enhance our marketing activities and capabilities could adversely affect demand for our products and in turn have a material adverse effect on our business, financial condition and results of operations.

If we fail to attract new customers, retain existing customers or maintain or increase sales to customers, our business, financial condition and results of operations could be harmed.

Our success depends in large part upon increased and repeat adoption of our products by our customers. In order to attract new customers and continue to expand our customer base, we must appeal to and attract customers who identify with our products. If the number of people who are willing to purchase our products does not continue to increase, if key international markets do not provide anticipated growth opportunities, if we fail to deliver a high-quality shopping experience or if our current or potential customers are not convinced that our products are superior to alternatives, then our ability to retain existing customers, acquire new customers and grow our business may be harmed. Further, we may not continue to attract new customers or increase our revenues at the same rates as we have in the past.

In addition, our future success depends in part on our ability to increase sales to our existing customers over time, as a significant portion of our net revenues is generated from sales to existing customers, particularly those existing customers who are highly engaged and make frequent and/or large purchases of the products we offer. If existing customers no longer find our products appealing or are not satisfied with our customer service or if we are unable to timely update our products to meet current trends and customer demands, our existing customers may not make purchases, or if they do, they may make fewer or smaller purchases in the future.

If we are unable to continue to attract new customers or our existing customers decrease their spending on the products we offer or fail to make repeat purchases of our products, our business, financial condition and results of operations could be harmed.

Merchandise returns could harm our business.

We allow customers to return products purchased through our e-commerce and owned retail stores. For example, for footwear and accessory sales to consumers in Europe and in the U.S., we generally accept merchandise returns for a full refund or exchange if returned within 30 days of delivery. We do not refund shipping charges unless required by law. Our revenue is reported net of sales tax, estimated returns, sales allowances and discounts. We estimate expected product returns based on our historical return rate adjusted for any known factors impacting expectations for future return rate. The return rate impacts reported revenues and profitability. The introduction of new products, changes in customer shopping habits or other competitive and general economic conditions could cause actual returns to exceed our estimates. If actual return costs differ from previous estimates, the amount of the liability and corresponding revenues are adjusted in the period in which such costs occur. In addition, from time to time, our products may be damaged in transit to the customer, which can also increase return rates. Returned goods may also be damaged in transit as part of the return process, which can impede our ability to resell such returned goods. From time

to time, customers abuse our shipping and return policy by, for example, pretending that products have not been delivered or by returning products that have been worn during the return window and therefore cannot be resold. Competitive pressures could cause us to alter our return policies or our shipping policies, which could result in an increase in damaged products and an increase in product returns. If the rate of product returns increases significantly or if product return economics become less efficient, our business, financial condition and results of operations could be harmed.

Counterfeit or “knock-off” products, as well as products that are “inspired-by-BIRKENSTOCK,” may siphon off demand we have created for our brand, and may result in customer confusion, harm to our brand, a loss of our market share or a decrease in our results of operations.

We face competition from counterfeit or “knock-off” products manufactured and sold by third parties in violation of our IP rights, as well as from products that are "inspired" by our footwear in terms of design and style, including private label offerings by retailers. In the past, third parties have established websites to target users on Facebook or other social media platforms with “look alike” websites intended to trick users into believing that they were purchasing BIRKENSTOCK products at a steep discount. These activities of third parties have in the past and may in the future result in customer confusion, require us to incur additional administrative costs to manage customer complaints related to counterfeit goods or poor service, divert customers from us, cause us to miss out on sales opportunities and result in a loss of our market share. In addition, third parties may try to offer, and have offered from time to time, their counterfeit products through online platforms and marketplaces, taking advantage of business practices applicable to open market operating models. If counterfeit products are sold in larger than de minimis quantities on e-commerce platforms managed by third parties, our brands and reputation can be severely damaged. In addition, we have refrained, and we may in the future refrain, from using certain third-party websites to distribute our products due to the selling of counterfeit products on such platforms, thereby impacting our revenue from such websites.

In addressing these or similar issues in the future, we may also be required to incur substantial expenses to protect our brand and enforce our IP rights, including through legal action in Germany, the United States or other countries, which could negatively impact our business, financial condition and results of operations. These and similar “counterfeit” or “inspired-by-BIRKENSTOCK” issues could result in customer confusion, harm to our brand and/or a loss of our market share and in turn have a material adverse effect on our business, financial condition and results of operations.

Our ability to successfully operate and expand retail stores depends on our ability to negotiate lease terms, achieve brand awareness and hire employees, among other factors.

Our ability to successfully operate and expand our owned retail stores depends on many factors, including, among others, our ability to negotiate acceptable lease terms, including desired rent and tenant improvement allowances, achieve brand awareness, affinity and purchase intent in our markets, achieve increased revenues and gross profit margins at our stores, hire, train and retain store associates and field managers, assimilate store associates and field managers into our corporate culture and source and supply sufficient inventory levels. If we are unable to successfully operate any of our retail stores due to our failure to satisfy any of these factors, our business, financial condition and results of operations could be materially adversely affected.

Leasing of significant amounts of real estate exposes us to possible liabilities and losses.

We lease certain of our logistics and production sites, office spaces, retail spaces and storage spaces. Accordingly, we are subject to the risks associated with leasing real estate. Store leases generally require us to pay a fixed minimum rent and sometimes a variable amount based on a percentage of revenues at that location. For certain leases, if revenue targets are not achieved or if the revenue-based rent amount decreases below a certain minimum, the lessor may terminate the lease agreement, unless we agree to an increased fixed fee rent. Moreover, in relation to certain lease agreements entered into for retail space in shopping or outlet centers, we may also enter into a service and marketing agreement, specific to such shopping or outlet

center, which may contain conditions that differ from the marketing practices we usually adopt. Some of our lease agreements provide for an annual automatic renewal if not terminated by either of the parties, which may allow our lessors to terminate on relatively short notice. If an existing or future store is not profitable, and we decide to close it, we may be committed to perform certain obligations under the applicable lease, including, among other things, paying rent for the balance of the applicable lease term. As each of our leases expires, if we do not have a renewal option, we may be unable to negotiate a renewal on commercially acceptable terms, or at all, which could cause us to close stores in desirable locations. Any of the above could have a material adverse effect on our business, financial condition and results of operations.

We own the majority of our production sites and one of our largest logistics sites. Because real property investments are relatively illiquid, our ability to promptly sell one or more properties on reasonable terms in response to changing economic, financial and investment conditions may be limited and we may be forced to hold non-income producing properties for extended periods of time, exposing us to possible liabilities and losses.

We own the majority of our production sites and one of our largest logistics sites. Because real property investments are relatively illiquid, our ability to promptly sell one or more properties on reasonable terms in response to changing economic, financial and investment conditions may be limited and we may be forced to hold non-income producing properties for extended periods of time, exposing us to possible liabilities and losses. In addition, even if we are able to promptly sell one or more of our properties, we cannot predict whether we will be able to sell such properties for the price or on the terms that we set or whether any price or other terms offered by a prospective purchaser would be acceptable to us. We also cannot predict the length of time needed to find a willing purchaser and to close the sale of any property we might wish to sell. Switching production sites would involve increased expenses, including due to potential idling of existing owned production sites. Any of the above could expose us to possible liabilities and losses and have a material adverse effect on our business, financial condition and results of operations.

Our non-footwear products face distinct risks, and our failure to successfully manage these businesses could have a negative impact on our profitability.

In addition to our core footwear products, our product offering includes skincare, accessories and sleep systems. The successful operation and expansion of these products are subject to certain business and operational risks that are different from those we experience with our footwear products, including an intense competitive environment, where we face a number of large and specialized competitors with an established market presence. Failure to successfully manage these products could result in increased costs and a reduction of revenues affecting our profitability, as well as damage to our reputation and brands, which could in turn have a material adverse effect on our business, financial condition and results of operations.

Our financial results may be adversely affected if substantial investments in businesses and operations fail to produce expected returns.

From time to time, we may invest in technology, business infrastructure, new businesses, new product offerings, manufacturing innovation and the expansion of existing businesses, such as our investment in our Pasewalk, Germany production site, redesign of our Görlitz, Germany production site and investment in our Portuguese components operation, which require substantial cash investments and management attention. We believe cost-effective investments and further integration of our production operations are essential to business growth and profitability; however, significant investments are subject to risks and uncertainties inherent in developing a new business or expanding an existing business. The failure of any significant investment to provide expected returns or profitability could have a material adverse effect on our business, financial condition and results of operations.

We may seek to grow our business through acquisitions of, or investments in, facilities or technologies or through other strategic initiatives; the failure to adequately manage these acquisitions, investments or initiatives, integrate them with our existing business or realize anticipated returns could adversely affect us.

From time to time, we may consider opportunities to acquire or make investments in facilities or technologies or pursue other strategic initiatives that may enhance our capabilities or expand our production and supplier network. Acquisitions, investments and other strategic initiatives involve numerous risks, including problems integrating the acquired facilities or technologies, as well as issues maintaining uniform standards, procedures, controls, policies and culture; unanticipated costs associated with acquisitions, investments or other strategic initiatives; diversion of management’s attention from our existing business; adverse effects on existing business relationships with suppliers, outsourced manufacturing partners and other third parties; potential loss of key employees of acquired businesses; and increased legal and accounting compliance costs.

We may be unable to identify acquisitions, investments or other strategic initiatives we deem suitable. Even if we do, we may be unable to successfully complete any such transactions on favorable terms or at all, or to retain any key personnel, suppliers or customers. Furthermore, even if we complete such transactions and effectively integrate the newly acquired business or strategic initiative into our existing operations, we may fail to realize the anticipated returns and/or fail to capture the expected benefits, such as strategic or operational synergies or cost savings. The efforts required to complete and integrate these transactions could be expensive and time-consuming and may disrupt our ongoing business and prevent management from focusing on our operations. If we are unable to identify suitable acquisitions, investments or other strategic initiatives, if we are unable to integrate any acquired facilities or technologies effectively or if we fail to realize anticipated returns or capture expected benefits, it could have a material adverse effect on our business, financial condition and results of operations.

We have grown rapidly in recent years and we have limited operating experience at our current scale of operations. If we are unable to manage our operations at our current size or manage any future growth effectively, our brand image and financial performance may suffer.

We have expanded rapidly, leading our transition to become a revered global brand and we have limited operating experience at our current size. Our substantial growth to date has placed a significant strain on our management systems and resources. If our operations continue to grow, of which there can be no assurance, we will be required to continue to expand our sales and marketing, product development and distribution functions, to upgrade our management information systems and other processes and to obtain more space for our production facilities. Moreover, our new innovations may require either new or different infrastructure, relationships or processes. Our continued growth could increase the strain on our resources, and we could experience serious operating difficulties, including difficulties in hiring, training and managing an increasing number of employees, difficulties in obtaining sufficient raw materials and manufacturing capacity to produce our products and delays in production and shipments. These difficulties would likely result in the erosion of our brand image and may have a material adverse effect on our business, financial condition and results of operations.

Challenging business, economic, market or political conditions may adversely affect our business, financial condition and results of operations.

Our business, financial condition and results of operations may be materially adversely affected by a challenging economic climate, including reductions in consumer spending, adverse changes in interest rates, adverse changes in currency exchange rates, volatile commodity and other markets, inflation and contraction in the availability of credit in the market. For example, discretionary spending generally declines during periods of economic uncertainty. In a prolonged economic downturn in the regions in which we operate, including Asia, we may experience declining revenues or decelerating revenue growth as a result of general reduced consumer spending. In addition, consumers have access to lower-priced offerings and, during economic downturns, may shift purchases to these lower-priced or other perceived value offerings. These trends also affect the business of our wholesale customers, which in turn has an adverse impact on our

revenues from these distribution channels. As a result, a slow-down in the general economy may cause a decline in demand for our products. If economic conditions result in decreased spending on footwear and have a negative impact on our consumers and suppliers, our business, financial condition and results of operations may be materially adversely affected.

It is difficult to predict how economic conditions will develop, as they are impacted by macro movements of the financial markets and many other factors, including the stock, bond and derivatives markets as well as measures taken by various governmental and regulatory authorities and central banks. Uncertainty remains in the global markets and the global economy could experience another recession, or a depression, which could be more prolonged or have a greater financial impact than the global recession that began in 2008. Any downturns in general economic conditions that impact consumer spending, including inflation and particularly in the countries where we sell a significant portion of our products, could have a material adverse effect on our business, financial condition and results of operations. See also "—Risks Related to Economic, Market and Political Matters—Inflation could adversely impact our business, financial condition and results of operations."

Our business, financial condition and results of operations may also be materially adversely affected by a challenging political climate, including events such as invasions, wars, civil unrest and terrorist activities and the imposition of sanctions and importation limitations. As examples, the conflict in the Middle East involving Israel, the Hamas in Gaza and the Hezbollah in Lebanon, and the war between Russia and Ukraine have led to disruption, instability and volatility in global markets and industries (see also "—If we encounter operational challenges relating to the distribution of our products, our business could be adversely affected."). In response to the war between Russia and Ukraine, the United States, the EU and other governments in jurisdictions in which we operate have imposed sanctions and export controls against Russia and Russian interests, including restrictions on selling or importing goods, services or technology in or from affected regions and travel bans and asset freezes impacting connected individuals and political, military, business and financial organizations in Russia. Such governments have threatened additional sanctions and controls and may take other actions should the conflict further escalate. We have no operations in Russia or Ukraine, but the war continues to impact the surrounding region. In particular, the war and the responses thereto have increased the risk of energy shortages and resulted in further increases in energy costs for us and our suppliers, which were already high as a result of the existing inflationary environment. We have taken steps to mitigate the impact of any potential energy shortages by preparing contingency plans. While we have not had to effect any such contingency plans to date, we cannot guarantee that such plans, if implemented in the future, will be sufficient to mitigate any such shortages. In addition, rising energy costs have resulted in additional pricing negotiations with our suppliers, put upward pressure on our costs of materials and increased the risk that we may be unable to acquire the materials and services we need to continue to make certain products at acceptable prices, if at all. While we have not experienced material supply chain disruptions to date, we are unable to predict how the war between Russia and Ukraine will develop or guarantee that we will not experience material supply chain disruptions in the future, including as a result of the conflict in the Middle East or the related Red Sea crisis, where Houthi forces based in Yemen and backed by Iran have been attacking freighters. Any further escalation or widening of such existing conflicts, e.g. as recently experienced with respect to Iran’s direct attacks on Israel and Israel’s retaliation, or in light of North Korea’s apparent involvement in the war between Russia and Ukraine, as well as any new conflicts (for example, involving China and Taiwan), could have a further adverse impact on the global economy, supply chains and demand, thereby materially adversely affecting our business, financial condition and results of operations.

Our business, financial condition and results of operations could be adversely affected by global or regional health events and related government, private sector and individual consumer responsive actions.

The occurrence or resurgence of global or regional health events, such as the COVID-19 pandemic, and related governmental, private sector and individual consumer responses, could contribute to a recession, depression, or global economic downturn, reduce store traffic and consumer spending, result in temporary or permanent closures of retail locations, offices, and factories, and could negatively impact the flow of goods.

Such events could cause health officials to impose restrictions and recommend precautions to mitigate the health crisis such as the temporary closure of our stores, limitations on the number of visitors allowed in our stores at any single time, minimum physical distancing requirements, and limited operating hours. A health event could also, and has done so in case of the COVID-19 pandemic, negatively impact our employees, customers, and brand by reducing consumer willingness to visit stores, malls, and lifestyle centers, and employee willingness to staff our stores. A global or regional health event may also cause long-term changes to consumer shopping behavior, preferences and demand for our products that may have a material adverse effect on our business.

A global or regional health event could, and has done so in case of the COVID-19 pandemic, significantly and adversely impact our supply chain if the factories that manufacture our products, the distribution centers where we manage our inventory, or the operations of our logistics and other service providers are disrupted, temporarily closed, or experience worker shortages.

Risks Related to Our Sales and Distribution Channels

Our sales and distribution channels are dependent on cooperation with third parties.

We rely on our ability to work together with third parties in our B2B channel to ensure that our products are sold in environments and in a manner consistent with our brand image. For the fiscal year ended September 30, 2024, sales through third parties in our B2B channel accounted for 60% of revenues. In the event of a dispute with a wholesaler or distributor, we may not have adequate contractual recourse, and insurance, if any, may not be sufficient to cover the cost of a potential claim. If we cannot replace or engage such third parties that meet our specifications in a short period of time, that could increase our expenses and cause shortages of our products. In addition, actions by these third-party sales and distribution channels that do not comply with our policies, such as presenting our products in a manner inconsistent with our preferred positioning or offering our products alongside “look-alike” products, could damage our brand and reputation. If our third-party partners do not maintain the standards of quality, brand positioning and exclusivity we require, or if they otherwise misuse the BIRKENSTOCK brand, there is a risk that our reputation and the integrity of the brand may be damaged. This may in turn have a material adverse effect on our business, financial condition and results of operations.

We face risks arising from the transformation of our operations through the conversion of wholesale distribution markets to owned and operated markets, as well as any productivity or efficiency initiatives we undertake in the future.

We continuously assess opportunities to streamline operations, achieve cost savings and fuel long-term profitable growth. For example, in some regions we have evolved our global distribution strategy from primarily wholesale distribution to operating through owned individual offices and local entities, with a view to having further distribution control as well as driving revenue. The implementation of our transformation strategy presents a number of significant risks, including: actual or perceived disruption of service or reduction in service levels to customers and consumers; actual or perceived disruption to suppliers, distribution networks and other important operational relationships and the inability to resolve potential conflicts in a timely manner; difficulty in obtaining timely delivery of products of acceptable quality from suppliers; diversion of management attention from ongoing business activities and strategic objectives; disruption to our culture; failure to maintain employee morale and retain key employees; and actual or threatened claims and law suits from current and/or former distributors.

In addition, relationships with certain of our distributors, particularly in markets outside of Europe, are not governed by written contracts, and disputes have arisen and may in the future arise with respect to such relationships, with such disputes potentially resulting in litigation or settlement proceedings. Such disputes could have a negative impact on our brand. Furthermore, if we experience adverse changes to our business, restructuring or reorganization activities may be required in the future. Due to these and other factors, we cannot predict whether we will fully realize the purpose and anticipated benefits or cost savings of any restructuring, productivity or efficiency initiatives, including the conversion of distributor markets to

owned and operated markets, and, if we do not, this could have a material adverse effect on our business, financial condition and results of operations.

If we encounter operational challenges relating to the distribution of our products, our business could be adversely affected.

We rely on both our own and third-party logistics centers to warehouse and ship products to our e-commerce customers, retail stores, wholesale partners and distributors throughout the world. These centers are subject to operational risks, including, among other things, mechanical and IT system failure, work stoppages or increases in transportation costs and the impact of pandemics, diminished vessel capacity, port congestion and strikes, cross border trade barriers (e.g., as a result of Brexit), natural disasters, political crises, civil unrest and other catastrophic events. Such and other disruptions could have an adverse effect on the availability of our in-store and warehoused inventory and would divert financial and management resources. In addition, distribution capacity is dependent on the timely performance of services by third parties, including the transportation of products to and from their distribution facilities. If we encounter problems with our distribution systems, whether our own or those of third parties, our ability to meet customer and consumer expectations, manage inventory, complete sales and achieve operating efficiencies could be adversely affected. Additionally, the success of our e-commerce business and the satisfaction of consumers depend on their timely receipt of products. The efficient flow of our products requires that our own and third-party operated distribution facilities have adequate capacity to support the current level of e-commerce sales and any anticipated increased levels that may follow from the planned growth of that part of our DTC channel. As a result, we could incur significantly higher costs and longer lead times associated with distributing our products to consumers and experience dissatisfaction from consumers, which could have a material adverse effect on our business, financial condition and results of operations.

For example, recently ports at the U.S. East Coast were affected by labor strikes, which combined with the ongoing war between Russia and Ukraine as well as the conflict in the Middle East have impacted lead times, and the resulting financial and economic sanctions imposed by various countries and organizations have affected transportation costs.

In addition, we use independent distributors and wholesalers to sell our products in certain of our markets. Failure by our distributors or wholesalers to meet planned annual revenue goals or to make timely payments on amounts owed to us due to, for example, economic difficulties faced by such distributors could have an adverse effect on our business, financial condition and results of operations, and it may be difficult and costly to locate an acceptable substitute distributor or wholesaler. If a change in distributor or wholesaler becomes necessary, we may experience increased costs, as well as substantial disruption and a resulting loss of revenues and brand equity in the market where such distributor or wholesaler operates, which could have a material adverse effect on our business, financial condition and results of operations.

If our relationship with one or more major wholesale partners deteriorates or terminates, our business could be adversely affected.

While our strategy is to continue to grow our DTC channel, and in particular our e-commerce business, our ability to attract and retain strategic wholesale partners remains critical to our continued success and growth.

Our wholesale partners purchases generally occur on an order-by-order basis, under a variety of framework agreements. If any major wholesale partner decreases or ceases purchasing from us, cancels its orders, reduces the floor space, assortments, fixtures or advertising for our products or changes the manner of doing business with us for any reason, such actions could adversely affect our business. In addition, a decline in the performance or financial condition of a major wholesale partner, including bankruptcy or liquidation, could result in a material loss of revenues to us and cause us to limit or discontinue business with that partner, require us to assume more credit risk relating to our receivables from that partner or limit our ability to collect amounts related to previous purchases by that partner. For example, as a precautionary matter in light of the COVID-19 pandemic, we have, from time to time, requested certain wholesale partners

pay deposits for their orders. These measures and other measures we may adopt to mitigate credit risk, however, may not be successful. In addition, retail consolidation could lead to fewer wholesale partners, wholesale partners seeking more favorable price, payment or other terms from us and a decrease in the number of stores that carry our products. While we seek to insure credit risk in certain cases, there can be no assurance that in the future we will be able to obtain credit risk insurance at commercially attractive terms or at all.

If our relationship with one or more major wholesale partners deteriorates or terminates, or if other changes occur in the wholesale channel that adversely impact our relationships with such third parties, this could lead to a material adverse effect on our business, financial condition and results of operations.

Our reliance on services arrangements with third-party service providers exposes us to a range of potential operational risks.

We have entered into a number of services arrangements with third-party service providers for the operation of distribution centers. In addition, we have entered into service agreements with third-party providers in Portugal, primarily for the outsourcing of closed-toe silhouette production. In the event the services of these service providers are disrupted or terminated and we do not engage suitable replacements on commercially acceptable terms or in a timely manner, we may not be able to effectively deliver our products to consumers and our wholesale partners, which may have a material adverse effect on our business, financial condition and results of operations.

Risks Related to Our Supply Chain

Our business is affected by seasonality and weather conditions, which could result in fluctuations in our operating results as well as excess or reduced inventory.

Our business is affected by seasonality, and demand in our channels varies by time of year. Our products, particularly our Core Silhouettes, were traditionally suited for warm weather. As a result, when the weather conditions vary significantly from typical conditions in our key markets, such as an unusually cold summer, consumer demand for our products is adversely affected.

While we manufacture our footwear year-round, we build inventory between October and January to prepare for increased demand during the subsequent summer season. Starting in May and during the warmer months of the year, demand for our products from our DTC channel increases. Demand for our products from our B2B channel increases from December through March. We incur significant additional expenses in advance of and during this period in anticipation of higher sales during that period, including the cost of additional inventory, which is stored on palettes in our warehouses until shipped, fixed cost such as rent and lease agreements for retail shops and outlets as well as depreciation and amortization of production plants.

Lower demand may result in excess inventory, which may require us to sell these products at discounted prices or to build up more finished goods inventory than expected and incur additional costs, which could, in turn, adversely affect our results of operations. At the same time, if we are unable to procure certain raw materials due to supply chain disruptions or fail to manufacture a sufficient quantity of merchandise, we may not have an adequate supply of products to meet consumer demand or if weather conditions permit us to sell seasonal products early in the season, this may reduce inventory levels needed to meet customers’ needs later in that same season, which could have a negative impact on our revenues during our busiest season. Any inability to effectively manage seasonality and weather conditions could have a material adverse effect on our business, financial condition and results of operations. See also “—Our operating results depend on effectively managing inventory levels, and any excess inventories or inventory shortages could harm our business."

Any adverse events influencing either the sustainability of the supply chain or our relationship with any major supplier or any increases in the costs of raw materials or labor, or any scarcity thereof, could adversely affect our business.

Our ability to competitively price our products depends on the cost of components (including those produced at our manufacturing facility in Arouca, Portugal), services, labor, equipment and raw materials, including leather and other materials used in the production of our products. The cost of services and materials is subject to change based on availability and market conditions that are difficult to predict. Various conditions, such as changes in food consumption patterns affecting the availability of leather, as well as changes in climate conditions impacting the availability of cork, jute or latex, affect the cost of our footwear. However, very few raw materials are traded as commodities (e.g., latex). We use certain public price and market tracking information as references for price developments. Factors such as weather and climate conditions, demand of competing industries (e.g., leather for car manufacturers, furniture) and general economic factors, such as global supply chain flows, supply and demand and raw material price developments, will affect the cost of our materials.

We source components and other raw materials (including leather, EVA, cork, adhesives, natural latex, jute, copper, wool felt and brass buckles) from suppliers located mainly in Europe, but also in Turkey, the Americas and Asia. For certain materials, we may rely on specific suppliers that are able to meet the level of quality and supply we require. For example, although our leathers are sourced from different tanneries, our requirement for materials of high quality may result in reducing the pool of available tanneries that can meet such requirements. In addition, some of our products use materials of high technical complexity and high-quality standards, such as EVA, or that require specific IP rights, such as the EVA buckles. We also have some regional dependencies. For example, while we do have multiple cork suppliers, they are predominantly based in Portugal, thus creating a specific geographical dependency, and we have similar regional dependencies for other raw materials. Such geographic dependencies expose us to risks in the case of, for example, extreme weather events affecting such areas.

Our relationships with suppliers are either based on individual purchase orders, on purchase orders governed by a framework agreement or on separate agreements governing the conditions for the supply of specific materials. Although our contracts with these suppliers contain provisions that ensure the suppliers are not able to terminate the contract on short notice, if one or more of these suppliers is unable to supply or decides to cease supplying us with raw materials and components, or decides to increase prices significantly due to indirect price increases, shortages or for other reasons that may be beyond our control, we may be unable to identify alternative suppliers of such materials at a reasonable cost or at all and, in any event, it may take a significant period of time to receive any materials from alternative suppliers. Moreover, if we expand beyond the production capacity of our current suppliers as we continue to grow, we may not be able to find new suppliers with an appropriate level of expertise and capacity in a timely manner.