As filed with the Securities and Exchange Commission on May 8, 2024

Registration No. 333-[●]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Premium Catering (Holdings) Limited

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of Registrants name into English)

| Cayman Islands | | 2090 | | Not Applicable |

(State or Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

6 Woodlands Walk

Singapore 738398

Tel. No. :65 6970 1488

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, New York 10168

800-221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Schlueter & Associates, P.C. 5655 South Yosemite St., Suite 350 Greenwood Village, CO 80111Telephone: (303) 292 3883 Attn: Mr. Henry F. Schlueter, Esq. Ms. Celia Velletri, Esq. | | Sichenzia Ross Ference Carmel LLP 1185 Avenue of the Americas, 31st Floor New York, NY 10036 Telephone: 212-930-9700 Attn: Mr. Benjamin A. Tan, Esq. |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The term new or revised financial accounting standard refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

| ● | Public Offering Prospectus. A prospectus to be used for the initial public offering of [●] shares of the Registrant (the “Public Offering Prospectus”) through the underwriter named in the Underwriting section of the Public Offering Prospectus. |

| | |

| ● | Resale Prospectus. A prospectus to be used for the potential resale by (i) Mr. Gao Lianquan of [●] shares; (ii) United Source of [●] shares; (iii) Ms. Kong Chan of [●] shares; (iv) True Sage of [●] shares, Trillion Able of [●] shares and Better Access of [●] shares; (the “Resale Prospectus”). The Resale Shares contained in the Resale Prospectus will not be underwritten and sold through the underwriter. |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| ● | they contain different outside and inside front covers; |

| | |

| ● | the Offering section in the Prospectus Summary section on page 11 of the Public Offering Prospectus is removed and replaced with the Offering section on page Alt-3 of the Resale Prospectus; |

| | |

| ● | they contain different Use of Proceeds sections on page 31 of the Public Offering Prospectus which are removed and replaced with the Use of Proceeds section on page Alt-3 of the Resale Prospectus; |

| | |

| ● | the Capitalization and Dilution sections on page 32 and page 34 of the Public Offering Prospectus are deleted from the Resale Prospectus respectively; |

| | |

| ● | a Resale Shareholders section is included in the Resale Prospectus beginning on page Alt-1 of the Resale Prospectus; |

| | |

| ● | references in the Public Offering Prospectus to the Resale Prospectus will be deleted from the Resale Prospectus; |

| | |

| ● | the Underwriting section on page 129 of the Public Offering Prospectus is removed and replaced with a Plan of Distribution section on page Alt-4 of the Resale Prospectus; |

| | |

| ● | the Legal Matters section on page 133 of the Public Offering Prospectus is removed and replaced with the Legal Matters on page Alt-5 of the Resale Prospectus; and |

| | |

| ● | the outside back cover of the Public Offering Prospectus is deleted from the Resale Prospectus. |

The Registrant has included in this Registration Statement, after the financial statements, a set of alternate pages to reflect the foregoing differences of the Resale Prospectus as compared to the Public Offering Prospectus.

The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by Resale Shareholders.

The information in this prospectus is not complete and may be changed or supplemented. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | | Subject to Completion, dated [●], 2024 |

Premium Catering (Holdings) Limited

[●] shares

This is an initial public offering of our ordinary shares, of par value at US$0.001 per share (the “Shares”). We are offering, on a firm commitment basis, [●] shares. Certain existing shareholders (“Selling Shareholders”) are offering an aggregate of [●] shares to be sold in the offering pursuant to this prospectus. We will not receive any proceeds from the sale of the shares to be sold by the Selling Shareholders. We anticipate that the initial public offering price of the shares will be between US$[●] and US$[●] per share.

Prior to this offering, there has been no public market for our shares. We intend to apply to list our Shares on the Nasdaq under the symbol “[●]”. This offering is contingent upon the listing of our shares on the Nasdaq. There can be no assurance that we will be successful in listing our shares on the Nasdaq.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Investing in our shares involves a high degree of risk, including the risk of losing your entire investment. See Risk Factors beginning on page 17 to read about factors you should consider before buying our shares.

We are a holding company incorporated in the Cayman Islands. As a holding company with no material operations of its own, we conduct our operations in Singapore through our wholly-owned subsidiary, Premium Catering. The shares offered in this offering are shares of our Company, a Cayman Islands holding company and not shares of the operating subsidiary. Investors in this offering will not directly hold equity interests in Premium Catering.

We are an “Emerging Growth Company” and a “Foreign Private Issuer” under applicable U.S. federal securities laws and, as such, are eligible for reduced public company reporting requirements. Please see Implications of Being an Emerging Growth Company and Implications of Being a Foreign Private Issuer beginning on page 15 and page 15 of this prospectus for more information.

| | | Per Share | | | Total(4) | |

| Initial public offering price(1) | | US$ | [●] | | | US$ | [●] | (4) |

| Underwriting discounts and commissions(2) | | US$ | [●] | | | US$ | [●] | |

| Proceeds to our Company before expenses(3) | | US$ | [●] | | | US$ | [●] | |

| Proceeds to the Selling Shareholders before expenses(3) | | US$ | [●] | | | US$ | [●] | |

(1) Initial public offering price per share is assumed to be US$[●] (being the mid-point of the offer price range mentioned above).

(2) We have agreed to pay the underwriter a discount equal to 7.5% of the gross proceeds of the offering. This table does not include a non-accountable expense allowance equal to 1.0% of the gross proceeds of this offering payable to the underwriter. For a description of the other compensation to be received by the underwriter, see “Underwriting” beginning on page 129.

(3) Excludes fees and expenses payable to the underwriter. The total amount of underwriter expenses related to this offering is set forth in the section entitled “Expenses Relating to This Offering” on page 123.

(4) Includes US$[●] gross proceeds from the sale of [●] shares offered by our Company and US$[●] gross proceeds from the sale of [●] shares offered by the Selling Shareholders.

If we complete this offering, net proceeds will be delivered to us and the Selling Shareholders on the closing date.

The underwriter expects to deliver the shares to the purchasers against payment on or about [●], 2024.

You should not assume that the information contained in the registration statement to which this prospectus is a part is accurate as of any date other than the date hereof, regardless of the time of delivery of this prospectus or of any sale of the shares being registered in the registration statement of which this prospectus forms a part.

No dealer, salesperson or any other person is authorized to give any information or make any representations in connection with this offering other than those contained in this prospectus and, if given or made, the information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any security other than the securities offered by this prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any jurisdiction in which the offer or solicitation is not authorized or is unlawful.

Bancroft Capital, LLC

The date of this prospectus is [●], 2024.

TABLE OF CONTENTS

Until [●], 2024 (the 25th day after the date of this prospectus), all dealers that effect transactions in these shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

ABOUT THIS PROSPECTUS

Neither we, the Selling Shareholders nor any of the underwriters have authorized anyone to provide you with any information or to make any representations other than as contained in this prospectus or in any related free writing prospectus. Neither we, the Selling Shareholders nor the underwriter take responsibility for, and provide no assurance about the reliability of, any information that others may give you. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we, the Selling Shareholders nor the underwriter have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares and the distribution of this prospectus outside the United States.

Certain amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, amounts, percentages and other figures shown as totals in certain tables or charts may not be the arithmetic aggregation of those that precede them, and amounts and figures expressed as percentages in the text may not total 100% or, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

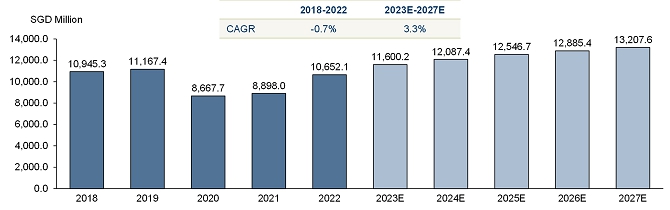

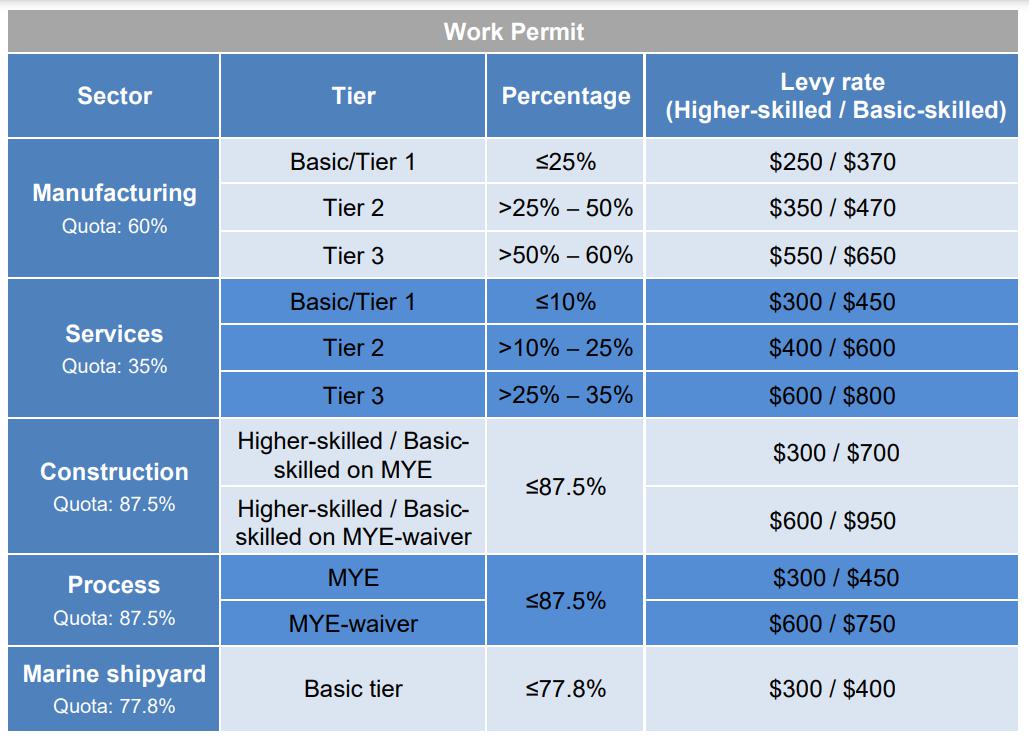

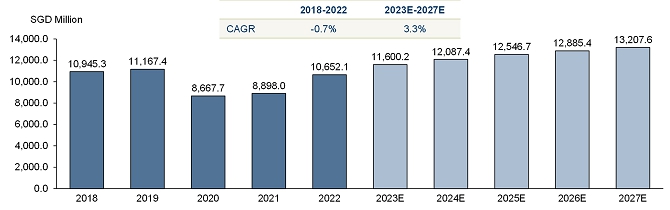

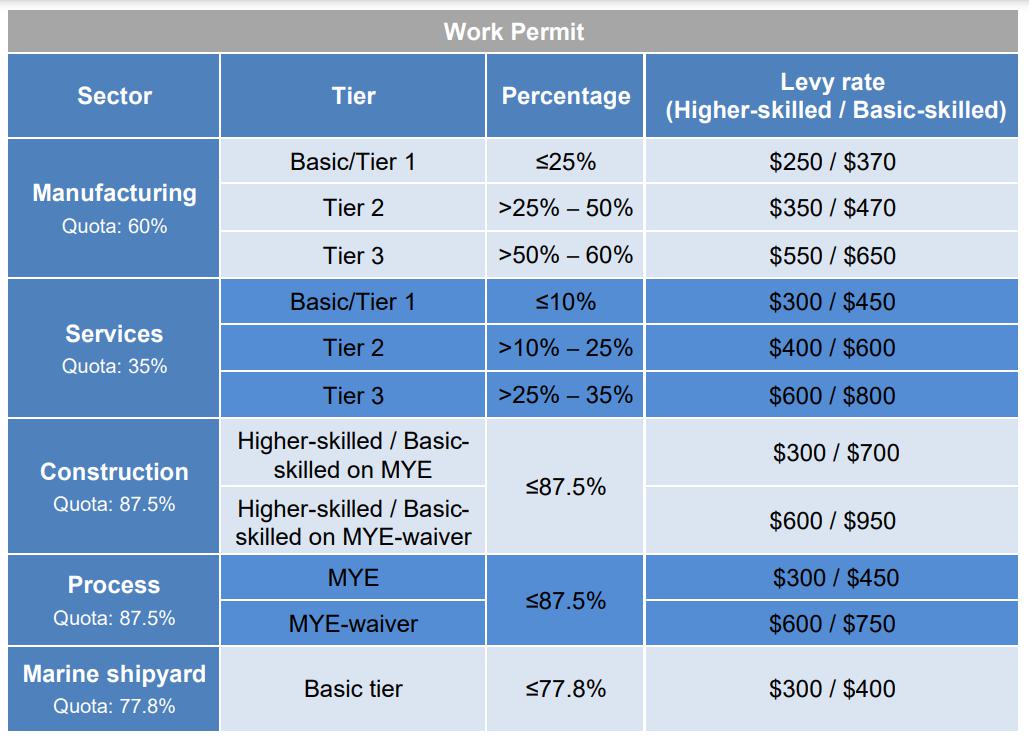

Certain market data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, reports of governmental and international agencies and industry publications and surveys including the Frost & Sullivan Report, a third party global research organization, commissioned by our Company. Industry publications and third-party research, surveys and reports generally indicate that their information has been obtained from sources believed to be reliable. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that relate to our current expectations and views of future events. These forward-looking statements are contained principally in the sections entitled “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Industry Overview” and “Business.” These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “believe”, “plan”, “expect”, “intend”, “should”, “seek”, “estimate”, “will”, “aim” and “anticipate”, or other similar expressions, but these are not the exclusive means of identifying such statements. All statements other than statements of historical facts included in this document, including those regarding future financial position and results, business strategy, plans and objectives of management for future operations (including development plans and dividends) and statements on future industry growth are forward-looking statements. In addition, we and our representatives may from time to time make other oral or written statements which are forward-looking statements, including in our periodic reports that we will file with the SEC, other information sent to our shareholders and other written materials.

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Risk Factors” and the following:

| ● | changes in the laws, regulations, policies and guidelines in Singapore; |

| ● | the regulatory environment in Singapore; |

| ● | competition in the food catering industry in Singapore; |

| ● | the overall economic environment and general market and economic conditions in Singapore; |

| ● | our ability to execute our strategies; |

| ● | our ability to continue as a going concern; |

| ● | changes in the need for capital and the availability of financing and capital to fund these needs; |

| ● | our ability to anticipate and respond to changes in the market in which we operate, and in client demands, trends and preferences; |

| ● | man-made or natural disasters, including war, acts of international or domestic terrorism, civil disturbances, occurrences of catastrophic events and acts of God such as floods, earthquakes, typhoons and other adverse weather and natural conditions that affect our business or assets; |

| ● | the loss of key personnel and the inability to replace such personnel on a timely basis or on terms acceptable to us; |

| ● | exposure to risks associated with food safety; and |

| ● | legal, regulatory and other proceedings arising out of our operations. |

The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results or performance may be materially different from what we expect.

This prospectus contains certain data and information that we obtained from various government and private publications. Statistical data in these publications also include projections based on a number of assumptions. The market for food catering may not grow at the rate projected by such market data, or at all. Failure of this industry to grow at the projected rate may have a material and adverse effect on our business and the market price of our shares. Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

DEFINITIONS

“Amended and Restated Memorandum and Articles of Association” means the amended and restated memorandum and articles of association of our Company adopted on [●], 2024 and as supplemented, amended or otherwise modified from time to time. A copy of the Amended and Restated Memorandum and Articles of Association are filed as Exhibit 3.2 to our Registration Statement of which this prospectus forms a part.

“Better Access” means Better Access Enterprises Limited, a company incorporated in the BVI with limited liability on August 28, 2023 and is wholly-owned by Ms. Tsoi, Kuen Fuk Cherry, an Independent Third Party and which owns 4.30% of our issued and outstanding shares prior to this offering.

“Board” means the board of directors of our Company.

“Business Day” means a day (other than a Saturday, Sunday or public holiday in the U.S.) on which licensed banks in the U.S. are generally open for normal business to the public.

“BVI” means the British Virgin Islands.

“Central Kitchen” means our central kitchen, storage and head office located at 21 Chin Bee Avenue, Singapore 619942, and where the context permits, shall also include the previous central kitchen located at 8A Admiralty Street #04-03, Food Exchange@Admiralty, Singapore 757437 and/or 8A Admiralty Street #06-36, Food Exchange@Admiralty, Singapore 757437.

“Company” means Premium Catering (Holdings) Limited, an exempted company incorporated in the Cayman Islands with limited liability under the Companies Act on May 30, 2023

“Companies Act” means the Companies Act (as amended) of the Cayman Islands.

“COVID-19” means the Coronavirus Disease 2019.

“Directors” means the directors of our Company.

“EPHR” means the Environmental Public Health (Food Hygiene) Regulations of Singapore, as amended, supplemented and/or otherwise modified from time to time.

“Exchange Act” means the United States Securities Exchange Act of 1934, as amended.

“Executive Directors” means the executive Directors of our Company as at the date of this prospectus, unless otherwise stated.

“Executive Officers” means the executive officers of our Company as at the date of this prospectus, unless otherwise stated.

“Food Stall” means the food stall selling Indian food we operate at Stall 1 (#01-K4), JTK Food and Beer House, located at 11A Jalan Tukang Road, #01-K3, Singapore 619267.

“Frost & Sullivan” means Frost & Sullivan Limited, a business consulting firm involved in market research, analysis and growth strategy consulting and an Independent Third Party.

“Group,” “our Group,” “we,” “us,” or “our” means our Company and its subsidiaries or any of them, or where the context so requires, in respect of the period before our Company becoming the holding company of its present subsidiaries, such subsidiaries as if they were subsidiaries of our Company at the relevant time or the businesses which have since been acquired or carried on by them or, as the case may be, their predecessors.

“Halal food” means food in accordance with the dietary standard as prescribed in the Muslim scripture, the Quran, or otherwise permissible for eating by Islamic law.

“Hero Global” means Hero Global Enterprises Limited, a company incorporated in the BVI with limited liability on August 16, 2021 and is our controlling shareholder, wholly-owned by Mr. Yu.

“HFCAA” means the Holding Foreign Companies Accountable Act.

“Independent Directors Nominees” means the independent non-Executive Directors of our Company as at the date of this prospectus, unless otherwise stated.

“Independent Third Party” means a person or company who or which is independent of and is not a 5% owner of, does not control and is not controlled by or under common control with any 5% owner and is not the spouse or descendant (by birth or adoption) of any 5% owner of our Company.

“MOM” means the Ministry of Manpower in Singapore.

“Mr. Gao” means Mr. Gao Lianquan, our Executive Director and Chief Executive Officer.

“Mr. Yu” means Mr. Yu Chun Yin, our Executive Director and controlling shareholder through Hero Global.

“Ms. Kong” means Ms. Kong Chan, an Independent Third Party, and which holds 4.90% of our issued and outstanding shares prior to this offering.

“MUIS” means Majlis Ugama Islam Singapura.

“NEA” means National Environmental Agency of Singapore.

“PCAOB” means the Public Company Accounting Oversight Board.

“Premium Catering” means Premium Catering Private Limited, a company incorporated in Singapore with limited liability on March 30, 2012 and an indirect wholly-owned subsidiary of our Company.

“Resale Shareholders” means collectively Mr. Gao, United Source, Ms. Kong, Trillion Able, Better Access and True Sage and each a “Resale Shareholder”.

“S$” means Singapore dollar(s), the lawful currency of Singapore.

“SEC” or “Securities and Exchange Commission” means the United States Securities and Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Selling Shareholders” mean collectively Ms. Kong as to [ ] shares and Mr. Gao as to [●] shares, each being existing shareholders of our Company that are selling a portion of their shares pursuant to this prospectus.

“SFA” means the Singapore Food Agency.

“Smart Incubator” means our custom-made compartmentalized, heated and insulated food vending locker we use to deliver budget prepared meals to our customers at designated dormitories or work sites in a secured, hygienic and contactless manner.

“Starry Grade” means Starry Grade Limited, a company incorporated in the BVI with limited liability on September 4, 2023, and a direct wholly-owned subsidiary of our Company.

“Trillion Able” means Trillion Able International Limited, a company incorporated in the BVI with limited liability on August 15, 2023 and is wholly-owned by Mr. Cheung Yik Hang, an Independent Third Party and owns 4.90% of our issued and outstanding shares prior to this offering.

“True Sage” means True Sage International Limited, a company incorporated in the BVI with limited liability on November 4, 2022 and is wholly-owned by Mr. Ng Hao Feng, and holds 4.90% of our issued and outstanding shares prior to this offering.

“United Source” means United Source Ventures Limited, a company incorporated in the BVI with limited liability on August 31, 2021 and wholly-owned by Mr. Lam Chi Hei, an Independent Third Party and which owns 4.50% of our issued and outstanding shares prior to this offering.

“US$”, “$” or “USD” or “United States Dollars” means United States dollar(s), the lawful currency of the United States of America.

“WSQ” means the Food and Beverage Workforce Skills Qualification system launched on July 12, 2006 by SkillsFuture Singapore as the national qualifications system for the food and beverage industry.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you, and we urge you to read this entire prospectus carefully, including the “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and our consolidated financial statements and notes to those statements, included elsewhere in this prospectus, before deciding to invest in our shares. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.”

Our Mission

Our mission is to provide exceptional catering services to foreign workers and others ensuring they are nourished, energized and satisfied throughout their workday. We are committed to delivering a variety of delicious, authentic and high quality meals that not only meet the dietary needs and preferences of consumers of our meals, but in a clean, efficient and easily accessible manner.

Overview

We are a certified Halal food caterer specializing in Indian, Bangladesh and Chinese cuisine and we have over 11 years of experience in the catering services industry in Singapore. Mr. Gao, our founder, Executive Director and Chief Executive Officer, is a veteran in the catering industry. Adopting the motto, “Your Welfare Is Our Top Priority”, Mr. Gao set up the Central Kitchen in 2012 under the brand “Premium Catering” to supply budget prepared meals to foreign construction workers (whether individually or through the construction companies that employ them) in Singapore. Over our 11 years of operations, we have expanded and diversified our business to (i) supply budget prepared meals to a wider spectrum of customers, including, among others, foreign workers, students and other individuals residing in dormitories as well as foreign workers working in the construction, marine and manufacturing industries); (ii) operate the Food Stall in the canteen of a dormitory; and (iii) provide buffet catering services for private functions as well as corporate and community events, in Singapore. We also provide ancillary delivery services. As at September 30, 2023 and December 31, 2023, we have a Central Kitchen and a Food Stall, employing a total of 47 and 45 employees respectively with a fleet of five delivery vans.

We endeavor to leverage our successful track record, our brand image and the experience of our management team to embark on an expansion plan to increase our market share in the catering services industry in Singapore through automation, increasing the number of our food stalls as well as active promotion of our services.

Our primary source of revenue is food catering. For the fiscal years ended June 30, 2022 and June 30, 2023 and for the six-month period ended December 31, 2022 and 2023, we recorded revenue of approximately S$5.3 million, S$5.2 million, S$2.6 million and S$2.8 million respectively, primarily contributed by the revenue from the supply of budget prepared meals to a wider spectrum of customers, including, among others, foreign workers, students and other individuals residing in dormitories as well as foreign workers working in the marine and manufacturing industries. Our net income (loss) amounted to approximately S$0.5 million, S$(0.4) million, $S0.02 million and S$(0.5) million for the years ended June 30, 2022 and 2023 and for the six-month period ended December 2022 and 2023, respectively.

Our Company’s ability to continue as a going concern depends upon its ability to market and sell its products to generate positive operating cash flows. For the year ended June 30, 2023 and six-month period ended December 2023, our Company reported net loss of S$0.4 million and S$0.5 million respectively. As of June 30, 2023 and December 31, 2023, our Company’s working capital deficit was S$0.4 million and S$1.5 million. Management has considered supplementing its available sources of funds through the cash generated from operations, other available sources of financing from Singapore banks and other financial institutions, financial comfort from our Company’s related party and financial support from our Company’s controlling shareholder. However, there can be no certainty that these additional financings will be available on acceptable terms or at all. If management is unable to execute this plan, there would likely be a material adverse effect on our Company’s business. All of these factors raise substantial doubt about the ability of our Company to continue as a going concern. The consolidated financial statements for the fiscal years ended June 30, 2023 and 2022 and for the six-month period ended December 2022 and 2023 have been prepared on a going concern basis and do not include any adjustments to reflect the possible future effects on the recoverability and classifications of assets or the amounts and classifications of liabilities that may result from the inability of the Company to continue as a going concern.

Competitive Strengths

We believe our competitive strengthens lie with the following:

| ● | our strong market recognition in the catering services industry in Singapore; |

| ● | our strong commitment to quality of our food and services and food safety; |

| ● | our deployment of an efficient and standardized management system; |

| ● | our established and stable relationship with our major suppliers; and |

| ● | our team of experienced managerial personnel. |

Growth strategies

Our principal objective is to sustain continuous growth in our business and strengthen our market position in the food catering industry with the following strategies:

| ● | Automation of our production line such as installing automated tray dispensers, rice loaders and feeding system, curry dispenser, soup dispenser, label applicator, heat sealing process and a built-in inspection system to bring up our production capacity to approximately 40,000 budget pre-packed meals |

| | ● | Open and/or acquire more food stalls in dormitory canteens or near worksites and/or dormitories, and increase our corporate catering business to cover a more diversified range of functions given our Halal certification, such as weddings, housewarming, conferences, seminars and opening ceremonies |

| | | |

| | ● | Invest and upgrade our computer system by installing an enterprise resource planning (“ERP”) system that manages and integrates our Group’s activities in real-time to facilitate our allocation of manpower and resources in an efficient manner, and link the ERP system with our Smart Incubators to streamline the process of food preparation, delivery and collection |

| | | |

| | ● | Enhanced marketing and sales strategies which shall include reaching out to non-profit organizations such as the Singapore Contractors Association Limited and the Dormitory Association Singapore Limited as well as conducting more door-to-door visits to construction work sites and dormitories |

| | | |

| | ● | Close monitoring and forecast of our pricing policy so that we keep abreast with costs of ingredients, operating costs and trends and spending patterns of customers |

Risks and Challenges

Investing in our shares involves risks. The risks summarized below are qualified by reference to “Risk Factors” beginning on page 17 of this prospectus, which you should carefully consider before making a decision to purchase shares. If any of these risks actually occurs, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our shares would likely decline, and you may lose all or part of your investment.

These risks include but are not limited to the following:

| | ● | social, economic, political and legal developments or instability, as well as any changes in government policies in Singapore could materially and adversely affect our business, results of operations, financial condition and business prospects; |

| | ● | exposure to risks associated with food safety may subject us to liability claims and damage to our reputation; |

| | ● | any deterioration in the market conditions of the industries where our customers work leading to the decline of hiring of foreign workers may affect our business, results of operations, financial condition and business prospects; |

| | ● | we may be unable to control our food costs and labor costs; |

| | ● | disruption in the operations of our Central Kitchen could have a material adverse effect on our business and results of operations; |

| | ● | changes in existing laws, regulations and government policies may cause us to incur additional costs; |

| | ● | The report of our independent registered public accounting firm on our consolidated financial statements includes an explanatory paragraph questioning our ability to continue as a going concern. We recorded net losses in the past and may not be able to continue as a going concern or achieve or maintain profitability in the future; |

| | ● | our operating results could be materially harmed if we are unable to accurately forecast consumer demand for our products and services or we fail to adopt to such changes; |

| | ● | our success depends on our ability to maintain our reputation. If events occur that damage our reputation, our business and financial results may be harmed; |

| | ● | we face dynamic competition from a wide variety of competitors and failure to compete successful could result in a loss of market share, decreased revenue and profitability; |

| | ● | we may implement business strategies and future plans that may not be successful; |

| | ● | we may need additional capital, and financing may not be available on terms acceptable to us, or at all; and |

| | ● | we may incur liabilities that are not covered by insurance. |

Risks Related to Our Securities and This Offering

| ● | an active trading market for our shares may not be established or, if established, may not continue and the trading price for our shares may fluctuate significantly; |

| | |

| ● | we may not maintain the listing of our shares on the Nasdaq which could limit investors’ ability to make transactions in our shares and subject us to additional trading restrictions; |

| | |

| ● | the trading price of our Shares may be volatile, which could result in substantial losses to investors; |

| ● | certain recent initial public offerings of companies with public floats comparable to our anticipated public float have experienced extreme volatility that was seemingly unrelated to the underlying performance of the relevant company. We may experience similar volatility, which may make it difficult for prospective investors to assess the value of our shares; |

| | |

| ● | if securities or industry analysts do not publish research or reports about our business, or if they adversely change their recommendations regarding our shares, the market price for our shares and trading volume could decline; |

| | |

| ● | the sale or availability for sale of substantial amounts of our shares, including the shares held by our Resale Shareholders that are being registered concurrently for resale in the Resale Prospectus, could adversely affect the market price; |

| | |

| ● | short selling may drive down the market price of our shares; |

| | |

| ● | because our public offering price per share is substantially higher than our net tangible book value per share, you will experience immediate and substantial dilution; |

| | |

| ● | you must rely on the judgment of our management as to the uses of the net proceeds from this offering, and such uses may not produce income or increase our share price; |

| | |

| ● | if we fail to implement and maintain an effective system of internal controls, we may be unable to accurately or timely report our results of operations or prevent fraud, and investor confidence and the market price of our shares may be materially and adversely affected; |

| ● | if we are classified as a passive foreign investment company, United States taxpayers who own our securities may have adverse United States federal income tax consequences; |

| | |

| ● | as a company incorporated in the Cayman Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from Nasdaq corporate governance listing standards. These practices may afford less protection to shareholders than they would enjoy if we complied fully with Nasdaq corporate governance listing standards; |

| ● | you may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law; |

| | |

| ● | recently introduced economic substance legislation of the Cayman Islands may impact us or our operations; |

| | |

| ● | certain judgments obtained against us by our shareholders may not be enforceable; |

| | |

| ● | we are an emerging growth company within the meaning of the Securities Act and may take advantage of certain reduced reporting requirements; |

| | |

| ● | we are a foreign private issuer within the meaning of the Exchange Act, and as such we are exempt from certain provisions applicable to United States domestic public companies; |

| | |

| ● | we may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses to us; |

| | |

| ● | we will incur significantly increased costs and devote substantial management time as a result of the listing of our shares on the Nasdaq; |

| | |

| ● | if we fail to meet applicable listing requirements, Nasdaq may delist our Shares from trading, in which case the liquidity and market price of our shares could decline; and |

| | |

| ● | the shares being delisted under the HFCAA if the PCAOB is unable to inspect auditors who are located in Singapore. |

Corporate Information

We were incorporated in the Cayman Islands as an exempted company on May 30, 2023. Our registered office in the Cayman Islands is at Cricket Square, Hutchins Drive, P.O. Box 2681, Grand Cayman, KY1-1111 Cayman Islands. Our principal executive office is at 6 Woodlands Walk, Singapore 738398. Our telephone number at this location is+ 65 6970 1488. Our principal website address is https://premium-catering.com.sg. The information contained on our website does not form part of this prospectus. Our agent for service of process in the United States is Cogency Global Inc., 122 E. 42nd Street, 18th Floor, New York, New York 10168.

Because we are incorporated under the laws of the Cayman Islands, you may encounter difficulty protecting your interests as a shareholder, and your ability to protect your rights through the U.S. federal court system may be limited. Please refer to the sections entitled “Risk Factors” and “Enforceability of Civil Liabilities” for more information.

Implications of Our Being an Emerging Growth Company

As a company with less than US$1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. These provisions include:

| | ● | being permitted to provide only two years of selected financial information (rather than five years) and only two years of audited financial statements (rather than three years), in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; and |

| | | |

| | ● | an exemption from compliance with the auditor attestation requirement of the Sarbanes-Oxley Act, on the effectiveness of our internal control over financial reporting. |

We may take advantage of these reporting exemptions until we are no longer an emerging growth company. We will remain an emerging growth company until the earliest of (1) the last day of the fiscal year in which the fifth anniversary of the completion of this offering occurs, (2) the last day of the fiscal year in which we have total annual gross revenue of at least US$1.235 billion, (3) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act, which means the market value of our shares that are held by non-affiliates exceeds US$700.0 million as of the prior December 31, and (4) the date on which we have issued more than US$1.0 billion in non-convertible debt during the prior three-year period. We may choose to take advantage of some, but not all, of the available exemptions. We have included two years of selected financial data in this prospectus in reliance on the first exemption described above. Accordingly, the information contained herein may be different from the information you receive from other public companies in which you hold stock.

Implications of Being a “Controlled Company”

Upon completion of this offering, our issued and outstanding shares will consist of [●] Ordinary Shares. We will be a controlled company as defined under the Nasdaq Capital Market Company Guide Section 801(a), immediately after the completion of this offering, Hero global will own approximately [●] Ordinary Shares, or [●]% of our total issued and outstanding Ordinary Shares, representing approximately [●]% of the total voting power. Consequently, our controlling shareholders will have the ability to determine all matters requiring approval by shareholders. Because, we will be a “controlled company” within the meaning of the Nasdaq Capital Market Rules, we are eligible for certain exemptions from the corporate governance requirements of the Nasdaq Capital Market listing rules. In the event that we were to lose our “controlled company” status, we intend to rely on the NASDAQ rules that permit a foreign private issuer to follow its home country requirements to some extent concerning corporate governance issues, including whether a majority of its board of directors must be independent.

Implications of Our Being a Foreign Private Issuer

Upon completion of this offering, we will report under the Exchange Act as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| | ● | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| | | |

| | ● | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| | | |

| | ● | the rules under the Exchange Act requiring the filing with the Securities and Exchange Commission, or the SEC, of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

Both foreign private issuers and emerging growth companies are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither emerging growth companies nor foreign private issuers.

In addition, as a company incorporated in the Cayman Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from the corporate governance listing requirements of the Nasdaq. These practices may afford less protection to shareholders than they would enjoy if we complied fully with corporate governance listing requirements of the Nasdaq. Following this offering, we will rely on home country practice to be exempted from certain of the corporate governance requirements of the NASDAQ, which includes the following:

| ● | that a majority of our Directors are not required to be independent Directors; |

| ● | that our non-management directors are not required to meet on a regular basis without management present; and |

| ● | that our Company is not required to seek shareholder approval for the implementation of certain equity compensation plans and dilutive issuance of Shares, such as transactions, other than a public offering, involving the sale of 20% or more of our shares for less than the greater of book or market value of the shares. |

The Offering

| Offering Price | The initial public offering price will be between US$[●] and US$[●] per share. |

| | |

| Shares offered by us | [●] shares. |

| | |

| Shares offered by the Selling Shareholders | [●] shares (of which Hero Global is selling [●] shares and Ms. Kong is selling [●] shares). |

| | |

| Shares issued and outstanding prior to this offering | [●] shares. |

| | |

| Shares to be issued and outstanding immediately after this offering | [●] shares. |

| | |

| Use of proceeds | We currently intend to use the net proceeds from this offering (i) to upgrade and integrate our information technology system; (ii) for automation of our production services; (iii) to strengthen our environmental, social, and governance (“ESG”); (iv) to expand and renew our fleet of delivery trucks; (v) for possible strategic acquisitions; (vi) for marketing and branding; (vii) to repay an interest free loan made by a shareholder to us for paying of expenses in connection with obtaining a listing of our shares; and; (viii) for general working capital and corporate purposes. See “Use of Proceeds” on page 31. |

| | |

| Lock-up | We, each of our Directors and Executive Officers and certain principal shareholders have agreed, subject to certain exceptions, for a period of 180 days after the date of this prospectus, not to, except in connection with this offering, offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend or otherwise transfer or dispose of, directly or indirectly, any shares or any other securities convertible into or exercisable or exchangeable for shares, or enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of shares. See “shares Eligible for Future Sale” and “Underwriting—Lock-Up Agreements” on page 130. |

| | |

| Risk factors | Investing in our shares involves risks. See “Risk Factors” beginning on page 17 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our Shares. |

| | |

| Listing | We plan to apply to list the shares on the Nasdaq. |

| | |

| Proposed trading symbol | [●] |

| | |

| Transfer agent | [●] |

| | |

| Payment and settlement | The underwriter expects to deliver the shares against payment therefor through the facilities of the Depository Trust Company on [●], 2024. |

RISK FACTORS

Investing in our shares is highly speculative and involves a significant degree of risk. You should carefully consider the following risks, as well as other information contained in this prospectus, before making an investment in our Company. The risks discussed below could materially and adversely affect our business, prospects, financial condition, results of operations, cash flows, ability to pay dividends and the trading price of our shares. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, prospects, financial condition, results of operations, cash flows and ability to pay dividends, and you may lose all or part of your investment.

This prospectus also contains forward-looking statements having direct and/or indirect implications on our future performance. Our actual results may differ materially from those anticipated by these forward-looking statements due to certain factors, including the risks and uncertainties faced by us, as described below and elsewhere in this prospectus.

Risks Related to Our Business and Industry

Social, economic, political and legal developments or instability, as well as any changes in government policies, in Singapore, could materially and adversely affect our business, results of operations, financial condition and business prospects

Our major assets and business operation is located in Singapore and, during the fiscal year ended June 30, 2023, all of our revenue was derived from Singapore. Therefore, our business, results of operations, financial condition and business prospects are significantly exposed to the social, economic, political and legal developments in Singapore. Uncertainties in these areas include, but are not limited to, the risks of war, regional conflicts, terrorism, extremism, nationalism, nullification of contracts, changes in interest rates, imposition of capital controls, foreign ownership restrictions and international sanctions, changes in government policies and introduction of new rules or regulations concerning our industry (such as the restriction on foreign labour), as well as methods of taxation. In particular, events with adverse impact on investors’ confidence and risk appetites, such as general deterioration of the economy, mass civil disobedience movements (such as strikes and industrial actions), significant fluctuations in the stock exchange, deterioration of political relations or tightening of foreign investment may lead to a reduction in the number of foreign labour as well as can affect the industries in which the foreign workers work, such as construction and shipping, affect our business, results of operations, financial condition and business prospects. Our Directors anticipate that Singapore will continue to be the principal base of our business operations in the near future. There is no assurance that any future changes in the existing government policies, economic, social and political conditions and the business environment in Singapore, some of which are beyond our control (such as natural disasters, pandemics/epidemics like the outbreak of COVID-19, severe acute respiratory syndrome, the H5N1 strain of avian influenza and the H1N1 strain of swine flu, acts of God and other disasters), will not have a negative effect on our business operations. Specifically, our business and results of operations could be materially and adversely affected by changes in laws and regulations concerning the foreign labor, as well as environmental or health and safety matters, in Singapore.

Going Concern and History of Net Losses

Our Company’s audited annual consolidated financial statements for the year ended June 30, 2023 (the “2023 Financial Statements”) and unaudited interim consolidated financial statement for the six-month period ended December 31, 2023, including the report of the independent registered public accounting firm with respect thereto, were prepared assuming that our Company will continue as a going concern, which assumes that our Company will be able to realize its assets and satisfy its liabilities in the normal course of business for the foreseeable future. As discussed in Note 2 to the 2023 Financial Statements, our Company has incurred losses and has negative cash flows from operations that raise substantial doubt about its ability to continue as a going concern.

For the year ended June 30, 2023, our Company generated a net loss of S$441,745 and a working capital deficit of S$352,500. For the six-month period ended December 31, 2023, our Company generated a net loss of S$455,890 and a working capital deficit of S$1,521,742. The continued operations of our Company are dependent on management’s ability to manage costs, raise additional equity or debt, and on future profitable operations. Whether and when our Company can generate sufficient operating cash flows to pay for its expenditures and settle its obligations as they fall due is uncertain. Furthermore, there can be no assurances that our Company will be able to raise funds through future debt or equity issuances. As a result of these conditions, management has concluded, in making its going concern assessment, that there are material uncertainties related to events and conditions that may cast significant doubt upon our Company’s ability to continue as a going concern.

Exposure to risks associated with food safety may subject us to liability claims and damage to our reputation

Our Group is exposed to risks associated with food safety which may subject us to liability claims, damage our reputation and/or affect our relationship with our customers. Our main business activity is the preparation and supply of food. As a result, we are particularly exposed to damage resulting from actual or perceived issues regarding the safety or quality of the food provided by us. For the fiscal years ended June 30, 2023 and 2022, and for the six-month period ended December 31, 2023 and 2022, we did not experience any food safety issues. However, claims of illness, food poisoning and injury relating to contaminated, spoiled, mislabeled or adulterated food can require costly measures to investigate and remediate to, such as withdrawing products or destroying supplies and inventory that are unfit for consumption. We rely on strict adherence by employees to standards for food handling and preparation. Claims related to food quality or food mishandling are common in the food service industry and a number of these claims may exist at any given time. If we are found to be negligent in food safety, we may be exposed to significant liability, which could have an adverse impact on our Group’s results of operations. Even if any such claims are without merit, any negative publicity as a result of allegations of unsafe food service can have a significant impact on our Group’s reputation.

Any deterioration in the market conditions of the industries where our customers work leading to the decline of hiring of foreign workers may affect our business, results of operations, financial condition and business prospects

We primarily provide meal services to foreign workers reside in dormitories in the construction, marine and manufacturing industries. General economic, social and political conditions affecting these industries may reduce their requirement for foreign workers and in turn reduce the demand for our Group’s services and affect our overall operations. Worldwide downturns in the construction, marine and manufacturing industries may be experienced as a result of generally weak economic conditions leading to fewer hires and requirement for staff, in particular foreign workers. As such, our Group is dependent on the number of foreign workers in these industries which, in turn, is dependent on those industries’ performance and demand.

We may be unable to control our food costs and labor costs

Our business relies on our ability to purchase food supplies and prepare meals on a cost-efficient basis. Food costs are variable and prices are subject to the risk of inflation. Inflation in the price of food can be driven by several factors, such as scarcity due to poor weather conditions, increased oil and transport prices and overall population growth. In addition, because our business also require that we maintain a sizeable workforce, we are also sensitive to labor costs. In order to operate efficiently, it is important that we accurately predict and manage staffing levels. Failure to accurate manage food costs and labor costs or if we fail to pass on these increased costs could have a material and adverse affect on our financial performance.

Disruption in the operations of our Central Kitchen could have a material adverse effect on our business and results of operations

We have established a Central Kitchen where our semi-processed or processed food are prepared. The purpose of the Central Kitchen is to centralise the process of ingredient preparation which would, in turn, bring about cost-saving and increase efficiency of the restaurant operations. Any disruption of operations at our Central Kitchen, such as electricity or water suspensions, for whatever reason, may result in our failure to prepare meals to our customers in a timely manner, or at all, which may cause part or all of our operations to suspend. If we are unable to offer our meals timely, we may experience a significant reduction in revenue and our brand value may suffer, resulting in a material adverse effect on our business and results of operations. As such, the disruptions at the Central Kitchen may potentially increase our cost and time in preparation of the meals leading to a decrease in revenue which ultimately have an adverse impact on our financial performance.

Changes in existing laws, regulations and government policies may cause us to incur additional costs

Our business operations are governed by various laws, regulations and government policies in Singapore. The SFA food safety regulations may change from time to time. We may be unable to comply with all these requirements in time, or at all, or we may need to incur substantial costs to be compliant, which may adversely affect our business operations and financial condition.

Our operating results could be materially harmed if we are unable to accurately forecast consumer trends and demand for our products and services or we fail to adapt to such change

We believe that our success is, to a significant extent, attributable to the ability of our Group’s to understand the types, variety and taste of food that foreign workers and other consumers crave and our ability to keep abreast with changes in their preference and seasonal ingredients. Due to the highly subjective nature of the consumer market and changes in tastes, we may be unable to capture or predict the future trend and continue to develop appealing and tasteful food products for our customers’ workers. If we fail to (i) capture, predict or respond timely to our customers’ workers’ preferences; or (ii) introduce appealing and tasteful products in a timely manner, our business and results of operations may be adversely affected.

Our success depends on our ability to maintain our reputation. If events occur that damage our reputation, our business and financial results may be harmed

Our business, results of operations and prospects depend, in part, on our ability to maintain our reputation for providing high quality food products and services. We could lose existing or potential clients if our reputation were to be associated with any negative publicity, including negative complaints raised by unsatisfied clients, poor food quality, contamination etc. that comes to the public’s attention. If we fail to successfully maintain, promote and position our brand and protect our reputation, our business, financial condition and operating results may be adversely affected.

We face dynamic competition from a wide variety of competitors and failure to compete successful could result in a loss of market share, decreased revenue and profitability

Our Group faces a dynamic competitive landscape marked by intense competition from a variety of players. Any inability by us to compete successfully with our competitors and adapt to changing market conditions could result in a loss in market share, decreased revenue and/or lower profitability. Our Group’s competitors range from small, local businesses to listed companies with substantial financial resources. We compete based on several factors, including the quality of our food products, the timeliness of deliveries, the variety of food products and our ability to tailor the food and services we offer to a client’s particular needs and our ability to manage costs effectively. If our clients and customers do not perceive the quality and cost value of our services, or if there is insufficient demand for our food products and services, our Group’s business, results of operations and financial position could be materially adversely affected.

We may implement business strategies and future plans that may not be successful

The successful implementation of our business strategies and future plans depends on a number of factors including general market conditions, government policies, the availability of funds, our technology, competition and our ability to retain and recruit competent employees. There is no assurance that our business strategies and future plans can be implemented effectively and successfully, as some of these factors are beyond our control. If any implementation of these strategies and plans fails or is delayed, we may be adversely affected by investment expenses that have not led to the anticipated results, by the distraction of management from our core business or by damage to our brand or reputation. Additionally, if we fail to secure adequate funds in a timely manner, we may also be unable to pursue opportunities to expand our business.

We may need additional capital, and financing may not be available on terms acceptable to us, or at all

Although our current cash and cash equivalents, anticipated cash flows from operating activities, other available sources of financing from Singapore banks and other financial institutions and the proceeds from this offering will be sufficient to meet our anticipated working capital requirements and capital expenditures in the ordinary course of business for at least 12 months following this offering, there is a risk that we may need additional cash resources in the future to fund our growth plans or if we experience adverse changes in business conditions or other developments. We may also need additional cash resources in the future if we find and wish to pursue opportunities for new investments, acquisitions, capital expenditures or similar actions. If we determine that our cash requirements exceed the amount of cash and cash equivalents we have on hand at the time, we may seek to issue equity or debt securities or obtain credit facilities. We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all. The issuance and sale of additional equity would result in further dilution to our shareholders. The occurrence of any of these risks could adversely affect our operations or financial condition.

We may incur liabilities that are not covered by insurance

Our Group may incur liabilities that are not covered by insurance. We have taken out various types of insurance policies including general liability coverage and directors’ liability insurance. We may not always be able to accurately foresee all activities and situations in order to ensure that they are fully covered by the terms of its insurance policies and, as a result, we may not be covered by insurance in specific instances. While we seek to maintain appropriate levels of insurance, not all claims are insurable and we may experience major incidents of a nature that is not covered by insurance. We maintain an amount of insurance protection that we believes is adequate, but there can be no assurance that our insurance coverage will be sufficient or effective under all circumstances and against all liabilities to which our Group may be subject. Our Group may be unable to maintain our current insurance coverage or do so at a reasonable cost, which could have an adverse effect on our Group’s business, results of operations and financial position in the event of an uninsured loss.

We may expose to interest rate risk for the bank borrowings outstanding

We currently have five bank facilities of which four are fixed interest rate term loans taken out by Premium Catering in aggregate of approximately S$1.6 million with maturity dates of between September 2025 and July 2026, one is variable interest rate short term facility taken out by Premium Catering in the amount of S$0.2 million with maturity dates of between July 2023 and October 2023. Singapore banks have increased interest rates, as most loans are based on the Singapore Overnight Rate Average (SORA) or the Singapore Interbank Offered Rate (SIBOR) which moves historically in tandem with the interest rates set by the US Federal Reserve. Four of the facilities taken out by Premium Catering are at a fixed interest rate and were not affected by the rate increase. As a result of the rate hike, borrowing costs for the Group increased by S$2,843 and S$8,233 for the fiscal year ended June 30, 2023 and for the six-month period ended December 31, 2023. Despite the effect of the rate increase on our Group not being significant, if rates continue to rise and we are unable to pass this increased cost to our customers, our financial performance may be materially and adversely affected.

Risks Related to Our Securities and This Offering

An active trading market for our shares may not be established or, if established, may not continue and the trading price for our shares may fluctuate significantly

We cannot assure you that a liquid public market for our shares will be established. If an active public market for our shares does not occur following the completion of this offering, the market price and liquidity of our shares may be materially and adversely affected. The public offering price for our shares in this offering was determined by negotiation between us and the underwriter based upon several factors, and we can provide no assurance that the trading price of our shares after this offering will not decline below the public offering price. As a result, investors in our shares may experience a significant decrease in the value of their shares.

We may not maintain the listing of our shares on the Nasdaq which could limit investors’ ability to make transactions in our shares and subject us to additional trading restrictions

We intend to list our shares on the Nasdaq concurrently with this offering. In order to continue listing of our shares on the Nasdaq, we must maintain certain financial and share price levels and we may be unable to meet these requirements in the future. We cannot assure you that our Shares will continue to be listed on the Nasdaq in the future.

If the Nasdaq delists our shares and we are unable to list our shares on another national securities exchange, we expect our shares could be quoted on an over-the-counter market in the United States. If this were to occur, we could face significant material adverse consequences, including:

| | ● | a limited availability of market quotations for our shares; |

| | | |

| | ● | reduced liquidity for our shares; |

| | | |

| | ● | a determination that our shares are “penny stock,” which will require brokers trading in our shares to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our shares; |

| | | |

| | ● | a limited amount of news and analyst coverage; and |

| | | |

| | ● | a decreased ability to issue additional securities or obtain additional financing in the future. |

As long as our shares are listed on the Nasdaq, U.S. federal law prevents or preempts the states from regulating their sale. However, the law does allow the states to investigate companies if there is a suspicion of fraud, and, if there is a finding of fraudulent activity, then the states can regulate or bar their sale. Further, if we were no longer listed on the Nasdaq, we would be subject to regulations in each state in which we offer our shares.

The trading price of our shares may be volatile, which could result in substantial losses to investors

The trading price of our shares may be volatile and could fluctuate widely due to factors beyond our control. This may happen because of the broad market and industry factors, like the performance and fluctuation of the market prices of other companies with business operations located in Singapore that have listed their securities in the United States. In addition to market and industry factors, the price and trading volume for our shares may be highly volatile for factors specific to our own operations, including the following:

| | ● | fluctuations in our revenues, earnings and cash flow; |

| | | |

| | ● | changes in financial estimates by securities analysts; |

| | | |

| | ● | additions or departures of key personnel; |

| | | |

| | ● | release of lock-up or other transfer restrictions on our outstanding equity securities or sales of additional equity securities; and |

| | | |

| | ● | potential litigation or regulatory investigations. |

Any of these factors may result in significant and sudden changes in the volume and price at which our shares will trade.

In the past, shareholders of public companies have often brought securities class action suits against those companies following periods of instability in the market price of their securities. If we were involved in a class action suit, it could divert a significant amount of our management’s attention and other resources from our business and operations and require us to incur significant expenses to defend the suit, which could harm our results of operations. Any such class action suit, whether or not successful, could harm our reputation and restrict our ability to raise capital in the future. In addition, if a claim is successfully made against us, we may be required to pay significant damages, which could have a material adverse effect on our financial condition and results of operations.

Certain recent initial public offerings of companies with public floats comparable to our anticipated public float have experienced extreme volatility that was seemingly unrelated to the underlying performance of the relevant company. We may experience similar volatility, which may make it difficult for prospective investors to assess the value of our shares

In addition to the risks addressed above in “— The trading price of our shares may be volatile, which could result in substantial losses to investors,” our shares may be subject to extreme volatility that is seemingly unrelated to the underlying performance of our business. Recently, companies with comparable public floats and initial public offering sizes have experienced instances of extreme stock price run-ups followed by rapid price declines, and such stock price volatility was seemingly unrelated to the respective company’s underlying performance. Although the specific cause of such volatility is unclear, our anticipated public float may amplify the impact the actions taken by a few shareholders have on the price of our shares, which may cause our share price to deviate, potentially significantly, from a price that better reflects the underlying performance of our business. Should our shares experience run-ups and declines that are seemingly unrelated to our actual or expected operating performance and financial condition or prospects, prospective investors may have difficulty assessing the rapidly changing value of our shares. In addition, investors of our shares may experience losses, which may be material if the price of our shares declines after this offering or if such investors purchase shares of our shares prior to any price decline.

If securities or industry analysts do not publish research or reports about our business, or if they adversely change their recommendations regarding our shares, the market price for our shares and trading volume could decline

The trading market for our shares will be influenced by research or reports that industry or securities analysts publish about our business. If one or more analysts downgrade(s) our shares, the market price for our shares would likely decline. If one or more of these analysts cease(s) to cover us or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause the market price or trading volume for our shares to decline.

The sale or availability for sale of substantial amounts of our shares, including the shares held by our Resale Shareholders that are being registered concurrently for resale in the Resale Prospectus, could adversely affect the market price

Sales of substantial amounts of our shares in the public market after the completion of this offering and from the sale of shares held by our Resale Shareholders through the Resale Prospectus, or the perception that these sales could occur could adversely affect the market price of our shares and could materially impair our ability to raise capital through equity offerings in the future. Prior to the sale of our shares in this offering, we have [●] shares outstanding. The shares sold in this offering will be freely tradable without restriction or further registration under the Securities Act, and shares held by the Resale Shareholders and registered for sale under the Resale Prospectus may also be sold in the public market and the Resale Shareholders’ shares are not subject to lock-up agreements. There will be [●] shares outstanding immediately after this offering. In connection with this offering, our Directors and Executive Officers named in the section “Management,” have agreed not to sell any shares until 180 days after the date of this prospectus without the prior written consent of the representative of the underwriter, subject to certain exceptions, unless the underwriters release these securities from these restrictions. In connection with sale of shares by the Resale Shareholders, they may be willing to accept a lower sales price than the price investors pay in this offering, which could substantially lower the market price of our shares. We cannot predict what effect, if any, market sales of securities held by the Resale Shareholders or any other shareholder or the availability of these securities for future sale will have on the market price of our shares. See “Underwriting” and “shares Eligible for Future Sale” for a more detailed description of the restrictions on selling our securities after this offering.

Short selling may drive down the market price of our shares