Investor Presentation September 2024

2 Forward-Looking Statements Some of the statements contained in this report (including the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section) that are not historical in nature are forward-looking statements within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements as to our expectations, beliefs, goals and strategies regarding the future. Words such as “anticipate,” “believe,” “create,” “expect,” “future,” “guidance,” “intend,” “plan,” “potential,” “seek,” “synergies,” “target,” “will,” “would,” similar expressions, and variations or negatives of these words identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. These forward-looking statements may involve current plans, estimates, expectations and ambitions that are subject to risks, uncertainties and assumptions that are difficult to predict, may be beyond our control and could cause actual results to differ materially from those described in such statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct, that our growth and operational strategies will achieve the target results. Important risk factors that may cause such a difference and could adversely affect attendance at our parks, our future financial performance, and/or our growth strategies, and could cause actual results to differ materially from our expectations or otherwise to fluctuate or decrease, include, but are not limited to: general economic, political and market conditions; the impacts of pandemics or other public health crises, including the effects of government responses on people and economies; adverse weather conditions; competition for consumer leisure time and spending; unanticipated construction delays; changes in our capital investment plans and projects; anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the Combined Company’s operations; failure to realize the anticipated benefits of the merger, including difficulty in integrating the businesses of legacy Six Flags and legacy Cedar Fair; failure to realize the expected amount and timing of cost savings and operating synergies related to the merger; legislative, regulatory and economic developments and changes in laws, regulations, and policies affecting the Combined Company; acts of terrorism or outbreak of war, hostilities, civil unrest, and other political or security disturbances; and other factors we discuss in the filings we make from time to time with the SEC. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation and are based on information currently and reasonably known to us. We do not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events, information or circumstances that arise after the date of this document.

3 Enhanced Scale and Market Position o Largest and most diverse amusement park operators with 42 parks across North America Geographic Diversification o Reduces regional weather-related risks and mitigates seasonal earnings volatility Significant Synergies o Efficiencies created from savings and better resource allocation across an expanded portfolio Robust Free Cash Flow o Opportunity to generate annual free cash flow >$800M driven by synergies & higher net revenues Strong Financial Position o Enhanced levels of cash flow to retain balance sheet strength and lower debt-to-EBITDA ratio Resilient Business Model o Proven operating playbook has driven growth and profitability through all economic cycles Management Expertise o Cedar Fair's leadership team now at the helm has a strong record of operational excellence Strategic Growth Opportunities o Broader scope of long-term growth opportunities through expansions, investments and innovation Six Flags: Merger Creates Compelling Investment Opportunity

4 Six Flags Governance – Decades of Industry Leadership Executive Leadership Richard Zimmerman Chief Executive Officer and Director Tim Fisher Chief Operating Officer Brian Witherow Chief Financial Officer Brian Nurse Chief Legal Officer Board Leadership Selim Bassoul Executive Chairman Dan Hanrahan Lead Independent Director

5 Benefits of scale Equity structure Efficiencies from consolidation Economic Flexibility Enhance guest experience Merger Rationale Equity structure. Investor participation in significant growth and value-accretive potential through tax-efficient transaction Benefits of scale. Mitigates the effects of seasonality and weather on earnings via significant geographic scale and continental footprint Efficiencies from consolidation. Drive cost savings through centralization and shared services, deploying best-in-breed strategies and smarter business practices Economic Flexibility. Generate higher levels of free cash flow across a larger customer base, utilizing a playbook proven to consistently grow attendance and revenues, improve capital allocation flexibility and strengthen capital structure Enhance the guest experience. Create an experience so rich and compelling that our guests view our parks as an indispensable choice and essential destination for out-of-home family fun 1 2 5 4 3 1 2 5 4 3

6 COMBINED ASSETS (POST MERGER) Amusement parks27 Attractive Portfolio of Park Assets Across North America Water parks 15 9 Resort properties with 2,300+ rooms and 600+ cabins / campground sites

7 Diversified Geographic Footprint Helps Mitigate Weather-Related and Seasonal Earnings Volatility Regional balance ensures that no single park contributes more than 17% of park-level Adjusted EBITDA, and no single region contributes more than 30%. Midwest 29% West 27% South 27% Northeast 17% Note: Geographic breakdown based on 2023 attendance; West: Arizona, California; Northeast: Canada, Massachusetts, Maryland, New Jersey, New York, Pennsylvania; South: Georgia, Mexico, North Carolina, Oklahoma, Texas; Midwest: Michigan, Minnesota, Missouri, Ohio

8 Strategically Positioned in All Top-10 DMAs • Proximity to major metro areas benefits guests who can easily drive to parks • 250 million people live within 100 miles of Six Flags parks(1) Major Six Flags Parks Near Fast-Growing and Desirable Metro Areas Across North America 1 Based on a 2023 survey of radio market population within designated market areas published by A.C. Nielsen Media Research

9 Amusement Parks 11 + 16 = 27 Water Parks 4 + 11 = 15 Hotels / Resort Properties 7 + 2 = 9 Campgrounds 4 + 2 = 6 Safaris / Animal Experiences - + 2 = 2 Sports Facilities 2 + - = 2 Marinas 3 + - = 3 Expanded Portfolio Offers Well-rounded Guest Experience

10 World’s Largest Regional Amusement Park Company Currently Well Positioned The Opportunity 1 2 5 4 3 6 7 Strategically located in desirable and growing metro areas Attractive real estate portfolio of iconic parks and resorts Long-term demand established in the highly competitive leisure space Geographic diversification reduces regional weather-related risks and earnings volatility Recurring revenue streams and stable free cash flow generation Resilient business model with track record of producing profitable growth Long tenured leadership team with history of innovation and value creation $200 million of total synergies over next 36 mos. Recovery of 10+ million visits at legacy SIX parks Enhanced guest experience to drive higher levels of attendance and guest spending All Parks Season Pass across 42 properties

11 2024 Season Passes and 2025 All Park Pass Opportunity “Traditional” Season Pass Passes valid from launch through following calendar year Active Base of 3.1M Sold 3.1M Traditional Season Pass Units Average Sales Price - $115 4.8 Visits Per Active Pass 28% Renewal Rate in 2023 “Traditional” Season Pass AND Membership Monthly subscription that auto-renews in 13th month after joining Active Base of 4.5M Sold 3.6M Traditional Units and 260k Memberships Additional 700k Memberships 13+ Average Sales Price - $79 3.0 Visits per Active Pass 18% Renewal Rate in 2023 Combined Active Base 7.6 million passes sold Offered for the 2025 Season at all 42 Parks

12 Guest satisfaction is vital to our long-term success and makes everything we do as a business easier to achieve P1 Six Flags Business Approach – Key Principles Strategically investing marketable capital into the business drives growth and ensures the long-term sustainability of our business P2 We are a volume-driven business where strong attendance drives longer length of stay, higher per caps and ongoing pricing power P3 Our season pass program provides a reliable, recurring revenue stream and continues to be the financial engine of our business P4 Guests today view the availability of unique, high-quality food and beverage an essential and increasingly valuable part of the experience P5 Safety, park cleanliness, attractive landscaping and family entertainment are core elements that resonate with parents who have share of wallet P6 We staff our parks to operate fully yet efficiently without sacrificing excellent customer service P7 Leveraging the power of scalable technologies today is fundamental to enhancing the guest experience P8

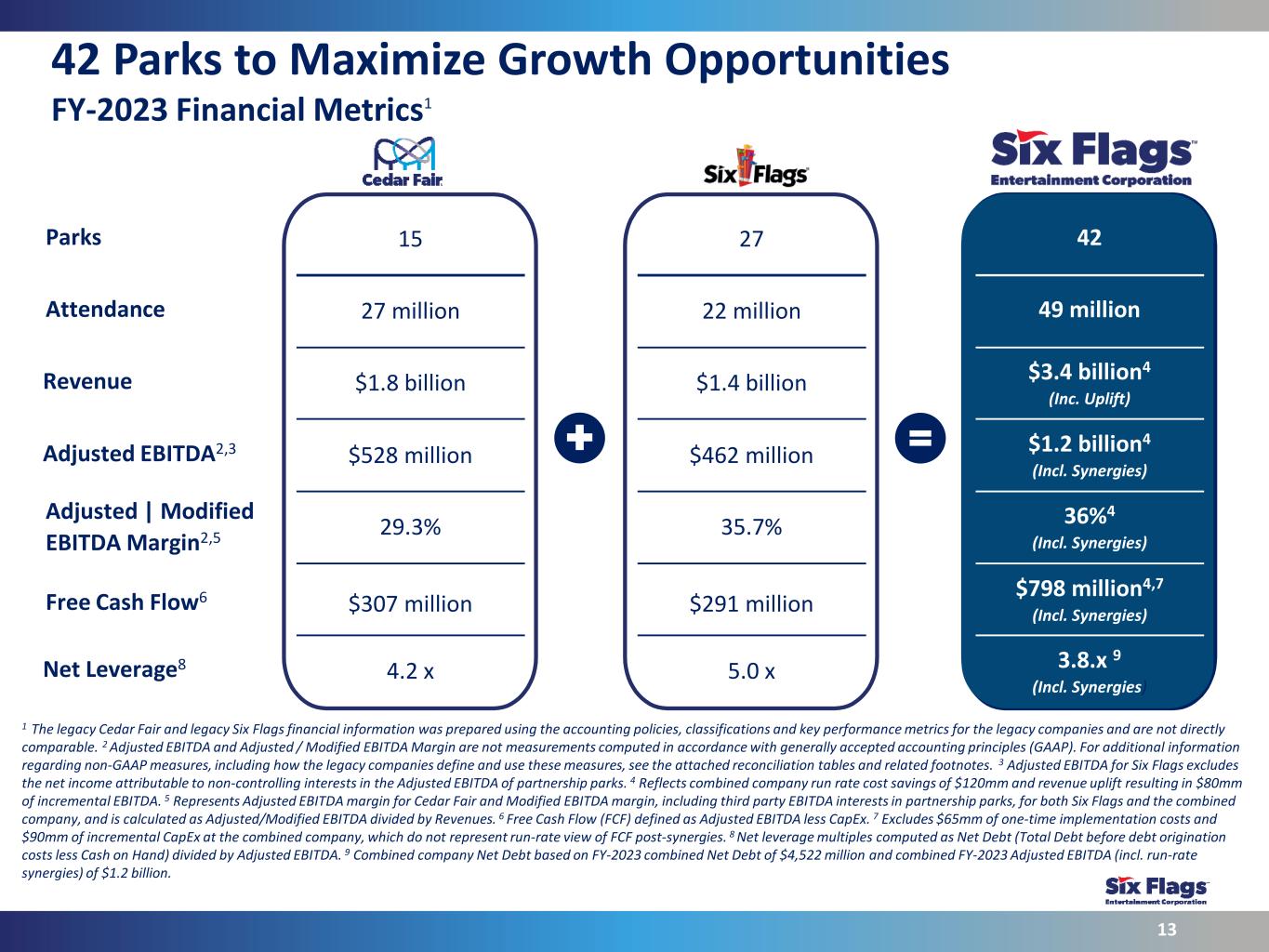

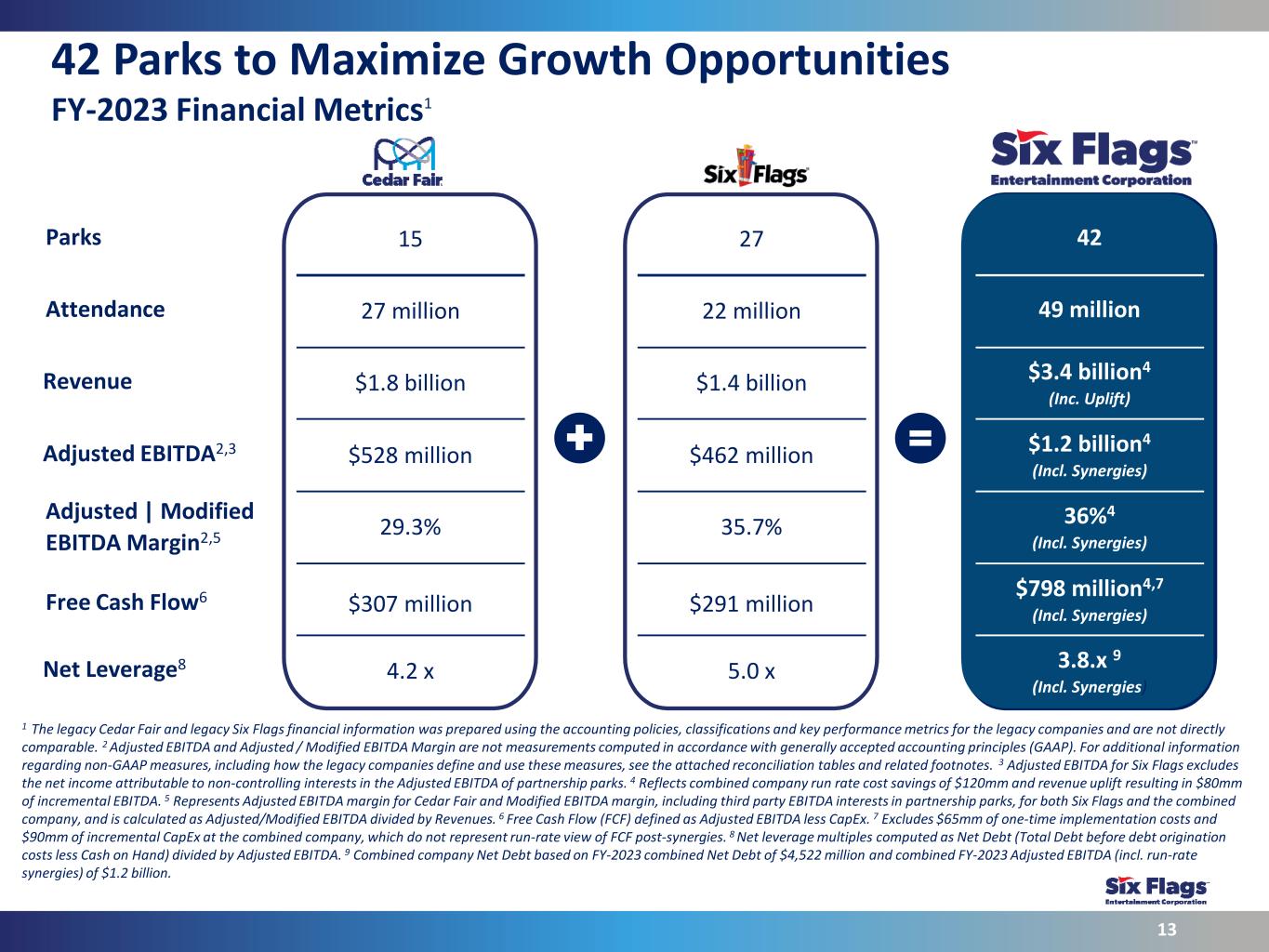

13 42 Parks to Maximize Growth Opportunities FY-2023 Financial Metrics1 Net Leverage8 Revenue Adjusted EBITDA2,3 Adjusted | Modified EBITDA Margin2,5 Attendance Free Cash Flow6 Parks 15 27 million $1.8 billion $528 million 29.3% $307 million 4.2 x 27 22 million $1.4 billion $462 million 35.7% $291 million 5.0 x 42 49 million $3.4 billion4 (Inc. Uplift) $1.2 billion4 (Incl. Synergies) 36%4 (Incl. Synergies) $798 million4,7 (Incl. Synergies) 3.8.x 9 (Incl. Synergies) 1 The legacy Cedar Fair and legacy Six Flags financial information was prepared using the accounting policies, classifications and key performance metrics for the legacy companies and are not directly comparable. 2 Adjusted EBITDA and Adjusted / Modified EBITDA Margin are not measurements computed in accordance with generally accepted accounting principles (GAAP). For additional information regarding non-GAAP measures, including how the legacy companies define and use these measures, see the attached reconciliation tables and related footnotes. 3 Adjusted EBITDA for Six Flags excludes the net income attributable to non-controlling interests in the Adjusted EBITDA of partnership parks. 4 Reflects combined company run rate cost savings of $120mm and revenue uplift resulting in $80mm of incremental EBITDA. 5 Represents Adjusted EBITDA margin for Cedar Fair and Modified EBITDA margin, including third party EBITDA interests in partnership parks, for both Six Flags and the combined company, and is calculated as Adjusted/Modified EBITDA divided by Revenues. 6 Free Cash Flow (FCF) defined as Adjusted EBITDA less CapEx. 7 Excludes $65mm of one-time implementation costs and $90mm of incremental CapEx at the combined company, which do not represent run-rate view of FCF post-synergies. 8 Net leverage multiples computed as Net Debt (Total Debt before debt origination costs less Cash on Hand) divided by Adjusted EBITDA. 9 Combined company Net Debt based on FY-2023 combined Net Debt of $4,522 million and combined FY-2023 Adjusted EBITDA (incl. run-rate synergies) of $1.2 billion.

14 Legacy Cedar Fair 2Q-2024 Results Deferred Revenues In-Park Per Capita Spending(1) Out-of-Park Revenues(1) Net Revenues Attendance Legacy Cedar Fair Adjusted EBITDA(1) +4% growth (despite 33 fewer operating days) driven primarily by a larger season pass base and continued recovery of the group channel Year-over-year (same-week basis) commentary (3%) decline due to a planned decrease in season pass pricing and a higher mix of season pass visitation +6% growth driven by solid performance of the Knott’s Hotel, which was under renovation last year, as well as higher ADR’s at the other properties +3% increase driven by the underlying growth in attendance and out-of-park revenues, somewhat offset by the small decline in per capita spending +10% year-over-year lift driven primarily by higher attendance levels and tighter management of operating costs +2% due to strong sales of advance purchase products, including sales of season passes which were up 3% 8.6 million guests $59.54 $73 million $572 million $205 million $289 million 3 Months Ended June 30, 2024 1 Description of Non-GAAP measures and reconciliation of GAAP to Non-GAAP measures are defined and reconciled in the appendix and can be found in the company financial statements filed with the SEC or at www.investors.sixflags.com.

15 Legacy Six Flags 2Q-2024 Results Deferred Revenues Total Guest Spending Per Capita(1) In-Park Spending Per Capita(2) Total Revenue Attendance Legacy Six Flags Adjusted EBITDA(4) (2%) driven by timing of Easter holiday and 58 fewer operating days Year-over-year commentary +1% growth with most channels showing improvement +5% growth continues underlying growth trend for several quarters (1%) due to discontinued legacy memberships and Easter timing +1% growth in underlying guest revenue(3) (14%) driven by legacy membership headwinds and higher media spend +8% the result of higher season pass sales, driven by increases in both quantity and average price 6.9 million guests $61.22 $28.23 $438 million $138 million $191 million 3 Months Ended June 30, 2024 3 Underlying growth for total revenue shown adjusted for $9 million headwind from discontinued legacy membership program. 1 Total guest spending per capita is calculated by dividing the sum of park admissions revenue and park food merchandise and other revenue by total attendance. This metric differs from the similarly titled measure, in-park per capita spending, presented by legacy Cedar Fair. 2 In-park spending per capita is calculated by dividing park food, merchandise and other revenue by total attendance. This metric differs from the similarly titled measure, in-park per capita spending, presented by legacy Cedar Fair. 4 Description of Non-GAAP measures and reconciliation of GAAP to Non-GAAP measures are defined and reconciled in the appendix and can be found in the company financial statements filed with the SEC or at www.investors.sixflags.com.

16 Capital Structure – Solid and Flexible Amounts in $MM (a) Revolving credit facility maturity is subject to restrictions on the amount of certain notes outstanding. $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 2025 2026 2027 2028 2029 2030 2031 2032 $850 $1,000 $200 $1,000 $300 $500 $800 $850 Revolver Capacity Term Loan B Senior Notes(a)

17 Path to Net Leverage Reduction

Appendix

19 Adjusted EBITDA Reconciliation (Legacy Cedar Fair)

20 Table of Key Operational Measures (Legacy Cedar Fair)

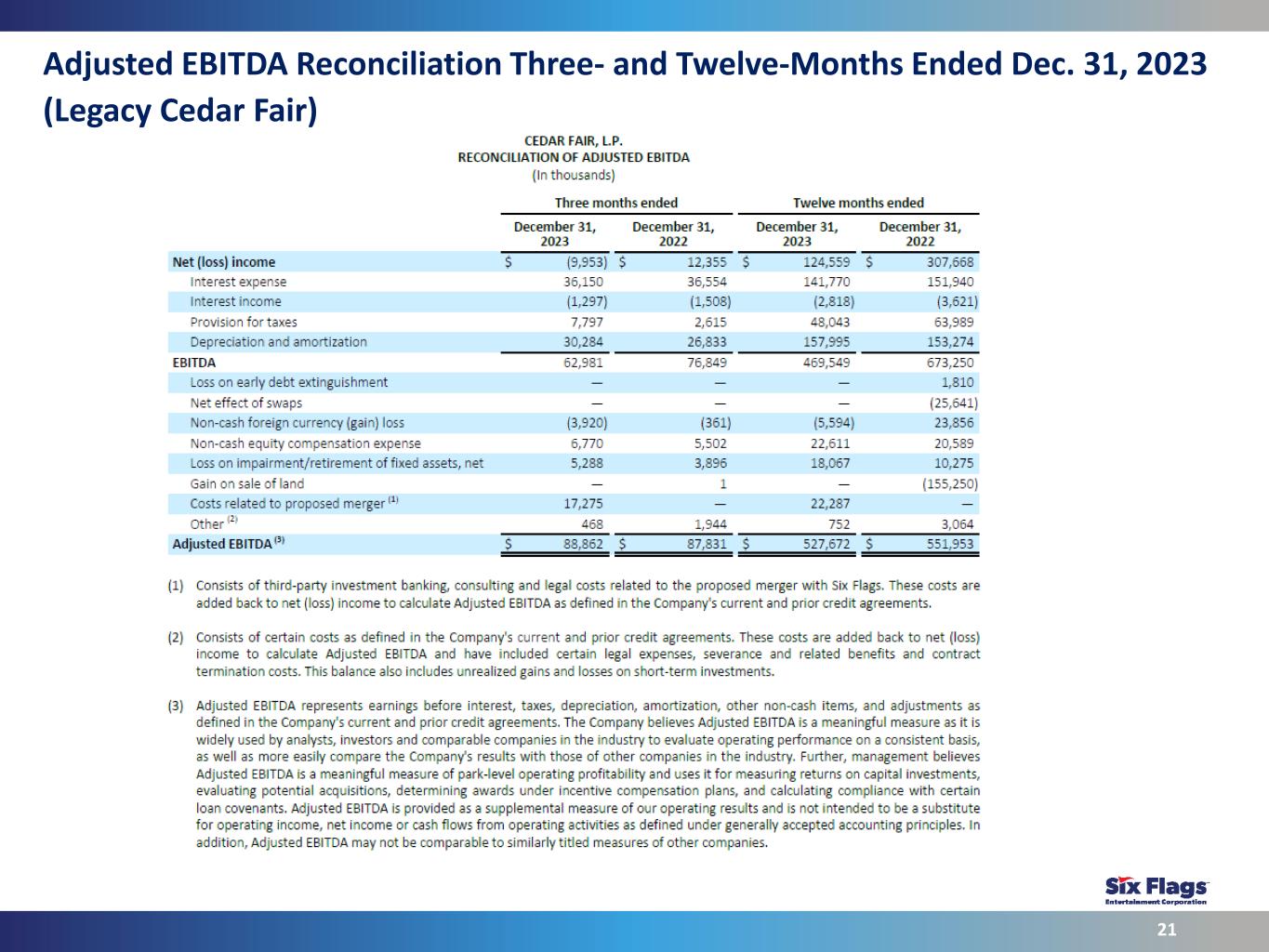

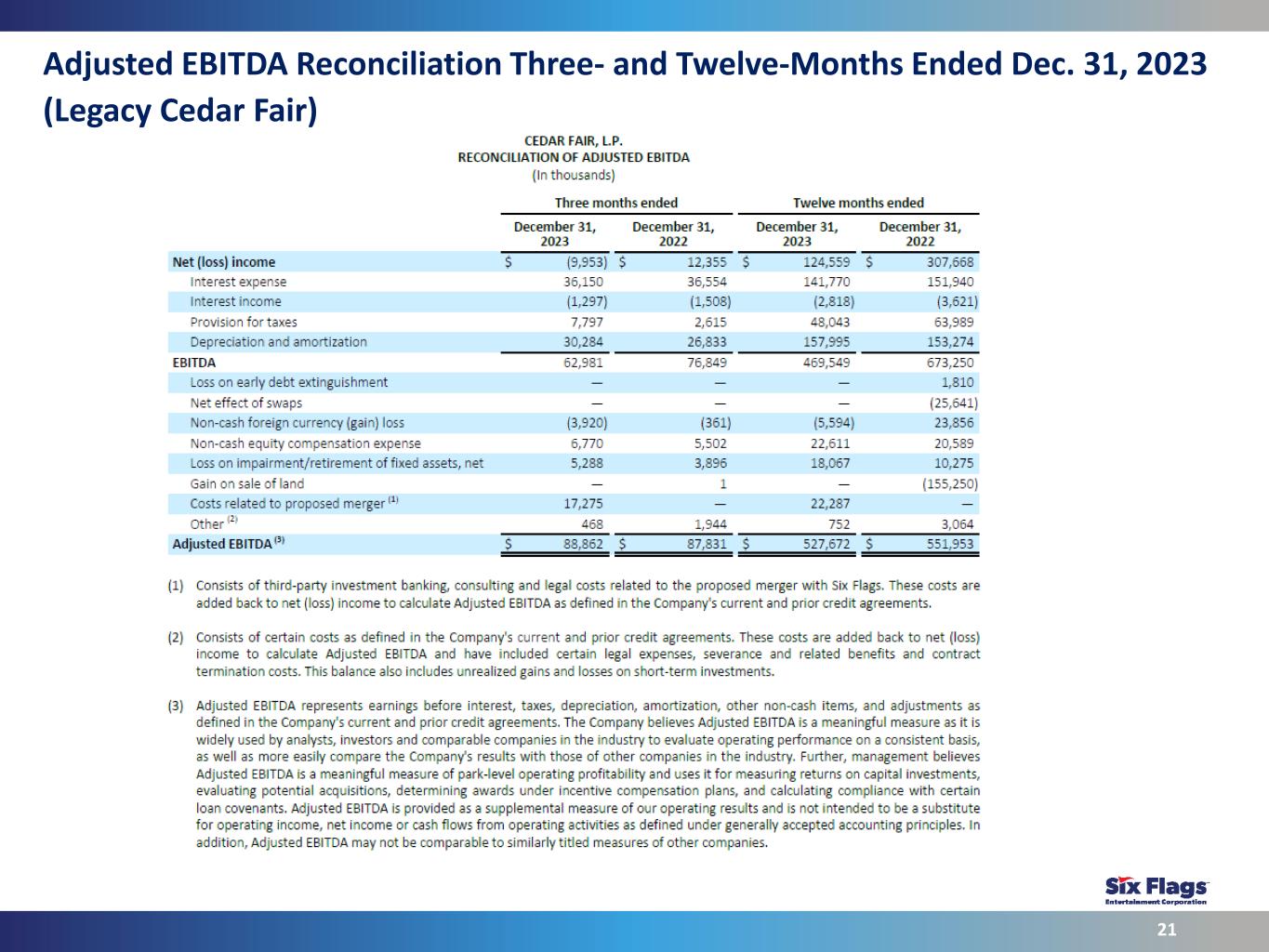

21 Adjusted EBITDA Reconciliation Three- and Twelve-Months Ended Dec. 31, 2023 (Legacy Cedar Fair)

22 Adjusted EBITDA Reconciliation (Legacy Six Flags)

23 Adjusted EBITDA Reconciliation Three- and Twelve-Months Ended Dec. 31, 2023(a) (Legacy Six Flags) (a) See next slide (page 24) for footnotes

24 Adjusted EBITDA Reconciliation Three- and Twelve-Months Ended Dec. 31, 2023 Footnotes (Legacy Six Flags)