Powered by Knowledge and Experience Investor Presentation NASDAQ: SUNS July 2024 Financial Solutions for Commercial Real Estate

2 A TCG Company Legal Disclaimers Forward Looking Statements Some of the statements contained in this presentation constitute forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, and we intend such statements to be covered by the safe harbor provisions contained therein. Such forward-looking statements are based on the current intent, belief, expectations and views of future events of Sunrise Realty, Inc. (“SUNS” and the “Company,” “we,” “us” and “our”). The forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results or performance, and may contain the words “believe,” “anticipate,” “expect,” “estimate,” “intends,” “project,” “could,” “would,” “will,” or words or phrases of similar meaning. Specifically, this presentation includes forward-looking statements regarding (i) our portfolio and strategies for the growth of our commercial real estate lending business; (ii) our strategic focus; (iii) our expectations and estimates regarding the commercial real estate lending business; (iv) our expectations regarding our target geographic market; (v) our expectation regarding the amount, collectability and timing of cash flows, if any, from our loans; (vi) our expected ranges of originations and repayments; and (vii) our investment strategy. Actual results could differ significantly from the results and events discussed in the forward-looking statements due to the factors set forth in “Risk Factors” in our Registration Statement, and the other documents we file from time to time with the Securities and Exchange Commission (the “SEC”). The forward-looking statements contained in this presentation involve a number of risks and uncertainties, including factors relating to: our lack of operating history as an independent company; our ability to identify a successful business and investment strategy and execute on our strategy; the ability of our manager to locate suitable loan opportunities for us and to monitor and actively manage our portfolio and implement our investment strategy; our expected ranges of originations and repayments; the allocation of loan opportunities to us by our manager; our projected operating results; changes in general economic conditions, in our industry and in the commercial finance and commercial real estate markets; the state of the U.S. economy generally or in the specific geographic regions in which we operate; the impact of a protracted decline in the liquidity of credit markets on our business; the amount, collectability and timing of our cash flows, if any, from our loans; our ability to obtain and maintain financing arrangements; changes in the value of our loans; losses that may arise due to the concentration of our portfolio in a limited number of loans and borrowers; our expected investment and underwriting process; the rates of default or recovery rates on our loans; the availability of investment opportunities in mortgage-related and commercial real estate-related instruments and other securities; changes in interest rates and impacts of such changes on our results of operations, cash flows and the market value of our loans; interest rate mismatches between our loans and our borrowings used to fund such loans; the departure of any of the executive officers or key personnel supporting and assisting us from SUNS Manager (as defined below) or its affiliates; impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters; our ability to maintain our exemption from registration under the Investment Company Act; our ability to qualify and maintain our qualification as a REIT for U.S. federal income tax purposes; estimates relating to our ability to make distributions to our shareholders in the future; our understanding of our competition; and market trends in our industry, interest rates, commercial real estate values, the securities markets or the general economy. We have based the forward-looking statements included in this presentation on information available to us on the date of this presentation, and we assume no obligation to update any such forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to consult any additional disclosures that we may make through reports that we have filed, or in the future may file, with the SEC, including the Registration Statement, annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. Important Notices This presentation is by Sunrise Realty, Inc. (“SUNS” or the “Company”), a publicly-traded company that has elected to be taxed as a REIT for federal income tax purposes. This presentation is provided for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy, any security or instrument. SUNS is managed by Sunrise Manager LLC (“SUNS Manager”). The information contained herein is not intended to provide, and should not be relied upon for accounting, legal or tax advice or investment recommendations for SUNS or any of its affiliates. Certain information contained in the presentation discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. D I S C L A I M E RN A S D A Q : A F C G | I N V E S T O R P R E S E N T A T I O N

3 Table of Contents 4Company Overview 5Investment Highlights 6Team 7-9Market Opportunity 10-12Investment Process 13Key Takeaways 15-20Closed Deals

4 A TCG Company Introducing Sunrise Realty Trust Sunrise Realty Trust (NASDAQ: SUNS) is an institutional lender that originates and funds loans to commercial real estate projects in the Southern United States SUNS seeks to target loans with transaction-level investment gross returns in the mid-teens Robust investment process with high-quality originations, methodical due diligence, specialized structuring and ongoing monitoring, emphasizing credit discipline throughout the cycle from sourcing to portfolio management Founded in August 2023 by veteran credit investors Leonard Tannenbaum and Brian Sedrish Collectively, the management team has directly structured over $20 billion in loan transactions C O M P A N Y O V E R V I E WS U N R I S E R E A L T Y T R U S T | I N V E S T O R P R E S E N T A T I O N 1. All company highlights data as of July 3, 2024 unless otherwise specified. 2. Current commitments as of July 3, 2024; Includes the Allen, Aster & Links and Jovie Belterra. 3. Based on SUNS’ closed deals. A component of these loans may be held through one or more co-investment vehicles managed by a manager affiliated with SUNS’ sponsor. 4. SUNS is in varying stages of negotiation and has not completed its due diligence process with respect to these projects. As a result, there can be no assurance that these potential investments will be completed on the terms described above or at all. A component of these loans may be held through one or more co-investment vehicles managed by a manager affiliated with SUNS' sponsor. 5. Based on SUNS’ closed deals. Last Dollar Cost Basis is the detachment point where SUNS’ anticipated tranche ends as a percentage of total capitalization. Combined Years in CRE and Credit Asset Management ~61% Last Dollar Cost Basis (based on total cost)(5) 125+ In loan transactions executed by management team ~17% Average Financing Rate of Loans to CRE Borrowers(3) >$1B Active Pipeline(4) ~$72MM Current Commitments YTD 2024(2) $20B+ Company Highlights(1)

5 A TCG Company Investment Highlights Lenders entering U.S. markets with capital to deploy are well-positioned, as legacy lenders with troubled assets face liquidity constraints with limited capacity to finance transitional business plans Over $2 trillion in CRE loans maturing by end of 2026 create opportunity for SUNS to scale quickly(2) Opportune Time with loan maturities looming Accelerated population and employment migration trends create economic tailwinds for the Southern U.S.(3) As resident experts in the South, SUNS targets Southern areas that are squarely within the path of growth(4) Strategic Focus on the growing Southern U.S. Management team with decades of experience investing in CRE and structured credit Extensive experience managing publicly traded credit vehicles, including multiple business development companies and a REIT Seasoned Team with $20+ billion in CRE credit Investments ~$19.4 billion of CRE deals sourced by SUNS manager and its affiliates since October 2023, only pursuing ~2.3% of deals sourced First investments closed in Q1 2024 and robust >$1 billion pipeline in place(1) Ideal Vintage with no legacy assets in the portfolio I N V E S T M E N T H I G H L I G H T SS U N R I S E R E A L T Y T R U S T | I N V E S T O R P R E S E N T A T I O N 1. SUNS is in varying stages of negotiation and has not completed its due diligence process with respect to these projects. As a result, there can be no assurance that these potential investments will be completed on the terms described above or at all. A component of these loans may be held through one or more co-investment vehicles managed by a manager affiliated with SUNS' sponsor. 2. Mortgage Bankers’ Association; Newmark Research. 3. U.S. Census Bureau Data; CoStar Market Data; Federal Reserve Bank of St. Louis. 4. Primary target states include FL, TX, NC, SC, TN, and GA; Other states that SUNS will consider for investment include AL, AR, DC, KY, LA, MD, MS, OK, VA, and WV.

6 A TCG Company Management Team with Demonstrated Track-Record Founder, CEO of Fifth Street prior to its 2017 sale to Oaktree Co-Founder of AFC Gamma, Inc. (NASDAQ: AFCG) Founded Tannenbaum Capital Group, a sponsor to alternative lenders focused on CRE and direct lending Former portfolio manager at Related Fund Management Former Head of Real Estate Acquisitions Special Situations at Deutsche Bank Previously employed at Fortress, Goldman Sachs and Lazard Freres & Co. Chief Financial Officer and Treasurer of AFC Gamma Former VP of Finance for El-AD National Properties, LLC Former manager in REIT audit practice at PwC Co-Founder and President of AFC Gamma 5+ years as Head of Investor Relations for three Fifth Street public entities 10+ years experience focused on mergers and acquisitions and leveraged loans at CIT Group General Counsel to Tannenbaum Capital Group Former General Counsel at Vatera Holdings, a large family office Former Chief Legal Officer at Tykhe Capital Previously VP & Assistant GC at J.P. Morgan Three decades of experience in brand development and content marketing Former Chief Marketing Officer at Fifth Street Asset Management Former CMO at Alliance Bernstein, rebranding the firm in 26 countries around the world Leonard Tannenbaum Brian Sedrish Brandon Hetzel Robyn Tannenbaum Anna Kim James Velgot Chief Executive Officer, Director Executive Chairman Chief Financial Officer Head of Capital Markets Chief Legal Officer, Secretary Chief Marketing Officer 30+ years experience 25+ years experience 14+ years experience 15+ years experience 20+ years experience 30+ years experience M A N A G E M E N T T E A MS U N R I S E R E A L T Y T R U S T | I N V E S T O R P R E S E N T A T I O N

7 A TCG Company Broad Economic Drivers Population & Employment Migration Right Time, Right Place Why CRE Debt Today Rising Rates & Inflation Portfolio Issues Growth Across Diverse SectorsRegulatory Forces Low Existing Supply of CRERegional Bank Failures COVID accelerated pre-existing population and employment migration trends to Southern U.S. The dual increase in both construction and borrowing costs squeezes CRE investors across the capital stack The business environment, climate and talent pool are among the factors driving corporations south Lenders dealing with legacy assets have neither the time nor capital to fund new transitional business plans Manufacturing ‘reshoring’ and a shift to value-added sectors further improve the region’s growth prospects Structural regulatory backdrop further reduces the incentives for banks to lend to transitional real estate Office and industrial capacity per capita in the Southern U.S. has lagged national averages(1) Silicon Valley Bank and Signature Bank’s collapse have increased the pressure facing other banks to tighten credit conditions Sunrise Realty Trust is pursuing an immediately actionable opportunity with a targeted geographical focus M A R K E T O P P O R T U N I T YS U N R I S E R E A L T Y T R U S T | I N V E S T O R P R E S E N T A T I O N Why the Southern U.S. 1. Co-Star Market Data.

8 A TCG Company Changes in Capital Stacks Present an Opportunity(1) Common Capital Structure in 2019 Due to the Fed’s rate increases and regional banks pulling back from the market, pricing for the types of deals that SUNS intends to focus on has gone up, while the attachment and detachment LTCs have shifted down(2)(3) Common Capital Structure in 2024 Lower Pricing at Higher Leverage Levels 3-5% 60% 80% Borrower’s Equity Senior Loan 6-8% N/A Subordinate Loan LTC Attachment Point LTC Detachment Point Loan to Cost Coupon Rate / Pricing Higher Pricing at Lower Leverage Levels Coupon Rate / Pricing 7-9% 70% 45% 12-14% N/A LTC Attachment Point LTC Detachment PointBorrower’s Equity Senior Loan Subordinate Loan Loan to Cost M A R K E T O P P O R T U N I T YS U N R I S E R E A L T Y T R U S T | I N V E S T O R P R E S E N T A T I O N 1. Source: Based on management estimates. Provided for illustrative purposes only and does not reflect the terms of any specific capital structure. These hypothetical capital structures are not necessarily indicative, nor are they a guarantee or prediction, of the details of any specific transactions that Sunrise Realty Trust may undertake. The specific details of any actual transactions undertaken may differ materially from the details presented. 2. CoStar, “Banks pull back on commercial real estate lending” 2023. 3. Attachment point LTC denotes the priority position in the capital structure where the senior loan layer ends and SUNS’ anticipated subordinate loan is expected to begin. Detachment point LTC denotes the priority position in the capital structure where the subordinate loan ends.

9 A TCG Company Demographic Shifts Favor The Southern U.S. M A R K E T O P P O R T U N I T YS U N R I S E R E A L T Y T R U S T | I N V E S T O R P R E S E N T A T I O N Select Southern Cities Outpacing on Employment Growth(1) Strong Population & Employment Growth(1) Migration trends are driving both population and employment growth in the South COVID has had a material impact on U.S. migration patterns, with the Southern U.S. benefiting from increased population and employment growth, which in select key Southern cities is outpacing the rest of the U.S. 2018-2023 Total Growth Rate Rest of U.S.Target States(2) Population 0.9%6.0% Total Employment 2.4%8.8% Office Employment 4.4%15.1% Industrial Employment 2.0%6.1% RaleighDallasNashville Tampa AtlantaMiami Charlotte Houston Rest of U.S. (5%) 0% 5% 10% 15% 20% Jul-20 Jul-21 Jul-22 Jul-23 With employment growth accelerating in key cities in SUNS’ target states since July 2020 1. U.S. Census Bureau Data; CoStar Market Data; Federal Reserve Bank of St. Louis. 2. Primary target states include FL, TX, NC, SC, TN, and GA; Other states that SUNS will consider for investment include AL, AR, DC, KY, LA, MD, MS, OK, VA, and WV.

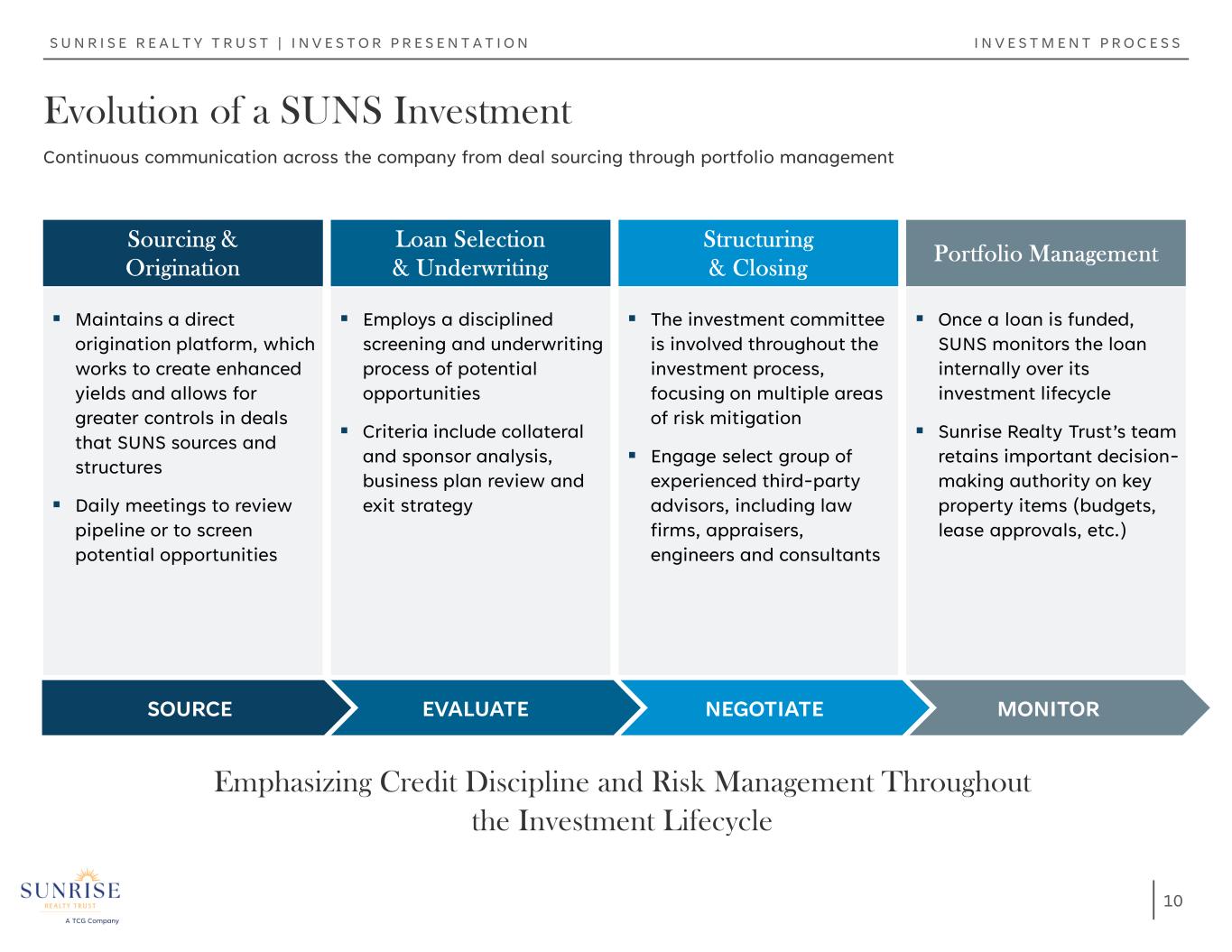

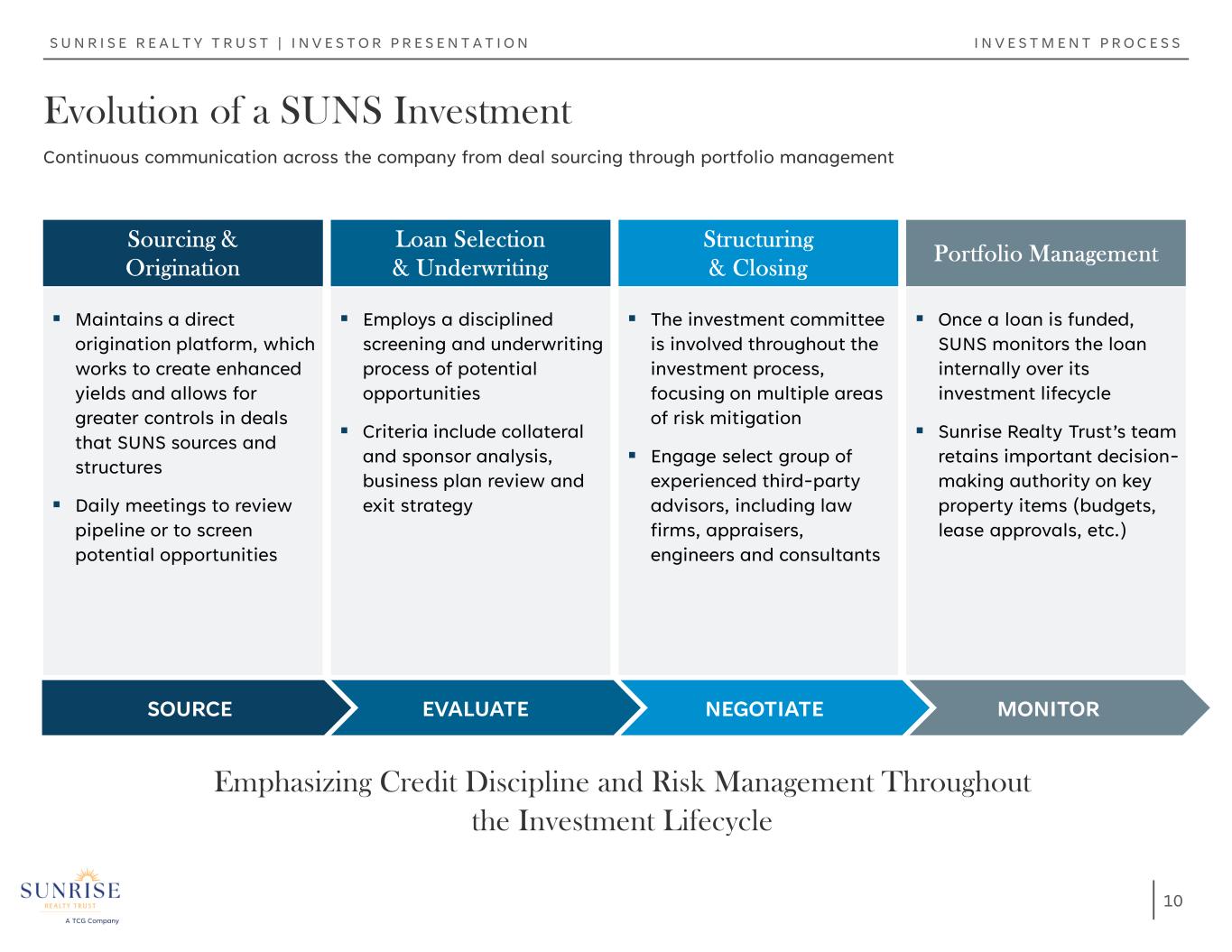

10 A TCG Company Evolution of a SUNS Investment Continuous communication across the company from deal sourcing through portfolio management Sourcing & Origination Loan Selection & Underwriting Portfolio Management Structuring & Closing Maintains a direct origination platform, which works to create enhanced yields and allows for greater controls in deals that SUNS sources and structures Daily meetings to review pipeline or to screen potential opportunities Employs a disciplined screening and underwriting process of potential opportunities Criteria include collateral and sponsor analysis, business plan review and exit strategy Once a loan is funded, SUNS monitors the loan internally over its investment lifecycle Sunrise Realty Trust’s team retains important decision- making authority on key property items (budgets, lease approvals, etc.) The investment committee is involved throughout the investment process, focusing on multiple areas of risk mitigation Engage select group of experienced third-party advisors, including law firms, appraisers, engineers and consultants MONITORNEGOTIATEEVALUATESOURCE Emphasizing Credit Discipline and Risk Management Throughout the Investment Lifecycle I N V E S T M E N T P R O C E S SS U N R I S E R E A L T Y T R U S T | I N V E S T O R P R E S E N T A T I O N

11 A TCG Company Sponsor Market Business Plan Transaction Highly-Selective Investment Process(1) Sunrise Realty Trust takes a patient approach to investing, targeting opportunities with clear potential for value creation that meet a defined set of investment criteria Supply constrained markets with recognizable demand drivers Superior location within market Readily executable strategy to stabilize property Ability to refinance upon stabilization or protect in downside case Significant equity cushion to absorb potential losses Conservative leverage provides strategic flexibility and mitigates risk Institutional sponsors and operators with track records and expertise Alignment of interests through appropriate capital commitments Positive Market Fundamentals Sound Business Plan Substantial Margin of Safety Strong Financial Sponsor Debt Structure & Terms I N V E S T M E N T P R O C E S SS U N R I S E R E A L T Y T R U S T | I N V E S T O R P R E S E N T A T I O N Target Investment Attributes 1. Disclaimer: The due diligence process in regard to our investment opportunities may not reveal all facts relevant to an investment and, as a result, we may experience losses, which could materially and adversely affect us.

12 A TCG Company Robust Direct Origination Platform I N V E S T M E N T P R O C E S S 1. Represents deals from 10/1/2023 to 7/1/2024 sourced by members of SUNS’ investment team on behalf of SUNS or on behalf of an entity managed by a manager affiliated with SUNS’ sponsor as of 7/1/2024. 2. Representative of full loan amounts on loans in documentation or loans funded in 2024, which includes loans held or anticipated to be held by SUNS and through one or more co-investment vehicles managed by a manager affiliated with SUNS’ sponsor. 3. Representative of full loan amounts on loans in documentation anticipated to be held by SUNS and through one or more co-investment vehicles managed by a manager affiliated with SUNS’ sponsor. 4. Current commitments as of July 3, 2024; Includes the Allen, Aster & Links and Jovie Belterra. SUNS continues to maintain a direct origination platform, produce a large universe of opportunities through multiple channels, then select the most attractive investments for comprehensive due diligence S U N R I S E R E A L T Y T R U S T | I N V E S T O R P R E S E N T A T I O N Co- Lenders Owners / Operators Brokers Private Equity Firms Other Financial Institutions 3rd Party Databases REITs Sourcing Channels Due Diligence Sourcing Structuring / Closing ~$542MM Executed Term Sheets(2) ~$394MM In Documentation(3) ~$19B CRE Deals Sourced(1) >$1B Active Pipeline Deep network of long-standing relationships Sector and product expertise paired with local knowledge generates targeted inbounds Reputation as a credible, reliable and regionally-focused partner Solution-driven flexibility and negotiating in good faith solidify repeat partnerships ~2.3% Deal Selectivity Multiple Origination Channels Powerful Deal Flow Engine Deal Funnel ~$72MM Current Commitments(4)

13 A TCG Company Strategy Meets Opportunity – Key Approaches Right Time, Place and Team To Execute SUNS’ Investment Strategy Two Converging Trends Have Created a Unique Market Opportunity Sunrise Realty Trust is Well Suited to Capitalize on Both Trends Seeking Equity-Like Returns for Debt-Like Risk Target transitional real estate projects with near- term value creation Invest in markets and sectors with strong fundamentals Focus on Southern U.S. areas with identifiable unmet demand Fewer competitors Higher pricing power Undersupply of debt Higher absolute returns Greater equity subordination Lower leverage Stronger covenants More favorable risk position Market dislocations in CRE have drained liquidity, causing a value shift from borrowers to lenders Southern U.S. migration trends have amplified the supply-demand imbalance for quality real estate Specific expertise in transitional real estate Bringing local insight and connections Ability to transact across the capital stack Management team’s cycle- tested track-record in CRE The Right Leadership The Right Market Opportunity The Right Strategy Sunrise Realty Trust is positioned to take advantage of converging trends favoring CRE in the Southern U.S. StrategyOpportunity Ability Objective T A K E A W A Y SS U N R I S E R E A L T Y T R U S T | I N V E S T O R P R E S E N T A T I O N

14 Appendix

15 A TCG Company Deal #1: The Allen C L O S E D D E A L SS U N R I S E R E A L T Y T R U S T | I N V E S T O R P R E S E N T A T I O N 1. Actual UPB is less than face value as residential condo closings are actively paying down the loan balances in pari passu arrangement. Current Senior UPB is $29.1 million as of 7/8/2024. 2. Aggregate subordinate loan size is $56.44 million, of which $28.22 million is funded by SUNS and the remaining by a co-investor affiliate. 3. Current total rate as of 7/1/2024. THE ALLEN HIGHLIGHTS Houston, TXLOCATION Mixed UsePROPERTY TYPE Loan PurchaseINVESTMENT TYPE Subordinate LoanINVESTMENT STRUCTURE $115MMSENIOR LOAN SIZE(1) $44.6MMTOTAL SUBORDINATE LOAN SIZE(1)(2) SOFR + 15.31% (20.64% current rate(3)) SUBORDINATE CASH INTEREST RATE November 2024MATURITY DATE Sunrise Realty TrustSUBORDINATE LENDER CLOSED Jan. 4, 2024

16 A TCG Company Deal #1: The Allen (Cont.) C L O S E D D E A L SS U N R I S E R E A L T Y T R U S T | I N V E S T O R P R E S E N T A T I O N 1. Actual UPB is less than face value as residential condo closings are actively paying down the loan balances in pari passu arrangement. Current Senior UPB is $29.1 million. 2. Aggregate subordinate loan size is $56.44 million, of which $28.22 million is funded by a co-investor affiliate. 3. Projected Yield calculations use Chatham Financial forward SOFR projections (as of 7/1/2024) and assume an Interest Rate Floor of 2.50%. Projected performance is based on management's estimates and is not a guarantee or prediction and is not necessarily indicative of future results. Potential investors should not rely on such projected performance information in connection with making an investment decision, as actual performance may vary significantly from the projected performance information set forth herein. Investment Rationale Subordinate loan on luxury mixed-use project in Houston that is nearing substantial completion Upon loan acquisition, the loan was modified to upsize proceeds and to increase the interest rate from SOFR +11% to SOFR +15.31%; Borrower required incremental funds for construction close-out, hotel/retail opening expenses, and subordinated interest reserve Compelling loan-to-value basis (<70% LTV) Significant de-risking on development front; substantial completion expected in Q3 2024, the Thompson flagged hotel opened on February 14th 2024, and the retail is 100% leased/completed, expecting to open in Q3 2024 Significant de-risking on residential condo sales; project is 79% sold at $703/SF; units are actively closing and paying down (pari passu) the senior and subordinate loan; condo sales have remained strong with recent contracts closing at $1,024/SF Retail (44K SF) is fully leased Key Metrics $28MM(1)(2) SUNS Commitment $28MM(1)(2) Co-investor Commitment 20.2%(3) Projected Yield CLOSED Jan. 4, 2024

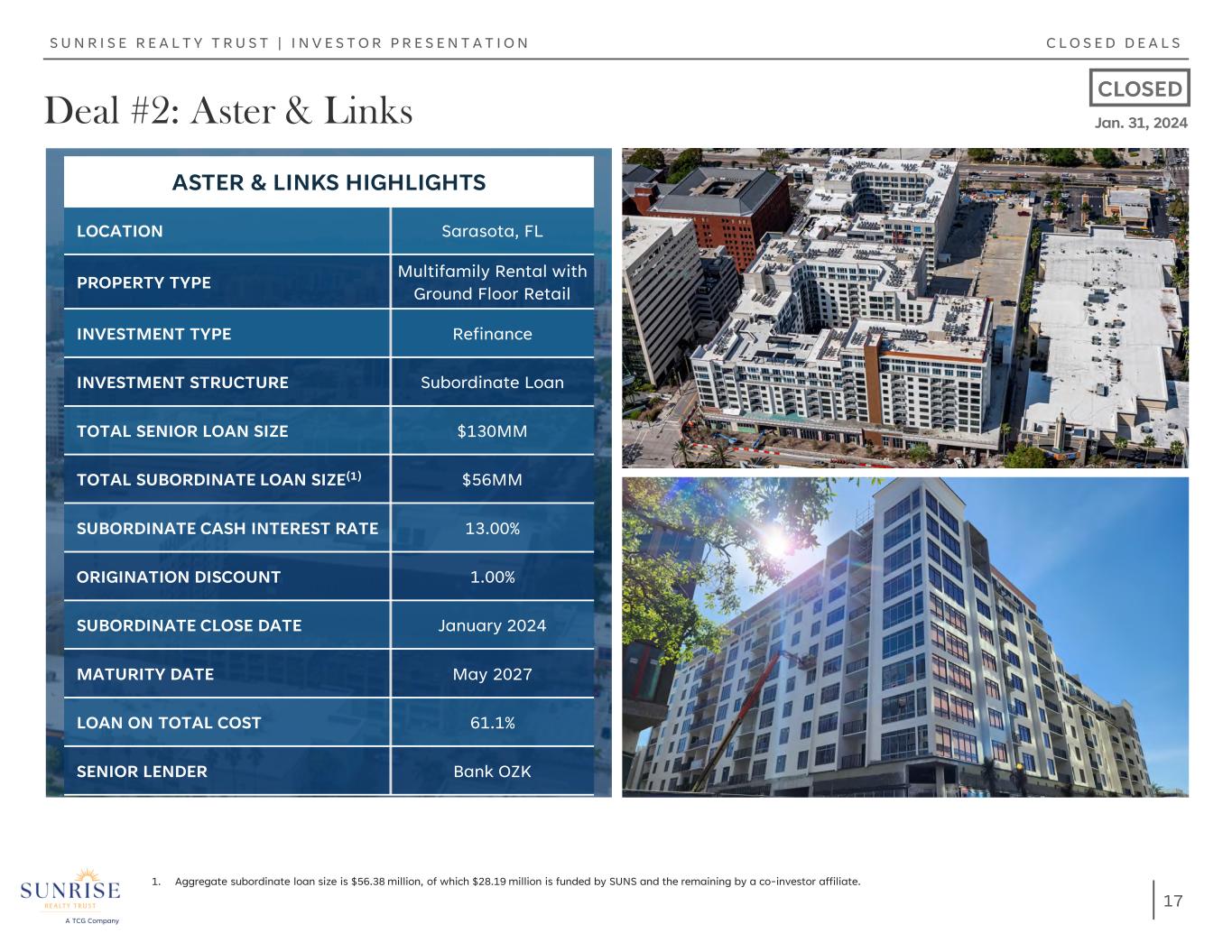

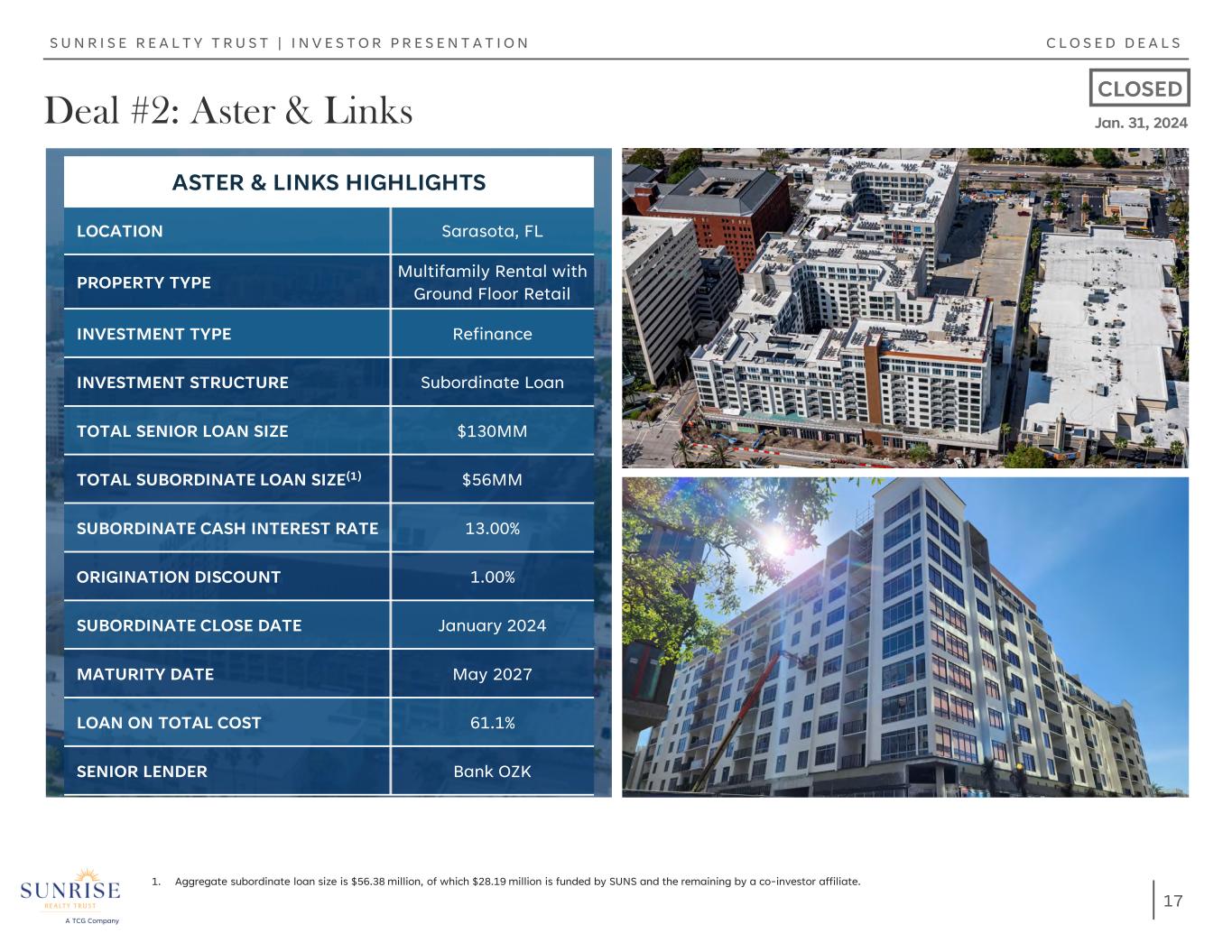

17 A TCG Company Deal #2: Aster & Links C L O S E D D E A L SS U N R I S E R E A L T Y T R U S T | I N V E S T O R P R E S E N T A T I O N 1. Aggregate subordinate loan size is $56.38 million, of which $28.19 million is funded by SUNS and the remaining by a co-investor affiliate. ASTER & LINKS HIGHLIGHTS Sarasota, FLLOCATION Multifamily Rental with Ground Floor Retail PROPERTY TYPE RefinanceINVESTMENT TYPE Subordinate LoanINVESTMENT STRUCTURE $130MMTOTAL SENIOR LOAN SIZE $56MMTOTAL SUBORDINATE LOAN SIZE(1) 13.00%SUBORDINATE CASH INTEREST RATE 1.00%ORIGINATION DISCOUNT January 2024SUBORDINATE CLOSE DATE May 2027MATURITY DATE 61.1%LOAN ON TOTAL COST Bank OZKSENIOR LENDER CLOSED Jan. 31, 2024

18 A TCG Company Deal #2: Aster & Links (Cont.) C L O S E D D E A L SS U N R I S E R E A L T Y T R U S T | I N V E S T O R P R E S E N T A T I O N 1. Aggregate subordinate loan size is $56.38 million, of which 50% or $28.19 million has been committed by a co-investor affiliate and 50% or $28.19 million has been committed by SUNS. 2. Projected Yield calculations are based on the draw schedule with the reserves not funded upfront but as needed and include a 13.0% cash interest rate (all current pay per annum paid monthly) and an origination discount of 1.0% on the total subordinate loan amount. Projected performance is based on management's estimates and is not a guarantee or prediction and is not necessarily indicative of future results. Potential investors should not rely on such projected performance information in connection with making an investment decision, as actual performance may vary significantly from the projected performance information set forth herein. 3. Minimum interest is not a guarantee or prediction and is not necessarily indicative of future results. Potential investors should not rely on such figures in connection with making an investment decision, as actual performance may vary significantly from the projected performance information set forth herein. CLOSED Jan. 31, 2024 Investment Rationale Subordinate loan (13% fixed, all current pay) with a compelling 61.1% LTC basis Significant de-risking on both the construction and funding fronts: i. Construction is ~90% complete ii. The Sponsor’s equity funding as of subordinate loan closing is ~$120 million; Sponsor providing completion + carry costs guarantees iii. In May 2023, Sponsor secured a senior construction loan at 42.6% LTC with draw funding that started in Nov. 2023 Collateral value provides significant cushion on a subordinated basis with a residential basis of $ / Resi NRSF at $276 and per unit at $392,456, comparing favorably to the most comparable 2023 trade at $502 / Resi NRSF (55% LTV) and $569,444 per unit (69% LTV) and underwriting to a SUNS Base Case LTV of 71.4% and a stabilized, untrended debt yield of 7.9% Subordinate Loan Commitment: $56.4 million with $41.4 million funded at first close.(1) Subordinated Term is ~3.3 years with a 1-year extension, which provides Sponsor runway for lease-up to stabilization In the heart of downtown Sarasota, an area demonstrating strong demand with record population growth, 3 of the 5 wealthiest zip codes in SW FL, over 1.94 million SF of office nearby, and consistent top rankings as the best place to live and retire in the US; comparable complete buildings and units are nearly fully leased, and vintages are 5-10 years old Key Metrics $28.2MM(1) SUNS Commitment $28.2MM(1) Co-investor Commitment $10MM(3) Subordinate Min. Interest 14.3%(2) Projected IRR

19 A TCG Company Deal #3: Jovie Belterra C L O S E D D E A L SS U N R I S E R E A L T Y T R U S T | I N V E S T O R P R E S E N T A T I O N 1. Aggregate Note size is $35.2 million, of which $14.1 million is committed by SUNS and the remaining by a co-investor affiliate. 2. Minimum Multiple is not a guarantee or prediction and is not necessarily indicative of future results. Potential investors should not rely on such figures in connection with making an investment decision, as actual performance may vary significantly from the projected performance information set forth herein. JOVIE BELTERRA HIGHLIGHTS Austin, TXLOCATION Active Adult Multi-family Rental PROPERTY TYPE RefinanceINVESTMENT TYPE Senior DebtINVESTMENT STRUCTURE $35MM / $14MMSENIOR LOAN/HOLD SIZE(1) SOFR + 4.25%; Floor 4.75%CASH INTEREST RATE 36 monthsLOAN TERM 68.4%LOAN ON TOTAL COST 150 UNITS 141,323RENTABLE SQUARE FEET 1.15xMINIMUM MULTIPLE(2) CLOSED Jul. 3, 2024

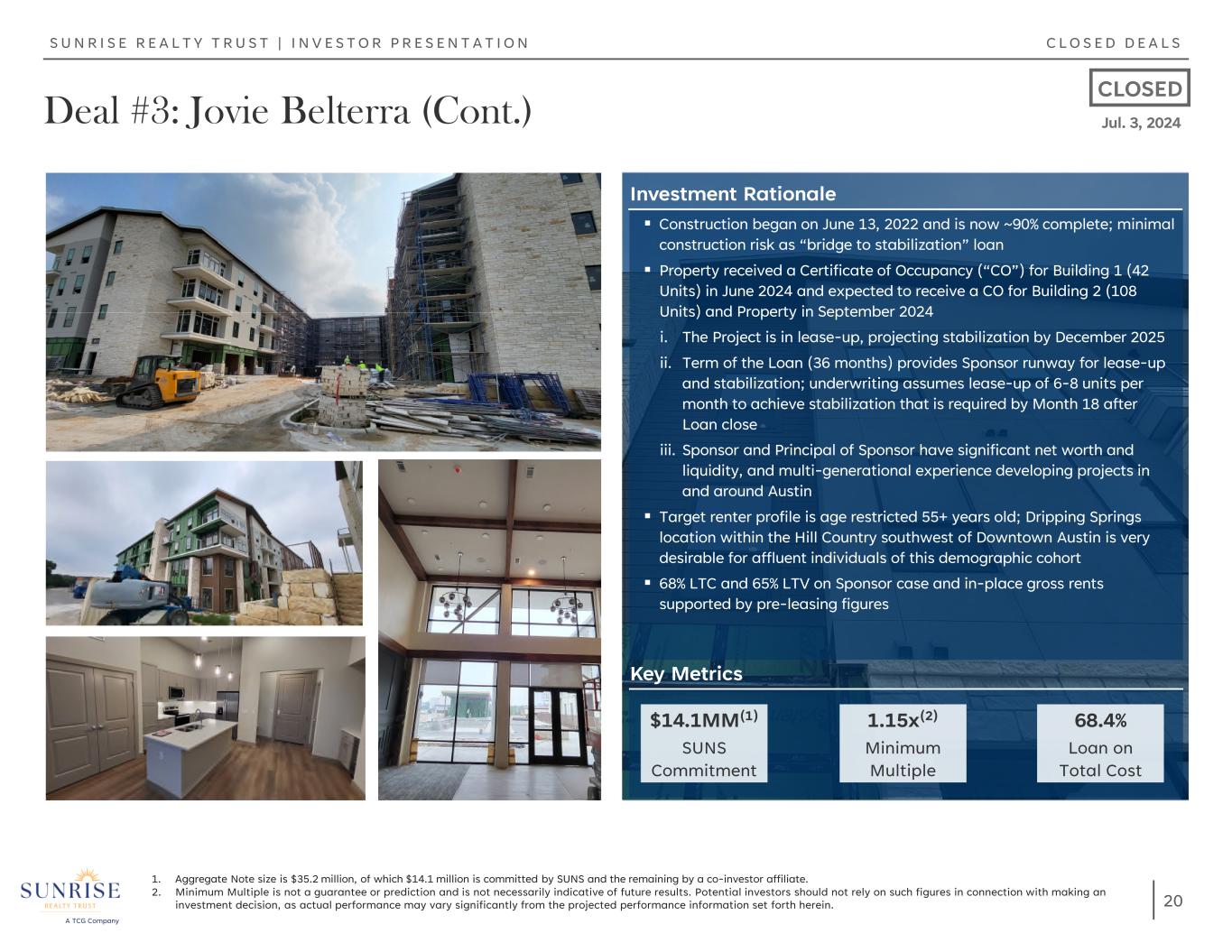

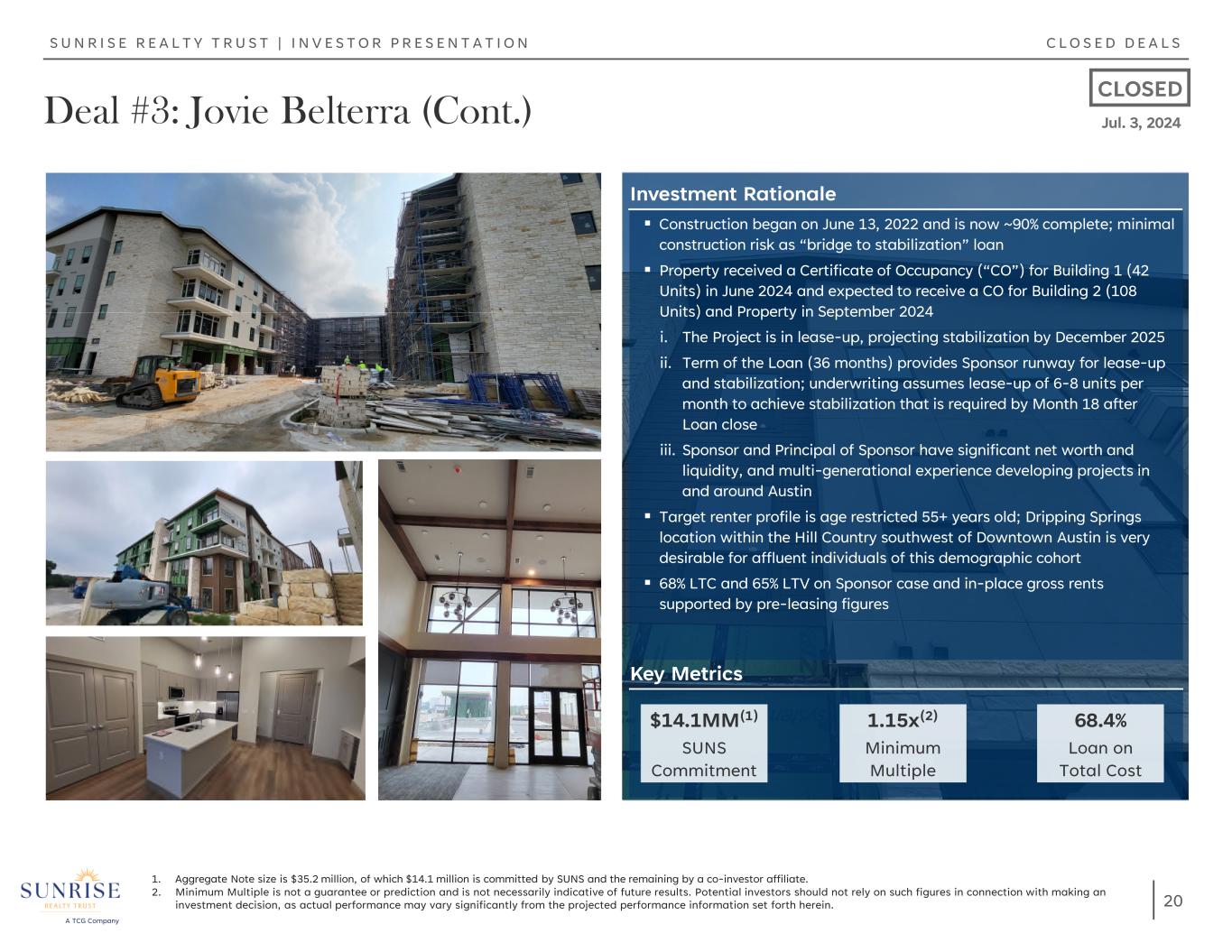

20 A TCG Company Deal #3: Jovie Belterra (Cont.) C L O S E D D E A L SS U N R I S E R E A L T Y T R U S T | I N V E S T O R P R E S E N T A T I O N 1. Aggregate Note size is $35.2 million, of which $14.1 million is committed by SUNS and the remaining by a co-investor affiliate. 2. Minimum Multiple is not a guarantee or prediction and is not necessarily indicative of future results. Potential investors should not rely on such figures in connection with making an investment decision, as actual performance may vary significantly from the projected performance information set forth herein. Investment Rationale Construction began on June 13, 2022 and is now ~90% complete; minimal construction risk as “bridge to stabilization” loan Property received a Certificate of Occupancy (“CO”) for Building 1 (42 Units) in June 2024 and expected to receive a CO for Building 2 (108 Units) and Property in September 2024 i. The Project is in lease-up, projecting stabilization by December 2025 ii. Term of the Loan (36 months) provides Sponsor runway for lease-up and stabilization; underwriting assumes lease-up of 6-8 units per month to achieve stabilization that is required by Month 18 after Loan close iii. Sponsor and Principal of Sponsor have significant net worth and liquidity, and multi-generational experience developing projects in and around Austin Target renter profile is age restricted 55+ years old; Dripping Springs location within the Hill Country southwest of Downtown Austin is very desirable for affluent individuals of this demographic cohort 68% LTC and 65% LTV on Sponsor case and in-place gross rents supported by pre-leasing figures Key Metrics $14.1MM(1) SUNS Commitment 1.15x(2) Minimum Multiple 68.4% Loan on Total Cost CLOSED Jul. 3, 2024

Contact Us ir@sunriserealtytrust.com www.sunriserealtytrust.com