Table of Contents

Registration No. 333-__________

As filed with the Securities and Exchange Commission on June 27, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

________________________

| DeltaSoft Corp. |

| (Exact name of registrant as specified in its charter) |

| Wyoming | | 7371 | | 32-0761940 |

(State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Number) | | (IRS Employer Identification Number) |

Address

91 Portland Road

London W11 4LN

United Kingdom

+44 20 3575 1093

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

____________________________

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Wyoming Registered Agent.

1621 Central Ave

Cheyenne, WY 82001

(307) 637-5151

__________________________

As soon as practicable after this Registration Statement becomes effective.

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box: ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this form is a post-effective registration statement filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this form is a post-effective registration statement filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

PROSPECTUS

THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED. THERE IS NO MINIMUM PURCHASE REQUIREMENT FOR THE OFFERING TO PROCEED.

DELTASOFT CORP.

6,000,000 SHARES OF COMMON STOCK

Initial Public Offering

This is the initial offering of common stock of DeltaSoft Corp. We are offering for sale a total of 6,000,000 shares of common stock, $0.001 par value, at a fixed price of $0.02 per share. There is no minimum number of shares that must be sold by us for the offering to proceed, and we will retain the proceeds from the sale of any of the offered shares. The offering is being conducted on a self-underwritten, best-efforts basis, which means our President, Andrey Novokhatski, will attempt to sell the shares. He will receive no commission or other remuneration for any shares he may sell.

DeltaSoft Corp is a development stage company and currently has limited operations. Any investment in the shares offered herein involves a high degree of risk. You should only purchase shares if you can afford a loss of your investment. Our independent registered public accountant has issued an audit opinion for DeltaSoft Corp which includes a statement expressing substantial doubt as to our ability to continue as a going concern.

There has been no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of this registration statement, we hope to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”) for our common stock to be eligible for trading on the OTC Link LLC. We do not yet have a market maker who has agreed to file such application. There can be no assurance that our common stock will ever be quoted on a stock exchange or a quotation service or that any market for our stock will develop.

Our sole officer and director Mr. Andrey Novokhatski currently controls the registrant Company (Please read risk factors associated to our business). It is expected that Mr. Andrey Novokhatski will hold control voting power or will hold 50% of voting power if the maximum number of common shares is purchased in this offering.

The Company, its executive, any company promoters or their affiliates intend for the company, once reporting, do not have any intentions for us to be used as a vehicle for a private company to become a reporting company.

DeltaSoft Corp. is not a Blank Check company. We have no plans, arrangements, commitments or understandings to engage in a merger with or acquisition of another company.

We are an “emerging growth company” as defined under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements.

THE PURCHASE OF THE SECURITIES OFFERED THROUGH THIS PROSPECTUS INVOLVES A HIGH DEGREE OF RISK. THEREFORE, BEFORE INVESTING, YOU SHOULD CAREFULLY READ THIS PROSPECTUS AND, PARTICULARLY THE RISK FACTORS, BEGINNING ON PG. 7.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

SUBJECT TO COMPLETION, DATED JUNE 27, 2024

TABLE OF CONTENTS

WE HAVE NOT AUTHORIZED ANY DEALER, SALESPERSON OR OTHER PERSON TO GIVE ANY INFORMATION OR REPRESENT ANYTHING NOT CONTAINED IN THIS PROSPECTUS. YOU SHOULD NOT RELY ON ANY UNAUTHORIZED INFORMATION. THIS PROSPECTUS IS NOT AN OFFER TO SELL OR BUY ANY SHARES IN ANY STATE OR OTHER JURISDICTION IN WHICH IT IS UNLAWFUL. THE INFORMATION IN THIS PROSPECTUS IS CURRENT AS OF THE DATE ON THE COVER. YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS PROSPECTUS.

PROSPECTUS SUMMARY

AS USED IN THIS PROSPECTUS, UNLESS THE CONTEXT OTHERWISE REQUIRES, “WE,” “US,” “OUR,” AND “DELTASOFT CORP.” REFERS TO DELTASOFT CORP. BECAUSE THIS IS A SUMMARY, IT MAY NOT CONTAIN ALL OF THE INFORMATION THAT IS IMPORTANT TO YOU. YOU SHOULD READ THE ENTIRE PROSPECTUS BEFORE MAKING AN INVESTMENT DECISION TO PURCHASE OUR COMMON STOCK.

Cautionary Note on Forward-Looking Statements

This prospectus contains forward-looking statements, which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors,” that may cause our industry’s actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

General Information about the Company

We were incorporated in Wyoming on January 4, 2024. We are development stage company and intends to commence operations in IT consulting services and software development. We intend to provide universal, all-in-one tool for effective planning and management of projects and performers.

We intend to use the net proceeds from this offering to develop our business operations (See “Description of Business” and “Use of Proceeds” elsewhere in this Prospectus). Our principal executive office is located at 91 Portland Road, London W11 4LN, United Kingdom. Our phone number is +44 20 3575 1093.

From inception until the date of this filing, we have had very limited operating activities. Our financial statements for the period from inception through March 31, 2024 reports revenues of $0 and a net loss of $273. Our independent registered public accounting firm has issued an audit opinion for DeltaSoft Corp. which includes a statement expressing substantial doubt as to our ability to continue as a going concern.

As of the date of this prospectus, there is no public trading market for our common stock and no assurance that a trading market for our securities will ever develop.

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during its last fiscal year, we qualify as an “emerging growth company” as defined in the JOBS Act. For as long as a company is deemed to be an emerging growth company, it may take advantage of specified reduced reporting and other regulatory requirements that are generally unavailable to other public companies. These provisions include:

| | · | a requirement to have only two years of audited financial statements and only two years of related Management’s Discussion and Analysis included in an initial public offering registration statement; |

| | | |

| | · | an exemption to provide less than five years of selected financial data in an initial public offering registration statement; |

| | | |

| | · | an exemption from the auditor attestation requirement in the assessment of the emerging growth company’s internal controls over financial reporting; |

| | | |

| | · | an exemption from the adoption of new or revised financial accounting standards until they would apply to private companies; |

| | | |

| | · | an exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; and |

| | | |

| | · | reduced disclosure about the emerging growth company’s executive compensation arrangements. |

An emerging growth company is also exempt from Section 404(b) of Sarbanes Oxley which requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting. Similarly, as a Smaller Reporting Company we are exempt from Section 404(b) of the Sarbanes-Oxley Act and our independent registered public accounting firm will not be required to formally attest to the effectiveness of our internal control over financial reporting until such time as we cease being a Smaller Reporting Company.

As an emerging growth company, we are exempt from Section 14A (a) and (b) of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We would cease to be an emerging growth company upon the earliest of:

| | · | the first fiscal year following the fifth anniversary of this offering; |

| | | |

| | · | the first fiscal year after our annual gross revenues are $1 billion or more; |

| | | |

| | · | the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt securities, or |

| | | |

| | · | as of the end of any fiscal year in which the market value of our common stock held by non-affiliates exceeded $700 million as of the end of the second quarter of that fiscal year. |

The Offering

The Issuer: | DeltaSoft Corp. |

| | |

Securities Being Offered: | 6,000,000 shares of common stock. |

| | |

Price Per Share: | $0.02 |

| | |

Duration of the Offering: | The offering shall terminate on the earlier of (i) the date when the sale of all 6,000,000 common shares is completed; (ii) one year from the date of this prospectus; or (iii) prior to one year at the sole determination of our director Mr. Andrey Novokhatski. |

| | |

Gross Proceeds | $120,000 |

| | |

| Securities Issued and Outstanding: | There are 3,500,000 shares of common stock issued and outstanding as of the date of this prospectus, held solely by our President and Secretary, Andrey Novokhatski. |

| | |

Subscriptions | All subscriptions once accepted by us are irrevocable. |

| | |

| Registration Costs | We estimate our total offering registration costs to be approximately $10,000. |

| | |

| Risk Factors | See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

SUMMARY FINANCIAL INFORMATION

The tables and information below are derived from our audited financial statements for the period from inception (January 4th, 2024) through March 31, 2024.

| Financial Summary | | March 31, 2024 ($) | |

| Cash and Deposits | | | 3,531 | |

| Total Assets | | | 3,531 | |

| Total Liabilities | | | 304 | |

| Total Stockholder’s Equity | | | 3,227 | |

| Statement of Operations | | From January 4, 2024 (Inception) to March 31, 2024 ($) | |

| Revenue | | | 0 | |

| Total Expenses | | | 273 | |

| Net Loss for the Period | | | 273 | |

RISK FACTORS

An investment in our common stock involves a high degree of risk and is speculative in nature. In addition to the other information regarding the Company contained in this Prospectus, you should consider many important factors in determining whether to purchase shares of common stock offered pursuant to this prospectus. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. This risk factor section includes all material risks of which our company is aware. The trading price of our common stock, when and if we are ever able to trade our common stock, could decline due to any of these risks, and you may lose all or part of your investment.

RISKS ASSOCIATED TO OUR BUSINESS

We are solely dependent upon the funds to be raised in this offering to start our business. If we don’t raise these proceeds, we will not achieve revenues and profitable operations and our business will likely fail.

Our current operating funds are less than we require to complete our intended operations plan. As of March 31, 2024, we had cash in the amount of $3,531 and liabilities of $304. As of this date, we have had limited operations and insignificant income. We require the proceeds from this offering to achieve sufficient revenue and profitable operations. There is no assurance that we will be successful in raising the funds from this offering. If we are not successful in raising the said funds our business may fail.

There is substantial uncertainly as to whether we will continue as a going concern. If we discontinue operations, you will lose your investment.

We have incurred losses since our inception resulting in an accumulated deficit of ($273) at March 31, 2024. However, we are anticipating losses during the development of our business. As a result, there is substantial doubt about our ability to continue as a going concern. In fact, our auditors have issued a going concern opinion in connection with their audit of our financial statements for the fiscal years ended March 31, 2024 This means that our auditors believe there is substantial doubt that we can continue as an on-going business for the next twelve months. Our ability to continue as a going concern is dependent upon our ability to generate profitable operations in the future and to obtain the necessary financing to expand our business operations, market our current product and develop new products. Based upon current plans, we expect to incur operating losses in future periods because we will be incurring expenses and generating minimal revenues. We cannot guarantee that we will be successful in generating substantial revenues in the future. Failure to generate revenues will cause us to go out of business.

We are a development stage company and have commenced limited operations in our business. We expect to incur operating losses for the foreseeable future

We have commenced limited business operations. Accordingly, we have no way to evaluate the likelihood that our business will be successful. Potential investors should be aware of the difficulties normally encountered by new companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the operations that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to the ability to generate sufficient cash flow to operate our business, and additional costs and expenses that may exceed current estimates. Prior to having an inventory, we anticipate that we will incur increased operating expenses without realizing any revenues. We expect to incur significant losses into the foreseeable future. We recognize that if the effectiveness of our business plan is not forthcoming, we will not be able to continue business operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is possible that we will not generate significant revenues or achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Since our services and software will not be protected by patents, there is a risk that a competitor might replicate our technology, potentially leading to our business’s downfall.

Our possible competitive edge will stem from our director’s professional experience and the services we offer. Given the high costs and potential challenges in qualifying, we have decided against seeking patent protection for our software. As a result, our business faces the danger of competitors either mimicking our business model or reverse-engineering our technology to launch a competing product with similar functionalities. Should such a scenario unfold, it could significantly undermine our capacity to market our services, potentially resulting in our business’s failure.

Because we are small company and have limited capital, our marketing campaign may not be enough to attract sufficient clients to operate profitably. If we do not make a profit, we will suspend or cease operations.

As a small company with restricted funds, our ability to launch an extensive marketing campaign is limited, potentially hindering our capability to draw in enough clients for profitable operations. Should our profits fall short, we might face the necessity to halt or completely discontinue our business activities.

Given our status as a small enterprise with finite capital, our marketing efforts will inevitably be constrained, which may impede our success in making our product widely known to prospective customers. This limitation in marketing could lead to an insufficient customer base to sustain profitable operations. In the event that we fail to achieve profitability, suspending or ceasing operations may become unavoidable

We plan to employ freelancers as independent contractors, which could lead to potential damage to our reputation if our future clients are dissatisfied with their use.

Being a software development firm, our growth will heavily rely on referrals and new projects from past clients as we strive to build a reputation for professionalism and integrity to draw in more customers. Failure to secure such engagements may result in investors facing a total loss of their investment

We do not currently have any general liability insurance to protect us in case of customer or other claims.

We do not have any general liability insurance to cover any potential claims to which we are exposed. Any imposition of liability would increase our operating losses and reduce our net worth and working capital.

Our operations will be conducted outside the United States. The U.S. stockholders would face difficulty in:

| | · | effecting service of process within the United States on our officers; |

| | | |

| | · | enforcing judgments obtained in U.S. courts based on the civil liability provisions of the U.S. federal securities laws against the officers; |

| | | |

| | · | enforcing judgments of U.S. courts based on civil liability provisions of the U.S. federal securities laws in foreign courts against our officers; and |

| | | |

| | · | bringing an original action in foreign courts to enforce liabilities |

If Andrey Novokhatski, our sole officer and director, should resign, that could result in our operations being suspended. If that should occur, our business could fail, and you could lose your entire investment.

We solely, and therefore are extremely depending on the services of our sole officer and director, A. Novokhatski. for the future success of the business. The loss of the services of Mr. Andrey Novokhatski, could have an adverse effect on our business, financial condition and results of operations. Mr. Andrey Novokhatski, our sole officer and director, and if he should die there will be no one to appoint a new officer and, in that event, we will have no alternative but to cease operations.

Our president Mr. Andrey Novokhatski has no significant experience in the software development industry.

Mr.Novokhatski has no significant experience in the software development industry. He has general software development expertise and has no significant experience in software development. Mr. Andrey Novokhatski, lacks this experience or expertise will pose risks to our company and its investors.

The market in which we participate is competitive and, if we do not compete effectively, our operating results could be harmed.

The market for our services and products is competitive and rapidly changing, and the barriers to entry are relatively low. With the introduction of new technologies and the influx of new entrants to the market, we expect competition to persist and intensify in the future, which could harm our ability to increase sales, limit customer attrition and maintain our prices.

Optimizing Markup on Freelancer Fees: Managing Client Expectations and Freelancer Satisfaction

Our revenue strategy involves earning from the markup on freelancer fees. This approach means we charge clients a rate for freelancer services that exceeds the amount paid to the freelancers. To draw in clients, it’s imperative that our pricing remains competitive with other platforms and freelancers in the industry. Setting our markup too high might drive potential clients to look for alternatives. Moreover, clients who are paying more will naturally have heightened expectations concerning the caliber of freelancers and the services they receive. It’s critical that the quality provided aligns with the price to sustain client trust. Additionally, freelancers might become uneasy if they feel a significant portion of their earnings is being deducted by our platform. Finding a fair balance is key to retaining skilled freelancers within our ecosystem

Investors cannot withdraw funds once their subscription agreements are accepted by the Company. Therefore, because the investment is irrevocable, investors must be prepared that they may lose their entire investment if the business fails

Investors do not have the right to withdraw invested funds once the subscription agreement is accepted by the Company. Subscription payments will be paid to DeltaSoft Corp. and held in our corporate bank account. Once the Company reviews the Subscription Agreements, and determines that they are in good order, and the Company accepts the subscription, investors will not have the right of return of such funds, the investment will become irrevocable. Therefore, if the business of the Company fails, the investor must be prepared to lose their entire investment in the Company.

Investors in this offering will have limited control over decision making because the company’s sole officer and director controls a majority of the issued and outstanding common stock

Our sole officer and director Mr. Andrey Novokhatski, owns a majority of the outstanding common stock at the present time and will continue to own a majority of the outstanding common stock even if the maximum number of common shares is purchased in this offering. As a result of such ownership, investors in this offering will have limited control over matters requiring approval by our security holders, including the election of directors, the approval of significant corporate transactions and any change of control and management. This concentrated control may also make it difficult for our stockholders to receive a premium for their shares of their common stock in the event we enter into transactions, which require stockholder approval.

As an “emerging growth company” under the JOBS act, we are permitted to rely on exemptions from certain disclosure requirements.

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

| | · | Have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| | | |

| | · | Comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| | | |

| | · | Submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and |

| | | |

| | · | Disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the Chief Executive’s compensation to median employee compensation. |

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Until such time, however, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

We may in the future issue additional shares of common stock, which will dilute share value of investors in the offering.

Our Articles of Incorporation authorize the issuance of 75,000,000 shares of common stock, par value $0.001 per share, of which 3,500,000 shares are issued and outstanding. We must raise additional capital in order for our business plan to succeed. Our most likely source of additional capital will be through the sale of additional shares of common stock. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by investors in the offering and might have an adverse effect on any trading market for our common stock.

RISKS ASSOCIATED WITH THIS OFFERING

The trading in our shares will be regulated by the securities and exchange commission rule 15g-9 which established the definition of a “penny stock.”

The shares being offered are defined as a penny stock under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), and rules of the Commission. The term “penny stock” generally refers to a security issued by a very small company that trades at less than $5 per share.

The Exchange Act and such penny stock rules generally impose additional sales practice and disclosure requirements on broker-dealers who sell our securities to persons other than certain accredited investors who are, generally, institutions with assets in excess of $10,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 ($300,000 jointly with spouse), or in transactions not recommended by the broker-dealer. For transactions covered by the penny stock rules, a broker dealer must make certain mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations, the compensation to be received by the broker-dealer and certain associated persons, and deliver certain disclosures required by the Commission. Consequently, the penny stock rules may make it difficult for you to resell any shares you may purchase, if at all.

Market for penny stock has suffered in recent years from patterns of fraud and abuse

According to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

| | · | Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; |

| | | |

| | · | Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; |

| | | |

| | · | Boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced salespersons; |

| | | |

| | · | Excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and, |

| | | |

| | · | The wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequential investor losses. |

Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

We will not be required to comply with certain provisions of the Sarbanes-Oxley act for as long as we remain an “emerging growth company.”

We are not currently required to comply with the SEC rules that implement Sections 302 and 404 of the Sarbanes-Oxley Act, and are therefore not required to make a formal assessment of the effectiveness of our internal controls over financial reporting for that purpose. Upon becoming a public company, we will be required to comply with certain of these rules, which will require management to certify financial and other information in our quarterly and annual reports and provide an annual management report on the effectiveness of our internal control over financial reporting. Though we will be required to disclose changes made in our internal control procedures on a quarterly basis, we will not be required to make our first annual assessment of our internal control over financial reporting pursuant to Section 404 until the later of the year following our first annual report required to be filed with the SEC, or the date we are no longer an “emerging growth company” as defined in the JOBS Act.

Our independent registered public accounting firm is not required to formally attest to the effectiveness of our internal control over financial reporting until the later of the year following our first annual report required to be filed with the SEC, or the date we are no longer an “emerging growth company.” At such time, our independent registered public accounting firm may issue a report that is adverse in the event it is not satisfied with the level at which our controls are documented, designed or operating. We will be exempt from the auditor attestation requirement concerning management’s report on the effectiveness of internal control over financial reporting for so long as we remain a smaller reporting company.

Our status as an “emerging growth company” under the JOBS act of 2012 may make it more difficult to raise capital when we need to do it.

Because of the exemptions from various reporting requirements provided to us as an “emerging growth company” and because we will have an extended transition period for complying with new or revised financial accounting standards, we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. Investors may be unable to compare our business with other companies in our industry if they believe that our financial accounting is not as transparent as other companies in our industry. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

Our sole officer and director has no experience managing a public company which is required to establish and maintain disclosure controls and procedures and internal control over financial reporting.

We have never operated as a public company. Andrey Novokhatski, our sole officer and director has no experience managing a public company, which is required to establish and maintain disclosure controls and procedures and internal control over financial reporting. As a result, we may not be able to operate successfully as a public company, even if our operations are successful. We plan to comply with all of the various rules and regulations, which are required for a public company. However, if we cannot operate successfully as a public company, your investment may be materially adversely affected. Our inability to operate as a public company could be the basis of losing your entire investment in us.

We plan to sell shares in this offering without an underwriter and may be unable to sell any shares.

This offering is self-underwritten, that is, we are not going to engage the services of an underwriter to sell the shares; we intend to sell our shares through our President, who will receive no commissions. He will offer the shares to friends, family members, and business associates; however, there is no guarantee that he will be able to sell any of shares. Unless he is successful in selling all of the shares and we receive the proceeds from this offering, we may have to seek alternative financing to implement our business plan.

Our president, Mr. Andrey Novokhatski, does not have any prior experience conducting a best-effort offering, and our best effort offering do not require a minimum amount to be raised. As a result of this we may not be able to raise enough funds to commence and sustain our business and investors may lose their entire investment.

Mr. Andrey Novokhatski, does not have any experience conducting a best-effort offering. Consequently, we may not be able to raise any funds successfully. Also, the best effort offering does not require a minimum amount to be raised. If we are not able to raise sufficient funds, we may not be able to fund our operations as planned, and our business will suffer and your investment may be materially adversely affected. Our inability to successfully conduct a best-effort offering could be the basis of your losing your entire investment in us.

As a section 15(d) filer, we will not be a fully reporting company.

We will not be subject to the proxy rules under Section 14 of the Exchange Act, the prohibition of short-swing profits under Section 16 of the Exchange Act and the beneficial ownership reporting requirements of Sections 13(d) and (g) of the Exchange Act. If we have less than 300 shareholders following the fiscal year in which our registration statement becomes effective, our periodic reporting obligations under Section 13(a) will be automatically suspended under Section 15(d) of the Exchange Act.

Due to the lack of a trading market for our securities, you may have difficulty selling any shares you purchase in this offering.

We are not registered on any market or public stock exchange. There is presently no demand for our common stock and no public market exists for the shares being offered in this prospectus. We plan to contact a market maker immediately following the completion of the offering and apply to have the shares quoted on the OTC Link LLC. The OTC Link LLC is a regulated quotation service that displays real-time quotes, last sale prices and volume information in over-the-counter securities. The OTC Link LLC is not an issuer listing service, market or exchange. Although the OTC Link LLC does not have any listing requirements per se, to be eligible for quotation on the OTC Link LLC, issuers must remain current in their filings with the SEC or applicable regulatory authority.

If we are not able to pay the expenses associated with our reporting obligations, we will not be able to apply for quotation on the OTC Link LLC. Market makers are not permitted to begin quotation of a security whose issuer does not meet this filing requirement. Securities already quoted on the OTC Link LLC that become delinquent in their required filings will be removed following a 30-day grace period if they do not make their required filing during that time.

We cannot guarantee that our application will be accepted or approved and our stock listed and quoted for sale. As of the date of this filing, there have been no discussions or understandings between DeltaSoft Corp. and anyone acting on our behalf, with any market maker regarding participation in a future trading market for our securities. If no market is ever developed for our common stock, it will be difficult for you to sell any shares you purchase in this offering. In such a case, you may find that you are unable to achieve any benefit from your investment or liquidate your shares without considerable delay, if at all. In addition, if we fail to have our common stock quoted on a public trading market, your common stock will not have a quantifiable value and it may be difficult, if not impossible, to ever resell your shares, resulting in an inability to realize any value from your investment.

Factors such as announcements of new services by us or our competitors, and quarter-to-quarter variations in our results of operations, as well as market conditions in our sector may have a significant impact on the market price of our shares. Further, the stock market has experienced extreme volatility that has particularly affected the market prices of the stock of many companies and such volatility may be unrelated or disproportionate to the operating performance of those companies.

We will incur ongoing costs and expenses for SEC reporting and compliance. Without revenue we may not be able to remain in compliance, making it difficult for investors to sell their shares, if at all.

Andrey Novokhatski,, our sole officer and director, has verbally agreed to loan the company funds to complete the registration process. After the effective date of this prospectus, we will be required to file annual, quarterly and current reports, and/or other information with the SEC.

We plan to contact a market maker immediately following the close of the offering and apply to have the shares quoted on the OTC Link LLC. To be eligible for quotation, issuers must remain current in their filings with the SEC. In order for us to remain in compliance we will require future revenues to cover the cost of these filings, which could comprise a substantial portion of our available cash resources. The costs associated with being a publicly traded company in the next 12 month will be approximately $14,000. If we are unable to generate sufficient revenues to remain in compliance it may be difficult for you to resell any shares you may purchase, if at all. Also, if we are not able to pay the expenses associated with our reporting obligations, we will not be able to apply for quotation on the OTC Link LLC.

USE OF PROCEEDS

Our offering is being made on a self-underwritten basis: no minimum number of shares must be sold in order for the offering to proceed. The offering price per share is $0.02. The following table sets forth the uses of proceeds assuming the sale 100%, 75%, 50% and 25% respectively, of the securities offered for sale by the Company. There is no assurance that we will raise the full $120,000 as anticipated.

| | | 25% of offering | | | 50% of offering | | | 75% of offering | | | 100% of offering | |

| Gross proceeds | | $ | 30,000 | | | $ | 60,000 | | | $ | 90,000 | | | $ | 120,000 | |

In order of priority, the gross proceeds of the offering will be used as follows:

| | | 25% of offering | | | 50% of offering | | | 75% of offering | | | 100% of offering | |

| Marketing Campaign | | $ | – | | | $ | 15,000 | | | $ | 35,000 | | | $ | 42,000 | |

| Office and Equipment | | $ | 1,000 | | | $ | 2,000 | | | $ | 5,000 | | | $ | 10,000 | |

| Software development | | $ | 15,000 | | | $ | 29,000 | | | $ | 36,000 | | | $ | 54,000 | |

| General and administrative | | $ | 14,000 | | | $ | 14,000 | | | $ | 14,000 | | | $ | 14,000 | |

| TOTAL | | $ | 30,000 | | | $ | 60,000 | | | $ | 90,000 | | | $ | 120,000 | |

The above figures represent only estimated costs.

“General and Administrative Costs” noted above include costs related to accounting, audit, legal and transfer agent costs that we incur in filing reports with the Securities and Exchange Commission, as well as general working capital, which are estimated to be approximately $14,000 per year.

We are not intending to use the net proceeds from the offering to pay compensation to Mr. Andrey Novokhatski or to repay the loan from Mr. Andrey Novokhatski.

If necessary, Andrey Novokhatski, our sole officer and director, has verbally agreed to loan the company funds to complete the registration process. Also, these loans would be necessary if the proceeds from this offering will not be sufficient to implement our business plan and maintain reporting status and quotation on the OTC Link LLC. Mr. Andrey Novokhatski, will not be repaid from the proceeds of this offering. There is no due date for the repayment of the funds advanced by Mr. Andrey Novokhatski. Mr. Andrey Novokhatski, will be repaid from revenues of operations if and when we generate sufficient revenues to pay the obligation.

DETERMINATION OF OFFERING PRICE

The offering price of the shares has been determined arbitrarily by us. The price does not bear any relationship to our assets, book value, earnings, or other established criteria for valuing a privately held company. In determining the number of shares to be offered and the offering price, we took into consideration our cash on hand and the amount of money we would need to implement our business plan. Accordingly, the offering price should not be considered an indication of the actual value of the securities.

DILUTION

The price of the current offering is fixed at $0.02 per share. This price is significantly higher than the price paid by the Company’s sole director and officer for common equity on March 30, 2024, Andrey Novokhatski paid $0.001 per share for the 3,500,000 shares of common stock.

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing stockholders.

As of March 31, 2024, the net tangible book value of the shares was $3,227 or approximately $0.0009 per share, based upon 3,500,000 shares outstanding. The following tables compare the differences of your investment in our shares with the investment of our existing stockholders.

| Percent of Offering Completed | | | 25% | | | | 50% | | | | 75% | | | | 100% | |

| Amount of new funding | | $ | 30,000 | | | $ | 60,000 | | | $ | 90,000 | | | $ | 120,000 | |

| Offering price | | $ | 0.02 | | | $ | 0.02 | | | $ | 0.02 | | | $ | 0.02 | |

| Shares outstanding after offering | | | 5,000,000 | | | | 6,500,000 | | | | 8,000,000 | | | | 9,500,000 | |

| Book value before distribution per share | | $ | 0.0009 | | | $ | 0.0009 | | | $ | 0.0009 | | | | 0.0009 | |

| Increase in book value per share | | | 0.0029 | | | | 0.0066 | | | | 0.0090 | | | | 0.0106 | |

| Book value after distribution per share | | $ | 0.0038 | | | $ | 0.0075 | | | $ | 0.0099 | | | $ | 0.0115 | |

| Dilution to purchasers | | $ | 0.0162 | | | $ | 0.0124 | | | $ | 0.0101 | | | $ | 0.0085 | |

| Dilution as percentage | | | 81% | | | | 62% | | | | 50% | | | | 43% | |

| % old shareholders’ ownership | | | 70% | | | | 54% | | | | 44% | | | | 37% | |

| % new shareholders’ ownership | | | 30% | | | | 46% | | | | 56% | | | | 63% | |

SELLING SECURITY HOLDERS

Not applicable, we do not have any selling security holders.

PLAN OF DISTRIBUTION

We have 3,500,000 shares of common stock issued and outstanding as of the date of this prospectus. The Company is registering an additional of 6,000,000 shares of its common stock for sale at the price of $0.02 per share. There is no arrangement to address the possible effect of the offering on the price of the stock.

In connection with the Company’s selling efforts in the offering, Andrey Novokhatski, will not register as a broker-dealer pursuant to Section 15 of the Exchange Act, but rather will rely upon the “safe harbor” provisions of SEC Rule 3a4-1, promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participate in an offering of the issuer’s securities. Mr. Andrey Novokhatski, is not subject to any statutory disqualification, as that term is defined in Section 3(a)(39) of the Exchange Act. Mr. Andrey Novokhatski, will not be compensated in connection with his participation in the offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities. Mr. Andrey Novokhatski, is not, nor has he been within the past 12 months, a broker or dealer, and he is not, nor has he been within the past 12 months, an associated person of a broker or dealer. At the end of the offering, Mr. Andrey Novokhatski, will continue to primarily perform substantial duties for the Company or on its behalf otherwise than in connection with transactions in securities. Mr. Andrey Novokhatski, not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

The Company will receive all proceeds from the sale of the 6,000,000 shares being offered. The price per share is fixed at $0.02 for the duration of this offering. Although our common stock is not listed on a public exchange or quoted over-the-counter, we intend to seek to have our shares of common stock quoted on the OTC Link LLC. In order to be quoted on the OTC Link LLC, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, nor can there be any assurance that such an application for quotation will be approved. However, sales by the Company must be made at the fixed price of $0.02.

The Company’s shares may be sold to purchasers from time to time directly by and subject to the discretion of the Company. Further, the Company will not offer its shares for sale through underwriters, dealers, agents or anyone who may receive compensation in the form of underwriting discounts, concessions or commissions from the Company and/or the purchasers of the shares for whom they may act as agents. The shares of common stock sold by the Company may be occasionally sold in one or more transactions; all shares sold under this prospectus will be sold at a fixed price of $0.02 per share.

In order to comply with the applicable securities laws of certain states, the securities will be offered or sold in those only if they have been registered or qualified for sale; an exemption from such registration or if qualification requirement is available and with which the Company has complied.

In addition, and without limiting the foregoing, the Company will be subject to applicable provisions, rules and regulations under the Exchange Act with regard to security transactions during the period of time when this Registration Statement is effective.

We will pay all expenses incidental to the registration of the shares (including registration pursuant to the securities laws of certain states) which we expect to be $10,000.

The shares of common stock being offered by us have not been registered for sale under the securities laws of any state as of the date of this prospectus.

DESCRIPTION OF SECURITIES TO BE REGISTERED

General

Our authorized capital stock consists of 75,000,000 shares of common stock, par value $0.001 per share. As of March 31, 2024, there were 3,500,000 shares of our common stock issued and outstanding those were held by one registered stockholder of record, our sole officer and Director.

Common Stock

The following is a summary of the material rights and restrictions associated with our common stock.

The holders of our common stock currently have (i) equal ratable rights to dividends from funds legally available therefore, when, as and if declared by the Board of Directors of the Company; (ii) are entitled to share ratably in all of the assets of the Company available for distribution to holders of common stock upon liquidation, dissolution or winding up of the affairs of the Company (iii) do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights applicable thereto; and (iv) are entitled to one non-cumulative vote per share on all matters on which stock holders may vote. Please refer to the Company’s Articles of Incorporation, Bylaws and the applicable statutes of the State of Wyoming for a more complete description of the rights and liabilities of holders of the Company’s securities.

Preferred Stock

We do not have an authorized class of preferred stock.

Share Purchase Warrants

We have not issued and do not have any outstanding warrants to purchase shares of our common stock.

Options

We have not issued and do not have any outstanding options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have any outstanding securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus as having prepared or certified any part of this Prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest exceeding $50,000, directly or indirectly, in the Company or any of its parents or subsidiaries. Nor was any such person connected with DeltaSoft Corp. or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

The validity of the issuance of the shares of common stock offered by us has been passed upon by LAW OFFICE OF CARL P. RANNO.

Experts

Bush & Associates CPA LLC, our independent registered public accounting firm, has audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in their audit report. Bush & Associates CPA LLC has presented its report with respect to our audited financial statements.

INFORMATION WITH RESPECT TO THE REGISTRANT

Description of Business

We are development stage company and intends to commence operations in software development and online industry. Our future program will be a universal, all-in-one tool for effective planning and management of projects and performers. Here are the anticipated benefits for users in the future:

Planning

At the project planning stage, the DeltaSoft program will allow for quick and detailed creation of a project description and requirements, both through convenient and thoughtful forms/surveys and with the help of AI.

Tasks

At the task creation stage, for project implementation, the DeltaSoft program will enable quick and easy creation and division of the main project into a series of subprojects and tasks for direct execution. This will be possible both independently, using forms in the control panel, and by utilizing AI functionality.

Performers

The DeltaSoft program will also assist in the stage of selecting and distributing performers (freelancers) and creating a team for a specific project or for individual tasks, with the functionality of creating advertisements both independently in the control panel and with the help of AI, suggesting a list of roles for a specific project, as well as creating advertisements.

Project Management and Tracking

For the project management stage, the DeltaSoft program will have a range of functionalities to assist in the most convenient and effective task execution, such as WBS (Work Breakdown Structure), stages, roadmap, weekly planning, product hub, etc.

In general terms, the DeltaSoft program will allow for quick and convenient creation and execution of a project, product, or any other complex task, accompanying the user at all stages of execution. Moreover, the AI functionality will significantly save time, speeding up and simplifying each stage, which ultimately leads to maximum efficiency and speed of project execution.

Currently, we are developing graphics for our future program with a contracted company.

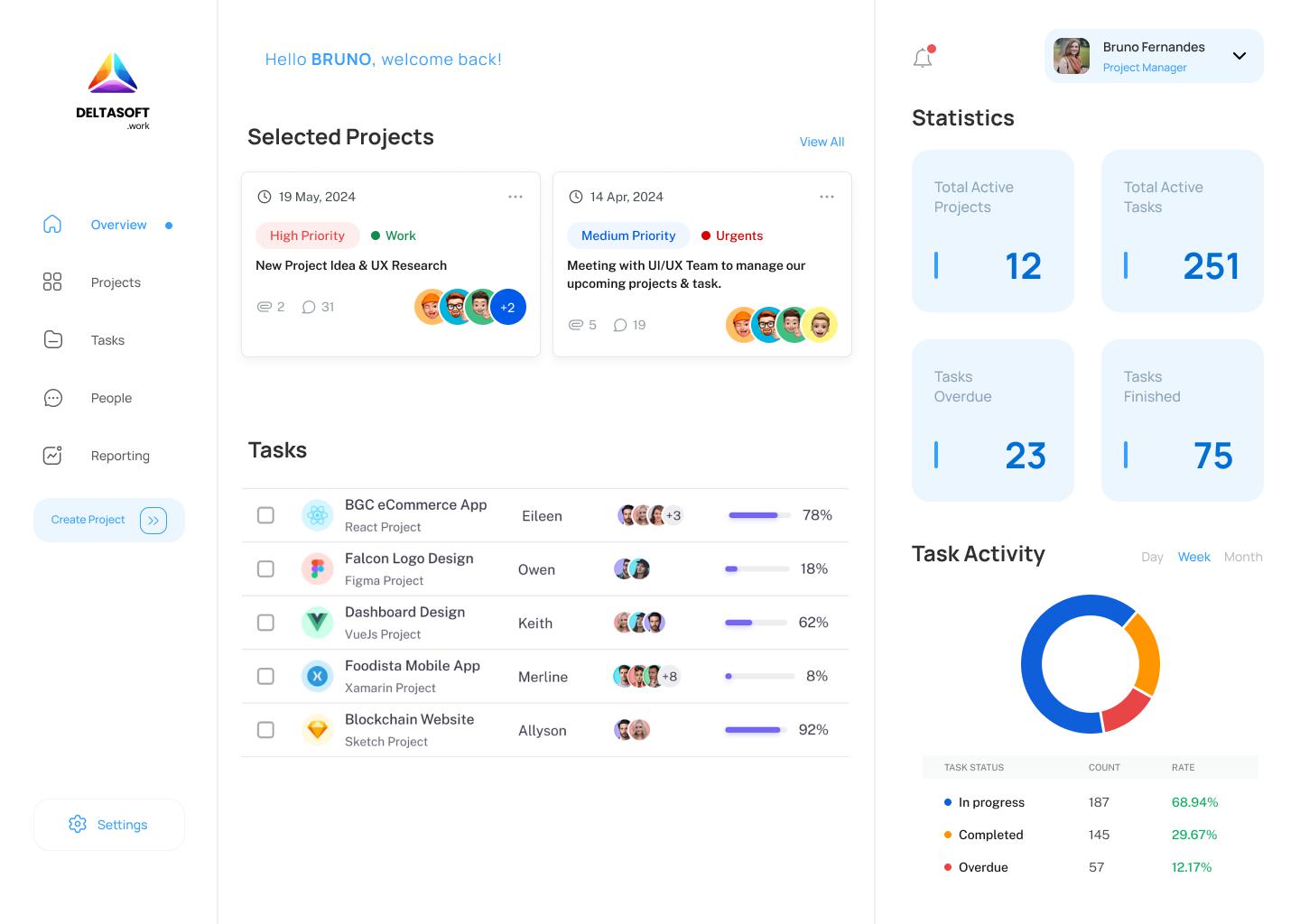

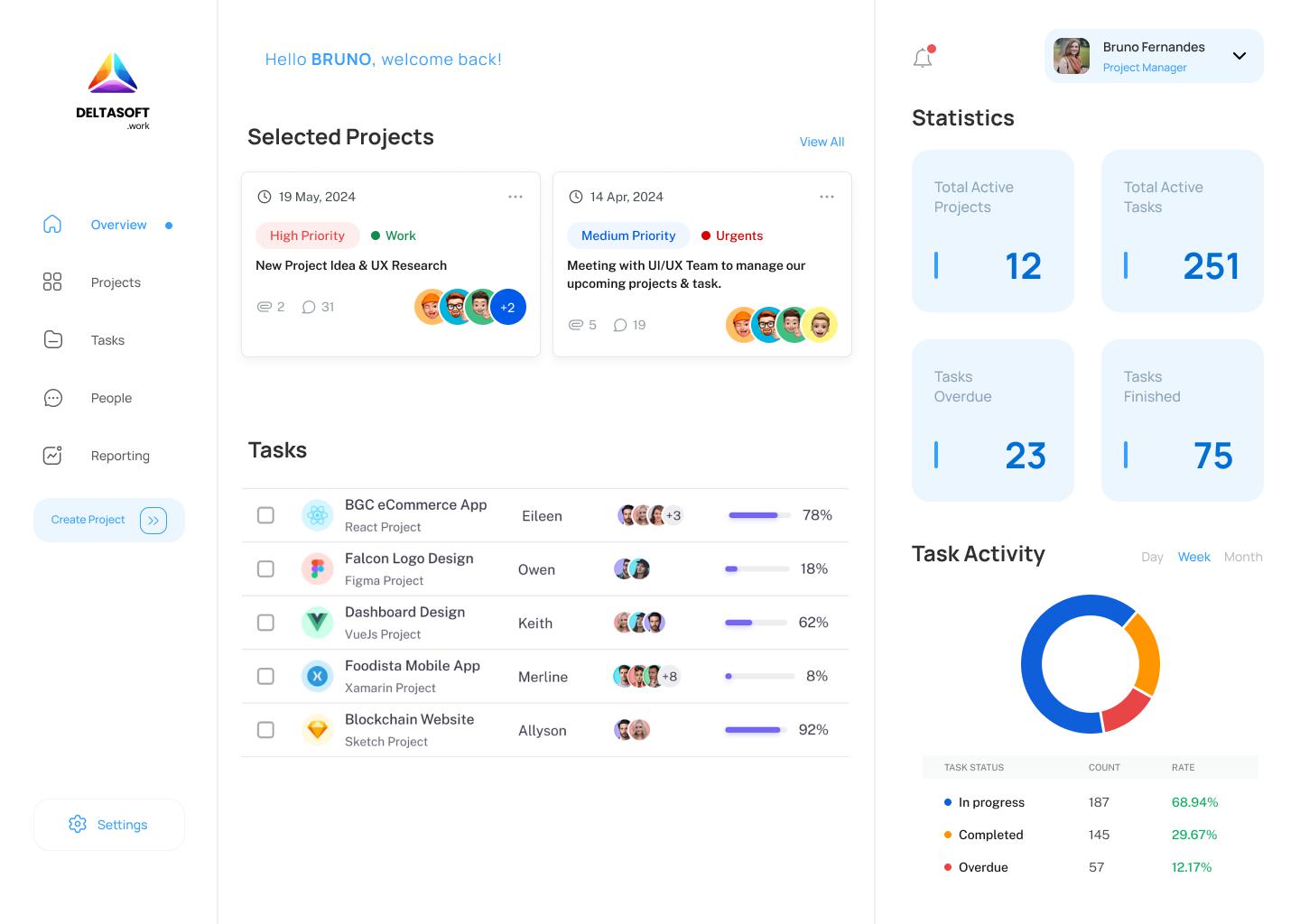

Application Structure from the User’s Perspective.

The application is organized into 5 primary sections: Overview, Projects, Tasks, People, and Reporting, each designed to streamline the user’s experience.

Overview

This is the entry point for users, presenting a comprehensive snapshot or bird’s eye view of the current status across all projects. It’s tailored to give users a quick and broad understanding of their projects’ standings at a glance.

Projects

In the Projects section, users are provided with a list showcasing each project along with vital details like the project’s current status, assigned team members, progress, and more. Selecting a project navigates the user to a page dedicated to that project, offering a detailed description, a list of subprojects, and the specific tasks required for the project’s completion.

Tasks

Upon selecting a specific task, users can access detailed information about it. The Tasks section is particularly useful as it compiles a list of all tasks across all projects, sorted by time frames such as today, tomorrow, and the upcoming week. This organization helps users understand the scope of work for any chosen period, facilitating better planning and management.

People

The People category is designed to show users a roster of team members, detailing who is assigned to which project and their respective tasks. This feature aids in the coordination and allocation of resources efficiently.

Reporting

Finally, the Reporting section allows users to view the list of tasks in a graphical format. This visual representation is intended to help users easily track progress and task distribution, providing a clear and immediate understanding of project dynamics and workload distribution.

Revenue

Our revenue strategy centers on the markup on freelancer fees. This approach means we’ll charge our clients a premium over the rates we pay to freelancers for their services.

Profit Margin: By adopting this model, we aim to derive a direct profit from the transactions facilitated on our soon-to-launch platform. The discrepancy between the charges to clients and payments to freelancers will constitute our profit margin, potentially becoming a significant revenue stream. We anticipate that clients will value the simplicity and transparency of handling payments through our platform, being prepared to pay extra for the convenience and reliability it offers.

Competition and Marketing

Our competitors would be other platforms that facilitate freelance work across various sectors, including but not limited to technology, design, writing, marketing, and consulting services. Some of the well-known competitors in this space include:

| 1. | Upwork - A global freelancing platform where businesses and independent professionals connect and collaborate remotely. |

| 2. | Fiverr - An online marketplace for freelance services, offering a platform for freelancers to offer services to customers worldwide. |

| 3. | Freelancer.com - One of the largest freelancing and crowdsourcing marketplaces by number of users and projects. |

| 4. | Toptal - A network of freelance software engineers, designers, and finance experts, focusing on connecting top-tier freelancers with corporate clients. |

| 5. | Guru - A platform that provides freelancers the opportunity to find various jobs and projects in multiple disciplines. |

| 6. | PeoplePerHour - This platform enables clients to find freelance workers for specific projects, with a wide range of skill sets available. |

To market our platform that connects freelancers with clients and earns revenue through markup on freelancer fees, we will implement a comprehensive strategy:

Content Marketing: We will create valuable, SEO-optimized content aimed at both freelancers and clients to position ourselves as industry leaders.

Social Media Marketing: We’ll actively engage with our audience on platforms like LinkedIn, Twitter, and Facebook, and run targeted advertising campaigns to reach specific demographics.

Email Marketing: We plan to build an email list by offering resources that add value, through which we’ll send regular updates and personalized content.

Referral Programs: We’ll incentivize our current users to refer new freelancers and clients by offering rewards, enhancing our user base organically.

Partnerships and Collaborations: We aim to partner with industry influencers and other platforms for increased visibility and mutually beneficial promotions.

PPC Advertising: We will invest in PPC campaigns on platforms like Google Ads to direct targeted traffic to our site.

Networking and Community Building: We’ll engage with online communities relevant to our target audience and host events like webinars to showcase our platform’s benefits.

Highlighting Competitive Advantages: We’ll ensure our platform’s unique features and benefits are well communicated to differentiate us from competitors.

Leveraging Customer Testimonials: Success stories and testimonials from satisfied users will be shared to build trust and credibility among potential users.

Public Relations: We plan to generate media coverage by pitching interesting stories about our platform to industry publications and news outlet

Employees; Identification of Certain Significant Employees.

We have no employees other than our sole officer and director, Andrey Novokhatski, who currently devotes approximately twenty hours per week to company matters.

Government Regulation

We are subject to compliance with laws, governmental regulations, administrative determinations, court decisions and similar constraints.

The company upon implementing its business plan expects to be in compliance with U.S. federal laws, including the U.S. Privacy Act of 1974, Health Insurance Portability and Accountability Act of 1996, Children’s Online Privacy Protection Act of 1998 (COPPA), 1999 Gramm-Leach Bliley Act that protects the rights and data of U.S. consumers, patients, minors and others.

The Wyoming state laws (Wyoming Revised Statutes – NRS)

CHAPTER 603A - SECURITY AND PRIVACY OF PERSONAL INFORMATION

SECURITY OF INFORMATION MAINTAINED BY DATA COLLECTORS AND OTHER BUSINESSES

State of Wyoming Online Privacy Policy - Effective Date 11/25/02 | 3.03 B.

We will also be subject to common business and tax rules and regulations pertaining to the normal business operations.

DESCRIPTION OF PROPERTY

Offices

Our business office is located at 91 Portland Road, London W11 4LN, United Kingdom. This address was provided by sole officer and president, Mr. Andrey Novokhatski. Our telephone number is +44 20 3575 1093

LEGAL PROCEEDINGS

We are not currently a party to any legal proceedings, and we are not aware of any pending or potential legal actions.

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

We are a development stage corporation with limited operations and insignificant revenues from our business operations. Our auditors have issued a going concern opinion. This means that our auditors believe there is substantial doubt that we can continue as an on-going business for the next twelve months. We do not anticipate that we will generate significant revenues until we have raised the funds necessary to conduct a marketing program. There is no assurance we will ever generate revenue even if we raised all necessary funds.

If we need additional cash and cannot raise it, we will either have to suspend operations until we do raise the cash, or cease operations entirely. If we raise 25% of money from this offering, we believe it will fund operations for approximately three months, but with limited funds available to build and grow our business. If we raise 100% of money from this offering, we believe the money will last for one year and also provide funds for a growth strategy.

To meet our need for cash we are attempting to raise money from this offering. We believe that we will be able to raise enough money through this offering to expand operations but we cannot guarantee that once we expand operations we will stay in business after doing so. If we are unable to successfully find customers, we may quickly use up the proceeds from this offering and will need to find alternative sources. At the present time, we have not made any arrangements to raise additional cash, other than through this offering.

PLAN OF OPERATION

As of March 31, 2024, our cash balance was $3,531. We may not be able to raise sufficient funds from this offering to sustain our operations. Andrey Novokhatski, our Chairman, President, and Secretary, has informally agreed to advance funds to allow us to pay for offering costs, filing fees, and professional fees. Mr. Andrey Novokhatski, however, has no formal commitment, arrangement or legal obligation to advance or loan funds to the company. We do not currently have any arrangements for additional financing. Our principal executive offices are located at 91 Portland Road, London W11 4LN, United Kingdom. Our phone number is +44 20 3575 1093.

After the effectiveness of our registration statement by the SEC, we intend to concentrate our efforts on raising capital. During this period, our operations will be limited due to the limited amount of funds on hand. Our plan of operations following the completion is as follows:

| | | 25% of

offering | | | 50% of

offering | | | 75% of

offering | | | 100% of

offering | |

| Office and Equipment | | $ | 1,000 | | | $ | 2,000 | | | $ | 5,000 | | | $ | 10,000 | |

| Marketing Campaign | | $ | – | | | $ | 15,000 | | | $ | 35,000 | | | $ | 42,000 | |

| Software development | | $ | 15,000 | | | $ | 29,000 | | | $ | 36,000 | | | $ | 54,000 | |

| General and administrative | | $ | 14,000 | | | $ | 14,000 | | | $ | 14,000 | | | $ | 14,000 | |

| TOTAL | | $ | 30,000 | | | $ | 60,000 | | | $ | 90,000 | | | $ | 120,000 | |

If we complete 25% of the offering described in this prospectus, we expect to receive net proceeds of $30,000. We are planning to spend $1,000 on the office equipment, $15,000 on the software development. It will also cover the estimated $14,000 in expenses as general and administrative costs. We will rely upon the proceeds that we receive from the sale of our services and loans from our president in order to cover the balance of general and administrative expenses, as well as marketing and advertising costs.

If we complete 50% of the offering described in this prospectus, we expect to receive net proceeds of $60,000. We intend to allocate $2,000 towards the office rent and office equipment, software development and website maintenance $29,000 and marketing expenses of $15,000. It will also cover the estimated $14,000 in expenses as general and administrative costs. We will rely upon the proceeds that we receive from the sale of our services and loans from our president in order to cover the balance of general and administrative expenses.

If we complete 75% of the offering described in this prospectus, we expect to receive net proceeds of $90,000. We intend to allocate $5,000 towards the office rent and office equipment, software development and website maintenance $36,000 and marketing expenses of $35,000. It will also cover the estimated $14,000 in expenses as general and administrative costs. We will rely upon the proceeds that we receive from the sale of our services and loans from our president in order to cover the balance of general and administrative expenses.

If we are successful in completing 100% of offering described in this prospectus, of which there is no assurance, we expect to receive net proceeds of $120,000. We intend to allocate $10,000 towards the office rent and office equipment, software development and website maintenance $54,000 and marketing expenses of $42,000. It will also cover the estimated $14,000 in expenses as general and administrative costs. We will rely upon the proceeds that we receive from the sale of our services and loans from our president in order to cover the balance of general and administrative expenses.

OFF-BALANCE SHEET ARRANGEMENTS

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

LIMITED OPERATING HISTORY; NEED FOR ADDITIONAL CAPITAL

There is no historical financial information about us upon which to base an evaluation of our performance. We are in start-up stage operations and have not generated any revenues. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources and possible cost overruns due to price and cost increases in services and products.

We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. Equity financing could result in additional dilution to existing shareholders.

Results of operations for the period from January 4, 2024 (inception) through March 31, 2024

During the period the Company did not generate any revenue.

Total expenses for the period from inception through March 31, 2024 were $273 consisting of general and administrative expenses ($74) and professional fees ($199).

The company recorded a net loss of $273 for the period from inception through March 31, 2024.

LIQUIDITY AND CAPITAL RESOURCES

As of March 31, 2024, the Company had $3,531 cash and our liabilities were $304, comprising $304 owed to Andrey Novokhatski, our sole officer and director. The available capital is not sufficient for the Company to remain operational.

Net cash used in operating activities for the period from January 4, 2024 (inception) through March 31, 2024, was $273.

Cash flows from financing activities for the period from January 4, 2024 (inception) through March 31, 2024, was $3,804.

Since inception, we have sold 3,500,000 shares of common stock in one offer and sale, which was to our sole officer and director, at a price of $0.001 per share, for aggregate proceeds of $3,500.

We cannot guarantee that we will be able to sell all the shares required. If we are successful, any money raised will be applied to the items set forth in the Use of Proceeds section of this prospectus. We will attempt to raise the necessary funds to proceed with all phases of our plan of operation. The sources of funding we may consider funding this work is public offering.

As of the date of this registration statement, the current funds available to the Company should be sufficient to continue maintaining our reporting status until we raise funds from this offering. In case raising funds will take longer than planned, or our short-term expenses exceed our expectations, the company’s sole officer and director, Andrey Novokhatski, has indicated that he may be willing to provide funds required to maintain the reporting status in the form of a non-secured loan until minimum required proceeds are obtained by the Company. However, there is no contract in place or written agreement securing this agreement. We believe that we will obtain this loan from our director as he is the majority owner of the company and therefore has an incentive to finance us.

Management believes if the company cannot maintain its reporting status with the SEC it will have to cease all efforts directed towards the company. As such, your investment previously made may be lost in its entirety.

Our auditors have issued a “going concern” opinion, meaning that there is substantial doubt if we can continue as an on-going business for the next twelve months unless we obtain additional capital. No substantial revenues are anticipated until we have completed the financing from this offering and implemented our plan of operations. Our only source for cash at this time is investments by others in this offering. We must raise cash to implement our strategy and stay in business. The amount of the offering will likely allow us to operate for at least one year and have the capital resources required to cover the material costs with becoming a publicly reporting. The company anticipates over the next 12 months the cost of being a reporting public company will be approximately $14,000.

Management believes that the net proceeds, assuming a minimum of $30,000 is raised (provided that we are not required to raise any minimum amount of funding in the offering), will be sufficient to sustain operations and to pay for our costs of being a reporting company for 12 months. However, after one year we may need to raise additional financing.

We will be highly dependent upon the success of future private offerings of equity or debt securities, as described herein. Therefore, the failure thereof would result in the need to seek capital from other resources such as taking loans, which would likely not even be possible for the Company. However, if such financing were available, because we are a development stage company with no operations to date, we would likely have to pay additional costs associated with high-risk loans and be subject to an above market interest rate. At such time these funds are required, management would evaluate the terms of such debt financing. If the Company cannot raise additional proceeds via a private placement of its equity or debt securities, or secure a loan, the Company would be required to cease business operations. As a result, investors would lose all of their investment.

We will have to meet all the financial disclosure and reporting requirements associated with being a publicly reporting company. The Company’s management will have to spend additional time on policies and procedures to make sure it is compliant with various regulatory requirements, especially that of Section 404 of the Sarbanes-Oxley Act of 2002. This additional corporate governance time required of management could limit the amount of time management has to implement is business plan and impede the speed of its operations.

SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

The Company reports revenues and expenses using the accrual method of accounting for financial and tax reporting purposes.

USE OF ESTIMATES

Management uses estimates and assumption in preparing these financial statements in accordance with generally accepted accounting principles. Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses.

INCOME TAXES

DeltaSoft Corp. accounts for its income taxes in accordance with Statement of Financial Accounting Standards No. 109, “Accounting for Income Taxes.” Under Statement 109, a liability method is used whereby deferred tax assets and liabilities are determined based on temporary differences between basis used of financial reporting and income tax reporting purposes. Income taxes are provided based on tax rates in effect at the time such temporary differences are expected to reverse. A valuation allowance is provided for certain deferred tax assets if it is more likely than not, that the Company will not realize the tax assets through future operations.

FAIR VALUE OF FINANCIAL INSTRUMENTS