Table A1.8, above, provides an overview of the projection for total expenses by major component.

Major Transfers to Persons

Major transfers to persons consist of elderly benefits, which includes Old Age Security and the Guaranteed Income Supplement; Employment Insurance (EI) benefits; the Canada Child Benefit; as well as previous COVID-19 income support for workers.

Elderly benefits are projected to reach $80.9 billion in 2024-25, up 6.4 per cent. Over the forecast horizon, elderly benefits are forecast to grow by 5.2 per cent on average annually. Growth in elderly benefits is due to the increasing population of seniors and projected consumer price inflation, to which benefits are fully indexed.

EI benefits are projected to increase by 20.4 per cent to reach $27.8 billion in 2024-25, largely reflecting a higher projected unemployment rate for 2024 and 2025. EI benefits are expected to grow at an average of 2.9 per cent over the forecast horizon.

Canada Child Benefit payments are projected to increase 6.9 per cent to $28.2 billion in 2024-25, largely reflecting the indexation of benefits to inflation. Payments are then expected to grow by 5.0 per cent in 2025-26, before moderating to an average 3.3 per cent growth over the remainder of the forecast horizon.

The government also provided important emergency pandemic support to Canadians. These include the Canada Emergency Response Benefit, the Canada Recovery Benefit, the Canada Recovery Sickness Benefit, the Canada Recovery Caregiving Benefit, and the Canada Worker Lockdown Benefit. These temporary programs are now closed, with forecasted amounts in 2024-25 mainly reflecting expected recoveries of benefit overpayments.

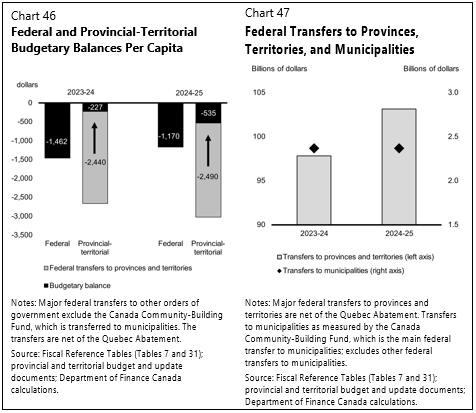

Major Transfers to Provinces, Territories, and Municipalities

Major transfers to provinces, territories, and municipalities, which include the Canada Health Transfer (CHT), the Canada Social Transfer (CST), Equalization, Territorial Formula Financing, health agreements with provinces and territories, Canada-wide early learning and child care, the Canada Community-Building Fund, and other fiscal arrangements, are expected to increase from $105.2 billion in 2024-25 to $125.5 billion in 2029-30.

The CHT is projected to increase from $52.1 billion in 2024-25 to $65.3 billion in 2029-30, supported by the CHT growth guarantee of at least 5 per cent for five years (in effect from 2023-24 to 2027-28), after which it will grow in line with a three-year moving average of nominal GDP growth, with funding guaranteed to grow by at least 3 per cent per year. The CST is legislated to grow at 3 per cent per year, from $16.9 billion in 2024-25 to $19.6 billion in 2029-30.