- DCO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ducommun (DCO) DEF 14ADefinitive proxy

Filed: 14 Mar 23, 4:32pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

DUCOMMUN INCORPORATED

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | ||

| No fee required. | |

| Fee paid previously with preliminary materials. | |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

Message to our Shareholders

Stephen G. Oswald

Chairman, President and

Chief Executive Officer

Dear Fellow Shareholders:

It is my pleasure to invite you to the 2023 Ducommun Incorporated Annual Meeting of Shareholders (the “Annual Meeting”).

Once again, our Annual Meeting will be conducted online through a live audiocast, which is often referred to as a “virtual meeting” of shareholders. Our digital format will allow our shareholders to participate safely, conveniently, and effectively, from any location with access to the internet. We intend to hold our virtual Annual Meeting in a manner that affords shareholders the same general rights and opportunities to participate, to the extent possible, as they would have at an in-person meeting.

The Annual Meeting will be held on Wednesday, April 26, 2023 at 9:00 a.m., Pacific Time and you will be able to attend online, vote your shares electronically, and submit your questions by visiting www.virtualshareholdermeeting.com/DCO2023 and entering your control number. You will not be able to attend the Annual Meeting in person. The attached Notice of Annual Meeting of Shareholders and Proxy Statement discuss the items scheduled for a vote by shareholders at the meeting.

The Securities and Exchange Commission rules allow companies to furnish proxy materials to their shareholders over the Internet. As a result, most of our shareholders will receive a notice in the mail regarding the availability of proxy materials for the Annual Meeting on the Internet instead of paper copies of those materials. The notice contains instructions on how to access the proxy materials over the Internet and instructions on how shareholders can receive paper copies of the proxy materials, including a proxy or voting instruction form. This process expedites shareholders’ receipt of proxy materials and lowers the cost of our Annual Meeting. The Board of Directors has fixed the close of business on February 27, 2023, as the record date for the determination of shareholders entitled to receive notice of and to vote at the Annual Meeting.

In 2022, with management continuing to build on its demonstrated track-record of strong operational leadership and cost management, along with the continued improvement in the commercial aerospace market and a solid defense business, our shareholders were the beneficiaries of year-over-year double digit growth in revenue and a relative total shareholder return that has consistently outperformed others in our peer group. I also want to thank our shareholders for sticking with us in 2022 and supporting the Company, my team and our board as we gave our best efforts in overcoming the many challenges and crises over the past few years, and as we position the Company for an exciting future ahead.

Finally, it is important that your shares be represented and voted at the Annual Meeting. Whether or not you plan to attend, please sign, date and return the enclosed proxy card or vote by telephone or using the internet as instructed on the enclosed proxy card. Please vote your shares as soon as possible. This is your Annual Meeting, and your participation is important.

Sincerely,

200 Sandpointe Avenue, Suite 700

Santa Ana, California 92707-5759

(657) 335-3665

April 26, 2023

DATE & TIME:

Wednesday, April 26, 2023

9:00 a.m. Pacific Time

PLACE: Online via live audio webcast at

www.virtualshareholdermeeting.com/DCO2023

| Meeting Agenda | ||||

| 1. | Elect three directors named in the Proxy Statement to serve on the Board of Directors until Ducommun’s 2026 Annual Meeting of Shareholders and until their successors have been duly elected and qualified, subject to their earlier death, resignation or removal | |||

| 2. | Approve Ducommun’s executive compensation on an advisory basis | |||

| 3. | Approve the frequency of future advisory votes on executive compensation on an advisory basis | |||

| 4. | Ratify the selection of PricewaterhouseCoopers LLP as Ducommun’s independent registered public accounting firm for the year ending December 31, 2023 | |||

| 5. | Transact any other business as may properly come before the meeting or any adjournment thereof | |||

| By Order of the Board of Directors | ||||

| Santa Ana, California March 14, 2023 | Rajiv A. Tata Secretary | |||

NOTICE

of Annual Meeting

of Shareholders

RECORD DATE:

February 27, 2023

Your vote is very important. Please read the proxy materials carefully and submit your votes as soon as possible by the methods set forth below to ensure your shares are represented at the 2023 Annual Meeting of Shareholders. Instructions for accessing the virtual annual meeting are more fully described in the accompanying proxy statement and a list of registered shareholders as of the record date will be accessible during the meeting at www.virtualshareholdermeeting.com/DCO2023. The record date for the annual meeting is February 27, 2023. Only shareholders of record at the close of business on that date may vote at the annual meeting or any adjournment thereof.

Important notice regarding the availability of proxy materials for the shareholder meeting to be held on April 26, 2023:

The Notice of Annual Meeting, our Proxy Statement and our Annual Report to Shareholders are available at http://materials.proxyvote.com/264147

| REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: |  |  |  |  | ||||

| Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you. | BY INTERNET Go to www.proxyvote.com and follow the instructions | BY TELEPHONE Call 1-800-690-4903 prior to 11:59 pm on April 25, 2023 | BY MAIL Sign the enclosed proxy card and mail it promptly in the enclosed postage-prepaid envelope | AT THE MEETING See page 71 for more information. |

This proxy summary highlights information generally contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider, and we encourage you to read the entire Proxy Statement before voting your shares. For additional and more complete information regarding our 2022 performance, please review Ducommun’s Annual Report on Form 10-K for the year ended December 31, 2022.

This Proxy Statement is first being made available to our shareholders on or about March 14, 2023.

| Date and Time: | Place: | Record Date: | ||

|  |  | ||

| Wednesday, April 26, 2023, at 9:00 a.m. Pacific Time | Online via live audio webcast at www.virtualshareholdermeeting.com/DCO2023 | February 27, 2023 |

Admission: To participate in the Annual Meeting online, including to vote during the Annual Meeting, shareholders will need the 16-digit control number included on their proxy card, the Notice or voting instruction form, or to contact their bank, broker or other nominee (preferably at least 5 days before the Annual Meeting) and obtain a “legal proxy” in order to be able to attend, participate in, or vote at the Annual Meeting.

| Proposal | Board’s recommendation | More information | ||

| Elect three directors to serve until the 2026 Annual Meeting | FOR each nominee | Page 8 | ||

| Approve Ducommun’s executive compensation on an advisory basis | FOR | Page 32 | ||

| Approve the frequency of future advisory votes on executive compensation on an advisory basis | N/A | Page 64 | ||

| Ratify the selection of the independent registered public accounting firm | FOR | Page 65 |

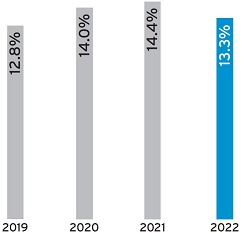

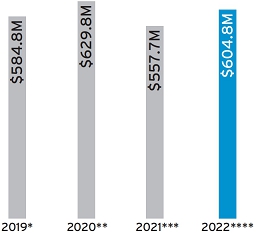

The year ended December 31, 2022 saw Ducommun attain double-digit revenue growth fueled by the recovery of the commercial aerospace market, which was a remarkable achievement despite the lingering effects of the COVID-19 pandemic and the challenges following the Boeing 737 MAX grounding. We effectively leveraged many of our successes from 2020 and 2021 and continued to benefit from offloading from defense primes, as demonstrated by our historically strong defense backlog - a clear sign that customers speak with orders, and which we believe positions Ducommun very well moving forward. In addition, our cost actions and lean organizational structure continued to provide significant value, with general and administrative (“SG&A”) expense among industry leaders, especially at the corporate level, and the implementation of a major restructuring initiative expected to accelerate the achievement of our strategic goals and objectives. 2022 also marked the fifth year since Mr. Oswald, our Chairman, President and CEO, joined the Company, and the graphs below depict the significant positive impact his leadership has had on our performance along several key metrics when viewed in the context of the past 10 years:

| 2023 Proxy Statement 1

| 2023 Proxy Statement 1

| 2013 - 2022 Shareholder Value by Market Capitalization (in $millions)(1) | 2013 - 2022 Net Revenue (in $millions) | |

|  | |

| 2013 - 2022 Adjusted Operating Income (in $millions) and % of Net Revenues | 2013 - 2022 Employee Count and Net Revenue per Employee (in $000s) | |

|  | |

| 2013 - 2022 Backlog (in $millions)(2) | 2013 - 2022 Adjusted EBITDA and % of Net Revenues (in $millions) | |

|  | |

| (1) | 2022 data based on 12,106,285 shares outstanding and closing price of $49.96 per share as of December 31, 2022. | |

| (2) | Adjusted Operating Income, Backlog, and Adjusted EBITDA are non-GAAP financial measures. For a discussion of these measures and for a reconciliation to the most directly comparable GAAP measures, see Appendix A to this Proxy Statement. |

| 2023 Proxy Statement 2

| 2023 Proxy Statement 2

Comparison of 5 Year* Cumulative Total Return

Ducommun Inc. vs. Median of Peers** and Russell 2000

Assumes Initial Investment of $100 as of

December 31, 2017

| * | Data depicted in the graph is as of December 31 of each year. | |

| ** | For information about our peer group, see “Compensation Discussion and Analysis–Benchmarking and Peer Groups.” |

| Cumulative Total Shareholder Return as of December 31, | |||||||||||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | |||||||||||

| Ducommun Incorporated | $ | 128 | $ | 178 | $ | 189 | $ | 164 | $ | 176 | |||||

| Russell 2000 Index | $ | 89 | $ | 112 | $ | 134 | $ | 154 | $ | 122 | |||||

| Median of proxy peers | $ | 94 | $ | 114 | $ | 101 | $ | 94 | $ | 83 | |||||

Our relative total shareholder return compared to the Russell 2000 Index over the 3-year period between 2020 and 2022 was in the 48th percentile, ranking 869th out of 2000 companies.(3)

| (3) | “Final Payout Determination for Performance Shares Granted in 2020,” Willis Towers Watson, January 20, 2023. |

| 2023 Proxy Statement 3

| 2023 Proxy Statement 3

| Director | Age | Gender | Under- represented | Principal Occupation | Director Since | Term Expires | Independent? | Committees | ||||||||

| Nominees for election at the 2023 Annual Meeting | ||||||||||||||||

| Richard A. Baldridge | 64 | M | Y | Vice Chairman, Viasat Inc. | 2013 | 2023 | Yes | Audit Innovation | ||||||||

| Stephen G. Oswald | 59 | M | N | Chairman, President and Chief Executive Officer, Ducommun Incorporated | 2017 | 2023 | No | Innovation | ||||||||

| Samara A. Strycker | 51 | F | N | Senior Vice President, Corporate Controller and Treasurer, Navistar International Corporation | 2021 | 2023 | Yes | Audit | ||||||||

| Continuing Directors | ||||||||||||||||

| Shirley G. Drazba | 65 | F | N | Former Corporate Vice President, Product Line Strategy and Innovation, IDEX Corporation | 2018 | 2024 | Yes | Comp Innovation (chair) | ||||||||

| Robert C. Ducommun | 71 | M | N | Business Advisor | 1985 | 2025 | Yes | Audit G&N (chair) | ||||||||

| Dean M. Flatt Independent Lead Director | 72 | M | N | Former President, Defense & Space, Honeywell International | 2009 | 2025 | Yes | Comp (chair) G&N | ||||||||

| Jay L. Haberland | 72 | M | N | Former Vice President, United Technologies Corporation | 2009 | 2024 | Yes | Audit (chair) Comp | ||||||||

| Sheila G. Kramer | 63 | F | N | Chief Human Resources Officer, Donaldson Company, Inc. | 2021 | 2024 | Yes | G&N | ||||||||

Ducommun is very proud that women and an individual from an underrepresented background collectively comprise half of our Board of Directors (the “Board”). The tenure of our directors, the change in gender diversity since 2018, our Board’s overall diversity compared to our peer group and our Board’s independence are summarized in the graphs below.

| Directors’ Tenure | Director Diversity & Independence (%) |

|  |

| 2023 Proxy Statement 4

| 2023 Proxy Statement 4

| Director Gender Diversity 2018 - 2022 (%) | Diversity of Ducommun’s Board Compared to Proxy Peers (%) |

|  |

| • | Stringent stock ownership guidelines for directors and executive officers |

| • | Lead Independent Director with significant authority and responsibilities |

| • | All committees except the Innovation Committee are made up entirely of independent directors |

| • | The Board and each Board committee conducts an annual self-evaluation |

| • | All directors attended at least 80% of all Board and applicable committee meetings during 2022 |

| • | Board-level oversight of ESG and cybersecurity initiatives |

| • | Regular shareholder engagement activities |

| • | Clawback policy applies to all incentive compensation and vested performance-based equity awards |

| • | Company-wide prohibition on hedging or pledging Ducommun securities |

| • | Annual advisory vote on executive compensation |

| • | Confidential ethics hotline available 24/7 by telephone or internet |

Our executive compensation program is oriented towards a pay-for-performance approach. In 2022, performance-based compensation represented a significant percentage of the total target compensation for each of the named executive officers.

| CEO Target Compensation Mix | Other NEO Target Compensation Mix |

|  |

| * | “Long-Term Incentives” includes the grant date closing price value of both equity and performance-based long-term incentive cash awards in 2022. Please also note that we do not offer any type of pension plan for our CEO or NEOs. |

| 2023 Proxy Statement 5

| 2023 Proxy Statement 5

Over the four-year period between January 1, 2019, and December 31, 2022, Ducommun’s lost time incident rate(4) decreased by approximately 78% and the total recordable incident rate(5) decreased by approximately 71%:

| Lost Time Incident Rate | Total Recordable Incident Rate |

|  |

Between 2019 and 2022, there was a 30% decrease in combined Scope 1 and 2 greenhouse gas emissions, and a 16% reduction in Ducommun’s total energy usage:

| Scope 1 and 2: Greenhouse Gas Emissions (tons CO2) | Total Energy Use (GigaJoules) |

|  |

| (4) | Lost time incidents are defined as incidents that resulted in days away from work. This measure is similar to the days away, restricted or transferred metric utilized by the Occupational Safety and Health Administration. The annual lost time incident rate is calculated by dividing the total number of lost time injuries in a year by the total number of hours worked in a year. |

| (5) | The total recordable incident rate is calculated by multiplying the annual number of OSHA Recordable Cases by 200,000, and dividing the product by the total hours worked by all employees during the year. The number 200,000 is used in the calculation to represent the number of hours worked in a year by 100 employees working 40 hours per week over 50 weeks, which provides the basis for calculating the incident rate for the entire year. |

| 2023 Proxy Statement 6

| 2023 Proxy Statement 6

This Proxy Statement includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical or current facts, including statements regarding the future results of our operations, expected benefits of our restructuring plan, and our environmental and other sustainability plans, made in this Proxy Statement are forward-looking. We use words such as anticipates, believes, expects, future, intends, and similar expressions to identify forward-looking statements. Forward-looking statements reflect management’s current expectations and are inherently uncertain. Actual results could differ materially for a variety of reasons. Risks and uncertainties that could cause our actual results to differ significantly from management’s expectations are described in our 2022 Annual Report on Form 10-K. Website references throughout this Proxy Statement are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document.

| 2023 Proxy Statement 7

| 2023 Proxy Statement 7

Three directors (out of a total of eight) are to be elected at the Annual Meeting to serve for a three-year term ending at the Annual Meeting of Shareholders in 2026 and the election and qualification of their respective successors. The nominees for such positions are Richard A. Baldridge, Stephen G. Oswald and Samara A. Strycker. In the absence of a contrary direction, proxies will be voted for the election of Ms. Strycker and Messrs. Baldridge and Oswald. If any nominee becomes unable or unwilling to serve as a director at the time of the Annual Meeting, the individuals named as proxies may vote for a substitute nominee chosen by the present Board to fill the vacancy. Alternatively, the Board may reduce its size. We have no reason to believe that Ms. Strycker or Messrs. Baldridge or Oswald will be unwilling or unable to serve for the stated terms if elected as directors. In the event that anyone other than Ducommun’s three nominees is nominated for election as a director, the proxy holders are not required to vote for all of the nominees and in their discretion may cumulate votes.

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF MS. STRYCKER AND MESSRS. BALDRIDGE AND OSWALD AS CLASS OF 2026 DIRECTORS. |

The Board of Directors believes that its members should possess a combination of skills, professional experience, and diversity of backgrounds necessary to oversee our management and support the interests of our shareholders. In addition, the Board has outlined in our Corporate Governance Guidelines certain attributes it believes every director should possess. Accordingly, the Board and its Corporate Governance and Nominating Committee consider the qualifications of directors and director candidates both individually and in the broader context of the Board’s overall composition and our current and future needs.

The Corporate Governance and Nominating Committee is responsible for developing and recommending director membership criteria to the Board for approval. The current criteria include independent and sound judgment, integrity, the ability to commit sufficient time and attention to Board activities, and the absence of potential conflicts with our interests. In addition, the Corporate Governance and Nominating Committee periodically evaluates the composition of the Board to assess the skills, experience, and perspectives that are currently represented and to determine which of those attributes will be valuable in the future given our current state and strategic direction. As part of this periodic assessment, the Corporate Governance and Nominating Committee also evaluates the effectiveness of the overall Board dynamic, including the effectiveness of our initiatives related to Board diversity.

While we do not have a formal policy on Board diversity, Ducommun’s Corporate Governance Guidelines reflect the Board’s belief that a blend of different perspectives contributes to the quality of the Board’s oversight and is an essential component of effective governance. We therefore are committed to the perspective that Board diversity is not reflected solely in the variety of our directors’ professional backgrounds and experiences. Rather, we believe that the quality of our deliberations and decisions, and of our overall governance, is enhanced by the perspectives represented by directors with different personal characteristics, particularly, gender, race, cultural heritage and age. As a result, the Corporate Governance and Nominating Committee has been deliberate in striving to achieve a broad range of diversity in the pools from which qualified director candidates are selected, as it has worked over the past few years to identify successors to a group of very capable directors. Over that time and with the assistance of Spencer Stuart, an independent executive search firm, the Corporate Governance and Nominating Committee successfully identified and engaged Mmes. Drazba, Kramer and Strycker, each from competitive pools of candidates, and recommended to the Board that they each be appointed as directors. We are very proud that women and a member from an underrepresented background collectively comprise half of our Board.

The Corporate Governance and Nominating Committee supports the Board’s commitment to engaging a diverse field of director candidates. As Board seats become available, the Corporate Governance and Nominating Committee will continue to actively identify qualified women and individuals from underrepresented communities to include in the pool from which Board nominees are chosen. The Corporate Governance and Nominating Committee is confident that this commitment will contribute to better representation and higher visibility for individuals with diverse perspectives and personal characteristics.

| 2023 Proxy Statement 8

| 2023 Proxy Statement 8

In evaluating director candidates, and considering incumbent directors for re-nomination to the Board, the Corporate Governance and Nominating Committee has reviewed a variety of factors, including each nominee’s independence, financial literacy, personal and professional accomplishments, and experience. Below is a matrix of the skills represented on our Board.

| Oswald | Baldridge | Drazba | Ducommun | Flatt | Haberland | Kramer | Strycker | |

| Senior Leadership Significant experience leading organizations, developing business strategies and talent |  |  |  |  |  |  |  |  |

| Global/International Global business and international experience necessary for expanding the footprint of the organization |  |  |  |  |  |  |  | |

| Financial Expertise with complex financial transactions and optimizing capital structures |  |  |  |  |  | |||

| Aerospace & Defense Industry Industry experience that provides insight on issues unique to the A&D industry |  |  |  |  |  |  |  | |

| Manufacturing Experience managing the operations of a complex A&D business |  |  |  |  |  |  |  | |

| Technology Experience identifying technological advances that may affect our business |  |  |  |  | ||||

| Strategy, Business Development and M&A Experience with identifying M&A targets that will advance strategic objectives |  |  |  |  |  |  |  | |

| Product Marketing/Innovation Experience in new product development and growing market share |  |  |  | |||||

| Cybersecurity/Information Security Experience with successfully implementing and overseeing measures to prevent data breaches |  |  |  | |||||

| Human Capital Expertise in compensation design and managing human capital issues |  |  |  |  |  |  |  | |

| Sustainability Experience in the areas of environmental impact, corporate responsibility or sustainability strategies |  |  |  | |||||

| Public Company Board Understanding of the extensive and complex oversight responsibilities of public company boards to protect the interests of shareholders based on experience serving on other public company boards |  |  |  |

| 2023 Proxy Statement 9

| 2023 Proxy Statement 9

The following information is furnished as of March 14, 2023, with respect to each person who is a nominee for election to the Board, as well as our other five directors whose terms of office will continue after the Annual Meeting.

| RICHARD A. BALDRIDGE Vice Chairman, Viasat, Inc.

Age: 64

Director Since: 2013

Term Expires: 2023

Committees: • Audit and Innovation | Professional background Mr. Baldridge is Vice Chairman of Viasat, Inc., a global communications company. Mr. Baldridge joined Viasat in 1999, serving as Executive Vice President, Chief Financial Officer and Chief Operating Officer from 2000, as Executive Vice President and Chief Operating Officer from 2002, as President and Chief Operating Officer from 2003, and as President and Chief Executive Officer from November 2020 until June 2022. In July 2022, Mr. Baldridge was appointed Vice Chairman of Viasat. Before joining Viasat, Mr. Baldridge was Vice President and General Manager of Raytheon Corporation’s Training Systems Division, and he held executive roles with Hughes Information Systems and Hughes Training Inc. before they were acquired by Raytheon in 1997. Mr. Baldridge is also a director of EvoNexus, a non-profit business incubator.

Key qualifications As Vice Chairman of a leading provider of satellite communications systems and services and secure networking systems, Mr. Baldridge contributes to the Board broad operational and financial experience and an understanding of the defense markets that Ducommun serves.

Other public company directorships Viasat (since 2016) |

| STEPHEN G. OSWALD Chairman, President and Chief Executive Officer

Age: 59

Director Since: 2017 Term Expires: 2023 Committee: • Innovation | Professional background Mr. Oswald has been the President and Chief Executive Officer of Ducommun since January 2017, and Chairman of the Board since May 2018. From 2012 to 2015, Mr. Oswald was Chief Executive Officer of Capital Safety Company, a manufacturer of fall protection, confined space, and rescue equipment. He elected to take time off from his career after the sale of Capital Safety Company to 3M Co. to manage personal investments. Before joining Capital Safety Company, Mr. Oswald spent approximately 15 years in various leadership roles at United Technologies Corporation, including as President of the Hamilton Sundstrand Industrial division.

Key qualifications As Chairman, President and Chief Executive Officer, Mr. Oswald provides management’s perspective in board discussions about Ducommun’s business and strategic direction. |

| SAMARA A. STRYCKER Senior Vice President, Corporate Controller and Treasurer, Navistar International Corporation

Age: 51

Director Since: 2021 Term Expires: 2023 Committee: • Audit | Professional background Ms. Strycker has been the Senior Vice President, Corporate Controller and Treasurer of Navistar International Corporation, a leading manufacturer and solutions provider for commercial trucks and engines, since January 2022. Previously, Ms. Strycker was the Senior Vice President and Corporate Controller of Navistar International Corporation between August 2014 and January 2022. Between 2008 and 2014, Ms. Strycker served in various controllership roles at General Electric’s Healthcare Division. Before joining General Electric, Ms. Strycker spent approximately 15 years as an auditor with PricewaterhouseCoopers LLP.

Key qualifications As Senior Vice President, Corporate Controller and Treasurer of Navistar International Corporation, Ms. Strycker contributes to the Board extensive senior leadership experience and financial expertise. |

| 2023 Proxy Statement 10

| 2023 Proxy Statement 10

| SHIRLEY G. DRAZBA Corporate Vice President, Product Line Strategy & Innovation, IDEX Corporation (Ret.)

Age: 65

Director Since: 2018 Term Expires: 2024 Committees: • Compensation and Innovation (Chair) | Professional background Ms. Drazba served as Corporate Vice President, Product Line Strategy & Innovation for IDEX Corporation, which designs, manufactures and markets a range of pump products, dispensing equipment, and other engineered products, both domestically and abroad, from 2014 until her retirement in 2017. Before that, Ms. Drazba spent almost 20 years at Honeywell International, Inc., a manufacturer of aerospace products and services, control technologies, automotive products, turbochargers and specialty materials, in increasingly important technical and engineering leadership positions.

Key qualifications As a long-time executive responsible for product strategy, innovation, and commercial excellence, Ms. Drazba contributes to the Board extensive experience in creating high value opportunities for Ducommun’s product lines, as well as experience in market positioning and leading strategic acquisitions to enhance product portfolios. |

| ROBERT C. DUCOMMUN Business Advisor

Age: 71

Director Since: 1985 Term Expires: 2025 Committees: • Audit and Corporate Governance & Nominating (Chair) | Professional background Mr. Ducommun has been an independent business advisor for over 30 years. He was previously the Chief Financial Officer for several private companies and a management consultant with McKinsey & Company.

Key qualifications As a former management consultant and Chief Financial Officer, Mr. Ducommun brings to the Board substantial financial acumen and leadership in setting the strategic direction for the Company, and also provides guidance on various environmental, social and governance (“ESG”) initiatives. |

| DEAN M. FLATT President, Defense & Space, Honeywell International, Inc. (Ret.)

Age: 72

Director Since: 2009 Term Expires: 2025 Committees: • Corporate Governance & Nominating and Compensation (Chair) | Professional background Mr. Flatt is the retired President, Defense & Space of Honeywell International, Inc., a position he occupied for three years until his retirement in 2008. Mr. Flatt was previously President, Aerospace Electronic Systems and President, Performance Materials of Honeywell.

Key qualifications As the former President of several divisions of one of the world’s largest avionics manufacturers, Mr. Flatt contributes to the Board diverse operational experience and understanding of technologies relevant to the Company’s business.

Other public company directorships Curtiss-Wright Company (since 2012) |

| 2023 Proxy Statement 11

| 2023 Proxy Statement 11

| JAY L. HABERLAND Vice President, United Technologies Corporation (Ret.)

Age: 72

Director Since: 2009 Term Expires: 2024 Committees: • Compensation and Audit (Chair)

| Professional background Mr. Haberland served on the board, and chaired the audit committee, of National Technical Systems (“NTS”), a portfolio company of Aurora Capital Partners, from November 2013 until the sale of NTS in September 2022. Mr. Haberland is also the retired Vice President, Business Controls of United Technologies Corporation, a position he held from 2003 until 2008. Mr. Haberland was previously the Chief Financial Officer of Sikorsky Aircraft Company, a subsidiary of United Technologies Corporation (“UTC”), and Vice President, Chief Financial Officer, Controller and Chief Accounting Officer of UTC.

Key qualifications As the former Chief Financial Officer of one of the world’s largest helicopter manufacturers, the former Chief Accounting Officer of a world-wide diversified manufacturer, and as a certified public accountant, Mr. Haberland provides the Board with significant expertise in financial and accounting matters, as well as substantial international experience.

Other public company directorships Wesco Aircraft Holdings, Inc. (between October 2011 and January 2020) |

| SHEILA G. KRAMER Chief Human Resources Officer, Donaldson Company, Inc.

Age: 63

Director Since: 2021 Term Expires: 2024 Committee: • Corporate Governance & Nominating | Professional background Ms. Kramer has been the Vice President, Chief Human Resources Officer of Donaldson Company, Inc., a provider of engine and industrial filtration solutions, since January 2020. Ms. Kramer joined Donaldson Company, Inc. in October 2015 as its Vice President, Human Resources. From 2013 to 2015, Ms. Kramer was Vice President, Human Resources of Taylor Corporation, a premier provider of interactive printing and marketing solutions to more than half of Fortune 500 companies. Before joining Taylor Corporation, Ms. Kramer spent approximately 22 years in various leadership roles at Lifetouch, Inc. one of the world’s largest employee-owned photography companies.

Key qualifications As the current Vice President and Chief Human Resources Officer of Donaldson Company, Inc., Ms. Kramer contributes to the Board extensive senior leadership experience as well as direction on human capital issues pertinent to Ducommun’s ESG program. |

Our Corporate Governance Guidelines provide that a majority—and preferably at least two-thirds—of the Board must be independent. The Board has determined that each of Mmes. Drazba, Kramer and Strycker, as well as Messrs. Baldridge, Ducommun, Flatt, and Haberland, qualify as independent directors as defined in the New York Stock Exchange’s (“NYSE”) listing standards.

| 2023 Proxy Statement 12

| 2023 Proxy Statement 12

• Stephen G. Oswald serves as the Chairman, President and Chief Executive Officer • Dean M. Flatt serves as the Lead Independent Director • 7 of our 8 current directors are independent under the NYSE listing standards • All of the members of the Board’s Audit, Compensation and Corporate Governance & Nominating Committees are independent |

Our Bylaws provide the Board with the discretion to elect a Chairman who may or may not be one of our officers. This flexibility enables the Board to decide what leadership structure is in our best interests at any given time. The Board periodically reviews its structure and our leadership as part of its succession planning process. Mr. Oswald has served as Chairman since our 2018 annual meeting.

The independent members of the Board have determined that, at this time, having the same person serve as Chairman and CEO provides us with an efficient leadership structure because it allows the Board to benefit from the CEO’s extensive knowledge of our business and strategy, promotes alignment between the Board and management on corporate strategy, facilitates management’s effective execution of that strategy, facilitates communications and relations with other members of senior leadership, and also bolsters the quality of our governance. In the future, the roles of Chairman and CEO may be filled by the same or different individuals.

The Board also believes that strong, independent leadership and oversight of management is an important component of an effective Board. To that end, the independent directors have elected Dean M. Flatt as the Lead Independent Director with significant leadership authority and responsibilities, including those as set forth below.

| Board Matter | Responsibility |

| Agendas | • Provides input on and approves the Board agenda.

• Approves schedules for Board meetings. |

| Board Meetings | • Presides at Board meetings at which the Chairman and CEO is not present, including regularly scheduled executive sessions of the independent directors held after regular meetings of the Board. |

| Executive Sessions | • Has authority to call executive sessions of the independent directors.

• Sets the agenda for and leads non-management and independent director sessions held by the Board.

• Briefs the Chairman and CEO on any issues arising from non-management and independent director sessions. |

| Communications with Directors | • Coordinates the activities of the independent directors, and serves as a liaison between the Chairman and CEO and the independent directors.

• Advises on the flow of information sent to the Board of Directors. |

| Communications with Shareholders | • Is available for consultation and communication with major shareholders as appropriate. |

| 2023 Proxy Statement 13

| 2023 Proxy Statement 13

The Board oversees risk management both collectively and through its individual committees. The Board regularly reviews information regarding, and risks associated with, our operations, liquidity, cybersecurity, ESG program and other matters. In addition, in 2022, the Board continued to receive regular updates from management regarding risks related to COVID-19. The Board’s review and discussions regarding COVID-19 spanned, and continues to span, a broad range of issues, including protecting the health and safety of our employees; evaluating the impact of the pandemic on strategy, operations, capital allocation, liquidity and financial matters; succession planning matters; interruptions in supply chains and financial markets; vaccination rates among our workforce; and compliance with applicable laws. The Board is highly engaged with management in identifying and overseeing such matters.

As part of the Board’s role in overseeing the Company’s ERM program, it devotes time and attention to cybersecurity and data privacy related risks in conjunction with the Audit and Innovation Committees. The Board and the aforementioned committees receive reports on cybersecurity, data privacy and technology-related risk exposures from management, including our head of IT and security, at least once a year and more frequently as applicable.

All Ducommun employees regularly participate in required, targeted data privacy and annual information security training designed to strengthen awareness and the adoption of secure behaviors. We also assess the efficacy of our information security program through internal detection and monitoring systems, as well as through the engagement of external, third-party experts.

While the full Board has the ultimate oversight responsibility for the risk management process, various Board committees also have risk management oversight responsibilities over certain substantive areas. The Board believes that its programs for overseeing risk, as described below, would be effective under a variety of leadership frameworks. Accordingly, the Board’s risk oversight function did not significantly impact its selection of the current leadership structure. The key risk oversight responsibilities of each of the Board’s committees are depicted in the diagram below:

| 2023 Proxy Statement 14

| 2023 Proxy Statement 14

The Corporate Governance and Nominating Committee believes that all Committee-recommended nominees for election as a director of Ducommun must, at a minimum, have:

| • | relevant experience and expertise, |

| • | sound judgment, |

| • | a record of accomplishment in areas relevant to our business activities, |

| • | unquestionable integrity, |

| • | a commitment to representing the interests of our shareholders in the fulfillment of our goals and objectives, |

| • | independence, and the absence of potential conflicts with Ducommun’s interests, |

| • | the willingness to devote sufficient time, energy, and attention in carrying out the duties and responsibilities of a director, and |

| • | the willingness to serve on the Board for an extended period of time. |

In identifying candidates to serve on the Board, the Corporate Governance and Nominating Committee follows the process delineated in the diagram below.

As a result of recent assessments, the Corporate Governance and Nominating Committee determined that the Board would benefit from additional expertise in the areas of product strategy, human capital management and finance. The committee retained Spencer Stuart, an outside search firm, to conduct searches for the best qualified candidates in these fields, which utilized a disciplined process that included research and reviewing the firm’s global database and network of contacts. Over the past few years, Spencer Stuart’s searches identified our three newest directors—Ms. Drazba, Ms. Kramer and Ms. Strycker—from competitive pools of candidates as a result of this process.

All director candidates considered for nomination by the Corporate Governance and Nominating Committee must complete a questionnaire, provide such additional information as the committee may request, and meet in person with our sitting directors.

The Corporate Governance and Nominating Committee will consider director candidates recommended by shareholders in accordance with the procedures set forth in Article II Section 13 of our Amended and Restated Bylaws. Shareholders may submit the name of individuals for consideration as a director candidate not later than the close of business on the ninetieth (90th) day nor earlier than the close of business on the one hundred twentieth (120th) day prior to the first anniversary of the preceding year’s annual meeting. The Corporate Governance and Nominating Committee considers and evaluates candidates recommended by shareholders in the same manner that it considers and evaluates other director candidates.

| 2023 Proxy Statement 15

| 2023 Proxy Statement 15

We have four standing Board committees: the Audit Committee, the Compensation Committee, the Corporate Governance and Nominating Committee, and the Innovation Committee. All committees, other than the Innovation Committee, are made up entirely of independent directors. The charters for all four committees are available on our website at https://investors. ducommun.com/corporate-governance. Shareholders may request paper copies of any charter by contacting Ducommun Incorporated, 200 Sandpointe Avenue, Suite 700, Santa Ana, California 92707-5759, Attention: Corporate Secretary.

Six meetings in 2022 (100% attendance)

| JAY L. HABERLAND Chair

Members

Richard A. Baldridge | All of the members of the Audit Committee meet the independence criteria of the NYSE’s listing standards. The Board, in its business judgment, has determined that each of Messrs. Baldridge, Ducommun, and Haberland, as well as Ms. Strycker, are “financially literate,” under the NYSE listing standards and that Mr. Haberland is an “audit committee financial expert,” as such term is defined in Securities and Exchange Commission (“SEC”) regulations.

The Audit Committee performs the following functions:

• Appoints, compensates, retains and oversees the work of our independent auditor; • Reviews the independent auditor’s internal quality control procedures and any material issues raised therein, and considers the independence of the independent auditor on an annual basis in accordance with rules of the Public Company Accounting Oversight Board; • Approves in advance all audit services to be provided by the independent auditor and establishes policies and procedures for the engagement of the independent auditor; • Oversees the integrity of our financial statements and compliance with legal and regulatory requirements, including procedures for handling claims of misconduct; • In conjunction with the Board as a whole, assists in the oversight of cybersecurity and data privacy disclosure risks; • Oversees the effectiveness of our disclosure controls and processes; and • Evaluates the effectiveness of our internal audit function. |

| 2023 Proxy Statement 16

| 2023 Proxy Statement 16

Five meetings in 2022 (100% attendance)

| DEAN M. FLATT Chair

Members

Shirley G. Drazba | All of the members of the Compensation Committee meet the independence criteria of the NYSE’s listing standards and the additional requirements for compensation committee members prescribed by the SEC.

The Compensation Committee performs the following functions:

• Oversees our compensation philosophy, policies and programs; • Reviews and approves corporate goals and objectives relevant to the CEO’s compensation, evaluates the CEO’s performance in light of those goals, and determines and approves the CEO’s compensation level based on this evaluation; • Approves the compensation of other executive officers based on the recommendation of the CEO, and approves the terms and grants of equity awards; • Selects and retains an independent compensation consultant, currently, Willis Towers Watson, to provide consulting services relating to our executive compensation program; • Administers and makes recommendations to the Board with respect to our incentive compensation plans for executive officers and employees generally; • Reviews and approves employment and severance agreements for executive officers, including change-in-control provisions, plans or agreements; • Reviews our succession plans relating to the CEO and other executive officers, in consultation with the Corporate Governance and Nominating Committee; • Oversees our human capital, diversity and inclusion and social programs and associated risks; • Reviews our Compensation Discussion and Analysis and related disclosures that are included in our annual report and proxy statement as required by SEC rules; • Assesses whether compensation consultants involved in recommending executive or director compensation raise any conflict of interest issues that require disclosure in our annual report and proxy statement; and • Oversees the evaluation of our management in conjunction with the Corporate Governance and Nominating Committee. |

| ROBERT C. DUCOMMUN Chair

Members

Dean M. Flatt | All of the members of the Corporate Governance and Nominating Committee meet the independence criteria of the NYSE’s listing standards.

The Corporate Governance and Nominating Committee performs the following functions:

• Recommends criteria for identifying candidates for the Board, and identifies, recruits, and reviews the qualifications of such candidates; • Assesses the contributions and independence of incumbent directors and recommends them for reelection to the Board; • Develops and recommends corporate governance principles to the Board, and reviews and recommends changes to those principles as necessary; • Makes recommendations to the Board relating to the structure, composition and functioning of the Board and its committees; • Recommends candidates for appointment to Board committees; • Reviews the compensation of directors for service on the Board and its committees, and recommends changes thereto; • Oversees ESG and sustainability initiatives, and reviews and makes recommendations to management relating to such issues; • Reviews our succession plans relating to the CEO and other executive officers, in consultation with the Compensation Committee; and • Oversees the performance of the Board and our management team in conjunction with the Compensation Committee. |

| 2023 Proxy Statement 17

| 2023 Proxy Statement 17

| SHIRLEY G. DRAZBA Chair

Members

Richard A. Baldridge | The Innovation Committee performs the following functions:

• Assists management and the Board in developing a technology roadmap to support our long-term business objectives; • Advises the Board and management on emerging science and technology trends, including evolving digital strategies being adopted in the aerospace and defense industry, and recommends strategies relating to new product and intellectual property development; • In conjunction with the Board as a whole, oversees cybersecurity and technology-related risks; • Monitors the overall direction, effectiveness, competitiveness and timing of our research and development programs; and • Assists the Board and management in identifying and developing key contributors to innovation at Ducommun and empowering implementation of the Board and management’s recommendations. |

The Corporate Governance and Nominating Committee, together with the Lead Independent Director, coordinates regular Board performance evaluations. These evaluations are conducted through a combination of formal and informal processes, including the following:

| • | The Board, along with each of its committees, annually conducts a self-evaluation of its performance which includes considerations as to the composition of the Board and its committees; whether committee charters, meeting content, and the amount of time dedicated to agenda items are appropriate; members’ concerns about the Board’s performance and that of its individual committees; and suggestions for addressing such issues. |

| • | At the end of each regular Board meeting, the Board holds an executive session at which feedback on the meeting is provided to the Lead Independent Director. |

| • | The Nominating and Corporate Governance Committee, in conjunction with the Lead Independent Director, periodically reviews the composition of the entire Board to assess the skills, experience and perspectives that are currently represented on the Board, and to determine what skills and experience would be valuable in the future given our current state and strategic plans. |

Feedback from these processes is communicated to the Chair of the Board, the Chair of the Nominating and Corporate Governance Committee, and the Lead Independent Director so that appropriate follow-up measures can be discussed, implemented and monitored. As discussed in the “Nominating Process” section above, as a result of such recent self-evaluations, the Board determined that it would benefit from additional expertise in the areas of product strategy, human capital management and finance. Our three newest directors, Ms. Drazba, Ms. Kramer and Ms. Strycker have enhanced the Board with these and other areas of expertise since their respective appointments and we are thrilled that half our Board is now comprised of women and a member of an underrepresented background.

Ducommun provides an orientation program for all new directors not only with respect to their role as directors, but also as members of the Board committees on which they will serve. In addition, Ducommun provides ongoing education and development for its directors to help them continuously improve their contributions as individual directors and collectively as a Board, and pays for all reasonable expenses for any director who wishes to attend external continuing education programs.

| 2023 Proxy Statement 18

| 2023 Proxy Statement 18

Our Board values the perspectives of our shareholders, who have placed their trust in Ducommun and its Board. We expect to engage regularly in meaningful conversations with shareholders concerning our business, executive compensation, corporate environmental and social responsibility, and other governance topics.

To this end, in the spring of 2022, we engaged with twenty of our top institutional shareholders, representing approximately seventy percent (70%) of our shares outstanding to discuss concerns expressed by Institutional Shareholder Services Inc. (“ISS”) relating to payments made to a former named executive officer, Rosalie F. Rogers, upon her retirement, despite finding that our pay and performance were aligned in 2021, as in prior years. Our Lead Independent Director and Chair of our Compensation Committee engaged with, and confirmed to, our shareholders that such payments did not constitute a policy change towards current retirement benefits, and did not anticipate taking similar actions in the future. Our Board believes that such candid and specific feedback from its shareholders will enhance our governance, social responsibility and compensation practices, and will contribute positively to Ducommun’s mission, performance and return to shareholders. A summary of our engagement efforts, along with actions taken in response to shareholder feedback is summarized in the tables below:

2022 Shareholder Engagement Key Statistics

Management attended more than 75 meetings with investors and 20 with research analysts in 2022.

Management met with our top 20 active institutional shareholders in 2022, representing approximately 70% of our shares outstanding.

Institutional investors representing more than 27% of our shares outstanding and 7 sell-side analysts attended our 2022 Investor Day, either in-person or via live webcast.

2022 Shareholder Engagement Overview

| Who External | Ducommun | How | Resources https://investors.ducommun.com/ | |||

| • Institutional Investors | • Executive Management | • 2022 Investor Day | • Quarterly and annual earnings publications | |||

| • Sell-side analysts | • Investor Relations | • Quarterly earnings calls | • Annual proxy statements and reports, and SEC Filings | |||

| • Proxy advisory firms | • Lead Independent Director | • One-on-one and group meetings | • Annual Meeting of Shareholders | |||

| • Rating agencies | • Telephone outreach via Ducommun Investor Relations | • ESG Report |

| Actions Implemented in Response to Shareholder Feedback During 2022 | Other Initiatives Implemented in 2022 | |

| • Implemented the “best practice” of reporting Adjusted Operating Income with amortization of intangibles and inventory step-up values added back. | • Began providing a quarterly presentation summarizing our earnings. | |

| • Provided additional disclosure of the Company’s shipset values on key aerospace platforms. | • Emailed updates to existing and potential investors after public disclosure of quarterly earnings and other key events or newsworthy items. | |

| • Included the disclosure of metrics related to the Company’s recent acquisitions. | • Engaged in outreach with investors and sell-side research analysts during the 2022 Farnborough Air Show. | |

| • Shared updates to the Company’s long-term goals in the context of recent macro-economic volatility. |

As a part of our ongoing dialogue with our shareholders, we will keep the channels of communication open and engage regarding any areas of concern to our shareholders.

| 2023 Proxy Statement 19

| 2023 Proxy Statement 19

The Board met five times in 2022. All directors attended at least 80% of all Board and applicable committee meetings during 2022. We strongly encourage all directors to attend the Annual Meeting of Shareholders, and accordingly, all eight of our directors attended the 2022 Annual Meeting of Shareholders.

We have a policy of holding regularly scheduled executive sessions of non-management directors following each scheduled Board meeting. Additional executive sessions of non-management directors may be held from time to time as required. Mr. Flatt, the Board’s Lead Independent Director is the current presiding director during executive sessions. The graphic below depicts the attendance of directors at Board and committee meetings held in 2022:

2022 Board and Committee Meetings with 100% Attendance

The Board has adopted a Code of Business Conduct and Ethics that is applicable to all directors, employees, and officers, including our CEO, Chief Financial Officer, Treasurer and Controller. Among other things, the Code of Business Conduct and Ethics requires directors, employees, and officers to avoid any activity that may result in a conflict of interest with Ducommun; maintain the confidentiality of information entrusted to them by us, our customers and employees (except when disclosure is authorized or legally mandated); deal fairly with our customers, suppliers, competitors, and employees; protect and ensure the efficient use of Ducommun’s assets; and maintain our books, records, accounts and financial statements in reasonable detail to fairly reflect our transactions and conform to both applicable legal requirements and our internal controls.

The Board has adopted a Code of Ethics for Senior Financial Officers that is applicable to our CEO and President, Chief Financial Officer, Treasurer and Controller, and the President, Vice President of Finance and Controller of each of our subsidiaries. The Code of Ethics for Senior Financial Officers, among other things, requires them to provide full, fair, accurate, timely, and understandable disclosure in reports and documents that we file with, or submit to, the SEC and in other public communications made by us and to promptly report violations of the Code to the Audit Committee. We intend to post on our website amendments, if any, to the Code of Ethics for Senior Financial Officers, as well as any waivers thereunder, with respect to our officers and directors as required to be disclosed by SEC and NYSE rules.

| 2023 Proxy Statement 20

| 2023 Proxy Statement 20

The Board adopted Corporate Governance Guidelines, which among other things, specify the criteria to be considered for director candidates; impose tenure limits on directors; and require the independent directors to hold periodic meetings without executive management present. In 2022, the Board revised our Corporate Governance Guidelines to emphasize its belief that diversity and a blend of different perspectives contribute to a vital board dynamic, which is essential to effective governance.

Our Board has approved or adopted several other important policies and statements, including:

| • | Policy on Trading Securities |

| • | Procedures for Employee Complaints About Accounting and Auditing Matters |

| • | Clawback Policy |

| • | California Transparency in Supply Chains Act Disclosure Statement |

| • | Prohibition Against Trafficking in Persons Policy |

| • | Regulation FD Policy |

All of the documents described above are available on our website at https://www.ducommun.com in the Corporate Governance section of the Investor Relations webpage, and will be forwarded in print to any shareholder upon request. Any such request should be addressed to Ducommun Incorporated, 200 Sandpointe Avenue, Suite 700, Santa Ana, California 92707-5759, Attention: Corporate Secretary.

The Corporate Governance section of our website also contains information on our confidential ethics hotline.

Directors who are not employees of Ducommun or its subsidiaries are paid a mix of cash and equity for their service on our Board, as shown below.

| Type of compensation | Amount $ | How paid | ||

| Cash Annual retainer | $ | 70,000 | Cash, paid in equal increments on a quarterly basis. | |

| Equity-Based Annual retainer | 100,000 | Restricted stock units for a number of shares (rounded to the nearest 100 shares) equal to the stated dollar amount divided by the average closing price of our common stock on the NYSE on the five trading days immediately preceding the date of grant, which typically occurs on or shortly after the date of our annual meeting. Restricted stock units vest on the one-year anniversary of the date of grant. | ||

| Additional retainer for Lead Director | 30,000 | Cash, paid in equal increments on a quarterly basis. | ||

| Additional retainer for committee chairs: | Cash, paid in equal increments on a quarterly basis. | |||

| Audit | 17,500 | |||

| Compensation | 12,500 | |||

| Innovation | 7,500 | |||

| Corporate Governance and Nominating | 7,500 | |||

| Fees for committee meetings | 2,000 | per meeting | Cash, paid in equal increments on a quarterly basis. |

Our non-employee directors are also eligible to participate in the Directors’ Deferred Income and Retirement Plan. Under this plan, a director may elect to defer payment of all or part of his or her fees for service as a director until he or she retires from service on the Board. Deferred directors’ fees may be notionally invested, at the election of the director, in a fixed interest account or a phantom stock account that tracks the value of our common stock including dividends (if any). All deferred amounts and related earnings will be paid in a lump sum when the director retires.

Upon retirement from the Board, Mr. Ducommun will receive an annual retainer fee of $25,000 for the shorter of his life or a period of twelve years.

| 2023 Proxy Statement 21

| 2023 Proxy Statement 21

The following table presents the compensation earned by, or paid to, the non-employee directors for the year ended December 31, 2022 for their services to Ducommun.

| Fees Earned or Paid in Cash ($) | Stock Awards ($) | (1)(2)(3) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | (4) | Total ($) | |||||||||||

| Richard A. Baldridge | 92,000 | 100,000 | — | 192,000 | ||||||||||||

| Shirley G. Drazba | 93,500 | 100,000 | — | 193,500 | ||||||||||||

| Robert C. Ducommun | 99,500 | 100,000 | (10,614 | ) | 188,886 | |||||||||||

| Dean M. Flatt | 128,500 | 100,000 | — | 228,500 | ||||||||||||

| Jay L. Haberland | 113,500 | 100,000 | — | 213,500 | ||||||||||||

| Sheila G. Kramer | 76,000 | 100,000 | — | 176,000 | ||||||||||||

| Samara A. Strycker | 86,000 | 100,000 | — | 186,000 | ||||||||||||

| (1) | During fiscal year 2022, 1,800 restricted stock units were granted to each of Mmes. Drazba, Kramer and Strycker, and Messrs. Baldridge, Ducommun, Flatt, and Haberland. Other than as set forth herein, our non-employee directors did not hold any other outstanding equity awards. |

| (2) | These amounts represent the aggregate grant date fair value of stock awards granted in 2022 as calculated pursuant to Financial Accounting Standards Board’s Accounting Standards Codification Topic 718. The methodology and assumptions used in the valuation of stock awards are contained in Footnote 11 to our consolidated financial statements included in the Annual Report on Form 10-K for the year ended December 31, 2022. |

| (3) | Restricted stock units for a number of shares (rounded to the nearest 100 shares) equal to the stated dollar amount divided by the average closing price of our common stock on the NYSE on the five trading days immediately preceding the date of grant. Restricted stock units vest on the one-year anniversary of the date of grant. |

| (4) | A description of the Director Deferred Income and Retirement Plan can be found above. Amounts represent the year-over-year change in present value of the director’s account based on actuarial tables. |

In August 2020, the Compensation and Corporate Governance and Nominating Committees of the Board updated the stock ownership requirements covering all non-employee directors and executive officers. Under the revised policy, non-employee directors must acquire and hold shares of our common stock equal in value to at least five times the annual Board cash retainer, or $350,000, paid to all non-employee directors. Non-employee directors are expected to meet these holding requirements by December 31 of the fifth year following their initial election to the Board. A non-employee director’s stock ownership is valued based on the average trading price of our stock over a twelve-month period ending on December 31 of each calendar year. All directors are in compliance or have additional time in which to comply with the stock ownership guidelines as of December 31, 2022.

We are committed to improving the lives of our shareholders, employees, customers, business partners, and the communities in which we operate. To that end, we believe having a strong focus on corporate responsibility, including ESG matters, and conducting our business in an ethical, transparent and accountable manner, creates value for all of our stakeholders.

We provide an overview of our ESG initiatives and practices below. Our complete Environmental, Social & Governance Report is available via the “Environment & Sustainability” link on our Investor Relations webpage.

| 2023 Proxy Statement 22

| 2023 Proxy Statement 22

| RESOURCE CONSERVATION IN PRODUCTION |

| GHG Reductions (2019 Baseline vs 2022) | GHG Reductions (2019-2021) Baseline vs | Energy Efficiency Projects | ||||||||||

• Ducommun reduced combined Scope 1 and 2 GHG emissions by 28% and 16%, normalized to revenue and employee count, respectively, compared to 2019 baseline levels. • We reduced our total energy usage by a 13% normalized to revenue, compared to 2019 baseline levels. | 2022 | |||||||||||

• Ducommun reduced combined Scope 1 and 2 GHG emissions by 20% and 8%, normalized to revenue and employee count, respectively, compared to a baseline average between 2019 and 2021. • We reduced our total energy usage by 9%, normalized to revenue, compared to baseline average between 2019 and 2021. | • Our use of renewable energy has increased by 15,900 Gigajoules (4.4M kWh) through partnerships with local utility providers and 80 Gigajoules (20K kWh) from the use of rooftop solar panels, compared to 2019. • We invested in installing variable frequency drives (VFD) on compressors and energy efficient burners on boilers to reduce energy consumption and costs. • Completed the installation of LED lighting at several additional performance centers. Ducommun now has seven performance centers that have completed this transition. | |||||||||||

| HUMAN CAPITAL AND DIVERSITY PROGRAMS |

| Health and Safety | Leadership Diversity | Awards and Recognition | ||||||||||

• We remain committed to prioritizing employee health, safety, and wellness and we took additional measures to insulate our employees from COVID 19. • Our lost time incident rate declined by 78% and our total recordable incident rate declined by 71%, between 2019 and 2022. | • Our Board now includes three female directors, with women constituting 37.5% of its members. Half of our Board is now comprised of women and a member from an underrepresented background. • Women represented 20% of the Company’s executives (VP and above) and 30% of corporate director-level positions. Members of underrepresented communities comprised 50% of the Company’s executives and 20% of corporate director-level positions. | • Orange County Business Journal named Ducommun to its list of 2022 Best Places to Work for the second consecutive year. | ||||||||||

| COMMUNITY SUPPORT |

| Company Donations | Community Investment | Scholarships | ||||||||||

• The Ducommun Foundation supports charitable organizations in the communities in which we operate and has made donations of more than $1.7 million since 2019 to support social justice causes and underrepresented communities. | • Our STEM on the Sidelines™ program serves as a contest to promote STEM education in high schools in Los Angeles and Orange Counties, in which over 600 students have participated since the program's inception five years ago. • We launched the Ducommun Philanthropy Cloud company-wide in the fourth quarter of 2022 to encourage employee support of the causes most important to them. | • We awarded 70 scholarships in 2022 to children and grandchildren of employees, an increase of 46% over 2021. The total value of scholarships awarded in 2022 was $199,000, up from $138,000 in 2021. | ||||||||||

| 2023 Proxy Statement 23

| 2023 Proxy Statement 23

| ETHICS AND PROTECTION OF HUMAN RIGHTS |

| Core Values | Code of Conduct | Human Rights | ||||||||||

• We continued to promote a culture of honesty, professionalism, respect, trust and teamwork through our Company Core Values and Code of Business Conduct, supported by our ethics hotline, employee communications and training. | • All employees are trained on ethical decision-making skills in the context of Ducommun’s Code of Conduct. | • Our Prohibition Against Trafficking in Persons Policy and California Transparency in Supply Chains Act disclosure statement continued to promote responsible sourcing practices. | ||||||||||

Our ESG and sustainability initiatives are overseen by the Board in general, and specifically, the Corporate Governance and Nominating Committee. In particular, the Corporate Governance and Nominating Committee reviews and provides input on ESG metrics applicable to us and of potential interest to our stakeholders. In 2020 and based on management’s recommendations, the Corporate Governance and Nominating Committee approved the development of an ESG program substantially based on the Sustainability Accounting Standards Board’s Aerospace and Defense Industry Standard (the “SASB Standard”), as modified, as being the standard most reflective of, and relevant to, Ducommun’s operations. In 2021, we formally established an ESG steering committee comprised of senior executives to monitor and manage the initiatives approved by the Corporate Governance and Nominating Committee to further strengthen our ESG program. The Corporate Governance and Nominating Committee and the full Board receive regular updates on the status of these initiatives.

We understand the importance of building trust with our investors, customers, vendors and suppliers, and that the foundation for doing so begins with our employees. To establish this trust and commitment, we rely on an anonymous hotline to support our Code of Business Conduct and Ethics and empower our employees to provide suggestions and report concerns or instances of misconduct. In keeping with our foundational core values of honesty and trust, we offer employees regular training and monthly ethics bulletins to promote a culture of high ethical standards where employees feel free to voice concerns.

We are also committed to respecting human rights and establishing expectations for high levels of ethical conduct throughout our supply chain. Ducommun’s California Transparency in Supply Chains Act Disclosure Statement and Prohibition Against Trafficking in Persons Policy are both available in the Corporate Governance section of our Investor Relations webpage.

Employee safety is also one of our top priorities and annual areas of focus. As a result of the ongoing COVID-19 pandemic, in 2022 we continued to incorporate stringent, preventative measures and protocols based on Centers for Disease Control (“CDC”) guidance at our locations to protect the health, welfare and safety of our employees. Such protocols included:

| • | Supporting social distancing at our facilities by implementing work station dividers and flex staffing, and staggering lunch breaks and work shifts; |

| • | Providing face coverings, gloves and other personal protective equipment at no cost to employees; |

| • | Providing sanitation stations with hand sanitizers and cleaning wipes throughout our facilities; |

| • | Performing deep cleanings and disinfecting facilities on a regular basis; |

| • | Implementing enhanced third-party visitor screening protocols before onsite visits and entry; |

| • | Providing regular employee communications with current best preventative practives to help mitigate the spread of the virus; and |

| • | Educating employees and their families on safety practices. |

Throughout 2022 management maintained a vaccine incentive program, first implemented in the spring of 2021, that offered $100 to all employees who became fully vaccinated. The Board of Directors was kept apprised with regular updates as to the successful implementation of our safety protocols and COVID-19 vaccination rates among our workforce during the year.

In 2021, Ducommun adopted environmental health and safety (“EHS”) key performance indicators (“KPIs”) that were regularly communicated across the enterprise by senior management in order to improve safety outcomes. In 2022, we continued to invest in infrastructure to improve internal safety protocols related to key processes. In addition, we refined our EHS software tools to track and engage performance centers to reduce lost time and total recordable incident rates.

| 2023 Proxy Statement 24

| 2023 Proxy Statement 24

Over the four-year period between January 1, 2019, and December 31, 2022, Ducommun’s lost time incident rate(6) decreased by approximately 78% and the total recordable incident rate(7) decreased by approximately 71%.

| Lost Time Incident Rate (2019 – 2022) | Total Recordable Incident Rate (2019 – 2022) |

|  |

In support of our pledge to deliver exceptional value to all stakeholders, we are committed to the following with respect to our environmental management practices:

| 1. | Striving to avoid adverse impact and harm to the environment in the communities in which we do business, and to identify business partners who share these values. |

| 2. | Promoting compliance with all applicable laws and regulations pertaining to the environment and natural resources. |

| 3. | Improving our Environmental Management System, employee awareness, and performance. |

| 4. | Establishing meaningful objectives in the pursuit of environmental, health and safety excellence, including but not limited to metrics established by SASB applicable to our operations. |

Below is a summary of our performance over the four-year time period between 2019 and 2022 relating to our greenhouse gas emissions and total energy use. Overall, there was a 28% decrease in combined Scope 1 and 2 greenhouse gas emissions, and a 16% reduction in total energy usage in 2022 compared to 2019.

| Scope 1 and 2: Greenhouse Gas Emissions (tons CO2) | Total Energy Use (GigaJoules) |

|  |

| (6) | Lost time incidents are defined as incidents that resulted in days away from work. This measure is similar to the days away, restricted or transferred metric utilized by the Occupational Safety and Health Administration. The annual lost time incident rate is calculated by dividing the total number of lost time injuries in a year by the total number of hours worked in a year. |

| (7) | The total recordable incident rate is calculated by multiplying the annual number of OSHA Recordable Cases by 200,000, and dividing the product by the total hours worked by all employees during the year. The number 200,000 is used in the calculation to represent the number of hours worked in a year by 100 employees working 40 hours per week over 50 weeks, which provides the basis for calculating the incident rate for the entire year. |

| 2023 Proxy Statement 25

| 2023 Proxy Statement 25

Ducommun understands that global warming and climate change will pose an increased risk to, and have the potential to impact, its business and operations. The Corporate Governance and Nominating Committee of our Board of Directors oversees our environmental, social and governance (“ESG”) programs, including the mitigation of climate-related risks to the business and strategies for decreasing GHG emissions and incorporating such measures into the Company’s overall strategy. We believe the first step in reducing the severity of such risks is by identifying them and therefore, we implemented a process to evaluate, identify, and mitigate climate-related risks and opportunities through the creation and implementation of business continuity plans (“BCPs”).

The BCPs developed for each of our performance centers provide a process for identifying and managing physical climate change-related risks. Each BCP contains processes and methodologies to help us prepare for, respond to, and recover from threats and risks, including natural disasters caused by climate change. The elements of our BCPs include:

Risk Assessment & Business Impact Analysis (BIA): Each performance center conducts a risk assessment to identify potential natural disasters that could compromise the entire facility, building, or the majority of its operations. The potential impacts from, and appropriate mitigation measures in response to, each type of natural disaster are identified to preserve the continuity of operations, and cover various functional areas such as procurement, engineering, maintenance, operations, and environmental, health and safety. These risk assessments and BIAs are reviewed annually by teams at each of our performance centers.

Crisis Response Plan: Each BCP includes communication and notification protocols to our local performance center and executive leadership teams.

Business Continuity and Response Plan: Each performance center is required to annually review and update its BIA and crisis response plan. For example, our Midwest and Coxsackie, New York facilities utilize their BIAs to identify, assess, prepare for and respond to tornado threats.

Annual Training and Exercise: Each performance center is required to be trained annually on its BCP processes. Tabletop exercises and drills are scheduled annually to assess the effectiveness of our Business Continuity Plans.

Ducommun also discloses its GHG emissions under the Carbon Disclosure Project (“CDP”), which includes a self-assessment that incorporates elements from the Task Force on Climate-Related Financial Disclosures (“TCFD”) framework. As part of this assessment process, we identified the following risks that could potentially impact our business along with concomitant mitigation measures:

| Category | General Description | Business Impact | Mitigation |

| Physical Risks | Risks associated with natural disasters such as tornados, earthquakes and floods. | Business interruption, supply chain and operations impacts, and employee disruptions. | Each BCP defines relevant threats, identifies response measures and requires training on remedial actions. |

| Regulatory Risks | Risks associated with new climate-related regulatory requirements that could impact energy pricing, emission restrictions and compliance costs. | Increased compliance and operational costs | Continued implementation of energy efficiency projects to reduce our GHG emissions. |