Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-277578

Prospectus Supplement to Prospectus dated March 1, 2024

$1,000,000,000 4.837% Fixed-to-Floating Rate Senior Callable Notes due 2028

$1,500,000,000 4.942% Fixed-to-Floating Rate Senior Callable Notes due 2030

$2,000,000,000 5.335% Fixed-to-Floating Rate Senior Callable Notes due 2035

Barclays PLC

We, Barclays PLC (the “Issuer”), are issuing $1,000,000,000 aggregate principal amount of 4.837% Fixed-to-Floating Rate Senior Callable Notes due 2028 (the “2028 notes”), $1,500,000,000 aggregate principal amount of 4.942% Fixed-to-Floating Rate Senior Callable Notes due 2030 (the “2030 notes”) and $2,000,000,000 aggregate principal amount of 5.335% Fixed-to-Floating Rate Senior Callable Notes due 2035 (the “2035 notes” and, together with the 2028 notes and the 2030 notes, the “notes”).

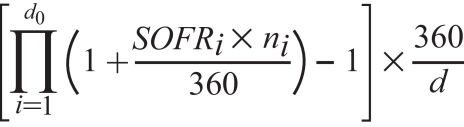

From (and including) the Issue Date (as defined below) to (but excluding) September 10, 2027 (the “2028 Notes Par Redemption Date”) (the “2028 Notes Fixed Rate Period”), the 2028 notes will bear interest at a rate of 4.837% per annum. During the 2028 Notes Fixed Rate Period, interest will be payable semi-annually in arrear on March 10 and September 10 in each year, commencing on March 10, 2025. From (and including) the 2028 Notes Par Redemption Date to (but excluding) the 2028 Notes Maturity Date (as defined below) (the “2028 Notes Floating Rate Period”), interest will accrue on the 2028 notes at a floating rate equal to a benchmark rate based on Compounded Daily SOFR (as defined below), calculated in arrear as described herein and compounding daily over each 2028 Notes Floating Rate Interest Period (as defined below), plus 1.34% per annum. During the 2028 Notes Floating Rate Period, interest will be payable quarterly in arrear on December 10, 2027, March 10, 2028, June 10, 2028 and the 2028 Notes Maturity Date.

From (and including) the Issue Date to (but excluding) September 10, 2029 (the “2030 Notes Par Redemption Date”) (the “2030 Notes Fixed Rate Period”), the 2030 notes will bear interest at a rate of 4.942% per annum. During the 2030 Notes Fixed Rate Period, interest will be payable semi-annually in arrear on March 10 and September 10 in each year, commencing on March 10, 2025. From (and including) the 2030 Notes Par Redemption Date to (but excluding) the 2030 Notes Maturity Date (as defined below) (the “2030 Notes Floating Rate Period”), interest will accrue on the 2030 notes at a floating rate equal to a benchmark rate based on Compounded Daily SOFR, calculated in arrear as described herein and compounding daily over each 2030 Notes Floating Rate Interest Period (as defined below), plus 1.56% per annum. During the 2030 Notes Floating Rate Period, interest will be payable quarterly in arrear on December 10, 2029, March 10, 2030, June 10, 2030 and the 2030 Notes Maturity Date.

From (and including) the Issue Date to (but excluding) September 10, 2034 (the “2035 Notes Par Redemption Date”, the 2028 Notes Par Redemption Date, the 2030 Notes Par Redemption Date and the 2035 Notes Par Redemption Date, each, a “Par Redemption Date”) (the “2035 Notes Fixed Rate Period”), the 2035 notes will bear interest at a rate of 5.335% per annum. During the 2035 Notes Fixed Rate Period, interest will be payable semi-annually in arrear on March 10 and September 10 in each year, commencing on March 10, 2025. From (and including) the 2035 Notes Par Redemption Date to (but excluding) the 2035 Notes Maturity Date (as defined below) (the “2035 Notes Floating Rate Period”), interest will accrue on the 2035 notes at a floating rate equal to a benchmark rate based on Compounded Daily SOFR, calculated in arrear as described herein and compounding daily over each 2035 Notes Floating Rate Interest Period (as defined below), plus 1.91% per annum. During the 2035 Notes Floating Rate Period, interest will be payable quarterly in arrear on December 10, 2034, March 10, 2035, June 10, 2035 and the 2035 Notes Maturity Date.