Conflict Minerals Report 2023

Overview of Apple’s commitment to responsible sourcing

At Apple, our respect for human rights begins with our commitment to treating everyone with dignity and respect. Apple’s Board of Directors adopted and oversees our human rights policy — Our Commitment to Human Rights (“Human Rights Policy”) — which governs how we treat everyone, including our customers, employees, business partners, and people at every level of our supply chain. In alignment with our Human Rights Policy as well as Apple’s Supplier Code of Conduct (“Code”), which includes Apple’s Supplier Responsibility Standard on the Responsible Sourcing of Materials (“Responsible Sourcing Standard”), we conduct human rights and environmental due diligence in our supply chain to identify risks and work to mitigate them. We also work to identify and remedy potential adverse impacts, track and measure our progress, and report our findings. In support of these goals, we also aim to expand access to learning opportunities and skills development for people across our supply chain, including through our $50 million Supplier Employee Development Fund.

We seek to one day use only recycled and renewable minerals and materials in our products and packaging, and we are committed to achieving carbon neutrality for our entire footprint by 2030 — from our supply chain to the use of the products we make. Apple continues to make progress on its work to expand recycled materials across its products, with 20 percent of all material shipped in Apple products in 2022 coming from recycled or renewable sources. Tin, tungsten, tantalum, and gold (“3TG”) are among 14 materials prioritized in our initial efforts to transition to recycled and renewable materials, based on an evaluation of the environmental, social, and supply impacts of 45 mined elements and raw materials. The results of this evaluation and the related methodology (“Material Impact Profiles”) are available on Apple’s website for others to access and use.1

As we make progress toward these ambitious goals, we continue to source 3TG and other minerals, such as cobalt and lithium, responsibly while working to improve conditions in and around mining communities, including in the Democratic Republic of the Congo (“DRC”) and adjoining countries. Although Apple does not directly purchase, procure, or source primary minerals, we are committed to meeting and exceeding internationally accepted due diligence standards for primary minerals and recycled materials in our supply chain. Our responsible minerals sourcing program includes requirements that apply to all levels of Apple’s supply chain. Conducting human rights and environmental due diligence in alignment with the Organisation for Economic Co-operation and Development’s (“OECD”) 2016 Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas and related Supplements (“OECD Due Diligence Guidance”) and the United Nations Guiding Principles on Business and Human Rights (“UN Guiding Principles”) is the foundation of Apple’s responsible sourcing programs for primary and recycled minerals and materials.

1 Available at apple.com/environment/pdf/Apple_Material_Impact_Profiles_April2019.pdf

Apple’s Code and Responsible Sourcing Standard require suppliers, smelters, refiners, and recyclers in our supply chain to identify and assess a broad range of risks beyond conflict, including social, environmental, and human rights risks. Suppliers are also required to review reported incidents and public allegations linked to their smelters and refiners, and to participate in 3TG traceability and independent third-party audit programs to mitigate identified risks.

As of December 31, 2023 — for the ninth consecutive year — 100 percent of the identified smelters and refiners in our supply chain for all applicable Apple products manufactured during 2023 participated in an independent third-party conflict minerals audit for 3TG. These audits encompassed the identified smelters and refiners that provide materials for the following Apple product categories: iPhone®, Mac®, iPad®, AirPods®, Apple TV®, Apple Watch®, Apple Vision ProTM, Beats® products, HomePod®, HomePod mini®, Apple Card®, and all Apple® accessories.

In 2023, we removed from our supply chain 14 smelters and refiners that were not willing to participate in, or complete, a third party audit or that did not otherwise meet Apple’s requirements for the responsible sourcing of minerals. Based on our due diligence efforts, including analyzing the information provided by third-party audit programs, upstream traceability programs, and our suppliers, we found no reasonable basis for concluding that any of the smelters or refiners of 3TG determined to be in our supply chain as of December 31, 2023 directly or indirectly financed or benefited armed groups in the DRC or an adjoining country.

In addition to our work to strengthen industrywide due diligence programs operating in areas where 3TG minerals are sourced, we engage with and support a broad range of multistakeholder and community initiatives. We provide funding for the Fund for Global Human Rights, a public foundation that supports human rights and environmental defenders around the world, including in the DRC. We also support whistleblower initiatives so independent, local voices can raise issues and report incidents at the mining level. Input from stakeholders and rights-holders in the DRC contributes to our robust due diligence program and drives industrywide progress.

We believe that all stakeholders (including governments, civil society, and industry) should enhance their efforts to implement comprehensive due diligence programs, measure impact, and work together with—and support—local communities to improve conditions and drive economic and social development in mining areas, including in the African Great Lakes region.

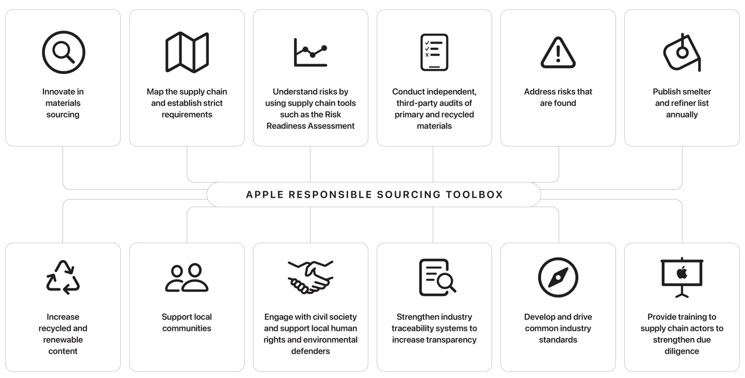

The below chart summarizes the comprehensive set of tools we utilize to drive progress throughout our supply chain.2

2 More information on Apple’s Responsible Minerals Sourcing program is available at apple.com/supplier-responsibility

OECD Step 1: Establish strong company management systems

In alignment with Step 1 of the OECD Due Diligence Guidance, Apple has robust internal policies and management systems overseeing its efforts for the responsible sourcing of minerals.

Apple conducts business ethically, honestly, and in compliance with applicable laws and regulations. This applies to every business decision in every area of the company worldwide.

Apple’s Supplier Code of Conduct and Responsible Sourcing of Materials Standard

Apple’s Code, which includes Apple’s Responsible Sourcing Standard, applies to all levels of Apple’s supply chain, including traders, suppliers, sub-suppliers, mining companies, and operators of collection points for recycled minerals used in Apple products. The Code and Responsible Sourcing Standard are based on industry and internationally accepted principles, including the UN Guiding Principles, the International Labour Organization’s International Labour Standards, and the OECD Due Diligence Guidance.

The Code outlines Apple’s requirements for its suppliers in the areas of labor and human rights, health and safety, the environment, ethics, and management systems. The Responsible Sourcing Standard specifically outlines Apple’s extensive requirements on the responsible sourcing of minerals and other materials, including expectations for suppliers concerning 3TG due diligence and related sourcing matters. The Code, including the Responsible Sourcing Standard, is available in 18 languages and evaluated and strengthened each year, raising the bar suppliers must meet.

Other relevant Apple Policies

| • | Business Conduct Policy: Provides a standard guide for what is required of everyone at Apple. Apple expects its suppliers, contractors, consultants, and other business partners to follow the Business Conduct Policy’s principles of honesty, respect, confidentiality, and compliance when providing goods or services to Apple or acting on its behalf. |

| • | Human Rights Policy: Governs how Apple treats everyone, from customers and teams to business partners and people at every level of its supply chain. |

| • | Global Whistleblowing Policy: Applies to all current and former employees, directors and officers, contractors and subcontractors of Apple and its subsidiaries, and sets out Apple’s approach to protecting and supporting individuals who report potential misconduct. |

Relevant Apple management systems

| • | Environment and Supply Chain Innovation (“ESCI”) team: Within Apple’s Worldwide Operations group, ESCI has primary responsibility for upholding Apple’s values across the global supply chain. The ESCI team coordinates efforts related to Apple’s Code and Responsible Sourcing Standard and works across Apple’s business teams and functions, including product design, manufacturing operations, environmental initiatives, procurement, legal, finance, and retail. The ESCI team also regularly reports to, and consults with, Apple’s senior management to review progress and set ongoing strategies for our responsible sourcing of materials and human rights and environmental due diligence efforts. |

| • | Board of Directors: Oversees Apple’s Chief Executive Officer and other senior management in the competent and ethical operation of Apple on a day-to-day basis. |

| • | Audit and Finance Committee: Consisting entirely of independent directors, the committee assists Apple’s Board of Directors in monitoring significant business risks, including operational and reputational risks. |

| • | Nominating and Corporate Governance Committee: Consisting entirely of independent directors, the committee assists Apple’s Board of Directors in overseeing Apple’s strategies, policies, and practices relating to environmental and social matters. |

Apple requires its suppliers to adhere to the Code and the Responsible Sourcing Standard, including any subsequent amendments or updates. Suppliers are also required to apply Apple’s requirements upstream to their own suppliers throughout all levels of the supply chain. In this way, and through direct outreach by Apple to all 3TG smelters and refiners identified in its supply chain, Apple implements its requirement that smelters and refiners in its supply chain comply with Apple’s strict standards, including participation in independent third-party audit programs.

We annually communicate our 3TG sourcing requirements to suppliers. Additionally, throughout the year we engage with suppliers using tailored communication and guidance, including:

| • | Conducting annual 3TG due diligence training webinars with suppliers that have reported to Apple the use of 3TG in parts and products. |

| • | Providing suppliers access to SupplierCare, our supplier communication platform, which enables suppliers to reach out to us with questions at any time. |

| • | Offering online training materials—in multiple languages—that focus on Apple’s due diligence expectations and requirements for 3TG reporting, among other topics. |

| • | Maintaining a dedicated Apple email that allows suppliers to report concerns or grievances related to 3TG mining, processing, and trading. The concerns or grievances submitted are reviewed by Apple, and follow-up activities are conducted when appropriate. |

We conduct third-party assessments of our suppliers who report to Apple the use of 3TG in their parts and products to confirm alignment with the OECD Due Diligence Guidance and the Code and Responsible Sourcing Standard. Additional information about these assessments is provided in Step 4 of this report. If we discover our standards are not being met, we provide support to help suppliers complete a corrective action plan, in line with the OECD Due Diligence Guidance framework of progressive improvement, to meet and exceed our requirements within the timeline identified as a result of the assessment or specialized audit. Timelines for corrective actions typically range between 30 and 90 days. If a supplier is unwilling or unable to meet Apple’s requirements, we will terminate applicable business relationships.

We also support industrywide grievance and allegations mechanisms at the smelter and refiner level and whistleblowing programs deeper in the supply chain at the mining level. These programs are discussed further in Step 2 of this report.

Civil society and industry engagement

We are committed to working in collaboration with stakeholders beyond our own supply chain. As part of this commitment, we regularly review and gather feedback on Apple’s programs and wider industry initiatives by engaging with experts on human rights, the environment, and minerals sourcing from civil society, non-governmental organizations (“NGOs”), industry, academia, and government. We work with these groups to discuss strategies for increasing the effectiveness and innovation of approaches to the responsible sourcing of recycled and primary sourced minerals in supply chains.

In 2023, we continued our active participation and leadership in multiple industry associations and multistakeholder initiatives, including supporting the ongoing development of industrywide, responsible sourcing standards. Apple representatives were also featured on multiple panels at the annual Responsible Business Alliance’s (“RBA”) and Responsible Minerals Initiative’s (“RMI”) annual conference and continued to serve on:

| • | The Board of Directors of the RBA |

| • | The Steering Committee of the RMI |

| • | The Governance Committee of the Public Private Alliance for Responsible Minerals Trade (“PPA”) |

| • | The European Partnership for Responsible Minerals |

OECD Step 2: Identify and assess risks in the supply chain

Consistent with Step 2 of the OECD Due Diligence Guidance, we work at multiple levels in our supply chain to continuously identify and assess risks in our minerals supply chains. The 14 priority materials outlined in our Material Impact Profiles3 were identified based, in part, on their salient environmental and human rights supply chain risks. We use this analysis to inform our process to map and conduct heightened due diligence on priority materials in Apple’s supply chain, including high-risk materials, such as gold. We also work with industry to promote effective and transparent systems that allow these and other materials to be sourced responsibly by others.

A foundational step in Apple’s 3TG risk assessment process is the requirement that all suppliers that utilize 3TG submit to Apple an industry-standard Conflict Minerals Reporting Template (“CMRT”). We collect and process data provided by suppliers through their completion of the CMRT to map our supply chain to the smelter and refiner level and, to the extent available, to the mining level. Our Responsible Sourcing Standard requires suppliers to inform Apple immediately if they identify certain high risks in their minerals supply chains included in Annex II of the OECD Due Diligence Guidance, such as conflict or human rights risks associated with 3TG.

Driving impact across industries

In addition to conducting our own supply chain due diligence, we help strengthen and increase the transparency of independent third-party audit programs to help identify a broad range of social, environmental, human rights, and governance risks at the smelter, refiner, and mining levels. These include audit programs by the RMI and the London Bullion Market Association (“LBMA”) and mine level monitoring programs led by the International Tin Supply Chain Initiative (“ITSCI”) and RCS Global Group’s Better Mining program (“Better Mining”).

We continue to innovate, develop, and scale tools to enhance risk identification and assessment beginning at the mining level, and emphasize the importance of cross-industry and multistakeholder collaboration in the use and refinement of these tools in order to drive greater collective impact throughout global supply chains. This includes a variety of tools aimed at enhancing risk identification and assessment, such as:

3 Available at apple.com/environment/pdf/Apple_Material_Impact_Profiles_April2019.pdf

| • | Risk Readiness Assessment (“RRA”): A self-assessment tool that has been a pre-requisite for RMI Responsible Minerals Assurance Process (“RMAP”) auditees since 2017. The RRA is available to all RMI member companies to assess risks in mineral supply chains. The Copper Mark assurance framework also requires copper and other minerals producers to conform to the RRA Criteria Guide in order to demonstrate responsible production practices. Apple first funded and developed the initial version of the RRA in 2016, and it has now been scaled through industry and recently undergone a comprehensive, multistakeholder revision through the RMI. |

| • | Minerals Grievance Platform: A cross-industry platform managed by RMI where allegations concerning minerals supply chains are investigated and addressed. Grievances can be anonymously submitted by NGOs, companies, or any member of the public. |

| • | Material Insights Platform: A resource for RMI member companies to identify and assess environmental, social, and governance issues in their materials supply chains, and encourage collective action in addressing risks and creating positive impacts for mining communities. |

In 2023, building on research Apple previously supported which assessed the human rights impacts of due diligence programs, we also supported initiatives aimed at:

| • | Developing strategies for generating better data on due diligence: We contributed to the conceptualization, design, and presenter selection for a virtual “data for impact symposium” for PPA members. |

| • | Highlighting standards for remediation: The International Organization for Migration continued to utilize the Remediation Guidelines for Victims of Exploitation in Extended Minerals Supply Chains, created previously in consultation with Apple. |

| • | Leveraging technology for supply chain transparency: Via our partnership with the Working Capital Fund, we supported 17 companies that are developing scalable innovations in technological solutions for more transparent supply chains. |

Supporting mining communities

Apple believes in supporting systemic progress in mineral supply chain due diligence, which requires us to work to address allegations beyond those that potentially affect Apple’s own supply chain. Accordingly, we have taken steps to work with a broad group of stakeholders to address public allegations together. This includes reviewing public allegations from civil society groups and analyzing investigative reports by international organizations — including NGOs and the United Nations Group of Experts on the DRC — related to risks outlined in Annex II of the OECD Due Diligence Guidance. In 2023, we also strengthened Apple’s Responsible Sourcing Standard by requiring the identification of risks related to retaliation against human rights and environmental defenders, and Indigenous Peoples’ right to free, prior, and informed consent.

Apple believes that supporting rights-holders at the mining level is critical to identifying and assessing risks in the 3TG supply chain. In 2023, this included our work on the following initiatives:

| • | Support for human rights and environmental defenders in the DRC: We continued and deepened our work with the Fund for Global Human Rights in support of human rights, labor, and environmental defenders in the DRC who work on a range of issues, including the economic and social rights of mining communities, inclusive economic growth, judicial advocacy, environmental justice, the rule of law, and health and safety. We work to incorporate learnings from these human rights and environmental defenders into our due diligence programs. |

| • | Whistleblowing mechanisms at mining level: For the eighth consecutive year, Apple funded ITSCI’s whistleblowing mechanism in the DRC, which enables people in and around mining communities in seven provinces of the DRC to place anonymous voice calls using a toll-free hotline to raise concerns related to mineral extraction, trade, handling, and exporting via local networks. In 2023, ITSCI and its partner organizations continued to increase awareness and utilization of the whistleblowing mechanism through radio campaigns in mining communities, distributing promotional material, and consulting with local civil society actors and other stakeholders. |

Several of the programs Apple supports include a specific focus on addressing concerns in and around artisanal and small-scale mining (“ASM”) communities. In 2023, these initiatives included:

| • | Rights awareness trainings: Apple supported a seventh year of programming with international development NGO Pact to deliver rights awareness training to miners, youth, and community officials in ASM communities in the DRC. These training sessions were designed to raise awareness on a range of human rights issues and were based in part on curriculum developed by the United Nations Children’s Emergency Fund (“UNICEF”). |

| • | Vocational education: Apple also provided funding to the RBA Foundation in support of Pact’s seventh year of a vocational education program for youth living in mining communities in the Lualaba province of the DRC. |

| • | Tools to connect ASM and downstream actors: We worked with IMPACT to support the continued development of solutions to measure and track supply chain activities related to social and environmental well-being in ASM communities. This includes the development of a web-based monitoring and evaluation tool that supports downstream actors’ supply chain due diligence and ability to track their progress in alignment with sustainability standards such as the United Nations Sustainable Development Goals. |

| • | Innovative approaches to responsible gold sourcing: We continued to work with the Massachusetts Institute of Technology’s D-Lab Innovation Centers in Colombia. These Innovation Centers support training for local gold miners and community leaders to develop sustainable solutions to ASM challenges. |

OECD Step 3: Design and implement a strategy to respond to identified risks

In alignment with Step 3 of the OECD Due Diligence Guidance, we implement our due diligence program and conduct supply chain analysis by leveraging information gained from independent research, engaging with civil society groups and rights-holders, analyzing independent third-party audits, and working directly with smelters and refiners to respond to risks identified in our supply chain.

We closely monitor completion of independent third-party audits and corrective action plans by the smelters and refiners in our supply chain. If smelters or refiners delay implementation of corrective action plans developed by third-party audits, we conduct applicable smelter or refiner outreach to reiterate that completion and closure of corrective action plans are required in order to remain in our supply chain.

If smelters or refiners are unable or unwilling to meet our standards, we take necessary actions, through our suppliers, to terminate the applicable business relationships. As of December 31, 2023, we found that all identified smelters and refiners in our supply chain participated in an independent third-party audit that met Apple’s requirements for the responsible sourcing of minerals.

Each year, we analyze incident data provided by ITSCI and Better Mining, two upstream traceability and due diligence programs that monitor tin, tungsten, and tantalum mines in the DRC and across the African Great Lakes region. We work with these programs to help strengthen their incident review processes, and review and monitor incidents generated through their respective reporting systems, including reviewing mitigation actions and confirming incidents are closed in accordance with the programs’ standards and procedures.

In 2023, we continued to review incidents and accompanying analysis reported by both ITSCI and Better Mining. As part of this process, we also reviewed reported incidents that could have directly or indirectly benefited or financed armed groups in the DRC or adjoining countries. As of December 31, 2023, we found no reasonable basis for concluding that any of the reported incidents were connected to tin, tungsten, or tantalum included in Apple’s products. The challenges of tracking specific mineral quantities through the supply chain continue to impede the traceability of any specific mineral shipment through the entire product manufacturing process.

Innovating responsible gold sourcing

Apple continues to address remaining challenges in the global gold supply chain through its due diligence program, which is aligned with the OECD Due Diligence Guidance Supplement on Gold and other sources. As part of our risk assessment and due diligence efforts, we designed and implemented systems that focus specifically on the gold supply chain. Apple requires certification from the RMI’s RMAP or the LBMA’s Responsible Gold Program for gold refiners in our supply chain. We also prioritize gold in our efforts to transition to recycled and renewable materials in our products, and 100 percent of our recycled gold refiners are audited. In 2023, we reviewed gold refiners in our supply chain to identify potential risks and other sourcing challenges, and subsequently worked with suppliers to address such identified risks and challenges and to remove refiners as necessary.

Apple believes that innovative and data-driven solutions to sourcing help reduce risk and improve traceability and is leading on responsible gold sourcing innovation. This includes pioneering industry-leading traceability mechanisms for recycled materials to build a supply chain of exclusively recycled gold. In 2023, we expanded our use of certified recycled gold to the USB-C connector plating as well as the wire of all cameras in the iPhone 15 family, along with printed circuit boards across Apple products, including the latest iPhone, Apple Watch, Mac family, and MacBook Pro.

We continued to work with sustainability nonprofit RESOLVE to fund the Regeneration project, which focuses on re-mining and processing waste material from legacy mines to restore natural environments and support rehabilitation and biodiversity. Regeneration is an expansion of the Salmon Gold project, which we continued to fund and scale with RESOLVE in 2023. The Salmon Gold project works with small-scale miners and Indigenous Peoples in remote regions of the Yukon, Alaska, and British Columbia to support a mining practice that helps restore rivers and streams so that salmon and other fish can thrive. Since RESOLVE first introduced the Salmon Gold project in 2017, the organization has connected local placer miners, environmentalists, and government agencies to mitigate the damage done by historic mining activities.

The gold mined from this project is then traced from its origin to a refiner in Apple’s supply chain using blockchain technology. Apple believes that blockchain solutions are a tool to support — but not replace — supply chain due diligence. The interests of people working at the mining level and in surrounding communities should be taken into consideration when utilizing new technologies such as blockchain. As the use of new technologies increases, our goal is to ensure that data captured contributes to positive impacts along the supply chain.

Apple believes that the lessons learned from these programs will help support further innovation across the supply chains of additional minerals.

OECD Step 4: Carry out independent third-party audits of smelter/refiner’s due diligence practices

Since 2015, we have continued to reach a 100 percent rate of participation in independent third-party audit programs by identified 3TG smelters and refiners in our supply chain. Apple requires certification from the RMI’s RMAP or the LBMA’s Responsible Gold Program for 3TG smelters and refiners in our supply chain.

Apple believes independent third-party audits remain foundational to robust due diligence systems. In particular, third-party audits play a significant role in providing assurance that smelters and refiners have appropriate due diligence systems in place while helping to confirm that operations and sourcing practices are aligned with the OECD Due Diligence Guidance and do not support conflict, including in the DRC or adjoining countries.

In addition to smelter and refiner audits, part of Apple's supplier engagement program and Code assessment process includes working with an independent audit firm to conduct specialized responsible sourcing audits of select suppliers in order to have a deeper review of their internal management systems and implementation of Apple's requirements related to 3TG and other minerals. At the end of an Apple-managed assessment or specialized audit, the supplier is given a list of areas to strengthen with regard to the Code and Responsible Sourcing Standard, and the supplier is required to correct any identified nonconformances in a timely manner.

OECD Step 5: Report annually on supply chain due diligence

Apple reports annually on its due diligence requirements through its Conflict Minerals Report filed with the U.S. Securities and Exchange Commission. Apple also publishes a list of all identified 3TG, cobalt, and lithium smelters and refiners in its supply chain, 100 percent of which participated in independent third-party audits as of December 31, 2023, and publishes its Supplier List based on direct spend for materials, manufacturing, and assembly of Apple products worldwide.4 In addition, we publish the following:5

| • | Environmental Progress Report |

| • | Material Impact Profiles |

| • | People and Environment in our Supply Chain Report |

| • | Product Environmental Reports |

| • | Smelter and Refiner List |

| • | Statement on Efforts to Combat Human Slavery and Trafficking |

As of December 31, 2023, based on our due diligence efforts, including the information provided by our suppliers, Apple believes that the smelters and refiners listed in Annex I were used to process 3TG in our products at some point during 2023. Through our smelter and refiner identification and validation process, we have identified a total of 235 smelters and refiners that processed 3TG in our supply chain during 2023. Of these 235 smelters and refiners, 221 remained in Apple's 3TG supply chain as of December 31, 2023. 14 were removed for the following reasons: those that previously participated in but subsequently stopped participating in an independent third-party audit program; were not willing to participate in an independent third-party audit within given timelines; exceeded independent third-party audit corrective action plan timelines; or failed to meet Apple’s Code, Responsible Sourcing Standard, or 3TG mineral requirements.

4 All referenced reports can be found at apple.com/supplier-responsibility

5 All referenced reports can be found via the following links:

apple.com/supplier-responsibility

apple.com/environment

Of all 221 smelters and refiners of 3TG determined to be in our supply chain as of December 31, 2023, Apple found no reasonable basis for concluding that any such smelter or refiner sourced 3TG that directly or indirectly financed or benefited armed groups in the DRC or an adjoining country.

Since 2009, Apple has directed the removal of 203 3TG smelters or refiners from our supply chain.

The total number of smelters and refiners directed to be removed from Apple’s supply chain since 2009 represents a cumulative count with smelters and refiners only counted once, when first removed from Apple’s supply chain. Smelters and refiners may subsequently re-enter the supply chain if they meet Apple’s Code and Responsible Sourcing Standard and other 3TG mineral requirements.6

Based on the information provided by our suppliers, smelters, and refiners, as well as from third-party audit programs, Apple believes that the 3TG contained in our products originated from the countries listed in Annex II, as well as from recycled and scrap sources. Apple’s reasonable country of origin inquiry is based on third-party audit information received through the RMI’s RMAP and the LBMA. To the extent reasonably possible, we have verified the country of origin of identified smelters and refiners via the collection of additional information by Apple using other sources such as the U.S. Geological Survey, a survey of smelters and refiners, and third-party reviews of publicly available information. However, because some country of origin information is reported at an aggregated level for all 3TG material processed by certain smelters or refiners, Apple does not have sufficient information to conclusively determine the countries of origin of the 3TG in all of our products.

About this report

This report has been prepared pursuant to Rule 13p-1 under the Securities Exchange Act of 1934, as amended, for the reporting period from January 1, 2023 to December 31, 2023. Information contained on the websites referenced in this report is not part of, or incorporated by reference into, this filing. Information presented in this report is based on calendar years.

Apple believes it constitutes a “downstream” company in that Apple’s suppliers purchase cassiterite, columbite-tantalite (“coltan”), wolframite, gold, or their derivatives, which presently are limited to tin-, tungsten-, tantalum-, and gold-related materials after processing by smelters or refiners. Apple does not directly purchase or procure primary sourced minerals from mine sites.

This report relates to the process undertaken in accordance with OECD Due Diligence Guidance for Apple products that were manufactured, or contracted to be manufactured, during 2023 and that contain 3TG. These product categories are iPhone®, Mac®, iPad®, AirPods®, Apple TV®, Apple Watch®, Apple Vision ProTM, Beats® products, HomePod®, HomePod mini®, Apple Card®, and all Apple® accessories. Third-party products that Apple retails but does not manufacture or contract to manufacture are outside the scope of this report.

The smelters and refiners identified in this report include those producing inputs for service or spare parts contracted for manufacturing in 2023 for use in connection with the subsequent service of previously sold products, including products serviced in subsequent years using those parts. This report does not include smelters of tin, tungsten, or tantalum or refiners of gold where such 3TG are included in end-of-life service parts for products that Apple no longer manufactures or contracts to manufacture.

This report’s use of the terms “smelters” and “refiners” refers to the facilities processing primary 3TG to retail purity. Apple suppliers have in some cases reported smelters and refiners that Apple believes are not operational or may have been misidentified as smelters and refiners. As a result, Apple continues to work with the RMI to determine accurate operational status of the smelters and refiners and to work with suppliers throughout its supply chain to revalidate, improve, and refine their reported information, taking into account supply chain fluctuations and other changes in status or scope and relationships over time. “Identified” smelters and refiners are those that (i) have been reported in a supplier’s CMRT, (ii) Apple believes are currently operational, were operational at some point during the applicable year, or, while inoperative, capable of re-engagement with minimal delay or effort, and (iii) otherwise meet the definition of a smelter or refiner, provided that Apple may determine to treat a third party as an identified smelter or refiner notwithstanding a reclassification of such third party or a change in its status. As part of its reasonable country of origin inquiry, Apple has determined that certain suppliers are utilizing at least some 3TG from secondary materials (i.e., scrap or recycled materials). Facilities that process only secondary materials (i.e., scrap or recycled materials) are excluded from the scope of this report.

6 Starting with calendar year 2023, the total number of smelters and refiners directed to be removed will not include smelters and refiners erroneously reported by suppliers due to reasons such as changes in a supplier’s supply chain or product line, or changes in a supplier’s declaration of scope in the supplier’s CMRT. Administrative removals may still be reflected in the historical cumulative data.

Participating smelters and refiners are those that have agreed to participate in or have been found compliant with independent third-party conflict minerals audit programs confirming their 3TG sourcing practices. Such programs may also include audits of traceability requirements, conformity with the OECD Due Diligence Guidance, management systems, and/or risk assessments. Independent third-party 3TG audit programs include the RMI’s RMAP and the LBMA’s Responsible Gold Program. Throughout this report, the audits by these programs are included in references to “independent third-party audit” programs.

ANNEX I: Smelter and Refiner List

List of identified smelters and refiners of 3TG reported in Apple’s supply chain as of December 31, 2023.

| | Conflict Mineral | | Name of Smelter or Refiner | | Location of Smelter or Refiner |

| | Gold | | Abington Reldan Metals, LLC* | | United States |

| | Gold | | Advanced Chemical Company* | | United States |

| | Gold | | Agosi AG* | | Germany |

| | Gold | | Aida Chemical Industries Co., Ltd.* | | Japan |

| | Gold | | Almalyk Mining and Metallurgical Complex (AMMC) | | Uzbekistan |

| | Gold | | AngloGold Ashanti Corrego do Sitio Mineracao | | Brazil |

| | Gold | | Argor-Heraeus S.A. | | Switzerland |

| | Gold | | Asahi Pretec Corp.* | | Japan |

| | Gold | | Asahi Refining Canada Ltd. | | Canada |

| | Gold | | Asahi Refining USA Inc. | | United States |

| | Gold | | Asaka Riken Co., Ltd.* | | Japan |

| | Gold | | Aurubis AG | | Germany |

| | Gold | | Bangko Sentral ng Pilipinas (Central Bank of the Philippines) | | Philippines |

| | Gold | | Boliden Ronnskar | | Sweden |

| | Gold | | C. Hafner GmbH + Co. KG* | | Germany |

| | Gold | | CCR Refinery - Glencore Canada Corporation | | Canada |

| | Gold | | Chimet S.p.A. | | Italy |

| | Gold | | Chugai Mining* | | Japan |

| | Gold | | Dowa* | | Japan |

| | Gold | | DSC (Do Sung Corporation)* | | South Korea |

| | Gold | | Eco-System Recycling Co., Ltd. East Plant* | | Japan |

| | Gold | | Eco-System Recycling Co., Ltd. North Plant* | | Japan |

| | Gold | | Eco-System Recycling Co., Ltd. West Plant* | | Japan |

| | Gold | | Geib Refining Corporation* | | United States |

| | Gold | | Gold by Gold Colombia* | | Colombia |

| | Gold | | Gold Refinery of Zijin Mining Group Co., Ltd. | | China mainland |

| | Gold | | Heimerle + Meule GmbH* | | Germany |

| | Gold | | Heraeus Germany GmbH Co. KG* | | Germany |

| | Gold | | Heraeus Metals Hong Kong Ltd. | | China mainland |

| | Gold | | Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. | | China mainland |

| | Gold | | Ishifuku Metal Industry Co., Ltd.* | | Japan |

| | Gold | | Istanbul Gold Refinery | | Turkey |

| | Gold | | Italpreziosi | | Italy |

| | Gold | | Japan Mint* | | Japan |

| | Gold | | Jiangxi Copper Co., Ltd. | | China mainland |

| | Gold | | JX Nippon Mining & Metals Co., Ltd. | | Japan |

| | Gold | | Kazzinc | | Kazakhstan |

| | Gold | | Kennecott Utah Copper LLC | | United States |

| | Gold | | KGHM Polska Miedz Spolka Akcyjna | | Poland |

| | Gold | | Kojima Chemicals Co., Ltd.* | | Japan |

| | Gold | | Korea Zinc Co., Ltd.* | | South Korea |

| | Gold | | L'Orfebre S.A.* | | Andorra |

| | Gold | | LS MnM Inc. | | South Korea |

| | Gold | | LT Metal Ltd.* | | South Korea |

| | Gold | | Materion* | | United States |

| | Gold | | Matsuda Sangyo Co., Ltd.* | | Japan |

| | Conflict Mineral | | Name of Smelter or Refiner | | Location of Smelter or Refiner |

| | Gold | | Metal Concentrators SA (Pty) Ltd. *** | | South Africa |

| | Gold | | Metalor Technologies (Hong Kong) Ltd. | | China mainland |

| | Gold | | Metalor Technologies (Singapore) Pte., Ltd. | | Singapore |

| | Gold | | Metalor Technologies (Suzhou) Ltd. | | China mainland |

| | Gold | | Metalor Technologies S.A. | | Switzerland |

| | Gold | | Metalor USA Refining Corporation | | United States |

| | Gold | | Metalurgica Met-Mex Penoles S.A. De C.V. | | Mexico |

| | Gold | | Mitsubishi Materials Corporation | | Japan |

| | Gold | | Mitsui Mining and Smelting Co., Ltd.* | | Japan |

| | Gold | | MKS PAMP SA | | Switzerland |

| | Gold | | MMTC-PAMP India Pvt., Ltd. | | India |

| | Gold | | Nadir Metal Rafineri San. Ve Tic. A.S. | | Turkey |

| | Gold | | Navoi Mining and Metallurgical Combinat | | Uzbekistan |

| | Gold | | NH Recytech Company* | | South Korea |

| | Gold | | Nihon Material Co., Ltd.* | | Japan |

| | Gold | | Ohura Precious Metal Industry Co., Ltd.* | | Japan |

| | Gold | | Ogussa Osterreichische Gold- und Silber-Scheideanstalt GmbH *** | | Austria |

| | Gold | | Planta Recuperadora de Metales SpA | | Chile |

| | Gold | | PT Aneka Tambang (Persero) Tbk | | Indonesia |

| | Gold | | PX Precinox S.A. | | Switzerland |

| | Gold | | Rand Refinery (Pty) Ltd. | | South Africa |

| | Gold | | REMONDIS PMR B.V.* | | Netherlands |

| | Gold | | Royal Canadian Mint | | Canada |

| | Gold | | SAFINA A.S.* | | Czechia |

| | Gold | | Sancus ZFS (L’Orfebre, SA)** | | Colombia |

| | Gold | | SEMPSA Joyeria Plateria S.A.* | | Spain |

| | Gold | | Shandong Gold Smelting Co., Ltd. | | China mainland |

| | Gold | | Shandong Zhaojin Gold & Silver Refinery Co., Ltd. | | China mainland |

| | Gold | | Sichuan Tianze Precious Metals Co., Ltd. | | China mainland |

| | Gold | | Solar Applied Materials Technology Corp.* | | Taiwan |

| | Conflict Mineral | | Name of Smelter or Refiner | | Location of Smelter or Refiner |

| | Gold | | Sumitomo Metal Mining Co., Ltd. | | Japan |

| | Gold | | SungEel HiMetal Co., Ltd.* | | South Korea |

| | Gold | | T.C.A S.p.A* | | Italy |

| | Gold | | Tanaka Kikinzoku Kogyo K.K.* | | Japan |

| | Gold | | Tokuriki Honten Co., Ltd.* | | Japan |

| | Gold | | TOO Tau-Ken-Altyn | | Kazakhstan |

| | Gold | | Torecom* | | South Korea |

| | Gold | | Umicore S.A. Business Unit Precious Metals Refining | | Belgium |

| | Gold | | United Precious Metal Refining, Inc.* | | United States |

| | Gold | | Valcambi S.A. | | Switzerland |

| | Gold | | Western Australian Mint (T/a The Perth Mint) | | Australia |

| | Gold | | WIELAND Edelmetalle GmbH* | | Germany |

| | Gold | | Yamakin Co., Ltd.* | | Japan |

| | Gold | | Yokohama Metal Co., Ltd.* | | Japan |

| | Gold | | Zhongyuan Gold Smelter of Zhongjin Gold Corporation | | China mainland |

| | Tantalum | | AMG Brasil | | Brazil |

| | Tantalum | | D Block Metals, LLC* | | United States |

| | Tantalum | | F&X Electro-Materials Ltd. | | China mainland |

| | Tantalum | | FIR Metals & Resource Ltd.* | | China mainland |

| | Tantalum | | Global Advanced Metals Aizu* | | Japan |

| | Tantalum | | Global Advanced Metals Boyertown* | | United States |

| | Tantalum | | Hengyang King Xing Lifeng New Materials Co., Ltd. | | China mainland |

| | Tantalum | | Jiangxi Dinghai Tantalum & Niobium Co., Ltd. | | China mainland |

| | Tantalum | | Jiangxi Tuohong New Raw Material | | China mainland |

| | Tantalum | | JiuJiang JinXin Nonferrous Metals Co., Ltd. | | China mainland |

| | Tantalum | | Jiujiang Tanbre Co., Ltd.* | | China mainland |

| | Tantalum | | Jiujiang Zhongao Tantalum & Niobium Co., Ltd. | | China mainland |

| | Tantalum | | KEMET de Mexico* | | Mexico |

| | Tantalum | | Materion Newton Inc.* | | United States |

| | Conflict Mineral | | Name of Smelter or Refiner | | Location of Smelter or Refiner |

| | Tantalum | | Metallurgical Products India Pvt., Ltd.* | | India |

| | Tantalum | | Mineracao Taboca S.A. | | Brazil |

| | Tantalum | | Mitsui Mining and Smelting Co., Ltd.* | | Japan |

| | Tantalum | | Ningxia Orient Tantalum Industry Co., Ltd. | | China mainland |

| | Tantalum | | NPM Silmet AS* | | Estonia |

| | Tantalum | | QuantumClean* | | United States |

| | Tantalum | | Resind Industria e Comercio Ltda. | | Brazil |

| | Tantalum | | RFH Yancheng Jinye New Material Technology Co., Ltd. | | China mainland |

| | Tantalum | | Taki Chemical Co., Ltd.* | | Japan |

| | Tantalum | | TANIOBIS Co., Ltd.* | | Thailand |

| | Tantalum | | TANIOBIS GmbH* | | Germany |

| | Tantalum | | TANIOBIS Japan Co., Ltd. | | Japan |

| | Tantalum | | TANIOBIS Smelting GmbH & Co. KG* | | Germany |

| | Tantalum | | Telex Metals* | | United States |

| | Tantalum | | Ulba Metallurgical Plant JSC* | | Kazakhstan |

| | Tantalum | | XIMEI RESOURCES (GUANGDONG) LIMITED | | China mainland |

| | Tantalum | | XinXing HaoRong Electronic Material Co., Ltd. | | China mainland |

| | Tantalum | | Yanling Jincheng Tantalum & Niobium Co., Ltd. | | China mainland |

| | Tin | | Alpha* | | United States |

| | Tin | | Aurubis Beerse* | | Belgium |

| | Tin | | Aurubis Berango* | | Spain |

| | Tin | | Chenzhou Yunxiang Mining and Metallurgy Co., Ltd.* | | China mainland |

| | Tin | | Chifeng Dajingzi Tin Industry Co., Ltd.* | | China mainland |

| | Tin | | China Tin Group Co., Ltd.* | | China mainland |

| | Tin | | CRM Fundicao De Metais E Comercio De Equipamentos Eletronicos Do Brasil Ltda* | | Brazil |

| | Tin | | CRM Synergies* | | Spain |

| | Tin | | CV Ayi Jaya | | Indonesia |

| | Tin | | CV Venus Inti Perkasa | | Indonesia |

| | Tin | | Dowa* | | Japan |

| | Conflict Mineral | | Name of Smelter or Refiner | | Location of Smelter or Refiner |

| | Tin | | DS Myanmar | | Myanmar (Burma) |

| | Tin | | EM Vinto | | Bolivia |

| | Tin | | Estanho de Rondonia S.A. | | Brazil |

| | Tin | | Fabrica Auricchio Industria e Comercio Ltda. | | Brazil |

| | Tin | | Fenix Metals* | | Poland |

| | Tin | | Gejiu Non-Ferrous Metal Processing Co., Ltd. | | China mainland |

| | Tin | | Guangdong Hanhe Non-Ferrous Metal Co., Ltd.* | | China mainland |

| | Tin | | HuiChang Hill Tin Industry Co., Ltd. | | China mainland |

| | Tin | | Jiangxi New Nanshan Technology Ltd.* | | China mainland |

| | Tin | | Luna Smelter, Ltd. | | Rwanda |

| | Tin | | Magnu's Minerais Metais e Ligas Ltda.* | | Brazil |

| | Tin | | Malaysia Smelting Corporation (MSC)* | | Malaysia |

| | Tin | | Metallic Resources, Inc.* | | United States |

| | Tin | | Mineracao Taboca S.A. | | Brazil |

| | Tin | | Minsur | | Peru |

| | Tin | | Mitsubishi Materials Corporation* | | Japan |

| | Tin | | O.M. Manufacturing (Thailand) Co., Ltd.* | | Thailand |

| | Tin | | O.M. Manufacturing Philippines, Inc.* | | Philippines |

| | Tin | | Operaciones Metalurgicas S.A. | | Bolivia |

| | Tin | | PT Aries Kencana Sejahtera | | Indonesia |

| | Tin | | PT Artha Cipta Langgeng | | Indonesia |

| | Tin | | PT ATD Makmur Mandiri Jaya | | Indonesia |

| | Tin | | PT Babel Inti Perkasa | | Indonesia |

| | Tin | | PT Babel Surya Alam Lestari | | Indonesia |

| | Tin | | PT Bangka Prima Tin | | Indonesia |

| | Tin | | PT Bangka Serumpun | | Indonesia |

| | Tin | | PT Bukit Timah | | Indonesia |

| | Tin | | PT Cipta Persada Mulia | | Indonesia |

| | Tin | | PT Menara Cipta Mulia | | Indonesia |

| | Tin | | PT Mitra Stania Prima | | Indonesia |

| | Tin | | PT Mitra Sukses Globalindo | | Indonesia |

| | Conflict Mineral | | Name of Smelter or Refiner | | Location of Smelter or Refiner |

| | Tin | | PT Premium Tin Indonesia | | Indonesia |

| | Tin | | PT Prima Timah Utama | | Indonesia |

| | Tin | | PT Putera Sarana Shakti (PT PSS) | | Indonesia |

| | Tin | | PT Rajawali Rimba Perkasa | | Indonesia |

| | Tin | | PT Rajehan Ariq | | Indonesia |

| | Tin | | PT Refined Bangka Tin | | Indonesia |

| | Tin | | PT Sariwiguna Binasentosa | | Indonesia |

| | Tin | | PT Stanindo Inti Perkasa | | Indonesia |

| | Tin | | PT Sukses Inti Makmur (SIM) | | Indonesia |

| | Tin | | PT Timah Nusantara | | Indonesia |

| | Tin | | PT Timah Tbk Kundur | | Indonesia |

| | Tin | | PT Timah Tbk Mentok | | Indonesia |

| | Tin | | PT Tinindo Inter Nusa | | Indonesia |

| | Tin | | PT Tommy Utama | | Indonesia |

| | Tin | | Resind Industria e Comercio Ltda. | | Brazil |

| | Tin | | Rui Da Hung* | | Taiwan |

| | Tin | | Super Ligas | | Brazil |

| | Tin | | Thaisarco* | | Thailand |

| | Tin | | Tin Smelting Branch of Yunnan Tin Co., Ltd.* | | China mainland |

| | Tin | | Tin Technology & Refining* | | United States |

| | Tin | | White Solder Metalurgia e Mineracao Ltda. | | Brazil |

| | Tin | | Yunnan Chengfeng Non-ferrous Metals Co., Ltd. | | China mainland |

| | Tin | | Yunnan Yunfan Non-ferrous Metals Co., Ltd. | | China mainland |

| | Tungsten | | A.L.M.T. Corp.* | | Japan |

| | Tungsten | | Asia Tungsten Products Vietnam Ltd.* | | Vietnam |

| | Tungsten | | China Molybdenum Tungsten Co., Ltd. | | China mainland |

| | Tungsten | | Chongyi Zhangyuan Tungsten Co., Ltd. | | China mainland |

| | Tungsten | | Cronimet Brasil Ltda | | Brazil |

| | Tungsten | | Fujian Xinlu Tungsten Co., Ltd. | | China mainland |

| | Tungsten | | Ganzhou Haichuang Tungsten Co., Ltd.** | | China mainland |

| | Tungsten | | Ganzhou Jiangwu Ferrotungsten Co., Ltd. | | China mainland |

| | Conflict Mineral | | Name of Smelter or Refiner | | Location of Smelter or Refiner |

| | Tungsten | | Ganzhou Seadragon W & Mo Co., Ltd. | | China mainland |

| | Tungsten | | Global Tungsten & Powders LLC | | United States |

| | Tungsten | | Guangdong Xianglu Tungsten Co., Ltd. | | China mainland |

| | Tungsten | | H.C. Starck Tungsten GmbH* | | Germany |

| | Tungsten | | Hubei Green Tungsten Co., Ltd.* | | China mainland |

| | Tungsten | | Hunan Chenzhou Mining Co., Ltd. | | China mainland |

| | Tungsten | | Hunan Shizhuyuan Nonferrous Metals Co., Ltd. Chenzhou Tungsten Products Branch | | China mainland |

| | Tungsten | | Japan New Metals Co., Ltd.* | | Japan |

| | Tungsten | | Jiangwu H.C. Starck Tungsten Products Co., Ltd. | | China mainland |

| | Tungsten | | Jiangxi Gan Bei Tungsten Co., Ltd. | | China mainland |

| | Tungsten | | Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. | | China mainland |

| | Tungsten | | Jiangxi Xinsheng Tungsten Industry Co., Ltd. | | China mainland |

| | Tungsten | | Jiangxi Yaosheng Tungsten Co., Ltd. | | China mainland |

| | Tungsten | | Kennametal Fallon | | United States |

| | Tungsten | | Kennametal Huntsville* | | United States |

| | Tungsten | | Lianyou Metals Co., Ltd.* | | Taiwan |

| | Tungsten | | Malipo Haiyu Tungsten Co., Ltd. | | China mainland |

| | Tungsten | | Masan High-Tech Materials* | | Vietnam |

| | Tungsten | | Niagara Refining LLC | | United States |

| | Tungsten | | Philippine Chuangxin Industrial Co., Inc.* | | Philippines |

| | Tungsten | | TANIOBIS Smelting GmbH & Co. KG* | | Germany |

| | Tungsten | | Tungsten Vietnam Joint Stock Company* | | Vietnam |

| | Tungsten | | Wolfram Bergbau und Hutten AG* | | Austria |

| | Tungsten | | Xiamen Tungsten (H.C.) Co., Ltd. | | China mainland |

| | Tungsten | | Xiamen Tungsten Co., Ltd.* | | China mainland |

* The smelter/refiner is believed to process at least some 3TG from recycled or scrap sources.

** The smelter/refiner has changed its compliance or operational status since December 31, 2023.

*** The smelter/refiner continues to be in the process of removal as of the filing of this report and/or is no longer approved to be in Apple’s supply chain.

ANNEX II: Countries of Origin of 3TG

| Argentina | | |

| Australia | | |

| Austria | | |

| Azerbaijan | | |

| Bolivia | | |

| Botswana | | |

| Brazil | | |

| Bulgaria | | |

| Burkina Faso | Lao People’s Democratic Republic | |

| Burundi* | | |

| Canada | | |

| Chile | | |

| China | | |

| Colombia | | |

| Congo, Democratic Republic of the* | | |

| Costa Rica | | |

| Côte d’Ivoire | | |

| Dominican Republic | | |

| Ecuador | | |

| Egypt | | |

| Eswatini | | |

| Ethiopia | | |

| Finland | | |

| France | | |

| French Guiana | | |

| Georgia | | |

| Ghana | | |

* The DRC or an adjoining country.

** Gold sourcing ceased during calendar year 2022 in accordance with United States law. Minerals from this country remain in the global supply chain in accordance with applicable sanctions laws.

22