UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02105

Fidelity Salem Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Nicole Macarchuk, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | April 30 |

|

|

Date of reporting period: | October 31, 2024 |

Item 1.

Reports to Stockholders

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity Flex® Mid Cap Index Fund Fidelity Flex® Mid Cap Index Fund : FLAPX |

| | | |

This semi-annual shareholder report contains information about Fidelity Flex® Mid Cap Index Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity Flex® Mid Cap Index Fund | $ 0 A | 0.00%B | |

A Amount represents less than $.50

B Amount represents less than 0.005%

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $458,809,372 | |

| Number of Holdings | 816 | |

| Portfolio Turnover | 29% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Industrials | 17.5 | |

| Financials | 16.2 | |

| Information Technology | 12.5 | |

| Consumer Discretionary | 10.6 | |

| Health Care | 9.7 | |

| Real Estate | 7.9 | |

| Materials | 5.9 | |

| Utilities | 5.7 | |

| Energy | 5.2 | |

| Consumer Staples | 4.9 | |

| Communication Services | 3.6 | |

| |

| Common Stocks | 99.7 |

| Preferred Stocks | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 98.7 |

| Brazil | 0.5 |

| Korea (South) | 0.3 |

| Canada | 0.1 |

| Bermuda | 0.1 |

| United Kingdom | 0.1 |

| Belgium | 0.1 |

| Puerto Rico | 0.1 |

| Japan | 0.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Palantir Technologies Inc Class A | 0.8 | |

| Digital Realty Trust Inc | 0.6 | |

| Williams Cos Inc/The | 0.5 | |

| Arthur J Gallagher & Co | 0.5 | |

| AFLAC Inc | 0.5 | |

| Hilton Worldwide Holdings Inc | 0.5 | |

| ONEOK Inc | 0.5 | |

| Bank of New York Mellon Corp/The | 0.5 | |

| Simon Property Group Inc | 0.5 | |

| United Rentals Inc | 0.5 | |

| | 5.4 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915087.100 2920-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Series Large Cap Growth Index Fund Fidelity® Series Large Cap Growth Index Fund : FHOFX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Series Large Cap Growth Index Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Series Large Cap Growth Index Fund | $ 0 A | 0.00%B | |

A Amount represents less than $.50

B Amount represents less than 0.005%

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $1,488,228,107 | |

| Number of Holdings | 399 | |

| Portfolio Turnover | 43% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 48.7 | |

| Consumer Discretionary | 14.1 | |

| Communication Services | 13.1 | |

| Health Care | 7.5 | |

| Financials | 6.6 | |

| Industrials | 4.6 | |

| Consumer Staples | 3.5 | |

| Materials | 0.6 | |

| Real Estate | 0.6 | |

| Energy | 0.4 | |

| Utilities | 0.2 | |

| |

| Common Stocks | 99.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 99.7 |

| Brazil | 0.2 |

| Korea (South) | 0.1 |

| Mexico | 0.0 |

| Puerto Rico | 0.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Apple Inc | 12.0 | |

| NVIDIA Corp | 11.3 | |

| Microsoft Corp | 11.1 | |

| Amazon.com Inc | 6.4 | |

| Meta Platforms Inc Class A | 4.5 | |

| Alphabet Inc Class A | 3.7 | |

| Alphabet Inc Class C | 3.1 | |

| Broadcom Inc | 2.8 | |

| Tesla Inc | 2.6 | |

| Eli Lilly & Co | 2.5 | |

| | 60.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915091.100 3222-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Large Cap Growth Index Fund Fidelity® Large Cap Growth Index Fund : FSPGX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Large Cap Growth Index Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Large Cap Growth Index Fund | $ 2 | 0.03% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $28,433,616,039 | |

| Number of Holdings | 399 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 48.5 | |

| Consumer Discretionary | 14.1 | |

| Communication Services | 13.1 | |

| Health Care | 7.5 | |

| Financials | 6.6 | |

| Industrials | 4.6 | |

| Consumer Staples | 3.5 | |

| Materials | 0.6 | |

| Real Estate | 0.6 | |

| Energy | 0.4 | |

| Utilities | 0.2 | |

| |

| Common Stocks | 99.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 99.7 |

| Brazil | 0.2 |

| Korea (South) | 0.1 |

| Mexico | 0.0 |

| Puerto Rico | 0.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Apple Inc | 12.0 | |

| NVIDIA Corp | 11.3 | |

| Microsoft Corp | 11.1 | |

| Amazon.com Inc | 6.4 | |

| Meta Platforms Inc Class A | 4.5 | |

| Alphabet Inc Class A | 3.7 | |

| Alphabet Inc Class C | 3.0 | |

| Broadcom Inc | 2.8 | |

| Tesla Inc | 2.6 | |

| Eli Lilly & Co | 2.5 | |

| | 59.9 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915084.100 2826-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity Flex® Small Cap Index Fund Fidelity Flex® Small Cap Index Fund : FLXSX |

| | | |

This semi-annual shareholder report contains information about Fidelity Flex® Small Cap Index Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity Flex® Small Cap Index Fund | $ 0 A | 0.00%B | |

A Amount represents less than $.50

B Amount represents less than 0.005%

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $423,819,778 | |

| Number of Holdings | 1,982 | |

| Portfolio Turnover | 15% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 18.6 | |

| Health Care | 17.2 | |

| Industrials | 17.0 | |

| Information Technology | 12.6 | |

| Consumer Discretionary | 9.7 | |

| Real Estate | 6.3 | |

| Energy | 5.1 | |

| Materials | 4.6 | |

| Utilities | 2.9 | |

| Consumer Staples | 2.7 | |

| Communication Services | 2.6 | |

| |

| Common Stocks | 99.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.7 |

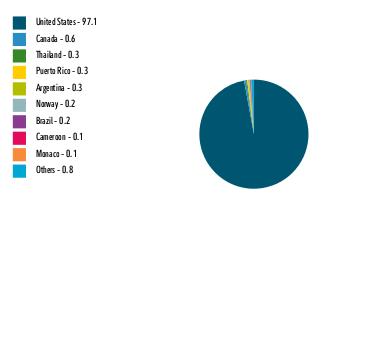

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 97.1 |

| Canada | 0.6 |

| Thailand | 0.3 |

| Puerto Rico | 0.3 |

| Argentina | 0.3 |

| Norway | 0.2 |

| Brazil | 0.2 |

| Cameroon | 0.1 |

| Monaco | 0.1 |

| Others | 0.8 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| FTAI Aviation Ltd | 0.6 | |

| Vaxcyte Inc | 0.6 | |

| Sprouts Farmers Market Inc | 0.5 | |

| Insmed Inc | 0.5 | |

| Mueller Industries Inc | 0.4 | |

| Fluor Corp | 0.4 | |

| Applied Industrial Technologies Inc | 0.4 | |

| Ensign Group Inc/The | 0.4 | |

| REVOLUTION Medicines Inc | 0.4 | |

| Jackson Financial Inc | 0.4 | |

| | 4.6 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915088.100 2921-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Large Cap Value Index Fund Fidelity® Large Cap Value Index Fund : FLCOX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Large Cap Value Index Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Large Cap Value Index Fund | $ 2 | 0.03% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $9,285,824,297 | |

| Number of Holdings | 876 | |

| Portfolio Turnover | 27% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 22.0 | |

| Health Care | 14.9 | |

| Industrials | 14.7 | |

| Information Technology | 9.0 | |

| Consumer Staples | 7.8 | |

| Energy | 6.8 | |

| Consumer Discretionary | 6.1 | |

| Real Estate | 4.8 | |

| Utilities | 4.8 | |

| Materials | 4.5 | |

| Communication Services | 4.3 | |

| |

| Common Stocks | 99.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 99.8 |

| Canada | 0.1 |

| Bermuda | 0.1 |

| United Kingdom | 0.0 |

| Belgium | 0.0 |

| Brazil | 0.0 |

| Puerto Rico | 0.0 |

| Japan | 0.0 |

| Luxembourg | 0.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Berkshire Hathaway Inc Class B | 3.4 | |

| JPMorgan Chase & Co | 2.6 | |

| Exxon Mobil Corp | 2.2 | |

| UnitedHealth Group Inc | 2.0 | |

| Johnson & Johnson | 1.6 | |

| Walmart Inc | 1.5 | |

| Procter & Gamble Co/The | 1.3 | |

| Bank of America Corp | 1.2 | |

| Chevron Corp | 1.1 | |

| Wells Fargo & Co | 1.0 | |

| | 17.9 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915085.100 2830-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Small Cap Index Fund Fidelity® Small Cap Index Fund : FSSNX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Small Cap Index Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Small Cap Index Fund | $ 1 | 0.02% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $26,857,343,200 | |

| Number of Holdings | 1,983 | |

| Portfolio Turnover | 19% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 18.7 | |

| Health Care | 17.4 | |

| Industrials | 17.1 | |

| Information Technology | 12.7 | |

| Consumer Discretionary | 9.7 | |

| Real Estate | 6.3 | |

| Energy | 5.2 | |

| Materials | 4.6 | |

| Utilities | 2.9 | |

| Consumer Staples | 2.7 | |

| Communication Services | 2.6 | |

| |

| Common Stocks | 99.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.1 |

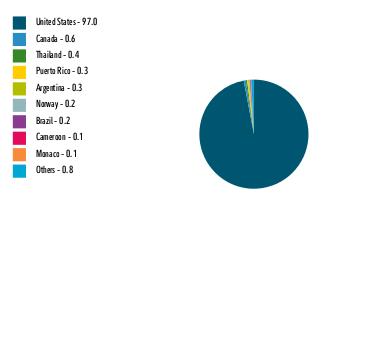

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 97.0 |

| Canada | 0.6 |

| Thailand | 0.4 |

| Puerto Rico | 0.3 |

| Argentina | 0.3 |

| Norway | 0.2 |

| Brazil | 0.2 |

| Cameroon | 0.1 |

| Monaco | 0.1 |

| Others | 0.8 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| FTAI Aviation Ltd | 0.6 | |

| Sprouts Farmers Market Inc | 0.6 | |

| Vaxcyte Inc | 0.6 | |

| Insmed Inc | 0.5 | |

| Mueller Industries Inc | 0.4 | |

| Fluor Corp | 0.4 | |

| Applied Industrial Technologies Inc | 0.4 | |

| Fabrinet | 0.4 | |

| Ensign Group Inc/The | 0.4 | |

| REVOLUTION Medicines Inc | 0.4 | |

| | 4.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915076.100 2358-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Mid Cap Index Fund Fidelity® Mid Cap Index Fund : FSMDX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Mid Cap Index Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Mid Cap Index Fund | $ 1 | 0.02% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $36,339,516,503 | |

| Number of Holdings | 814 | |

| Portfolio Turnover | 28% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Industrials | 17.6 | |

| Financials | 16.2 | |

| Information Technology | 12.5 | |

| Consumer Discretionary | 10.6 | |

| Health Care | 9.7 | |

| Real Estate | 7.9 | |

| Materials | 5.9 | |

| Utilities | 5.7 | |

| Energy | 5.2 | |

| Consumer Staples | 4.9 | |

| Communication Services | 3.5 | |

| |

| Common Stocks | 99.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 98.8 |

| Brazil | 0.5 |

| Korea (South) | 0.3 |

| Canada | 0.1 |

| Bermuda | 0.1 |

| United Kingdom | 0.1 |

| Belgium | 0.1 |

| Puerto Rico | 0.0 |

| Japan | 0.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Palantir Technologies Inc Class A | 0.8 | |

| Digital Realty Trust Inc | 0.6 | |

| Bank of New York Mellon Corp/The | 0.6 | |

| Williams Cos Inc/The | 0.5 | |

| Arthur J Gallagher & Co | 0.5 | |

| AFLAC Inc | 0.5 | |

| Hilton Worldwide Holdings Inc | 0.5 | |

| ONEOK Inc | 0.5 | |

| Simon Property Group Inc | 0.5 | |

| United Rentals Inc | 0.5 | |

| | 5.5 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915075.100 2352-TSRS-1224 |

Item 2.

Code of Ethics

Not applicable.

Item 3.

Audit Committee Financial Expert

Not applicable.

Item 4.

Principal Accountant Fees and Services

Not applicable.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable

Item 7.

Financial Statements and Financial Highlights for Open-End Management Investment Companies

Fidelity® Mid Cap Index Fund

Fidelity® Small Cap Index Fund

Semi-Annual Report

October 31, 2024

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

A fund is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). The LSE Group does not accept any liability whatsoever to any person arising out of the use of a fund or the underlying data.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2024 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies (Semi-Annual Report)

Fidelity® Mid Cap Index Fund

Schedule of Investments October 31, 2024 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 99.7% |

| | | Shares | Value ($) |

| COMMUNICATION SERVICES - 3.5% | | | |

| Diversified Telecommunication Services - 0.2% | | | |

| Frontier Communications Parent, Inc. (a) | | 770,258 | 27,521,318 |

| Iridium Communications, Inc. | | 246,223 | 7,221,721 |

| Liberty Global Ltd.: | | | |

| Class A | | 638,322 | 12,645,159 |

| Class C | | 464,748 | 9,583,104 |

| | | | 56,971,302 |

| Entertainment - 1.5% | | | |

| Electronic Arts, Inc. | | 829,607 | 125,146,216 |

| Liberty Media Corp. Liberty Formula One: | | | |

| Class A (a) | | 80,198 | 5,953,900 |

| Class C (a) | | 631,427 | 50,413,132 |

| Liberty Media Corp. Liberty Live: | | | |

| Class C (a) | | 144,313 | 8,422,107 |

| Series A (a) | | 63,256 | 3,589,145 |

| Live Nation Entertainment, Inc. (a) | | 489,905 | 57,387,472 |

| Madison Square Garden Sports Corp. (a) | | 57,660 | 12,840,882 |

| Playtika Holding Corp. | | 250,756 | 1,963,419 |

| Roblox Corp. Class A (a) | | 1,599,699 | 82,736,432 |

| Roku, Inc. Class A (a) | | 401,450 | 25,724,916 |

| Take-Two Interactive Software, Inc. (a) | | 534,913 | 86,506,130 |

| TKO Group Holdings, Inc. (a) | | 244,712 | 28,575,020 |

| Warner Bros Discovery, Inc. (a) | | 7,687,805 | 62,501,855 |

| | | | 551,760,626 |

| Interactive Media & Services - 0.3% | | | |

| IAC, Inc. Class A (a) | | 264,488 | 12,682,200 |

| Match Group, Inc. (a) | | 697,955 | 25,147,319 |

| Pinterest, Inc. Class A (a) | | 1,890,225 | 60,090,253 |

| TripAdvisor, Inc. Class A (a) | | 181,261 | 2,907,426 |

| Trump Media & Technology Group (a)(b) | | 181,064 | 6,398,802 |

| Zoominfo Technologies, Inc. (a) | | 705,176 | 7,792,195 |

| | | | 115,018,195 |

| Media - 1.5% | | | |

| Charter Communications, Inc. Class A (a) | | 291,894 | 95,627,393 |

| Fox Corp.: | | | |

| Class A | | 691,077 | 29,025,234 |

| Class B | | 433,347 | 16,883,199 |

| Interpublic Group of Companies, Inc. | | 1,168,861 | 34,364,513 |

| Liberty Broadband Corp.: | | | |

| Class A (a) | | 46,942 | 3,766,157 |

| Class C (a) | | 350,218 | 28,304,619 |

| News Corp.: | | | |

| Class A | | 1,173,625 | 31,981,281 |

| Class B | | 359,208 | 10,431,400 |

| Nexstar Media Group, Inc. | | 98,275 | 17,288,538 |

| Omnicom Group, Inc. | | 600,477 | 60,648,177 |

| Paramount Global: | | | |

| Class A (b) | | 34,724 | 760,108 |

| Class B (b) | | 1,901,805 | 20,805,747 |

| Sirius XM Holdings, Inc. | | 772,555 | 20,596,316 |

| The New York Times Co. Class A | | 498,628 | 27,843,388 |

| The Trade Desk, Inc. Class A (a) | | 1,371,114 | 164,821,614 |

| | | | 563,147,684 |

TOTAL COMMUNICATION SERVICES | | | 1,286,897,807 |

| CONSUMER DISCRETIONARY - 10.6% | | | |

| Automobile Components - 0.3% | | | |

| Aptiv PLC (a) | | 844,675 | 48,002,880 |

| BorgWarner, Inc. | | 733,327 | 24,661,787 |

| Gentex Corp. | | 719,339 | 21,803,165 |

| Lear Corp. | | 188,501 | 18,050,856 |

| QuantumScape Corp. Class A (a)(b) | | 771,487 | 3,973,158 |

| | | | 116,491,846 |

| Automobiles - 0.2% | | | |

| Harley-Davidson, Inc. | | 399,604 | 12,767,348 |

| Lucid Group, Inc. Class A (a)(b) | | 3,428,307 | 7,576,558 |

| Rivian Automotive, Inc. Class A (a)(b) | | 2,202,041 | 22,240,614 |

| Thor Industries, Inc. | | 168,175 | 17,503,654 |

| | | | 60,088,174 |

| Broadline Retail - 0.7% | | | |

| Coupang, Inc. Class A (a) | | 3,592,847 | 92,659,524 |

| Dillard's, Inc. Class A (b) | | 10,430 | 3,874,954 |

| eBay, Inc. | | 1,570,070 | 90,294,726 |

| Etsy, Inc. (a) | | 286,842 | 14,755,152 |

| Kohl's Corp. | | 403,576 | 7,458,084 |

| Macy's, Inc. | | 891,439 | 13,674,674 |

| Nordstrom, Inc. | | 319,829 | 7,231,334 |

| Ollie's Bargain Outlet Holdings, Inc. (a) | | 192,067 | 17,637,513 |

| | | | 247,585,961 |

| Distributors - 0.4% | | | |

| Genuine Parts Co. | | 434,450 | 49,831,415 |

| LKQ Corp. | | 849,499 | 31,253,068 |

| Pool Corp. | | 117,086 | 42,342,981 |

| | | | 123,427,464 |

| Diversified Consumer Services - 0.4% | | | |

| ADT, Inc. | | 901,034 | 6,487,445 |

| Bright Horizons Family Solutions, Inc. (a) | | 178,819 | 23,866,972 |

| Duolingo, Inc. Class A (a) | | 114,613 | 33,578,171 |

| Grand Canyon Education, Inc. (a) | | 90,731 | 12,440,127 |

| H&R Block, Inc. | | 430,572 | 25,718,066 |

| Service Corp. International | | 442,542 | 36,133,554 |

| | | | 138,224,335 |

| Hotels, Restaurants & Leisure - 3.4% | | | |

| Aramark | | 812,160 | 30,724,013 |

| Boyd Gaming Corp. | | 213,089 | 14,764,937 |

| Caesars Entertainment, Inc. (a) | | 667,096 | 26,717,195 |

| Carnival Corp. (a) | | 3,107,593 | 68,367,046 |

| Cava Group, Inc. (a) | | 234,007 | 31,253,975 |

| Choice Hotels International, Inc. (b) | | 86,613 | 12,083,380 |

| Churchill Downs, Inc. | | 216,162 | 30,284,296 |

| Darden Restaurants, Inc. | | 369,307 | 59,096,506 |

| Domino's Pizza, Inc. | | 107,878 | 44,632,365 |

| Draftkings Holdings, Inc. Class A (a) | | 1,421,491 | 50,207,062 |

| Dutch Bros, Inc. Class A (a) | | 346,849 | 11,487,639 |

| Expedia Group, Inc. Class A (a) | | 392,298 | 61,320,100 |

| Hilton Worldwide Holdings, Inc. | | 762,217 | 179,006,662 |

| Hyatt Hotels Corp. Class A | | 135,867 | 19,761,855 |

| Las Vegas Sands Corp. | | 1,098,361 | 56,950,018 |

| Light & Wonder, Inc. Class A (a) | | 280,535 | 26,308,572 |

| Marriott Vacations Worldwide Corp. | | 68,586 | 5,283,180 |

| MGM Resorts International (a) | | 737,787 | 27,202,207 |

| Norwegian Cruise Line Holdings Ltd. (a) | | 1,203,842 | 30,505,356 |

| Penn Entertainment, Inc. (a) | | 467,234 | 9,227,872 |

| Planet Fitness, Inc. (a) | | 270,057 | 21,204,876 |

| Royal Caribbean Cruises Ltd. | | 735,454 | 151,760,933 |

| Texas Roadhouse, Inc. | | 206,802 | 39,523,998 |

| Travel+Leisure Co. | | 213,033 | 10,185,108 |

| Vail Resorts, Inc. | | 122,070 | 20,225,778 |

| Wendy's Co. | | 571,186 | 10,915,364 |

| Wingstop, Inc. | | 91,026 | 26,187,270 |

| Wyndham Hotels & Resorts, Inc. | | 238,582 | 21,071,562 |

| Wynn Resorts Ltd. | | 318,581 | 30,590,148 |

| Yum! Brands, Inc. | | 874,171 | 114,656,268 |

| | | | 1,241,505,541 |

| Household Durables - 2.0% | | | |

| D.R. Horton, Inc. | | 921,113 | 155,668,097 |

| Garmin Ltd. | | 480,365 | 95,280,398 |

| Leggett & Platt, Inc. | | 236,803 | 2,841,636 |

| Lennar Corp.: | | | |

| Class A | | 737,348 | 125,570,364 |

| Class B | | 39,686 | 6,362,460 |

| Mohawk Industries, Inc. (a) | | 140,026 | 18,801,291 |

| Newell Brands, Inc. | | 1,363,338 | 11,997,374 |

| NVR, Inc. (a) | | 8,914 | 81,588,148 |

| PulteGroup, Inc. | | 641,413 | 83,082,226 |

| SharkNinja, Inc. | | 205,273 | 18,928,223 |

| Tempur Sealy International, Inc. | | 531,855 | 25,481,173 |

| Toll Brothers, Inc. | | 320,529 | 46,938,267 |

| TopBuild Corp. (a) | | 101,166 | 35,750,041 |

| Whirlpool Corp. | | 176,201 | 18,238,566 |

| | | | 726,528,264 |

| Leisure Products - 0.2% | | | |

| Brunswick Corp. | | 226,563 | 18,066,134 |

| Hasbro, Inc. | | 432,521 | 28,386,353 |

| Mattel, Inc. (a) | | 1,067,618 | 21,758,055 |

| Polaris, Inc. | | 177,828 | 12,431,955 |

| YETI Holdings, Inc. (a) | | 161,320 | 5,680,077 |

| | | | 86,322,574 |

| Specialty Retail - 2.3% | | | |

| Advance Auto Parts, Inc. | | 208,337 | 7,435,548 |

| AutoNation, Inc. (a) | | 80,910 | 12,579,078 |

| Bath & Body Works, Inc. | | 596,115 | 16,917,744 |

| Best Buy Co., Inc. | | 668,732 | 60,473,435 |

| Burlington Stores, Inc. (a) | | 196,721 | 48,741,562 |

| CarMax, Inc. (a) | | 500,201 | 36,204,548 |

| Carvana Co. Class A (a) | | 335,664 | 83,013,064 |

| Dick's Sporting Goods, Inc. | | 173,692 | 34,000,209 |

| Five Below, Inc. (a) | | 176,581 | 16,738,113 |

| Floor & Decor Holdings, Inc. Class A (a) | | 330,859 | 34,095,020 |

| GameStop Corp. Class A (a)(b) | | 1,168,009 | 25,906,440 |

| Gap, Inc. | | 636,595 | 13,222,078 |

| Lithia Motors, Inc. Class A (sub. vtg.) | | 85,933 | 28,561,551 |

| Murphy U.S.A., Inc. | | 57,494 | 28,082,944 |

| Penske Automotive Group, Inc. | | 57,473 | 8,653,710 |

| RH (a) | | 48,311 | 15,365,314 |

| Ross Stores, Inc. | | 1,020,656 | 142,606,056 |

| Tractor Supply Co. | | 334,609 | 88,842,036 |

| Ulta Beauty, Inc. (a) | | 149,567 | 55,187,232 |

| Valvoline, Inc. (a) | | 402,430 | 16,209,880 |

| Wayfair LLC Class A (a)(b) | | 219,988 | 9,422,086 |

| Williams-Sonoma, Inc. | | 395,555 | 53,055,792 |

| | | | 835,313,440 |

| Textiles, Apparel & Luxury Goods - 0.7% | | | |

| Amer Sports, Inc. | | 189,553 | 3,383,521 |

| Birkenstock Holding PLC (a) | | 127,308 | 5,856,168 |

| Capri Holdings Ltd. (a) | | 182,513 | 3,602,807 |

| Carter's, Inc. | | 122,161 | 6,682,207 |

| Columbia Sportswear Co. (b) | | 103,972 | 8,366,627 |

| Crocs, Inc. (a) | | 185,598 | 20,011,176 |

| Deckers Outdoor Corp. (a) | | 470,508 | 75,700,032 |

| PVH Corp. | | 178,638 | 17,588,697 |

| Ralph Lauren Corp. Class A | | 124,714 | 24,684,642 |

| Skechers U.S.A., Inc. Class A (sub. vtg.) (a) | | 410,451 | 25,226,318 |

| Tapestry, Inc. | | 711,244 | 33,748,528 |

| Under Armour, Inc.: | | | |

| Class A (sub. vtg.) (a) | | 470,032 | 4,018,774 |

| Class C (non-vtg.) (a) | | 819,266 | 6,472,201 |

| VF Corp. | | 1,107,034 | 22,926,674 |

| | | | 258,268,372 |

TOTAL CONSUMER DISCRETIONARY | | | 3,833,755,971 |

| CONSUMER STAPLES - 4.9% | | | |

| Beverages - 0.3% | | | |

| Boston Beer Co., Inc. Class A (a) | | 29,667 | 8,635,174 |

| Brown-Forman Corp.: | | | |

| Class A | | 186,501 | 8,127,714 |

| Class B (non-vtg.) | | 514,062 | 22,634,150 |

| Celsius Holdings, Inc. (a)(b) | | 563,075 | 16,937,296 |

| Coca-Cola Consolidated, Inc. | | 18,719 | 21,045,023 |

| Molson Coors Beverage Co. Class B | | 542,892 | 29,571,327 |

| | | | 106,950,684 |

| Consumer Staples Distribution & Retail - 1.6% | | | |

| Albertsons Companies, Inc. | | 1,296,124 | 23,459,844 |

| BJ's Wholesale Club Holdings, Inc. (a) | | 409,124 | 34,665,077 |

| Casey's General Stores, Inc. | | 114,797 | 45,232,314 |

| Dollar General Corp. | | 694,213 | 55,564,809 |

| Dollar Tree, Inc. (a) | | 570,403 | 36,870,850 |

| Grocery Outlet Holding Corp. (a) | | 348,300 | 4,980,690 |

| Kroger Co. | | 2,058,236 | 114,787,822 |

| Maplebear, Inc. (NASDAQ) (a) | | 542,709 | 23,933,467 |

| Performance Food Group Co. (a) | | 474,088 | 38,519,650 |

| Sysco Corp. | | 1,545,389 | 115,826,906 |

| U.S. Foods Holding Corp. (a) | | 710,475 | 43,800,784 |

| Walgreens Boots Alliance, Inc. | | 2,409,348 | 22,792,432 |

| | | | 560,434,645 |

| Food Products - 2.1% | | | |

| Archer Daniels Midland Co. | | 1,484,419 | 81,954,773 |

| Bunge Global SA | | 437,976 | 36,798,744 |

| Campbell Soup Co. | | 595,737 | 27,791,131 |

| Conagra Brands, Inc. | | 1,491,350 | 43,159,669 |

| Darling Ingredients, Inc. (a) | | 509,694 | 19,934,132 |

| Flowers Foods, Inc. | | 581,674 | 12,930,613 |

| Freshpet, Inc. (a) | | 144,359 | 19,133,342 |

| General Mills, Inc. | | 1,732,249 | 117,827,577 |

| Hormel Foods Corp. | | 779,795 | 23,822,737 |

| Ingredion, Inc. | | 203,226 | 26,980,284 |

| Kellanova | | 813,238 | 65,587,645 |

| Lamb Weston Holdings, Inc. | | 454,644 | 35,321,292 |

| McCormick & Co., Inc. (non-vtg.) | | 781,513 | 61,145,577 |

| Pilgrim's Pride Corp. (a) | | 127,919 | 6,196,396 |

| Post Holdings, Inc. (a) | | 153,196 | 16,730,535 |

| Seaboard Corp. | | 844 | 2,334,512 |

| The Hershey Co. | | 451,854 | 80,240,233 |

| The J.M. Smucker Co. | | 321,801 | 36,527,632 |

| Tyson Foods, Inc. Class A | | 872,498 | 51,119,658 |

| | | | 765,536,482 |

| Household Products - 0.4% | | | |

| Church & Dwight Co., Inc. | | 756,815 | 75,613,387 |

| Reynolds Consumer Products, Inc. | | 168,614 | 4,544,147 |

| Spectrum Brands Holdings, Inc. | | 89,582 | 8,028,339 |

| The Clorox Co. | | 385,144 | 61,064,581 |

| | | | 149,250,454 |

| Personal Care Products - 0.5% | | | |

| BellRing Brands, Inc. (a) | | 404,316 | 26,616,122 |

| Coty, Inc. Class A (a) | | 854,212 | 6,355,337 |

| elf Beauty, Inc. (a) | | 171,186 | 18,017,327 |

| Kenvue, Inc. | | 5,966,186 | 136,804,645 |

| | | | 187,793,431 |

TOTAL CONSUMER STAPLES | | | 1,769,965,696 |

| ENERGY - 5.2% | | | |

| Energy Equipment & Services - 0.7% | | | |

| Baker Hughes Co. Class A | | 3,096,738 | 117,923,783 |

| Halliburton Co. | | 2,735,193 | 75,874,254 |

| NOV, Inc. | | 1,221,261 | 18,941,758 |

| TechnipFMC PLC | | 1,330,630 | 35,514,515 |

| Weatherford International PLC | | 223,931 | 17,690,549 |

| | | | 265,944,859 |

| Oil, Gas & Consumable Fuels - 4.5% | | | |

| Antero Midstream GP LP | | 1,051,266 | 15,106,692 |

| Antero Resources Corp. (a) | | 900,060 | 23,293,553 |

| APA Corp. | | 1,122,340 | 26,487,224 |

| Cheniere Energy, Inc. | | 712,445 | 136,347,724 |

| Chord Energy Corp. | | 191,724 | 23,984,672 |

| Civitas Resources, Inc. | | 325,158 | 15,864,459 |

| Coterra Energy, Inc. | | 2,301,279 | 55,046,594 |

| Devon Energy Corp. | | 1,952,134 | 75,508,543 |

| Diamondback Energy, Inc. | | 585,102 | 103,428,481 |

| DT Midstream, Inc. | | 301,183 | 27,151,647 |

| EQT Corp. | | 1,828,375 | 66,808,823 |

| Expand Energy Corp. | | 702,147 | 59,485,894 |

| Hess Corp. | | 866,673 | 116,550,185 |

| HF Sinclair Corp. | | 489,985 | 18,918,321 |

| Kinder Morgan, Inc. | | 6,014,210 | 147,408,287 |

| Marathon Oil Corp. | | 1,734,705 | 48,051,329 |

| Matador Resources Co. | | 364,754 | 19,007,331 |

| New Fortress Energy, Inc. Class A (b) | | 260,726 | 2,192,706 |

| ONEOK, Inc. | | 1,810,272 | 175,379,151 |

| Ovintiv, Inc. | | 816,998 | 32,026,322 |

| Permian Resource Corp. Class A | | 2,030,427 | 27,674,720 |

| Range Resources Corp. | | 735,613 | 22,090,458 |

| Targa Resources Corp. | | 681,656 | 113,809,286 |

| Texas Pacific Land Corp. | | 58,250 | 67,919,500 |

| The Williams Companies, Inc. | | 3,775,650 | 197,730,791 |

| Viper Energy, Inc. Class A | | 314,217 | 16,307,862 |

| | | | 1,633,580,555 |

TOTAL ENERGY | | | 1,899,525,414 |

| FINANCIALS - 16.2% | | | |

| Banks - 2.9% | | | |

| Bank OZK | | 360,900 | 15,789,375 |

| BOK Financial Corp. | | 70,358 | 7,474,130 |

| Citizens Financial Group, Inc. | | 1,400,729 | 58,998,705 |

| Columbia Banking Systems, Inc. | | 686,563 | 19,573,911 |

| Comerica, Inc. | | 420,272 | 26,775,529 |

| Commerce Bancshares, Inc. | | 369,495 | 23,093,438 |

| Cullen/Frost Bankers, Inc. | | 182,398 | 23,228,385 |

| East West Bancorp, Inc. | | 427,894 | 41,715,386 |

| Fifth Third Bancorp | | 2,118,324 | 92,528,392 |

| First Citizens Bancshares, Inc. | | 37,165 | 72,001,613 |

| First Hawaiian, Inc. | | 407,258 | 10,075,563 |

| First Horizon National Corp. | | 1,707,218 | 29,586,088 |

| FNB Corp., Pennsylvania | | 1,114,534 | 16,160,743 |

| Huntington Bancshares, Inc. | | 4,478,569 | 69,820,891 |

| KeyCorp | | 2,659,621 | 45,878,462 |

| M&T Bank Corp. | | 515,511 | 100,359,681 |

| Nu Holdings Ltd. Class A (a) | | 9,871,725 | 148,964,330 |

| Pinnacle Financial Partners, Inc. | | 235,067 | 24,787,815 |

| Popular, Inc. | | 221,208 | 19,738,390 |

| Prosperity Bancshares, Inc. | | 278,234 | 20,366,729 |

| Regions Financial Corp. | | 2,849,882 | 68,026,683 |

| Synovus Financial Corp. | | 446,635 | 22,273,687 |

| TFS Financial Corp. | | 183,832 | 2,362,241 |

| Webster Financial Corp. | | 543,433 | 28,149,829 |

| Western Alliance Bancorp. | | 332,984 | 27,707,599 |

| Wintrust Financial Corp. | | 201,242 | 23,321,935 |

| Zions Bancorporation NA | | 448,529 | 23,350,420 |

| | | | 1,062,109,950 |

| Capital Markets - 5.0% | | | |

| Affiliated Managers Group, Inc. | | 97,280 | 18,862,592 |

| Ameriprise Financial, Inc. | | 310,840 | 158,621,652 |

| Ares Management Corp. Class A, | | 567,706 | 95,192,942 |

| Bank of New York Mellon Corp. | | 2,292,726 | 172,779,831 |

| Blue Owl Capital, Inc. Class A | | 1,556,131 | 34,795,089 |

| Carlyle Group LP | | 680,517 | 34,046,266 |

| Cboe Global Markets, Inc. | | 327,219 | 69,884,162 |

| Coinbase Global, Inc. Class A (a) | | 614,210 | 110,097,143 |

| Evercore, Inc. Class A | | 111,247 | 29,388,120 |

| FactSet Research Systems, Inc. | | 117,964 | 53,562,734 |

| Franklin Resources, Inc. | | 945,575 | 19,639,593 |

| Houlihan Lokey Class A | | 162,579 | 28,088,774 |

| Interactive Brokers Group, Inc. | | 327,390 | 49,953,166 |

| Invesco Ltd. | | 928,681 | 16,103,329 |

| Janus Henderson Group PLC | | 400,842 | 16,558,783 |

| Jefferies Financial Group, Inc. | | 541,377 | 34,637,300 |

| Lazard, Inc. Class A | | 339,473 | 17,988,674 |

| LPL Financial | | 230,915 | 65,159,595 |

| MarketAxess Holdings, Inc. | | 114,567 | 33,157,981 |

| Morningstar, Inc. | | 82,785 | 27,157,619 |

| MSCI, Inc. | | 238,358 | 136,150,090 |

| NASDAQ, Inc. | | 1,277,791 | 94,454,311 |

| Northern Trust Corp. | | 618,322 | 62,153,727 |

| Raymond James Financial, Inc. | | 586,531 | 86,935,625 |

| Robinhood Markets, Inc. (a) | | 2,060,002 | 48,389,447 |

| SEI Investments Co. | | 309,912 | 23,169,021 |

| State Street Corp. | | 934,984 | 86,766,515 |

| Stifel Financial Corp. | | 307,888 | 31,903,355 |

| T. Rowe Price Group, Inc. | | 680,508 | 74,760,609 |

| TPG, Inc. Class A | | 260,591 | 17,636,799 |

| Tradeweb Markets, Inc. Class A | | 360,036 | 45,724,572 |

| Virtu Financial, Inc. Class A | | 251,813 | 7,796,130 |

| XP, Inc. Class A | | 1,293,669 | 22,587,461 |

| | | | 1,824,103,007 |

| Consumer Finance - 0.8% | | | |

| Ally Financial, Inc. | | 853,413 | 29,912,126 |

| Credit Acceptance Corp. (a)(b) | | 19,601 | 8,330,425 |

| Discover Financial Services | | 775,725 | 115,140,862 |

| OneMain Holdings, Inc. | | 359,550 | 17,858,849 |

| SLM Corp. | | 669,697 | 14,753,425 |

| SoFi Technologies, Inc. Class A (a)(b) | | 3,260,498 | 36,419,763 |

| Synchrony Financial | | 1,224,288 | 67,507,240 |

| | | | 289,922,690 |

| Financial Services - 2.0% | | | |

| Affirm Holdings, Inc. Class A, (a) | | 727,797 | 31,913,898 |

| Block, Inc. Class A (a) | | 1,731,179 | 125,198,865 |

| Corebridge Financial, Inc. | | 792,883 | 25,189,893 |

| Corpay, Inc. (a) | | 211,828 | 69,843,928 |

| Equitable Holdings, Inc. | | 1,013,381 | 45,946,695 |

| Euronet Worldwide, Inc. (a) | | 134,185 | 13,213,197 |

| Fidelity National Information Services, Inc. | | 1,743,810 | 156,472,071 |

| Global Payments, Inc. | | 793,213 | 82,264,120 |

| Jack Henry & Associates, Inc. | | 224,953 | 40,925,699 |

| MGIC Investment Corp. | | 797,836 | 19,977,813 |

| Rocket Companies, Inc. Class A (a) | | 445,502 | 7,172,582 |

| Shift4 Payments, Inc. Class A (a)(b) | | 192,500 | 17,409,700 |

| The Western Union Co. | | 1,048,607 | 11,283,011 |

| Toast, Inc. (a) | | 1,376,135 | 41,325,334 |

| UWM Holdings Corp. Class A | | 386,743 | 2,490,625 |

| Voya Financial, Inc. | | 314,410 | 25,247,123 |

| WEX, Inc. (a) | | 126,991 | 21,918,647 |

| | | | 737,793,201 |

| Insurance - 5.2% | | | |

| AFLAC, Inc. | | 1,731,109 | 181,402,912 |

| Allstate Corp. | | 814,925 | 151,999,811 |

| American Financial Group, Inc. | | 222,605 | 28,700,463 |

| Arch Capital Group Ltd. (a) | | 1,119,083 | 110,296,820 |

| Arthur J. Gallagher & Co. | | 669,595 | 188,290,114 |

| Assurant, Inc. | | 161,320 | 30,925,044 |

| Assured Guaranty Ltd. | | 161,322 | 13,463,934 |

| Axis Capital Holdings Ltd. | | 240,798 | 18,844,851 |

| Brighthouse Financial, Inc. (a) | | 209,122 | 9,891,471 |

| Brown & Brown, Inc. | | 740,837 | 77,521,184 |

| Cincinnati Financial Corp. | | 474,895 | 66,879,463 |

| CNA Financial Corp. | | 68,075 | 3,261,473 |

| Everest Re Group Ltd. | | 133,473 | 47,464,334 |

| Fidelity National Financial, Inc. | | 804,899 | 48,430,773 |

| First American Financial Corp. | | 310,047 | 19,889,515 |

| Globe Life, Inc. | | 275,508 | 29,093,645 |

| Hanover Insurance Group, Inc. | | 110,681 | 16,417,313 |

| Hartford Financial Services Group, Inc. | | 907,654 | 100,241,308 |

| Kemper Corp. | | 187,861 | 11,698,104 |

| Kinsale Capital Group, Inc. | | 68,304 | 29,241,625 |

| Lincoln National Corp. | | 527,640 | 18,335,490 |

| Loews Corp. | | 555,467 | 43,859,674 |

| Markel Group, Inc. (a) | | 39,826 | 61,412,090 |

| Old Republic International Corp. | | 770,913 | 26,927,991 |

| Primerica, Inc. | | 107,173 | 29,666,558 |

| Principal Financial Group, Inc. | | 712,694 | 58,725,986 |

| Prudential Financial, Inc. | | 1,115,109 | 136,578,550 |

| Reinsurance Group of America, Inc. | | 203,730 | 43,003,328 |

| RenaissanceRe Holdings Ltd. | | 159,120 | 41,753,088 |

| RLI Corp. | | 128,472 | 20,037,778 |

| Ryan Specialty Group Holdings, Inc. Class A | | 317,348 | 20,903,713 |

| Unum Group | | 572,937 | 36,771,097 |

| W.R. Berkley Corp. | | 911,478 | 52,109,197 |

| White Mountains Insurance Group Ltd. | | 7,736 | 13,902,675 |

| Willis Towers Watson PLC | | 317,070 | 95,815,383 |

| | | | 1,883,756,755 |

| Mortgage Real Estate Investment Trusts - 0.3% | | | |

| AGNC Investment Corp. | | 2,290,798 | 21,327,329 |

| Annaly Capital Management, Inc. | | 1,552,096 | 29,505,345 |

| Rithm Capital Corp. | | 1,590,113 | 16,839,297 |

| Starwood Property Trust, Inc. | | 975,520 | 19,256,765 |

| | | | 86,928,736 |

TOTAL FINANCIALS | | | 5,884,614,339 |

| HEALTH CARE - 9.7% | | | |

| Biotechnology - 1.7% | | | |

| Alnylam Pharmaceuticals, Inc. (a) | | 392,177 | 104,550,466 |

| Apellis Pharmaceuticals, Inc. (a) | | 205,539 | 5,602,993 |

| Biogen, Inc. (a) | | 455,931 | 79,331,994 |

| BioMarin Pharmaceutical, Inc. (a) | | 591,462 | 38,971,431 |

| Exact Sciences Corp. (a) | | 573,390 | 39,523,773 |

| Exelixis, Inc. (a) | | 887,806 | 29,475,159 |

| Grail, Inc. (b) | | 114,087 | 1,548,161 |

| Incyte Corp. (a) | | 493,509 | 36,578,887 |

| Ionis Pharmaceuticals, Inc. (a) | | 509,567 | 19,562,277 |

| Natera, Inc. (a) | | 351,044 | 42,462,282 |

| Neurocrine Biosciences, Inc. (a) | | 312,216 | 37,550,218 |

| Repligen Corp. (a) | | 178,390 | 23,952,425 |

| Roivant Sciences Ltd. (a) | | 1,319,387 | 15,238,920 |

| Sarepta Therapeutics, Inc. (a) | | 281,698 | 35,493,948 |

| Ultragenyx Pharmaceutical, Inc. (a) | | 294,487 | 15,015,892 |

| United Therapeutics Corp. (a) | | 135,452 | 50,654,984 |

| Viking Therapeutics, Inc. (a) | | 326,184 | 23,661,387 |

| | | | 599,175,197 |

| Health Care Equipment & Supplies - 2.8% | | | |

| Align Technology, Inc. (a) | | 235,402 | 48,264,472 |

| Baxter International, Inc. | | 1,594,441 | 56,921,544 |

| Dentsply Sirona, Inc. | | 468,828 | 10,862,745 |

| DexCom, Inc. (a) | | 1,251,564 | 88,210,231 |

| Enovis Corp. (a) | | 200,193 | 8,261,965 |

| Envista Holdings Corp. (a) | | 619,542 | 12,991,796 |

| GE Healthcare Technologies, Inc. | | 1,369,400 | 119,617,090 |

| Globus Medical, Inc. Class A (a) | | 347,244 | 25,536,324 |

| Hologic, Inc. (a) | | 709,327 | 57,363,274 |

| IDEXX Laboratories, Inc. (a) | | 256,046 | 104,190,238 |

| Inspire Medical Systems, Inc. (a) | | 92,148 | 17,972,546 |

| Insulet Corp. (a) | | 217,862 | 50,441,589 |

| Masimo Corp. (a) | | 133,467 | 19,220,583 |

| Penumbra, Inc. (a) | | 117,338 | 26,855,148 |

| QuidelOrtho Corp. (a) | | 96,114 | 3,657,138 |

| ResMed, Inc. | | 451,092 | 109,376,277 |

| Solventum Corp. | | 431,549 | 31,321,826 |

| STERIS PLC | | 305,775 | 67,836,184 |

| Teleflex, Inc. | | 146,073 | 29,369,437 |

| The Cooper Companies, Inc. (a) | | 605,512 | 63,384,996 |

| Zimmer Biomet Holdings, Inc. | | 634,478 | 67,838,388 |

| | | | 1,019,493,791 |

| Health Care Providers & Services - 2.2% | | | |

| Acadia Healthcare Co., Inc. (a) | | 294,186 | 12,558,800 |

| Amedisys, Inc. (a) | | 99,391 | 9,402,389 |

| Cardinal Health, Inc. | | 755,572 | 81,994,673 |

| Cencora, Inc. | | 515,243 | 117,516,623 |

| Centene Corp. (a) | | 1,631,670 | 101,587,774 |

| Chemed Corp. | | 46,039 | 24,872,109 |

| DaVita, Inc. (a) | | 156,391 | 21,865,026 |

| Encompass Health Corp. | | 306,939 | 30,528,153 |

| Henry Schein, Inc. (a) | | 398,865 | 28,012,289 |

| Humana, Inc. | | 375,706 | 96,868,278 |

| Labcorp Holdings, Inc. | | 260,774 | 59,526,881 |

| Molina Healthcare, Inc. (a) | | 180,412 | 57,951,943 |

| Premier, Inc. Class A | | 369,331 | 7,442,020 |

| Quest Diagnostics, Inc. | | 344,374 | 53,319,426 |

| R1 RCM, Inc. (a) | | 487,206 | 6,947,558 |

| Tenet Healthcare Corp. (a) | | 294,976 | 45,727,180 |

| Universal Health Services, Inc. Class B | | 179,562 | 36,686,312 |

| | | | 792,807,434 |

| Health Care Technology - 0.3% | | | |

| Certara, Inc. (a) | | 225,727 | 2,302,415 |

| Doximity, Inc. Class A (a) | | 383,468 | 16,005,954 |

| Veeva Systems, Inc. Class A (a) | | 459,752 | 96,010,010 |

| | | | 114,318,379 |

| Life Sciences Tools & Services - 2.2% | | | |

| 10X Genomics, Inc. Class A (a) | | 383,844 | 6,153,019 |

| Agilent Technologies, Inc. | | 908,738 | 118,417,649 |

| Avantor, Inc. (a) | | 2,103,796 | 47,061,917 |

| Azenta, Inc. (a) | | 115,106 | 4,729,706 |

| Bio-Rad Laboratories, Inc. Class A (a) | | 62,079 | 22,236,077 |

| Bio-Techne Corp. | | 481,767 | 35,530,316 |

| Bruker Corp. | | 343,846 | 19,465,122 |

| Charles River Laboratories International, Inc. (a) | | 158,423 | 28,291,179 |

| Fortrea Holdings, Inc. (a) | | 320,077 | 5,383,695 |

| Illumina, Inc. (a) | | 496,747 | 71,601,113 |

| IQVIA Holdings, Inc. (a) | | 559,193 | 115,093,103 |

| Medpace Holdings, Inc. (a) | | 78,842 | 24,773,733 |

| Mettler-Toledo International, Inc. (a) | | 65,469 | 84,569,581 |

| QIAGEN NV | | 693,275 | 29,186,878 |

| Revvity, Inc. | | 381,615 | 45,255,723 |

| Sotera Health Co. (a) | | 480,653 | 7,531,833 |

| Waters Corp. (a) | | 182,849 | 59,080,340 |

| West Pharmaceutical Services, Inc. | | 225,750 | 69,515,198 |

| | | | 793,876,182 |

| Pharmaceuticals - 0.5% | | | |

| Catalent, Inc. (a) | | 561,339 | 32,894,465 |

| Elanco Animal Health, Inc. (a) | | 1,233,635 | 15,593,146 |

| Intra-Cellular Therapies, Inc. (a) | | 323,172 | 27,388,827 |

| Jazz Pharmaceuticals PLC (a) | | 195,066 | 21,463,112 |

| Organon & Co. | | 817,084 | 15,344,838 |

| Perrigo Co. PLC | | 299,146 | 7,667,112 |

| Royalty Pharma PLC Class A | | 1,213,869 | 32,774,463 |

| Viatris, Inc. | | 3,735,138 | 43,327,601 |

| | | | 196,453,564 |

TOTAL HEALTH CARE | | | 3,516,124,547 |

| INDUSTRIALS - 17.6% | | | |

| Aerospace & Defense - 1.8% | | | |

| Axon Enterprise, Inc. (a) | | 222,730 | 94,326,155 |

| BWX Technologies, Inc. | | 282,766 | 34,426,761 |

| Curtiss-Wright Corp. | | 118,311 | 40,812,563 |

| HEICO Corp. | | 133,809 | 32,776,515 |

| HEICO Corp. Class A | | 255,694 | 49,095,805 |

| Hexcel Corp. | | 256,862 | 15,075,231 |

| Howmet Aerospace, Inc. | | 1,257,029 | 125,350,932 |

| Huntington Ingalls Industries, Inc. | | 122,484 | 22,654,641 |

| L3Harris Technologies, Inc. | | 587,502 | 145,389,120 |

| Loar Holdings, Inc. (b) | | 32,869 | 2,832,650 |

| Spirit AeroSystems Holdings, Inc. Class A (a) | | 372,110 | 12,045,201 |

| Textron, Inc. | | 579,679 | 46,617,785 |

| Woodward, Inc. | | 186,446 | 30,593,924 |

| | | | 651,997,283 |

| Air Freight & Logistics - 0.3% | | | |

| C.H. Robinson Worldwide, Inc. | | 360,183 | 37,113,256 |

| Expeditors International of Washington, Inc. | | 437,881 | 52,107,839 |

| GXO Logistics, Inc. (a) | | 378,677 | 22,648,671 |

| | | | 111,869,766 |

| Building Products - 1.5% | | | |

| A.O. Smith Corp. | | 372,768 | 27,994,877 |

| AAON, Inc. | | 211,807 | 24,192,596 |

| Advanced Drain Systems, Inc. | | 217,436 | 32,589,308 |

| Allegion PLC | | 271,270 | 37,877,430 |

| Armstrong World Industries, Inc. | | 134,745 | 18,803,665 |

| Builders FirstSource, Inc. (a) | | 372,244 | 63,802,622 |

| Carlisle Companies, Inc. | | 142,782 | 60,286,844 |

| Fortune Brands Innovations, Inc. | | 381,911 | 31,824,644 |

| Hayward Holdings, Inc. (a) | | 443,146 | 7,205,554 |

| Lennox International, Inc. | | 99,422 | 59,908,715 |

| Masco Corp. | | 682,599 | 54,546,486 |

| Owens Corning | | 267,590 | 47,307,236 |

| Simpson Manufacturing Co. Ltd. | | 131,444 | 23,632,317 |

| The AZEK Co., Inc. Class A, (a) | | 445,246 | 19,590,824 |

| Trex Co., Inc. (a) | | 340,923 | 24,154,395 |

| | | | 533,717,513 |

| Commercial Services & Supplies - 0.8% | | | |

| Clean Harbors, Inc. (a) | | 157,933 | 36,523,586 |

| MSA Safety, Inc. | | 114,779 | 19,047,575 |

| RB Global, Inc. | | 567,937 | 48,126,981 |

| Rollins, Inc. | | 866,749 | 40,858,548 |

| Stericycle, Inc. (a) | | 285,882 | 17,573,167 |

| Tetra Tech, Inc. | | 826,493 | 40,398,978 |

| Veralto Corp. | | 766,120 | 78,289,803 |

| Vestis Corp. | | 438,840 | 5,933,117 |

| | | | 286,751,755 |

| Construction & Engineering - 1.1% | | | |

| AECOM | | 420,981 | 44,960,771 |

| API Group Corp. (a) | | 705,379 | 24,081,639 |

| Comfort Systems U.S.A., Inc. | | 109,007 | 42,626,097 |

| EMCOR Group, Inc. | | 144,202 | 64,324,186 |

| MasTec, Inc. (a) | | 194,324 | 23,880,476 |

| MDU Resources Group, Inc. | | 629,917 | 18,173,105 |

| Quanta Services, Inc. | | 450,597 | 135,913,573 |

| Valmont Industries, Inc. | | 61,728 | 19,239,383 |

| Willscot Holdings Corp. (a) | | 572,790 | 18,982,261 |

| | | | 392,181,491 |

| Electrical Equipment - 1.6% | | | |

| Acuity Brands, Inc. | | 95,499 | 28,715,594 |

| AMETEK, Inc. | | 716,194 | 131,307,008 |

| Generac Holdings, Inc. (a) | | 182,607 | 30,230,589 |

| Hubbell, Inc. | | 166,088 | 70,924,559 |

| nVent Electric PLC | | 512,477 | 38,215,410 |

| Regal Rexnord Corp. | | 205,945 | 34,298,080 |

| Rockwell Automation, Inc. | | 355,576 | 94,835,675 |

| Sensata Technologies PLC | | 463,450 | 15,914,873 |

| Vertiv Holdings Co. | | 1,110,586 | 121,375,944 |

| | | | 565,817,732 |

| Ground Transportation - 1.0% | | | |

| Avis Budget Group, Inc. (b) | | 58,947 | 4,892,601 |

| J.B. Hunt Transport Services, Inc. | | 254,350 | 45,940,697 |

| Knight-Swift Transportation Holdings, Inc. | | 496,736 | 25,870,011 |

| Landstar System, Inc. | | 110,316 | 19,390,243 |

| Lyft, Inc. (a) | | 1,150,226 | 14,918,431 |

| Old Dominion Freight Lines, Inc. | | 609,429 | 122,690,246 |

| Ryder System, Inc. | | 131,958 | 19,302,816 |

| Saia, Inc. (a) | | 82,456 | 40,288,826 |

| Schneider National, Inc. Class B | | 145,940 | 4,127,183 |

| U-Haul Holding Co. (a)(b) | | 26,943 | 1,975,730 |

| U-Haul Holding Co. Class N | | 307,713 | 21,004,489 |

| XPO, Inc. (a) | | 355,739 | 46,434,612 |

| | | | 366,835,885 |

| Machinery - 3.8% | | | |

| AGCO Corp. | | 194,129 | 19,381,839 |

| Allison Transmission Holdings, Inc. | | 271,074 | 28,966,968 |

| CNH Industrial NV Class A | | 2,722,424 | 30,572,822 |

| Crane Co. | | 151,677 | 23,855,759 |

| Cummins, Inc. | | 423,850 | 139,438,173 |

| Donaldson Co., Inc. | | 372,411 | 27,245,589 |

| Dover Corp. | | 425,372 | 80,535,681 |

| ESAB Corp. | | 175,375 | 21,578,140 |

| Flowserve Corp. | | 407,259 | 21,438,114 |

| Fortive Corp. | | 1,091,562 | 77,970,274 |

| Gates Industrial Corp. PLC (a) | | 636,143 | 12,309,367 |

| Graco, Inc. | | 518,791 | 42,255,527 |

| IDEX Corp. | | 234,965 | 50,432,888 |

| Ingersoll Rand, Inc. | | 1,251,988 | 120,190,848 |

| ITT, Inc. | | 255,537 | 35,805,844 |

| Lincoln Electric Holdings, Inc. | | 171,224 | 32,970,893 |

| Middleby Corp. (a) | | 165,400 | 21,452,380 |

| Nordson Corp. | | 175,994 | 43,627,153 |

| Oshkosh Corp. | | 202,405 | 20,693,887 |

| Otis Worldwide Corp. | | 1,253,302 | 123,074,256 |

| Pentair PLC | | 512,092 | 50,758,559 |

| RBC Bearings, Inc. (a) | | 88,149 | 24,712,572 |

| Snap-On, Inc. | | 160,475 | 52,977,612 |

| Stanley Black & Decker, Inc. | | 437,627 | 40,673,053 |

| Timken Co. | | 200,525 | 16,643,575 |

| Toro Co. | | 323,995 | 26,075,118 |

| Westinghouse Air Brake Tech Co. | | 542,646 | 102,006,595 |

| Xylem, Inc. | | 749,620 | 91,288,724 |

| | | | 1,378,932,210 |

| Marine Transportation - 0.0% | | | |

| Kirby Corp. (a) | | 179,908 | 20,646,242 |

| Passenger Airlines - 0.8% | | | |

| Alaska Air Group, Inc. (a) | | 393,081 | 18,832,511 |

| American Airlines Group, Inc. (a)(b) | | 2,077,556 | 27,839,250 |

| Delta Air Lines, Inc. | | 1,998,480 | 114,353,026 |

| Southwest Airlines Co. (b) | | 1,857,551 | 56,803,910 |

| United Airlines Holdings, Inc. (a) | | 1,015,587 | 79,479,839 |

| | | | 297,308,536 |

| Professional Services - 2.9% | | | |

| Amentum Holdings, Inc. | | 387,008 | 11,509,618 |

| Booz Allen Hamilton Holding Corp. Class A | | 397,174 | 72,150,629 |

| Broadridge Financial Solutions, Inc. | | 363,234 | 76,591,521 |

| CACI International, Inc. (a) | | 68,460 | 37,828,258 |

| Clarivate PLC (a)(b) | | 1,374,979 | 9,074,861 |

| Concentrix Corp. | | 101,892 | 4,331,429 |

| Dayforce, Inc. (a)(b) | | 473,029 | 33,561,408 |

| Dun & Bradstreet Holdings, Inc. | | 937,979 | 11,152,570 |

| Equifax, Inc. | | 381,111 | 101,002,037 |

| FTI Consulting, Inc. (a) | | 109,073 | 21,277,961 |

| Genpact Ltd. | | 545,069 | 20,805,284 |

| Jacobs Solutions, Inc. | | 386,685 | 54,360,177 |

| KBR, Inc. | | 412,780 | 27,660,388 |

| Leidos Holdings, Inc. | | 418,181 | 76,594,032 |

| ManpowerGroup, Inc. | | 157,990 | 9,929,672 |

| Parsons Corp. (a) | | 141,886 | 15,346,390 |

| Paychex, Inc. | | 997,705 | 139,010,238 |

| Paycom Software, Inc. | | 159,091 | 33,254,792 |

| Paycor HCM, Inc. (a) | | 260,063 | 3,924,351 |

| Paylocity Holding Corp. (a) | | 136,058 | 25,112,225 |

| Robert Half, Inc. | | 317,748 | 21,641,816 |

| Science Applications International Corp. | | 158,474 | 22,866,213 |

| SS&C Technologies Holdings, Inc. | | 666,593 | 46,614,848 |

| TransUnion | | 601,903 | 60,972,774 |

| Verisk Analytics, Inc. | | 441,864 | 121,388,878 |

| | | | 1,057,962,370 |

| Trading Companies & Distributors - 2.0% | | | |

| Air Lease Corp. Class A | | 323,673 | 14,354,898 |

| Core & Main, Inc. Class A (a) | | 595,281 | 26,359,043 |

| Fastenal Co. | | 1,775,783 | 138,830,715 |

| Ferguson Enterprises, Inc. | | 627,591 | 123,472,253 |

| MSC Industrial Direct Co., Inc. Class A | | 144,471 | 11,423,322 |

| SiteOne Landscape Supply, Inc. (a) | | 139,958 | 19,557,731 |

| United Rentals, Inc. | | 206,122 | 167,535,962 |

| W.W. Grainger, Inc. | | 134,999 | 149,744,941 |

| Watsco, Inc. | | 107,260 | 50,735,053 |

| WESCO International, Inc. | | 135,952 | 26,098,705 |

| | | | 728,112,623 |

TOTAL INDUSTRIALS | | | 6,392,133,406 |

| INFORMATION TECHNOLOGY - 12.5% | | | |

| Communications Equipment - 0.3% | | | |

| Ciena Corp. (a) | | 446,416 | 28,351,880 |

| F5, Inc. (a) | | 181,171 | 42,372,273 |

| Juniper Networks, Inc. | | 1,010,181 | 39,296,041 |

| Lumentum Holdings, Inc. (a) | | 214,457 | 13,697,369 |

| Ubiquiti, Inc. | | 12,917 | 3,431,918 |

| | | | 127,149,481 |

| Electronic Equipment, Instruments & Components - 1.8% | | | |

| Arrow Electronics, Inc. (a) | | 164,745 | 19,550,289 |

| Avnet, Inc. | | 278,634 | 15,104,749 |

| CDW Corp. | | 416,805 | 78,455,205 |

| Cognex Corp. | | 442,750 | 17,811,833 |

| Coherent Corp. (a) | | 410,009 | 37,901,232 |

| Corning, Inc. | | 2,377,743 | 113,156,789 |

| Crane NXT Co. | | 154,318 | 8,374,838 |

| IPG Photonics Corp. (a) | | 94,548 | 7,654,606 |

| Jabil, Inc. | | 343,947 | 42,336,436 |

| Keysight Technologies, Inc. (a) | | 540,609 | 80,556,147 |

| Littelfuse, Inc. | | 77,267 | 18,901,826 |

| TD SYNNEX Corp. | | 233,835 | 26,972,867 |

| Teledyne Technologies, Inc. (a) | | 143,599 | 65,383,497 |

| Trimble, Inc. (a) | | 755,393 | 45,701,277 |

| Vontier Corp. | | 479,244 | 17,770,368 |

| Zebra Technologies Corp. Class A (a) | | 158,644 | 60,597,249 |

| | | | 656,229,208 |

| IT Services - 2.0% | | | |

| Akamai Technologies, Inc. (a) | | 467,073 | 47,211,739 |

| Amdocs Ltd. | | 355,245 | 31,170,973 |

| Cloudflare, Inc. Class A (a) | | 930,801 | 81,640,556 |

| Cognizant Technology Solutions Corp. Class A | | 1,544,226 | 115,183,817 |

| DXC Technology Co. (a) | | 564,734 | 11,215,617 |

| EPAM Systems, Inc. (a) | | 172,313 | 32,506,847 |

| Gartner, Inc. (a) | | 233,812 | 117,490,530 |

| Globant SA (a)(b) | | 131,179 | 27,533,160 |

| GoDaddy, Inc. Class A (a) | | 438,559 | 73,151,641 |

| Kyndryl Holdings, Inc. (a) | | 705,532 | 16,149,627 |

| MongoDB, Inc. Class A (a) | | 220,912 | 59,734,605 |

| Okta, Inc. Class A (a) | | 500,867 | 36,007,329 |

| Twilio, Inc. Class A (a) | | 531,952 | 42,901,929 |

| VeriSign, Inc. (a) | | 262,241 | 46,374,698 |

| | | | 738,273,068 |

| Semiconductors & Semiconductor Equipment - 2.1% | | | |

| Allegro MicroSystems LLC (a) | | 397,922 | 8,292,694 |

| Amkor Technology, Inc. | | 350,014 | 8,907,856 |

| Astera Labs, Inc. (a) | | 69,199 | 4,855,002 |

| Cirrus Logic, Inc. (a) | | 166,750 | 18,312,485 |

| Enphase Energy, Inc. (a) | | 408,707 | 33,939,029 |

| Entegris, Inc. | | 467,156 | 48,915,905 |

| First Solar, Inc. (a) | | 330,781 | 64,330,289 |

| GlobalFoundries, Inc. (a) | | 305,204 | 11,139,946 |

| Lattice Semiconductor Corp. (a) | | 426,156 | 21,589,063 |

| MACOM Technology Solutions Holdings, Inc. (a) | | 173,013 | 19,446,661 |

| Microchip Technology, Inc. | | 1,645,144 | 120,704,215 |

| MKS Instruments, Inc. | | 207,445 | 20,605,512 |

| Monolithic Power Systems, Inc. | | 145,693 | 110,624,695 |

| ON Semiconductor Corp. (a) | | 1,333,196 | 93,976,986 |

| Onto Innovation, Inc. (a) | | 151,894 | 30,125,137 |

| Qorvo, Inc. (a) | | 293,557 | 20,918,872 |

| Skyworks Solutions, Inc. | | 498,209 | 43,633,144 |

| Teradyne, Inc. | | 484,549 | 51,463,949 |

| Universal Display Corp. | | 144,677 | 26,088,157 |

| Wolfspeed, Inc. (a)(b) | | 421,004 | 5,603,563 |

| | | | 763,473,160 |

| Software - 5.1% | | | |

| ANSYS, Inc. (a) | | 270,635 | 86,714,160 |

| AppFolio, Inc. Class A, (a) | | 70,314 | 14,616,171 |

| AppLovin Corp. Class A, (a) | | 813,611 | 137,817,567 |

| Aspen Technology, Inc. (a) | | 83,452 | 19,588,688 |

| Bentley Systems, Inc. Class B | | 434,832 | 20,984,992 |

| Bill Holdings, Inc. (a) | | 324,863 | 18,959,005 |

| CCC Intelligent Solutions Holdings, Inc. Class A (a) | | 1,402,342 | 14,598,380 |

| Confluent, Inc. Class A (a) | | 784,869 | 20,540,022 |

| Datadog, Inc. Class A (a) | | 927,307 | 116,321,390 |

| DocuSign, Inc. (a) | | 630,173 | 43,721,403 |

| Dolby Laboratories, Inc. Class A | | 181,413 | 13,225,008 |

| DoubleVerify Holdings, Inc. (a) | | 273,766 | 4,667,710 |

| Dropbox, Inc. Class A (a) | | 747,615 | 19,325,848 |

| Dynatrace, Inc. (a) | | 914,614 | 49,206,233 |

| Elastic NV (a) | | 254,876 | 20,448,701 |

| Fair Isaac Corp. (a) | | 73,594 | 146,680,937 |

| Five9, Inc. (a) | | 105,204 | 3,106,674 |

| Gen Digital, Inc. | | 1,686,208 | 49,085,515 |

| GitLab, Inc. Class A (a) | | 373,662 | 20,084,333 |

| Guidewire Software, Inc. (a) | | 253,860 | 47,283,964 |

| HashiCorp, Inc. Class A (a) | | 437,513 | 14,814,190 |

| HubSpot, Inc. (a) | | 151,713 | 84,168,855 |

| Informatica, Inc. Class A (a) | | 200,634 | 5,477,308 |

| Manhattan Associates, Inc. (a) | | 189,973 | 50,031,289 |

| MicroStrategy, Inc. Class A (a)(b) | | 486,046 | 118,838,247 |

| nCino, Inc. (a) | | 262,365 | 9,786,215 |

| Nutanix, Inc. Class A (a) | | 753,235 | 46,775,894 |

| Palantir Technologies, Inc. Class A (a) | | 6,241,806 | 259,409,459 |

| Pegasystems, Inc. | | 138,259 | 10,983,295 |

| Procore Technologies, Inc. (a) | | 335,043 | 21,995,573 |

| PTC, Inc. (a) | | 367,212 | 68,055,400 |

| RingCentral, Inc. Class A (a) | | 254,818 | 9,175,996 |

| SentinelOne, Inc. Class A (a)(b) | | 861,965 | 22,230,077 |

| Smartsheet, Inc. Class A (a) | | 414,883 | 23,407,699 |

| Teradata Corp. (a) | | 308,651 | 9,947,822 |

| Tyler Technologies, Inc. (a) | | 131,502 | 79,636,296 |

| UiPath, Inc. Class A (a) | | 1,461,289 | 18,061,532 |

| Unity Software, Inc. (a)(b) | | 978,080 | 19,639,846 |

| Zoom Video Communications, Inc. Class A (a) | | 818,069 | 61,142,477 |

| Zscaler, Inc. (a) | | 285,521 | 51,619,342 |

| | | | 1,852,173,513 |

| Technology Hardware, Storage & Peripherals - 1.2% | | | |

| Hewlett Packard Enterprise Co. | | 4,025,603 | 78,459,002 |

| HP, Inc. | | 3,034,095 | 107,771,054 |

| NetApp, Inc. | | 639,138 | 73,699,003 |

| Pure Storage, Inc. Class A (a) | | 952,116 | 47,653,406 |

| Super Micro Computer, Inc. (a)(b) | | 1,539,775 | 44,822,850 |

| Western Digital Corp. (a) | | 1,012,264 | 66,110,962 |

| | | | 418,516,277 |

TOTAL INFORMATION TECHNOLOGY | | | 4,555,814,707 |

| MATERIALS - 5.9% | | | |

| Chemicals - 2.7% | | | |

| Albemarle Corp. (b) | | 330,489 | 31,307,223 |

| Ashland, Inc. | | 155,549 | 13,154,779 |

| Axalta Coating Systems Ltd. (a) | | 683,383 | 25,913,883 |

| Celanese Corp. | | 340,096 | 42,841,893 |

| CF Industries Holdings, Inc. | | 565,505 | 46,501,476 |

| Corteva, Inc. | | 2,170,071 | 132,200,725 |

| Dow, Inc. | | 2,183,606 | 107,826,464 |

| DuPont de Nemours, Inc. | | 1,297,361 | 107,667,989 |

| Eastman Chemical Co. | | 362,725 | 38,118,770 |

| Element Solutions, Inc. | | 694,464 | 18,819,974 |

| FMC Corp. | | 386,196 | 25,098,878 |

| Huntsman Corp. | | 560,770 | 12,336,940 |

| International Flavors & Fragrances, Inc. | | 793,305 | 78,878,316 |

| LyondellBasell Industries NV Class A | | 807,642 | 70,143,708 |

| NewMarket Corp. | | 20,861 | 10,951,399 |

| Olin Corp. | | 375,252 | 15,396,590 |

| PPG Industries, Inc. | | 725,051 | 90,276,100 |

| RPM International, Inc. | | 394,259 | 50,114,261 |

| The Chemours Co. LLC | | 507,459 | 9,215,455 |

| The Mosaic Co. | | 1,020,475 | 27,307,911 |

| The Scotts Miracle-Gro Co. | | 134,126 | 11,666,279 |

| Westlake Corp. | | 104,067 | 13,730,600 |

| | | | 979,469,613 |

| Construction Materials - 0.7% | | | |

| Eagle Materials, Inc. | | 103,182 | 29,454,334 |

| Martin Marietta Materials, Inc. | | 190,169 | 112,644,705 |

| Vulcan Materials Co. | | 410,501 | 112,448,539 |

| | | | 254,547,578 |

| Containers & Packaging - 1.5% | | | |

| Amcor PLC | | 4,462,208 | 49,664,375 |

| Aptargroup, Inc. | | 204,733 | 34,376,718 |

| Avery Dennison Corp. | | 248,557 | 51,458,756 |

| Ball Corp. | | 952,209 | 56,418,383 |

| Berry Global Group, Inc. | | 355,345 | 25,034,055 |

| Crown Holdings, Inc. | | 362,742 | 33,934,514 |

| Graphic Packaging Holding Co. | | 921,462 | 26,040,516 |

| International Paper Co. | | 1,074,759 | 59,692,115 |

| Packaging Corp. of America | | 274,980 | 62,953,921 |

| Sealed Air Corp. | | 475,752 | 17,212,707 |

| Silgan Holdings, Inc. | | 257,236 | 13,309,391 |

| Smurfit Westrock PLC | | 1,617,609 | 83,306,864 |

| Sonoco Products Co. | | 304,548 | 15,994,861 |

| | | | 529,397,176 |

| Metals & Mining - 1.0% | | | |

| Alcoa Corp. | | 787,024 | 31,551,792 |

| ATI, Inc. (a) | | 382,689 | 20,171,537 |

| Cleveland-Cliffs, Inc. (a) | | 1,469,406 | 19,072,890 |

| MP Materials Corp. (a)(b) | | 430,273 | 7,740,611 |

| Nucor Corp. | | 743,616 | 105,474,493 |

| Reliance, Inc. | | 177,119 | 50,716,254 |

| Royal Gold, Inc. | | 203,682 | 29,749,793 |

| Steel Dynamics, Inc. | | 461,009 | 60,161,675 |

| United States Steel Corp. | | 691,303 | 26,857,122 |

| | | | 351,496,167 |

| Paper & Forest Products - 0.0% | | | |

| Louisiana-Pacific Corp. | | 199,787 | 19,758,934 |

TOTAL MATERIALS | | | 2,134,669,468 |

| REAL ESTATE - 7.9% | | | |

| Equity Real Estate Investment Trusts (REITs) - 7.1% | | | |

| Agree Realty Corp. | | 307,294 | 22,816,580 |

| Alexandria Real Estate Equities, Inc. | | 504,451 | 56,271,509 |

| American Homes 4 Rent Class A | | 1,047,847 | 36,926,128 |

| Americold Realty Trust | | 931,789 | 23,928,342 |

| AvalonBay Communities, Inc. | | 440,039 | 97,517,043 |

| Brixmor Property Group, Inc. | | 935,555 | 25,213,207 |

| BXP, Inc. | | 444,526 | 35,811,015 |

| Camden Property Trust (SBI) | | 320,931 | 37,160,600 |

| Cousins Properties, Inc. | | 500,326 | 15,324,985 |

| Crown Castle, Inc. | | 1,361,664 | 146,365,263 |

| CubeSmart | | 704,959 | 33,725,239 |

| Digital Realty Trust, Inc. | | 1,003,850 | 178,916,186 |

| EastGroup Properties, Inc. | | 156,521 | 26,808,917 |

| EPR Properties | | 270,836 | 12,287,829 |

| Equity Lifestyle Properties, Inc. | | 582,870 | 40,870,844 |

| Equity Residential (SBI) | | 1,171,703 | 82,452,740 |

| Essex Property Trust, Inc. | | 198,050 | 56,218,473 |

| Extra Space Storage, Inc. | | 650,916 | 106,294,583 |

| Federal Realty Investment Trust (SBI) | | 258,068 | 28,604,257 |

| First Industrial Realty Trust, Inc. | | 420,231 | 22,057,925 |

| Gaming & Leisure Properties | | 808,069 | 40,556,983 |

| Healthcare Realty Trust, Inc. | | 976,920 | 16,783,486 |

| Healthpeak Properties, Inc. | | 2,199,205 | 49,372,152 |

| Highwoods Properties, Inc. (SBI) | | 337,439 | 11,317,704 |

| Host Hotels & Resorts, Inc. | | 2,229,990 | 38,445,028 |

| Invitation Homes, Inc. | | 1,928,747 | 60,581,943 |

| Iron Mountain, Inc. | | 903,162 | 111,748,234 |

| Kilroy Realty Corp. | | 273,597 | 11,004,071 |

| Kimco Realty Corp. | | 2,077,861 | 49,286,863 |

| Lamar Advertising Co. Class A | | 270,076 | 35,650,032 |

| Lineage, Inc. (b) | | 191,238 | 14,159,262 |

| Medical Properties Trust, Inc. (b) | | 1,243,947 | 5,759,475 |

| Mid-America Apartment Communities, Inc. | | 360,192 | 54,511,457 |

| National Storage Affiliates Trust | | 235,027 | 9,906,388 |

| NNN (REIT), Inc. | | 562,356 | 24,428,745 |

| Omega Healthcare Investors, Inc. | | 765,474 | 32,509,681 |

| Park Hotels & Resorts, Inc. | | 382,972 | 5,319,481 |

| Rayonier, Inc. | | 475,323 | 14,844,337 |

| Realty Income Corp. | | 2,704,111 | 160,543,070 |

| Regency Centers Corp. | | 573,442 | 40,966,696 |

| Rexford Industrial Realty, Inc. | | 585,433 | 25,109,221 |

| SBA Communications Corp. Class A | | 338,072 | 77,577,382 |

| Simon Property Group, Inc. | | 1,003,739 | 169,752,340 |

| STAG Industrial, Inc. | | 599,457 | 22,347,757 |

| Sun Communities, Inc. | | 389,337 | 51,657,233 |

| UDR, Inc. | | 1,018,225 | 42,958,913 |

| Ventas, Inc. | | 1,251,117 | 81,935,652 |

| VICI Properties, Inc. | | 3,234,341 | 102,722,670 |

| Vornado Realty Trust | | 552,154 | 22,864,697 |

| Weyerhaeuser Co. | | 2,298,499 | 71,621,229 |

| WP Carey, Inc. | | 672,086 | 37,448,632 |

| | | | 2,579,262,479 |

| Real Estate Management & Development - 0.8% | | | |

| CBRE Group, Inc. (a) | | 948,924 | 124,280,576 |

| CoStar Group, Inc. (a) | | 1,263,298 | 91,955,461 |

| Howard Hughes Holdings, Inc. (a) | | 113,352 | 8,619,286 |

| Jones Lang LaSalle, Inc. (a) | | 146,591 | 39,720,297 |

| Seaport Entertainment Group, Inc. (b) | | 31,815 | 863,777 |

| Zillow Group, Inc.: | | | |

| Class A (a) | | 174,185 | 10,111,439 |

| Class C (a) | | 476,950 | 28,659,926 |

| | | | 304,210,762 |

TOTAL REAL ESTATE | | | 2,883,473,241 |

| UTILITIES - 5.7% | | | |

| Electric Utilities - 2.8% | | | |

| Alliant Energy Corp. | | 794,782 | 47,686,920 |

| Avangrid, Inc. | | 219,989 | 7,855,807 |

| Edison International | | 1,180,115 | 97,241,476 |

| Entergy Corp. | | 661,301 | 102,356,169 |

| Evergy, Inc. | | 690,905 | 41,758,298 |

| Eversource Energy | | 1,098,513 | 72,337,081 |

| Exelon Corp. | | 3,104,336 | 122,000,405 |

| FirstEnergy Corp. | | 1,785,969 | 74,707,083 |

| IDACORP, Inc. | | 156,917 | 16,237,771 |

| NRG Energy, Inc. | | 643,968 | 58,214,707 |

| OGE Energy Corp. | | 619,981 | 24,793,040 |

| PG&E Corp. | | 6,631,804 | 134,095,077 |

| Pinnacle West Capital Corp. | | 352,246 | 30,930,721 |

| PPL Corp. | | 2,290,949 | 74,593,299 |

| Xcel Energy, Inc. | | 1,725,597 | 115,287,136 |

| | | | 1,020,094,990 |

| Gas Utilities - 0.3% | | | |

| Atmos Energy Corp. | | 466,612 | 64,756,413 |

| National Fuel Gas Co. | | 288,319 | 17,451,949 |

| UGI Corp. | | 501,113 | 11,981,612 |

| | | | 94,189,974 |

| Independent Power and Renewable Electricity Producers - 0.5% | | | |

| Brookfield Renewable Corp. (b) | | 431,930 | 13,208,419 |

| Clearway Energy, Inc.: | | | |

| Class A | | 132,119 | 3,519,650 |

| Class C | | 251,514 | 7,137,967 |

| The AES Corp. | | 2,264,699 | 37,344,887 |

| Vistra Corp. | | 1,068,704 | 133,545,252 |

| | | | 194,756,175 |

| Multi-Utilities - 1.8% | | | |

| Ameren Corp. | | 825,357 | 71,896,848 |

| CenterPoint Energy, Inc. | | 1,975,259 | 58,329,398 |

| CMS Energy Corp. | | 923,205 | 64,264,300 |

| Consolidated Edison, Inc. | | 1,074,398 | 109,244,789 |

| DTE Energy Co. | | 641,302 | 79,662,534 |

| NiSource, Inc. | | 1,391,120 | 48,911,779 |

| Public Service Enterprise Group, Inc. | | 1,547,007 | 138,317,896 |

| WEC Energy Group, Inc. | | 981,253 | 93,739,099 |

| | | | 664,366,643 |

| Water Utilities - 0.3% | | | |

| American Water Works Co., Inc. | | 612,604 | 84,606,738 |

| Essential Utilities, Inc. | | 790,060 | 30,496,316 |

| | | | 115,103,054 |

TOTAL UTILITIES | | | 2,088,510,836 |

| TOTAL COMMON STOCKS (Cost $27,343,637,774) | | | 36,245,485,432 |

| | | | |

| U.S. Treasury Obligations - 0.0% |

| | | Principal Amount (c) | Value ($) |

U.S. Treasury Bills, yield at date of purchase 5.08% 11/21/24 (d) (Cost $5,204,456) | | 5,219,000 | 5,205,627 |

| | | | |

| Money Market Funds - 1.3% |

| | | Shares | Value ($) |

| Fidelity Cash Central Fund 4.87% (e) | | 66,204,606 | 66,217,847 |

| Fidelity Securities Lending Cash Central Fund 4.87% (e)(f) | | 391,183,696 | 391,222,815 |

| TOTAL MONEY MARKET FUNDS (Cost $457,436,745) | | | 457,440,662 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 101.0% (Cost $27,806,278,975) | 36,708,131,721 |

NET OTHER ASSETS (LIABILITIES) - (1.0)% | (368,615,218) |

| NET ASSETS - 100.0% | 36,339,516,503 |

| | |

| Futures Contracts |

| | Number of contracts | Expiration Date | Notional Amount ($) | Value ($) | Unrealized Appreciation/ (Depreciation) ($) |

| Purchased | | | | | |

| | | | | | |

| Equity Index Contracts | | | | | |

| CME E-mini S&P MidCap 400 Index Contracts (United States) | 319 | Dec 2024 | 99,323,840 | 1,281,628 | 1,281,628 |

| | | | | | |

| The notional amount of futures purchased as a percentage of Net Assets is 0.3% |

Legend

| (b) | Security or a portion of the security is on loan at period end. |

| (c) | Amount is stated in United States dollars unless otherwise noted. |