- JOB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

GEE (JOB) DEF 14ADefinitive proxy

Filed: 15 Aug 23, 8:53pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

|

|

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ | Definitive Proxy Statement |

|

|

☐ | Definitive Additional Materials |

|

|

☐ | Soliciting Material under § 240.14a–12 |

GEE GROUP INC. |

(Name of Registrant as Specified in its Charter) |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required |

|

|

☐ | Fee paid previously with preliminary materials |

|

|

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(4) and 0-11 |

GEE GROUP INC.

7751 Belfort Parkway, Suite 150

Jacksonville, Florida 32256

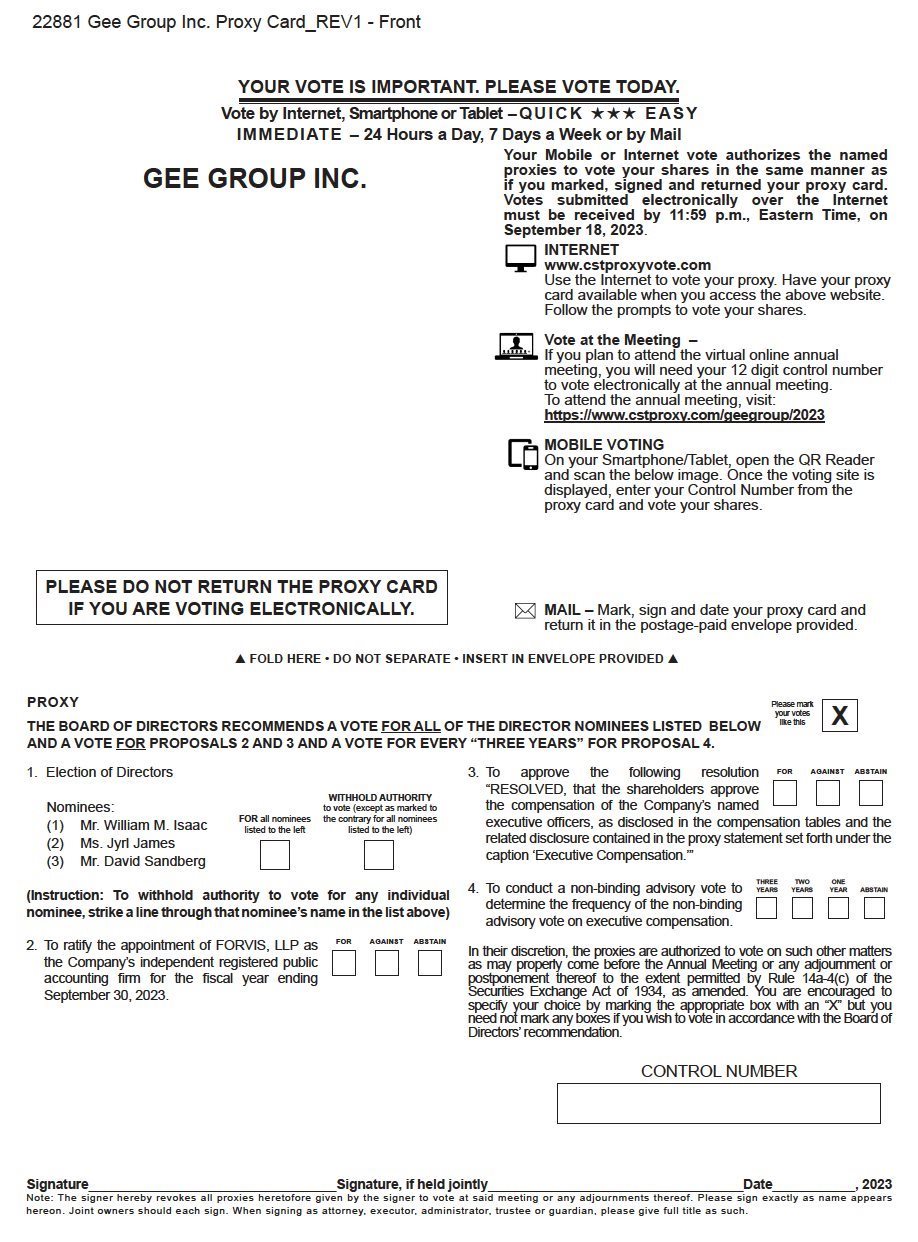

NOTICE OF VIRTUAL ANNUAL MEETING OF SHAREHOLDERS TO BE HELD SEPTEMBER 19, 2023

Dear Shareholders of GEE Group Inc.:

Notice is hereby given that the 2023 Annual Meeting of Shareholders (the “Annual Meeting”) of GEE Group Inc. (the “Company”), will be held in a virtual meeting format at 11:00 a.m. on September 19, 2023 at https://www.cstproxy.com/geegroup/2023. Shareholders will NOT be able to attend the Annual Meeting in person. The accompanying proxy statement includes instructions on how to access the virtual Annual Meeting and how to listen, vote and submit questions from home or any remote location with Internet connectivity. At the Annual Meeting, the Company will ask you to:

| 1. | Vote to elect three Class I directors to the Company’s Board of Directors (the “Board”), each to serve until the 2026 Annual Meeting of Shareholders or until their respective successor is elected and qualified (Proposal 1); |

|

|

|

| 2. | Vote to ratify the appointment of FORVIS, LLP (“FORVIS”) as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2023 (Proposal 2); |

|

|

|

| 3. | To conduct a non-binding advisory vote to approve the compensation paid to the Company’s named executive officers (Proposal 3); and |

|

|

|

| 4. | To conduct a non-binding advisory vote to determine the frequency of the non-binding advisory vote on executive compensation (Proposal 4). |

Shareholders may also transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

Only shareholders of record as of the close of business on August 8, 2023 (the “Record Date”) are entitled to receive notice of, and to vote at, the Annual Meeting. Additional details regarding the Annual Meeting, the business to be conducted, and information about the Company that you should consider when you vote your shares are described in the proxy statement.

All shareholders as of the Record Date are cordially invited to attend the Annual Meeting virtually. Whether or not you expect to attend the Annual Meeting, it is important that your shares be represented at the Annual Meeting (virtually or by proxy), regardless of the number of shares you may hold. Even though you may plan to attend the Annual Meeting, please promptly vote using one of the following methods: on the Internet, by telephone, by accessing the website address printed on your proxy card; or by completing, signing and returning the enclosed proxy card in the enclosed postage-paid return envelope. Voting by any of these methods will not prevent you from attending the Annual Meeting and voting your shares virtually. You may change or revoke your proxy at any time before it is voted. Your vote is extremely important, and we appreciate you taking the time to vote promptly.

If your brokerage firm, bank, trustee or other similar organization is the holder of record of your shares (i.e., your shares are held in “street name”), you will receive a voting instruction form from the holder of record. You must provide voting instructions by filling out the voting instruction form in order for your shares to be voted. We recommend that you instruct your brokerage firm, bank, trustee or other nominee to vote your shares on the enclosed proxy card.

The Board strongly recommends that you vote on the enclosed proxy card “FOR” the election of William Isaac, Jyrl James and David Sandberg as directors of the Company, “FOR” the ratification of the appointment of FORVIS as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2023, “FOR” the approval of the compensation paid to the Company’s named executive officers on an advisory, non-binding basis and “FOR” the approval of a vote of every “three years” for the frequency of the non-binding advisory vote on executive compensation.

| 2 |

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE ANNUAL MEETING, REGARDLESS OF WHETHER OR NOT YOU PLAN TO ATTEND VIRTUALLY. ACCORDINGLY, AFTER READING THE ACCOMPANYING PROXY STATEMENT, PLEASE FOLLOW THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD AND PROMPTLY SUBMIT YOUR PROXY BY INTERNET, TELEPHONE OR MAIL AS DESCRIBED ON THE PROXY CARD. PLEASE NOTE THAT EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING VIRTUALLY, WE RECOMMEND THAT YOU VOTE USING THE ENCLOSED PROXY CARD PRIOR TO THE ANNUAL MEETING TO ENSURE THAT YOUR SHARES WILL BE REPRESENTED. EVEN IF YOU VOTE YOUR SHARES PRIOR TO THE ANNUAL MEETING, IF YOU ARE A RECORD HOLDER OF SHARES, OR A BENEFICIAL HOLDER WHO OBTAINS A “LEGAL” PROXY FROM YOUR BROKERAGE FIRM, BANK, TRUSTEE, OR NOMINEE, YOU STILL MAY ATTEND THE ANNUAL MEETING AND VOTE YOUR SHARES VIRTUALLY.

Regardless of the number of shares of common stock of the Company that you own, your vote will be important. Thank you for your continued support, interest and investment in the Company.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON September 19, 2023

The proxy statement, the accompanying proxy card, and the Company’s Annual Report to Shareholders (including its Annual Report on Form 10-K for the fiscal year ended September 30, 2022) are available free of charge at http://ir.geegroup.com/all-sec-filings and www.sec.gov. Information on these websites, other than the proxy statement, is not a part of the proxy statement.

Please sign, date and promptly return the enclosed proxy card in the envelope provided, or grant a proxy and give voting instructions by Internet or telephone, so that you may be represented at the Annual Meeting. Instructions are on your proxy card or on the voting instruction form provided by your brokerage firm, bank, trustee or other nominee.

Brokers cannot vote on proposals 1, 3 or 4 without your instructions.

********************

The accompanying proxy statement provides a detailed description of the business to be conducted at the Annual Meeting. We urge you to read the accompanying proxy statement carefully and in its entirety.

If you have any questions concerning the business to be conducted at the Annual Meeting, would like additional copies of the proxy statement or need help submitting a proxy for your shares, please contact Advantage Proxy, Inc., the Company’s proxy solicitor:

Advantage Proxy, Inc. Shareholders Call Toll Free: 1-877-870-8565 Email: ksmith@advantageproxy.com

|

| BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

|

| /s/ Derek E. Dewan |

|

| Derek E. Dewan |

|

| Chairman of the Board |

|

Jacksonville, Florida

August 15, 2023

| 3 |

GEE GROUP INC.

7751 Belfort Parkway, Suite 150

Jacksonville, Florida 32256

PROXY STATEMENT

This proxy statement sets forth information relating to the solicitation of proxies by the Board of Directors (the “Board”) of GEE Group Inc. (the “Company”, “JOB” or “GEE Group”) in connection with the Company’s 2023 Annual Meeting of shareholders and any adjournment or postponement (the “Annual Meeting”), which will be held virtually. Shareholders will NOT be able to attend the Annual Meeting in person. The Annual Meeting will take place on September 19, 2023 at 11:00 a.m., Eastern Time, virtually at https://www.cstproxy.com/geegroup/2023.

This proxy statement and form of proxy will be first mailed or made available on or about August 21, 2023, to our shareholders of record as of the close of business on August 8, 2023 (the “Record Date”).

QUESTIONS AND ANSWERS ABOUT OUR ANNUAL MEETING

What is the purpose of the Annual Meeting?

The Annual Meeting will be held for the following purposes:

1. | To elect three Class I directors to the Board, each to serve until the 2026 Annual Meeting of Shareholders (the “2026 Annual Meeting”) or until their respective successor is elected and qualified (Proposal 1); |

|

|

2. | To ratify the appointment of FORVIS, LLP (“FORVIS”) as the Company’s independent registered public accounting firm for 2023 (Proposal 2); |

|

|

3. | To conduct a non-binding advisory vote to approve the compensation paid to the Company’s named executive officers (Proposal 3); and |

|

|

4. | To conduct a non-binding advisory vote to determine the frequency of the non-binding advisory vote on executive compensation (Proposal 4). |

Shareholders may also consider such other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

How does the Board recommend I vote?

The Board recommends the following votes:

| · | “FOR” each of the Board’s candidates, William Isaac, Jyrl James and David Sandberg for election to the Board to serve until the 2026 Annual Meeting or until their respective successor is duly elected and qualified (Proposal 1); |

| · | “FOR” the ratification of the appointment of FORVIS as the Company’s independent registered public accounting firm for 2023 (Proposal 2); |

| · | “FOR” the approval of the compensation paid to the Company’s named executive officers on an advisory, non-binding basis (Proposal 3); and |

| · | “FOR” the approval of a vote of every “three years” for the frequency of the non-binding advisory vote on executive compensation (Proposal 4). |

The Board recommends a vote “FOR” the election of each of the director candidates recommended by the Board and named in this proxy statement and on the enclosed proxy card.

To vote “FOR” all of the Board’s candidates, please complete, sign, date and return the enclosed proxy card or follow the instructions provided in the proxy card for submitting a proxy over the Internet, by telephone or vote at the Annual Meeting.

| 4 |

Beneficial owners who own their shares in “street name” should follow the voting instructions provided by their brokerage firm, bank, trustee or other nominee to ensure that their shares are represented and voted at the Annual Meeting, or to revoke prior voting instructions.

Who can vote at the Annual Meeting?

You can vote at the Annual Meeting if, as of the close of business on the Record Date, you were a holder of record of the Company’s common stock, no par value (the “Common Stock”). As of the Record Date, there were 113,145,730 shares of Common Stock issued and outstanding, each of which is entitled to one vote on each matter to come before the Annual Meeting.

How many shares must be present to conduct business at the Annual Meeting?

A quorum is necessary to hold a valid meeting of shareholders. A quorum will be present if shareholders holding a majority of the outstanding shares entitled to vote on a matter are present virtually or represented by proxy at the Annual Meeting. Thus, for each of the proposals to be presented at the Annual Meeting, the holders of shares of our Common Stock outstanding on the Record Date representing 56,572,865 votes must be present at the Annual Meeting, virtually or by proxy. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your brokerage firm, bank, trustee or other nominee) or if you are present at the Annual Meeting. Abstentions will be counted for the purposes of determining a quorum. If there is no quorum, the Chairman of the Annual Meeting, or if so requested by the Chairman of the Annual Meeting, the shareholders present virtually or represented by proxy may adjourn the Annual Meeting to another date.

What if another matter is properly brought before the Annual Meeting?

We do not expect that any other items of business will be presented for consideration at the Annual Meeting other than those described in this proxy statement. However, by completing, signing, dating and returning the enclosed proxy card or submitting your proxy or voting instructions over the Internet or by telephone, you will give to the persons named as proxies on the proxy card discretionary voting authority with respect to any matter that may properly come before the Annual Meeting, and such persons named as proxies intend to vote on any such other matter in accordance with the instructions of the Board to the extent permitted by Rule 14a-4(c) of the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated therein (the “Exchange Act”).

How do I vote?

Registered Shareholders. If you are a registered shareholder (i.e., you hold your shares in your own name through our transfer agent, Continental Stock Transfer & Trust Co., referred to herein as “Continental”) as of the Record Date, then you may vote by proxy via telephone or the Internet, or by mail by following the instructions provided on the proxy card. Shareholders of record who attend the Annual Meeting virtually may vote during the virtual Annual Meeting by visiting https://www.cstproxy.com/geegroup/2023 and following the on-screen instructions (have your proxy card available when you access the webpage).

Beneficial Owners. If you are a beneficial owner of shares (i.e., your shares are held in the name of a brokerage firm, bank or a trustee) as of the Record Date, then you may vote by proxy by following the instructions provided in the voting instruction form or other materials provided to you by the brokerage firm, bank, trustee or other nominee that holds your shares. To vote virtually at the Annual Meeting, you must obtain a legal proxy from the brokerage firm, bank or other nominee that holds your shares. If you do not provide voting instructions to your broker, then your shares will not be voted at the Annual Meeting on any proposal with respect to which the broker does not have discretionary authority (i.e., non-routine proposals such as Proposals 1, 3 and 4). If you do not provide voting instructions to your broker with respect to routine proposals, such as Proposal 2, your broker may exercise discretion to vote your shares on Proposal 2, even in the absence of your instruction. If your shares are voted on Proposal 2, as directed by your broker, your shares will constitute “broker non-votes” on each of the non-routine proposals (i.e., Proposals 1, 3 or 4). The “broker non-votes” will be counted for purposes of determining whether a quorum exists at the meeting.

| 5 |

If you are beneficial owner, we encourage you to instruct your broker how to vote your shares using the voting instruction form provided by your broker so that your vote can be counted on all proposals. The voting instruction form provided by the broker holding your shares may also include information about how to submit your voting instructions over the Internet or telephone, if such options are available. The proxy card accompanying this proxy statement will provide information regarding Internet voting.

If voting via the Internet, shareholders can vote as instructed on the website identified on the proxy card. The Internet procedures are designed to authenticate a shareholder’s identity to allow the shareholder to vote their shares and confirm that their instructions have been properly recorded. Internet voting for shareholders of record is available 24 hours a day and will close at 11:59 p.m., Eastern Time, on September 18, 2023.

If you have any questions or need assistance in voting your proxy, please contact Advantage Proxy at the following numbers or email address: Advantage Proxy, Inc. PO Box 13581, Des Moines, WA 98198, Telephone: Toll Free: 1-877-870-8565 and Collect: 1-206-870-8565, Email: ksmith@advantageproxy.com.

Whether or not you expect to attend the Annual Meeting virtually, the Board urges shareholders to submit a proxy to vote your shares in advance of the meeting by (a) visiting https://www.cstproxy.com/geegroup/2023 and following the on screen instructions (have your proxy card available when you access the webpage), or (b) submitting your proxy card by mail by using the previously provided self-addressed, stamped envelope. Submitting a proxy will not prevent you from revoking a previously submitted proxy or changing your vote as described above, but it will help to secure a quorum and avoid added solicitation costs.

If you vote via the Internet, telephone or by mailing a proxy card, we will vote your shares as you direct. For the election of directors (Proposal 1), you may specify whether your shares should be voted for all, some or none of the nominees for director listed. With respect to the ratification of the appointment of FORVIS as the Company’s independent registered public accounting firm (Proposal 2) and the approval of the compensation paid to the Company’s named executive officers on a non-binding advisory basis (Proposal 3), , you may vote “FOR” or “AGAINST” the ratification or approval, or you may abstain from voting on the ratification or approval. With respect to the approval of a non-binding advisory resolution to determine the frequency of the non-binding advisory vote on executive compensation (Proposal 4), you may vote for “one year,” “two years,” or “three years,” or you may abstain from voting on Proposal 4.

Your vote is very important. Please submit a proxy by following the instructions on your proxy card even if you plan to attend the Annual Meeting virtually.

How can I vote my shares without attending the Annual Meeting?

To vote your shares without attending the Annual Meeting, please follow the instructions for Internet or telephone voting in the proxy materials. You may also vote by signing and submitting your proxy card and returning it by mail, if you are the shareholder of record, or by signing the voter instruction form provided by your brokerage firm, bank, trustee or other nominee and returning it by mail, if you are the beneficial owner but not the shareholder of record. This way your shares will be represented whether or not you are able to attend the Annual Meeting.

How will the persons named as proxies vote?

If you are a record shareholder and you submit a signed proxy card or submit your proxy by telephone or the Internet but do not indicate how you want your shares voted, the persons named in the enclosed proxy card will vote your shares of Common Stock:

| · | “FOR” each of the Board’s candidates for election to the Board to serve until the 2026 Annual Meeting or until their respective successor is duly elected and qualified (Proposal 1); |

| · | “FOR” the ratification of the appointment of FORVIS as the Company’s independent registered public accounting firm for 2023 (Proposal 2); |

| · | “FOR” the approval of the compensation paid to the Company’s named executive officers on an advisory non-binding basis (Proposal 3); and |

| · | “FOR” the approval of a vote of every “three years” for the frequency of the non-binding advisory vote on executive compensation (Proposal 4). |

| 6 |

With respect to any other matter that properly comes before the Annual Meeting, the persons named in the enclosed proxy card will vote your shares of Common Stock in their discretion in accordance with their best judgment and in the manner they believe to be in the best interests of the Company to the extent permitted by Rule 14a-4(c) of the Exchange Act.

Will my shares be voted if I do not provide voting instructions? What are broker non-votes? What is discretionary voting?

If you are a shareholder of record and you properly sign, date and return a proxy card, but do not indicate how you wish to vote with respect to a particular nominee or proposal, then your shares will be voted “FOR” the election of the Board’s three candidates for director named in Proposal 1: Election of Directors, “FOR” Proposal 2: Ratification of the Appointment of FORVIS as the Company’s Independent Registered Public Accounting Firm for 2023, “FOR” Proposal 3: Say-On-Pay Resolution and “THREE YEARS” on Proposal 4: Say-on-Pay Frequency Resolution.

If you are a shareholder whose shares are not registered in your name and instead are held in an account at a brokerage firm, bank, trustee or other nominee, then you are the beneficial owner of shares held in “street name.” Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Under the Broker Rules, brokerage firms have the authority to vote shares held for a beneficial owner on “routine” matters.

Brokers or nominees will be entitled to vote shares held for a beneficial owner on routine matters, such as Proposal 2, without instructions from the beneficial owner of those shares. Brokers or nominees are not entitled to vote the shares on non-routine items. Accordingly, if you do not submit any voting instructions to your broker or nominee, your broker or nominee may exercise discretion to vote your shares on Proposal 2, even in the absence of your instruction. If your shares are voted on Proposal 2, as directed by your broker, your shares will constitute broker non-votes on each of the non-routine proposals (i.e., Proposals 1, 3 and 4). The broker non-votes will be counted for purposes of determining whether a quorum exists at the meeting.

Can I change my vote after I have voted or revoke my proxy?

Subject to any rules and deadlines your brokerage firm, bank, trustee or other nominee may have, you may change your proxy instructions at any time before your proxy is voted at the Annual Meeting. If you are a shareholder of record, you may change your vote by (1) delivering to the Company’s Corporate Secretary, prior to your shares being voted at the Annual Meeting, a written notice of revocation dated later than the prior proxy card relating to the same shares, (2) delivering a valid, later-dated proxy in a timely manner, (3) attending and voting at the Annual Meeting virtually (although virtual attendance at the Annual Meeting will not, by itself, revoke a proxy) or (4) voting again via Internet or telephone at a later date.

If you are a beneficial owner of shares held in street name, you may change your vote (1) by submitting new voting instructions to your brokerage firm, bank, trustee or other nominee, or (2) if you have obtained a legal proxy from the brokerage firm, bank, trustee or other nominee that holds your shares giving you the right to vote the shares and provided a copy to Continental Stock Transfer & Trust Co. together with your email address by attending the Annual Meeting virtually and voting electronically.

Any written notice of revocation or subsequent proxy card must be received by the Company’s Corporate Secretary prior to the taking of the vote at the Annual Meeting. Unless properly revoked, properly executed and delivered proxies that are received before the polls are closed at the Annual Meeting will be voted in accordance with the directions provided. Only the latest dated and validly executed proxy that you submit will count.

What is the deadline to vote?

If you hold shares as the shareholder of record, your vote by proxy must be received before the polls close at the Annual Meeting. If you are the beneficial owner of shares as of the Record Date, please follow the voting instructions provided by your brokerage firm, bank, trustee or other nominee.

| 7 |

What vote is required to elect directors or take other action at the Annual Meeting?

Proposal 1: Election of three Class I Directors. The election of the three Class I director nominees named in this proxy statement requires the affirmative vote of shares of Common Stock representing a plurality of the votes cast on the proposal at the Annual Meeting. You may not cumulate your votes for the election of directors. Votes that are withheld from a director nominee will be excluded entirely from the vote for such nominee and will have no effect on the result. Brokers may not use discretionary authority to vote shares on the election of directors if they have not received specific instructions from their clients. For your vote to be counted in the election of directors, you will need to communicate your voting decisions to your bank, broker or other nominee before the date of the Annual Meeting in accordance with their specific instructions. Broker non-votes, if any, will have no effect on this proposal.

Proposal 2: Ratification of the Appointment of FORVIS as the Company’s Independent Registered Public Accounting Firm for 2023. Ratification of the appointment of FORVIS as the Company’s independent registered public accounting firm for the year ending September 30, 2023, requires the affirmative vote of shares of Common Stock representing the majority of shares represented and entitled to vote on this proposal at the Annual Meeting. Abstentions will have the same legal effect as a vote “AGAINST” this proposal. Broker non-votes will have the same legal effect as a vote “AGAINST” on this proposal.

Proposal 3: Say-On-Pay Resolution. The Say-On-Pay Resolution requires the affirmative vote of shares of Common Stock representing the majority of shares represented and entitled to vote on this proposal at the Annual Meeting. Abstentions will have the same legal effect as a vote “AGAINST” this proposal and broker non-votes, if any, will have no effect on the outcome of this proposal.

Proposal 4: Say-On-Pay Frequency Resolution. The Say-On-Pay Frequency Resolution requires the affirmative vote of shares of Common Stock representing the majority of shares represented and entitled to vote on this proposal at the Annual Meeting. Abstentions will have the same legal effect as a vote “AGAINST” this proposal and broker non-votes, if any, will have no effect on the outcome of this proposal.

In general, other business properly brought before the Annual Meeting requires the affirmative vote of shares of Common Stock representing the majority of shares represented and entitled to vote on such matter at the Annual Meeting.

Where can I find the results of the voting?

We intend to announce preliminary voting results at the Annual Meeting and will publish final results through a Current Report on Form 8-K to be filed with the Securities and Exchange Commission (the “SEC’) within four business days after the Annual Meeting. If our final voting results are not available within four business days after the Annual Meeting, we will file a Current Report on Form 8-K reporting the preliminary voting results and subsequently file the final voting results in an amendment to the Current Report on Form 8-K within four business days after the final voting results are known to us. The Current Report on Form 8-K will be available on the Internet at our website, www.geegroup.com.

How can I attend the virtual Annual Meeting?

In order to attend the virtual Annual Meeting, you will need to pre-register by 9:00 a.m. Eastern Time on September 11, 2023. To pre-register for the Annual Meeting, please follow these instructions:

| · | If you are a shareholder of record, please pre-register to participate in the Annual Meeting remotely by visiting https://www.cstproxy.com/geegroup/2023. Please have your proxy card, or Notice of Annual Meeting of Shareholders, containing your control number available and follow the instructions to complete your registration request. |

|

|

|

| · | If you are not a shareholder of record but hold shares as a beneficial owner in street name, you will be required to obtain a legal proxy from your broker, bank, trustee, or nominee, indicating that you were a beneficial owner of shares as of the Record Date and the number of shares that you beneficially owned at that time. You then must submit a request for registration to Continental Stock Transfer & Trust Co.: (1) by email to proxy@Continentalstock.com; (2) by calling Continental Stock Transfer at 917-262-2373; or (3) by calling Advantage Proxy, Inc. our proxy solicitor, Toll Free: 1-877-870-8565 and Collect: 1-206-870-8565. Requests for a control number must be submitted 48 hours prior to the virtual Annual Meeting. |

| 8 |

After registering, shareholders will receive a confirmation email with a link and instructions for accessing the virtual Annual Meeting. We recommend that shareholders carefully review in advance the procedures needed to gain admission virtually to the Annual Meeting. If you do not comply with the procedures outlined above, you will not be admitted to the virtual Annual Meeting.

Who will pay for the cost of soliciting proxies?

Proxies will be solicited on behalf of the Board by the Company’s directors, director candidates, and certain executive officers and other employees of the Company. The costs and expenses of the Board’s soliciting of proxies, including the preparation, assembly and mailing of this proxy statement, the proxy card, the Notice of the Annual Meeting of Shareholders and any additional information furnished to shareholders will be borne by the Company. Solicitation of proxies may be in person, by telephone, facsimile, electronic mail or personal solicitation by our directors, officers or employees. Other than the persons described in this proxy statement, no general class of employee of the Company will be employed to solicit shareholders in connection with this proxy solicitation. However, in the course of their regular duties, our employees, officers and directors may be asked to perform clerical or ministerial tasks in furtherance of this solicitation. None of these individuals will receive any additional or special compensation for doing this, but they may be reimbursed for reasonable out-of-pocket expenses. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodian holding shares of the Common Stock in their names that are beneficially owned by others to forward to those beneficial owners. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation material to the beneficial owners of Common Stock.

You may also vote by proxy via telephone by calling Advantage Proxy, Inc. Toll Free: 1-877-870-8565 and Collect: 1-206-870-8565. We have engaged Advantage Proxy, Inc. to assist in the solicitation of proxies in connection with the Annual Meeting, for a service fee and the reimbursement of customary disbursements, which are not expected to exceed $[·] in total.

If you have any questions or need assistance in voting your proxy, please contact Advantage Proxy at the following numbers or email address: Advantage Proxy, Inc. PO Box 13581, Des Moines, WA 98198, Telephone: Toll Free: 1-877-870-8565 and Collect: 1-206-870-8565, Email: ksmith@advantageproxy.com.

Do I have appraisal or dissenters’ rights?

None of the applicable Illinois law, our Amended and Restated Articles of Incorporation, nor our Amended and Restated By-Laws (the “By-Laws”), provide for appraisal or other similar rights for dissenting shareholders in connection with any of the proposals set forth in this proxy statement. Accordingly, you will have no right to dissent and obtain payment for your shares in connection with such proposals.

Who should I call if I have questions or need assistance voting my shares?

If you have questions about the Annual Meeting, would like additional copies of this proxy statement or need assistance voting your shares, requests should be directed as described below:

Advantage Proxy, Inc.

PO Box 13581, Des Moines, WA 98198

Telephone: Toll Free: 1-877-870-8565 and Collect: 1-206-870-8565

Email: ksmith@advantageproxy.com

| 9 |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

General

Our By-Laws provide for a classified Board consisting of three classes of directors with staggered three-year terms. The Board currently consists of nine directors, having terms expiring at the respective annual meetings of shareholders noted below:

Class I – 2023 Annual Meeting |

| Class II – 2024 Annual Meeting | Class III – 2025 Annual Meeting | |

William Isaac Jyrl James David Sandberg |

| Darla Moore Matthew Gormly J. Randall Waterfield |

| Peter Tanous Thomas Vetrano Derek E. Dewan |

Election of Three Directors to Hold Office for Three Years until the 2026 Annual Meeting

Upon the recommendation of the Nominating Committee of the Board, the Board has nominated for election at the Annual Meeting the following slate of three nominees, each to hold office for three years until the 2026 Annual Meeting or until their respective successor is duly elected and qualified:

Name | Age | Position | Director Since |

William Isaac | 79 | Director | 2015 |

Jyrl James | 70 | Director | 2023 |

David Sandberg | 50 | Director | 2023 |

_________

Each of the Company’s nominees is currently serving as a member of our Board.

Information About Directors

The following table sets forth the names, ages, committee assignments, and positions of our directors as of August 11, 2023. Our Board consists of an experienced group of business leaders, with experience in corporate governance, corporate finance, capital markets, insurance, employee benefits and real estate.

Name | Age | Position |

Derek E. Dewan | 68 | Chief Executive Officer, Chairman of the Board |

Peter Tanous (1)(2)(3)(5) | 85 | Director |

Darla D. Moore (1)(2)(3)(4)(5) | 68 | Director |

William Isaac (1)(3)(4)(5) | 79 | Director |

Jyrl James (2)(3)(5) | 70 | Director |

Matthew Gormly (1)(2)(4) | 64 | Director |

Thomas Vetrano (2)(3)(6) | 62 | Director, Lead Independent Director |

J. Randall Waterfield (1)(4) | 50 | Director |

David Sandberg (4)(5) | 50 | Director |

(1) Member of the Audit Committee.

(2) Member of the Compensation Committee.

(3) Member of the Nominating Committee.

(4) Member of the Mergers and Acquisitions Committee.

(5) Member of the Corporate Governance Committee.

(6) Lead Independent Director.

| 10 |

Class I Directors Up for Re-Election at the Annual Meeting

William “Bill” Isaac – Director

Mr. Isaac joined the Company as a director in June 2015 and is currently Chairman of Secura/Isaac Group and its three branches Secura/Isaac Advisory, Secura/Isaac Technologies and Secura/Isaac Talent. He is a member of the boards of directors of Emigrant Bank and New York Private Bank & Trust and serves as Chairman of Sarasota Private Trust and Cleveland Private Trust, all of which are owned by Howard Milstein and his family.

William “Bill” Isaac served as Chairman of the FDIC during one of the most important and tumultuous periods in US banking history. Some 3,000 banks and thrifts failed during the 1980s, including Continental Illinois and nine of the ten largest banks in Texas. In addition to the failures of many of the largest regional banks throughout the US, most of the money center banks in the US were on the watch list due in large part to the enormous amount of loans on their books to less developed countries.

President Carter appointed Bill Isaac to the board of the FDIC in 1978. He was confirmed by the Senate at the age of 34. President Reagan named him Chairman of the FDIC two years later, making him the youngest FDIC board member and Chairman in history. Bill Isaac also served as Chairman of the Federal Financial Institutions Examination Council (1983-85), as a member of the Depository Institutions Deregulation Committee (1981–85), and on the Vice President’s Task Group on Regulation of Financial Services (1984).

After completing his service as Chairman of the FDIC at the end of 1985, Bill Isaac founded The Secura Group, a leading consulting firm, which he sold in 2008. He served as Chairman of the Board of Fifth Third Bancorp, one of the nation’s leading banks, and worked as Senior Managing Director at FTI Consulting from 2011 to 2019. He then joined Howard Milstein in the financial services business. Bill Isaac is a former board member at TSYS, a leading payment processing company that today is part of Global Payments. He has served on the boards of Amex Bank, The Associates (a finance company formerly owned by Ford Motor Company), credit reporting company TransUnion, and staffing firm MPS Group (now owned by Adecco).

Bill Isaac is involved extensively in thought leadership relating to the financial industry. He is the author of ‘Senseless Panic: How Washington Failed America’ with a foreword by legendary former Federal Reserve Chairman Paul Volcker. ‘Senseless Panic’ provides an inside account of the banking and savings and loans crises of the 1980s and compares that period to the financial crisis of 2008/2009. Bill Isaac’s articles appear in the Wall Street Journal, the Washington Post, the New York Times, The Hill, American Banker, Forbes, the Financial Times, the Washington Times, and other leading publications. He appears regularly on television and radio, testifies before Congress, and is a speaker before audiences throughout the world.

Bill Isaac is a former senior partner at Arnold & Porter, which was a founding partner of The Secura Group. He left the law firm in 1993 when Secura purchased Arnold & Porter’s interest in Secura. Before his appointment to the FDIC, Bill Isaac served as vice president, general counsel and secretary of First Kentucky National Corporation and its subsidiaries, including First National Bank of Louisville and First Kentucky Trust Company. He began his career with Foley & Lardner in Milwaukee where he practiced general corporate law specializing in banking law.

Bill Isaac received a Distinguished Achievement Medal in 1995 from Miami University and a Distinguished Alumnus Award in 2013 from The Ohio State University. He is a Life member of both the Board of Directors of the Miami University Foundation and the Board of Directors of The Ohio State University Foundation. Bill co-founded in 2016, with his former classmate, the William Isaac & Michael Oxley Center for Business Leadership at Miami University.

Mr. Isaac began his career as an attorney with Foley & Lardner and was a senior partner with Arnold & Porter. Before his appointment to the FDIC, Bill Isaac served as Vice President, General Counsel and Secretary of First Kentucky National Corporation and its subsidiaries, including First National Bank of Louisville and First Kentucky Trust Company. He received a “Distinguished Achievement Medal” in 1995 from Miami University and a “Distinguished Alumnus Award” in 2013 from the Ohio State University (“OSU”). He is a former member of the Board of Directors of the Miami University Foundation and is a Life Member of the Board of Directors of the OSU Foundation. Mr. Isaac is involved with several charitable and not for profit organizations and in 2016, co-founded with his former classmate, the William Isaac & Michael Oxley Center for Business Leadership at Miami University. Mr. Isaac earned a B.B.A. from Miami University and a J.D. from OSU. Mr. Isaac’s extensive business experience spans over 40 years and includes expertise in financial services, consulting, contingent labor and mergers and acquisition. He has served in the roles of lawyer, consultant, regulator and director to numerous organizations. He brings a wealth of knowledge to the board and is an invaluable resource to GEE Group.

| 11 |

Jyrl James – Director

Jyrl James has served as a director of the Company since August 11, 2023. Ms. James has significant business and legal experience. She has been the general counsel and consultant to minority owned small businesses, such as Rae’s Playze Adult Daycare Center, Rightvarsity Technologies LLC, and Learning Right Technology LLC, since September 2012, where she has been overseeing and advising the businesses on matters of corporate governance, contracts, real estate, employment matters, internal policy development, participating in the ongoing strategic planning process as an integral member of the senior management team, advising on interactive computer technology and workforce development. Also, she has advised an education services company regarding intellectual property, employment and labor relations, contract issues and intellectual property. In addition, she has been a member of the board of directors of Rae’s Playze Adult Daycare Center. Mrs. James has been the President of Joslyse, LLC, a real estate investment company since June 2010, responsible for purchase, ownership, rental and sale of residential and commercial real estate and overseeing finance, operations, maintenance, administration, and improvement of commercial and residential properties. From September 2009 to December 2013, Ms. James served as general counsel and corporate secretary to an investment group at Queen City Venture Partners, LLC.

During her 30-year legal career Ms. James served as strategic leader in legal and business roles. She has been a key participant in company acquisitions and development of infrastructures for both legal and human resources functions. Ms. James has been instrumental in successfully guiding companies through business expansions and business crisis, including a chemical explosion with multiple fatalities, an SEC investigation and labor strife. During the course of her career, she led and developed professional staff and executives in North American countries and England. Her governance experience includes presenting to boards on various legal and structural matters and ensuring that the preparation of committee and board documents were thorough and complete.

Ms. James was the first in-house attorney for Adecco Group North America (“Adecco”), the largest subsidiary of the Zurich based global human resources solutions and staffing services company, Adecco SA, from 1998 to 2005. As Senior Vice President and General Counsel for North America, Ms. James was a member of key management of the then 4.5-billion-dollar billion enterprise of Adecco SA, then the world’s largest staffing services solutions and talent development provider. As part of the Adecco executive management team, Ms. James was a critical participant in setting the direction of the company, providing legal advice, and managing a wide range of legal activities through a team of 30 in-house attorneys in 3 countries and numerous outside counsels. She served as corporate secretary and held a government security clearance.

Ms. James served as vice president of human resources and general counsel at the Akron Beacon-Journal from 1994 to 1998. Previous to that, she was an attorney specializing in employment/labor/benefits law at the Atlantic Richfield Company and at private law firms. She also served as chairperson of the California Agricultural Labor Relations Board.

Ms. James has completed the University of Santa Clara Black Corporate Board Readiness program, a program that accelerates diversity in corporate governance by accompanying highly experienced, qualified Black leaders through a structured executive education program. She holds a degree in business and labor relations from the Illinois Institute of Technology and a law degree from DePaul University Law School.

There is no arrangement or understanding between any director or executive officer and any other person pursuant to which Ms. James was or is to be selected as a director.

| 12 |

David Sandberg – Director

David Sandberg has served as a director of the Company since August 11, 2023. Mr. Sandberg serves as the Managing Member, Founder, and Portfolio Manager of Red Oak Partners, LLC (“Red Oak Partners”), an investment advisory firm with a focus on value investing, since 2003. Prior to founding Red Oak Partners, he co-managed J.H. Whitney & Co’s Green River fund, a private equity firm, from 1998 to 2002. Mr. Sandberg currently serves as Chairman of the Board of CBA Florida, Inc. (formerly OTC: CBAI), a healthcare service company, since April 2015. Mr. Sandberg also currently serves on the board of directors of W.O. Partners, LLC, a privately-held parent company that owns and operates construction and poultry staffing companies, since February 2020 and WTI Holdings, LLC, a privately-held holding company involving technology businesses, since 2017. He previously served on the board of directors of Asure Software, Inc. (NASDAQ: ASUR), a software services company, including as Chairman of the Board, from June 2009 to August 2020, SMTC Corporation (formerly NASDAQ: SMTX), a global manufacturing company, from April 2009 to April 2021, Issuer Direct Corporation (NASDAQ: ISDR), a communications company, from August 2013 to August 2016, Kensington Vanguard, a private title insurance company, including as its Chairman, from August 2012 to August 2016, Planar Systems Inc. (formerly NASDAQ: PLNR), an electronics manufacturing company from March 2012 to February 2015, RF Industries, Ltd. (NASDAQ: RFIL), an interconnect and cable products manufacturing company, from September 2011 to March 2013, and EDCI Inc. (formerly NASDAQ: EDCI), a holding company, from June 2009 to December 2012. Mr. Sandberg has experience serving as a member of and as Chairman of each of the audit, compensation, nominating and governance, and strategic committees for public companies. Mr. Sandberg graduated from Carnegie Mellon University with a B.S. in Industrial Management and a B.A. in Economics.

Except for the Cooperation Agreement (as defined and described in “Agreements with Respect to Director Nominations and Voting - Agreement with Red Oak”), there is no arrangement or understanding between any director or executive officer and any other person pursuant to which Mr. Sandberg was or is to be selected as a director.

Continuing Directors

Class II Directors

Matthew E. Gormly III – Director

Matthew E. Gormly, III, joined the Company in March 2020, as an independent director, bringing with him a wealth of experience and expertise. Mr. Gormly is a Founder and the Managing Partner of Reynolds Gormly & Co., LLC ("Reynolds Gormly"), where he leads his organization on origination and capital market opportunities while overseeing the firm's overall management. His vast experiences have helped him hone his ability to navigate complex financial landscapes during which he has led or played a significant role in the origination of over $1.5 billion in financings for acquisitions, leveraged recapitalizations, and re-financings throughout his esteemed career. He has served on the boards of directors for over 25 companies, spanning an impressive 30-year period. His board leadership has provided invaluable guidance and strategic insights to these companies, including GEE Group, contributing to their growth and success.

Mr. Gormly is an experienced, thoughtful executive leader and decision maker. He vast business and finance experience includes commercial banking, investment banking, management of small and medium size business, and private equity partnerships. His particular areas of expertise include business development and strategy, corporate finance, corporate governance, mergers, acquisitions, and divestitures, capital markets, policy formulation and execution, and strategic planning.

Prior to his involvement with Reynolds Gormly, Mr. Gormly played a pivotal role in the growth and transformation of Wicks Capital Partners ("Wicks") during his seventeen-year tenure as a Managing Partner, before departing in 2016. The Wicks Funds invested in information, education and media companies broadly defined. Mr. Gormly was a managing partner and part owner of the management company. He also was a member of the Firm’s General Partner Management and Investment Committees. He and his partners managed all aspects of the management company and multiple funds and limited partner relationships and held board positions in all portfolio company investments.

During his time at Wicks, Mr. Gormly demonstrated exceptional leadership focusing his efforts on a wide range of responsibilities, including originating, acquiring, managing, growing, and divesting the firm's portfolio of control buyout investments. His extensive experience in every facet of the investment process, such as developing investment theses, origination, acquisitions, strategic planning, and divestitures, has been instrumental in his success. He was at the forefront of originating new investments, facilitating financing for transactions, and effectively managing these investments through the sale processes. And his contributions extend beyond his direct involvement with Reynolds Gormly and Wicks.

Educationally, Mr. Gormly holds a Bachelor of Arts degree from Hampden-Sydney College, complemented by a Master of Business Administration (MBA) degree from the Babcock School of Management at Wake Forest University. Mr. Gormly’s academic credentials, combined with his extensive professional experience, form a solid foundation for his exceptional performance and continued contributions to GEE Group.

| 13 |

Darla D. Moore – Director

Darla D. Moore joined the Company as an independent director in June 2018, bringing with her a wealth of experience and expertise. Ms. Moore is a highly accomplished businesswoman and philanthropist who has made significant contributions to the business world and society at large throughout her career.

As the Founder and Chair of the Palmetto Institute, a nonprofit think-tank, Ms. Moore is dedicated to fostering economic growth and increasing per capita income in South Carolina. She is also the visionary behind the Charleston Parks Conservancy, a foundation that focuses on enhancing the parks and public spaces of the City of Charleston, creating a better environment for its residents. Ms. Moore is the esteemed Chairwoman of the Darla Moore Foundation, further exemplifying her dedication to philanthropy and making a positive impact on society. In addition to her involvement with the Darla Moore Foundation, Ms. Moore holds positions on the Board of Directors of The Shed, a renowned cultural institution in New York City, the Lebanese American University of Beirut, the Santa Fe Institute, Oxbow Carbon, in addition to GEE Group.

Prior to her current roles, Ms. Moore served as the Vice President of Rainwater, Inc., a prestigious private investment company. During her tenure, she played a pivotal role in the company's success and demonstrated her exceptional leadership skills.

Ms. Moore's accomplishments have gained her significant recognition in the business world. She was featured on the cover of Fortune magazine, becoming the first woman to receive this distinction. Additionally, she has been named among the Top 50 Most Powerful Women in American Business, in recognition of her influence and impact on American business.

Throughout her career, Ms. Moore has served on numerous corporate and philanthropic boards, showcasing her commitment to making a difference. In addition to GEE Group, some notable organizations she has been involved with include Hospital Corporation of America (HCA), Martha Stewart Living Omnimedia, The South Financial Group, MPS Group, the National Advisory Board of JP Morgan, the National Teach for America Board of Directors, the Board of Trustees of the New York University Medical School and Hospital, and the University of South Carolina Board of Trustees.

In recognition of her outstanding achievements, the University of South Carolina's business school proudly bears her name, making it the first business school in America named after a woman. Ms. Moore's dedication to the business community has earned her the Business Person of the Year Award from the South Carolina Chamber of Commerce and induction into the South Carolina Business Hall of Fame.

Ms. Moore's passion for golf led her to become one of the first women members of the prestigious Augusta National Golf Club, alongside Condoleezza Rice. This accomplishment demonstrates her commitment to breaking barriers and paving the way for future generations of women in sports.

Ms. Moore holds an undergraduate degree from the University of South Carolina and an M.B.A. from The George Washington University, solidifying her academic foundation and complementing her remarkable professional achievements.

Through her leadership, vision, and philanthropic efforts, Ms. Moore has left an indelible mark on the world, inspiring others to strive for excellence and make a difference.

| 14 |

J. Randall Waterfield – Director

J. Randall Waterfield has served as a director of the Company since August 11, 2023. Mr. Waterfield is Chairman of The Board & Chief Executive Officer of Waterfield Holdings. Waterfield Holdings traces its roots back to 1928, when Richard H. Waterfield founded Waterfield Mortgage Company and Waterfield Insurance Agency in Fort Wayne, Indiana. After selling the largest private mortgage company in the US and largest Indiana based bank in 2006 and 2007 respectively, Waterfield Holdings has diversified into technology, real estate, asset management and merchant banking. Waterfield Holdings today has over $2 billion in managed assets.

Mr. Waterfield was the 2017-2018 Chairman of Young Presidents’ Organization (YPO) International (www.ypo.org) an organization of over 34,000 CEOs from over 140 countries with combined revenue of over US$ 9 trillion. He is currently a director of 26 Capital Acquisition Corp., (NASDAQ: ADER), US Strategic Metals, Linden Lab, and WTI Holdings, and has served on various boards previously including SMTC Corporation, (formerly NASDAQ: SMTX), a global manufacturing company, Red Oak Partners, RF Industries, Ltd. (NASDAQ: RFIL), an interconnect and cable products manufacturing company and Asure Software. Prior to joining Waterfield, Mr. Waterfield was employed by Goldman Sachs Asset Management, where he was responsible for the small cap growth portfolios. Through the Waterfield Foundation and J. Randall Waterfield Foundation, Mr. Waterfield supports a variety of environmental and Midwestern based causes. Mr. Waterfield graduated from Harvard University in 1996; he holds the Chartered Financial Analyst designation (CFA) and is a member of MENSA.

Except for the Letter Agreement and Cooperation Agreement (each as defined and described in “Agreements with Respect to Director Nominations and Voting”), there is no arrangement or understanding between any director or executive officer and any other person pursuant to which Mr. Waterfield was or is to be selected as a director.

Class III Directors

Derek E. Dewan – Chief Executive Officer, Chairman of the Board

Derek E. Dewan was appointed Chairman and CEO of General Employment Enterprises, Inc. (k/k/a GEE Group Inc.) (NYSE American: JOB) in 2015, following its merger with Scribe Solutions, Inc. He is a highly accomplished executive with a proven track record of success and outstanding leadership achievements. Throughout his career, he has demonstrated exceptional abilities in driving organic growth, executing strategic acquisitions, and delivering outstanding financial performance. With extensive experience in the staffing services industry, Mr. Dewan has consistently achieved remarkable results and established himself as a respected figure in the industry. Since 2015, Mr. Dewan has successfully led JOB through 5 strategic acquisitions, significant post-acquisition integration, the COVID-19 pandemic, significant deleveraging of JOB resulting in the elimination of approximately $120 million in debt, and a $57.5 million follow-on public equity offering. The results of these activities have been transformational, including transitioning JOB away from industrial staffing towards professional staffing led by information technology (“IT”), revenue growth of 4 times, significantly higher gross profit and earnings margins, consistent profitability and positive cash flow.

Prior to this, Mr. Dewan served as Chairman and CEO of MPS Group, Inc., a publicly-traded staffing company. His tenure at MPS Group began in January 1994 when he joined AccuStaff Incorporated, MPS Group's predecessor, as President and Chief Executive Officer and led the IPO in August of that year. Notably, under Mr. Dewan's leadership, the company underwent significant organic growth and successfully executed over 100 strategic acquisitions, transforming it into a Fortune 1000 world-class, global multi-billion-dollar staffing services provider.

MPS Group's expansion under Mr. Dewan's guidance extended its reach to include a vast network of offices across the United States, Canada, the United Kingdom, Continental Europe, Asia, and Australia. The company consistently achieved remarkable success during his tenure, marked by completed secondary stock offerings of $110 million and $370 million, inclusion in the Standard and Poor's (S&P) Mid-Cap 400, and recognition on the Wall Street Journal's "top performing stock list" for three consecutive years. He led the company’s growth from a microcap to one of the largest U.S. professional staffing firms with human resources solutions verticals in IT, accounting, legal, healthcare and engineering. Under his leadership, the premier software vendor management system (“VMS”), Beeline, and managed services provider (“MSP”) Pontoon, were developed. Mr. Dewan’s final pivotal leadership achievement was the sale of MPS Group to Adecco Group in 2010, the largest staffing company in the world, for an impressive $1.3 billion. To our knowledge, this was the largest and most successful shareholder return story within the staffing industry at the time and still sets a high water mark today. This transaction exemplified Mr. Dewan’s ability to navigate complex negotiations and deliver exceptional value to stakeholders.

| 15 |

Before his tenure at MPS Group, Mr. Dewan started his career as a CPA with Price Waterhouse and rapidly ascended to the manager level in less than five (5) years. Subsequently, he moved to Coopers & Lybrand where he was promoted to the positions of Tax Partner in Charge and Managing Partner at that international accounting firm, now PricewaterhouseCoopers LLP (“PwC”). He was admitted as a partner at age 29, one of the youngest individuals to achieve this status in the history of the firm. This role provided him with a strong foundation in organizational leadership and excellence, operational and financial management, and expertise in tax and accounting practices, further enhancing his abilities as a strategic and effective business leader.

Mr. Dewan's extensive experience, demonstrated success, and exceptional leadership skills make him a valuable asset to the Company. With a proven ability to drive growth, execute strategic initiatives, and achieve outstanding financial results, he is well-positioned to contribute to the continued success of GEE Group’s future endeavors. He is a recipient of the “Ellis Island Medal of Honor”, the ATFL “Joseph J. Jacobs Distinguished Achievement Award”, the RMF “Distinguished Lifetime Achievement Award” and the “USF Alumni Award for Entrepreneurship”. He has served on the “NYSE Listed Company Advisory Committee”, the “SMU Cox School of Business Executive Board”, the “University of South Florida (“USF”) School of Accountancy Advisory Council” and the “ALSAC Board” which is the fund-raising arm of St. Jude Children’s Research Hospital. Mr. Dewan has a B.A. in Accounting with a concentration in finance from the University of South Florida.

Peter Tanous – Director

Peter J. Tanous is a highly accomplished and esteemed figure in the field of finance and investment. He currently holds the position of Chairman Emeritus at Lynx Investment Advisory, a SEC registered investment advisory firm located in Washington D.C. With an extensive career spanning several prestigious institutions, Mr. Tanous has created a lasting impact on the financial industry.

Before joining Lynx Investment Advisory, Mr. Tanous served as the International Director at Smith Barney and a member of the executive committee at Smith Barney International, Inc. Prior to that, he held the position of executive vice president and director at Bank Audi (USA) in New York for a decade. He also served as the chairman of Petra Capital Corporation in New York.

Education played a significant role in shaping Mr. Tanous’s career. He is a graduate of Georgetown University, where he currently serves on the board of Georgetown University's Center for Contemporary Arab Studies and is a member of the Georgetown University Library Board. Additionally, he dedicated two decades to the university's investment committee. His educational journey also included attending The American School of Paris in France, where he became fluent in French.

Mr. Tanous is a distinguished author, having written several influential books in the financial realm. His book "Investment Gurus," published in 1997 by Prentice Hall, became a bestseller and garnered critical acclaim within financial circles. It was selected as a main choice by The Money Book Club. He followed up with "The Wealth Equation," which also became a main selection of the Money Book Club. Tanous's other publications include "Investment Visionaries" (published by Penguin Putnam in August 2003) and "Kiplinger's Build a Winning Portfolio" (published by Kaplan Press in January 2008). Notably, he co-authored "The End of Prosperity" with Dr. Arthur Laffer and Stephen Moore, which was published by Simon & Schuster in October 2008. Mr. Tanous also has authored several well-reviewed published novels.

In addition to his remarkable achievements in the financial sector, Mr. Tanous has been involved in various organizations and served on the boards of several publicly held companies. Notable among these are his current or former positions on the boards Accustaff, Inc., MPS Group, and GEE Group, Inc., all companies in the staffing industry, where he served as the chairman of the Audit Committee. He also served on the board of Worldcare, Ltd., a healthcare services and telemedicine diagnostics company based in Cambridge, Massachusetts. Another notable role was his service on the board of directors of Kistler Aerospace, a pioneer in Low Earth Orbit satellite development.

Mr. Tanous's commitment to promoting Lebanese American relations led him to found and serve as the founding chairman of The American Task Force on Lebanon in Washington D.C. He actively engaged prominent Lebanese Americans across the United States to further this cause. Notably, an award at the organization is named after Tanous. He also served on the National Committee of St. Jude Children's Research Hospital in Memphis, Tennessee, contributing his expertise to the investment committee of this renowned charity. MR. Tanous also served as the Chairman of the Board of Trustees at Lebanese American University from 2018 to 2020.

| 16 |

Mr. Tanous also has generously supported Georgetown University by endowing the Tanous Lecture Series, which invites esteemed speakers from finance, government, and the arts to share their insights with the university community. The series has featured prominent individuals such as Treasury Secretary Janet Yellen, Pulitzer Prize winner Sara Ganim, Nobel Laureate George Akerlof, and Former Secretary of Defense Robert Gates. In recognition of his contributions, Tanous was honored with the Georgetown University William Gaston Alumni Award in 2021.

Thomas Vetrano – Director, Lead Independent Director

Mr. Vetrano joined the Company as a director in March 2020. On July 5, 2023, the Nominating Committee elected Mr. Vetrano as the Lead Independent Director of the Board. He is an accomplished executive leader and business consultant who has over 40 years of international business experience in environmental, health, safety, and sustainability issues. With a strong track record of success in various leadership positions, Mr. Vetrano has made significant contributions to renowned organizations.

As President and Managing Director of Ramboll Environment and Health (REH) from 2014 to 2019, Mr. Vetrano led the largest division of Copenhagen-based Ramboll Group. REH is a $450 million environmental and health sciences consultancy, with a global presence of over 2,600 employees in 25 countries. Under his guidance, the REH achieved exceptional financial performance and strategic growth, solidifying its position among the top ten global environmental consultancies. Mr. Vetrano oversaw all REH business operations, including finance and accounting, IT, risk management, human resources, marketing, sustainability, and employee health and safety. Prior to its acquisition by REH, Mr. Vetrano participated in the management buyout of ENVIRON Holdings, Inc. in 1998, and served as Chief Operating Officer and Secretary of ENVIRON from 2004 until 2014. During his tenure, ENVIRON experienced remarkable expansion, growing from 300 employees in the US and UK to over 1,500 employees across 25 countries. Under Mr. Vetrano's leadership, ENVIRON's revenues tripled to surpass $300 million, achieving consistent top-quartile industry growth and profitability. Following the successful sale of ENVIRON to REH, Mr. Vetrano directed post-merger integration and synergy realization efforts.

Mr. Vetrano's career also includes positions such as Managing Director and Vice President of Environmental Services at Kroll Associates, and Practice Leader and West Coast Regional Manager at Fred C. Hart Associates / McLaren-HART.

Mr. Vetrano currently serves as a member of the Boards of Directors for GEE Group, Inframark LLC, Locus Fermentation Solutions, and Cumming Group. He also serves as Chairman of the Board of Directors for The First Tee of the Virginia Blue Ridge, a charitable organization focused on youth development. Mr. Vetrano previously served as a Director for Smarter Sorting, and as an Advisory Board member for Daybreak LLC.

Throughout his career, Mr. Vetrano has demonstrated his commitment to ethical practices and corporate governance. During his time as a Director for ENVIRON and REH and on other international statutory and corporate governance boards, he has served on various Board committees including Ethics, Equity, Executive Compensation, Finance, Governance, Risk, and Valuation Committees. He currently serves as Chair of the Compensation Committee for GEE Group and Locus Fermentation Solutions, and Chair of the Risk Committee for Inframark LLC.

Mr. Vetrano has provided business consulting services to corporations, private equity firms, financial institutions, and legal counsel. Mr. Vetrano is internationally recognized for his expertise in merger and acquisition (M&A) due diligence, having directed environmental, health, safety, and sustainability due diligence for over 500 global transactions across diverse industries and sectors. He has shared his knowledge as a chairman or speaker at numerous professional conferences and seminars and has authored and contributed to publications on due diligence, environmental auditing, and cost recovery litigation support.

Mr. Vetrano holds a B.S. in Environmental Science from Rutgers University, graduating cum laude in 1982. He pursued further education at the New Jersey Institute of Technology, where he earned an M.S. in Environmental Engineering/Toxicology and received the prestigious EXXON Graduate Fellowship in 1984.

| 17 |

Executive Officer and Significant Employees

Alex Stuckey – Chief Operating Officer

Alex P. Stuckey joined GEE Group when it merged with Scribe Solutions in 2015, and currently serves as the Chief Operating Officer. At the time of the merger, Mr. Stuckey held the position of President and Chief Operating Officer at Scribe Solutions, Inc., where he played a pivotal role in the company's achievements. His exceptional leadership skills and strategic insights contributed to Scribe Solutions' success, ultimately leading to his association with Derek Dewan, our Chairman and CEO, the merger of Scribe Solutions with General Employment Enterprises in 2015, and the beginnings of today’s GEE Group Inc.

Mr. Stuckey is an accomplished business executive with a proven track record of success in various leadership roles and brings extensive experience and expertise to his position. Prior to his tenure at Scribe, Mr. Stuckey served as the Chief Executive Officer of Fire Fighters Equipment Co., where he successfully transformed a startup into a successful multi-million-dollar enterprise. Through his visionary approach, innovation and hard work, Mr. Stuckey implemented groundbreaking marketing strategies that revolutionized the fire safety industry and resulted in substantial net profits for his former company. His exemplary leadership attracted the attention of industry giant Cintas, which acquired Fire Fighters through a successful stock purchase.

In addition to his accomplishments in the business world, Mr. Stuckey possesses a wealth of experience in banking and finance. As a special assets officer at Barnett Bank, not only did Mr. Stuckey develop his keen understanding of financial management and risk assessment, he honed his skills in dispute resolution, negotiation and litigation management, skills that he brings to his current position as GEE Group’s COO and valued member of the executive management team.

Mr. Stuckey served as Education Chairman and Forum Moderator, as a member of Y.P.O., Government Affairs & Legislative Chairman for eight years for BOMA, Board of Director of Sila Heating & Air Conditioning, Super Home Services and Castleworks Home Services Company, all private equity backed, providers of residential home services. His involvement in these roles showcases his commitment to contributing his expertise and leadership to multiple industries.

Mr. Stuckey earned his bachelor's degree in Entrepreneurship and Business Enterprises from Florida State University, establishing his educational foundation, that has and continues to serve him and his organizations well. This, coupled with his extensive professional experience, equips him with a comprehensive understanding of business operations and the skills necessary to drive growth and success.

Overall, Mr. Stuckey's remarkable career journey, marked by transformative achievements and valuable expertise, positions him as an invaluable asset of GEE Group. His ability to lead teams, implement innovative strategies, and drive sustainable growth makes him a respected and sought-after business executive.

Kim Thorpe – Senior Vice President and Chief Financial Officer

Kim Thorpe joined the Company on May 1, 2018, as the Vice President of Finance, and was appointed Senior Vice President and Chief Financial Officer on June 15, 2018. He is an accomplished financial executive with a wealth of experience spanning various industries over four decades. As the newest member of GEE Group’s executive team, Mr. Thorpe already has played instrumental roles in the Company’s successful restructuring and integration initiatives following the SNI acquisition, navigation through the COVID-19 pandemic, deleveraging initiatives resulting in the elimination of approximately $120 million in debt, and completion of JOB’s follow-on equity offering, which in combination, have led to the Company’s return to profitable growth and generation of free cash flow.

Mr. Thorpe also serves as the Managing Principal of FRUS Capital LLC (“FRUS”), which he formed in February 2013, as a platform for providing consulting services to clients. At FRUS, he has been able to leverage his strong leadership skills and financial acumen, helping clients overcome obstacles toward achieving their goals and success. From November 2013 to May 2017, Mr. Thorpe accepted appointment as the Chief Financial Officer of one of his clients, Delta Company of Insurance Services, Inc., and became an investor, member and director, and was appointed CFO of NeuLife Neurological Services LLC, an affiliate, where he made significant contributions to the financial operations, capital formation, growth, and leadership of both organizations.

| 18 |

Prior to forming FRUS, Mr. Thorpe held senior executive positions in a privately-owned insurance organization and a specialty real estate lender from May 2006 to February 2013. In the case of the private insurance organization, Mr. Thorpe was instrumental in negotiations leading to its successful acquisition by its successor insurance organization. Leveraging his outstanding industry knowledge and M&A skills, in combination with his good reputation and relationships with decision makers at both buyer and seller, Mr. Thorpe remained a key figure in the transaction through its closing and post-acquisition integration stages.

From November 1999 to March 2006, Mr. Thorpe served as the Executive Vice President and Chief Financial Officer of FPIC Insurance Group, Inc., a prominent public company formerly listed on Nasdaq Global Select Market (NASDAQ: FPIC). His exceptional financial stewardship, strategic decision-making and leadership played a pivotal role in the successful turnaround of FPIC, following a period of accelerated growth through acquisitions accompanied by manifestations of significant post-acquisition integration and operational risks.

Mr. Thorpe also served as the Senior Vice President and Chief Financial Officer of a very large insurance and financial services business unit of GE Capital with assets of over $30 billion and annual revenues of nearly $2 billion. Although his time at GE Capital was relatively brief (March 1998 to November 1999), he honed his leadership skills and demonstrated his ability to manage very large, complex financial organizations, build and manage outstanding teams, and drive sustainable results. He also played a very important role, and one for which he specifically was recruited, in helping achieve improvements in the cultural assimilation of his business unit with GE Capital. For his many accomplishments in a short time, Mr. Thorpe achieved “Green Belt” status as a Six Sigma™ professional, had one of his Six Sigma™ projects nominated for an annual global Six Sigma™ award, one of GE’s most coveted business awards, attended GE’s invitation-only Advance Finance Council, and was invited to attend GE’s prestigious, Global Business Management Course.

Earlier in his career, from October 1993 to February 1998, Mr. Thorpe was a partner at the international accounting firm Coopers & Lybrand, a predecessor firm to PricewaterhouseCoopers LLP. In this capacity, he honed his expertise in accounting and financial management, as well as organizational leadership, solidifying the foundation for his many successes since. During his tenure, Mr. Thorpe served as the engagement partner in charge of audits of some of the Firm’s largest insurance clients and was considered one of his former Firm’s subject matter experts in insurance industry accounting, auditing, SEC and other regulatory matters.

Mr. Thorpe earned his BSBA, with honors, in Accounting from the University of Florida, and is a Certified Public Accountant. His educational background, coupled with his extensive professional experience, equips him with a comprehensive understanding of business and financial strategies, and best practices.

Board of Directors Leadership Structure and Role in Risk Oversight

Our Board has no policy regarding the separation of the offices of Chairman of the Board and Chief Executive Officer, and we currently bestow the roles and responsibilities of Chairman of the Board and Chief Executive Officer with Mr. Dewan. The Board believes that Mr. Dewan’s service as both Chairman of the Board and Chief Executive Officer is in the best interests of the Company and its shareholders. Mr. Dewan possesses detailed and in-depth knowledge of the issues, opportunities and challenges facing the Company and its business and is thus best positioned to develop agendas that ensure that the Board’s time and attention are focused on the most critical matters. His combined role enables decisive leadership, ensures clear accountability, and enhances the Company’s ability to communicate its strategy clearly and consistently to the Company’s shareholders, employees, and customers.

Independent directors and management have different perspectives and roles in strategy development. The Company’s independent directors bring experience, oversight, and expertise from outside the company and industry, while the management brings company-specific experience and expertise. The Board believes that a board of directors combined with independent board members and management is in the best interests of shareholders because it promotes strategy development and execution and facilitates information flow between management and the Board, which are essential to effective governance.

| 19 |