ADI SHAREHOLDER PRESENTATION Fall 2024 Exhibit 99.1

Forward-Looking Statements ©2024 Analog Devices, Inc. All Rights Reserved. This presentation contains forward-looking statements, which address a variety of subjects including, for example, our statements regarding future financial performance, including expected future revenue, operating income, operating margin and other future financial results; matters relating to our 2025 Annual Meeting of Shareholders; anticipated growth and trends in our business; future compensation actions; our strategy; and other future events. Statements that are not historical facts, including statements about our beliefs, plans and expectations, are forward-looking statements. Such statements are based on our current expectations and are subject to a number of factors and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. The following important factors and uncertainties, among others, could cause actual results to differ materially from those described in these forward-looking statements: economic, political, legal and regulatory uncertainty or conflicts; changes in demand for semiconductor products; manufacturing delays, product and raw materials availability and supply chain disruptions; products that may be diverted from our authorized distribution channels; changes in export classifications, import and export regulations or duties and tariffs; our development of technologies and research and development investments; our future liquidity, capital needs and capital expenditures; our ability to compete successfully in the markets in which we operate; our ability to recruit and retain key personnel; risks related to acquisitions or other strategic transactions; security breaches or other cyber incidents; adverse results in litigation matters; reputational damage; changes in our estimates of our expected tax rates based on current tax law; risks related to our indebtedness; unanticipated difficulties or expenditures related to integrating Maxim Integrated Products, Inc.; the discretion of our Board of Directors to declare dividends and our ability to pay dividends in the future; factors impacting our ability to repurchase shares; and uncertainty as to the long-term value of our common stock. For additional information about factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to our filings with the Securities and Exchange Commission, including the risk factors contained in our most recent Annual Report on Form 10-K. Forward-looking statements represent management’s current expectations and are inherently uncertain. Except as required by law, we do not undertake any obligation to update forward-looking statements made by us to reflect subsequent events or circumstances. Non-GAAP Financial Information This presentation includes non-GAAP financial measures that have been adjusted in order to provide investors with information regarding our results of operations, business trends and financial goals. Reconciliation of these non-GAAP measures to their most directly comparable GAAP measures can be found in the appendix. Management uses non-GAAP measures internally to evaluate the Company’s operating performance from continuing operations against past periods and to budget and allocate resources in future periods. These non-GAAP measures also assist management in evaluating the Company’s core business and trends across different reporting periods on a consistent basis. Management also uses these non-GAAP measures as primary performance measurements when communicating with analysts and investors regarding the Company’s earnings results and outlook and believes that the presentation of these non-GAAP measures is useful to investors because it provides investors with the operating results that management uses to manage the Company and enables investors and analysts to evaluate the Company’s core business. Management also believes that free cash flow, a non-GAAP liquidity measure, is useful both internally and to investors because it provides information about the amount of cash generated after capital expenditures that is then available to repay debt obligations, make investments and fund acquisitions, and for certain other activities.

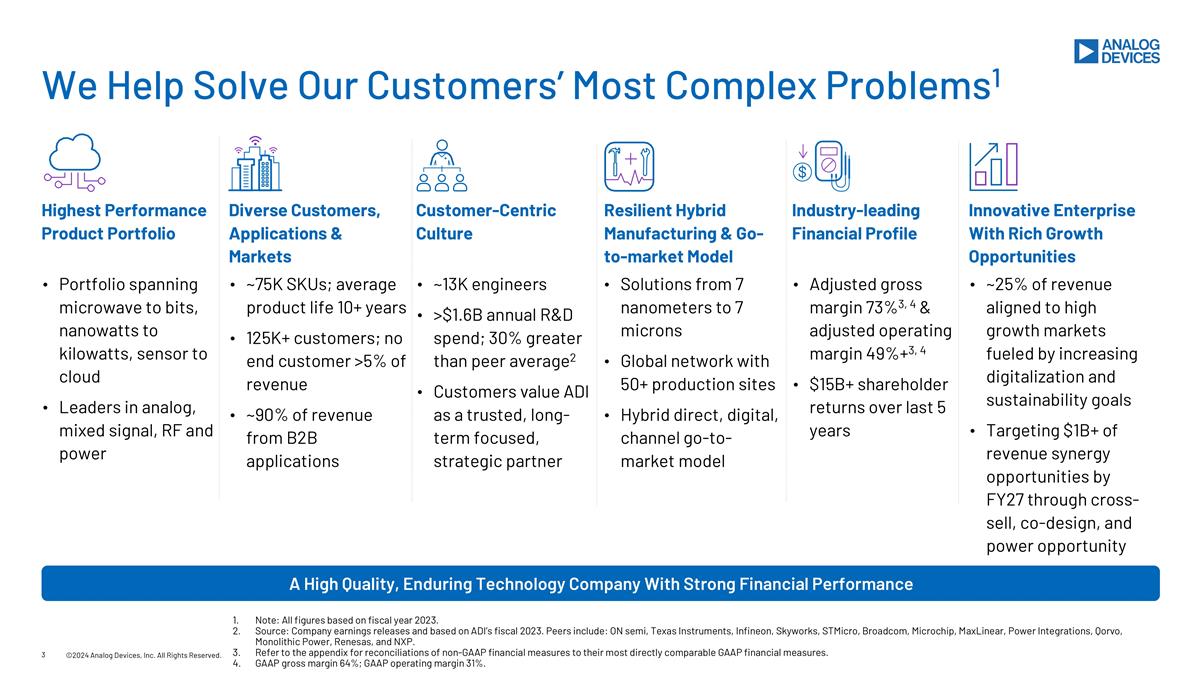

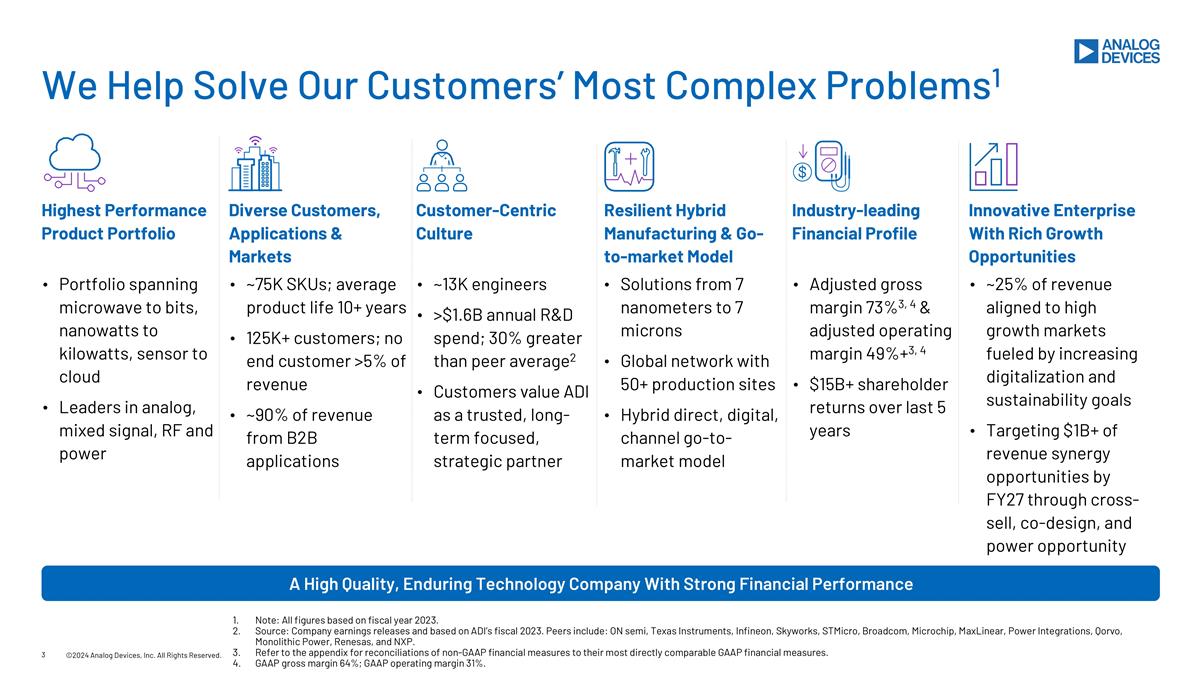

Portfolio spanning microwave to bits, nanowatts to kilowatts, sensor to cloud Leaders in analog, mixed signal, RF and power ©2024 Analog Devices, Inc. All Rights Reserved. We Help Solve Our Customers’ Most Complex Problems1 Highest Performance Product Portfolio A High Quality, Enduring Technology Company With Strong Financial Performance ~75K SKUs; average product life 10+ years 125K+ customers; no end customer >5% of revenue ~90% of revenue from B2B applications Diverse Customers, Applications & Markets ~13K engineers >$1.6B annual R&D spend; 30% greater than peer average2 Customers value ADI as a trusted, long-term focused, strategic partner Customer-Centric Culture Solutions from 7 nanometers to 7 microns Global network with 50+ production sites Hybrid direct, digital, channel go-to-market model Resilient Hybrid Manufacturing & Go-to-market Model Adjusted gross margin 73%3, 4 & adjusted operating margin 49%+3, 4 $15B+ shareholder returns over last 5 years Industry-leading Financial Profile ~25% of revenue aligned to high growth markets fueled by increasing digitalization and sustainability goals Targeting $1B+ of revenue synergy opportunities by FY27 through cross-sell, co-design, and power opportunity Innovative Enterprise With Rich Growth Opportunities Note: All figures based on fiscal year 2023. Source: Company earnings releases and based on ADI’s fiscal 2023. Peers include: ON semi, Texas Instruments, Infineon, Skyworks, STMicro, Broadcom, Microchip, MaxLinear, Power Integrations, Qorvo, Monolithic Power, Renesas, and NXP. Refer to the appendix for reconciliations of non-GAAP financial measures to their most directly comparable GAAP financial measures. GAAP gross margin 64%; GAAP operating margin 31%.

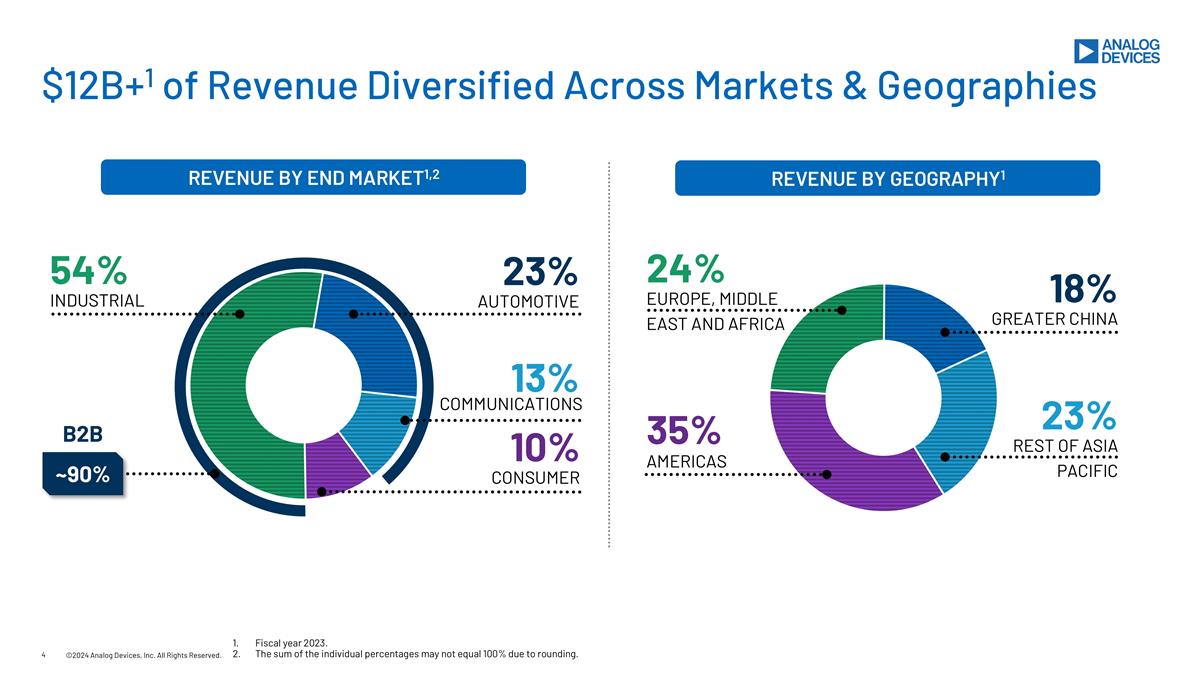

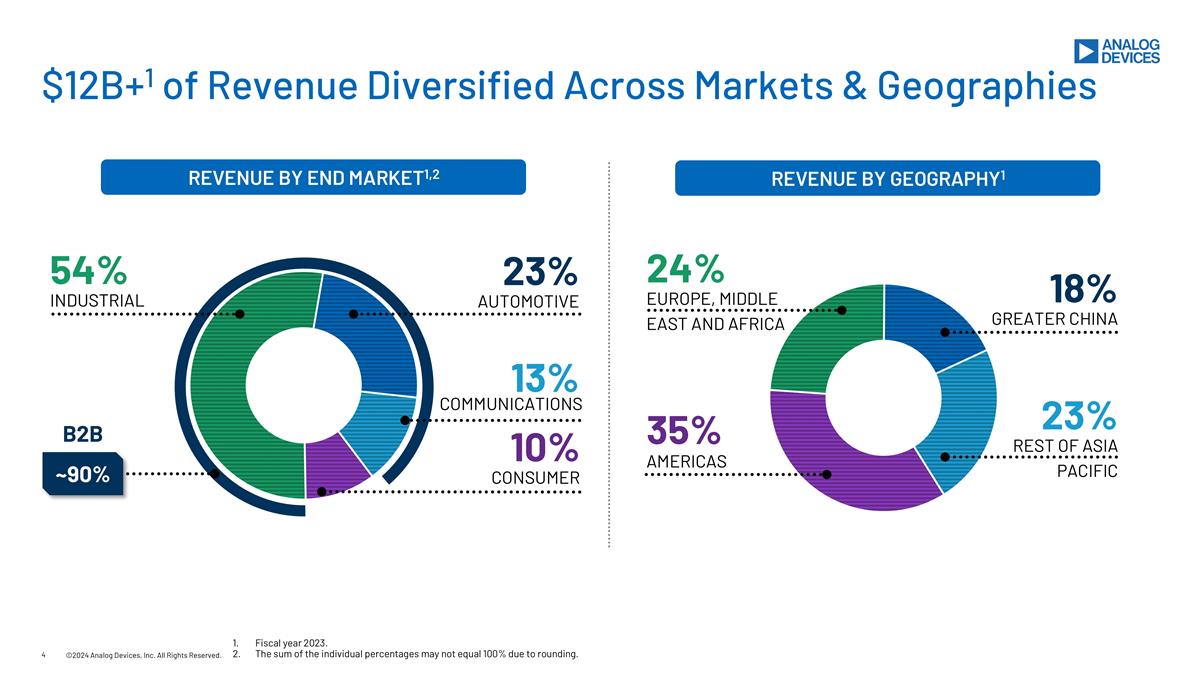

Revenue by Geography1 REVENUE BY END MARKET1,2 ©2024 Analog Devices, Inc. All Rights Reserved. $12B+1 of Revenue Diversified Across Markets & Geographies INDUSTRIAL 54% AUTOMOTIVE 23% COMMUNICATIONS 13% CONSUMER 10% AMERICAS 35% EUROPE, MIDDLE EAST AND AFRICA 24% GREATER CHINA 18% REST OF ASIA PACIFIC 23% ~90% B2B Fiscal year 2023. The sum of the individual percentages may not equal 100% due to rounding.

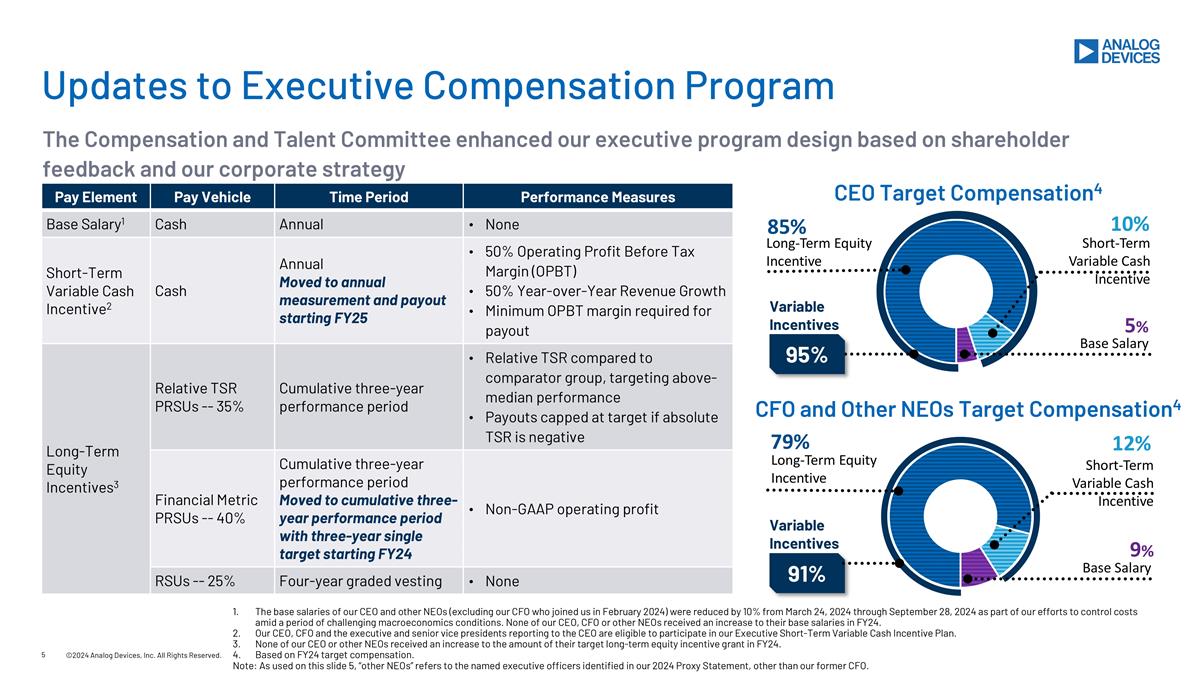

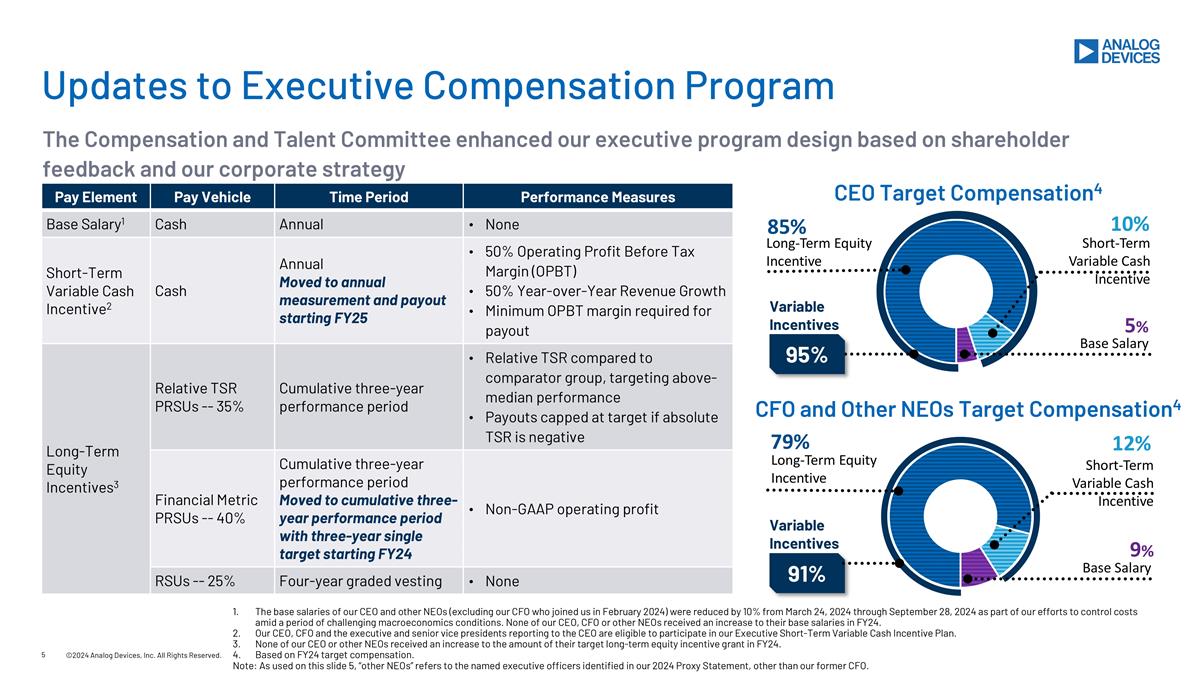

The Compensation and Talent Committee enhanced our executive program design based on shareholder feedback and our corporate strategy ©2024 Analog Devices, Inc. All Rights Reserved. Updates to Executive Compensation Program Pay Element Pay Vehicle Time Period Performance Measures Base Salary1 Cash Annual None Short-Term Variable Cash Incentive2 Cash Annual Moved to annual measurement and payout starting FY25 50% Operating Profit Before Tax Margin (OPBT) 50% Year-over-Year Revenue Growth Minimum OPBT margin required for payout Long-Term Equity Incentives3 Relative TSR PRSUs -- 35% Cumulative three-year performance period Relative TSR compared to comparator group, targeting above-median performance Payouts capped at target if absolute TSR is negative Financial Metric PRSUs -- 40% Cumulative three-year performance period Moved to cumulative three-year performance period with three-year single target starting FY24 Non-GAAP operating profit RSUs -- 25% Four-year graded vesting None Short-Term Variable Cash Incentive 12% Base Salary 9% 91% Variable Incentives Long-Term Equity Incentive 79% CEO Target Compensation4 CFO and Other NEOs Target Compensation4 Base Salary Short-Term Variable Cash Incentive Long-Term Equity Incentive 85% 5% 10% 95% Variable Incentives The base salaries of our CEO and other NEOs (excluding our CFO who joined us in February 2024) were reduced by 10% from March 24, 2024 through September 28, 2024 as part of our efforts to control costs amid a period of challenging macroeconomics conditions. None of our CEO, CFO or other NEOs received an increase to their base salaries in FY24. Our CEO, CFO and the executive and senior vice presidents reporting to the CEO are eligible to participate in our Executive Short-Term Variable Cash Incentive Plan. None of our CEO or other NEOs received an increase to the amount of their target long-term equity incentive grant in FY24. Based on FY24 target compensation. Note: As used on this slide 5, “other NEOs” refers to the named executive officers identified in our 2024 Proxy Statement, other than our former CFO.

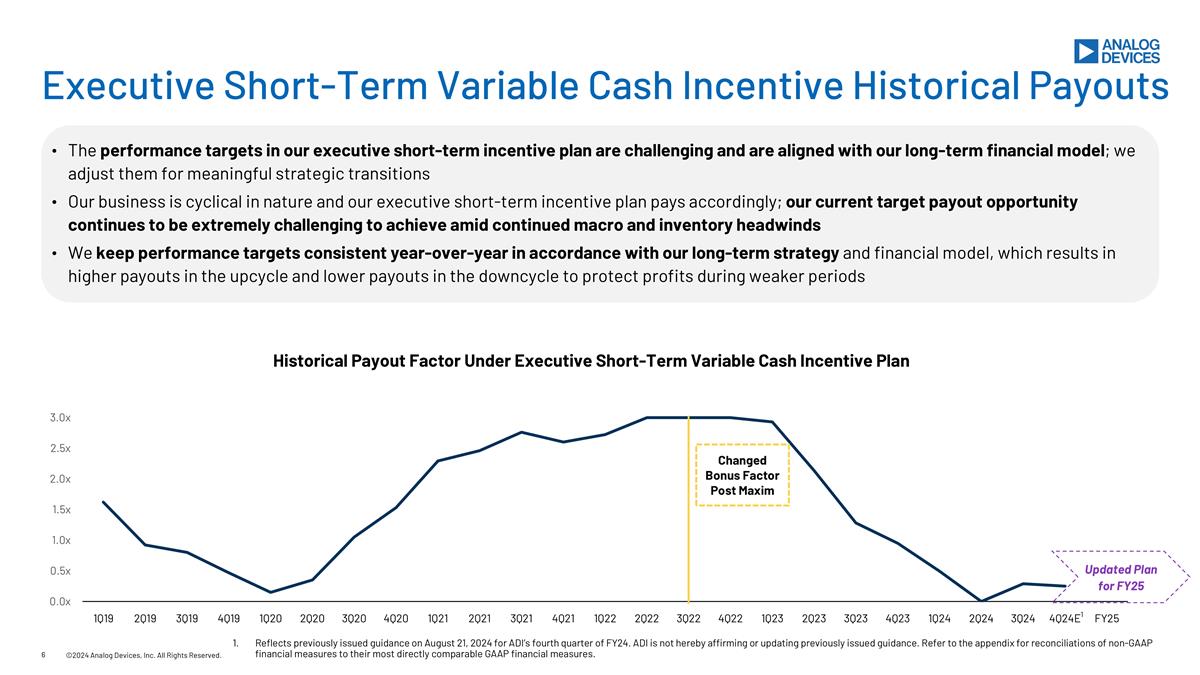

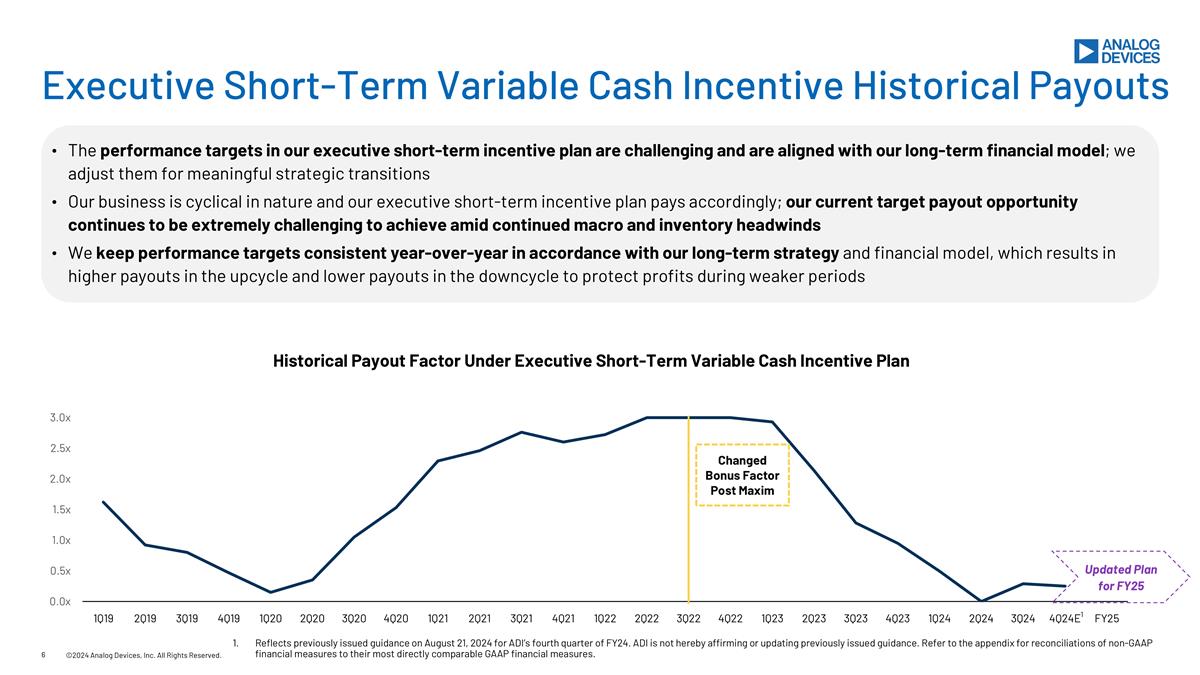

The performance targets in our executive short-term incentive plan are challenging and are aligned with our long-term financial model; we adjust them for meaningful strategic transitions Our business is cyclical in nature and our executive short-term incentive plan pays accordingly; our current target payout opportunity continues to be extremely challenging to achieve amid continued macro and inventory headwinds We keep performance targets consistent year-over-year in accordance with our long-term strategy and financial model, which results in higher payouts in the upcycle and lower payouts in the downcycle to protect profits during weaker periods Executive Short-Term Variable Cash Incentive Historical Payouts ©2024 Analog Devices, Inc. All Rights Reserved. 1 Updated Plan for FY25 Changed Bonus Factor Post Maxim Reflects previously issued guidance on August 21, 2024 for ADI’s fourth quarter of FY24. ADI is not hereby affirming or updating previously issued guidance. Refer to the appendix for reconciliations of non-GAAP financial measures to their most directly comparable GAAP financial measures.

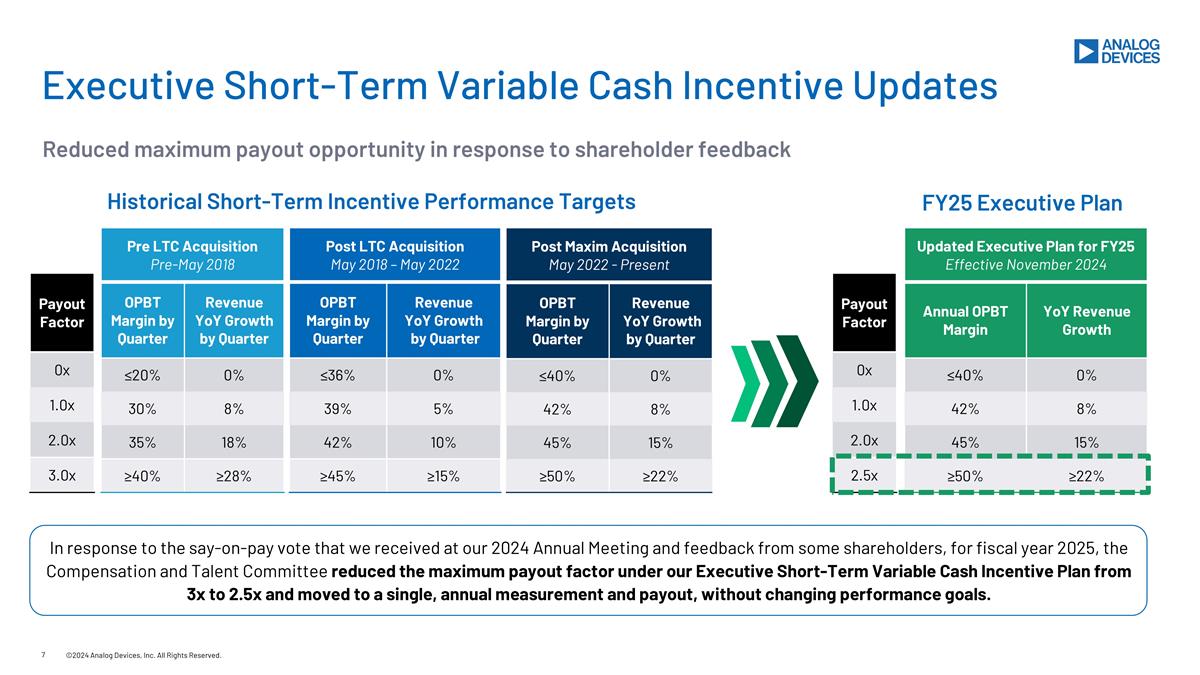

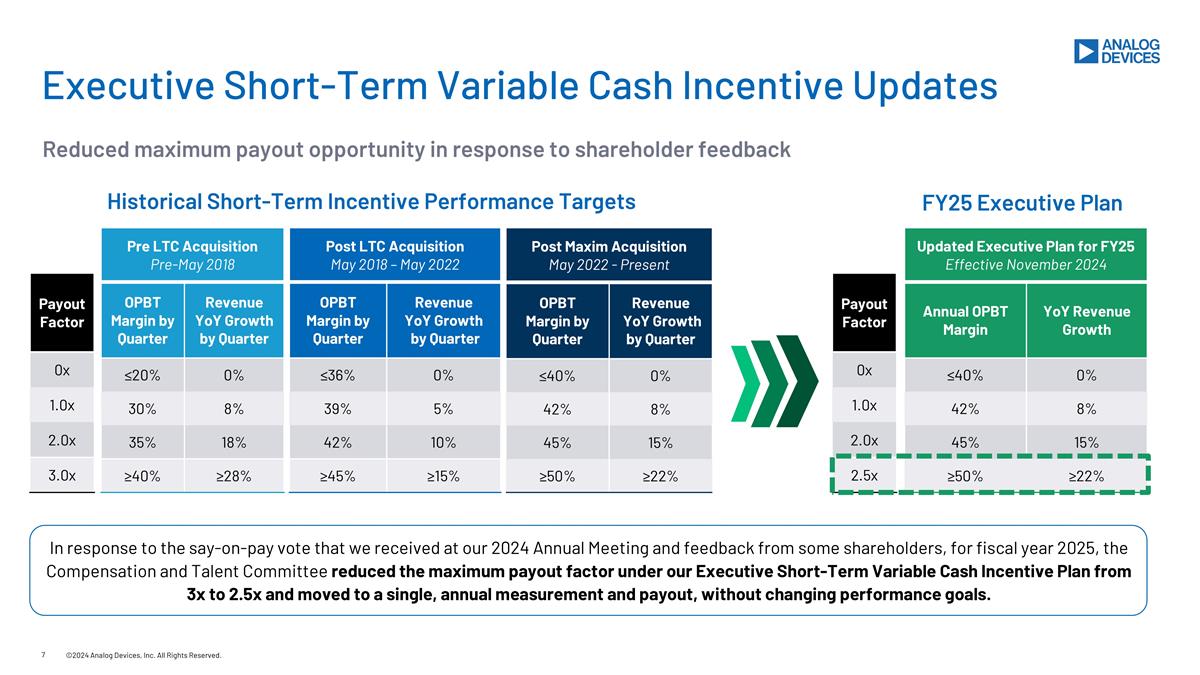

Reduced maximum payout opportunity in response to shareholder feedback ©2024 Analog Devices, Inc. All Rights Reserved. Executive Short-Term Variable Cash Incentive Updates FY25 Executive Plan Historical Short-Term Incentive Performance Targets Post Maxim Acquisition May 2022 - Present OPBT Margin by Quarter Revenue YoY Growth by Quarter ≤40% 0% 42% 8% 45% 15% ≥50% ≥22% Pre LTC Acquisition Pre-May 2018 OPBT Margin by Quarter Revenue YoY Growth by Quarter ≤20% 0% 30% 8% 35% 18% ≥40% ≥28% Post LTC Acquisition May 2018 – May 2022 OPBT Margin by Quarter Revenue YoY Growth by Quarter ≤36% 0% 39% 5% 42% 10% ≥45% ≥15% Payout Factor 0x 1.0x 2.0x 3.0x Updated Executive Plan for FY25 Effective November 2024 Annual OPBT Margin YoY Revenue Growth ≤40% 0% 42% 8% 45% 15% ≥50% ≥22% Payout Factor 0x 1.0x 2.0x 2.5x In response to the say-on-pay vote that we received at our 2024 Annual Meeting and feedback from some shareholders, for fiscal year 2025, the Compensation and Talent Committee reduced the maximum payout factor under our Executive Short-Term Variable Cash Incentive Plan from 3x to 2.5x and moved to a single, annual measurement and payout, without changing performance goals.

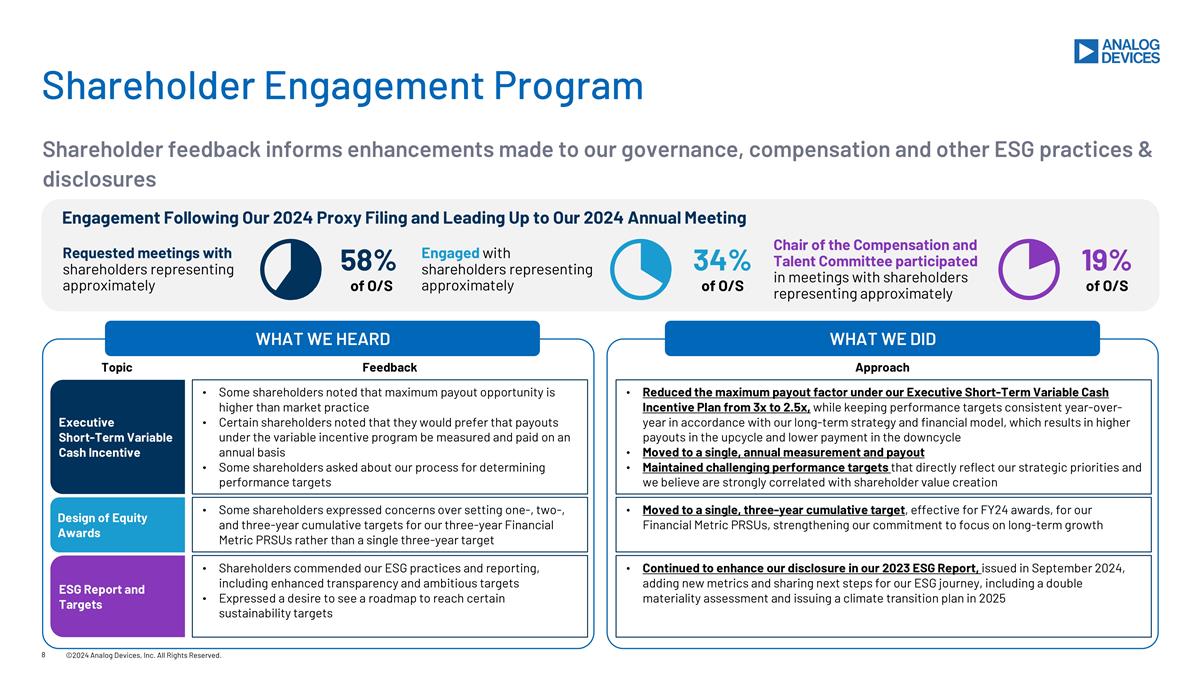

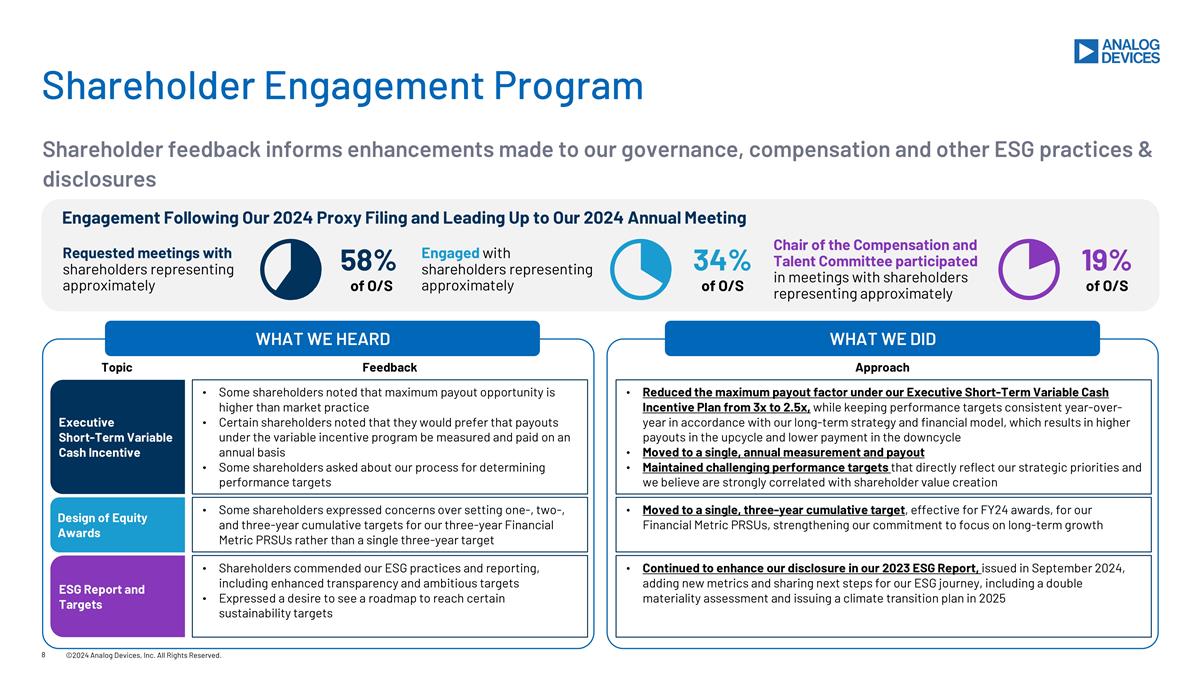

Shareholder feedback informs enhancements made to our governance, compensation and other ESG practices & disclosures ©2024 Analog Devices, Inc. All Rights Reserved. Shareholder Engagement Program Requested meetings with shareholders representing approximately 58% of O/S Engaged with shareholders representing approximately 34% of O/S Chair of the Compensation and Talent Committee participated in meetings with shareholders representing approximately 19% of O/S Engagement Following Our 2024 Proxy Filing and Leading Up to Our 2024 Annual Meeting WHAT WE DID WHAT WE HEARD Approach Some shareholders noted that maximum payout opportunity is higher than market practice Certain shareholders noted that they would prefer that payouts under the variable incentive program be measured and paid on an annual basis Some shareholders asked about our process for determining performance targets Reduced the maximum payout factor under our Executive Short-Term Variable Cash Incentive Plan from 3x to 2.5x, while keeping performance targets consistent year-over-year in accordance with our long-term strategy and financial model, which results in higher payouts in the upcycle and lower payment in the downcycle Moved to a single, annual measurement and payout Maintained challenging performance targets that directly reflect our strategic priorities and we believe are strongly correlated with shareholder value creation Some shareholders expressed concerns over setting one-, two-, and three-year cumulative targets for our three-year Financial Metric PRSUs rather than a single three-year target Moved to a single, three-year cumulative target, effective for FY24 awards, for our Financial Metric PRSUs, strengthening our commitment to focus on long-term growth Shareholders commended our ESG practices and reporting, including enhanced transparency and ambitious targets Expressed a desire to see a roadmap to reach certain sustainability targets Continued to enhance our disclosure in our 2023 ESG Report, issued in September 2024, adding new metrics and sharing next steps for our ESG journey, including a double materiality assessment and issuing a climate transition plan in 2025 Executive Short-Term Variable Cash Incentive Design of Equity Awards ESG Report and Targets Topic Feedback

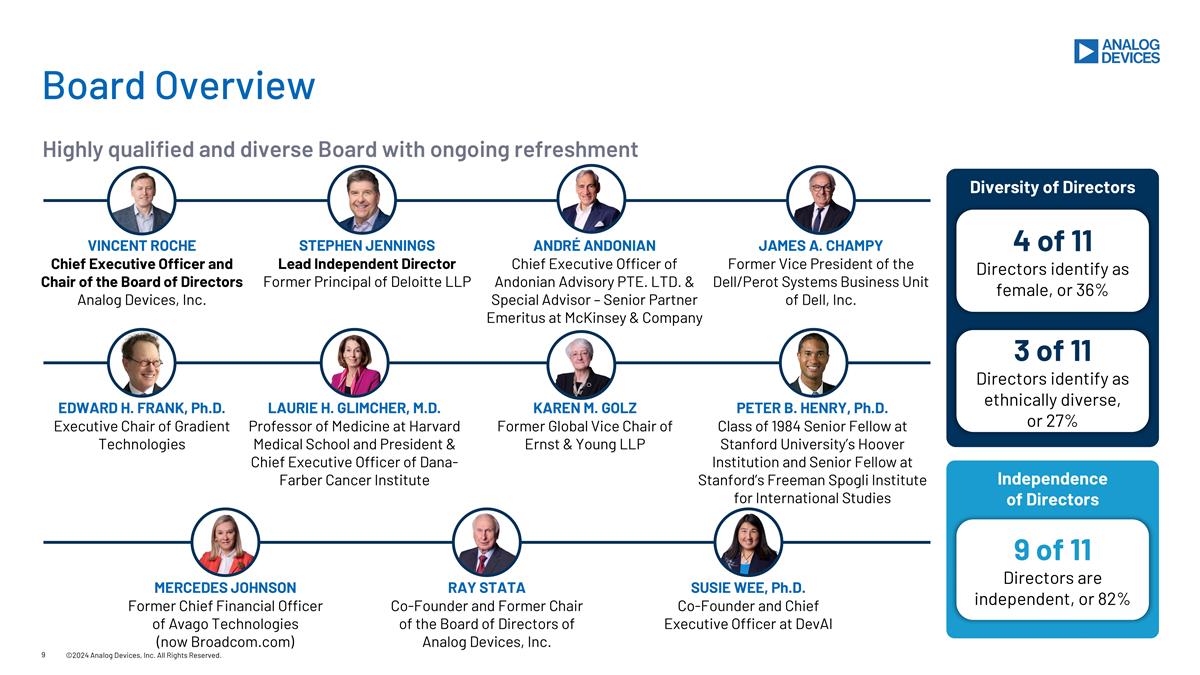

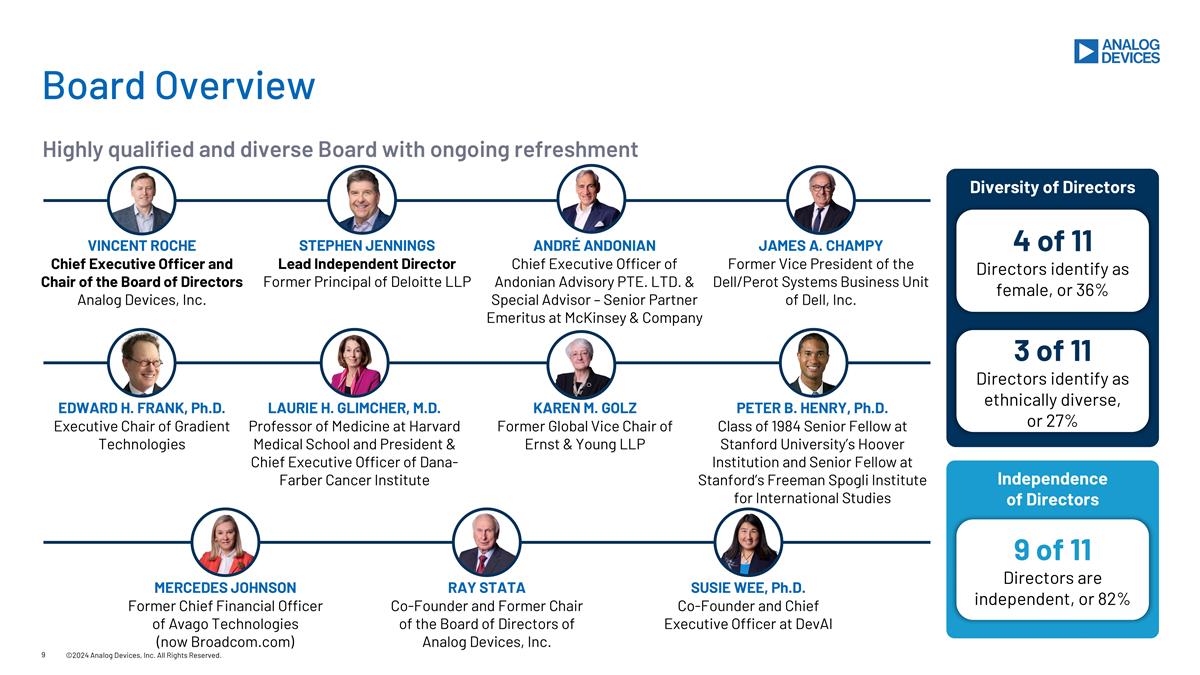

Highly qualified and diverse Board with ongoing refreshment ©2024 Analog Devices, Inc. All Rights Reserved. Board Overview Diversity of Directors Independence of Directors 4 of 11 Directors identify as female, or 36% 3 of 11 Directors identify as ethnically diverse, or 27% 9 of 11 Directors are independent, or 82% VINCENT ROCHE Chief Executive Officer and Chair of the Board of Directors Analog Devices, Inc. STEPHEN JENNINGS Lead Independent Director Former Principal of Deloitte LLP ANDRÉ ANDONIAN Chief Executive Officer of Andonian Advisory PTE. LTD. & Special Advisor – Senior Partner Emeritus at McKinsey & Company JAMES A. CHAMPY Former Vice President of the Dell/Perot Systems Business Unit of Dell, Inc. EDWARD H. FRANK, Ph.D. Executive Chair of Gradient Technologies LAURIE H. GLIMCHER, M.D. Professor of Medicine at Harvard Medical School and President & Chief Executive Officer of Dana-Farber Cancer Institute KAREN M. GOLZ Former Global Vice Chair of Ernst & Young LLP PETER B. HENRY, Ph.D. Class of 1984 Senior Fellow at Stanford University’s Hoover Institution and Senior Fellow at Stanford’s Freeman Spogli Institute for International Studies MERCEDES JOHNSON Former Chief Financial Officer of Avago Technologies (now Broadcom.com) RAY STATA Co-Founder and Former Chair of the Board of Directors of Analog Devices, Inc. SUSIE WEE, Ph.D. Co-Founder and Chief Executive Officer at DevAI

Our Board is committed to effective corporate governance, promoting effective board oversight and ensuring responsiveness to shareholder feedback ©2024 Analog Devices, Inc. All Rights Reserved. Committed to Corporate Governance Best Practices SHAREHOLDER RIGHTS AND ACCOUNTABILITY EFFECTIVE BOARD LEADERSHIP, INDEPENDENT OVERSIGHT, AND STRONG CORPORATE GOVERNANCE Governance Highlights Majority of directors are independent Average tenure of independent directors is 6.0 years Regular executive sessions of independent directors Clawback policy for CEO and other officers Active engagement by our Board in overseeing talent and long-term succession planning for executives Annual election of directors Majority voting for directors in uncontested director elections Proxy access bylaw Annual Board and committee self-evaluations No dual class of stock or controlling shareholder In response to a shareholder proposal regarding simply majority voting at our 2024 Annual Meeting, we plan to propose an amendment to our charter to replace supermajority vote requirements for amending, altering, or repealing our charter and approving a merger or similar transaction with simple majority standards. This proposal is expected to be voted on at our 2025 Annual Meeting.

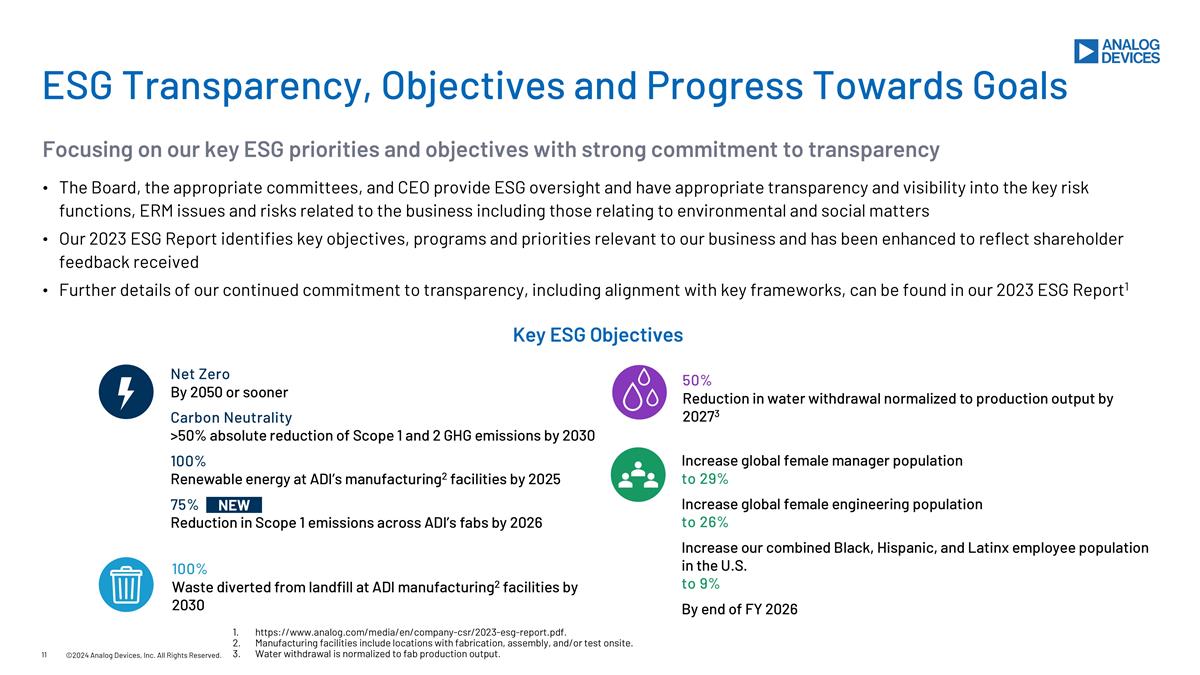

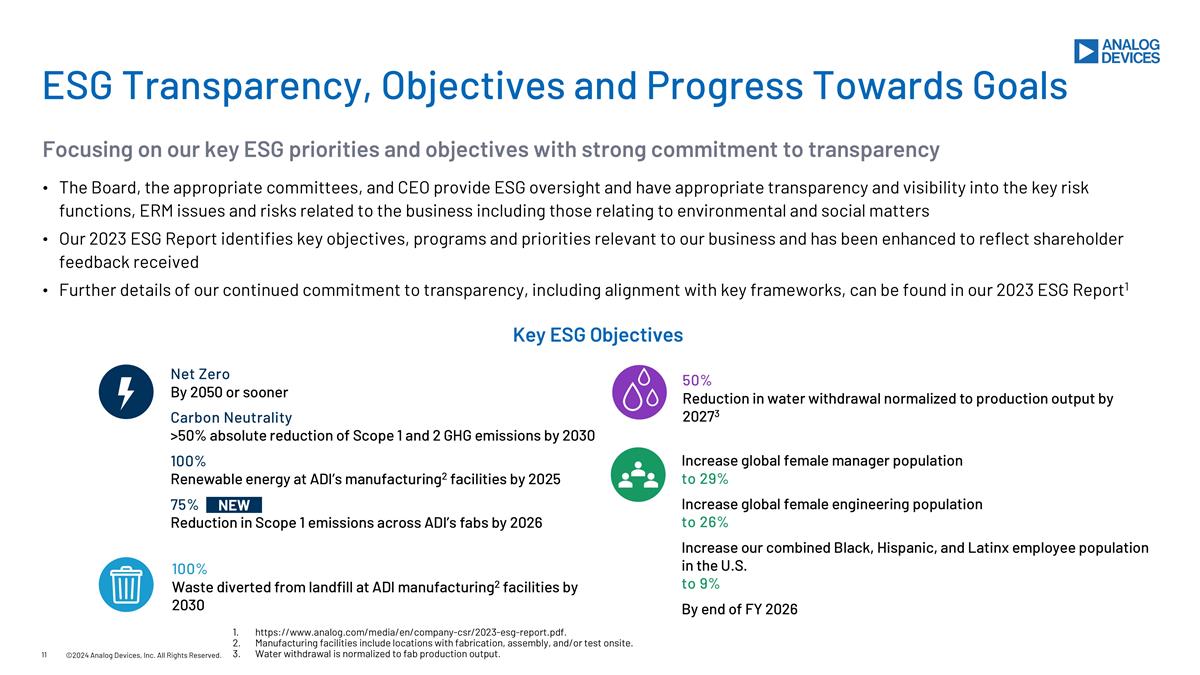

The Board, the appropriate committees, and CEO provide ESG oversight and have appropriate transparency and visibility into the key risk functions, ERM issues and risks related to the business including those relating to environmental and social matters Our 2023 ESG Report identifies key objectives, programs and priorities relevant to our business and has been enhanced to reflect shareholder feedback received Further details of our continued commitment to transparency, including alignment with key frameworks, can be found in our 2023 ESG Report1 ©2024 Analog Devices, Inc. All Rights Reserved. ESG Transparency, Objectives and Progress Towards Goals Key ESG Objectives 100% Waste diverted from landfill at ADI manufacturing2 facilities by 2030 50% Reduction in water withdrawal normalized to production output by 20273 Net Zero By 2050 or sooner Carbon Neutrality >50% absolute reduction of Scope 1 and 2 GHG emissions by 2030 100% Renewable energy at ADI’s manufacturing2 facilities by 2025 75% Reduction in Scope 1 emissions across ADI’s fabs by 2026 Increase global female manager population to 29% Increase global female engineering population to 26% Increase our combined Black, Hispanic, and Latinx employee population in the U.S. to 9% By end of FY 2026 NEW https://www.analog.com/media/en/company-csr/2023-esg-report.pdf. Manufacturing facilities include locations with fabrication, assembly, and/or test onsite. Water withdrawal is normalized to fab production output. Focusing on our key ESG priorities and objectives with strong commitment to transparency

Appendix

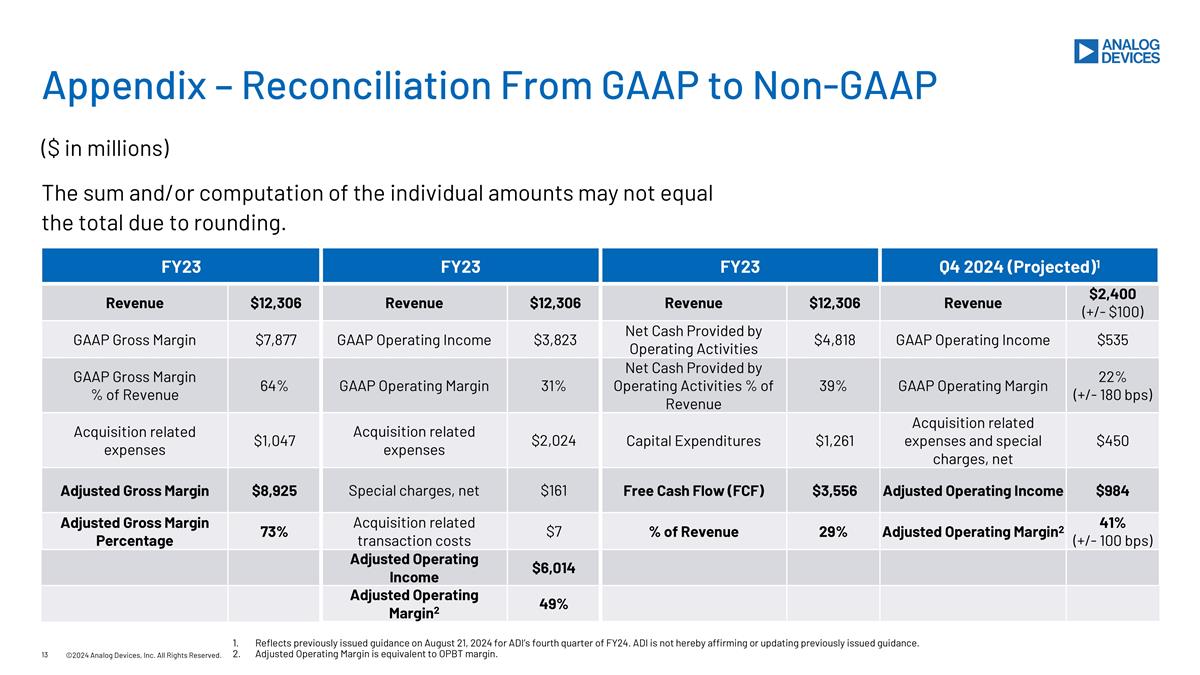

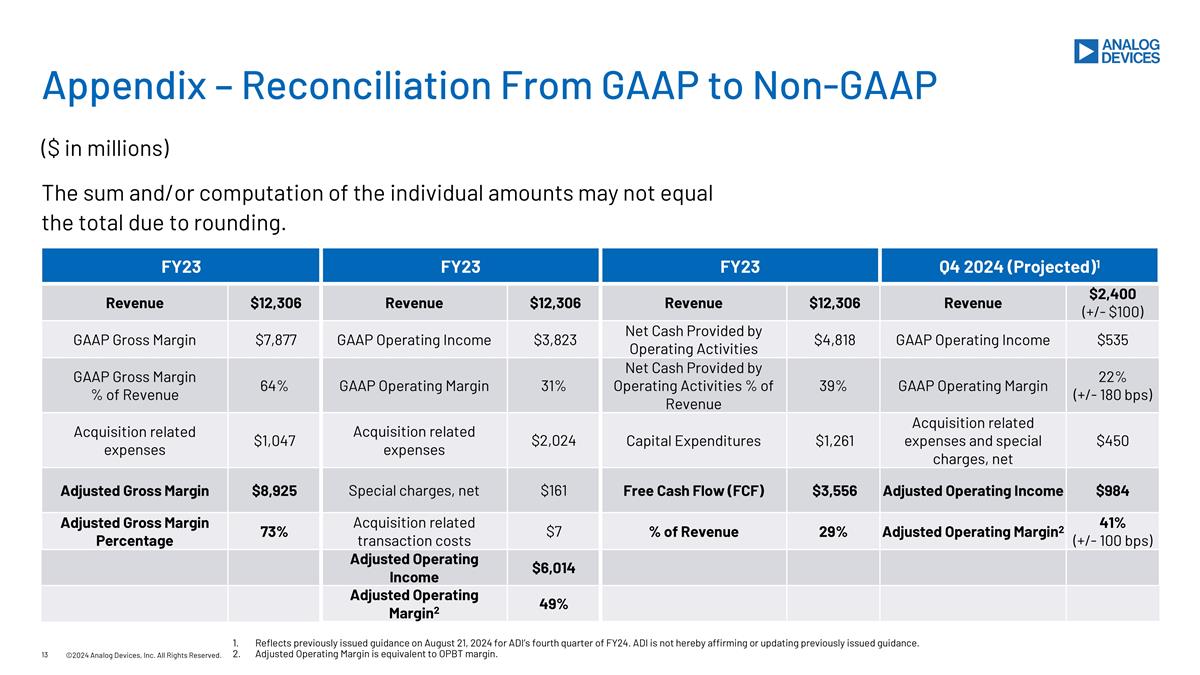

Appendix – Reconciliation From GAAP to Non-GAAP ©2024 Analog Devices, Inc. All Rights Reserved. ($ in millions) The sum and/or computation of the individual amounts may not equal the total due to rounding. FY23 FY23 FY23 Q4 2024 (Projected)1 Revenue $12,306 Revenue $12,306 Revenue $12,306 Revenue $2,400 (+/- $100) GAAP Gross Margin $7,877 GAAP Operating Income $3,823 Net Cash Provided by Operating Activities $4,818 GAAP Operating Income $535 GAAP Gross Margin % of Revenue 64% GAAP Operating Margin 31% Net Cash Provided by Operating Activities % of Revenue 39% GAAP Operating Margin 22% (+/- 180 bps) Acquisition related expenses $1,047 Acquisition related expenses $2,024 Capital Expenditures $1,261 Acquisition related expenses and special charges, net $450 Adjusted Gross Margin $8,925 Special charges, net $161 Free Cash Flow (FCF) $3,556 Adjusted Operating Income $984 Adjusted Gross Margin Percentage 73% Acquisition related transaction costs $7 % of Revenue 29% Adjusted Operating Margin2 41% (+/- 100 bps) Adjusted Operating Income $6,014 Adjusted Operating Margin2 49% Reflects previously issued guidance on August 21, 2024 for ADI’s fourth quarter of FY24. ADI is not hereby affirming or updating previously issued guidance. Adjusted Operating Margin is equivalent to OPBT margin.