- AMAT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Applied Materials (AMAT) DEF 14ADefinitive proxy

Filed: 24 Jan 24, 4:46pm

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| Applied Materials, Inc. 3050 Bowers Avenue Santa Clara, California 95054 (408) 727-5555 |

January 24, 2024

Dear Fellow Shareholders:

On behalf of the Board of Directors, we are pleased to invite you to attend Applied Materials’ 2024 Annual Meeting of Shareholders, which will be held on Thursday, March 7, 2024, at 10:00 a.m. Central Time at our offices at 9700 US 290 East, Building 37, Austin, Texas 78724.

We encourage you to read this Proxy Statement because it contains important information for voting your shares and sets forth how the Board oversaw your investment over the past year. This year’s Proxy Statement reflects our continued focus on our business strategy, an engaged and effective Board, sound corporate governance and executive compensation practices, our sustainability strategy, and our regular dialogue with and responsiveness to our shareholders.

Financial Performance and Business Strategy

In fiscal 2023, Applied Materials delivered record revenue, earnings and cash flow, and we are outgrowing the wafer fabrication equipment market for the fifth year in a row. Our revenue increased 3% and earnings per share increased 9% year-over-year, despite semiconductor and wafer fabrication equipment spending both being down in 2023.

As we look ahead, we remain very positive about our long-term growth opportunities. Semiconductors are the foundation of digital transformation that will affect nearly every sector of the global economy in the coming years. The strategic importance of semiconductors is increasing throughout the world, and Applied Materials is in a great position to benefit from this exciting period of industry innovation and growth. We have the industry’s broadest portfolio of products and technologies that enable improvements in chip performance and power consumption, and we are collaborating closely with our customers to accelerate development and commercialization of next-generation technologies.

Making Possible a Better Future

We also continued to make strong progress towards our 10-year sustainability roadmap, which considers our direct impact and how we run our business (1X), our industry’s impact and those of our customers and suppliers (100X), and how our technology can be used to advance sustainability on a global scale (10,000X). Among our other achievements, we continued to make progress toward our 2030 greenhouse gas emission goals – which were validated in 2023 by the Science Based Targets initiative, strengthen our culture of inclusion, and accelerate sustainable innovation, including improving the energy efficiency and longevity of our products. We also designed and deployed a Net Zero 2040 Playbook to work collaboratively across our industry to reduce and mitigate our climate impact. We are committed to significantly reducing our impacts by bringing improved efficiency across our global operations, using cleaner, renewable energy and enabling groundbreaking technology innovation.

An Independent, Diverse and Skilled Board

This year’s director nominees possess a wide range of backgrounds, skills and experience, and further our Board’s commitment to maintain a composition that aligns with the Company’s evolving business and strategic needs. With a balance of tenures, a diversity of personal characteristics and experiences, and a range of skills – including relevant subject matter expertise – our Board is well-positioned to oversee Applied’s management team and support Applied’s long-term strategy. This Proxy Statement also includes information about the Board’s governance practices – including its active and ongoing Board refreshment process, annual self-evaluation, independent leadership and committee practices – that foster this effective oversight.

Robust Shareholder Engagement

We remain committed to effective corporate governance that is informed by our shareholders, promotes the long-term interests of our Company and its shareholders, and strengthens the Board’s and management’s accountability. Our corporate governance practices are enhanced by a robust shareholder engagement program, which includes regular outreach to holders of more than half of our outstanding shares. Our shareholder engagement program focuses on issues of interest to our shareholders, particularly in the areas of governance, compensation, environmental sustainability, and human capital matters such as diversity, equity and inclusion. Shareholder feedback continues to directly inform the Board’s decision-making on a variety of important matters.

Thank you for your continued investment in and support of Applied Materials.

Sincerely,

Thomas J. Iannotti

Chairman of the Board |

Gary E. Dickerson

President and Chief Executive Officer |

Notice of 2024 Annual Meeting of Shareholders

| When |

Thursday, March 7, 2024 at 10:00 a.m. Central Time

| ||||

| Where |

Applied Materials, Inc., 9700 US 290 East, Building 37, Austin, Texas 78724

| ||||

| | Who Can Vote | |

Shareholders of record at the close of business on January 10, 2024 and holders of proxies for those shareholders

| ||

Items of Business

1. To elect ten directors to serve for a one-year term and until their successors have been duly elected and qualified. |

2. To approve, on an advisory basis, the compensation of our named executive officers for fiscal year 2023. |

4. To ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2024. |

5. To consider two shareholder proposals, if properly presented at the Annual Meeting. |

6. To transact any other business that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

Your vote is important to us. You may vote via the Internet or by telephone, or if you requested to receive printed proxy materials, by signing, dating and returning your proxy card. If you are voting via the Internet or by telephone, your vote must be received by 11:59 p.m. Eastern Time on Wednesday, March 6, 2024. For specific voting instructions, please refer to the information provided in the following Proxy Statement, together with your proxy card or the voting instructions you receive by e-mail or that are provided via the Internet.

If you received a Notice of Internet Availability of Proxy Materials on how to access the proxy materials via the Internet, a proxy card was not sent to you, and you may vote only via the Internet, unless you have requested a paper copy of the proxy materials, in which case, you may also vote by telephone or by signing, dating and returning your proxy card. Shares cannot be voted by marking, writing on and returning the Notice of Internet Availability. Any Notices of Internet Availability that are returned will not be counted as votes. Instructions for requesting a paper copy of the proxy materials are set forth on the Notice of Internet Availability.

By Order of the Board of Directors

Teri A. Little

Senior Vice President,

Chief Legal Officer and Corporate Secretary

Santa Clara, California

January 24, 2024

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on March 7, 2024: The Proxy Statement and Annual Report to Shareholders are available at www.proxyvote.com.

Table of Contents

Page | ||||

| 2024 Proxy Statement Summary | i | |||

| i | ||||

| i | ||||

| ii | ||||

| iii | ||||

| iv | ||||

| v | ||||

| xi | ||||

| Proposal 1 – Election of Directors | 1 | |||

| 1 | ||||

| Board and Corporate Governance Practices | 12 | |||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 15 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| Director Compensation | 26 | |||

| 26 | ||||

| 28 | ||||

| Stock Ownership Information | 29 | |||

| 29 | ||||

| 30 | ||||

| Proposal 2 – Approval, on an Advisory Basis, of the Compensation of Our Named Executive Officers | 31 | |||

| Compensation Discussion and Analysis | 32 | |||

| 32 | ||||

| 38 | ||||

| 39 | ||||

| 51 | ||||

Reconciliation of non-GAAP adjusted financial measures used in the Compensation Discussion and Analysis section and elsewhere in this Proxy Statement, other than as part of disclosure of target levels, can be found in Appendix A.

Cautionary Note Regarding Forward-Looking Statements

This Proxy Statement contains forward-looking statements, including those regarding anticipated growth and trends in our businesses and markets, industry outlooks and demand drivers, technology transitions, our business, strategies and financial performance, our investment and growth strategies, our development of new products and technologies, our sustainability goals and commitments, and other statements that are not historical fact, and actual results could differ materially. Risk factors that could cause actual results to differ are set forth in the “Risk Factors” section of, and elsewhere in, our 2023 Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. All forward-looking statements are based on management’s estimates, projections and assumptions as of the date hereof, and we undertake no obligation to update any such statements.

Proxy Statement Summary

2024 Proxy Statement Summary

Your proxy is being solicited on behalf of the Board of Directors of Applied Materials, Inc. We are making this Proxy Statement available to shareholders beginning on January 24, 2024. This summary highlights information contained in detail elsewhere in this Proxy Statement. We encourage you to read the entire Proxy Statement for more information prior to voting.

Annual Meeting of Shareholders

| Date and Time: | March 7, 2024, 10:00 a.m. Central Time | |

| Location: | Applied Materials, Inc., 9700 US 290 East, Building 37, Austin, Texas 78724 | |

| Record Date: | January 10, 2024 | |

| Voting: | Shareholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on. | |

| Attendance: | Shareholders and their duly appointed proxies may attend the meeting. | |

Proposals and Board Recommendations

|

| For More Information | Board Recommendation | ||||||||

PROPOSAL 1 – Election of Directors | Pages 1 to 11 |

| FOR each Nominee | |||||||

Rani Borkar |

Gary E. Dickerson |

Yvonne McGill | ||||||||

Judy Bruner | Thomas J. Iannotti | Scott A. McGregor | ||||||||

Xun (Eric) Chen Aart J. de Geus | Alexander A. Karsner Kevin P. March | |||||||||

PROPOSAL 2 – Executive Compensation |

Page 31 |

| FOR | |||||||

Approval, on an advisory basis, of the compensation of our named executive officers for fiscal year 2023 | ||||||||||

PROPOSAL 3 – Ratification of Registered Accounting Firm |

Page 66 |

| FOR | |||||||

Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2024 | ||||||||||

PROPOSAL 4 – Shareholder Proposal Regarding Lobbying Report |

Pages 69 to 71 |

| AGAINST | |||||||

Shareholder proposal requesting that the Company prepare a report disclosing Company policy and procedures governing lobbying and payments by the Company used for lobbying | ||||||||||

PROPOSAL 5 – Shareholder Proposal Regarding Pay Equity Reporting |

Pages 72 to 75 |

| AGAINST | |||||||

Shareholder proposal requesting that the Company report on quantitative median and adjusted pay gaps across race and gender | ||||||||||

| APPLIED MATERIALS, INC. 2024 PROXY STATEMENT | i |

Proxy Statement Summary

Director Nominees

Name and Occupation

| Age

| Director Since

| Independent

| Committees

| ||||

Rani Borkar Corporate Vice President, Azure Hardware Systems and Infrastructure, Microsoft Corporation | 62 | 2020 |

| Compensation Strategy and Investment | ||||

Judy Bruner Executive Vice President, Administration and Chief Financial Officer, SanDisk Corporation (retired) | 65 | 2016 |

| Audit (Chair) Governance (Chair) | ||||

Xun (Eric) Chen Executive Chairman, ParityBit Technologies, Inc. | 54 | 2015 |

| Compensation Strategy and Investment | ||||

Aart J. de Geus Executive Chair of the Board of Directors, Synopsys, Inc. | 69 | 2007 |

| Strategy and Investment | ||||

Gary E. Dickerson President and Chief Executive Officer, Applied Materials, Inc. | 66 | 2013 |

|

| ||||

Thomas J. Iannotti Senior Vice President and General Manager, Enterprise Services, Hewlett-Packard Company (retired) | 67 | 2005 |

| Compensation (Chair) | ||||

Alexander A. Karsner Senior Strategist, X (parent company: Alphabet Inc.) | 56 | 2008 |

| Compensation Governance | ||||

Kevin P. March Senior Vice President, Chief Financial Officer, Texas Instruments, Incorporated (retired) | 66 | 2022 |

| Audit | ||||

Yvonne McGill Chief Financial Officer, Dell Technologies Inc. | 56 | 2019 |

| Audit Governance | ||||

Scott A. McGregor President and Chief Executive Officer, Broadcom Corporation (retired) | 67 | 2018 |

| Strategy and Investment (Chair) Audit | ||||

| ii | APPLIED MATERIALS, INC. 2024 PROXY STATEMENT |

Proxy Statement Summary

Board Practices and Composition

Ensuring the Board is composed of directors who possess a wide variety of relevant skills, professional experience and backgrounds, bring diverse viewpoints and perspectives, and effectively represent the long-term interests of shareholders is a top priority of the Board and the Corporate Governance and Nominating Committee (the “Governance Committee”). Our Board composition reflects strong Board practices that support regular refreshment based on our board needs, evolving strategy, and proactive succession planning.

Director Nominee Expertise

Key Attributes

* Ethnically diverse means a director who self-identifies as one or more of the following (defined by Nasdaq as an Underrepresented Minority): African American or Black, Alaskan Native or Native American, Asian, Hispanic or Latinx, or Native Hawaiian or Pacific Islander.

| APPLIED MATERIALS, INC. 2024 PROXY STATEMENT | iii |

Proxy Statement Summary

Board Practices Support Thoughtful Board Composition

| Board Composition to Support Company Strategy |

The Board and the Governance Committee regularly evaluate the size and composition of the Board to ensure appropriate alignment with the Company’s evolving business and strategic needs.

|

| Policy on Board Diversity |

The Board is committed to having a Board that reflects diverse perspectives, including those based on gender, ethnicity, skills, experience at policy-making levels in areas that are relevant to the Company’s global activities, and functional, geographic or cultural background. The Board has adopted a Policy on Board Diversity as part of its Corporate Governance Guidelines, which highlights its commitment to actively seek out women and ethnically diverse director candidates.

|

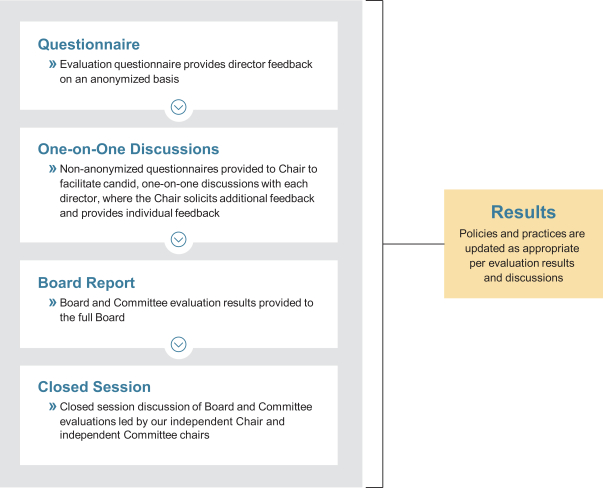

| Annual Board Evaluations |

The Board conducts an annual self-assessment of the Board, Board Committees and individual directors to evaluate effectiveness.

|

| Board Refreshment |

The Board believes the fresh perspectives brought by new directors are critical to a forward-looking and strategic Board when appropriately balanced by the deep understanding of Applied’s business provided by longer-serving directors.

|

| Director Succession Planning |

The Governance Committee reviews the short-term and long-term strategies and interests of Applied to determine what current and future skills and experience are required of the Board in exercising its oversight function.

|

Corporate Governance

We are committed to effective corporate governance that is informed by our shareholders, promotes the long-term interests of our shareholders, and strengthens Board and management accountability.

Governance Highlights

| Annual Election of Directors | |

| Independent Chair of the Board | |

| Highly Independent Board (9 of 10 Director nominees) and Committees | |

| Annual Board, Committee and Individual Evaluations | |

| Robust Board Succession Planning | |

| Policy on Board Diversity | |

| Active Shareholder Engagement Practices | |

| Shareholder Right to Call a Special Meeting | |

| Shareholder Right to Act by Written Consent | |

| Shareholder Proxy Access | |

| No Poison Pill | |

| No Supermajority Vote Requirements | |

| Majority Voting for Directors | |

| Regular Executive Sessions of Independent Directors | |

| Stock Ownership Guidelines for Directors and Executives | |

| Clawback Policy for Annual and Long-Term Incentive Plans | |

| iv | APPLIED MATERIALS, INC. 2024 PROXY STATEMENT |

Proxy Statement Summary

Shareholder Engagement

We believe that strong corporate governance should include regular engagement with our shareholders to enable us to understand and respond to shareholder concerns. In addition to the regular meetings that our CEO, CFO and Investor Relations team holds with investors, prospective investors and investment analysts, we have a robust shareholder outreach program led by a cross-functional team that includes members of our Investor Relations, Global Rewards, ESG and Legal functions. Independent members of our Board are also involved, as appropriate. In the fall, we proactively solicit feedback on our executive compensation program, corporate governance practices, and sustainability and diversity and inclusion initiatives, as well as any matters voted on at our prior annual meeting. After the filing of our proxy statement, we engage again with our shareholders about important topics to be addressed at our annual meeting. Following our annual meeting, our Board of Directors, led by its Human Resources and Compensation Committee (the “HRCC”) and Governance Committee, reviews the results of the meeting and investor feedback, as well as evaluate emerging trends in corporate governance and other areas. See “Shareholder Engagement” on page 22 for more information.

In response to shareholder support at last year’s annual meeting for the proposal to lower the ownership threshold required for shareholders to call a special meeting to 10%, as part of our shareholder outreach in 2023, we also asked our shareholders about their views on our special meeting right. The feedback we received from our shareholders on this topic was reviewed and discussed with our Governance Committee and the Board. In response to the feedback and the support for the proposal at last year’s annual meeting, in December 2023 the Board approved an amendment and restatement of our Bylaws to lower the ownership threshold required to call a special meeting from 20% to 10%. See “Shareholder Engagement” on page 22 for more information.

Executive Compensation

Company Overview

Applied Materials is the leader in the materials engineering solutions used to produce virtually every new chip and advanced display in the world. Our expertise in modifying materials at atomic levels and on an industrial scale enables customers to transform possibilities into reality. At Applied Materials, our innovations Make Possible® a Better Future.

We develop, design, produce and service semiconductor and display equipment for manufacturers that sell into highly competitive and rapidly changing end markets. Our competitive positioning is driven by the ability of our talented workforce to identify major technology inflections early, and to develop highly differentiated materials engineering solutions for our customers to enable those technology inflections. Through our broad portfolio of products, technologies and services, innovation leadership and focused investments in research and development, we are enabling our customers’ success and creating significant value for our shareholders. Applied’s ability to hire, develop and retain a world-class global workforce is based on our commitment to creating a Culture of Inclusion that embraces different backgrounds, perspectives, and experiences to build stronger, more resilient teams. Consistent with our core values, we enable our employees to do their best work by providing quality training, learning and career development opportunities; promoting diversity, equity and a connected and inclusive culture; and upholding a high standard of ethics and respect for human rights.

In addition to our other accomplishments, we continue to make strong progress towards our 10-year road map for environmental and social responsibility, which we introduced in 2020. At Applied, making a positive contribution is at the foundation of our culture and of our vision to Make Possible® a Better Future. Our 1x, 100x and 10,000x sustainability framework refers to the holistic goals and commitments we’ve set for our operations, how we work with customers and suppliers, and how our technology can be used to advance sustainability on a global scale. In 2023, we announced our Net Zero 2040 playbook – a clear pathway and detailed plan to work across our industry, including with customers and supply chain partners, to reduce the semiconductor industry’s carbon emissions. More details of Applied’s sustainability vision and strategy, including a copy of the Company’s most recent Sustainability Report, can be found at https://www.appliedmaterials.com/company/corporate-responsibility.

| APPLIED MATERIALS, INC. 2024 PROXY STATEMENT | v |

Proxy Statement Summary

Our Performance Highlights

Over the past several years, our broad portfolio of products and services has enabled Applied to extend its leadership at the major technology inflections that are driving our customers’ roadmaps and future industry growth. In fiscal 2023, we delivered record revenue, earnings and cash flow, and we are outgrowing the wafer fabrication equipment market for the fifth year in a row. Key highlights of our financial outperformance include:

| » | Record revenue of $26.5 billion, up 3% year-over-year, despite overall semiconductor and wafer fabrication equipment spending both being down in 2023. |

| » | Record GAAP EPS of $8.11, and record non-GAAP adjusted EPS of $8.05 (see Appendix A for a reconciliation of non-GAAP adjusted measures). |

| » | Record $8.7 billion in cash from operations, and record free cash flow of $7.6 billion (see Appendix A for a reconciliation of non-GAAP measures). |

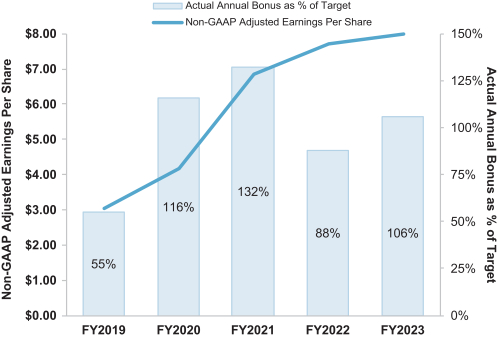

Highlights of five-year performance achievements across key financial measures

Non-GAAP adjusted operating margin and non-GAAP adjusted EPS are performance targets under our long-term incentive and bonus plans. See Appendix A for non-GAAP reconciliations.

Key financial highlights for our reporting segments in fiscal 2023 include the following:

| » | Semiconductor Systems segment: we grew annual revenue by 5% year-over-year to $19.7 billion and outperformed the market by delivering record net sales overall and in key product areas: foundry-logic, implant, packaging, metal deposition and chemical vapor deposition (CVD). |

| » | Applied Global Services segment: we grew revenue to a record $5.7 billion, increased the number of installed base tools by 5% year-over-year and grew long-term subscription service agreements to 63% of our total parts and service revenues. |

| » | Display and Adjacent Markets segment: we delivered revenue of $868 million and maintained profitability during an industry down cycle. |

Strategic and Operational Highlights

Applied’s strategy is to deliver highly differentiated materials engineering products and services that enable major technology inflections and drive our customers’ success.

| vi | APPLIED MATERIALS, INC. 2024 PROXY STATEMENT |

Proxy Statement Summary

Semiconductors are at the foundation of the digital transformation that will affect almost every sector of the economy over the coming years. Long-term megatrends including the Internet of Things (IoT), big data and artificial intelligence (AI) are fueling a new era of growth for semiconductors and driving the need for advancements in silicon technologies. Applied Materials has focused its strategy and investments to deliver innovations that accelerate improvements in the power, performance, area, cost and time-to-market (PPACt™) of semiconductor devices. Key strategic and operational accomplishments during fiscal 2023 include:

| » | Many of our business units delivered new records and major milestones including in etch, where we passed 10,000 shipments of our Centris Sym3 chamber. |

| » | We released new products and secured production-tool-of-record positions in gate-all-around, backside power delivery, patterning, advanced dynamic random-access memory (DRAM) and high-bandwidth memory, and heterogeneous integration. |

| » | We strengthened our IoT, communications, automotive, power and sensors (ICAPS) business that serves IoT, communications, automotive, power and sensor customers with new products and application wins in etch, epitaxy, and implant, as well as metrology and inspection. |

| » | In our services business, we grew our industry-leading installed base to more than 48,000 systems, increased the number of systems under service agreement to 16,600, and added new types of subscription agreements including sensor and AI-based solutions. In addition, we signed a unique environmental services agreement with a customer that helps reduce electricity consumption and carbon emissions. |

| » | We continued to make substantial progress towards our 10-year roadmap for environmental and social responsibility, as described in more detail on pages xii and xiii. |

Total Shareholder Return Performance

In fiscal 2023, Applied delivered strong total shareholder return, as a result of the Company’s ability to deliver record financial results in a down year for the wafer fabrication equipment market. As shown below, for the five year period beginning with fiscal 2019, Applied has substantially outperformed the S&P 500 Index, reflecting the company’s ability to create unique and innovative materials engineering solutions that accelerate our customers’ technology roadmaps.

Fiscal 2019 – Fiscal 2023 Total Shareholder Return vs. S&P 500 and Proxy Peers1

| 1 | Reflects results from October 28, 2018 through October 29, 2023. Proxy peer data reflects the companies in Applied’s current compensation peer group approved by the HRCC in June 2023, as described on page 39, weighted by market capitalization. |

| APPLIED MATERIALS, INC. 2024 PROXY STATEMENT | vii |

Proxy Statement Summary

Key Compensation Actions

Performance-Based Compensation Decisions. The HRCC approved an aggressive set of performance goals for the executive officers for fiscal 2023, including challenging financial and operational targets despite a difficult external landscape, including macro-economic uncertainty, a complex geopolitical environment and an anticipated down year for the wafer fabrication equipment market. During fiscal 2023, Applied delivered exceptional financial and operational results, meeting or exceeding most of its stretch objectives for the year in a continuing challenging environment, and made meaningful progress towards our long-term strategic goals that remain focused on enabling strong longer-term revenue and EPS growth. As a result, bonus payouts for the executive officers were, on average, modestly above target. No adjustments were made during the year to the performance goals or to the Company’s results used in determining incentive payouts.

As part of our multi-year incentive program, for the period of fiscal 2021 through 2023, the HRCC approved challenging goals for non-GAAP adjusted operating margin and relative total shareholder return. The results for this three-year performance period significantly exceeded target performance levels, resulting in above-target vesting of performance share unit awards granted to our executive officers in fiscal 2021.

| viii | APPLIED MATERIALS, INC. 2024 PROXY STATEMENT |

Proxy Statement Summary

Primary Compensation Elements and Executive Compensation Highlights for Fiscal 2023

The primary elements of our compensation program are base salary, annual incentive bonuses and long-term incentive awards. Other elements of compensation include a 401(k) savings plan, deferred compensation benefits and other benefits programs that are generally available to all eligible employees. Primary elements and highlights of our fiscal 2023 compensation program for our named executive officers (“NEOs”) were as follows:

| Element of Pay | Structure | Highlights |

| |||||

|

Base Salary

(see page 40) |

|

» Fixed cash compensation for performing expected day-to-day responsibilities

» Reviewed annually and adjusted as appropriate, based on scope of responsibility, performance, time in role, experience, and competitive market for executive talent

|

» Reflecting (i) continued strong performance across the business, driven by our executive leadership, (ii) the continued growth in the size and complexity of the Company and (iii) continued demand for proven executive talent among technology companies, in fiscal 2023, the HRCC approved salary increases for three of our NEOs ranging from 5% to 9.5%

» Reflecting the increased responsibilities of his role assumed in late fiscal 2022, the HRCC approved a salary increase of 37% for Mr. Deane for fiscal 2023

» Reflecting the HRCC’s belief that CEO compensation should be predominantly tied to long-term results, the Committee has not increased the salary for our CEO since December 2018

|

| |||

|

| Annual

Incentive

Bonus

(see page 40) |

| » Variable cash compensation

» Based on performance compared to pre-established financial, operational, strategic and individual performance objectives

» Includes assessment of the Company’s progress towards sustainability goals

» Financial and non-financial metrics provide a comprehensive assessment of executive performance

» Performance metrics evaluated annually to maintain continued alignment with strategy and market practice

» NEO annual incentives determined through a three-step performance assessment process:

| » No increase in target bonus as a percentage of base salary from fiscal 2022 to fiscal 2023 for any of the NEOs, with the exception of Mr. Deane, to reflect his new role

» The initial performance hurdle for fiscal 2023 was $6.00 of non-GAAP adjusted EPS, requiring continued strong financial performance. Actual non-GAAP adjusted EPS for fiscal 2023 was $8.05

» Because the initial performance hurdle was met, annual bonuses for the NEOs were based on (i) the Company’s results as compared to the objective and quantifiable business and strategic goals in the corporate scorecard and (ii) an assessment of individual performance results as compared to quantitative and strategic objectives

» Resulting payouts ranged from 98% to 108% of target for our NEOs

• Corporate scorecard modifiers ranged from 0.893x to 0.980x (see corporate scorecard information on pages 42 and 43)

• Individual performance modifiers were set at 1.1x for each of the NEOs (see individual performance factor details on page 44) | ||||

|

| Long-Term

Incentives

(see page |

| » Significant portion delivered through performance share units (PSUs), to establish rigorous long-term performance alignment

» Balance of award delivered in restricted stock units (RSUs) to provide a strong tie to shareholder value and enhance retention

» PSUs vest based 50% on achievement of 3-year non-GAAP adjusted operating margin goal and 50% on 3-year TSR relative to the members of the S&P 500 Index

» PSUs vest at end of 3-year performance period, based on achievement of performance goals; RSUs vest ratably over 3 years | » The target mix of long-term incentive awards consists of 75% PSUs and 25% RSUs for the CEO and 50% PSUs and 50% RSUs for the other NEOs

» Non-GAAP adjusted operating margin is a key measure of our Company’s long-term success

» Relative TSR incentivizes management to outperform the market in any business environment | ||||

| APPLIED MATERIALS, INC. 2024 PROXY STATEMENT | ix |

Proxy Statement Summary

Pay Mix

In fiscal 2023, a significant portion of our executives’ compensation consisted of variable compensation and long-term incentives. As illustrated below, 96% of CEO compensation for fiscal 2023 consisted of variable compensation elements, and 90% of CEO compensation was delivered in long-term incentive awards with multi-year vesting.

| Fiscal 2023 Compensation Mix1 | ||

| CEO | All Other NEOs | |

|  | |

| 1 | Represents total direct compensation for fiscal 2023, including the grant date fair value of annual long-term incentive awards. |

Summary of 2023 Total Direct Compensation

The following table summarizes elements of annual total direct compensation for our NEOs for fiscal 2023, consisting of (1) base salary received during the year, (2) actual annual incentive bonus payout and (3) long-term incentive awards (the grant date fair value of stock awards). This table excludes amounts not considered by the HRCC to be annual total direct compensation, such as certain other amounts required by the SEC to be reported in the “All Other Compensation” column in the Summary Compensation Table (see page 54 of this Proxy Statement).

Name and Principal Position | Salary ($) | Annual ($) | Annual ($) | Total ($) | ||||||||||||

Gary E. Dickerson President and Chief Executive Officer | 1,030,000 | 1,631,520 | 23,951,048 | 26,612,568 | ||||||||||||

Brice Hill Senior Vice President, Chief Financial Officer and Global Information Services | 708,846 | 1,019,304 | 5,530,849 | 7,258,999 | ||||||||||||

Prabu G. Raja President, Semiconductor Products Group | 740,000 | 1,091,475 | 6,636,826 | 8,468,301 | ||||||||||||

Omkaram Nalamasu Senior Vice President, Chief Technology Officer | 625,385 | 742,203 | 4,037,503 | 5,405,091 | ||||||||||||

Timothy M. Deane Group Vice President, Applied Global Services | 574,947 | 733,590 | 3,097,266 | 4,405,803 | ||||||||||||

| x | APPLIED MATERIALS, INC. 2024 PROXY STATEMENT |

Proxy Statement Summary

Our Commitment to Sustainability

Our Approach

Our unique industry position comes with responsibility to our employees, customers and society. In the era of Artificial Intelligence and the Internet of Things, we are committed to working across the technology ecosystem to “Make Possible a Better Future” for our shareholders and other stakeholders.

At the heart of Applied’s sustainability vision and strategy is a focus on how we can use our technology and people to strengthen our industry, improve our communities and enable leading innovation – all with an additional focus on limiting our environmental footprint. To drive change and innovation, we invest in our research and development, operations, supply chain, and interactions with our local communities. We are committed to advancing sustainability, not only through improvements in our own operations but also through investing in technological innovation. We are also committed to transparency and have aligned our disclosures and objectives with the United Nations Sustainable Development Goals and leading Environmental, Social and Governance reporting standards and frameworks such as those developed by the Sustainability Accounting Standards Board (SASB), Global Reporting Initiative (GRI), Task Force on Climate-related Financial Disclosure (TCFD) and CDP (formerly the Carbon Disclosure Project).

To learn more about Applied’s approach to sustainability, please refer to our annually published Sustainability Report, which can be found at https://www.appliedmaterials.com/company/corporate-responsibility.

Sustainability Framework

Our sustainability framework covers our direct impact and the impact of our value chain (customers and suppliers), as well as how we can advance sustainability on a global scale. Our 10-year sustainability strategy, which we introduced in 2020, considers the magnitude of our opportunities, including social and environmental impacts in our operations (1X), how we design solutions to address our industry’s impact, including that of our customers and suppliers (100X), and how our technology can be used in innovation to advance sustainability and equity on a global scale (10,000X).

| APPLIED MATERIALS, INC. 2024 PROXY STATEMENT | xi |

Proxy Statement Summary

Our Sustainability Strategy and Recent Initiatives

| Lead with Purpose Leaning into our core values to make |  | Invest in People Cultivating a culture and talent engine | |||||

» Leading with purpose is about protecting our brand reputation, attracting the best talent, building operational efficiency and resiliency, and ensuring the long-term sustainability of our company and industry.

» Our Standards of Business Conduct was refreshed for improved readability and comprehension, and has been released in 14 languages.

» We have established regional compliance committees and conducted a company-wide, third-party administered Ethical Culture and Compliance Perceptions Assessment.

» We completed 240 supply chain cybersecurity assessments and are monitoring approximately 2,500 suppliers for disruption

» We successfully advocated for inclusion of an investment tax credit in the U.S. CHIPS and Science Act; Applied Chief Technology Officer Omkaram Nalamasu serves on the Industrial Advisory Committee of CHIPS for America. |

» We value diversity of thought, race, ethnicity, national origin, gender, gender identity, sexual orientation, age, culture and expertise because they strengthen our business and power the innovations that define our enterprise.

» Our commitment to invest in Applied’s people is underpinned by goals to increase women’s representation at Applied globally and in the U.S., increase underrepresented minorities’ representation in our U.S. workforce, and maintain ambitious occupational health and safety total case incident rates.

» We have created a Diversity, Equity and Inclusion (DEI) Engine, a framework of tools, training and processes to accelerate our Culture of Inclusion.

» We achieved a 98% completion rate for training and learning hours by full-time employees, with a per-employee average of 57 training hours.

» Our commitment to protecting human rights was furthered by our completion of a human rights salience assessment, including an implementation action plan, and we began building a Responsible Manufacturing Program to implement our Human Rights Statement of Principles and the Responsible Business Alliance (RBA) Code of Conduct.

| |||||||

| Protect our Planet Accelerate our transition to a low-carbon future powered by renewables |  | Innovate for Progress Advancing innovations that enable our | |||||

» With 99% of our greenhouse gas emissions stemming from our value chain, we designed a Net Zero 2040 Playbook to work collaboratively across our industry to reduce and mitigate our climate impact.

» Our science-based Scope 1, 2 and 3 emissions reduction targets received validation from the Science Based Targets initiative (SBTi).

» Through a combination of onsite generation, virtual power purchase agreements, green utility programs and renewable energy credits, we have achieved 100% renewable electricity in the U.S. and 69% worldwide, through 2022.

» We achieved a decrease in water intensity even as absolute water withdrawal increased due to business growth. |

» From the earliest stages of design, we employ Design for Sustainability (DfSu) methods and principles—innovating systems that consume fewer resources, last longer, and support circularity.

» Our commitment to innovate for progress is underpinned by our 3x30 goals pertaining to energy consumption, chemical consumption and footprint intensity for semiconductor products.

» Our Supply Chain Certification for Environmental and Social Sustainability (SuCCESS2030) initiative offers training and resources to help our suppliers deliver on our sustainability expectations, and we conduct periodic supplier audits and assessments to verify their compliance.

» Our supplier diversity program is one of the main pillars of our SuCCESS2030 initiative, and in 2022 we achieved $462 million of spending with certified diverse suppliers.

| |||||||

| xii | APPLIED MATERIALS, INC. 2024 PROXY STATEMENT |

Proxy Statement Summary

Our 2030 Sustainability Goals

Applied drives progress under our 1X/100X/10,000X framework in large part through setting and focusing on a series of 2030 environmental and social goals.

|

» Greater than 25% women representation at Applied globally |

|

» 100% of electricity at Applied globally to come from renewable sources

» 50% reduction in Scope 1 and Scope 2 CO2e emissions (from 2019 baseline)

» 55% reduction of Scope 3 GHG emissions from use of sold products per $1 million of value added (gross profit) by 2030 (from 2019 baseline) | |||||

» Greater than 21% executive women representation at Applied globally, with an aspiration to achieve equal global and executive representation of women by 2040 | ||||||||

» Greater than 25% underrepresented minority representation in Applied’s U.S. workforce | ||||||||

» Greater than 10% executive underrepresented minority representation in Applied’s U.S. workforce

|

|

» Reduce equivalent energy consumption per wafer for semiconductor products by 30% by 2030 (from 2019 baseline) | |

» Reduce the impact from chemical consumption per wafer for semiconductor products by 20% by 2030 (from 2019 baseline) | ||

» 30% reduction in the physical footprint of our semiconductor products (sqm/wph) (from 2019 baseline) | ||

» $1 billion spend with (and representation of) women- and minority-owned businesses by 2027

| ||

For more information on Applied’s recent progress toward meeting the goals underpinning our sustainability strategy, including our SuCCESS2030 roadmap and 3x30 product improvements, please refer to our 2022 Sustainability Report available at https://www.appliedmaterials.com/company/corporate-responsibility.

Our 2023 Sustainability Accomplishments

To better enable Applied to meet its ambitious long-term sustainability goals, we established a set of interim objectives for fiscal 2023. As described in more detail on page 42, the Company’s level of achievement of these objectives was added to the corporate scorecard, which informs bonus payouts for our executive officers. In 2023, Applied made strong progress toward our 10-year sustainability roadmap. Key achievements included that we:

| Continued to reduce our Scope 1 and 2 emissions, achieved our goal of 100% renewable electricity in the U.S., and remained on track to achieve our 2030 environmental goals |

| Designed and deployed a Net Zero 2040 Playbook to work collaboratively across our industry to reduce and mitigate our climate impact, including through accelerating grid decarbonization, innovating with customers, and improving product efficiency | |||

| Received SBTi validation for our Scope 1, 2 and 3 science-based targets, and continued to report our carbon impact and risks in-line with the TCFD |

| Advanced our 3x30 and SuCCESS2030 goals, including accelerating sustainable innovation, improving the longevity of our products, and enabling our suppliers to better meet our sustainability expectations | |||

| Established a Diversity, Equity and Inclusion Engine, a framework of tools, training and processes to empower employees at every level to accelerate our progress |

| Strengthened our Culture of Inclusion by continuing to provide comprehensive diversity training, including a month-long Culture of Inclusion Summit at 17 Applied sites globally | |||

| Working in partnership with third-party advisors, completed an assessment to proactively identify potential human rights risks and assess how effectively we are managing any such risks |

| Followed or exceeded all regulatory requirements applicable to the health and safety performance of our operations, processes and products | |||

| APPLIED MATERIALS, INC. 2024 PROXY STATEMENT | xiii |

Proxy Statement Summary

Sustainability Oversight and Management

Our Board and management actively oversee sustainability matters to foster accountability. The Board’s Governance Committee oversees the Company’s overall sustainability strategy, policies and performance. We have established executive leadership of a company-wide strategy on sustainability matters and reporting. We are focused on integrating sustainability into our operations and company culture through initiatives aligned to company strategy that address a broad set of stakeholders, including shareholders, customers, employees, suppliers, governments, and our local communities.

Our ESG Leadership Council, which includes leaders from across all of Applied’s sustainability-focused delivery teams, oversees implementation of our sustainability strategy. To ensure accountability, the Council regularly reports progress to Applied’s Executive Leadership Team as part of the strategic review process, and quarterly to the Governance Committee. The Council is also responsible for reviewing all content in our annual Sustainability Report. The Council is supported by employees and leaders from across all business units and functions that are responsible for delivering progress toward our sustainability strategy. Our Senior Director of ESG, Corporate Sustainability and Reporting leads the Council and sustainability efforts across our business and has primary responsibility for the quarterly written and in-person reports to the Governance Committee and Executive Leadership Team. The Governance Committee’s sustainability oversight process also includes presentations by internal and third-party experts to discuss topics such as renewable energy, our Net Zero 2040 Playbook, the sustainability data assurance process, our 3x30 program and other relevant topics.

Our Environmental, Health and Safety (“EHS”) organization is dedicated to maintaining a safe and healthful working environment, demonstrating environmental leadership, and meeting or exceeding regulatory compliance. The Governance Committee receives a quarterly report on EHS matters, including an annual in-depth review of Applied’s EHS practices and policies.

We have a team fully dedicated to supporting our work in designing a Culture of Inclusion, and the HRCC oversees our corporate culture and human capital management programs, including our diversity and inclusion practices and initiatives. The HRCC approved the sustainability objectives for our annual bonus program to incentivize our leadership team to maintain progress toward all our 2030 sustainability goals.

| xiv | APPLIED MATERIALS, INC. 2024 PROXY STATEMENT |

PROPOSAL 1 – Election of Directors

Proxy Statement

PROPOSAL 1 – Election of Directors

Nominees

Applied’s Board of Directors is elected each year at the Annual Meeting of Shareholders. Applied currently has ten directors. Upon the recommendation of the Governance Committee, the Board has nominated the ten individuals listed below for election at the Annual Meeting, each of whom currently serves as a director of Applied. These nominees bring a wide variety of relevant skills, professional experience and backgrounds, as well as diverse viewpoints and perspectives to represent the long-term interests of shareholders and to fulfill the leadership and oversight responsibilities of the Board.

If any nominee listed below becomes unable to stand for election at the Annual Meeting, the persons named as proxies may vote for any person designated by the Board to replace the nominee. Alternatively, the proxies may vote for the remaining nominees and leave a vacancy that the Board may fill later, or the Board may reduce the authorized number of directors. As of the date of this Proxy Statement, the Board is not aware of any nominee who is unable or will decline to serve as a director.

Each director elected at the Annual Meeting will serve until Applied’s 2025 Annual Meeting of Shareholders or until they are succeeded by another qualified director who has been elected, or, if earlier, until their death, resignation, or removal.

| The Board recommends that you vote FOR each of the following director nominees | |

| APPLIED MATERIALS, INC. 2024 PROXY STATEMENT | 1 |

PROPOSAL 1 – Election of Directors

| Rani Borkar

Corporate Vice President, Azure Hardware Systems and Infrastructure, Microsoft Corporation

Ms. Borkar brings extensive semiconductor industry experience to our Board in technology, strategy and innovation, and global business operations and services. Ms. Borkar has served as Corporate Vice President, Azure Hardware Systems and Infrastructure, at Microsoft Corporation, a global technology provider, since June 2019. She also served as Microsoft’s Corporate Vice President, Microsoft Cloud Capacity, Supply Chain and Provisioning, from 2017 to June 2019. From 2016 to 2017, Ms. Borkar was Vice President, OpenPOWER Development at IBM Corporation, a global technology and consulting company. Prior to IBM, Ms. Borkar worked at Intel Corporation for 27 years, most recently as Intel’s Corporate Vice President and General Manager, Product Development Group.

Key skills and qualifications

Industry and Technology: Ms. Borkar has gained over 30 years of experience in our industry and related technologies. This experience includes her current leadership role at Microsoft Azure and prior roles at IBM and Intel. Ms. Borkar also serves as a board member of the Global Semiconductor Alliance, a leading semiconductor and technology industry organization which strives to establish a profitable and sustainable semiconductor ecosystem.

Strategy and Innovation; Executive Leadership; Growth and Emerging Technologies; Global Business: Each role in Ms. Borkar’s career has featured increased responsibility and accountability for strategic planning and oversight in a broad range of global, high-growth businesses. As the head of Azure Hardware Systems and Infrastructure, she leads organizations that architect, invent, and sustain the silicon, platforms, and systems that power Azure. She is responsible for the vision, strategy, and architecture of silicon development as well as global capacity deployment for Microsoft’s cloud data center infrastructure. Ms. Borkar’s other relevant experience includes her role as Corporate Vice President at Intel, leading Intel’s silicon product development strategy while managing a large and diverse global engineering organization.

Service, Operations and Manufacturing: Under Ms. Borkar’s leadership in her current role, Microsoft’s engineers focus on developing technologies to drive end-to-end business value for Azure’s products and solutions. Her experience with and understanding of service management and service offerings for technology companies, manufacturing operations and other operational processes provide important insights to our Board.

| |

INDEPENDENT

Age: 62

Director Since: 2020

Board Committees

• Human Resources and Compensation

• Strategy and Investment

Other Current Public Company Directorships

• None

Former Public Company Directorships (within last five years)

• None

Other Directorships and Memberships

• Board member, Global Semiconductor Alliance

|

| 2 | APPLIED MATERIALS, INC. 2024 PROXY STATEMENT |

PROPOSAL 1 – Election of Directors

| Judy Bruner

Executive Vice President, Administration and Chief Financial Officer, SanDisk Corporation (retired)

Ms. Bruner has deep financial, accounting and strategic planning expertise, as well as global operations and leadership experience, that provides valuable insights and contributions to our Board. Ms. Bruner is the former Executive Vice President, Administration and Chief Financial Officer of SanDisk Corporation, a supplier of flash storage products, a role she held from 2004 until its acquisition by Western Digital in 2016. Previously, she was Senior Vice President and Chief Financial Officer of Palm, Inc., a provider of handheld computing and communications solutions, from 1999 until 2004. Prior to Palm, Inc., Ms. Bruner held financial management positions at 3Com Corporation, Ridge Computers and Hewlett-Packard Company.

Key skills and qualifications

Executive Leadership; Financial and Accounting; Strategy and Innovation; Global Business: Ms. Bruner’s career has been distinguished by roles of increasing responsibility in and oversight of financial management. These roles included serving as Chief Financial Officer at SanDisk Corporation and Palm, Inc. Ms. Bruner’s experience also included setting corporate strategy and diversifying businesses into new product areas that are less cyclical and less capital intensive, while focusing on the core business. Her prior roles in finance also included positions at 3Com, Ridge Computers and Hewlett-Packard.

Industry and Technology: Ms. Bruner’s career has been centered in the technology sector, giving her particular insight into the challenges and opportunities of our sector and industry, as well as our end markets. Ms. Bruner’s extensive experience in the semiconductor industry at SanDisk provided an understanding of the capital intensity, business cycles, customers and engineering requirements of the semiconductor equipment business, which she brings to our Board.

Risk Management; Cybersecurity: In Ms. Bruner’s role at SanDisk, she was responsible for the firm’s enterprise risk management and information technology, including cybersecurity. As a director, Ms. Bruner oversees enterprise risk management and cybersecurity at all the companies on which she currently serves as a board member, including at Rapid7, a security data and analytics solutions provider. She brings valuable insights from this experience to our Board to facilitate its oversight and considerations of these important topics.

| |

INDEPENDENT

Age: 65

Director Since: 2016

Board Committees

• Audit (Chair)

• Corporate Governance and Nominating (Chair)

Other Current Public Company Directorships

• Qorvo, Inc.

• Rapid7, Inc.

• Seagate Technology plc

Former Public Company Directorships (within last five years)

• Varian Medical Systems, Inc.

|

| APPLIED MATERIALS, INC. 2024 PROXY STATEMENT | 3 |

PROPOSAL 1 – Election of Directors

| Xun (Eric) Chen

Executive Chairman, ParityBit Technologies, Inc.

Dr. Chen has extensive experience establishing, working for and investing in companies in the technology sector and related industries. Since August 2023, Dr. Chen has been Executive Chairman of ParityBit Technologies, Inc. (“ParityBit”), a data technology company he co-founded. From 2018 to August 2023, Dr. Chen was a Managing Partner of SB Investment Advisers (“SBIA”), an investment adviser focused on investments in the technology sector. Prior to joining SBIA, Dr. Chen was the Chief Executive Officer and Co-Founder of ParityBit. He served as CEO of ParityBit since it was founded in 2015, except from 2016 until 2017, when ParityBit was a portfolio company of Team Curis Group, a group of integrated biotechnology and data technology companies and laboratories, during which time Dr. Chen served as CEO of Team Curis Group. From 2008 to 2015, Dr. Chen served as a managing director of Silver Lake, and prior to Silver Lake, he was a senior vice president and member of the executive committee of ASML Holding N.V. Dr. Chen joined ASML following its 2007 acquisition of Brion Technologies, Inc., a company he co-founded in 2002 and served as Chief Executive Officer. Prior to Brion Technologies, Dr. Chen was a senior vice president at J.P. Morgan.

Key skills and qualifications

Industry and Technology; Strategy and Innovation; Growth and Emerging Technologies: Dr. Chen’s career has focused on the technology sector, and he provides his expertise on our industry, technologies and end markets in the boardroom. Dr. Chen is currently Executive Chairman of ParityBit, a technology company focused on leveraging the power of Big Data, AI technologies, and privacy computing. His other relevant experiences have included serving as a Managing Partner of SBIA, an investment adviser focused on investments in the technology sector, serving as a managing director at Silver Lake, a leading private investment firm focused on technology-enabled and related growth industries, and founding and serving as CEO of Brion Technologies, a firm working in computational lithography for integrated circuits in semiconductor manufacturing.

Executive Leadership; Global Business: The Board values Dr. Chen’s perspective gained through his various leadership roles at firms with global operations. For example, Dr. Chen is currently the Executive Chairman, and prior to joining SBIA was the CEO and Co-Founder, of ParityBit. Dr. Chen grew ParityBit’s presence globally, including throughout the Asia Pacific Region. Prior to this, Dr. Chen worked at ASML Holding N.V., an industrial manufacturer for chipmakers in the semiconductor industry that is headquartered in The Netherlands and has 60 locations globally.

| |

INDEPENDENT

Age: 54

Director Since: 2015

Board Committees

• Human Resources and Compensation

• Strategy and Investment

Other Current Public Company Directorships

• None

Former Public Company Directorships (within last five years)

• None

|

| 4 | APPLIED MATERIALS, INC. 2024 PROXY STATEMENT |

PROPOSAL 1 – Election of Directors

| Aart J. de Geus

Executive Chair of the Board of Directors, Synopsys, Inc.

Dr. de Geus has extensive executive leadership experience and provides the Board his deep expertise in our industry, technology and corporate strategy. Dr. de Geus currently serves as Executive Chair of the Board of Directors of Synopsys, Inc., the leading provider of electronic design automation software, design IP and related services for semiconductor design companies. Since founding Synopsys in 1986, Dr. de Geus has held various positions at the company, including serving as Chief Executive Officer or co-Chief Executive Officer from 1994 to January 2024, Chairman of the Board from 1998 to January 2024, Senior Vice President of Engineering and Senior Vice President of Marketing. Prior to founding Synopsys, Dr. de Geus was employed by General Electric, where he was the Manager of the Advanced Computer-Aided Engineering Group.

Key skills and qualifications

Industry and Technology; Executive Leadership; Strategy and Innovation; Global Business; Risk Management: As the leading founder of Synopsys, Dr. de Geus has grown Synopsys for over three and a half decades and has held senior roles in engineering and marketing before becoming Chief Executive Officer and subsequently Executive Chair of the Board. He has been involved in all aspects of executive leadership at Synopsys, including determining corporate strategy, overseeing enterprise risk management, closing well over a hundred strategic acquisitions and transactions, and expanding the operations globally. Synopsys now has offices and development centers in North America, Europe, Armenia, Israel, India, Japan, Vietnam, South Korea and China.

Growth and Emerging Technologies; Government Policy and Sustainability: Dr. de Geus has expanded Synopsys from a start-up synthesis company to a global high-tech leader in electronic design automation. He has long been considered one of the world’s leading experts on logic synthesis and simulation, frequently keynotes major conferences, is a member of the National Academy of Engineering and the recipient of numerous awards including the IEEE Robert N. Noyce Medal, the Global Semiconductor Alliance Dr. Morris Chang Exemplary Leadership Award, and the Silicon Valley Leadership Group Lifetime Achievement Award. As a longtime CEO, Dr. de Geus has experience in government policy, such as the CHIPS Act and evolving international export controls, as well as driving sustainability initiatives in the context of regulatory requirements and stakeholder input.

| |

INDEPENDENT

Age: 69

Director Since: 2007

Board Committees:

• Strategy and Investment

Other Current Public Company Directorships:

• Synopsys, Inc.

Former Public Company Directorships (within last five years):

• None

Other Directorships and Memberships

• Executive Board Member and Past Chairman, Silicon Valley Leadership Group

• Board Member, Global Semiconductor Alliance

• Governing Council Member, Electronic System Design Alliance

|

| APPLIED MATERIALS, INC. 2024 PROXY STATEMENT | 5 |

PROPOSAL 1 – Election of Directors

| Gary E. Dickerson

President and Chief Executive Officer, Applied Materials, Inc.

Mr. Dickerson has been President of Applied Materials since 2012 and Chief Executive Officer and a member of the Board of Directors since 2013. Mr. Dickerson joined Applied following its acquisition in 2011 of Varian Semiconductor Equipment Associates, Inc., a supplier of semiconductor manufacturing equipment. Mr. Dickerson had served as Chief Executive Officer and a director of Varian since 2004. Prior to joining Varian in 2004, Mr. Dickerson served 18 years with KLA-Tencor Corporation, a supplier of process control and yield management solutions for the semiconductor and related industries, where he held a variety of roles, including President and Chief Operating Officer. Mr. Dickerson started his semiconductor career in manufacturing and engineering management at General Motors’ Delco Electronics Division and AT&T Technologies, Inc.

Key skills and qualifications

Industry and Technology; Executive Leadership; Strategy and Innovation; Global Business; Risk Management: Mr. Dickerson has over three decades of experience in executive-level positions at large multi-national companies in the semiconductor and technology industries, including nearly two decades as a chief executive officer at Varian and Applied. Mr. Dickerson’s knowledge of our industry, technologies and end markets provides important insight and leadership to the oversight, planning and execution of our business strategy and operations. At Applied, this has resulted in the company being the world’s leading semiconductor and display equipment company with over $26 billion in annual revenues and operations in 150 cities in 24 countries.

Growth and Emerging Technologies; Service, Sales and Operations; Government Policy and Sustainability: Throughout Mr. Dickerson’s career, he has held roles responsible for identifying and developing emerging technologies and service offerings for the semiconductor industry. This includes his first roles in manufacturing and engineering management with General Motors’ Delco Electronics Division and AT&T Technologies, 18 years at KLA-Tencor, progressing from roles in product development and general management of products, sales and services business units to his appointment as President and Chief Operating Officer, and to his leadership and contributions as Chief Executive Officer at Varian and Applied. Mr. Dickerson has government policy experience in guiding Applied through the geopolitical and regulatory environment, as well as from his service as a board of member of the U.S.-China Business Council. Mr. Dickerson’s experience in sustainability stems from his deep involvement in developing Applied’s sustainability roadmap and championing its sustainability initiatives. Mr. Dickerson draws on these experiences to provide leadership and insight in guiding our core semiconductor business, and as we develop new technologies and services to enable significant value creation for our customers and Applied.

| |

EXECUTIVE DIRECTOR

Age: 66

Director Since: 2013

Board Committees

• None

Other Current Public Company Directorships

• None

Former Public Company Directorships (within last five years)

• None

Other Directorships and Memberships

• Board Member, U.S. – China Business Council

|

| 6 | APPLIED MATERIALS, INC. 2024 PROXY STATEMENT |

PROPOSAL 1 – Election of Directors

| Thomas J. Iannotti

Senior Vice President and General Manager, Enterprise Services, Hewlett-Packard Company (retired)

Mr. Iannotti serves as the Chairman of the Board of Applied. Mr. Iannotti has extensive leadership experience at global firms where he gained invaluable expertise in service management, offerings for technology companies, and operational processes. He served as Senior Vice President and General Manager, Enterprise Services, for Hewlett-Packard Company, a technology solutions provider to consumers, businesses, and institutions globally, from 2009 until his retirement in 2011. Prior to that role, Mr. Iannotti held various executive positions at Hewlett-Packard, including Senior Vice President and Managing Director, Enterprise Business Group, Americas. Mr. Iannotti also worked at Digital Equipment Corporation, a vendor of computer systems and software, and at Compaq Computer Corporation, a supplier of personal computing systems, following its acquisition of Digital Equipment Corporation.

Key skills and qualifications

Industry and Technology; Executive Leadership; Strategy and Innovation; Global Business: Mr. Iannotti had a distinguished three-decade career managing large, complex global businesses in the electronics and technology industries. He held numerous executive positions at Hewlett-Packard, with his final role as Senior Vice President and General Manager, Enterprise Services, responsible for driving profitable revenue growth and customer satisfaction across the globe. Mr. Iannotti also chaired the Americas Leadership Team responsible for managing cross-business group strategies and developing partnerships with key Hewlett-Packard stakeholders. His other relevant experience included working at Digital Equipment Corporation, a vendor of computer systems and software, and at Compaq Computer Corporation, a supplier of personal computing systems.

Service, Operations and Manufacturing; Risk Management: While at Hewlett-Packard, Mr. Iannotti was integral in setting and executing operational and service strategies for the Enterprise Services group, which supported and provided services and products for all of the company’s offerings. Mr. Iannotti’s roles also involved oversight and management of risk, and he has served as the lead independent director of the board of directors of a large, public global services company. These experiences provide important input to our Board and are an integral part of successful planning and execution of our long-term vision, including the Board’s oversight of Applied’s enterprise risk management program.

| |

Chairman of the Board

INDEPENDENT

Age: 67

Director Since: 2005

Board Committees

• Human Resources and Compensation (Chair)

Other Current Public Company Directorships

• Rigetti Computing, Inc.

Former Public Company Directorships (within last five years)

• Atento S.A.

|

| APPLIED MATERIALS, INC. 2024 PROXY STATEMENT | 7 |

PROPOSAL 1 – Election of Directors

| Alexander A. Karsner

Senior Strategist, X (parent company: Alphabet Inc.)

Mr. Karsner has extensive global executive leadership experience as well as deep expertise in technology innovation, private equity, public policy and regulation, corporate strategy and sustainability. He is currently a Senior Strategist at X (the Moonshot Factory), the innovation lab of Alphabet Inc., and Executive Chairman of Manifest Energy Inc., an energy technology development and investment firm he founded in 2009. Mr. Karsner is also Founder of Elemental, which innovates market-based solutions and technology for conservation and environment.

Key skills and qualifications

Executive Leadership; Global Business: Mr. Karsner has over 30 years of experience in executive leadership positions with numerous organizations with significant global operations, including his current role at X and public company board experience at ExxonMobil. Mr. Karsner was the Founder and Managing Director of Enercorp., a company involved in international project development, management and financing of energy infrastructure.

Industry and Technology; Growth and Emerging Technologies; Strategy and Innovation: Mr. Karsner currently serves as Senior Strategist at X, which has catalyzed technologies for autonomous vehicles, drone delivery and industrial robotics. From 2016 to 2019, Mr. Karsner served as Managing Partner of Emerson Collective, an investment platform funding venture and private equity portfolios, as well as non-profit, philanthropic investments advancing education, immigration, health and the environment. As a private equity investor, venture partner and strategic advisor, Mr. Karsner’s portfolios have included some of the most innovative startups over the last 15 years, such as Nest (AI), Tesla (mobility), Recurrent (solar), Codexis (biotech), Boom (aerospace) and Carbon (3-D printing).

Government Policy and Sustainability: Mr. Karsner has extensive experience in government policy and relations, and offers our Board valuable insight into the regulatory environment. From 2006 to 2008, he served as Assistant Secretary for Energy Efficiency and Renewable Energy at the U.S. Department of Energy, responsible for multi-billion dollar federal applied science R&D programs and national labs. In this role, he helped assemble significant bipartisan coalitions to implement the Energy Policy Act and enact the Energy Independence and Security Act and the America Competes Act. Mr. Karsner was a U.S. Principal representative to the United Nations Framework Convention on Climate Change and a delegate to the bilateral U.S.-China and U.S.-India Track II dialogues on Climate Change, and is a member of the Council on Foreign Relations and the Trilateral Commission. Mr. Karsner also serves on the board of Conservation International and is a member of the boards of advisors of the Energy Futures Initiative, MIT Media Lab and the Precourt Institute for Energy at Stanford University. With these experiences, Mr. Karsner brings a valuable perspective to our Board’s oversight of sustainability, government relations and public policy engagement strategies.

| |

INDEPENDENT

Age: 56

Director Since: 2008

Board Committees

• Corporate Governance and Nominating

• Human Resources and Compensation

Other Current Public Company Directorships

• Exxon Mobil Corporation

Former Public Company Directorships (within last five years)

• Broadscale Acquisition Corp.

Other Directorships and Memberships

• Board Member of Conservation International

• Advisory Board Member of: Energy Futures Initiative; Precourt Institute for Energy, Stanford University; MIT Media Lab

|

| 8 | APPLIED MATERIALS, INC. 2024 PROXY STATEMENT |

PROPOSAL 1 – Election of Directors

| Kevin P. March

Senior Vice President, Chief Financial Officer of Texas Instruments, Incorporated (retired)

Mr. March brings deep semiconductor industry experience, strong financial expertise, and executive leadership to our Board. Mr. March joined Texas Instruments Incorporated, a global semiconductor company, in 1984 and built a career of varying positions of increasing responsibility over his 33-year tenure at the company. He was appointed Controller in 2002 and was named Chief Financial Officer in 2003.

Key skills and qualifications

Industry and Technology; Strategy and Innovation; Service, Operations and Manufacturing; Global Business: Mr. March was a longtime executive of Texas Instruments, with extensive experience in the semiconductor industry. Mr. March held numerous roles in finance, operations and business management across corporate and business unit functions during his career at Texas Instruments. Mr. March’s leadership was instrumental in shaping Texas Instruments into a focused semiconductor company, including his role in the formation of the company’s global Analog Semiconductor segment, which became the world’s largest analog semiconductor business.

Executive Leadership; Financial and Accounting; Risk Management: From 2003 to 2017, Mr. March served as Senior Vice President and Chief Financial Officer of Texas Instruments, where he led its finance organization and developed the company’s capital management strategy and was also responsible for executive management of the company’s global information technology services, procurement, logistics, facilities, and operations planning. In addition to being a member of the company’s management committee, Mr. March was a member of its strategic leadership team. At Texas Instruments, Mr. March led the company’s assessment and management of strategic, financial and operational risks, including facilitating the oversight of risk management processes by the company’s board of directors. Given the breadth and scope of its businesses and range of strategic, operational, financial and compliance risks, Mr. March’s experience at Texas Instruments positions him well to provide Applied with guidance across our risk landscape.

| |

INDEPENDENT

Age: 66

Director Since: 2022

Board Committees:

• Audit

Other Current Public Company Directorships

• None

Former Public Company Directorships (within last five years)

• None

|

| APPLIED MATERIALS, INC. 2024 PROXY STATEMENT | 9 |

PROPOSAL 1 – Election of Directors

| Yvonne McGill

Chief Financial Officer, Dell Technologies Inc.

Ms. McGill has extensive executive leadership experience and provides the Board deep industry expertise, financial acumen, and strategic planning experience. She has been Chief Financial Officer of Dell Technologies Inc. (“Dell”), a leading global end-to-end technology provider, since August 2023, and previously held various leadership positions at Dell since joining the company in 1997, including corporate controller and CFO of the Infrastructure Solutions Group, CFO of Asia-Pacific, Japan and China business, and Chief Accounting Officer.

Key skills and qualifications

Executive Leadership; Financial and Accounting; Strategy and Innovation; Risk Management: Since joining Dell in 1997, Ms. McGill has served in various finance leadership roles, including her current role as Chief Financial Officer. At Dell, Ms. McGill oversees all aspects of the company’s finance function, including accounting, financial planning and analysis, tax, treasury and investor relations, as well as corporate development, global business operations and Dell financial services. She also partners closely with the office of Dell’s CEO to develop and execute a long-term strategy that creates value for Dell’s stakeholders. Prior to Dell, Ms. McGill worked at ManTech International Corporation and Price Waterhouse. Ms. McGill is a Certified Public Accountant (inactive).

Industry and Technology; Global Business: During her over 26-year career at Dell, Ms. McGill has gained experience across the company’s comprehensive portfolio of IT hardware, software and service solutions spanning both traditional infrastructure and emerging, multi-cloud technologies. Ms. McGill’s deep knowledge and expertise in the technology sector, including with regards to our end-users and the markets in which we compete, offer valuable insights to our Board.

| |

INDEPENDENT

Age: 56

Director Since: 2019

Board Committees:

• Audit

• Corporate Governance and Nominating

Other Current Public Company Directorships

• None

Former Public Company Directorships (within last five years)

• None

|

| 10 | APPLIED MATERIALS, INC. 2024 PROXY STATEMENT |

PROPOSAL 1 – Election of Directors

| Scott A. McGregor

President and Chief Executive Officer, Broadcom Corporation (retired)

Mr. McGregor brings to our Board executive leadership and deep experience working in the semiconductor and technology industries over many decades. Mr. McGregor served as President and Chief Executive Officer and as a member of the board of directors of Broadcom Corporation, a world leader in wireless connectivity, broadband and networking infrastructure, from 2005 until the company was acquired by Avago Technologies Limited in 2016. Mr. McGregor joined Broadcom from Philips Semiconductors (now NXP Semiconductors), where he was President and Chief Executive Officer. He previously served in a range of senior management positions at Santa Cruz Operation Inc., Digital Equipment Corporation (now part of HP), Xerox Corporation’s Palo Alto Research Center (PARC) and Microsoft, where he was the architect and development team leader for Windows 1.0.