does not “target” pay at any specific percentile. Rather, individual pay positioning depends on a variety of factors, such as prior job performance, job scope and responsibilities, skill set, prior experience, time in position, internal comparisons of pay levels for similar skill levels or positions, our goals to attract and retain executive talent, Company performance, and general market conditions.

Assessment of Compensation Risk

Management, with the assistance of Compensia, the committee’s independent compensation consultant, conducted a compensation risk assessment in 2024 and concluded that risks arising from the Company’s current employee compensation programs are not reasonably likely to have a material adverse effect on the Company.

Policies and Practices Related to Timing of Option Awards

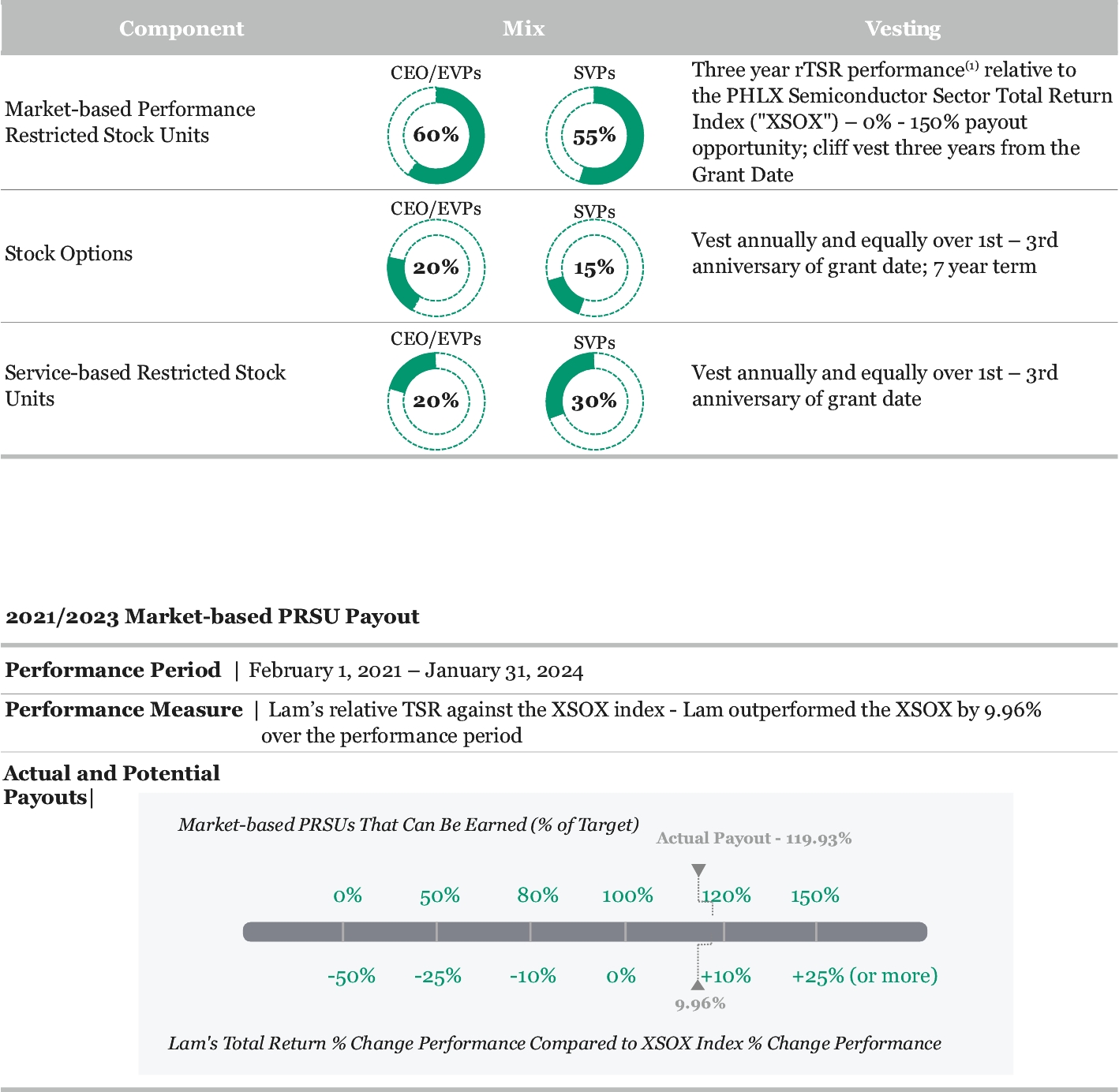

As was noted above, our executive compensation program includes a long-term incentive program, or LTIP, which is described in more detail in “III. Primary Components of NEO Compensation; CY2023 Compensation Payouts; CY2024 Compensation Targets and Metrics” below. The LTIP consists of a mix of vehicles, including stock options. Executives below the level of senior vice president, and non-executive employees who do not participate in the LTIP, are generally not eligible to receive stock options.

Our standard practice is for the committee to annually approve the grant of equity awards, including stock options, under the LTIP for the current calendar year at each regularly scheduled February meeting of the committee. In addition, the committee recommends to the independent members of the Board the approval of equity awards to the CEO under the LTIP for the current calendar year, and the independent members of our Board then review and approve such awards to the CEO during their regularly scheduled February meeting. The grant date for all of the aforementioned annual equity awards under the LTIP, including stock options, is generally on March 1 of each applicable calendar year, unless March 1 falls on a Saturday or a Sunday, in which case we grant awards on the preceding Friday or succeeding Monday, respectively.

The grant date for annual equity awards under the LTIP occurs at a time when the Company is generally not expected to be in possession of material non-public information regarding our business, and at a time when the Company is not expected to have recently disclosed, or to be imminently disclosing, material non-public information. Were it to happen that, in a particular year, the Company were to be in possession of material non-public information at or around the time of the approval date and/or the grant date for annual equity awards under the LTIP, the committee may consider departing from the regular stock option grant timing if it deems such departure to be appropriate and in the best interests of the Company and its stockholders.

We may grant equity awards, including options, to NEOs and other eligible executives outside of our annual award cycle for new hires, promotions, recognition, retention, or other purposes. In determining when to grant “off-cycle” stock option awards, the committee generally would seek to do so at a time when the Company is not expected to be in possession of material non-public information regarding our business, and at a time when the Company is not expected to have recently disclosed, or to be imminently disclosing, material non-public information.

During fiscal year 2024, the Company did not (i) time the disclosure of material non-public information for the purpose of affecting the value of executive compensation, or (ii) grant any stock options to any of its NEOs in any period beginning four business days prior to the filing of a periodic report on Form 10-Q, Form 10-K or current report on Form 8-K that discloses material non-public information, and ending one business day after the filing of such Form 10-Q, Form 10-K or Form 8-K.

Tax and Accounting Considerations

Taxation of “Parachute” Payments

Sections 280G and 4999 of the Internal Revenue Code (the “Code”) provide that “disqualified individuals” within the meaning of the Code (which generally includes certain officers, directors, and employees of the Company) may be subject to additional tax if they receive payments or benefits in connection with a change in control of the Company that exceed certain prescribed limits. The Company or its successor may also forfeit a deduction on the amounts subject to this additional tax.

We did not provide any of our executive officers, any director, or any other service provider with a “gross-up” or other reimbursement payment for any tax liability that the individual might owe as a result of the application of sections 280G or 4999 during fiscal year 2024, and we have not agreed and are not otherwise obligated to provide any individual with such a “gross-up” or other reimbursement as a result of the application of sections 280G and 4999.

Internal Revenue Code Section 409A

Section 409A of the Code imposes significant additional taxes on an executive officer, director, or service provider that receives non-compliant “deferred compensation” that is within the scope of section 409A. Among other things, section 409A potentially applies to cash awards under the LTIP, if any, the Elective Deferred Compensation Plan, certain equity awards, and severance arrangements.