Exhibit 99.2 SECOND QUARTER 2024 EARNINGS CALL LEON TOPALIAN Chair, President and CEO STEVE LAXTON Executive Vice President and CFO July 23, 2024

FORWARD-LOOKING STATEMENTS Certain statements made in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties. The words “anticipate,” “believe,” “expect,” “intend,” “may,” “project,” “will,” “should,” “could” and similar expressions are intended to identify forward-looking statements. These forward-looking statements reflect the Company’s best judgment based on current information, and although we base these statements on circumstances that we believe to be reasonable when made, there can be no assurance that future events will not affect the accuracy of such forward-looking information. The Company does not undertake any obligation to update these statements. The forward-looking statements are not guarantees of future performance, and actual results may vary materially from the projected results and expectations discussed in this presentation. Factors that might cause the Company’s actual results to differ materially from those anticipated in forward- looking statements include, but are not limited to: (1) competitive pressure on sales and pricing, including pressure from imports and substitute materials; (2) U.S. and foreign trade policies affecting steel imports or exports; (3) the sensitivity of the results of our operations to general market conditions, and in particular, prevailing market steel prices and changes in the supply and cost of raw materials, including pig iron, iron ore and scrap steel; (4) the availability and cost of electricity and natural gas, which could negatively affect our cost of steel production or result in a delay or cancellation of existing or future drilling within our natural gas drilling programs; (5) critical equipment failures and business interruptions; (6) market demand for steel products, which, in the case of many of our products, is driven by the level of nonresidential construction activity in the United States; (7) impairment in the recorded value of inventory, equity investments, fixed assets, goodwill or other long- lived assets; (8) uncertainties and volatility surrounding the global economy, including excess world capacity for steel production, inflation and interest rate changes; (9) fluctuations in currency conversion rates; (10) significant changes in laws or government regulations affecting environmental compliance, including legislation and regulations that result in greater regulation of greenhouse gas emissions that could increase our energy costs, capital expenditures and operating costs or cause one or more of our permits to be revoked or make it more difficult to obtain permit modifications; (11) the cyclical nature of the steel industry; (12) capital investments and their impact on our performance; (13) our safety performance; (14) our ability to integrate businesses we acquire; (15) the impact of the COVID-19 pandemic, any variants of the virus, and any other similar public health situation; and (16) the risks discussed in “Item 1A. Risk Factors” of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and elsewhere therein and in the other reports we file with the U.S. Securities and Exchange Commission. 2

NON-GAAP FINANCIAL MEASURES The Company uses certain non-GAAP (Generally Accepted Accounting Principles) financial measures in this news release, including EBITDA and Free Cash Flow (FCF). Generally, a non-GAAP financial measure is a numerical measure of a company’s performance or financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable financial measure calculated and presented in accordance with GAAP. We define EBITDA as net earnings before noncontrolling interests adding back the following items: interest expense, net; provision for income taxes; depreciation; amortization; and losses and impairments of assets. We define Free Cash Flow (FCF) as Cash Provided by Operating Activities less Capital Expenditures. Please note that other companies might define their non-GAAP financial measures differently than we do. Management presents the non-GAAP financial measures of EBITDA and FCF in this news release because it considers them to be an important supplemental measure of performance. Management believes that these non-GAAP financial measures provide additional insight for analysts and investors evaluating the Company’s financial and operational performance by providing a consistent basis of comparison across periods. Non-GAAP financial measures have limitations as an analytical tool. Investors are encouraged to review the reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures provided in this presentation, including in the accompanying tables located in the Appendix. 3

Q2 2024: EXECUTING ON MULTIPLE FRONTS 1 ✓✓ $ $1 1.5 .2 3 Bil bliilo lio nn E E BI BI TT DD AA FINANCIAL ✓ $645 million Net Earnings ✓ $845 Million Net Earnings PERFORMANCE ✓ $2.68 Earnings Per Share (diluted) ✓ $3.46 Earnings Per Share (diluted) ✓ $1 Billion in Share Repurchases ✓ $500 million in Q2 Share Repurchases (~2.9 million shares) CAPITAL ALLOCATION ✓✓ Red $801 u ces millsh ion a re in Q co 2 uCap nt by ~ ex; $6 5.5 80 m m illiio llin on sh in a an resnounced Acquisitions & BALANCE SHEET ✓ Moody’s revised Nucor’s credit outlook from Stable to Positive ✓ $128 Million in Dividend Payments ✓ Safest first half in Nucor history SAFETY ✓ Injury & Illness rate of 0.74 YTD PERFORMANCE ✓ 52 of 109 divisions with Zero Recordables YTD ✓ Construction milestones at Lexington (bar) & West Virginia (sheet) CONSTRUCTION AND ✓ Grand opening of new Gallatin tube mill RAMP-UPS ✓ Record production quarters for Gallatin (sheet) & Brandenburg (plate) ✓ Acquisition of Southwest Data Products expands our growing suite of solutions for data center customers STRATEGIC GROWTH INITIATIVES ✓ Pending acquisition of Rytec significantly expands our commercial overhead door offering 4 1 EBITDA is a non-GAAP financial measure. For a reconciliation of non-GAAP measures, please refer to the Appendix.

EXPANDING OUR SUITE OF DOWNSTREAM CAPABILITIES AND SOLUTIONS RYTEC SOUTHWEST DATA PRODUCTS I • An industry leader in high-growth mkt • A leading player in the high- • Known for product quality, on-time performance door market delivery, and skilled install services Strategic Fit • Complements C.H.I. offerings and • Exceptional customer base of leading advances Nucor’s presence in $2.4B ✓ ✓ hyperscalers and co-locators U.S. commercial overhead door mkt • ~130 teammates highly regarded by • ~300 highly engaged teammates Cultural Fit leading hyperscalers and co-locators ✓ ✓ • High teens EBITDA margin • +20% EBITDA margins Higher Margins ✓ ✓ Lower Capital • Modern, highly automated facilities. • Very low capital intensity, FCF/EBITDA > 90% FCF/EBITDA >90% Intensity ✓ ✓ • Double digit top line growth for the five • Data center market growing at double- Higher Growth years ended 2023 digit rate ✓ ✓ Earnings • Significant recurring aftermarket • Replacement cycle on data center services and parts revenue stream cabinets and racking: ~ 2 years Stability ✓✓ 5

A LONG-TERM STRATEGY TO DRIVE GROWTH AND CREATE SHAREHOLDER VALUE STRATEGY INITIATIVES & INVESTMENTS ▪ Leverage our market intelligence and ▪ Advanced separation technology flexible supply chain to provide lower- ▪ Carbon Capture & Storage (DRI) cost, more sustainable inputs RAW MATERIALS ▪ Investing in low-emission ironmaking and process gas capabilities ▪ Shifting mix to higher-margin products▪ West Virginia Sheet Mill ▪ Creating value through our cost ▪ Brandenburg, KY Plate Mill STEEL MILLS advantages, sustainability leadership ▪ Micro mill Bar projects and broad set of capabilities ▪ Offer customers a comprehensive set of ▪ Investments in automation to solutions with best-in-class service, decrease costs and improve safety deserving of premium pricing STEEL PRODUCTS ▪ New product development ▪ Create value by cross-selling more products through our Solutions team ▪ Grow in complementary businesses ▪ Recent and pending acquisitions of aligned with steel-intensive mega-trends Southwest Data Products and Rytec EXPAND BEYOND▪ Pursue opportunities with attractive ▪ Broadening customer base with new growth and margins, steady FCF and high- channels to market & cross-selling synergy potential ▪ New greenfield projects 6

SIGNIFICANT PROGRESS TO DATE, BUT PLENTY MORE TO ACCOMPLISH WEST VIRGINIA SHEET MILL REGIONAL BAR MICRO MILLS GROW BRANDENBURG PLATE MILL THE GALLATIN SHEET & TUBE EXPANSION CORE CALIFORNIA STEEL INDUSTRIES (CSI) VALUE-ADDED FINISHING LINES 2021 2023 2025 2027+ INSULATED METAL PANELS WAREHOUSE SYSTEMS OVERHEAD DOORS EXPAND BEYOND TOWERS & STRUCTURES DATA CENTER INFRASTRUCTURE NEW DOWNSTREAM PLATFORMS 7

REPOSITIONING THE BUSINESS TO DOUBLE NUCOR'S “THROUGH CYCLE” EARNINGS POTENTIAL • Midway through our multi-year capex plan designed to double Nucor’s through-cycle EBITDA • Investments to further diversify our set of capabilities and generate more sustained earnings • Many recently completed projects yet to reach full earnings potential 2H 2024 – beyond ~$6.7 • Maintain strong $5.9 2020 – 1H 2024 balance sheet • $8.8B CAPEX • Return >40% earnings to shareholders $2.3 • $11.4B Returned to Shareholders • Investing ~$6.5B (1) through 2027 in 8 key • $5.8B Acquisitions $3.2 growth projects $0.5 • Focus on completing construction projects safely and on-budget $3.6 $2.7 • Begin to reduce pre- operating start-up costs 2017-2019 Average LTM 6/29/24 FUTURE (Baseline) STATE STEEL MILLS + RAW MATERIALS STEEL PRODUCTS 1 Includes $565M Rytec transaction announced on June 3, 2024, but not yet closed 2 EBITDA is before non-controlling interest expense. Allocation of Consolidated EBITDA to segments is derived by allocating corporate 8 overhead in proportion to each segment’s pre-tax earnings. (2) EBITDA in $Billions

ELEVATED IMPORTS OF VARIOUS STEEL PRODUCTS PUTTING PRESSURE ON PRICING Impacts on U.S. Import Surge – Key Nucor Products 1H 2024 vs. 1H 2023 Domestic Steel Producers Corrosion Resistant Sheet +705,000mt +50.3% • Compression of domestic steel prices Wire Rod +144,000mt +36.8% • Industry capacity factor down to 76.4% Cold Rolled Sheet +170,000mt +29.8% th through July 6 Hot Rolled Sheet +97,000mt +10.7% • U.S. carbon footprint increases due to steel consumed from non-domestic producers Cut-To-Length Plate +25,000mt +8.4% Remedies to Address Impact Annual U.S. Import Data All Carbon & Alloy Steel Import Surge 40 30% • Enact Leveling the Playing Field Act 2.0 30 27% 27 30 27 25 24% 19 20 14• Maintain Vietnam's Non-Market Economy Status 13 21% 12 10 18% • Enforce Section 232 agreements with Mexico 0 15% and Canada 2018 2019 2020 2021 2022 2023 2023 2024 1H 2H 1H International Trade Administration, U.S. Dept. of Commerce data through June 2024 (includes June SIMA permits and May final imports) 9 Million Metric Tons % ADC

CONSOLIDATED FINANCIAL RESULTS ($s in billions except per share data) 1 Diluted EPS EBITDA 2023 2024 2023 2024 $10.26 $4.23 $6.14 $2.73 $5.81 $2.34 $2.68 $1.23 Q2 YTD Q2 YTD Q2 YTD Q2 YTD 2 Capex Returns to Shareholders 2023 2024 2023 2024 $1.77 $1.47 $1.14 $1.06 $0.80 $0.58 $0.53 $0.63 Q2 YTD Q2 YTD Q2 YTD Q2 YTD (1) EBITDA is a non-GAAP financial measure. For a reconciliation of non-GAAP measures, please refer to the Appendix 10 (2) Returns to Shareholders include dividends and share repurchases

SEGMENT RESULTS (a) PRE-TAX SEGMENT EARNINGS Q2 2024 SEGMENT RESULTS VS PRIOR (LAST 5 QTRS, $M) QUARTER $138 • Relatively flat volumes STEEL • lower avg selling price & metal margin $1,011 MILLS $71 • 41% lower EBT/ton $10 $512 $807 • higher volumes $39 STEEL • lower avg selling price, $656 $441 higher material costs PRODUCTS $1,404 $1,102 • 23% lower EBT/ton $883 $588 $645 ($14) ($151) ($213) ($228) ($398) RAW • Lower volumes ($503) MATERIALS • Lower avg selling price Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 • Lower operating costs Steel Mills Steel Products Raw Materials Corporate/Eliminations (1) Total segment earnings before income taxes and non-controlling interests 11

BALANCE SHEET & CAPITAL ALLOCATION 25% REDUCTION TO SHARECOUNT SINCE 2017 COMMITTED TO A STRONG BALANCE SHEET Shares rounded to closest million xLTM $USD in millions 318 1 as of June 29, 2024 Amount EBITDA % cap Total Debt 6,892 ~1.2x 24% 237 Cash and Cash Equivalents 5,434 Net Debt 1,458 Total Equity & Non-Controlling Int. 21,773 76% Total Book Capitalization 28,665 100% 2017 2019 2021 2023 Q2 2024 RETURNS TO SHAREHOLDERS (2020 – Q2 2024) CASH RETURNS RETURNS AS A % OF NET EARNINGS 118% ✓ Committed to at least 40% of annual net earnings DIVIDENDS returned to Nucor shareholders $2.3B 74% 55% 46% 43% $11.4B 40% SHARE REPURCHASES $9.1B 2020 2021 2022 2023 2024 YTD 1 EBITDA is a non-GAAP financial measure. For a reconciliation of non-GAAP measures, please refer to the Appendix. 12 2 Long-Term Debt includes Current Portion of Long-Term Debt and Finance Lease Obligations

CAPEX PLAN FUNDED WITH ROBUST OPERATING CASHFLOW AND HEALTHY BALANCE SHEET $3,000 FCF Line = Operating Cashflow minus Capex Annual Annual Annual Cash Period Operating (1) Capex FCF Balance $2,500 Cashflow 2017 – 2019 $2.1B $1.0B $1.1B $1.4B (average) $2,000 2021 – 2023 $7.8B $1.9B $5.9B $4.9B (average) $1,500 $5.9B $2.6B $3.3B $5.4B LTM Q2 ’24 $1,000 Operating Cashflow $500 $0 Capex -$500 -$1,000 2017 2018 2019 2020 2021 2022 2023 ’24 YTD $millions QUARTERLY CAPEX QUARTERLY OPERATING CASH FLOW QUARTERLY FCF (1) Represents average year-end cash, cash equivalents and short-term investments during multi-year periods. For LTM period, represents balance at end of Q2 ‘24. 13

Q3 2024 OUTLOOK IMPACT ON Q3 SEGMENT EXPECTATIONS FOR Q3 2024 EARNINGS VS Q2 • Primarily due to lower average selling prices Steel Mills • Expected to decrease due to lower average Steel Products selling prices • Decreased profitability, and lower DRI Raw Materials shipments due to planned outages • Intercompany eliminations expected to be Corp / Eliminations lower (a net positive to earnings) Steel Mills • Steel Mills conversion costs per ton expected to be generally flat Conversion Costs Consolidated • Overall lower compared to Q2 Earnings 14

MEDIUM-TERM OUTLOOK FOR KEY END MARKETS NUE Primary Markets and % of Total External Shipments (2023) HEAVY EQUIPMENT, TRADITIONAL CONSTRUCTION & AUTO & CONSUMER TRANSPORTATION, AND RENEWABLE INFRASTRUCTURE DURABLES LOGISTICS & OTHER ENERGY % NUE ‘23 Shipments: 53% 25% 13% 9% • Advanced Manufacturing (CHIPS, EV, Battery) • Renewable Energy • Data Centers • Electric Transmission • Bridge & Highway • Institutional Buildings • Traditional • Traditional Energy • Heavy Equipment • Light Vehicles Manufacturing • Truck & Trailer • Appliances • Residential Construct. • Rail • HVAC & Water Heaters • Agriculture • Warehouse • Barge • Traditional Office 15 Market Outlook

APPENDIX 16

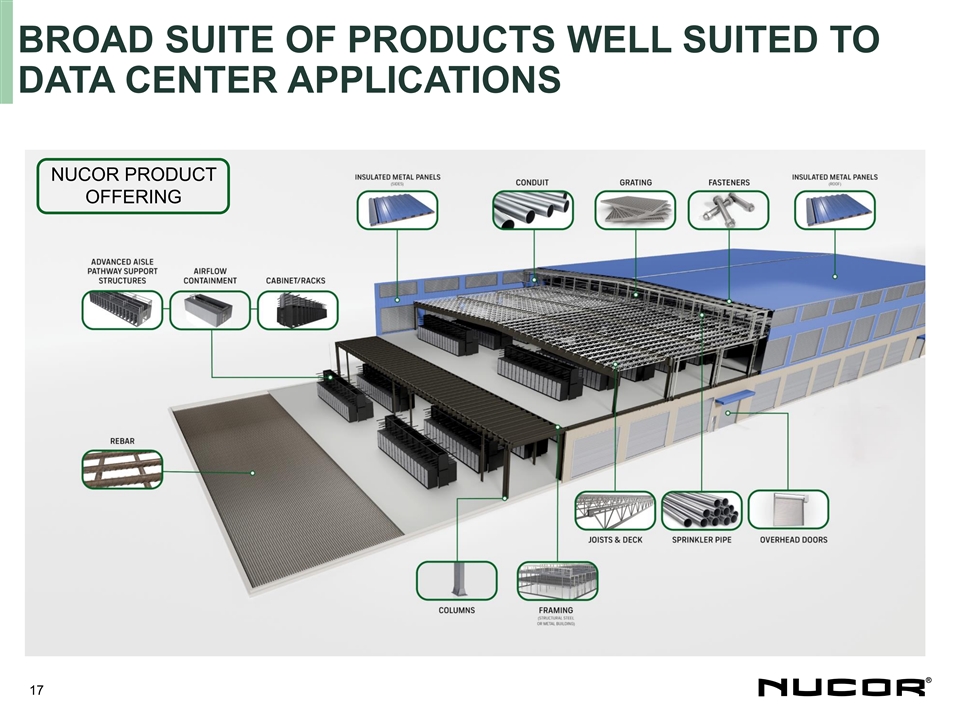

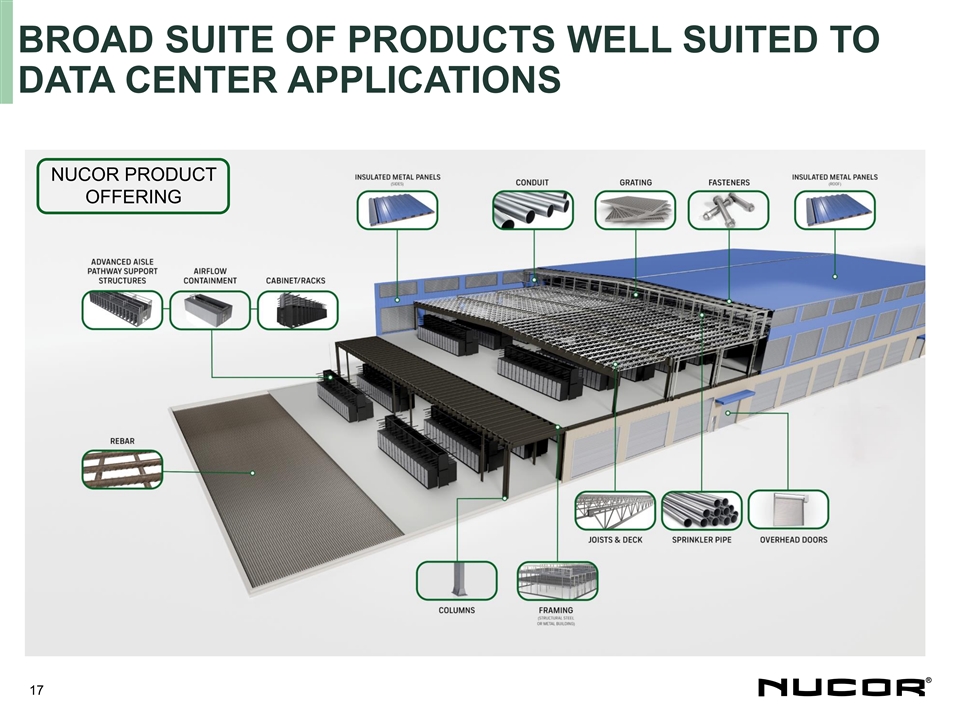

BROAD SUITE OF PRODUCTS WELL SUITED TO DATA CENTER APPLICATIONS NUCOR PRODUCT OFFERING 17

SUMMARY OF MAJOR CAPEX PROJECTS Est. Capex Project Investment Rationale Est. Completion ($ millions) Kingman, AZ • 600,000 tpa melt shop to increase regional flexibility Early 2025 $150 Melt Shop • Allows Utah bar mill to transition toward higher value bar products Lexington, NC • New 430,000 tpa micro mill H1 2025 $440 Rebar Micro Mill • Serving high-growth Southeast and mid-Atlantic markets Decatur, AL & • Highly automated manufacturing complexes Crawfordsville, IN • Increases Nucor Towers & Structures ability to provide Mid 2025 $370 Transmission Tower Plants engineered solutions to utility infrastructure customers • Crawfordsville, IN Adding continuous galvanizing (300,000 tpa) and prepaint Late 2025 $430 Coating Complex (250,000 tpa) lines to better serve regional construction market • Berkeley, SC 500,000 tpa galvanizing line to increase participation in regional Mid 2026 $430 Galvanizing Line automotive and consumer durables markets • 3,000,000 tpa sheet mill with low cost and low GHG profile Apple Grove, WV • Product mix includes ~66% value-added, finished products Late 2026 $3,500 Sheet Mill • Located in the heart of America’s largest regional sheet market CSI, Fontana, CA • 500,000 tpa galvanizing capability to serve western U.S. market Mid 2027 $375 Galvanizing Line • Pacific Northwest Mill location still TBD Late 2027 $860 • Rebar Micro Mill 650,000 tpa rebar micro mill to better serve northwest bar market Total Est Capex $6.5 BN 18

SEGMENT RESULTS: STEEL MILLS AND STEEL PRODUCTS STEEL MILLS % Change Versus Q2 2024 vs. Q1 2024 Shipments (tons in thousands) Q2 ’24 Q1 ’24 Q2 ’23 Prior Qtr. Prior Year Sheet 2,869 2,974 2,786 -4% 3% • Overall flat shipments Bars 2,005 1,912 2,122 5% -6% • Lower realized pricing and metal margin Structural 512 550 505 -7% 1% Plate 448 412 520 9% -14% Other Steel 33 42 46 -21% -28% Total Shipments 5,867 5,890 5,979 0% -2% 1 EBT ($ in millions) $645 $1,102 $1,404 -42% -54% 1 EBT /Ton ($) $110 $187 $235 -41% -53% STEEL PRODUCTS % Change Versus Q2 2024 vs. Q1 2024 Shipments (tons in thousands) Q2 ’24 Q1 ’24 Q2 ’23 Prior Qtr. Prior Year Tubular 214 208 239 3% -10% Joist & Deck 185 180 249 3% -26% • Higher shipments Rebar Fabrication 265 238 332 11% -20% • Lower realized pricing & higher material Piling 158 98 113 61% 40% costs Cold finished 96 99 112 -3% -14% Other 156 142 148 10% 5% Total Shipments 1,074 965 1,193 11% -10% 1 EBT ($ in millions) $441 $512 $1,011 -14% -56% 1 EBT /Ton ($) $411 $531 $847 -23% -52% 1 EBT refers to Earnings (loss) before income taxes and noncontrolling interests as disclosed 19 in relevant Nucor quarterly earnings news release

SEGMENT RESULTS: RAW MATERIALS RAW MATERIALS % Change Versus Q2 2024 vs. Q1 2024 Production (tons in thousands) Q2 ’24 Q1 ’24 Q2 ’23 Prior Qtr. Prior Year DRI 987 1,066 1,028 -7% -4% • Lower production and average pricing Scrap Processing 1,037 1,049 1,075 -1% -4% per ton 1 Total Production 2,024 2,115 2,103 -4% -4% • Lower operating expenses 2 EBT ($ in millions) $40 $10 $138 300% -71% 1 Total production excluding scrap brokerage activities. 2 EBT refers to Earnings (loss) before income taxes and noncontrolling interests as disclosed in relevant 20 Nucor quarterly earnings news release

QUARTERLY SALES AND EARNINGS DATA EARNINGS SALES TONS (THOUSANDS) TO OUTSIDE CUSTOMERS (LOSS) BEFORE STEEL STEEL PRODUCTS INCOME TAXES COMP. SALES OTHER TOTAL PRICE TOTAL STEEL STEEL COLD REBAR TUBULAR STEEL STEEL RAW TOTAL NET SALES PER $ PER YEAR SHEET BARS STRUCTURAL PLATE STEEL JOISTS DECK FINISH FAB PILING PRODS PRODS PRODS MATLS TONS ($ 000’S) TON ($) ($ 000’S) TON 2024 Q1 2,517 1,344 431 384 4,676 99 81 99 238 98 208 142 965 583 6,224 $8,137,083 $1,307 $1,111,220 $188 Q2 2,318 1,445 407 417 4,617 103 82 96 265 158 214 156 1,074 598 6,289 $8,077,172 $1,284 $831,237 $139 Q3 Q4 YEAR 2023 Q1 2,384 1,550 440 430 4,804 135 99 117 279 101 275 135 1,141 498 6,443 $8,709,980 $1,352 $1,501,697 $244 Q2 2,404 1,481 399 490 4,774 142 107 112 332 113 239 148 1,193 621 6,588 $9,523,256 $1,446 $1,924,061 $306 Q3 2,305 1,408 439 426 4,578 127 104 103 307 117 223 160 1,141 521 6,240 $8,775,734 $1,406 $1,468,333 $247 Q4 2,239 1,402 414 341 4,396 106 91 96 251 102 212 153 1,011 527 5,934 $7,704,531 $1,298 $990,676 $175 YEAR 9,332 5,841 1,692 1,687 18,552 510 401 428 1,169 433 949 596 4,486 2,167 25,205 $34,713,501 $1,377 $5,884,767 $245 21

QUARTERLY SALES PRICES & SCRAP COST STEEL MILLS AVERAGE SCRAP AND SCRAP AVG TOTAL SUBSTITUTE COST EXTERNAL STEEL TOTAL SALES PRICE STRUCTURAL SHEET BARS PLATE PRODUCTS PER GROSS PER NET STEEL PER NET TON TON USED TON USED 2024 2024 st st 1 Quarter $1,079 $993 $1,417 $1,334 $1,108 $2,608 $421 $376 1 Quarter nd nd 2 Quarter $1,015 $942 $1,374 $1,301 $1,051 $2,517 2 Quarter $396 $354 First Half $1,048 $967 $1,396 $1,317 $1,079 $2,560 First Half $409 $365 rd 3 Quarter rd 3 Quarter Nine Months Nine Months th th 4 Quarter 4 Quarter YEAR YEAR 2023 2023 st st 1 Quarter $876 $1,031 $1,452 $1,490 $1,035 $2,872 1 Quarter $414 $370 nd nd 2 Quarter $1,103 $1,080 $1,456 $1,506 $1,168 $2,884 2 Quarter $455 $406 $990 $1,055 $1,454 $1,499 $1,101 $2,878 $435 $388 First Half First Half rd rd 3 Quarter $1,021 $1,029 $1,429 $1,558 $1,114 $2,837 3 Quarter $415 $371 Nine Months $1,000 $1,047 $1,445 $1,517 $1,105 $2,865 Nine Months $429 $383 th th 4 Quarter $914 $961 $1,407 $1,407 $1,015 $2,776 4 Quarter $397 $354 YEAR $979 $1,026 $1,436 $1,495 $1,084 $2,845 YEAR $421 $376 22

RECONCILIATION OF GAAP TO NON-GAAP MEASURE - EBITDA $ in millions 2020 2021 2022 2023 YTD ‘23 YTD ‘24 LTM Net earnings before non-controlling $836 $7,122 $8,080 $4,913 $2,819 $1,671 $3,765 interests Net Interest expense $153 $159 $170 ($30) $15 ($40) ($85) Income taxes -- $2,078 $2,165 $1,360 $828 $452 $984 Depreciation expense $702 $735 $827 $930 $449 $528 $1,009 Amortization expense $83 $129 $235 $238 $117 $120 $241 Losses and $614 $62 $102 -- -- -- -- impairments of assets $7,411 $4,227 $2,731 $5,915 EBITDA $2,388 $10,292 $11,579 23

RECONCILIATION OF GAAP TO NON-GAAP MEASURE – FREE CASH FLOW (FCF) $ in millions YTD YTD 2020 2021 2022 2023 LTM 2023 2024 CASH PROVIDED BY $2,697 $6,231 $10,072 $7,112 $3,128 $1,945 $5,929 OPERATING ACTIVITIES CAPITAL EXPENDITURES ($1,543) ($1,622) ($1,948) ($2,214) ($1,057) ($1,471) ($2,628) FREE CASH FLOW $1,154 $4,609 $8,124 $4,898 $2,071 $474 $3,301 24

INDUSTRY LEADING GHG INTENSITY 2023 GHG INTENSITY COMPARISON 1 1 Overall Global and BF-BOF Global Scope 1, 2 and 3 Intensities are based on Worldsteel Association’s latest sustainability indicator report. 25

2023 SUSTAINABILITY REPORT HIGHLIGHTS th • 5 consecutive year of improved safety, with 0.71 injury & illness rate – 25% lower than prior year SAFETY & • 28 Nucor divisions had zero recordable injuries in 2023 TEAMMATES • An employer of choice with a + 90% retention rate • 93% of teammates feel a sense of pride in their work • Committed to meaningful GHG emissions reduction toward net zero in 2050 - consistent with IEA decarbonization pathway for the steel sector • Supporting U.S. transition to clean power ENERGY & GHG • Investing in Nuclear REDUCTION GOALS • Sourcing incremental renewable power through PPAs • Working to implement on-site renewable power generation and storage • Investing in CCS and novel, low or no GHG iron-making technologies • Eight-member Board of Directors: seven independent, three women (two of whom are minority women) GOVERNANCE • Our CEO and our entire executive team are fully engaged in Nucor’s progress toward achieving our sustainability goals and initiatives 26