UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04008

Fidelity Investment Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | October 31 |

|

|

Date of reporting period: | April 30, 2020 |

Item 1.

Reports to Stockholders

Fidelity® International Small Cap Fund

Semi-Annual Report

April 30, 2020

Includes Fidelity and Fidelity Advisor share classes

See the inside front cover for important information about access to your fund’s shareholder reports.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose 'no' under Required Disclosures to continue to print) | 1-800-343-0860 |

| Advisor Sold Accounts Serviced Through Your Financial Intermediary: | Contact Your Financial Intermediary | Your Financial Intermediary's phone number |

| Advisor Sold Accounts Serviced by Fidelity: | institutional.fidelity.com | 1-877-208-0098 |

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you’re an individual investing directly with Fidelity, call 1-800-835-5092 if you’re a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you’re an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2020 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, the U.S. government took unprecedented action – in concert with the U.S. Federal Reserve and central banks around the world – to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Investment Summary (Unaudited)

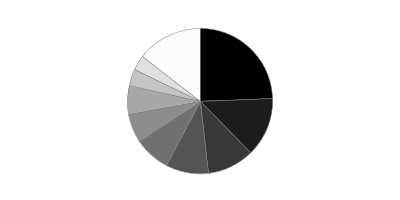

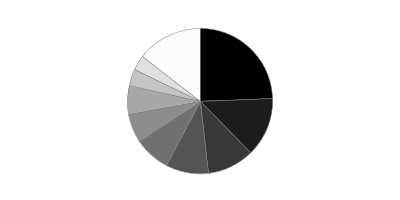

Geographic Diversification (% of fund's net assets)

| As of April 30, 2020 |

| | Japan | 26.4% |

| | United Kingdom | 10.7% |

| | Canada | 6.1% |

| | Cayman Islands | 5.2% |

| | Australia | 4.1% |

| | Taiwan | 3.9% |

| | Germany | 3.9% |

| | Netherlands | 3.8% |

| | United States of America* | 3.1% |

| | Other | 32.8% |

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable.

Asset Allocation as of April 30, 2020

| | % of fund's net assets |

| Stocks | 96.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.1 |

Top Ten Stocks as of April 30, 2020

| | % of fund's net assets |

| Arata Corp. (Japan, Distributors) | 1.3 |

| RHI Magnesita NV (Netherlands, Construction Materials) | 1.3 |

| Renesas Electronics Corp. (Japan, Semiconductors & Semiconductor Equipment) | 1.2 |

| Persol Holdings Co., Ltd. (Japan, Professional Services) | 1.2 |

| Nihon Parkerizing Co. Ltd. (Japan, Chemicals) | 1.1 |

| SITC International Holdings Co. Ltd. (Cayman Islands, Marine) | 1.1 |

| Tullett Prebon PLC (United Kingdom, Capital Markets) | 1.0 |

| Open Text Corp. (Canada, Software) | 1.0 |

| Hyundai Fire & Marine Insurance Co. Ltd. (Korea (South), Insurance) | 1.0 |

| North West Co., Inc. (Canada, Food & Staples Retailing) | 0.9 |

| | 11.1 |

Top Market Sectors as of April 30, 2020

| | % of fund's net assets |

| Industrials | 23.7 |

| Consumer Discretionary | 13.9 |

| Financials | 10.3 |

| Materials | 10.0 |

| Consumer Staples | 9.8 |

| Real Estate | 9.3 |

| Information Technology | 8.9 |

| Health Care | 6.4 |

| Energy | 3.0 |

| Communication Services | 1.6 |

Schedule of Investments April 30, 2020 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 96.7% | | | |

| | | Shares | Value |

| Australia - 4.1% | | | |

| GUD Holdings Ltd. | | 1,776,890 | $10,547,526 |

| Hansen Technologies Ltd. | | 4,481,185 | 8,148,548 |

| Imdex Ltd. | | 13,853,042 | 9,599,862 |

| Inghams Group Ltd. (a) | | 7,819,167 | 17,715,075 |

| Nanosonics Ltd. (b) | | 1,887,880 | 8,413,235 |

| National Storage (REIT) unit | | 8,888,431 | 9,983,322 |

| Pact Group Holdings Ltd. (b) | | 3,348,128 | 4,141,644 |

| Servcorp Ltd. (c) | | 5,058,615 | 8,600,957 |

| SomnoMed Ltd. (a)(b)(c) | | 4,653,036 | 3,604,456 |

|

| TOTAL AUSTRALIA | | | 80,754,625 |

|

| Austria - 2.3% | | | |

| IMMOFINANZ Immobilien Anlagen AG | | 663,674 | 12,276,607 |

| Mayr-Melnhof Karton AG | | 120,100 | 16,504,093 |

| Wienerberger AG | | 853,000 | 15,937,659 |

|

| TOTAL AUSTRIA | | | 44,718,359 |

|

| Belgium - 0.8% | | | |

| Aedifica SA | | 39,700 | 3,841,513 |

| Econocom Group SA | | 5,882,100 | 11,331,891 |

|

| TOTAL BELGIUM | | | 15,173,404 |

|

| Bermuda - 0.5% | | | |

| Hiscox Ltd. | | 1,046,720 | 9,262,684 |

| Brazil - 0.6% | | | |

| Estacio Participacoes SA | | 2,221,300 | 12,397,517 |

| Canada - 6.1% | | | |

| CCL Industries, Inc. Class B | | 358,600 | 11,209,229 |

| Computer Modelling Group Ltd. | | 1,590,180 | 5,346,487 |

| ECN Capital Corp. | | 2,694,400 | 7,646,022 |

| Genesis Land Development Corp. (b)(c) | | 2,969,722 | 2,410,852 |

| Lassonde Industries, Inc. Class A (sub. vtg.) | | 162,199 | 16,403,429 |

| McCoy Global, Inc. (b) | | 1,328,570 | 353,153 |

| North West Co., Inc. | | 967,100 | 18,272,733 |

| Open Text Corp. | | 522,296 | 19,736,894 |

| Richelieu Hardware Ltd. | | 634,100 | 12,044,688 |

| TFI International, Inc. (Canada) | | 483,500 | 13,407,881 |

| Total Energy Services, Inc. | | 611,300 | 733,411 |

| Western Forest Products, Inc. (a) | | 13,914,875 | 9,296,910 |

| Whitecap Resources, Inc. | | 2,982,553 | 3,921,170 |

|

| TOTAL CANADA | | | 120,782,859 |

|

| Cayman Islands - 5.2% | | | |

| AMVIG Holdings Ltd. | | 35,672,000 | 6,818,769 |

| ASM Pacific Technology Ltd. | | 1,145,800 | 11,577,974 |

| Best Pacific International Holdings Ltd. | | 17,846,000 | 2,652,357 |

| China Metal Recycling (Holdings) Ltd. (b)(d) | | 436,800 | 1 |

| Haitian International Holdings Ltd. | | 7,330,000 | 12,969,292 |

| Impro Precision Industries Ltd. (e) | | 15,697,300 | 5,135,425 |

| Pico Far East Holdings Ltd. | | 51,988,061 | 7,423,035 |

| Precision Tsugami China Corp. Ltd. | | 12,672,453 | 10,444,001 |

| SITC International Holdings Co. Ltd. | | 21,015,000 | 20,759,912 |

| Tongcheng-Elong Holdings Ltd. (b) | | 1,103,600 | 1,860,944 |

| Value Partners Group Ltd. | | 22,126,000 | 8,782,106 |

| Xingda International Holdings Ltd. | | 60,321,591 | 14,358,896 |

|

| TOTAL CAYMAN ISLANDS | | | 102,782,712 |

|

| China - 1.4% | | | |

| Qingdao Port International Co. Ltd. (H Shares) (e) | | 26,926,000 | 14,489,201 |

| Weifu High-Technology Group Co. Ltd. (B Shares) | | 7,848,986 | 13,375,046 |

|

| TOTAL CHINA | | | 27,864,247 |

|

| Denmark - 1.3% | | | |

| Jyske Bank A/S (Reg.) (b) | | 316,603 | 8,555,267 |

| Scandinavian Tobacco Group A/S (e) | | 526,528 | 6,070,044 |

| Spar Nord Bank A/S | | 1,685,026 | 11,680,174 |

|

| TOTAL DENMARK | | | 26,305,485 |

|

| Finland - 1.4% | | | |

| Ahlstrom-Munksjo OYJ | | 754,445 | 10,565,974 |

| Asiakastieto Group Oyj (a)(e) | | 249,564 | 8,778,859 |

| Olvi PLC (A Shares) | | 210,138 | 8,865,770 |

|

| TOTAL FINLAND | | | 28,210,603 |

|

| France - 2.7% | | | |

| Altarea SCA | | 81,424 | 9,957,900 |

| Lectra | | 200,235 | 3,159,756 |

| Maisons du Monde SA (e) | | 1,213,007 | 10,959,862 |

| Rexel SA | | 764,700 | 7,164,870 |

| The Vicat Group (a) | | 393,256 | 11,032,309 |

| Thermador Groupe SA | | 212,266 | 10,304,698 |

|

| TOTAL FRANCE | | | 52,579,395 |

|

| Germany - 3.9% | | | |

| CTS Eventim AG | | 218,900 | 9,101,107 |

| DIC Asset AG | | 1,069,300 | 14,155,252 |

| DWS Group GmbH & Co. KGaA (e) | | 355,700 | 11,265,042 |

| JOST Werke AG (e) | | 503,872 | 13,666,161 |

| Takkt AG | | 1,271,000 | 10,348,692 |

| Talanx AG | | 500,700 | 17,876,388 |

|

| TOTAL GERMANY | | | 76,412,642 |

|

| Greece - 0.9% | | | |

| Mytilineos SA | | 2,398,716 | 17,874,704 |

| Hong Kong - 2.1% | | | |

| Dah Sing Banking Group Ltd. | | 10,539,200 | 10,346,385 |

| Far East Horizon Ltd. | | 14,766,000 | 11,953,587 |

| Magnificent Hotel Investment Ltd. | | 316,412,000 | 5,047,627 |

| Sino Land Ltd. | | 9,590,837 | 13,403,486 |

|

| TOTAL HONG KONG | | | 40,751,085 |

|

| India - 1.6% | | | |

| Cyient Ltd. | | 1,428,166 | 4,332,286 |

| Embassy Office Parks (REIT) | | 1,985,800 | 9,748,773 |

| L&T Technology Services Ltd. | | 562,833 | 9,177,596 |

| Oberoi Realty Ltd. (b) | | 1,957,500 | 8,858,711 |

|

| TOTAL INDIA | | | 32,117,366 |

|

| Indonesia - 0.9% | | | |

| PT ACE Hardware Indonesia Tbk | | 61,050,100 | 6,213,951 |

| PT Media Nusantara Citra Tbk | | 67,557,800 | 4,119,960 |

| PT Selamat Sempurna Tbk | | 88,504,400 | 7,370,931 |

|

| TOTAL INDONESIA | | | 17,704,842 |

|

| Ireland - 1.5% | | | |

| Irish Residential Properties REIT PLC | | 11,551,000 | 16,303,714 |

| Mincon Group PLC (c) | | 11,680,944 | 10,368,456 |

| Origin Enterprises PLC | | 920,300 | 2,687,681 |

|

| TOTAL IRELAND | | | 29,359,851 |

|

| Italy - 1.7% | | | |

| Banca Generali SpA | | 464,900 | 11,544,379 |

| MARR SpA | | 501,800 | 6,576,774 |

| Recordati SpA | | 369,511 | 16,063,519 |

|

| TOTAL ITALY | | | 34,184,672 |

|

| Japan - 26.4% | | | |

| Aeon Delight Co. Ltd. | | 623,200 | 17,944,258 |

| Arata Corp. | | 624,000 | 25,933,374 |

| Arc Land Sakamoto Co. Ltd. | | 1,398,400 | 13,486,875 |

| Aucnet, Inc. | | 623,530 | 6,333,203 |

| Central Automotive Products Ltd. | | 374,100 | 6,379,378 |

| DaikyoNishikawa Corp. | | 2,342,200 | 11,763,927 |

| Daiwa Industries Ltd. | | 1,506,700 | 13,057,177 |

| Dexerials Corp. | | 1,903,700 | 12,612,689 |

| DTS Corp. | | 180,500 | 3,483,348 |

| GMO Internet, Inc. | | 772,000 | 16,970,116 |

| Iida Group Holdings Co. Ltd. | | 461,751 | 6,191,676 |

| Inaba Denki Sangyo Co. Ltd. | | 518,200 | 11,115,840 |

| Isuzu Motors Ltd. | | 2,169,400 | 16,486,477 |

| Jm Holdings Co. Ltd. | | 494,200 | 12,157,555 |

| JSR Corp. | | 350,100 | 6,655,211 |

| Kenedix, Inc. | | 3,366,700 | 15,435,087 |

| Kirindo Holdings Co. Ltd. (c) | | 647,909 | 12,793,358 |

| Meitec Corp. | | 205,400 | 9,139,310 |

| Mirait Holdings Corp. | | 814,700 | 10,673,887 |

| Mitani Shoji Co. Ltd. | | 306,800 | 18,010,902 |

| Morinaga & Co. Ltd. | | 203,700 | 8,418,297 |

| Nihon Parkerizing Co. Ltd. | | 2,030,400 | 20,906,602 |

| Nishimoto Co. Ltd. | | 501,400 | 8,526,814 |

| NOF Corp. | | 375,700 | 12,533,253 |

| NSD Co. Ltd. | | 800,300 | 11,514,357 |

| PALTAC Corp. | | 240,700 | 12,650,123 |

| Paramount Bed Holdings Co. Ltd. | | 388,400 | 16,141,863 |

| Persol Holdings Co., Ltd. | | 1,948,300 | 22,893,410 |

| Renesas Electronics Corp. (b) | | 4,403,900 | 23,801,538 |

| Ricoh Leasing Co. Ltd. | | 382,000 | 10,269,487 |

| S Foods, Inc. | | 710,969 | 15,191,277 |

| San-Ai Oil Co. Ltd. | | 1,533,100 | 15,728,865 |

| Santen Pharmaceutical Co. Ltd. | | 570,900 | 10,129,000 |

| SG Holdings Co. Ltd. | | 318,100 | 8,868,799 |

| Shinsei Bank Ltd. | | 890,300 | 10,739,624 |

| Ship Healthcare Holdings, Inc. | | 307,800 | 13,996,776 |

| Taiheiyo Cement Corp. | | 298,800 | 5,865,701 |

| THK Co. Ltd. | | 591,700 | 14,374,150 |

| TKC Corp. | | 262,700 | 13,096,445 |

| Tsuruha Holdings, Inc. | | 86,700 | 11,617,630 |

| Yamada Consulting Group Co. Ltd. | | 496,380 | 5,212,880 |

|

| TOTAL JAPAN | | | 519,100,539 |

|

| Korea (South) - 1.0% | | | |

| Hyundai Fire & Marine Insurance Co. Ltd. | | 893,556 | 19,197,435 |

| Luxembourg - 1.3% | | | |

| B&M European Value Retail SA | | 3,380,300 | 14,168,920 |

| Stabilus SA | | 267,500 | 11,450,044 |

|

| TOTAL LUXEMBOURG | | | 25,618,964 |

|

| Mexico - 1.4% | | | |

| Credito Real S.A.B. de CV | | 6,947,800 | 4,180,038 |

| Genomma Lab Internacional SA de CV (b) | | 14,074,348 | 11,334,928 |

| Gruma S.A.B. de CV Series B | | 1,325,700 | 12,584,826 |

|

| TOTAL MEXICO | | | 28,099,792 |

|

| Netherlands - 3.8% | | | |

| AerCap Holdings NV (b) | | 297,600 | 8,368,512 |

| Amsterdam Commodities NV | | 788,455 | 16,969,518 |

| Arcadis NV | | 572,058 | 8,895,566 |

| Intertrust NV (e) | | 779,900 | 12,289,916 |

| RHI Magnesita NV | | 829,974 | 25,527,502 |

| Van Lanschot NV (Bearer) | | 184,017 | 2,823,170 |

|

| TOTAL NETHERLANDS | | | 74,874,184 |

|

| New Zealand - 0.9% | | | |

| EBOS Group Ltd. | | 1,279,174 | 17,276,492 |

| Philippines - 1.4% | | | |

| Altus San Nicolas Corp. (d) | | 433,681 | 44,523 |

| Century Pacific Food, Inc. | | 39,638,200 | 11,181,915 |

| Jollibee Food Corp. | | 1,740,050 | 4,910,099 |

| Robinsons Land Corp. | | 35,274,000 | 10,409,770 |

|

| TOTAL PHILIPPINES | | | 26,546,307 |

|

| Romania - 0.5% | | | |

| Banca Transilvania SA | | 21,820,136 | 9,398,607 |

| Singapore - 2.3% | | | |

| Boustead Singapore Ltd. | | 12,196,612 | 5,176,668 |

| Hour Glass Ltd. | | 13,304,580 | 5,840,383 |

| HRnetgroup Ltd. | | 17,015,500 | 6,486,108 |

| Mapletree Industrial (REIT) | | 9,073,716 | 16,290,554 |

| Wing Tai Holdings Ltd. | | 9,317,200 | 11,390,874 |

|

| TOTAL SINGAPORE | | | 45,184,587 |

|

| Spain - 1.3% | | | |

| Laboratorios Farmaceuticos ROVI SA | | 474,932 | 13,479,765 |

| Prosegur Compania de Seguridad SA (Reg.) | | 5,722,185 | 12,591,478 |

|

| TOTAL SPAIN | | | 26,071,243 |

|

| Sweden - 1.8% | | | |

| Dustin Group AB (e) | | 2,934,679 | 14,978,327 |

| Granges AB | | 1,584,221 | 11,575,708 |

| John Mattson Fastighetsforetag (b) | | 627,800 | 8,938,357 |

|

| TOTAL SWEDEN | | | 35,492,392 |

|

| Taiwan - 3.9% | | | |

| King's Town Bank | | 10,796,000 | 11,519,172 |

| Lumax International Corp. Ltd. | | 4,827,600 | 10,465,272 |

| Makalot Industrial Co. Ltd. | | 1,149,000 | 4,883,553 |

| Sporton International, Inc. | | 1,786,740 | 11,768,649 |

| Test Research, Inc. | | 7,615,000 | 13,164,982 |

| Tripod Technology Corp. | | 3,360,000 | 11,850,900 |

| Yageo Corp. unit (e) | | 109,000 | 7,153,239 |

| Yung Chi Paint & Varnish Manufacturing Co. Ltd. | | 2,551,000 | 5,866,454 |

|

| TOTAL TAIWAN | | | 76,672,221 |

|

| Thailand - 1.0% | | | |

| Star Petroleum Refining PCL | | 97,763,800 | 17,531,332 |

| TISCO Financial Group PCL | | 1,296,100 | 2,911,178 |

|

| TOTAL THAILAND | | | 20,442,510 |

|

| United Kingdom - 10.7% | | | |

| Alliance Pharma PLC | | 17,604,410 | 16,740,430 |

| Anhui Heli Co. Ltd. ELS (UBS AG London Branch Bank Warrant Program) Class A warrants 1/21/22 (b)(e) | | 8,436,556 | 10,947,354 |

| Big Yellow Group PLC | | 45,900 | 619,734 |

| Bodycote PLC | | 1,121,200 | 8,239,903 |

| Bond International Software PLC (b)(d) | | 899,666 | 11 |

| Informa PLC (f) | | 809,186 | 4,469,832 |

| ITE Group PLC | | 17,284,530 | 4,974,414 |

| John Wood Group PLC | | 6,441,900 | 16,438,099 |

| Luxfer Holdings PLC sponsored | | 1,078,459 | 14,634,689 |

| McColl's Retail Group PLC (a)(c) | | 9,602,129 | 5,212,463 |

| Mears Group PLC | | 5,257,440 | 10,892,772 |

| Moneysupermarket.com Group PLC | | 3,029,193 | 12,117,293 |

| PayPoint PLC | | 726,111 | 6,045,088 |

| Savills PLC | | 1,089,300 | 13,239,543 |

| Ten Entertainment Group PLC (c) | | 4,668,735 | 9,320,231 |

| Topps Tiles PLC (c) | | 11,029,354 | 5,000,930 |

| Tullett Prebon PLC | | 4,775,184 | 20,412,684 |

| Ultra Electronics Holdings PLC | | 533,981 | 13,255,942 |

| Victrex PLC | | 477,800 | 12,011,710 |

| Vistry Group PLC | | 1,224,704 | 12,463,519 |

| Volution Group PLC | | 6,328,501 | 13,151,733 |

|

| TOTAL UNITED KINGDOM | | | 210,188,374 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $2,188,310,905) | | | 1,903,400,699 |

|

| Nonconvertible Preferred Stocks - 0.2% | | | |

| Brazil - 0.2% | | | |

| Banco ABC Brasil SA | | | |

| (Cost $6,327,913) | | 1,785,926 | 4,693,150 |

|

| Money Market Funds - 3.4% | | | |

| Fidelity Cash Central Fund 0.16% (g) | | 45,561,628 | 45,575,296 |

| Fidelity Securities Lending Cash Central Fund 0.11% (g)(h) | | 20,440,110 | 20,442,154 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $66,010,042) | | | 66,017,450 |

| TOTAL INVESTMENT IN SECURITIES - 100.3% | | | |

| (Cost $2,260,648,860) | | | 1,974,111,299 |

| NET OTHER ASSETS (LIABILITIES) - (0.3)% | | | (6,713,958) |

| NET ASSETS - 100% | | | $1,967,397,341 |

Categorizations in the Schedule of Investments are based on country or territory of incorporation.

Legend

(a) Security or a portion of the security is on loan at period end.

(b) Non-income producing

(c) Affiliated company

(d) Level 3 security

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $115,733,430 or 5.9% of net assets.

(f) Security or a portion of the security purchased on a delayed delivery or when-issued basis.

(g) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(h) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $639,543 |

| Fidelity Securities Lending Cash Central Fund | 113,950 |

| Total | $753,493 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Other Affiliated Issuers

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows:

| Affiliate | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Realized Gain (loss) | Change in Unrealized appreciation (depreciation) | Value, end of period |

| Genesis Land Development Corp. | $4,820,743 | $524,035 | $-- | $-- | $-- | $(2,933,926) | $2,410,852 |

| Kirindo Holdings Co. Ltd. | 12,969,727 | -- | -- | 117,207 | -- | (176,369) | 12,793,358 |

| McColl's Retail Group PLC | 5,671,782 | -- | -- | -- | -- | (459,319) | 5,212,463 |

| Mincon Group PLC | 10,176,939 | 2,581,048 | -- | 219 | -- | (2,389,531) | 10,368,456 |

| Servcorp Ltd. | 15,135,173 | 131,039 | -- | 321,780 | -- | (6,665,255) | 8,600,957 |

| SomnoMed Ltd. | 7,022,858 | 589,626 | 296,441 | -- | 110,189 | (3,821,776) | 3,604,456 |

| Ten Entertainment Group PLC | 14,596,790 | 1,446,815 | 1,333,854 | 209,786 | 239,919 | (5,629,439) | 9,320,231 |

| Topps Tiles PLC | 6,354,270 | 3,738,943 | -- | 194,979 | -- | (5,092,283) | 5,000,930 |

| Total | $76,748,282 | $9,011,506 | $1,630,295 | $843,971 | $350,108 | $(27,167,898) | $57,311,703 |

Investment Valuation

The following is a summary of the inputs used, as of April 30, 2020, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Communication Services | $30,088,348 | $14,075,521 | $16,012,827 | $-- |

| Consumer Discretionary | 278,041,637 | 169,515,520 | 108,526,117 | -- |

| Consumer Staples | 191,245,159 | 162,348,169 | 28,896,990 | -- |

| Energy | 60,052,517 | 42,521,185 | 17,531,332 | -- |

| Financials | 205,056,579 | 148,804,527 | 56,252,052 | -- |

| Health Care | 127,180,464 | 97,886,281 | 29,294,183 | -- |

| Industrials | 462,536,051 | 344,716,573 | 117,819,478 | -- |

| Information Technology | 171,934,974 | 122,860,273 | 49,074,690 | 11 |

| Materials | 196,048,591 | 152,180,452 | 43,868,138 | 1 |

| Real Estate | 185,909,529 | 88,240,202 | 97,624,804 | 44,523 |

| Money Market Funds | 66,017,450 | 66,017,450 | -- | -- |

| Total Investments in Securities: | $1,974,111,299 | $1,409,166,153 | $564,900,611 | $44,535 |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | April 30, 2020 (Unaudited) |

| Assets | | |

Investment in securities, at value (including securities loaned of $18,929,552) — See accompanying schedule:

Unaffiliated issuers (cost $2,105,211,660) | $1,850,782,146 | |

| Fidelity Central Funds (cost $66,010,042) | 66,017,450 | |

| Other affiliated issuers (cost $89,427,158) | 57,311,703 | |

| Total Investment in Securities (cost $2,260,648,860) | | $1,974,111,299 |

| Cash | | 5,193 |

| Foreign currency held at value (cost $287,706) | | 287,706 |

| Receivable for investments sold | | 12,334,726 |

| Receivable for fund shares sold | | 1,976,220 |

| Dividends receivable | | 9,932,104 |

| Distributions receivable from Fidelity Central Funds | | 21,326 |

| Prepaid expenses | | 1,010 |

| Other receivables | | 56,274 |

| Total assets | | 1,998,725,858 |

| Liabilities | | |

| Payable for investments purchased | | |

| Regular delivery | $980,111 | |

| Delayed delivery | 3,092,758 | |

| Payable for fund shares redeemed | 4,796,674 | |

| Accrued management fee | 1,370,479 | |

| Distribution and service plan fees payable | 37,653 | |

| Other affiliated payables | 360,312 | |

| Other payables and accrued expenses | 252,470 | |

| Collateral on securities loaned | 20,438,060 | |

| Total liabilities | | 31,328,517 |

| Net Assets | | $1,967,397,341 |

| Net Assets consist of: | | |

| Paid in capital | | $2,307,930,859 |

| Total accumulated earnings (loss) | | (340,533,518) |

| Net Assets | | $1,967,397,341 |

| Net Asset Value and Maximum Offering Price | | |

| Class A: | | |

| Net Asset Value and redemption price per share ($91,582,065 ÷ 4,222,260 shares)(a) | | $21.69 |

| Maximum offering price per share (100/94.25 of $21.69) | | $23.01 |

| Class M: | | |

| Net Asset Value and redemption price per share ($12,410,570 ÷ 574,243 shares)(a) | | $21.61 |

| Maximum offering price per share (100/96.50 of $21.61) | | $22.39 |

| Class C: | | |

| Net Asset Value and offering price per share ($17,768,689 ÷ 848,607 shares)(a) | | $20.94 |

| International Small Cap: | | |

| Net Asset Value, offering price and redemption price per share ($1,020,507,122 ÷ 46,127,368 shares) | | $22.12 |

| Class I: | | |

| Net Asset Value, offering price and redemption price per share ($582,095,067 ÷ 26,146,551 shares) | | $22.26 |

| Class Z: | | |

| Net Asset Value, offering price and redemption price per share ($243,033,828 ÷ 10,926,751 shares) | | $22.24 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Six months ended April 30, 2020 (Unaudited) |

| Investment Income | | |

| Dividends (including $843,971 earned from other affiliated issuers) | | $28,266,845 |

| Income from Fidelity Central Funds (including $113,950 from security lending) | | 753,493 |

| Income before foreign taxes withheld | | 29,020,338 |

| Less foreign taxes withheld | | (1,852,066) |

| Total income | | 27,168,272 |

| Expenses | | |

| Management fee | | |

| Basic fee | $9,888,063 | |

| Performance adjustment | 533,552 | |

| Transfer agent fees | 1,966,581 | |

| Distribution and service plan fees | 278,887 | |

| Accounting fees | 518,328 | |

| Custodian fees and expenses | 183,788 | |

| Independent trustees' fees and expenses | 7,250 | |

| Registration fees | 119,808 | |

| Audit | 55,008 | |

| Legal | 2,209 | |

| Miscellaneous | 85,806 | |

| Total expenses before reductions | 13,639,280 | |

| Expense reductions | (85,991) | |

| Total expenses after reductions | | 13,553,289 |

| Net investment income (loss) | | 13,614,983 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers (net of foreign taxes of $198,038) | (32,274,358) | |

| Fidelity Central Funds | 13,789 | |

| Other affiliated issuers | 350,108 | |

| Foreign currency transactions | (106,045) | |

| Total net realized gain (loss) | | (32,016,506) |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers (net of decrease in deferred foreign taxes of $173,552) | (361,971,113) | |

| Fidelity Central Funds | (1,490) | |

| Other affiliated issuers | (27,167,898) | |

| Assets and liabilities in foreign currencies | (45,171) | |

| Total change in net unrealized appreciation (depreciation) | | (389,185,672) |

| Net gain (loss) | | (421,202,178) |

| Net increase (decrease) in net assets resulting from operations | | $(407,587,195) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Six months ended April 30, 2020 (Unaudited) | Year ended October 31, 2019 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $13,614,983 | $46,988,829 |

| Net realized gain (loss) | (32,016,506) | 12,739,673 |

| Change in net unrealized appreciation (depreciation) | (389,185,672) | 117,471,715 |

| Net increase (decrease) in net assets resulting from operations | (407,587,195) | 177,200,217 |

| Distributions to shareholders | (60,415,664) | (106,530,925) |

| Share transactions - net increase (decrease) | (15,770,979) | 413,223,659 |

| Total increase (decrease) in net assets | (483,773,838) | 483,892,951 |

| Net Assets | | |

| Beginning of period | 2,451,171,179 | 1,967,278,228 |

| End of period | $1,967,397,341 | $2,451,171,179 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity International Small Cap Fund Class A

| | Six months ended (Unaudited) April 30, | Years endedOctober 31, | | | | |

| | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $26.32 | $25.78 | $29.24 | $23.81 | $22.69 | $24.98 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .11 | .49 | .38 | .29 | .34 | .27 |

| Net realized and unrealized gain (loss) | (4.16) | 1.43 | (2.87) | 5.70 | 1.64 | 1.05 |

| Total from investment operations | (4.05) | 1.92 | (2.49) | 5.99 | 1.98 | 1.32 |

| Distributions from net investment income | (.44) | (.38) | (.23) | (.28) | (.25) | (.16) |

| Distributions from net realized gain | (.14) | (1.00) | (.74) | (.29) | (.62) | (3.45) |

| Total distributions | (.58) | (1.38) | (.97) | (.57) | (.87) | (3.61) |

| Redemption fees added to paid in capitalA | – | – | –B | .01 | .01 | –B |

| Net asset value, end of period | $21.69 | $26.32 | $25.78 | $29.24 | $23.81 | $22.69 |

| Total ReturnC,D,E | (15.79)% | 8.00% | (8.83)% | 25.83% | 9.11% | 6.21% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | 1.42%H | 1.47% | 1.49% | 1.55% | 1.61% | 1.59% |

| Expenses net of fee waivers, if any | 1.42%H | 1.47% | 1.49% | 1.55% | 1.61% | 1.58% |

| Expenses net of all reductions | 1.42%H | 1.46% | 1.48% | 1.55% | 1.61% | 1.58% |

| Net investment income (loss) | .88%H | 1.94% | 1.33% | 1.11% | 1.50% | 1.18% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $91,582 | $105,786 | $80,395 | $63,459 | $36,480 | $28,238 |

| Portfolio turnover rateI | 54%H | 28% | 25% | 22% | 29% | 36% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the sales charges.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity International Small Cap Fund Class M

| | Six months ended (Unaudited) April 30, | Years endedOctober 31, | | | | |

| | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $26.18 | $25.62 | $29.07 | $23.65 | $22.55 | $24.81 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .07 | .41 | .30 | .21 | .27 | .21 |

| Net realized and unrealized gain (loss) | (4.14) | 1.43 | (2.86) | 5.69 | 1.63 | 1.04 |

| Total from investment operations | (4.07) | 1.84 | (2.56) | 5.90 | 1.90 | 1.25 |

| Distributions from net investment income | (.36) | (.27) | (.15) | (.19) | (.19) | (.06) |

| Distributions from net realized gain | (.14) | (1.00) | (.74) | (.29) | (.62) | (3.45) |

| Total distributions | (.50) | (1.28)B | (.89) | (.48) | (.81) | (3.51) |

| Redemption fees added to paid in capitalA | – | – | –C | –C | .01 | –C |

| Net asset value, end of period | $21.61 | $26.18 | $25.62 | $29.07 | $23.65 | $22.55 |

| Total ReturnD,E,F | (15.91)% | 7.65% | (9.10)% | 25.47% | 8.79% | 5.90% |

| Ratios to Average Net AssetsG,H | | | | | | |

| Expenses before reductions | 1.73%I | 1.78% | 1.77% | 1.84% | 1.90% | 1.87% |

| Expenses net of fee waivers, if any | 1.73%I | 1.78% | 1.77% | 1.84% | 1.90% | 1.86% |

| Expenses net of all reductions | 1.72%I | 1.77% | 1.76% | 1.84% | 1.90% | 1.86% |

| Net investment income (loss) | .58%I | 1.62% | 1.05% | .82% | 1.21% | .90% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $12,411 | $16,013 | $16,362 | $18,148 | $13,331 | $12,400 |

| Portfolio turnover rateJ | 54%I | 28% | 25% | 22% | 29% | 36% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $1.28 per share is comprised of distributions from net investment income of $.274 and distributions from net realized gain of $1.002 per share.

C Amount represents less than $.005 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity International Small Cap Fund Class C

| | Six months ended (Unaudited) April 30, | Years endedOctober 31, | | | | |

| | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $25.27 | $24.77 | $28.21 | $22.97 | $21.96 | $24.27 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .01 | .28 | .16 | .08 | .16 | .09 |

| Net realized and unrealized gain (loss) | (4.02) | 1.39 | (2.76) | 5.53 | 1.59 | 1.02 |

| Total from investment operations | (4.01) | 1.67 | (2.60) | 5.61 | 1.75 | 1.11 |

| Distributions from net investment income | (.18) | (.17) | (.10) | (.08) | (.13) | – |

| Distributions from net realized gain | (.14) | (1.00) | (.74) | (.29) | (.62) | (3.42) |

| Total distributions | (.32) | (1.17) | (.84) | (.37) | (.75) | (3.42) |

| Redemption fees added to paid in capitalA | – | – | –B | –B | .01 | –B |

| Net asset value, end of period | $20.94 | $25.27 | $24.77 | $28.21 | $22.97 | $21.96 |

| Total ReturnC,D,E | (16.11)% | 7.17% | (9.51)% | 24.85% | 8.26% | 5.37% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | 2.20%H | 2.24% | 2.24% | 2.33% | 2.40% | 2.36% |

| Expenses net of fee waivers, if any | 2.19%H | 2.24% | 2.24% | 2.33% | 2.40% | 2.35% |

| Expenses net of all reductions | 2.19%H | 2.23% | 2.23% | 2.32% | 2.39% | 2.35% |

| Net investment income (loss) | .11%H | 1.16% | .58% | .33% | .71% | .41% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $17,769 | $23,937 | $41,918 | $26,005 | $12,187 | $11,359 |

| Portfolio turnover rateI | 54%H | 28% | 25% | 22% | 29% | 36% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the contingent deferred sales charge.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity International Small Cap Fund

| | Six months ended (Unaudited) April 30, | Years endedOctober 31, | | | | |

| | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $26.86 | $26.29 | $29.77 | $24.23 | $23.06 | $25.34 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .15 | .57 | .48 | .37 | .40 | .34 |

| Net realized and unrealized gain (loss) | (4.24) | 1.45 | (2.93) | 5.79 | 1.67 | 1.07 |

| Total from investment operations | (4.09) | 2.02 | (2.45) | 6.16 | 2.07 | 1.41 |

| Distributions from net investment income | (.51) | (.45) | (.29) | (.34) | (.29) | (.24) |

| Distributions from net realized gain | (.14) | (1.00) | (.74) | (.29) | (.62) | (3.45) |

| Total distributions | (.65) | (1.45) | (1.03) | (.63) | (.91) | (3.69) |

| Redemption fees added to paid in capitalA | – | – | –B | .01 | .01 | –B |

| Net asset value, end of period | $22.12 | $26.86 | $26.29 | $29.77 | $24.23 | $23.06 |

| Total ReturnC,D | (15.66)% | 8.27% | (8.54)% | 26.18% | 9.39% | 6.53% |

| Ratios to Average Net AssetsE,F | | | | | | |

| Expenses before reductions | 1.14%G | 1.19% | 1.20% | 1.25% | 1.34% | 1.31% |

| Expenses net of fee waivers, if any | 1.14%G | 1.19% | 1.20% | 1.25% | 1.34% | 1.31% |

| Expenses net of all reductions | 1.14%G | 1.18% | 1.19% | 1.24% | 1.33% | 1.31% |

| Net investment income (loss) | 1.16%G | 2.22% | 1.62% | 1.41% | 1.77% | 1.45% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $1,020,507 | $1,282,412 | $1,256,193 | $1,418,452 | $906,420 | $811,534 |

| Portfolio turnover rateH | 54%G | 28% | 25% | 22% | 29% | 36% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Annualized

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity International Small Cap Fund Class I

| | Six months ended (Unaudited) April 30, | Years endedOctober 31, | | | | |

| | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $27.03 | $26.45 | $29.97 | $24.42 | $23.24 | $25.34 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .15 | .58 | .47 | .38 | .41 | .36 |

| Net realized and unrealized gain (loss) | (4.26) | 1.46 | (2.95) | 5.82 | 1.69 | 1.07 |

| Total from investment operations | (4.11) | 2.04 | (2.48) | 6.20 | 2.10 | 1.43 |

| Distributions from net investment income | (.52) | (.46) | (.30) | (.37) | (.31) | (.08) |

| Distributions from net realized gain | (.14) | (1.00) | (.74) | (.29) | (.62) | (3.45) |

| Total distributions | (.66) | (1.46) | (1.04) | (.66) | (.93) | (3.53) |

| Redemption fees added to paid in capitalA | – | – | –B | .01 | .01 | –B |

| Net asset value, end of period | $22.26 | $27.03 | $26.45 | $29.97 | $24.42 | $23.24 |

| Total ReturnC,D | (15.66)% | 8.28% | (8.58)% | 26.17% | 9.43% | 6.60% |

| Ratios to Average Net AssetsE,F | | | | | | |

| Expenses before reductions | 1.14%G | 1.19% | 1.21% | 1.28% | 1.31% | 1.24% |

| Expenses net of fee waivers, if any | 1.14%G | 1.18% | 1.21% | 1.28% | 1.31% | 1.23% |

| Expenses net of all reductions | 1.13%G | 1.18% | 1.20% | 1.27% | 1.31% | 1.23% |

| Net investment income (loss) | 1.16%G | 2.22% | 1.61% | 1.39% | 1.80% | 1.53% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $582,095 | $777,771 | $564,988 | $237,469 | $22,727 | $10,070 |

| Portfolio turnover rateH | 54%G | 28% | 25% | 22% | 29% | 36% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Annualized

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity International Small Cap Fund Class Z

| | Six months ended (Unaudited) April 30, | Years endedOctober 31, | |

| | 2020 | 2019 | 2018 A |

| Selected Per–Share Data | | | |

| Net asset value, beginning of period | $27.03 | $26.46 | $28.78 |

| Income from Investment Operations | | | |

| Net investment income (loss)B | .16 | .61 | .03 |

| Net realized and unrealized gain (loss) | (4.25) | 1.47 | (2.35) |

| Total from investment operations | (4.09) | 2.08 | (2.32) |

| Distributions from net investment income | (.56) | (.50) | – |

| Distributions from net realized gain | (.14) | (1.00) | – |

| Total distributions | (.70) | (1.51)C | – |

| Net asset value, end of period | $22.24 | $27.03 | $26.46 |

| Total ReturnD,E | (15.62)% | 8.44% | (8.06)% |

| Ratios to Average Net AssetsF,G | | | |

| Expenses before reductions | 1.01%H | 1.05% | 1.15%H |

| Expenses net of fee waivers, if any | 1.00%H | 1.05% | 1.15%H |

| Expenses net of all reductions | 1.00%H | 1.04% | 1.14%H |

| Net investment income (loss) | 1.30%H | 2.35% | 2.01%H |

| Supplemental Data | | | |

| Net assets, end of period (000 omitted) | $243,034 | $245,252 | $7,421 |

| Portfolio turnover rateI | 54%H | 28% | 25% |

A For the period October 2, 2018 (commencement of sale of shares) to October 31, 2018.

B Calculated based on average shares outstanding during the period.

C Total distributions of $1.51 per share is comprised of distributions from net investment income of $.504 and distributions from net realized gain of $1.002 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended April 30, 2020

1. Organization.

Fidelity International Small Cap Fund (the Fund) is a fund of Fidelity Investment Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class M, Class C, International Small Cap, Class I and Class Z shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Class C shares will automatically convert to Class A shares after a holding period of ten years from the initial date of purchase, with certain exceptions. The Fund's investments in emerging markets can be subject to social, economic, regulatory, and political uncertainties and can be extremely volatile.

Effective January 1, 2020:

Investment advisers Fidelity Investments Money Management, Inc., FMR Co., Inc., and Fidelity SelectCo, LLC, merged with and into Fidelity Management & Research Company. In connection with the merger transactions, the resulting, merged investment adviser was then redomiciled from Massachusetts to Delaware, changed its corporate structure from a corporation to a limited liability company, and changed its name to "Fidelity Management & Research Company LLC".

Broker-dealer Fidelity Distributors Corporation merged with and into Fidelity Investments Institutional Services Company, Inc. ("FIISC"). FIISC was then redomiciled from Massachusetts to Delaware, changed its corporate structure from a corporation to a limited liability company, and changed its name to "Fidelity Distributors Company LLC".

Fidelity Investments Institutional Operations Company, Inc. converted from a Massachusetts corporation to a Massachusetts LLC, and changed its name to "Fidelity Investments Institutional Operations Company LLC".

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date ranged from less than .005% to .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of April 30, 2020 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on capital gains by certain countries in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, certain foreign taxes, passive foreign investment companies (PFIC) and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $199,340,239 |

| Gross unrealized depreciation | (521,405,879) |

| Net unrealized appreciation (depreciation) | $(322,065,640) |

| Tax cost | $2,296,176,939 |

Delayed Delivery Transactions and When-Issued Securities. During the period, the Fund transacted in securities on a delayed delivery or when-issued basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. The securities purchased on a delayed delivery or when-issued basis are identified as such in the Fund's Schedule of Investments. Losses may arise due to changes in the value of the underlying securities or if the counterparty does not perform under the contract's terms, or if the issuer does not issue the securities due to political, economic, or other factors.

Restricted Securities (including Private Placements). The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, are noted in the table below.

| | Purchases ($) | Sales ($) |

| Fidelity International Small Cap Fund | 608,684,270 | 618,605,597 |

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company LLC (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .60% of the Fund's average net assets and an annualized group fee rate that averaged .23% during the period. The group fee rate is based upon the monthly average net assets of a group of registered investment companies with which the investment adviser has management contracts. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of +/- .20% of the Fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the relative investment performance of International Small Cap as compared to its benchmark index, the MSCI ACWI (All Country World Index) ex USA Small Cap Index, over the same 36 month performance period. For the reporting period, the total annualized management fee rate, including the performance adjustment, was .88% of the Fund's average net assets. The performance adjustment included in the management fee rate may be higher or lower than the maximum performance adjustment rate due to the difference between the average net assets for the reporting and performance periods.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Company LLC (FDC), an affiliate of the investment adviser, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates, total fees and amounts retained by FDC were as follows:

| | Distribution Fee | Service Fee | Total Fees | Retained by FDC |

| Class A | -% | .25% | $129,174 | $3,216 |

| Class M | .25% | .25% | 37,690 | 210 |

| Class C | .75% | .25% | 112,023 | 18,079 |

| | | | $278,887 | $21,505 |

Sales Load. FDC may receive a front-end sales charge of up to 5.75% for selling Class A shares and 3.50% for selling Class M shares, some of which is paid to financial intermediaries for selling shares of the Fund. Depending on the holding period, FDC may receive contingent deferred sales charges levied on Class A, Class M and Class C redemptions. The deferred sales charges are 1.00% for Class C shares, 1.00% for certain purchases of Class A shares and .25% for certain purchases of Class M shares.

For the period, sales charge amounts retained by FDC were as follows:

| | Retained by FDC |

| Class A | $12,813 |

| Class M | 1,328 |

| Class C(a) | 2,349 |

| | $16,490 |

(a) When Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company LLC (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund, except for Class Z. FIIOC receives an asset-based fee of Class Z's average net assets. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements. Effective February 1, 2020, the Board approved to change the fee for Class Z from .046% to .044%.

For the period, transfer agent fees for each applicable class were as follows:

| | Amount | % of Class-Level Average Net Assets(a) |

| Class A | $108,369 | .21 |

| Class M | 19,732 | .26 |

| Class C | 25,543 | .23 |

| International Small Cap | 1,104,098 | .18 |

| Class I | 649,942 | .18 |

| Class Z | 58,897 | .04 |

| | $1,966,581 | |

(a) Annualized

Accounting Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. For the period, the fees were equivalent to the following annualized rates:

| | % of Average Net Assets |

| Fidelity International Small Cap Fund | .04 |

Brokerage Commissions. A portion of portfolio transactions were placed with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were as follows:

| | Amount |

| Fidelity International Small Cap Fund | $91 |

Interfund Trades. Funds may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

6. Committed Line of Credit.

Certain Funds participate with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The participating funds have agreed to pay commitment fees on their pro-rata portion of the line of credit, which are reflected in Miscellaneous expenses on the Statement of Operations, and are as follows:

| | Amount |

| Fidelity International Small Cap Fund | $3,038 |

During the period, there were no borrowings on this line of credit.

7. Security Lending.

The Fund lends portfolio securities from time to time in order to earn additional income. For equity securities, lending agents are used, including National Financial Services (NFS), an affiliate of the Fund. Pursuant to a securities lending agreement, NFS will receive a fee, which is capped at 9.9% of daily lending revenue, for its services as lending agent. The Fund may lend securities to certain qualified borrowers, including NFS. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. Total fees paid by the Fund to NFS, as lending agent, amounted to $5. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. During the period, there were no securities loaned to NFS.

8. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $68,134 for the period. In addition, through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, custodian credits reduced the Fund's expenses by $427.

In addition, during the period the investment adviser or an affiliate reimbursed and/or waived a portion of fund-level operating expenses in the amount of $5,210.

In addition, during the period the investment adviser or an affiliate reimbursed the Fund $12,220 for an operational error which is included in the accompanying Statement of Operations.

9. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Six months ended

April 30, 2020 | Year ended

October 31, 2019 |

| Distributions to shareholders | | |

| Class A | $2,384,232 | $4,227,273 |

| Class M | 304,208 | 800,268 |

| Class C | 295,806 | 1,885,280 |

| International Small Cap | 31,519,090 | 68,518,204 |

| Class I | 18,753,159 | 29,933,675 |

| Class Z | 7,159,169 | 1,166,225 |

| Total | $60,415,664 | $106,530,925 |

10. Share Transactions.

Share transactions for each class were as follows and may contain automatic conversions between classes or exchanges between affiliated funds:

| | Shares | Shares | Dollars | Dollars |

| | Six months ended April 30, 2020 | Year ended October 31, 2019 | Six months ended April 30, 2020 | Year ended October 31, 2019 |

| Class A | | | | |

| Shares sold | 1,165,345 | 2,237,245 | $26,699,655 | $54,946,164 |

| Reinvestment of distributions | 87,479 | 171,183 | 2,326,940 | 4,094,693 |

| Shares redeemed | (1,050,240) | (1,507,211) | (24,133,878) | (37,924,113) |

| Net increase (decrease) | 202,584 | 901,217 | $4,892,717 | $21,116,744 |

| Class M | | | | |

| Shares sold | 45,613 | 98,480 | $1,147,963 | $2,472,682 |

| Reinvestment of distributions | 11,416 | 33,142 | 302,969 | 790,760 |

| Shares redeemed | (94,406) | (158,670) | (2,202,922) | (3,947,659) |

| Net increase (decrease) | (37,377) | (27,048) | $(751,990) | $(684,217) |

| Class C | | | | |

| Shares sold | 105,295 | 177,459 | $2,646,766 | $4,292,617 |

| Reinvestment of distributions | 11,407 | 81,103 | 293,855 | 1,875,111 |

| Shares redeemed | (215,524) | (1,003,566) | (4,902,665) | (24,351,495) |

| Net increase (decrease) | (98,822) | (745,004) | $(1,962,044) | $(18,183,767) |

| International Small Cap | | | | |

| Shares sold | 6,935,505 | 14,687,346 | $169,156,342 | $373,563,417 |