UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [_]

Check the appropriate box:

[_] Preliminary Proxy Statement

[_] Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[_] Definitive Additional Materials

[_] Soliciting Material Pursuant to §240.14a-12

National Retail Properties, Inc.

--------------------------------------------------------------------------------

(Name of Registrant as Specified in Its Charter)

--------------------------------------------------------------------------------

(Name of Person(s) Filing Proxy Statements, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[_] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

--------------------------------------------------------------------------------

(2) Aggregate number of securities to which transaction applies:

--------------------------------------------------------------------------------

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

--------------------------------------------------------------------------------

(4) Proposed maximum aggregate value of transaction:

--------------------------------------------------------------------------------

(5) Total fee paid:

--------------------------------------------------------------------------------

[_] Fee paid previously with preliminary materials.

[_] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

--------------------------------------------------------------------------------

(2) Form, Schedule or Registration Statement No.:

--------------------------------------------------------------------------------

(3) Filing Party:

--------------------------------------------------------------------------------

(4) Date Filed:

--------------------------------------------------------------------------------

NATIONAL RETAIL PROPERTIES, INC.

450 South Orange Avenue, Suite 900

Orlando, Florida 32801

Tel: 407-265-7348

March 22, 2021

To Our Stockholders:

You are cordially invited to attend the annual meeting of stockholders of National Retail Properties, Inc. (the “Company”) on May 12, 2021, at 8:30 a.m. local time, at 450 South Orange Avenue, Suite 900, Orlando, Florida 32801. As part of the Company's precautions regarding the coronavirus or COVID-19, the Company is planning for the possibility that stockholder attendance may not be permitted by local, state or federal law or may not be in the best interest of the Company's employees, stockholders and community to permit stockholder attendance. If stockholder attendance is not permitted or the Company determines that it is not in the best interest of the Company's employees, stockholders and community to permit stockholder attendance, the Company will arrange for stockholders to have access to the meeting via live telecast or webcast. If the Company takes this step, the Company will announce the decision to do so by April 28, 2021, via a press release and post details on its website that will also be filed with the SEC as proxy material. Enclosed for your review are the Proxy Card, Proxy Statement and Notice of Meeting for the Annual Meeting of Stockholders, which describe the business to be conducted at the meeting. The matters proposed for consideration at the meeting are:

1. The election of eight directors;

2. An advisory vote on executive compensation; and

3. The ratification of the selection of our independent registered public accounting firm for 2021.

Whether you own a few or many shares of stock of the Company, it is important that your shares be represented. If you cannot personally attend the meeting, we encourage you to make certain you are represented at the meeting by signing and dating the accompanying proxy card and promptly returning it in the enclosed envelope. You may also vote either by telephone (1-800-690-6903) or on the Internet (http://www.proxyvote.com). Returning your proxy card, voting by telephone or voting on the Internet will not prevent you from voting in person, but will assure that your vote will be counted if you are unable to attend the meeting. As always, the Company encourages you to vote your shares prior to the Annual Meeting.

Sincerely,

| | | | | |

| /s/ Julian E. Whitehurst Julian E. Whitehurst President and Chief Executive Officer

|

NATIONAL RETAIL PROPERTIES, INC.

450 South Orange Avenue, Suite 900

Orlando, Florida 32801

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 12, 2021

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of NATIONAL RETAIL PROPERTIES, INC. will be held at 8:30 a.m. local time, on May 12 2021 , at 450 South Orange Avenue, Suite 900, Orlando, Florida 32801*, for the following purposes:

1. The election of eight directors;

2. An advisory vote on executive compensation; and

3. The ratification of the selection of our independent registered public accounting firm for 2021.

We will also transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

Stockholders of record at the close of business on March 15, 2021, will be entitled to notice of and to vote at the annual meeting or at any adjournment thereof.

Stockholders are cordially invited to attend the meeting in person. PLEASE VOTE, EVEN IF YOU PLAN TO ATTEND THE MEETING, by completing, signing and returning the enclosed proxy card, by telephone (1-800-690-6903) or on the internet (http://www.proxyvote.com) by following the instructions on your proxy card. If you decide to attend the meeting you may revoke your Proxy and vote your shares in person. It is important that your shares be voted.

By Order of the Board of Directors,

| | | | | |

| /s/ Christopher P. Tessitore Christopher P. Tessitore Executive Vice President, General Counsel, and Secretary |

March 22, 2021

Orlando, Florida

*As part of the Company's precautions regarding the coronavirus or COVID-19, the Company is planning for the possibility that stockholder attendance may not be permitted by local, state or federal law or may not be in the best interest of the Company's employees, stockholders and community to permit stockholder attendance. If stockholder attendance is not permitted or the Company determines that it is not in the best interest of the Company's employees, stockholders and community to permit stockholder attendance, the Company will arrange for stockholders to have access to the meeting via live telecast or webcast. If the Company takes this step, the Company will announce the decision to do so by April 28, 2021, via a press release and post details on its website that will also be filed with the SEC as proxy material. As always, the Company encourages you to vote your shares prior to the Annual Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE ANNUAL MEETING TO BE HELD ON MAY 12, 2021

Our Proxy Statement and our Annual Report to shareholders,

which includes our Annual Report on Form 10-K, are available at

www.nnnreit.com/proxyvote

NATIONAL RETAIL PROPERTIES, INC.

450 South Orange Avenue, Suite 900

Orlando, Florida 32801

Tel: 407-265-7348

General. This Proxy Statement is furnished by the Board of Directors of National Retail Properties, Inc. (the “Company”) in connection with the solicitation by the Board of Directors of proxies to be voted at the annual meeting of stockholders to be held on May 12, 2021, and at any adjournment thereof, for the purposes set forth in the accompanying notice of such meeting. All stockholders of record at the close of business on March 15, 2021 (the “Record Date”), will be entitled to vote. It is anticipated that this Proxy Statement and the enclosed Proxy will be mailed to stockholders on or about April 2, 2021. The Proxy Statement and our Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) will also be available on the Internet at www.nnnreit.com/proxyvote.

When we use the words “we,” “us,” “our” or “Company,” we are referring to National Retail Properties, Inc.

Voting/Revocation of Proxy. If you complete and properly sign and mail the accompanying proxy card, it will be voted as you direct. If you are a registered stockholder and attend the meeting, you may deliver your completed proxy card in person. “Street name” stockholders who wish to vote at the meeting will need to obtain a proxy from the institution that holds their shares.

If you are a registered stockholder, you may vote by telephone (1-800-690-6903), or electronically through the Internet (http://www.proxyvote.com), by following the instructions included with your proxy card. If your shares are held in “street name,” please check your proxy card or contact your broker or nominee to determine whether you will be able to vote by telephone or electronically.

Any proxy, if received in time, properly signed and not revoked, will be voted at such meeting in accordance with the directions of the stockholder. If no directions are specified, the proxy will be voted FOR each of Proposals I, II, and III contained herein. Any stockholder giving a proxy has the power to revoke it at any time before it is exercised. A proxy may be revoked (1) by delivery of a written statement to the Secretary of the Company stating that the proxy is revoked, (2) by presentation at the annual meeting of a subsequent proxy executed by the person executing the prior proxy, or (3) by attendance at the annual meeting and voting in person.

Vote Required for Approval; Quorum. The nominees for director who receive a majority of the votes cast will be elected. If you indicate “withhold authority to vote” for a particular nominee by entering the number of any nominee (as designated on the proxy card) below the pertinent instruction on the proxy card, your vote will not count either for or against the nominee. As of the Record Date, 175,579,683 shares of the common stock of the Company (the “Common Stock”) were outstanding, of which 174,987,931 shares entitled the holder thereof to one vote on each of the matters to be voted upon at the annual meeting. As of the Record Date, our executive officers and directors had the power to vote approximately 0.35% of the outstanding shares of Common Stock. Our executive officers and directors have advised us that they intend to vote their shares of Common Stock FOR each of Proposals I, II, and III contained herein.

Votes cast in person or by proxy at the annual meeting will be tabulated and a determination will be made as to whether or not a quorum is present. We will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence or absence of a quorum, but as unvoted for purposes of determining the approval of any matter submitted to the stockholders. If a broker submits a proxy indicating that it does not have discretionary authority as to certain shares to vote on a particular matter (broker non-votes), those shares will not be considered as present and entitled to vote with respect to such matter. Broker non-votes with respect to the election of directors will have no effect on the outcome of the vote on that proposal.

YOUR VOTE AT THE ANNUAL MEETING IS VERY IMPORTANT TO US.

Solicitation of Proxies. Solicitation of proxies will be primarily by mail. We will bear the cost of soliciting proxies from our stockholders. In addition to solicitation by mail, our directors, officers, employees, and agents may solicit proxies by telephone, internet, or otherwise. These directors, officers, and employees will not be additionally compensated for the solicitation, but may be reimbursed for out-of-pocket expenses incurred in connection with the solicitation. Copies of solicitation materials will be furnished to brokerage firms, fiduciaries, and other custodians who hold shares of our common stock of record for beneficial owners for forwarding to such beneficial owners. We may also reimburse persons representing beneficial owners for their reasonable expenses incurred in forwarding such materials.

Stockholders who authorize their proxies through the internet should be aware that they may incur costs to access the internet, such as usage charges from telephone companies or internet service providers and these costs must be borne by the stockholder.

TABLE OF CONTENTS

PROPOSAL I

ELECTION OF DIRECTORS

Nominees

Based on the recommendation of our Governance and Nominating Committee, the persons named below have been nominated by the Board of Directors of the Company (the “Board of Directors” or the “Board”) for election as directors to serve until the next annual meeting of stockholders or until their successors shall have been elected and qualified.

In selecting the candidates to nominate for election as directors, the Governance and Nominating Committee’s principal qualification is whether an individual has the ability to act in the best interests of the Company and its stockholders. The Governance and Nominating Committee endeavors to identify individuals to serve on the Board who have expertise that is useful to the Company and complementary to the background, skills and experience of other Board members. Each individual serving on the Board should be willing to devote the time necessary to carry out the responsibilities of a director of the Company. The Governance and Nominating Committee’s assessment of the composition of the Board should include: (a) skills - business and management experience, real estate experience, accounting experience, finance and capital markets experience, and an understanding of corporate governance regulations and public policy matters, (b) character - ethical and moral standards, leadership abilities, sound business judgment, independence and innovative thought, and (c) composition - diversity, age and public company experience. The Governance and Nominating Committee measures the Board’s composition by taking into account the entirety of the Board and the criteria listed above rather than having any representational directors.

Our Board views diversity in a broad sense, taking into consideration not only racial, ethnic and gender diversity, but also the mix of qualifications of our directors including tenure, experience levels and types of experience, including both industry and subject matter expertise. Although we do not have a separate policy specifically governing diversity, when considering board candidates, the Governance and Nominating Committee considers whether an individual would bring a diverse viewpoint to the Board, including with respect to the candidate’s gender, race and ethnicity. In recent years, the Governance and Nominating Committee has demonstrated its commitment to consideration of diverse candidates. Over the past five years, we have added four new directors to the Board, two of whom are female, deepening its diversity of composition, thought and experience, adding fresh perspectives, and preparing the Board for the eventual retirement of its long-serving members. The Governance and Nominating Committee intends to continue considering the diversity of experience and perspective, including racial, ethnic and gender diversity, that future candidates may bring when nominating individuals to serve on our Board.

The table sets forth each nominee’s name, age, principal occupation or employment and directorships in other public corporations during at least the last five years, as well as the specific experience, qualifications, attributes and skills each nominee has acquired in such positions. Each of the nominees below have been recommended by the Governance and Nominating Committee and approved by the Board of Directors for inclusion on the attached proxy card.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ALL OF THE

NOMINEES DESCRIBED BELOW FOR ELECTION AS DIRECTORS.

| | | | | |

| Name and Age | Background |

| |

| Pamela K.M. Beall, 64 | Ms. Beall has served as a director of the Company since August 2016. Ms. Beall is Executive Vice President, Chief Financial Officer and director of MPLX GP LLC, a subsidiary of Marathon Petroleum Corporation ("MPC"). MPLX GP LLC is the general partner of MPLX LP, a publicly traded master limited partnership, and is one of the largest petroleum pipeline companies and natural gas processors in the United States. In October 2018, Ms. Beall was appointed director of Tesoro Logistics G.P. LLC, a subsidiary of MPC and the general partner of Andeavor Logistics LP a publicly traded master limited partnership and a diversified midstream crude oil, natural gas and refined products logistics company. Ms. Beall was Executive Vice President of Corporate Planning and Strategy of MPLX LP from January 2016 to October 2016; Senior Vice President of Corporate Planning, Government and Public Affairs of MPC and President of MPLX from January 2014 to January 2016, and was Vice President of Investor Relations of MPC from July 2011 to January 2014. She currently serves on the board of trustees of the University of Findlay, and is a member of the executive, audit, business affairs, and capital campaign committees. Ms. Beall received a Bachelor of Science, Accounting degree from the University of Findlay, and a Master of Business Administration from Bowling Green State University, and is a non-practicing Certified Public Accountant.

The Board believes, that in these positions, Ms. Beall has acquired the experience, qualifications, attributes and skills, including business and management, finance, capital markets, accounting and real estate experience and an understanding of corporate governance regulations necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Ms. Beall should serve as a director for the Company. |

| Steven D. Cosler, 65 | Mr. Cosler has served as a director of the Company since August 2016. Mr. Cosler served as the CEO of Priority Healthcare, which was acquired by Express Scripts in 2005 and was lead director of Catamaran Corporation, which was acquired by United Healthcare in July 2015. Mr. Cosler currently serves on the boards of EBMS, ELAP Services, Southern Scripts and Eversana, all of which are Water Street Healthcare portfolio companies. and privately held MedShorts. He also serves as the Chairperson and co-founder of Elevate Indianapolis, a non-profit organization.

The Board believes, that in these positions, Mr. Cosler has acquired the experience, qualifications, attributes and skills, including business and management experience, real estate experience, finance and capital markets experience and an understanding of corporate governance regulations necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Mr. Cosler should serve as a director for the Company. |

| |

| | | | | |

| Don DeFosset, 72 | Mr. DeFosset has served as a director of the Company since December 2008. Mr. DeFosset currently serves on the boards of directors for Regions Financial Corporation, ITT Corporation and Terex Corporation and also serves on the board of trustees for the University of Tampa. Mr. DeFosset retired in November 2005 as Chairperson , President and Chief Executive Officer of Walter Industries, Inc., a diversified company with principal operating businesses in homebuilding and home financing, water transmission products and energy services. Mr. DeFosset is a graduate of Purdue University, where he earned a Bachelor’s degree in Industrial Engineering. He received his MBA from Harvard Business School in 1974.

The Board believes, that in these positions, Mr. DeFosset has acquired the experience, qualifications, attributes and skills, including business, management, finance, capital markets and real estate experience, and an understanding of corporate governance regulations necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Mr. DeFosset should serve as a director for the Company. |

| |

| David M. Fick, 63 | Mr. Fick has served as a director of the Company since November 2010. Mr. Fick is an adjunct professor at the Johns Hopkins University Carey Business School where he teaches graduate-level Real Estate Finance, Capital Markets, and REIT Structuring and Analysis. He is President of Nandua Oyster Company, an aquaculture business he founded in 2007. Mr. Fick served as Managing Director at Stifel Nicolaus & Company, a successor to Legg Mason Wood Walker. In that position he headed Real Estate Research and was an analyst covering real estate investment trusts from 1997 to 2010. During this period he was also a member of the Legg Mason Real Estate Capital Investment Committee. Mr. Fick also served as Equity Vice President, Finance with Alex Brown Kleinwort Benson and LaSalle Partners from 1993 to 1995, and as Chief Financial Officer at Mills Corporation and Western Development Corporation from 1991 to 1994. Prior to that, he was a practicing CPA and consultant with a national accounting firm, specializing in the real estate industry. He is also a member of the National Association of Real Estate Investment Trusts (“Nareit”), and the American Institute of Certified Public Accountants, and is a non-practicing Certified Public Accountant. He is also a member of the Johns Hopkins University Carey Business School Real Estate Advisory Board. Mr. Fick is also an active investor in private real estate funds and partnerships.

|

| The Board believes, that in these positions, Mr. Fick has acquired the experience, qualifications, attributes and skills, including business, management, finance, capital markets, accounting, real estate and REIT experience, and an understanding of corporate governance regulations necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Mr. Fick should serve as a director for the Company. |

| |

| | | | | |

| Edward J. Fritsch, 62 | Mr. Fritsch has served as a director of the Company since February 2012. Mr. Fritsch retired in September 2019 as President and Chief Executive Officer of Highwoods Properties, Inc., a publicly traded REIT (NYSE: HIW) and now serves as a retained consultant to the Company. Joining Highwoods in 1982, Mr. Fritsch was a partner in the predecessor firm which launched its initial public offering in 1994. In 2004, Mr. Fritsch assumed the role of Chief Executive Officer. Mr. Fritsch is a former member of the Nareit Board of Governors and served as its 2015/2016 national chair. Mr. Fritsch is currently a member on the following boards: University of North Carolina at Chapel Hill Foundation, University of North Carolina at Chapel Hill Real Estate Holdings, Dix Park Conservancy and Executive Committee, Cristo Rey High School, North Carolina Chamber of Commerce, Triangle Family Services, and the YMCA of the Triangle. |

| The Board believes, that in these positions, Mr. Fritsch has acquired the experience, qualifications, attributes and skills, including business, management, finance, capital markets, real estate and REIT experience, and an understanding of corporate governance regulations necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Mr. Fritsch should serve as a director for the Company. |

| |

| Kevin B. Habicht, 62 | Mr. Habicht has served as a director of the Company since June 2000, as Executive Vice President and Chief Financial Officer of the Company since December 1993 and as Treasurer of the Company since January 1998. Mr. Habicht served as Secretary of the Company from January 1998 to May 2003. Mr. Habicht is a Certified Public Accountant and a Chartered Financial Analyst. |

| The Board believes, that in these positions, Mr. Habicht has acquired the experience, qualifications, attributes and skills, including business, management, finance, capital markets, accounting, real estate and REIT experience, and an understanding of corporate governance regulations necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Mr. Habicht should serve as a director for the Company. |

| | | | | |

| Betsy D. Holden, 65 | Ms. Holden has served as a director of the company since February 2019. Ms. Holden is an independent consultant primarily serving privately held food companies. She served as a Senior Advisor to McKinsey & Company from April 2007 to December 2020, leading strategy, marketing and board effectiveness initiatives for consumer goods, healthcare, and financial services clients. Prior to that, Ms. Holden spent 25 years in marketing and line positions in consumer goods. Ms. Holden served as President, Global Marketing and Category Development of Kraft Foods Inc. from January 2004 to June 2005, Co-Chief Executive Officer, Kraft Foods, Inc. 2001-2003, Chief Executive Officer of Kraft Foods North America from May 2000 to December 2003. Ms. Holden currently serves as a Director of Dentsply Sirona and Western Union. She has served on nine public boards over the last 20 years, including Diageo Plc (2009 - 2018), Time, Inc. (2014 - 2018), and Catamaran Corporation (2012 - 2015). Ms. Holden was selected as a 2015 NACD Directorship 100 honoree and was inducted into the Chicago Business Hall of Fame in 2016. She currently serves on the board of Lyons Magnus, a private equity food service portfolio company. Ms. Holden graduated Phi Beta Kappa with a Bachelor of Arts from Duke University and serves on the Executive Committee of Duke University's Board of Trustee's. She received a Master of Management in Marketing and Finance from Northwestern University's Kellogg School of Management and serves on the Global Advisory Board.

The Board believes, that in these positions, Ms. Holden has acquired the experience, qualifications, attributes and skills, including business, management and finance experience, and an understanding of corporate governance regulations necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Ms Holden should serve as a director for the Company.

|

|

Julian E. Whitehurst, 63 .. | Mr. Whitehurst has served as a director of the Company since February 2017, as CEO of the Company since April 2017, and as President of the Company since May 2006. He also previously served as Chief Operating Officer of the Company from June 2004 to April 2017, as Executive Vice President of the Company from February 2003 to May 2006, as Secretary of the Company from May 2003 to May 2006, and as General Counsel from 2003 to 2006. Prior to February 2003, Mr. Whitehurst was a shareholder at the law firm of Lowndes, Drosdick, Doster, Kantor & Reed, P.A. He also serves as a member of the board of directors of InvenTrust Properties, Inc. Mr. Whitehurst is a member of ICSC and Nareit, and serves on the Nareit Advisory Board of Governors.

The Board believes, that in these positions, Mr. Whitehurst has acquired the experience, qualifications, attributes and skills, including business, management, finance, capital markets, legal, real estate and REIT experience and an understanding of corporate governance regulations necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Mr. Whitehurst should serve as a director for the Company. |

In the event that any nominee(s) should be unable to accept the office of director, which is not anticipated, it is intended that the persons named in the Proxy will vote FOR the election of such other person in the place of such nominee(s) for the office of director as the Board of Directors may recommend.

Corporate Governance

General. We are currently managed by an eight-member Board of Directors that consists of Mses. Beall and Holden, and Messrs. Cosler, DeFosset, Fick, Fritsch, Habicht, and Whitehurst, with Mr. DeFosset serving as Chairperson of the Board.

The Board of Directors has adopted a set of corporate governance guidelines, which, along with the written charters for the Board committees described below, provide the framework for the Board’s governance of the Company. Our corporate governance guidelines are available on our website at http://www.nnnreit.com.

Highlights of our corporate governance include:

| | | | | |

•Annual board self-assessment process | •Board oversight of human capital management |

•Independent standing Board committees | •Risk oversight by Board and Committees |

•Independent Chairperson of the Board with defined role | •Annual advisory vote on executive compensation |

•Six of our eight directors are independent | •Procedures for stockholders to communicate directly with the Board |

•A majority voting standard for uncontested elections of directors | •Stock ownership guidelines for executive officers and directors |

•25% of directors are female or racially diverse | •Periodic review of Committee charters and corporate governance guidelines |

•Average Board tenure of 8 years (as of December 31, 2020) | •Recent adoption of proxy access to make it easier for shareholders to nominate director candidates |

•Annual evaluation of the CEO by independent directors | •Policies prohibiting hedging, short selling and pledging of our common stock for all employees and directors |

•Regular meetings of our independent directors without management present | •Board oversight of all Environmental, Social and Governance ("ESG") matters |

•Audit Committee oversight of all cyber risks and data privacy risks |

|

Independence and Composition. Our corporate governance guidelines and the rules and regulations of the New York Stock Exchange, which we refer to as the NYSE listing standards, each requires that a majority of the Board of Directors are “independent” directors, as that term is defined in the NYSE listing standards.

Leadership Structure. The Board of Directors has determined that Mses. Beall and Holden and Messrs. Cosler, DeFosset, Fick, and Fritsch representing a majority of the Board of Directors, qualify as independent directors (the “Independent Directors”) as that term is defined in the NYSE listing standards. The Board of Directors made its determination based on information furnished by all directors regarding their relationships with us and our affiliates and research conducted by management. In addition, the Board of Directors consulted with our external legal counsel to ensure that the Board’s determination would be consistent with all relevant securities laws and regulations as well as the NYSE listing standards.

Our Board of Directors has been directed by a non-executive Chairperson of the Board since 2017. The Board of Directors believes that having its own leadership separate from our Chief Executive Officer provides the Board of Directors with an effective way to ensure that they are fully informed and have the opportunity to fully debate all important issues in order to fulfill its oversight responsibilities and hold management accountable for the performance of the Company. This also allows our Chief Executive Officer to focus his time on running our day-to-day business. Mr. DeFosset has served as Chairperson of the Board since his election on December, 20, 2018. In his role as Chairperson of the Board, Mr. DeFosset presides over all meetings of the stockholders and directors, and reviews and approves Board meeting schedules, agendas, and information provided to the Board. In addition, Mr. DeFosset presides as Chairperson when the Board meets in executive session and he serves as the interface between the Board and the Chief Executive Officer in communicating matters discussed during the executive session.

Risk Oversight. Our management is responsible for managing the day-to-day risks associated with our business. The Board of Directors, however, is elected to provide effective oversight of our affairs for the benefit of our stockholders, and among its primary responsibilities, in accordance with our corporate governance guidelines, is overseeing management in the competent and ethical operation of the Company, reviewing and approving our business plans and corporate strategies, and adopting and evaluating policies of corporate and ethical conduct and

governance. Implicit in these duties is risk oversight, the primary responsibility of which has been delegated to the Board’s Audit Committee. Among the significant risks that we oversee are operational risk; legal and regulatory compliance risk, financial risk, such as credit risks, interest rate risk, market risk, and liquidity risk; privacy and data security risk. The Audit Committee reviews with management annually, or more frequently as the Audit Committee deems necessary, our significant risks or exposures and discusses guidelines and policies to govern this process and assesses steps that management has taken to minimize such risks to the Company.

While the primary responsibility has been delegated to the Audit Committee, the Governance and Nominating Committee and the Compensation Committee consider risks within their area of responsibility. Further, each director may consult with management at any time and is encouraged to discuss with management any questions such director may have.

With respect to risks related to compensation matters, our management, together with the Compensation Committee, reviewed our compensation policies and practices for our employees in order to determine whether they are reasonably likely to have a material adverse effect on the Company. We believe that our compensation policies and practices do not promote unreasonable risk-taking behavior and are not reasonably likely to have a material adverse effect based on the following factors:

•the Compensation Committee consists solely of independent non-employee directors, and the Compensation Committee has engaged an independent, external compensation consultant to assist with creating the executive compensation program;

•the Compensation Committee maintains the right, in its sole discretion, to modify the compensation policies and practices at any time;

•the Compensation Committee has elected to use awards of restricted stock instead of other equity awards, such as stock options, because, as a REIT, which pays a large portion of its annual earnings to stockholders in the form of dividends, the Compensation Committee believes that restricted stock provides a better incentive and alignment of interest than stock options;

•restricted stock grants are intended to provide our named executive officers with a significant interest in the long-term performance of our stock;

•restricted stock awards are subject to forfeiture upon certain employment termination events;

•certain performance-contingent restricted stock grants are tied to our three-year total shareholder returns relative to a broad REIT peer group (60% weighting in 2020) to further focus our executive officers on long-term shareholder value creation and; certain performance-contingent restricted stock grants are tied to our Core FFO three-year total growth (20% weighting in 2020);

•bonus awards to our executive officers are reduced if balance sheet leverage exceeds levels previously approved by the Compensation Committee;

•we have adopted a stock ownership policy for our executive officers and members of our Board which requires all directors and executive officers to own meaningful levels of Company stock;

•we have adopted an insider trading policy which prohibits, among other things, trading of Company securities on a short-term basis, buying puts or calls on Company securities, short sales of Company securities, and certain other activities. We have adopted an anti-hedging policy that prohibits all employees, non-employee directors and executive officers from engaging in short sales of our securities, buying or selling puts or calls on our securities or otherwise engaging in hedging transactions (such as zero-cost dollars, exchange funds, and forward sale contracts) involving our securities;

•we have adopted a pledging limitation policy for our directors and executive officers which restricts directors and executive officers from pledging shares of the Company and holding of shares of the Company in margin accounts (no directors or executive officers have pledged any shares);

•we have adopted a clawback policy for our executive officers which allows the Board to recover certain incentive compensation if the Company has a material restatement of financial results, as a result of such restatement the incentive compensation would not have been earned, and the executive officer engaged in fraud or other intentional misconduct;

•none of our employees are paid commission compensation;

•bonus and incentive awards to our employees eligible for bonus awards are capped; and

•we base executive compensation on several critical success factors.

Given these factors, we believe we have mitigated potential short-term excessive risk-taking and aligned compensation with increasing long-term shareholder value.

Meetings and Attendance. The Board of Directors met seven times in the fiscal year ended December 31, 2020. Each of the nominees serving on the Board of Directors in 2020 attended (i) not less than 100% of the Board of Director meetings (including 100% of the Board's regular quarterly meetings), and (ii) 100% of the committee meetings held during the period that the nominee served on the committees of the Board of Directors. Our corporate governance guidelines provide that it is the responsibility of individual directors to make themselves available to attend scheduled and special Board meetings on a consistent basis. In addition to the seven Board of Directors meetings, all of our directors were in attendance for the 2020 annual meeting of the Company’s stockholders. In addition, non-management members of the Board of Directors met in executive session seven times in the fiscal year ended December 31, 2020. These sessions were presided over by Mr. DeFosset in his capacity as Chairperson .

Interested Party Communications. The Board of Directors has adopted a process whereby stockholders and other interested parties can send communications to our directors. Anyone wishing to communicate directly with one or more directors may do so in writing addressed to the director or directors, c/o National Retail Properties, Inc., 450 South Orange Avenue, Suite 900, Orlando, Florida 32801, attention: Secretary of the Company. All correspondence will be reviewed by the Secretary of the Company and forwarded directly to the addressee so long as, in the Secretary’s discretion, such correspondence is reasonably related to protecting or promoting legitimate interests of interested parties or the reliability of the financial markets.

Corporate Responsibility.

We are focused on achieving success for our shareholders, providing a world class working environment for our associates, enriching our community and maximizing the preservation of environmental resources. We operate our business in accordance with the highest ethical standards and best-in-class corporate governance standards not just because it is the right thing to do, but because it is critical to the long term success of our shareholders, associates, and community.

Human Capital Development. As of January 31, 2021, the Company employed 69 associates. Our success is dependent upon the dedication and hard work of our talented associates. Our associates are true experts in their fields. We encourage continued professional and personal development of all associates by providing hundreds of hours of in-person and online training opportunities that touch all aspects of our business. We also have associate mentoring and training programs and formalized talent development programs at all levels of the Company. The success of our commitment to our associates is shown in the long tenure of our associates. Our executive team, our department heads, and our senior managers all average over 18 years of experience with the Company. In addition, half of our associates have been with company for 10 years or longer. The institutional knowledge and long tenure of our associates is a true competitive advantage of the Company. We have adopted a Human Capital Policy which is available on our website at http://www.nnnreit.com.

Total Rewards, Benefits & Work-Life Balance. The Company also focuses on additional benefits for our associates to make sure our associates are not only well compensated but also engaged, developed and satisfied with their work-life balance. There are six key elements to our total rewards system: Compensation, Benefits, Wellness, Work-Life Balance, Professional Development and Recognition. Our programs include but are not limited to a

401(k) plan with a company match, flexible work schedules, college saving plans, educational assistance program, adoption benefits, flexible spending and health saving accounts, health and wellness events, and access to a state of the art online wellness platform. We have been the recipient of numerous wellness awards, including the prestigious Cigna Well-Being Award.

Community Service and Partnerships. We care about the communities in which we live and work. We stand behind our commitment to improving education, strengthening neighborhoods, and encouraging volunteer service. We actively promote volunteering by our associates. We organize and sponsor specific volunteer days throughout the year at various charities, including Ronald McDonald House of Central Florida and Give Kids the World. Associates are encouraged to volunteer on work days during work hours. In addition to our donation of time, we also are a meaningful financial investor in numerous charities in the Central Florida community, including Boys and Girls Club of Central Florida, Second Harvest Food Bank and Elevate Orlando (a teacher mentor program for high risk urban youth that help young women and men graduate high school with a plan for the future).

Environmental Practices and Impact. As an owner of a large number of properties throughout the United States it is important to the Company to be a good corporate citizen and a good steward of the environment. We demonstrate our commitment to be a good stewardship of the environment in a variety of ways both at our headquarters and at our properties across the country.

Our Headquarters. Our headquarters building is EPA’s Energy Star certified. A building that has earned EPA’s Energy Star certification uses 35% less energy and generates 35% fewer greenhouse gas emissions. In order to receive this designation, the following components must be met:

•Utilization of energy efficient LED lighting.

•Use of environmentally friendly cleaning products. The products must meet the Green Seal certification standards.

•Variable Frequency drives and more energy efficient motors are purchased and installed in all cooling tower units.

•Mandatory shut down of all lighting and HVAC systems daily.

•The building utilizes a bulb crusher for all lamps which contains a dust removal system that exceed HEPA standards by removing 99.99% of particles for the building fluorescents.

•To minimize generation of waste and release of pollutants, the building requires all paint to be low VOC.

•Storm water retention is managed through water runoff from roofs and paved areas and are routed to various underground drainage basins. All water runoff is naturally filtered and returned to the aquifer.

•Green-friendly native and drought-tolerant plants are used in landscaping to minimize watering needs.

Furthermore, we encourage a culture of environmental preservation and efficient usage of environmental resources throughout the company by supporting the following green initiatives:

•Associates are provided with a pre-tax payroll deduction for the use of the commuter rail system to limit the number of automobile trips and reduce our carbon footprint.

•Single-stream recycling is implemented at our headquarters.

•We purchase ENERGY STAR certified desktop and laptop computers, monitors and printers.

•We use ENERGY STAR power management settings on our computers and monitors.

•We recycle old computer equipment, printers and any other electronic items.

•We dispose all ink cartridges utilizing TOSHIBA’s recycling program.

•Our document destruction provider recycles all shredded materials (resulting in annual savings of roughly 200 trees a year).

•We require all associates to use personal cups and have installed water machines to limit the use of plastic cups and bottles.

We have located our headquarters where our associates can reduce their carbon footprint by using the following green transportation programs: (i) electric charging stations and designated parking spaces for hybrid vehicles, (ii) bicycle storage lockers as well as bike racks, (iii) electric commuter bike and scooter rental stations, and (iv) free commuter bus for travel throughout downtown Orlando.

Our Portfolio of Properties. The properties in our portfolio are generally leased to our tenants under long-term triple net leases which gives our tenants exclusive control over and the ability to institute energy conservation and environmental management programs at our properties. Our tenants are overwhelmingly large companies with sophisticated conservation and sustainability programs. These programs limit the use of resources and limit the impact of the use of our properties on the environment, including, but not limited to, implementing green building and lighting standards, and recycling programs. Our leases also typically require the tenants to fully comply with all environmental laws, rules and regulations, including any remediation requirements. Our risk management department actively monitors any environmental conditions on our properties to make sure that the tenants are meeting their obligations to remediate or remedy any open environmental matters. On all properties that we acquire we obtain an environmental assessment from a licensed environmental consultant to understand any environmental risks and liabilities associated with a property and to ensure that the tenant will address any environmental issues on our properties.

We actively engage with our tenants to promote good environmental practices on our properties, including discussions regarding the following: (i) environmental sustainability and recycling requirements, (ii) energy efficiency requirements, including Energy Star requirements, and EPA Water Sense program requirements, (iii) environmental conservation and green building requirements, in accordance with industry best practices, and (iv) energy usage reporting requirements.

Climate Preparedness. We regularly monitor the status of impending natural disasters and the impact of such disasters on our properties. In most leases our tenants are required to carry full replacement cost coverage on all improvements located on our properties. For those properties located in a nationally designated flood zone, we typically require our tenants to carry flood insurance pursuant to the federal flood insurance program. For those properties located in an area of high earthquake risk, we typically require our tenants to carry earthquake insurance above what is typically covered in an extended coverage policy. In addition, we also carry a contingent extended coverage policy on all of its properties which also provides coverage for certain casualty events, including fire and windstorm.

Audit Committee

General. The Board of Directors has established an Audit Committee, which is governed by a written charter, a copy of which is available on our website at http://www.nnnreit.com. Among the duties, powers and responsibilities of the Audit Committee as provided in its charter, the Audit Committee:

•has sole power and authority concerning the engagement and fees of independent registered public accounting firms;

•reviews with the independent registered public accounting firm the plans and results of the audit engagement;

•pre-approves all audit services and permitted non-audit services provided by the independent registered public accounting firm;

•reviews the independence of the independent registered public accounting firm;

•reviews the adequacy and effectiveness of our internal control over financial reporting;

•oversees and reviews all privacy and data security risks, including internal control over all such risks, and

•reviews accounting, auditing and financial reporting matters with our independent registered public accounting firm and management.

Independence and Composition. The composition of the Audit Committee is subject to the independence and other requirements of the Securities Exchange Act of 1934 and the rules and regulations promulgated by the SEC thereunder (the “Exchange Act”), and the NYSE listing standards.

The Board of Directors, upon the unanimous recommendation of the Governance and Nominating Committee, has determined that all current members of the Audit Committee are “independent,” as that term is defined in the NYSE listing standards and as required by the Exchange Act, and meet all audit committee composition requirements of the Exchange Act and the NYSE listing standards, and that each of Mses. Beall and Holden and Mr. Fick qualifies as an “audit committee financial expert” as that term is defined in the Exchange Act.

Meetings. The Audit Committee met eight times in the fiscal year ended December 31, 2020. The current Audit Committee consists of Mses. Beall and Holden and Messrs. Fick and Fritsch, with Mr. Fick serving as Chairperson .

Governance and Nominating Committee

General. The Board of Directors has established a Governance and Nominating Committee, which is governed by a written charter, a copy of which is available on our website at http://www.nnnreit.com. As provided in the Governance and Nominating Committee charter, the Governance and Nominating Committee:

•identifies and recommends to the Board of Directors individuals to stand for election and re-election to the Board of Directors at our annual meeting of stockholders and to fill vacancies that may arise from time to time;

•develops and makes recommendations to the Board of Directors for the creation and ongoing review and revision of a set of effective corporate governance principles that promote our competent and ethical operation and a policy governing ethical business conduct of our employees and Directors; and

•makes recommendations to the Board of Directors as to the structure and membership of committees of the Board of Directors.

Selection of Director Nominees. Our corporate governance guidelines provide that the Governance and Nominating Committee will endeavor to identify individuals to serve on the Board of Directors who have expertise that is useful to us and complimentary to the background, skills and experience of other Board members. The process undertaken by the Governance and Nominating Committee is described under the section of this proxy statement entitled "PROPOSAL 1 - ELECTION OF DIRECTORS - Nominees".

The Governance and Nominating Committee also considers director nominees recommended by stockholders. See the section of this proxy statement entitled “PROPOSALS FOR NEXT ANNUAL MEETING” for a description of how stockholders desiring to make nominations for directors and/or to bring a proper subject before a meeting should do so. The Governance and Nominating Committee evaluates director candidates recommended by stockholders in the same manner as it evaluates director candidates recommended by our directors, management or employees.

In addition, in February 2021, the Board of Directors adopted amendments to our bylaws to implement proxy access. A stockholder, or group of up to 20 stockholders, owning continuously for at least three years shares of Company Common Stock representing an aggregate of at least 3% of our outstanding shares, may nominate and include in the Company’s proxy materials director nominees constituting up to the greater of (i) two directors or (ii) 20% of the Board, provided that the shareholder(s) and nominee(s) satisfy the requirements in the bylaws.

Independence and Composition. The NYSE listing standards require that the Governance and Nominating Committee consist solely of independent directors. The Board of Directors, upon the unanimous recommendation of the Governance and Nominating Committee, has determined that all current members of the Governance and Nominating Committee are “independent” as that term is defined in the NYSE listing standards.

Meetings. The Governance and Nominating Committee met four times in the fiscal year ended December 31, 2020. The current Governance and Nominating Committee consists of Ms. Beall and Messrs. Fritsch and Cosler, with Mr. Fritsch serving as Chairperson .

Compensation Committee

General. The Board of Directors has established a Compensation Committee, which is governed by a written charter, a copy of which is available on our website at http://www.nnnreit.com.

Processes and Procedures for Executive and Director Compensation Determinations

•Role of Compensation Committee. The Compensation Committee is responsible for discharging the responsibilities of the Board of Directors with respect to approving and evaluating compensation plans, policies and programs for our executive officers and directors and approving all awards to any executive officer, director or associate under our equity incentive plans. The Compensation Committee also serves as the administrator of our 2017 Performance Incentive Plan.

•Role of Management in Compensation Determinations. The Compensation Committee considers the recommendations of our Chief Executive Officer when determining the base salary and incentive performance compensation levels of the other executive officers. Similarly, the Compensation Committee also considers the recommendations of our Chief Executive Officer when setting specific Company and individual incentive performance targets. In addition, officers may be invited to attend committee meetings. Management generally does not have a role in the setting of director compensation.

•Role of Compensation Consultants. The Compensation Committee has the authority, in its sole discretion, to engage compensation consultants as needed or desired to assist the Compensation Committee in researching and evaluating executive officer and director compensation programs. Since 2012, the Compensation Committee has retained Pearl Meyer & Partners, an independent compensation consulting firm (“Pearl Meyer”), to assist the Compensation Committee in reviewing and evaluating the Company’s executive and non-employee director compensation programs. The use of independent third-party consultants provides additional assurance that our executive compensation programs are reasonable, consistent with Company objectives, and competitive with executive compensation for companies in our peer group. Pearl Meyer reports directly to the Compensation Committee, provides no other services to the Company, and regularly participates in committee meetings. The Compensation Committee assessed the independence of Pearl Meyer pursuant to the applicable SEC rules and concluded no conflict of interest exists that would prevent Pearl Meyer from serving as an independent advisor to the Compensation Committee.

•Delegation of Authority by the Committee. The Compensation Committee may delegate its authority to make and administer awards under our equity incentive plans to another committee of the Board of Directors or, except for awards to individuals subject to Section 16 of the Exchange Act, to one or more of our officers. On an annual basis, the Compensation Committee typically authorizes a limited number of shares of restricted stock to be awarded by our Chief Executive Officer to such of our non-executive associates as he determines, in consultation with our other executive officers.

Our executive compensation programs and philosophy are described in greater detail under the section entitled “Compensation Discussion and Analysis.”

Independence and Composition. The NYSE listing standards require that the Compensation Committee consist solely of independent directors. The Board of Directors, upon the unanimous recommendation of the Governance and Nominating Committee, has determined that all current members of the Compensation Committee are “independent” as that term is defined in the NYSE listing standards.

Meetings. The Compensation Committee met five times in the fiscal year ended December 31, 2020. The current Compensation Committee consists of Ms. Holden and Messrs. Cosler and Fick, with Mr. Cosler serving as Chairperson .

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee is or was previously an officer or employee of the Company, and no executive officer of the Company serves on the board of directors of any company at which any member of the Compensation Committee is employed.

Director Compensation

The following table shows the compensation paid to our non-employee directors during fiscal year 2020.

| | | | | | | | | | | | | | |

| Name | Fees Earned or Paid in

Cash

($) | | Stock

Awards

($)(1) | Total

($) |

| (a) | (b) | | (c) | (d) |

| Pamela K. M. Beall | -- | | $216,000 | $216,000 |

Steven D. Cosler(2) | -- | | $228,000 | $228,000 |

| Don DeFosset | $127,500 | | $160,000 | $287,500 |

David M. Fick(2) | $113,000 | | $120,000 | $233,000 |

| Edward J. Fritsch | -- | | $225,000 | $225,000 |

Betsy D. Holden(2) | $98,000 | | $120,000 | $218,000 |

Sam L. Susser(3) | $47,000 | | $60,000 | $107,000 |

__________

(1) The awards shown in column (c) represent stock awards as a result of an annual election to receive stock in lieu of cash made to directors of the Company. The amounts represent the grant date fair value with respect to the fiscal year in accordance with FASB ASC Topic 718.

(2) The cash fees and stock awards earned by Ms. Holden ($120,000), as well as the stock awards earned by Mr. Fick ($120,000), and Mr. Cosler ($228,000) are deferred into shares of our common stock under our Deferred Fee Plan, which is described in greater detail below.

(3) Mr. Susser retired as a director effective as of May 12, 2020.

The Company only compensates non-employee directors for services provided as directors of the Company. Following a study by Pearl Meyer which found that total compensation levels for our directors were below the 50th percentile (or "median") of industry peers (as identified in “Executive Compensation-Compensation Discussion and Analysis-Benchmarking”), effective July 1, 2017, board compensation was set at $200,000 per year, payable in quarterly increments. Non-employee directors may elect to receive up to $80,000 of their annual board compensation in the form of cash, with the remainder paid in shares of the Company’s Common Stock. Additionally, the Non-Employee Chairperson of the Board, the Chairperson of the Audit Committee, the Chairperson of the Compensation Committee, and the Chairperson of the Governance and Nominating Committee receive $87,500, $25,000, $20,000 and $15,000, respectively. Additionally, each non-chair member of the Audit Committee, Compensation Committee and Governance and Nominating Committee receives $10,000, $8,000, and $6,000, respectively. The Committee retainers are payable in cash or stock at the election of the directors.

Pursuant to our corporate governance guidelines, each of our non-employee directors is required to own our Common Stock equivalent to three times the annual total board compensation within five years of becoming a board member. The Compensation Committee reviews progress toward meeting these ownership requirements annually, and each of the nominees that have served on the Board of Directors for the requisite number of years exceeds the ownership requirements.

A Deferred Fee Plan was established by the Company for the benefit of its directors and their beneficiaries. A director may elect to defer all or part of his or her director’s fees to be earned in any calendar year by filing a deferred fee agreement with the Company no later than December 15 of the previous year. A director has the option to have deferred fees paid in cash, in shares of Common Stock or in a combination of cash and Common Stock. If the director elects to have the deferred fees paid in stock, the number of shares allocated to the director’s stock account is determined based on the market value of the Common Stock on the trading day preceding the date the deferred director’s fees were earned. A director is entitled to receive the vested portion of the amounts credited to his or her deferred fee account on the time specified in such director’s fee agreement.

The following table sets forth fees deferred into shares of Common Stock, as well as dividends earned on the deferred shares by directors under the Deferred Fee Plan.

| | | | | | | | | | | |

| Number of Shares Credited to Deferred Fee Account |

| Name | 2020 | | Total |

| Steven D. Cosler | 7,124 | | 22,612 |

| Don DeFosset | 1,740 | | 32,466 |

| David M. Fick | 5,156 | | 38,105 |

| Betsy D. Holden | 3,418 | | 5,671 |

| Sam L. Susser | 217 | | 8,848 |

| | | |

| Total | 17,655 | | 107,702 |

Code of Business Conduct, Insider Trading Policy, and Anti-Corruption Policy

Our directors, as well as our officers and employees, are also governed by our Code of Business Conduct, an Insider Trading Policy, and Anti-Corruption Policy, all of which are available on our website at http://www.nnnreit.com. Amendments to, or waivers from, a provision of the Code of Business Conduct that applies to our directors, executive officers or employees will be posted to our website within four business days following the date of such amendment or waiver.

Executive Officers

Our current executive officers are listed below.

| | | | | |

| Name | Position |

| |

| Julian E. Whitehurst | President and Chief Executive Officer |

| Kevin B. Habicht | Executive Vice President, Chief Financial Officer, Assistant Secretary and Treasurer |

| Stephen A. Horn, Jr. | Executive Vice President and Chief Operating Officer |

| Michelle L. Miller | Executive Vice President and Chief Accounting Officer |

| Christopher P. Tessitore | Executive Vice President, General Counsel and Secretary |

The backgrounds for Messrs. Horn and Tessitore, and Ms. Miller are set forth below. The backgrounds of Messrs. Whitehurst and Habicht are described above at “PROPOSAL I - ELECTION OF DIRECTORS - Nominees.” Paul E. Bayer retired as the Company's Executive Vice President and Chief Investment Officer on December 31, 2020.

Stephen A. Horn, Jr., age 49, has served as Chief Operating Officer of the Company since August 2020, and as Executive Vice President and Chief Acquisition Officer of the Company since January 2014. He also previously served as Senior Vice President of Acquisitions for the Company from June 2008 to December 2013, and as Vice President of Acquisitions of the Company from 2003 to 2008. Prior to 2003, Mr. Horn worked in the mergers and acquisitions group at A.G. Edwards & Sons in St. Louis, MO. He is a member of ICSC and Nareit. Mr. Horn serves on the Board of Trustees of Windermere Preparatory School.

Michelle L. Miller, age 52, has served as Executive Vice President and Chief Accounting Officer since March 2016. She joined National Retail Properties in 1999 and currently leads the accounting department as well as oversees financial reporting, forecasting, lease administration and information technology. Prior to 1999, Ms. Miller worked as a Senior Manager with KPMG and focused primarily on real estate and financial institutions. She is a CPA and received her B.S. in Accounting and Finance from Florida State University in 1991. Ms. Miller is a member of the American Institute of CPAs, the Florida Institute of CPAs, and ICSC.

Christopher P. Tessitore, age 53, has served as Executive Vice President of the Company since January 2007, as General Counsel since February 2006 and as Secretary since May 2006. He also previously served as Senior Vice President and Assistant General Counsel of the Company from 2005 to 2006. Prior to March 2005, Mr. Tessitore was a shareholder at the law firm of Lowndes, Drosdick, Doster, Kantor & Reed, P.A., where he specialized in real estate acquisition, development and finance, as well as general business law. He is a member of ICSC, Nareit, and the Association of Corporate Counsel.

AUDIT COMMITTEE REPORT

The information contained in this report shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any previous or future filings under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act except to the extent that the Company incorporated it by specific reference.

Management is responsible for the Company’s financial statements, internal controls and financial reporting process. The independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and to issue a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes. The Audit Committee is governed by a charter, a copy of which is available on our website at http://www.nnnreit.com. The Audit Committee charter is designed to assist the Audit Committee in complying with applicable provisions of the Exchange Act and the NYSE listing standards, all of which relate to corporate governance and many of which directly or indirectly affect the duties, powers and responsibilities of the Audit Committee.

Review and Discussions with Management and Independent Registered Public Accounting Firm. In this context, the Audit Committee has met and held discussions with management and the independent registered public accounting firm. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, and the Audit Committee has reviewed and discussed the audited consolidated financial statements with management and the independent registered public accounting firm. The Audit Committee has discussed with the independent auditor the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board ("PCAOB") and the SEC.

The Company’s independent registered public accounting firm also provided to the Audit Committee the written disclosures and letter required by applicable requirements of PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence, and the Audit Committee discussed with the independent registered public accounting firm that firm’s independence. The Audit Committee has reviewed the original proposed scope of the annual audit of the Company’s financial statements and the associated fees and any significant variations in the actual scope of the audit and fees.

Conclusion. Based on the review and discussions referred to above, the Audit Committee recommended that the Board of Directors include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC.

AUDIT COMMITTEE

David M. Fick, Chairperson

Pamela K. M. Beall

Edward J. Fritsch

Betsy D. Holden

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Executive Summary

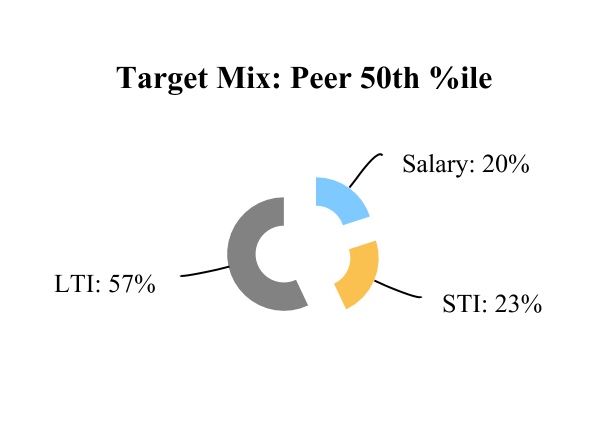

We design our executive compensation program to attract and retain talented and experienced executive officers and to reinforce key business objectives in support of long-term value creation. Our Compensation Committee (for purposes of this discussion, the "Committee") seeks to provide compensation that is not only competitive relative to our peer group, but also structured so as to align our executives’ short-term and long-term interests with the interests of our stockholders. Accordingly, the Committee seeks to incentivize our executive officers and emphasize pay-for-performance by basing a significant portion of compensation on achievement of critical success factors. The primary elements of our total compensation program for our named executive officers ("NEOs") include base salary, annual cash incentives and long-term equity-based incentives. We have designed a compensation program that makes a substantial percentage of executive pay variable, subject to increase and decrease based on actual versus planned corporate performance and total shareholder returns relative to our peers. In addition, executive officers are subject to market competitive stock ownership guidelines which further aligns executive interests with shareholders.

Executive Compensation Program. In 2020, the Committee approved annual incentive awards and long-term incentive awards. Annual incentives were initially tied to (i) the achievement of certain increased core funds from operations ("Core FFO") per share goals, excluding any impairments and severance charges (80% weighting), and (ii) a subjective assessment of contributions toward corporate strategic objectives and achievement of individual performance goals (20% weighting), which include certain ESG goals. As noted below, annual incentive performance metrics and award opportunities were adjusted to align with revised corporate strategic priorities due to COVID-19 pandemic. Annual incentives are subject to downward adjustment if our debt leverage ratio exceeds a cap established by the Board. For 2020, the Committee approved long-term incentive compensation through grants of the following: (i) service-based restricted stock vesting ratably over four years (20% weighting), and (ii) performance-based restricted stock awards, the vesting of which is tied to (a) the three-year relative total shareholder return of the Company compared to a broad group of REIT companies as of December 31, 2022 (60% weighting), and (b) three-year Core FFO per share growth as of December 31, 2022 (20% weighting).

Changes to the 2020 Short-Term Incentive (STI) Program due to COVID-19. On March 11, 2020, the World Health Organization declared a novel strain of coronavirus ("COVID-19") a pandemic, and on March 13, 2020, the United States declared a national emergency with respect to COVID-19. Actions taken by the government to mitigate the spread of COVID-19 by ordering closure of many businesses and ordering residents to generally stay at home has resulted in the loss of revenue for many of our tenants and challenged their ability to pay rent.

Management responded quickly during the year to safeguard employees, avoid layoffs, preserve capital, defer material new property investments, maintain operations, and structure rent deferrals to assist certain hard-hit tenants while protecting shareholder interests. However, disruptions were unpredictable, beyond management’s control, and made the Company’s 2020 pre-pandemic Core FFO per share performance goals unrealistic and unattainable. In response to the economic challenges resulting from the pandemic, the Company revised strategic priorities to further the interests of our stockholders. To strengthen the motivational impact of our 2020 STI program, in the third quarter 2020, after consultation with it's compensation consultant, the Compensation Committee replaced the financial performance goal (80% weighting) of the 2020 (STI) program with the following financial performance goals to appropriately incentivize our NEOs during the COVID-19 pandemic:

1. Maintain a strong liquidity position to preserve optionality for acquisitions, debt rating, and dividend purposes, including a focus on maintaining over $900 million of liquidity in the form of cash and undrawn capacity on the Company’s unsecured revolving credit facility, prior to consideration of potential acquisitions;

2. Structure rent deferral agreements with affected tenants, focusing on maintaining cash flow, cementing tenant/customer relationships, and maximizing long-term value for the Company, with a goal of achieving rent collections of at least 85% of original budget; and

3. Achieve Core FFO per share of at least $2.40.

The Committee did not, however, change the individual performance goal (20% weighting) component of the 2020 STI program. In addition, the Compensation Committee made no changes to the long-term incentive compensation shares granted in 2019 and 2020 including no changes to the multi-year Core FFO per share goals for performance shares.

The Committee viewed the revised financial goals as very challenging, as those goals exceeded then-current internal forecasts and critical to protect the business and shareholder interests during a time of significant uncertainty. Due to the hard work and focus of our NEOs and other employees, the Company exceeded the revised financial performance goals, with liquidity remaining above $900 million throughout 2020 and equal to $1,167 million at year end, rent collections increasing significantly during the third and fourth quarters and averaging 90% for the full year, and earning Core FFO of to $2.59. Additionally, our NEOs met or exceeded all individual goals tied to their respective roles and functional responsibilities. However, in light of the ongoing pandemic and its impact on our financial performance and stock price, in the third quarter 2020, the Compensation Committee decided that total 2020 STI bonus award potential for each NEO (including the component for individual goals) would not exceed 80% of each NEO’s total target bonus opportunity.

As described below, STI bonuses were awarded by the Compensation Committee based on its discretion regarding progress and results in the three performance goals or such other factors as the Compensation Committee determined. Such other factors included the raising of capital during 2020; dividends paid regularly in cash and raised for the 31st consecutive year; maintenance of debt credit rating; lack of furloughs and layoffs; lack of missed or delayed payments to any parties; number of leases amended; and rent forgiveness and litigation avoided to date. While all revised goals were exceeded, in light of the ongoing pandemic and its impact on the Company’s financial performance and stock price, the compensation committee decided to cap STI payouts at 80% of each NEO’s target award opportunity. The Compensation Committee will continue to work with its compensation consultant, Pearl Meyer, to evaluate any potential changes to our STI program for 2021.

Restricted Stock. Restricted stock grants are intended to provide our NEOs with a significant interest in the long-term performance of our stock. The Committee has elected to use awards of restricted stock instead of other equity awards, such as stock options, because, as a REIT, which pays a large portion of its annual earnings to stockholders in the form of dividends, we believe that restricted stock provides a better incentive and alignment of interest than stock options. The Committee has determined that our desired compensation objectives are better achieved by awarding restricted stock. The Company did not issue any stock options to its executive officers in 2020, and there are no outstanding stock options. Consistent with our pay for performance philosophy, 80% of the target long-term incentive award opportunity for our NEOs in 2020 was provided in the form of performance-contingent restricted stock grants.

2020 Business Results. The following are some of the highlights of our business results in 2020:

•Generated Core FFO (excluding impairments, severance charges and loss on early extinguishment of debt) per share of $2.59 per share and Adjusted FFO (which is Core FFO adjusted for certain non-cash items) of $2.51 per share;

•Dividends increased 2.0% to $2.07 per share marking the 31st consecutive year of annual dividend increases;

•Invested $180 million in 63 properties at a projected 6.5% initial cash return on assets;

•Sold 38 properties for $54.5 million, producing $16.2 million of gains on sale;

•Raised $826 million of long term debt and equity capital;

•Balance sheet leverage and portfolio property occupancy remained at industry leading levels; and

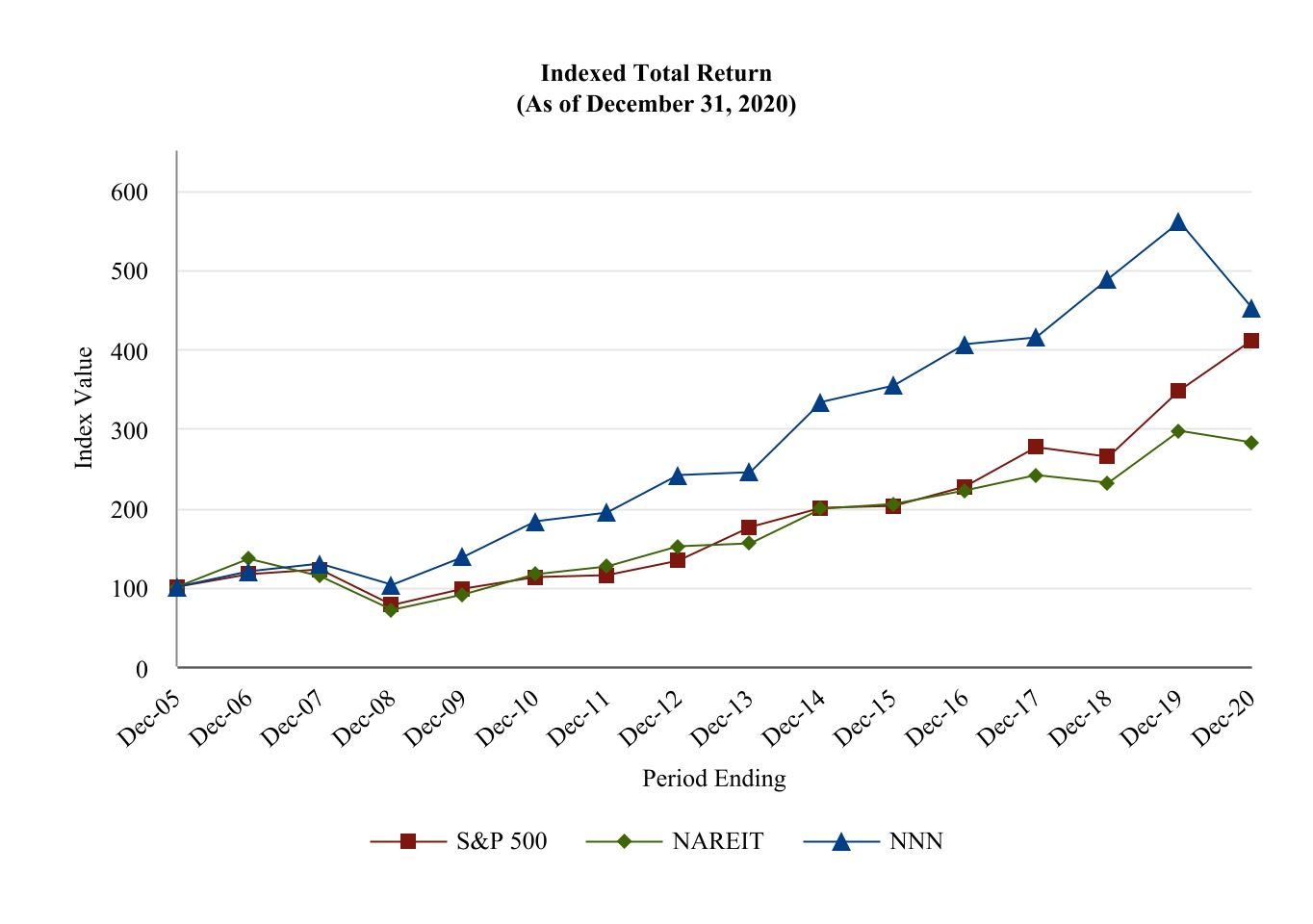

•Three year total shareholder return (TSR) in top half of all Equity REITs.