As filed with the Securities and Exchange Commission on December 16, 2024

Registration No. 333-278562

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NEXTTRIP, INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 4724 | | 27-1865814 |

(State or Other Jurisdiction of Incorporation) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.)

|

3900 Paseo del Sol

Santa Fe, New Mexico 87507

(954) 526-9688

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

William Kerby

Chief Executive Officer

NextTrip, Inc.

3900 Paseo del Sol

Santa Fe, New Mexico 87507

(954) 526-9688

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Christopher L. Tinen, Esq. Snell & Wilmer LLP 12230 El Camino Real Suite 300 | San Diego, CA 92130 (858) 910-4809 | Ross D. Carmel, Esq.

Benjamin E. Sklar, Esq.

Sichenzia Ross Ference Carmel LLP 1185 Avenue of the Americas, 31st Floor New York, NY 10036 (212) 930-9700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | | Accelerated filer ☐ |

| Non-accelerated filer ☒ | | Smaller reporting company ☒ |

| | | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED DECEMBER 16, 2024 |

Shares of Common Stock

Pre-Funded Warrants

Common Warrants

Shares of Common Stock Underlying the Common Warrants

and Pre-Funded Warrants

of

NextTrip, Inc.

This is a firm commitment public offering of shares of our common stock, par value $0.001 per share, and warrants to purchase shares of our common stock (the “Common Warrants”), to be sold together with each share of common stock, at an assumed combined public offering price of $ per share and Common Warrant (based upon the last reported sale price of our common stock on the Nasdaq Capital Market on , 2024). Each Common Warrant will have an exercise price of $ per share (100% of the combined public offering price per share of common stock and Common Warrant), will become exercisable commencing on the date of issuance, and will expire five years from the date of issuance.

We are also offering to those purchasers, if any, whose purchase of common stock in this offering would otherwise result in such purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation of this offering, the opportunity to purchase, if any such purchaser so chooses, pre-funded warrants (the “Pre-Funded Warrants”) in lieu of shares common stock that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock. The purchase price of each Pre-Funded Warrant will be equal to the combined public offering price per share of common stock and Common Warrant sold in this offering minus $0.001, the exercise price per share of common stock of each Pre-Funded Warrant. The Pre-Funded Warrants are immediately exercisable and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full.

For each Pre-Funded Warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. Because we will issue a Common Warrant for each share of common stock and each Pre-Funded Warrant sold in this offering, the number of Common Warrants sold in this offering will not change as a result of a change in the mix of shares of common stock and Pre-Funded Warrants sold. The shares of common stock (or Pre-Funded Warrants) and the accompanying Common Warrants can only be purchased together in this offering, but the securities will be immediately separable upon issuance and will be issued separately. The shares of common stock issuable from time to time upon exercise of the Common Warrants and the Pre-Funded Warrants are also being offered by this prospectus.

The actual combined public offering price per share of common stock (or Pre-Funded Warrant) and Common Warrant will be determined between us and the underwriter at the time of pricing, and may be at a discount to the current market price of our common stock. Therefore, the assumed combined public offering price used throughout this prospectus may not be indicative of the final offering price.

Our common stock is traded on The Nasdaq Capital Market tier of The Nasdaq Stock Market, LLC under the symbol “NTRP”. The last reported sale price of our common stock on the Nasdaq Capital Market on December 13, 2024 was $4.40 per share. There is currently no established trading market for the offered Common Warrants or the Pre-Funded Warrants. We do not intend to list the Common Warrants or Pre-Funded Warrants on the Nasdaq Capital Market or any other national securities exchange or nationally recognized trading system. Without an active trading market, the liquidity of the Common Warrants and the Pre-Funded Warrants will be limited.

We are a “smaller reporting company” as defined under the federal securities laws and, as such, are eligible for reduced public company reporting requirements.

Investing in our securities involves a high degree of risk. Before making an investment decision, please read “Risk Factors” on page 11 of this prospectus.

| | | Per Share of Common Stock and Accompanying Common Warrant | | | Per Pre-Funded Warrant and Accompanying Common Warrant | | Total | |

| Public offering price | | $ | | | | | | $ | | |

| Underwriting discounts and commissions(1) | | $ | | | | | | $ | | |

| Proceeds to NextTrip, Inc. before expenses | | $ | | | | | | $ | | |

| (1) | The underwriting discount does not include a non-accountable expense allowance of 1.0% of the gross proceeds of the shares sold in the offering. The registration statement, of which this prospectus is a part, also registers for sale those shares of common stock issuable upon exercise of warrants to purchase shares of our common stock to be issued to the underwriter, or its designated affiliates, in connection with this offering (the “Underwriter’s Warrants”). We have agreed to issue the warrants to the underwriter as a portion of the underwriting compensation payable to the underwriters in connection with this offering. See the section titled “Underwriting” for a description of the compensation payable to the underwriter. |

We have granted the underwriter an option for a period of 30 days after the closing date of the offering to purchase up to an additional shares of our common stock, Pre-Funded Warrants and/or Common Warrants at the combined public offering price, less the underwriting discounts and commissions, solely to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the securities to purchasers on or about , 2024.

Sole Bookrunner

The Benchmark Company, LLC

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”). We have not, and the underwriter has not, authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. When you make a decision about whether to invest in our securities, you should not rely upon any information other than the information in this prospectus or in any free writing prospectus that we may authorize to be delivered or made available to you. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus or any free writing prospectus is correct after the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful.

For investors outside the United States: We have not taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside the United States.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management’s estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management’s estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Our management’s estimates have not been verified by any independent source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Risk Factors” and “Cautionary Statement on Forward-Looking Statements.”

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

NextTrip, Inc., the NextTrip logo and other trademarks or service marks of NextTrip appearing in this prospectus are the property of NextTrip, Inc. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or that the applicable owner will not assert its rights, to these trademarks and tradenames.

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision in our securities. Before investing in our securities, you should carefully read this entire prospectus, including our financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” As used in this prospectus, unless the context otherwise requires, references to “we,” “us,” “our,” “Company,” and “NextTrip” refer to NextTrip, Inc. and its subsidiaries.

Business Overview

NextTrip is an early-stage, innovative technology company that is building next generation solutions to power the travel industry. NextTrip, through its subsidiaries, provides travel technology solutions with sales originating in the United States, leisure travel, business travel, groups travel, media and tech. We connect people to new places and discoveries by utilizing digital media engagement, seasoned planning expertise, and unique inventory to curate custom vacations and business travel across the globe. Our proprietary booking engine, branded as NXT2.0, provides travel distributors access to a sizeable inventory.

Our vision is to drive the evolution of the travel industry by merging advanced digital solutions with personalized travel services. Our core technology – a fully integrated travel booking platform – focuses on untapped and underserved sectors of the travel industry, intending to capture new markets. We expect that our future growth will be accelerated by interactive technology, immersive media and unparalleled travel industry expertise.

Presently, NextTrip generates revenue through two core methods: travel bookings and advertising revenue. Each division can independently drive revenue through their respective channels, but we have created exponential value by bringing the divisions together to create an engaging consumer-focused ecosystem. We have created opportunities to seamlessly move customers from one portion of the ecosystem to the next, with the ultimate goal of influencing a travel purchase decision.

For the six months ended August 31, 2024, we recognized revenue of $343,291 and recorded a net loss applicable to common stockholders of $3,534,743. For the fiscal year ended February 29, 2024, we recognized revenue of $458,752 and recorded a net loss applicable to common stockholders of $7,339,276.

We estimate that we will need to raise a minimum of $5.5 million in net proceeds to sustain our operations for the next twelve months. If we fail to raise the minimum amount needed, we will likely need to raise capital from other sources. Other than the Common Stock SPA entered into on September 19, 2024 (and described below), we currently have no arrangement to obtain any additional financing, and there is no assurance as to the amount and availability of any required future financing or the terms thereof. Any such financing, if in the form of equity, may be highly dilutive to our existing stockholders and may otherwise include onerous terms. If in the form of debt, such financing may include covenants and repayment obligations which may be difficult to meet and that could adversely affect our business and operations. To the extent that funds are not available to us, we may be required to delay, limit, or terminate our business and operations and/or lose our Nasdaq listing.

Organizational History

Historical Monaker Group Business

NextTrip’s travel business was the principal business of NextPlay (then, Monaker Group, Inc. (“Monaker”)) until June 30, 2020, when Monaker entered into a share exchange transaction with HotPlay Enterprise Limited (“HotPlay”), resulting in HotPlay becoming a wholly owned subsidiary of Monaker and HotPlay’s business becoming the principal business of Monaker. Prior to this share exchange, the primary focus of Monaker had been its travel business, which included the sale of vacation rentals, and in particular, alternative lodging rentals (“ALRs”), to consumers through its proprietary booking engine. To support its travel offerings, Monaker introduced travelmagazine.com, featuring travel and lifestyle content to appeal to travelers researching destinations and planning future vacations. In January 2023, NextPlay spun the NextTrip business out to its founders to separate it from NextPlay’s primary business. This resulted in NextTrip Group, LLC (“NTG”) operating the NextTrip business which was held in its wholly-owned subsidiary NextTrip Holdings, Inc. (“NTH”).

COVID-era Transition and Technology Development

The spread of the COVID-19 virus globally beginning in January 2020 severely impacted NTH’s historical business. Beginning in March 2020, many U.S. states and foreign countries began issuing “stay-at-home” orders and closed their borders to interstate and international travel. Such restrictions on travel, together with other measures implemented by governments around the world, severely restricted the level of economic activity around the world and had an unprecedented effect on the global travel industry. The public’s ability to travel was severely curtailed through border closures, mandated travel restrictions and limited operations of hotels, airlines, and additional voluntary or mandated closures of travel-related businesses from December 2019 through the beginning of 2022 (and beyond in some jurisdictions). Measures implemented during the COVID-19 pandemic led to unprecedented levels of temporary and permanent business closures, cancellations and limited new travel bookings, having a severe negative impact on our business, financial condition and results of operations.

Due to the significant decrease in demand for the travel related services provided by us during the peak of the COVID-19 pandemic, NTH shifted its focus to developing and enhancing our program offerings. For example, NTH began to develop its online media platform - TravelMagazine.com - allowing consumers to research future travel options as well as enhancing the functionality of its booking engines, including developing a booking engine platform that allows customers to book packaged vacations and wellness programs along with the development of a platform to arrange and manage business travel.

Acquisition of Bookit.com Asset

Following NTH’s separation from NextPlay, NTH’s team focused on the continued technological development of its booking platform. As part of this development, NTH acquired a travel platform, Bookit.com, in June 2022 to help power NTH’s proprietary NXT2.0 booking technology. The intent with this acquisition was to integrate Bookit.com’s technology into NTH’s existing booking platform to create NXT2.0. Pursuant to the terms of Asset Purchase Agreement (the “APA”), in exchange for a cash payment of $600,000, NTH acquired the Bookit.com booking engine, customer lists, all content associated to hotel and destination product in the booking engine, including pictures, hotel descriptions, restaurant descriptions, room descriptions, amenity descriptions, and destination information, and source code related thereto (the “Purchased Assets”). The Purchased Assets included: (i) all permits and licenses related to the purchased assets; (ii) all contracts and agreements oof Bookit.com (the “Assumed Contracts”); and (iii) any goodwill related to the Purchased Assets. Further to the APA, we agreed to assume any obligation or liability of Bookit.com, and any related claims, whether asserted prior to or following the Purchased Assets, with the exception of: (i) all tax obligations and liabilities of any nature arising in connection with or related to Bookit.com and/or the Purchased Assets prior to the Closing Date, and (ii) any post-Closing payment or performance obligations arising under the Assumed Contracts.

Previously, this technology powered the Bookit.com business, a well-established online leisure travel agent generating over $400 million in annual sales as recently as 2019 (pre-pandemic). As part of the acquisition of the assets of Bookit.com, NTH was not only able to acquire a proven technology platform that could be integrated with its core travel sectors, but it was also able to secure the Bookit.com database with millions of past travelers and opt-in consumers.

Since 2022 and the acquisition of the Bookit.com assets, NTH has been focused on the integration of Bookit.com into the NXT2.0 technology platform, which serves as a base for current and future technology projects as well as proprietary system enhancements. Bookit.com had negotiated contracts and created API’s linking it to approximately 250 travel related companies, based on NTH’s diligence in connection with such Bookit.com acquisition. The travel product offerings included conglomerate travel suppliers such as Expedia as well as uniquely contracted rates with airlines, hotel chains, car rental companies, cruise lines, tour operators and travel marketing companies. The contracts were terminated upon the closure of Bookit.com; however, NextTrip was afforded access to the previously developed API’s that gave Bookit access to these significant travel products. The Company has begun the process of contacting these former suppliers in an effort to re-engage with them, and re-negotiate new contracts which were previously in place with Bookit.com. The reactivation of some of these contracts will both increase the Company’s travel product offerings and improve the current pricing, thereby increasing revenues through commissions on sales of product offerings. To-date, through its negotiations, the Company has strategically reactivated 12-15 of these contracts for Phase 1 of its product launch, ensuring top-tier rates and options in premier destinations in Mexico and the Caribbean. NextTrip has also secured a contract with Expedia which represents unique product inventory of more than 3 million lodging, air and tour product suppliers at exceptional rates to over 2,100 destinations in 200+ countries worldwide, based on information from Expedia. Additionally, the Company continues efforts to establish partnerships with additional hotel, air, cruise and excursion suppliers. which is the “supply” or “product” side of the NXT2.0 booking platform.

Through this strategic offering, we will focus on key areas of opportunity in the travel sector and drive enhanced booking conversion rates. Our proprietary technology, when combined with media, product offerings and customer service, provides a unique lane to serve mid- to luxury travelers.

Our Integrated Travel Booking Platform

Our direct-to-consumer travel platform, NXT2.0, powers several websites, including our main leisure site, nexttrip.com, our widgets for groups travel and travel agents as well as providing travel booking solutions for our media hubs, travelmagazine.com and Compass.TV. We serve both leisure and business travelers by offering them access to travel blogs, videos and concierge assistance to aid in planning travel, coupled with our proprietary booking platform for the direct purchase of flights, hotels, tours, and other travel products. Our content includes destination guides, maps, and travel tips, designed to help travelers plan memorable trips and book those trips on our travel platform.

Our Travel Products and Services

NextTrip’s offerings span leisure and business travel, alternative lodging, wellness travel, and media solutions, engaging customers throughout their travel journey with both individual and packaged options. Highlights include:

| | ● | NextTrip Leisure – A robust booking engine providing customized vacation packages, flights, hotels, tours, wellness vacations, and group travel options. |

| | | |

| | ● | NextTrip Business – Corporate travel management for small to mid-sized businesses, featuring booking, expense reporting, concierge services, and 24/7 support. |

| | | |

| | ● | NextTrip Solutions – A suite for product management and white-label solutions, including property management, vacation rentals, and a portal to support travel agents. |

| | | |

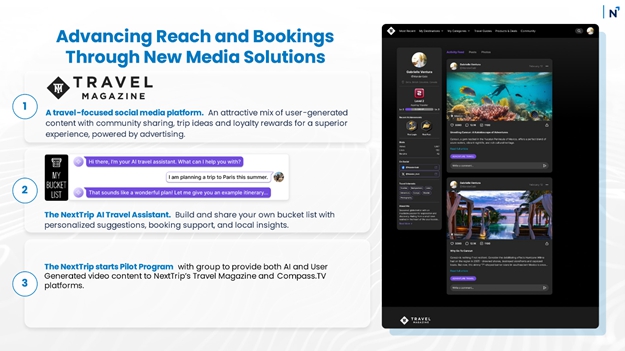

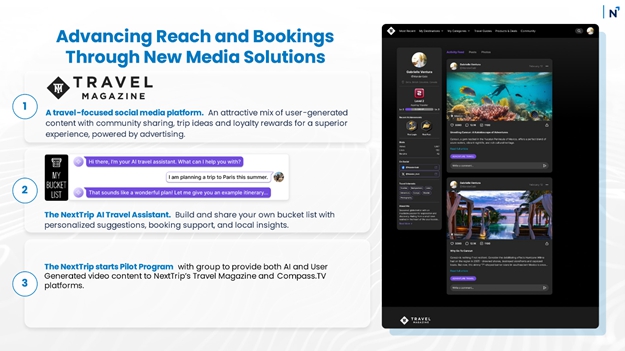

| | ● | NextTrip Media – Travel Magazine and Compass.TV offering travelers inspiration and information through articles, videos, and immersive digital experiences. This will include customizable travel channels for users to explore and share with friends and family. |

Traveler Features

Our marketplace at nexttrip.com offers tools for browsing and comparing flights, hotels, tours and activities. Additionally, we allow travelers to defer payments on select vacation packages with our proprietary FlexPay program. FlexPay allows travelers to purchase travel with a small deposit and make subsequent payments between purchase and the week before travel. Registered NextTrip travelers can manage bookings, receive updates on special offers, and subscribe to newsletters with travel tips and destination highlights. Security is a priority, with rigorous content screening and Payment Card Industry compliance to safeguard customer information.

Platform Evolution

Since COVID-19, we’ve focused on enhancing our booking engine and supplier partnerships. After acquiring Bookit.com’s technology in 2022, we launched our platform in May 2023 with limited listings. Since then, we have scaled to over a million hotel properties globally, now offering a complete leisure travel experience. We will continue to expand our platform to include specialty travel products and services like cruises and travel rewards programs in 2025.

Revenue Strategy and Ecosystem

NextTrip’s strategy focuses on integrating its Media and Travel divisions, offering users a comprehensive ecosystem designed to guide and support them throughout the travel experience. Presently, NextTrip generates revenue through two core methods: travel bookings and advertising revenue.

Travel Bookings

The company generates revenue from the sale of travel products. Product sales can either be structured as a set commission for the sale of a travel product whereby the supplier controls the pricing, or through a negotiated contract between the product supplier and the company that allows the company to set its own retail pricing based upon market forces and a need to maintain a markup above its fixed cost. This flexibility affords the company the opportunity to both run specials that are highly competitive but result in low margins, or to simply adjust pricing to maintain competitiveness within its market. Key factors that affect revenues and profitability include competitive market pressures from other travel suppliers and distributors, marketing budget to create awareness, and seasonality.

Advertising

The company is building its own ecosystem through Compass.tv and Travel Magazine. These media platforms are designed to allow users to explore and educate themselves on travel. As the number of viewers/users grows, it determines the advertising rates the company can charge others to promote travel products and services to our audience. Not only are the advertising dollars generated from our ecosystem expected to become a key driver of higher margin revenue than those earned from travel product sales, but as the audience grows it will provide additional opportunities for NextTrip to promote its own travel offerings to highly targeted viewers, thus lessening the need for spending significant marketing dollars through other mediums to attract consumers. To drive this initiative, the Company has entered into a partnership with Leap Media Group, a respected leader with over 35 years in TV advertising, media planning and buying. Compass.tv is now equipped to deliver branded entertainment content and advertising seamlessly across its platform, supported by targeted media strategy designed to optimize revenue well delivering high quality content to travel enthusiasts.

Though each division can independently drive revenue through their respective channels, we have created additional value by bringing the divisions together to create an engaging consumer-focused ecosystem. Today, we have created opportunities to seamlessly move customers from one portion of the ecosystem to the next, with the ultimate goal of influencing a travel purchase decision. As we move into the future, NextTrip will add additional revenue streams including more diversified, exclusive product from around the world, niche travel segments, technology licensing and enhanced media advertising opportunities.

In our current early stage of development, NextTrip travel offers travel product worldwide, but with a targeted initial focus on Mexico and the Caribbean. We intend to strategically expand this as the business scales. Compass.tv offers travel content across a variety of destinations and travel interests with the intent of capturing a broad audience. The audience capture and traffic directly impacts the advertising opportunity on the channel, so we anticipate this broad approach to continue as the business scales.

Key user benefits available today include:

| | ● | Access to relevant travel videos and articles for trip planning. |

| | ● | Personalized profiles for saving destinations and activities. |

| | ● | Social sharing of travel ideas and communication with others. |

| | ● | Concierge support for travel planning. |

| | ● | Options to book travel online or via our call center. |

| | ● | Proprietary payment solutions like FlexPay |

| | ● | Exclusive rates and promotions from targeted suppliers, creating strategic pricing and competitive advantage. |

| | ● | Technology for booking groups travel, applicable to both corporate and leisure travel. |

| | ● | Continuous customer support from booking through post-travel. |

Key user benefits under development for 2025 include:

| | ● | Introduction of a NextTrip Rewards programs for repeat bookings. |

| | ● | Introduction of Travel Magazine “My Bucket List” personalized planner. |

| | ● | Group chat and sharing platform. |

| | ● | AI travel assist to compliment concierge services. |

| | ● | Enhanced groups and travel agent widgets. |

| | ● | AI video creation for customized travel solutions. |

| | ● | Expanded travel product offerings including cruise and wellness vacations. |

NextTrip is in the early stages of development and roll out of its comprehensive travel and media model. While the products introduced to date (see above “Key user benefits available today”) are now functional and responsible for the revenue generation of the Company, the corresponding revenue streams are currently both small and unpredictable relative to the established travel industry leaders. Our ability to capitalize on existing travel technology platforms is severely restricted due to the lack of funding to drive marketing programs. Enhancements to the existing platforms along with the introduction of new programs under development (see above “Key user benefits under development for 2025”) are needed to complete the model. The timeline to complete these programs is dependent upon our ability to raise capital; however, we believe that most programs can be delivered within 180 days of completing the Offering. Once fully functioning, we believe the model will deliver accelerated growth as its “conversion technology” focuses on underserved areas in the travel sector utilizing platforms (i.e. FlexPay, Groups Bookings and Travel Agents) that are not well serviced by the major travel industry leaders. Additionally, we have introduced engagement and media solutions (i.e. Compass.TV and Travel Magazine), allowing users to better plan future travel. We believe a natural extension of providing users with media solutions to assist with travel planning will further the development and growth of a NextTrip ecosystem. This ecosystem is expected to assist NextTrip in reducing external marketing expenditures while creating a new revenue channel from targeted and timely advertising designed to assist users in their travel planning. Upon completion of the NextTrip model, the Company expects to drive revenues from travel solutions outside of the focus of major travel competitors as highlighted in the table below.

Technology and Infrastructure

Our websites are hosted using cloud services distributed globally across multiple regions. Our systems architecture has been designed to manage increases in traffic through additional computing power without making software changes. Our cloud services provide our online marketplace with scalable and redundant Internet connectivity and redundant power and cooling to its hosting environments. We use security methods to ensure the integrity of our networks and protection of confidential data collected and stored on our servers. We have developed and use internal policies and procedures to protect the personal information of our travelers using our websites that we collect and use as part of our normal operations. Access to NextTrip’s networks, and the servers and databases, on which confidential data is stored, is protected by industry standard firewall and encryption technology. Physical access to our servers and related equipment is secured by limiting access to the data center to operations personnel only.

Competition

The U.S. travel market is highly competitive and rapidly evolving. The markets are dominated by a few key distributors, which has caused suppliers to look for viable alternatives that would diversify their business mix.

Our competition, which is strong and increasing, includes online and offline travel companies that target leisure and corporate travelers, including travel agencies, tour operators, travel supplier direct websites and their call centers, consolidators and wholesalers of travel products and services, large online portals and search websites, certain travel metasearch websites, mobile travel applications, social media websites, as well as traditional consumer eCommerce and group buying websites. These companies include Expedia, Booking.com, TripAdvisor, Sabre Corp., TravelZoo and AirBnb. We are an early-stage company with nominal revenues. Though we do consider these companies competitors, they are all much larger and more advanced in development than our current offerings and we may be unable to raise sufficient capital or develop our technology at such a rate to compete for meaningful market share. In some cases, competitors are offering more favorable terms and improved interfaces to suppliers and travelers, which makes competition increasingly difficult. Also, in some cases, we offer larger, conglomerate product offerings like Expedia on our site for booking at a lower commission, which is common in the industry. We also face competition for customer traffic on internet search engines and metasearch websites, which impacts our customer acquisition and marketing costs.

Seasonality

We experience seasonal fluctuations in the demand for our travel products and services. For example, traditional leisure travel bookings are generally the highest in the first three quarters as travelers plan and book their spring, summer and winter holiday travel. The number of bookings typically decreases in the fourth quarter. Because revenue for most of our travel products is recognized when the travel takes place rather than when it is booked, revenue typically lags bookings by several weeks to several months. As a result, although travel bookings through our platforms tend to be highest from the period from January to June, moderate from July through September and low from October through December, the majority of revenue is recognized in the summer months (June, July, and August), and during the winter holidays (November and December).

Intellectual Property

Our intellectual property includes the content of our websites, registered domain names, registered and unregistered trademarks, business plan, business strategies and trade secrets, proprietary and acquired software platforms and related assets, licensed software platforms, and customer and third-party supplier lists. We believe that our intellectual property is an essential asset of our business and that our registered domain names and our technology infrastructure will give us a competitive advantage in the online market and arrangements with attractions and tour operators. We rely on a combination of trademark, copyright and trade secret laws in the United States, as well as contractual provisions, to protect our proprietary technology and our brands. We also rely on copyright laws to protect the appearance and design of our sites and applications. We have registered numerous Internet domain names related to our business in order to protect our proprietary interests.

Our key proprietary software platforms and systems include our booking engine, NXT2.0 which we enhanced through our acquisition and subsequent integration of the Bookit.com assets, the group travel booking platform, which allows for efficient and streamlined travel planning and booking for travel groups of five or more, FlexPay technology, which allows travelers to book a trip for as little as $1.00 down and pay over time with no interest, TravelMagazine, which offers tools to create personalized travel using video, blogs, reviews, tourism boards and AI planner and our recently launched FAST TV channel, Compass.TV, which aims to inspire audiences by highlighting the world’s best travel experiences and offering viewers a rich source of inspiration for planning their next journey.

Regulation

Our ability to provide our services and any future services is affected by legal regulations of governments and regulatory authorities around the world, many of which are evolving and subject to revised interpretations. Violations of any laws or regulations could result in fines, penalties, and criminal sanctions against us, our officers or employees, and prohibitions on how or where we conduct our business, which could damage our reputation, brands, global expansion efforts, ability to attract and retain employees and business partners, business, and operating results. Even if we comply with these laws and regulations, doing business in certain jurisdictions or violations of these laws and regulations by the parties with which we conduct business runs the risk of harming our reputation and our brands. Regulations that impact our business or our industry include in the areas of data protection and privacy, payment processing and travel-related regulations on “overtourism” and climate-related issues.

Recent Developments

Non-binding Letter of Intent to Acquire Luxury Travel Company Five Star Alliance

On November 5, 2024, we announced that we had signed a non-binding Letter of Intent (LOI) to acquire Five Star Alliance, an online luxury travel agency founded in 2004 and renowned for its curated collection of five-star luxury hotels and resorts worldwide. Five Star Alliance specializes in helping travelers discover and book the world’s top luxury hotels, offering personalized recommendations, competitive rates, and is known for world-class customer service. With a proprietary search engine that secures the best rates for thousands of 5-star hotels globally, the company also handles group travel bookings and high-end cruises.

Negotiations and due diligence with Five Star Alliance are ongoing and while the transaction is progressing, as of December 13, 2024 the parties have not yet agreed on definitive terms and it is uncertain as to whether such agreement will occur.

Acquisition of NextTrip Holdings, Inc.

On October 12, 2023, the Company (formerly known as Sigma Additive Solutions, Inc.) entered into a Share Exchange Agreement with NextTrip Holdings, Inc. (“NTH”), NextTrip Group, LLC (“NTG”) and William Kerby (the “NTH Representative”), pursuant to which the Company acquired NTH (the “Acquisition”) in exchange for shares of our common stock, which we refer to as the Exchange Shares. The Acquisition was consummated on December 29, 2023. As a result, NTH became a wholly owned subsidiary of the Company.

Upon the closing of the Acquisition, the shareholders of NTG, which we refer to collectively as the NTG Sellers, were issued a number of Exchange Shares equal to 19.99%, or 156,007 shares, of our issued and outstanding shares of common stock immediately prior to the closing. Under the Share Exchange Agreement, the NTG Sellers will be entitled to receive additional shares of our common stock, referred to as the Contingent Shares, subject to NTH’s achievement of future business milestones specified in the Share Exchange Agreement as follows:

| Milestone | | Date Earned | | Contingent Shares | | Status as of November 30, 2024 |

| Launch of NTH’s leisure travel booking platform by either (i) achieving $1,000,000 in cumulative sales under its historical “phase 1” business, or (ii) commencement of its marketing program under its enhanced “phase 2” business. | | As of a date six months after the closing date | | 1,450,000 Contingent Shares | | Achieved. Marketing program under “phase 2” has commenced. |

| | | | | | | |

| Launch of NTH’s group travel booking platform and signing of at least five (5) entities to use the groups travel booking platform. | | As of a date nine months from the closing date (or earlier date six months after the closing date) | | 1,450,000 Contingent Shares | | Achieved. Five groups have been contracted to use the groups travel booking platform. |

| | | | | | | |

| Launch of NTH’s travel agent platform and signing up of at least 100 travel agents to the platform (which calculation includes individual agents of an agency that signs up on behalf of multiple agents). | | As of a date 12 months from the closing date (or earlier date six months after the closing date) | | 1,450,000 Contingent Shares | | Not achieved. Three travel agencies which employ more than 100 travel agents have been identified but not yet engaged as the technology platform continues to be under development. |

| | | | | | | |

| Commercial launch of FlexPay technology in the NXT2.0 system. | | As of a date 15 months after the closing date (or earlier date six months after the closing date) | | 1,650,000 Contingent Shares, less the Exchange Shares issued at the closing of the Acquisition | | Achieved. FlexPay has been commercially launched. |

Alternatively, independent of the aforementioned milestones, for each month during the fifteen (15) month period following the closing date that in which $1,000,000 or more in gross travel bookings are generated by the combined company, to the extent not previously issued, the Contingent Shares will be issuable up to the maximum Contingent Shares issuable under the Share Exchange Agreement.

The Contingent Shares, together with the shares of our common stock issued at the closing, will not exceed 6,000,000 shares of our common stock, or approximately 90.2% of our issued and outstanding shares of common stock immediately prior to the closing. Assuming all the business milestones are achieved, historical Company shareholders will retain 9.8% of the Company’s outstanding shares.

As noted above, as of November 30, 2024, three of the four business milestones have been achieved. As a result, 4,393,993 of the contingent shares are eligible to be issued. The remaining 1,450,000 Contingent Shares will be eligible for issuance upon the launch of the Company’s Travel Agent platform,

Despite having achieved three of the four business milestones, the Company cannot issue the Contingent Shares without risk of the Company’s common stock being suspended from trading and delisted until Nasdaq approves the Company’s initial listing application, which is pending with Nasdaq. The Company has been advised by Nasdaq that issuing the contingent shares prior to approval of the application will result in the immediate delisting of the Company, as provided in Nasdaq Listing Rule 5110(a).

To date, NextTrip Holdings has not provided formal notice as required under the Share Exchange Agreement because, as described in more detail below, the issuance of said shares prior to Nasdaq approval of an initial listing application would result in the Company’s delisting and suspension of trading. In addition, no board appointment rights related to the Contingent Shares have been exercised. Notwithstanding the foregoing, on December 9, 2024, due to the indefinite nature of some of the recent delays and pressure from NTG Sellers, NTH and the Company entered into a Forbearance Agreement (the “Forbearance Agreement”) whereby NTH agreed to forebear from providing notice under the Share Exchange Agreement for the issuance of the Contingent Shares until January 31, 2025 in exchange for the Company acknowledging that 3 of the 4 milestones have been met and that it does not dispute that the Contingent Shares are earned and that the Company will, if the Nasdaq initial listing application is not approved on or before January 31, 2025, that the Company will (i) issue all such earned Contingent Shares within five (5) business days of January 31, 2025 and (ii) all such board appointment rights will be exercised and such members will be approved within five (5) business days of January 31, 2025. The Company has filed the Forbearance Agreement with the Commission pursuant to a Form 8-K filed on December 13, 2024 and has filed it as an Exhibit to this Registration Statement.

The Share Exchange Agreement provided that William Kerby, the Chief Executive Officer and co-founder of NTH, was appointed as Chief Executive Officer of the Company and Donald P. Monaco was appointed as a director of the Company as of the closing of the Acquisition. The NTH Representative (Mr. Kerby) will be entitled to designate a replacement for one additional director of the Company upon achievement of each of the milestones under the Share Exchange Agreement.

Asset Sale to Divergent

On October 6, 2023, the Company entered into an Asset Purchase Agreement with Divergent Technologies, Inc., or Divergent, pursuant to which the Company agreed to sell to Divergent, and Divergent agreed to purchase from us, certain legacy assets of the Company consisting primarily of patents, software code and other intellectual property for a purchase price of $1,626,242, including a $37,000 earnest-money deposit previously paid to us by Divergent. In the interim, between the signing date and closing date of the Asset Purchase Agreement, we granted Divergent a non-exclusive, non-transferable, non-sublicensable (except to Divergent customers and affiliates), limited, irrevocable (except in connection with the termination of the Asset Purchase Agreement in certain circumstances as described below), worldwide, royalty-free license to the “Licensed IP” (as defined) for testing, evaluation, and commercialization purposes.

The Asset Purchase Agreement closed on January 12, 2024. As a result, the NTH business became the primary business of the Company.

Name Change and Increase in Authorized Shares

Following the closing of the NTH Acquisition and the asset sale of the legacy Company assets to Divergent, the Company sought and obtained stockholder approval to change the name of the Company to NextTrip, Inc. and to increase the authorized shares from 1,200,000 shares of common stock to 250,000,000 shares of common stock. The name change and increase in authorized shares were approved by the Company’s stockholders at a Special Meeting of Stockholders held on March 8, 2024.

On March 11, 2024, the Company filed a Certificate of Amendment to its Amended and Restated Articles of Incorporation (the “Charter Amendment”), as amended to date (the “Current Articles”), with the Secretary of State of the State of Nevada, pursuant to which effective as of 12:01 a.m. Pacific time on March 13, 2024, (i) the Company’s corporate name was changed from Sigma Additive Solutions, Inc. to “NextTrip, Inc.”, and (ii) the number of shares of Company common stock authorized for issuance under the Current Articles will be increased from 1,200,000 shares to 250,000,000 shares.

In connection with the name change, effective as of the open of the market on March 13, 2024, the Company’s common stock began trading on the Nasdaq Capital Market under the new ticker symbol “NTRP”.

Promethean TV License Agreement

On January 26, 2024 (the “Effective Date”), the Company and NTH, now a wholly owned subsidiary of the Company, entered into a Perpetual License Agreement (the “License Agreement”) with Promethean TV, Inc. (“Promethean”), pursuant to which Promethean (i) sold NTH the code for the Licensed Software (as defined in the License Agreement) and (ii) granted NTH an irrevocable, worldwide, perpetual right and non-exclusive license to forever retain and use the code and each executable copy of the Licensed Software for the commercial exploitation by NTH in the travel solutions industry, subject to certain limitations set forth in the License Agreement (the “Perpetual License”). Promethean is the owner and developer of the Ignite TV interactive video platform used for driving engagement and commerce.

As consideration for the Perpetual License and the other rights granted pursuant to the License Agreement, the Company issued Promethean 100,000 restricted shares of its Series G Convertible Preferred Stock (“Series G Preferred”), and NTH waived all past debts to NTH previously incurred by Promethean. For a period of six months from the Effective Date, the Company has the right to repurchase up to fifty percent of the Series G Preferred issued to Promethean, or the shares of Company common stock underlying the Series G Preferred if converted during such period, for $1.00 as consideration for any breaches of representations and warranties or indemnities of Promethean pursuant to certain provisions of the License Agreement.

The Company did not exercise its option to repurchase up to 50% of the Series G Preferred Stock, and all such shares were converted to common stock by Promethean on March 15, 2024.

Nasdaq Compliance

On September 18, 2024, the Company received a notification letter (the “Notice”) from the Nasdaq Listing Qualifications Staff (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that its amount of stockholders’ equity has fallen below the $2,500,000 required minimum for continued listing set forth in Nasdaq Listing Rule 5550(b)(1). The Notice also noted that the Company does not meet the alternatives of market value of listed securities or net income from continuing operations, and therefore, the Company no longer complies with Nasdaq’s Listing Rules.

Under Nasdaq Listing Rules, the Company has until November 4, 2024 to provide Nasdaq with a specific plan to achieve and sustain compliance. If Nasdaq accepts the Company’s plan to regain compliance, Nasdaq may grant an extension of up to 180 calendar days from the date of the Notice to evidence compliance. If Nasdaq does not accept the Company’s plan to regain compliance, the Company will have the opportunity to appeal the decision to a Nasdaq Hearings Panel. A hearing request will stay the suspension and delisting of the Company’s securities pending the Nasdaq Hearings Panel’s decision. The Company has, as of November 4, 2024, submitted said compliance plan to Nasdaq as required and is awaiting a response from Nasdaq.

The Notice has no immediate effect on the listing of the Company’s common stock on the Nasdaq Capital Market, and, therefore, the Company’s listing remains fully effective.

Reverse Stock Split

On September 22, 2023, the Company effected a reverse stock split (the “Reverse Split”) of the issued and outstanding shares of our common stock and the number of shares of common stock that we are authorized to issue. The Reverse Split combined each 20 shares of the issued and outstanding common stock into one share of common stock. No fractional shares were issued in connection with the Reverse Split, and any fractional shares resulting from the Reverse Split were rounded up to the nearest whole share. All stock options, warrants, shares issuable upon conversion of the Company’s preferred stock and stock awards of the Company outstanding immediately prior to the Reverse Split were adjusted in accordance with their terms. All share and earnings per share information presented in this prospectus have been adjusted for the Reverse Split.

Securities Purchase Agreement

On September 19, 2024, the Company entered into a securities purchase agreement (the “Note & Warrant SPA”) with Alumni Capital LP (“Alumni Capital”) for the sale of a short-term promissory note (the “Alumni Note”) and warrants (“Warrants”) to Alumni Capital for total consideration of $250,000. After deducting commissions, net proceeds to the Company were $230,000.

The Alumni Note is in the principal amount of $300,000 with an original issue discount of $50,000 and guaranteed interest on the principal amount of ten percent (10%) per annum which shall be due and payable on December 19, 2024. In the event of a failure to re-pay the Alumni Note on or before December 19, 2024, the interest rate will increase to the lesser of twenty-two percent (22%) per annum or the maximum amount permitted under law from the due date thereof until the same is paid. The Alumni Note is convertible into common stock of the Company only upon an event of default.

On September 19, 2024, the Company also entered into a Common Stock Securities Purchase Agreement (the “Common Stock SPA”) with Alumni Capital. Pursuant to the Common Stock SPA, the Company has the right, but not the obligation to cause Alumni Capital to purchase up to $10 million shares of common stock (the “Commitment Amount”) at the Purchase Price (defined below) during the period beginning on the execution date of the Common Stock SPA and ending on the earlier of (i) the date on which Alumni Capital has purchased $10 million shares of common stock pursuant to the Common Stock SPA or (ii) December 31, 2025. Pursuant to the Common Stock SPA, the “Purchase Price” means the lowest traded price of Company common stock during the five (5) business days prior a closing date multiplied by eighty nine percent (89%). No Purchase Notice will be made without an effective registration statement and no Purchase Notice will be in an amount greater than $500,000. See Risk Factors – “If we raise additional capital through the sale of shares of our common stock, convertible securities or debt in the future, your ownership in us could be diluted and restrictions could be imposed on our business and “Our existing stockholders may experience significant dilution from the sale of our common stock pursuant to the Common Stock SPA” for more information.

Corporate Information

We were incorporated as Messidor Limited in Nevada on December 23, 1985, and changed our name to Framewaves Inc. in 2001. On September 27, 2010, we changed our name to Sigma Labs, Inc. On May 17, 2022, we began doing business as Sigma Additive Solutions, and on August 9, 2022, changed our name to Sigma Additive Solutions, Inc. On March 13, 2024, we changed our name to NextTrip, Inc.

Our principal executive offices are located at 3900 Paseo del Sol, Santa Fe, New Mexico 87507, and our telephone number is (954) 526-9688. Our website address is www.nexttrip.com. Unless expressly noted, none of the information on our corporate website is part of this prospectus or any prospectus supplement.

Risk Factor Summary

Below is a summary of the principal factors that make an investment in our securities speculative or risky. This summary does not address all of the risks that we face. Additional discussion of the risks summarized in this risk factor summary, and other risks that we face, can be found below and should be carefully considered, together with other information included in this prospectus.

We face risks and uncertainties related to our business, many of which are beyond our control. In particular, risks associated with our business include:

● Uncertainty and illiquidity in credit and capital markets can impair our ability to obtain credit and financing on acceptable terms and can adversely affect the financial strength of our business partners;

● The Company will need to raise a minimum of $5.5 million in net proceeds to support its operations, which funding may not be available on favorable terms, if at all;

● The Company’s operations have been negatively affected by, and have experienced material declines as a result of, COVID-19 and the governmental responses thereto, additional future government shutdowns or travel restrictions may have a material adverse impact on our business and financial condition;

● The Company’s operations are subject to uncertainties and risks outside of its control, including third party delays in submissions of listings and failures to maintain such rental listings, integrations of such listings and the renewal of such listings;

● The Company is subject to extensive government regulations and rules, the failure to comply which may have a material adverse effect on the Company;

● There is no assurance that we will continue to satisfy the listing requirements of The Nasdaq Capital Market;

● The success of the Company is subject to the development of new products and services over time;

● The Company is subject to competition with competitors who have significantly more resources, more brand recognition and a longer operating history than the Company;

● The Company is subject to risks associated with failures to maintain intellectual property and claims by third parties relating to an allegation that the Company violated such third parties’ intellectual property rights;

● The Company relies on third party service providers and the failure of such third parties to provide the services contracted for, on the terms contracted, or otherwise, could have a material adverse effect on the Company;

● The Company relies on the internet and internet infrastructure for its operations and in order to generate revenues;

● The Company’s ability to raise funding, and dilution caused by such fundings, anti-dilution rights included in outstanding warrants;

● Our business depends substantially on suppliers renewing their listings;

● The market in which we participate is highly competitive, and we may be unable to compete successfully with our current or future competitors;

● If we are unable to adapt to changes in technology, our business could be harmed;

● We have incurred significant losses to date and require additional capital which may not be available on commercially acceptable terms, if at all;

● There is no public market for the Pre-Funded Warrants or the Common Warrants being offered in this offering;

● We may not receive any additional funds upon the exercise of the Common Stock Warrants or the Pre-Funded Warrants; and

● Those discussed under the caption “Risk Factors” of this Registration Statement.

THE OFFERING

| Common stock outstanding before this | | 1,454,492 shares. |

| offering | | |

| | | |

| Common stock offered by us | | shares. |

| | | |

| Common Warrants offered by us | | Common Warrants to purchase up to shares of our common stock. Each Common Warrant will have an exercise price of $ per share, will be exercisable commencing on the date of issuance and will expire five (5) years from the date of issuance. The shares of common stock and Common Warrants will be sold together, with each share of common stock to be sold together in a fixed combination with a Common Warrant to purchase a share of common stock. This offering also relates to the shares of common stock issuable upon exercise of Common Warrants sold in this offering. To better understand the terms of the Common Warrants, you should carefully read the section of the prospectus entitled “Description of Securities We Are Offering–Common Warrants.” You should also read the form of Common Warrant, which is filed as an exhibit to the registration statement of which this prospectus forms a part. |

| | | |

| Pre-Funded Warrants offered by us | | We are also offering to those purchasers, if any, whose purchase of common stock in this offering would otherwise result in such purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation of this offering, the opportunity to purchase, if any such purchaser so chooses, Pre-Funded Warrants in lieu of shares common stock that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock. This offering also relates to the shares of common stock issuable upon exercise of any Pre-Funded Warrant sold in this offering. For each Pre-Funded Warrant that we sell, the number of shares of common stock that we are offering will be decreased on a one-for-one basis. The purchase price of each Pre-Funded Warrant will be equal to the combined public offering price per share of common stock and Common Warrant sold in this offering minus $0.001, the exercise price per share of common stock of each Pre-Funded Warrant. The Pre-Funded Warrants are immediately exercisable and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. To better understand the terms of the Pre-Funded Warrants, you should carefully read the section of the prospectus entitled “Description of Securities We Are Offering–Pre-Funded Warrants.” You should also read the form of Pre-Funded Warrant, which is filed as an exhibit to the registration statement of which this prospectus forms a part. |

| | | |

| Option to purchase additional shares | | We have granted the underwriter an option, exercisable for 30 days after closing of this offering, to purchase up to additional shares of Common Stock, Pre-Funded Warrants and/or Common Warrants from us at the combined public offering price per share less the underwriting discounts and commissions, solely to cover over-allotments, if any. |

| | |

| Common stock to be outstanding immediately after this offering | | shares (or shares if the underwriter exercises its over-allotment option in full), assuming no sales of Pre-Funded Warrants, which, if sold, would reduce the number of shares of common stock that we are offering on a one-for-one basis, and no exercise of Common Warrants sold in this offering or Underwriter’s Warrants issued in connection with this offering. |

| | | |

| Use of proceeds | | We estimate that our net proceeds from the sale of the shares of common stock (or Pre-Funded Warrants in lieu thereof) and accompanying Common Warrants we are offering under this prospectus will be approximately $ million (or approximately $ million if the underwriter exercises its option to purchase additional shares in full), assuming a public offering price of $ per share, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We currently intend to use the net proceeds we receive from this offering for general corporate purposes, including operating expenses, capital expenditures and working capital. See the section titled “Use of Proceeds” for additional information. |

| | | |

| Underwriter’s Warrants | | We have agreed to issue to the underwriter warrants to purchase up to a total of shares of our common stock (or shares assuming the over-allotment option is exercised in full), representing seven percent (7%) of the aggregate number of shares of our common stock and Pre-Funded Warrants (if any) sold in this offering. The warrants will be exercisable, at a price per share equal to 100% of the combined public offering price per share of common stock and Common Warrant, at any time and from time to time, in whole or in part, from 180 days after the commencement of sales in this offering to the fifth anniversary thereof. The registration statement of which this prospectus is a part also registers for sale the number of shares of common stock issuable upon exercise of the Underwriter’s Warrants. Please see “Underwriting – Underwriter’s Warrants” for a description of these warrants. |

| | | |

| Risk factors | | You should read the “Risk Factors” section of this prospectus beginning on page 11 and the other information in this prospectus for a discussion of factors to consider carefully before deciding to invest in our securities. |

| | | |

| Market symbol and trading | | Our common stock is listed on the Nasdaq Capital Market under the ticker symbol “NTRP”. We do not intend to apply for a listing of the Pre-Funded Warrants or the Common Warrants on any national securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants and Common Warrants will be limited. |

The number of shares of our common stock to be outstanding after this offering, as set forth above, is based on 1,454,492 shares of our common stock outstanding as of December 13, 2024. The number of shares of our common stock to be outstanding after this offering, as set forth above, excludes the following:

| | ● | 78,867 shares of our common stock subject to outstanding options having a weighted-average exercise price of $58.19 per share; |

| | | |

| | ● | 719,737 shares of our common stock subject to outstanding warrants having a weighted-average exercise price of $6.34 per share; |

| | | |

| | ● | 3,310 shares of our common stock issuable upon conversion of our Series E Convertible Preferred Stock; |

| | | |

| | ● | 33,000 shares of our common stock issuable upon conversion of our Series H Convertible Preferred Stock; |

| | | |

| | ● | 192,204 shares of our common stock issuable upon conversion of our Series I Convertible Preferred Stock; |

| | | |

| | ● | shares of our common stock issuable upon exercise of the Common Warrants being offered hereunder; and |

| | | |

| | ● | shares of common stock (or shares assuming the over-allotment option is exercised in full), issuable upon exercise of Underwriter’s Warrants to be issued to the underwriter or its designees as compensation in connection with this offering at an exercise price equal to 100% of the combined public offering price of the shares of common stock (or Pre-Funded Warrants in lieu thereof) and Common Warrants being offered hereunder. |

Except as otherwise indicated, all information in this prospectus assumes no exercise by the underwriter of its option to purchase additional shares from us.

Unless otherwise indicated, this prospectus reflects and assumes the following:

| | ● | the sale and issuance by us of all shares of common stock (or Pre-Funded Warrants in lieu thereof) and accompanying Common Warrants being offered hereunder; |

| | | |

| | ● | no exercise of the Common Warrants being offered hereunder; |

| | | |

| | ● | no exercise of the Underwriter’s Warrants to be issued upon consummation of this offering; |

| | | |

| | ● | no exercise of outstanding options or warrants; and |

| | | |

| | ● | no exercise by the underwriters of their option to purchase up to additional shares of our Common Stock, Pre-Funded Warrants and/or Common Warrants from us to cover over-allotments, if any. |

To the extent that any outstanding options, warrants, and convertible securities are exercised or converted, there may be further dilution to new investors. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

SUMMARY FINANCIAL DATA

The following tables summarize our historical financial data for the periods ended on and as of the dates indicated. We have derived the statements of operations data for the years ended February 29, 2024 and February 28, 2023 from our audited financial statements and related notes included elsewhere in this prospectus.

We have derived the unaudited financial data as of and for the six months ended August 31, 2024 and 2023 from our unaudited condensed financial statements included elsewhere in this prospectus, which have been prepared in accordance with generally accepted accounting principles in the United States of America on the same basis as the annual audited financial statements and, in the opinion of management, the unaudited data reflects all adjustments, consisting only of normal recurring adjustments, necessary for the fair presentation of the financial information in those statements.

Our historical results are not necessarily indicative of results that may be expected in the future, and results for the period ended August 31, 2024 are not necessarily indicative of the results to be expected for the full year ending February 28, 2025.

You should read the following summary financial data together with our financial statements and the related notes appearing elsewhere in this prospectus, as well as with the information in the section of this prospectus entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| (in thousands, except per share data) | | Year Ended February 29 and 28, | | | Six Months Ended August 31, | |

| | | 2024 | | | 2023 | | | 2024 | | | 2023 | |

| | | | | | (unaudited) | | | | | | (unaudited) | |

| Revenue | | $ | 459 | | | $ | 383 | | | $ | 343 | | | $ | 47 | |

| Cost of revenue | | $ | 398 | | | $ | 355 | | | $ | 329 | | | $ | 41 | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| General and administrative | | $ | 3,788 | | | $ | 3,566 | | | $ | 2,845 | | | $ | 1,364 | |

| Sales and marketing | | $ | 484 | | | $ | 707 | | | $ | 208 | | | $ | 91 | |

| Depreciation and amortization | | $ | 1,469 | | | $ | 707 | | | $ | 383 | | | $ | 668 | |

| Total operating expenses | | $ | 5,741 | | | $ | 4,980 | | | $ | 3,436 | | | $ | 2,123 | |

| Other income (expense) | | $ | (977 | ) | | $ | (82 | ) | | $ | (99 | ) | | $ | (139 | ) |

| Gain (loss) from discontinued operations | | $ | (675 | ) | | $ | — | | | $ | 8 | | | $ | — | |

| Provision for income taxes | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Preferred dividends | | | (7 | ) | | | — | | | | (21 | ) | | | | |

| Net loss applicable to common shareholders | | $ | (7,339 | ) | | $ | (5,034 | ) | | $ | (3,534 | ) | | $ | (2,256 | ) |

| Net loss per share – basic and diluted | | $ | (32.12 | ) | | $ | (70.32 | ) | | $ | (1.07 | ) | | $ | (27.06 | ) |

| Basic and diluted weighted average number of common shares | | | 228 | | | | 72 | | | | 3,277 | | | | 83 | |

| (in thousands) | | As of August 31, 2024 | |

| | | Actual | | | As Adjusted (1) | |

| | | (unaudited) | | | (unaudited) | |

| | | | | | | |

| Balance Sheet Data: | | | | | | | | |

| Cash and cash equivalents | | $ | 102 | | | $ | | |

| Current Assets | | $ | 1,358 | | | $ | | |

| Total Assets | | $ | 4,889 | | | $ | | |

| Current Liabilities | | $ | 5,023 | | | $ | | |

| Total Liabilities | | $ | 5,023 | | | $ | | |

| Accumulated Deficit | | $ | (27,686 | ) | | $ | | |

| Total Stockholders’ Equity (Deficit) | | $ | (134 | ) | | $ | | |

| (1) | As adjusted balance sheet data gives effect to our sale of shares of common stock in this offering at a public offering price of $ per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. As adjusted balance sheet data is illustrative only and will change based on the actual public offering price and other terms of this offering determined at pricing. Each $0.10 increase (decrease) in the combined public offering price per share of common stock and Common Warrant would increase (decrease) the amount of cash and cash equivalents, working capital, total assets, and total stockholders’ equity by approximately $ million, assuming no sale of Pre-Funded Warrants, that the number of shares of common stock offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting underwriting discounts and commissions, estimated offering expenses payable by us. We may also increase or decrease the number of shares of common stock and Common Warrants to be issued in this offering. Each increase (decrease) of 500,000 shares of common stock and Common Warrants offered by us would increase (decrease) the as adjusted amount of cash and cash equivalents, working capital, total assets and total stockholders’ deficit by approximately $ million, assuming no sale of Pre-Funded Warrants, that the combined public offering price per share of common stock remains the same, and after deducting underwriting discounts and commissions, and estimated offering expenses payable by us. |

RISK FACTORS

Investing in our securities involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this prospectus, including our financial statements and the related notes and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding whether to invest in our securities. The occurrence of any of the events or developments described below could harm our business, financial condition, operating results, and/or growth prospects. The risks described below are not the only ones facing us. Our business is also subject to the risks that affect many other companies, such as competition, labor relations, general economic conditions, inflation, supply chain constraints, geopolitical changes, and international operations. We operate in a rapidly changing environment that involves a number of risks, some of which are beyond our control. Additional risks not currently known to us or that we currently believe are immaterial also may impair our business operations and our liquidity. The risks described below could cause our actual results to differ materially from those contained in the forward-looking statements we have made in this prospectus, the information incorporated herein by reference, and those forward-looking statements we may make from time to time. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider the following to be a complete discussion of all potential risks or uncertainties.

Risks Related to Our Business

Our revenue is derived from the global travel industry, and a prolonged or substantial decrease in global travel, particularly air travel, could adversely affect our operating results.

Our revenue is derived from the global travel industry and would be significantly impacted by declines in, or disruptions to, travel activity, particularly air travel. Global factors over which we have no control, but which could impact our clients’ willingness to travel and, depending on the scope and duration, cause a significant decline in travel volumes include, among other things:

● widespread health concerns, epidemics or pandemics, such as the COVID-19 pandemic, the Zika virus, H1N1 influenza, the Ebola virus, avian flu, SARS or any other serious contagious diseases;

● global security concerns caused by terrorist attacks, the threat of terrorist attacks, or the precautions taken in anticipation of such attacks, including elevated threat warnings or selective cancellation or redirection of travel;

● cyber-terrorism, political unrest, the outbreak of hostilities or escalation or worsening of existing hostilities or war, such as Russia’s invasion of Ukraine and the military conflict in Israel, resulting sanctions imposed by the U.S. and other countries and retaliatory actions taken by sanctioned countries in response to such sanctions;

● natural disasters or severe weather conditions, such as hurricanes, flooding and earthquakes;