5875 Landerbrook Drive, Suite 220

Cleveland, Ohio 44124

September 30, 2022

VIA EDGAR CORRESPONDENCE

Securities and Exchange Commission

Division of Corporation Finance

Office of Energy & Transportation

100 F Street, N.E.

Washington, D.C. 20549

Re: NACCO Industries, Inc.

Form 10-K for the Fiscal Year Ended December 31, 2021 Filed March 2, 2022

Form 10-Q for the Fiscal Quarter Ended June 30, 2022 Filed August 3, 2022

File No. 001-09172

Ladies and Gentlemen:

On behalf of NACCO Industries, Inc. (“NACCO” or the “Company”), set forth below are responses to the comments from the staff (the “Staff”) of the United States Securities and Exchange Commission (the “Commission”) received by letter, dated September 14, 2022 (the “Comment Letter”), regarding the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 (the “10-K”) and the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2022. The numbered paragraphs of this letter correspond to the paragraph numbers contained in the Comment Letter and, to facilitate the Staff’s review, we have reproduced the text of the Staff’s comments in bold and italics below.

Form 10-K for the Fiscal Year Ended December 31, 2021 Item 2. Properties

2.0 Material Mining Properties, page 33

1.Please locate your property within one mile using an easily recognizable coordinate system and provide maps for your material properties as required by Item 1304(b)(1)(i) of Regulation S-K.

In response to the Staff’s comment, the Company intends to revise its disclosure in future filings starting with its Annual Report on Form 10-K for the year ending December 31, 2022 (the “2022 Form 10-K”) to include easily recognizable coordinate system and maps within Item 2. Properties.

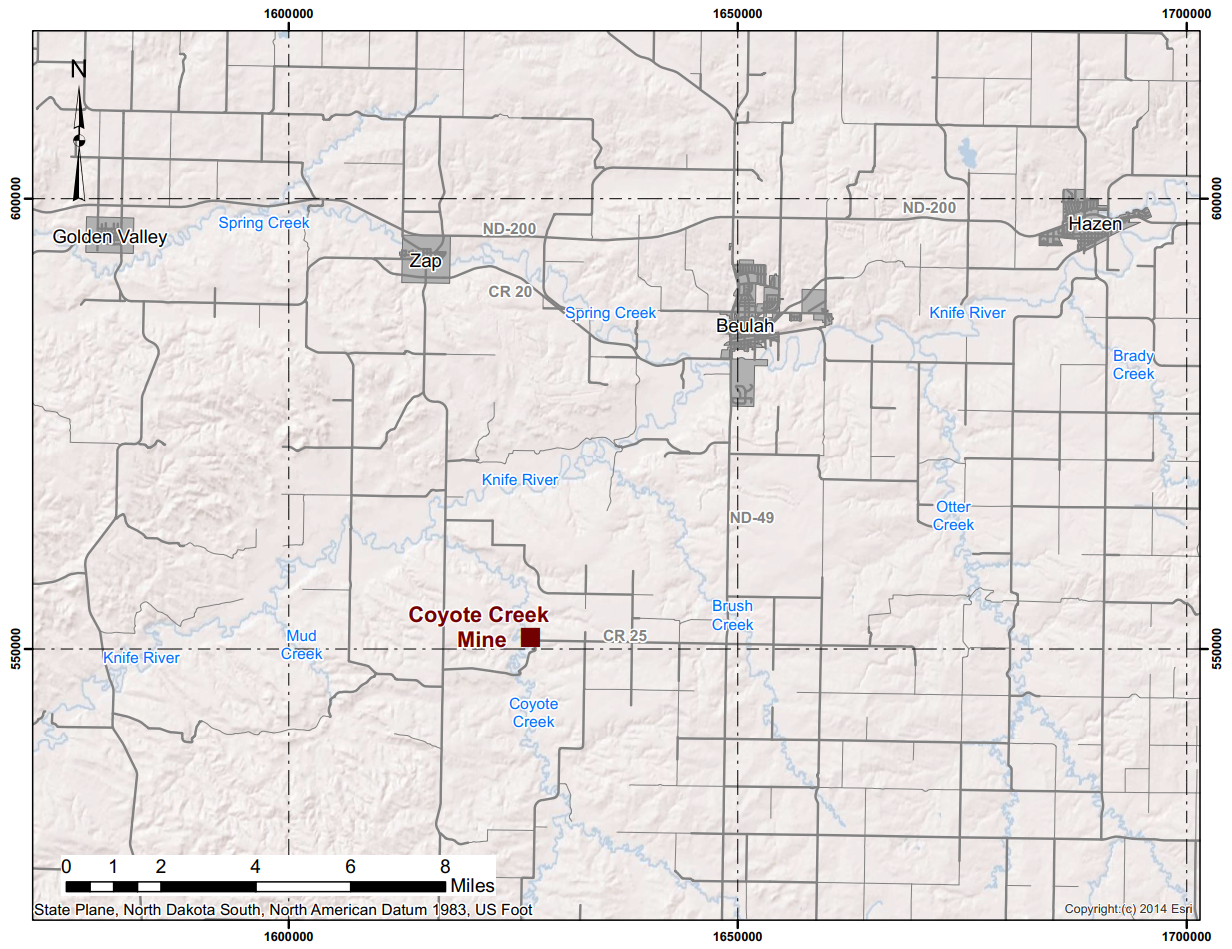

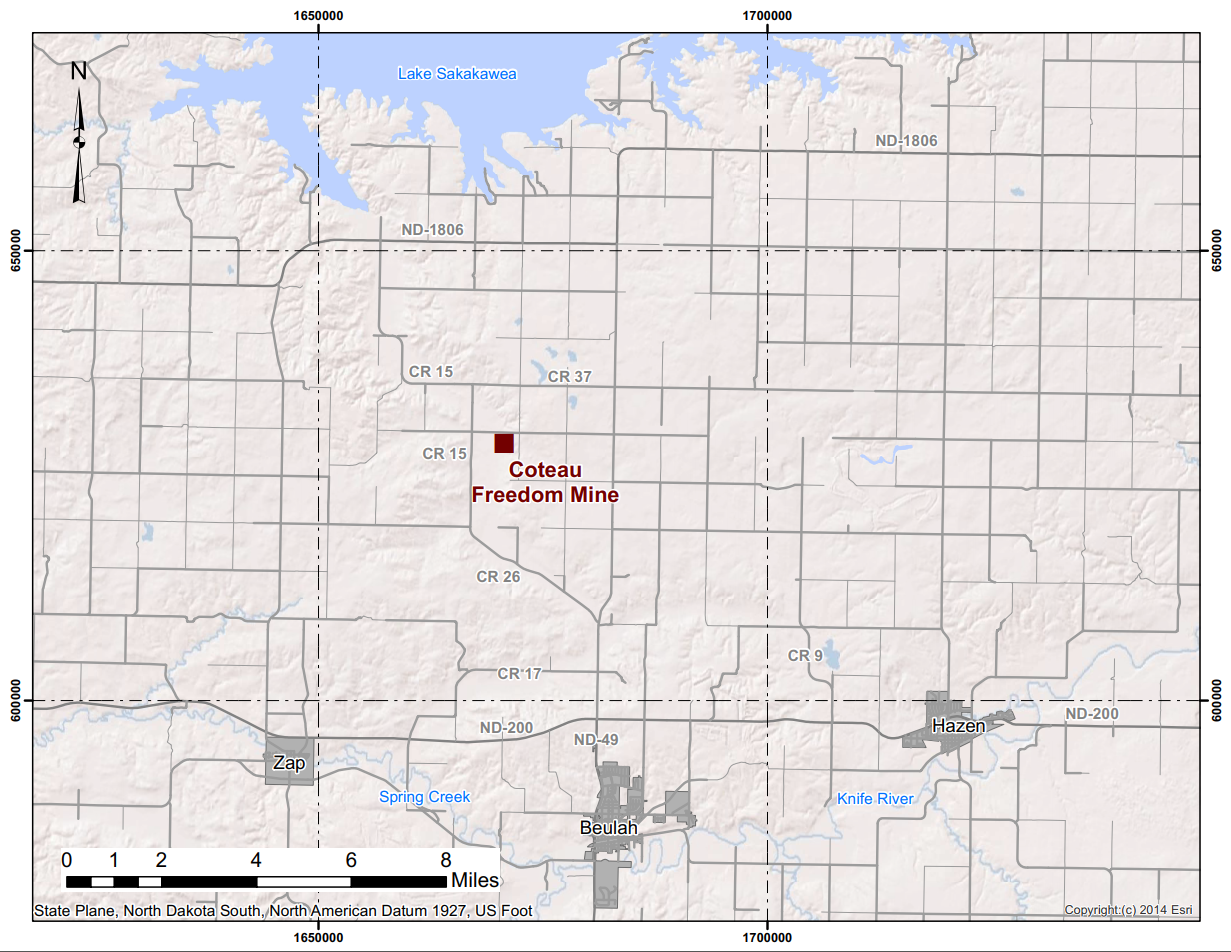

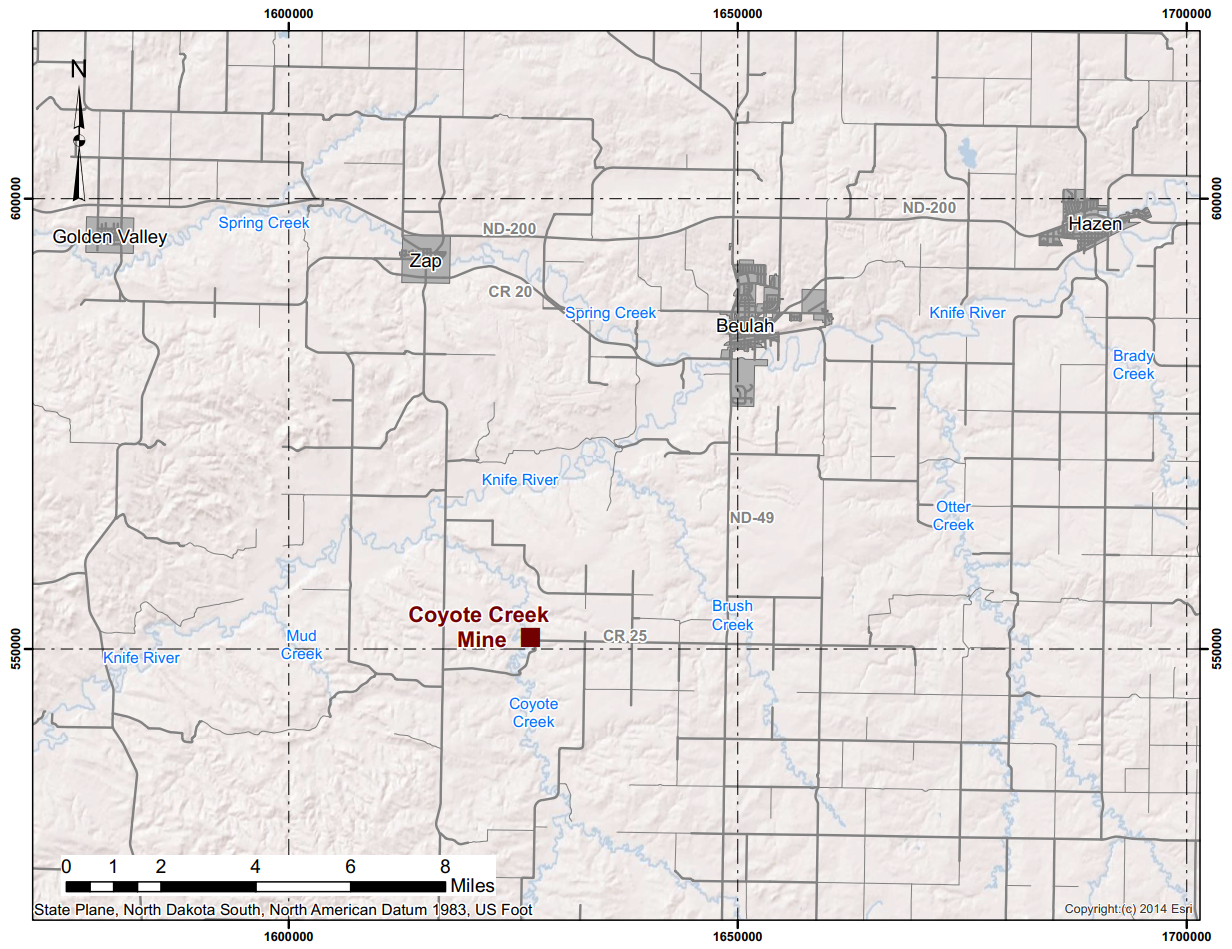

The following maps will be included:

3.0 Mineral Resources and Reserves, page 35

2.We note your Falkirk and Coyote Creek mines report resources inclusive of reserves. Please revise to present your resources exclusive of reserves and provide clear disclosure that your resources are reported exclusive of reserves in your filing. See Item 1304(d)(2) of Regulation S-K.

In response to the Staff’s comment, the Company intends to revise its disclosure in future filings starting with its 2022 Form 10-K to present resources exclusive of reserves and provide clear disclosure that resources are reported exclusive of reserves.

The Company will revise Table 3.1 to remove Measured Mineral Resources and Indicated Mineral Resources for Coyote Creek Mining Company and The Falkirk Mining Company, update the Mineral Resources for The Coteau Properties Company to be exclusive of Mineral Reserves and update the title of the table to be “Mineral Resources Summary, Exclusive of Mineral Reserves.”

The updated table will be amended as follows (all information is as of December 31, 2021):

3.Please disclose the price used to estimate your resources and reserves as required by Item 1304(d) footnote 1 to Table 1 and 2 of Paragraph (d)(1) of Regulation S-K.

In response to the Staff’s comment, the Company notes that the prices are disclosed in the headings of Table 3.1 and Table 3.2 on pages 35 and 36, respectively. The Company intends to revise its disclosure in future filings starting with its 2022 Form 10-K to include the price used to estimate resources and reserves within a paragraph before, and referring to, Tables 3.1 and 3.2.

4.Please revise to compare your current resource and reserve estimates to your previous estimates. See Item 1304(e) of Regulation S-K.

In response to the Staff’s comment, the Company notes that this information was included in Exhibits 96.1 through 96.4 but was not included in the body of the Annual Report on Form 10-K for the year ending December 31, 2021. The Company intends to revise its disclosure in future filings starting with its 2022 Form 10-K to include this information within Item 2. Properties.

In Exhibits 96.1 through 96.4, this information was included in the Discussion of Prior Resource and Reserve Estimations within the Individual Property Disclosure included at the end of each TRS on the following pages:

Exhibit 96.1 – Pages 17-18

Exhibit 96.2 – Pages 6-7

Exhibit 96.3 – Pages 18-19

Exhibit 96.4 – Pages 14-15

Item 15. Exhibits and Financial Statement Schedules Exhibit 96.1

Drilling Type and Extent, page 43

5.The drill hole location map for the Freedom Mine found on Figure 7.1 in the Supplemental Figures Attachment is not legible. Please revise. See Item 601(b)(96)(iii)(b)(3)(i) of Regulation S-K.

In response to the Staff’s comment, the Company intends to revise its drill hole location map in Exhibit 96.1 starting with its 2022 Form 10-K to ensure legibility.

Exhibit 96.3

Capital Costs, page 87

6. We note the life of mine capital costs do not compare to the amounts at Table 18.3. Please explain or revise accordingly.

In response to the Staff’s comment, the Company notes that there was typographical error in the paragraph above Table 18.3. The Company will edit the paragraph as follows in its 2022 Form 10-K.

18.2 CAPITAL COSTS

Capital Costs were estimated to a PFS level of study based on past equipment purchase history and vendor quotes. Capital Costs include equipment expenditures, mine development, mitigation, and land acquisitions. All capital costs incurred by the Falkirk Mine are provided by or reimbursed by the customer as required under the terms of the CSA’s. There are risks regarding the capital costs estimates, including escalating costs of raw materials, equipment availability and timing due to either production delays or supply chain gaps. Future capital costs included in the LOM plan are expected to total approximately $59.0 MM$130.8 MM. The estimated annual capital costs are summarized in Table 18.3. Should the CSA be extended beyond 2031, additional capital costs would be required and funded by CCSPP.

Table 18.3. Capital Costs.

Exhibits 96.1, 96.2, 96.3, & 96.4

Property Description, page ES-1

7.Please locate your property within one mile using an easily recognizable coordinate system as required by Item 601(b)(96)(iii)(B)(3)(i) of Regulation S-K.

Response: In future filings, the Company will revise the technical report summaries to comply with Item 601(b)(96)(iii)(B)(3)(i).

The Company will revise Exhibit 96.1 to incorporate the following map:

The Company will revise Exhibit 96.2 to incorporate the following:

The Company will revise Exhibit 96.3 to incorporate the following map:

The Company will revise Exhibit 96.4 to incorporate the following map:

Exhibits 96.1, 96.2, 96.3, & 96.4

Mineral Resource Estimates, page ES-2

8.We note your Falkirk and Coyote Creek mines report resources inclusive of reserves. Please revise to present your resources exclusive of reserves and provide clear disclosure that your resources are reported exclusive of reserves in your filing. See Item 601(b)(96)(iii)(B)(11)(ii) of Regulation S-K.

Response: In future filings, the Company will revise the technical report summaries to comply with Item 601(b)(96)(iii)(B)(11)(ii). In future filings, the items required in the Individual Property Disclosure (1304) will be included in the Form 10-K rather than attached to the end of the TRS reports.

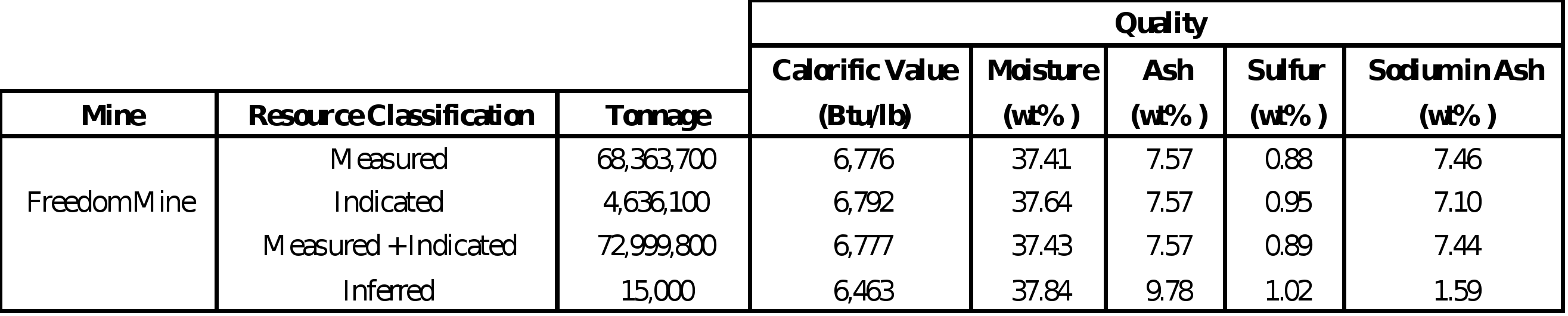

The Company will revise Exhibit 96.1 (The Coteau Mining Company – Freedom Mine) to incorporate the following:

Table 1.1 on page 11, Table 11.4 on page 67, and Table 1.3 on page 17 of the Individual Property Disclosure included in Exhibit 96.1 after the TRS report will be amended to be titled “Mineral Resources, Exclusive of Mineral Reserves” and the table will be amended as follows:

Table 1.6 on page 18 of the Individual Property Disclosure included in Exhibit 96.1 after the TRS report will be amended to include the Mineral Resource tonnages in the table above and the title of the table will be amended to be “Net difference between 2021 and 2022 reported Mineral Resources (exclusive of Mineral Reserves) and Reserves”

The Company will revise Exhibit 96.2 (Coyote Creek Mining Company) to incorporate the following:

Table 1.1 on page 12 and Table 11.5 on page 52 will be removed and the Company will add the following above the table “At the time of the TRS report, there are no Mineral Resources exclusive of Mineral Reserves.”

Table 1.2 on page 6 of the Individual Property Disclosure included in Exhibit 96.2 after the TRS report will be removed and the Company will change the paragraph above Table 1.2 to the following sentence “At the time of the filing, there are no Mineral Resources exclusive of Mineral Reserves.”

Table 1.5 on page 7 of the Individual Property Disclosure included in Exhibit 96.2 after the TRS report will be amended to show 0 tons for Mineral Resources at January 1, 2022.

The Company will revise Exhibit 96.3 (Falkirk Mining Company) to incorporate the following (insertions underlined and deletions stricken):

Table 1.1 on page 11 and Table 11.5 on page 62 will be removed.

The Company will edit the paragraph above Table 1.1 as follows (insertions underlined and deletions stricken)

At the time of this TRS report, Tthere are no reported Mineral Resources exclusive of Mineral Reserves at the Falkirk Mine. The economically mineable portions of the Measured and Indicated Mineral Resources within the constraints of the CSA and under lease control have been converted to Mineral Reserves.

The Company will edit the paragraph above Table 11.5 as follows (insertions underlined and deletions stricken):

At the time of this TRS report, there are noThe categorized Mineral Resources reported herein are exclusive (or inclusive) of Mineral Reserves at the Falkirk Mine. The effective date of Mineral Resource estimates is December 31, 2021.

Table 1.3 on page 17 of the Individual Property Disclosure included in Exhibit 96.3 after the TRS report will be removed and the Company will change the paragraph above Table 1.3 to the following sentence “At the time of the filing, there are no Mineral Resources exclusive of Mineral Reserves.”

Table 1.6 on page 19 will be amended to show 0 tons for Mineral Resources 1-Jan 21.

The Company notes that no revisions are required for Exhibit 96.4 (Mississippi Lignite Mining Company).

Exhibits 96.1, 96.2, 96.3, & 96.4

Mining Methods, page ES-3

9.Please provide a life of mine production schedule that supports your economic analysis. See Item 601(b)(96)(iii)(B)(13) of Regulation S-K.

In response to the Staff’s comment, the Company notes that for The Coteau Properties Company, Coyote Creek Mining Company and The Falkirk Mining Company (Exhibit 96.1 through 96.3), each contract with their respective customers is a cost-plus management fee contract. For these three locations, the Company is paid a management fee per ton of coal delivered. In future filings, the Company will include within the Executive Summary the following detail that is currently included in Section 13.1 in the respective TRS reports:

Exhibit 96.1: The Freedom Mine is designed to supply approximately 14 to 16 million tons of lignite per year but generally produces between 12.5 million and 13.5 million tons of lignite coal annually. All production from the mine is delivered to DCC, a wholly owned subsidiary of BEPC. DCC then sells the coal to DGC (planned through 2045), AVS (planned through 2045), and to LOS (planned through 2040), all of which are operated by affiliates of BEPC (See Figure 12.1 Life of Mine Map, located in the Supplemental Figures Attachment).

Exhibit 96.2: The Coyote Creek Mine is designed to supply a maximum of 2.5 million tons but generally supplies approximately 1.7 to 2.0 million tons of lignite per year to the adjacent Coyote Station Power Plant through 2040. Actual production is dictated by customer utilization. Approximately 36 Mt of lignite is expected to be mined and sold from 2022 through 2040 bringing the projected 25-year LOM tonnage to approximately 46 Mt since the mine’s inception. An outline of these tons is shown in Figure 12.1 Life-of-Mine Map.

Exhibit 96.3: The Falkirk Mining Company’s Falkirk Mine is a surface lignite mining operation located near Underwood, North Dakota. This operation is a multiple seam mining operation, which is projected to ultimately produce approximately 7.0 million tons per year through 2031.

For Mississippi Lignite Mining Company, the Company will include within the Executive Summary the following detail that is currently included in Section 13.2 in the TRS report:

The Red Hills Mine was designed to supply approximately 2.6 to 3.2 million tons of lignite per year to the adjacent RHPP. Actual production is dictated by customer MMBtu demand. MLMC provides the lignite for the RHPP under a contract that runs through April 2032. Mining dimensions are discussed in Sections 13.1 and 13.3 of this TRS.

Exhibits 96.1, 96.2, 96.3, & 96.4

Market Studies, page ES-4

10.Please provide a summary of the major terms of your coal contracts. See Item 601(b)(96)(iii)(B)(16) of Regulation S-K.

In future filings, the Company will include the following summary of the major terms of the Lignite Sales Agreement within the Executive Summary of Exhibit 96.1 (insertions are underlined):

Coteau provides mining services to DCC. DCC is Coteau’s only customer under an all-requirements cost-plus management fee LSA. Coteau is paid a management fee per ton of coal delivered. The contract specifies the indices and mechanics by which fees change over time,

generally in line with broad measures of U.S. inflation. DCC is responsible for funding all mine operating costs, including final mine reclamation, and directly or indirectly provides all of the capital required to operate the mine. This contract structure eliminates exposure to spot coal market price fluctuations. Debt financing provided is by or supported by DCC and is without recourse to NACCO. Coteau performs contemporaneous reclamation activities in the normal course of operations. Coteau holds the mine permit and is therefore responsible for final mine reclamation activities and will be compensated by DCC for providing those services in addition to receiving reimbursement from DCC for actual reclamation costs incurred. Additional discussion of material contracts is provided in “16.0 Market Studies - 16.2 – Material Contracts.”

In future filings, the Company will include the following summary of the major terms of the Lignite Sales Agreement within the Executive Summary of Exhibit 96.2 (insertions are underlined):

Coyote provides mining services under the LSA. Coyote Station is Coyote’s only customer under an all-requirements cost-plus management fee LSA. Under the LSA, Coyote receives a contractually-agreed fee based on the amount of lignite delivered. While Coyote is responsible for all mine operations, the Coyote Station Owners are responsible for funding all mine operating costs, including final mine reclamation, and guarantee all of the capital required to build and operate the mine. This contract structure eliminates exposure to spot coal market price fluctuations. Debt financing is provided by or supported by the Coyote Station Owners and is without recourse to NACCO. Coyote performs contemporaneous reclamation activities in the normal course of operations. Coyote holds the mine permit and is therefore responsible for final mine reclamation activities and will be compensated by the Coyote Station Owners for providing those services in addition to receiving reimbursement for actual reclamation costs incurred. Additional discussion of material contracts is provided in “16.0 Market Studies - 16.2 – Material Contracts.”

In future filings, the Company will include the following summary of the major terms of the Coal Sales Agreement within the Executive Summary of Exhibit 96.3 (updated to reflect the sale of the Coal Creek Station Power Plant (the “CCSPP”) that was completed on May 2, 2022 (insertions are underlined):

Falkirk is the sole supplier of lignite coal to the CCSPP.

Falkirk provided mining services to GRE until May 2, 2022 when the sale of CCSPP and the adjacent high-voltage direct current transmission line to Rainbow Energy Center, LLC (“Rainbow Energy”) and its affiliates was completed. The new Coal Sales Agreement (“CSA”) between Falkirk and Rainbow Energy became effective upon the closing of the transaction. Falkirk will continue to supply all coal requirements of CCSPP. Falkirk will be paid a management fee and Rainbow Energy will be responsible for funding all mine operating costs, including mine reclamation, and directly or indirectly providing all of the capital required to operate the mine. The initial production period is expected to run through May 2032, but the CSA may be extended or terminated early under certain circumstances. To support the transfer to new ownership, Falkirk agreed to a reduction in the per ton management fee from May 2022 through May 31, 2024. After May 31, 2024, the per ton management fee increases to a higher base in line with 2021 fee levels, and thereafter adjusts annually according to an index which tracks broad measures of U.S. inflation. Debt financing is provided by or supported by Rainbow Energy and is without recourse to NACCO. The Company performs contemporaneous reclamation activities in the normal course of operations. Rainbow Energy has the obligation to fund final mine reclamation activities. Falkirk holds the mine permit and is therefore responsible for final mine reclamation activities and will be compensated by Rainbow Energy for providing those services in addition to receiving reimbursement for actual reclamation costs incurred. Additional discussion of material contracts is provided in “16.0 Market Studies - 16.1.1 – Material Contracts.”

In future filings, the Company will include the following summary of the major terms of Lignite Sales Agreement within the Executive Summary of Exhibit 96.4 (insertions are underlined):

MLMC is the exclusive supplier of lignite to the Red Hills Red Hills Power Plant (RHPP) in Choctaw County, Mississippi under a lignite sales agreement (LSA) with Choctaw Generation

Limited Partnership (CGLP) that runs through April 2032. The RHPP supplies electricity to the Tennessee Valley Authority (TVA) under a long-term Power Purchase Agreement (PPA). CGLP leases the RHPP from a Southern Company subsidiary pursuant to a leveraged lease arrangement. The Life of Mine (LOM) plan used in this TRS report covers the period from January 2022 through April 2032 as the LOM plan assumes the RHPP will not continue to operate after the expiration of the current LSA with CGLP and the expiration of the existing PPA between TVA and CGLP in April 2032. MLMC sells coal to CGLP at a contractually agreed-upon price which adjusts monthly, primarily based on changes in the level of established indices which reflect general U.S. inflation rates. MLMC is responsible for all operating costs, capital requirements and final mine reclamation. Profitability at MLMC is affected by customer demand for coal and changes in the indices that determine sales price and actual costs incurred. As diesel fuel is heavily weighted among the indices used to determine the coal sales price, fluctuations in diesel fuel prices can result in significant fluctuations in earnings at MLMC. Additional discussion of material contracts is provided in “16.0 Market Studies - 16.2 – Material Contracts.”

Exhibits 96.1, 96.2, 96.3, & 96.4

Economic Analysis, page ES-5

11.Please provide annual numerical values for your annual cash flow, including your annual production, salable product quantities, revenues, major cost centers, taxes and royalties, capital, and final reclamation and closure costs. See Item 601(b)(96)(iii)(b)(19) of Regulation S-K. Please provide supplementally a functioning excel file of your cash flow analysis.

In response to the Staff’s comment, the Company notes that for The Coteau Properties Company, Coyote Creek Mining Company and The Falkirk Mining Company (Exhibit 96.1 through 96.3), each contract with their respective customers is a cost-plus management fee contract. For these three locations, the Company is paid a management fee per ton of coal delivered. The contract specifies the indices and mechanics by which fees change over time, generally in line with broad measures of U.S. inflation. Each customer is responsible for funding all mine operating costs, including final mine reclamation, and directly or indirectly provides all of the capital required to operate the mine. This contract structure eliminates exposure to spot coal market price fluctuations. In future filings, the Company will include the following detail from Section 19.2 within the Executive Summary:

Within Exhibit 96.1, the Company will add: The cost-plus nature of the LSA provides assurance that all costs incurred by Coteau will be reimbursed by DCC and negates any risk of loss to Coteau, which allows the mine to remain cash flow positive in 2022 and remain so through 2037.

Within Exhibit 96.2, the Company will add: The cost-plus nature of the LSA provides assurance that all costs incurred by the Coyote Creek Mine will be reimbursed by the Coyote Station Owners and negates any risk of loss to the Coyote Creek Mine and allows the mine to remain cash flow positive in 2022 and remain so through the end of the term of the LSA in 2040.”

Within Exhibit 96.3, the Company will add: The cost-plus nature of the CSA provides assurance that all costs incurred by Falkirk will be reimbursed by the customer and negates any risk of loss to Falkirk and allows the mine to remain cash flow positive in 2022 and remain so through the end of the CSA.

In future filings, the Company will revise the ECONOMIC ASSESSMENT section of the Executive Summary in Exhibit 96.4 to comply with Item 601(b)(96)(iii)(b)(19) (insertions underlined and deletions stricken).

ECONOMIC ASSESSMENT

The primary driver in determining the economic viability of the Red Hills Mine was the expected annual operating performance of the RHPP, which was forecasted using two main inputs: the annual projection notice (nomination for MMBtu requirements) received from the RHPP and a comparison to historical prior years actual delivered lignite fuel. The annual MMBtu requirement used in the Red Hills LOM Economic Model was 27,215,000 MMBtu. This resulted in a production schedule of approximately 2.7 million tons (Mt) of dedicated lignite per year each year until LSA contract expiration in April 2032.

LOM operating costs for a plan delivering 27,215,000 MMBtu per year to the RHPP total approximately $830 million (M). Operating costs included major cost categories for mine development, burden removal, severing of lignite, reclamation, maintenance and handling of stockpiled lignite and delivery to the adjacent RHPP along with the necessary maintenance required to keep all equipment operating safely and efficiently.

Capital costs to fulfill the LSA for a plan delivering 27,215,000 MMBtu per year to the RHPP are expected to total approximately $32 M. Capital Costs included categories for equipment expenditures, mine development, mitigation, and land acquisitions.

The base price for the dedicated lignite is defined in the LSA and consists of eight indexed components including a power cost component, a pass-through component, a royalty component and a fixed component. Over the LOM plan, the average price per ton for lignite delivered and sold is $28.04 providing revenues totaling approximately $769 M.

The projected annual cash flow forecast based on the lignite production schedule over the remaining LOM results in a total after-tax cash flow projection of $80M resulting in a net present value of $42 M at a 10% discount rate.

The Economic Assessment used what could be considered a conservative assumption in light of historical trends, current conditions and expected future developments for delivered fuel to the RHPP of 27,215,000 MMBtu annually. Therefore, the QP is of the opinion that any downside risks to the economic viability of the project to be minimal. There is a risk to the LOM plan if the RHPP takes less than the LOM plan MMBtu’s, but this scenario is not considered a significant risk as a result of the minimum take provisions included in the LSA. Other downside risks modeled were the effects of an increase in diesel prices and labor.

The Income Statement and Annual Cash Flows based on the lignite production schedule for the LOM plan, along with the Net Present Value are detailed in Table 19.1. A Discount Rate of 10% was used, as this was consistent with the Red Hills Mine’s weighted average cost of capital. The calculation of Net Present Value and Internal Rate of Return are nuanced due to the ongoing nature of this mining operation. As modeled, the cash flows for the period 2022 through 2045 indicate the project is cash flow positive over the remaining life of the project.

In the opinion of the QP, the income statement and cash flow projection based on the LOM plan assumptions as shown in Table 19.1 are reasonable in light of historical trends, current conditions and expected future developments. As modeled, the future cash flow projection is estimated to be approximately $80 M and the net present value is estimated to be approximately $42 M.

Note that the net present value calculated for this report does not consider previous cash inflows and outflows and is only calculated from 2022 through the remainder of the LOM.

Table 1.3 Summary of Income Statement and Cash Flow for LOM plan delivering 27,215,000 MMBtu

The Company will also supplementally provide an excel file that supports the MLMC cash flow analysis.

Form 10-Q for the Fiscal Quarter Ended June 30, 2022

Part 1. Financial Information Item 1. Financial Statements

Unaudited Condensed Consolidated Statements of Operations, page 2

12.We note that the company recognized a gain of $30.9 million within the Unaudited Condensed Consolidated Statements of Operations during the second quarter of 2022 as Great River Energy ("GRE") paid The North American Coal Corporation $14.0 million in cash, as well as transferred ownership of an office building with an estimated fair value of $4.1 million, and conveyed membership units in a privately-held company involved in the ethanol industry with an estimated fair value of $12.8 million, as agreed to under the termination and release of claims agreement between The Falkirk Mining Company and GRE. In this regard, $14.0 million was recorded as Operating Profit and $16.9 million was recorded as Other Income. Tell us how you determined which gains were operating versus non-operating, citing the relevant accounting literature.

The Company considered Item 5-03 of Regulation S-X which indicates the various line items which, if applicable, and except as otherwise permitted by the Commission, should appear on the face of the statements of comprehensive income.

The underlying assets that resulted in the gain of $16.9 million of income that the Company included as a component of other income are an office building located in Bismarck, North Dakota and membership units in a privately-held company, both non-operational in nature.

The investment in the privately-held company will be accounted for using the equity method, as required by ASC 323, under which we will report our proportionate share of the net earnings or losses of this private company as a component of other income from May 2, 2022, the effective date of the transaction. The rental income associated with the office building will also be recorded as a component of other income. The Company believes that this presentation is consistent with the guidance of Rule 5-03(b)(7) and 5-03(b)(9) of Regulation S-X as the Company believes these items are non-operational in nature as they are not part of its core business activities related to its operating businesses.

The Company also considered that many financial statement users disregard non-cash items when analyzing the Company’s performance and including the office building and membership units as a component of other income (expense) helps to facilitate that analysis.

The Company recorded the $14.0 million cash payment as a component of operating profit as this classification is consistent with the income statement classification of the recurring income associated with this operation. This is also consistent with the classification of a contract termination fee recognized in the third quarter of 2021 under which the Company received a cash payment of $10.3 million.

****

Please contact me at 440-229-5151 with any questions you may have regarding this letter. Electronic mail transmissions may be sent to me at jcb@nacco.com.

Sincerely,

/s/ J.C. Butler, Jr.

J.C. Butler, Jr.

Chief Executive Officer

NACCO Industries, Inc.