UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-04643

Volumetric Fund, Inc.

87 Violet Drive, Pearl River, NY 10965

Jeffrey Gibs

87 Violet Drive, Pearl River, NY 10965

(Name and address of agent for service)

Registrant's telephone number: 845-623-7637

Date of fiscal year end: December 31, 2022

Date of reporting period: December 31, 2022

Item 1. Reports to Stockholders.

December 31, 2022

2022

Volumetric Fund, Inc.

A Conservative Equity Growth Fund

Annual Report

2

3

To Our Shareholders: (Unaudited)

For 2022, Volumetric Fund’s (the “Fund”) net asset value (“NAV”) per share ended the year at $20.67 per share, as adjusted for distributions. This was a decline of 14.25% for the year, but a 5.86% increase for the 4th Quarter. The compounded annual growth rate, over our 44-year history, has been 8.80%. The Volumetric Index, a proprietary index, intended to measure the value of a $10,000 hypothetical investment in the Fund on January 1, 1979, was $409,761 on December 31, 2022.

The Fund uses two benchmarks to compare performance. These benchmarks are the S&P 500 Index, for the stock portion of the portfolio, and the FTSE 3 Month Treasury Bill Index for the money market portion of the portfolio. A combination of these benchmarks should be considered when making a comparison. For the year 2022, the S&P 500 Index declined 18.11% and the FTSE 3 Month T-Bill Index gained 1.50%.

The Fund went ex-dividend on December 28, 2022, with a long-term capital gain distribution of $1.13 per share, for shareholders of record on December 27, 2022. The distribution was reinvested with the purchase of additional shares, at the December 28, 2022, closing price of $20.54, except for shareholders with a cash dividend account. This distribution is reflected on your December 31, 2022, account statement. Additionally, a letter noting the distribution details was sent to shareholders along with the statement.

The investment objective of the Fund is capital growth and secondly downside protection. The Fund utilizes its proprietary “Volume and Range System” to raise cash during negative market conditions and conversely reduce cash during positive market conditions. Therefore, the asset allocation between stocks and cash (money market investments) may change due to market conditions. The Fund typically invests in a broadly diversified portfolio of large and mid-cap stocks, although the portfolio may also contain small cap stocks. The Fund’s securities are generally a blend of value and growth stocks.

PORTFOLIO UPDATES (Unaudited)

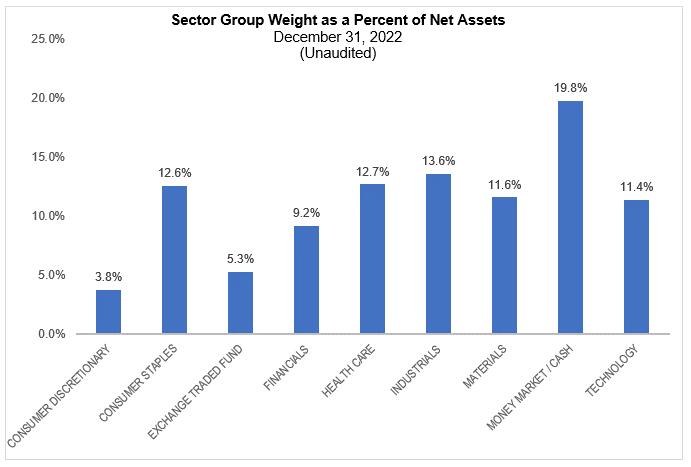

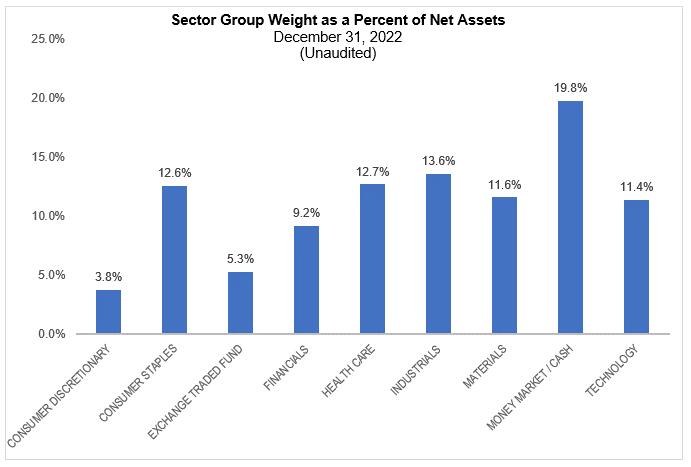

As of December 31, 2022, the Fund’s portfolio allocation was 80.2% equities and 19.8% cash and cash equivalent (Fidelity Investments Money Market Government Portfolio Class I).

The Fund held 53 securities, of which 44 had unrealized gains and 9 with unrealized losses. The average security in the portfolio had an unrealized gain of 45.4%. Our best percentage gaining stock was Microsoft Corp., with a 317.5% unrealized gain at year end. Our worst performing stock was McCormick & Co., with a 19.2% unrealized loss at year end. Our ten leading stocks are shown in the “Top Stock and Sector Holdings” section.

The following stocks were purchased during the 4th quarter: Air Products & Chemicals Inc, Bank of New York Mellon Corp, Becton Dickinson & Co, Cisco Systems Inc, Cognizant Technology Solutions Corp, Expeditors Int'l of Washington Inc, Lear Corporation, Norfolk Southern Corp, Olin Corp, Packaging Corp of America, and Pilgrim’s Pride Corp.

Based on the guidelines of our proprietary “Volume and Range” system, during the 4th quarter the following stocks were sold: Carlisle Companies Inc (partial position sold), Consolidated Edison Inc, Nasdaq Inc, Newell Brands Inc, PNC Financial Group, and Stanley Black & Decker Inc.

TOP STOCKS AND SECTOR HOLDINGS (Unaudited)

As of December 31, 2022, our ten top unrealized stock percentage gains are listed below. See Statement of Net Assets on pages 4 to 6 for details.

Company | Unrealized Gain (%) | % of Fund's Net Assets | | Sector | % of Fund's Net Assets |

Microsoft Corporation | 317.5 | 0.9 | | Consumer Discretionary | 3.8 |

Waste Connections Inc. | 202.9 | 2.4 | | Consumer Staples | 12.6 |

Apple, Inc. | 198.8 | 1.5 | | Exchange Traded Fund | 5.3 |

Bunge, Ltd. | 154.3 | 2.5 | | Financials | 9.2 |

CF Industries Holdings Inc. | 153.8 | 1.9 | | Health Care | 12.7 |

Applied Materials Inc. | 148.6 | 0.9 | | Industrials | 13.6 |

Raymond James Financial | 96.7 | 2.1 | | Materials | 11.6 |

Morgan Stanley | 94.2 | 1.3 | | Technology | 11.4 |

Carlisle Companies Inc. | 91.5 | 1.4 | | | |

Jacobs Solutions Inc. | 88.3 | 2.0 | | | |

| Total: | 16.9% | | Total: | 80.2% |

GO PAPERLESS AND ONLINE ACCOUNT ACCESS

Receive your statements electronically and help the environment! Shareholders have the option to elect paperless statements by either logging into their online Volumetric account or contacting us directly. With online account access you can view your account value and transactions, download tax statements, update account information, make additional investments electronically, sign up for paperless statements and more! To create a user login and password go to volumetric.com and select the “Sign In” button. It is a free service.

If you or someone you know would like more information about the Fund including the Prospectus, new account application, past performance, financial reports and more, please visit our website, volumetric.com, email us at info@volumetric.com or call us at 800-541-FUND. Please do not hesitate to contact us if you have any questions.

Thank you for your continued trust and confidence.

February 13, 2023

Sincerely,

Jeffrey Gibs Vincent Arscott

Chief Executive Officer and President Vice President

PRIVACY POLICY

Volumetric Fund, Inc. and its affiliate Volumetric Advisers, Inc. have always worked hard to maintain the highest standard of confidentiality and to respect the privacy of its shareholders and clients. The non-public personal information collected about you comes primarily from the account applications or other forms you submit to Volumetric Fund, Inc.

We do not market or disclose information about you to anyone, except as permitted by law. For example, this may include disclosing information according to your express consent to fulfill your instructions, such as in a mortgage application, or to comply with applicable laws and regulations.

We limit information about you to those of our employees who are involved in servicing your account and outside companies that are used to service and maintain your account. We maintain physical, electronic, and procedural safeguards that are designed to comply with federal standards to guard the information. If our relationship ends, we will continue to treat the information as described in this Privacy Policy notice.

This notice complies with Federal law and SEC regulations regarding privacy. If you have any questions or concerns please contact us at Volumetric Fund, Inc.

2

Growth of a $10,000 Investment*

From December 31, 2012 to December 31, 2022

(Unaudited)

*The above chart represents the historical 10-year performance of a hypothetical investment of $10,000 in Volumetric Fund, Standard & Poor’s 500 Index (the “S&P 500 Index”) and FTSE 3 Month T-Bill Index. The performance shown above does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares. All distributions and dividends are assumed to be reinvested. Volumetric Fund reflects the Fund’s average annual total return as of December 31, 2022. The S&P 500 Index reflects the 500 largest corporations by market capitalization, listed on the New York Stock Exchange or NASDAQ. The FTSE 3 Month T-Bill Index intends to track the daily performance of the 3 Month Treasury Bills. Both indexes are unmanaged, and their performance does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Past performance is not predictive of future performance.

**Total annual operating expenses, as disclosed in the Fund’s Prospectus, dated April 29, 2022, which included acquired fund fees and expenses of less than 0.01%, were 1.89% of average daily assets. The Fund’s performance reflects the deduction of fees for these services. Past performance is not predictive of future performance. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost; and that current performance may be lower or higher than the performance data quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (800) 541-3863 or visiting volumetric.com.

3

| VOLUMETRIC FUND, INC. | |

| STATEMENT OF NET ASSETS | |

| December 31, 2022 | |

| | |

Equities: 80.2% | |

Shares | Description | Value |

| Aerospace & Defense -- 1.6% | |

2,400 | General Dynamics Corp. | $ 595,464 |

| | 595,464 |

| Apparel & Textile Products -- 1.4% | |

4,800 | Ralph Lauren Corp. | 507,216 |

| | 507,216 |

| Asset Management -- 2.1% | |

7,200 | Raymond James Financial | 769,320 |

| | 769,320 |

| Automotive -- 1.2% | |

3,500 | Lear Corp. | 434,070 |

| | 434,070 |

| Beverages -- 1.4% | |

4,900 | Monster Beverage Corp.* | 497,497 |

| | 497,497 |

| Biotech & Pharma -- 4.6% | |

2,900 | Johnson & Johnson | 512,285 |

12,500 | Pfizer Inc. | 640,500 |

700 | Regeneron Pharmaceuticals* | 505,043 |

| | 1,657,828 |

| Chemicals -- 7.3% | |

1,800 | Air Products & Chemicals | 554,868 |

8,000 | CF Industries Holdings Inc. | 681,600 |

2,700 | Ecolab Inc. | 393,012 |

9,300 | Olin Corp. | 492,342 |

5,300 | Westlake Chemical Corp. | 543,462 |

| | 2,665,284 |

| Commercial Support Services -- 2.4% | |

6,600 | Waste Connections Inc. | 874,896 |

| | 874,896 |

| Construction Materials -- 1.4% | |

2,200 | Carlisle Companies, Inc. | 518,430 |

| | 518,430 |

| Containers & Packaging -- 1.3% | |

3,600 | Packaging Corporation of America | 460,476 |

| | 460,476 |

| Diversified Industrials -- 1.6% | |

6,100 | Emerson Electric Company | 585,966 |

| | 585,966 |

| E-Commerce Discretionary -- 1.2% | |

5,000 | Amazon.com Inc.* | 420,000 |

| | 420,000 |

| Engineering & Construction -- 2.1% | |

6,200 | Jacobs Solutions Inc. | 744,434 |

| | 744,434 |

| Exchange Traded Fund -- 5.3% | |

5,000 | SPDR S&P 500 ETF Trust | 1,912,150 |

| | 1,912,150 |

| Food -- 5.2% | |

4,400 | McCormick & Co., Inc. | 364,716 |

7,000 | Mondelez International | 466,550 |

18,200 | Pilgrim’s Pride Corp.* | 431,886 |

3,900 | J.M. Smucker Company | 617,994 |

| | 1,881,146 |

| | |

| | |

| | |

4

| VOLUMETRIC FUND, INC. | |

| STATEMENT OF NET ASSETS | |

| December 31, 2022 (continued) | |

| | |

Shares | Description | Value |

| Health Care Facilities & Services -- 4.5% | |

5,300 | CVS Health Corp. | $ 493,907 |

900 | Humana Inc. | 460,971 |

1,300 | UnitedHealth Group, Inc. | 689,234 |

| | 1,644,112 |

| Household Products -- 1.2% | |

5,300 | Church & Dwight Co Inc. | 427,233 |

| | 427,233 |

| Institutional Financial Services -- 3.7% | |

10,500 | Bank Of New York Mellon | 477,960 |

2,400 | CME Group, Inc. | 403,584 |

5,600 | Morgan Stanley | 476,112 |

| | 1,357,656 |

| Insurance -- 3.4% | |

10,000 | American Intl Group, Inc. | 632,400 |

3,100 | Arthur J Gallagher & Co | 584,474 |

| | 1,216,874 |

| Machinery -- 1.6% | |

5,100 | Toro Company (The) | 577,320 |

| | 577,320 |

| Medical Equipment & Devices -- 3.6% | |

2,900 | Agilent Technologies Inc. | 433,985 |

1,900 | Becton, Dickinson and Co. | 483,170 |

1,900 | ResMed Inc. | 395,447 |

| | 1,312,602 |

| Retail - Consumer Staples -- 1.0% | |

825 | Costco Wholesale Corp. | 376,613 |

| | 376,613 |

| Semiconductors -- 2.5% | |

3,600 | Analog Devices Inc. | 590,508 |

3,200 | Applied Materials Inc. | 311,616 |

| | 902,124 |

| Software -- 3.2% | |

920 | Intuit Inc. | 358,082 |

1,300 | Microsoft Corp. | 311,766 |

3,700 | Salesforce, Inc.* | 490,583 |

| | 1,160,431 |

| Steel -- 1.6% | |

4,300 | Nucor Corp. | 566,783 |

| | 566,783 |

| Technology Hardware -- 2.9% | |

4,300 | Apple, Inc. | 558,699 |

10,500 | Cisco Systems Inc. | 500,220 |

| | 1,058,919 |

| Technology Services -- 2.8% | |

2,500 | Automatic Data Processing | 597,150 |

7,500 | Cognizant Tech Solutions | 428,925 |

| | 1,026,075 |

| Transportation & Logistics -- 2.7% | |

4,800 | Expeditors Intl Wash Inc. | 498,816 |

2,000 | Norfolk Southern Corp. | 492,840 |

| | 991,656 |

| Transportation Equipment -- 1.5% | |

5,600 | Westinghouse Air Brake Technologies Corp. | 558,936 |

| | 558,936 |

| | |

| | |

| | |

5

| VOLUMETRIC FUND, INC. | |

| STATEMENT OF NET ASSETS | |

| December 31, 2022 (continued) | |

| | |

Shares | Description | Value |

| Wholesale - Consumer Staples -- 3.9% | |

5,300 | Archer Daniels Midland | $ 492,105 |

9,200 | Bunge, Ltd. | 917,884 |

| | 1,409,989 |

| |

TOTAL EQUITIES (Cost: $ 21,547,668) | 29,111,500 |

INVESTMENT COMPANY 19.8% | |

7,185,375 Shares -- Fidelity Investments Money Market | |

Gov Portfolio - Class I (FIGXX), 4.06%** (Cost: $7,185,375) | 7,185,375 |

TOTAL INVESTMENTS (Cost: $28,733,043): 100.0% | 36,296,875 |

RECEIVABLES: 0.2% | |

Capital Shares Receivable | 8,000 |

Dividends and Interest Receivable | 70,574 |

TOTAL RECEIVABLES | 78,574 |

TOTAL ASSETS | 36,375,449 |

| | |

LIABILITIES: -0.2% | |

Accrued Management Fees | (59,583) |

TOTAL LIABILITIES | (59,583) |

| | |

NET ASSETS 100.0% | $ 36,315,866 |

| | |

VOLUMETRIC SHARES OUTSTANDING | 1,757,040 |

NET ASSET VALUE, OFFERING & REDEMPTION | |

PRICE PER SHARE | $20.67 |

| | |

See notes to financial statements

*Non-income producing security.

** Variable Rate Security as of December 31, 2022.

6

7

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each year)

Years ended December 31 | 2022 | 2021 | 2020 | 2019 | 2018 |

| | | | | | | |

Net asset value, beginning of year | $25.43 | $23.32 | $21.41 | $18.42 | $21.02 |

Income (loss) from investment operations | | | | | |

| Net investment loss | (0.07) | (0.17) | (0.12) | (0.03) | (0.09) |

| Net realized and change in unrealized | | | | | |

| | gain (loss) on investments | (3.56) | 4.32 | 2.27 | 3.74 | (2.07) |

| Total from investment operations | (3.63) | 4.15 | 2.15 | 3.71 | (2.16) |

Less distributions from: | | | | | |

| Net realized gains | (1.13) | (2.04) | (0.24) | (0.72) | (0.44) |

Total distributions | (1.13) | (2.04) | (0.24) | (0.72) | (0.44) |

Net asset value, end of year | $20.67 | $25.43 | $23.32 | $21.41 | $18.42 |

Total return | (14.25%) | 17.78% | 10.05% | 20.13% | (10.26%) |

| | | | | | | |

Ratios and Supplemental Data: | | | | | |

Net assets, end of year (in thousands) | $36,316 | $43,330 | $37,866 | $35,178 | $30,903 |

Ratio of expenses to average net assets | 1.89% | 1.89% | 1.91% | 1.90% | 1.90% |

Ratio of net investment loss to average net assets | (0.31%) | (0.67%) | (0.58%) | (0.17%) | (0.43%) |

Portfolio turnover rate | 67% | 34% | 36% | 60% | 71% |

NOTES TO FINANCIAL STATEMENTS

As of December 31, 2022

1.Significant Accounting Policies

Volumetric Fund, Inc. (the “Fund”) is registered with the Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified, open-end investment company. The Fund’s investment objective is capital growth. Its secondary objective is downside protection. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The financial statements have been prepared in conformity with U.S. Generally Accepted Accounting Principles (“GAAP”), as detailed in the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”). The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of FASB ASC Topic 946 “Financial Services – Investment Companies” including FASB Accounting Standards Update 2013-08.

a)Valuation of Securities: Investments in securities traded on a national securities exchange (or reported on the NASDAQ national market) are valued at the closing price on the day of valuation. If a market quote is not available, the Fund will value the security at fair market value as determined in good faith by the Volumetric Advisers, Inc. (the “Adviser”), as directed by the Board of Directors (the “Board”).

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires certain disclosures about fair value measurements. Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

·Level 1 – quoted prices in active markets for identical securities

·Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc.)

·Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments)

The inputs or methodology used for valuing securities are not necessarily indications of the risk associated with investing in those securities.

As of December 31, 2022, all the securities held by the Fund were valued using Level 1 inputs. See the Fund’s Statement of Net Assets for a listing of securities valued using Level 1 inputs by security type and industry type, as required by GAAP.

8

b)Securities Transactions and Investment Income: Realized gains and losses are determined on the identified cost basis which is the same basis used for federal income tax purposes. Dividend income and distributions to shareholders are recorded on the ex-dividend date and interest income is recognized on an accrual basis.

c)Federal Income Taxes: The Fund’s policy is to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all the Fund’s taxable income to its shareholders. Therefore, no federal income tax provision is required.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions taken on Federal and state income tax returns for all open tax years (2019-2021) or expected to be taken during the year ended December 31, 2022 and concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements.

d)Distributions to Shareholders: It is the Fund’s policy to distribute all net investment income and all net realized gains, in excess of any available capital loss carryovers, at year end. The Fund declared the following distributions.

Record Date | December 27, 2022 | December 28, 2021 |

Ex-Dividend Date | December 28, 2022 | December 29, 2021 |

Payment Date | December 29, 2022 | December 30, 2021 |

Distribution | $1.13 per share | $2.04 per share |

The tax character of distributions recorded and paid during the years ended December 31, 2022, and 2021 were as follows: Long Term Capital Gains: 2022: $1,884,250; 2021: $3,228,575. Ordinary Income: 2022: $0, 2021: $0.

e)Use of Estimates: The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reported period. Actual results could differ from those estimates.

2.Management Fee and Other Transactions with Affiliates

The Fund receives investment management and advisory services pursuant to the Investment Advisory Agreement, dated April 28, 2022, between the Fund and the Adviser, that provides for fees to be paid at an annual rate of; (I) 2.0% of the first $10,000,000 of average daily net assets, (ii) 1.90% of such net assets from $10 million to $25 million; (iii) 1.80% of such net assets from $25 million to $50 million; (iv) 1.50% of such net assets from $50 million to $100 million; and (v) 1.25% of such net assets over $100 million. The Adviser pays the cost of all management, supervisory and administrative services required in the operation of the Fund. This includes investment management, fees of the custodian, independent public accountants and legal counsel, remuneration of officers and directors, state registration fees and franchise taxes, shareholder services, including maintenance of the shareholder accounting system, insurance, marketing expenses, shareholder reports, proxy related expenses and transfer agency. Certain officers and directors of the Fund are also officers and directors of the Adviser.

3.Capital Stock Transactions

On December 31, 2022, there were 4,000,000 shares of $0.01 par value capital stock authorized. Transactions in capital stock were as follows:

| Year Ended December 31, 2022 | Year Ended December 31, 2022 | Year Ended December 31, 2021 | Year Ended December 31, 2021 |

| Shares | Amount | Shares | Amount |

Shares Sold | 42,927 | $998,883 | 39,461 | $975,711 |

Distributions Reinvested | 89,101 | 1,830,139 | 121,518 | 3,096,272 |

| 132,028 | 2,829,022 | 160,979 | 4,071,983 |

Shares Redeemed | (79,156) | (1,775,978) | (80,518) | (2,052,579) |

Net Increase | 52,872 | $1,053,044 | 80,461 | $2,019,404 |

9

4.Purchases and Sales of Investment Securities / Federal Tax Cost Information

For the year ended December 31, 2022, purchases, and proceeds from sales of securities were $20,549,324 and $23,638,884, respectively. On December 31, 2022, the cost of investments for Federal income tax purposes was $28,733,043. Accumulated net unrealized appreciation on investments was $7,563,832 consisting of $7,952,767 gross unrealized appreciation and $388,935 gross unrealized depreciation.

5.Composition of Net Assets

As of December 31, 2022, net assets consisted of:

Net capital paid in on shares of stock | $28,752,034 |

Distributable Earnings | 7,563,832 |

Net Assets | $36,315,866 |

| |

| |

6.Federal Income Tax

As of December 31, 2022, the components of distributable earnings on a tax basis were as follows:

Unrealized appreciation | $7,563,832 |

Distributable earnings | $7,563,832 |

For the year ended December 31, 2022, the Fund recorded the following reclassification: distributable earnings increased by $124,437 and net capital paid in on shares of stock was decreased by $124,437. Such reclassifications, the result of permanent differences between the financial statements and income tax reporting requirements, have no effect on the Fund’s net assets.

7.Commitments and Contingencies

Under the Fund’s organizational documents, its Officers and Directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund entered into contracts with its service providers, on behalf of the Fund, and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. The Fund expects the risk of loss to be remote.

8.Market and Geopolitical Risks

The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Securities in the Fund’s portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, pandemics, epidemics, terrorism, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years may result in market volatility and may have long term effects on both the U.S. and global financial markets. The current novel coronavirus (COVID-19) global pandemic and the aggressive responses taken by many governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines or similar restrictions, as well as the forced or voluntary closure of, or operational changes to, many retail and other businesses, has had negative impacts, and in many cases severe negative impacts, on markets worldwide. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown, which may impact your Fund investment.

9.Subsequent Events

Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued and has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

10

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and the Shareholders

of Volumetric Fund, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of net assets of Volumetric Fund, Inc. (the “Fund”), as of December 31, 2022, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2022, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and its financial highlights for each of the years in the five-year period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2022 by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

BBD, LLP

We have served as the auditor of one or more of the Funds in the Volumetric Fund, Inc. since 2009.

Philadelphia, Pennsylvania

February 22, 2023

11

SHAREHOLDER APPROVAL OF INVESTMENT ADVISORY AGREEMENT, DIRECTORS AND AUDITOR (Unaudited)

At the Annual Shareholder Meeting, held on April 28, 2022, Shareholder approved the following:

1.The Investment Advisory Agreement, Dated April 28, 2022, between Volumetric Fund, Inc. and Volumetric Advisers, Inc. (the “Adviser”). This agreement was previously approved by the Board of Directors on December 1, 2021. The result of the vote were: For 926,015 shares (96.94%), Against 2,551 shares (0.26%); Withheld/Abstain 26,749 shares (2.80%).

2.Election of Directors: Jeffrey M. Gibs: For 953,814 shares (99.85%), Against 0 shares (0%); Withheld/Abstain 1,501 shares (0.15%); Irene J. Zawitkowski: For 955,044 shares (99.98%), Against 0 shares (0%); Withheld/Abstain 271 shares (0.02%); Alexander M. Olbrecht: For 955,044 shares (99.98%), Against 0 shares (0%); Withheld/Abstain 271 shares (0.02%); Cornelius O’Sullivan: For 955,315 shares (100%), Against 0 shares (0%); Withheld/Abstain 0 shares (0%); Stephen J. Samitt: For 955,315 shares (100%), Against 0 shares (0%); Withheld/Abstain 0 shares (0%); Josef Haupl: For 955,044 shares (99.98%), Against 0 shares (0%); Withheld/Abstain 271 shares (0.02%); Allan A. Samuels: For 955,069 shares (99.98%), Against 0 shares (0%); Withheld/Abstain 245 shares (0.02%); Raymond W. Sheridan: For 955,071 shares (99.98%), Against 0 shares (0%); Withheld/Abstain 244 shares (0.02%); Stacey S Yanosy: For 955,069 shares (99.98%), Against 0 shares (0%); Withheld/Abstain 245 shares (0.02%); All directors had been reelected for an additional term except, this is Stacey S. Yanosy’s first term elected as a Director.

3.BBD, LLP was ratified as the independent registered accounting firm of the Fund for fiscal year December 31, 2022; The result of the vote were: For 926,015 shares (96.94%), Against 2,551 shares (0.26%); Withheld/Abstain 26,749 shares (2.80%).

PROSPECTUS, PROXY AND PORTFOLIO INFORMATION (Unaudited)

This report for the period ended December 31, 2022, is intended for the shareholders of the Fund and may not be used as sales literature unless preceded or accompanied by a current prospectus. To obtain a current prospectus please call 800-541-3863 or visit volumetric.com.

Information is available to shareholders who are interested in the Fund’s proxy voting guidelines and proxy voting record for the 12-month period ended June 30, 2022. This information may be obtained without charge either by calling the Fund’s toll-free number, 800-541-3863, or by visiting the SEC’s website at sec.gov.

The Fund files its complete schedule of portfolio holdings with the SEC, for the first and third quarters of each fiscal year on Form N-PORT. These forms are available on the Commission’s website at sec.gov. This information is also available from the Fund by calling 800-541-3863 or visiting volumetric.com. The Fund also files with the SEC its monthly holdings on form N-PORT. The N-PORT information for the first and second months (form N-PORT-NP) for each of the Fund’s fiscal quarters is non-public information. The monthly report on N-PORT for the third month of the quarter is publicly available on the Commission’s website at sec.gov. This information is also available from the Fund by calling 800-541-3863 or visit volumetric.com.

DIRECTORS (Unaudited)

Directors, who are not salaried employees of the Adviser, (the Adviser’s address is 87 Violet Drive, Pearl River, NY 10965), receive a fee for each Board or committee meeting they attend. Directors’ fees had no effect on the Fund’s expenses and expense ratio since all their fees were paid by the Adviser. On an annual basis, the full Board meets four times, and the Directors of whom are not “interested persons” (as defined in the 1940 Act), meet four times. There were no “special meetings” held in 2022. In addition, on a yearly basis, the Audit Committee meets twice, and the Governance & Nominating committee meets once.

LIQUIDITY RISK MANAGEMENT PROGRAM (Unaudited)

In compliance with Rule 22e-4 under the Investment Company Act of 1940, as amended (the "Liquidity Rule"), the Fund has adopted and implemented a liquidity risk management program (the “Program”), which is designed to assess and manage the risk that the Fund could not meet requests to redeem shares issued by the Fund without significant dilution of remaining investors' interests in the Fund. The Fund's Board of Directors (the "Board") previously approved the designation of Volumetric Advisers, Inc as the Program’s administrator.

The Board reviewed the Fund’s Liquidity Program's assessment and was briefed on the fair value pricing and liquidity status, during the various quarterly Board meetings throughout the year. No significant pricing or liquidity events impacting the Fund were

12

reported. There were no material changes to the Program during the reporting period. The report to the Board concluded that the Program is operating effectively to assess and manage the Fund’s liquidity risk, and that the Program continues to be effectively implemented to monitor and respond to the Fund’s liquidity risk. The Fund only holds assets that are defined under the Liquidity Rule as "highly liquid investments".

There can be no assurance that the Program will achieve its objectives under all circumstances in the future. Please refer to the Fund's prospectus for more information regarding the Fund's exposure to liquidity risk and other risks to which it may be subject.

INFORMATION ABOUT YOUR FUND’S EXPENSES

For the six months ended December 31, 2022 (Unaudited)

As a shareholder of the Fund, you incur ongoing costs, including management fees. These Fund expenses are further clarified in this report on page 9, Note 2. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the period and held for the entire semi-annual period, July 1, 2022, to December 31, 2022.

Below are two ways to evaluate your Fund’s costs.

Actual Fund Return

This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return for the six month period, the “Expense Ratio” column shows the period’s annualized expense ratio and the “Expenses Paid During Period” column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund at the beginning of the period. You may use the information here, together with your account value, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, a $7,000 account value divided by $1,000 = 7.0), then multiply the result by the number given in the first line under the heading entitled “Expenses Paid During Period.”

Hypothetical 5% Return

This section is intended to help you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses, and the expense ratio is unchanged. Because the return used is not the Fund’s actual return, the results do not apply to your investment. This sample is useful in making comparisons to other mutual funds because the Securities and Exchange Commission requires all mutual funds to provide examples of expenses calculated and based on an assumed 5% annual return. You can assess your Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees. Volumetric Fund does not charge any sales loads, redemption fee, or exchange fees, but these fees may be present in other funds to which you compare our Fund. Therefore, the hypothetical portions of the table are useful in comparing ongoing costs only and will not help you to determine the relative total costs of owning different funds.

| Beginning Account Value, 07/01/22 | Ending Account Value, 12/31/22* | Net Expense Ratio | Expenses Paid During Period** |

Actual | $1,000 | $ 1,022.80 | 1.89% | $9.64 |

Hypothetical 5% Return | $1,000 | $ 1,015.68 | 1.89% | $ 9.60 |

*The actual total return for the six-month period ended December 31, 2022, was 2.28%.

**Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

13

DIRECTORS (Unaudited)

The Directors of the Fund and their ages, positions, addresses and principal occupations during the past five years are set forth below. There is no limit on the length of the term that each director serves. The Fund’s Statement of Additional Information contains additional information about the Directors and is available without charge, upon request, by calling 1-800-541-FUND or visiting volumetric.com.

Interested Directors | | | | | |

Name, Address** and Age | Position(s) Held with Fund | Term of Office and Length of Time Served | Occupation | Number of Portfolios in Fund Complex Overseen by Director | Other Director ships Held by Director during Past Five Years |

Jeffrey M. Gibs

Age: 56 | CEO, President, Portfolio Manager, CCO and Director (6) | Annually 2018 | Chief Executive Officer (“CEO”) since 2022, President and Portfolio Manager since 2016 (Titled: Co-Portfolio Manager 2016 to 2021) and Chief Compliance Officer (“CCO”) since 2005. Jeffrey was Executive Vice President from 2015 to 2016 and Vice President from 1997 to 2015. He has worked as a consultant to the Fund since 1989. Jeffrey is President of Volumetric Advisers, Inc. He was previously employed by US Bank and AIS (acquired by US Bank), as Vice President of hedge fund accounting and operations (2005 to 2015). | 1 | None |

Irene J. Zawitkowski

Age: 69 | Chair, and Director (7) | Annually 1978 | Chair since 2018. Ms. Zawitkowski was CEO from 2016 to 2022, Portfolio Manager from 2003 to 2022, President from 2003 to 2016, and Executive Vice President of the Fund from inception to 2003. Ms. Zawitkowski was also Executive Vice President of Volumetric Advisers, Inc until 2022. | 1 | None |

Independent Directors | | | | | |

Josef Haupl

Age: 78 | Director (1) | Annually 2004 | Engineering consultant to the chemical industry, since 2002. Previously, Director of Technology of Lurgi PSI, an engineering and construction services company for the chemical industry. | 1 | None |

Alexandre M. Olbrecht, PhD. Age 44 | Director (3) | Annually 2012 | Professor of Economics, Anisfield School of Business at Ramapo College of NJ, since 2005. Executive Director of the Eastern Economic Association. He was elected by the Board as the Fund’s Vice Financial Expert. | 1 | None |

Cornelius O’Sullivan Age 54 | Director (3) | Annually 2017 | Proprietor of Neil T. O’Sullivan, CPA, LLC since 2009. Previously Partner, Cherian, O’Sullivan & Tatapudy, LLP, certified public accountants, since 2003. Mr. O’Sullivan started his accounting career with Ernst & Young, LLP certified public accountants. | 1 | None |

Stephen J. Samitt

Age: 81 | Director (1)(4) | Annually 1996 | Stephen Samitt, CPA, LLC, since 2008. Previously, Principal, Briggs Bunting & Dougherty, LLP, a full-service public accounting firm, since 1997. He was elected by the Board as the Fund’s Financial Expert. | 1 | None |

14

Independent Directors | | | | | |

Name, Address** and Age | Position(s) Held with Fund | Term of Office and Length of Time Served | Occupation | Number of Portfolios in Fund Complex Overseen by Director | Other Director ships Held by Director during Past Five Years |

Allan A. Samuels

Age: 84 | Director (2) (5) | Annually 2007 | CEO and President of Rockland Business Association (RBA) since 2001. RBA is a non-profit organization of about 1,000 businesses in Rockland County, NY, for the advancement of its members via public relations, seminars, networking and legislation. He is also Board member of several non-profit and business organizations. | 1 | None |

Raymond W. Sheridan

Age: 72 | Director (1) (2) | Annually 1995 | President, Raymond Sheridan Financial, Inc., insurance and financial services. Vice President and Treasurer of the Fund between 1997 and 2005. | 1 | None |

Stacey S. Yanosy Age: 53 | Director (3) | Annually since 2022 | Member Development Officer at Affinity Federal Credit Union since 2019, Previously, she was a Banker at People’s United Bank (2017 to 2019) and Branch Manager at Palisades Federal Credit Union (2009 to 2017). | 1 | None |

(1) Member of the Governance & Nominating Committee; (2) Co-Chair of the Governance & Nominating Committee; (3) Member of the Audit Committee;

(4) Chair of the Audit Committee; (5) Lead Independent Director; (6) Interested Director is an employee and owner of Volumetric Advisers Inc.; (7) Interested Director, and also former employee and former owner of Volumetric Advisers Inc. as of December 31, 2022.

** The address of each director is c/o Volumetric Fund, Inc., 87 Violet Drive, Pearl River, New York 10965.

15

16

87 Violet Drive

Pearl River, New York 10965

845-623-7637

800-541-FUND

Ticker: VOLMX

volumetric.com

info@volumetric.com

Investment Adviser

Volumetric Advisers, Inc.

Pearl River, New York 10965

Custodian

U.S. Bank N.A.

Milwaukee, Wisconsin 53212

Independent Registered Public

Accounting Firm

BBD, LLP

Philadelphia, Pennsylvania 19103

Transfer Agent and Fund Accountant

Ultimus Fund Solutions, LLC

Cincinnati, Ohio 45246

Distributor

Ultimus Fund Distributors, LLC

Cincinnati, OH 45246

Board of Directors

Jeffrey M. Gibs

Josef Haupl

Alexandre M. Olbrecht, PhD

Cornelius O’Sullivan

Stephen J. Samitt

Allan A. Samuels

Raymond W. Sheridan

Stacey S. Yanosy

Irene J. Zawitkowski, Chair

Officers

Jeffrey M. Gibs

CEO, President, Portfolio Manager, CCO

Vincent D. Arscott

Vice President, Portfolio Manager

Item 2. Code of Ethics.

(a) As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

(b) For purposes of this item, 'code of ethics' means written standards that are reasonably designed to deter wrongdoing and to promote:

(1) Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships.

(2) Full, fair, accurate, timely, and understandable disclosure in reports and documents that a registrant files with, or submits to, the Commission and in other public communications made by the registrant.

(3) Compliance with applicable governmental laws, rules, and regulations.

(4) The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and

(5) Accountability for adherence to the code.

(c) Amendments: During the period covered by the report, there have not been any amendments to the provisions of the Code of Ethics.

(d) Waivers: During the period covered by the report, the registrant has not granted any express or implicit waivers from the provisions of the Code of Ethics.

(e) The Code of Ethics is not posted on Registrant's website; however, the website states how the Code of Ethics may be obtained free of charge upon request.

(f) A copy of the Code of Ethics is attached as an exhibit. You may request a free copy of the Code of Ethics by calling the Fund at 800-541-3863 or writing to Volumetric Fund, 87 Violet Drive, Pearl River, New York 10965.

Item 3. Audit Committee Financial Expert.

(a) The Registrant's Board of Directors has determined that Stephen Samitt is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Samitt is independent for purposes of this Item.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees: The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years were as follows:

2022 - $16,500

2021 - $16,500

(b) Audit Related Fees: The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item were as follows:

2022 - None

2021 - None

(c) Tax Fees: The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning were as follows:

2022 - $2,000

2021 - $2,000

2

Preparation of Federal & State income tax returns, assistance with calculation of required income, capital gain and excise distributions and preparation of Federal excise tax returns.

(d) All Other Fees: The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item were as follows:

2022 - None

2021 - None

(e)

(1) Audit Committee's Pre-Approval Policies

The Registrant's Audit Committee is required to pre-approve all audit services and non-audit services (including audit-related, tax and all other services) to the registrant. The Registrant's Audit Committee also is required to pre-approve, when appropriate, any non-audit services (including audit-related, tax and all other services) to its adviser, or any entity controlling, controlled by or under common control with the adviser that provides ongoing services to the registrant, to the extent that the services may be determined to have an impact on the operations or financial reporting of the registrant. Services are reviewed on an engagement by engagement basis by the Audit Committee.

(2) The percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X are as follows:

Audit-Related Fees:0%

Tax Fees:0%

All Other Fees:0%

(f) During the audit of registrant's financial statements for the most recent fiscal year, less than 50 percent of the hours expended on the principal accountant's engagement were attributed to work performed by persons other than the principal accountant's full-time, permanent employees.

(g) The aggregate non-audit fees billed by the registrant's accountant for services rendered to the registrant, and rendered to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant:

2021 - $0

2020 - $0

(h) The registrant's audit committee has considered whether the provision of non-audit services to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant, that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, is compatible with maintaining the principal accountant's independence.

Item 5. Audit Committee of Listed Companies.

Not applicable to open-end investment companies.

Item 6. Schedule of Investments:

(a)Schedule of investments in securities of unaffiliated issuers is included under Item 1.

(b)Not applicable.

3

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Funds.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Funds.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

None

Item 11. Controls and Procedures.

(a) Based on an evaluation of the registrant's disclosure controls and procedures as of a date within 90 days of filing date of this Form N-CSR, the principal executive officer and principal financial officer of the registrant have concluded that the disclosure controls and procedures of the registrant are reasonably designed to ensure that the information required in filings on Form N-CSR is recorded, processed, summarized, and reported by the filing date, including that information required to be disclosed is accumulated and communicated to the registrant's management, including the registrant's principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure.

(b) There were no significant changes in the registrant's internal control over financial reporting that occurred during the registrant's last fiscal half-year that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 13. Exhibits.

(a)(1) Code of Ethics filed herewith.

(a)(2) Certifications required by Section 302 of the Sarbanes-Oxley Act of 2002 (and Item 11(a)(2) of Form N-CSR) are filed herewith.

(a)(3) Not applicable for open-end investment companies.

(c)Certifications required by Section 906 of the Sarbanes-Oxley Act of 2002 (and Item 11(b) of Form N-CSR) are filed herewith.

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Volumetric Fund, Inc.

By: /s/ Jeffrey Gibs

Jeffrey Gibs

Chief Executive Officer

Date 2/22/2022

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: /s/ Jeffrey Gibs

Jeffrey Gibs

Chief Executive Officer

Date 2/22/2022

By: /s/ Vincent Arscott

Vincent Arscott

Vice President

Date 2/22/2022

5