Registration No. 333

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHINA NATURAL RESOURCES, INC.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| British Virgin Islands F4 | | 1040 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification number) |

Room 2205, 22/F, West Tower, Shun Tak Centre

168-200 Connaught Road Central

Sheung Wan, Hong Kong

011-852-2810-7205

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue

Suite 204

Newark, Delaware 19711

(302)738-6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Richard J. Chang, Esq.

Gunderson Dettmer Stough Villeneuve

Franklin & Hachigian, LLP

Suite 2202, Building C, Yintai Center

#2 Jianguomenwai Ave.

Chaoyang District

Beijing, P.R. China 100022

+86 10 5680 3888

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED MARCH 18, 2024 |

Up to 1,190,297 Common Shares underlying Warrants

Offered by the Selling Shareholders of

CHINA NATURAL RESOURCES, INC.

This prospectus relates to the resale, from time to time, by the selling shareholders (the “Selling Shareholders”) identified in this prospectus under the caption “Selling Shareholders,” of up to 1,190,297 of our common shares, no par value (the “Common Shares”), issuable upon exercise of certain outstanding warrants (the “Warrants”) to purchase Common Shares.

The Warrants include:

| | | |

| | 1) | the warrants (the “Unregistered Investor Warrants”) we issued to the investors pursuant to a securities purchase agreement dated February 16, 2024 (the “Securities Purchase Agreement”), to purchase up to an aggregate of 1,115,903 Common Shares at an exercise price equal to $3.00 per share, which warrants expire on August 21, 2027; and |

| | 2) | the warrant (the “Placement Agent Warrant”) we issued to the president and the staff of FT Global Capital, Inc. (“FT Global”), the placement agent in connection with the Securities Purchase Agreement, pursuant to a placement agency agreement dated February 16, 2024 (the “Placement Agency Agreement”) to purchase up to an aggregate of 74,394 Common Shares at an exercise price equal to $2.20 per share, which warrants expire on August 21, 2027. |

We are not selling any Common Shares under this prospectus and will not receive any proceeds from the sale of Common Shares by the Selling Shareholders. We will receive proceeds from cash exercise of the Warrants which, if exercised for cash with respect to all of the 1,190,297 Common Shares, would result in gross proceeds of $3,511,375 to us. The Selling Shareholders will bear all commissions and discounts, if any, attributable to the sale of the Common Shares.

The Selling Shareholders may sell the Common Shares offered by this prospectus from time to time on terms to be determined at the time of sale through ordinary brokerage transactions or through any other means described in this prospectus under the caption “Plan of Distribution.” The Common Shares may be sold at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market price or at negotiated prices.

Our Common Shares are listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “CHNR.” On March 15, 2024, the last reported sale price of our Common Shares on Nasdaq was $1.20 per share. There is no established trading market for the Warrants and we do not intend to list the Warrants on any exchange or other trading system.

The Company is not an operating company but a British Virgin Islands holding company with operations primarily conducted by its subsidiaries in China. The Company’s PRC Subsidiaries face various legal and operational risks and uncertainties related to doing business in China and the complex and evolving PRC laws and regulations. For example, we face risks associated with the fact that the PRC government has significant authority in regulating our operations and may influence or intervene in our operations, regulatory approvals on offerings conducted overseas by, and foreign investment in, China-based issuers, anti-monopoly regulatory actions, and oversight on data security, which may impact our ability to conduct certain businesses, accept foreign investments, or list on a United States exchange. For a detailed description of risks related to doing business in China, see “Risk Factors — Risks Relating to Our PRC Operations and Doing Business in the PRC” in this prospectus.

China Securities Regulatory Commission, or the “CSRC”, promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”), which became effective on March 31, 2023. The Company’s securities are currently publicly listed on the Nasdaq Stock Market, and it shall make filings on the offering with the CSRC within three working days after the offering is completed.

The Company’s corporate structure as a British Virgin Islands holding company with operations primarily conducted by its subsidiaries in China involves unique risks to investors. According to the Foreign Investment Law in China, the State Council shall promulgate or approve a list of special administrative measures for market access of foreign investments, or the Negative List. The Foreign Investment Law grants national treatment to foreign-invested entities, except for those foreign-invested entities that operate in industries specified as either “restricted” or “prohibited” from foreign investment in the Negative List. The Foreign Investment Law provides that foreign-invested entities operating in “restricted” or “prohibited” industries will require market entry clearance and other permissions or approvals from relevant PRC government authorities. On December 27, 2021, the National Development and Reform Commission of China (“NDRC”) and the Ministry of Commerce (“MOFCOM”) jointly issued the Special Administrative Measures for Foreign Investment Access (Negative List) (2021 Edition), and the Special Administrative Measures for Foreign Investment Access in Pilot Free Trade Zones (Negative List) (2021 Edition), effective January 1, 2022. As a company operating its business in exploration and mining, which are not included in the 2021 Negative List, the Company believes its business is not subject to any ownership restrictions. However, since the Negative List has been adjusted and updated almost on an annual basis in the recent years, we cannot assure you that the aforementioned business segments will continuously be beyond the “prohibited” category, which would likely result in a material change in our operations or in the value of our securities. The PRC government has established a foreign investment information reporting system, according to which foreign investors or foreign-invested enterprises shall submit investment information to the competent department for commerce concerned through the enterprise registration system and the enterprise credit information publicity system, and a security review system under which the security review shall be conducted for foreign investment affecting or likely affecting the state security.

The Company may encounter several limitations related to cash transfer among its PRC Subsidiaries, the holding company and its investors. Any funds we transfer to the PRC Subsidiaries, either as a shareholder loan or as an increase in registered capital, are subject to permission and approval by or registration with relevant governmental authorities in China. According to the relevant PRC regulations on foreign invested enterprises in China, capital contributions to our PRC Subsidiaries are subject to the registration with the State Administration for Market Regulation or its local counterpart and registration with a local bank authorized by SAFE. In addition, (i) any foreign loan procured by our PRC Subsidiaries is required to be registered with the SAFE or its local branches and (ii) any of our PRC Subsidiaries may not procure loans which exceed the difference between its total investment amount and registered capital or, as an alternative, only procure loans subject to the calculation approach and limitation as provided by the People’s Bank of China. As a holding company with no operations, our ability to distribute dividends largely depends on the distribution from our PRC Subsidiaries. In addition, if the Company is determined to be a PRC resident enterprise for enterprise income tax purposes, we could be subject to PRC tax at a rate of 25% on our worldwide income, which could materially reduce our net income, and we may be required to withhold a 10% withholding tax from dividends we pay to our shareholders that are non-resident enterprises, including the holders of our Common Shares, and non-resident enterprise shareholders (including our Common Shareholders) may be subject to PRC tax at a rate of 10% on gains realized on the sale or other disposition of Common Shares, if such income is treated as sourced from within China. An “indirect transfer” of PRC assets, including a transfer of equity interests in an unlisted non-PRC holding company of a PRC resident enterprise, by non-PRC resident enterprises may be re-characterized and treated as a direct transfer of the underlying PRC assets, if such arrangement does not have a reasonable commercial purpose and was established for the purpose of avoiding payment of PRC enterprise income tax. As a result, gains derived from such indirect transfer may be subject to PRC enterprise income tax, and the transferee or other person who is obligated to pay for the transfer is obligated to withhold the applicable taxes, currently at a rate of 10% for the transfer of equity interests in a PRC resident enterprise. See “Risk Factors - Risks Relating to Our PRC Operations and Doing Business in the PRC - We may be classified as a “resident enterprise” for PRC enterprise income tax purposes; such classification could result in unfavorable tax consequences to us and our non-PRC shareholders” on page 27 of this prospectus.

Pursuant to the Holding Foreign Companies Accountable Act, as amended by the Consolidated Appropriations Act, 2023, or the HFCAA, if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspections by the PCAOB for two consecutive years, the SEC will prohibit our shares from being traded on a national securities exchange or in the over-the-counter trading market in the United States. On December 16, 2021, the PCAOB issued a report on its determinations that it was unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, and our auditor was subject to that determination. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions. If PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland China or Hong Kong and we continue to use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed with the SEC, we would be identified as a Commission-Identified Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not be identified as a Commission-Identified Issuer for any future fiscal year, and if we were so identified for two consecutive years, we would become subject to the prohibition on trading under the HFCAA and as a result, NASDAQ may determine to delist our securities. See “Risk Factors - Risks Relating to Our PRC Operations and Doing Business in the PRC - The PCAOB had historically been unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections of our auditor in the past has deprived our investors with the benefits of such inspections.” and “Risk Factors - Risks Relating to Our PRC Operations and Doing Business in the PRC - Our common shares may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in China. The delisting of our common shares, or the threat of their being delisted, may materially and adversely affect the value of your investment.” on page 22 of this prospectus. The Holding Foreign Companies Accountable Act, as amended by the Consolidated Appropriations Act, 2023, decreased the number of “non-inspection years” from three years to two years, and thus, reduced the time before our securities may be prohibited from trading or delisted. The delisting of our securities, or the threat of them being delisted, may materially and adversely affect the value of your investment.”

Cash and asset transfers through the Group are primarily attributed to shareholder loans from us to our subsidiaries. Under PRC laws and regulations, we are subject to some restrictions on intercompany fund transfers and foreign exchange controls. Our subsidiaries receive substantially all revenue in CNY, and the PRC or Hong Kong governments could prevent the CNY maintained in the PRC or Hong Kong from leaving, impose controls on its conversion into foreign currencies, restrict deployment of the CNY into the business of our subsidiaries and restrict the ability to pay dividends. There are no restrictions or limitations imposed by the Hong Kong government on the transfer of capital within, into and out of Hong Kong (including funds from Hong Kong to the PRC), except for the transfer of funds involving money laundering and criminal activities. However, there is no guarantee that the Hong Kong government will not promulgate new laws or regulations that may impose such restrictions in the future. To the extent cash in the business is in the PRC or Hong Kong or our PRC or Hong Kong entities, the funds may not be available to fund operations or for other use outside of the PRC or Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries by the PRC or Hong Kong governments to transfer cash. We cannot assure you that the PRC or Hong Kong governments will not intervene in or impose restrictions on our ability to make intercompany cash transfers.

See “Transfers of Cash and Assets Between Our Company and Our Subsidiaries” on page 8 of this prospectus for all cash or asset transfers between us and our subsidiaries for each of the three years ended December 31, 2022. No cash or asset transfers were made between us and our subsidiaries during the six months ended June 30, 2023. The purpose of the outbound transfers, in the form of shareholder loans, was to pay off the subsidiaries’ expenses. The purpose of the inbound transfers, in the form of loan repayments, was to centralize the treasury function of the Company and our subsidiaries. There are no fixed repayment terms and no tax implication for these transfers. We did not make any capital contributions to, or receive any dividends from, our subsidiaries during these periods. No transfers, dividends or distributions have been made to investors during these periods. PRC laws and regulations may restrict our ability to make dividends and distributions to investors, including U.S. investors. We currently have not maintained any cash management policies that dictate the purpose, amount and procedure of cash transfers between the Company, our subsidiaries, or the investors. Rather, the funds can be transferred in accordance with the applicable laws and regulations in the PRC and other jurisdictions.

According to the Foreign Investment Law of the People’s Republic of China and its implementing rules, which jointly established the legal framework for the administration of foreign-invested companies, a foreign investor may, in accordance with other applicable laws, freely transfer into or out of China its contributions, profits, capital earnings, income from asset disposal, intellectual property rights, royalties acquired, compensation or indemnity legally obtained, and income from liquidation, made or derived within the territory of China in CNY or any foreign currency, and any entity or individual shall not illegally restrict such transfer in terms of the currency, amount and frequency. According to the currently effective Company Law of the People’s Republic of China and other Chinese laws and regulations, our PRC subsidiaries may pay dividends out of their respective accumulated profits as determined in accordance with Chinese accounting standards and regulations. In addition, each of our PRC subsidiaries is required to set aside at least 10% of its accumulated after-tax profits, if any, each year to fund a certain statutory reserve fund, until the aggregate amount of such fund reaches 50% of its registered capital. Where the statutory reserve fund is insufficient to cover any loss the PRC subsidiary incurred in the previous financial year, its current financial year’s accumulated after-tax profits shall first be used to cover the loss before any statutory reserve fund is drawn therefrom. Such statutory reserve funds and the accumulated after-tax profits that are used for covering the loss cannot be distributed to us as dividends. At their discretion, our PRC subsidiaries may allocate a portion of their after-tax profits based on Chinese accounting standards to a discretionary reserve fund. See “Risk Factors - Risks Relating to Our PRC Operations and Doing Business in the PRC - Our PRC subsidiaries are subject to restrictions on paying dividends and making other payments to us.” on page 19 of this prospectus.

Renminbi is not freely convertible into other currencies. Shortages in availability of foreign currency may then restrict the ability of our PRC subsidiaries to remit sufficient foreign currency to our offshore entities for our offshore entities to pay dividends or make other payments or otherwise to satisfy our foreign-currency-denominated obligations. The Renminbi is currently convertible under the “current account,” which includes dividends, trade and service-related foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and foreign currency debt, including loans we may secure for our onshore subsidiaries. Currently, our PRC subsidiaries may purchase foreign currency for settlement of “current account transactions,” including payment of dividends to us, without the approval of SAFE by complying with certain procedural requirements. Foreign exchange transactions under the capital account remain subject to limitations and require approvals from, or registration with, SAFE and other relevant Chinese governmental authorities. This could affect our ability to obtain foreign currency through debt or equity financing for our subsidiaries. See “Risk Factors - Risks Relating to Our PRC Operations and Doing Business in the PRC - Our PRC subsidiaries are subject to restrictions on paying dividends and making other payments to us.” on page 19 of this prospectus for a detailed discussion of the Chinese legal restrictions on the payment of dividends and our ability to transfer cash within our group. In addition, holders of our Common Shares may potentially be subject to Chinese taxes on dividends paid by us in the event we are deemed a Chinese resident enterprise for Chinese tax purposes. See “Risk Factors - Risks Relating to Our PRC Operations and Doing Business in the PRC - We may be classified as a “resident enterprise” for PRC enterprise income tax purposes; such classification could result in unfavorable tax consequences to us and our non-PRC shareholders” on page 27 of this prospectus. To the extent cash in the business is in the PRC/Hong Kong or a PRC/Hong Kong entity, the funds may not be available to fund operations or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of our Company or our subsidiaries by the PRC government to transfer cash. For detailed discussions, see “Prospectus Summary-Dividends and Other Distributions” on the accompanying prospectus and “Risk Factors - Risks Relating to Our PRC Operations and Doing Business in the PRC - Governmental control of currency conversion may affect payment of any dividends or foreign currency denominated obligations, and the value of your investment” on page 20 of this prospectus.

You should read this prospectus, together with additional information described under the heading “Where You Can Find More Information,” carefully before you invest in any of our securities.

Investing in our securities involves a high degree of risk. Before buying any securities, you should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 17 of this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Prospectus dated , 2024.

TABLE OF CONTENTS

We have not authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we may have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters have not authorized any other person to provide you with different or additional information. We are offering to sell, and seeking offers to buy the Common Shares, only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the Common Shares.

We have not taken any action to permit a public offering of the Common Shares outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of the Common Shares and the distribution of the prospectus outside the United States.

i

About This Prospectus

This prospectus describes the general manner in which the Selling Shareholders may offer from time to time up to an aggregate of 1,190,297 Common Shares issuable upon the exercise of the Warrants. You should rely only on the information contained in this prospectus and the related exhibits, any prospectus supplement or amendment thereto and the documents incorporated by reference, or to which we have referred you, before making your investment decision. Neither we nor the Selling Shareholders have authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus, any prospectus supplement or amendments thereto do not constitute an offer to sell, or a solicitation of an offer to purchase, the Common Shares offered by this prospectus, any prospectus supplement or amendments thereto in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. You should not assume that the information contained in this prospectus, any prospectus supplement or amendments thereto, or the information we have previously filed with the U.S. Securities and Exchange Commission (the “SEC”), is accurate as of any date other than the date on the front cover of the applicable document.

If necessary, the specific manner in which the Common Shares may be offered and sold will be described in a supplement to this prospectus, which supplement may also add, update or change any of the information contained in this prospectus. To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date - for example, a document incorporated by reference in this prospectus or any prospectus supplement - the statement in the document having the later date modifies or supersedes the earlier statement.

Neither the delivery of this prospectus nor any distribution of Common Shares pursuant to this prospectus shall, under any circumstances, create any implication that there has been no change in the information set forth or incorporated by reference into this prospectus or in our affairs since the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since such date.

As permitted by SEC rules and regulations, the registration statement of which this prospectus forms a part includes additional information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at its website, as described below under “Where You Can Find More Information.”

Except as otherwise indicated by the context, references in this prospectus to “we,” “us,” the “Company,” and “our” refer to China Natural Resources, Inc., a British Virgin Islands (“BVI”) company limited by shares, and its consolidated subsidiaries.

ii

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider before investing in our securities. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in the common shares discussed under “Risk Factors,” before deciding whether to invest in the common shares.

Overview

We are dedicated to becoming a leading multi-resources company in China, and is devoted to exploring the opportunities presented by other sectors in China as well, through complying with high international standards of corporate governance, continually expanding operations with profit growth potentials, enhancing overall cost effectiveness and productivity performance, collaborating with governments, communities and non-governmental organizations, optimizing our technical talent teams and innovation programs and maintaining responsible environmental practices.

We are committed to:

| · | | delivering superior long-term value to our shareholders; |

| · | | providing a safe, healthy and fulfilling work environment for our employees while improving production efficiency and operating effectiveness; |

| · | | contributing to the economic and social development of the regions where we operate; and |

| · | | responsibly managing the environmental impact of all our operations. |

We are principally engaged in exploration for lead, silver and other metals in the Inner Mongolia Autonomous Region of the PRC and exploration of attractive opportunities in other sectors in the PRC. Our operating subsidiary, Bayannaoer City Feishang Mining Company Limited (“Bayannaoer Mining”) holds an exploration permit issued by the Land and Resources Department of Inner Mongolia Autonomous Region covering the Moruogu Tong Mine, located in Wulatehouqi, Bayannaoer City, Inner Mongolia. The exploration permit evidences Bayannaoer Mining’s right to explore for minerals at the Moruogu Tong Mine. Initial results of the exploration program indicate the presence of lead and silver, with the prospect that further surveying and exploration may indicate the presence of other ores such as copper. We are also actively seeking opportunities of exploration and mining of other metals outside of the PRC. See, “Corporate History and Structure — Acquisition of Williams Minerals.”

We continuously pivot our business by exploring new opportunities for growth or diversification. We had engaged in the trade of copper ore in the PRC since 2019. Due to volatile fluctuations in the price of copper, we ceased trading copper ore in the second half of 2020. See “Corporate History and Structure — Copper Ore Trading.” Between July 2021 and July 2023, we also engaged in the rural wastewater treatment business in China through the acquisition of PST Technology, which held 51% equity interest of Shanghai Onway, a PRC company which is principally engaged in the development of rural wastewater treatment technologies, the provision of equipment and materials for rural wastewater treatment, undertaking EPC and PPP projects in relation to rural wastewater treatment, and the provision of consulting and professional technical services. We ceased the wastewater treatment business segment following the disposition of PST Technology in July 2023. See “Corporate History and Structure — Acquisition and Sale of Precise Space-Time Technology Limited.”

Company History and Structure

China Natural Resources, Inc. was incorporated in the BVI on December 14, 1993, and is a company limited by shares organized under the BVI Business Companies Act. We are primarily engaged in the exploration for lead, silver and other metals in the PRC and have been actively exploring growth opportunities in other sectors that we believe have great growth potential and align with our strategic business strategies and objectives. We are an offshore holding company incorporated in the British Virgin Islands and we are not a Chinese operating company. As a holding company with no operations of our own, our operations are conducted in China through the operating entities, and this structure involves unique risks to investors. Holders of our Common Shares will not directly hold any equity interests in the operating entities. We have not adopted a VIE structure. The Chinese regulatory authorities could disallow our corporate structure, which could result in a material change in our operations and the value of our Common Shares could decline or become worthless. See “Risk Factors — Risks Relating to Our Operations and Doing Business in the PRC —The PRC government may intervene or influence our operations at any time, or may exert more control over the China operations of an offshore holding company and offerings conducted overseas and foreign investment in China-based issuers, such as our PRC subsidiaries. Such control or influence may significantly limit our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.”

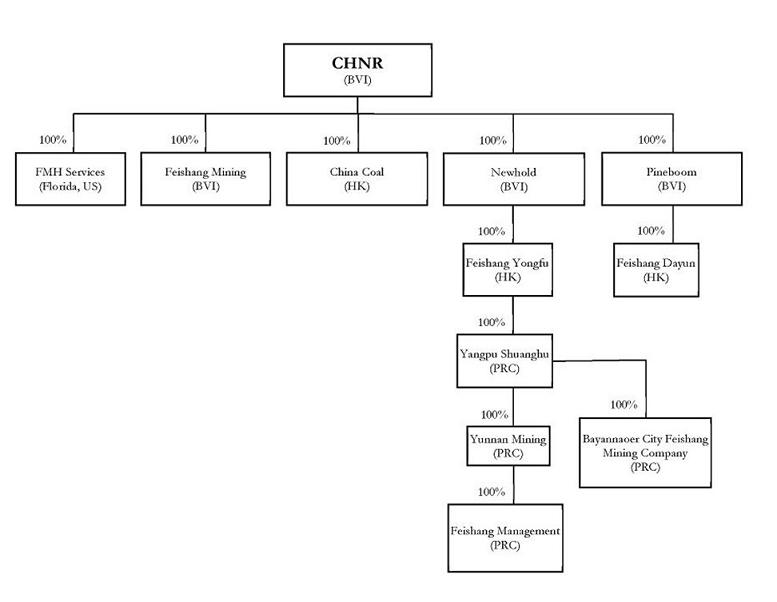

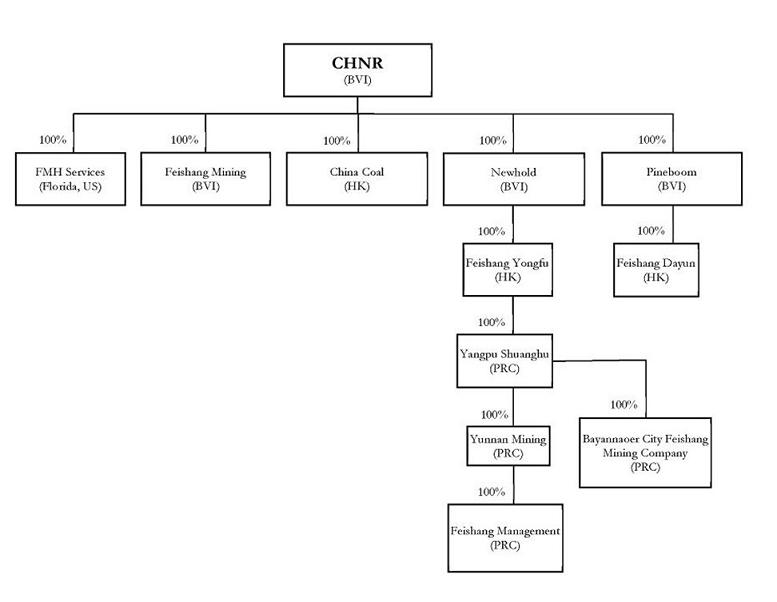

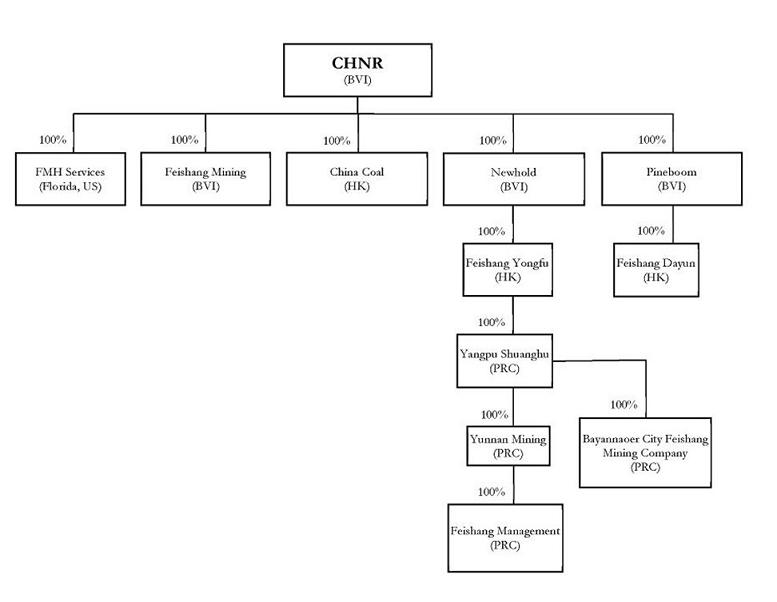

The following diagram illustrates our current corporate structure, which includes our significant subsidiaries as of the date of this prospectus:

Acquisition of Williams Minerals

On February 27, 2023, the Company entered into a material definitive agreement (the “Zimbabwe SPA”) with Feishang Group and Top Pacific (China) Limited (together, the “Sellers”), and the respective beneficial owner of the Sellers, Mr. Li Feilie and Mr. Yao Yuguang, to indirectly acquire all interests in Williams Minerals, which owns the mining permit for a Zimbabwean lithium mine. On April 14, 2023, the Company announced that it completed its due diligence investigation with satisfactory results and decided to proceed with the acquisition of William Minerals (the “Acquisition”). The Company paid an aggregate of $35 million by way of promissory notes (instead of cash) as a deposit on April 21, 2023, and will pay an aggregate of $140 million by way of promissory notes and/or cash as an initial installment.

On December 22, 2023, the Company entered into an amendment agreement (the “Amendment Agreement”) to the Zimbabwe SPA with the parties thereto. As the Sellers are still in the process of satisfying conditions precedent to the closing of the Acquisition in accordance with the Zimbabwe SPA, including but not limited to obtaining requisite governmental approvals, the parties entered into the Amendment Agreement to extend the long stop date for closing the acquisition from December 31, 2023 to December 31, 2024. See. “Corporate History and Structure — Acquisition of Williams Minerals.”

Sale of Precise Space-Time Technology Limited

On July 28, 2023, the Company entered into a Sale and Purchase Agreement (“SPA”) with Feishang Group Limited (“Feishang Group”). Pursuant to the SPA, the Company agreed to sell 100% equity interest of Precise Space-Time Technology Limited to Feishang Group, together with PST Technology’s outstanding payable owed to the Company, for consideration of approximately CNY95,761,119 comprising: (i) CNY34,197,300, the fair value of 100% equity interest of PST Technology as determined by the independent valuation report dated July 28, 2023; (ii) CNY129,958,419, the book value of PST Technology’s outstanding payable owed to the Company.

PST Technology, through its wholly owned subsidiaries, owns a 51% equity interest in Shanghai Onway and Shanghai Onway’s subsidiaries which are principally engaged in the development of rural wastewater treatment technologies, the provision of equipment and materials for rural wastewater treatment, undertaking EPC and PPP projects in relation to rural wastewater treatment, and the provision of consulting and professional technical services. After PST Technology’s disposition, the Company discontinued the operation in wastewater treatment segment and continue engaging in the exploration and mining business. See, “Corporate History and Structure — Acquisition and Sale of Precise Space-Time Technology Limited”

Summary of Risk Factors

Investing in our Common Shares involves significant risks. You should carefully consider all of the information in this prospectus before making an investment in our Common Shares. Below please find a summary of the principal risks we face, organized under relevant headings. These risks are discussed more comprehensively in the section titled “Risk Factors.”

Risks Relating to Our PRC Operations and Doing Business in the PRC

| · | | Changes in China’s economic, political or social conditions or government policies could have a material and adverse effect on our business and operations. |

| · | | Uncertainties with respect to the PRC legal system could adversely affect us. |

| · | | The PRC government may intervene or influence our operations at any time, or may exert more control over the China operations of an offshore holding company and offerings conducted overseas and foreign investment in China-based issuers, such as our PRC subsidiaries. Such control or influence may significantly limit our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. |

| · | | Changes in PRC laws and regulations may have a material and adverse effect on our business. |

| · | | PRC regulation of loans to and direct investment in PRC entities by offshore holding companies may delay or prevent us from making loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our ability to fund and expand our business. |

| · | | Inflation in the PRC, or a slowing PRC economy, could negatively affect our profitability and growth. |

| · | | Our PRC subsidiaries are subject to restrictions on paying dividends and making other payments to us. |

| · | | Governmental control of currency conversion may affect payment of any dividends or foreign currency denominated obligations, and it may adversely affect the value of your investment. |

| · | | The fluctuation of the CNY may materially and adversely affect your investment. |

| · | | The PRC State Administration of Foreign Exchange (“SAFE”) regulations regarding offshore financing activities by PRC residents have undergone changes which may increase the administrative burden we face and create regulatory uncertainties that could adversely affect us, and a failure by our shareholders who are PRC residents to make any required applications and filings pursuant to such regulations may prevent us from being able to distribute profits and could expose us and our PRC resident shareholders to liability under PRC law. |

| · | | The PCAOB may determine that it is unable to inspect our auditor in relation to its audit work performed for our financial statements to its satisfaction, and the inability of the PCAOB to conduct inspections over our auditor may affect our investors’ ability to benefit from such inspections. |

| · | | Our common shares may be prohibited from trading in the United States under the HFCAA if the PCAOB is unable to inspect or fully investigate our auditor for three consecutive years, or two consecutive years if proposed changes to the HFCAA are enacted. The delisting of our common shares, or the threat of their being delisted, may materially and adversely affect the value of your investment. |

| · | | PRC regulations establish complex procedures for some acquisitions conducted by foreign investors, which could make it more difficult for us to pursue growth through acquisitions in China. |

| · | | We and our PRC subsidiaries are required to maintain a series of licenses, permits and approvals from PRC authorities to operate our business in the PRC, and failure to maintain or renew such licenses, permits or approvals in a timely manner could materially affect our business. |

| · | | The approval of or filing with the CSRC or other PRC government authorities may be required in connection with our offshore offerings under PRC law, and, if required, we cannot predict whether or for how long we will be able to complete such filing. |

| · | | Failure to comply with PRC regulations and other legal obligations concerning data protection and cybersecurity may materially and adversely affect our business, as we routinely collect, store and use data during the conduct of our business. |

| · | | We may be classified as a “resident enterprise” for PRC enterprise income tax purposes; such classification could result in unfavorable tax consequences to us and our non-PRC shareholders. |

| · | | Any failure to comply with PRC regulations regarding the registration requirements for employee stock incentive plans may subject the PRC plan participants or us to fines and other legal or administrative sanctions. |

| · | | Failure to make adequate contributions to various mandatory social security plans as required by PRC regulations may subject us to penalties. |

| · | | Enforcement of stricter labor laws and regulations may increase our labor costs. |

| · | | If the chops of our PRC subsidiaries are not kept safely, are stolen or are used by unauthorized persons or for unauthorized purposes, the corporate governance of these entities could be severely and adversely compromised. |

Risks Relating to Our Mine Exploration Activities in Inner Mongolia

| · | | The Moruogu Tong Mine is in the exploration stage. |

| · | | The northern part of Moruogu Tong Mine is currently being explored under an agreement that reduces our share in any future profits. |

| · | | Any estimates of the reserves contained in the Moruogu Tong Mine may be inaccurate. |

| · | | There are no assurances that we can produce minerals on a commercially viable basis. |

| · | | Volatility in the market prices of metals may adversely affect the results of our operations. |

| · | | We are subject to government regulations in various aspects of our exploration activities and our failure to comply with applicable government regulations could adversely affect us. |

| · | | We do not have binding agreements with customers to purchase any future output of metals. |

Risks Relating to the Sale of PST Technology

| · | | We face risks associated with the divesture of our wastewater treatment segment. |

Risks Relating to the Potential Closing of the Acquisition of Williams Minerals and the Timing of Such Closing

| · | | There may be unforeseen risks relating to the Acquisition that were not discovered by us through our due diligence investigation prior to our Acquisition. |

| · | | Completion of the Acquisition is conditional upon satisfaction or waiver of various conditions. There can be no assurance that the conditions will be fulfilled or waived, or that the Acquisition will be completed. |

| · | | Failure to complete the Acquisition may have a material adverse effect on the Company’s business, financial condition and results of operations. |

| · | | Even if the Acquisition is completed, we may fail to realize the anticipated benefits associated with it, those benefits may take longer to realize than expected, and we may encounter significant difficulties. |

Risks Relating to Additional Acquisitions and Expansion into Other Sectors

| · | | We may acquire other businesses or form joint ventures that could negatively affect our operating results, dilute our shareholders’ ownership, increase our debt or cause us to incur significant expense. |

| · | | Future acquisitions or strategic investments could be difficult to identify and integrate, divert the attention of management, disrupt our business, dilute shareholder value and adversely affect our business, results of operations, and financial condition. |

| · | | Because a majority of our management’s prior business experience has been limited to industries outside of other spaces that we are exploring, they may lack the necessary experience to assess a business combination with a target business in those industries. |

| · | | We may become subject to additional extensive and evolving regulatory requirements, noncompliance with which, or changes in which, may materially and adversely affect our business and prospects. |

Risks Relating to Our Financial Condition and Business

| · | | We have incurred losses from operations in each of the preceding three fiscal years and there is no assurance that we will generate profits from operations in the future. |

| · | | We will have to fund operating expenses from other sources until we are able to generate sufficient revenue to pay them. |

| · | | The loss of key personnel could affect our business and prospects. |

| · | | Any failure to maintain effective internal controls could have an adverse effect on our business, results of operations and the market price of our shares. |

Risks Relating to Foreign Private Issuer Status

| · | | Because our assets are located outside of the United States and all of our directors and officers reside outside of the United States, it may be difficult for you to enforce your rights based on the U.S. federal securities laws against us or our officers and directors or to enforce a judgment of a United States court against us or our officers and directors in the PRC. |

| · | | Our status as a foreign private issuer results in less information being available about us. |

| · | | Due to our status as a foreign private issuer, we have adopted IFRS accounting principles, which are different from accounting principles under U.S. generally accepted accounting principles (“U.S. GAAP”). |

| · | | As a foreign private issuer we are not subject to certain requirements that other Nasdaq-listed issuers are required to comply with, some of which are designed to provide information to and protect investors. |

| · | | Due to an exemption from Nasdaq rules applicable to foreign private issuers, our related party transactions may not receive the type of independent review process that those of other Nasdaq-listed companies receive; the terms of these transactions are not negotiated at arm’s-length and may not be as favorable as could be obtained from unrelated parties. |

Risks Relating to Our Common Shares

| · | | You may experience dilution to the extent that our common shares are issued upon the exercise of outstanding warrants or other securities that we may issue in the future. |

| · | | Substantial future sales or perceived potential sales of our Common Shares in the public market could cause the price of our Common Shares to decline. |

| · | | Certain of the Selling Shareholders may acquire their Common Shares at a price that is less than the market price of the Common Shares in the future, may earn a positive rate of return even if the price of the Common Shares declines and may be willing to sell their Common Shares at a price less than shareholders that acquired Common Shares in the public market. |

| · | | The price at which Common Shares are quoted on Nasdaq may increase or decrease due to a number of factors, which may negatively affect the price of the Common Shares. |

| · | | Our principal beneficial owner and his affiliates control us through their share ownership; and their interests may differ from those of other shareholders. |

| · | | The rights of our shareholders are governed by BVI law, the provisions of which may not be as favorable to shareholders as under U.S. law, and our directors may take actions with which you disagree without first receiving shareholder approval |

| · | | We may be classified as a passive foreign investment company, which could result in adverse U.S. federal income tax consequences to U.S. shareholders. |

Permissions Required from the PRC Authorities for Our Operations and Offerings and Recent Regulatory Developments

Prerequisite Regulatory Licenses, Permits and Approvals

Except as disclosed in “Risk Factors — Risk Related to Our PRC Operations and Doing Business in the PRC — We and our PRC subsidiaries are required to maintain a series of licenses, permits and approvals from PRC authorities to operate our business in the PRC, and failure to maintain or renew such licenses, permits or approvals in a timely manner could materially affect our business,” We believe that as of the date of this prospectus, we and our subsidiaries have received from the PRC authorities all requisite licenses, permissions, and approvals needed to engage in the businesses currently conducted in the PRC, which solely include the business licenses that authorize the scope of business operations, and no permission or approval has been denied. These licenses, permits and filings include, exploration and mining licenses, among others. Given the changes and developments of interpretation and implementation of relevant laws and regulations and the enforcement practice by relevant government authorities, we may be required to obtain additional licenses, permits, or approvals or complete additional filings for our and our subsidiaries’ business operations in the future. If we or any of our subsidiaries is found to be in violation of any existing or future PRC laws or regulations, or fail to obtain or maintain any of the required permits or approvals in a timely manner, or at all, the competent PRC regulatory authorities would have discretion to take action regarding such violations or failures. In addition, if we had inadvertently concluded that any approvals, permits, registrations or filings were not required, or if applicable laws, regulations or interpretations change in a way that requires us to obtain additional approvals, permits, registrations or filings in the future, we may be unable to obtain such necessary approvals, permits, registrations or filings in a timely manner, or at all. Such approvals, permits, registrations or filings may be rescinded even if obtained. Any such circumstance may subject us to fines and other regulatory, civil or criminal liabilities, and we may be ordered by the competent government authorities to suspend relevant operations, which will materially and adversely affect our business operations. For risks relating to licenses and approvals required for our operations in China, see “Risk Factors — Risk Related to Our PRC Operations and Doing Business in the PRC — We and our PRC subsidiaries are required to maintain a series of licenses, permits and approvals from PRC authorities to operate our business in the PRC, and failure to maintain or renew such licenses, permits or approvals in a timely manner could materially affect our business.

Cybersecurity Review

On December 28, 2021, the Cyberspace Administration of China (the “CAC”), and 12 other PRC government authorities jointly published the amended Cybersecurity Review Measures, which came into effect on February 15, 2022. The final Cybersecurity Review Measures provide that a “network platform operator” that possesses personal information of more than one million users and seeks a listing in a foreign country must apply for a cybersecurity review. Further, the competent PRC governmental authorities have the authority to initiate a cybersecurity review even without a specific application against a company if they determine certain network products, services, or data processing activities of such company affect or may affect national security.

We and our PRC subsidiaries do not carry out business in China through any self-owned network platform and hold personal information of less than one million individuals from PRC operations. We and our PRC subsidiaries have not been identified as critical information infrastructure operators by any PRC authorities. The data collected from our China operations is mainly information related to our production, customers, suppliers and our employees. We believe that we and our PRC subsidiaries do not commit any acts that threaten or endanger the national security of the PRC, and to our knowledge we and our PRC subsidiaries have not received or been subject to any investigation, notice, warning or sanction from any PRC authority with respect to national security issues arising from our business operations. As of the date of this prospectus, we do not believe that we need to proactively apply for the cybersecurity review required by the CAC. See, “Risk Factors — Risks Relating to Our PRC Operations and Doing Business in the PRC — Failure to comply with PRC regulations and other legal obligations concerning data protection and cybersecurity may materially and adversely affect our business, as we routinely collect, store and use data during the conduct of our business.”

CSRC Filing Requirements

On February 17, 2023, the CSRC promulgated Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic Companies, along with five supporting guidelines, or the New Overseas Listing Rules. These regulations became effective on March 31, 2023. According to the New Overseas Listing Rules, PRC domestic companies that seek to offer and list securities in overseas markets, either through direct or indirect means, are required to complete the filing procedure with the CSRC and report relevant information.

The New Overseas Listing Rules provide that if the issuer meets the following criteria at the same time, the overseas securities offering and listing conducted by such issuer will be deemed as an indirect overseas offering subject to the filing procedures as set forth under the New Overseas Listing Rules: (i) 50% or more of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited combined financial statements for the most recent accounting year is accounted for by domestic companies; and (ii) the main parts of the issuer’s business activities are conducted in the mainland China, or its main place(s) of business are located in the mainland China, or the senior managers in charge of its business operations and management are mostly Chinese citizens or domiciled in the mainland China.

According to the New Overseas Listing Rules, issuers shall file with the CSRC within three business days after the initial submission of the registration statement to the SEC for its nonpublic review and to report to the CSRC upon the completion of the reported offering. Moreover, the New Overseas Listing Rules mandate that overseas-listed issuers conducting follow-on securities offerings in the same overseas market must file with the CSRC within three business days after the completion of such offering. Additionally, issuers listed overseas are required to report “material events” to the CSRC within three business days following the occurrence and public announcement of such events. These material events include change of control, voluntary delisting or being ordered to delist, and investigations or penalties by overseas securities regulatory bodies, among other things. Failure to fulfill these obligations to make timely filings or reports to the CSRC may result in fines, legal or administrative sanctions and other adverse consequences and could materially and adversely affect our ability to raise funds in overseas markets. For details of the associated risks, see “Risk Factors — Risks Relating to Our PRC Operations and Doing Business in the PRC — The filing with the CSRC or other PRC government authorities may be required in connection with our offshore offerings under PRC law, and, if required, we cannot predict whether or for how long we will be able to complete such filing.”

Transfers of Cash and Assets between Our Company and Our Subsidiaries

Cash and asset transfers through the Group are primarily attributed to shareholder loans from us to our subsidiaries. All cash or asset transfers between us and our subsidiaries for each of the three years ended December 31, 2022, are set forth in the table below. No cash or asset transfers were made between us and our subsidiaries during the six months ended June 30, 2023. The purpose of the outbound transfers, in the form of shareholder loans, was to pay off the subsidiaries’ expenses. The purpose of the inbound transfers, in the form of loan repayments, was to centralize the treasury function of the Company and our subsidiaries. There are no fixed repayment terms and no tax implication for these transfers. We did not make any capital contributions to, or receive any dividends from, our subsidiaries during these periods. No transfers, dividends or distributions have been made to investors during these periods. We currently have not maintained any cash management policies that dictate the purpose, amount and procedure of cash or asset transfers between us and our subsidiaries, or the investors. Rather, the funds can be transferred in accordance with the applicable laws and regulations in the PRC and other jurisdictions.

| | | | | Year ended December 31, | |

| Transferor | | Transferee | | 2020 | | | 2021 | | | 2022 | | | 2022 | |

| | | | | HK$ | | | HK$ | | | HK$ | | | US$ | |

| |

| Outbound Transfers | | |

| | | | | | | | | | | | | | | | | | | |

| China Natural Resources, Inc. | | Feishang Mining | | | — | | | | 50,000 | | | | — | | | | — | |

| China Coal | | | | | 8,000 | | | | 8,000 | | | | 8,000 | | | | 1,026 | |

| Feishang Yongfu | | | | | 8,000 | | | | 8,000 | | | | 8,000 | | | | 1,026 | |

| Feishang Dayun | | | | | 8,000 | | | | 8,000 | | | | 8,000 | | | | 1,026 | |

| | | Total | | | 24,000 | | | | 74,000 | | | | 24,000 | | | | 3,078 | |

| | | | | | | | | | | | | | | | | | | |

| Inbound Transfers | | |

| Feishang Mining | | China Natural Resources, Inc. | | | 150,000 | | | | — | | | | — | | | | — | |

| China Coal | | | | | 30,000 | | | | — | | | | — | | | | — | |

| Feishang Yongfu | | | | | 50,000 | | | | 30,000 | | | | — | | | | — | |

| Feishang Dayun | | | | | 50,000 | | | | 30,000 | | | | — | | | | — | |

| | | Total | | | 280,000 | | | | 60,000 | | | | — | | | | — | |

Under PRC laws and regulations, we are subject to some restrictions on intercompany fund transfers and foreign exchange controls. Our subsidiaries receive substantially all revenue in CNY, and the PRC or Hong Kong governments could prevent the CNY maintained in the PRC or Hong Kong from leaving, impose controls on its conversion into foreign currencies, restrict deployment of the CNY into the business of our subsidiaries and restrict the ability to pay dividends. There are no restrictions or limitations imposed by the Hong Kong government on the transfer of capital within, into and out of Hong Kong (including funds from Hong Kong to the PRC), except for the transfer of funds involving money laundering and criminal activities. However, there is no guarantee that the Hong Kong government will not promulgate new laws or regulations that may impose such restrictions in the future. To the extent cash in the business is in the PRC or Hong Kong or our PRC or Hong Kong entities, the funds may not be available to fund operations or for other use outside of the PRC or Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries by the PRC or Hong Kong governments to transfer cash. We cannot assure you that the PRC or Hong Kong governments will not intervene in or impose restrictions on our ability to make intercompany cash transfers.

According to the Foreign Investment Law of the People’s Republic of China and its implementing rules, which jointly established the legal framework for the administration of foreign-invested companies, a foreign investor may, in accordance with other applicable laws, freely transfer into or out of China its contributions, profits, capital earnings, income from asset disposal, intellectual property rights, royalties acquired, compensation or indemnity legally obtained, and income from liquidation, made or derived within the territory of China in CNY or any foreign currency, and any entity or individual shall not illegally restrict such transfer in terms of the currency, amount and frequency. According to the the currently effective Company Law of the People’s Republic of China and other Chinese laws and regulations, our PRC subsidiaries may pay dividends out of their respective accumulated profits as determined in accordance with Chinese accounting standards and regulations. In addition, each of our PRC subsidiaries is required to set aside at least 10% of its accumulated after-tax profits, if any, each year to fund a certain statutory reserve fund, until the aggregate amount of such fund reaches 50% of its registered capital. Where the statutory reserve fund is insufficient to cover any loss the PRC subsidiary incurred in the previous financial year, its current financial year’s accumulated after-tax profits shall first be used to cover the loss before any statutory reserve fund is drawn therefrom. Such statutory reserve funds and the accumulated after-tax profits that are used for covering the loss cannot be distributed to us as dividends. At their discretion, our PRC subsidiaries may allocate a portion of their after-tax profits based on Chinese accounting standards to a discretionary reserve fund. See “Risk Factors - Risks Relating to Our PRC Operations and Doing Business in the PRC - Our PRC subsidiaries are subject to restrictions on paying dividends and making other payments to us.”

Renminbi is not freely convertible into other currencies. Shortages in availability of foreign currency may then restrict the ability of our PRC subsidiaries to remit sufficient foreign currency to our offshore entities for our offshore entities to pay dividends or make other payments or otherwise to satisfy our foreign-currency-denominated obligations. The Renminbi is currently convertible under the “current account,” which includes dividends, trade and service-related foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and foreign currency debt, including loans we may secure for our onshore subsidiaries. Currently, our PRC subsidiaries may purchase foreign currency for settlement of “current account transactions,” including payment of dividends to us, without the approval of SAFE by complying with certain procedural requirements. Foreign exchange transactions under the capital account remain subject to limitations and require approvals from, or registration with, SAFE and other relevant Chinese governmental authorities. This could affect our ability to obtain foreign currency through debt or equity financing for our subsidiaries. See “Risk Factors - Risks Relating to Our PRC Operations and Doing Business in the PRC - Our PRC subsidiaries are subject to restrictions on paying dividends and making other payments to us” for a detailed discussion of the Chinese legal restrictions on the payment of dividends and our ability to transfer cash within our group. In addition, holders of our Common Shares may potentially be subject to Chinese taxes on dividends paid by us in the event we are deemed a Chinese resident enterprise for Chinese tax purposes. See “Risk Factors - Risks Relating to Our PRC Operations and Doing Business in the PRC - We may be classified as a “resident enterprise” for PRC enterprise income tax purposes; such classification could result in unfavorable tax consequences to us and our non-PRC shareholders.” To the extent cash in the business is in the PRC/Hong Kong or a PRC/Hong Kong entity, the funds may not be available to fund operations or for other use outside of the PRC/Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of our Company or our subsidiaries by the PRC government to transfer cash. For detailed discussions, see “Prospectus Summary-Dividends and Other Distributions” on the accompanying prospectus and “Risk Factors - Risks Relating to Our PRC Operations and Doing Business in the PRC - Governmental control of currency conversion may affect payment of any dividends or foreign currency denominated obligations, and the value of your investment.”

Implications of The Holding Foreign Companies Accountable Act

Pursuant to the Holding Foreign Companies Accountable Act, as amended by the Consolidated Appropriations Act, 2023, or the HFCAA, if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspections by the PCAOB for two consecutive years, the SEC will prohibit our shares from being traded on a national securities exchange or in the over-the-counter trading market in the United States. On December 16, 2021, the PCAOB issued a report on its determinations that it was unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, and our auditor was subject to that determination. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions. If PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland China or Hong Kong and we continue to use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed with the SEC, we would be identified as a Commission-Identified Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not be identified as a Commission-Identified Issuer for any future fiscal year, and if we were so identified for two consecutive years, we would become subject to the prohibition on trading under the HFCAA and as a result, NASDAQ may determine to delist our securities. See “Risk Factors - Risks Relating to Our PRC Operations and Doing Business in the PRC - The PCAOB may determine that it is unable to inspect our auditor in relation to its audit work performed for our financial statements to its satisfaction, and the inability of the PCAOB to conduct inspections over our auditor may affect our investors’ ability to benefit from such inspections.”. “Risk Factors - Risks Relating to Our PRC Operations and Doing Business in the PRC - Our common shares may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in China. The delisting of our common shares, or the threat of their being delisted, may materially and adversely affect the value of your investment.” and “Risk Factors - Risks Relating to Our PRC Operations and Doing Business in the PRC - Our common shares may be prohibited from trading in the United States under the HFCAA if the PCAOB is unable to inspect or fully investigate our auditor for three consecutive years, or two consecutive years if proposed changes to the HFCAA are enacted. The delisting of our common shares, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

Implication of Being a Foreign Private Issuer

We are a foreign private issuer within the meaning of the rules under the Exchange Act. As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| · | | we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; |

| · | | for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; |

| · | | we are not required to provide the same level of disclosure on certain issues, such as executive compensation; |

| · | | we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; |

| · | | we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and |

| · | | we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

Corporate Information

The Company’s executive offices are located at Room 2205, 22/F, West Tower, Shun Tak Centre, 168-200 Connaught Road Central, Sheung Wan, Hong Kong, telephone +852 28107205. The Company does not currently maintain an agent in the United States.

The SEC maintains an internet website that contains reports, information statements and other documents that we furnish to or file with the SEC. Those documents may be viewed, downloaded and/or printed. The address of the SEC website is http://www.sec.gov.

We maintain a company website at http://www.chnr.net. The information on our website is not a part of this prospectus, and is not incorporated by reference herein.

Conventions That Apply to This Prospectus

Unless otherwise indicated or the context otherwise requires, references in this prospectus to:

| · | | “BVI” are to the British Virgin Islands; |

| · | | “Common Shares” are to our common shares, no par value; |

| · | | “China” or the “PRC” are to the People’s Republic of China, excluding, for the purposes of this prospectus only, Hong Kong, Macau and Taiwan; |

| · | | “China Natural Resources,” “CHNR,” “we,” “us,” “our company” and “our” are to China Natural Resources, Inc., our BVI holding company, and its subsidiaries; |

| · | | “CNY”, “Chinese yuan” and “Renminbi” are to the legal currency of China; |

| · | | “FT Global” are to FT Global Capital, Inc.; |

| · | | “LME” are to London Mercantile Exchange; |

| · | | “Nasdaq” are to the Nasdaq Capital Market; |

| · | | “Shanghai Onway” are to Shanghai Onway Environmental Development Co., Limited; |

| · | | “SHFE” are to Shanghai Futures Exchange; |

| · | | “Selling Shareholders” are to the selling shareholders named in this prospectus, including their transferees, donees, pledgees and other successors-in-interest; |

| · | | “PST Technology” are to Precise Space-Time Technology Limited; |

| · | | “US$,” “U.S. dollars,” “$,” and “dollars” are to the legal currency of the United States; |

| · | | “Warrants” are to certain outstanding warrants that we issued to the investors pursuant to a securities purchase agreement dated February 16, 2024 to purchase up to 1,115,903 Common Shares at an exercise price equal to $3.00 per share and to the president and the staff of FT Global pursuant to a placement agency agreement dated February 16, 2024 to purchase up to an aggregate of 74,394 Common Shares at an exercise price equal to $2.20 per share; |

| · | | “Moruogu Tong Mine” are to Wulatehouqi Moruogu Tong Mine in Inner Mongolia. |

For the convenience of readers, amounts in Renminbi, the Chinese currency (“CNY”), have been translated into United States dollars (“US$”) at the applicable rate of US$1.00 = CNY7.2535 as quoted by www.ofx.com as of June 30, 2023, except as otherwise disclosed. No representation is made that the CNY amounts could have been, or could be, converted into US$ at that rate, or at all.

THE OFFERING

| | | |

| Common Shares issued and outstanding as of March 18, 2024 | | 9,865,767 Common Shares. |

| | | |

| Common Shares that may be offered and sold from time to time by the Selling Shareholders | | Up to 1,190,297 Common Shares underlying the Warrants (1,115,903 Common Shares underlying the Unregistered Investor Warrants and 74,394 Common Shares underlying the Placement Agent Warrant). |

| | | |

| Common Shares to be outstanding immediately after this offering | | 11,056,064 Common Shares, assuming the exercise of all of the Warrants for cash and without adjustment. |

| | | |

| Terms of the offering | | The Selling Shareholders may sell, transfer or otherwise dispose of any or all of the Common Shares offered by this prospectus from time to time on Nasdaq or any other stock exchange, market or trading facility on which the shares are traded or in private transactions. The Common Shares may be sold at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices. |

| | | |

| Use of proceeds | | We will not receive any proceeds from the sale of the Common Shares by the Selling Shareholders. The Selling Shareholders will receive all of the proceeds from the sale of any Common Shares sold by them pursuant to this prospectus. We may receive proceeds in the event that any of the Warrants are exercised at their respective exercise prices per share which may result in gross proceeds of up to an aggregate of $3,511,375.80. Any proceeds that we receive from the exercise of the Warrants will be used for general corporate purposes. See “Use of Proceeds” in this prospectus. |

| | | |

Listing | | Our Common Shares are listed on Nasdaq under the symbol “CHNR.” There is no established trading market for the Warrants and we do not intend to list the Warrants on any exchange or other trading system. |

| | | |

Risk factors | | Investing in our securities involves a high degree of risk. See “Risk Factors” below, beginning on page 17 of this prospectus. |

| | | |

The number of common shares that will be outstanding immediately after this offering:

| · | | is based on 9,865,767 Common Shares issued and outstanding as of the date of this prospectus; |

| · | | includes 1,190,297 Common Shares that we will issue, and the Selling Shareholders may offer and sell from time to time, upon exercise of all of the Warrants for cash and without adjustment; and |

| · | | excludes all Common Shares issuable upon exercise of our outstanding options and Common Shares reserved for future issuances under our share incentive plan. |

SUMMARY CONSOLIDATED FINANCIAL DATA AND OPERATING DATA

The following summary consolidated statements of operations and comprehensive loss for the years ended December 31, 2020, 2021 and 2022, summary consolidated balance sheets data as of December 31, 2020, 2021 and 2022 and summary combined and consolidated cash flows data for the years ended December 31, 2020, 2021 and 2022 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The following summary consolidated statements of operations and comprehensive loss for the six months ended June 30, 2022 and 2023, summary consolidated balance sheets data as of June 30, 2023 and summary consolidated cash flows data for the six months ended June 30, 2022 and 2023 are derived from our unaudited interim consolidated financial statements included elsewhere in this prospectus.

Our historical results are not necessarily indicative of results expected for future periods. You should read this Our Summary Consolidated Financial Data and Operating Data section together with our consolidated financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

The following table presents our summary consolidated statements of operations and comprehensive loss data for the periods indicated:

| | | Six Months Ended June 30, | |

| | | 2022 | | | 2023 | | | 2023 | |

| | | CNY | | | CNY | | | US$ | |

| | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | |

| | | (Amounts in thousand, except per share data) | |

| | | | |

| Revenue | | | 16,072 | | | | 12,216 | | | | 1,684 | |

| Cost of sales | | | (8,771 | ) | | | (5,376 | ) | | | (741 | ) |

| GROSS PROFIT | | | 7,301 | | | | 6,840 | | | | 943 | |

| PROFIT/(LOSS) BEFORE INCOME TAX | | | 4,030 | | | | (7,634 | ) | | | (1,052 | ) |

| | | | | | | | | | | | | |

| Income tax expense | | | (357 | ) | | | (1,827 | ) | | | (252 | ) |

| | | | | | | | | | | | | |

| PROFIT /(LOSS) FOR THE PERIOD | | | 3,673 | | | | (9,461 | ) | | | (1,304 | ) |

| | | | | | | | | | | | | |

| ATTRIBUTABLE TO: | | | | | | | | | | | | |

| Owners of the Company | | | 1,949 | | | | (10,742 | ) | | | (1,481 | ) |

| Non-controlling interests | | | 1,724 | | | | 1,281 | | | | 177 | |

| | | | | | | | | | | | | |

| | | | 3,673 | | | | (9,461 | ) | | | (1,304 | ) |

| | | | | | | | | | | | | |

| EARNINGS/(LOSS) PER SHARE ATTRIBUTABLE TO OWNERS OF THE COMPANY: | | | | | | | | | | | | |

| Basic and diluted | | | | | | | | | | | | |

| - Earnings/(loss) per share | | | 0.24 | | | | (1.31 | ) | | | (0.18 | ) |

The following table presents our summary consolidated balance sheets data as of the dates indicated:

| | | | | | | | | | |

| | | December 31, | | | June 30, | |

| | | 2022 | | | 2023 | | | 2023 | |

| | | CNY | | | CNY | | | US$ | |

| | | (Audited) | | | (Unaudited) | | | (Unaudited) | |

| | | | (Amounts in thousand) | |

| | | | | | | | | | | | | |